Constructing a Better Future

Multiplex Europe

ESG Strategy and Performance Review

Multiplex Europe

ESG Strategy and Performance Review

We are a leading international contractor with a focus on sustainable growth and operations across the UK, Australia, and Canada. Established in Australia in 1962, we are known for shaping skylines and producing iconic projects around the world. We have delivered over 1,140 projects with a combined value exceeding US$128 billion so far, supported by a global workforce of more than 2,800 dedicated professionals. We take immense pride in our people, whose collaboration and expertise drive the consistent application of global best practices across every project we undertake.

In the past 25 years, we have delivered some of the UK’s most complex and high-profile developments. While our primary focus remains on prime London markets, we also maintain a presence in Glasgow.

Our purpose is simple yet powerful: to construct a better future. We are committed to raising industry standards at every stage of project delivery through robust quality systems, advanced digital and data capabilities, market-leading health and safety practices, and the lasting positive impact we create for society, local communities, and the environment.

Our Purpose Our Mindset

Our Values

To construct a better future

We are known for delivering the world’s best projects. And we recognise that what we’re good at can make the world better.

To outperform in everything we do Outperformance is at the core of our operations, and it’s a mindset shared by our team. Meeting targets isn’t what makes us exceptional – it’s our collective determination to overachieve that sets us apart.

We keep it real

We are upfront, open and realistic. We are genuine about delivering what we say we will.

We care about people

We respect, include and look after our people and those around us, empowering and supporting them to thrive. We are collaborative

We bring everyone together, making meaningful connections to bring about positive impact. We are consultative and responsive from the earliest opportunity.

We have grit

We are driven, pragmatic and agile thinkers continuously learning and exploring possibilities. We have the courage to solve the most complex problems when others can’t, and the staying power to last the distance.

Multiplex Europe is committed to mitigating our impact on the environment, whilst ensuring that we have a strong, positive impact on the people and places in which we work. We continue to advance our business, and the industry more broadly, through the implementation of initiatives which focus on:

1. Leading industry towards decarbonisation

In support of these pursuits, we have:

2. Reducing our impact on the natural environment

3. Investing in social value 4. Supporting our people to thrive

5. Advocating for diversity within our industry

Partnered with the UKGBC

Embodied Carbon Measurement and Reporting Project

Launched our Global ESG Update

Conducted ISO14064 verification of our carbon data to a reasonable level of assurance

Launched our biodiversity volunteering partnership with RSPB

Partnered with WGBC’s ‘Social Impact Across the Built Environment’ report

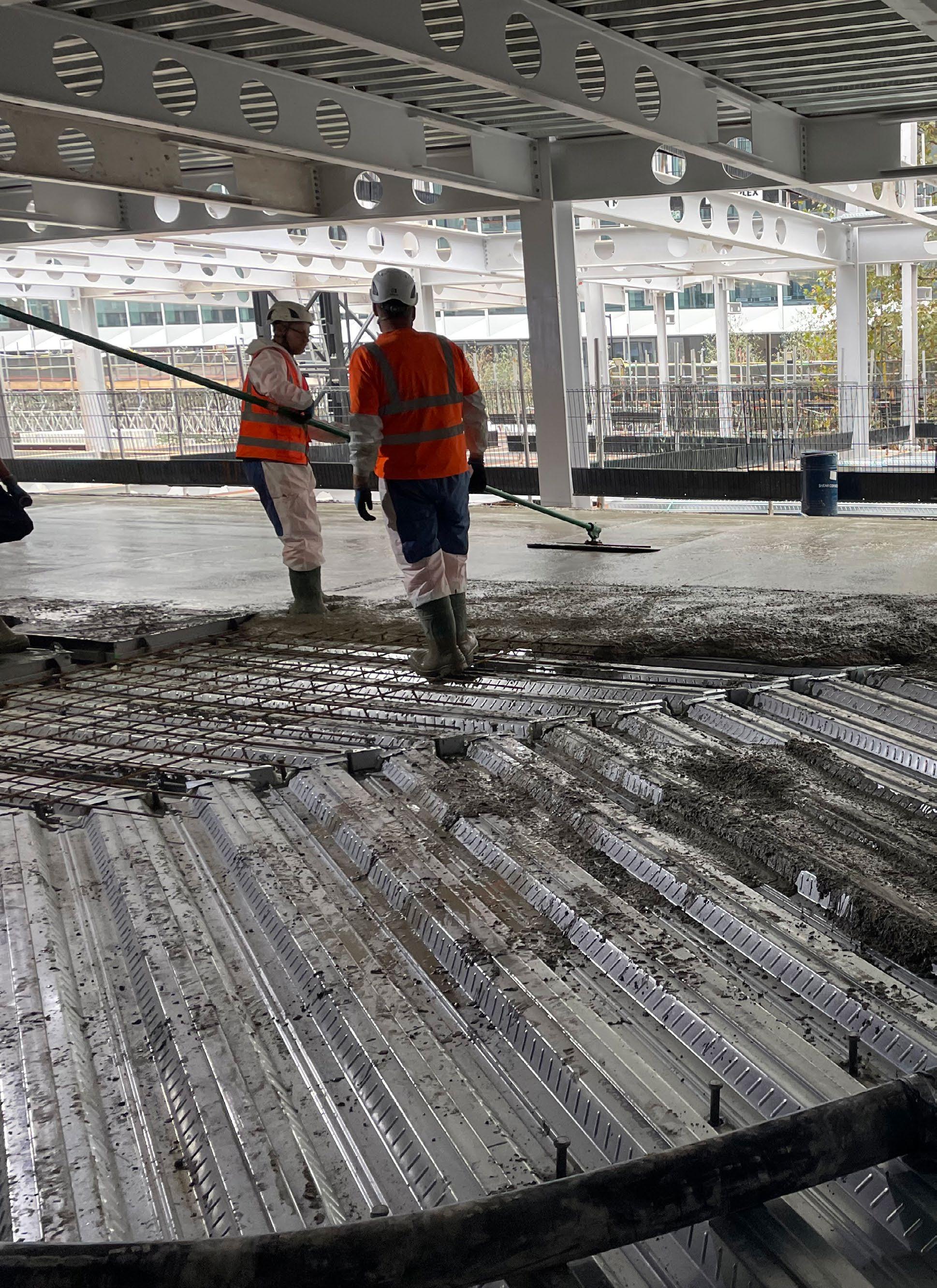

Installed reused steel for the first time on a Multiplex project at 76 Southbank

Been awarded the CTBUH Equity, Diversity & Inclusion Award: Neurodiverse Work Experience ProgrammeBuild Your Own House

Commenced reporting on demographic D&I data

Implemented a 30% gender target across all learning and culture programs globally

Completed the material passports pilot at One Nine Elms

Transitioned to supporting projectspecific charities to deliver an even greater impact for the local communities in which we work

Launched our Neurodiversity Awareness Programme

Collaborated with St Gobain to enable glass recycling at New Zealand House

Launched our Apprenticeship Programme

Launched our Power Purchase Agreement with Additionality

Supported the transition to PPAC 2.0 to strengthen our Right-To-Work checks

Completed 76 Southbank, our first adaptive reuse

Become accredited as a Living Wage Employer

Started construction of our solar farm

Joined Romulus initiative, which focuses on creating a reusable materials marketplace

Launched our Ethnicity Network Supported NLA’s Skill for Places report

Achieved a 20% reduction in our Gender Pay Gap since commencement of reporting in 2020

Welcomed our first cohort of interns from the 10,000 Interns Programme

Launched our Construction Youth Trust Partnership with the 3-days programme ‘Building Future Skills’

As we reflect on our ESG journey, it is clear that the pace of change around us is accelerating. Global megatrends, from climate change and resource scarcity to demographic shifts and technological disruption, are reshaping the built environment and redefining what it means to be a responsible business.

At Multiplex, we see these challenges not as constraints, but as catalysts for innovation and leadership. Our ESG Strategy Update builds on the foundations laid through One Decade to Act and Leave No One Behind and sets out a clear path to deepen our impact across environmental, social, and governance domains.

