The secret to succeeding in the office sector today?

IFor Redline Property Partners it’s about the draw of urbanized suburbia, the right location and the right amenities

By Dan Rafter, Editor

t’s no secret that the office sector continues to struggle. Companies are downsizing their office space as more of their employees work at least part-time from home. Older office buildings are struggling to attract tenants, many of whom are now renting a smaller amount of higher-quality space. And a growing number of owners are considering converting their underperforming office properties into multifamily space, an option that only works for a select few buildings.

This doesn’t mean that there aren’t opportunities in the office sector today. Just ask Redline Property Partners, an investment, management and development firm with offices in Minneapolis and Charlotte, North Carolina.

Redline Property Partners is seeing plenty of success with its office projects, operating several in Minnesota and the Carolinas that boast low vacancy rates and quality tenants.

What’s the secret formula? Andrew Webb, managing principal of Redline, points to hard work: Redline spends countless hours on selecting the right office properties in the right locations. The company also improves the properties it owns, transforming what might be outdated office spaces into modern, amenity-rich spaces, the kind of office space that is outperforming its competitors today.

Office to page 18

Were we spoiled? Demand still surpassing pre-pandemic levels in Twin Cities industrial market

By Dan Rafter, Editor

The demand for industrial real estate remains high throughout the Minneapolis-St. Paul market. So why does it feel like the industrial sector here is going through a slowdown?

Could it be that people got a bit spoiled during the industrial boom years of 2020 and 2021?

We spoke about the Twin Cities industrial market with Dan Larew, executive vice president of the Minneapolis industrial and tenant representation team with

JLL. He agreed that industrial sales and leasing activity in 2020 and 2021 was an aberration. But what does he expect to see in this sector in 2024? Larew says that he expects sales and leasing activity to be more in line with what the Minneapolis-St. Paul industrial market saw in the years leading up to the COVID-19 pandemic.

Here is some of what Larew had to say about the Minneapolis-St. Paul industrial market.

Did anything in JLL’s 2023 fourth quarter industrial report, released last month, surprise you?

Dan Larew: I don’t think there was anything unexpected. Industrial demand in the Twin Cities peaked in the first quarter of 2022. The primary demand drivers here were the same things we saw across the country: a rise in ecommerce sales, a slight benefit from onshoring and more companies increasing their invento-

©2024 Real Estate Publishing Corporation February 2024 • VOL. 41 No. 2

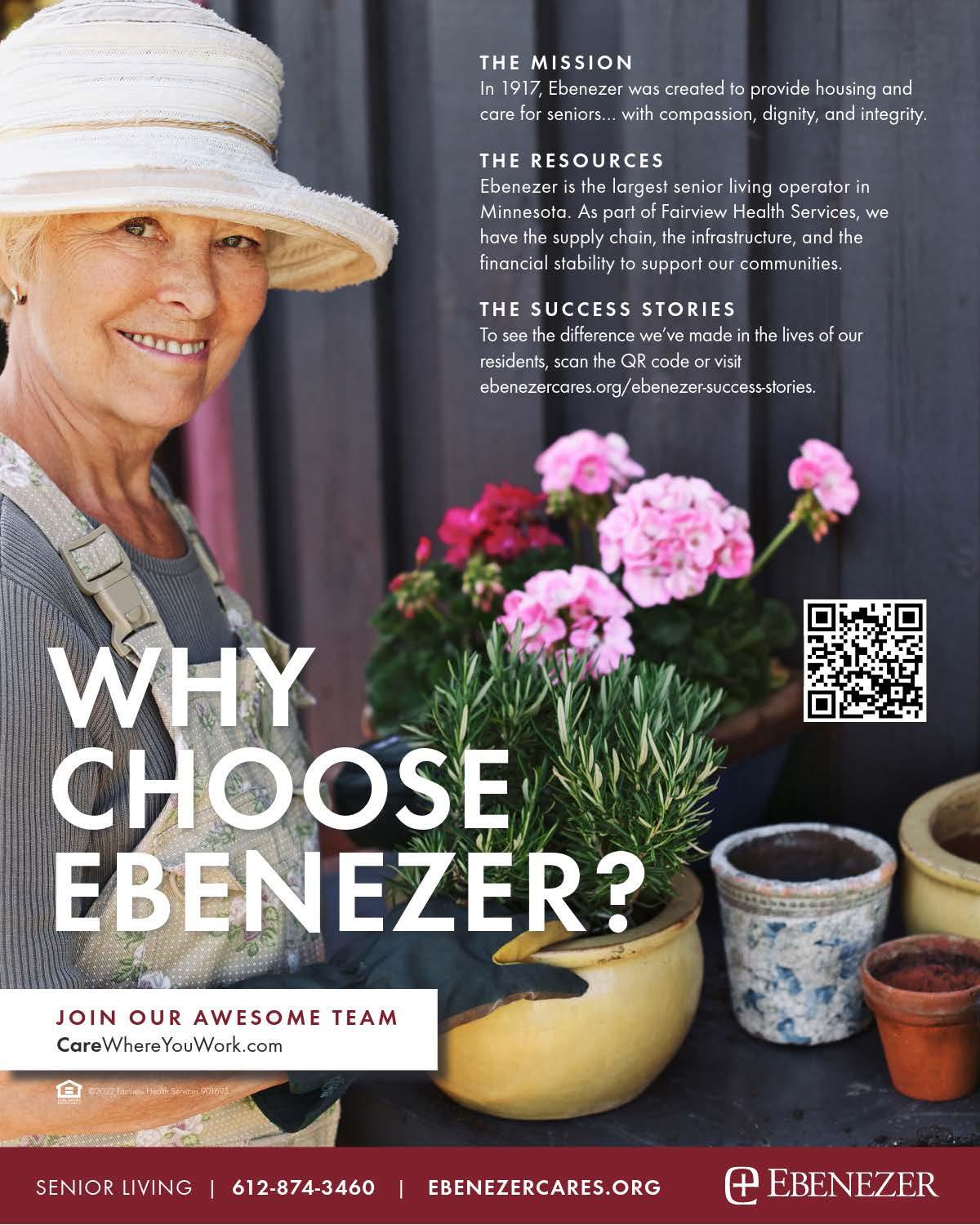

Industrial to page 19 Redline’s International Plaza is an 11-stoy office building located along Interstate-494 in Bloomington, Minnesota. (Photo courtesy of Redline Property Partners.)

April 18, 2024

local approach BWBMN.COM Member FDIC Discover Bridgewater Bank. to banking. A refreshingly

CONTENTS

1 The secret to succeeding in the office sector today? A focus on quality helps

1 Were we spoiled? Demand still surpassing pre-pandemic levels in Twin Cities industrial market

4 Office sales today? Yes, they still happen … with the right building in the right location

6 For owners struggling with Class -B and -C office properties? Online auctions might be the escape hatch

8 Developing mixed-use dwellings: Bringing one of today’s most popular building types to life

14 CBRE report: Multifamily developers enjoyed a boom year in 2023. But expect a slowdown in new deliveries this year

16 One type of office space that isn’t seeing soaring vacancy rates? High-rises are still drawing tenants

February 2024

17 The top 100 industrial leases of 2023? Tenants didn’t go as big last year

20 Three tips for non-profit organizations’ real estate decisions in 2024: Here’s how to make this year a winning one

21 The sky isn’t Falling: Here’s why we remain bullish on CRE

22 Expansion mode on: These are the fastest-growing retailers in the United States

23 Top 10 features and amenities renters in the Midwest prioritize: What tenants want today might surprise you

Minnesota Real Estate Journal Copyright © 2024 by the Minnesota Real Estate Journal is published bi-monthly for $85 a year. 7767 Elm Creek Boulevard, Suite 210, Maple Grove, MN 55369. 952-405-7780. For more commercial real estate news and information, please visit our website www.rejournals.com ©2024 Real Estate Publishing Corporation. No part of this publication may be reproduced without the written permission of the publisher.

3

President | Publisher

Jeff Johnson jeff.johnson@rejournals.com

Managing Editor

Dan Rafter drafter@rejournals.com

Senior Vice President Jay Kodytek jay.kodytek@rejournals.com

Chief Financial Officer

Todd Phillips todd.phillips@rejournals.com

Art Director | Graphic Designer Alan Davis alan.davis@rejournals.com

Managing Director

National Events & Marketing Kaitlyn LaCroix kaitlyn.lacroix@rejournals.com

Office sales today?

Yes, they still happen … with the right building in the right location

By Dan Rafter, Editor

Y7767 Elm Creek Boulevard, Suite 210 Maple Grove, MN 55369

For information call 952-885-0815

EDITORIAL ADVISORY BOARD

JOHN ALLEN

JEFF EATON

MARK EVENSON

PATRICIA GNETZ

TOM GUMP

CHAD JOHNSON

BILL WARDWELL

JEFFREY LAFAVRE

WADE LAU

JIM LOCKHART

DUANE LUND

CLINT MILLER

WHITNEY PEYTON

MIKE SALMEN

es, the office market is struggling today. That doesn’t mean, though, that buyers aren’t interested in any office spaces today. Modern buildings filled with amenities? Those office properties can still attract buyers.

As an example, consider 13305 12th Ave. N. in Plymouth, Minnesota, a suburb of Minneapolis.

