MRIDU GUPTA

LXMT 749, M.A FINAL PROCESS BOOK PROFESSOR CARIN WIGHTMAN THE PROCESS BOOK TRANSCENDS FROM BLACK AND WHITE TO HINTS OF COLOUR, ENDING WITH RED, SHOWCASING A NOVEL VISION FOR CELINE ROUGE

INTRODUCTION Secondary Research

CELINE Brand Overview 1. About 2. History 3. Identity 4. Current Status 5. Financial Status 6. Future Prospect 7. Projects 8. Current Marketing Strategy 9. Advertising and Campaign Strategy 10. Marketing Mix 11. Brand Analysis Chapter II: Industry and Market Research 1. Luxury Industry 2. Beauty Industry 3. Prestige Beauty Industry 3.b LVMH Recherche 4. Market Share and Insights 5. Market Value and Driving Factors 6. Market Leaders

CONTENTS

Part 1 Chapter I:

TABLE OF

Chapter III: Key Findings Secondary Research

a. Beauty brands utilise culture commerce and social media to connect with today's consumer b. Green luxury in beauty c. Authentic connection with millennials d. Influencers are a big investment in beauty

Primary Research Part 2

Chapter I: Research Design 1. Ethnography - Observation 2. Tangible and Intangible 3. Focus Group 4. Interview Chapter II: Key Findings Primary Research

a. Finding trends b. Research Analysis

Celine Beauty Strategy Part 3

Chapter I: The Business Canvas

7. Defining Trends

Target Consumer Part 4

Chapter I: Target Market

Chapter II: Celine Customer Segmentation

Chapter III: Celine Rouge Customer Segmentation

Competitive Landscape Part 5

Chapter I: Competitive Beauty Analysis

Chapter II: Perceptual Map

Marketing Strategy Part 6

Chapter I: Marketing Mix

Chapter II: Campaign Concept

Chapter III: Launch Plan

Chapter IV: Marketing Campaign 2.

Cost Structure Part 7

Chapter I: Demand Plan

Chapter II: P&L Conclusion Part 8

3. Social Media Strategies 4. Influencer Marketing 5. Print Media / Magazine 6. RFM Model

CRM

INTRODUCTION

The LVMH group has owned the French ready to wear and leather luxury goods brand Celine since 1996. Since November 2015, the corporate offices have been housed in the Hotel Colbert de Torcy, a French Historic Monument, at 16 rue Vivienne in Paris' 2nd arrondissement Since April 2017, Séverine Merle has served as CEO The label pushed the reset button on everything to signify this new direction, and the new design is modelled after the iconic 1960s identity with 1930s era modernist writing. The first 'e"s accent has been removed, indicating a concentration on simplified purity, similar to 1960s fashion collections

Hedi Slimane, is the new creative director appointed to this heritage French brand There is no denying the presence of Slimane's signature style, yet it has been transformed into something fresh Unorthodox designs, excessively brilliant colours, and dazzling materials characterise Celine's innovative and disruptive style. Hedi Slimane is aware of the new political influencers' strength and influence, which is no longer limited to entertainment. The characteristics of young online girls and the cool kids who make us fall in love from the other side of the screen are used here to display Celine's evolving style, which has evolved into a bolder, more vibrant version of Celine's style.

Celine aims at extending their product line into a newer segment of coloured cosmetic beauty under the maestro supervision of Hedi Slimane and LVMH. This is to enter an exponentially growing uncharted territory with complete control over the beauty and cosmetic industry

Celine has always proven to be a feminist driven french brand for the past decade, therefore, this brand extension will enhance their awareness and loyalty for a novel segment of audience Celine believes that through this creativity, they will be able to develop and position themselves with timeless products, both meaningful and inspirational, to people and their lives

Secondary Research Part 1

Chapter I - Brand Overview

1. About

Celine's fundamental strengths and competitive advantage stem from the fact that they are established with at par excellent craftsmanship and heritage. They have a strong brand loyalty and identity because of their French history and culture, which consumers are aware of and value. The brand is owned by the superpower conglomerate, LVMH The nuanced blending of energy is what gives Celine's designs life. Their work occasionally combines toughness, elegance, and eccentricity, It has a stronger sense of femininity and depth because it is more like a personality than a marketing image

Celine has a remarkable talent for predicting the direction of the zeitgeist in culture. Hedi Slimane's Celine is doesn't adhere to traditional beauty standards and is bored with commercial fashion pictures and henceforth has a good taste in temper

2. History

The fact that the namesake French fashion brand really began as a made to measure children's shoe shop surprises many people. With the opening of their store in 1945, Céline Vipiana and her husband Richard began selling made to order custom shoes that quickly gained notoriety for their fashionable designs The couple felt it was time to enter the women's footwear market in the late 1950s or early 1960s, and they quickly grew their business to include additional accessories and a women's ready to wear sports range The designs of Céline helped to create a new sub genre of contemporary that focused more on practicality than whimsy.

After successfully expanding, Céline eventually unveiled Vent Fou, the company's debut fragrance, in 1963 In 1966, Céline expanded even further and started making gloves, belts, and bags. Never one to skimp, Cébrand established a factory in Florence, Italy to meet the demand for her line without compromising the excellent standard for which she was well recognised

The Blazon Chaine, a newly created logo by Vipiana that featured an interlaced double C shape and a complex central pattern referencing the Arc de Triomphe's architecture, was unveiled in 1973. The attention of Bernard Arnault, CEO of LVMH, was drawn to the brand as it developed and expanded its market globally to places like Beverly Hills and Hong Kong. Arnault made the decision to invest in Celine in 1987, but it wasn't until almost ten years later that he chose to add the brand to the LVMH portfolio by purchasing it for about three billion French francs after Vipiana passed away.

Micheal Kors ( 1997 2004)

Micheal Kors ( 1997 2004)

When Kors was appointed the brand's first creative director in 1997, he set out to transform Celine into a force that the LVMH group could be proud of. His inspiration accomplished this and re focused the attention of the fashion elite on the long forgotten brand The brand improved slowly under Kors' leadership, becoming more recognisable and sought after. Finding the next creative leader who would be the ideal match proved to be difficult after he left in 2004

This experience left the brand feeling let down. As Michael Kors' reign came to an end, the brand's initial hype started to fade. Two seasoned creative directors were hired by LVMH, but neither one seemed up to the job Manichetti and Omazic each had a year at the house, and when they failed to change the brand, LVMH was obliged to make a crucial choice.

Roberto Manichetti and Ivana Omazic (2005 2008)

Roberto Manichetti and Ivana Omazic (2005 2008)

Phoebe Philo #Old Celine (2008 2018)

Phoebe Philo succeeded over Céline from Ivana Omazics in 2008 and completely transformed the 72 year old company A Londoner had turned a second tier fashion name into an unstoppable premier superpower that understood the demands of modern women better than any other brand on the planet. Her ability to intuit what her customers desired before giving them with a better rendition was her strength as a designer and creative director. Philo, was an outspoken feminist, had long been a critic of fashion's sexualization of the female form.

Her creations were carefully chosen, simple, and finely cut, giving "power to women." Here's how Philo infused female strength into Celine's DNA The obvious appeal of Céline was its easiness. While many designers had a track record of creating collections that, while gorgeous, alienate modern women, Philo had a direct conduit to their demands. Philo's vision had touched a nerve with its subtlety and relative sobriety, as well as its emphasis on quality over quantity

Hedi Slimane #New Celine (2018 Current)

Celine’s newly appointed creative director, Hedi Slimane on February 1 2008 with his debut collection had sparked some some serious outrage. Slimane's presence, in reality threw, the opulent house into disarray. Starting with the elimination of the emphasis on the accent to his distinct rock 'n' roll aesthetic dazzling tiny dresses, studded leather, and exaggerated '80s silhouettes his predecessor's fan base was alienated. Slimane made some big adjustments to Celine, and many people thought it was a drastic move for the brand. The collection's strengths, as well as the accuracy with which it was executed, appeared to be irrelevant The prominence of such infantilising ideas drowned out Slimane's tight curation of antique references, excellent styling, and the way his tailoring had developed from genuinely tiny to a cut that was slim but just sloppy enough to communicate Parisian exuberance

After Celine moved into menswear for the first time in the history of the brand, it's safe to say the most vocal attackers of Slimane's debut were exaggerating at least a little when they attempted to link Slimane's collection with the many injustices of living in a patriarchy Celine's full category rollout under Slimane expanded the brand's offerings to include menswear, perfumes, and a bigger jewellery sector demonstrates LVMH's desire to transform the brand into the next luxury powerhouse

3. Identity

Celine's brand awareness and brand density are significant success drivers. The brand is well known, but you'll have to go out of your way to find it due to it’s scarcity Consumers also pay particular attention to the fabrics because, throughout the "Philo" era, she placed a premium on the quality of the materials used and the skill that went into the products. Celine is finally more confident today that it has introduced a fresh wave of price rises for luxury goods with the new styles and new Triomphe logo, with three more rounds scheduled this year (it only increased prices once in 2020).

4. Current Status

Celine is sold in 178 stores (LVMH) worldwide, mostly in Europe and America The company sells to numerous multi brand stores, most of which are upscale department stores including Galeries Lafayette, Harrods, Selfridges, Saks Fifth Avenue, and Bergdorf Goodman The brand can be purchased from upscale online retailers like Net A Porter, MatchesFashion com, Farfetch, and Moda Operandi, according to a check of retailer websites.

The Maison has a large product portfolio of leather goods such handbags and trunks Haute Couture and Ready to Wear in women's, mens and children's clothing. Additionally, sells fragrances, sunglasses and the company has been experimenting with a few capsule collections for the outdoor apparel and home décor markets

Celine did exceptionally well after the outbreak in terms of revenue and profitability. Celine succeeded well in the important Chinese market, incorporating influencers and celebrities, and drawing in newer brand associations with the Millennials and Genz, so 2021 was the year of recovery for Slimane and Celine.

While Celine continues to sell Philo designed “It” bags, newer models have begun to appear with the reopening of stores in China and the emergence of "revenge shopping" at a time when Celine's popularity was on the rise. Celine is benefiting from a stronger presence on WeChat in China, where the brand's mini program combines social media content with the ability to buy things in real time.

4. Financial Status

Following a record breaking year, Celine kept up its remarkable growth, proving its potent appeal across all product categories The popularity of Hedi Slimane's designs and the viewers drawn to the Maison's digital shows filmed and directed by the former itself helping the ready to wear sales pick up steam

The Maison kept expanding its selection of leather goods, especially the Triomphe, an iconic model, and 16 other items in its premium leather goods line. The premium perfumery collection's buoyant expansion was another factor in Celine's steady advancement

The brand's success was aided by other noteworthy initiatives in addition to the ready to wear line and handbags. Pop up shops, Asian collaborations, e commerce runways, and social media focused marketing initiatives, among other events, were highly successful in raising brand recognition and boosting sales. Celine did exceptionally well after the outbreak in terms of revenue and profitability (LVMH). Celine succeeded well in the important Chinese market, incorporating influencers and celebrities, and drawing in newer brand associations with the Millennials and Gen Z, so 2021 was the year of recovery for Slimane and Celine. While Celine continues to sell Philo designed “It” bags, newer models have begun to appear with the reopening of stores in China and the emergence of "revenge shopping" at a time when Celine's popularity was on the rise. Celine is benefiting from a stronger presence on WeChat in China, where the brand's mini program combines social media content with the ability to buy things in real time Celine has one of the fastest growth rates in the business, according to LVMH management, thanks to creative director Hedi Slimane and CEO Séverine Merle. The Group's organic revenue growth of 22% in the fourth quarter compared to the same period last year demonstrates its operations' rapid expansion Fashion & Leather Goods saw significant growth over the time, with organic revenue up 21% from the previous year (LVMH) Over the course of the year the

5. Future Prospect

Celine's expansion will be aided by the development of its omni channel strategy to enhance customer service and the selective extension of its shop network. This exclusive plan of action will keep moving forward toward a vision of luxury that is ever more sustainable and responsible over the coming few months One of the factors propelling the achievement of this goal will be the continued implementation backed by their highly motivated and adaptable team, and equipped with a number of valuable resources Including digital tools to keep in touch with their clients and creativity combined with an unwavering focus on excellence. (LVMH)

Celine has begun to make inroads in integrating concepts of timeless elegance with current tastes, especially among younger buyers. As the collections progress, the brand is regaining momentum with younger clients, thanks to a blend of timeless luxury and more dressed down pieces Increased marketing and social media investment on Celine has been seen online and in fashion capitals throughout the world.

6. Projects

The Celine Art Project by Hedi : The nexus of art and fashion

The creative director of Celine, Hedi Slimane, has always placed art at the centre of his work. As part of the Celine Art Project, he has embraced a curatorial style at Celine and has partnered with up and coming artists to commission site specific artwork for flagship locations across the world The brand is firmly committed to the arts on all levels, and believes that art is the axis of Celine.