We are proud of the progress we’ve made, from pioneering decarbonisation efforts through technically-led solutions, to embedding ethical labour practices and expanding inclusive employment pathways. These achievements are the result of strong partnerships and collaborations with our stakeholders, a valuesdriven culture, and the dedication of our people.

But we know there is more to do. As expectations rise and the ESG landscape evolves, we must continue to challenge ourselves to go further, act faster, and lead with integrity. This strategy is not just a roadmap for our business; it is a commitment to shaping a built environment that works in harmony with people and planet.

Callum Tuckett Managing Director, Multiplex Europe

Together, we are constructing a better future.

Since the launch of One Decade to Act and Leave No One Behind in 2021, stakeholder engagement with ESG topics has grown significantly. This heightened interest, spanning everything from lifecycle emissions in our clients’ projects, to the delivery of social value, has accelerated our planned initiatives and strengthened our ability to support clients in achieving their sustainability goals, while advancing our own.

As we reflect on our progress and look to the future, transparency remains a cornerstone of our approach. It enables us to remain accountable to our commitments and fosters meaningful engagement with stakeholders on our journey to net zero.

In the following section of this report, we present a detailed analysis of our performance to date, measured against the targets we set in 2021.

Our approach reflects our longterm view of everything we do in creating sustained value.

When we introduced One Decade to Act (ODTA) in 2021, we established five core goals to guide our journey toward net zero by 2050. These goals encompass Scope 1, Scope 2, and, critically, Scope 3 emissions. As we near the midpoint of the decade, we are taking this moment to assess the progress we have made across our operations, supply chain, and client partnerships.

However, it is vital that we avoid falling into ‘carbon tunnel vision’. While carbon remains a central metric, our activities also leave broader ecological footprints that impact biodiversity, water systems, and air quality. As a business with influence over land use and material selection, we recognise our responsibility not only to reduce environmental harm but also to actively restore and protect natural ecosystems.

In line with the carbon accounting categories defined by the Greenhouse Gas (GHG) Protocol, the vast majority of our carbon footprint stems from indirect emissions (Scope 3). These are primarily driven by the embodied carbon in the building materials we use, and the emissions associated with the operational phase of the buildings we deliver. In contrast, our direct emissions (Scope 1 and Scope 2) account for much less than 1% of our total footprint and are limited to the electricity, fuel, and gas we purchase.

As outlined throughout this report, we have achieved a notable reduction in emissions in recent years. This progress has been driven by a combination of external market dynamics, evolving policy landscapes, and our own targeted internal actions:

Multiplex Actions Market Trends

Partnering with our energy broker to secure REGObacked electricity contracts for projects where we control the supply.

In February 2019, we became the first contractor in the UK to have our carbon reduction targets validated by the Science Based Targets initiative (SBTi), committing to a 55% reduction in direct emissions (Scope 1 and 2) by 2030.

Increasing involvement in adaptive reuse projects, where access to existing mains electricity reduces reliance on temporary generators.

Transitioning from diesel to Hydrotreated Vegetable Oil (HVO), while acknowledging the importance of feedstock traceability and associated risks.

Collaborating across the industry and engaging our supply chain to deliver technically led, lower-carbon solutions.

Supportive local policies promoting zero fossil fuel buildings, helping to minimise gas use during commissioning.

Growing adoption of Whole Life Carbon Assessments (WLCAs) and upfront carbon targets, driven by planning requirements, funding agreements, and rising client and industry expectations.

By December 2024, we achieved a 95% reduction in Scope 1 and 2 emissions compared to our 2017 baseline, and a 63% reduction in Scope 3 emissions over the same period.

Thanks to the measures implemented through One Decade to Act, we’ve made substantial progress. In the past 12 months alone, we’ve achieved a further 25.75% reduction in Scope 1 and 2 emissions. This was driven by a significant decrease in white diesel and natural gas consumption, alongside an increase in renewable energy tariff coverage across our sites from 79% in 2023 to 96% in 2024.

In 2019, we also set a Scope 3 engagement target, aiming for key suppliers representing 95% of emissions from purchased goods to adopt science-based targets by 2023. By the end of that year, 79.55% of our key suppliers and subcontractors had either committed to or set an SBT. We are now in the process of revalidating our science-based target, proposing a shift from an engagement-based approach to an absolute reduction target for Scope 3 emissions.

Our Power Purchase Agreement (PPA) with additionally is now active across multiple projects, helping to increase the supply of clean energy to the UK grid.

We are proud to be the first and only contractor in the UK to operate a Power Purchase Agreement with Additionality.

Since 1 April 2025, four major construction projects in Central London have been powered by renewable energy secured through this PPA. All future projects will also benefit from this arrangement, as part of our 15-year strategic partnership with Ampyr Solar.

This long-term commitment to clean energy directly supports our goal of achieving zero onsite emissions and significantly reduces our Scope 2 emissions. The renewable energy is sourced from the Northwold PV project, which features:

Generation capacity

MWp Solar panels

Site area 19 hectares (equivalent to 26 football pitches)

Annual energy generation

MWh (equivalent to powering over 4,200 households)

By securing a dedicated supply of renewable electricity, we are not only reducing our own emissions but also contributing to the decarbonisation of the wider grid. This initiative reflects our commitment to innovation, leadership in sustainability, and long-term collaboration to accelerate the transition to a low carbon built environment.

Across our business, we have strengthened our processes to reflect the growing emphasis on upfront carbon, from validating project targets at tender stage to implementing innovative lowcarbon solutions onsite. This evolution includes upskilling our workforce through mandatory training and workshops.

We remain firm in our belief that industry-wide collaboration is essential to decarbonising the built environment. That’s why we continue to actively participate in initiatives such as ConcreteZero and SteelZero, supporting collective efforts to reduce emissions from key construction materials.

Similarly to upfront carbon, the focus over the last five years on operational energy consumption has grown, with project teams using new, innovative strategies to minimise overall energy usage while maintaining high-end functionality.

For commercial buildings, the NABERS UK – Design for Performance (DfP) scheme is driving the validation of building performance prior to occupation, with all of our current commercial new builds being assessed under the scheme. While the principles of NABERS are being incorporated into all Multiplex projects – with specific modelling, sub-metering, and commissioning strategies developed to ensure that the building can meet the increasing performance expectations of our clients.

Having made significant progress with our diversion from landfill rate, we must not only maintain that level of performance but ensure that we remain focused on minimising the volume of waste that is generated through our activities. Along with the rest of the industry, we have a lot of work to do in this space as we seek to adopt a more circular approach. However, the lag in UK waste statistics makes it challenging to assess industry-wide trends, with the latest published data from 2020.

We continued to increase the use of reused materials on our sites in 2024, including utilising over 214.6 tonnes of reused steel across five of our projects, with an estimated 575 tonnes of carbon saved. Other examples include the reuse of 88 tonnes of marble and terrazzo for internal walls, and 3.1 tonnes of granite and marble as part of a refurbished reception area at our New Zealand House project.

In partnership with structural engineers WSP, contractor Bourne Steel, and steel stockholder EMR, we installed 70 tonnes of reused steel on our Elephant & Castle Town Centre scheme.

In 2023, domestic transport accounted for 29% of total domestic emissions in the United Kingdom, where HGVs (18.2 MtCO2e) and light vans (18.0 MtCO2e) each contributed to 16% of domestic transport GHG emissions. Comparatively, in 2024, transport emissions accounted for 2% of our Scope 3 emissions.

Whilst alternative transport methods such as rail, cargo bikes and barges will have a role to play in the decarbonisation of surface transport, HGVs and LGVs are, and will continue to be, the primary means of getting materials to our projects. As such, it is imperative that we support industry-wide calls to accelerate the transition to low or zero emission freight.

Our Model First approach to design enables us to bring efficiencies to the delivery process and design-out-waste. This can be achieved through standardisation of products, modularisation of systems and identifying issues before they arise onsite. We work closely with our design partners and supply chain to create a design that brings together the best of all disciplines.

Michael Richards Head of Digital Construction

We also continue to lead Tier 1 contractors on the implementation of material passports. Building upon the passports we developed at One Nine Elms for 1,400 tonnes of fit-out materials in 2023, our Holborn Viaduct project is now passporting 1,267 tonnes of steel, connecting building owners with in-depth data to best identify servicing requirements, replacement parts, and the most suitable method for dealing with materials at end-of-life.

