SPECIAL REPORT FROM ELECTRIC TO AUTONOMOUS, THE FUTURE OF CARS SHOWCASED LUXURY CONCIERGE REAL ESTATE'S SHITIJ KAPOOR TELLS US WHAT IT TAKES TO THRIVE IN THE UAE'S COMPETITIVE REAL ESTATE MARKET P.38 RIDING THE DIGITAL WAVE: Neobanks are disrupting the region's banking sector P.67 THE RISE OF THE ECOPRENEUR: How startups can play a profitable role in the rising green tide BD 2.10 KD 1.70 RO 2.10 SR 20 DHS 20 gulfbusiness.com / OCTOBER 2023

THE RIGHT MOVES

30

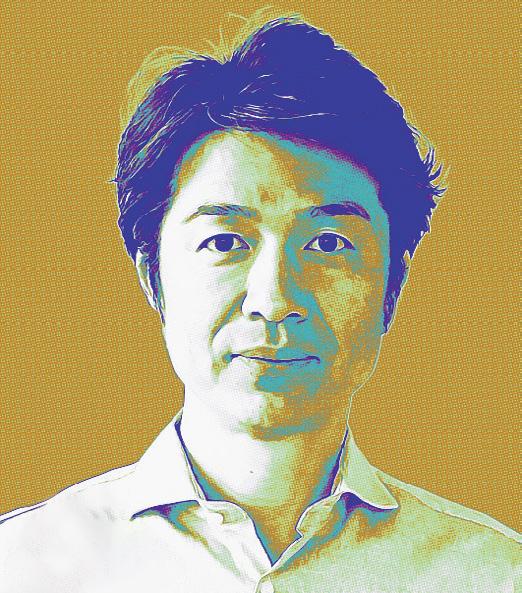

DRIVEN BY CORE VALUES

Shitij Kapoor, founder and CEO of Luxury Concierge Real Estate, shares how the company’s success is founded on key partnerships and factors that make the brokerage a preferred choice with investors