Colliers late last year brokered the sale of this 31,780-square-foot office building, a deal that closed on Dec. 18. The sale was a good example of the type of office property that remains in demand today: 13305 12th Ave. N. was named Building of the Year by the NAIOP in 2016 and boasts an extensive glass line, LED lighting and a high-tech audio/visual system. The property also features an inviting outdoor space with a patio and a deck on its second floor.

Nick Leviton

Nick Leviton

Nick Leviton, a senior vice president with Colliers and one of the brokers who represented the building’s seller, said that this property is an example of the type of office space designed to flourish today: modern, bright, new and amenitized.

The property was also the right size. Leviton said that it’s easier today to sell office buildings that are under 40,000 square feet. These properties attract more buyers. Leviton said that three potential buyers bid on the Plymouth office property.

“No expenses were spared on this building,” Leviton said. “An owner-occupier built it as a showpiece, something that

would show well for a long period of time. The audio-visual equipment, the finishes, the amenities, everything is top end. That helped attract buyers.”

Laura Moore, vice president of Colliers’ Minneapolis-St. Paul, also represented the seller in this deal. Jason Sell of Cushman & Wakefield represented the buyer.

Leviton said that the sale is evidence that the office market, while struggling, is far from dead. The right properties in the right locations will still sell, he said.

Shortly before the COVID pandemic took hold, the previous owners of the building renovated about one-third of its space. That space was never occupied until the sale, meaning that it was in what Leviton calls pristine condition.

The Plymouth building also came with its own office furniture, much of which was barely used. That, too, sweetened the deal for the buyer, Leviton said.

“Any group looking at this building was comparing it against office space that had to be completely built out from scratch,” he said. “The cost of construction permits is exorbitant today. The work that goes into building an office from scratch is intense. Even renovating an existing space can be time-consuming and expensive. Our building was being compared to properties that would require significant improvements from both a cost and time perspective. That’s part of the reason why our building attracted so much attention from buyers.”

MINNESOTA REAL ESTATE JOURNAL February 2024 4

Location to page 14

Photo courtesy of Colliers

Photo courtesy of Colliers

MINNESOTA REAL ESTATE JOURNAL February 2024 5

For owners struggling with Class-B and -C office properties? Online auctions might be the escape hatch

By Dan Rafter, Editor

It remains a tale of two markets in the U.S. office sector. And one of those markets? The online auction format could prove a true benefit to it.

That’s the thought of Steve Jacobs, president of online CRE auction company Ten-X Commercial.

As Jacobs says, investors are still interested in high-quality Class-A office space. So are tenants, which is why vacancy rates tend to be lower for newer office space that offers plenty of amenities.

But older Class-B and -C office properties? Those spaces aren’t attracting investment dollars. They’re seeing soaring vacancy rates. And the situation for these outmoded office properties isn’t improving.

One solution? Jacobs says that the owners of those older office properties should consider the online property auction, which has proven to be a successful way for owners to sell Class-B and -C office properties that need reinvention.

Jacobs says that Ten-X has seen steady year-overyear growth in the number of Class-C and -B office properties on its platform since the start of the COVID19 pandemic. As Jacobs says, the online auction format provides these owners a type of “escape hatch” to unload underperforming office properties.

This is a trend that Jacobs says will only gain strength as more office space is removed from the market and sellers need a fast method of offloading their lower-quality buildings. According to Ten-X’s statistics, the company boasts a trade rate of 58% with its online auction format, more than twice the rate of sale compared to traditional listings. Online sales close quickly, too, with Ten-X reporting that properties on its platform move from list to close in an average of under 100 days, again twice as fast as offline transactions.

“The auction format expedites a transaction’s timeline,” Jacobs said. “The typical timeline to transact commercial real estate is five to seven months. With our process, we are selling and closing in 98 days on average. That was our average timeframe last year.

That’s whether you are selling a Class-A, -B or -C property. If a seller wants to sell and monetize the transaction quickly, the auction format is a great option. That is the overarching theme, regardless of asset.”

Desperate times for office owners

There has been plenty of chatter that office building owners can convert their high-vacancy properties into other uses, with most suggesting that they can transform these spaces into multifamily units.

That’s often expensive, though. And it requires the right type of office building in the right location. Many Class-B and -C office properties can’t be converted to other uses. As Jacobs says, these properties are often located in less-desirable neighborhoods. They might have lower ceilings, smaller floorplates and structural issues.

“To convert those into something new and shiny is more difficult,” Jacobs said.

Class-C and -B office buildings are struggling, too, because of the flight to quality that is happening in today’s office sector. Many tenants, because of the enduring strength of the work-from-home movement and hybrid schedules, are reducing the amount of

office space that they need. When they move to a new office building, then, they are often relocating to higher-quality Class-A space. They can afford this move because they are renting a smaller amount of square footage.

This leaves the owners of lower-class office space with even more vacancies.

“This isn’t all about the pandemic. It’s about the flight to quality, too,” Jacobs said. “If you are the owner of a Class-C building and you can’t reposition it -- you can’t knock it down and build housing -- you want to monetize that property as quickly as you can. The auction format is good for that.”

Jacobs said that more owners of these older buildings are doing just that. Ten-X has its first auction of the year later this month. Jacobs said that most properties in the auction are Class-C buildings. The occupancy rate in these buildings ranges from 0% to 49%.

What kind of buyer will the auction attract? Jacobs says that he sees a variety of investors for his company’s online auctions, mostly depending on where the assets are located. A C-building in a stable market like Irvine, California, will attract more potential buyers than will properties in less-desirable markets.

Properties not in “A” markets tend to attract local investors, Jacobs says. A group of high-net-worth local investors might pool their dollars, buy an underperforming office building and turn it into, say, a medical office.

Other local investors might turn a Class-B or -C office property into a professional building with doctors, dentists or lawyers who need smaller suites.

“There is a lot of money out there,” Jacobs said. “There is a ton of money waiting to buy, for example, a Baltimore high-rise office property for a low price. Those investors know that they can turn that building into the best office property in Baltimore if they are buying the property for 30 cents on the dollar. They know that they can charge lower rent and lease-up their building if they spend less on it upfront.”

And the sellers participating in online auctions today? Jacobs says that some institutional owners are willing to sell their office space at a discount, taking the loss on a property and moving on. They can then

purchase a new office asset – or other asset type – at a lower price.

Other sellers, even if they are not distressed are stressed, Jacobs said. They might have purchased an office building four years ago for $8 million with $7 million in debt at 3.5% interest. The market has since shifted, and the buildings that they purchased might now be worth $6 million. They haven’t defaulted on their loans, but they might have to negotiate with their lenders if they want to sell their properties for what they are worth today.

As Jacobs says, buyers won’t get great deals when working with these stressed sellers. But these types of deals will offer opportunities for buyers willing to spend market-rate for an office property. He predicts that more of these sales from “stressed but not distressed” owners will happen in 2024.

Like others in the commercial real estate business, Jacobs says that he expects CRE sales activity – both offline and online – to increase in 2024 now that the Federal Reserve Board has indicated that it will no longer be increasing its benchmark interest rate.

But this increase in sales might not happen until the second half of the year as investors wait for interest rates to not just stabilize but fall.

“I do believe investors love the idea that rates aren’t going to go up,” Jacobs said. “But I do think that investors also have the sense that rates will go down this year. Many have told me that they are going to wait to see in the next six months whether rates do fall. They will wait until they see that first decline in rates before they buy something. Right now, all we have is a prediction that rates are going to go down. We don’t have the rates falling yet.”

No lost causes

And in good news for the owners of underperforming office space? Jacobs says that he doesn’t view any office property as a lost cause. As he says, everything sells for the right price. That price might not be what owners want, but there is a price for every office property, Jacobs said.

Jacobs says that there are many office properties that will be auctioned this year by Ten-X that have been built in the 1980s and are stuck with sky-high vacancy rates. Even these properties will sell by auction at the right price, he said.

“If you price it right, someone will buy it and figure it out for you,” Jacobs said.

For those office buildings that are the direst of straits? Jacobs often recommends an absolute-bid auction. In these auctions, the owners agree to accept the highest offers they receive, even if they come in low.

“You take whatever you can get for it,” Jacobs said. “The owners get rid of the taxes and obligations and get out of the deal. Many times, those properties sell for several hundreds of thousands of dollars because you’ll get several bidders. You might still get a low price, but you end up with more than you expected because some other bidder views the space as a useful piece of property.”

MINNESOTA REAL ESTATE JOURNAL February 2024 6

Steve Jacobs

(Photo courtesy of Ten-X)

Developing mixed-use dwellings: Bringing one of today’s most popular building types to life

by Jesse Hadley, JLG Architects

Whether developing a single building or an entire city block, the investment risk is big, bold and real, but nothing to be afraid of. The right architect can package up a pre-design with feasibility studies and multi-faceted expertise, empowering a dynamic dwelling that minimizes the risk and maximizes ROI.

From integration of sustainable features to smart security, commerce partners and indoor/outdoor lifestyle amenities, JLG Architects knows how to hit the sweet spot for long-term financial success.

Kick-start the story

Some developers kick-start their project with a strong vision – a well-defined brand that requires the architect to interpret elements of storytelling from the street to the rooftop patio. Others have a wide-open space, tumbleweed and an empty site waiting to make its mark.

In between these projects is a long list of exceptions in which somebody must seek out the sweet spot, not too big, not too small and sprinkling in just the right amount of character, efficiencies and amenities that will keep units full and prosperous for decades to come.

