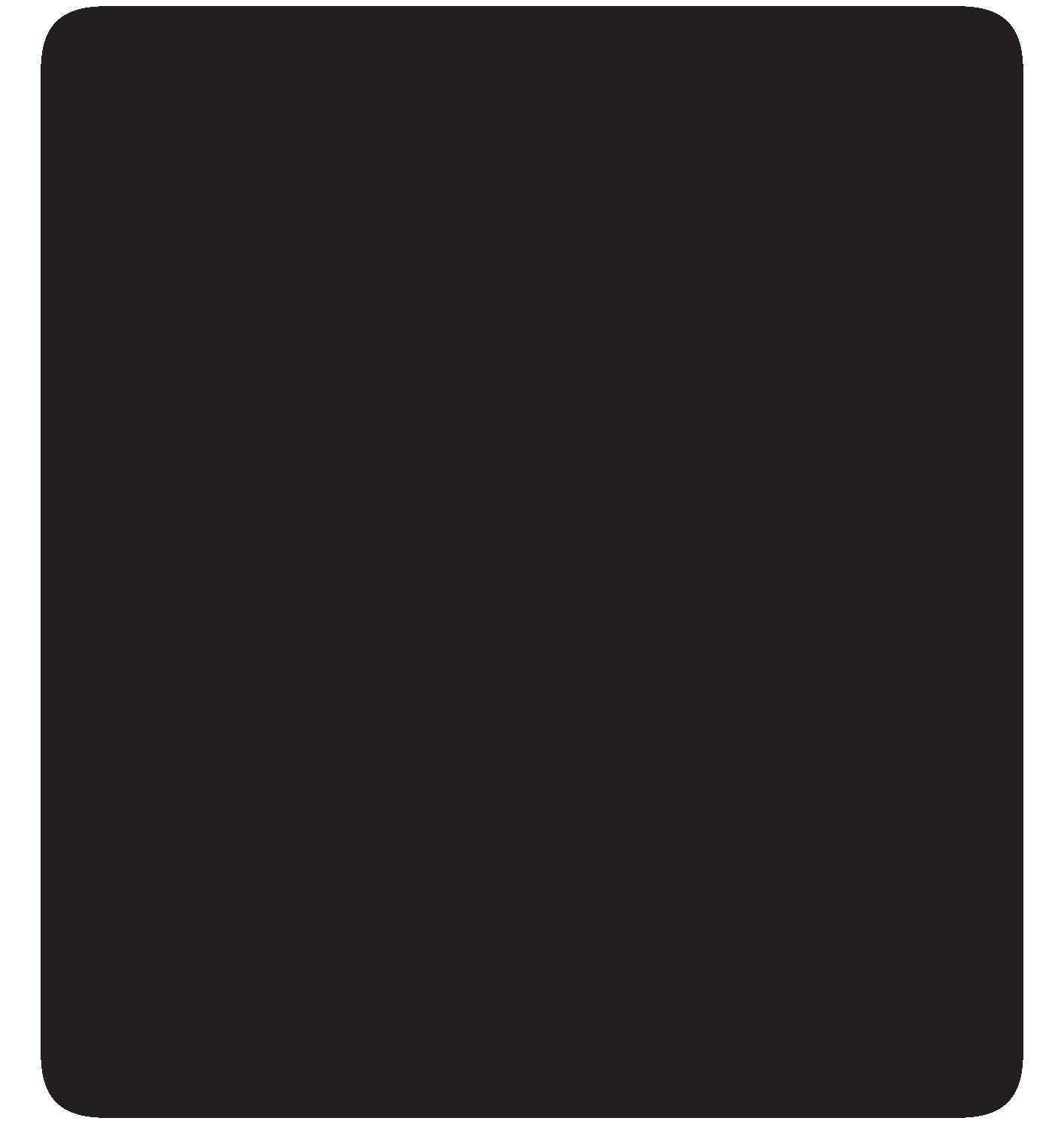

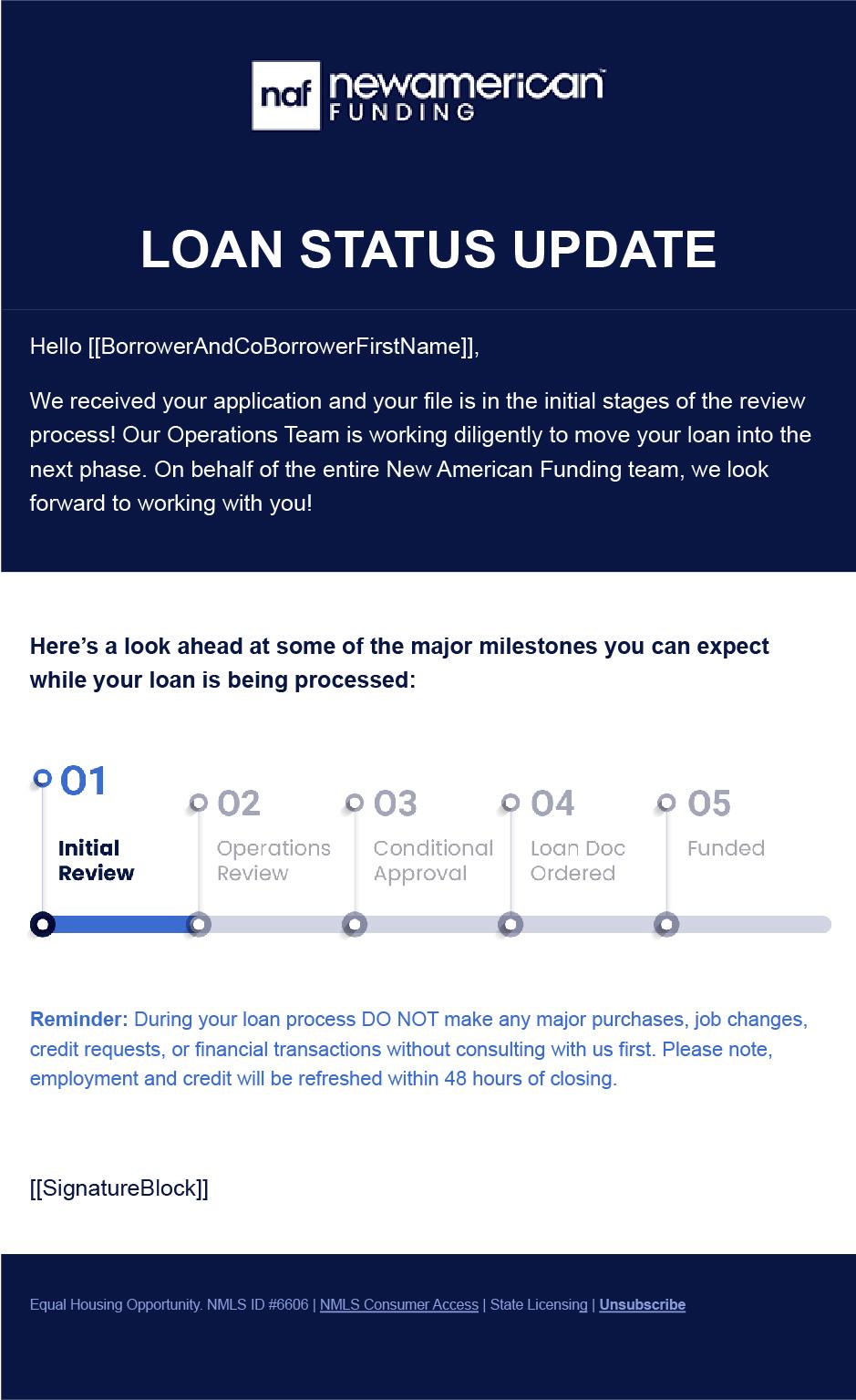

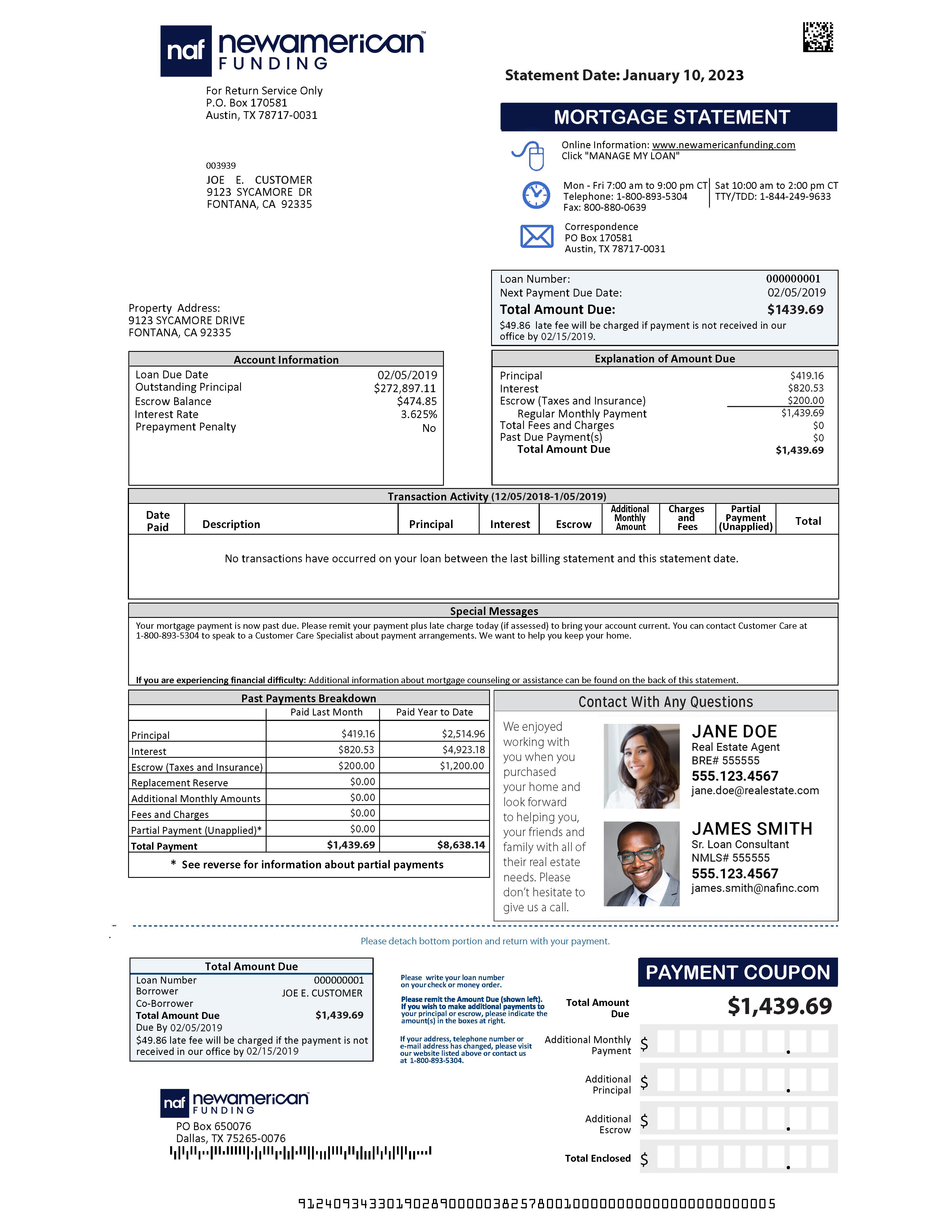

New American Funding keeps you top of mind with co-branded Loan Status update emails to keep the client in the loop every step of the way.

Co-branded closing cards are mailed to our mutual clients with information on how to download closing documents.

