convenience.org Advancing Convenience & Fuel Retailing JANUARY 2023 FOOD TRENDS 23 predictions from foodservice pros AT THE HELM Meet the new NACS chairman RELIABLE RESPONSIVE What shoppers say they want now from c-stores

NACS JANUARY 2023 1 Subscribe to NACS

industry headlines and legislative and regulatory

with knowledge and resources

your

STAY CONNECTED WITH NACS @nacsonline facebook.com/nacsonline instragram.com/nacs_online linkedin.com/company/nacs On the cover: David Peperkamp/Shutterstock. This page: Photography by Tom McKenzie A Time to Give Back New NACS chairman applauds the industry for giving. 36 FEATURES 28 Looking Backward— And Forward The NACS 2022 Convenience Voices survey finds today’s c-store shopper wants the store they know and love—but better. 44 Next-Level Goodness A Q&A with KeHE. 46 23 for 2023 Here’s what c-store foodservice pros see

on-trend. 50

NACS / JANUARY 2023

Daily—an indispensable “quick read” of

news, along

from NACS, delivered to

inbox every weekday. Subscribe at www.convenience.org/NACSdaily

as

What’s Your Food Safety Culture? The inaugural NACS Food Safety Conference explored ways to drive change and manage risk in c-store foodservice programs. ONTENTS

2 JANUARY 2023 convenience.org The presence of an article in our magazine should not be permitted to constitute an expression of the association’s view. PLEASE RECYCLE THIS MAGAZINE somchaisom/Getty Images CATEGORY CLOSE-UP PAGE 60 IT’S A FACT $2,562 The average monthly sales per store of milk in 2021. DEPARTMENTS 6 From the Editor 8 The Big Question 10 NACS News 18 Convenience Cares 20 Inside Washington Here’s what to expect in the 118th Congress. 26 Ideas 2 Go Ewing Oil strives to fulfill its mission of excellent customer service in a friendly atmosphere. 56 Cool New Products 58 Gas Station Gourmet From chili dogs to live worms to beauty supplies—this is what convenience is all about. 60 Category Close-Up The milk category in convenience stores has been trending upward. 64 By the Numbers ONTENTS NACS / JANUARY 2023

EDITORIAL

Kim Stewart Editor-in-Chief (703) 518-4279 kstewart@convenience.org

Lisa King Managing Editor (703) 518-4281 lking@convenience.org

Sara Counihan

Contributing Editor (703) 518-4278 scounihan@convenience.org

CONTRIBUTING WRITERS

Sarah Hamaker, Al Hebert, Bruce Horovitz

DESIGN

Imagination www.imaginepub.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth

National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski

Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas

Marketing Director (703) 518-4290 npappas@convenience.org

NACS BOARD OF DIRECTORS

CHAIR: Don Rhoads, The Convenience Group LLC

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Varish Goyal, Loop Neighborhood Markets; Brian Hannasch, Alimentation Couche-Tard Inc.; Chuck Maggelet, Maverik Inc.; Ken Parent, Pilot Flying J LLC; Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

PAST CHAIRS: Jared Scheeler, The Hub Convenience Stores Inc.; Kevin Smartt, TXB Stores

MEMBERS: Chris Bambury, Bambury Inc.; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC

Terry Gallagher, Gasamat Oil/ Smoker Friendly; Douglas S. Haugh; Raymond M. Huff HJB Convenience Corp. dba Russell’s Convenience; John Jackson, Jacksons Food Stores Inc.; Ina (Missy) Matthews, Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Charles McIlvaine, Coen Markets Inc.; Lonnie McQuirter, 36 Lyn Refuel Station; Tony Miller, Delek US; Jigar Patel, FASTIME; Elizabeth Pierce, Applegreen LTD; Robert Razowsky, Rmarts LLC; Richard Wood III, Wawa Inc.

SUPPLIER BOARD REPRESENTATIVES: David Charles, Cash Depot; Kevin Farley, GSP

STAFF LIAISON: Henry Armour, NACS

GENERAL COUNSEL: Doug Kantor, NACS

NACS SUPPLIER BOARD CHAIR: Kevin Farley, GSP

CHAIR-ELECT: David Charles, Cash Depot

VICE CHAIRS: Josh Halpern, JRS Hospitality; Vito Maurici, McLane Company; Bryan Morrow, PepsiCo Inc.

PAST CHAIRS: Brent Cotten, The Hershey Company; Rick Brindle, Mondelez International; Drew Mize, PDI Technologies

MEMBERS: Tony Battaglia, Juul Labs; Alicia Cleary, AnheuserBush/In Bev; Jerry Cutler InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falconi, Oberto Snacks Inc.; Mike Gilroy, Mars Wrigley;

Danielle Holloway,Altria Group Distribution Company; Jim Hughes, Molson Coors Beverage Company; David Jeffco, Dirty Dough LLC; Kevin Kraft, Q Mixers; Kevin M. LeMoyne, Coca-Cola Company; Lesley D. Saitta, Impact 21; Sarah Vilim, Keurig Dr Pepper

RETAIL BOARD

REPRESENTATIVES: Scott E. Hartman, Rutter’s; Steve Loehr, Kwik Trip Inc.; Chuck Maggelet, Maverik Inc.

STAFF LIAISON: Bob Hughes NACS

SUPPLIER BOARD NOMINATING CHAIR: Kevin Martello, Keurig Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2022 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

COME TOGETHER. DO MORE. Join us at conveniencecares.org

/ JANUARY 2023

The Rich, The Bold Flavo Bold FlavoR o oF Our premium quality cigarettes, pipe tobacco, cigarette tubes, and roll-your-own tobacco products are all made from the finest U.S. tobacco. ContaCt us today! www.gopremier.com/contact a customer favorite — now available — in enticing NeW PacKaGiNG

How It Used to Be

Some of the COVID-19-inspired business practices have stuck around now that we are nearing the end of year three of the pandemic. Can you believe it? Take mobile apps, for instance. Before 2020, I was an infrequent user of the Starbucks mobile app and rewards program and had a smattering of other apps for convenience stores and QSRs on my phone. If the apps aren’t clunky—and the rewards are decent—I use them. Ordering and paying in-person for a beverage or food item that I intend to consume on the go seems so dated. I even use a mobile app to activate the fuel pump and pay for my purchase when I buy gas. That said, I seldom use curbside pickup now, but I did frequently when the risk of contracting COVID-19 seemed quite high. One thing I’d wished had stuck around: vigorous cleaning of everything from the floors to the pin pads on the POS system. Those are things that shoppers appreciate anytime.

Our cover story unveils the findings of the 2022 NACS Convenience Voices mobile shopper insights survey. The upshot? Convenience store shoppers want the c-store of yesterday—and the one of the future. Convenience in terms of location is still the No. 1 reason why consumers visit a particular c-store. Increasingly, consumers are looking at price, rewards and loyalty programs, plus product assortment and speed of service, when they decide where to shop. They also want quality food and ease of checkout, especially mobile payments.

What would the first issue of a new year be without predictions? To that end, we asked some foodservice pros

We’ve come a long way from the ribbon typewriter era to mobile apps for paying at the pump.

to share their thoughts about what lies ahead for c-store foodservice operations (Think: value, simplicity, local, LTOs, coffee). Here’s mine: By the time 2024 rolls around, people will have grown tired of the spicy/sour/flavor mashup craze in favor of simple, classic foods, whether healthy or indulgent.

Finally, welcome to Don Rhoads, our new NACS chairman. Get to know Don and his plans for the year ahead in “A Time to Give Back.”

I hope your New Year is off to a great start! Here’s to new beginnings, my friends.

Stewart , Editor-In-Chief

6 JANUARY 2023 convenience.org

Kim

UP FRONT FROM THE EDITOR

Photography by Kim Stewart

Convenience store shoppers want the c-store of yesterday— and the one of the future

.

POWERFUL BRAND. HOMETOWN FEEL.

We know that the true power behind the Cenex® brand comes from our locally-owned retailers – valued partners who are invested in their customers and community. That’s why we’re committed to your success and helping you build your business from the moment you become a Cenex® retailer. From flexible brand conversion and marketing, to convenient payment processing and training programs, we can provide your business with the support it needs to help you grow.

A name your customers trust, a brand you can count on –visit cenex.com/businessopportunities to learn more.

©

Inc.

2021 CHS Inc. Cenex® is a registered trademark of CHS

RUNNING YOUR BUSINESS YOUR WAY.

POWERED LOCALLY.

I think we are forced to creatively solve a lot of problems that are unique to the time we’re in. I just earned my blue belt in jujitsu, and I like to draw analogies to being a small operator. You have an opponent, right? And your opponent could be federal government regulations, for example. It could be the person across the street who might be a Wawa or Sheetz or someone who has it dialed in so well.

It’s your job to think about the angle you approach things with, and moving forward is one move but not always the right move. Sometimes when you look at the scenario, moving backwards makes more sense. In jujitsu, you have to think in 3D, and there are times on the mat when you realize moving forward is the worst place to put yourself in.

During COVID, a lot of places slowed down, but our industry sped up. For two years it was to stay open— that’s still very challenging. Some of my colleagues have had to close doors because they don’t have anyone to work. Is there another angle? Is there an opportunity to be nimble and move faster than your opponent when it comes to innovation or getting the store staffed in a creative way? In terms of innovation, I don’t know that it’s always this big thing. Sometimes it’s just solving problems on the fly and in a new way.

Handling product availability is one example. We’ve always said stay open, keep the store staffed, well-

lit, friendly, clean and well-stocked. Well-stocked is an issue right now, so instead of that forward momentum of saying we need to keep the store stocked, maybe it’s, ‘let’s reduce the stock and create more space. Let’s create a new, more inviting environment that doesn’t feel so crowded.’ Or, ‘let’s highlight the things that our customers really want.’ I’ve noticed my competitors are doing

that. In one store I just visited it was all foodservice, and the actual shelf space and the gondolas in the store set were very minimal.

Everyone in this industry says what you always did isn’t good enough anymore. You have to constantly reinvent yourself, and I think this period is showing us that that’s absolutely necessary, because if you want to be viable to your customers and continue to be convenient, the fast-forward button has been pressed.