Right-sizing for revenue

Developing mixed-use dwellings is a balancing act that is best informed by strong studies and defining data, which can help determine the right size, the right branding and the perfect budgeting balance for high-performance durability. With developers, investors and city regulators counting down the days, there is no time to play guessing games.

At JLG, we develop mixed-use properties on our own and alongside many new and well-established developers. After 34 years of work in mixed-use dwellings, including historic preservations, entire blocks and our own mixed-use offices, we know the clearest path to success starts with pre-designs aimed at flexibility and financial performance. Ultimately, site feasibility studies, pre-designs, up-front internal cost estimating and a strong understanding of generatable revenue informs how your building will perform.

Earning investor interest

The phrase, “if you build it, they will come,” does not apply in development. Developers generally must show what they know early on to gain interest from investors. Once you’ve found an architect, completed studies, gathered the data and determined the size with up-front and internal cost estimates, it’s time for show and tell.

We routinely create colorized hand sketches to demonstrate the data, studies and project metrics of the building. Here, we tie the cost information into the building, helping clients and investors understand exactly how it will perform.

For our mixed-use developments in downtown St. Cloud, Minnesota, and Westport Avenue in Sioux

Falls, South Dakota, our team delivered concept drawings and preliminary budgets that generated a positive path forward. The pre-design helped socialize and gain support for the projects with the local municipality while developing a preliminary proforma to engage prospective investors. With a cost-effective pre-design solution that established the budgets, our clients gained excellent traction in both efforts.

The Sioux Falls 204-unit project was led by an up-and-coming developer, CAM Companies, which made this exercise even more important. The developer’s team was able to take that information to

conventions, allowing everyone to see where they fit within a wide range of developers.

In both cases, JLG used 3D visualization as a tool to communicate interior and exterior concept images, a quick way to generate excitement and buzz around each project. JLG’s VizLab team also used Virtual Reality (VR) technology to give clients a walking tour through the building, helping communicate the details of key spaces so developers can make confident design decisions. Once the design was completed, this same technology allowed developers to give potential tenants 3D walkthroughs of units to secure early interest and leases, well before the development is built.

MINNESOTA REAL ESTATE JOURNAL February 2024 8

Pure Development, designed by JLG Architects, is a lifestyle development with onsite grocery, dining and banking. (Photo by Chad Ziemendorf.

RiverHouse in downtown Fargo, North Dakota. (Rendering by JLG Architects.)

MINNESOTA REAL ESTATE JOURNAL February 2024 9 For questions or sponsorship opportunities, contact: Jeff Johnson 612-819-0385 jeff.johnson@rejournals.com Jay Kodytek 612-940-3713 jay.kodytek@rejournals.com 975 attended in 2023! APRIL 18, 2024 3:30PM-5:00PM COCKTAIL HOUR | 5:00PM DINNER & PROGRAM DOUBLETREE BY HILTON HOTEL BLOOMINGTON 7800 NORMANDALE BOULEVARD, MINNEAPOLIS, MN REGISTER TO ATTEND

Branded storytelling

Distinctive developments should tell a distinctive story, preferably one that resonates with future tenants, investors and adjacent neighborhoods. Jiving with the vibe of the existing neighborhood is a great way to pay thoughtful homage to historical character. It’s also wise to think deeper about new development and how it can be elevated as a catalyst to future economic growth.

We have worked extensively with Kilbourne Group on several downtown Fargo developments, and each project brings a captivating story aligned with the history of the site and the city’s economic vitality.

The developer’s most recent mixed-use development, Mercantile, embodies a modern lifestyle and vibrant future inspired by the downtown site’s historic roots. After Fargo’s Mercantile Co. building was demolished in 1966, the wholesale grocer site hosted countless other endeavors, including Goodyear Service Center’s 1968 garage, which later became an eclectic home to pop-up food trucks, theater, art galleries and the Red River Market.

Working closely with Kilbourne Group, we created a design that would give this prominent Broadway corner new life built for the next generation. Mercantile’s 1909 character inspired six floors of walkable residential and premium retail experiences that elevate the everyday lifestyle.

Mercantile offers timeless, neoclassical character with modern amenities, unique floorplans and builtin smart-apartment technology. This home gives tenants what they want – high ceilings, floor-to-ceiling windows, an automated parking ramp, pet wash

and relief areas and a well-appointed club room with kitchen, pool table and rooftop patio.

The adjoining patio provides access to an outdoor TV, grill stations and fire pits overlooking spectacular downtown views. Overall, the development has helped reactivate Broadway’s nearby businesses and downtown lifestyle living, all while alleviating parking congestion in proximity to over 100 local hots spots at the heart of the city.

Crafty design, budget aligned

While a building’s branding may help find the sweet spot of storytelling, lack of material planning can lead to a development’s demise. As architects, it’s our job to get crafty and dig into the design details. We collaborate with owners and contractors, consultants and subcontractors to provide the highest level of efficiency, aimed at maximizing value

MINNESOTA REAL ESTATE JOURNAL February 2024 10

Westport Avenue in Sioux Falls. (Rendering by JLG Architects.)

In times of disruption, tried-and-true solutions won’t do. You need more — more innovation, broader perspective, keener foresight. We’ve learned this in our three decades of service to the real estate community. Through ups and downs. In good times and hard times. We’re ready to put our experience to the test again and help you find the way forward. Visit us at:

MINNESOTA REAL ESTATE JOURNAL February 2024 11

MMBLawFirm.com WHEN THE WORLD TURNS UPSIDE DOWN, IT’S TIME TO REDRAW THE MAP

and appeal. In other words, we don’t wait until the project goes to bid, which can add more time and money. We take the strategic fast-track, working closely with subs to source more efficient materials – reducing costs and seeking out new, sophisticated applications of readily available, cost-effective materials.

For example, standard-sized fiber cement panels can be recreated in visually appealing dimensions and patterns that coordinate with various architectural components. This process involves minimal waste and maximum use of materials. Metal panels are also cost-effective and customizable to a variety of styles: industrial, contemporary or traditional.

We also push our precast suppliers to provide creative options that fit the look and feel of the project, finding new approaches to add a richer quality to basic materials. Precast sandwich panels are typically cost-effective for structural design and building envelope and come with an architectural finish that doesn’t require additional cladding material. To maximize all options, we work closely with suppliers to understand every aspect of their products, deciphering finite details that help keep projects under budget and on time.

Lifestyle amenities

Today’s tenants want their home to reflect their lifestyle. To achieve what often seems like the impossible, we evaluate the client’s goals for these spaces – including the goals that don’t generate revenue but help attract and retain tenants. In some cases, it could be as simple as providing a single amenity, whether it’s a community room or fitness center, typically aligned with the needs of a particular market location.

A location and tenant target might also require a total lifestyle brand, providing everything active residents want and need. This is where being attuned to location is critical. Is this lifestyle development in proximity to the river, bike trails, or a lake? If so, developers need to walk in their tenants’ shoes to understand nontraditional amenities that will help them hit the sweet spot.

At RiverHouse in downtown Fargo, we worked with Kilbourne Group to design an amenity-rich space that appeals to active lifestyle tenants on the banks of the Red River. Anticipating its opening in fall 2024, tenants will have direct access to the water, river trails, beautiful views from the rooftop patio, and of course, secure bike and kayak storage with outdoor gear lockers, a fitness center, a graband-go mini-market and a heated parking garage.

Is sustainability worth the investment?

A decade ago, it wasn’t uncommon for investors to ignore the concept of integrating sustainability features. Back then, it was more expensive, and the ROI seemed unproven and out of grasp. Like all newer concepts, it took some time to catch on while investors awaited the overwhelming evidence that proved its worth.

Today, both tenants and investors look for sustainability in their mixed-use dwellings, all sides now understanding the operational savings, environmental impact and tenant health benefits, including sustainable materials, LED lighting, natural daylighting, energy-efficient appliances, low VOC finishes and HVAC systems that improve air quality.

Embedded at the start of the design process, JLG gives developers access to an in-house sustainability core team that helps combat price point challenges and make a proforma pencil out. This team provides expertise on sustainable building materials, evaluation of mechanical systems and building envelope and basic infrastructure for future solar panel installation.

Happiness home, happy investors

Whether a seasoned developer or an up-andcomer, it’s worth the reminder that this big investment should lead to a happy home, one that doesn’t just surround people but serves them. The end goal isn’t achieved by solely focusing on investor ROI, it’s conquered with an acute focus on creative architectural solutions, data-driven studies and tenant ROI.

Successful investments start by building on the well-informed concepts of thriving lifestyles that reflect its tenants, reinvigorate community and unlock economic vitality designed to open new doors for future development.

MINNESOTA REAL ESTATE JOURNAL February 2024 12

Jesse Hadley is principal architect with JLG Architects, which has Minnesota offices in Minneapolis, St. Cloud and Alexandria.

The Mercantile Apartments in Fargo, North Dakota. (Photo by Chad Ziemendorf.)

The Mercantile Apartments’ patio area. (Photo by Chad Ziemendorf.)

