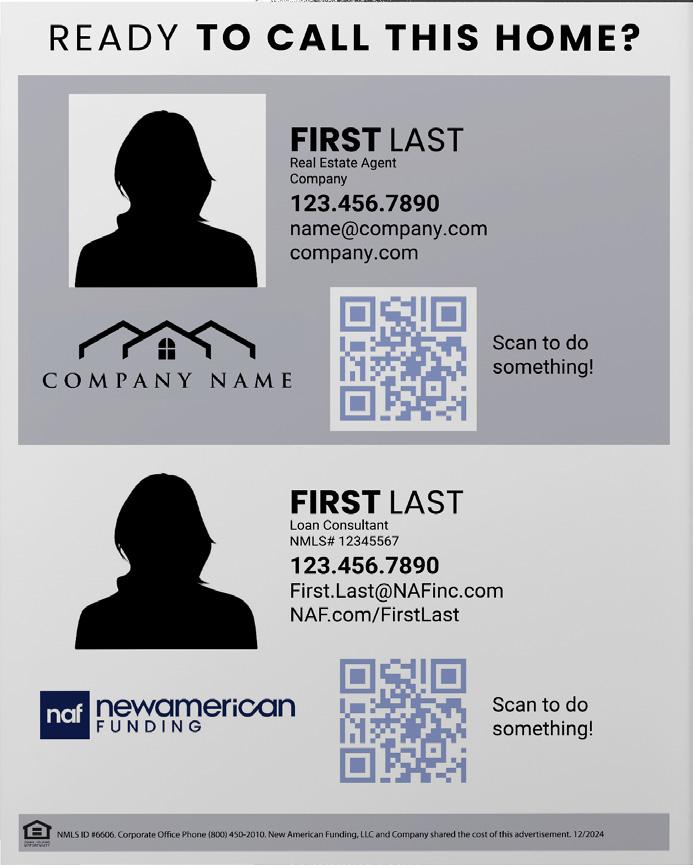

We keep you front and center before, during and after the loan closes.

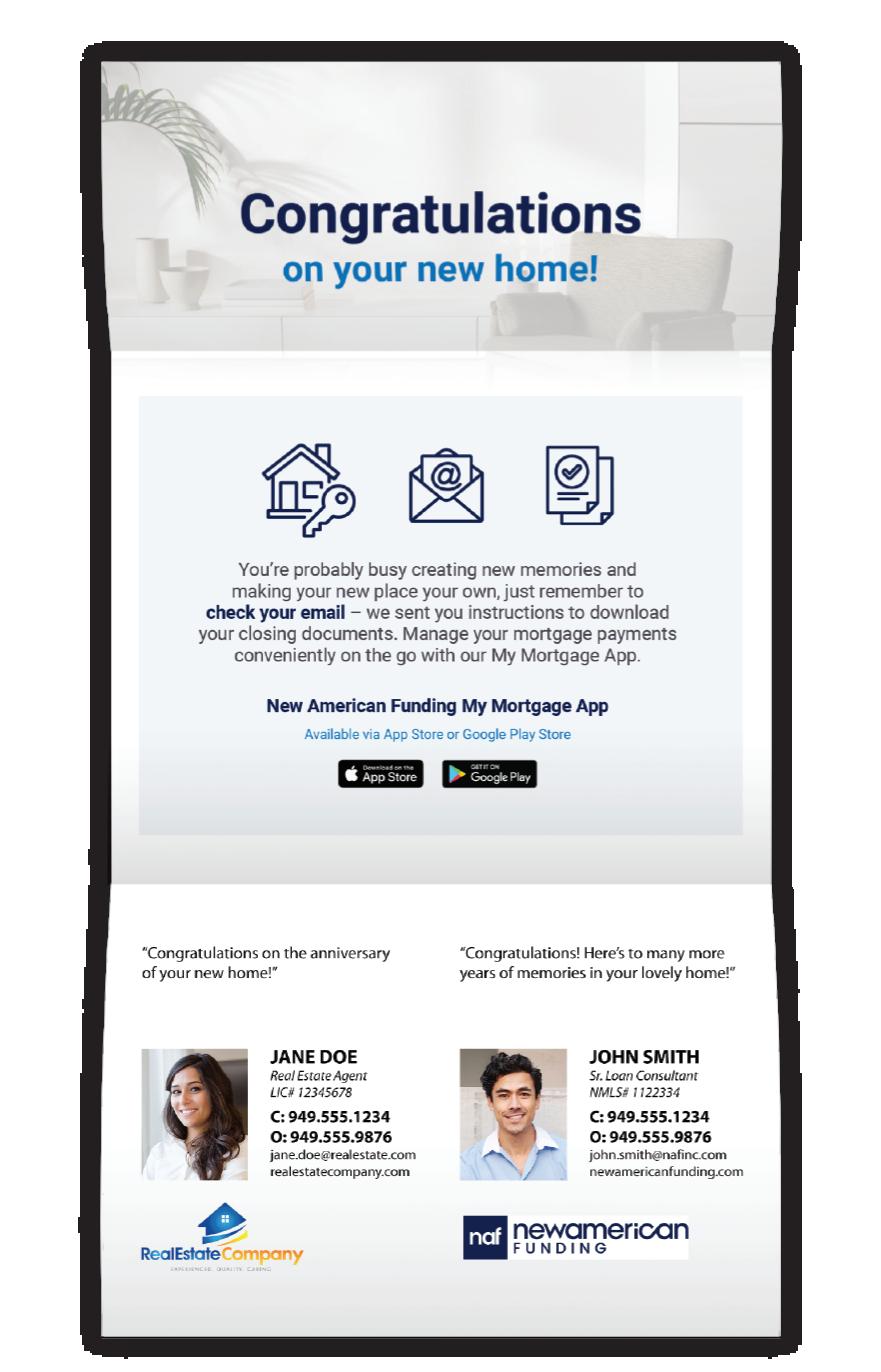

Milestone Updates keep your Buyers in the loop during the loan process, Drip E-mail Campaigns keep you top of mind after closing. Co-Branded Closing Cards are mailed to our mutual client with information on how to download Closing Documents and Payment App.

