BREAKING NEW GROUND

Structuring Success, One Home at a Time - Your New Construction

Lending Partner! We make hard loans EASY.

YOUR LENDING SOLUTION

W e process, underwrite and fund your loan in-house, so you’ll always get fast and a ccurate information.

O ur dedicated builder team provides unparalleled visibilit y, streamlined communication, and complete control from inception to closing. You can count on the loan to close on time and within plan.

320K Reviews

$70.4 BILLION+ IN HOME LOANS

WHY PARTNER WITH NEW

AMERICAN FUNDING

Like the dirt you build on, your mortgage partner is an essential part of your business foundation.

BUILDER BENE FITS

• Cutting-edge t echnology sp ecifically t hat simplifie s the lendin g process .

• Dedicated b uilder o perations team sp ecializing in pipelin e managemen t of new builds

•Direc t lender for Fannie, Freddie , FHA, VA , & USDA, meaning we don’ t have the overlay s ou r competitors do .

•Dynamic marketin g strategie s that ensur e home s are sold swiftly

•Improve your margins wit h ASA and lender c redits

•A s a tru e partner, we can pl an with you to buil d communities

•More produc t offerings fo r unique new c onstruction homes

• Pre-appraisals available, if needed, to ensure comps support price point

WE SAY YES

TRADITIONAL AND NICHE LOAN PRODUCTS

• FHA, USDA, and VA

• Conventional Loans

• Temporary Buydowns

• No Income Verification Loans

• No Mortgage Insurance Options

• Interest-Only Options

• Construction to Perm

• Down Payment Assistance Programs

• Investment Properties & 2nd Homes

• Jumbo Loans Up to 95% LTV

• Investment Property/DSCR

• 80/15/5 Loan Program

• ITIN

• Bank Statement Program

• Reverse Mortgages

• Foreign National Loans

SUPERIOR MORTGAGE PROGRAMS

With over 400 loan products, we consistently evaluate and update our offerings to provide you with innovative mortgage solutions regardless of the buyer.

CONSTRUCTING THE PERFECT PARTNERSHIP

Creative lending solutions.

FO R W ARD C OM MITMENT A V AIL AB LE

A specialized financing option that allows home builders to secure a block of mortgage funds at a pre-determined interest rate for future buyers. This helps protect against market fluctuations and provides buyers with a stable, competitive rate, making it easier to sell new construction homes.

JUMBO HOME LOANS

We’ll help you r clients get int o higher-priced homes.

NON - QM L OANS

Flexible financing options for borrowers who don’t meet traditional loan guidelines. These loans are ideal for self-employed buyers, or those with unique income situations

N A F B R I D G E L O A N

A short-term financing solution designed to cover the down payment and/or closing costs on a new home before the sale of an existing property. With no monthly payments during the loan term, a bridge loan provides financial flexibility, reducing the stress of managing and qualifying for two mortgage payments simultaneously.

CLOSE MORE DEALS

EXTENDED RATE LOCKS

Up to one full year with float down option.

CONVENTIONAL LOAN 95% LTV

Special no PMI payment option for homebuyers. 620 credit score.

TEMPORARY BUYDOWN OPTIONS

Buyers can receive a payment rate 1%, 2%, or 3% lower than the note rate for the first 12, 24, or 36 months.

BUILDER SERVICES

Specialized mortgage lending program designed to help you increase unit turn and profit growth. With a unique blueprint in mortgage banking and builder services, we have dedicated processing and underwriting teams for builders. We truly understand the nuisances of new construction. We’re dedicated to exceeding your expectations and consistently delivering on our promises.

