Grid Trading Strategy In Forex and Other Assets

To use the strategy, a trader buys and sells positions at set intervals around a central price. These intervals are known as the “grid.” In doing so, traders capture market price movements of a security within a set range.

What is Grid Trading

As explained above, the Grid trading strategy requires placing orders at set intervals around a central price, called the grid. Traders must be patient with market price movements, profiting only when prices move within a set range

This flexible strategy works in different market conditions. As a forex trader, you can adjust the grid to accommodate various market conditions and trading strategies

You can also combine grid trading with other technical analysis tools, such as support and resistance levels, to determine the grid’s parameters.

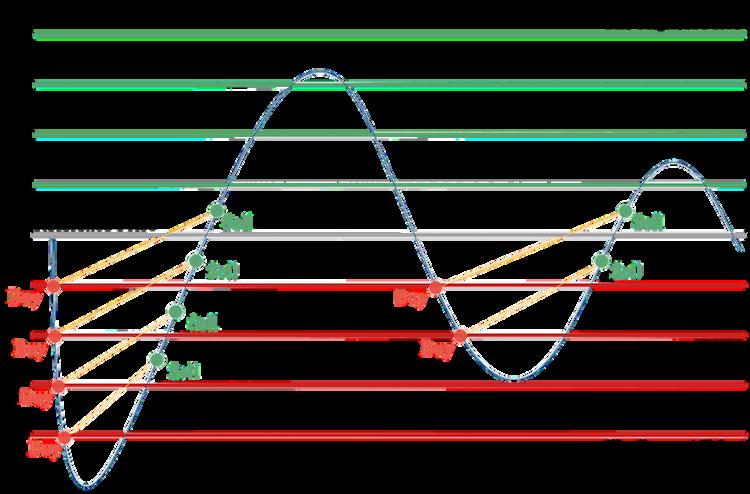

For example, suppose the central price is $100, and the trader decides to set up a grid with a 20-pip interval. In that case, the trader places buy orders at $80, $60, and $40 and sell orders at $120, $140, and $160 The interval between each buy and sell order is 20 pips.

How Does Grid Trading Work?

The grid system isn’t complicated. It involves setting up a grid around a central price and placing buy and sell orders at regular intervals within the grid You can also adjust the method to reflect different trading strategies and market conditions.

You can combine the system with other technical indicators, such as support and resistance This helps you to determine the grid’s parameters Grid construction assumes prices move within a specific range.

For example, if the central price is $100 and a trader decides to set up a grid with a 20-pip interval, the trader would place buy orders at $80, $60, and $40 The sell orders would be at $120, $140, and $160. The interval between each buy and sell order would be 20 pips.

Image from here

Understanding Grid Trading:

The grid trading system involves setting up a grid around a central price. This is followed by placing buy and sell orders at regular intervals. The method of trading is flexible It can also be used in different market conditions and combined with other strategies, such as ranging markets where grids are set up at smaller intervals.

The grid system can also be adjusted for a trending market. In this scenario, the grids are set up with larger intervals This allows one to take advantage of larger price movements in one direction and avoid getting caught in whipsaws or choppy conditions.

Grid Trading Construction:

As a trader, you will need to set up buy and sell orders at set intervals around a central price when constructing a grid. After placing this order, it will be possible for you to adjust the grid to reflect different trading strategies and market conditions.

During grid construction, you can opt to use technical analysis tools, such as support and resistance, to determine the grid’s parameters You will also be able to adjust the grid to reflect different market conditions, such as ranging markets or trending markets.

Favorable Conditions:

One of the most favorable conditions in which you can use the grid trading strategy is a ranging market In these types of markets, you can capture price movements within the grid and potentially generate a profit.

For instance, take a scenario where the price of the security moves up to $120, and the sell order at $120 would be executed, generating a profit If the price moves back down to $100, then you would buy back the security at $100, creating a new grid with new buy and sell orders

Unfavorable Conditions:

Despite its popularity with traders, the grid trading system, when not executed properly, can result in losses For instance, taking a trade using the strategy when prices are moving in only one direction can result in losses, especially when prices move beyond the grid’s range.

A good scenario is when prices are moving to the upside, and a trader decides to place an order at, say, $160. At that point, the trader would likely not be able to take a sell order, resulting in significant losses.