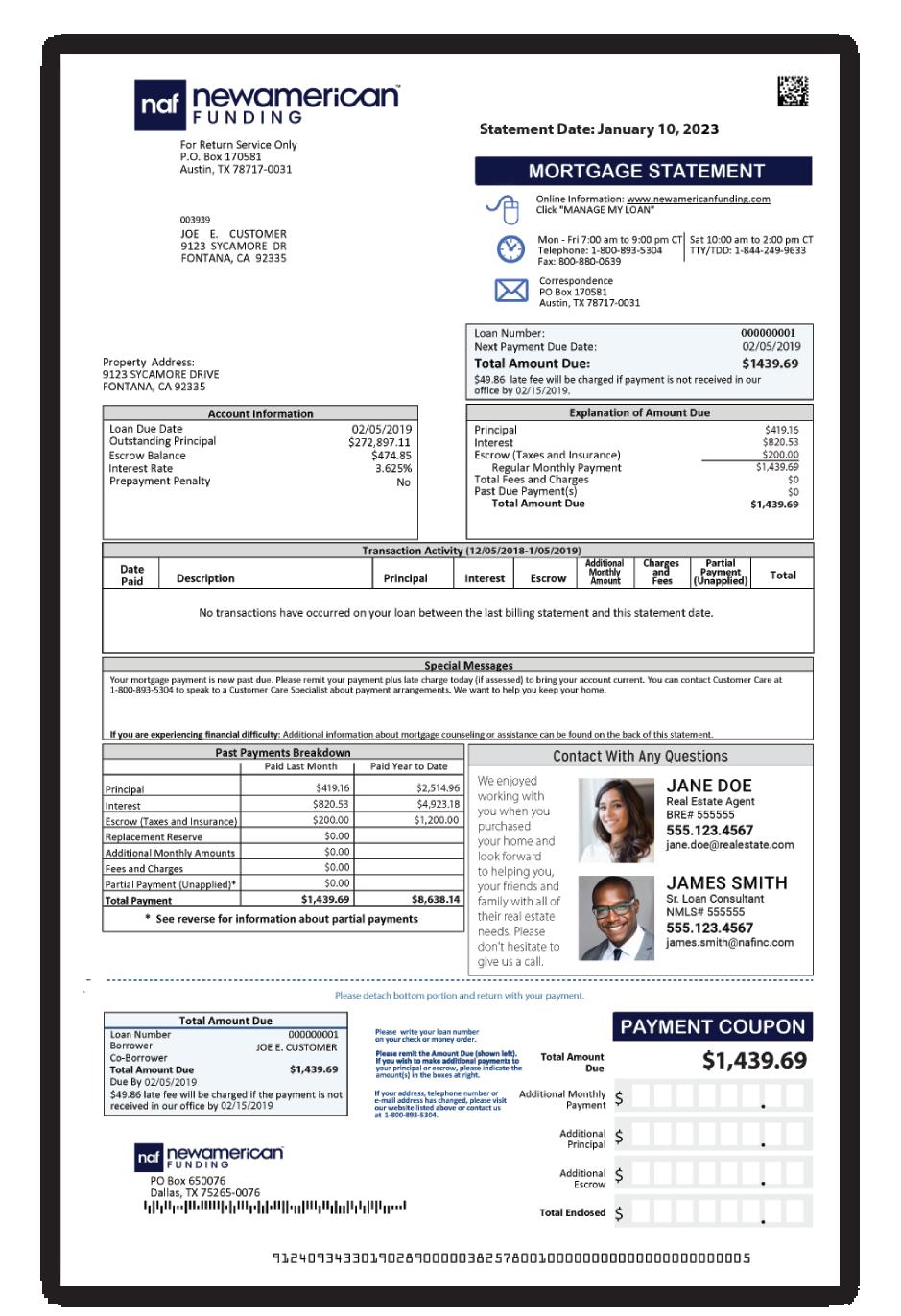

Personalized co-branded Greeting Cards sent to clients on Birthdays and Loan Anniversaries. Our Agent Partners appear on the Mortgage Statement for the life of the loan.