Over 99% of major construction materials were responsibly sourced in 2024, including again ensuring that 100% of all temporary and permanent timber products were FSC or PEFC certified.

Minerva House was the first private development on the River Thames to utilise a barge to remove construction materials from site, according to GPS Marine.

Goal 1: Zero onsite emissions by 2025

Target 1.1:

By 2022, power 100% of onsite electricity through renewable energy tariffs.

Our partnership with an energy broker enabled a transition to REGO-backed electricity contracts, saving 1,842 tCO2e compared to standard fuel mixes. Since 2020, nonrenewable contracts have mostly applied to legacy projects, leased offices, or commissioning phases — areas where we are now implementing measures to introduce green tariffs.

Goal 2: 50% reduction in embodied carbon intensity by 2030

Target 2.1:

By 2021, all new projects to report in accordance with Whole Lifecycle Carbon Stages.

Upfront carbon targets are becoming standard across Multiplex projects in the UK.

Between 2021–2023, only 20% of projects had formal targets; from 2024, this rose to 83%.

By 2025, we expect nearly all new projects to include upfront carbon targets, with many clients setting additional stretch goals.

Target 1.2:

By 2023, reduce onsite emissions by 50%, powered by 100% renewable energy through a Power Purchase Agreement (PPA).

In 2022, we achieved a 76% emissions reduction against our 2017 baseline. Although our PPA launched later than planned, its successful implementation, an industry first, was made possible through close collaboration with our partners.

Target 1.3:

By 2025, zero emissions power onsite.

In November 2023, we signed a Power Purchase Agreement with Ampyr Solar Europe to decarbonise project energy supply. By 2024, this contributed to a 96% reduction in Scope 1 and 2 emissions compared to our 2017 baseline.

Target 2.2:

By 2025, all project to have 30% less embodied carbon.

Of the 11 projects with formal carbon targets, 5 are on track to meet the 2025 One Decade to Act goals.

Goal 3: Net zero carbon building operations by 2030

Target 3.1:

By 2022, offer our clients net zero enable designs for all new buildings.

We continue to offer netzero enabled designs for our clients across all our projects, and work with design and commercial teams to make these viable.

Goal 4: Zero transport emissions by 2030

Target 4.1:

By 2022, establish a task force for zero emissions transport.

A task force with supply chain partners identified limited access to up-to-date data as a key barrier to investing in zero-carbon vehicles. To address this, leading vehicle manufacturers were invited to share the latest market-ready solutions.

Goal 5: Zero avoidable waste by 2030

Target 5.1:

By 2022, divert 99% of nonhazardous construction, demolition and excavation waste form landfill on all new projects.

We consistently meet or exceed our landfill diversion targets.

Target 3.2:

By 2025, embed the principles of Design for Performance – NABERS UK into all new projects.

The NABERS UK – Design for Performance (DfP) scheme has seen strong uptake, with all relevant projects from 2024 formally seeking at least a 4.5* rating.

Target 3.3:

By 2030, all new projects to achieve net zero operational building emissions. While progress toward net-zero operational buildings continues, two key drivers are needed to accelerate wider industry adoption: more competitive energy pricing to discourage gas use, and broader uptake of the UK Net Zero Carbon Buildings Standard (UK NZCBS). With two of our projects in the UK NZCBS pilot, we’re proud to support its development.

Target 4.2:

By 2030, achieve zero transport emissions.

In November 2021, the UK government pledged to phase out the sale of new diesel LGVs from 2035 and HGVs by 2040.

Subsequently, the Department for Transport published the Future of Freight report, which sets out a long-term vision for the freight and logistics sector.

Without radical government intervention, notably for charging infrastructure, it will prove challenging to realise zero transport emissions by 2030.

Target 5.2:

By 2025, achieve 45% reduction in waste intensity.

Since 2017, we’ve reduced waste intensity by 74%, significantly surpassing our 45% target.

Target 5.3:

By 2030, achieve 90% reduction in waste intensity.

Our project portfolio’s cyclical dynamics lead to notable variations in waste intensity. To better reflect long-term trends, a three-year moving average is likely a more suitable metric.

We recognise our ecological footprint and the responsibility to reduce harm while restoring and protecting nature. Environmental considerations are embedded across our project lifecycle from design to delivery, guided by nature-positive principles.

As the climate crisis intensifies, the link between climate and nature becomes clearer. At Multiplex, we are integrating nature into our climate strategy to build a resilient, sustainable business that addresses climate risks and supports ecosystem regeneration. The figure to the right illustrates significant nature-related considerations on our construction sites, with table below providing the corresponding key.

Consideration Description

Biodiversity Net Gain and Urban Greening Factor

Planning requirements for post-construction ecological value

Air Quality

Water Use

Using compliant non-road mobile machinery (NRMM) and monitor noise, dust, and vibration with on-site equipment

Tracking water intensive activities to avoid excessive water use

Water Discharge Monitoring water discharge, compliance and volume

Temporary Ecology Adding temporary ecological enhancements to site during construction

WINT Water Management uses artificial intelligence to continuously learn and adapt to a building’s water usage patterns. It applies specialised algorithms tailored to different use cases, enabling it to detect anomalies in consumption. When irregularities are identified – such as potential leaks or system malfunctions – WINT sends real-time alerts, helping teams respond quickly and prevent water waste.

Over the past four years, Multiplex has prioritised biodiversity, water stewardship, and air quality, supported by hands-on partnerships with environmental charities like RSPB, Idverde, and Groundwork London. Our teams have contributed over 1,130 volunteer hours to habitat restoration and ecological enhancement – strengthening local environments and deepening environmental awareness across our workforce.

By combining practical action with strategic intent, we continue to build a culture that values nature and recognises its essential role in a sustainable built environment.

Since the launch of our Leave No One Behind strategy in 2021, we have remained committed to embedding social equity across our operations. Central to this commitment is the strength of our partnerships with local authorities, not-for-profit organisations, and our supply chain, who play a vital role in helping us deliver meaningful employment and education outcomes that benefit individuals and communities.

Recognising the construction industry as a high-risk sector for labour exploitation, we have taken proactive steps to lead change. Our global and complex supply chain includes consultants, subcontractors, and suppliers who provide the materials, equipment, and services essential to our projects. We have worked collaboratively with NGOs, industry bodies, and peers to promote a unified approach to ethical labour practices.

By continuing to share knowledge, build capacity, and drive collective action, we aim to create lasting change and ensure that no one is left behind.

Since setting our original health, safety, and wellbeing targets in 2021, we have undertaken a strategic review to assess progress and recalibrate our priorities. Over the past four years, the landscape has shifted significantly, both within the UK construction industry and internally at Multiplex.

Our initial targets were shaped by industry-wide concerns around musculoskeletal health and fatigue risk management. However, emerging evidence has highlighted a more urgent issue: the rise of accelerated silicosis, a severe respiratory condition affecting stoneworkers and related trades. This has led to regulatory action overseas, including the Australian Government’s ban on engineered stone.

While UK legislation has yet to respond, we have chosen to lead by example. In June 2025, we implemented a ban on the use of artificial stone across all new projects. This forms part of our broader Silica Impact Reduction Programme, which aims to improve worker protection, enhance health monitoring, and establish measurable KPIs under our wellbeing pillar.

In 2024, we also introduced Neurodiversity Awareness Training, developed in collaboration with our Wellbeing Committee. Delivered to all staff, the training promotes understanding of neurodiversity and provides practical guidance on how to support neurodiverse colleagues through inclusive workplace practices.

Our objective to implement a maximum five-day working week in 2025 was a key takeaway from our review. While wellintentioned, consultation across our sites and with industry stakeholders revealed concerns about reduced earning potential and increased workforce transience. In response, we pivoted to a more targeted solution: the introduction of a fatigue management system, with the goal of ensuring no worker exceeds 65 hours per week by 2028.

This reflective process has allowed us to evolve our strategy in line with emerging risks, workforce needs, and industry trends, ensuring our approach remains responsive, supportive and responsible.