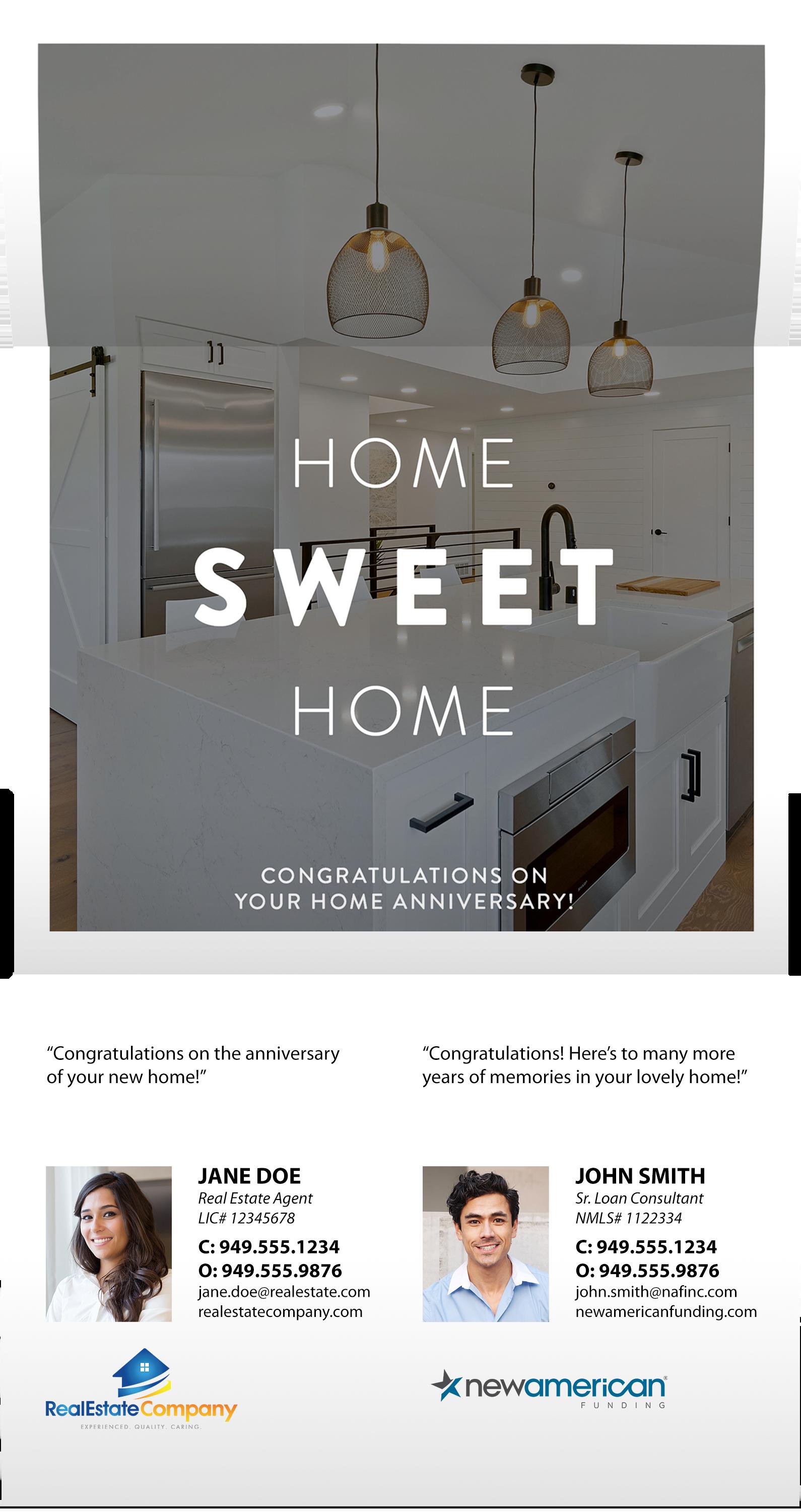

Personalized co-branded greeting cards sent to clients for years after a loan closes on birthdays, holidays and loan anniversaries.

