Senior Mortgage

Market challenges in 2023-2024

How to overcome these challenges

Why focus on this niche?

How to overcome these challenges

Why focus on this niche?

• Average mortgage payment is $1200 more than just 2 years ago

• To get back to the 25 year average housing payment (as % of income):

• 28% Decline in home pricing

• 4% Decline in interest rates

• 60% growth in household income

• 70,000+ Realtors have exited the business so far this year: 1 exits every 3-5 minutes

• Licensed Loan Officer count down 50%.

• Active LO (1 deal in 12 mo): 2022: 179,428. End of 2023-under 80,000

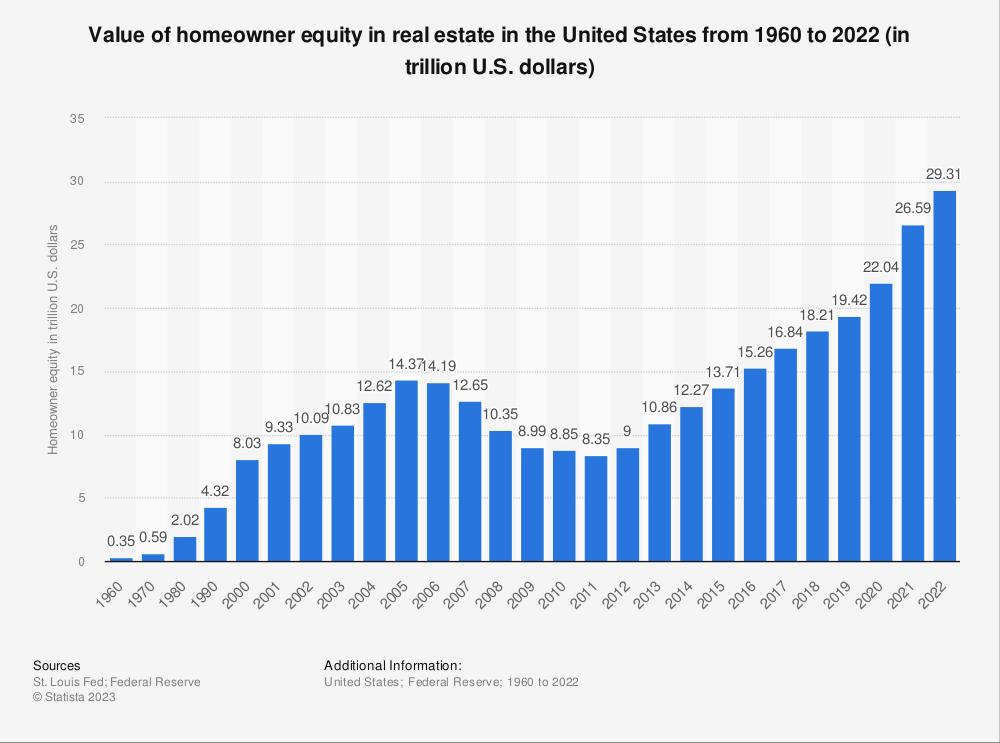

• Homeowners have RECORD Equity

• Average equity as of first quarter 2023:

$275,000

• Those over 65: $300,000+

First time since 2014:

39% share of the market

How to mortgage a home without a required payment.

How to save cash at the time of purchase and monthly for life.

How to remove price point and rate objections

• Convert frustrated buyers into happy homeowners

• Help unrealistic buyers get the home they want even if it’s seemingly over their budget

• Open buyers to better possibilities, previously thought to be unattainable

• Overcome rate and sales price objectives without impacting monthly cash flow

• Get more listings showing how senior homeowners can sell and buy a dream retirement home with no monthly mortgage payment (borrower must continue to pay taxes, insurance and maintain the home)

• We’ll review specific executable ideas with bankable results you can use immediately to get more listings and convert more buyers

•Over $12 Trillion in Equity

•15 Million People

•Largest Asset Class

•Opportunity to serve this generation and change their retirement cashflow

Wanting to be closer to family

Wanting to reduce home expenses

Change in health status

Change in marital status

Empty-nesting/children moving out

Wanting the cash from the sale of prior home

•Last year, approximately 4.2 million Baby Boomers moved homes

•Only 51% downsized into a smaller home

•They sold a home and purchased another

$600,000 Purchase Example

$120,000 Required monthly payments of $4,080/month

7.22% Interest Rate

7.433% APR

$1,469,104

$600,000 Purchase Example

H4P Loan Down Payment 62-year-old $385,800 $214,200* Loan @MRICEONLINE

*Negative Amortization could cause the total amount due at the end of the loan to increase if optional** reverse mortgage payments are not made. **Borrower must still pay taxes and insurance, and maintain the home. The example is used for illustration purposes only. This information is provided as a guideline; the actual reverse mortgage available funds are based on current interest rates, current charges associated with the loan, borrower date of birth, the property sales price and standard closing cost.