UPCOMING EVENTS

March 8, 2024

17th Annual Minnesota

Capital Markets Summit - 4 Hours of CE Approved

March 15, 2024

20th Annual Minnesota

Land Development Summit - 4 Hours of CE Approved

April 10, 2024

7th Annual Minnesota

Women In Real Estate Summit - 4 Hours of CE will be Applied for

April 18, 2024

Minnesota

Real Estate Awards

May 2, 2024

9th Annual Fargo Moorhead

Commercial Real Estate Summit

May 10, 2024

20th Annual Minnesota

Medical Properties Summit - 4 Hours of CE will be Applied for

May 15, 2024

Minnesota

Cannabis Real Estate Summit - 4 Hours of CE will be Applied for

June 19, 2024

8th Annual Rochester

Commercial Real Estate Summit - 4 Hours of CE will be Applied for

upcoming events - registration sites to come:

4/26 - 2nd Annual Reuse and Reposition Summit

5/16 - 5th Annual St Cloud Development Summit

5/23 - 2nd Annual Southeast Development Summit

5/30 - 17th Annual Retail and Restaurant Summit

6/6 - 12th Annual Mid-Year Commercial Real Estate Forecast

6/12 - 12th Annual Mid-Year Apartment Summit

6/14 - 18th Annual Property Management Summit

CBRE report: Multifamily developers enjoyed a boom year in 2023. But expect a slowdown in new deliveries this year

By Dan Rafter, Editor

How busy were multifamily developers last year? They added more than 416,000 new apartment units to the United States’ multifamily supply in 2023, including a record-setting number of new units in the fourth quarter.

That’s the big takeaway from CBRE’s U.S. fourth-quarter multifamily market report, a report that highlights an apartment sector that is still booming despite the challenges brought by higher interest rates and persistent inflation.

As the CBRE research shows, demand remains high for modern multifamily units. And that demand isn’t about to slow as higher mortgage interest rates push many potential homebuyers out of the single-family housing market.

According to the latest numbers from CBRE, the multifamily market in the United States witnessed a significant surge in new construction deliveries throughout 2023. The high number of new units did bring about one negative stat for apartment owners: Multifamily rent growth did slow in 2023, largely because of all the new supply.

In the fourth quarter of 2023, new apartment construction deliveries soared to a record high of 140,800 units, contributing to an impressive four-quarter total of 416,500 new units.

Don’t, though, expect a similar surge in 2024. CBRE said that fewer construction starts in the last half of 2023 means that developers will bring fewer new multifamily buildings in 2025.

The multifamily vacancy rate experienced a slight uptick in the fourth quarter, rising by 20 basis points quarter-over-quarter to 5.4% by the end of 2023. Despite this, net absorption in the fourth quarter of 2023 was strong, reaching 84,800 units, marking a performance more than four times the pre-pandemic fourth-quarter average.

“Record new construction was met with robust renter demand in the fourth quarter,” said Kelli Carhart, leader of Multifamily Capital Markets for CBRE.

Carhart said that she anticipates an upturn in investment activity in the multifamily market, most

likely starting in the second quarter. This uptick will be driven by potential rate cuts by the Federal Reserve, which are expected to improve capital market conditions, Carhart said.

Additionally, an increase in loan maturities should create transaction opportunities for investors focusing on distressed assets.

The average monthly net effective rent saw a modest year-over-year growth of 0.4% in the fourth quarter of 2023. This growth rate stands significantly lower than the pre-pandemic five-year average of 2.7% and is notably below the peak of 15.2% recorded in first quarter of 2022.

The Midwest and Northeast were the sole regions to experience positive year-over-year rent growth across all markets. The Midwest led with 2.7% growth, slightly down from 2.9% in the third quarter

Then there is the outdoor space that comes with 13305 12th Ave. N. Outdoor space has become a desired amenity by office tenants, who often promote it as one way to entice their workers back to the office. As Leviton says, smaller buildings such as the Plymouth space rarely feature the kind of extensive office space that this property offers.

This doesn’t mean that selling 13305 12th Ave. N. came without challenges. As Leviton says, buyers and lenders were still leery of higher interest rates when this deal was negotiated.

“There was a time when people almost put their pencils down and pulled away from doing any deals,” Leviton said. “Everyone saw interest rates go up

of 2023, followed by the Northeast with 2.4%, also down from 2.9%.

Among the 69 markets tracked by CBRE, 56 reported positive net absorption in the fourth quarter of last year, with New York (8,800 units), Austin (6,700 units) and Atlanta (6,000 units) leading in absorption.

The top-five markets for new apartment deliveries in 2023 -- New York, Dallas, Austin, Houston, and Atlanta -- made up 27% of the national total.

A total of 68 out of the 69 markets monitored by CBRE had vacancy rates at or above 3%, with Madison, Wisconsin, boasting the lowest vacancy rate at just 2.8%.

and no one knew whether they would stop or move back down. Nobody wanted to guess and do anything for that first part of 2023. The whole financing piece was a challenge.”

The buyer of the Plymouth property, though, was ready to move, even in an environment in which interest rates were higher. Leviton said that the buyer was willing to commit to the space for a seven- to 10-year period. That made its decision to invest in 13305 12th Ave. N. an easier one, he said.

MINNESOTA REAL ESTATE JOURNAL February 2024 14

Image by Pexels from Pixabay

Location from page 4

Healthg

g

s t

lPaza g V a l l e y C r e e k k

SPS Tower gSteelman

Creativ e g

g

IIIdnEtseW g W

knaBSUgretneCpr

g g IDSCentergInterlachen C o r p o r a t e retneC gertneClanoitanretnIg retneCngiseDlanoitanretnI g tIacsa Biu l d i n g I I I & I V g

Trapp 1245 g Trapp 1279 g

gSouthdaleMedicalCenter g S o uthdale MedicalCenter

g Excelsior Cro s s i n g s g reseRlaredeF v e B a n k fo lopaenniM i s g F ifth Street Towe r s Loose-WilesBuildi n g g M a y o cinilC erauqSg

tcejorPs’notyaDeh ghTiLednne B

g Mide c a l A r t s Bu ilding gMetroOffice g NorthlandCenter g M N V a l l e y D si noitubirt IrtC g NM V a l l e y tseW g ciaZoM tsaE a n d W e s t g

Nathan Lane Technol o g y g g NormandaleLake8200 Tower g N o r m a n elad ekaL rewoT0038 g amroN n elad ekaL rewoT0048g dnamroN la e L a k e 8500 g

11th Annual

NorthstarWestg One Marketpointe gOne Merid i a n C r o s s i n g s g enO gnissorCtsewhtuoS

PlymouthPointBusiness Center g Prairie LakesCorporateCenterII g g azalPCWPgyawetaGCBR

III g S o u t h d a l e O f feci ertneC geladhtuoS ecalP S o tni eciffO retneCg thtuoS nwo O f f i c e P a r k g

g CBR azalP gecalPyawkraPreviRgiRlpreveca g

maNcM a r a retneCinmulA

g O p u s retneCetaroproC g

Thank You To Our Sponsors:

EtseW IId g

TwoMarketpoint e g ssogni s g) IFNUg22owT weiVy g vinU e ytisr II g naBSU

WaterfordInnovation g Wells FargoEastTowersg s eWgazalPograF dn neC g W e ts dnE I g

WestEnd

g

Downtown

orthern C

p

graT

azalPt

JET55CorporateCenter g nretseW reniatnoC (

Xcel Energy

g g nalniuQ g TargetN

am

u s g

e

ggnidliuB51ehT gehT eda gn g

l

i

T he

i l

iu

d

n g g

M

lwrightBuilding g

CBRE |CSM CORPORATION | DAVIS | HD SUPPLY | JLL | KRAUS-ANDERSON REALTY COMPANY | LVC, INC. | NELSON | SCHINDLER ELEVATOR | SHORENSTEIN REALTY SERVICES | THE RMR GROUP PLATINUM SPONSORS GOLD SPONSORS SILVER SPONSORS

One type of office space that isn’t seeing soaring vacancy rates? High-rises

By Dan Rafter, Editor

While demand for office space has been sluggish since the start of the COVID-19 pandemic, there is one office sector that is still seeing lower vacancy rates: high-rise buildings.

New research from JLL suggests that vacancy rates will remain low in the country’s high-rise office spaces, largely because the development of new office space in general, and high-rise buildings in particular, will slow during the next several years.

According to JLL, while office space nationally had a vacancy rate of more than 20% as of December of 2023, office suites on floors 20 and above in high-rise buildings had a vacancy rate of just 12.4%, when excluding figures in New York City.

Signature high-rise buildings across the country also boast low office vacancy rates. JLL reported that the Empire State Building in New York City was 90.2% occupied as of December of last year while the Willis Tower in Chicago was 87% occupied. That Willis Tower figure is especially impressive considering that the overall office vacancy rate in the Chicago market was higher than 20% in December.

Jacob Rowden, JLL research manager, says that one of the reasons for the lower vacancy rates is that many high-rise buildings are built in what he calls “ultra-core” locations.

He pointed to One Vanderbilt in New York City as an example. This 93-story skyscraper is located right across from Grand Central Terminal, making the building a desirable location for companies hoping to make it easier for commuters to reach their offices.

Taller buildings, because they rise so much higher than their neighbors, also offer better natural light on their upper floors, something that companies increasingly strive to offer to their employees, Rowden said.

“These are rare assets,” Rowden said. “Only about 1% of our office space sits on the 40th floor or above. When you talk about those top-level penthouse suites in the highest buildings, those are even rarer. A lot of tenants are interested in that. There is very limited space of that kind available.”

Larger buildings also taper as they rise higher. This means that there isn’t as much room for office space available on these buildings’ upper floors. That also limits the amount of top-floor office space available, helping to increase the demand for it.