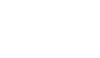

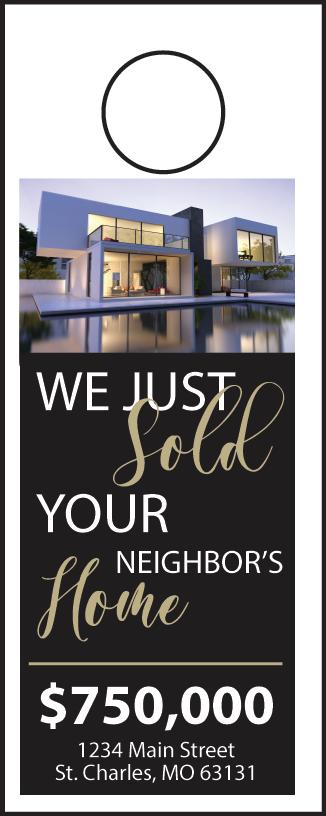

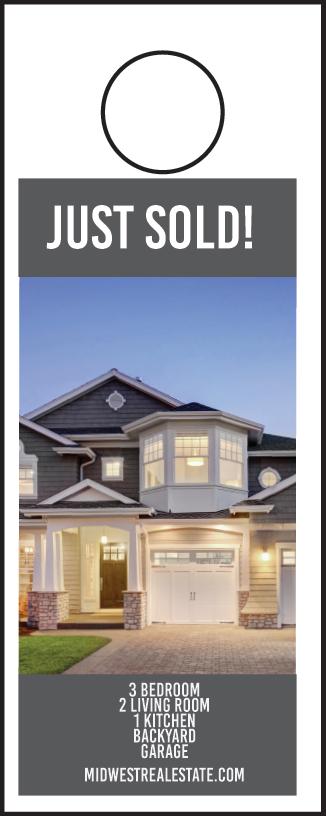

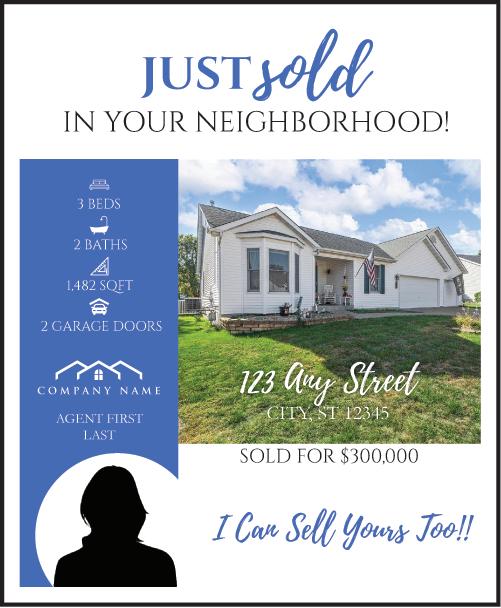