*With reverse mortgage loan must pay property related charges, like taxes and insurance.

**This advertisement is not tax or financial advice. You should consult a tax expert or financial advisor for your specific situation.

• $800,000 new construction purchase. Borrower taking proceeds of $600k from his sale. $200k H4P loan. Does NOT have to tap into his investment portfolio. Continues to pull from that as needed for income, has no required mortgage payment, AND moves up in home.---Youngest borrower here is 58-wife is 62.

• Client wants $425k home. Only qualifies for forward mortgage of $100,000 which is $325,000 down. On a H4P, borrower only needs to bring $250k to closing AND never has a payment. Saves $75k in down payment and no payment.

• Clients looking to purchase at $600,000. Planned to put down $250k from current home proceeds and have monthly payment of $3100. H4P option: pull from savings and put down $325,000. Never have a payment again.

• Client wants to purchase at $400,000. Has $290,000 to put down from sale of current home. No usable income on forward mortgage. Use assets for qualification and able to purchase at $400,000 and never have a payment.

• Refi example: client wants to draw SSI in 5 years. Wife wants to retire now. Set up a line of credit now that will allow up to $2900/month in additional income until SSI starts. Wife can now retire 5 years early.

James

to move to a newly constructed home to retire. The home values in their desired community are almost twice as much as their current area. A Realtor® recommended a Home Equity Conversion Mortgage so they could afford to buy a new home in the community they want.

$373,600

James and Mary could continue living in this $373,600 home.

$600,000

For $373,600 down, they could move to a $600,000 home with no monthly mortgage payments, except for taxes, insurance and maintenance.

They could sell their house for $373,600 and purchase a newly constructed home for $600,000. The houses and stories are used for illustration purposes only. Houses may not be available for purchase. This information is provided as a guideline; the actual reverse mortgage available funds are based on current interest rates, current charges associated with loan, borrower date of birth, the property sales price and standard closing cost. Interest rates and loan fees are subject to change without notice.

•Age 62 or older (only one, except TX)

•FHA-qualified home

•Must live in the home for more than six months a year

•Optional monthly mortgage payments (must pay property charges, like taxes and insurance)

•Minimal credit and income

Note: Any mortgages (liens) on the home must first be paid off in full borrowers typically use reverse mortgage loan proceeds at closing to pay off an existing mortgage.

•Keep the title to their home

•Does not require repayment until last borrower moves out of the home permanently

•Never owe more than the house is worth (non-recourse feature insured by the FHA)*

*There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change

•No Lender Credits

•No Realtor® Credits

•Sellers can pay for the following:

•Owner’s title insurance

•Home warranty

•Fees required to be paid under state or local law (Transfer Taxes)

•If a home inspection is listed on the purchase contract, a copy of the home inspection must be provided to the lender for review and any safety issues must be fixed

A few ways a HECM for Purchase (H4P) loan could benefit your clients:

•Purchase in a 55+ community

•Increase purchasing power and flexibility

•No monthly mortgage payments (taxes, insurance and maintenance required)

•Move closer to family, better weather or a more appropriate home

•Purchase a home for 40%-70% down*

•Close in as little as 17 days**

I would say…

•Well, it's like a cleaned-up, distant cousin

•It has some similarities, but nobody loses their house and you still own your home

•Like any other mortgage, it's a mortgage

•It has some things that are specially designed for seniors so that they can stay in their homes and have more cash. Not the traditional qualification process.

•I'd like to talk to you about it. It all comes out in the numbers whether it’s a good fit for you or not

•A well-informed buyer is a better buyer

•Let's talk about it

Then you know to let the loan officer handle it.

“Hi, <<client name>>, I was just thinking of you and wanted to make you aware that many of my clients are underinsured. With property values and construction costs increasing so dramatically, you may not have enough insurance to cover replacing your home. I’m calling as a courtesy to let you know you should check with your insurance agent to confirm you have enough coverage.”

“Out of curiosity, is this your forever home or have you considered buying another?”

Reconnect with buyers (age 62+)

who you were previously unable to help!

•Buyers who stopped pursuing purchases due to sticker shock

•Cash buyers with limited mortgage qualifications that wanted to keep more cash on hand

•Buyers who didn’t want to settle for a less desirable house

•Buyers that are stuck in a competitive price point but, if possible, would move up to a higher price range, as there is more inventory and less buying pressure

•Ask them if their parents have ever considered moving closer

•Do they miss their grandchildren?

•Are they in their long-term house for retirement?

Open yourself up to more clients…

• Help clients improve monthly cash flow in retirement

• Open buyers up to different price points without impacting their monthly cash flow

• Help clients realize they can make the retirement move desired

• Clients are now able to move to their desired location or price point.