"I always aim for a store concept that is simultaneously cold yet warm, architectural yet organic" by Hedi Slimane.

A hybrid project such as the Celine Art Project, where artists and Celine share a fascination with materiality and site, regardless of how formal or political their approaches are Their work makes references to the Minimalist and Post Minimalist Era's, although not actively engaging with them. Hedi has created a tension between "natural" and "industrial" materials, pursued in the same way as it was previously addressed by artists working in the 1960s and 1970s And it succeeds; these works of art, chosen by Slimane and his team, echo his ethos at Celine, fusing avant garde experimentation with a wide range of materials and media (Sotheby's, 2021)

Buyers experience a kaleidoscope artistic experience at Celine while admiring the stunning architecture of the recently refurbished structure. Specially commissioned, site specific art pieces hang from the ceilings, sit on the walls, and stand throughout the multi level stores around the world, amidst the lavish, arresting designs by Slimane. All of them are remarkably bold in their vigour and composition, that draws the attention to the sculpture because of its tastefully juxtaposition with items of clothes, footwear, accessories, and perfumes

Celine’s Madison Avenue boutique anchored by Jose Dávila’s Aporía IV (2017).

Limited Edition Celine Homme Pop up with Mr Porter

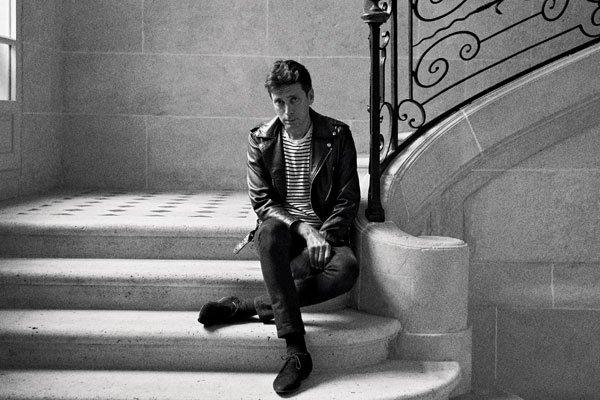

The collection may have been created before lockdown, but Slimane says it is "a candid portrait of a generation that took advantage of the confinement and isolation to assert itself and emancipate itself creatively " Celine debuted 48 styled in 2020, for Celine Homme as a line for the menswear collection; the designer's inspiration gained additional weight after everyone's movements were restricted and the youth of the world turned to their phones for creative expression. Slimane's finger is always on the pulse of teenage society, so the designer tuned into this phenomenon and used his own high octane energy to replicate the on screen culture. Bring on the psychedelic knits, studded leathers, and candy colored racing helmets.

Slimane has long practised and mastered the technique of showcasing up and coming performers The musicians were both captured on camera by Slimane in London wearing items from both the men's and women's collections, along with a new capsule of supersized earrings that features costume jewellery made by the French designer. Youth culture is still, above all, at the centre of Slimane's artistic expression. He continues to support emerging talent with an electrifying and genuine passion while creating a desired and attractive reality

Portrait of a Performer

Portrait of a Performer

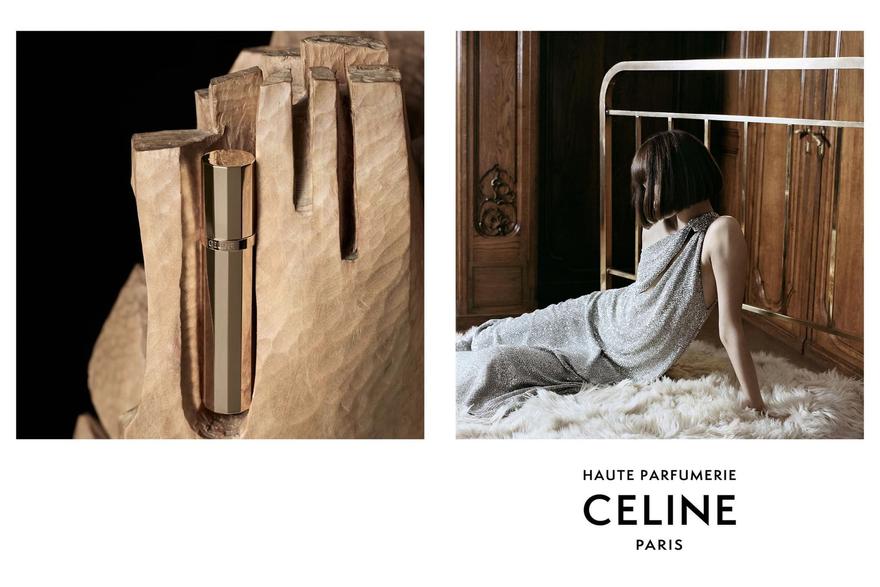

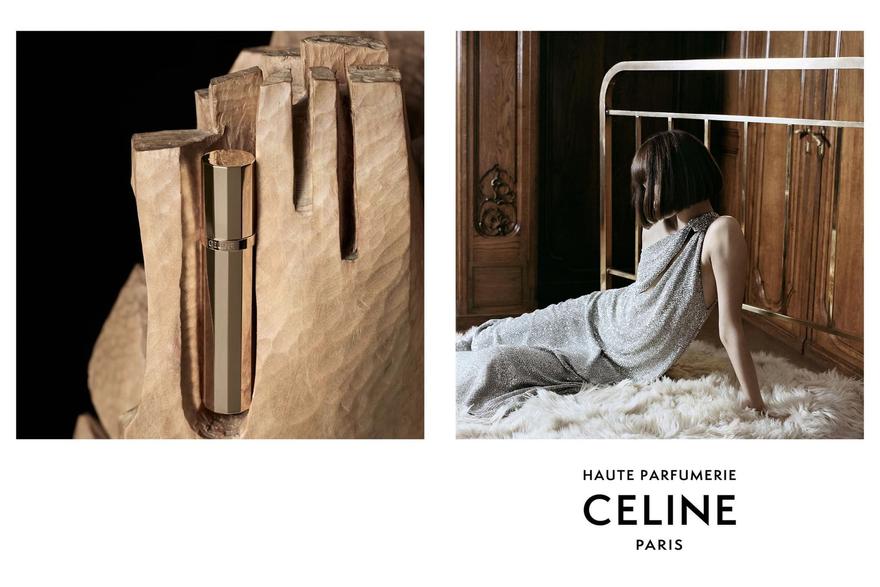

Celine is a house of objects, and this is apparent in the flacon's style. Celine Haute Perfumerie unveiled in 2020, a brand and art extension by Hedi as a mean to work his magic as a couturier parfumeur

The line, which consists of eleven distinct scents, depicts the key moments in the designer's life through an olfactory experience A crucial translation of a recollection of moments, places, and people, serving as a recall of particularly special times and stages in life. The shape of the glass bottle, made of pure and flowing lines, is best described as somewhere between French Art Déco and global modernism The design was polished with a straightforward black screw top with the Maison's emblem, the "Triomphe"; in this way, d l d h d h

Figure 2 Celine HAUTE PERFUMERIE France

Figure 2 Celine HAUTE PERFUMERIE France

There are various definitions for the French word Triomphe The direct translation of triomphe is achievement, however many people may be more familiar with the word because of the "Arc de Triomphe de l'Étoile," a famous monument in Paris.

Today, the new beginning of Celine under Hedi, the change of the logo was the epitome of an artistic change in the history of the brand. As usual, the 1960s to the 1980s are the main inspiration for Hedi's creations, but in reality, he is referencing Celine's history and background more than ever His analysis of past decades takes on a new timelessness as a result of the way he examines them, a new classic.

An old new identity is what speaks for this art project, although the new Celine appearance may not be hip and trendy in the traditional sense, but the Celine woman may be looking for just that A cool, modern approach that is simply timeless and artistic but still has a certain something

7. Competitive Landscape

CHANEL

French fashion house founded in 1910, a privately owned company with haute couture, ready to wear, handbags, shoes, jewellery, watches, eyewear, fragrance, makeup, and skincare. It's distribution has a vast portfolio of 310 stores worldwide (boutiques, flagship stores and multi brand retailers) and e commerce sites Chanel has a distinct competitive edge thanks to its loyal client base, established brand identification, and distinctive brand positioning. Chanel has mastered the art of affordable luxury with its beauty line.

YVES SAINT LAURENT

Founded in 1961, Yves Saint Laurent was the first couture house to introduce the concept of luxury prêt à porter In 1999, the luxury goods division of the Kering Group acquired Yves Saint Laurent Today, Saint Laurent collections include women's and men's ready to wear, shoes, handbags, small leather goods, jewellery, scarves, ties, and eyewear.

DIOR

French fashion house founded in 1946, under the parent company and conglomerate LVMH with a products varying from haute couture, ready to wear, children wear, handbags, shoes, jewellery, watches, eyewear, fragrance, makeup, and skincare.

It has 493 stores worldwide (boutiques, flagship stores, pop ups and multi brand retailers) and e commerce sites Dior's core method of market operation is customer focus which aims to target every segment of the age chart The company is constantly attentive to spotting evolving market trends and practices.

Although its products are pricey, they provide the greatest possible service to customers, in order to create new items for the market, the company also makes investments in research and development.

HERMES

Hermès is characterised by outstanding manufacturing inspired by the values of traditional craftsmanship. The company remains a family firm.

Hermès carries a wide range of product categories: leather goods and saddlery, men's and women's ready to wear, footwear, belts gloves, hats, silk and textiles, jewellery, furniture, wallpaper, interior fabrics, tableware, perfumes, watches, petit h. The company believes that dynamic craftsmanship drives sustainable, profitable growth.

Pierre Hardy made items that are poetic, practical, and refillable Rouge Hermès, a robust piece made of lacquered, polished, and brushed metal, is shielded by a canvas pouch and tucked within its tiny orange box.

ARMANI

An Italian fashion house founded in 1975, with the initial stint of luxury hotels and hospitality Later with the expertise of Georgia himself, he extended his privately owned company into a vast product line of high fashion, ready to wear, leather products, footwear, accessories, and home furnishings. Armani beauty is a luxury beauty line owned by mega company L'Oréal. It has over 500 stores worldwide of all it's different lines (boutiques, flagship stores, pop ups and multi brand retailers) and e commerce sites. Armani has a great sense of what sustainability means.

GUCCI

Gucci is one of the world's leading luxury fashion brands, with a renowned reputation for creativity and high brand awareness. It is considered a star brand in 2015, Gucci chief executive Marco Bizzarri and newly installed designer Alessandro Michele set off a remarkable renaissance at the long ailing luxury giant, revamping the brand's aesthetic codes with a timely injection of eclectic, bohemian glamour and reversing a two year trend of declining sales

PRADA

Prada is part of the Prada Group which represents 2.6% of the luxury fashion market. It is an Italian luxury fashion house, founded in 1913 The brand is recognized for designing cutting edge style pieces and focused on experimentation The brand is centered on combining concepts, structures, and images that go beyond trends. The brand specializes in leather handbags, travel accessories, shoes, and ready to wear collections The company is always looking forward to expanding into new sectors and innovating with attractive retail spaces and strategies.