One of the things that’s really important about NACS is you get to collaborate with people. When I’m in jujitsu class, my training partner is a black belt and my instructor is a 4th degree BJJ black belt, brown belt in judo and a karate master. You can literally stop in the middle of a roll and be like, ‘hey, I’m stuck. What advice do you have for me?’ And they’ll show you things that you don’t even realize—like you think you’re trapped and there’s no way you’re going to get out of this. And it’s like, ‘OK, bridge your hips up and move this way, and you’re like, ‘oh, I didn’t see that.’

It’s this big moving puzzle of problem solving, and if you train at the right place, the people around you are vested in your success . It’s not unlike NACS. It’s having people around you that help you solve problems.

As a small operator there are a lot of problems to solve right now, and sometimes you feel like you are being crushed by a 200-pound opponent, and you’re not. Sometimes it takes people on the outside to see what you don’t see and to give you the advice you need to move. You don’t have to be the biggest, strongest person in the room. It’s about using leverage, angles, space and the stronger parts of you against the weaker parts of your opponent.

8 JANUARY 2023 convenience.org

UP FRONT THE BIG QUESTION

Lisa Dell’Alba is president and CEO of Square One Markets Inc., based in Bethlehem, Pennsylvania, and a member of the NACS executive committee.

What are some of the challenges of being a small operator?

ONE BILLION IN RETAIL REVENUE

Stock your shelves with proven moneymakers.

ZYN is the first and only nicotine pouch to break one billion in retail sales. Increase your bottom line with America’s #1 nicotine pouch.

CELEBRATING

FOR TRADE PURPOSES ONLY. | Source: IRI Total US Multi-Outlet, YTD Ending 11-06-22. | ©2023 Swedish Match North America LLC Call 800-367-3677 or contact your Swedish Match Rep to learn more.

Register for NACS HR Forum

If you are a human resources professional, you are fully aware that the current labor market and hiring practices are in a period of extraordinary transformation. What are the lasting changes? How do other departments manage attracting stellar staff and retaining top performers?

During the 31st meeting of the NACS Human Resources Forum, set for March 20-22 in Savannah, Georgia, you will get the opportunity to talk with other

HR leaders, develop new ideas and exchange insights into the top issues in the industry. Participants will forge lasting connections and share innovative solutions to stay on top of current challenges throughout the year.

“As an HR leader in our industry, I attend the NACS HR Forum because it is a great place to network and meet new people who are facing and dealing with the same issues as I am—plus, all the legal updates keep me out of

trouble and in compliance,” said Kurt Weigel, recruiting manager for Weigel’s Stores Inc. He adds, “It is great to hear from peers I have known for a long time, sharing insights near and dear to their hearts and the companies they represent.”

This exceptional event educates and connects HR professionals specifically working in the convenience retailing industry. Attendees receive engaging presentations on topics vital to their job, case studies that can generate new ideas and valuable opportunities to build relationships with peers.

Here’s what you can expect when you attend:

Exceptional content—We provide custom-made, high-level content that fosters a fruitful dialogue among participants.

Working group discussions— Engage in in-depth discussions on how HR can innovate within recruiting, retention and development.

Legal and data-driven insights— Sessions are delivered by legal counsel and focus on new laws and regulations that impact the convenience industry; exclusive NACS data on compensation and hiring is also presented.

Lasting relationships Attendees build a strong peer network that can function as a personal board of advisers to help with work issues and opportunities throughout the year and in years to come.

HR solutions—Firsthand look at HR solutions and technologies via a curated list of HR partners who will help prepare you for the future of work.

CEU credits—Participants will receive CEU credits from HRCI and SHRM.

Attend the NACS Human Resources Forum and leave with the toolkit you need to deliver next-level human resource expertise. Register today at www.convenience.org/events/ HR-Forum

10 JANUARY 2023 convenience.org UP FRONT NACS NEWS PeopleImages/Getty Images

Future Capabilities of ICE Vehicles and Liquid Fuels

The U.S. transportation sector includes nearly 300 million internal combustion engine (ICE) vehicles, and American consumers were on pace to purchase another 14 million in 2022. Despite the rapid increase in electric vehicle sales, the market will continue to be dominated by ICE vehicles for decades to come. In the pursuit of reducing carbon emissions from the transportation sector, finding solutions for these vehicles must be a priority.

The Fuels Institute report “Future Capabilities of Combustion Engines and Liquid Fuels” presents a high-level summary of research and development projects focused on improving ICE efficiency and emissions and reducing the carbon intensity of liquid fuels. Understanding the objectives and potential benefits of such initiatives is important to better evaluate the potential emission contributions of the transportation sector.

Despite reports that work on ICE technology has ceased and that no additional improvements can be had, this study found thousands of current citations pertaining to research that could yield significant improvements in the performance and environmental footprint of these vehicles.

The report is a snapshot of what might be possible on the path to decarbonizing transportation. Decision-makers should seek viable solutions and support further progress in technology and fuel formulations to achieve a lower carbon future.

Start 2023 With NACS Membership

NACS membership is the best way for convenience retailers and industry suppliers to thrive today and solve for tomorrow’s challenges. Don’t be left behind!

Whether you want to launch your membership or learn about NACS offers for your entire company, NACS is here for you. By becoming a NACS member, your teams will have access to exclusive benefits that you can’t find anywhere else. Learn more about your NACS membership benefits at www.convenience.org/MaxYourNACS

NACS JANUARY 2023 11

Expand Your Fuels Knowledge

Fuels Market News (FMN), published by NACS, is the downstream petroleum industry’s trusted source for fuels-related news and information, covering the fuel marketer and the fuels of today and tomorrow.

Fuels Market News Magazine explores topics from a high level all the way down to the operational details that readers need to stay profitable. FuelsMarketNews.com is the content-rich news website that reliably covers all things related to the fuels industry—from refinery supply to terminal and bulk plant storage to transportation via pipe-

line, barge, rail and truck, to wholesale distribution and retail marketing.

The Fuels Market News Weekly e-newsletter offers OPIS fuel price data each week through a special arrangement with OPIS, a Dow Jones Company. The data are regional, encompass both retail and rack and cover gasoline (all grades), ULSD, E85 and DEF. This provides retailers and distributors with useful benchmarking metrics to help evaluate their operations.

Accessing the data is as simple as subscribing at www.fuelsmarketnews.com/subscribe-fmn

12 JANUARY 2023 convenience.org UP FRONT NACS NEWS

2022 FMN Fuels Innovator of the Year Award Winners Celebrating Innovations and Excellence at the Forecourt SPECIAL ISSUE 2022 In the Lead: Kum & Go’s Brad Petersen Biofuels Don’t Ignore Advanced Biofuels in the Pursuit of Zero Carbon Return

Majors? Some oil companies are re-exploring direct retail opportunities FALL 2022 2023 FEBRUARY NACS Leadership Forum February 08–10 | Eden Roc | Miami Beach, Florida NACS Convenience Summit Asia February 28–March 02 | Waldorf Astoria Bangkok | Bangkok, Thailand MARCH NACS Day on the Hill March 07–08 | Washington, D.C. NACS Human Resources Forum March 20-22 | The DeSoto | Savannah, Georgia APRIL NACS State of the Industry Summit April 18-20 | Hyatt Regency DFW International Airport | Dallas, Texas NACS Leadership for Success April 30-May 05 | Virginia Crossings Hotel & Conference Center | Glen Allen (Richmond), Virginia MAY NACS Convenience Summit Europe May 30-June 01 | Intercontinental Dublin | Dublin, Ireland

NACS Financial Leadership Program at Wharton July 16-21 | The Wharton School University of Pennsylvania | Philadelphia, Pennsylvania NACS Marketing Leadership Program at Kellogg July 23-28 | Kellogg School of Management | Northwestern University | Evanston, Illinois NACS Executive Leadership Program at Cornell July 30-August 03 | Dyson School, Cornell University | Ithaca, New York

NACS SHOW October 03-06 | Georgia World Congress Center | Atlanta, Georgia

NACS Innovation Leadership Program at MIT November 05-10 | MIT Sloan School of Management | Cambridge, Massachusetts Calendar of Events For a full listing of events and information visit www.convenience.org/events. In the Lead: Powerhouse’s Alan Levine E-Fuels A future carbon-neutral alternative to fossil fuels Training Up Truckers SUMMER 2022

of the

JULY

OCTOBER

NOVEMBER

NACS JANUARY 2023 13

Member News

RETAILERS

Kwik Trip CEO and President Donald P. Zietlow retired effective December 31, 2022, after 52 years with the Wisconsin-based retailer, including 22 years as CEO and president. Under Zietlow, Kwik Trip more than doubled its store count, launched new foodservice programs and debuted its loyalty program. Scott Zietlow took over as president and CEO on January 1, 2023, after retiring from his role as a professor of surgery at the Mayo Clinic in Rochester, Minnesota.

Pilot Company announced Angie Cody is now director of inclusion, diversity and equity. Cody will manage current inclusion, diversity, equity and awareness efforts, craft strategic action plans for the advancement of an accessible, equitable and inclusive work environment and help increase the company’s diversity recruitment pipeline.

Stewart Spinks , founder and chairman of the board of The Spinx Company, received the Order of the Palmetto at the company’s 50th anniversary celebration. Presented by South Carolina Gov. Henry McMaster, the award honors people who have generously served the state and its inhabitants by recognizing their achievements and contributions to the community.

SUPPLIERS

Petroleum Equipment Inc. (PEI) has named Joe Barker president and owner of the fourthgeneration, family-owned business. PEI focuses on designing mission-critical fuel systems. Founded in 1932, by Bill Morgan, the company has since operated under continual family leadership.

Dave Hinton has joined Flexeserve Inc. as president of the Americas. Hinton will lead the Flexeserve team at its new headquarters and culinary support center in Southlake (Dallas), Texas. Hinton was most recently group vice president of Middleby Corporation’s Star Holdings Group, where he was responsible for eight different commercial equipment brands. He also has worked for European-based Electrolux Professional.

