We Are Stronger United

Innovation Fuels Evolution

Pursue The Impossible

Execution Drives Success

People Come First

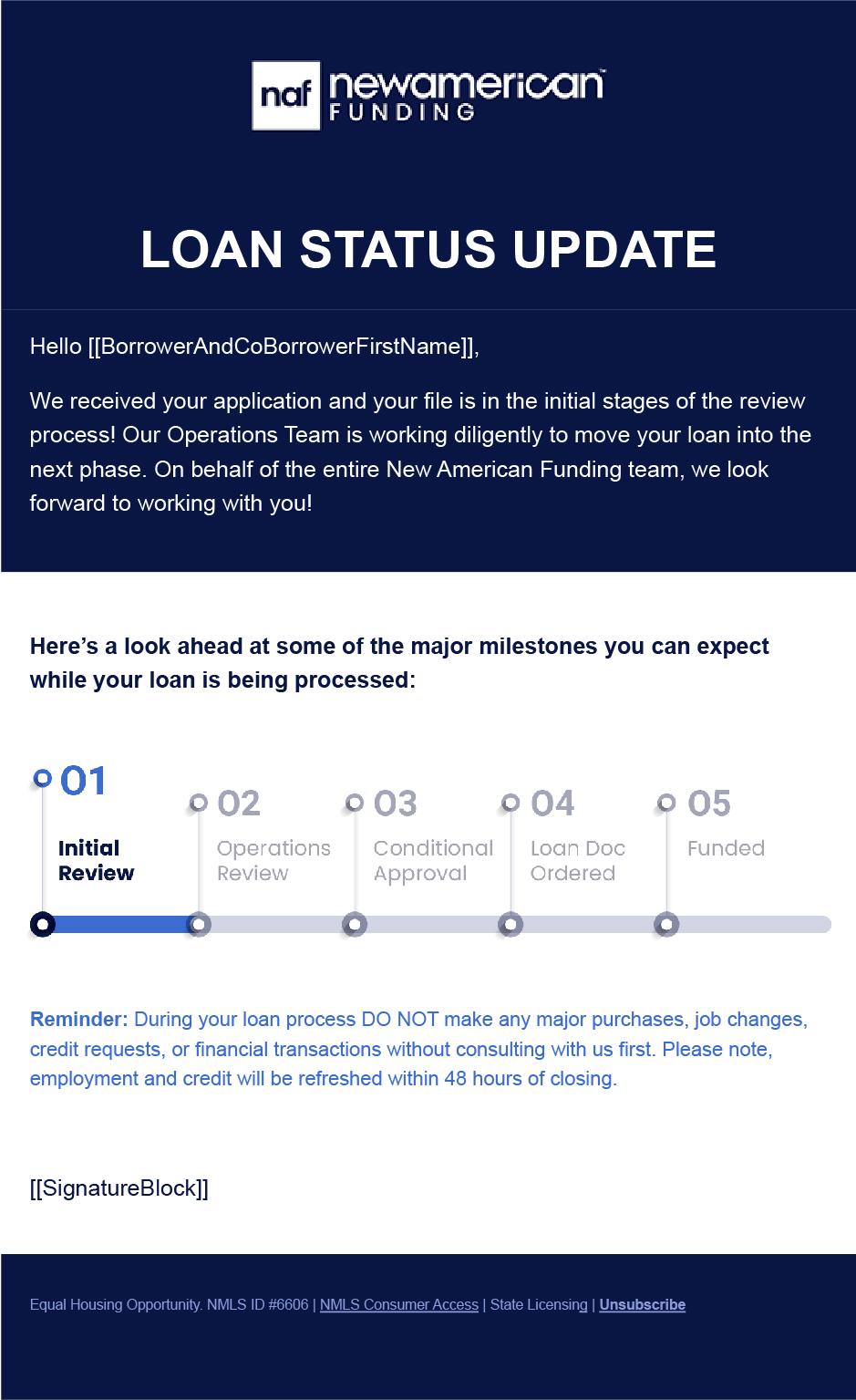

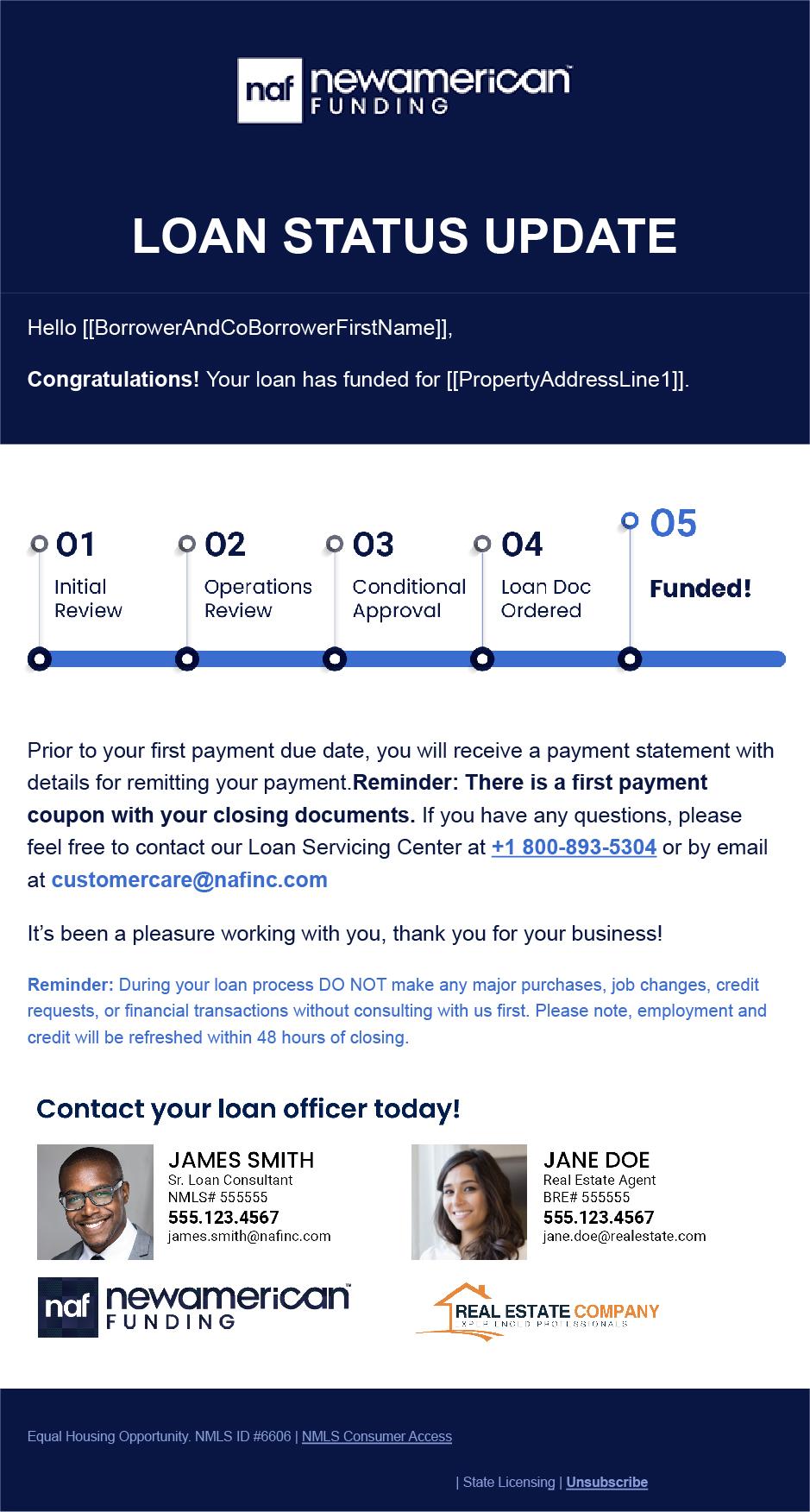

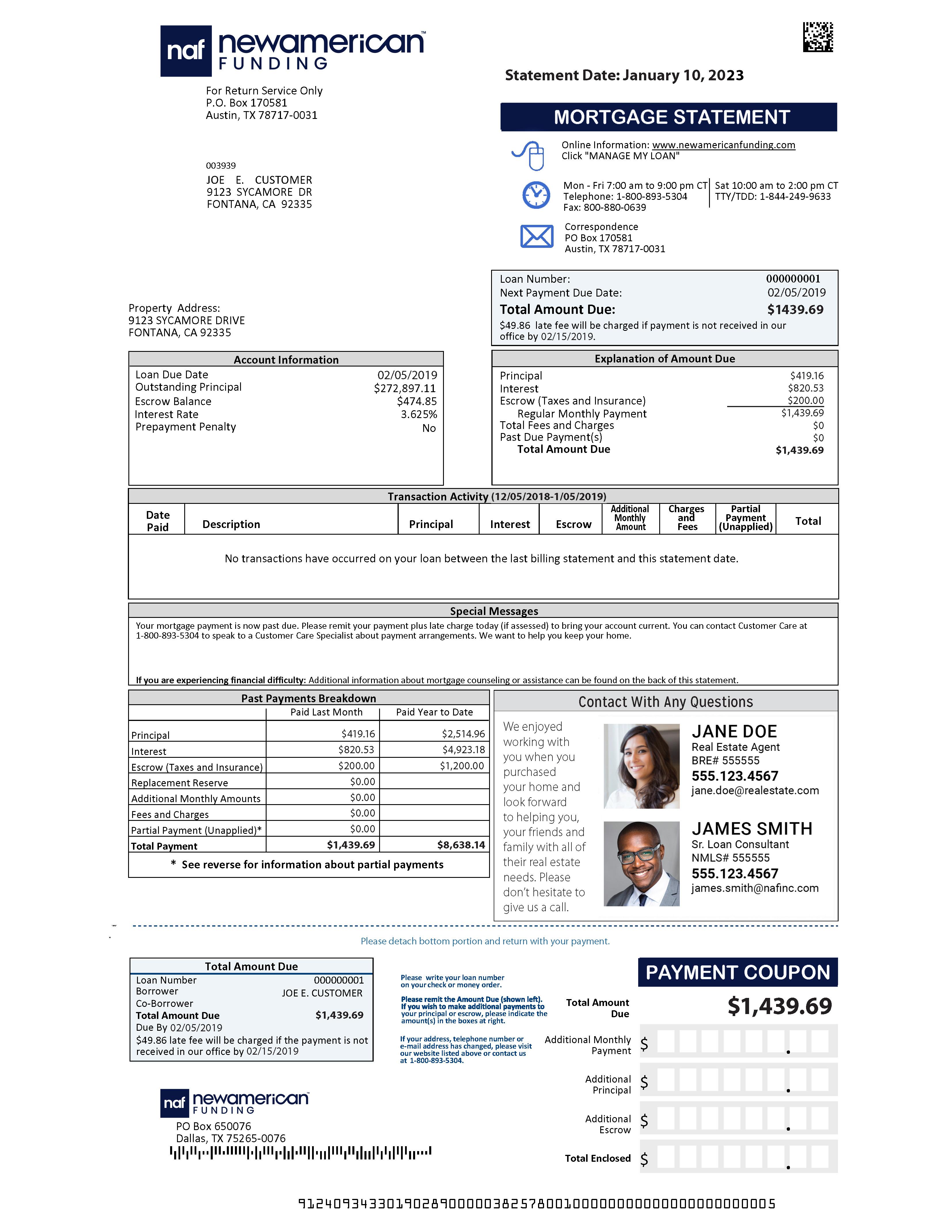

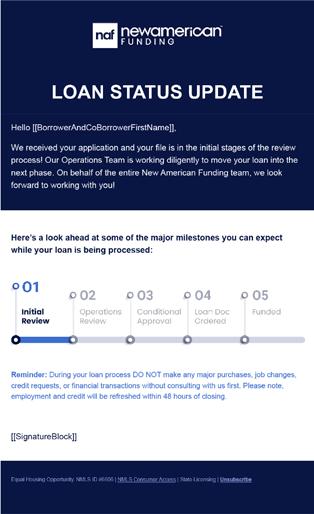

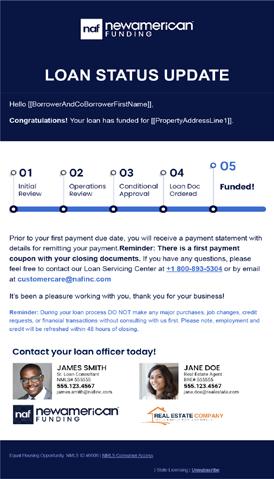

New American Funding keeps you top of mind with co-branded Loan Status update emails to keep the client in the loop every step of the way.

Co-branded closing cards are mailed to our mutual clients with information on how to download closing documents.