In recent years, we have made significant progress in our approach to Diversity & Inclusion. While we still have much work to do, it is important to celebrate the progress we have made on many fronts, including but not limited to:

Meaningful falls in our gender pay gap – specifically, since 2020, our Median Gender Pay Gap has fallen by 21.5% and our Mean Gender Pay Gap has fallen by 23.8%

Improving our awareness of our demographics through significantly improved D&I reporting

Consistent improvement in female representation across the business, with 7.5% growth in our female employee population since 2022

Approaching 50-50 female representation for new entrants, specifically achieving a 48% female graduate intake for 2025

− Successful launch of our Women’s (2020) and Ethnicity (2025) Networks

Developing our proactive approach to prevention of sexual harassment

Continuing to evolve and embed our approach to workplace flexibility

Progressing neurodiverse awareness across the organisation by commencing awareness workshops in February 2024

Since 2021, we have also undergone a significant period of organisational change and global alignment on our approach to Diversity & Inclusion. This has resulted in our UK business working under a broader global Diversity & Inclusion strategy, designed to help us harness diversity of thought to maximise business performance, be recognised as a diverse and inclusive global employer, and send ripples of positive change into our industry and broader society.

While this does not entirely replace our efforts from the 2021 strategy, it has allowed us to revisit, and where appropriate, reset our approach and more clearly define what is achievable and realistic, while still pushing us to deliver the greatest possible impact.

As the importance of delivering social value grows across the industry, so does the emphasis on quantifying its impact in monetary terms. We initially partnered with Loop (formerly Social Profit Calculator), which allowed us to:

Attribute a £ value per £ spent on projects

Map our impact against the UN Sustainable Development Goals (SDGs) and the TOMs (Themes, Outcomes, Measures) framework

However, a 2022 review of Loop’s metrics revealed issues such as previous double counting and fluctuating proxy values. Despite a new and improved software platform, this led to a lack of confidence in the robustness of the data. As a result, we discontinued our partnership with Loop in February 2023.

Following a review of platforms used by clients and competitors, we partnered with Social Value Portal in April 2023. This partnership offered:

Despite these strengths, an independent review of the system revealed significant metric changes, and the platform’s complexity led to:

Reduced clarity around metrics

− Declining confidence from internal and external teams Cumbersome reporting processes

After a consultation and feedback process, we ceased measuring social value in monetary terms.

We believe that true social value lies in the outcomes we deliver, not just the numbers we report. Our new approach prioritises:

Storytelling and case studies, capturing meaningful outcomes

Community engagement and feedback

Alignment with strategic goals, stakeholder priorities, and community needs

Transparency and authenticity in how we communicate our contributions

When we set our targets in 2021, we acknowledged that we had an opportunity to maximise our impact using our purchasing power to generate social value far above what we spend, contributing to improve the livelihoods of local communities and multiplying the gains for local businesses, SMEs and Social Enterprises. Our priorities have included:

Enhancing data systems to improve visibility of SME and diverse business spend

Streamlining payment processes to support supply chain efficiency

Progressing toward Prompt Payment Code signatory status

In recent years, our Procurement Team has implemented M-Partners, a more robust supply chain management system designed to improve data accuracy and operational efficiency. This platform supports a revised pre-qualification process that integrates ESG considerations across procurement, enables targeted reporting on social procurement goals, and helps identify skills gaps for supplier development.

Led by the Social Value Team, we are also developing a new Social Value Pre-Qualification tool. Once embedded across the business, this will provide deeper insights into supplier capabilities and highlight opportunities for growth and support.

We have made significant strides in improving payment terms across our supply chain. In 2020, our average payment time was 49 days. By 2022, this had reduced by 12 days, and in 2023, we achieved an average of 30 days. Although 2024 saw a slight increase to 33 days, this still represents a substantial improvement from pre-strategy levels. We remain committed to further progress and are actively reviewing the requirements to become a Prompt Payment Code signatory.

Supporting small and medium-sized enterprises (SMEs) is central to our social procurement approach and our commitment to driving inclusive economic growth. We have consistently exceeded our SME spend target, achieving:

42%

total SME spend in 2022 (11% local, 31% non-local)

53%

total SME spend in 2023 (14% local, 39% non-local)

34%*

SME spend in 2024 (13% local, 21% non-local)

These figures reflect our ongoing efforts to support SMEs both locally and nationally, helping to build capacity and resilience across our supply chain.

We have consistently exceeded expectations in delivering employment outcomes that go beyond planning obligations and our client’s expectations. Our efforts have centred on integrating local entrants and apprentices into our supply chain across multiple projects, supported by tailored interventions to ensure sustained employment. In reviewing our progress, we recognised the need to scale our efforts in response to the growing skills shortage and to maximise the social value we generate through our operations.

new entrants and apprentices per £100m turnover (Yearly average between 2021 - 2024)

A key area of focus has been improving access to employment for underrepresented groups – including individuals not in education, employment or training (NEET), ex-offenders, and those experiencing homelessness. This commitment reflects our broader ambition to promote income equality and create inclusive pathways into the construction industry.

In 2025, we launched our Apprenticeship Programme, aimed at developing the next generation of skilled workers. Through our initial recruitment drive, we will be onboarding 14 new apprentices this year, with plans to expand annually.

* The drop in performance is partly due to several long-standing supply chain partners growing beyond the SME threshold, meaning their spend no longer contributes towards our SME targets.

As part of our commitment to delivering meaningful social value and fostering inclusive pathways into the built environment sector, Multiplex proudly hosted the Building Future Skills programme in July 2025, in collaboration with Construction Youth Trust. The three-day initiative welcomed 20 students aged 16–18 from across London, offering an immersive experience designed to inspire and equip young people with the skills, confidence, and insight to pursue careers in the industry.

Multiplex volunteers from across the business played a central role in delivering the programme, leading workshops, mentoring students, and sharing their professional journeys. Through hands-on activities, real-world challenges, and direct engagement with industry professionals, students gained an understanding of the sector and the diverse opportunities it offers.

Initiatives like Building Future Skills reflect our ongoing dedication to creating lasting social value and empowering the next generation of professionals in the built environment.

Since launching our Ethical Labour Management System in 2019, we have embedded ethical standards across operations and our supply chain, ensuring all workers are treated with dignity, fairness, and respect. We’ve led efforts against modern slavery through transparency, accountability, and advocacy, consistently publishing progress since our first Modern Slavery Statement in 2016.

We’ve embedded the UN Guiding Principles (protect, respect, remedy) into our operations, resolving 100% of grievances promptly. In 2025, we introduced PPAC 2.0 across all projects, aligning with UK Right to Work guidance to verify identity and employment eligibility, helping mitigate risks of undocumented labour.

In June 2025, we ensured 100% of first-tier subcontractors pay the Real Living Wage, verified through internal and third-party audits, securing our accreditation as a Living Wage Employer. This reflects our commitment to fair pay, driving ethical employment across the construction industry.

All first-tier supply chain partners must comply with our Ethical Labour Principles. Our risk-led audit approach, aligned with UK standards, enables targeted supply chain mapping and third-party audits. In partnership with Achilles, we have conducted biannual site audits for three years, focusing on modern slavery, recruitment, and working conditions. Working with Nutral has also deepened visibility into labour conditions and ethical risks. Additionally, Ethical Labour Training is mandatory for all subcontractors.

In 2024, we continued our partnership with Achilles to conduct biannual site engagement audits across all project locations, interviewing nearly 830 workers. Now in its third consecutive year, this initiative has significantly enhanced our understanding of the challenges faced by subcontractors and their workforce on-site.

Following each audit cycle, we collaborate closely with our supply chain partners to review findings and strengthen both their processes and those of their subcontractors. The consistent year-on-year reduction in audit findings is a strong indicator of the effectiveness of our implemented mechanisms and the depth of our shared commitment to ethical employment practices.

Our audits have driven positive change within our operations but also our supply chain. Following feedback from the Achilles audits, two of our subcontractors, Gardner & Co and Phoenix ME, revised their onboarding processes to better align with the expectations highlighted in the audit responses.

Inspired by the findings, we reviewed our internal systems to identify opportunities for improvement.