Chris Howard now serves as executive vice president, external affairs and new product compliance at Swisher. Howard succeeds Joe Augustus, who recently announced his retirement. Howard will lead Swisher’s external affairs strategic objectives and provide regulatory approval and compliance support for new product development. Howard previously held the role of senior vice president, general counsel and chief compliance

officer at E-Alternative Solutions (EAS), a Swisher company.

Zach Duesler was promoted to vice president of design and architectural services at Food Concepts Inc. Duesler is a registered architect with 18 years of experience, including over a decade working for Cuningham Group Architects. Duelser will draw on his broad project experience and design influence with a focus on providing inspired design of branded foodservice programs, proprietary equipment and improved aesthetics to the retail marketplace.

Food Concepts has promoted Jake Kneebone to vice president of operations.

Kneebone is an 11-year veteran of the company who came with a degree in construction management and a background in cabinet building. Kneebone reorganized operations and led improvements in printing, cabinet building and general assembly operations.

Alex Kulis was promoted to vice president of national accounts at Food Concepts. Kulis joined FCI in 2009 as a design consultant. Kulis’ background includes a degree in architecture and expertise in construction, hospitality, manufacturing and in supporting large retailers.

14 JANUARY 2023 convenience.org UP FRONT NACS NEWS

Donald P. Zietlow

Dave Hinton

Chris Howard

Zach Duesler

Angie Cody

Joe Barker

Alex Kulis

Jake Kneebone

Stewart Spinks

New Members

NACS welcomes the following companies that joined the association in September and October 2022. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting www.convenience.org/Create-Login. All members receive access to the NACS Online Membership directory, latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership.

NEW RETAIL MEMBERS

1207 Convenience LLC dba Country Farm Monroe Township, NJ

A Plus Pawn Shop Inc. Bartow, FL www.apluspawnbartow.com

Aden Investment Inc. dba Super Stop Tuscaloosa, AL

AleSat Combustíveis S/A São Paulo, Brazil

Australian Association of Convenience Stores Burleigh Heads QLD, Queensland, Australia www.aacs.org.au

Beyond Food Mart Chino, CA www.beyondfoodmart.com

CC OF HAYS LLC Hays, KS

Compket Trading Rabat , Morocco

DAR USA Inc. Albany, OR www.darusa1.com

De Vapors Vape Lounge Yuma, AZ

Domans General Store Inc. Vassar, KS

Enterprise America Dallas, TX www.enterpriseamerica.com

Estepp Energy LLC Lexington, KY www.esteppenergy.com

Fen’s Market Inc. Woodstock, NB Canada

Fraziers Newnan, GA www.fraziersonestop.com

Granada Fuel & Food Livermore, CA

Have A Snack Valero Highland, CA

Hump Convenience Texarkana, TX

Hough Petroleum Corp. Ewing, NJ www.houghpetroleum.com

Jamoline LLC Lacombe, LA www.boatstuf.com

JFC Tobacco Corp Mayaguez, Puerto Rico

Jitterbugs Box Elder, MT

Kajy Petroleum Company Farmington, MI

Kaya Inc. Hammond, LA

Kimura General Store Hilo, HI

KWIK SERV/Joe’s Gas & Smog Oxnard, CA

Little Snap Stores La Grange, TX

M&M Market Lynn Haven, FL

Maggie’s Mini Mart Laverne, OK

Mercier Enterprises Inc. dba Chuck’s Corner Market Burbank, CA

Morgan Fuels Ireland Killean, Newry, County Down, Ireland www.morgan fuels.com

Pit Stop Express Dorton, KY

Priya Nidhi Inc. Calhoun, GA Raje Inc. Jefferson, GA

Ray’s Oasis Harlowton, MT RaysOasis.com

RockAndRoll GmbH Dessau-Rosslau Germany

Rodeo West LLC Cody, WY

Samcor Fuel & Tobacco Mount Vernon, WA

Suncor Energy Inc. Calgary, BC, Canada www.suncor.com

TA Express Cookeville Cookeville, TN

The New Era/ Uncle Abe’s Pizza Bedford, IA

The Trails Burien, WA

Tobbins Inc. Bakersfield, CA www.tobbins.com

Trashless Inc. Austin, TX www.trashless.com

TyKo Gas & Go Kanab, UT

Welch’s Stop N Shop LLC Oakdale, LA

Wills Investments Group Flower Mound, TX

NEW HUNTER CLUB MEMBER

Bucked Up American Fork, UT www.Buckedup.com

NEW SUPPLIER MEMBERS

4SCORE® Wixom, MI www.its4score.com

Anigriv LLC New York, NY

Atlantic Beverage Distributors Holliston, MA www.atlanticbeveragedistributors.com

Bay Labs Inc. Baldwin Park, CA

Beaver Street Fisheries Jacksonville, FL www.beaverstreetfisheries.com

Bedrock Analytics Oakland, CA

Beverage Parts Source Norton Shores, MI www.beveragepartssource.com

Bonneval Waters LLC Atlanta, GA www.bonnevalwaters.com

BURRITOBAR USA Inc. Toronto, ON, Canada www.myburritobar.com

Canadian Canning Inc. Hamilton, ON, Canada www.canadiancanning.com

Car IQ Inc. Oakland, CA www.gocariq.com

Celegans Labs Inc. dba AtoB San Francisco, CA www.atob.co

ChargePoint Campbell, CA www.chargepoint.com

Children’s Miracle Network Hospitals Salt Lake City, UT www.childrensmiraclenetworkhospitals.org

Cloud Foodie LLC Las Vegas, NV www.cloud-foodie.com

CoBank Greenwood Village, CO www.cobank.com

Converge IoT Coral Springs, FL www.convergeiot.com

CS Hudson Inc. Hauppauge, NY www.cs-Hudson.com

Dakota’s Best Distributing Rapid City, SD www.dakotasbest.com

DARI LLC Clinton, WI www.realdari.com

16 JANUARY 2023 convenience.org

UP FRONT NACS NEWS

DecoCookies

Tomball, TX www.decocookies.com

Delta Munchies Los Angeles, CA www.deltamunchies.com

Dewey’s Bakery Winston Salem, NC www.deweys.com

Dible Dough LLC Fayetteville, AR www.dibledough.com

Dispositivos Mecanicos RB Temecula, CA

Earthly Treats Inc. Boonton, NJ www.fromthegroundupsnacks. com

Electric Era Seattle, WA www.electriceratechnologies. com

Elite Beverage International Miami, FL www.elite-beverage.com

Energy and Environmental Design Boca Raton, FL

Freedom Beverage Group Irvine, CA

Fresh Farms E-Liquid Costa Mesa, CA www.freshfarmseliquid.com

Fresh Products Perrysburg, OH www.freshproducts.com

Finish Line Sales

Brokerage & Marketing Sunland, CA

Fire Department Coffee Rockford, IL www.firedeptcoffee.com

Furmano Foods Inc. Northumberland, PA www.furmanosfoodservice.com

Gaming Hospitality Solutions Inc. Aurora, CO www.ghsloyalty.com

GC3 West Des Moines, IA www.gc3builders.com

Generation 195 San Francisco, CA

GLOW Beverages Rancho Cucamonga, CA www.drinkglow.com

Granite Bay Gourmet Foods San Rafael, CA www.granitebaygourmetfoods. com

Growers 2 Home Corporation Doral, FL www.growers2home.com

Grupo Nutresa South Pasadena, CA

Heartland Works Charlotte, NC

Hempsi LLC Vancouver, WA www.hempsi.com

Hilt Ventures LLC Las Vegas, NV www.hiltventures.com/hilt-locations-nevada

Hygeia Carson City, NV www.hygeiadistro.com

ICON International Inc. San Clemente, CA

Iconex North Chelmsford, MA www.iconex.com

Integrated Cash Logistics Wilmington, DE

Investors Gone Wild Panama City, FL www.investshortterm.com

Juxta Kensington, London United Kingdom www.juxta.ai

KBI - Kens Beverage Montgomery, IL www.kensbeverage.com

Kepak Convenience Foods Dublin 15, Ireland www.kepak.com

Lactalis Heritage Dairy Chicago, IL www.lactalisheritagedairy.com

Landmark Snacks LLC Beatrice, NE www.landmarksnacks.com

Le Nid Consortium International Scottsdale, AZ www.lenidinternational.com

LifeMade Products LLC Greer, SC www.livelifemade.com

LionExt Santa Fe Springs, CA www.lionext.com

Locatium Madrid, Spain www.locatium.ai

Made In Nature LLC Boulder, CO www.madeinnature.com

Mananalu Boone, NC www.mananalu.com

Metaplus SA de CV MERIDA, Yucatán, Mexico

Mountain/Service Distributors

South Fallsburg, NY www.mtnservice.com

nData Services LLC Centennial, CO www.ndataservices.com

Novamex El Paso, TX www.novamex.com

Nutrislice Denver, CO www.nutrislice.com

Olivier Agency Chicago, IL www.olivieragency.com

Original New York Seltzer Cornelius, NC www.newyorkseltzer.com

Point Mobile Seoul, South Korea www.pointmobile.com

Proximo Spirits Jersey City, NJ www.proximospirits.com

Reckitt Benckiser Parsippany, NJ www.reckitt.com

Republic Amusements

Arvada, CO www.republicamusements.com

Riboli Family Wine Los Angeles, CA www.riboliwines.com

RYSE Up Sports Nutrition Frisco, TX www.rysesupps.com

Services Petrolier Harrisson Joliette, QC, Canada www.servicespetrolier.com

Shopworks Limited TRING, United Kingdom www.shopworks.co.uk

Shout About Us Del Mar, CA www.shoutaboutus.com

Smart Soda Mayfield Heights, OH www.smartsoda.com

Snacks R Us San Bernardino, CA

SSE Group LLC Houston, TX www.ssegroupllc.com

Star Snacks Jersey City, NJ www.starsnacks.net

Strateq Sdn Bhd Petaling Jaya, Selangor, Malaysia www.strateqgroup.com

SZCO Baltimore, MD szco.com

TankU Ltd Haifa, Israel www.tanku.com

TARGIT Tampa, FL www.targit.com

T-DOH Packaging Salt Lake City, UT www.tdohpackaging.com

The Cronos Group Toronto, ON, Canada www.thecronosgroup.com

The Plascon Group Traverse City, MI

Tru Fru LLC Salt Lake City, UT www.trufru.com

UNiTE Yorba Linda, CA www.unitefood.com

Unity Wholesale Centerville, GA www.unitywholesales.com

VMT Distribution Paterson, NJ

VendPro Inc. Riverside, CA www.vend-pro.com

Vermont Cider Company Middlebury, VT www.vtciderco.com

Veroniusa Swedesboro, NJ www.veroni.com

VMT Distribution Paterson, NJ

Wasserstrom dba Amtekco Industries Inc. Columbus, OH www.wasserstrom.com

White Sign Texarkana, TX whitesign.com

Wise Power Inc. Las Vegas, NV

World Wide Foods Las Vegas, NV

NACS JANUARY 2023 17

CONVENIENCE CARES

7-Eleven Expands CMN Fundraising

Children’s Miracle Network Hospitals and 7-Eleven last year launched a holiday fundraising campaign at participating 7-Eleven, Speedway and Stripes stores. Through January 10, customers can round up their purchase at checkout or donate $1 to help support more than 105 member hospitals in communities across the country.