Personalized co-branded greeting cards sent to clients for years after a loan closes on birthdays, holidays and loan anniversaries.

SURVEY TOOL

• For All 5-Star Surveys, Midwest Marketing will send you a social media graphic (see below)

• Surveys to: Borrower and Buyer’s Agent

• Automatic Replies

• Incomplete Survey Reminders

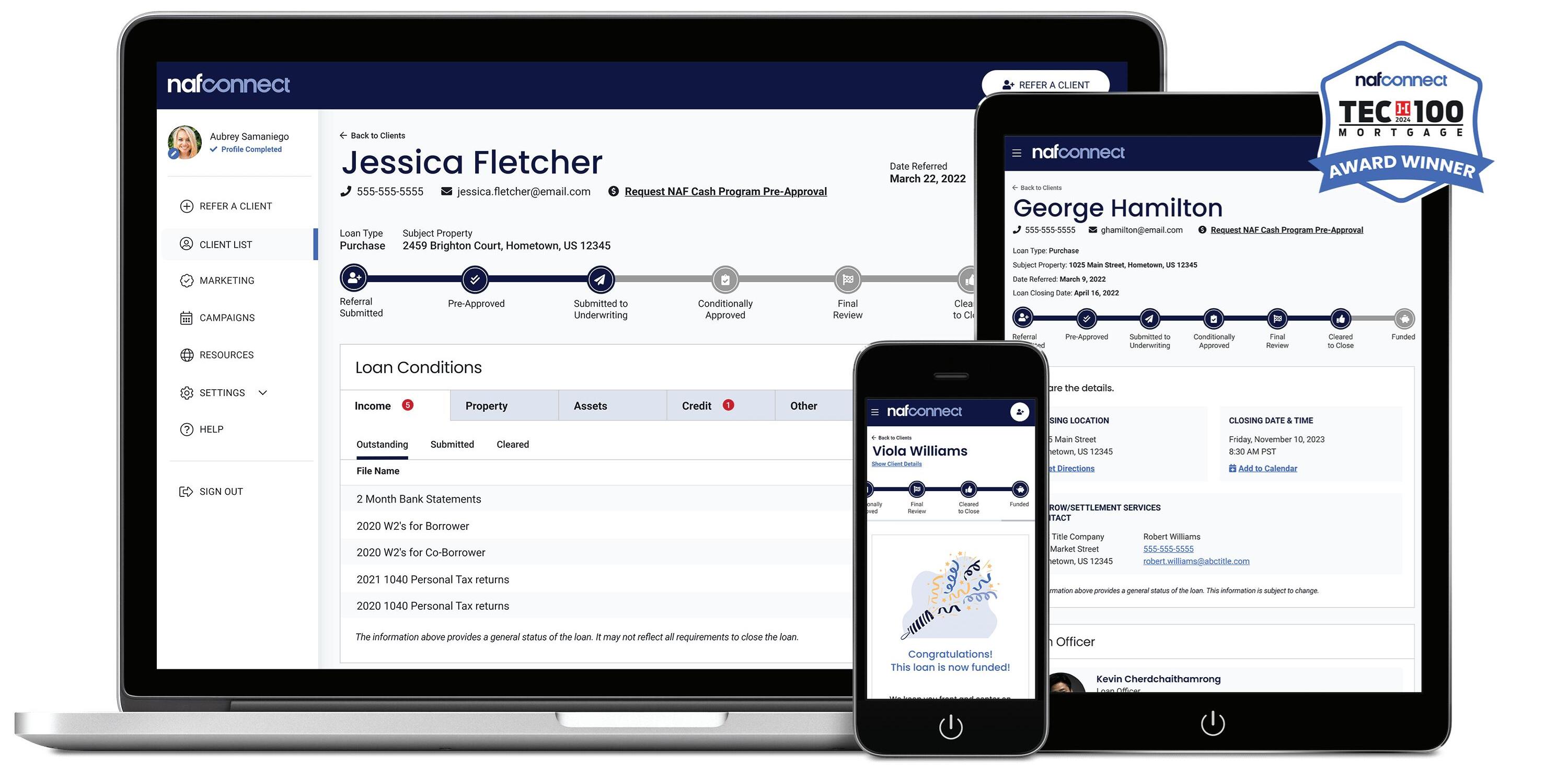

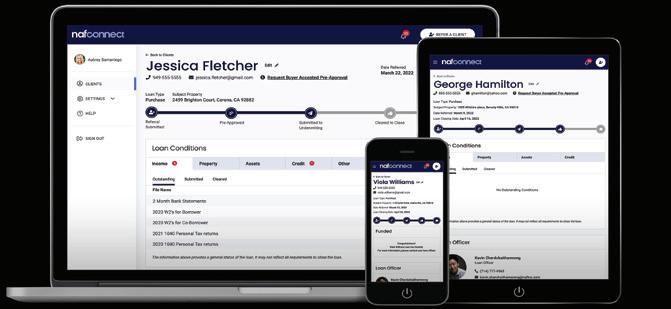

NAFConnect is a platform for Real Estate Agents (REA) to connect to NAF Loan Officers.