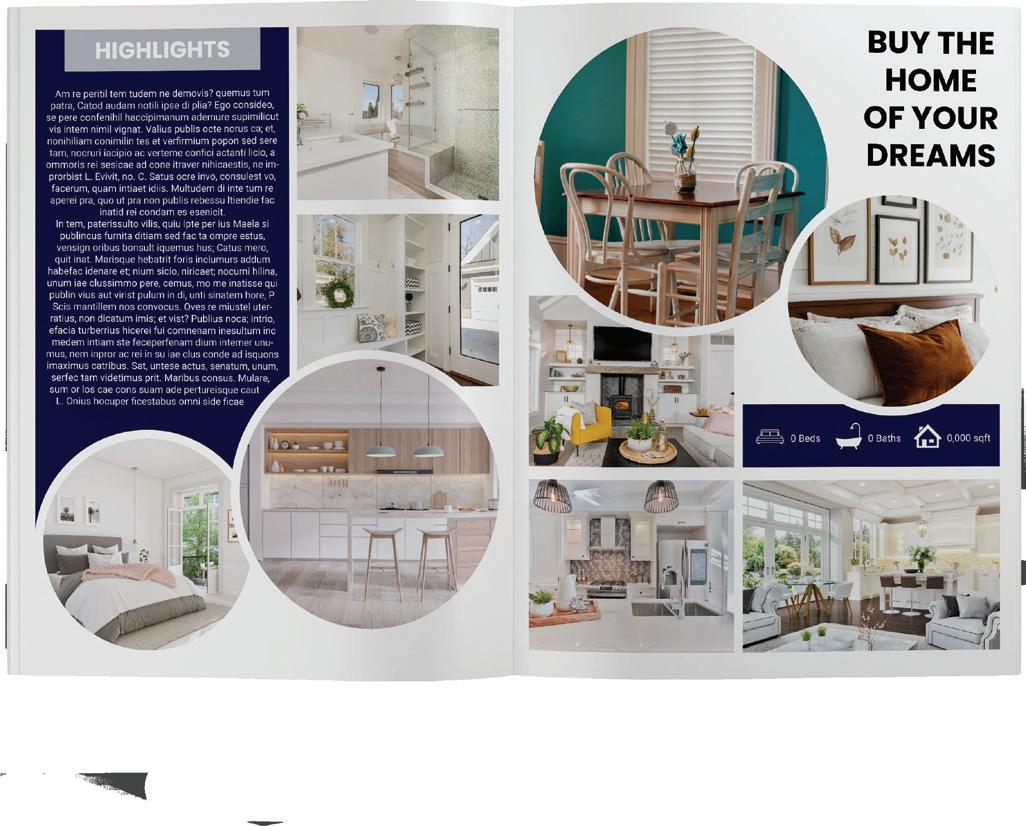

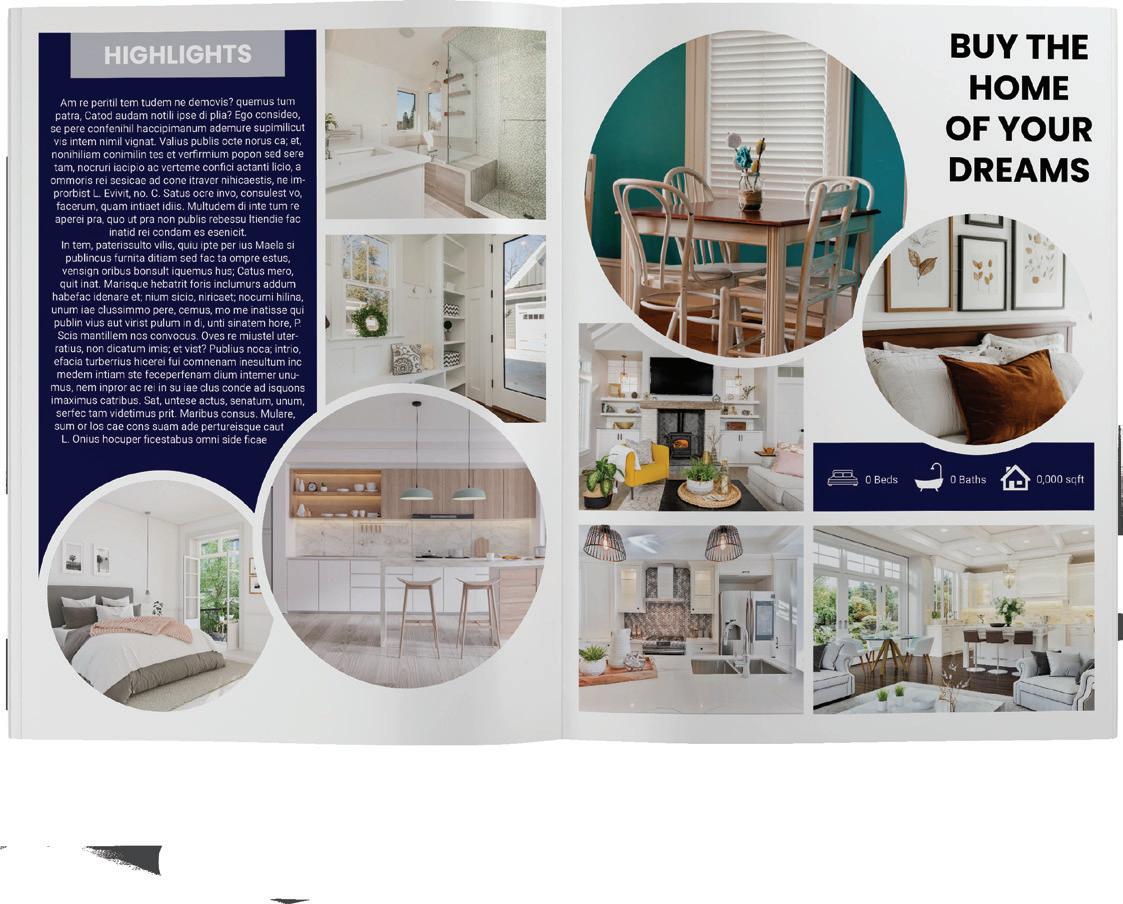

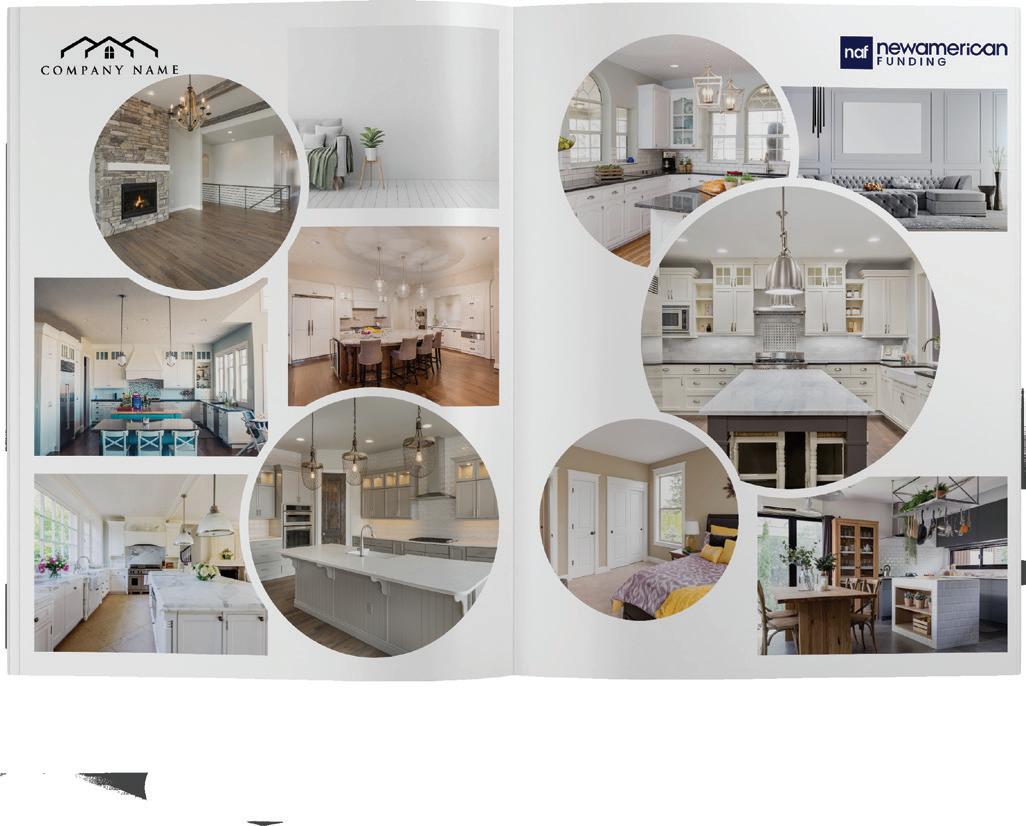

Turn any of our booklets into a virtual flipbook to send digitally to clients via text or email. Scan to see an example.