As a result, we have developed a comprehensive online onboarding process for labour providers. This portal outlines clear expectations, compliance requirements, and best practices to ensure a consistent and transparent approach across all sites - ultimately enhancing worker experience and operational efficiency.

As part of our commitment to ethical employment practices and combating Modern Slavery, we have developed a bespoke digital onboarding portal requiring all Suppliers, Sub-Contractors, and Consultants to (re)enrol by completing enhanced pre-qualification and compliance checks which include our ethical employment standards. This is followed by individual operative registration to ensure adherence to company policies and confirmation of fair employment conditions, including payment of at least the London Living Wage.

John Lambert Head of Installations at Gardner & Co.

The process enabled us to rethink our internal processes and policies which we have actioned since the ethical labour audits took place.

We annually update our policies and from the audit, it highlighted some best practice initiatives that we have included within our policy. This included incorporating modern slavery statements into all of our subcontracts to ensure our supply chain are aware of our stance and processes regarding modern slavery.

We have also ensured that modern slavery training has been passed onto our supply chain management teams. Moreover, one of the outcomes of the ethical labour audit was to enhance and review our PQQ processes for the procurement of our supply chain. We have invested into a new internal PQQ software that has streamlined and digitalised the auditing and onboarding of our supply chain.

We appreciate that construction activities can be challenging for local stakeholders, given the potential disruption they can bring. To mitigate this, we are laser-focused on delivering long term value to the communities in which we work by involving and enabling active participation by local communities.

Through volunteering and other charitable efforts, we are proud to deliver social value while maintaining full compliance with industry standards across all our projects.

As a business, we have made significant strides in strengthening community engagement and enhancing our social impact. We have actively involved project teams and supply chain partners in organising company-wide charity events, fostering a culture of collaboration and shared purpose. Over the years, we have had hugely successful partnerships with two key charity partners, Chickenshed and The Willow Foundation. Since 2022, we have raised £287,124 for Chickenshed and £298,577 for The Willow Foundation.

To maximise impact, we have refocused our charitable funding towards key partners helping people into employment in our local communities – supporting local charities including Depaul, Islington Giving, and Breaking Barriers.

In 2024, the One Leadenhall team took fundraising to new heights – literally – by organising a charity abseil from Level 32 of the Northern Terrace down to Level 4, a thrilling 120m descent. Open to all involved in the project, including Multiplex staff, supply chain partners, consultants, and local stakeholders, the event offered 100 spots on a first-comefirst-served basis, with a minimum £500 sponsorship per participant. Fancy dress was optional, but enthusiasm was essential.

Partnering with MTS Abseil Events, a team of 23 professionals ensured the event ran safely and smoothly, from setup and harness checks to guiding participants through the descent.

Fifty brave volunteers took part, raising an impressive £29,538 for our chosen charities:

The Lighthouse Club (£16,210.50)

Chickenshed Theatre Trust (£13,327.50)

The event was a resounding success, with overwhelmingly positive feedback and a strong sense of community and purpose.

To streamline our volunteering efforts, we created a consolidated list of volunteering partners, making it easier for all projects to access and engage with meaningful opportunities. This initiative is supported by the formal launch and regular updates of our volunteering policy, which encourages staff participation in charitable and community-based activities.

Neighbourhood Engagement and Management

We have strengthened neighbourhood engagement by improving audit processes and using our internal system, Tether, to log and track community feedback, ensuring timely responses and shared learnings.

Open communication channels extend across our workforce and supply chain, in compliance with Considerate Constructors Scheme (CCS) registration on all projects. This helps us uphold high standards and drive positive social and environmental outcomes.

Pilot a 5 day working week. KPI removed after consultation.

5 day working week for new projects. KPI removed after consultation.

Measure and track musculoskeletal health impact on 100% of the workforce.

Currently some emerging technologies in limited use by our supply chain.

Implement flexible working across 100% of project sites.

Achieved.

Ongoing wellbeing and resilience monitoring and coaching programme for 100% of staff.

Implementation of Better Workspaces for 100% of Projects.

Limited success in implementation. Standards revised in 2025 to suit the context of the business operations, particularly relating to adaptive reuse projects.

Zero exposure to diesel emissions from plant on 100% of projects.

Following a recent review, our Mental Health Awareness Programme and consultant psychotherapist support will continue indefinitely. We’ve also introduced neurodiversity training for all staff and are actively developing tools to measure and monitor psychosocial risks across our operations.

In progress. HVO alternatives continue to be used as well as increasing use of electric mobile plant and equipment.

Adaptive technologies in use on 100% of projects to minimise progressive musculoskeletal disorders. While market offerings remain limited, we have expanded the use of drilling robots across projects to improve safety and efficiency. Further advancements are underway, with lift shaft drilling robots scheduled for deployment in late 2026.

Implementation of a maximum 14 hour day door to door policy.

In line with our 2025 fatigue management process, we informally monitor site access data to identify individuals working over 60 hours per week.

Complete IOT shared research pilot with HSE for respiratory and musculoskeletal disorders.

Pilot not forthcoming.

Mandatory Mental Health Awareness Training for 100% of staff.

93% of the business is trained. This number allows for churn of employees.

Mandatory stress and fatigue management training to be rolled out to 100% of staff. Not introduced. Mandatory Mental Health awareness training was identified as sufficient to cover these areas.

50% of all graduate intakes will be female. While our 2025 graduate intake achieved 48% female graduates, we are still yet to hit the 50% mark. Prior intakes (2022-2024) also fell short (ranging from 33%44%).

30% of future talent intakes to be from an ethnically diverse background.

This objective was unable to be measured due to ethnicity reporting not being available until 2022.

A minimum increase of 5% in the number of females holding management positions.

Since 2022, there has been a 57% increase, well beyond our original 5% target.

Our UK business will have a female representation of 25%.

Report ethnicity data. Voluntary reporting of ethnicity data was launched in Autumn 2022.

As a project-led business, we will also endeavour to have at least 10% of our projects led by a female team member.

Currently, no projects are female-led.

Improve our median gender pay gap by at least 10% and strive to better than the industry average of the top 100 contractors in the UK.

Our UK business is currently 26% female, this has steadily risen from 21% in 2021.

Our median gender pay gap has fallen by 21% since 2021. There is however much work to be done in this space with women still earning approximately 32% less than men on average at the median level.

30% of project leadership teams to be female or from an ethnically diverse background. Further measurement required but unlikely to be achieved.

Our leadership team is currently 29% female with no ethnic minorities. Achieved

30% of our executive leadership team to be female or from an ethnically diverse background.

Socio-Economic Value

Social Procurement

100% of projects to monitor diverse business procurement.

While we have not yet achieved full monitoring across all projects, we have made significant progress in strengthening our systems. Our supply chain platform, M-Partners, has undergone an internal review to improve data accuracy and reporting.

Each project to spend a minimum of 3% of project procurement by value with diverse businesses.

Data currently unavailable.

A new Social Value PreQualification tool is nearing completion, which will enable more consistent tracking of diverse business procurement going forward.

Each project to spend a minimum of 5% of project procurement with diverse businesses

See previous.

Leverage industry groups to support Supplier Diversity Development.

We have not yet achieved this objective, and it will be a focal point moving forward.

Per project, a minimum of 1 local SME to be awarded a package above £1m.

BAME and female led/ managed supplier preference.

A new Social Value PreQualification tool is nearing completion, which will enable more consistent tracking of diverse business procurement going forward.

Per project, a minimum of 2 local SMEs to be awarded a package below £1m.

Metrics unavailable due to current tracking of SME packages. To be reviewed for improved tracking.

Metrics unavailable due to current tracking of SME packages. To be reviewed for improved tracking.

20% spend with SMEs. We exceeded our target of 20% SME spend, reporting 37% SME spend in 2021.

33% spend with SMEs. We reported 40% SME spend in 2022, 53% SME spend in 2023 and 34% SME spend in 2024.

We will achieve an average of 35 days to pay suppliers. We reported an average of 38 days to pay our supply chain in 2021. We will achieve an average of 30 days to pay suppliers and become a signatory of the Prompt Payment Code. We have previously achieved an average of 37 days to pay our supply chain in 2022, 30 days to pay our suppliers in 2023, however this increased slightly to an average of 33 days in 2024. We are in the process to become signatories of the Prompt Payment Code.