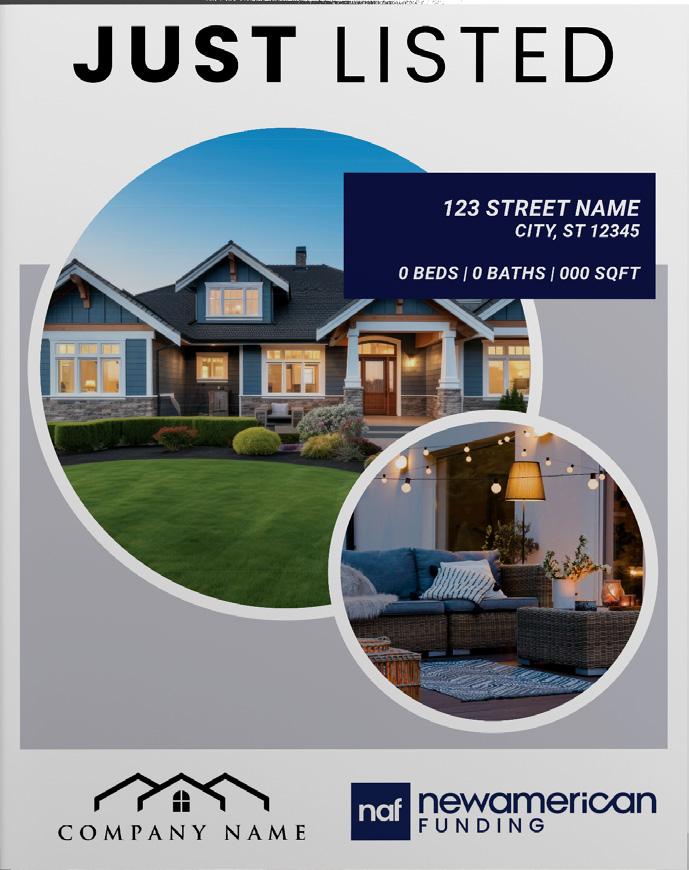

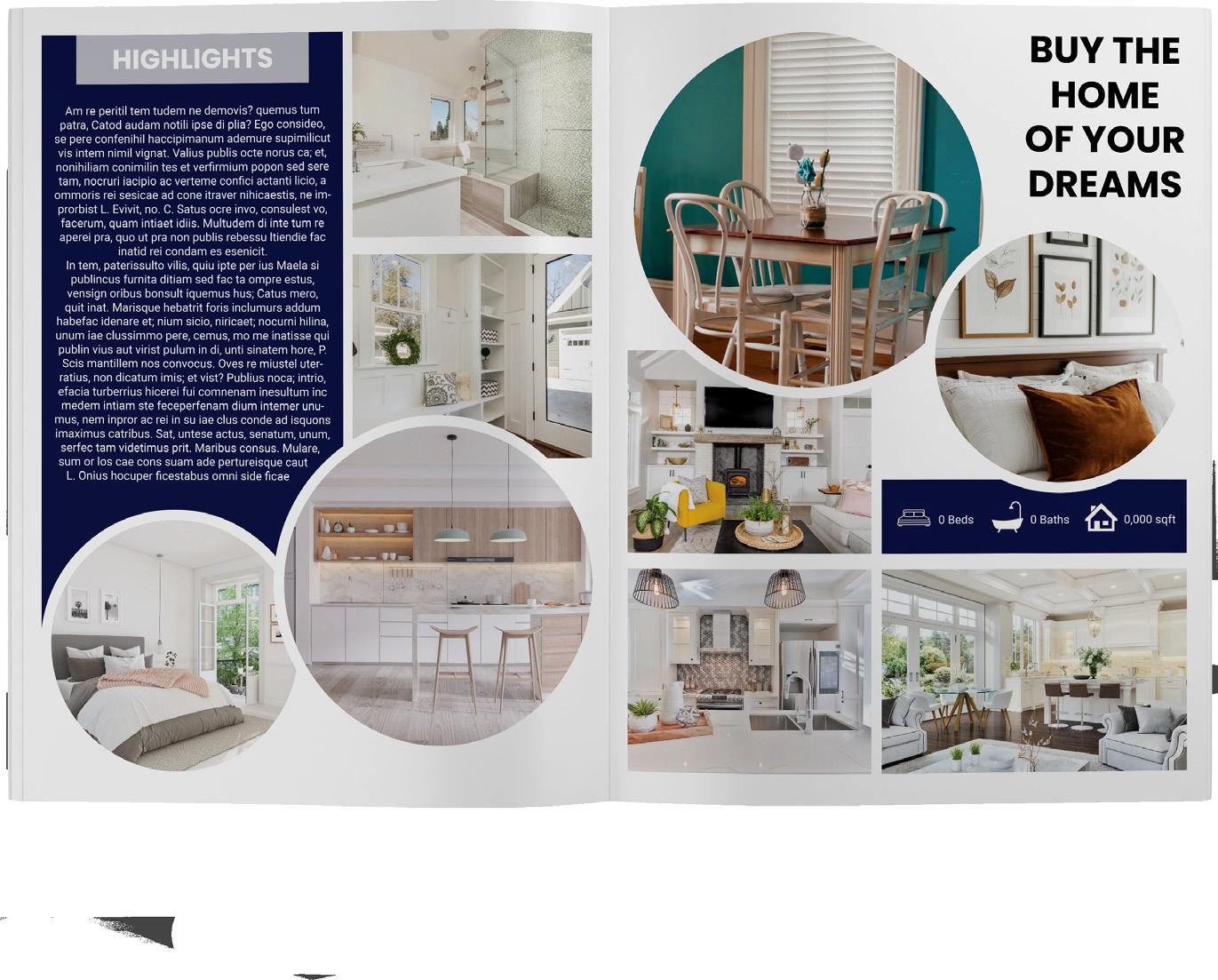

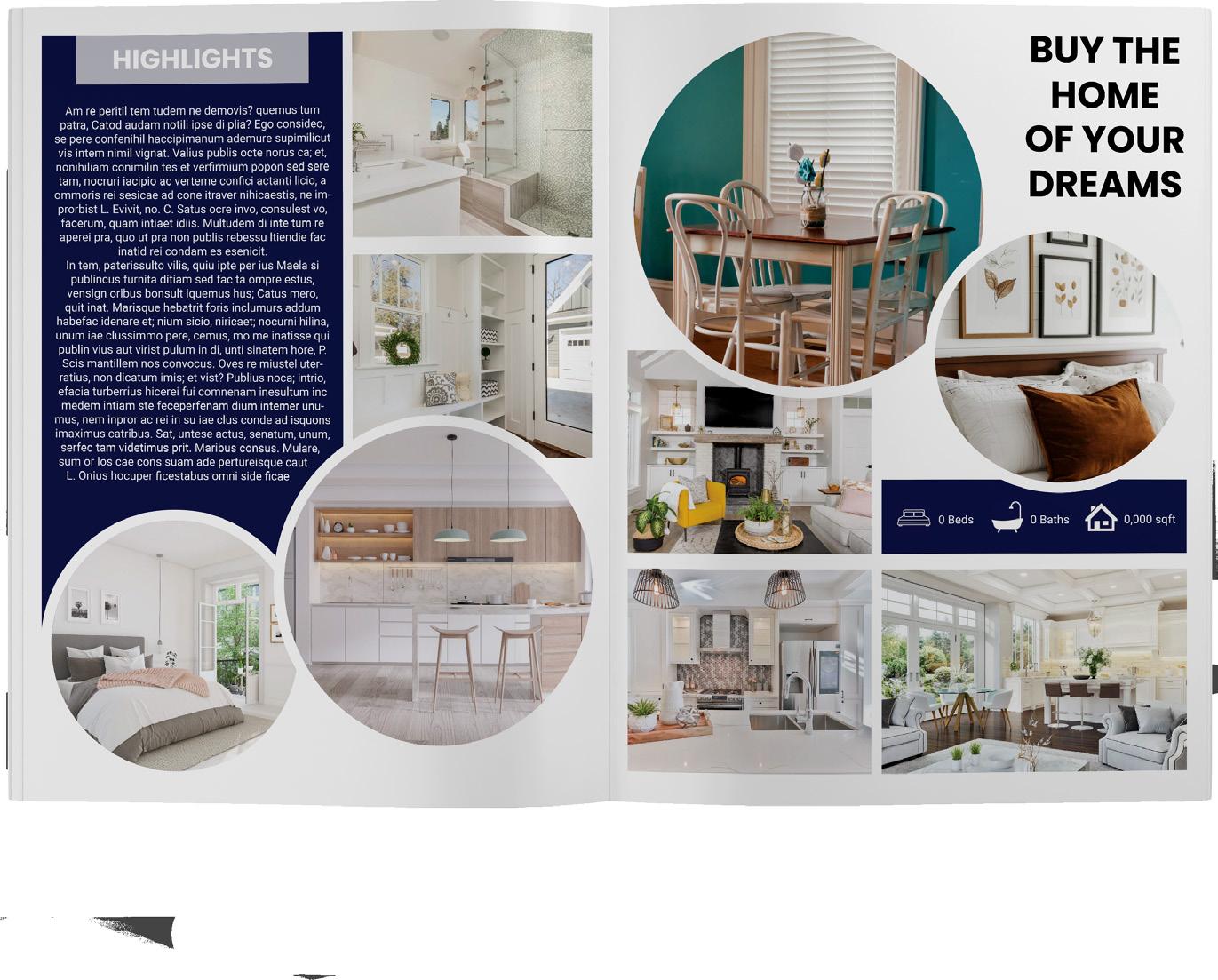

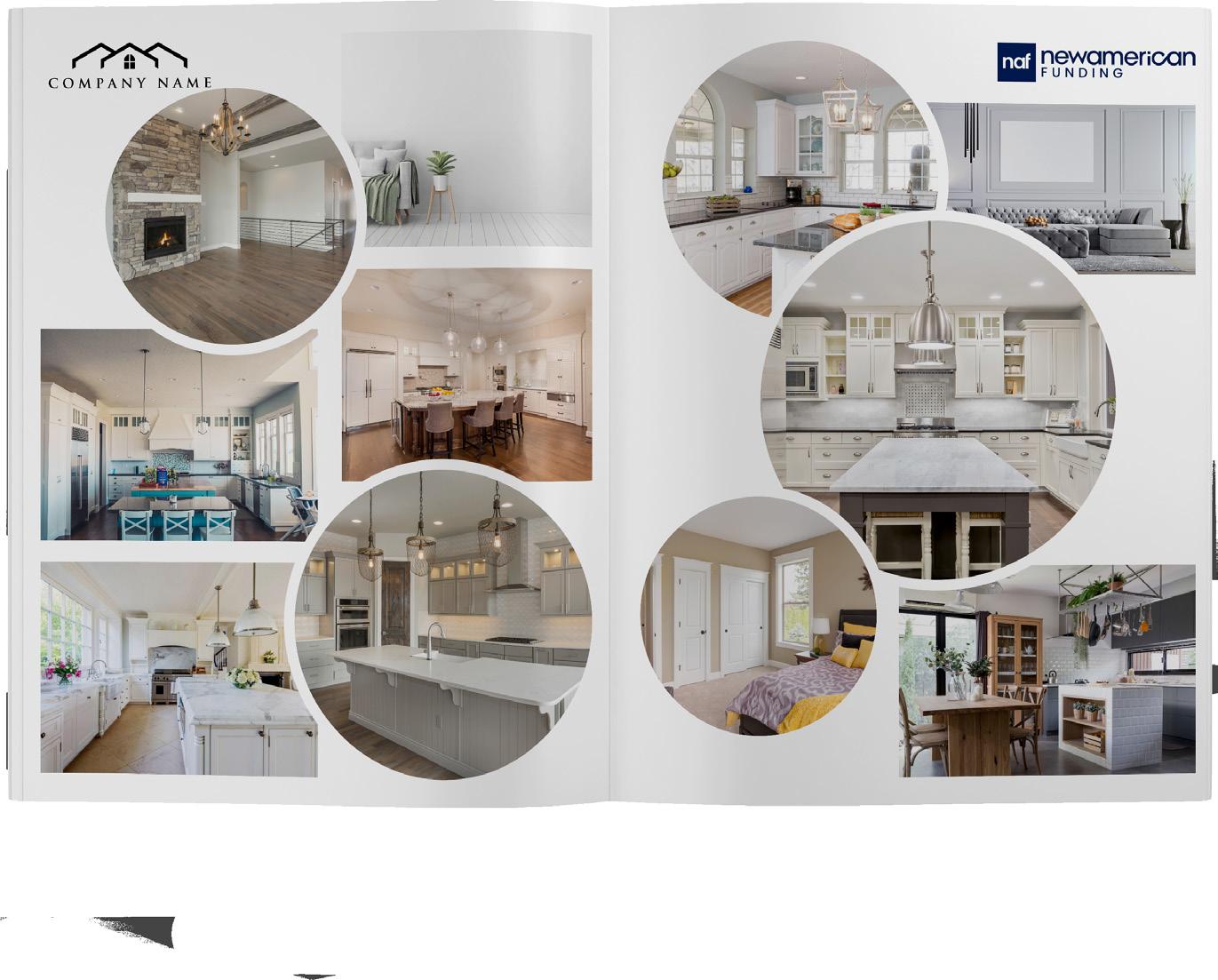