43

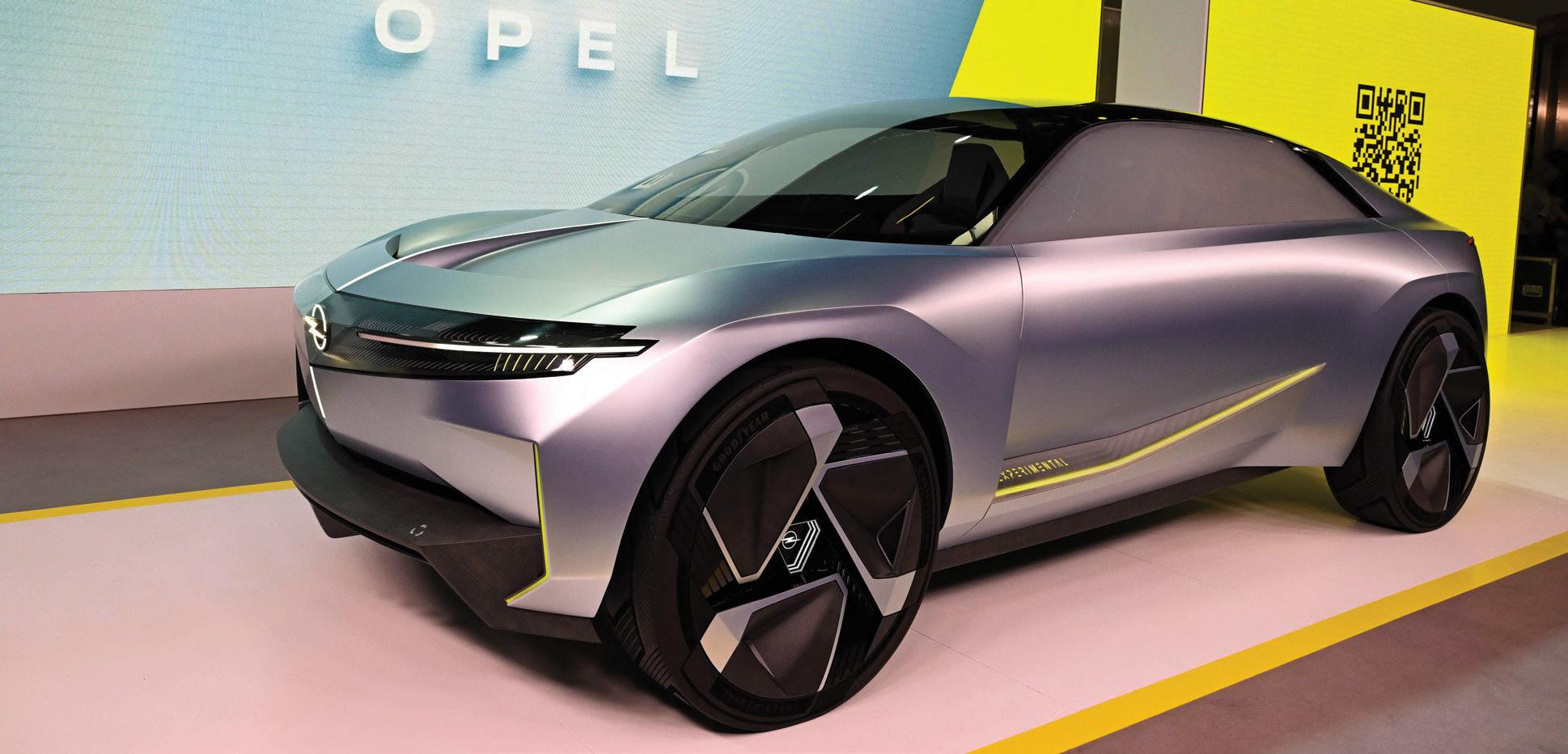

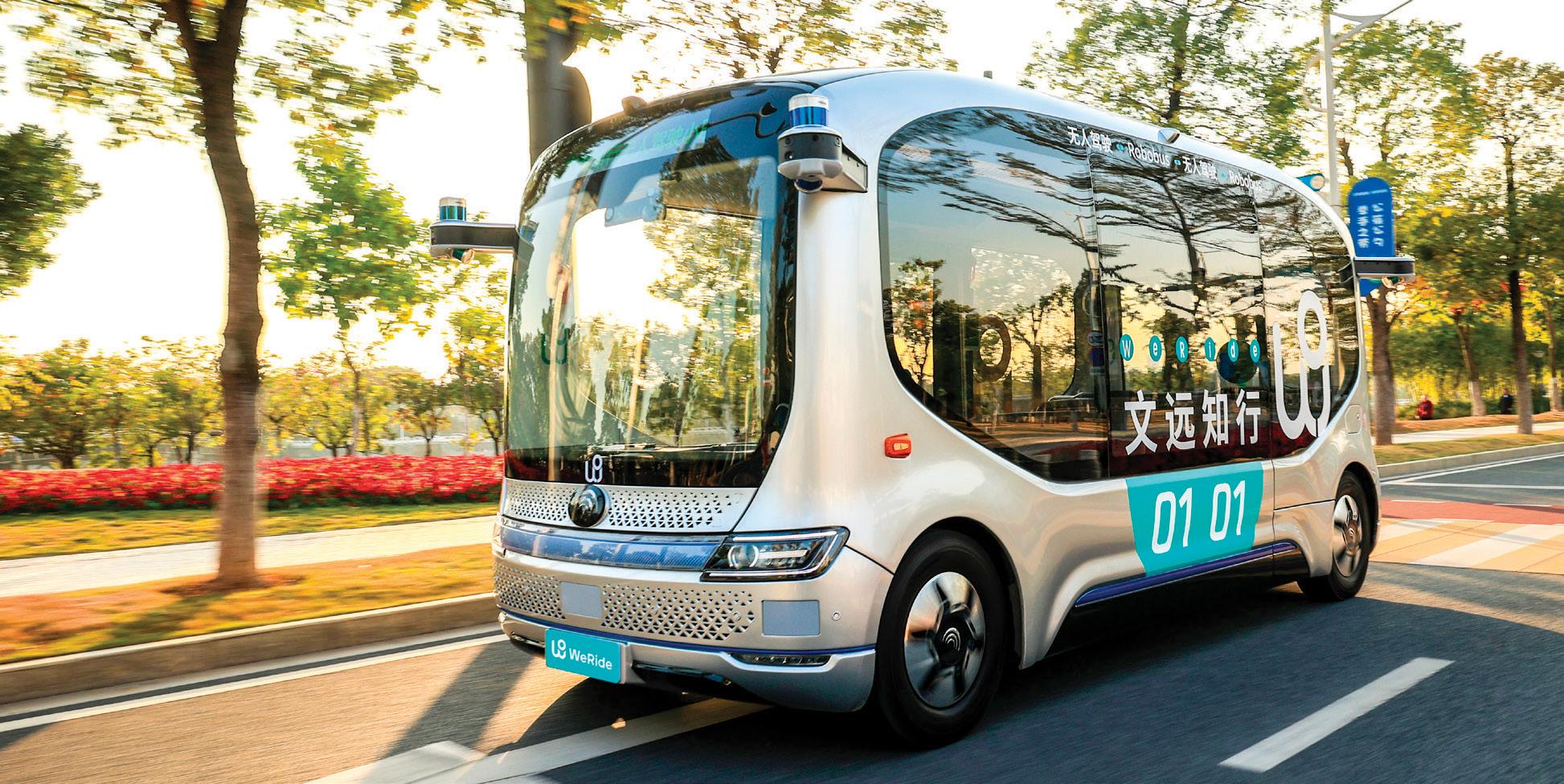

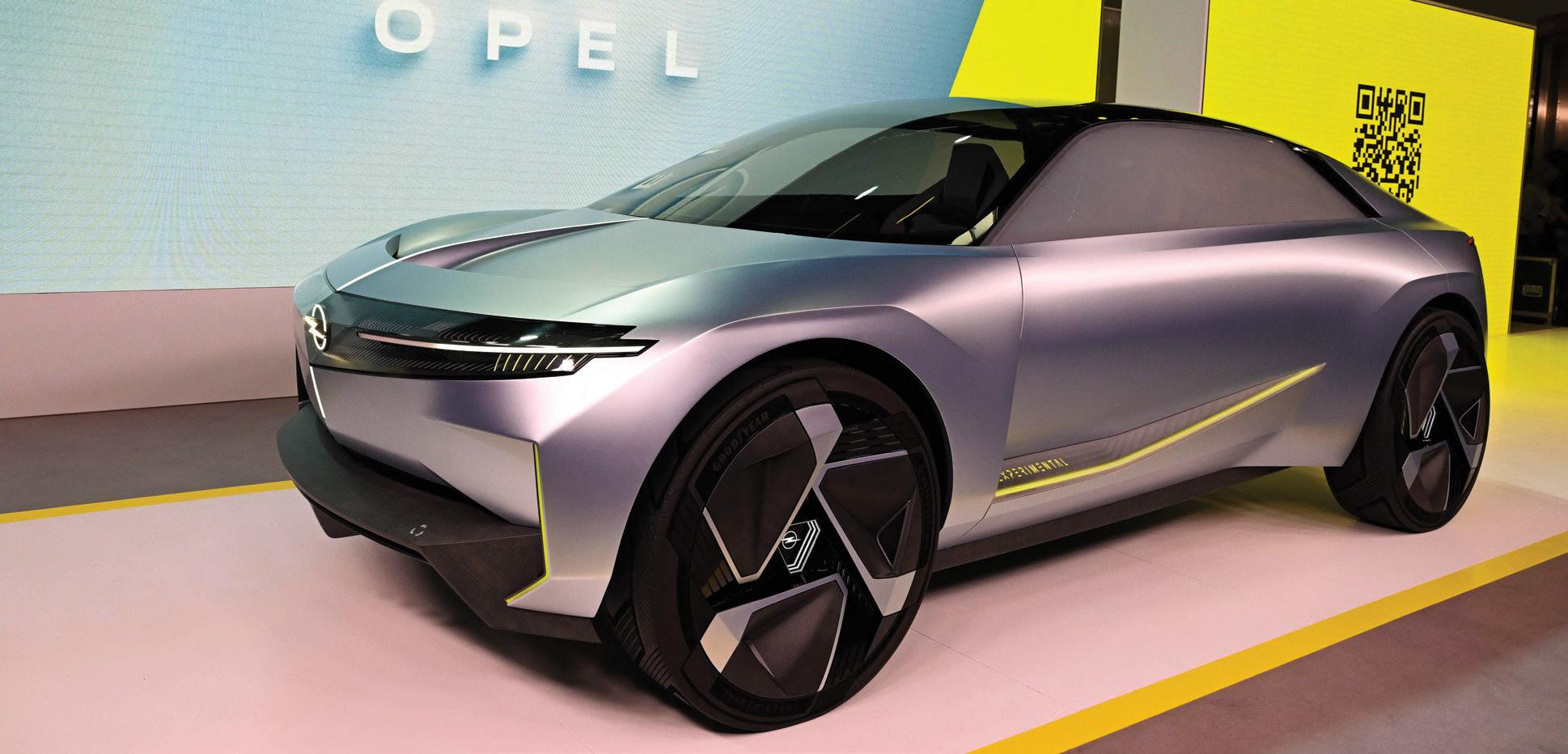

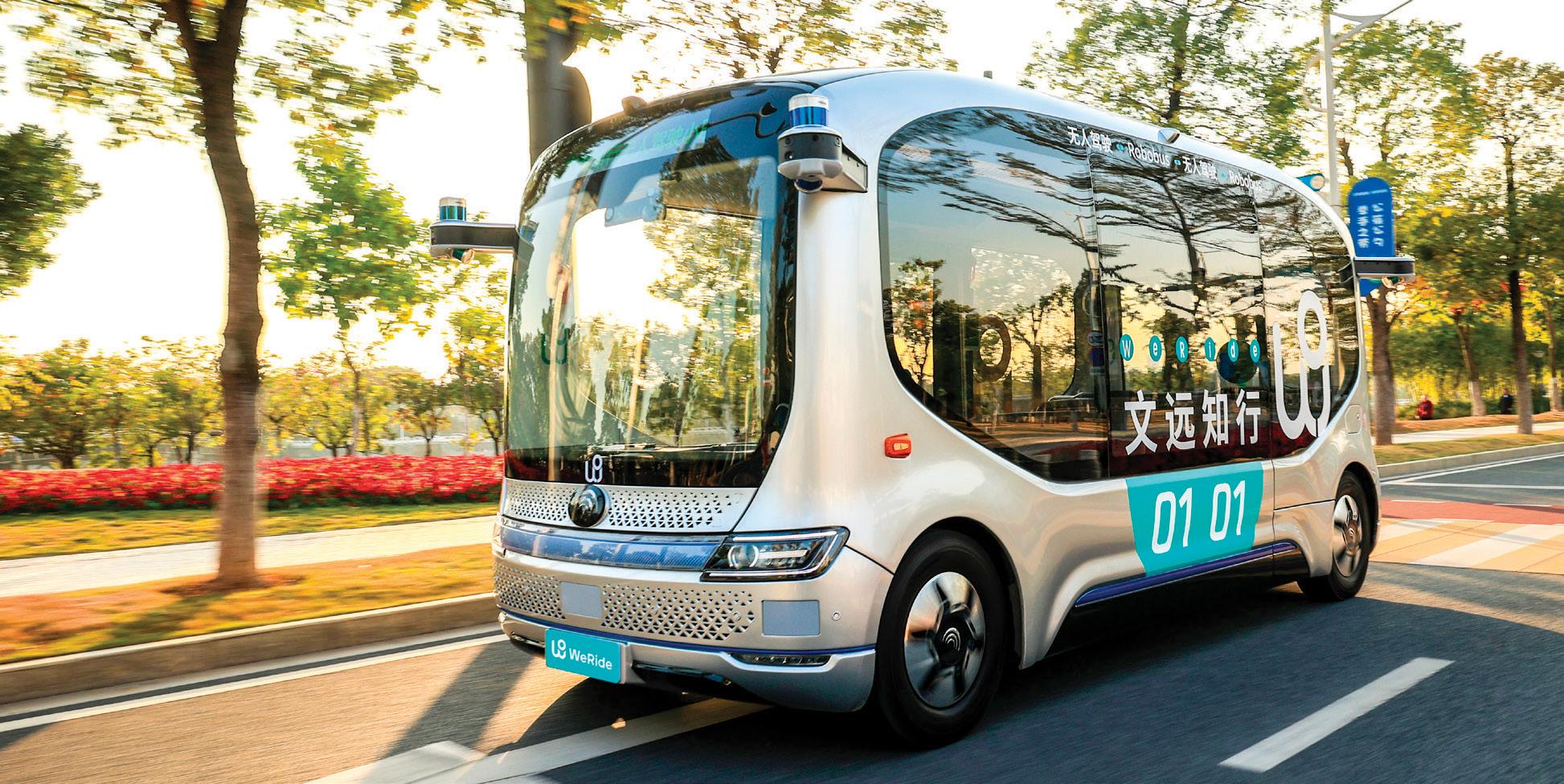

What does the future of automobiles look like?

From electric and self-driving cars to innovative new designs and materials — we look at the trends disrupting the auto industry

gulfbusiness.com 4 October 2023

CONTENTS / OCTOBER 2023

Gulf Business

07 The brief An

the

and

with

and

Pic: Supplied Illustration: Getty images/kmlmtz66 Pic: Supplied

insight into

news

trends shaping the region

perceptive commentary

analysis

Calling all podcasters and content creators!

Whether you are looking to record, edit or manage your podcast, our fully equipped podcast and video recording studio has it all.

+971 4 427 3000 | podcast@motivate.ae

YOUR STUDIO motivatemedia.com

BOOK

CONTENTS / OCTOBER 2023

59 Lifestyle

Sleep easy: The Mattress Store, a sleep and comfort retailer, wants you to enjoy your deep slumber p.61

The magic of masks: Homegrown skincare brand GLIST’s luxurious sheet masks are perfect to pamper your skin p.62

“Honestly, I see myself as an astronaut ready to go on any mission. Personally, I would love to go to the Moon and to Mars, if possible. I don’t think it is going to happen soon to Mars. The lunar mission is closer, accessible”

Sultan Al Neyadi, UAE astronaut

67 The SME Story

Interviews with entrepreneurs and insights from experts on how the regional SME ecosystem is evolving