“Following a successful Speedway Miracle Tournament and Celebration Dinner this summer, which raised nearly $3 million, we are excited to expand our support of CMN Hospitals with the launch of a holiday fundraising campaign in 7-Eleven, Speedway and Stripes stores,” said Rankin Gasaway, executive vice president and chief administrative officer for 7-Eleven. “Funds raised through this campaign will help advance pediatric health care by providing critical lifesaving equipment and much needed resources to treat children throughout the communities we serve,” Gasaway said.

“The holiday season is always a special time of year—a time for reflection and giving back,” said Teri Nestel, president and CEO of CMN Hospitals. “Roundup campaigns hosted by our corporate partners, like 7-Eleven, make it easier

for consumers to share the holiday spirit this season and support their local CMN Hospital. Their generosity will help ensure kids have access to holistic, best-inclass care to unleash their full potential.”

7-Eleven began its partnership with CMN Hospitals during 2022 to help protect kids’ health and well-being across local communities. Since 1991, Speedway, a part of the 7-Eleven family of brands, has partnered with CMN Hospitals to raise more than $150 million for local children’s hospitals through in-store campaigns, promotions and its annual Speedway Miracle Tournament and Celebration Dinner. In 2021, Speedway’s generous customers, vendor partners and associates raised more than $19 million for the nonprofit organization.

Children’s Miracle Network Hospitals® raises funds for 170 children’s hospitals that support the health of 10 million kids each year across the U.S. and Canada. Donations go to local hospitals to fund critical life-saving treatments and health-care services, along with innovative research, vital pediatric medical equipment, child life services that put kids’ and families’ minds at ease during difficult hospital stays and financial assistance for families who could not otherwise afford these health services.

Every year, the convenience and fuel retailing industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America, and to share these powerful stories.

Learn more at www.conveniencecares.org

CARROLL FUEL, HIGH’S RAISE $100,000+

1 Carroll Fuel and High’s raised more than $100,000 to support the Johns Hopkins Children’s Center through two campaigns: the 16th Annual Doug Miller Sr. Golf Tournament and the High’s Keep the Change program. The annual golf tournament was recently renamed to honor the late Miller, who had been a part of the Carroll Fuel organization for over 40 years. High’s launched “Keep the Change” in November of 2021 to support organizations within Carroll Fuel and High’s community, including the Johns Hopkins Children’s Center, local animal shelters, food banks, The American Red Cross and the American Cancer Society.

CASEY’S FUNDS YOUTH SPORTS

2 Casey’s has partnered with Gatorade to provide $60,000 in funding to three youth sports organizations in Knoxville, Kansas City and Oklahoma City through Gatorade’s Fuel Tomorrow initiative. The funding provides $20,000 to each of the organizations for equipment and resources to better serve youth in underserved communities.

18 JANUARY 2023 convenience.org

In The Community

SOCIAL SHARES

NACS encourages retailers to share their giving-back news on social media using #ConvenienceCares.

“Casey’s is proud to partner with Gatorade to ensure the athletes of tomorrow have a level playing field,” said Katie Petru, director of communications and community at Casey’s. “From purchasing necessary sports equipment to hiring new coaches, our combined resources are allowing these young athletes the chance to excel at their passions, and we couldn’t be happier to fuel a better tomorrow for these rising stars.”

GATE FOUNDATION BACKS DOWN SYNDROME AWARENESS

3 The GATE Foundation, the philanthropic arm of Jacksonville-based GATE Petroleum Company, and GATE customers raised $40,000 in support of Down Syndrome Awareness Month in October. Funds were raised in GATE convenience stores in Florida, Georgia, North Carolina and South Carolina through the company’s “Buddy for a Buck” paper icon campaign. From October 1 to 21, customers could donate $1 and sign their name on a paper icon displayed in the GATE store. Customers could also donate by rounding up their purchase to the nearest dollar. Funds were allocated to local Down Syndrome associations in the communities where collected.

OnCue DONATES TO FOOD BANKS

4 OnCue collected $60,236 in nonperishable items from stores to distribute to local food banks and other high-impact community organizations in 2022, along with $19,713 in monetary donations for specially labeled sales items in stores. The largest recipi-

ent of donations was the Regional Food Bank of Oklahoma, which received over 3,500 pounds, the equivalent to 2,916 meals for those in need. The organization also received over $14,000 in financial support through the sale of select wines at OnCue stores. Our Daily Bread, a food resource center in OnCue’s hometown of Stillwater, Okla., received over $11,000 worth of food products and $5,706 in financial support. In 2023, the sale of reusable fountain cups under the OnCue Gives program will benefit the Regional Food Bank of Oklahoma and Our Daily Bread through the end of March. For each cup purchased, 50 cents will be donated.

RUTTER’S SUPPORTS WOUNDED WARRIORS

5 Rutter’s Children’s Charities donated $20,000 to PA Wounded Warriors in honor of Veteran’s Day. The statewide nonprofit provides support to Pennsylvania Wounded Warriors, veterans in crisis and their families. “We’re very appreciative of all those who selflessly serve our country each and every day.” said Chris Hartman, president of Rutter’s Children’s Charities. “It was an easy decision to support PA Wounded Warriors because of the

amazing work they do for any veteran in need of assistance throughout our communities.”

SINCLAIR OIL AWARDS SCHOLARSHIPS TO VETERAN FAMILIES

6 Sinclair Oil’s fall giving campaign, Fueling Folds of Honor, raised nearly $1 million to support the children and spouses of fallen or disabled veterans and first responders by providing educational scholarships. A portion of fuel bought at participating Sinclair stations was set aside for Folds of Honor during the campaign. Sinclair anticipates awarding more than 180 educational scholarships of $5,000 each to families of fallen veterans in areas served by Sinclair stations. “Words cannot express how grateful and humbled we are by the actions of our Sinclair family during this campaign,” said Jack Barger, senior vice president of marketing for HF Sinclair. “Together I believe we have done something meaningful for the next generation, and we’re honored by how our station partners embraced this program.”

NACS JANUARY 2023 19

1 2 4 5 6 3

Divided Government

Key Figures 1st

Sen. Patty Murray will be the first woman to be Senate president pro tempore.

2The number of years that the 118th Congress will meet.

BY JON TAETS

It wasn’t until eight days after the 2022 midterm elections closed that most media outlets made the call that Republicans had successfully wrested the majority control in the House of Representatives from the Democrats. It was only a few days before that they were able to make the call that the Democrats had retained their majority control in the Senate when they reached the 50-seat threshold, guaranteeing the majority regardless of the outcome of the December 6 runoff in Georgia, thanks to Vice President Harris’ tie-breaking vote. Such was the result of hard-fought midterm elections which saw tight races in both chambers.

Once these final outcomes were in hand, the members of both chambers turned their attention to leadership elections, and Republicans looked forward to taking control of the House and setting the agenda on the floor and in committees. While Republicans did swing control of the House, they fell far short of what many expected to be a red wave. They even lost a seat in the Senate and failed to pick up the Georgia seat, which was retained by Democratic Sen. Raphael Warnock, who defeated Herschel Walker.

The results were particularly discouraging to many Senate Republicans who had hoped to take the majority in that chamber. In the aftermath, some members organized an ill-fated challenge to Republican Leader Mitch McConnell’s (R-Ky.) leadership position. National Republican Congressional Committee Chairman Rick Scott (R-Fla.) stepped up to challenge McConnell for party leader but was defeated easily in a caucus vote. At the same time, Sen. John Thune (R-S.D.) was reelected as Republican Whip, and Sen. John Barrasso (R-Wyo.) was reelected as Republican conference chair. Sen. Joni Ernst (R-Iowa) claimed the vacant Republican Policy Committee chair, and two new members of the caucus joined the leadership table. Sen.

20 JANUARY 2023 convenience.org INSIDE WASHINGTON Andrii Yalanskyi/Getty Images

Here’s what to expect in the 118th Congress.

Shelley Moore-Capito (R-W.Va.) claimed the vice chair of the conference seat, and Sen. Steve Daines (R-Mont.) will replace Scott at the helm of the NRCC.

Senate Democrats chose to hold their leadership elections after the Georgia runoff in December, and no major changes were expected. Sen. Charles Schumer (D-N.Y.) will remain majority leader. Majority Whip Sen. Dick Durbin (D-Ill.), Assistant Leader Patty Murray (D-Wash.) and Communications Committee Chair Debbie Stabenow (D-Mich.) were not expected to face challenges. The only change to Senate leadership will be president pro tempore. Sen. Patrick Leahy (D-Vt.) holds that position but is retiring. The job, while largely ceremonial, presides over the

Senate in the vice president’s absence, and the position is third in the line of presidential succession. Traditionally, the role goes to the most senior member of the majority party. For the 118th Congress, Sen. Schumer has tapped Sen. Murray to be the first woman to hold that role in Senate history.