THE ROW

Ashley Olsen and Mary Kate Olsen founded The Row in 2006, in New York The house mixes a timeless perspective with subtle attitudes to create an irreverent classic trademark, focusing on excellent fabrics, immaculate details, and exact workmanship. Additionally, The Row's collections explore the power of straightforward designs that speak to discretion and are built on unwavering quality The Row unveiled a full collection of all product categories that featured knits, jeans, suits, accessories, shoes, bags and suits. The Olsens spent two years studying the topic before releasing the line, which hit stores in October 2018

BOTTEGA VENETA

Bottega Veneta is an Italian luxury goods and high fashion brand Founded in 1966 in Vicenza, Veneto The company offers men's and women's apparel, small leather goods, eyewear, handbags, shoes, and luggage. Bottega Veneta maintains retail boutiques around the world and it was purchased by Gucci Group, and is now a part of the French conglomerate Kering

8. Current Marketing strategy

Following the appointment of new leadership at the LVMH owned business, primarily CEO Séverine Merle in 2017 and creative director Hedi Slimane in 2018, which also spurred a rebranding and logo change, the brand shifted to social media and online sales The company also started its e commerce operation in December 2017, initially in France. In 2018, it expanded to the US and Europe, with Japan following in 2019. Although online orders are not yet available, Celine expanded its list of regions for e commerce in that year to include Singapore, Taiwan, Hong Kong, Macau, mainland China, and Japan. Things on the China website are now labelled as unavailable, however it has omni channel alternatives for checking store inventories or reserving items WeChat became the second social network worldwide where Celine opened an official account, following Instagram in February of that year Asia plays a significant role in Celine's newly discovered digital strategy Cult like mansion Celine has begun to realise its social media and marketing present potential, and the brand debuted its first ever Mini Program, on China's most popular messaging app WeChat Which provided educational content, a store locator, and a way to make store appointments

To gain followers among China's internet shoppers, Celine has implemented a number of social media initiatives But critics claim that the company has adopted digital transformation in a very "slow and conservative" manner. More than 20,000 pieces of user generated material have been created on the accessory thanks to Hedi Slimane's interpretation of Celine's Triomphe bag, which has received multiple mentions on the platform Little Red Book The Celine Box, Phoebe Philo's simple predecessor, is steadily being surpassed by the handbag with the new emblem, demonstrating the significance of KOL and KOC seeding activities on China's social networks

9. Advertising and Campaign strategy

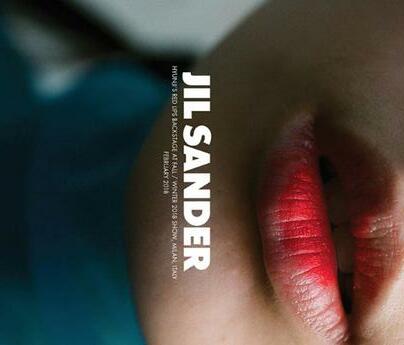

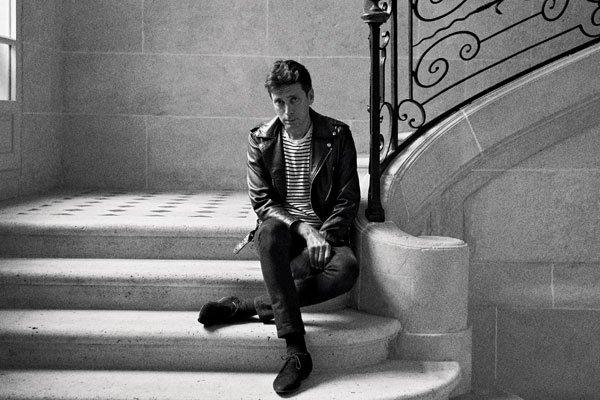

HEDI'S CELINE 2019 DEBUT

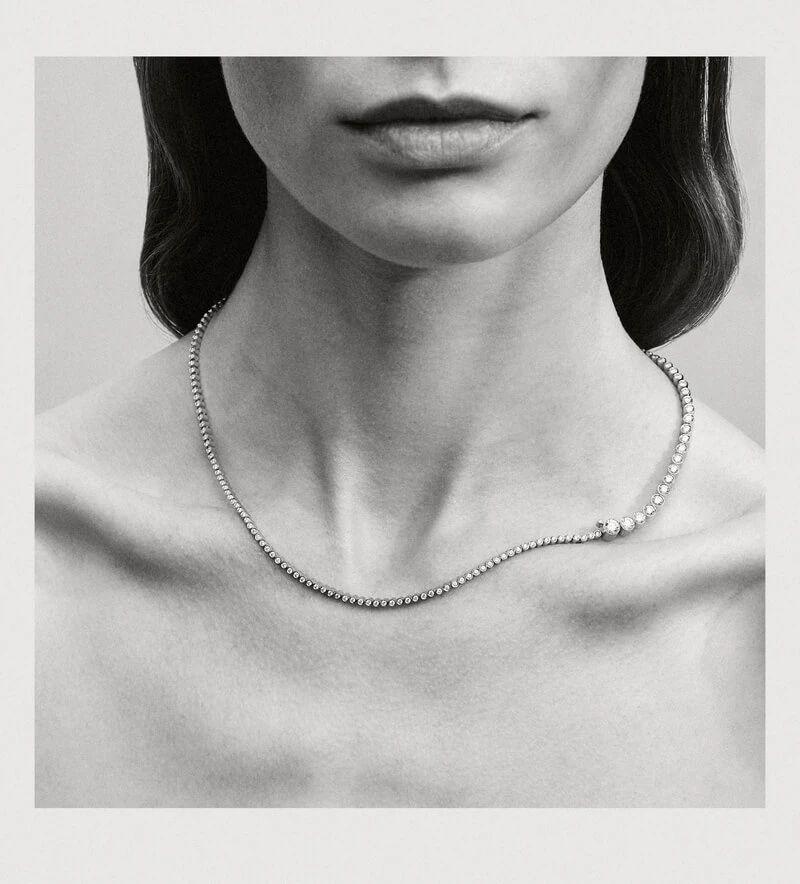

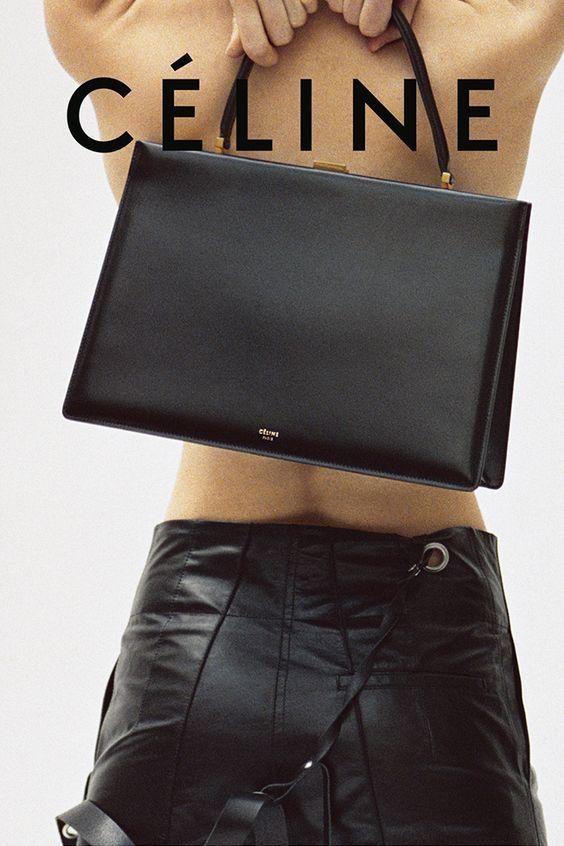

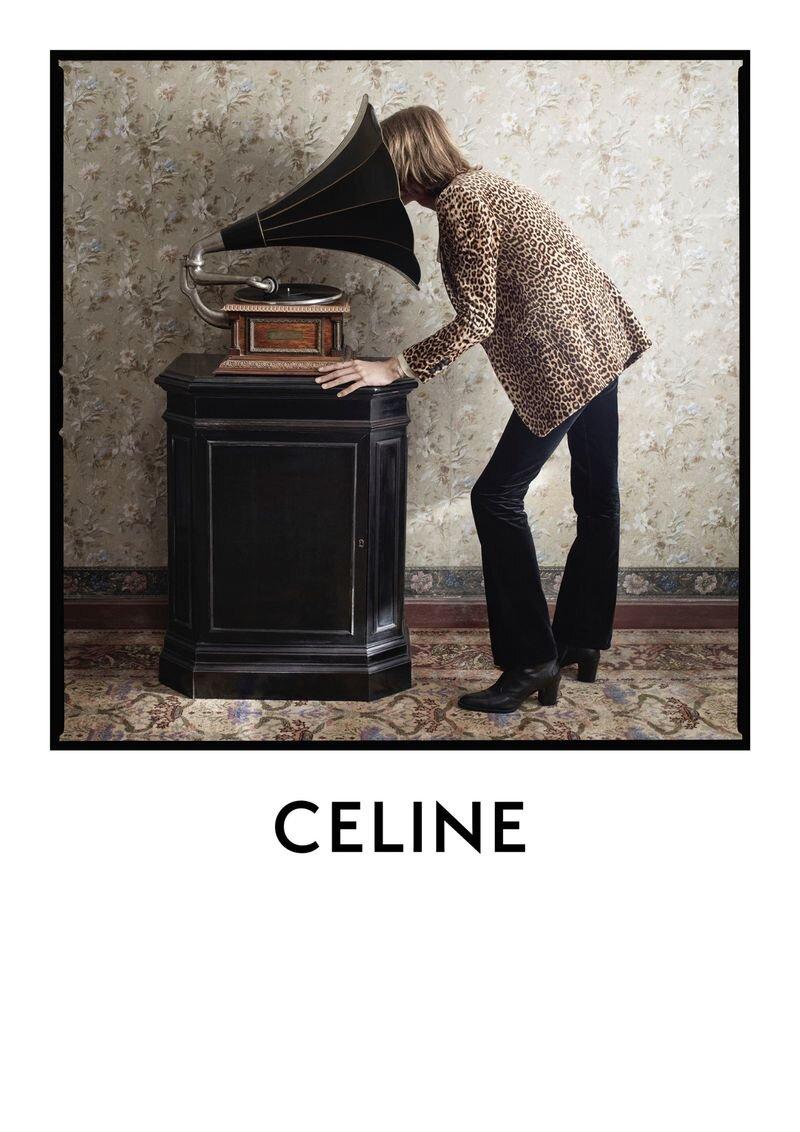

Hedi Slimane has unveiled his first male ad for Celine, featuring his Paris La Nuit SS19 collection. For Celine's FW19 advertising campaign, Hedi Slimane made a comeback as a photographer. To convey the tale of the winter collection and capture its laid back French bourgeois vibe, the designer combines his characteristic black and white style with a touch of colour Alternating between shearling and blazer lined jackets, stonewashed trousers and skirts, leather cardigans and jackets, striped shirts and floral blouses, cosy wool sweaters, and '70s vibes, the models wear a variety of different outfits High boots and brand new bags are prominent accessories. Although Slimane's debut at Celine was novel for the brand and its devoted followers who are so emotionally invested in it, it probably couldn't have been a difficult feat for the designer to accomplish himself

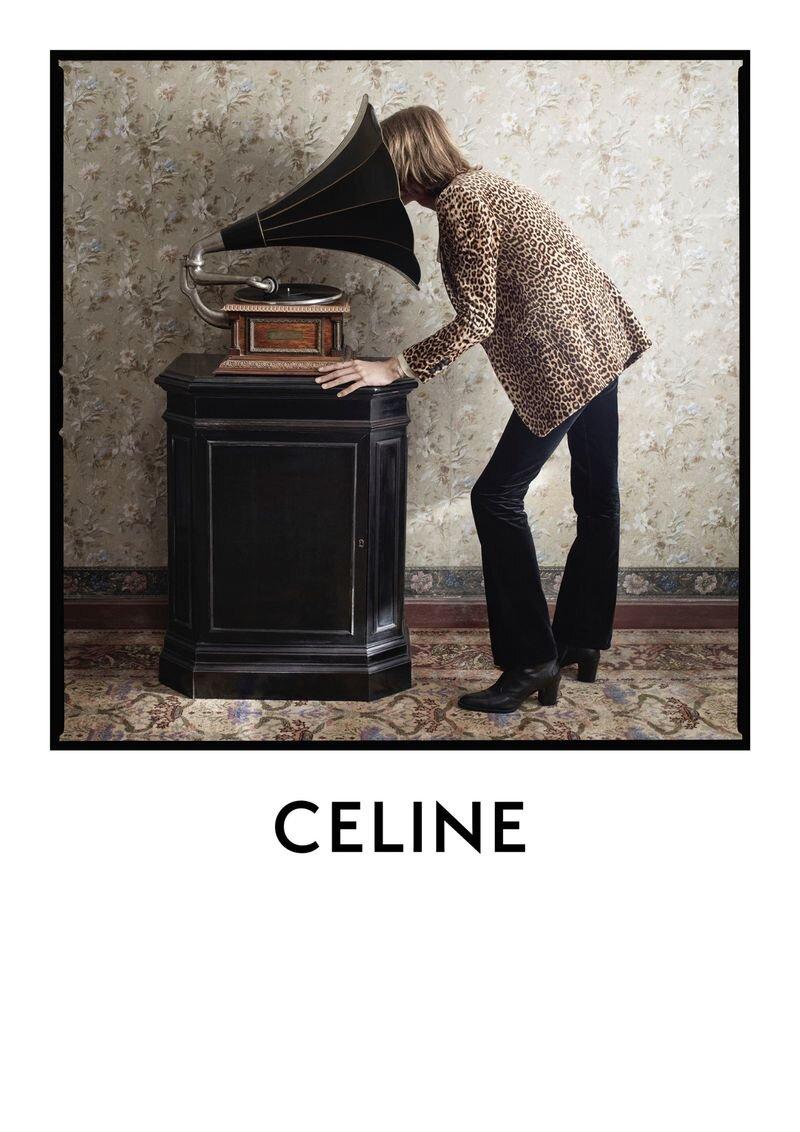

HEDI'S MOMENT AT CELINE 2020

Since the first appearance of the modernist box, Slimane has quickly captured the spirit of classic Celine and transformed it into a modern lexicon that is both authentic to the brand and clearly his. Models exited the runway wearing velvet, leather, and silk blouses both the girls' and the boys' were always wearing silk blouses all beneath a massive, kinetic light projection of the house's Triomphe emblem, an emblem inspired by the Arc de Triomphe. The hand embroidery screamed envy from a great distance away; once you've seen true couture work, there is nothing else The liquid shine of true couture work reigns supreme. Autumn/Winter 2020 marked a new era in sharing because it was arguably the designer's most unisex collection to date If you want it, you can have it, exactly like the great rock couples' closets This season's separate men's show was cancelled, further emphasising the point.