Editor-in-chief Obaid Humaid Al Tayer

Managing partner and group editor Ian Fairservice

Chief commercial officer Anthony Milne anthony@motivate.ae

Publisher Manish Chopra manish.chopra@motivate.ae

Editor Neesha Salian neesha.salian@motivate.ae

Digital editor Marisha Singh marisha.singh@motivate.ae

Tech editor Divsha Bhat divsha.bhat@motivate.ae

Senior feature writer Kudakwashe Muzoriwa

Kudakwashe.Muzoriwa@motivate.ae

Senior art director Freddie N. Colinares freddie@motivate.ae

Senior art director Olga Petroff olga.petroff@motivate.ae

General manager – production S Sunil Kumar

Production manager Binu Purandaran

Production supervisor Venita Pinto

Senior sales manager Sangeetha J S Sangeetha.js@motivate.ae

Group marketing manager Joelle AlBeaino joelle.albeaino@motivate.ae

Cover: Freddie N Colinares

gulfbusiness.com 6 October 2023

HEAD OFFICE: Media One Tower, Dubai Media City, PO Box 2331, Dubai, UAE, Tel: +971 4 427 3000, Fax: +971 4 428 2260, motivate@motivate.ae DUBAI MEDIA CITY: SD 2-94, 2nd Floor, Building 2, Dubai, UAE, Tel: +971 4 390 3550, Fax: +971 4 390 4845 ABU DHABI: PO Box 43072, UAE, Tel: +971 2 677 2005, Fax: +971 2 677 0124, motivate-adh@motivate.ae SAUDI ARABIA: Regus Offices No. 455 - 456, 4th Floor, Hamad Tower, King Fahad Road, Al Olaya, Riyadh, KSA, Tel: +966 11 834 3595 / +966 11 834 3596, motivate@motivate.ae LONDON: Acre House, 11/15 William Road, London NW1 3ER, UK, motivateuk@motivate.ae

us on social media: Linkedin: Gulf Business Facebook: GulfBusiness Twitter: @GulfBusiness Instagram: @GulfBusiness

Follow

Pics: Supplied

gulfbusiness.com October 2023 7 Islamic Finance 08 Construction 10 Sustainability 16 Governance 18 Alan’s Corner 24 OCT 23 The Brief SAUDI HNWI* VIEWS ON DUBAI’S RESIDENTIAL MARKET 5/10 6/10 SOURCE: SOURCE: KNIGHT FRANK, YOUGOV *High-Net-Worth Individual (HNWI) Is the insurance sector ready for change? Insurance solutions are leveraging disruptive tech and becoming more personalised to stay relevant to customers p.12 ILLUSTRATION: GETTY IMAGES/ ZHUWEIYI49 Keen to purchase a branded residence in Dubai 8/10 1/10 Keen to purchase a residential property in Dubai Parks are the most important consideration when purchasing a property Would be less likely to buy a property in Dubai should a casino open

On a rising trajectory

$49bn in sukuk issued during Q2 alone in the core Islamic markets of the Gulf Cooperation Council, Malaysia, Indonesia, Türkiye and Pakistan. Fitch rates around 70 per cent of the global outstanding sukuk in hard currencies.

Macro developments, such as rising interest rates, volatile oil prices and additional layers of shariacompliance complexities, didn’t deter its growth. Quarterly sukuk issuance was up by 10 per cent on the previous quarter, bucking the trend the rest of the bond market experienced in the same markets, which fell by almost 5 per cent.

Sovereigns and supranationals were the largest issuers of sukuk in the quarter, followed by corporates and financial institutions. Local currency issues held 75.2 per cent of the total outstanding sukuk. Sukuk remains a sizable part of emerging market debt issuance (excluding China), with its share reaching 6 per cent in H1 23.

Sukuk defaults remained minimal at only 0.21 per cent of all issued sukuk, with a number of distressed issuers and investors preferring out-of-court consensual restructurings. Hence, there is a lack of restructuring and legal precedents relating to effective enforcement, despite the growth of the global sukuk market over the past decade.

Most Fitch-rated sukuk continued to be investment-grade, at 79 per cent of outstanding volumes, with 12.6 per cent of issuers displaying a positive outlook, and 77.5 per cent having a stable outlook at the end of Q2.

ESG SUKUK IN THE YEAR OF COP28

The global Islamic finance industry is on a growth trajectory, with its assets estimated to have crossed $3.3tn as of H1 2023 despite multiple headwinds. The first half of the year saw a strong uptake in the global sukuk markets, with a diverse range of issuers, currencies and geographies, in addition to larger volumes. Yet global sukuk supply still remains limited compared with demand from investors.

MARKET PROFILE

Outstanding sukuk volumes crossed $800bn for the first time in Q2 this year. This was driven by over

The volume of outstanding environmental, social, and governance (ESG) sukuk reached $30.5bn at the end of Q2, a significant 22 per cent rise quarteron-quarter. This included over $3.5bn issued in the quarter in the core markets of the GCC, Malaysia and Türkiye, up 124 per cent from the previous quarter.

ESG sukuk issuers are mainly from Saudi Arabia, UAE, Indonesia and Malaysia. However, ESG debt development, as well as debt capital markets in general, lagged in most other core Islamic markets.

MULTIPLE MILESTONES IN 2023

A wave of diverse instruments swept international markets in H1 2023, such as the largest-ever sukuk from a US-based corporate issued by Air Lease Corporation (rated BBB by Fitch Ratings).

gulfbusiness.com 8 October 2023

The Brief / Islamic Finance

The medium-to-long-term outlook for the global sukuk market is positive, supported by issuers’ funding diversification push and refinancing needs

COMMENT

ILLUSTRATION: GETTY IMAGES/ ARTPARTNER-IMAGES

In the UAE, we witnessed the government’s first Emirati dirham-denominated treasury sukuk and the first UAE-dirham sukuk issued by a UAE bank (A+).

Egypt also debuted a $1.5bn sovereign sukuk and the first ever project-finance sukuk was issued by GreenSaif Pipelines (A+).

The world’s largest Islamic bank, Al Rajhi Bank, also marked an entry of their inaugural US dollar sustainable sukuk (A-). Another entry was the first Kazakhstani tenge sukuk (A+) issued by the Islamic Corporation for the Development of the Private Sector.

Mexican officials are also currently in exploratory talks to issue sukuk.

PRICING AND INVESTOR CREDIT RISK PERCEPTION

The pricing of most sukuk and comparable bonds continued to be similar and highly correlated in H1 2023, with this trend likely to persist. However, analysis shows periods of global volatility or sukuk-specific developments, where the correlation between sukuk and bond yields fell and average spreads expanded, albeit temporarily.

REGUL ATORY INITIATIVES

Regulatory initiatives could help create a more enabling ecosystem for Islamic finance. For example,

SUKUK* VOLUMES BY SECTOR IN Q2 2023

Fitch rates more than 80 per cent of the ESG sukuk market in hard currencies

Saudi Arabia’s Capital Market Authority announced a cancellation of its share in sukuk and bonds trading commission as of May 2023, to help reduce costs for market participants and increase liquidity.

In UAE, the Securities and Commodities Authority issued regulations exempting companies wishing to list their green or sustainability-related sukuk or bonds in a local market from registration fees for 2023. The Higher Sharia Authority of the Central Bank of the UAE still requires sukuk issuers, investors and arrangers in the UAE to comply with AAOIFI sharia standards.

FUTURE OUTLOOK

However, in the short-term sukuk as a whole is expected to slow in Q3, coinciding with summer vacations in many countries, before picking up pace again in Q4. The medium-to-long term outlook for global sukuk market is positive, supported by issuers’ funding diversification push and refinancing needs, as well as a continued Islamic investor demand.

ESG sukuk remains a promising subsegment and we expect it to remain a key issuance theme during H2 and beyond amid the government initiatives promoting sustainability and economic diversification.

ESG sukuk currently accounts for 3.8 per cent of global outstanding sukuk, and we expect this share to almost double to 7.5 per cent by 2028.

gulfbusiness.com October 2023 9

ESG sukuk outstanding out of total ESG bonds and sukuk – Q2 2023 COUNTRY % BAHRAIN 100 SAUDI ARABIA 54 MALAYSIA 52 UAE 43 INDONESIA 23 TÜRKIYE 4 GCC COUNTRIES 51

Hard-currency

S OVEREIGN/ SUPRANATIONAL CORPORATES AND OTHERS FINANCIAL INSTITUTIONS STRUCTURED FINANCE INFRASTRUCTURE AND PROJECT FINANCE 59% 4% 2% INTERNATIONAL PUBLIC FINANCE 2% 16% 17% *Fitch rated sukuk

Bashar Al-Natoor, global head of Islamic Finance at Fitch Ratings

Setting the foundation for sustainability

Construction demand and activity in the Middle East is booming as governments across the region drive investment in business and tourism, while diversifying markets’ economies away from fossil fuels. Developments are growing not only in number but in size and complexity, with increasing investment in major programmes and ‘giga-projects’ such as Saudi Arabia’s NEOM.

While this growth paints an exciting picture for the future prosperity of the region’s societies, it poses significant challenges for the progress of sustainability and decarbonisation. Delivery of some of the world’s largest, most ambitious projects will be carbon intensive and place pressure on resources, particularly on water, energy supplies and material availability. However, the investment also poses an opportunity for the Middle East to start to place sustainability at the core of development and lead the way on the global stage. We know the appetite from the industry is there. Turner & Townsend’s Building a sustainable future in the Middle East report recently found that a majority of developers, investors, consultancies and

government bodies in the region are now discussing sustainability requirements from the outset –at the project briefing stage. Less encouraging is that fewer than half are then translating these considerations through to operation, meaning that the potential impact is not being fully realised.

It’s clear there’s awareness of the importance of sustainability but the challenge is understanding how that translates to action and impact.

GEARING UP FOR CHANGE

There are reasons to be optimistic that change is afoot, with political pressure building to bridge the gap between ambition and delivery.