While NACS has enjoyed positive relationships with most of these members, some of have presented challenges to our industry. Sen. Thune opposed NACS efforts to protect SNAP data, Sens. Murray and Stabenow have both been staunch opponents of certain health initiatives, including menu labeling and SNAP hot foods. On the positive side, Sen. Durbin has long been our industry’s champion on swipe fees, and Sens.

Barrasso, Ernst and Moore-Capito have been our allies on energy policy.

HOUSE LEADERSHIP

On the House side, the fact that Republicans won fewer seats than expected impacted their internal leadership races, most notably for speaker. Rep. Kevin McCarthy has been the Republican leader since 2014, serving as majority leader under speakers John Boehner (R-Ohio) and Paul Ryan (R-Wis.) and minority leader since 2018. He sought the speakership after Boehner’s resignation but was blocked by the party’s right wing, resulting in Ryan’s election to the position. It is that same right flank of the party that challenged him again. In the end McCarthy easily won the internal vote and, as of this writing, is expected to earn the majority vote he needs on the House floor. Rep. Steve Scalise (R-La.) was unopposed in his bid for majority leader. The third-ranking position of majority whip was a spirited three-person race, ultimately won by Rep. Tom Emmer (R-Wis.), who has chaired the Republicans’ campaign arm for the past four years. Rep. Elise Stefanik (R-N.Y.) beat back a challenge to remain conference chair. Wrapping up the elections, Rep. Lisa McClain (R-Mich.) joins the leadership as conference secretary, and Rep. Richard Hudson (R-N.C.) will take the helm of the National Republican Congressional Committee.

After losing the majority, the Democrats saw a seismic shift in House leadership. Speaker Nancy Pelosi (D-Calif.), the first woman to hold that position, and Rep. Steny Hoyer (D-Md.) have held the top two positions in House Democratic leadership for the past two de-

NACS JANUARY 2023 21

INSIDE WASHINGTON

cades. In an impassioned floor speech in November, Pelosi reflected on her years as leader and announced her intention to step down from leadership but remain in Congress. Hoyer followed by announcing the same decision. The Democrat caucus elected Rep. Hakeem Jeffries (D-N.Y.) as party leader, and Rep. Katherine Clarke (D-Mass.) was tapped as party whip. Rep. Pete Aguilar (D-Calif.) will be caucus chairman. Beyond that, the other positions may have competitive races, though Rep. James Clyburn (D-S.C.) has served alongside Pelosi, and Hoyer is also expected to seek the assistant Democrat leader position he has held in the past.

NACS has good relationships with many of these members. Reps. Scalise and Emmer have participated in NACS In Store events, and the others have enjoyed a strong relationship with the industry. On the Democrat side, Jeffries and Clarke are members with whom NACS has worked with in the past and will seek to continue to foster those relationships. In both chambers, changes among the key committees will impact legislation brought forward at those panels and then ultimately to the floor. Here is a look at how those changes may impact key industry issues.

PAYMENTS

The Senate Banking Committee and House Financial Services Committee have jurisdiction over banking and financial services industries, including Federal Reserve oversight. While the issue of swipe fees falls mostly under the jurisdiction of these committees, their leadership has tended to shy away from the issue given the strong views of both the retail and banking industries. In the Senate, Sen. Sherrod Brown (D-Ohio) will remain chairman. In the House, Rep. Patrick McHenry (R-N.C.) will take the gavel. Rep. McHenry participated in a NACS In Store event at a QuikTrip in his district in 2018. He has said he will focus on digital assets and privacy as chairman. NACS and the Merchants Payments Coalition will continue to engage the committees and their members on the need for a competitive payment system.

Last year, the Senate Judiciary, chaired by Sen. Durbin, held a hearing looking at the anticompetitive practices of Visa and Mastercard. Sen. Durbin has long been a champion of the convenience industry on payments policy. He sponsored the Durbin Amendment in 2010 and last year introduced the Credit Card Competition Act. He will remain the Judiciary Committee chairman in the new Congress, which may present opportunities for the committee to analyze and address the monopolistic control of dominant credit card brands.

SNAP

The main responsibility of both the Senate and House Agriculture committees next year is drafting the Farm Bill, which authorizes the Supplemental Nutrition Assistance Program (SNAP) and is set to expire in 2023. In the Senate, Chairman Stabenow will remain at the top of the committee. With Republicans holding the gavel in the House, Rep. G.T. Thompson (R-Pa.) will become the chairman of the House Agriculture Committee. Rep. Thompson participated in a NACS In Store event in 2018 at a

22 JANUARY 2023 convenience.org

Andrii Yalanskyi/Getty Images

Sheetz in his district and understands the critical role convenience stores play in the program. NACS will work with both parties as the 2023 Farm Bill process begins and will advocate for two changes to the program. First, NACS is asking that Congress remove the restriction on hot foods to give SNAP families needed flexibility with their benefits and to ease administrative burdens within stores. Second, NACS is asking that the ban on processing fees, which expires with the current Farm Bill, be made permanent.

TOBACCO

Most tobacco policy in 2023 will come from the Food and Drug Administration, which is expected to introduce a proposed rule on very low nicotine this spring and potentially finalize rulemakings banning menthol cigarettes and flavored cigars. With Republicans at the helm of the Energy and Commerce Committee, it is not expected that they will take up tobacco policy. The Senate Health, Education, Labor and Pensions Committee, which also has jurisdiction over tobacco policy, will be chaired by Sen. Bernie Sanders (I-Vt.), who has supported stronger regulation of the tobacco and vaping industries. It is unclear where tobacco will fall on Senate Democrats’ agenda.

FUELS

The Senate Environment and Public Works Committee and the House Energy and Commerce Committee have primary jurisdiction over issues relating to the supply, production, refining, distribution, labeling and sale of motor fuels, including the Clean Air Act and Renewable Fuel Standard (RFS) program. They also have oversight authority over the Environmental Protection Agency (EPA), which implements these programs. Both committees regularly hold oversight hearings on the EPA and the RFS program and will continue to do so in the 118th Congress. With the EPA working on the next stage of the

What does NACS political engagement mean to you, and what benefits have you experienced from being politically engaged?

Before I was involved with NACS political engagement efforts, I was skeptical as to how I can make a difference as a single supplier in a massive industry. As I got to know the retailers and fellow suppliers, I realized that NACS was so much more than the NACS Show. There are real issues that constantly affect our industry that need to be addressed. As our business grew in the industry, and I became aware of the issues that really mattered to the retailers in this space, I felt it was incumbent that I help address the issues that could impact this incredible family of retailers and supplier partners. Being involved with NACS became a real passion of mine. By participating, in addition to all the incredible relationships you make along the way, you are more in

RFS program and creating an e-RINs program, both committees will be actively reviewing the agency’s efforts. In the Senate, Sen. Tom Carper (D-Del.) and Sen. Moore Capito will remain as chair and ranking member, respectively.

In the House, Rep. Cathy McMorris Rodgers (R-Wash.) will lead the Energy

ONE VOICE

This month, NACS talks to Frank Squilla, EVP, industry and trade relations, InComm Payments.

tune with what is important to maintain and grow the business you have come to love, and the retailers recognize that you care about more than just your business. I can’t say enough about this organization and the benefits to my business and the long-term, sincere personal relationships that have been born out of mutual passion about a wonderful industry.

What federal legislative or regulatory issues keep you up at night?

I am not one to lose sleep on many items, but I always concern myself with federal overreach, especially on the current motor fuel and EV discussions. Mandating specific fuels or transportation technology is not good for consumers, the environment or the convenience industry. The government should remain technology neutral and let competition drive the best energy solutions to reduce carbon emissions. The force-feeding of EVs and the demonization of liquid motor fuels are truly concerning.

What c-store product could you not live without?

Being from Philadelphia, you know I need my Wawa morning coffee every day. Then, of course, the egg white breakfast Sizzli. It’s my go-to.

and Commerce Committee, and Rep. Frank Pallone (D-N.J.) will be the ranking member. Both Reps. McMorris Rodgers and Pallone and Sen. Carper participated in NACS In Store events. One of the top House Republican issues of the 118th Congress is to pass a comprehensive energy bill focused on domestic

NACS JANUARY 2023 23

INSIDE WASHINGTON

energy production and encouraging an “all of the above” approach to energy supply. Although there may be attempts to make changes to the RFS program, past efforts to make even minor changes have proved elusive. These past debates have been more of a regional battle between the oil-producing Gulf region and ethanol-producing Midwest region.

Supply constraints and gas prices also have met congressional scrutiny with both the House Energy and Commerce Committee and Senate Commerce Committee holding hearings during the last Congress. If high fuel prices continue, there could be another round of hearings, especially in the Senate. The Senate Commerce Committee, chaired by Sen. Maria Cantwell (D-Wash.), has also been trying to move pricegouging legislation, but efforts stalled last Congress. Sen. Cantwell will continue to chair the Commerce Committee, and Sen. Ted Cruz (R-Texas) will take over from Sen. Roger Wicker (R-Mo.) as ranking member.

CLIMATE POLICY AND EVs

While it is unlikely Congress will move legislation on climate in the 118th Congress, the White House will use its

NACSPAC DONORS

executive authority to advance its climate agenda, and agencies will pursue climate-related requirements within their authority. The executive branch will continue to implement the climate, EV and EV charging programs under the Infrastructure Investment and Jobs Act and the Inflation Reduction Act. Republicans in the House are expected to use their oversight authority to review how these multibilliondollar programs are being implemented.

The chairs of the House Energy and Commerce, Transportation and Infrastructure and Oversight and Reform committees have indicated they will hold hearings.

Rep. Sam Graves (R-Mo.) will be taking over the House Transportation and Infrastructure Committee from Rep. Peter DeFazio (D-Ore.), who retired. Rep. Rick Larsen (D-Wash.) will be ranking member. Rep. James Comer (R-Ky.) will lead the House Oversight and Reform Committee. Rep. Comer has participated in a NACS In Store event in his district. Following the primary loss of Rep. Carolyn Maloney (D-N.Y.), who chaired the committee last Congress, Rep. Jamie Raskin (DMd.) will be ranking member.