CELINE'S TIKTOK COSMIC CRUISER FOR SS22

Since the epidemic year, there have been no physical shows in Paris, but Hedi Slimane has has the ability to introduce something fresh for Celine The designer understood and focused on the real teenagers and their fashion taste through TikTok trends as advertising strategies. One such moment was the SS22 Summer Cruise collection, even with the Slimanesque black and white, the silhouettes were still graphic and simple References to the 1970s, rock, and TikTok fads like #doityourself and #custom were created on pieces like a black blazer with a patch on the back or a leather bomber jacket with silver safety pins. Hedi looks at fresh ways to style clothing in a way that radically departs from haute bourgeois to middle class, making it appear more youthful and recognisable. All these recent techniques from the styling to the designs showcasing such as the an enormous leather jacket can go with flared denim, a glittery top, and boots has attracted a large new customer segment for Celine in the past year (TheFashionLaw)

In line with the current strategy, seasons, capsule collections, collaborations, and initiatives all of which will be discussed in more detail in the marketing mix Celine has created a number of campaigns across a variety of media and artists, in addition to focus on younger consumers but also the strategy's main objective is raising awareness on a global scale

10. Marketing Mix

PRODUCT

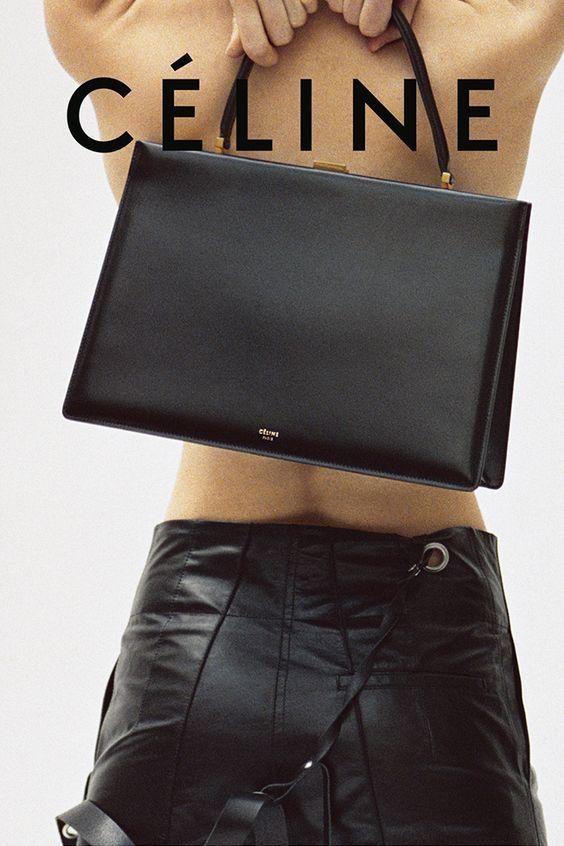

As was already noted in the first section of the article, Celine mostly sells upscale fashion items The leather items produced by the company are its best selling item in terms of sales that speaks about its heritage and timelessness. Since its inception, Celine has been manufacturing leather goods, including purses, tiny accessories, and luggage, the company also sells ready to wear for both men & women The product of Celine is very iconic to its structure with minimal usage of branding, therefore the "luggage bag" can be personified as the brand's It product

PRICE

Celine is a premium luxury brand with high prices as well as price offerings that fall under the "extra pricing" strategy. Prices for leather goods, for instance, range from 2,000 to 32,000 USD on the brand's website Furthermore, Celine does not currently provide sales or discounted products through its shops or website Customers unquestionably need a sizable money in order to buy any of the brand's goods.

PLACEMENT

Celine has a strategically exclusive distribution, even though its official website worldwide with a constant growth and expansion to other countries The brand offers its products through its limited store locations in developing countries and owns 178 stores distributed around the world, concentrating the majority of them in Europe and America. Also, Celine products have a presence in 160 multi brand retailers worldwide; most of them are luxury retailers.

PROMOTION

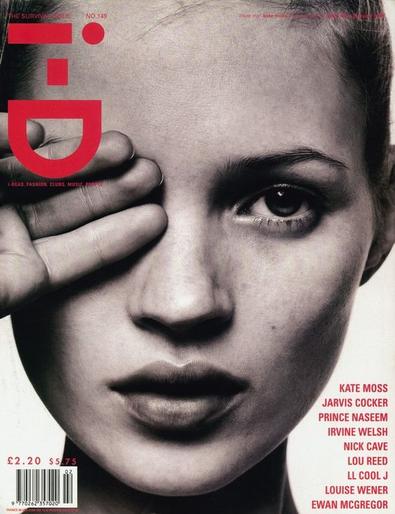

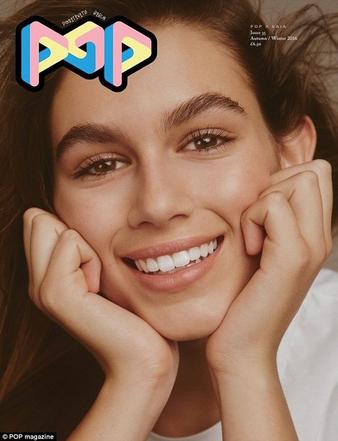

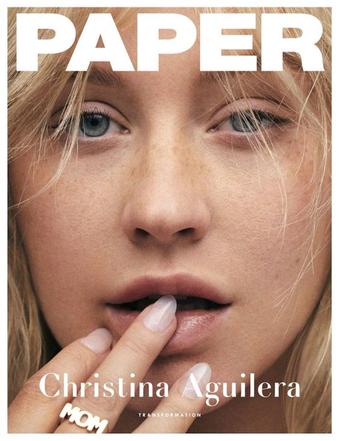

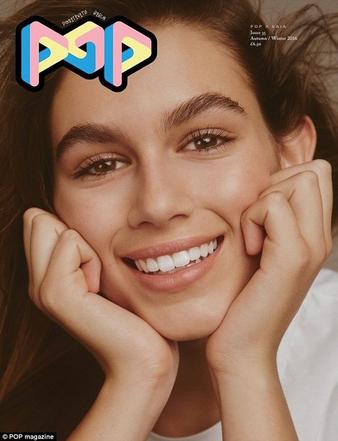

Celine until very recently was not heavy on marketing nor social media, but with the onset of Hedi's online strategies the brand's mysterious and silent launches are amongst its strongest factors Celine's new campaigns with newer artists like Kaia Gerber and media friendly influencer elements of each campaign reflect how versatile the brand is with a multi faceted identity. The brand has been on top of it's promotional frolic with Asian real time apps for an omni channel experience alongside it's digital presence.

11. Brand Analysis

SWOT ANALYSIS

S T R E N G H T S

Powerful brand identity with exuberant french heritage LVMH, strengthening their association and creative resources Under Hedi’s reign, the brand has widened into stronger brand extensions to elevate equity.

The website is unique and speaks well for the brand, with latest campaigns displayed ; alongside it's worldwide shipping Celine is well known for its expertise in leather and craftsmanship, the know how and the artisan's work are remarkably valuable.

One of a kind brick & motor experience in all major cities

a

W E A K N E S S

Despite lower brand awareness amongst it's competitors, Celine can come across as elitist. Does not mindfully seek on seeking new target market or build clientele

New change in creative direction brought confusion and distraught to Celine followers.

Low on marketing efforts, especially with influencer marketing is not that strong yet Instagram growth is significant; however, the brand's engagement is low

O P P O R T U N I T I E S

Room for improvement in the digital world and social media China market expansion as TikTok Gen Z culture growing rapidly. User generated content through sharable experiences can benefit the brand

Omni channel strategies to build familiarity world wide, especially in India (2nd largest population). Newer segment of audience are choosing affordable products from luxury brands as a sense of pride and association. Brand collaborations and new brand extensions for younger consumers.

Low brand popularity and reach in Asian marketplace. Counterfeit products damaging the brand's authenticity Oversaturated market in the brand's most popular product category i.e leather goods. Dynamic competitive landscape. Social, economic, political conflicts can affect the brand performance

Street style and styling buying preferences of the younger generation is more towards upcoming brands vs heritage brands.

T H R E A T S

AS A

BRAND AS AN ORGANISATION

Celine as an organisation is a conglomerate in itself with its vast

PHYSIQUE PERSONALITY CULTURE REFLECTION RELATIONSHIP SELF IMAGE Vision Monochromatic, Nudes, Vintage shapes , Sleek, Oversized, Minimalist, Dark Renaissance, Tailored Logo Quaint, Parisian, Classic, Triumph Luggage IT bag La Femme Brave Portrait of a Generation Sultry Unisex French Heritage Traditional Reticent Culture Zeitgeist Socially Exclusive Introverted yet Curious Fountain of youth Credible Gen Z & Boomer Loyal Sartorial elegance Upper Middle class to Affluent Craftsmanship Connoisseur Well educated Timeless perspective Aesthetically Inclined Values quality and intricacies Opinionated and Unexpected High on expenditure Anti Fast Fashion c. AAKER MODEL Figure 5 Celine's brand analysis Kapferer model

vision

connoisseurs who

bag.

brick

mortar stores

online merchants

elegance

BRAND

PRODUCT Celine as a product is timeless and is a

for

invest in quaintness of a

The Luggage Tote, which debuted in 2010, was Phoebe Philo's first "It bag." It was a huge hit right first, selling out from both

and

and

due to its size and

offerings

BRAND IDENTITY

product

like its parent company, LVMH b.

PRISM

BRAND AS A PERSON

Celine speaks only Hedi Slimane.

BRAND AS A SYMBOL

TRIOMPHE, classic and French.

d. CANNATA's DIAMOND

Promotion:

Mysterious and silent campaign and promotion (CD, Phoebe Philo) Media promotion Instagram and Celebrities align core values Recently, WeChat platform combined a mini program enables the ability to buy things in real time.

Product: Price: Placement:

Exclusivity, Unique designs and quality of craftsmanship

Neutral palette, loose fit garments & artisanal silhouettes

The laid back, contemporary feminine side and expressive approach

Monochromatic Brand's Signature Luggage tote

Premium priced justifying quality of its product

Focus on improving quality and brand experience

Luxury brand with "Extra pricing strategy"

Locations major cities and countries

Top luxury retailers. Worldwide e commerce website. Curated uniquely with relevance to the cultural offering

People:

Prime customer Ultimate form of sophistication and simplicity

Values craftsmanship and quality of a well made product Bold, Independent, Classy and Timeless Seek to be part of Celine's universe

LVMH, Investors, Hedi Slimane and team and brand employees and associates.

Purpose:

To build the strongest foundation between the French art and fashion

Strengthen core values and environmental demands

Push towards diverse digital strategy implemented through collaborations

Chapter II Industry and Market Research

1. Luxury Industry

As the year 2020 confined us to rethink our indifferent, consciousness, and dutifulness, the topics of conversation started to change. Henceforth before analysing the trends and market ; it is relevant to define the luxury industry. As per Kapferer, luxury identifies its origin in the Latin “luxation”, i e , distance, and suggests that luxury describes a considerable departure from the usual way of satisfying needs (Kapferer, Jean Noël). The Statista study on the luxury market states that exclusivity is the fundamental notion to comprehend the luxury sector Exclusivity is attained through several factors, such as high price, restricted availability, and limited reduced goods or services.

The luxury market is centered on goods and services that are more of a want than a necessity The industry is linked to customers with a rising disposable income since it provides things that are not seen as essential needs.

At a CAGR of 3 7%, the market for luxury goods is predicted to grow from US$349 1 billion in 2022 to US$419 billion in 2027 The significance of physical stores is growing despite the fact that luxury internet sales are expanding globally. In the age of eCommerce, businesses employ a variety of tactics to improve their retail experience The luxury market has a reputation for promoting excessive consumption and a general disregard for the environment. However, the sector is increasingly shifting toward ethical and sustainable goods and experiences as a result of the growing influence of Millennials and Generation Z, who carefully examine the social impact of their luxury purchases.