At the same time, tenants have been more interested in smaller floor plates since the start of the pandemic. That, too, has boosted demand for the smaller office spaces typically offered on the higher floors of office buildings.

Don’t expect demand for high-rise office space to lessen in the future, either. JLL says that there simply aren’t enough new high-rise spaces on the way. Of the 253 office buildings that remain under construction nationally, just 12 are planned to rise 30 stories or higher. At least six of those buildings

have fully pre-leased their high-rise floors, according to JLL.

“The pipeline for super-tall buildings is very thin in most markets,” Rowden said. “Outside of Miami

or Austin, we don’t expect to see the construction of any tallest buildings in any markets for a while.”

As Rowden says, since the pandemic, the demand for new office construction has fallen, and tall buildings represent the largest and most challenging office projects of all.

“These buildings are costly, difficult to propose, difficult to find financing for and challenging to build in this environment,” he said.

Don’t underestimate the power of brand names, either. Many high-rise office buildings rank among the most prominent and well-known office spaces in their cities. Rowden said that many tenants seek out that name recognition, often using it as a way to entice and retain top employees.

“We definitely see tenants that are interested in the architectural significance of these buildings,” Rowden said. “Being in an iconic building carries a level of prominence that can elevate their brand from a recruiting standpoint and overall branding of their company.”

MINNESOTA REAL ESTATE JOURNAL February 2024 16

Photo courtesy of Vladey Meer from Pixaby

Jacob Rowden

(Photo courtesy of JLL)

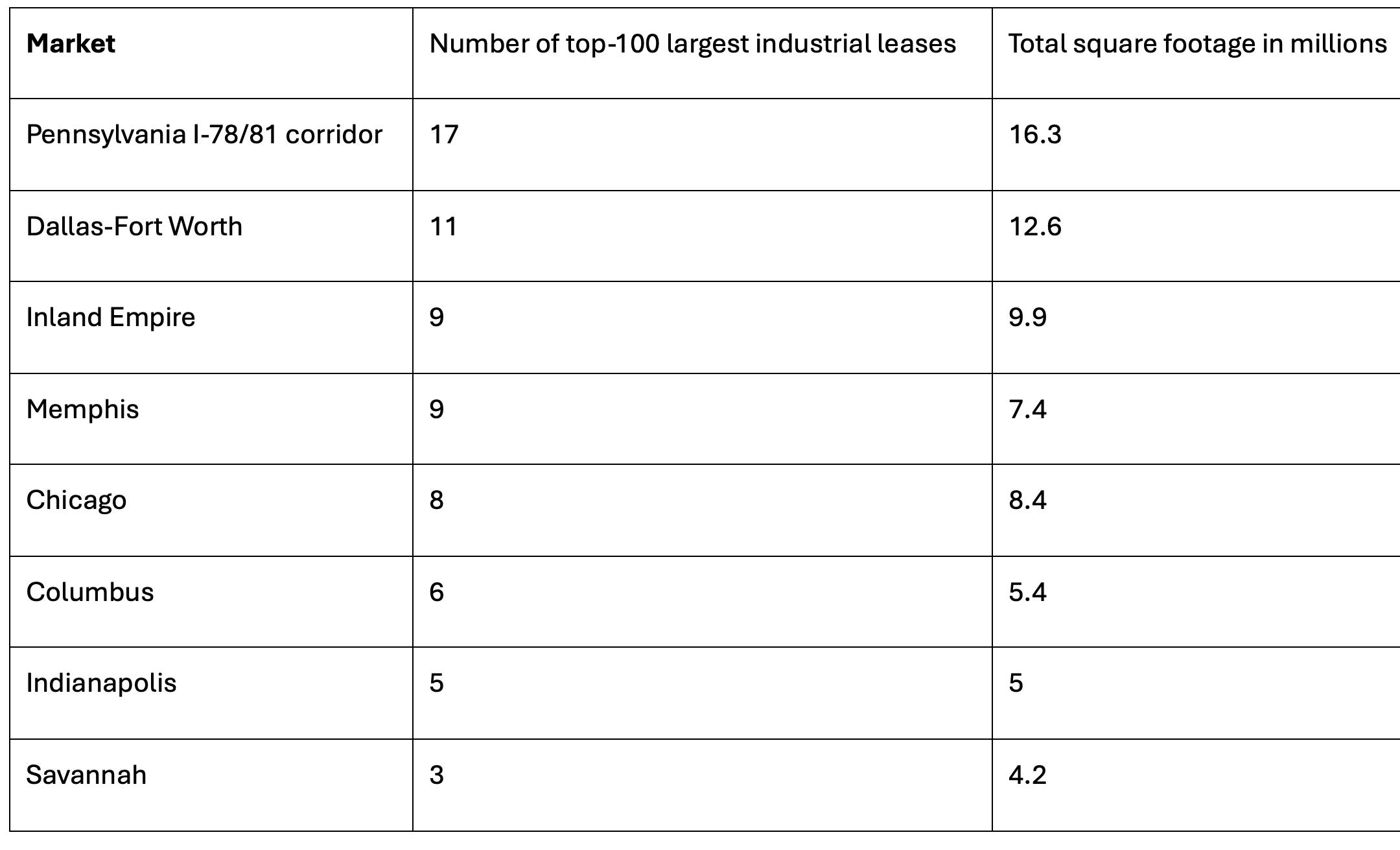

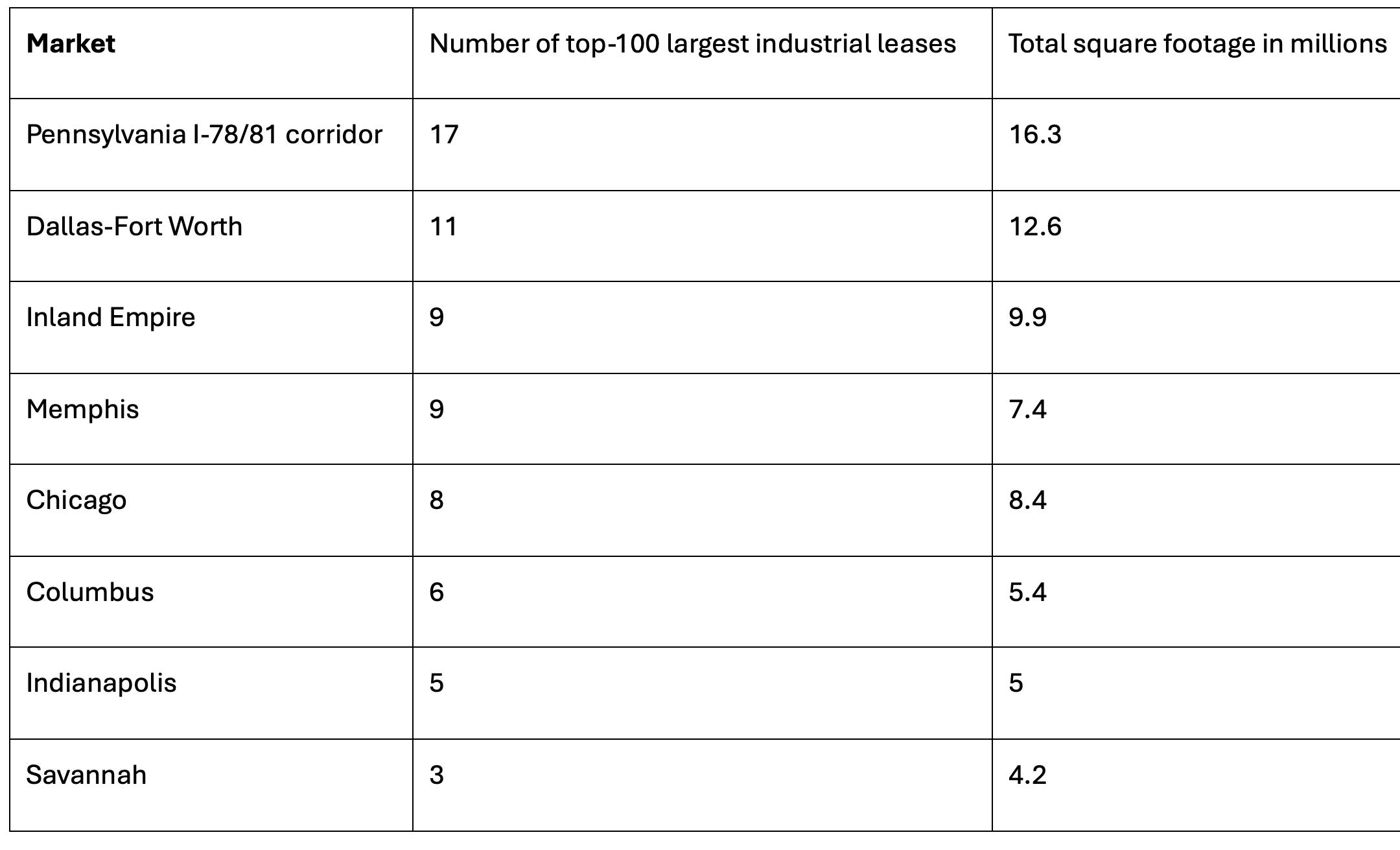

The top 100 industrial leases of 2023? Tenants didn’t go as big last year

By Dan Rafter, Editor

Going big? Industrial tenants didn’t do that as often last year.

Slowing demand for industrial and logistics warehousing space meant that tenants signed a smaller number of big industrial leases of 1 million square feet or more in 2023, according to a new CBRE report.