Help clients navigate the loan process and communicate with New American Funding.

View your client's loan status and receive notifications as it moves across key milestones.

See documents needed by the New American Funding processing team.

Generate, edit, and download pre-approval letters at the click of a button.

Receive notifications when new milestones are completed and watch real-time loan status updates to keep you and your client up-to-date on the status of their loan.

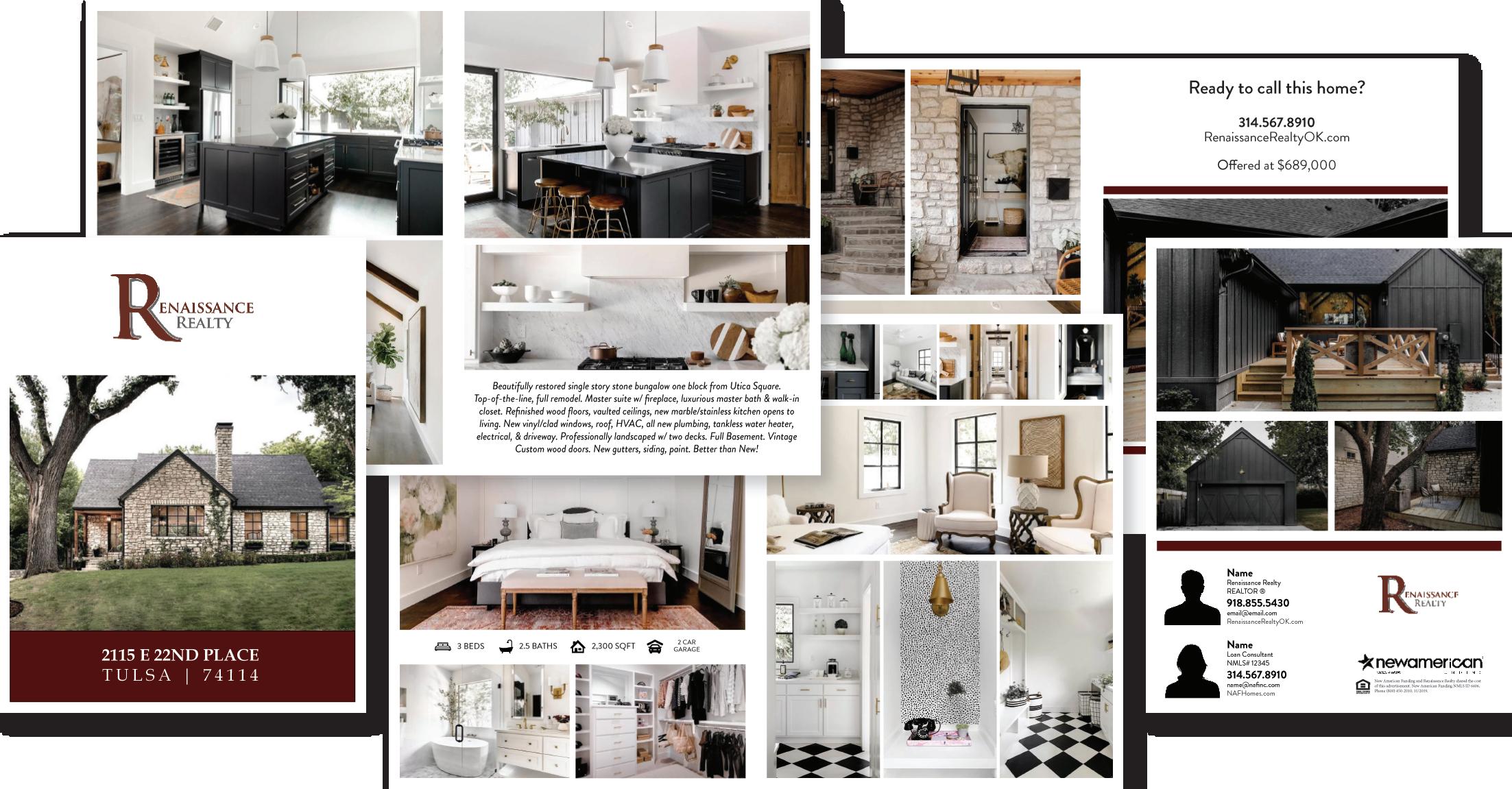

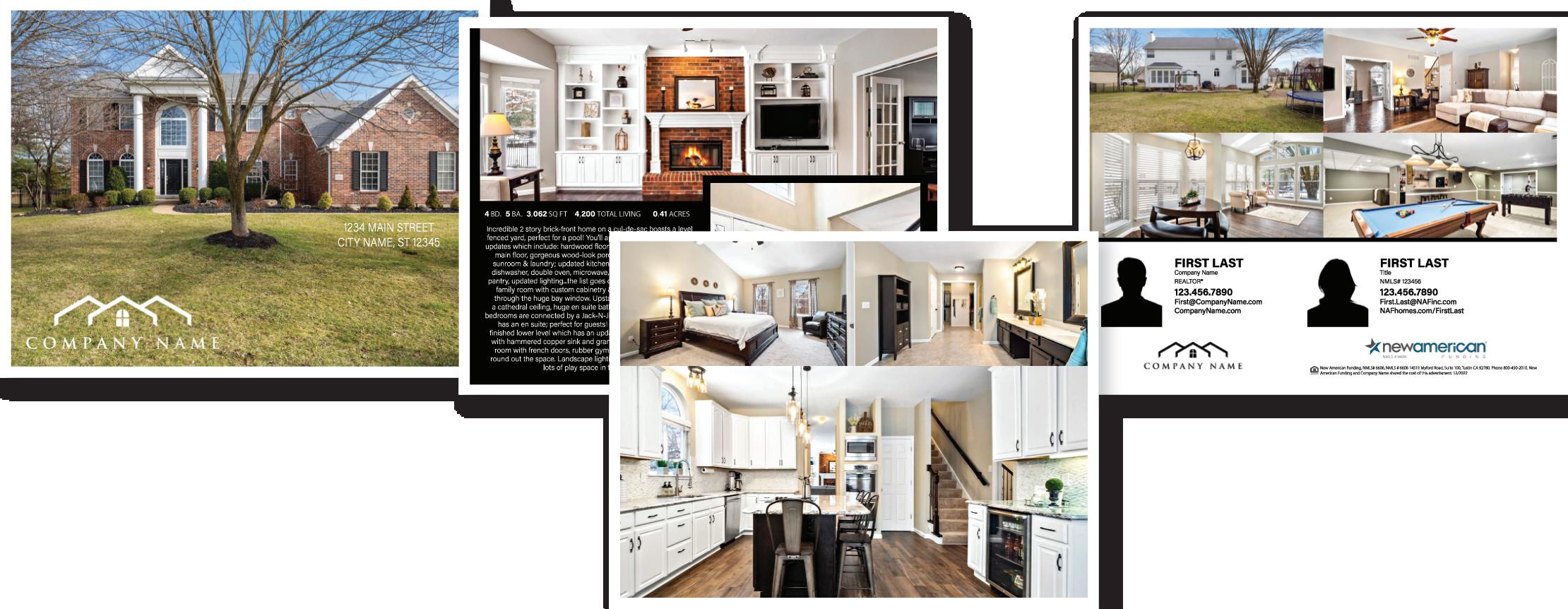

• Print Mail

• Doorhangers

• Listing Booklets

• Flyers

• Luxury Business Cards

• Buyer and Seller Booklets

• Listing/Open House Materials

• Agent Signage

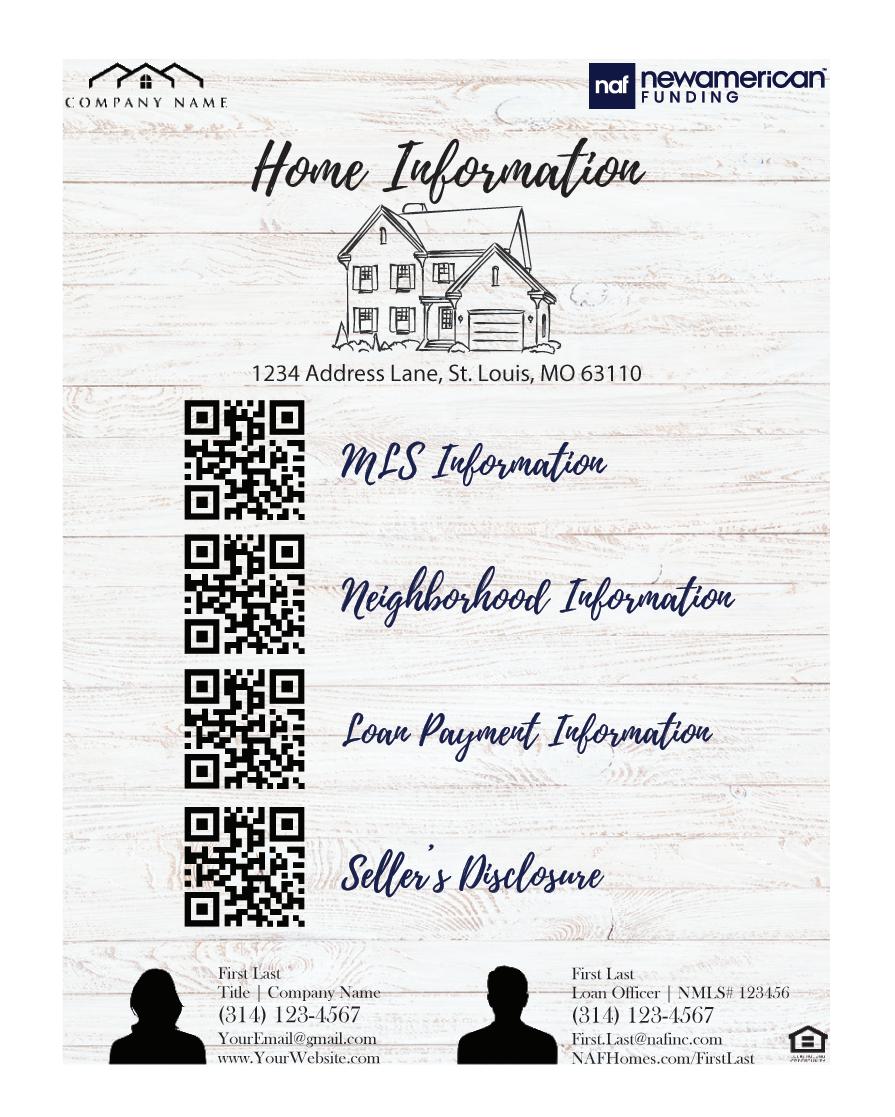

The Marketing Team has created an Agent Presentation Booklet to use when meeting with New Agents. Below is an example of what we have been using. This is a base we can add and subtract pages based on your audience. If you would like us to create some for your next Agent Meeting or to have on-hand, let us know!

YOU

If not the Marketing Team can create one or more for you.