EDDM | 8.5x7 / 7x8.5

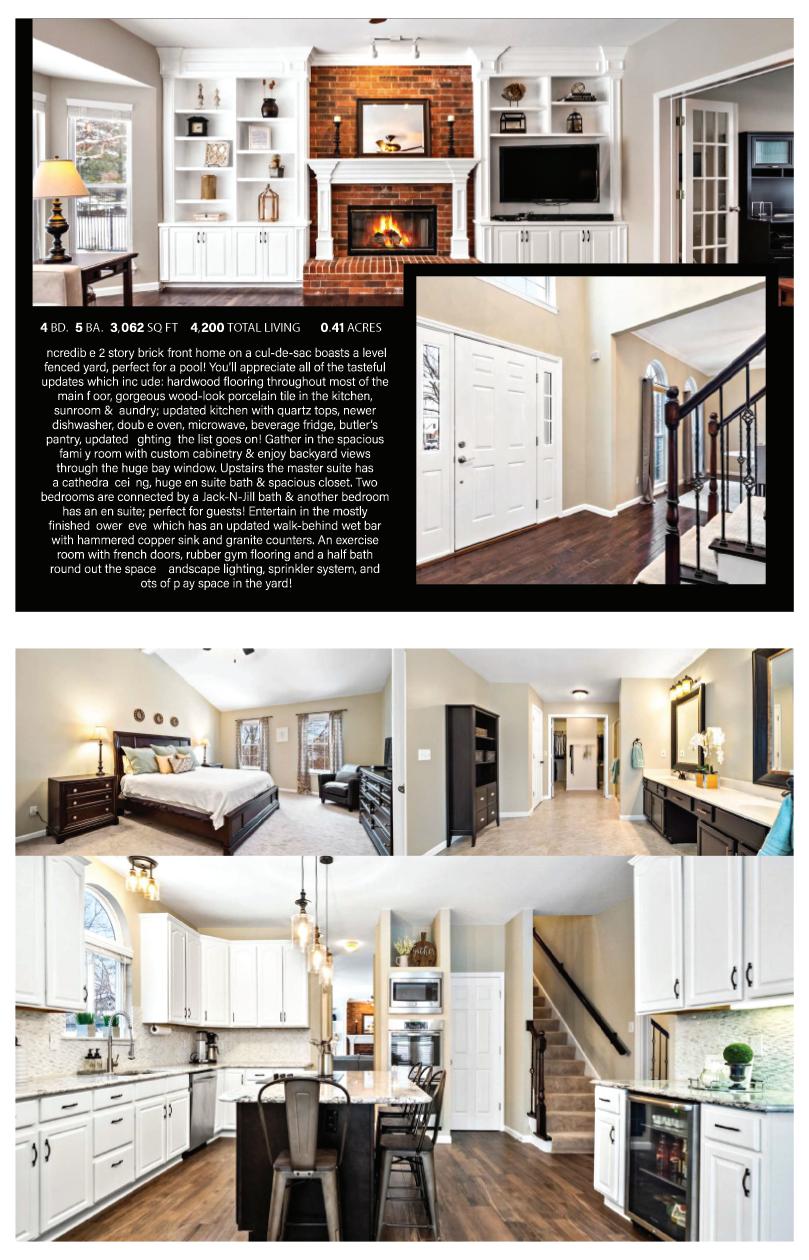

Postcard | 8.5x5.5 / 5.5x8.5

8 page

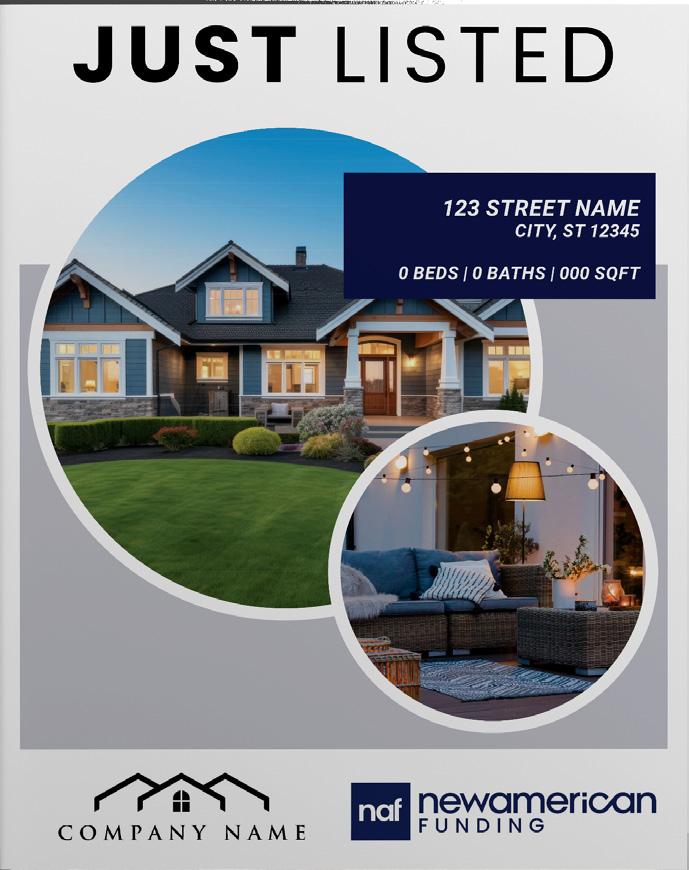

