NAF’s story begins more than 20 years ago when the husband-and-wife team of Rick and Patty Arvielo combined Rick’s technical expertise and Patty’s extensive mortgage industry knowledge to create a new kind of mortgage company. Leveraging the latest technology and streamlined operations, Rick and Patty developed a highly efficient lending process that allows us to offer industry-leading loan closing times, meaning our borrowers get into their new home or complete their mortgage refinance faster than ever. Additionally, we also give Loan Officers state-of-the-art marketing support, this includes a full in-house production studio for cutting edge videos and an in-house print facility for high-quality, customized printing. This marketing support helps our Loan Officers and their Referral Partners stand out in the crowded marketplace.

DIRECT LENDER

New American Funding maintains a servicing portfolio of over 272,000+ loans for $71.1 billion. We service 90% of our Agency Loans. (As of Jan 2025) This means your Buyer will be a New American Funding client for the life of their loan.

REALTOR® CENTRIC

Our team is focused on our REALTOR® relationships!

30 day closings or less on most transactions

Local operations team allows us to hit commitment and closing dates

Digital Closings which allows the borrower to e-sign most of the closing package leaving very few documents to be signed at closing

Ability to hand pick In-House Appraisal Panels in our markets

Competitive Rates and a large suite of Loan Products

STAY TOP OF MIND

Keep your buyers in the loop with loan status updates and drip email campaigns that can be co-branded with partnet real estate agents.

Co-branded post-close email campaigns

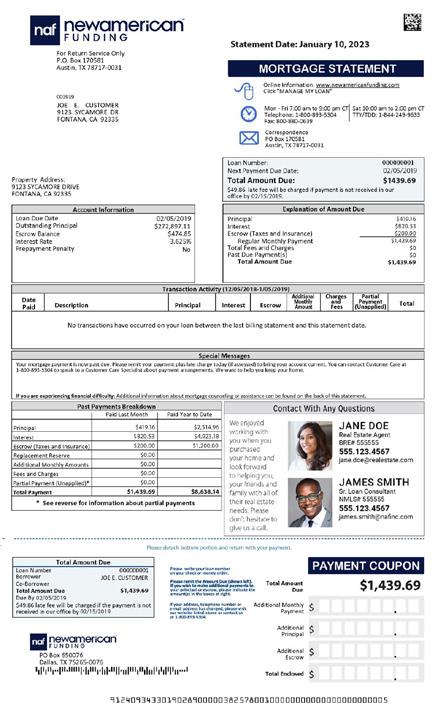

Co-branded mortgage statements

Co-branded marketing

Co-branded closing cards

NAF CASH

With NAF Cash, an affiliated company of New American Funding, your buyer can make a competitive, true cash offer that is not contingent on financing and close in as little as seven days. Clients can also buy their new home before selling their current home. Agents get commissions quickly and close on more homes faster.

HOME EQUITY LOANS

Our HELOC and Fixed Rate Second Mortgages are creative options that allow our customers to keep their Low-Rate first mortgage, while still accessing their Home’s equity and getting the money they need. This is a great option to access cash for Down Payment and Closing Costs for Vacation Homes and Investment Properties.

NAF BRIDGE LOAN

Avoid missing out on helping your clients secure the home they really want because their current home hasn’t sold yet. This product bridges the gap by providing funds to cover the new purchase while finalizing the sale of their existing home. It allows clients to use the equity from their current property towards purchasing a new home, enabling them to present a strong non-contingent offer and gain a competitive edge in the market. Plus, with no monthly payments during the loan term, it reduces the financial stress of managing two mortgage payments, making it a valuable option for your clients.

LOCK-IN AND FLOAT

With our Float Down Opt-In Program, your buyer can lock in a rate with confidence knowing that if rates improve during the lock period, they may receive a better rate.

HOLD FOR TRANSFER

In the event the Buyer is unable to perform, or the Property falls out due to inspection issues, NAF can hold the Lock and Transfer it to another Property or another Borrower.

$5000 SELLER GUARANTEE

Elite Home Loan Team will pay the Seller $5,000 if we fail to close a Certified Homebuyer by the scheduled closing date per an executed sales contract. This offers peace of mind to the Sellers and a strong Pre-Approval for our Buyers.