Luxury companies have prospered and built a solid name around the world in recent decades The luxury sector is rapidly expanding, and customer behaviour has changed significantly. Since Veblen first introduced the concept of conspicuous consumption, the wealthy's use of luxury has drawn a lot of attention Although Asian and Western societies share many luxury products, people may not purchase them for the same reasons. Consumers' perceived values, motivations, and opinions about products are influenced by a variety of circumstances

2. Beauty Industry

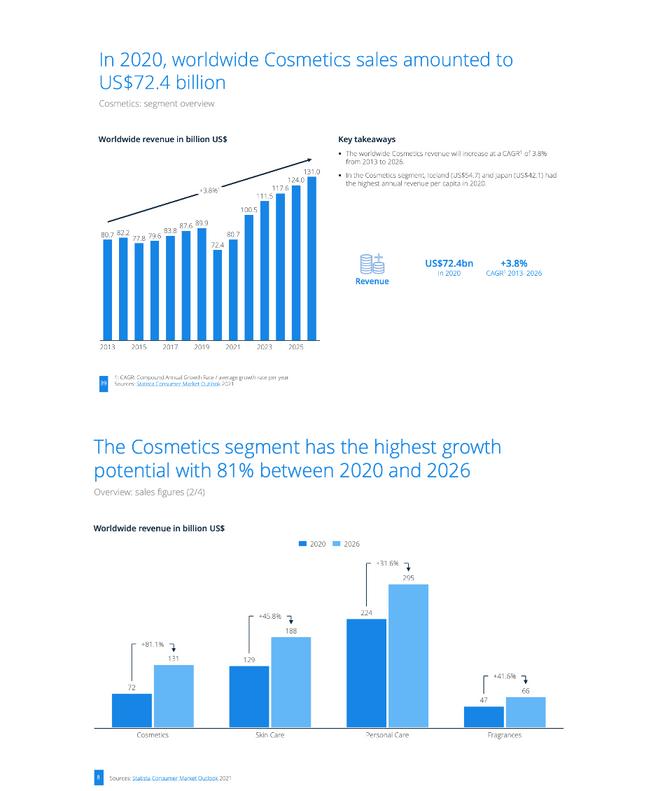

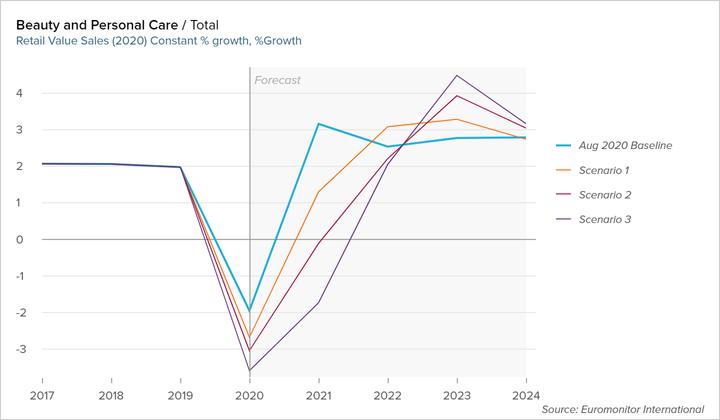

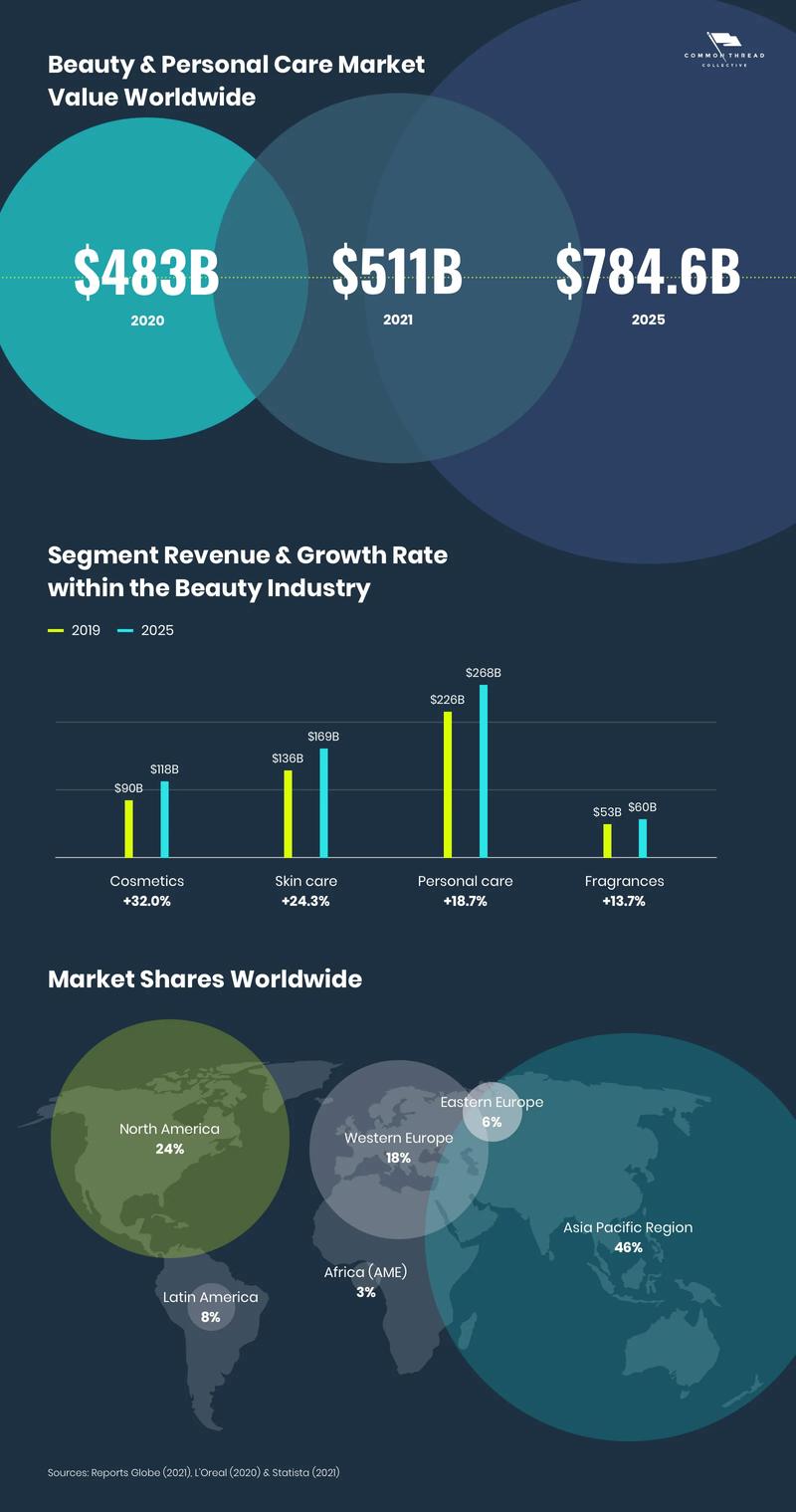

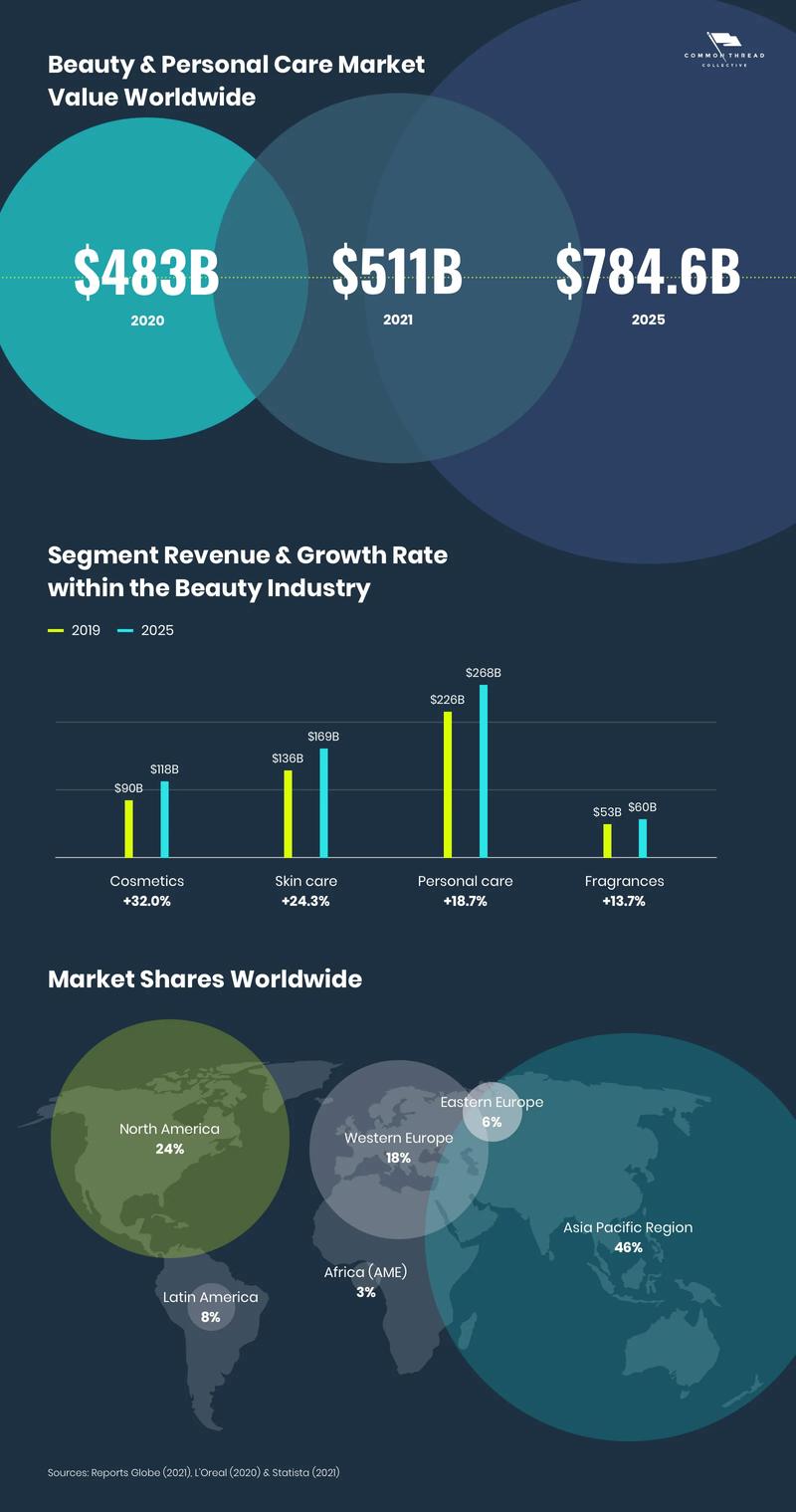

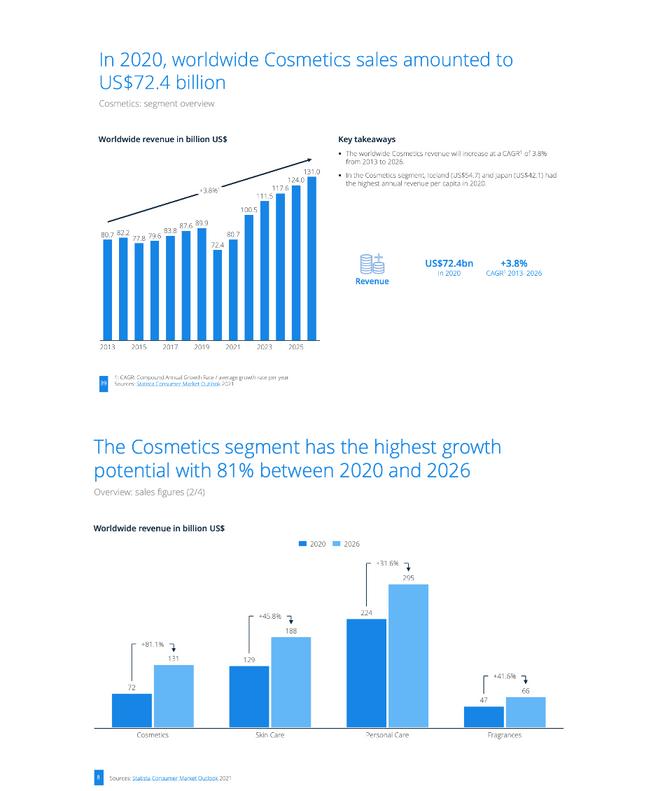

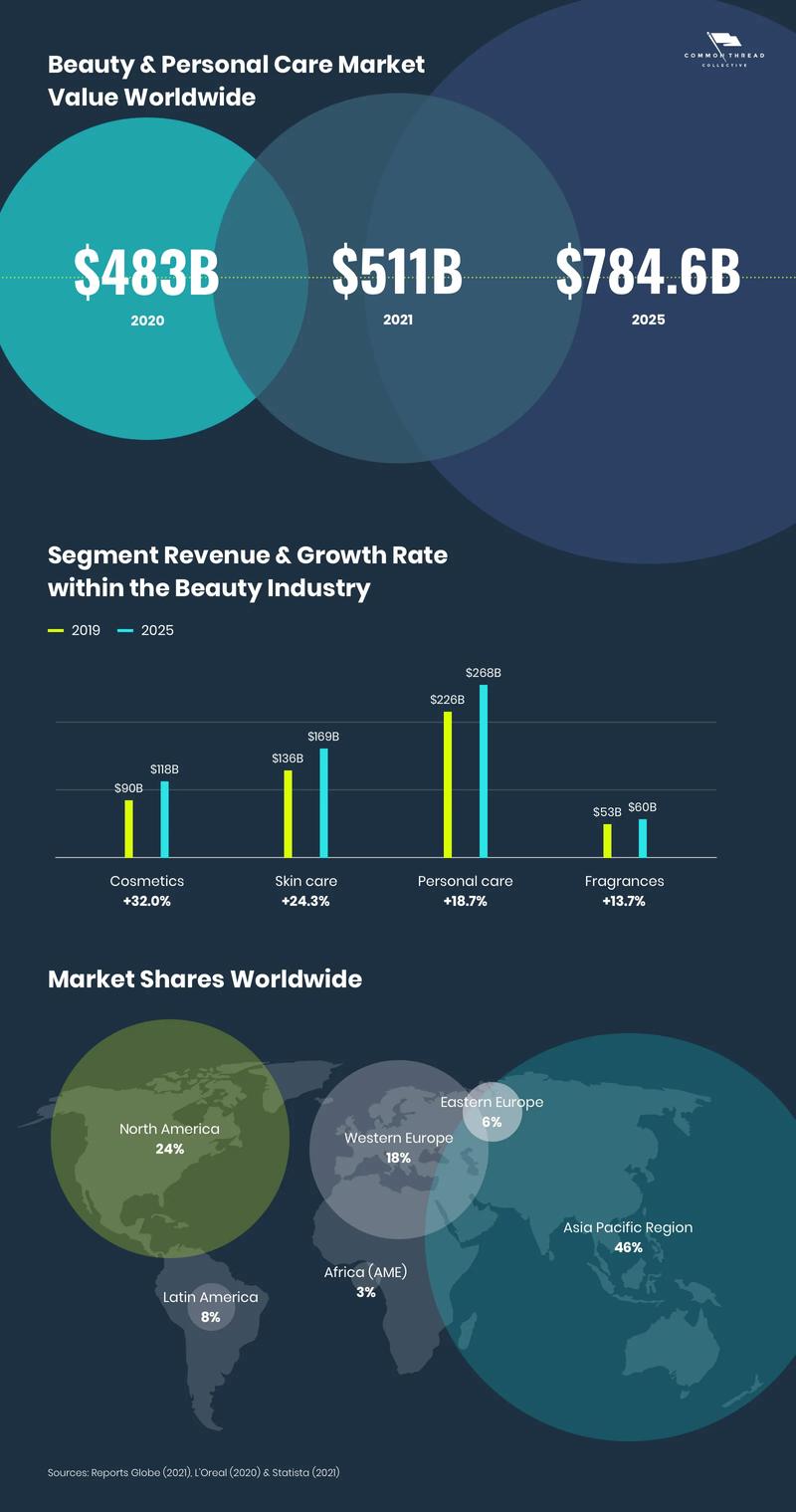

The global market for cosmetics, which reached $75 1 billion in 2020, is predicted to grow to $169.67 billion by 2025, according to Statista. Among them, the values expected based on the growth rate of prior years are 2021 and 2022. According to McKinsey, throughout the outbreak, online sales in the global beauty sector rose by 20% to 30%.(McKinsey). Online sales of beauty products surged by around 30% year over year on Amazon and Sephora, two major American e commerce sites. Sephora is a beauty retailer owned by LVMH. Brands were more inclined to expand their distribution to mass channels as a result of the democratisation of beauty, which involved combining expensive and inexpensive products and debunking the notion that expensive is synonymous with "better." It took decades for the places we purchase beauty products to change from department stores to specialty shops However, the transition to big box retailers and possibly pharmacies is taking place far more quickly.

The global cosmetics business is a dynamic one that experienced a major recovery in the second half, driven by strong consumer demand, despite an extraordinary crisis of supply in 2020 The growth of the middle and upper income levels, the escalating senior population, and the expanding urban population, all of whom are looking for products that may satisfy their varied needs, are the main drivers of the long term potential

The Beauty industry thrives on fashion trends, increased desire for products with convenience and many uses, increasing demand from niche consumer groups, particularly from youthful affluent groups, teenagers, and baby boomers

Despite its many advantages, the beauty business suffers from low industry awareness and loyalty. Industry players must create new associations in order to stand out, which is particularly challenging in the oversaturated and fiercely competitive beauty market Additionally, the companies may have difficulties development in creating a line of beauty products that matches with customers' perceptions of self love

3. Prestige Beauty Industry

According to Nicolas Hieronimus, CEO of L'Oréal, "High End Beauty Demand Drives L'Oréal's First Quarter Sales Rise." There is a very high demand overall for high end goods and premium goods A June 2021 WWD survey, the prestige beauty industry is expected to develop at a faster rate than other markets, 8.5% yearly. These figures are specifically driven by millennials, gen z, and Chinese consumers. According to Jane Hertzmark Hudis, executive group president of Estée Lauder, the latter two consumer categories will account for nearly 60% of all beauty luxury expenditure by 2026. As a result, many labels are entering the beauty sector.

In just the first half of 2021, Unilever's skincare and luxury cosmetics growth climbed by double digits. According to CEO Alan Jope, the company's strategic focus on prestige cosmetics is "making good progress," and as Unilever continues to offer high end items, the sector is exhibiting a significant growth in sales Exposing Gen Z to luxury brands is possible with diffusion lines. An illustration is Clarins' skincare line, which retails for a tenth of the price of its primary brand. The authenticity that Gen Z values makes heritage hero items popular Estée Lauder and Kith collaborated on a successful product line that drew inspiration from the beauty company's mid 20th century New York roots.

Due to the rising demand for cosmetics, the decorative cosmetics product segment held the greatest revenue share of more than 61% in 2020. Lipsticks, mascara, foundation creams, and other cosmetics are some examples. The market for decorative cosmetics has also grown as a result of a rise in celebrity endorsements and advertisements on various social media platforms Due to the increasing product usage, the luxury cosmetics product segment is anticipated to experience the quickest CAGR of over 3.1% from 2021 to 2028. (Statista) These goods are created from premium quality organic materials When compared to cheaper alternatives, luxury cosmetics are more expensive Demand for luxury cosmetics is rising as consumer disposable income levels rise in developing economies. (McKinsey)

Figure 7 Statista Report for Cosmetic sales © 2020

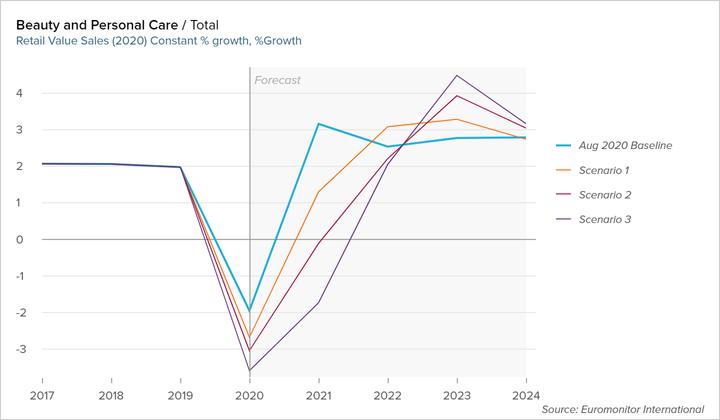

Figure 8 Personal and Beauty Care, Euromonitor 2020

Figure 7 Statista Report for Cosmetic sales © 2020

Figure 8 Personal and Beauty Care, Euromonitor 2020

3.b

LVMH Recherche

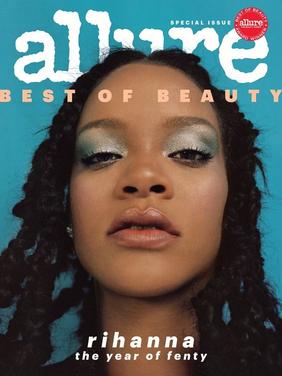