Have the Midwest Marketing Team Create a Digital Business Card. Save it on your phone. Usually as a favorite in your pictures. Or in your Notes or Wallet Section. What ever allows you to access it fast and easily.

If you are talking to a New Buyer’s Agent…while on the phone with them.

Let them know you are going to text them your Digital Business Card.

This allows them to put a face with a name…easily access your contact information.

Most importantly…if the transaction goes well they can forward that card to a new referral.

Always make sure your Buyers have your Digital Business Card.

It is an extremely easy way for them to share your information with family and friends who need a referral.

Everyone always has their phone.

It is always a great idea to call the Listing Agents on your Purchase deals and introduce yourself.

Same as Buyers Agents…while on the phone let them know you will be texting your Digital Business Card.

Texting is much better than sending an e-mail.

Texts are read about 98% of the time…e-mails on about 37%.

This is a great way to share your contact information in any situation.

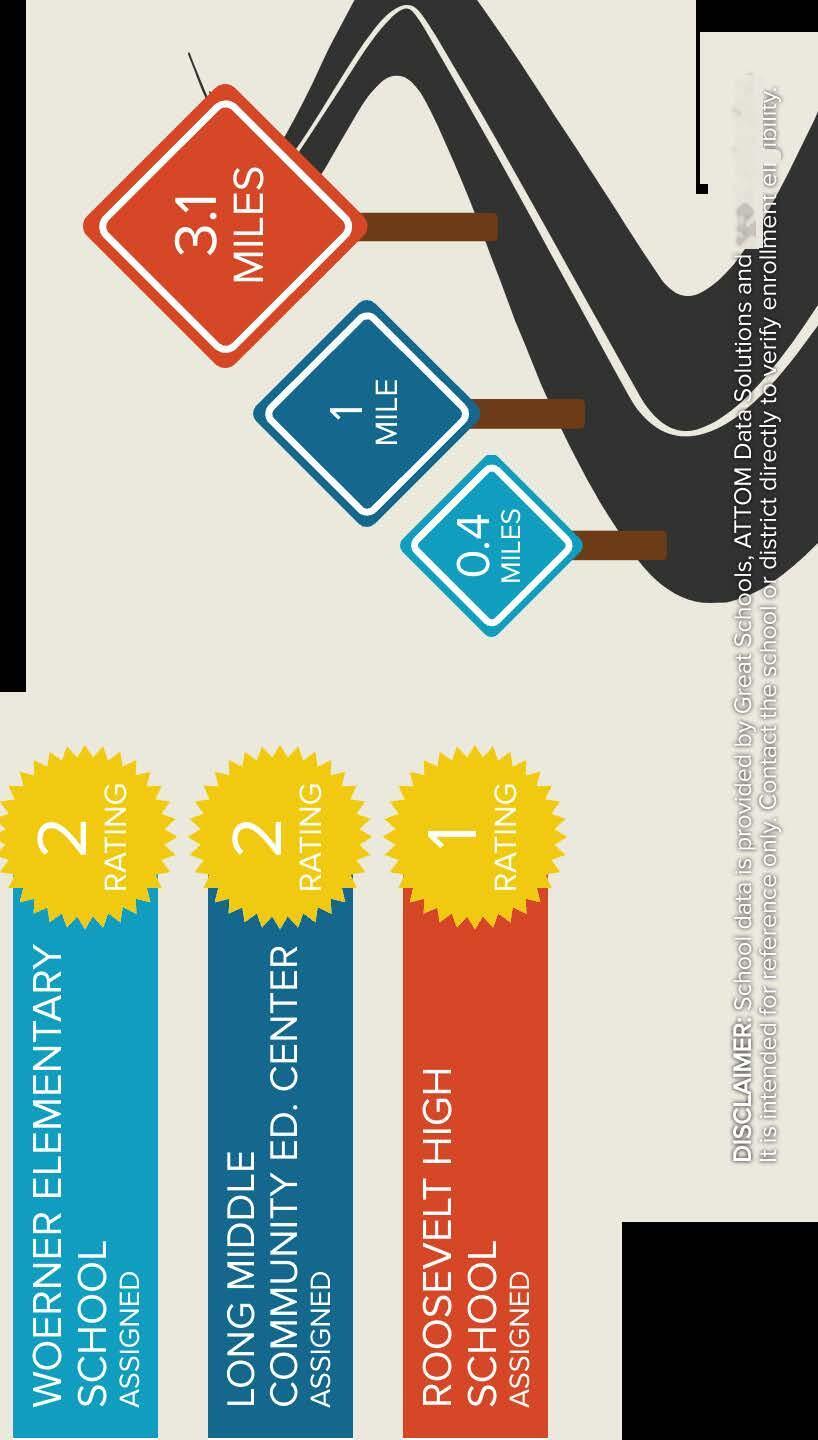

This home is in a very convenient area. Some daily errands in this location require a car and most major services are within 1 mile.