We will pay 100% of subcontractors by the contractual due date. We always aim to pay our subcontractors on time, and for 2021, we reported an on-time payment rate of 88%. For the first half of 2025, our on-time payment rate was 83%.

100% of our first-tier supply chain partners to be signed up to Multiplex’s ESG Supply Chain Charter. We launched our ESG Supply Chain Charter in 2022 to outline our expectations and commitments. While it was shared with preferred partners, we lacked a reliable system to track signatories across our full supply chain.

27 new roles per £100 million pounds turnover.

Providing 10 work placements to disadvantaged groups to address income inequality.

Averaged 45 new entrants and apprentices employed per £100m of turnover in 2021.

Provided 22 work placements from underrepresented groups in 2021.

30 new roles per £100 million turnover.

Provide 50 work placements to disadvantaged groups to address income inequality.

Averaged 28 new entrants and apprentices employed per £100m of turnover in 2024.

Provided 163 work placements across 2024

− 24 of these were from underrepresented groups.

45 new roles per £100 million turnover. See previous.

Provide 100 work placements to disadvantaged groups to address income inequality.

See previous.

Ensure socio-economic considerations are given to the types of offsetting schemes adopted. This has not been implemented as we do not offset any residual emissions.

Provide 5 green job opportunities to support transition to a zero-carbon economy.

We now recognise that all jobs within the built environment are, and need to be, green jobs. We have therefore chosen not to make the distinction on what a ‘green job’ is.

100% of new supply chain partners screened and audited against our Ethical Labour Principles.

Using our risk-led audit approach, we have been assessing compliance and identifying areas for improvement to uphold responsible sourcing standards.

20% of second tier supply chain audited against Multiplex’s Ethical Labour Principles.

All supply chain partners are required to sign up to Multiplex’s Ethical Labour Principles. Compliance is enforced through a combination of internal audits and third-party assessments. In addition, we are undertaking third-party system audits of our supply chain to further strengthen oversight and accountability.

100% of key materials to be screened for human rights risks.

Pilot one technical solution to manage labour agency risks.

Recent trials have included platforms such as Earwig and TierOnes, aimed at improving transparency and risk management.

100% of our first tier supply chain paying the Real Living Wage. It is a contractual requirement that all operatives are paid the London Living Wage. We also undertake bi-annual third-party audits through Achilles to ensure compliance. In 2025, we became members of the Living Wage Foundation, reinforcing our wider commitment to fair pay.

100% of projects to report churn rate. All projects reported on churn rate. 10% reduction in labour churn rate in our first tier.

The original target of a 10% reduction in churn by 2025 has proven ineffective due to the many variables influencing churn. As a lagging indicator, churn does not distinguish between planned and unplanned departures, limiting its usefulness. As a result, the relevance of the 10% labour churn rate target is currently under review, with both the metrics and the overall approach being reassessed.

50% of our secondtier supply chain paying the Real Living Wage.

We have not yet commenced our own internal review of materials; however, we have undertaken a review to understand which material certifications include ethical labour items to ensure alignment with our social value and responsible sourcing objectives.

By 2030, we aim to maintain London Living Wage compliance across all operatives, supported by bi-annual Achilles audits and our Living Wage Foundation membership.

20% increase in directly employed labour per £1m spent.

Target removed. Instead, we will continue to strengthen our support for the supply chain in promoting ethical labour practices.

40% increase in directly employed labour per £1m spent. See previous.

100% of projects to carry out initial community engagement within 6 weeks of contract award.

100% of projects to develop and implement a site-specific Stakeholder Engagement Strategy within 6 weeks of contract award.

All complaints, queries and compliments to be closed out within 48 hrs.

100% of projects to achieve a CCS score of 45 during the project lifecycle.

100% of London based supply chain partners to be registered with CLOCS.

In many cases, engagement activities began even earlier, demonstrating a proactive approach to building relationships with local communities from the outset.

These strategies are typically drafted during the tender stage and then refined and finalised once the contract is awarded, ensuring they are tailored and responsive to the specific needs of each site.

In instances where resolution within this timeframe was not possible, affected stakeholders were kept informed of progress.

For completed projects in 2024, all had achieved a score of 45 in CCS. Many projects have achieved additional points for innovations and best practice.

Across all our projects, our London-based supply chain partners are required to be registered with CLOCS.

100% of projects to contribute to a minimum of 200 volunteering hours per annum. Projects have gone above and beyond to ensure targeted volunteering has been a key focus. All projects have achieved this target.

100% of projects to contribute £10,000 worth of charitable fundraising per annum.

For our charitable fundraising, projects have delivered fantastic results, all projects have achieved the minimum targets, with projects totalling over £314,000 raised for vital causes.

As we look toward 2030, our business strategy will continue to support our decarbonisation pathway and a just transition, working collaboratively with clients, partners, and our supply chain to construct a better, more sustainable future. Building on the foundations laid by One Decade to Act and Leave No One Behind, we are prepared to set even more ambitious targets where needed, positioning our business to further reduce its environmental impact while maximising social value.

The ESG landscape is evolving rapidly. Stakeholders are increasingly expecting businesses to demonstrate measurable progress across a broader range of issues, from climate resilience and biodiversity, to human rights, equity, and circular economy principles. Regulatory frameworks are tightening, with growing emphasis on mandatory disclosures, nature-related financial risks, and supply chain transparency. At the same time, investors and clients are prioritising ESG performance as a core metric of long-term value and risk management.

In response, we are committed to deepening our ESG integration across all aspects of our operations. This includes:

Continuing our decarbonisation efforts through science-based targets, our PPA, and low-carbon construction methods.

Integrating biodiversity enhancements into project delivery.

Enhancing social equity by expanding inclusive employment pathways and supporting underrepresented groups.

Strengthening governance and transparency through robust data, reporting, and stakeholder engagement.

By taking a proactive and holistic approach, we aim to continue leading the way in shaping a built environment that works in harmony with people and planet.

With ESG embedded in our business, we focus on five core principles. Within these, we pursue actions where our opportunity for positive impact is the greatest, and the impact of our efforts the most material. These core principles - spanning Environment, People, Communities, Partnerships, and Governance and Operational Excellence − enable us to track progress against clear baselines and adapt to regulatory and industry changes, while maintaining our ambition to create lasting positive impact.

Our updated strategy provides clear direction to our clients, project teams, supply chain, and the communities in which we operate - defining not only what we aim to deliver, but also the pathway through which we will achieve it.

− Carbon and Circular Resourcing Low Carbon Sites

− Sustainable Ecosystems

− Health, Safety and Wellbeing Diversity & Inclusion

− Equitable Employment Communities

− Social Value Investment Respecting our Communities Partnerships

Governance and Operational Excellence

− Social Procurement

− Ethical Labour Practices

We have taken a pivotal step by resetting our Science Based Targets initiative (SBTi) baseline year, reflecting the significant carbon reductions achieved since 2017 and reinforcing our commitment to further progress.

This reset enables us to set more ambitious goals for reducing both upfront and operational carbon impacts across our projects. We have also expanded our carbon benchmarks to ensure every project aligns with clear, measurable targets, strengthening accountability and consistency across our portfolio.

Our revised approach encourages the adoption of innovative materials and low-carbon construction methods, helping accelerate the uptake of emerging technologies and build confidence in sustainable solutions across our sites.

Site Emissions

Digital transformation

Driving improvements in productivity and efficiency.

Waste Greater opportunity for modularisation and reduction in rework.

Transport Modularisation can facilitate a reduction in vehicle movements.

Maintained focus on adaptive reuse projects

Reducing whole-life carbon by extending an assets lifetime.

Supporting our clients through early engagement

Ability to influence carbonintensive enabling stage and promote design solutions.

Promoting reuse rather than new build, reducing demolition waste.

Brownfield sites generally tied to existing transport links.

Pre-demolition audits can be used to assess reuse viability.

Greater opportunities to explore consolidation and alternative modal shares.

42% reduction in Scope 1, 2 and 3 emissions by 2030 (on 2024 baseline).