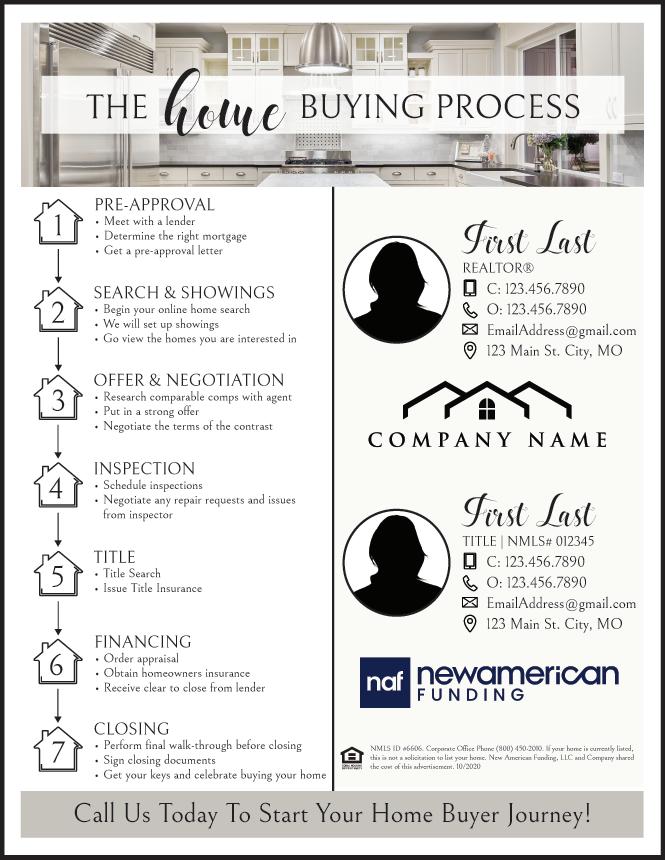

GET PREAPPROVED & FULLY UNDERWRITTEN

Get pre-approved and start home shopping.

90%

Secure your new home with a cash offer.