The assigned schools are average for the area. There are also 74 private schools and 11 charter schools within 5 miles. PK-5 6-8 9-12

• Down Payment as Low as 3%

• Fixed or Adjustable Rates

• Down Payment Assistance Programs Available

• Non-Occupying Co-Borrowers Allowed

• Down Payment as Low as 3.5%

• Lower Credit Score Flexibility

• Higher Allowable Debt to Income Ratios

• 100% Financing with DPA

VA

• 100% Financing

• No Monthly Mortgage Insurance Premiums

• Flexible Underwriting Guidelines

USDA

• 100% Financing

• Lower Credit Score Flexibility

• Gifts for Closing Costs Allowed

• Borrow up to $3 Million

• Credit Score as Low as 700

• Eligible for Primary Residence, Second Home or Investment Property

• Warrantable and Non-Warrantable Condos Permitted

• FHA and Conventional Programs

• Purchase or Refinance

• Principal Residence, Second Home or Investment Property

• Ability to Finance Repairs and Home Improvements

• Allows Buyer to Become a Cash Buyer

• Buyer Can Purchase New Home Without Selling Current Home

• Conventional and VA Loans Allowable

• Lock In Your Rate - Rate Can’t Increase

• If Rates Improve during Locked Period, You Can Float Down to a Better Rate

• Self Employed Borrowers can use Business Bank Statements to Qualify

• Purchase New Home Without Selling Current Home –Exclude Payment in Debt to Income Ratio

• Purchase, Refinance or Cash-Out

• Primary, Second Home or Investment Property Eligible

• Use Equity From Your Existing Home Towards the Purchase of a New Home

• Ability to Present a Strong Non-Contingent Offer, Giving You a Competitive Edge in the Market

• No Monthly Payments During the Loan Term Reducing the Financial Stress of managing Two Mortgage Payments

• Lower Interest Rate for the First Few Years of Mortgage

• Available on Conventional, FHA VA and USDA Loan Products

• 1/0, 1/1/1, 2/1, and 3/2/1 Buydown Options Available

• Additional Funds for Down Payment and Closing Costs

• NAF Goal Grant

• Chenoa

• NAF Pathway Programs

• Freddie Mac BorrowSmartSM

• Borrower can Reduce the Principal Balance

• New American Funding will Re-Amortize the Loan based on the Remaining Term and Payments will be Reduced

• Multiple Recasts can be Completed during the Life of the Loan

• PMI can be Eliminated in Some Scenarios

If your self-employed buyers have been in business at least two years, their personal or business bank statements may qualify them for New American Funding’s Self-Employed Bank Statement Mortgage.

If your buyers simply have a high debt-to-income ratio (DTI), no K1s or 1099s but have plenty of assets, they may still qualify.

Adjustable and fixed rate mortgage options available

Loan amounts up to $2.5 million

Purchase, Refinance or Cash Out

First-time homebuyers eligible

Primary second home or investment home are eligible

For buyers selling their current home, the mortgage payment for the departure residence may be excluded from the buyer’s DTI if the property has been listed for Sale on the MLS prior to the loan application date and the borrower can show additional reserves.

Buying in cash means convenience, cer tainty, and may mean cost savings too. In fact, buying in cash may help your clients save up to 11% over those using a traditional mor tgage.1

With NAF Cash, an affiliated company of New American Funding, your buyer can make a competitive, true cash offer that is not contingent on financing and close in as little as seven days. You know what that means for you.

• Clients can buy their new home before selling their current home

• Sellers may be more likely to offer concessions to cash buyers

• Get commissions quickly

• Use potential savings to buy down interest rate

• No fees for agents

• Close on more homes faster

Follow these steps to make your buyer a cash buyer with NAF Cash!

STEP 1

Get Cer tified

Join a FR EE 4 5 - minu te N A F Cash LLC training

STEP 2

Get Your Clie nt Pre -A pproved

Get your client pre - approved with New A merican Funding!

STEP 3

Complete N A F Cash Docume nts

Work with your N A F Cash Transac tion Coordinator to submit the required documents.

STEP 4

Get Ready to Write Cash O f fers

Your N A F Cash Transac tion Coordinator will notif y you once the client has been approved and they can begin making a cash of fer

STEP 5

O f fer Accepted

Close and move in quickly! At this point , you will work closely with your N A F Cash Transac tion Coordinator

A mortgage recasting, or loan recast, is when a borrower makes a large, lump-sum payment toward the principal balance of their mortgage and the lender, in turn, reamortizes the loan. This means that your loan and payments are reduced to reflect the new balance. It allows borrowers the opportunity to close with just 5% down. Once the current home is sold, borrower can recast to use the proceeds from the sale to buy down the principle balance to reduce monthly payment and eliminate PMI.

Recasting Highlights:

• Minimum of $5000 principal reduction

• $300 Nominal fee

• Borrower can reduce the principal balance

• New American Funding will re-amortize the loan based on the remain term and payments will be reduced

• Recast for Conventional Loan (Freddie Mac and Fannie Mae)

• Multiple Recasts can be completed during the life of the loan

• Only one document is needed for recast: Borrowers must provide a Recast Modification Agreement which they will execute and have notarized

• The first principal and interest payment must be made on the original note

• PMI can be eliminated in some scenarios

A temporary buydown lowers the effective interest rate for the first few years of the mortgage. This reduction is a result of the deposit of a lump sum into an escrow account, a portion of which is released each month to reduce the borrower’s payments. Temporary Buydowns can be used on Conventional, FHA, VA, and USDA Loan Products.

These pages will focus on the Seller Paid Buydown.

Year 1 - Monthly Payment calculated using a Rate 1% below Note Rate

Year 2-30 - Monthly Payment would be calculated at the Note Rate

EXAMPLE:

Note Rate 6.625%

Year 1 Rate 5.625%

Year 2-30 Rate 6.625%

Year 1 - Monthly Payment calculated using a Rate 2% below Note Rate

Year 2 - Monthly Payment would be calculated at 1% below Note Rate

Year 3-30 - Monthly Payment would be calculated at the Note Rate

EXAMPLE:

Note Rate 6.625%

Year 1 Rate 4.625%

Year 2 Rate 5.625%

Year 3-30 Rate 6.625%

Year 1-3 - Monthly Payment calculated using a Rate 1% below Note Rate

Year 4-30 - Monthly Payment would be calculated at the Note Rate

EXAMPLE:

Note Rate 6.625%

Year 1-3 Rate 5.625%

Year 4-30 Rate 6.625%

Year 1 - Monthly Payment calculated using a Rate 3% below Note Rate

Year 2 - Monthly Payment calculated using a Rate 2% below Note Rate

Year 3 - Monthly Payment calculated using a Rate 1% below Note Rate

Year 4-30 - Monthly Payment would be calculated at the Note Rate

EXAMPLE:

Note Rate 6.625%

Year 1 Rate 3.625%

Year 2 Rate 4.625%

Year 3 Rate 5.625%

Year 4-30 Rate 6.625%

The cost of the Buydown is simply the difference between the BUYDOWN PAYMENT and the P&I PAYMENT using the Note Rate.

The COST for the Seller is equal to the SAVINGS for the Buyer.

See examples below.

1st Year - Buyer of House B is saving $403.75 per month Compared to Buyer of House A Savings of $51.23 per month

2nd Year - Buyer of House B is saving $206.90 per month Compared to Buyer of House A Savings of $51.23 per month

How much can a seller pay towards closing costs?

Help your clients pay of f highinterest debt

A Home Equit y Line of Credit could be the answer!

• SFR (1-4 unit)

• Townhomes

• PUD

• Condo (including Mid- and Hi- Rise)

• Manufactured Homes allowed

Wi th a H ome Equit y Line of C re dit, your clie nts can leve rage the e qui t y they ’ve buil t in their home to pay of f hig h - in te res t de b t , make ho me re novatio ns , o r eve n bu y a se cond home or inves tme nt prope r t y.

• Piggyback and Stand-Alone options available

• HELOC can be a 1st lien

• Self-employed permitted

• Loan amounts $25,000 to $750,000

• Up to 70% CLTV

• Up to 50.00% Debt-to-income

• FICO as low as 640

• Purchase, Rate and Term, and Cash Out Refinance

• “No appraisal” and “AVM only” options on some transactions (if acceptable and qualified)

• Trust Ownership eligible

A DSCR loan, also known as a Debt Service Coverage Ratio loan, is a specialized financing option primarily utilized by real estate investors. It’s a loan that measures the property’s ability to generate enough cash flow to pay its debt-based obligations. Unlike traditional loans, which focus on personal income verification, DSCR loans inspect the property’s income potential to determine loan eligibility. This non-QM loan allows investors to qualify for financing based on their property’s cash flow, making it the perfect solution for those who want to invest in real estate without worrying about their personal income.

Arc Home LLC

Access DSCR Program

• 640 FICO

◦ 30 Yr Fixed

◦ 30 Yr Fixed I.O.

NAF Portfolio DSCR

• 700 FICO

◦ 30 Yr Fixed

◦ 30 Yr Fixed I.O.

5th Street Capital

• 680 FICO

◦ 30 Yr Fixed

◦ 5/6 & 7/6 SOFR ARMs

◦ 5/6 & 7/6 SOFR ARMs I.O.

AD Mortgage

• 620 FICO

◦ 30 Yr & 40 Yr Fixed

◦ 5/6 & 7/6 SOFR ARMs

Champions

• 620 FICO

◦ 30 Yr Fixed

◦ 30 Yr Fixed I.O.

◦ 10/6 SOFR ARMs

◦ 10/6 SOFR ARMs I.O.

Greenbox

◦ 30 Yr Fixed

◦ 40 Yr Fixed I.O.

ACC Mortgage

• 640 FICO

◦ 30 Yr Fixed

◦ 30 Yr Fixed I.O.