The Senate Energy and Resources Committee will continue to be led by Sen. Joe Manchin (D-W.Va.) as chair and Sen. Barrasso. The committee has primary jurisdiction over issues related to electricity, the Department of Energy and the Federal Energy Regulatory Commission. In the past, this committee has been able to function in a surprisingly bipartisan basis. Both senators have expressed concerns with the EV-only approach to climate and may provide an opening to inject a more technology-neutral and proprivate sector investment approach to the issue.

TAXES

The Republican majority in the House will all but assure no dramatic tax policy changes. Divided government means that the Democrats will no longer have the ability to push their favored tax policies through the budget reconciliation process bypassing bipartisan agreement. Senate Finance Committee leadership will remain unchanged. Sens. Sherrod Brown (D-Ohio) and Mike Crapo (R-Idaho) will retain their respective positions of chair and ranking member. The top spot on the House

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac . NACSPAC donors who made contributions November 1-30, 2022, are:

Blake Benefiel Altria Group Distribution Company

Ned Bowman

Florida Petroleum Marketers Association

Stephen Brady Techniche

Brad Call

J&T Management

Benjamin Englefield Englefield Inc.

James F. Fiene Clark Oil Company Inc.

D. Brian Griffith Golden Pantry Food Stores Inc.

Robby Posener RaceTrac Inc.

Mark Reese RaceTrac Inc.

Don Rhoads

The Convenience Group LLC

Anna Serfass NACS

Eric Taylor Taylor Quik Pik

Richard Wood Wawa Inc.

Minton OnCue Marketing

Scott

Jared Scheeler

The Hub Convenience Stores Inc.

Brian Wright Executive Leadership Solutions Inc.

24 JANUARY 2023 convenience.org

Ways and Committee is vacant with the retirement of Rep. Kevin Brady (R-Texas). As of this writing, his successor atop the GOP side of the committee was undecided. The candidates are Reps. Jason Smith (R-Mo.), Adrian Smith (R-Neb.) and Vern Buchannan (R-Fla.). Rep. Jason Smith is the top Republican on the Budget Committee, so if he is tapped for Ways and Means that will create another chair opening. On the Democrat side, Rep. Richard Neal (D-Mass.) will continue as the panel’s top Democrat.

Much of the committee’s time on the House side will be taken up with oversight of the Internal Revenue Service, which just received a significant boost in funding from the Inflation Reduction Act passed last year, of which the new Republican majority is skeptical. Both committees will begin tackling what to do about the individual tax cuts

from the Tax Cuts and Jobs Act passed in 2017 that will begin to expire in the coming years and what to do about the ever-present issue of tax extenders.

LABOR

At the helm of the Senate Health, Education, Labor and Pensions Committee, Sen. Sanders is likely to pursue an aggressive pro-organized labor agenda, but very few, if any, of the policies he will push in the panel will reach the Senate floor. The Republicans will elevate Sen. Bill Cassidy (R-La.) to be the ranking member. The lack of bipartisan agreement on labor policy is likely to keep the issue muted in terms of actual legislation adopted.

On the House side, Rep. Virginia Foxx (R-N.C.) secured a waiver to continue as the top Republican on the Education and Labor Committee and is expected

to take the gavel. Rep. Tim Walberg (R-Mich.), though, has announced he also will seek the chairmanship. Rep. Bobby Scott (D-Va.) will continue as the Democrats’ top member of the committee. The Republican majority will likely spend much of its time focused on oversight of the Biden Labor and Education departments as the White House is expected to continue to ramp up rulemaking and executive orders related to labor issues.

Jon Taets is NACS director of government relations. He can be reached at jtaets@ convenience.org.

NACS JANUARY 2023 25

BY SARAH HAMAKER

With a mission to serve its communities, customers and team members, Ewing Oil LLC has worked hard to become a unique shopping destination. “Our vision is to become the region’s leading customer service-oriented gas stations and convenience stores,” said Tyler Meyer, operations manager for the four-store chain headquartered in Grand Forks, North Dakota. Three of the stores are in North Dakota—Grand Forks, Drayton and Hillsboro—and one is in Warren, Minnesota.

In 2017, the owners heard about a co-op looking to sell its four convenience stores with fuel and decided to purchase the stores and make a go at being owners of a

26 JANUARY 2023 convenience.org IDEAS 2 GO

Ewing Oil strives to fulfill its mission of excellent customer service in a friendly atmosphere. Service With a Smile Name of company: Ewing Oil Year founded: 2017 # of stores: 4 Website: www.ewingoilcstores.com

small chain. Ewing Oil—named for the 1980s “Dallas” TV show oil tycoon, J.R. Ewing—was born.

The long-neglected stores had an unappealing appearance when the new owners took over in September 2017. Meyer joined them in January 2018 and immediately set out to upgrade the stores. “We’ve handled most of the small upgrades ourselves, like replacing lighting with LED light fixtures to make the stores brighter,” he said.

They decided to leave the outside alone and focus on the interior. “We wanted people to feel welcome when they entered,” Meyer said. They started with the Grand Forks location, which had an early 1990s appearance with an orange coffee bar and front desk area. “We rebuilt the checkout and coffee bar, as well as refaced everything to transform it into a more modern convenience store,” he said.

One of the main things was to remerchandise the store to make it more shoppable. For example, the Grand Forks store had three, 20-foot selling units creating long aisles. With no tile underneath the units, a crew had to work overnight ripping out the old flooring and laying new tile. Then they replaced the longer shelving units with six four-foot and one eight-foot units on a diagonal to the front entrance. “Now customers can easily see 70% of the merchandise right when they walk in the door,” he said.

After revamping the store layout, Meyer focused his attention on the products. “Our Grand Forks location has more price-conscious shoppers, so we stock lower priced items there, and offer as many twofer deals as we can,” he said.

He trains the store managers to keep a close eye on the products and pull slow sellers every three to six months. “I also encourage the managers to discuss new items with our vendors and to not be afraid to try new products,” he

said. “That way, we’re giving customers a reason to keep coming back to see what’s new.”

Like many convenience stores today, three locations offer fresh foodservice through Cooper’s Chicken, Wingman Pizza and Hot Stuff Pizza. Grand Forks is the only store without foodservice. “It’s a small store, and we tried offering cooked food, but it didn’t sell, so we stopped,” Meyer said.

Foodservice sales at the other locations have been good, averaging $50,000 to $60,000 a month. “We know foodservice can be a great way to boost our bottom line, so I’m always checking in with our managers to make sure they have what they need to make the foodservice grow,” he said. In addition to fresh-prepared food, those stores offer grab-and-go items, too.

STAFFING SERVICE

Because offering customers a warm and inviting experience depends more on staffing than a store’s appearance, Ewing Oil takes the time to get the right mix of workers. “We are always trying to find ways to engage potential employees,” Meyer said.

The training process builds on skills, so as employees grow in the position, the manager will give them more and more responsibility. “In this industry, we know that not all employees (especially younger staff) will stick with us for the long term, so our goal is to train them to be the best they can be for any job in the future. However, we do have quite a few longer-term employees, including several who were at the stores before Ewing Oil bought them,” he said.

“This helps with overall staff retention as the newer workers can see it’s a company worth sticking around in.”

While Ewing Oil does have plans to eventually expand with more stores, for now, Meyer is satisfied when “customers leave in a better mood than when they walked in the door.”

BRIGHT IDEAS

To Todd Meyer, operations manager for Ewing Oil, customer service tops the list of how to provide guests with a unique experience. “Our focus on customer service has done more to grow our business than fixing things up on the inside,” he said. “We really push our employees to greet everyone who walks in with a hello and smile. Great customer service is an absolute—you have to make sure you greet customers and treat them with respect, or you won’t have repeat guests.”

While the typical convenience store customer is only inside a store for a few minutes, “that’s enough time to let them know we care about them and that our employees are trying to make their experience—and their day—better,” he said. This emphasis on customer service fulfills the company tagline: Fuel your way to a great day with Ewing Oil.

Sarah Hamaker is a freelance writer, NACS Magazine contributor, and romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow.

To see videos of the c-stores we profiled in 2022 and earlier, go to www.convenience.org/Ideas2Go