Later this year, the UAE will hold the Conference of the Parties of the UNFCCC (COP28) in Dubai. This will offer a time for political and business leaders to reflect on progress made and plan further action. With the eyes of global governments and investors on the UAE and the wider region, we should expect significant, wide-reaching and potentially rapid change in regulation surrounding sustainability requirements.

gulfbusiness.com 10 October 2023

The Brief / Construction COMMENT

As global investment strategies focus on tightening ESG criteria, it’s increasingly essential that development projects align with sustainability requirements

ILLUSTRATION: GETTY IMAGES/ SERGEYTIKHOMIROV

Though most construction businesses agree that government incentives and regulation would help fast-track progress towards decarbonisation, there will be significant ground to make up. Our data shows that the majority of existing projects don’t exceed current minimum regulatory requirements.

That matters because it creates risk both for new and existing assets. As global investment strategies focus on tightening ESG criteria, it’s increasingly essential that development projects can demonstrate their alignment with sustainability requirements. The same trend applies for established assets which are becoming less attractive to investors, occupiers and end users unless they can be upgraded or retrofitted.

SETTING PROJECTS UP FOR SUCCESS

Sustainability, as with any other project outcome, should be considered from the outset to have the best chance of success. This means integrating it into the procurement process, making sustainability a core decision driver alongside cost, quality and delivery.

This is particularly vital when it comes to developers tracking, understanding and ultimately reducing Scope 3 emissions – those which are produced not directly by the organisation itself, but by partners and suppliers throughout its value chain. Awareness around Scope 3 emissions is growing across the sector but more action is needed to fully get a hold on what, for most developers, will make up the majority of emissions. Feeding requirements, from material provenance and fuel usage on site to water efficiency and operational carbon in operation, into prequalification and tenders will help first to ensure minimum conditions are met. By engaging the supply chain early on, we will be able to achieve more in a shorter timeframe and in a more cost-effective way than would be the case by retrofitting sustainability goals into a project at a later stage.

More importantly, in the longer term, a focus on sustainability requirements within procurement will encourage the standardisation of emissions reporting, building greater transparency around and understanding of current performance and potential improvements.

ASSESSING THE WHOLE LIFE IMPACT OF PROJECTS

While regulatory change is expected to come as a result of COP28, we can’t yet say what form this will take. Even as new regulations become clear in the coming months, these will of course continue to evolve well beyond this year’s climate conference –as will consumer needs driving the use of buildings and infrastructure.

Assets will need to flex with these developments. To ensure they’re sustainable, usable and profitable in the long term, clients must broaden their approach to a project’s sustainability credentials, undertaking whole life assessments to consider the full impact throughout its lifecycle.

A great example is Expo City in Dubai, which took this approach from the outset of the project. The project team assessed the nature and purpose of the development not just for its main purpose of Expo 2020, but how it would then need to adapt following the event. The site has since transitioned into an innovative ‘city of the future’. Its environmentallyfriendly residential, leisure and commercial space will help to attract businesses, citizens and tourists, support sustainable growth and reinforce Dubai as a global destination.

Whether it’s a large-scale development zone or an individual residential building, we need to understand how the asset may need to be transformed to suit future requirements and what impact these changes may have on emissions and natural resources.

LOOKING BEYOND COP28

Increased regulation is needed to drive positive change across the Middle East’s construction sector and should be welcomed. COP28 is set to be the catalyst for this.

It will inevitably come with its challenges for the whole supply chain, particularly given change is likely to be introduced quickly. We need to see a shift in approach with sustainability being brought to the fore – not just in theory during the design phase, but in practice throughout construction and operation.

As investor appetite grows for future-proofed, sustainable assets, we have an imperative to act. However, we should also see this as a brilliant opportunity – to create jobs, deliver economic growth and secure a green, healthy future for the Middle East.

gulfbusiness.com October 2023 11

Lindsey Malcolm, sustainability lead at Turner & Townsend Middle East

“DELIVERY OF SOME OF THE WORLD’S LARGEST, MOST AMBITIOUS PROJECTS WILL BE CARBON INTENSIVE AND PLACE PRESSURE ON RESOURCES, PARTICULARLY ON WATER, ENERGY SUPPLIES AND MATERIAL AVAILABILITY”

A MAJORITY OF DEVELOPERS, INVESTORS, CONSULTANCIES AND GOVERNMENT BODIES IN THE REGION ARE NOW DISCUSSING SUSTAINABILITY REQUIREMENTS FROM THE OUTSET – AT THE PROJECT BRIEFING STAGE

Insuring its future

Over the years, the insurance sector in the GCC region has undergone a remarkable evolution. We have witnessed a significant shift from a mandatory and more traditional focus on motor and health insurance to a more diverse range of offerings.

Today’s insurance players provide comprehensive coverage for health, life, and specialised sectors, tailored to the unique needs of diverse customer segments, with personalisation becoming a major focus.

According to research conducted by investment banking advisory firm Alpen Capital, the insurance industry in the GCC region is projected to grow from $26.5bn in 2021 to $31.1bn in 2026. This trend can be attributed to several key drivers.

Firstly, the region’s expanding population creates an increased demand for insurance coverage across various sectors. Furthermore, regulatory reforms have created a more competitive landscape, attracting foreign investments and promoting innovation. The rising awareness of the importance of insurance among individuals and businesses, coupled with the region’s economic diversification efforts, has further fuelled the sector’s growth.

While insurance companies will always retain the role of society’s risk managers that instil confidence

gulfbusiness.com 12 October 2023

The Brief / Insurance COMMENT

We explore how disruptive technologies are reshaping the insurance landscape

ILLUSTRATION: GETTY IMAGES/ ERHUI1979

Martin Rueegg, group CEO of NLGIC Group (to be rebranded as Liva)

in people to live the life they want, the way insurance solutions are built and delivered is evolving, and so are the products themselves. For example, driverless cars come with a very different set of risks than we have been used to with conventional cars, and the industry needs to respond to this change.

HOW TECH IS TRANSFORMING THE SECTOR

So how can insurance players keep pace with the ever-changing landscape? This is a simple yet difficult question. The most effective way is investing in advanced technology, combined with adopting a customer-centric approach.

Innovation is at the heart of the industry. Technology makes customers’ lives easier while driving efficiency, transparency, and agility for insurers and partners. Digital channels allow customers to easily purchase policies, manage claims, and access support, providing them with unprecedented convenience and a seamless experience.

Additionally, the integration of internet of things (IoT) devices enables companies to gather valuable data to gain insights into customer preferences and behaviours with the aim of developing even more personalised insurance solutions through accurate underwriting. Meanwhile, regular customer feedback and market research help them to proactively adapt to changing needs. Other topics, such as cybersecurity and data privacy, are very much at the centre of any insurance operation to ensure the utmost protection for policyholders.

Disruptive technologies are reshaping the industry as we know it. Artificial intelligence and machine learning algorithms have become integral in automating underwriting and claims processing, streamlining operations and ensuring faster service delivery. Moreover, the adoption of telematics and IoT devices allows insurance companies to offer usage-based policies and obtain real-time data for accurate risk assessment. Parametric insurance is a prime example of an area which disruptive technologies are truly redefining by supporting the creation of products that automatically arrange payments based on certain events. For instance, if a flight is delayed by more than three hours, the customers receive compensation paid straight into their bank accounts without having to do anything.

A HOLISTIC APPROACH

Today, the role of insurance players transcends risk transfer through an insurance contract. In this dynamic landscape, companies are starting to look beyond insurance to build holistic ecosystems of solutions that safeguard all aspects of people’s lives. Making data and information available to prevent events is just as important as insuring them. For example, insurers can share the insights gained out of the millions of records they have, providing support and guidance to people and organisations along their journeys. To remain relevant well into the future, insurance companies must serve as trusted partners to their customers, empowering them to navigate an ever-changing world with confidence.

gulfbusiness.com October 2023 13

THE INSURANCE INDUSTRY IN THE GCC REGION IS PROJECTED TO GROW FROM $26.5BN IN 2021 TO $31.1BN IN 2026 $26.5BN $31.1BN 2021 2026

“REGULATORY REFORMS HAVE CREATED A MORE COMPETITIVE LANDSCAPE, ATTRACTING FOREIGN INVESTMENTS AND PROMOTING INNOVATION. THE RISING AWARENESS OF THE IMPORTANCE OF INSURANCE AMONG INDIVIDUALS AND BUSINESSES, COUPLED WITH THE REGION’S ECONOMIC DIVERSIFICATION EFFORTS, HAS FURTHER FUELLED THE SECTOR’S GROWTH”

Unlocking opportunities

Blockchain technology can help address the pressing challenges faced by carbon credits in the non-compliance market

The idea of ‘stressed assets’ has taken on a new meaning in today’s quickly changing global economy. Traditionally associated with financial organisations dealing with non-performing loans, this phrase was eventually broadened to cover assets that are misunderstood, mishandled, or underutilised.

Carbon credits, the key tool at our disposal to e ectively reduce emissions by putting a price on pollution, are at the vanguard of this disruptive asset class. As we plunge deeper into the realm of stressed assets, it becomes clear that carbon credits, particularly in the non-compliance market, are confronted with hurdles that impede their potential.

Stressed assets, in the context of our discourse, refer to resources that are undervalued or mismanaged, thereby missing their potential contributions.

CHALLENGES FACED

Carbon credits, o ten linked to emissions reductions and environmental sustainability, have become a prime example of such stressed assets. Despite its promise, this asset class has obstacles that prevent it from serving its full potential in the non-compliance market.

A significant obstacle involves the limited comprehension surrounding carbon credits. Many stakeholders, including businesses and individuals, feel doubtful or perplexed about the mechanics and benefits of carbon credit trading.