The number of 1-million-square-foot industrial lease signings dropped to 43 in 2023 from a record 63 in 2022. The culprits behind this drop? Blame economic uncertainty and changing inventory management practices, both of which CBRE says lowered the demand for big-box warehouse facilities.

Last year’s top 100 industrial leases by size totaled 98.6 million square feet, down 8% from 2022’s 106.9-millionsquare-foot total. The average lease size among the top 100 industrial leases last year fell to 986,744 square feet, down from 1.07 million square feet in 2022. Thirty of the top 100 biggest industrial leases last year were renewals, six more than in 2022.

Traditional retailers and wholesalers — previously leasing industrial space at a rapid clip — signed 30 of the largest 100 leases last year, down from 53 the year prior. Still, this category represented the largest number of top leases, according to CBRE’s research.

Meanwhile, third-party logistics companies responded to continued e-commerce growth by signing 29 of the top 100 leases in 2023, up from 11 in 2022.

The

“Throughout the pandemic and shortly thereafter, many occupiers were forced to shift from a ‘just-in-time’ to a ‘just-in-case’ inventory management approach,” said John Morris, president of Americas industrial and logistics for CBRE, in a statement. “This helped boost demand for warehouse space. While demand has now receded moderately, it remains historically strong. However, we do not expect as many mega industrial leases in the near and mid-term as we saw in 2022.”

MINNESOTA REAL ESTATE JOURNAL February 2024 17

A N N I V E R S A R Y 1974 2024 www.BoisclairCorporation.com

April 18, 2024 www.rejournals.com

eight U.S. markets with the highest share of top-100 industrial lease transactions in 2023

Office

from page 1

We spoke with Webb about what it takes to succeed in the office market today. Here is some of what he had to say.

A winning strategy

The investment strategy on which we are founded plays a big part in our success. When we started in the office space in 2017, we believed that we were going to see a shift in office-space-using tenants moving from urban areas to urbanized suburban areas, walkable suburban areas that have plenty of restaurants, shops and entertainment options that you can walk to.

Our portfolio is in Minneapolis and the Carolinas. We focus on well-located properties that serve that walkable multi-use suburban area. We find buildings in those locations that are currently underperforming that we can convert to best accommodate the needs of today’s tenants.

The evolving office space

It was true pre-COVID but is even truer now: The office is not a space in which you need to sit in a cube, answer emails and go home. The office space should help companies mentor, recruit and retain employees and it should foster collaboration.

It’s not just the four walls that you rent. When we renovate or build an office project, we are equally focused on the common-area spaces that we are providing, not just the leasable office spaces.

We focus on unique amenities that can be attractive to new tenants. We might not decide to go with a traditional fitness center. Maybe instead we’ll offer a Peloton studio tied into a bike-share program. We also try to bring as much outdoor space programming as we can. We want to build an entire structure that can allow people to meet and collaborate in different parts of the building, not just in their own individual office spaces.

The power of self-management

We also self-manage our properties. For us, the tenant experience is so important. It is the whole ballgame. Just as important as the building itself is how the tenants enjoy their time in the building. That starts with how we form a relationship with our tenants. We think of our tenants as our business partners. It’s hard to execute that strategy when you outsource it to others. We’ve found that self-managing gives us the best opportunity to deliver the best tenant experience.

The demand for urbanized suburban

The biggest positive that comes with working in an urban environment is the fact that office workers can walk to restaurants and shops. But that walkability comes with other challenges associated with working in an urban environment. You have to deal with parking. There’s the commute into the city.

But with urbanized suburban locations, you can recreate 17-hour cities in small suburban areas. The reason we thought that these locations were going to be a high-growth spot was mainly because of Millennials. They are no longer all single and living downtown. They have families. They are moving to the suburbs for schools and to get more living space as the size of their families increases.

We believe that suburban areas are going to be the benefactor of most population growth in the next 10 years. And we are always looking for projects that are in the way of that natural growth pattern.

There are some property types that work well with office buildings in these urbanized suburban locations. Retail is the obvious one. Experience-based retail or eatertainment uses are an especially good fit. Workers can walk to food and beverage options and enjoy some entertainment, too. The other asset we like to have adjacent to our office buildings is a hotel with limited or full-service food options. The hotel provides additional amenities such as food and conference rooms. Hotels, then, are a good complement to office space.

A good example of one of our projects in an urbanized suburban area is International Plaza in Bloomington. We purchased this project back in 2006, before Redline even existed. We bought it at 82% occupied and took it up to 96% before the 2008 downturn. We then gave the property a full

renovation and in 2012 brought the occupancy rates back up. Today we are at all-time high rents. There are food options in the building. There is food adjacent to the building. We have hotels on either side of the building. The whole area is walkable. And you are only one light-rail stop away from Mall of America. It has everything. It’s an urban feel in the suburbs.

Not just a flight to quality space .. a flight to a quality experience, too

We are seeing a flight to quality in the office market. But that’s not the full sentence. The word left out is “experience.” We are seeing a flight to a quality experience. It’s not necessarily that tenants are seeking the most expensive or newest office buildings. They are also looking for an office building that provides them with the best experience.

We are also seeing tenants looking for smaller office footprints. Most of our office tenants are looking at office spaces that are under 10,000 square

MINNESOTA REAL ESTATE JOURNAL February 2024 18

Redline Property Partners’ Barrel house is a three-building office project located along the Mississippi River in downtown Minneapolis. (Photo courtesy of Redline Property Partners.)

Office to page 19

Redline’s Edina 100 is a six-story office building near the intersection of Highway-100 and Interstate-494 in Edina, Minnesota. (Photo courtesy of Redline Property Partners.)

Industrial from page 1

ry levels. Just-in-time worked prior to the pandemic. But it no longer works in today’s environment.

In the first quarter of 2022, we were tracking tenants that were looking for about 17 million square feet of industrial space across the Twin Cities metro area. Pre-pandemic, that activity was closer to 5 million to 6 million square feet in our market. That high demand drove vacancy rates down and inspired many developers to build new industrial space on a spec basis. We saw about 4.5 million square feet of spec industrial projects delivered in the Twin Cities market in 2022 and about 7 million square feet in 2023.

Those projects were built to satisfy that record-setting demand. But then the interest rate movement we started to see at the end of 2022 and throughout 2023 impacted tenant demand. It made companies act more conservatively. We saw it with Amazon. Amazon significantly halted warehouse expansion across the country.

In the Twin Cities, the tenant demand dropped closer to 9 million to 12 million square feet. At the same time, we had record-setting new spec space delivered. That’s why we saw a slightly tempered 2023 compared to 2022 in our industrial market.

Is this good news for tenants? Can they find a good deal in the Twin Cities’ industrial market today?

Larew: If you were an occupier in the Twin Cities, you probably thought, ‘Hey. They delivered 7 million square feet in spec space last year. Vacancy rates were over 5% for the first time in two years. I should be able to find a good deal.’ Unfortunately for occupiers, that really isn’t happening.

If you look at that 7 million square feet, just over 30% of it was in four buildings that were 300,000 square feet in space each. That kind of space doesn’t work for most occupiers. So that leaves about 5 million square feet of spec industrial space that will work for most of our occupiers. That’s only slightly above the amount of spec space delivered in 2022.

Even with tenant demand for industrial space dropping, we are still tracking tenants in our market who are looking for about 10 million square feet of industrial space. That is still higher than pre-pandemic levels. That is a healthy level of demand. A vacancy rate of 5% to 6% is still a healthy market. Because of that, occupiers aren’t landing any great deals on industrial space here.

Do you expect to see more spec development in the second half of 2024 in the Twin Cities market?

Larew: New speculative developments don’t pencil now. Developers would love to build more, but they can’t make the math work. I don’t think we are going to see much new spec industrial development in our market this year. Maybe we will see one or two new spec developments in 2024.

I think we’d have to see two interest-rate cuts in the next six months for the numbers to get closer to making sense for spec industrial development. If I were to guess, the type of project that could go spec would be an infill conversion or redevelopment in the Interstate-694 loop. Those are the only projects that could achieve premium rental rates.

Do you think the demand for industrial space that we saw during the COVID years was an aberration that we aren’t likely to see again?

Larew: I’m not sure we will ever see a flurry of demand like what we saw in late 2021 and early 2022. We are talking about a hopefully once-in-a-generation event like COVID. That climbed on top of the demands that were already trending, such as the rise of ecommerce.

What about investment sales? Will we see more industrial sales transactions in the second half of 2024?

Larew: If you see one or two rate cuts, you will potentially see more groups putting packages and portfolios on the market for sale. There is not a lack of interest in acquiring industrial properties. Plenty of groups want to buy. The challenge is that sellers’ expectations on pricing have not adjusted to the new reality.

Sellers are evaluating whether they should make a sale today or wait 12, 16 or 18 months to see if they can get a better price. However, we are starting to see some clarity on what the rest of 2024 will look like. That might help increase the number of industrial sales in the second half of the year.

We already spoke about spec construction. But what about build-to-suit activity? Do you think we’ll see any increases in the number of build-to-suit properties that are built this year in the Twin Cities?

Larew: I do see a slight uptick in build-to-suit projects. You can make those projects work because you can go to the lender with a lease in hand. You know what your costs are, what your rents are and the credit profiles of the tenants. You have all the factors you need to put together a total-project cost summary.

You talked briefly about reshoring. Will reshoring efforts have any impact on the Twin Cities industrial market?