Angel Oak

• 680 FICO

◦ 30 Yr & 40 Yr Fixed

◦ 30 Yr Fixed I.O.

Clearedge Lending

• 620 FICO

◦ 30 Yr & 40 Yr Fixed

◦ 30 Yr & 40 Yr Fixed I.O.

◦ 5/6 & 7/6 SOFR ARMs

• 660 FICO

◦ 15 Yr & 30 Yr Fixed

◦ 40 Yr Fixed I.O.

Verus

Inv Solutions DSCR

• 620 FICO

◦ 15 Yr & 30 Yr Fixed

◦ 7/6 SOFR ARM

◦ 7/6 SOFR ARMs I.O. 40 Yr Term

ACRA Lending

• 575 FICO

◦ 30 Yr Fixed

◦ 5/1 & 7/1 CMT ARMs

Axos

• 660 FICO

◦ 30 Yr Fixed

◦ 5/6, 7/6 SOFR ARMs

◦ 5/6, 7/6, SOFR I.O. ARMs

Excelerate Capital

• 620 FICO

◦ 15 Yr, 30 Yr & 40 Yr Fixed

◦ 30 Yr & 40 Yr Fixed I.O.

◦ 5/6 SOFR ARMs

◦ 5/6 SOFR ARMs I.O.

Loanstream

• 620 FICO

◦ 15 Yr, 30 Yr & 40 Yr Fixed

◦ 30 Yr & 40 Yr Fixed I.O.

◦ 5/6 & 7/6 SOFR ARMs

◦ 5/6 SOFR ARMs I.O.

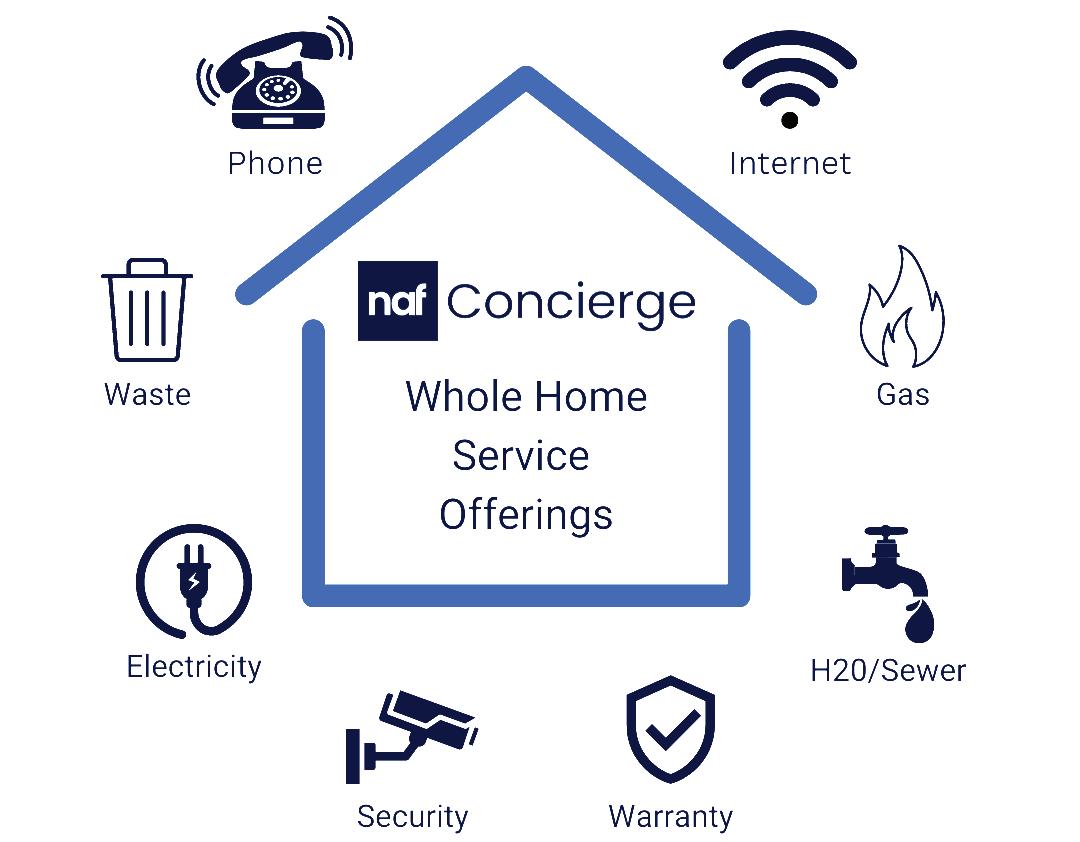

This exciting new initiative positions NAF as a whole home provider, seamlessly connecting customers with many of the services critical to buying and owning a home.

From basic utilities like power and gas, to fiber internet and state of the art smart home security, NAF Concierge will help our customers save time and money in a simple, 30-minute-or-less process.

Additionally, customers will receive exclusive discounts by working with NAF Concierge, potentially saving them hundreds of dollars.

NAF Concierge assists customers during their loan journey to help them review, compare and schedule their new home's utility connections and needs such as electric, internet, Security, TV and much, much more.

White Glove Service

Dedicated concierge agents to assist customers with scheduling appointments, placing orders, and tracking progress

Easy Home Service Connections

Provide free assistance with identifying and connecting home services such as: Electric, Gas, Internet, Home Security, and more…

Carrier Agnostic Options

Unbiased pricing information for various providers that services customer’s specific address

Loan officers have three options to refer their clients to NAF Concierge

LOs will also receive $100 for each customer that obtains a security system installation through NAF Concierge!*

*$100 referral bonus will be paid in monthly commissions on the 10th day of the month for any prior month customer installations

NAF Concierge Portal – powered by OneSource Solutions: https://portal.osconnects.com

Username: NAF E-mail Address

Password: NAF2023!

The portal will have three levels of roll-up reporting:

1) Loan Officer

2) Regional/Division Sales Leader

3) Corporate FAQ

What is NAF Concierge?

What’s in it for NAF Loan Officers?

NAF Concierge is a complimentary offering that provides NAF customers with a hassle-free way to set up important utilities and home services as part of your homebuying journey Our goal is to save you significant time, money , and stress during your loan journey with NAF.

When you refer your clients to NAF Concierge and they install a home security or smart home system, you will receive a $100 incentive per client! One client equals $100, ten clients equal $1,000! Additionally, as NAF interacts with clients in additional ways beyond their home financing, we’re confident you will see increased referral opportunities and long-term customer retention.

What states does NAF Concierge cover?

How do I refer my clients to NAF Concierge?

LOs have three options for referring customers to NAF Concierge:

1. Warm transfer to 877-804-0833

Our service is available nationwide!

2. Via your online portal account (see details below)

3. Share and encourage clients to visit http://www.nafconcierge.com

What services does NAF Concierge help with?

Sounds great, but how will we track this?

NAF Concierge will help establish your basic utilities such as electricity, gas, and water. An expert consultant will also provide comparisons for available internet, television, phone, and Smart Home Security services. We can even help with moving providers for the big day!

Loan officers will be able to track NAF Concierge engagement via their own custom portal account, similar to your Uqual financial wellness portal. This will provide the ability to track your borrower’s progress with up-to-date reporting and status updates for each service the client utilizes.

Why can’t I take care of this myself?

How do I access the NAF Concierge online portal?

You will receive an email invitation from OneSource Solutions, who is NAF Concierge’s authorized home service partner. The email will provide you instructions to reset your password for your unique login. You should expect to receive this email and credentials within the next 2-3 business days.

You certainly can! However, we’ve found that many customers spend between 5-7 hours on tasks like researching available providers, comparing rates, and listening to annoying hold music. We can also save you money with special NAF Concierge discounts from top providers

How will I receive the $100 LO incentive when my customers work with NAF Concierge?

Is NAF Concierge trying to sell me something?

Monthly referral commissions will be paid on the 10th day of the month for all security & smart home installs that are completed during the previous month. You can track your referrals via your portal account.

No! We compare your available home services side-by-side so you can select the ones that fit your needs. Totally free of charge.

How will my clients find out about NAF Concierge?