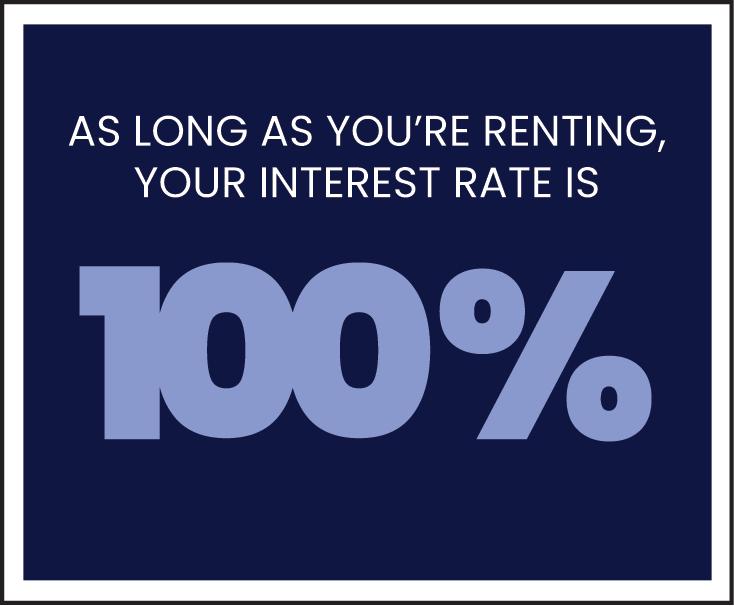

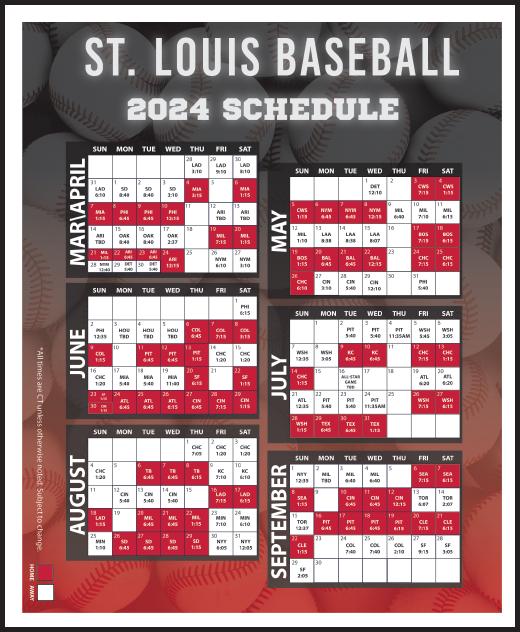

Direct Mail has an open rate of 80- 90%

Average email open rates are 20 – 30%

70% of people prefer direct mailers to email because of the emotional connection they feel receiving something physical in the mail 112%

OFFER ACCEPTED Cash offer accepted & NAF Cash purchases the home.

Direct Mail has the best ROI across all media at 112%

MOVE IN Congratulations! you’re ready to move into your new home.