We will reduce our Scope 1 and 2 emissions in line with a revised near-term Science Based Target. Building on the progress we have made, we anticipate that future reductions will be driven by a combination of enhanced site efficiencies and the continued transition toward electric plant and equipment.

In 2023, we identified that the SBTi Buildings criteria were not suitable for main contractors. As a result, we revised our commitment and set a new 2024 baseline that better reflects our current project volume and future pipeline.

Ensure all direct and in-direct supplies of HVO are covered by Renewable Fuel Declarations as part of the Renewable Fuels Assurance Scheme (RFAS).

50% reduction in project embodied carbon intensity by 2030.

We have updated our upfront carbon targets to align with the UK Net Zero Carbon Buildings Standard (UK NZCBS), while expanding the scope to reflect our evolving project pipeline. Targets now include retrofit office, life sciences, and data centre projects, with residential and hotel targets separated to account for their unique characteristics.

While the limits set within the Standard for new build office and residential projects are particularly ambitious, we remain committed to advancing low-impact materials and innovative design and construction practices to further reduce upfront carbon across the industry.

2030 Upfront Carbon Project Targets

Type

By 2030, all projects to have 50% less embodied carbon.

Propose validated embodied carbon reduction measures in every bid, and present the business case to the client to secure buy-in.

Apply circular economy principles to all new projects, including seeking to maximise the reuse and/or recovery of materials.

Collaborate with the supply chain to increase availability of low carbon major construction materials, including procuring steel and concrete that meets the SteelZero and ConcreteZero criteria.

Notes:

All embodied carbon reporting on our projects follows the RICS Whole Life Carbon Assessment (WLCA) methodology.

The target year (e.g., 2030) for all upfront and operational benchmarks refers to the project’s ‘date of commencement’, as defined with the UK Net Zero Carbon Buildings Standard.

For adaptive reuse projects, upfront carbon targets are calculated using an area-weighted approach that distinguishes between new build and retrofit elements.

Goal 3:

Embed the principles of Design for Performance (DfP)NABERS UK into all new projects.

We have identified key principles of Design for Performance and set out how these principles will be applied, both on projects with DfP assessments, and those without.

Energy use intensity (EUI) targets have also been revised to align our operational carbon goals for all projects with the principles.

Energy use intensity (EUI) targets for offices have been retained, to cover both new build and adaptive reuse projects. EUI targets for residential, higher education, life sciences, and hotels have been aligned to the UK Net Zero Carbon Buildings Standard (UK NZCBS) to better reflect industry expectations. A UK NZCBSaligned power usage effectiveness (PUE) target has been introduced for data centres.

EUI targets for retail have not been provided given the diversity of potential use types, while healthcare projects are to refer to the NHS Net Zero Building Standard targets.

Principle Projects with DfP Assessment

Dynamic building thermal model

Metering and BMS strategies

DfP simulation will be updated through Stages 4 and 5 to reflect change and procurement.

Metering and BMS strategies will be developed with the design team and supply chain to meet the assessment requirements.

Design reviews Independent Design Review recommendations will be reviewed and implemented.

Projects without DfP Assessment

Modelling will be carried out in line with specific project approaches (Part L, EPC etc), with change and procurement assessed through Stages 4 and 5.

Multiplex will endeavour to develop metering and BMS strategies with the design team and supply chain that align with NABERS requirements.

Energy modelling will be carried out in line with specific project approaches, with opportunities for EUI improvements identified.

Building handover Commissioning

Building handover

An independent commissioning agent will be appointed, with detailed commissioning plans for each service produced.

Tenant designs are reviewed to ensure they align with Multiplex’s NABERS post-commissioning simulation.

Develop strategy with project team to ensure post-PC energy data aligns with the NABERS model.

An independent commissioning agent will be appointed, with detailed commissioning plans for each service produced.

Where applicable, tenant designs are reviewed to ensure they align with the project’s postcommissioning energy model.

Develop strategy with project team to ensure post-PC energy data aligns with the NABERS model.

All projects to meet energy use intensity (EUI) targets for their relevant

Zero avoidable waste by 2030.

We remain committed to achieving zero avoidable waste in line with the Green Construction Board’s original definition. Whilst a reduction in waste intensity will be our primary performance indicator, it is also proposed that future diversion from landfill performance is split amongst construction, demolition and excavation to promote transparency during each stage.

Businesses that adopt the principles of circularity within their operating model within the remainder of this decade will possess a significant market advantage, as local policies tighten, and the cost of raw materials continues to escalate.

90% Reduction in waste intensity by 2030 (t/100m2 GIA, 3-year moving average).

Construction: Set waste reduction targets for structures and drylining works, whilst promoting the use of take-back schemes and reusable packaging. Action #2

Demolition: Continue to support the adaptive reuse market, supply and use of reclaimed materials and the implementation of material passports. Action #3

Excavation: Improve processes related to the testing and classification of soils to increase opportunities for the reuse of site-won soils.

Notes:

Zero Avoidable Waste in construction means preventing waste being generated at every stage of a project’s lifecycle, from the manufacture of materials and products, the design, specification, procurement and assembly of buildings and infrastructure through to deconstruction. At the end of life, products, components and materials should be recovered at the highest possible level of the waste hierarchy, i.e. reused before being recycled, whilst ensuring minimal environment impact – Green Construction Board, 2020.

A 3-year moving average is proposed to smooth fluctuations in performance data given the low number (but high-value) of our project portfolio, resulting in data that can be heavily influenced by the stage of only a few projects. This would make our ‘by 2030’ target measurable using data between 2027 to 2029.

Goal 5:

Annual increase in electric Light Goods Vehicles (LGVs) by 2030.

The Climate Change Committee’s Seventh Carbon Budget provides some crucial insights to future trends and how surface transport will contribute a 27% of emission reductions by 2040.

We are already beginning to see EV sales have a measurable effect in reducing emissions. This will accelerate rapidly over the coming years as prices fall and sales grow, with fully electric options accounting for nearly all new car and van sales by 2030 and making up over three-quarters of the fleet on the road by 2040. The zero-emission HGV market will see fast growth during the 2030s, enabled by financial support in the early years.*

We will seek to support the Construction Leadership Council’s (CLC) position, as detailed within its CO2nstructZero Performance Framework, to enable a year-on-year increase in the proportion newly registered electric Light Goods Vehicles (LGVs).

Continue to support our supply chain on the uptake of electric transport options through connection with leading manufacturers.

Increase granularity of transport emission data through improvements to delivery booking systems used by ourselves and logistics partners.

Where appropriate, support research that seeks to identify and/or unlock barriers to the accelerated uptake of battery electric LGVs.

to increasing the availability of vehicle emission data which is typically assumed. This could be achieved by utilising Vehicle Registration Numbers to assess fuel type against the DVLA (Driver and Vehicle Licensing Agency).

Biodiversity is essential in maintaining the systems that provide our food, water, medicine, climate stability, and economic resilience. Over half of global GDP depends on nature, and more than a billion people rely on forests for their livelihoods. Land and oceans absorb over half of all carbon emissions, making their protection critical to both climate and community resilience.

We are refocusing our strategy to prioritise long-term impact over short-term ambition. Our Sustainable Ecosystems approach is about actively restoring nature, improving environmental health, and building resilience into how we work, with a more targeted, measurable approach to create lasting impact.

The table outlines current developments across these critical environmental domains, highlighting relevant legislation, emerging initiatives, and market trends shaping the built environment and that will drive our next steps.

Principle Biodiversity

Legislation and Initiatives

Local planning requirements for Biodiversity Net Gain and Urban Greening Factor.

Environment Act’s commitment to halt species declines by 2030, increasing abundance by 10% by 2042.

Taskforce for Nature Financial Disclosures (voluntary).

Current Events and Drivers Nature-inclusive design: Emphasis on habitat protection and nature-based solutions.

Water Air Quality

Water Act 2025: Tougher pollution and wastewater rules.

Part G (2025): Labels on fittings; stricter targets in stressed zones.

Freshwater Science-Based Targets (voluntary).

Non-road mobile machinery (NRMM) Regulations: By 2030, all NRMM must comply with Stage V.

Market Trends Nature-positive sites: Rising demand, better rents, smoother planning.

Biodiversity value: Key for developers, investors, and insurers.