NACS JANUARY 2023 27

LOOKING BACKWARD—AND FORWARD

BY SARA COUNIHAN

BY SARA COUNIHAN

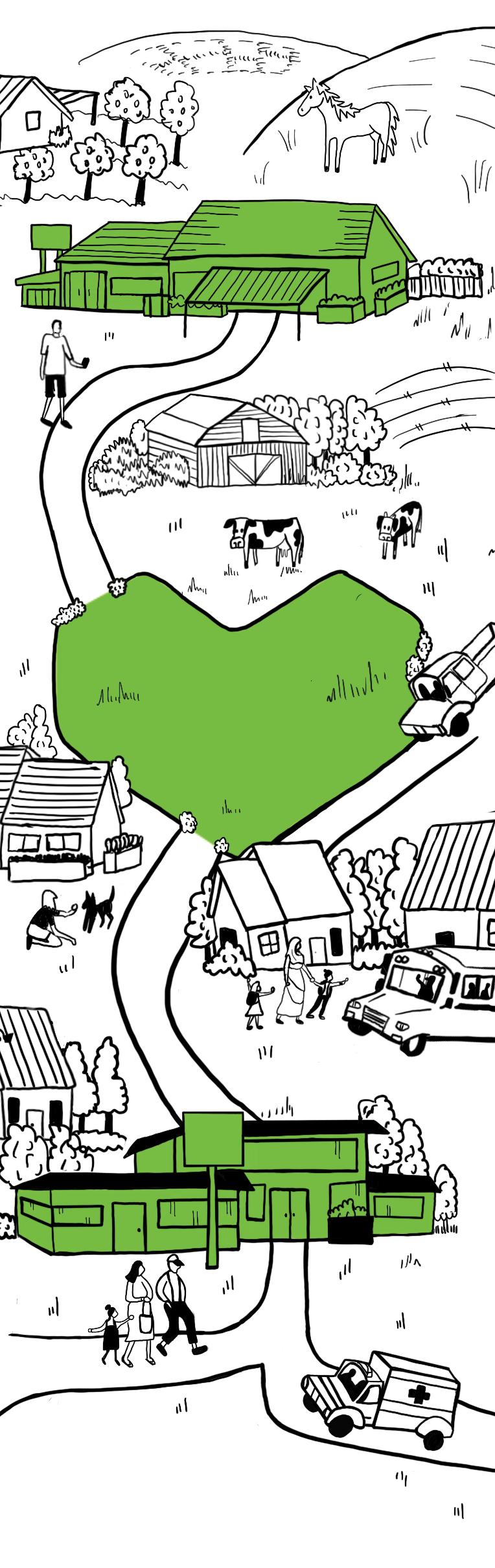

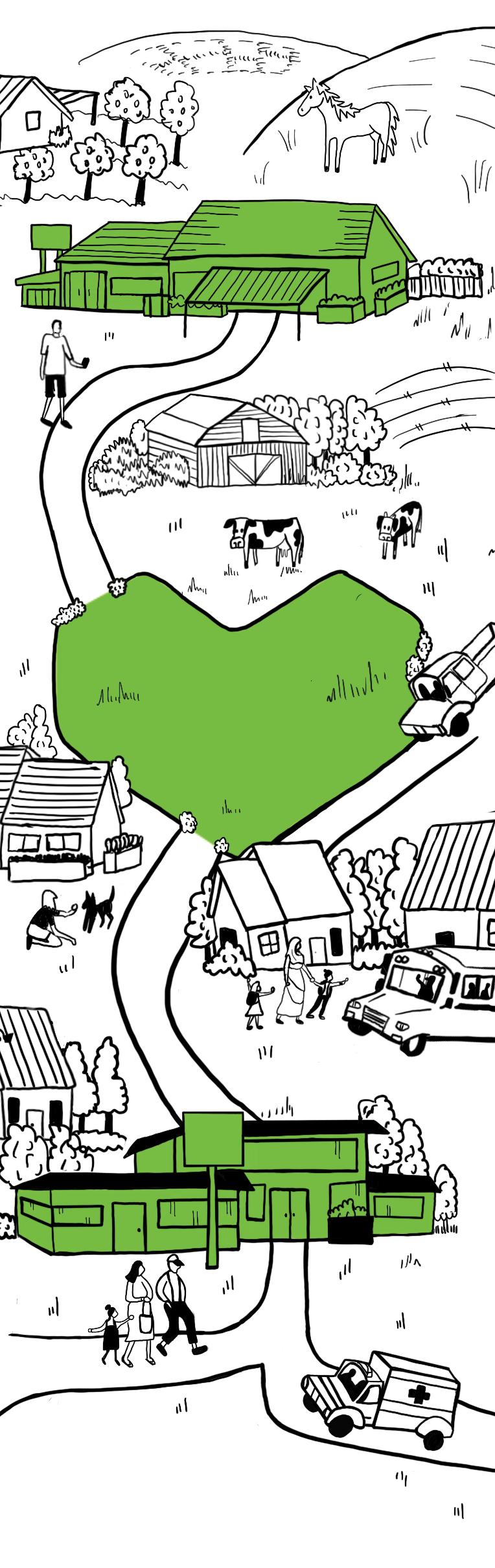

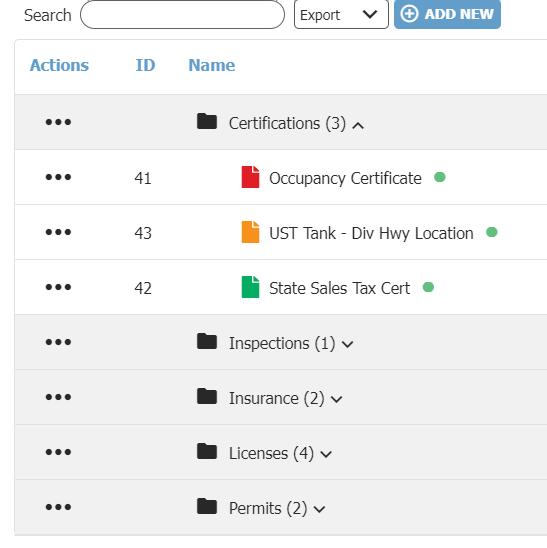

Sometimes what is old is new again and for convenience stores, shoppers want their beloved convenience store of old (pre-2020). But at the same time, the shopper has changed, and they expect the c-store to not only change with them and meet their evolving needs but also be a step ahead of them, providing them with in novation and even more convenience, according to results of the 2022 NACS Convenience Voices survey, conducted July 10 through September 10.

“Shoppers want us how they remember us before the pandemic,” said Leroy Kelsey, NACS director of research. “They want us in stock, friendly, fast and efficient. But convenience stores need to be more to shoppers.”

That “more” includes the ability to consoli date their trips. During a time of decades-high inflation and skyrocketing prices, convenience store shoppers want to conserve their resources (gas, time) and move around less, said Kelsey. “When they do move, they’re making sure that they’re getting a lot done at every interaction and at every stop,” he said.

28 JANUARY 2023 convenience.org

The NACS 2022 Convenience Voices survey finds today’s c-store shopper wants the store they know and love—but better.

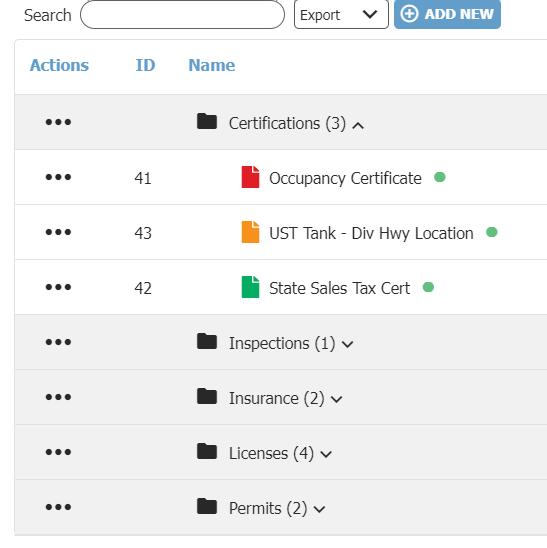

Convenience store shoppers not only expect their experience at a c-store to be the same as prior to the pandemic, but NACS data show those expectations are heightened. When asked why they chose to shop at a certain location, 66.7% of respondents cited a convenient location close to home, work or a sales route— in line with the 2019 survey—and 16.7% cited a modern, welcoming or well-maintained store, compared with 15.9% in 2019.

Of note, 22.6% of respondents answered speedy service and friendly staff, which was 4.7 points higher than those who answered in 2019. In the latest survey, 27.5% of respondents said that products were the reason why they stopped at a particular store, up 8.5 points from 2019.

“Shoppers want the same level of quality interaction they know and love from c-stores, but they now want these same attributes at an above average execution,” said Kelsey.

C-store shoppers are looking for the “three Rs” from convenience retailers, according to Kelsey. First, they want relevance , meaning they want the convenience store to be aligned with their needs and interests (e.g., a specific fuel, refreshment or service). Shoppers are looking for reliability with consistent execution in areas such as overall shopping experience and product availability and assortment, and they also want responsiveness . They want additional complementary products and services that enhance their experience, such as seamless checkout and in-store pickup.

NACS JANUARY 2023 29

FORWARD 15.9% 17.9% 19.0% 18.5% 67.1% 16.7% 22.6% 27.5% 29.9% 67.7% 0.0% 20.0% 40.0% 60.0% 80.0% Modern, welcoming or well-maintained store/lot Speed of service and friendly staff Products (merchandise, food, beverages) Price (discounts, coupons, rewards, fuel loyalty) Convenient location (close to home, work or sales route) Top 5 Reasons Why Shoppers Chose a Specific Location (2022 vs. 2019) 2022 2019 Source: 2022 NACS Convenience Voices, 2019 NACS Convenience Tracking Program

Not surprisingly, nearly twice as many shoppers in 2022 said that price was why they chose a certain store compared with 2019 (29.9% in 2022 vs. 18.5% in 2019). “Inflation is creating price sensitivity,” said Kelsey. “More shoppers are indicating they’re not buying products because they’re too expensive. Price has more of a priority.”

When shoppers were asked what about the prices made them choose to shop at a particular location, the top answer was low gasoline prices at 55.6%, up 7.5 points over 2019. However, the second answer was loyalty program rewards and discounts at 51.7%, up almost 18 points over 2019.

“More than 1 out of 2 shoppers (57.5%) were members of a convenience loyalty program in 2022, and they want an integrated loyalty program with exclusive, relevant rewards,” said Kelsey. “They want to feel understood and appreciated.”