Larew: Reshoring will have a very limited impact in our Twin Cities market. Reshoring was a buzzword that was hot during COVID. It’s easy to say that we are going to move everything out of Asia and South America. The reality is, that is a lot more challenging that it sounds on paper. You have contracts. You have heavy investment in capital and equipment.

That doesn’t mean that reshoring isn’t happening in the United States in some markets. But it is more

industry driven. It’s happening with electric vehicle and battery production. But the reshoring isn’t going to be evenly distributed across the United States. You see that in Detroit and Michigan. There is a flurry of onshoring happening there in the electric vehicle industry. Companies are going to go where the employees and industry are drawing them.

Do you think 2024 will be a strong year for the Twin Cities industrial market?

Larew: There is a lot of pent-up capital that wants to buy industrial. Investors just need to make the numbers work. We probably need to see some seller corrections, but I do think we could see an uptick in sales activity at the end of 2024. Hopefully that picks up even more in 2025. We do need capital flowing through the system for the industry to keep moving.

From the tenant side, I expect a very solid year, one that is comparable to last year as far as the amount of absorption. We still have roughly 10 million square feet of active requirements. Those groups have to go somewhere. There is still a need for additional industrial space to accommodate that demand. As we move into the third or fourth quarter of 2024, the available options will grow smaller and vacancy rates will probably push back down to 3% or 4%. I think that will lead in 2025 to a larger percentage of new spec industrial development.

Office from page 18

feet. We only focus on buildings that cater to smaller-footprint clients. If you look at any of our buildings, the largest tenant might only be taking 20,000 to 25,000 square feet while the rest are taking under 10,000 square feet. The growth in the office sector is coming from companies looking for under 10,000 square feet of space.

A stable interest-rate environment is a positive for the office sector

When interest rates reduce, that is a good thing. The better thing, though, is having a definitive answer on what interest rates will do. If you look at where lending rates have been historically, we are still lower than where we were in 2008. We are much higher than where we have been in the last several years. Some people in our business haven’t seen this before. In the bigger picture, though, we are not in a bad spot with interest rates. The problem is that they were increased too quickly, and we had no definitive answer to when the Fed was going to stop raising its rate. The impact of knowing that interest rates have now settled is probably more valuable than what the actual interest rate is.

The path of growth

When we are looking at properties to acquire, we like to find locations in the path of growth. We typically buy distressed assets that are underperforming. We look for some dislocation between how the property is performing now and how the rest of the submarket is performing. Can we make a meaningful change to the property to capture tenants? If we can’t improve something, we’re not interested in buying it.

MINNESOTA REAL ESTATE JOURNAL February 2024 19

Dan Larew

(Photo courtesy of JLL)

Three tips for non-profit organizations’ real estate decisions in 2024 Hint: They aren’t that much different than for-profit organizations

By Dan Lofgren, senior vice president – Real Estate Advisory, Forte Real Estate Partners

As the new year gets underway, many organizations kick off a planning process to guide their year, with planning often including an evaluation of the current real estate footprint. While non-profit organizations have unique needs due to funding sources, cyclical revenue, and multiple stakeholders, much of the real estate advice is similar to the advice I give for-profit businesses.

Most importantly, I counsel any organization to have strong, credible, creative real estate experts on their side – from advisor to project managers. Those experts will save organizations both time and money in the short- and long-term and ensure that the organization has a roadmap for future growth. Non-profit organizations need to put their real estate strategy on their to-do list this year to make sure it serves them now and into the future.

Tip #1: Consider acquiring your real estate asset rather than leasing

If you’re nearing the end of your lease, consider whether owning your commercial real estate is an option. Non-profits receive significant federal and state tax incentives for owning versus leasing space. While not all non-profits have the funding sources that can support that investment, there may also be new sources of capital that are structured specifically for real estate ownership, like from the State of Minnesota or other foundations.

This was the case with Every Meal, a non-profit organization solely focused on reducing childhood hunger by providing non-school day food distribution. Their volunteers come to their location in Roseville, Minnesota, to pack, organize and distribute food to children through their schools, and handle intake of new recipients.

Executive Director and Founder Rob Williams planned for the potential acquisition of the building that they previously leased for many years, coordinated funding and enlisted partners who could help make the acquisition a reality.

The acquisition, which closed on Dec. 21 last year, was part of Every Meal’s strategic plan since the State of Minnesota exempts non-profits from property tax when they own the property.

“Our goal was to acquire the space so that we have long-term certainty for our employees and volunteers, can control the operating expenses, and have a long-term location that supports future growth,” said Williams.

Often, landlords don’t entertain offers from tenants to buy buildings. But in this case, the asset fell out of previous owner Link Logistics’ portfolio parameters because of its size, the mezzanine space, and its age. It just so happened that those attributes of the property suit Every Meal perfectly. And Link made a generous donation towards the purchase of the building because Every Meal’s mission fits the landlord’s initiative focused on driving lasting,

positive change in our community by combating childhood hunger.

Tip #2: Hire a real estate expert to uncover hidden costs in your contract language

There’s a perception it is less expensive to handle your own real estate lease negotiations, but often the costs increase due to unanticipated lease language. From early exits to expansions of the existing footprint, non-profits (and in fact, all companies that lease without professional CRE help) can get stung by lease terms that benefit the landlord more than the tenant.

Lease language dictates the tenant charges for operating expenses, infrastructure improvements, and tenant services. With strong representation, non-profit organizations can ensure they have flexible lease terms, allowing reduced penalties for an early exit or requested expansion. They can also ne-

gotiate favorable terms between the tenant and the landlord for sharing space improvements expenses, like moving walls, adjustments to HVAC power and coverage, and adding new training or lunchroom areas for employees.

Tip #3: Work with an advisor who understands your mission

The power of non-profits comes from having a compelling mission. Volunteers, donors, other foundations, and recipients of service latch onto a mission that resonates with them – from environmental, societal, or governance work. With a clear mission, the CRE advisor can advise the non-profit on its site selection or space evaluation, predicated on more than just price per square foot.

The mission may drive the physical location of the office when a funding source requires the organization to reside within the geographic boundaries of those it serves. The mission may drive the type of property that is considered, especially if a non-profit needs to accommodate in-person volunteers, distribution of products or services, and its employees.

Most often, an advisor can find space that fits the brand of the non-profit by considering options that meet the economic goals and is in a safe area to accommodate a high-volume of volunteer traffic.

The best CRE experts understand the pros and cons of each submarket (and even the niche submarkets within them) and can ensure that they offer space that is owned by landlords with a good reputation for taking care of tenants.

Dan Lofgren, senior vice president – Real Estate Advisory with Bloomington, Minnesota-based Forte Real Estate Partners, has worked in commercial real estate for more than 20 years, focusing primarily in industrial properties. He’s a member of SIOR, MNCAR as a leader on the Industrial Advisory Board, the St Cloud State Real Estate Alumni Association, and TCN Worldwide.

MINNESOTA REAL ESTATE JOURNAL February 2024 20

Photo by Patrick Perkins on Unsplash.

Dan Lofgren

(Photo by Lucas Botz Photography.)

The sky isn’t Falling: Here’s why we remain bullish on CRE

By Eli Randel, Chief Operating Officer, Crexi

In the face of economic uncertainties, timing the market for the acquisition (or disposition) of commercial real estate can be challenging. And while it’s been posed that market timers usually fail, acquisition price is crucial to investment success. An abundance of pessimistic voices insinuates adverse market outcomes painting a grim picture of doom and gloom as we head into 2024. Social media and echo chambers can make these voices seem outsized, but many qualitative views and quantitative metrics indicate that those voices don’t tell the entire story.

Plenty of indicators suggest that if you have access to capital, commercial real estate may currently present a good buy opportunity. These, as well as real estate’s inherent and historic stability amidst fluctuating signals, suggest that those who stay levelheaded and key into signals within the noise may tap into significant potential returns.

There’s real distress, but trends are cyclical

Cycles occur and exist as an inevitable component of any investment sector. After 9/11, for example, some thought people would never work in high-rise office buildings again. Yet - until COVID-19 changed many of our norms – offices were a strong product type. The Dot-com bubble, the savings and loan crisis, the Global Financial Crisis… the commercial real estate sector swelled and compressed through each of these yet stands at nearly $4 trillion of total market value in 2022.

The psychology of markets propels these shifts: People swing from bullish to bearish and sometimes believe the pendulum will freeze until it inevitably moves again. The herd often thinks the good times and the bad times will never end while we are in them. Those who ignore the noise and zig while others are zagging can make fortunes.

Much of today’s distress is driven by interest rate increases, but these rates are still historically lowjust ask an investor from the 1980s, when rates were in the high teens. One can argue that several years of near-zero rates have bred complacency and that these rate hikes are calling on CRE stakeholders to level up to survive. It’s not easy money anymore, but that doesn’t diminish the sector’s potential.

This leveling up ultimately will make the overall sector much stronger, built on more well-crafted debt structures, invested in better value deals and a sharper-honed sense of the market’s cyclical reality.

There are asset class-specific and macroeconomic concerns that are worth mentioning. Global news has many on high alert as we watch developments in geopolitical conflicts and their economic impacts ripple through the U.S. economy. Inflation’s growth is slowing as of last month, yet our GDP continues to rise.