This misperception is further exacerbated by the lack of trust in the current system. Scepticism abounds due to concerns about authenticity, accountability, and credibility within the carbon credit market. Moreover, the lack of transparency

DESPITE ITS PROMISE, THIS ASSET CLASS HAS OBSTACLES THAT PREVENT IT FROM SERVING ITS FULL POTENTIAL IN THE NON-COMPLIANCE MARKET

gulfbusiness.com 14 October 2023 The Brief / Carbon Credits COMMENT

ILLUSTRATION: GETTY IMAGES/ CEMILE BINGOL

across a fragmented lifecycle and processes has hindered effective decision-making and use of the credits, thereby stifling the growth of this asset class.

Numerous instances showcase the significant influence of carbon credits along with the situations where their envisioned potential has not been fully realised.

The European Union Emissions Trading System (or EUETS) has experienced achievements as well as drawbacks. While it has effectively prompted the reduction of emissions in various industries throughout the continent, the occurrence of deceitful issuance of carbon credits has tarnished its standing.

CREATING POSITIVE IMPACT

In contrast, voluntary carbon offset projects, such as reforestation initiatives in developing countries, have highlighted the potential for positive impact. However, these projects often struggle to attract sufficient investment due to the challenges.

New tech platforms provide an innovative answer that addresses the pressing challenges faced by carbon credits in the non-compliance market. By harnessing the power of blockchain, technology platforms aim to establish a transparent, reliable, and united ecosystem for carbon credit trading.

This technology will not only instil trust but also enable transparency and collaboration across a streamlined platform for the tokenisation of carbon credits, unlocking their full potential.

Transparency, accountability, and reliability are the cornerstones of modern technology that successfully demolish the pressures that have been holding back carbon credits. Every transaction and credit route can be traced and validated as a result of the blockchain’s intrinsic openness, removing worries about legitimacy.

Rishi Vaidya, head of partnerships and marketing at Carbo-X

CARBON CREDITS EMBODY INNOVATION, COLLABORATION, AND RESPONSIBLE INVESTMENT, DRIVING BOTH FINANCIAL RESILIENCE AND A LOW-CARBON ECONOMY

A unified platform connects buyers and sellers, resulting in a more integrated market with less fragmentation. Furthermore, such platforms’ commitment to accountability ensures that credits are backed by genuine, verifiable emission reductions, addressing the trust gap that has plagued this asset class.

CATALYSTS FOR CHANGE

Focusing on carbon credits’ significance reveals the potential to be catalysts for change across various sectors. Beyond tokens; they embody innovation, collaboration, and responsible investment, driving both financial resilience and a low-carbon economy. By diversifying revenue streams, companies can safeguard their financial future while contributing to a low-carbon economy.

Industrial operations, too, stand to benefit, as carbon credit adoption can revitalise processes, making them more efficient and sustainable. Carbon credits, in the broader scale of things, can be the trigger for a shift in fundamental assumptions, transcending their status as stressed assets. By embracing these credits, industries can help power the transition to a low-carbon economy.

Carbon credits have languished as stressed assets for too long, trapped by challenges that obscure their true potential. The introduction of blockchain technology, on the other hand, gives a transformational chance to release the potential of these credits.

Through blockchain-powered transparency, accountability, and unity, carbon credits can rise from the shadows to reach their full potential in helping reduce emissions globally.

Carbon credits offer an opportunity for the business world to effectively enact urgent transformational change, as the global community wrestles with the pressing need for climate action.

gulfbusiness.com October 2023 15

“THIS TECHNOLOGY WILL NOT ONLY INSTIL TRUST BUT ALSO ENABLE TRANSPARENCY AND COLLABORATION ACROSS A STREAMLINED PLATFORM FOR THE TOKENISATION OF CARBON CREDITS, UNLOCKING THEIR FULL POTENTIAL”

BY EMBRACING THESE CREDITS, INDUSTRIES CAN HELP POWER THE TRANSITION TO A LOW-CARBON ECONOMY

$

Water partnership

Public-private partnerships are driving water security in the UAE and the learnings from these initiatives can be leveraged to drive sustainability on a global scale

Oil and water are often used in metaphors describing polar opposites, but when it comes to the Middle East, there are several parallels one can draw between these natural resources.

For example, just as they proved instrumental in the growth of the region’s petrochemicals sector, public-private partnerships (PPPs) are playing a similarly pivotal role in ensuring long-term water security and sustainability for the region. Economies such as the UAE have proved particularly adept at encouraging and facilitating commercial partnerships, providing a playbook for the rest of the world to follow.

So, how exactly are PPPs advancing water innovation in the Emirates and the wider Middle East?

STRONG FOUNDATIONS

The UAE Water Security Strategy 2036 sets out a number of ambitious targets, including a 21 per cent reduction in demand for water resources, a $110 per cubic metre increase in the water productivity index, a three-degree decrease in the water scarcity index, 95 per cent reuse of treated water, and a national water storage capacity of two days.

Achieving these goals will require significant innovation, meaning international experts from the commercial sector must work closely with policymakers to drive change. Fortunately, the UAE has a strong track record when it comes to leveraging private-sector investment in water infrastructure.

Abu Dhabi, for instance, is pursuing an array of tenders in this space. As legal research

gulfbusiness.com 16 October 2023

The Brief / Sustainability

COMMENT

ILLUSTRATION: GETTY IMAGES/ KMLMTZ66

platform Lexology notes, these include the Mirfa 2 Independent Water Project, the Shuweihat 4 RO Independent Water Project, and the Abu Dhabi Islands Independent Water Project. Similar programmes are also taking place elsewhere in the UAE, with PPPs being used to develop reverse osmosis facilities in Hassayan, Dubai and Hamriyah, Sharjah.

These partnerships are playing – and will continue to play – an instrumental role in strengthening the UAE’s water infrastructure. By bringing together the expertise, resources and shared goals of both the public and private sectors, enabling them to pool knowledge and leverage cuttingedge technology, these partnerships are serving to foster innovation, resulting in solutions with the potential to tackle scarcity, boost quality and improve the way in which water is managed.

DRIVING SUSTAINABILITY

Such issues seem especially pertinent this year as the UAE prepares to host COP28. From November 30 to December 12, delegates will meet in Dubai to engage in discussions about a variety of pressing issues, including the relationship between water and climate. Priority action areas will also be identified as part of the first-ever Global Stocktake, with the aim of achieving a 43 per cent reduction in emissions by 2030.

COP28 represents a golden opportunity for the UAE and its Gulf neighbours to build on the progress achieved to date, showcasing regional water innovations and catalysing future collaborations

PRIORITY ACTION AREAS WILL BE IDENTIFIED AS PART OF THE FIRST-EVER GLOBAL STOCKTAKE, WITH THE AIM OF ACHIEVING A 43 PER CENT REDUCTION IN EMISSIONS BY 2030

Pietro Moro, managing director, Xylem Middle East & Türkiye

THE UAE WATER SECURITY STRATEGY 2036 SETS OUT A NUMBER OF AMBITIOUS TARGETS, INCLUDING:

A 21 per cent reduction in demand for water resources, A $110 per cubic metre increase in the water productivity index

A three-degree decrease in the water scarcity index 95 per cent reuse of treated water

A national water storage capacity of two days

between governments and private entities with the power to overcome water-related challenges on a global scale.

A GLOBAL ISSUE

Water scarcity has represented a challenge for communities across the Middle East for millennia, but it is no longer an issue confined to those living in desert environments. As the effects of climate change have accelerated, people in every corner of the planet are having to think and act creatively to conserve this precious resource.

As the UAE has demonstrated, sustained support from government officials and private-sector experts can propel the global water agenda forward, contributing to a more secure and resilient water future for all. Now more than ever, policymakers and business leaders must come together to foster strong and strategic PPPs that will drive water innovation and sustainability in other regions.

Oil may have represented the economic backbone of the Middle East historically, but I would argue that water security will exert an even greater influence over the region’s future. The UAE and its Gulf neighbours are ideally placed to teach the international community important lessons about water innovation, not to mention the power of PPPs.

So, as we look towards COP28, we should seize every possible opportunity to enable long-term water sustainability, whether we hail from the public or private sector.

gulfbusiness.com October 2023 17

“BY BRINGING TOGETHER THE EXPERTISE, RESOURCES AND SHARED GOALS OF BOTH THE PUBLIC AND PRIVATE SECTORS, ENABLING THEM TO POOL KNOWLEDGE AND LEVERAGE CUTTINGEDGE TECHNOLOGY, THESE PARTNERSHIPS ARE SERVING TO FOSTER INNOVATION, RESULTING IN SOLUTIONS WITH THE POTENTIAL TO TACKLE SCARCITY, BOOST QUALITY AND IMPROVE THE WAY IN WHICH WATER IS MANAGED”

The path to sustainable progress

A HOLISTIC APPROACH

The traditional pursuit of profit at any cost is yielding to a more holistic approach that values long-term value creation. Research demonstrates that purpose-driven companies outperform the market by 5 – 7 per cent annually. However, achieving sustainable economic growth demands a corporate mindset transcending short-term gains and prioritising lasting positive impacts. Such a transformative shift, underpinned by robust corporate governance practices, benefits shareholders and instils investor confidence, contributing to market stability.

Corporate control involves balancing power and influence among shareholders, management, and boards. Striking the proper equilibrium ensures that all stakeholders act in the organisation’s best interest.

The best-performing companies are undoubtedly the ones that champion transparency, fairness, and integrity in corporate control, creating an environment where decisions align with the company’s long-term vision.

Stakeholders play a pivotal role in shaping the destiny of corporations. Effective corporate governance acknowledges the interests of diverse stakeholders, including employees, customers, suppliers, and local communities.