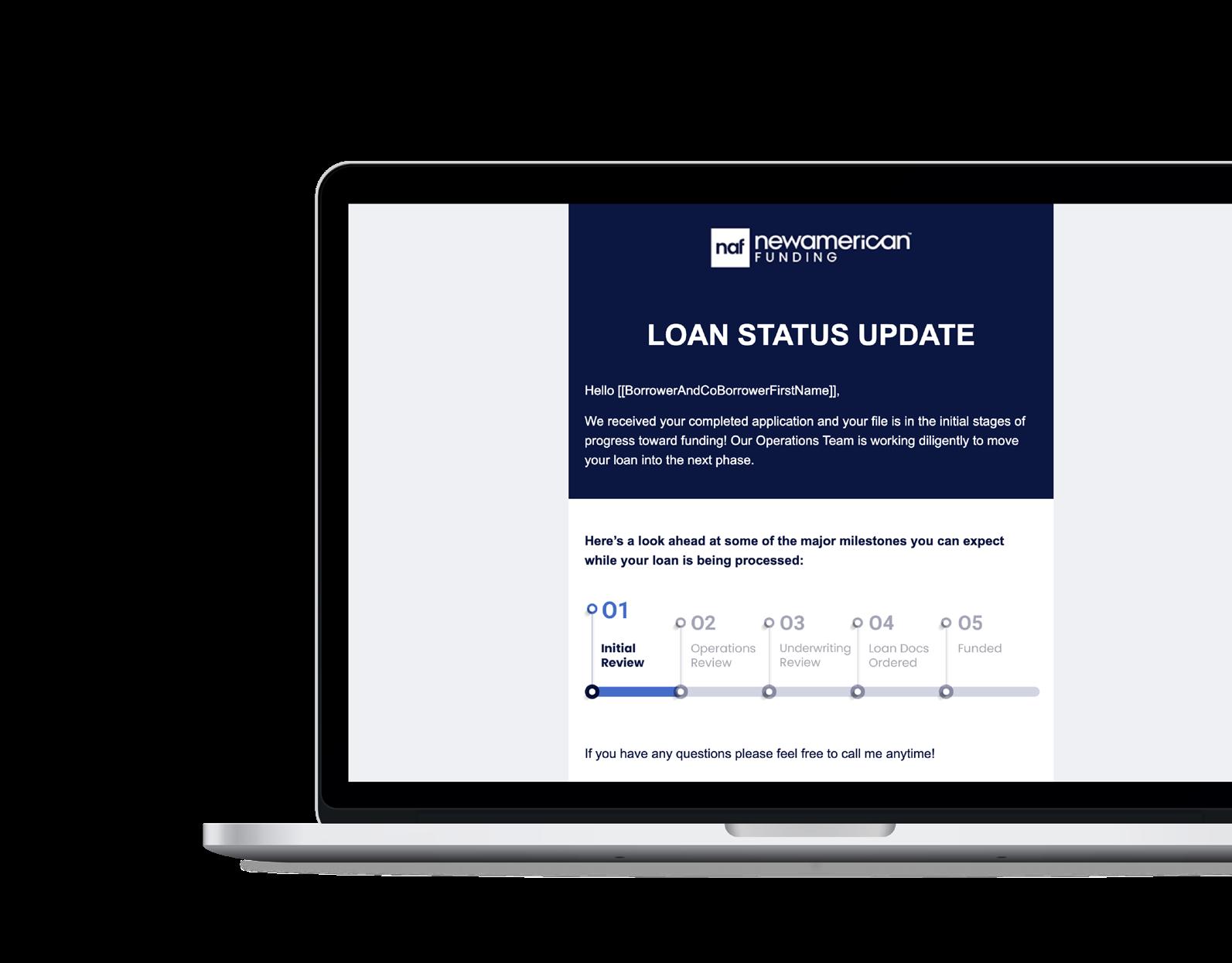

BUILDER REPORTING

Weekly statu s reports o n your clien ts that we served .

Major milestone noti f ications to track your pipeline .

Ye arly report on your clients. Broken down by zip code, household income, age, credit score, loan program & more.

MARKETING TECHNOLOGY

In a competitive environment, advertising and marketing dollars must be maximized efficiently and effectively. We developed unconventional advertising & marketing programs that target your prospective customers wherever they are to help you drive more traffic.

DIRECT MAIL

Direct mail allows you to showcase new communities, model homes, incentives, and financing options while creating a personalized, high-impact connection with potential buyers.

LISTING BOOKLETS

Our custom listing booklets provide a professional and visually compelling way to showcase your model home and community offerings. Featuring high-quality images, detailed floor plans, and key home features, these booklets give potential buyers an in-depth look at your craftsmanship and available designs. Available in both print and digital formats, these booklets can be printed in-house for immediate use or easily shared online to reach a broader audience.

CO-BRANDED FLYERS AND SOCIAL MEDIA GRAPHICS

Our co-branded flyers and social media graphics help market new neighborhoods and specialty listings. These professionally designed materials showcase stunning home images , key features, pricing, and financing options, ensuring your properties stand out. By leveraging both print and digital platforms, we create a consistent, eyecatching marketing presence that attracts buyers and drives more traffic to your community.

LUXURY NEW CONSTRUCTION MAGAZINE

O ur Luxury New Construction Magazines offer a sophisticated way to showcase every aspect of your subdivision, from model homes and elevations to floor plans, standard features, and upgrade options. These high-end magazines provide an in-depth look at your community’s offerings, highlighting the quality and craftsmanship that set your homes apart. Available in both printed and digital formats, these magazines can be distributed in-person or shared online to reach a wider audience, helping to drive interest and sales.