Droughts: Prolonged periods of low rainfall, with knock-on effects on water supplies.

Water tech: Smart meters, rainwater, and greywater systems now common in new builds.

Risk assessments: Retrofit demand rising for efficiency and certification.

Diesel enforcement rising: Stricter checks and retrofits required in urban zones; Stage V or retrofit compliance enforced via ULEZ expansion.

Electric/hybrid NRMM: Uptake rising due to regs and incentives.

Leasing services: Offering lowemission compliant fleets.

Advancing Nature-Based Solutions Beyond Compliance.

We are committed to integrating Nature-based Solutions (NbS) beyond planning requirements, recognising their vital role in climate mitigation, biodiversity enhancement, and resilience against environmental risks such as flooding and drought. By restoring natural ecosystems and embedding biodiversity into our project designs, we contribute to long-term ecological regeneration.

KPIs 1:

Year-on-year progress on these actions.

Action #1

Action #2

Embed nature-positive principles into early-project stages, ensuring NbS are considered beyond compliance and aligned with long-term environmental goals.

Work closely with ecologists and landscape designers to identify and implement high-impact NbS, such as green roofs, rain gardens, and habitat corridors, tailored to each site’s context.

Action #3

Monitor BNG and UGF performance across projects, using data insights to refine approaches and replicate successful NbS strategies in other projects.

76 Southbank achieved a 172% increase in biodiversity net gain, showcasing the potential of NbS when applied ambitiously.

Goal 2:

Reduce water usage during construction to improve resource efficiency, protect ecosystems, and build resilience against future water scarcity.

Water is essential to construction, from concrete production and equipment washout to commissioning and welfare facilities. However, with increasing pressure on UK water supplies due to climate change and population growth, efficient water use is critical. Poor water management not only harms ecosystems, but also wastes energy and financial resources.

KPIs 2:

Year-on-year progress on these actions.

Action #1

Applying a Water Reduction Hierarchy: Avoid > Reduce > Reuse > Recycle > Dispose Responsibly.

Monitoring and benchmarking water use across all sites (m³/100m² GIA) and tracking groundwater/trade effluent discharge.

Using AI technology to detect leaks and optimise consumption.

Developing a water reduction target based on the Science Based Target principals, informed by collected data.

At the University of Glasgow project, we’ve implemented a range of Sustainable Drainage Systems (SuDS) – including rain gardens, tree pits, and underground storage – to manage surface water and meet SEPA requirements. These features not only treat and attenuate runoff but also enhance biodiversity suited for the local climatic conditions.

Reduce air pollution from construction activities, particularly emissions from Non-Road Mobile Machinery (NRMM) to protect public health, improve urban air quality, and minimise ecological impact.

Although national emissions of pollutants like NOx, PM10, and PM2.5 have declined overall, the construction sector’s share has grown since the 1990s due to slower adoption of cleaner technologies. NRMM remains the primary source of site-based air pollution. In high-activity areas, NRMM emissions can exceed those from road vehicles, contributing to elevated levels of black carbon and PM2.5 – pollutants linked to serious health risks and environmental degradation. That is why managing these emissions is essential for improving air quality and reducing our ecological footprint.

KPIs 3:

Year-on-year reduction on key air quality indicators. Action #1

Using air quality industry tools to identify high-emitting equipment and set targeted reduction goals.

#2

Action #3

Monitoring key air quality indicators (PM10, PM2.5, NOx) using the Urban Health Calculator.

Integrating air quality into procurement, planning, and site operations, supported by audits and best practices.

100% NRMM compliance in audits across all projects.

At Multiplex, our social strategy is grounded in a commitment to equity, dignity, and opportunity for all. We recognise that the construction sector presents elevated risks of labour exploitation and social exclusion. In response, we have adopted a proactive, partnership-led approach, collaborating with local authorities, NGOs, industry bodies, and our supply chain to safeguard our workforce from occupational health and safety risks, while promoting inclusive employment, fair treatment, and community wellbeing. This section outlines our progress and future goals across four key pillars:

Together, these pillars reflect our ambition to create a more inclusive, resilient, and socially responsible built environment. As captured in the ‘Eight Experiences’ illustrated below, our mission is for everyone who works with us to feel:

While our world and industry constantly evolves, at our core we remain a people focused business.

Our focus on wellbeing and resilience at work has evolved to consider a broader, more global context. Recent research by Safe Work Australia, for example, shows that psychosocial risks can negatively affect worker wellbeing – findings which we have taken on board. Moving forward, our Human Resources team will work collaboratively with our global business to identify potential psychosocial risks, and opportunities to mitigate them. We will use relevant metrics to measure our performance.

The proposed Research Pilot by HSE for musculoskeletal and respiratory diseases within the ‘Discovering Safety’ portfolio has not materialised as a collaborative project. Nevertheless, we have increased our use of drilling robots across our operations to reduce overhead drilling of mechanical and electrical systems, and containment fixings. Use of drilling robots eliminates the hazard of silica dust inhalation for these works. We have also identified further risk reduction techniques, such as suspended drilling robots for work in lift shafts, which will be used on our 50 Fenchurch Street project in 2026.

Eliminate the use of artificial or ‘engineered’ stone on all of our UK projects by 2028.

We work closely with our Australian business, and through this partnership, we became aware of a severe global occupational health risk: accelerated silicosis. The first recorded case was in 2015, and in 2024, the Australian Government banned the use of artificial stone – acknowledging it as the source. By 2025, there were 1,000 confirmed cases of silicosis.

In the UK, we are working with Dr. Johanna Feary, a leading respiratory consultant, who identified the first UK cases in 2024. These have since risen to 40, with numbers expected to grow. Her research, published in Thorax (BMJ, 2024), shows that the highest exposure occurs during shaping and cutting artificial stone in small workshops.

Given the high silica content and associated health risks, we have banned artificial stone benchtops, panels, and slabs on all new projects from June 2025 – following Australia’s lead.

All new projects at design Stage 3 to specify only low silica alternative products.

Action #1

Action #2

Announce a company – wide ban on the use of artificial stone on all future projects from June 2025 to supply chain and clients.

Provide clarity by identifying the specification requirements of safer alternative products and communicate these to our supply chain and clients.

Action #3

Notes:

Monitor projects in PCSA and during construction to ensure compliance with the ban.

2028 Target is set to reflect a 3-year project cycle where current projects in progress using artificial stone products will be largely complete.

Develop a strategy to manage psychosocial risks within our organisation by 2028.

Alignment with our Australian business highlighted the growing global focus on psychosocial risks – workplace stressors that impact wellbeing and business performance.

Drawing on research by Lingard and Turner (RMIT University), Safe Work Australia’s 2022 Code of Practice, and ISO 45003:2021, we’ve refined our approach. Our updated target focuses on identifying, managing, and monitoring psychosocial risks more effectively recognising the clear link between organisational design and health, safety, and wellbeing.

KPI 2:

Achieve compliance with ISO 45003:2021.

Working with the Global Multiplex business, determine the psychosocial risks and opportunities that need to be addressed.

Establish appropriate objectives and determine how they will be achieved to effectively manage psychosocial risks and fulfil legal requirements.

Effectively minimise the impact of fatigue across our operations by 2028.

Our standardised site access control system across all UK projects has improved visibility of working hours, highlighting the need for proactive fatigue risk management. While only a small percentage of workers exceed a weekly average of 65 hours, the system flags repeated exceedances, enabling employers to review workloads and rest periods to help maintain safe site operations.

KPI 3:

No worker exceeding 65 hours worked per week on our projects.

Consider the needs of worker groups, workplace tasks, and psychosocial risk assessments, integrating findings into existing consultation and management review processes to support continuous improvement. Action

Pilot our data-driven fatigue risk management system on our Western Yards Building 2, London project.

Review the results of the pilot, consult with our workers and supply chain and identify any changes necessary to the fatigue management system.

Implement the fatigue management system across all projects by mid-2026.

We regularly review and refresh our Diversity & Inclusion Strategy to ensure it is progressive, responsive and impactful – driving meaningful strides towards a more equitable and inclusive workplace. Our ambition is to embed inclusion into the fabric of our culture, ensuring that very person feels seen, hard and valued.