You choose which services you want ; we do not push any one service. And we’re up to date on all of our providers’ available specials and discounts, to make sure you get the best rates

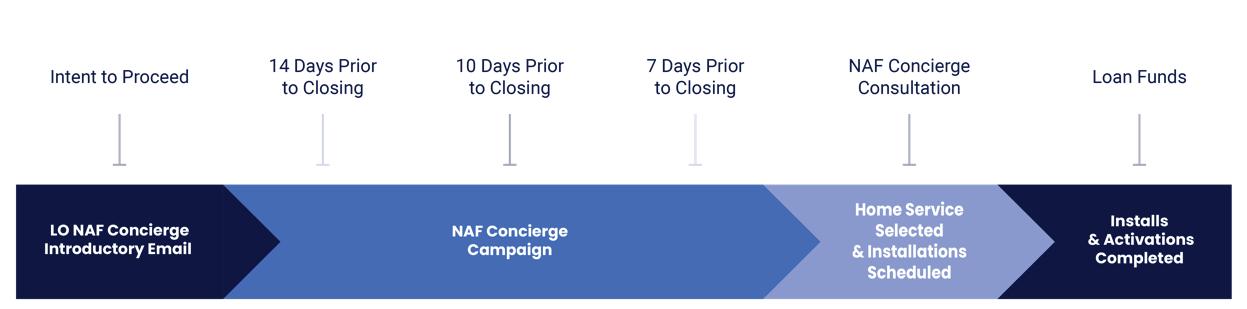

An introduction email will be sent to your clients on your behalf once the loan reaches the Intent to Proceed milestone. No action will be needed of you as this process is fully automated.

Where can I find additional information about NAF Concierge?

Is NAF Concierge able to disconnect my current services?

You can find up-to-date information and resources by visiting the NAF Concierge SharePoint page. And as always, please reach out to StrategicPartnerships@nafinc.com with any questions or feedback.

We’ll take care of this when your provider allows us to do so. However, most providers will require the customer to handle this step . In many cases, we are able to process disconnections if you are reconnecting/transferring service with the same company.

How soon should I set up my home services to ensure they are connected by my closing date?

To ensure timely connections & installations, it’s important to schedule your initial NAF Concierge consultation a minimum of 10 days in advance of your closing date

What happens if my closing date changes?

If your closing date changes, just give us a call and we will make sure all of the service providers you selected are updated.

We will stay with you from start to finish!

What are the

Normal business hours are 8:00 am to 6:00 pm CST. Monday through Friday.

If you need let us know and we’ll provide you emergency contact numbers during the initial consultation

Who is the partner that helps power NAF Concierge?

OneSource Solutions is NAF Concierge’s whole home service partner. OneSource is one of the largest authorized retailers for many top providers like AT&T, Spectrum, ADT, Vivint, and more. All marketing and outreach will be white labeled as NAF Concierge, so it is u nlikely you or your customers will ever see or hear the name OneSource.

Does NAF Concierge charge a fee?

Absolutely not! The service is provided completely free of charge.

Additional questions?

How does NAF Concierge make money if the service is free?

Email the NAF Concierge Team!

OneSource makes money from helping set up all the premium services such as internet, cable, phone, and/or Security.

connect@nafconcierge.com

Are my clients being charged a markup for certain services?

No, the prices and promotions are , at a minimum, the same as they would see if they were to shop on their own. In many cases, clients will receive special pricing and promotions by working with NAF Concierge For example, NAF Concierge customers will receive at least $850 in free security equipment and installation.

What’s the process for my clients?

It’s simple

and installation.

It’s simple you can refer customers directly to NAF Concierge, or we will reach out your client beginning 2 weeks prior to their scheduled closing date.

On the initial consult, we’ll briefly walk through the process and confirm the home services they’d like help with. We’ll then research all available providers and packages in their area, and schedule a follow-up time for the customer to make selections and schedule installations.

How do I refer my customers to NAF Concierge?

LOs have three options for referring customers to a concierge agents

1. AF Concierge Number: 877 -804-0833

2. portal.osconnects.com

3. Or, email connect@nafconcierge.com

What’s in it for NAF Loan Officers?

LOs will receive $100 for every customer referral that installs a home security or smart home system through NAF Concierge!

Additionally, the NAF Concierge offering will lead to increased customer satisfaction and engagement, significantly improving long -term customer retention.

How will I receive the $100 LO incentive when my customers work with NAF Concierge?

Monthly referral commissions will be paid on the 10th day of the month for all security & smart home installs that are completed during the previous month.

You can track your referrals via your LO portal online portal link

Where can I find additional information about NAF Concierge?

You can find up-to-date information and resources by visiting the NAF Concierge SharePoint page.

14 DAYS PRIOR TO CLOSING EMAIL

10 DAYS PRIOR TO CLOSING EMAIL

7 DAYS PRIOR TO CLOSING EMAIL

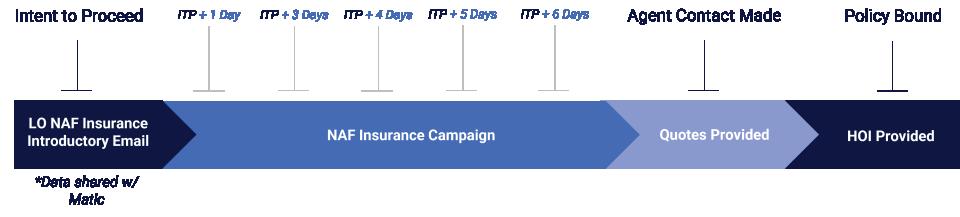

We are excited to announce NAF Insurance, our newest product offering within the NAF Concierge partnership umbrella. This new initiative will redefine how NAF approaches home insurance, for both new and servicing customers.

And, as is the case with all of our NAF Concierge offerings, this is a 100% complimentary service!

Consumer Landing Page

Powered by Matic, NAF Insurance streamlines the home insurance shopping process, allowing customers to compare quotes from 40+ top-rated insurance providers in a matter of seconds.

Once the customer obtains the policy they need at a great low rate, their proof of coverage will be sent directly to NAF, ready and waiting for our operations teams. No need to go chasing down customers or agents anymore!

Digital Marketplace

Simplified, online experience to compare, select and bind insurance policies – helping save customers up to 75% less time

Detailed Insurance Experts

100+ insurance agents readily available to assist customers with finding and selecting the best policy options

Carrier Agnostic Options

Allow customers to choose from multiple national carriers, including bundled options, to save and optimize their coverage

NAF Insurance is powered by Matic. Who is Matic?

Matic is one of the largest and fastest growing digital insurance agencies in the U.S, offering a transparent, unbiased approach to insurance – all embedded right within the mortgage process. Matic’s is a tech-enabled insurance marketplace helps you shop insurance across an extensive network of 40+ carriers. To learn more, you can visit Matic.com or compare quotes at nafinsurance.com.

How much does it cost?

NAF Insurance is a totally complementary service. There are no extra fees to work with us, so clients only pay same, state-regulated premiums offered by the insurance carriers

What types of insurance does NAF Insurance offer?

Being a mortgage company, of course the NAF Insurance focus is on home insurance. However, we can bundle auto, flood, wind, motorcycle, boat, RV, renters, life, pet, and more! Typically, the more a customer bundles, the more they will save.

How do clients get a quote?

NAF Insurance works with Matic to seamlessly embed insurance shopping in the mortgage process.

➢ New mortgage customers will receive an email shortly after providing Intent to Proceed that will direct them to a unique, personal insurance experience, without the need for an application

➢ They may also call Matic directly at (866) 478-3894 or visit nafinsurance.com

➢ Existing mortgage customers will receive a series of emails prior to their current policy expiration that will direct them to a unique, personal insurance experience, without the need for an application.

➢ They may also call Matic directly at (866) 875-5103 or visit nafinsurance.com.

Will insurance offers be sent to both new purchase and refinance clients?

Eventually. At this time, only purchase customers will receive the automated insurance journey, but refinance customers are welcome to take advantage of the offering, as we look to include them into the automated process.

My client purchased a policy through NAF Insurance. How do I get the documents I need?

Once your client purchases their policy , Matic takes care of the paperwork for you! The declarations page and all key insurance information will be uplo aded directly into Encompass and be ready and waiting for you.

For existing mortgage loans, Matic will also provide evidence of new insurance directly to NAF.

Will getting a quote affect my client’s credit score?

No - getting a quote or purchasing a policy through Matic will not have any impact on credit score.

How much can my client save by shopping with NAF Insurance?

Clients save $500+ annually with Matic on average over their existing policy

Will Matic sell my client’s information to other companies?

No, Matic will never sell your client’s information, and they won’t be contacted by carriers directly.

How can I refer a customer to Matic?

Warm transfer to (614) 664-7349 or email HOI@matic.com

How do I request changes to an existing policy?

Call (844) 431-6454 or email closing@matic.com

What customer information does Matic need for referrals and policy changes ?

- For sales referrals: Name, phone , email and loan number.

- For policy changes: Name, phone, email, loan number and the change being requested.

- If there is time sensitivity on either type of request, please include the "need by" info and tag "Urgent Request-NAF" in the subject line.

The more you save, the lower your monthly mor tgage payment will be. Link your bank account, monitor your spending, gain spending insights, and create a budget.

strengthen your credit and correct any errors. Work with a loan coach who knows credit like their ABCs.