In an era marked by unprecedented challenges and opportunities, the role of corporations in driving sustainable economic development and societal progress has never been more crucial. According to McKinsey’s insightful report, Urban World: The Shifting Global Business Landscape, emerging regions are set to house more than 45 per cent of Fortune Global 500 companies by 2025. As businesses navigate these transformative changes and emerging markets redefine competitive dynamics worldwide, corporate control, power and accountability pillars appear as the bedrock of longterm value creation. Fostering an environment of responsible governance is paramount in driving sustainable economies, empowering society, and safeguarding the environment.

Enhancing accountability and transparency empowers stakeholders to actively participate in governance. Research highlights that consumers are four times more likely to support companies with a strong sense of purpose, underscoring the significance of disclosure and reporting practices.

The impact of corporate actions on the environment and society demands conscientious consideration. According to S&P Global Market Intelligence, 80 per cent of the world’s largest companies report exposure to physical and market transition risks associated with climate change.

As Europe battles with extreme heatwaves, climate-related weather events are expected to cost businesses $1.3tn by 2026, according to a CDP report. This demonstrates that sustainable strategies, encompassing environmental and social considerations, are no longer optional – they are vital. However, cultivating responsible corporate

gulfbusiness.com 18 October 2023

The Brief / Governance

Responsible corporate governance is vital for businesses seeking long-term success and societal impact, and it requires a commitment to transparency, accountability, sustainability and ethics

ILLUSTRATION: GETTY IMAGES/CARGO

80 PER CENT

OF THE WORLD’S LARGEST COMPANIES REPORT EXPOSURE TO PHYSICAL AND MARKET TRANSITION RISKS ASSOCIATED WITH CLIMATE CHANGE

practices extends beyond mere compliance. Collaboration between companies, regulators, and investors is key to successfully embedding governance practices that propel positive change.

LONG-TERM VALUE CREATION

We can all envision a future of shared prosperity and environmental harmony, where the significance of corporate governance cannot be overstated. By diligently managing corporate control, power and accountability, we pave the way for long-term value creation that enriches economies, empowers societies, and safeguards the environment.

Together, we can all embark on this journey, passionately advocating for responsible governance practices that create a brighter, more sustainable future for all. Collectively, we can shape a world where corporations become agents of positive change, leaving an enduring legacy of progress for generations to come.

Expanding upon these themes, it’s essential to delve deeper into the mechanisms and practices underpinning responsible corporate governance. The bedrock of sound governance lies in the composition and functioning of corporate boards. Diverse and independent boards are more likely to provide effective oversight and strategic guidance, reducing the risk of conflicts of interest and myopic decision-making.

Furthermore, the role of executive compensation should be scrutinised within the context of corporate governance. Excessive executive pay can undermine the alignment of interests between management and shareholders, eroding long-term value creation.

Adopting compensation structures that tie executive remuneration to long-term performance metrics and sustainability goals can promote responsible behaviour.

THE SHIFTING GLOBAL BUSINESS LANDSCAPE: EMERGING REGIONS ARE SET TO HOUSE MORE THAN 45 PER CENT OF FORTUNE GLOBAL 500 COMPANIES BY 2025

Corporate governance is not a static concept; it must evolve to address emerging challenges. Cybersecurity and data privacy have become integral components of corporate risk management in today’s digital age. Companies must establish robust cybersecurity policies and data protection measures to safeguard their operations, customer trust, and reputation.

FOCUS ON ETHICS

Another facet of responsible corporate governance pertains to supply chain ethics. Businesses are increasingly being held accountable for the conduct of their suppliers. Ensuring ethical practices throughout the supply chain, from sourcing raw materials to production and distribution, is paramount to avoid reputational damage and legal liabilities.

Inclusivity in decision-making is another aspect that deserves attention. Companies that actively engage with their stakeholders, including marginalized communities and vulnerable populations, demonstrate a commitment to social responsibility. Such engagement can lead to innovative solutions addressing societal challenges, fostering goodwill, and enhancing a company’s social licence.

Technological advancements such as artificial intelligence (AI) and automation will continue to shape corporate governance practices as we look to the future. Ethical AI deployment, data ethics, and responsible automation should be integral considerations for boards and management teams as they navigate the evolving landscape of technologydriven business operations.

In conclusion, responsible corporate governance is not a mere buzzword; it’s an imperative for businesses seeking long-term success and societal impact. It requires a commitment to transparency, accountability, sustainability, and ethical behaviour.

By continuously evolving and embracing these principles, corporations can navigate the complexities of the modern business landscape, contribute positively to society and the environment, and ensure their enduring relevance and prosperity.

gulfbusiness.com October 2023 19

Dr Ashraf Gamal El Din, CEO of Hawkamah, the Institute for Governance

“INCLUSIVITY IN DECISION-MAKING IS ANOTHER ASPECT THAT DESERVES ATTENTION. COMPANIES THAT ACTIVELY ENGAGE WITH THEIR STAKEHOLDERS, INCLUDING MARGINALISED COMMUNITIES AND VULNERABLE POPULATIONS, DEMONSTRATE A COMMITMENT TO SOCIAL RESPONSIBILITY”

Built on a vision

AMER KHARBUSH, HEAD OF PROGRAMME AND PROJECT MANAGEMENT WITH SAUDI-BASED ROSHN GROUP, TELLS GULF BUSINESS ABOUT THE COMPANY’S APPROACH TO INTEGRATED COMMUNITY DEVELOPMENT

BY KUDAKWASHE MUZORIWA

BY KUDAKWASHE MUZORIWA

QWhat opportunities do you foresee in Saudi Arabia’s real estate market?

Projections have put the Saudi population at 50 million by 2030, and the government has outlined its intentions to ensure there is housing for all the people in the country. This demand provides an opportunity for all big developers in real estate, specifically those focusing on community projects. ROSHN is supporting the goal of Saudi home ownership of 70 per cent in line with Vision 2030. The future looks promising, and it is exciting that there will always be the latest innovations and products in the market.

Saudi Arabia’s real estate and infrastructure projects have crossed $1.23tn. How do you envision the future of the industry going forward?

From my background in design and construction, I see a very positive future for

the real estate and infrastructure market in Saudi Arabia and believe it will overtake the pace of development in the rest of the world. Future development will focus on how best to industrialise construction and focus less on building on-site and more on building in factories.

We want to ensure that we attain the best quality while reducing the time, waste, and impact on the environment by outsourcing everything to factories. This has not been done in construction in the past. As ROSHN, we are always looking at ways of making this happen and are working with multiple vendors to ensure that we design for the future.

Tell us how the company is contributing to Saudi Arabia’s infrastructure development under Vision 2030.

Our approach to development at ROSHN is to put people at the centre of all our projects.

This applies not only to the homes that we build but across our entire infrastructure development philosophy. We understand that infrastructure is not simply a case of providing utilities, but it is about providing the necessary social infrastructure to support people-centric communities. We simultaneously work to ensure that we provide electricity, power, and water in a way that meets the needs of the residents, but we also implement integrated master planning to ensure that the residents of our communities are supported by an evolved social infrastructure including schools, healthcare clinics, retail outlets, mosques, and transport services. In this way, we align with the objectives of Vision 2030.

Our most recent project, MARAFY, is an example of our approach to integrated community development, and our commitment to putting people first.

Tell us more about ROSHN’s investments and development projects?

As one of the biggest real estate developers in Saudi Arabia, our focus is to develop community developments and mixed-use developments at scale, and we are now known as the leading master community developer in the kingdom.

We have several projects underway across the kingdom, including the western, eastern and central regions. We are also continually investigating new potential projects across Saudi Arabia and have partnered with several exciting companies – the details of which we will disclose soon. We have stepped up our game with MARAFY, which marked the company’s entry into the mixed-use development market and will see us developing brandnew canal access in Jeddah.

gulfbusiness.com 20 October 2023 INTERVIEW

THE BRIEF

ILLUSTRATION: GETTY IMAGES/ FOTOGRAFIABASICA

ROSHN IS SUPPORTING THE GOAL OF SAUDI HOME OWNERSHIP OF 70 PER CENT IN LINE WITH VISION 2030. THE FUTURE LOOKS PROMISING, AND IT IS EXCITING THAT THERE WILL ALWAYS BE THE LATEST INNOVATIONS AND PRODUCTS IN THE MARKET”

Aligned with the agenda

ABDALLA AL BANNA OF DUBAI WORLD TRADE CENTRE SHARES HOW ITS FREE ZONE IS SUPPORTING DUBAI’S D33 ECONOMIC AGENDA

People are key to the design philosophy of the group. Tell us more about it.

Our design philosophy is people-centred while remaining as efficient and sustainable as possible: it’s all about the people, and about the residents. We want to make the lives of the people living in our communities better and easier. Our group CEO has stated many times that we ensure that our homes are fit for purpose and as energyefficient as possible.

Every house in the community has a form of solar-powered utility and electric vehicle charger provisions to prepare for a future in which electric vehicles will become dominant. PIF-backed Lucid is playing a big role in this transition.

Our design philosophy is also centred on providing mixed-use communities in which residents will be able to combine work and play.

ROSHN is the first PIF-funded giga project to become a member of the UN Global Compact. What does this mean for the company?

We are proud to have been the first Saudi giga-project to have joined the UN Global Compact. The group is strongly committed to the key principles of human rights, labour rights, environmental protection, anti-corruption, trust, integrity and transparency, all of which are included in the UN Global Compact. We will be reporting on our ongoing performance against these principles annually and will work tirelessly to continue to raise the standards of real estate development in Saudi Arabia and beyond.