For each of the Perfumes & Cosmetics Houses of the LVMH group, the global leader in luxury: Guerlain, Acqua Di Parma, Parfums Christian Dior, Givenchy, Loewe, and Fenty, among others, LVMH Recherche is the development backbone that customises makeup, skincare, perfumes, and derivative products. LVMH Recherche is dedicated to offering every customer high performance products with remarkable sensitivities, screened rigorously for verified harmlessness, and created with the utmost regard for the environment in the direction of tomorrow's sustainable cosmetics Visionary alchemists of art and science, produce extraordinary goods in collaboration with the goal of promoting beauty in the world. LVMH Recherche is a subsidiary of the conglomerate that works at the intersection of art and science, building on its legacy of luxury and supported by its distinctive know how and acknowledged expertise. They promote the excellence of our products by giving customers a singular sensory experience and demanding unmatched quality They are expanding our comprehensive understanding of customers globally as well as our sustainable, risk taking, and practical collaborations, creating a true innovation ecosystem. For Celine Rouge, LVMH Recherche will be responsible for all the research and development of the product, to make it not only timeless but also have the highest order of impact for a beauty extension They are committed to working together to create the

Figure 9 LVMH Research and Development Unit, LVMH com

Figure 9 LVMH Research and Development Unit, LVMH com

4. Market Share and Insights

In 2020, the market for cosmetics was worth USD 277.67 billion. The impact of COVID 19 on the world has been unprecedented and astounding, and the epidemic has had a detrimental effect on demand for cosmetics in every region According to our data, global market growth was 10.57% lower in 2020 than it was on average between 2017 and 2019. The market is anticipated to increase at a CAR of 5.0% between 2021 and 2028, rising from USD 287 94 billion in 2021 to USD 415 29 billion in 2028 The demand and expansion of this market are to blame for the increase in CAR, which will decline after the pandemic to pre pandemic levels.

Because of the closing of retail stores, there was a quick transition to online channels, which gave manufacturers room to flourish. According to L'Oréal's 2020 annual results, which were released in February 2021, the company's e commerce sales climbed by 62% across all divisions and geographies in 2020, making up around 26 6% of the whole company's sales. (L'Oréal Annual Report) In order to optimise their supply chains and increase online sales during the epidemic, firms in the cosmetics market are doing so. The opening of offline stores, on the other hand, would increase product sales in the near future.

5. Market Value driving factors

Growth of E commerce Industry and Improved Marketing Activities by Manufacturers are Vital Trends

A number of market participants are starting digital marketing campaigns, creating interactive commercials, and exerting significant effort to promote their products through social media, which is likely to increase consumer demand for the product Consumers are drawn to e commerce to purchase personal care items due to the growing influence of social media and expanding internet usage. To meet consumer demand, manufacturers are concentrating on providing a wide range of items through an online channel

Adoption of Sustainable Cosmetics to Drive Market Growth

Because they are safe and non toxic, products made with naturally derived substances are becoming more and more popular all over the world. Due to public awareness of sustainability developing, there will likely be a rise in the demand for eco friendly items in the near future. This is due to growing public knowledge of the harmful impact that synthetic chemicals have on human health and the environment For instance, the organic personal care market in the UK had growth of 7% in 2018, according to the research "Organic Beauty and Wellbeing Market" issued by the Soil Association Certification report In order to draw in more customers and lower their carbon footprint, manufacturers also concentrate on offering sustainable packaging solutions, such as paper based, biodegradable, and refillable packaging options.

Rise in Middle Class Income to Fuel Demand

Given the fast changes in their preferences, the middle class people is likely to buy cosmetic goods as they emerge As a result, the region's expanding middle class is to blame for the increased product demand specifically for prestige cosmetics as a sense of pride and belonging to the luxury brand For instance, according to the essay The Middle Class in India From 1947 To The Present and Beyond, which was published by the Association for Asian Studies in 2018, the middle class in India made up between 5% and 10% of the total population in 2005 and is projected to reach 90% by 2039

6. Market Leaders

L'Oréal

L'Oreal sells more than $27.2 billion worth of beauty products every year They are established in France and market products for skincare, perfumes, hair care, and sun protection L'Oréal Paris, Garnier, Maybelline New York, and Softsheen are some of their most well known brands. They also provide products from upscale names including Kiehl's, Giorgio Armani, Lancôme, and Yves Saint Laurent

UNILEVER

London is home to the second largest corporation in the beauty industry. It boasts $21.3 billion in yearly revenues and a number of well known mass market brands, similar to P&G They have some of the best selling goods in every sector of the cosmetics business that they sell.