Offices are potentially nearing a trough but there will likely be plentiful opportunities to acquire great assets at a discount for those who can source capital. If demand for space returns as companies call the herd back to the office (in some form), a lack of new office development may result in a shortage and a return to health or even prosperity. Retail and industrial are relatively insulated despite potential

shifts in consumer spending habits. Multifamily housing becomes ever more crucial as families get priced out of single-family homes.

Real estate’s inherent diversification proves immensely attractive in a world of fast-shifting share prices, exchanges escalating up and down and meme stocks. Investing in commercial properties broadens your portfolio beyond the traditional forms of investments, like stocks and bonds, into the world of industrial, retail, and housing.

CRE is built on relationships

As any good broker or investor knows, the commercial real estate industry is built on relationships. During less free-flowing market phases, especially as we come off a long bull run, these relationships become ever more crucial.

Within this sector, CRE participants are making moves amid distress to creatively problem-solve refinancing issues, deal flow and even landlord-tenant relationships. Banks and lenders, with an understanding that buildings are best retained and managed by more entrepreneurial borrowers,

are motivated to meet owners at the bargaining table and come up with creative term adjustments and modifications. Especially as banks continue tightening their lending requirements overall, it’s essential to build up these good relationships now and reaffirm a commitment to mutual success.

While buyers are taking longer to source, evaluate and close deals, they’re much better prepared to take advantage of good opportunities when they appear if they’ve cultivated fruitful relationships with brokers, financiers, and other key transaction personnel. Many, indeed, are assembling such networks and keeping a close eye on market trends to strike when the iron’s most hot.

Landlords, too, are engaging in ongoing conversations with prospective and current tenants, especially those with upcoming lease renewals. By keeping these dialogue channels open, tenants get more attractive lease terms, while landlords can rest assured of their rent payments. Happy tenants are much likelier to stick around for the long haul – a reassuring guarantee of stable cash flow amid more volatile markets.

Strong careers are forged in tough times

What’s different this time around? New tech tools and broader access to democratized information are unlocking efficiency and potential more than ever, making now an exciting, if challenging, time to enter and stay in commercial real estate.

Advanced digital marketing tools not only widen the reach of a listing to prospective buyers or tenants but provide detailed insights into who that audience pool is or even could be. More and more brokers are adopting digital listing platforms, social media, and advanced CMS software to establish and nurture client relationships. Outside of a particular deal, these relationship tracking tools facilitate relationship builders - which, as mentioned above, are crucial to the industry’s success.

The integration of big data and analytics is also transforming the way commercial real estate operators make decisions. The aggregation of data such as market trends, demographic shifts, sales

MINNESOTA REAL ESTATE JOURNAL February 2024 21

Eli Randel

(Photo courtesy of Crexi)

CRE to page 24

Photo courtesy of StockSnap from Pixabay.

Expansion mode on: These are the fastest-growing retailers in the United States

By Lanie Beck | Senior Director, Content & Marketing Research at Northmarq

The retail landscape is witnessing a diverse range of strategies among brands with a brick-and-mortar presence. While some companies are aggressively opening new locations and exploring innovative concepts and formats, others are taking a more cautious approach by evaluating their real estate footprints or even making the difficult decision to close store locations.

Price-conscious retailers among fastest-growing

Discount retailers continue to thrive in today’s uncertain economic environment, as consumers tighten purse strings.

Dollar General remains committed to its growth strategy with 800 new stores on the horizon for 2024. Five Below continues to expand, too, with up to 600 new locations planned for its next fiscal year.

Established big-box brands like Target and Walmart are taking divergent paths when it comes to the future of their stores, however. Target, with just 30 new locations planned, is exploring a large format concept of more than 150,000 square feet beginning in 2024, while Walmart is focused on remodeling existing stores with the goal of enticing customers to stay and shop longer.

In the apparel sector, Ross Dress For Less and Burlington have long-term plans to open 500 or more stores each. Additionally, both are now close to obtaining a nationwide presence, as Ross just recently entered the Minnesota and New York markets.

A variety of retail brands supporting the automotive industry are also looking to expand. Aftermarket parts retailers AutoZone and O’Reilly have each announced robust growth plans in 2024 and beyond, with a combined 700 or more new locations planned.

Take 5 Oil Change, which now has a presence across 41 states, has 300 new units in the development pipeline. Gas station and convenience store brands Sheetz and Wawa have 300 and 800 stores, respectively, planned in the long-term, while 7-Eleven looks to operate a total of 20,000 locations in the U.S., resulting in future growth of several thousand stores.

ALDI leads the pack in grocery store expansion, with 45 new locations planned for 2024, while European rival Lidl continues to open stores along the east coast, although not at the originally expected pace announced several years ago.

Fast-food expansion goes global

Domestic growth among quick service restaurants continues at a fast pace, as U.S. consumers value their convenience and lower price points compared to casual-dining restaurants. But a number of fastfood chains have announced a substantial focus on international expansion in 2024. Some of the fastest growing brands both home and abroad include:

• McDonald’s – planning 10,000 new locations globally by 2027, with 900 of them in the U.S.

• Starbucks – 2024’s exact plans are unknown, but the fourth quarter of 2023 saw 208 U.S. locations open and more than 800 stores open worldwide

• Chipotle – up to 315 restaurants are planned for 2024

• Bojangles – more than 250 new restaurants are in the pipeline

• Krystal – will open 200 locations in the next three to four years

• Raising Cane’s – plans to open 100 restaurants in 2024

Mergers, acquisitions, and bankruptcies to watch in 2024

In the past few months, several brands have made major announcements that may impact their brick-and-mortar presence in the coming years.

In the drugstore sector, Rite Aid filed for bankruptcy in October and has already closed 200 stores since the filing. Also in the retail pharmacy sector, experts are watching Walgreens – not for bankruptcy or M&A activity necessarily, but in December, Moody’s downgraded the drugstore chain’s credit rating to Ba2, which could impact the pricing of net lease investments and influence the appetites of real estate investors.

ALDI is moving forward with its planned acquisition of Winn-Dixie’s parent company, which was announced in August. Plans call for some Winn-Dixie stores to be converted to the ALDI brand, and although no mention of store closures has been made yet, the company does intend to close all instore pharmacies and transfer customers to CVS or Walgreens.

In May, Tempur Sealy announced plans to acquire Mattress Firm in a $4 billion deal that’s set to close in the second half of 2024. It’s unclear what impact, if any, the transaction will have on Mattress Firm’s retail footprint of more than 2,300 stores across the U.S., but it’s been several years since any meaningful growth has happened for the brand.

Read Northmarq’s Q4 2023 Top 100: Tenant Expansion Trends report for more information about these retailers and other top brands.

Lanie Beck is senior director of content and marketing research at Northmarq.

MINNESOTA REAL ESTATE JOURNAL February 2024 22

Lanie Beck

(Photo courtesy of Northmarq)

Image by Alexa from Pixabay

Top 10 features and amenities renters in the Midwest prioritize

Value-added features and amenities can make all the difference when attracting and retaining top-notch renters

By Sarah Yaussi

Renters everywhere are looking for more balance in their lives and in their homes. And renters in the Midwest are no exception, according to findings from the 2023 NMHC and Grace Hill Renter Preferences Survey Report, a national report that includes responses from renters in 11 major Midwest markets.

The report highlights renters’ double-edged desire for both the latest bells and whistles and practical everyday features and amenities. The data paint a picture of Midwest renters focused on space, convenience and lifestyle when choosing a rental home.

Understanding these preferences can make all the difference between a rental property that’s simply attractive and one that’s irresistible. Multifamily developers, owners and operators must keep a finger on the pulse of renters’ wishes and wants. Knowing what they like, love and can’t live without can provide a competitive edge, keeping your units occupied and communities thriving.

Top 10 Features Ranked

Air Conditioning (95 percent)

In-Unit Washer/ Dryer (94 percent)

High-speed Internet Access (90 percent)

Dishwasher (89 percent)

Soundproof Walls (89 percent)

Walk-In Closet (87 percent)

Garbage Disposal (85 percent)

Pre-installed Window Shades/Blinds (83 percent)

Noise-reducing Windowpanes (81 percent)

Refrigerator with Water/Ice Dispenser (79 percent)

There was a time when air conditioning and a washer/dryer in unit were nice-to-haves, especially in cooler Midwestern markets. Now, however, renters in the Midwest expect these features and place them at the very top of their list of life’s necessities. Renters expect to be comfortable year-round, and they expect to be able to do their laundry without a trip to the laundromat or scaling flights of stairs.

Similarly, renters in the Midwest now also want all the conveniences in the kitchen. Updated and upgraded kitchen appliances were considered essential by many of the survey respondents, with a dishwasher, garbage disposal and refrigerator equipped with water/ice dispenser ranking high in this year’s features list. These ensure both everyday convenience and value-added convenience for entertaining and hosting.

High-speed internet is also a staple, made even more essential by things like a growing preference

for streaming services, the adoption of smart home features and a shift to more remote work. Some of the other highly desired features and amenities in the Midwest seem tailor-made for work-from-home lifestyles. Beyond high-speed internet access, Midwest renter respondents were very interested in soundproof walls and noise-reducing windowpanes—all of which ensure more privacy, more noise control and more reliable home office setups so that those Zoom meetings can go off without a hitch.

Rounding out the list were walk-in closets and pre-installed window shades and blinds, both reflecting a desire for more efficient space and easier move-ins for greater satisfaction with the home from day one.

Top 10 Amenities Ranked

Reliable Cell Reception (87 percent)