Dubai World Trade Centre Authority (DWTCA) Free Zone recently reported a robust performance in H1 2023, reflecting its alignment with Dubai’s D33 Economic Agenda of attracting foreign investment through the provision of a conducive business environment. It also reported that licence renewals recorded a 32 per cent year-onyear growth against H1 2022. Here, Abdalla Al Banna, VP of Free Zone Regulatory Operations at Dubai World Trade Centre (DWTC), tells Gulf Business more about how the authority is supporting the growth of SMEs and bolstering the emirate’s economy and sustainability targets.

gulfbusiness.com October 2023 21 INTERVIEW

THE BRIEF

PICS: SUPPLIED

INTERVIEW

How is Dubai World Trade Centre Authority (DWTCA) Free Zone aligned with Dubai’s D33 Economic Agenda?

The DWTCA Free Zone is an emblem of Dubai’s future economy, fostering a probusiness climate with ultra-modern infrastructure. As a well-regulated ecosystem, it has rapidly become a leading driver of global competitiveness and pioneering business ecosystems, with a particular emphasis on the digital economy.

Our tenants span more than 40 diverse sectors, including Fortune Global 500 companies, SMEs, digital transformation startups, research and development firms, and tech innovators, reinforcing the D33 agenda’s strategic priorities.

The free zone is aligned with the agenda’s goals of attracting foreign investment and positioning Dubai as a hub for innovative economic ventures is evident.

One Central, currently at 75 per cent occupancy, also bears testament to our contributions to Dubai’s economic agenda.

By capitalising on the momentum of the D33 agenda, the UAE Industrial Strategy and other relevant strategies, we are continuously exploring growth avenues and innovative ideas.

How was H1 2023 for the free zone?

DWTCA Free Zone experienced a striking 250 per cent increase in licence renewals during H1 2023, from 254 to 892 renewals. We also welcomed 322 new companies, enhancing our international community of more than 2,000 companies.

This includes diverse enterprises such as BlueCrest Capital Management, Merz Middle East, MMBI Food Trading, and Korean Tourism Organisation, among others. The surge in license applications reflects the growing interest in virtual assets and family offices, and DWTCA Free Zone’s reputation, fortified by the DWTC’s four-decade-long business facilitation expertise, makes it a preferred destination for these sectors.

How has the authority supported the growth of SMEs in the emirate?

Our in-depth understanding of SMEs’ needs, drawn from extensive experience and relationships, allows us to offer straightforward, simple, and streamlined

procedures for rapid establishment. Our comprehensive support services, from licensing, company registration, visa processing to administrative tasks, ensure a smooth process for SMEs.

We offer appealing financial incentives including discounted license fees, reduced rental rates, flexible payment schemes, and rent-free services during the application phase, contingent on the scope and validity of their business proposal. We also provide cost-effective and adaptable office spaces, networking events, workshops, seminars, business advisory services, mentorship programmes, and dedicated platforms for the exchange of industry-specific insights and knowledge.

The Intelak Incubators initiative, launched in H1 2023, exemplifies our proactive approach, offering tailored accelerator and incubation programmes to foster start-ups and early-stage ventures within our dynamic Free Zone ecosystem.

Tell us about some of the success stories that underscore the authority’s commitment to building Dubai’s business ecosystem.

DWTCA Free Zone serves as a business success enabler and an attractive hub for entrepreneurs and emerging industry champions, fostering a culture of innovation and growth.

Noteworthy examples include Kitopi, which expanded its physical footprint from 5,000 to 21,000 square feet in 2022, and BlueCrest Capital Management, which expanded its office space from just under 4,500 to 6,900 square feet. These instances underscore how DWTCA Free Zone’s environment fuels the growth of diverse enterprises.

How is the free zone supporting the emirate’s focus on advanced technologies?

The free zone, designed to catalyse Dubai’s future economy, offers a pro-business environment and cutting-edge infrastructure.

Our well-regulated ecosystem is a magnet for digital transformation pioneers, R&D companies, and tech innovators. Capitalising on Dubai’s prominence in next-gen technologies such as the metaverse, artificial intelligence, Web3 and blockchain, we are strategically nurturing the virtual

DWTCA FREE ZONE EXPERIENCED A STRIKING 250 PER CENT INCREASE IN LICENCE RENEWALS DURING H1 2023, FROM 254 TO 892 RENEWALS. WE ALSO WELCOMED 322 NEW COMPANIES, ENHANCING OUR INTERNATIONAL COMMUNITY OF MORE THAN 2,000 COMPANIES”

assets ecosystem and consolidating the emirate’s reputation as a leading accelerator for the future economy.

How is the free zone conforming to the emirate’s sustainability agenda?

We are committed to a net-zero sustainable future and we place sustainability at the heart of our strategic decision-making. This has been institutionalised through our core values, green building initiatives, waste management, resource optimisation, renewable energy integration, and proactive stakeholder engagement. This commitment to sustainability has not only improved our brand reputation and operational efficiency in the short term but also made us resilient and poised for long-term growth.

Our efforts align with Dubai’s agenda, reinforcing our contribution to the city’s broader sustainability goals. Moreover, our focus on sustainability has cultivated a culture of responsibility and foresight within DWTCA Free Zone, influencing all aspects of our decision-making process.

An evident example of this is our LEED Gold-certified One Central development which adheres to the highest sustainability standards under the International Management Regime from the Royal Institution of Chartered Surveyors.

We collaborate with environmental organisations on environmental campaigns and initiatives and prioritise waste management using the “reduce, reuse, recycle” principle. We also recognise the crucial role of sustainability in our planet’s future and are steadfastly committed to making a difference.

gulfbusiness.com 22 October 2023

Q

THE BRIEF

Transforming food industry, enabling innovation

Global well-being conglomerate, GMG, is focused on supporting UAE’s national food security strategy

By Mohammad A Baker, deputy chairman and CEO of GMG

By Mohammad A Baker, deputy chairman and CEO of GMG

As a homegrown company, GMG supports the UAE’s food security strategy – a critical national goal heightened by the recent upheavals in the global supply chain. The company is helping advance national efforts to develop sustainable food production systems through modern technologies while enhancing local production.

Our ‘farm to fork’ strategy is the key driver for this vision, which covers the entire food consumption chain, from homegrown food brands to food retail stores that distribute a plethora of brands under the Everyday Goods division.

In the food retail segment, GMG holds exclusive rights to expand wellknown supermarket brands across most of the Middle East region. These include Géant, Franprix, Monoprix, and monop, which belong to the French retailing giant Groupe Casino as well as our recent acquisition aswaaq, which added 22 supermarkets to our rapidly growing retail network.

A prominent player

GMG’s position is further strengthened by its expanding manufacturing capabilities, establishing us as a prominent player in the country’s food production industry. The current production infrastructure covers six product lines: meat, seafood, Himalayan pink salt, herbs and spices, sausages and cold cuts, and butchery and marination. These make up all our homegrown brands: Farm Fresh, Chef’s Choice, Klassic, Sapora, Noor Al Islami, RUH, and Quality 1st Choice.

This year, we’ve achieved a significant milestone with the opening of four new factories that manufacture a range of food products. Collectively, these factories rank among the largest food production facilities in the UAE. Additionally, we’ve established the world’s secondlargest fully automated Himalayan pink salt factory, producing 200,000 kilogrammes daily. Our adaptable, top-tier international machinery ensures we meet current and future customer demands, setting us apart from competitors.

This production process is paired with a digitally-optimised logistics infrastructure. An advanced set of interconnected digital applications and tools aligned to create a seamless flow of goods from port to warehouse and finally the store and/or customer.

All of this is monitored through a state-of-the-art command centre to ensure consistent service delivery.

Supporting other players

GMG is keen to support other players in the country’s food

value chain while ensuring we fill gaps in our farm-to-fork vision. Our recent strategic partnership with other local producers such as Bustanica, the world’s largest hydroponic farm, is a testament to this objective. Under this agreement Bustanica will supply high-quality leafy greens to Géant Hypermarkets and supermarkets across the UAE, ensuring fresh and organic ingredients/food for our consumers. In addition, GMG has signed an MoU with Silal, which is part of ADQ and one of the region’s largest holding companies, to drive collaboration in the food sector by connecting consumers directly with farmers.

The current trajectory builds on my father, Abdul Aziz Baker’s legacy dating back to 1977. He set up a butchery in Dubai with a vision to enhance the quality of life for UAE residents by offering fresh meat, fish and cold cuts. Since then, GMG has grown into a global retail and manufacturing conglomerate and a major private sector contributor to UAE’s food security objectives.

We are proud to be a part of a transformative change in the food production system that leverages sustainable practices and modern technology to enhance local production. We believe this is a collective responsibility we can achieve by working with stakeholders and partners with a shared vision of innovation and excellence in food production and retail.

BRAND VIEW

Alan’s Corner

Alan O’Neill Managing

Alan O’Neill Managing

Behaviours that boost business

In your organisation, you and your colleagues are most likely defined by the department you belong to. You might be in sales, IT, marketing, operations, finance, or whatever. “She or he is from the marketing department” may be a description that your colleagues comfortably use to define you when speaking in public. But do you know how you are defined in private? Are you fast-moving and very direct? Are you a loyal and great team player? Do you slow things down by being very analytical? Or are you the bubbly and chatty one?

When you are faced with di erent scenarios, such as problem-solving, in a sales call, or in a meeting, your own default or preferred style is never far from the surface. Unless you are very aware and have a high level of emotional intelligence, your inherent social style will drive your behaviour. And it’s your behaviour that impacts others, either positively or negatively.

gulfbusiness.com 24 October 2023

We look at the role that leaders play in encouraging positive and productive team behaviours

director of Kara, change consultant and speaker

ILLUSTRATION: GETTY IMAGES/ FANATIC STUDIO / GARY WATERS

Kerrie Barron, who is part of my team, supports individuals and teams to maximise their team performance. “When teams reach peak performance, there is less energy spent on debating the politics and intentions of various players and much more on the work at hand,” she says. “But that requires a level of trust that comes from a better understanding of each other’s style and motivation.”