ESTEE LAUDER

The annual sales of this New York based business are over $11.8 billion. In the major cosmetic areas, such as colour cosmetics, skin care, hair care, and perfumes, they have a number of prestigious brands. Estée Lauder, Bobbi Brown, La Mer, MAC, Smashbox and Clinique and more well known brands are among their offerings. The items from this brand are ideal ones to imitate if you work on more pricey cosmetics

Proctor and Gamble

Sales of beauty products at this enormous corporation totaled about $11.8 billion annually, a substantial decline from the $20 billion+ levels of earlier years. But in order to be more effective, they sold a number of their brands to Coty. They still maintain eminent positions in the skin care and hair care industries, and are based in Cincinnati, Ohio, USA

The majority of their colour cosmetics were sold off. It is not unexpected that they have a number of well known companies like Aussie, Gillette, and Head & Shoulders because they spend the most money on advertising

COTY

This New York based conglomerate has recently grown its beauty industry through acquisitions. Their revenues totaled $7.7 billion in 2017. They are a major player in professional hair care (#2), colour cosmetics (#3), and fragrance (#1). They also own high end labels like Philosophy, Hugo Boss, Marc Jacobs, Calvin Klein, Chloé, and Gucci

7. Defining Trends

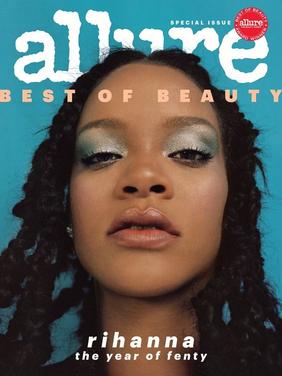

a Inclusivity is Indispensable

According to study by market research firm Nielsen, America's beauty aisles are now starting to represent diversity. While the number of unique coloured cosmetics sold has increased three times as quickly as the rate of new cosmetic products creation overall, the number of unique colour ranges has increased seven times as quickly as product lines as a whole. Consumers today look for products with a good value that match their personalities and lifestyles According to data from the global cosmetics industry, sales of multicultural beauty products are growing at a rate twice as fast as the general market. Companies that are embracing inclusive styles and lines are experiencing a positive impact on their annual revenue.

b. Beauty tech partnerships

The world's top augmented reality startup, Perfect Corp, teamed up with Jack Ma's Alibaba Group a few years ago to integrate its YouCam Makeup AR virtual try on technology into online shopping experiences. This gave Chinese consumers access to fresh virtual trials. Alibaba reported that after adopting technology for only six months, its conversion rate has grown by four times Since then, innovation in the beauty sector has advanced rapidly, incorporating AI, AR, and VR into well known companies like MAC, NARS, and L'Oreal.

Due to the market impact and constantly changing customer habits made worse by the current worldwide pandemic, the CEO of L'Oreal set a global objective for the business to "transform from a beauty to a beauty technology company," according to the managing director of L'Oreal India Many other companies now provide virtual reality try on services on their websites and mobile apps, including Chanel, YSL, Charlotte Tilbury, and Maybelline.

c Personalised experiences take priority

Consumers are placing more value on personalisation, which also helps firms improve their online CRO approach Personalisation enables customers to feel as though they are receiving messages that are specifically designed for them in a world where we are always being inundated with marketing messages. Personalisation can also foster a sense of connection and loyalty between a customer and a brand. In a separate survey, 80% of consumers said they only shopped with companies that provided tailored experiences as of 2020, while 56% of online customers acknowledged to returning to an online store that offered personalised recommendations.

d. Beauty subscription services

According to a McKinsey study of 5,000 US consumers, curation services, which try to seek out and surprise customers by offering novel products or highly customised experiences, got 55% of all subscriptions and were by far the most popular, indicating a huge demand for personalised services

e Leveraging big data for new product development

At the WWD Digital Beauty event, Ipsy co founder Jennifer Goldfarb said, "The next big idea in beauty is community." The brands who can engage their consumers, followers, and fans and actually enlist their support in building the brand, product development, marketing, and all other elements of the business, are the ones that will succeed in the future. The expansion of big data in the beauty sector, gathered through survey data, search phrase data, and purchasing patterns

Chapter III Key Findings Secondary Research

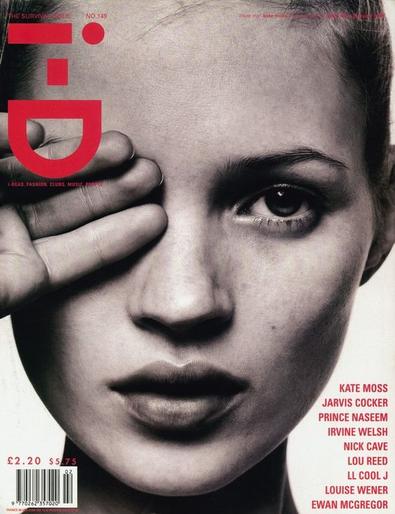

a Beauty brands utilise culture commerce and social media to connect with today's consumer

Luxury businesses are increasingly reaching out to younger consumers through social media and culture e commerce These platforms frequently have the power to both inspire consumers and encourage them to make purchases. Social media is more than just a platform for discoveries, the new customer acquisition opportunity is highlighted by the fact that 84% and 81% (Statista), millennial consumers who follow luxury brands on social media have bought a product after seeing it there. For example, Celine generally bases its marketing campaigns on celebrities, but this year the French fashion house took a different approach by hiring a TikTok influencer for its social media platform

b Green luxury in beauty

The field of sustainable/clean beauty is one that is always changing and trending. More firms have prioritised eco friendly products, packaging, and production techniques during the past few years It can be difficult to stay updated with all of the ins and outs of clean beauty given its rapid growth, but luxury consumers' want for long lasting, well made products has increased and are aware that buying less and quality can benefit both the environment In August, we witnessed yet another luxury brand tap into beauty, Stella McCartney owned by LVMH. This gained credibility with beauty consumers looking for "clean" solutions thanks to her history as a leader in sustainable design (WWD)

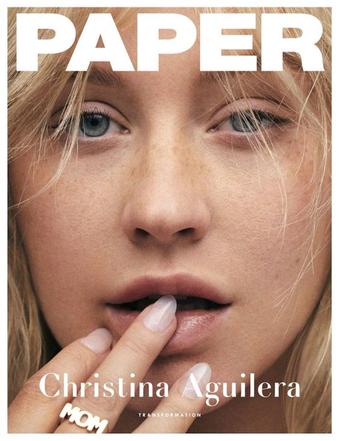

c. Authentic connection with millennials

Millennials embrace authenticity, and they enjoy engaging with brands whose beliefs are similar to their own. It's no longer sufficient for luxury firms to merely create viral products or build up a sizeable social following. For younger generations, their impact outside of the beauty industry is of the utmost importance One of the simplest ways for beauty firms to loose fascination is by failing to establish a connection with the younger market. Instead of presuming what their customers want, beauty brands are reaching out to them and asking what they want One such example is the launch of the iconic brand, Chanel making inroads into the lives of millennials with the launch of their new clean beauty line.

d Influencers are a big investment in beauty

For the past few years, influencer marketing has been a component of beauty e commerce strategy According to the British Beauty Council's 2020 Value of Beauty report, influencer marketing has once again significantly increased the industry's economic potential. Brands received an average return on investment of $11.45 for every $1 they invested in influencer marketing

The beauty business and its advertising outlets have finally discovered a return on investment in renewable resources with the advent of influencers, and now micro influencers. According to a Harvard study, the amount spent globally on influencer marketing increased from an estimated $2 billion in 2017 to roughly $8 billion in 2019, and it is anticipated that this amount would increase to $15 billion by 2022

Primary Research Part 2

Chapter I - Research Design

1. Ethnographic - Obersvation

Objective

Learn about Celine's aesthetics, marketing strategies, advertising, brand identity and core values. Identify Celine's store space distribution strategy, assortment plan, product’s construction in order to provide insights to develop collaterals

PLace

Celine 650 Madison Ave New York

Date July 2022

Findings

The largest Celine site to date, with a design by the's creative director, Hedi Slimane, emphasises the contrast of natural materials with a balanced and vast sculptural aesthetic, making it one of the best works of a concept store in luxury.

The idea is the use of natural stones and cream veined black granite (visible in walls and shelving), together with a combination of marbles and grey travertine that gave a sense of absolute luxury. The product assortment including everything starting from men's, women's, leather goods and footwear Each product is highlighted as though it's a piece of art, keeping it minimal and true to brand identity The monochromatic feel with a hint of gold can be intimidating but the sales associates exude an inclusive experience where customers are welcome PLace

Celine Soho New York Date August 2022

Findings

Brutalist inspired area highlights the new architectural concept that Celine has announced will be implemented in all of its boutiques this year, and that is what is evidently visible even in the Soho store

Figure 11 Celine Concept Store, Madison Avenue New York, Business of Fashion

Two site specific installations, highlight the white cube space's gallery like aesthetic. The furnishings and fixtures in the store have been created to mimic the sculptural nature of these items. The associates give a guided tour and explain the history of the store's focal point, emphasising the newest collections, recognisable bags, and Hedi's masterpiece It is similar to the idea of browsing artwork at a gallery. The store was incorporates the perfumes and the newly launched candles, acing all the senses of a customer with an exuberayting warm atmosphere

Figure 12, Celine Soho Store, New York

Figure 12, Celine Soho Store, New York

2. Ethnographic Tangible and Intangible

Touch Leather furniture, marbles slabs, rock art works, metallic gold framing and shelves and suede

Taste La Maison du Chocolat bites with Perrier Water bottles.

Smell BERGAMOT, NEROLI, VETIVER, MUSK, OAK MOSS and the Smell of fresh lilacs and lillies

Sound Music is the cornerstone of Slimane’s aesthetic his collections are a dedication of sorts to the musicians he admires; pseudo stage wardrobes set to the soundtrack of distorted guitars and gravelly vocals.

Example I'M YOU,

ORACLE SISTERS

Sight A cool mid day light to a warm evening yellow light Integral joinery lighting and recessed spotlights emphasising Celine’s product range discretely.

3. Focus Group

Objective

Obtain consumer insights on beauty trends and popular cosmetic brands

Identify awareness of Celine amongst the target consumer. Obtain insights on the brand perception

Understand consumer behaviour during shopping for a lipstick

Understand consumer relationship to prestige beauty brands

PLace New York

Date 2nd Oct 2022

People 8 participants from the luxury experience background varying in fashion, beauty and technology in the age group of 25 30 years

Findings The findings have been divided in four main category distribution to understand the cumulative thought process of the participants.

a Brand Awareness

Moderate level of brand awareness and recognition

High familiarity with Celine's leather goods

If a consumer, descriptions included: classic, monochrome, exquisite, elitist and expensive.

Brand attributes: personal, vintage, memories, innovative, defining future of luxury leather goods, fresh, minimalistic, straightforward, mysterious, niche, connoisseur, French.

Loyal beauty consumers, buying specific brands as a part of beauty regime Trust social media for reviews and comments

on product recommendations from friends Buying newer products from brand that is already part of routine Expensive products from prestige brands are better than mass brand products Sense of flaunt when buying expensive beauty brands Clean ingredients with an easy application process

of branding and product packaging

Rely

Big

b Beauty Habits c Product Attributes

Prefer a simple ingredient list but want to enjoy the scent

Preference of wide assortment of products with different colour and texture options to choose from

High preference on appearance and smoothness of the ingredient

Preference of smaller carry on products such as lipstick and gloss from prestige brands ; so it can be used in public

d. Price Sensitivity

Price should match brand image

Depends on product but most willing to pay $50 100 for a product

Willing to pay more for personalised beauty cases and packaging

Willing to pay more for luxury brand limited edition beauty products

4. Interview

Objective

PLace New York

Date 21 September 2022 via phone call

Interview with Nicholas Dunlevy, Ex CRM Manager Celine, currently at Bergdorf Goodman.

Comprehend beauty trends and the growth of prestige beauty Get insights and recommendations from industry experts to design the experience. Understand the feasibility and profitability of the project, potential challenges, opportunities and competitive advantages

Findings

Nicholas started his journey with Celine as a client advisor in 2020, promoting himself to a Client Relations manager in 2022 and now at Bergdorf Goodman as a Sales head He likes to call himself a "hungry" person for fashion and film as that's his utmost desire Alongside being a veteran in sales and client service, he has always been motivated to immerse himself more with luxury brands and their visuals. Having introduced this brand extension to him for Celine, he was very forthcoming and appreciative on a thought process like this one for a brand like the former. Few take aways were mainly :

The current market outlook makes this extension even more dynamic While the luxury market has recovered from the pandemic, the situation of the economy implies that big sized fashion enterprises are and may face even greater profits in the near future as higher middle class and wealthy customers have become more care free about their purchases

Given the extremely low absolute average price of these products, you can reach a very large audience. Brands like us, hope to convert some of these consumers to other product categories in the future

The RFM (recency, frequency, monetary) model rate is very high amongst younger consumers purchasing luxury goods, which might work very well in an entry level product like lipsticks.