55% of consumers visit the sender’s website after receiving direct mail

NAF Cash sells the home back

6606. Source: Compare Media, MarketingSherpa, and USPS.

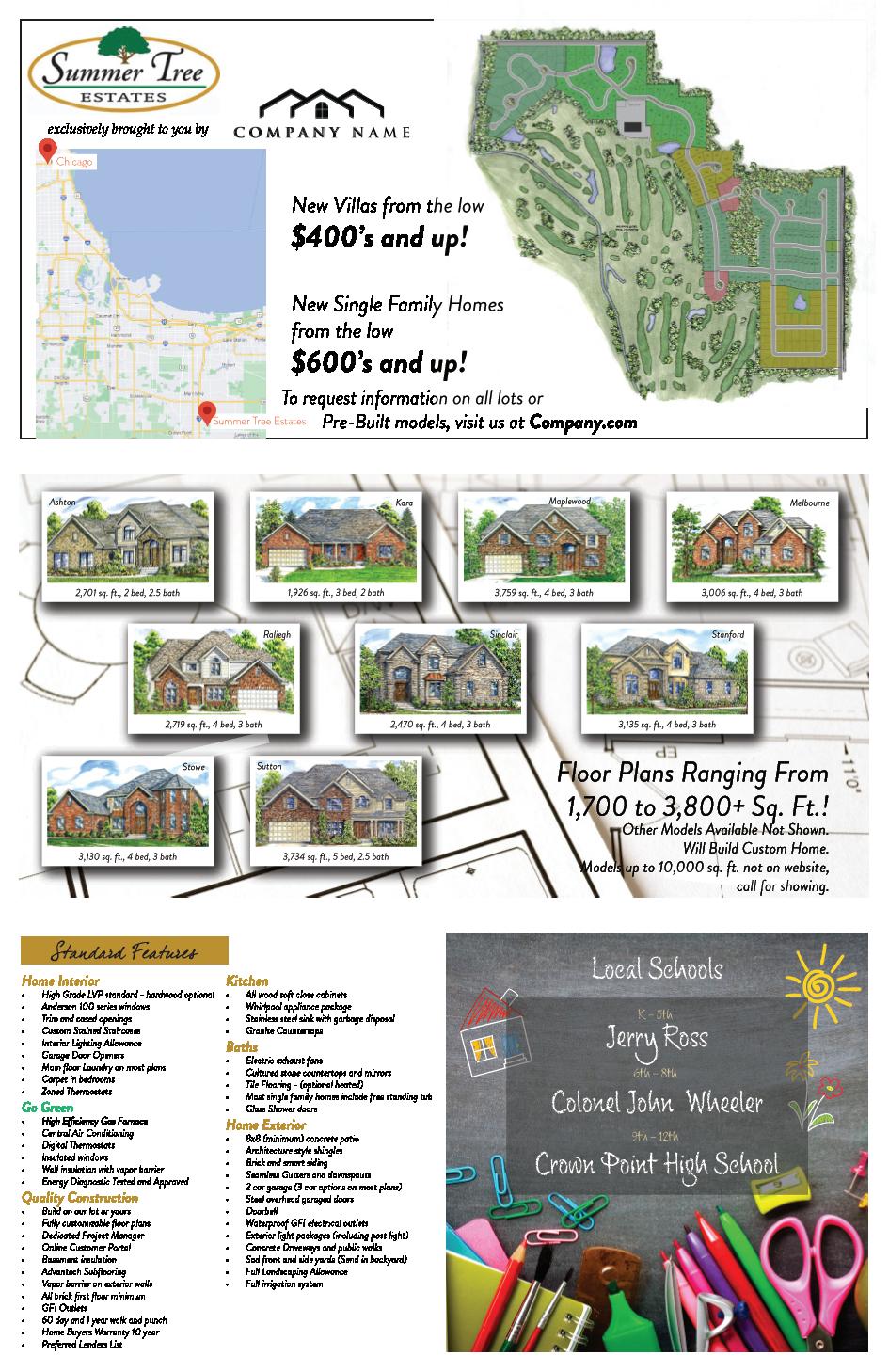

• Down Payment as Low as 3%

• Fixed or Adjustable Rates

• Down Payment Assistance Programs Available

• Non-Occupying Co-Borrowers Allowed

• Down Payment as Low as 3.5%

• Lower Credit Score Flexibility

• Higher Allowable Debt to Income Ratios

• 100% Financing with DPA

VA

• 100% Financing

• No Monthly Mortgage Insurance Premiums

• Flexible Underwriting Guidelines

• 100% Financing

• Lower Credit Score Flexibility

• Gifts for Closing Costs Allowed

• Borrow up to $3 Million

• Credit Score as Low as 700

• Eligible for Primary Residence, Second Home or Investment Property

• Warrantable and Non-Warrantable Condos Permitted

• FHA and Conventional Programs

• Purchase or Refinance

• Principal Residence, Second Home or Investment Property

• Ability to Finance Repairs and Home Improvements

• Allows Buyer to Become a Cash Buyer

• Buyer Can Purchase New Home Without Selling Current Home

• Conventional and VA Loans Allowable

• Lock In Your Rate - Rate Can’t Increase

• If Rates Improve during Locked Period, You Can Float Down to a Better Rate

Program

• Self Employed Borrowers can use Business Bank Statements to Qualify

• Purchase New Home Without Selling Current Home – Exclude Payment in Debt to Income Ratio

• Purchase, Refinance or Cash-Out

• Primary, Second Home or Investment Property Eligible Down Payment Assistance

• Additional Funds for Down Payment and Closing Costs

• Chenoa

• Freddie Mac BorrowSmartSM

• Use Equity From Your Existing Home Towards the Purchase of a New Home

• Ability to Present a Strong Non-Contingent Offer, Giving You a Competitive Edge in the Market

• No Monthly Payments During the Loan Term Reducing the Financial Stress of managing Two Mortgage Payments

• Lower Interest Rate for the First Few Years of Mortgage

• Available on Conventional, FHA, VA and USDA Loan Products

• 1/0, 1/1/1, 2/1, and 3/2/1 Buydown Options Available

Option

• Borrower can Reduce the Principal Balance

• New American Funding will Re-Amortize the Loan based on the Remaining Term and Payments will be Reduced

• Multiple Recasts can be Completed during the Life of the Loan

• PMI can be Eliminated in Some Scenarios

• Purchase or Refinance

• Lock Interest Rate

• If Market Improves Before Closing – Take Advantage of Current Market Pricing

Buying in cash means convenience, certainty and could mean a cost saving too. With NAF Cash, an affiliated company of New American Funding, you can make a competitive, true cash offer that is not contingent on financing and close in as little as seven days without having to sell your current home first.

• Allows Buyer to Become a Cash Buyer

• Purchase Your Dream Home Before Selling Your Current Home

• Help Qualified Buyers Win in Multiple Offer Environment

• Conventional and VA Loan Programs Allowable

Avoid missing out on the home you really want because your current home has not yet sold. This product bridges the gap by giving you funds to cover the new purchase while finalizing the sale of your current home.

• Use Equity From Your Existing Home Towards the Purchase of a New Home

• Ability to Present a Strong Non-Contingent Offer, Giving You a Competitive Edge in the Market

• No Monthly Payments During the Loan Term Reducing the Financial Stress of managing Two Mortgage Payments

The NAF Recast allows you to buy your next home now and adjust your Mortgage balance later. With a recast, you can purchase without selling first, then apply proceeds from your sales to reduce your mortgage balance and monthly payment.

• Reduce Principal Balance and Re-Amortize Loan

• Monthly Payments Reduced Accordingly

• PMI Can Be Eliminated in Some Instances

Get pre-approved and start home shopping.

Secure your new home with a cash offer.

Cash offer accepted & NAF Cash purchases the home. MOVE IN Congratulations! You’re ready to move into your new home.

NAF Cash sells the home back to your through lender financing.

Turn any of our booklets into a virtual flipbook to send digitally to clients via text or email. Scan to see an example.

With a passion for helping people navigate homeownership, I’ve been part of the real estate industry since 2019—starting as an agent, working in home warranty, and exploring different sides of the business before finding my home with Parker Mortgage. The team here is everything I could ask for—supportive, structured, and full of genuinely great people. I bring a mix of heart and know-how to everything I do, ensuring my clients feel informed, confident, and cared for throughout their journey. Plus, with an expansive network of real estate professionals, I can connect you with trusted experts for just about any need—from agents to inspectors, contractors, and beyond. Beyond work, I’m a mom to an amazing son, a lovable dog, and a quirky little axolotl. I thrive on connection, believe in kindness above all, and always aim to make the mortgage process feel a little less overwhelming—and maybe even a little fun.

American Funding, LLC. NMLS #6606. nmlsconsumeraccess.org https://www.newamericanfunding.com/legal/statelicensing/. NAF Cash is ful lled by NAF Cash, LLC, an a liated real estate company of New American Funding that is managed and operated in compliance with applicable legal and regulatory requirements. NAF Cash, LLC. MI Real Estate Broker #6502431375. NAF Cash, LLC does not originate loans or issue loan commitments. NAF Cash, LLC charges a Transaction Fee of 1.5%-3.5% of purchase price for its service (fee varies by state). Terms and conditions apply, not available in all states. 41050 W 11 Mile Rd, Ste 220, Novi, MI, 48375. Phone 844-344-0531. NAF Bridge Loan not available in MA, TX. NMLS ID #6606. New American Funding, LLC. Corporate O ce Phone (800) 450-2010. 1/2025