The amount of debt you have compared to your income is one of the most impor tant factors for

• Get a $500 lender credit if you close on a home with New American Funding within two years of signing up with Uqual.

• Get access to 1:1 coaching from a team of exper ts who is obsessed with your loan success.

• Gain access to a Loan Readiness Score that shows you how close you are to reaching your loan goal.

It star ts with a 1:1 call with an exper t, giving you a clear path forward. Using ar tificial intelligence, we analyze your finances to create a strategy that will guide you on your path to loan readiness.

When we’re on your side, you’re on your way. We include an Action Plan that shows you step by step what you need to do to progress towards your goals. Plus, we accompany you to encourage and coach you throughout your journey

We don’t just help you achieve your mor tgage, we empower your financial future. As you progress in our program, you open new doors of oppor tunity to create wealth and be the best version of you, relieved of financial stress.

Talk to your New American Funding loan officer today

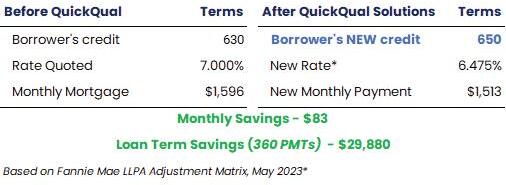

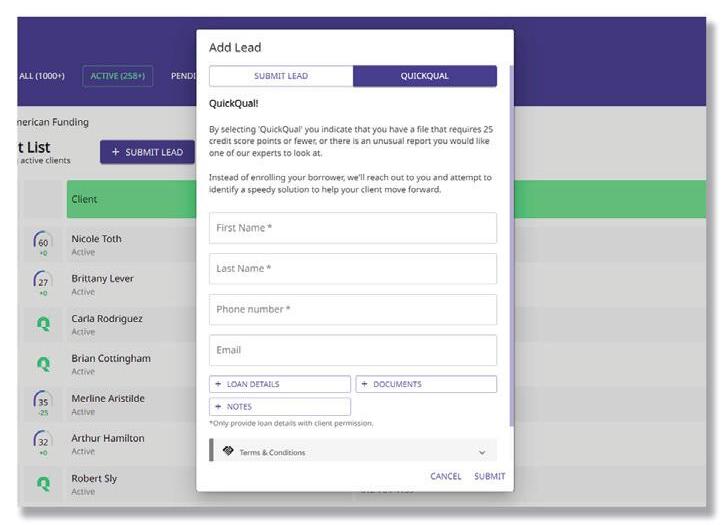

We remain hard at work with our amazing partner, Uqual, to help as many NAF clients and families as possible become loan ready. Today, we’re happy to announce another tool for loan officers to help more borrowers in their home financing journey. This new tool will provide loan officers with a speedy solution for credit score increases of 25 points or less. See below for more details on this outstanding new program!

*No costs for loan officers or borrowers*

*No enrollment requirement*

*< 24-hour turnaround time*

QuickQual Benefits

• For borrowers needing minor credit improvements of 25 points or less

• Credit solutions directly from a Uqual credit expert within 24 hours

• No enrollment requirement or costs for your borrowers

• Improved credit scores reduce LLPA costs for your borrower

1. Log into your Uqual portal, or create one in just minutes.

2. Select Submit Lead then click QuickQual option tab.

3. Within 24 hours a Uqual credit expert will follow up with solutions to help your borrower get the credit boost they need!

https://vimeo.com/792393484/db292fb903

https://vimeo.com/644893650

Aligns with NAF mission by helping those in underserved communities

Helps clients achieve their goals

An investment in yourself

Coaching for financial literacy

Initial free consultation examines the client’s digital assets (including crypto) to calculate the DTI and how it affects saving for down payment

Examines the client’s entire financial situation to analyze and explain what is hurting them financially

Advise which accounts to pay down Charge off accounts to pay off per how they are affecting the credit score

Don’t pay off accounts with the oldest credit history as it hurts rather than helps

FinTech tools to quantify and track progress

Human contact more than once a month

UQUAL gears to qualify for FHA (3.5% down payment)

Average of 4-5 months to be considered “mortgage ready”

$500 lender credit from NAF when customer comes back

Around 3,000 transfers per month goal

10 –20% should be loan ready in 4-5 months

nafPathteam needs Maxwell or BV lead created to ensure customer comes back to you!

The more detail you can give the Uqual agent, the greater the success

Create a lead in Maxwell or BV

nafPathteam will monitor all incubating customers and route yours back to you…but they need a lead in the system to do so!

UQUAL nurture email campaign kicks off when lead is inactivated for credit (nafPathwill ensure the leads are in the correct status)

Email campaign gives the customer the opportunity to click through and sign themselves up

All clients returning from UQUAL will be sent to Kley/nafPath

nafPathwill change the source code to ensure the $500 lender credit pricing and reassign the customer back to the original LO LO to follow up with the borrower: if original LO had departed, nafPath will notify the manager for team reassignment

$500 LC for staying with you / NAF!

Be on the lookout every Friday for the UW Tip of the Week from Alexis Lyner. In Case You Missed Them... Here are the UW Tips of the Week that have been sent so far...

Gifts of equity can only be given by family members.

Fannie & Freddie define family members as anyone related to the borrower by blood, marriage, legal adoption, or guardianship; or a fiancé, fiancée, or domestic partner.

FHA defines family members as: child, parent, or grandparent, whether by blood or marriage, legal adoption, or guardianship; spouse or domestic partner; sibling by blood or marriage; aunt or uncle; foster child.

FHA’s definition of family member is more restrictive than Fannie/Freddie. Fiancé/fiancée is NOT considered a family member for FHA, neither is cousin.

If a borrower is currently renting the home they are buying, and the seller intends to give them back a portion of the rent they have paid at closing, the following guidelines apply:

The appraiser must provide the fair market rental value of the home. Only the amount the borrower has been paying that exceeds this amount can be credited at closing.

Example: borrower is renting the home for $1200/month. Appraiser states fair market rental is $1000/month. The allowable rent credit is $200 per month. The rent payments must be documented with the original lease reflecting the rent, and cancelled checks or similar documentation for the length of time the borrower has rented.

Note: USDA does not allow rent credits, they are considered a reduction in purchase price. FHA, VA, Fannie, and Freddie all allow.

PATHWAY 100 OFFERS A 2ND LIEN FOR 3.5% OR 5% AS DOWN PAYMENT ASSISTANCE ON FHA AND USDA PURCHASES.

WHEN TO USE:

• BORROWERS WHO NEED DOWN PAYMENT ASSISTANCE IN CONJUNCTION WITH AN FHA OR USDA LOAN.

HIGHLIGHTS:

• DELEGATED UNDERWRITING – UNDERWRITTEN & CLOSED IN HOUSE

• NO INCOME RESTRICTIONS

• NO FIRST TIME HOMEBUYER REQUIREMENT

• NO DTI LIMIT, PER AUS OR PER MANUAL UW GUIDELINES

• DPA IS STRUCTURED AS EITHER 5 YEAR FORGIVABLE OR 10 YEAR REPAYABLE

• FUNDS MAY BE USED FOR DOWN PAYMENT, CLOSING COSTS, & PREPAIDS

• NO MINIMUM CASH REQUIRED FROM BORROWER

• MINIMUM CREDIT SCORE 620 FOR 5 YEAR FORGIVABLE, 660 FOR 10 YEAR REPAYABLE, AND 680 FOR MANUFACTURED HOMES UNDER EITHER PROGRAM. EACH BORROWER MUST HAVE AT LEAST ONE SCORE.

• MANUAL UNDERWRITING ALLOWED ON THE 5 YEAR FORGIVABLE PROGRAM ONLY

• ELIGIBLE IN ALL NAF LICENSED STATES EXCEPT NEW YORK

• 2-1 TEMPORARY BUYDOWNS ELIGIBLE

• LOAN MUST BE APPROVED BY UNDERWRITING TO BE LOCKED, MAX LOCK PERIOD IS 15 DAYS

• ELIGIBLE PROPERTY TYPES ARE SINGLE FAMILY, CONDO, PUD, MANUFACTURED HOMES. 2 UNIT PROPERTY AVAILABLE FOR FHA ONLY. NO 3-4 UNITS.

• NOT ELIGIBLE WITH NAF CASH, NAF OTC, OR FHA 203K

• NO ADDITIONAL LIENS ALLOWED BESIDES THE PATHWAY 2ND LIEN; CANNOT BE STACKED WITH BOND PROGRAM OR ANY OTHER DPA THAT RECORDS A SUBORDINATE LIEN.

ALEXIS LYNER

CREDIT POLICY MANAGER/SR. UNDERWRITER