PLace New York

Date 21 September 2022 via Teams meeting

Interview with Esha Agarwal, Business planning and Supply Chain Strategy at Celine.

Findings

Esha Agarwal, an Indian who started her journey in the luxury fashion industry much later in her career, after gaining experience in the big accounting firms such as KPMG

Esha found her stint at Celine as a part of the Business strategy building team and now heads the supply chain for the brand from London. Esha showcased advanced presenting and relationship skills with a proven track record of enhancing financial performance and the capacity to incorporate wise decision making over the phone call Few take aways were mainly :

Beauty is a sector that is largely recession resistant. Despite the epidemic, the prestige beauty industry stayed strong and is still expanding When times are rough, beauty may be a profitable industry for even larger fashion firms to rely on. She also added, "Beauty is a more stable and sustainable business than fashion". The lipstick effect is a well known phenomenon that might be more relevant to the brand, Celine and the extension, Esha added She believes that, it might be a good starting point.

A major supply chain challenge she pointed out is that, whether a cosmetics firm is large or small, it sells to the mainstream market domestically or abroad, through specialty retail, or e commerce, considering transportation and logistics is essential to reducing any ongoing supply and demand issues and supply chain vulnerabilities such as temperature control in beauty products This extension might brew up in the future because as we know of Hedi's artistic vision for Celine, involves more out of box product categories in the near future.

Lastly, it makes sense that most luxurious homes adhere to the tried and true colour scheme of a few

Chapter II Key Findings and Analysis Primary Research

After reviewing all the research, including secondary and primary, some findings are vital to understand the feasibility of the project and also define the strategy These research findings mentioned, are the top few detailed finding segments for a better clarity into this product extension for Celine.

1 Key

Findings

a. Brands are betting big on beauty

Given the extremely low average price of beauty products, beauty can be a very lucrative industry for fashion houses and attract a very large audience. The next generation of luxury brands can begin a relationship with consumers by building a strong beauty business, which also serves as an efficient client acquisition strategy According to market research firm NPD, the luxury cosmetics industry has continued to develop strongly despite the epidemic, with sales in the US in the first quarter of 2022 up 19% year over year An instance would be the recently acquired Dries Van Noten brand by Puig, which has experienced a rise in the number of younger, first time customers buying the line alongside regular, older customers. (Business of Fashion)

b. Millennials are seeking affordable luxury in beauty

Affordable luxury doesn't necessarily equate to cheap; rather, it's an effort to seize that personalised touch and spend money on things that will last and be put to good use. Beauty extensions act as an entry point into the brand at companies like Dior, Chanel, and Tom Ford, giving ambitious buyers who can't afford a signature piece an opportunity to be associated with them Luxury businesses want to appeal to these increasingly politically active, globally conscious customer groups who appreciate diversity and despise the status quo, they adopt a more open, approachable attitude. One of the guiding principles that luxury businesses must follow in order to maintain their perceived exclusivity as they expand is category segregation.

c. Hypermarkets/ Market places to dominate due to wide availability under one roof

Regarding distribution channels, the market is divided into hypermarkets/supermarkets, specialty shops, internet channels, and others Due to the availability of a wide selection of products from numerous cosmetic companies under one roof and the various discounts and incentives that come with bulk purchases from these stores, the hypermarkets and supermarkets segment commands a significant portion of the global market The segment expanded as a result

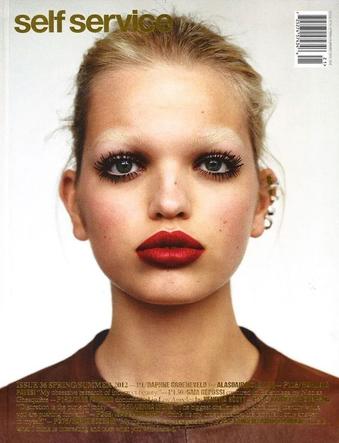

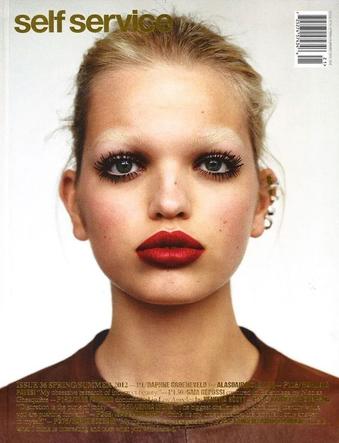

d. The Lipstick effect

The Lipstick Effect, also known as the Lipstick Index, is touted as the industry's top economic indicator in the world of beauty. The idea is that women will indulge in discretionary purchases that uplift their emotions without going over their budget during recessions and other economic stressors Although the "lipstick effect" may not have much of an impact in conventional economic circles, new data from global market research firm NPD Group shows that sales of lipstick and other lip makeup increased 48% in the first quarter over the same period the previous year, growing more than twice as quickly as other beauty products.

A number alternative explanations exist for why the "lipstick effect" might exist Proponents of the idea typically base their arguments on the notion that customers view lipstick as a minor luxury: an indulgent buy that doesn't cost a fortune. In other words, psychological factors have a role in the "lipstick effect." Lipstick sales continue to increase week after week, with premium brands accounting for a larger portion of sales than mass market brands. This year, women are choosing bolder, more dramatic hues rather than subdued, natural appearances.

According to NPD analyst Larissa Jensen, lipstick was the makeup product whose sales were most adversely affected by the epidemic, but demand is increasing right now, especially at the top end. According to NPD data, the $400 million US market for high end lipstick is expanding at a 44 percent annual rate, which is twice as fast as the overall makeup market. Since lipstick allows ambitious consumers who cannot afford a purse or pair of shoes to support a brand, it has long been a significant source of revenue for designer labels in the beauty industry Although the prices of this new accessory of ultra luxe lipsticks are out of this world, the positioning of the products is comparable to how luxury players go about their primary core product operations Players are using scarcity to make things more desirable and exclusive, keeping them more aspirational since distribution is limited. In the meanwhile, the beautiful packaging and refillable lipsticks help sell purchases as long term investments rather than single use cosmetics

New market niches are emerging thanks to people's willingness to try new things if they are clean, but clean beauty also calls for an increasingly transparent process. Consumers are now looking for brands that are as natural in their products as they are clear in their ingredient lists Clean beauty has been a growing trend in the business since 2018, but it is still a contentious, perplexing, and incredibly intriguing topic that can raise more questions than it does solutions.

2 Research Analysis

Fashion businesses transitioning into the cosmetics industry is nothing new; for decades, the most prestigious brands have benefited from the sale of designer scents Designer lipstick that has recently gained popularity, with companies like La Bouche Rouge and Hermes producing statement bullets to appeal to the younger generation of high end consumers As the market continues to become oversaturated, businesses must provide something distinctive: something that enhances rather than dilutes their brand DNA and resonates to both ready to wear customers and those seeking an entry level introduction A half trillion dollar industry, cosmetics is still growing Young people's interest in cosmetics is expanding, in part because of more aggressive marketing campaigns, sponsored influencer initiatives on social media, and the current emphasis on self care. As with any industry, maintaining a competitive edge and addressing common supply chain related difficulties require an effective and transparent supply chain. The demand for eco friendly and sustainable beauty goods is greater than ever, which increases the supply chain's complexity on a whole new level. Customers desire speedy and transparent product delivery, as well as the assurance that it was carried out sustainably. Lipsticks are an excellent place to start for a makeup line since they give customers a taste of what is to come and because the texture and colour will set the standard for future releases Additionally, lipsticks are easier to match to specific skin tones and colours than other beauty products like foundations, so the brand's introduction will appeal to a larger range of consumers with a "one size fits all" philosophy. A skill fully executed beauty offering is a great method for marketers to gain these ambitious consumers' loyalty

e. Clean and Transparent

Beauty

Because the brand is concentrating on a single, widely used beauty product and because the lipstick has been meticulously crafted to reflect the brand's DNA and values, including features like colour shades that mimic the Celine brand colours and opulent refillable packaging that can stand alone as collectibles, this lipstick venture may very well be a success for the company. With a brand so true to it's French heritage, the company's current plan is to grow to new markets in order to boost revenue by raising awareness and luring their target younger, yet luxury, customer, even if Celine is only available to a high end and knowledgeable audience. Stretching Celine, into product categories outside of their core competencies is a tried and true commercial development tactic in the luxury industry and Hedi has successfully conquered the same. They leverage their reputation in one sector to expand it into another where they haven't previously played during the stretch

Celine Beauty Strategy Part 3

Chapter I - The Business Canvas Objective

Creating a natural perfection, where the French craftsmanship plays a pivotal role to create a unique line, increasing revenue and strengthening loyalty from current customers and future clients within the next five years. Attract a younger, wealthy target market.

Goals

New Product Category

Creating a new product category will help scale and grow brand equity while adding a new revenue stream for Celine

Exposure

Introducing a beauty line will attract a new and different customer segment to Celine, aiming at the new money millennials

Brand Loyalty

Customers rely on Celine's to deliver high quality products This will create an opportunity for the brand to find another way to meet the customers' needs. Celine will offer existing customers exclusive access to buy new products first

Differential Competitive Advantage

A new product category will strengthen Celine's competitive advantage in the beauty industry as the brand is giving current customers a greater selection of products to buy from

Vision

The goal of Celine Beauty is to produce luxury that enhances the beauty of life while also preserving the environment for future generations, a luxury that is timeless and doesn't destroy, or pollute.

Mission

The strategic plan to enhance the brand further in sales and artistic timelessness, to make beautiful, sincere and genuine products which empower women and give them joy in dressing and living for themselves Also, to build a shift in Celine's consumption patterns, as well as in production & redistribution, with the aim of having a good effect on everything.

THE BUSINESS MODEL CELINE BEAUTY

KEY ACTIVITIES

Keyroleistocoordinate thecreation,promotion,and releaseofanewproduct,to makeeachlauncha successfulevent

Committingtocreatingthe futureofbeauty,thatisboth environmentallyfriendlyand aestheticallypleasingusing digitaltechnologyforthe globalmarket

KEY RESOURCES

LVMH'smanufacturingunit

Machineryandassets

Financialrecoursessupported byseniormanagement

Employeesandhumanasset management

VALUE PROPOSITIONS

Turning a new page, for the beauty lover of today:

Celine Beauty is meeting their customer where they are, at a time when gender has little to do with beauty This line is as timeless, as it is gender less

Luxurious beauty, the way you like it: clean

Celine Beauty is taking out the guesswork from the mindful shopper's add to cart experience This line is produced with only the choicest ingredients, given the most luxurious finish, and without any of the chemicals every other brand has on its ingredient list

CUSTOMER RELATIONSHIPS

Personalvaluesinsyncwith Frenchtraditions

Celine'sstrongcooperate relationshipwithmedia

Newerbondswithupcoming generations

Exceptionalloyalsupportfrom thosewhohavebeenassociated withCelineoveradecade

CHANNELS

Celine'sHAUTEPARFUMERIE BOUTIQUEat390RUESAINT HONORÉINPARIS

Celineofficialwebsite, wwwcelinecom

Omnichannelengagement

Digitalandsocialmedia marketing

COST STRUCTURE REVENUE STREAMS

Visionaryalchemistsofartandscience

Researchanddevelopmentmanagement

Celinedirectorandemployees

Marketingandpromotionalcosts

Packaging,deliveryandmiscellaneouscosts

Supplychaincosts

Revenuefromsalesoftheproducts

CUSTOMER KSEGMENTS EY PARTNERS

LVMHRecherche,anin housesubsidiaryforcustom cosmetics,skincare, fragrances,andrelated itemsforeachoftheLVMH group'sParfume& CosmeticsHouses

Creativedirector, HediSlimane

LVMHProduct developmentmanager

Digitalprojectmanager

ChiefMarketingOfficer andInfluencermarketing manager

Pressrelationsofficer

Eventsmanager

Thissegmentationofthe extensionwidelypersistsfrom theagerangeof28 55years withconsumershavingastrong perceptionofbuyingluxuryasa feelingofrarity This segmentationofmillennialsand babyboomers botholdand newmoneykeepthe knowledgeofintricacies, understandingthateverypiece ofCeline'swilllastbeyonda seasonoramomentbecauseof itstimelessness Newly acquaintedconsumerstothe brand,alsohaveasignificant presenceonsocialmediawhen itcomestostylingtheir purchasesfromthebrand

UNIQUE SELLING PROPOSITION