SIGNAGE

Our eye-catching signage effectively markets your subdivision by highlighting key elements like financing incentives, builder offerings, and upcoming completed homes. Strategically placed at key locations, these signs grab attention and drive traffic, helping to generate interest from potential buyers.

SUBDIVISION EVENTS TO MARKET YOUR COMMUNITY

We can help organize and prom ote special subdivision events tailored to both real estate agents and consumers. For agents, we offer exclusive showcases to highlight your community and homes, helping them better market the properties to potential buyers. For consumers, we create open house events or VIP tours to give them an up-close look at the new construction homes, complete with detailed information about features, upgrades, and financing options. These events provide an excellent opportunity to build relationships, boost sales, and generate buzz around your community.

JET PROGRAM

We understand the risk of building a home. The JET program is designed to minimize it by providing Upfront Underwriting to get fast approvals.

PRIORITY BOARDING

Pre-qual: LO will provide a pre-qualification letter after consulting client and reviewing credit report.

ALL CALL

LO -Collects all docs and finalizes application.

ARRIVAL & CROSSCHECK

Loan Set-Up: Order all third-party docs (appraisal, title, VOE) Order Plans & Specs Appraisal for Pre-sale. Submitted directly to Underwriting.

FLIGHT LEVEL

Conditional Approval: We’ve reached our cruising altitude. Processor notifies customer of Conditional Approval & requests any conditions needed for Final Approval. Appraisal sent to all parties upon receipt.

IN CASE OF TURBULENCE

In case of turbulence, fasten seat belt sign is on. All parties notified of RED flag item, the solution and timeline of resolution.

READY FOR TAKEOFF

Upfront Underwriting: NAF underwrites the loan upfront to ensure on time arrival, to avoid turbulence and last-minute flight delays.

FINAL APPROACH FOR LANDING

Closing Department: Prepares loan documents and sends package to attorney. Closing disclosure is finalized and all wires are sent.

PREPARE CABIN FOR LANDING

Final Approval: Loan conditions reviewed by UW. UW issues final approval. Processor sends file to Closing department.

WELCOME HOME!

CLOSING DAY HAS ARRIVED

IN-FLIGHT SERVICE WILL BEGIN

Final Processing: Confirm final contract terms with builder and collect final builder documents. Submit conditions to UW to final approval. Send closing disclosures for signature.

WHEN IT COMES TO BUILDER LOANS, WE NAIL IT!

Equal Housing Opportunity. This is not a loan commitment or guarantee of any kind. Terms and conditions apply. Subject to borrower and property qualifications. Not all applicants will qualify. Rates and terms are subject to change without notice. All mortgage loan products are subject to credit and property approval. Pathway - Credit up to $8,000 maximum. Due to maximum seller concession rules applicable to purchase loan transactions, this credit could be less than $8,000 in some cases where other concessions have been made to the consumer. Reverse - Borrower is responsible for paying taxes, insurance, and other property expenses. Borrower must occupy home as their principal residence. A new loan will require a new credit check, appraisal, title search, initial mortgage insurance premium, closing costs and fees. Consult your tax advisor. Buydown - When choosing a buydown program, a portion of each monthly payment for the first 12, 24 or 36 months will be prepaid by either the seller or lender (depending on consumer’s selection) and held by the lender to supplement the consumer’s required monthly payment. The consumer’s required monthly payment is calculated using an interest 1%, 2% or 3% below the note rate for the buydown period(s), then the note rate for the remainder of the term. Borrower must qualify based on the note rate. 5 year Protection - If rates change after you obtain a loan through New American Funding, you may qualify for a refinance loan with Lender through the 5-year Rate Protection Pledge. Applicable on new applications only. Visit newamericanfunding.com/legal/5year for full terms and conditions. NAF Cash - NAF Cash is fulfilled by NAF Cash, LLC, an affiliated real estate company of New American Funding that is managed and operated in compliance with applicable legal and regulatory requirements. NAF Cash, LLC. MI Real Estate Broker #6502431375. NAF Cash, LLC does not originate loans or issue loan commitments. NAF Cash, LLC charges a Transaction Fee of 1.5%-5.5% of purchase price for its service (fee varies by state). Terms and conditions apply, not available in all states. 41050 W 11 Mile Rd, Ste 220, Novi, MI, 48375. Phone 844-344-0531. ©️ New American Funding, LLC. NMLS #6606. nmlsconsumeraccess.org. Corporate office 14511 Myford Rd., Ste 100, Tustin, CA 92780. Phone: (800) 450-2010. Not intended for distribution to consumers as defined by Section 1026.2 of Regulation Z which implements the Truth-in-Lending Act. The information is to inform the real estate industry only and is not marketing material to be provided to consumers. Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. 10/2024.