• Down Payment as Low as 3%

• Fixed or Adjustable Rates

• Down Payment Assistance Programs Available

• Non-Occupying Co-Borrowers Allowed

• Down Payment as Low as 3.5%

• Lower Credit Score Flexibility

• Higher Allowable Debt to Income Ratios

• 100% Financing with DPA

VA

• 100% Financing

• No Monthly Mortgage Insurance Premiums

• Flexible Underwriting Guidelines

USDA

• 100% Financing

• Lower Credit Score Flexibility

• Gifts for Closing Costs Allowed

• Borrow up to $3 Million

• Credit Score as Low as 700

• Eligible for Primary Residence, Second Home or Investment Property

• Warrantable and Non-Warrantable Condos Permitted

• FHA and Conventional Programs

• Purchase or Refinance

• Principal Residence, Second Home or Investment Property

• Ability to Finance Repairs and Home Improvements

• Allows Buyer to Become a Cash Buyer

• Buyer Can Purchase New Home Without Selling Current Home

• Conventional and VA Loans Allowable

• Lock In Your Rate - Rate Can’t Increase

• If Rates Improve during Locked Period, You Can Float Down to a Better Rate

• Self Employed Borrowers can use Business Bank Statements to Qualify

• Purchase New Home Without Selling Current Home –Exclude Payment in Debt to Income Ratio

• Purchase, Refinance or Cash-Out

• Primary, Second Home or Investment Property Eligible

• Use Equity From Your Existing Home Towards the Purchase of a New Home

• Ability to Present a Strong Non-Contingent Offer, Giving You a Competitive Edge in the Market

• No Monthly Payments During the Loan Term Reducing the Financial Stress of managing Two Mortgage Payments

• Lower Interest Rate for the First Few Years of Mortgage

• Available on Conventional, FHA VA and USDA Loan Products

• 1/0, 1/1/1, 2/1, and 3/2/1 Buydown Options Available

• Additional Funds for Down Payment and Closing Costs

• Chenoa

• Freddie Mac BorrowSmartSM

• Borrower can Reduce the Principal Balance

• New American Funding will Re-Amortize the Loan based on the Remaining Term and Payments will be Reduced

• Multiple Recasts can be Completed during the Life of the Loan

• PMI can be Eliminated in Some Scenarios

Buying in cash means convenience, certainty and could mean a cost saving too. With NAF Cash, an affiliated company of New American Funding, you can make a competitive, true cash offer that is not contingent on financing and close in as little as seven days without having to sell your current home first.

• Allows Buyer to Become a Cash Buyer

• Purchase Your Dream Home Before Selling Your Current Home

• Help Qualified Buyers Win in Multiple Offer Environment

• Conventional and VA Loan Programs Allowable

Avoid missing out on the home you really want because your current home has not yet sold. This product bridges the gap by giving you funds to cover the new purchase while finalizing the sale of your current home.

• Use Equity From Your Existing Home Towards the Purchase of a New Home

• Ability to Present a Strong Non-Contingent Offer, Giving You a Competitive Edge in the Market

• No Monthly Payments During the Loan Term Reducing the Financial Stress of managing Two Mortgage Payments

The NAF Recast allows you to buy your next home now and adjust your Mortgage balance later. With a recast, you can purchase without selling first, then apply proceeds from your sales to reduce your mortgage balance and monthly payment.

• Reduce Principal Balance and Re-Amortize Loan

• Monthly Payments Reduced Accordingly

• PMI Can Be Eliminated in Some Instances

Follow these steps to make your buyer a cash buyer with NAF Cash!

STEP 1

Get Cer tified

Join a FR EE 4 5 - minu te N A F Cash LLC training

STEP 2

Get Your Clie nt Pre -A pproved

Get your client pre - approved with New A merican Funding!

STEP 3

Complete N A F Cash Docume nts

Work with your N A F Cash Transac tion Coordinator to submit the required documents.

STEP 4

Get Ready to Write Cash Of fers

Your N A F Cash Transac tion Coordinator will notif y you once the client has been approved and they can begin making a cash of fer

STEP 5

O f fer Accepted

Close and move in quickly! At this point , you will work closely with your N A F Cash Transac tion Coordinator

Buying in cash means convenience, cer tainty, and may mean cost savings too. In fact, buying in cash may help your clients save up to 11% over those using a traditional mor tgage.1

With NAF Cash, an affiliated company of New American Funding, your buyer can make a competitive, true cash offer that is not contingent on financing and close in as little as seven days. You know what that means for you.

• Clients can buy their new home before selling their current home

• Sellers may be more likely to offer concessions to cash buyers

• Get commissions quickly

• Use potential savings to buy down interest rate

• No fees for agents

• Close on more homes faster