THE ONE-STOP SHOP

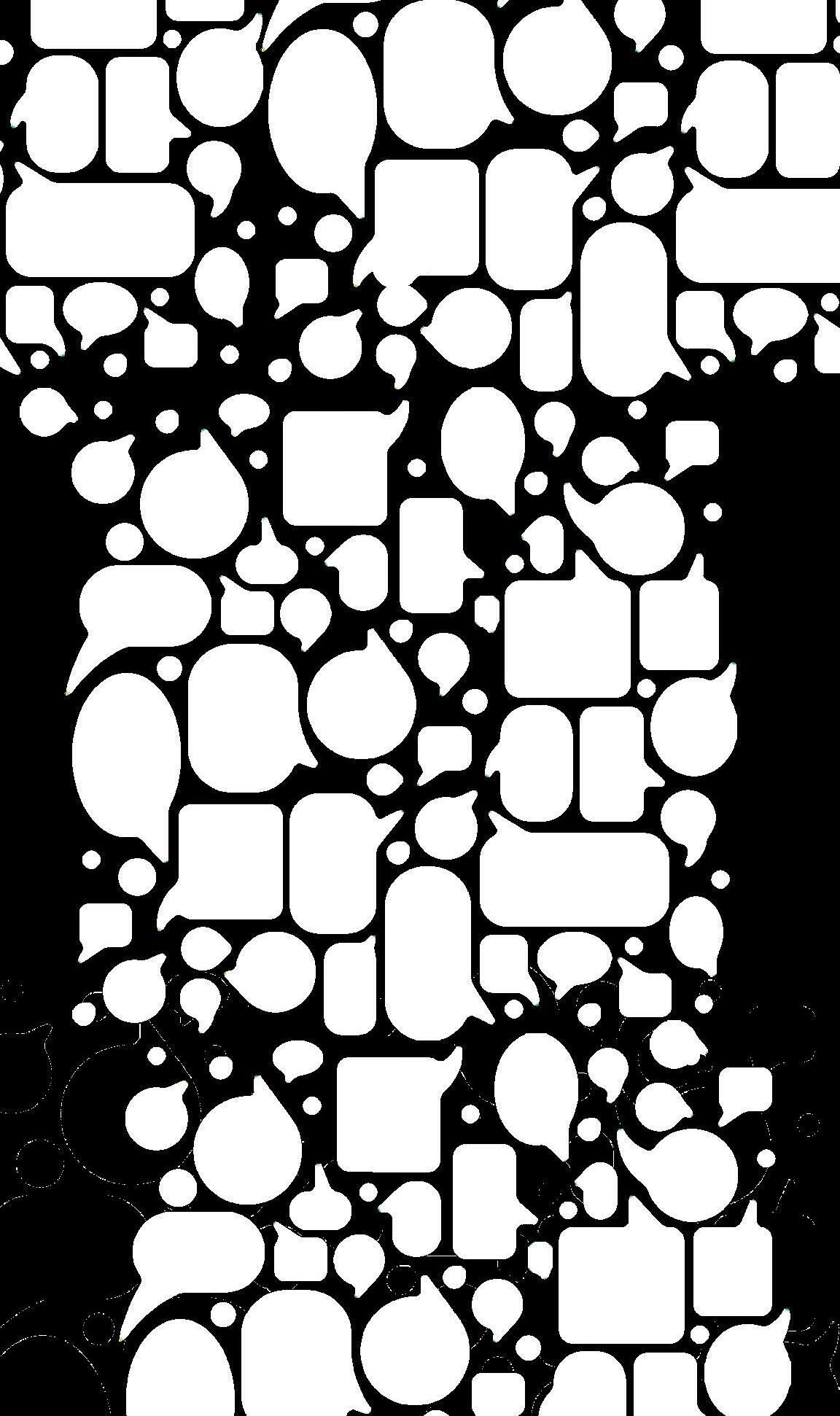

According to the survey data, shoppers are increasingly deciding what to purchase on site, as opposed to a premeditated decision or en route to the convenience store. Nearly 20% (19.8%) of shoppers surveyed decided to purchase their products on site—up from 9.3% in 2019.

“This tells us that shoppers are looking for value and buying bigger baskets, consolidating trips and coming less often,” said Kelsey. “They are looking for deals and can be compelled to purchase unintended items with thoughtful promotion.”

The survey data show that customers are indeed visiting c-stores less often. In 2022, shoppers indicated that they are averaging 2.4 trips to convenience stores each week, which is down slightly from the average of 2.6 in 2021 and 2.7 in 2019.

When shoppers were asked what would make them shop at convenience stores more

frequently, 23.3% said a wider product selection. Kelsey said this indicates that shoppers now have higher expectations for assortment, including finding staples and essentials at a convenience store.

When asked what about the products made shoppers choose to shop at a particular convenience store, the top response was, “I can easily find what I’m looking for” at 56.9%, up nearly 7 points from 2019. The second most common response was, “The store is wellstocked” at 46.3%, also up nearly 7 points over 2019. Other top reasons included “good merchandise selection” (34.8%) and “good food prepared in store” (34.3%).

Looking at specific products that are bringing in customers, packaged beverages are key trip drivers. Among the shoppers surveyed, 18.5% indicated that packaged beverages were the most important item out of everything in their basket. In comparison, in the 2019 survey, shoppers were more likely to deem cold dispensed beverages as the most important item to buy on their visit to a c-store. Also in 2019, hot dispensed beverages were the fourth most important item that customers purchased in store, but in 2022, they were the 10th most important item.

“Shoppers shifted to packaged products during the moratorium on dispensed beverages in 2020, and dispensed beverages haven’t fully recovered,” said Kelsey, adding that the commuter still hasn’t returned to a traditional commute in many markets as remote work persists. The trip type of commuting was historically between 32% and 36% of total trips. Now, it stands at 27.0%, up from 25% the prior year.

However, prepared food is now among the top five main items that shoppers indicated purchasing in 2022, with 6.4% of customers saying prepared food was the main thing they planned to buy, up from 5.8% in 2019. “Customers are looking for great food on-thego, and retailers are leaning into foodservice with new builds to accommodate larger kitchens and renovations that emphasize food preparation and service,” said Kelsey.

INNOVATION 2.0

Innovation has been a buzzword in the convenience retailing industry for a few years now, with experts saying innovation is what attracts new customers and builds loyalty. While this is true, and convenience stores have been innovating to meet the evolving consumer, the question now is, are those innovations paying off?

30 JANUARY 2023 convenience.org

1 9% 23 2% 39 6% 34 0% 48 1% 2 4% 36.9% 48 9% 51 7% 55 6% 0 0% 10 0% 20 0% 30 0% 40 0% 50 0% 60 0% Other Low food and merchandise prices Good sales, discounts and promotions Loyalty program rewards/discount Low gas prices What about the prices made you choose to shop at this store? 2022 2019

Shoppers want the same level of quality interaction they know and love from c-stores, but they now want these same attributes at an above average execution.”

Source: 2022 NACS Convenience Voices, 2019 NACS Convenience Tracking Program

Big taste and big savings are two things you get with Wildhorse cigarettes. Our American blend tobacco comes from the finest crops. Enjoy a bold, rich taste and smooth smoking experience. Are you ready to EXPERIENCE THE FREEDOM?

GOPREMIER.COM

THE BOLD CHOICE

“Convenience retailers should be asking themselves, ‘What is the return on our innovations?’ and ‘How do we innovate during a period of uncertainty?’” said Kelsey. “As they look forward, retailers should anticipate shopper needs in 2023, as consumers get back into the swing of things, and how retailers can help shoppers get things done, keeping in mind many shoppers’ budgets have become limited.”

The survey data show that c-store shoppers are responding well to certain trends. When asked what about a certain c-store’s products made them choose to shop at that location, 44.4% cited quality fountain and frozen beverages, up 6 points over 2019. What’s more, 27.9% said quality coffee is the reason they chose to shop at a specific c-store, up 5.6 points over 2019, and 21.2% of shoppers cited the selection

of take-home items (up 4.81 points from 2019).

On the flip side, not as many customers indicated that pre-packaged food was the reason they chose to shop at a particular retailer, slipping 6.22 points in 2022 over 2019. Easing of food safety concerns during the endemic phase of the COVID-19 pandemic and the consistent availability of prepared food and ready-to-eat meal offerings reduced demand for sandwiches and wraps in 2021. This trend continued in 2022.

Mobile payments are also a more recent innovation that c-store customers are adopting, according to the survey. When shoppers were asked what about the checkout options made them shop at a particular c-store, more than half (51.5%) said mobile payments were the reason—the top answer. The second most popular reason was self-checkout at 44.4%.

“Speed and quick service still drive trips,” said Kelsey. “The convenience store adage of ‘we sell time’ still rings true today, especially as shoppers return to pre-pandemic habits like commuting, kids’ activities and travel.”

A NEW GENERATION

With the evolution of the convenience store shopper comes the entrance of new generations to the c-store shopper demographic, and Generation Z, born in 1997 through 2012, is now having a stronger influence on how c-stores cater to this evolving shopper. “A higher percentage of Gen Z is now legal in terms of the products they can consume from convenience stores, and they’re becoming

32 JANUARY 2023 convenience.org

0 0% 10 0% 20 0% 30 0% 40 0% 50 0% 60 0% Premeditated En Route On Site 43.6% 48.0% 36.6% 42.7% 19.8% 9.3% When did you decide to purchase your products? 2022 2019 Speed and quick service still drive trip occasions.” 0 0% 10 0% 20 0% 30 0% 40 0% 50 0% 60 0% What about the products made you choose to shop at this store? 2022 2019 50 0% 56 9% I can easily find what I'm looking for 39 3% 46 3% The store is well-stocked 38 4% 44 4% Quality fountain or frozen beverages 39 2% 37 0% Wide product selection 35 5% 34 8% Good merchandise selection 32 9% 34 3% Good food prepared in the store 22 3% 27 9% Quality coffee 25 2% 27 6% Freshness of products 32 1% 25 9% Good pre-packaged food 16 5% 15 6% Good beer/alcohol selection 12 8% 15 5% Unique or quality store brands, generic or private label 14 5% 13 8% Healthy options 21 2% Selection of take-home items 16 4% 2 9% 2 7% Other

2022 NACS Convenience Voices, 2019 NACS Convenience

Voices,

Source:

Tracking Program Source: 2022 NACS Convenience

2019 NACS Convenience Tracking Program

When best-guesses just don’t cut it. Sharing growth-igniting data and insights is what we do at NACS and the NACS State of the Industry Summit is where it’s all unveiled. We’re gearing up for 2023 — and we’re moving to Dallas! Join us for two jam-packed days designed to help you understand the industry outlook and use it to your advantage.

MAKE BETTER DECISIONS.

April

2023

Registration opens this month: convenience.org/CarpeData

18-20,

Dallas, TX

more independent now, as they’ve started to earn higher incomes,” said Kelsey.

When asked why shoppers decided to visit a convenience store that day, the top reason cited by Gen Z was to purchase gas or charge their vehicle (46.9%), while the top visit reason for millennials, Gen X and boomers was that they wanted something to drink now (44.9%, 44.7% and 49.2%, respectively).

Also, Gen Z is looking to the convenience store to meet their needs for indulgence. In the survey, 22.1% of Gen Z respondents said they decided to visit a c-store that day to treat themselves, compared to 19.0% of millennials, 15.7% of Gen X and 12.7% of baby boomers.