YOUR SOCIAL STYLE AND ITS IMPACT

Let me start by saying there is no such thing as a ‘right’ or ‘wrong’ style. However, in given situations, some styles help achieve an e ective result, while others can inhibit it. For example, let’s say your primary style is to be dominant, decisive, and resultsfocused in every situation. That might be perfect in a crisis but not if you’re trying to coach one of your teams.

In summary, there are four main styles, determined on one axis by the extent of your level of assertiveness versus introversion. On the other axis your orientation on tasks and results versus people and relationships. Here are just some characteristics to illustrate the extremes of each style.

TIPS TO IMPROVE YOUR SOCIAL STYLE

Great leaders create a high-performance and motivating culture that brings out the best in every team member. That’s done with great communication and

EMPATHETIC LEADERSHIP SAW

AN INCREASE IN EMPLOYEE ENGAGEMENT, LEADING TO A

25 PER CENT BOOST IN PRODUCTIVITY

through understanding relationships. In turn, that generates increased collaboration and teamwork across the organisation.

Be aware of your style and of those who are around you. Engage in a facilitated workshop to help you determine the style of each team member.

Flex your style to work more e ectively with diverse styles that are di erent to yours. In the past, leaders expected their people to adapt to them. That model has completely reversed now. Leaders now “serve” the team. So, when there is potential for conflict or di erent agendas, seek common ground and mutual interest with those of a di erent style.

Clashes of styles are inevitable. Develop the emotional intelligence of your team so that they become more aware of each other and know when to let go or adapt as needed.

Paced and more introverted

Task/Goal focus

ANALYTICAL

Technical specialists Process driven Works slowly

AMIABLE

High avoidance Dependable Loyal

Team focused

Little self-direction

DRIVING

Direct and decisive Results-focused

Competitive

Poor listening

EXPRESSIVE

Extroverted Works quickly Very persuasive Poor planning

Open and people oriented

Fastpaced and assertive

Put people in positions not just based on their technical expertise but also those that play to their strengths. For example, putting a ‘driver’ type salesperson in front of an ‘amiable’ buyer is a recipe for conflict. If you have no choice in this, then ensure that the salesperson knows how to recognise it and adapt.

THE LAST WORD

Organisational life has undergone significant changes in recent years, driven by the pandemic, evolving workforce dynamics, technological advancements, globalisation and other factors.

New-style leaders will be those who can navigate these changes and create environments that foster collaboration, learning and growth.

Empathy is a characteristic that has escalated in importance. Being understanding of others helps to earn their trust. And there is evidence to prove its value. Recent research by McKinsey showed that empathetic leadership saw an increase in employee engagement, leading to a 25 per cent boost in productivity.

Now, that’s worth going a ter.

gulfbusiness.com October 2023 25 The Brief / Alan’s Corner

“WHEN YOU ARE FACED WITH DIFFERENT SCENARIOS, SUCH AS PROBLEM-SOLVING, IN A SALES CALL, OR IN A MEETING, YOUR OWN DEFAULT OR PREFERRED STYLE IS NEVER FAR FROM THE SURFACE”

The business case for creativity

Saudi Arabia’s economic vision is fuelled by a growing culture of the creative arts industry

Saudi Arabia is leveraging the power of storytelling and it has garnered global attention for its e orts. Over the past several years, the Middle East’s largest economy has leaned into its cultural identity, explored new ideas and pathways, and launched numerous projects to support its economic expansion plans. Its path towards achieving the Vision 2030 objectives are being forged by empowering citizens through localisation in all spheres. Rooted in the objectives of the national vision, every sector is encouraged to innovate, to contribute to the kingdom’s future.

As it advances towards new frontiers, the country’s cultural and creative industries (CCIs) have been recognised as a key contributor in reaching its socioeconomic goals. Access to creative tools, avenues for people to monetise their craft and the steady rise of digital creators have created an exciting future for the creative and cultural economy in Saudi Arabia.

Industry experts estimate the value of creative industries globally stands at $985bn. By the close of the decade, research projects that the creative economy will grow by 40 per cent and create more than 8 million new jobs.

Domestically, reports place the value of Saudi Arabia’s CCIs at approximately $15bn per year. The industry is expected to grow at more than 10 per cent per year in the Middle East and North Africa (MENA) region and an impressive 13 per cent within Saudi Arabia. Studies have shown that the creative industries have measurable value in ensuring the well-being of people and promoting innovation, two benefits that the kingdom is ready to actualise.

The progression of the kingdom’s CCIs is being guided by the country’s young population, with 63 per cent of citizens below the age of 30. Ongoing localisation e orts have created job opportunities for more than 500,000 Saudi nationals in the private sector from 2019 to 2022, giving citizens the resources and acumen needed to thrive in the country’s emerging industries. Coupled with a wide variety of cultural initiatives, engagements and public events hosted by the Ministry of Culture and other governing bodies, citizens are being encouraged to pursue their creative passions more than ever before.

Saudi Arabia’s creative spirit is deeply rooted in and continues to be influenced

by its Islamic heritage and geography. Located at the crossroads of three continents, it has been the epicentre of trade for centuries. Its identity is hence entrenched in innovation and commerce, evident in its culture, cuisine, attire, literature, music, and communication styles influenced by diverse traditions . Each region in the kingdom has a distinct cultural identity, visible through their unique music and folk tales which serve as an inspiration for Saudi artists, enabling them to creatively express and celebrate their heritage through their stories.

AS IT ADVANCES TOWARDS NEW FRONTIERS, THE COUNTRY’S CULTURAL AND CREATIVE INDUSTRIES (CCIS) HAVE BEEN RECOGNISED AS A KEY CONTRIBUTOR IN REACHING ITS SOCIOECONOMIC GOALS. ACCESS TO CREATIVE TOOLS, AVENUES FOR PEOPLE TO MONETISE THEIR CRAFT AND THE STEADY RISE OF DIGITAL CREATORS HAVE CREATED AN EXCITING FUTURE FOR THE CREATIVE AND CULTURAL ECONOMY IN SAUDI ARABIA

to bring together global players to help foster a culture of creativity across the country’s vast landscape. Recognising the importance of blending creativity with commerce, Saudi Arabia’s capital city Riyadh will soon host an event that brings together the country’s culture, creativity, talent, and technology.

The inaugural edition of ‘Athar –Saudi Festival of Creativity’ will take place in November. Spread over four days the festival will host a three-day young talent academy programme, along with industry awards. It is set to unveil a distinguished speaker lineup of more than 100 national and global industry strategists, innovators, and experts. Additionally, 12 young talent academies, each addressing a di erent creative marketing topic – ranging from PR to strategy, integrated marketing to design, branding, copywriting and much more, will run in tandem with the event.

ONGOING LOCALISATION EFFORTS HAVE SUCCESSFULLY CREATED JOB OPPORTUNITIES FOR MORE THAN 500,000 SAUDI NATIONALS IN THE PRIVATE SECTOR

Cultural initiatives introduced across the kingdom aim to ensure Saudi heritage is preserved and celebrated. At the 45th session of the UNESCO World Heritage Committee in Riyadh earlier last month, Saudi Arabia and UNESCO organised the ‘Dive into Heritage’ initiative, which harnessed the power of digital technology, such as 3D modelling and interactive maps, to recreate an immersive digital viewing experience.

As the kingdom ramps up its CCI initiatives, e orts on the ground are afoot

The festival will culminate with the Athar Awards Gala Dinner, which will feature the Creative Legacy Awards, verified jointly by the organisers of Dubai Lynx and Cannes Lions. It will be presented to the agencies, networks and brands of the decade.

With more than 1,500 industry professionals and young talent expected to come together in an environment that inspires cultural exchange, collaboration, training, and development, Athar Festival looks forward to celebrating the power of creativity, spotlighting the kingdom’s CCIs as an important facet of the country’s long-term socioeconomic development.

BRAND VIEW

GROWTH OF GLOBAL WEALTH

DESPITE CHALLENGES FACED IN 2022, GLOBAL WEALTH IS EXPECTED TO REBOUND IN 2023 BY 5 PER CENT. HERE, WE LOOK AT KEY FINANCIAL HIGHLIGHTS AND FORECASTS

RECENT PERFORMANCES AND FUTURE FORECASTS FOR FINANCIAL AND REAL ASSETS SHOW STRONG REGIONAL VARIATION

TOP 10 BOOKING CENTRES*

Regionally, Western European players showed the strongest resilience in 2022, posting a 3.8% decrease in CBV*, compared with far steeper declines of 13.1% in North America and 13.7% in Asia-Pacific

Following nearly 15 years of steady expansion that began in the wake of the 2007-2008 financial crisis, the growth of global financial wealth was stopped in its tracks in 2022, declining by 4 per cent to $255tn.

THE DOWNTURN IN 2022 FOLLOWED A STRONG YEAR IN 2021, DURING WHICH FINANCIAL WEALTH ROSE BY MORE THAN 10% , ONE OF THE SHARPEST RISES IN OVER A DECADE

The Brief / Infographics gulfbusiness.com 28 October 2023

SOURCE BCG GLOBAL WEALTH REPORT 2023: RESETTING THE COURSE

*Chartered Business Valuators (or CBVs) are accredited finance professionals with extensive knowledge and expertise in the specialised field of business valuation

GLOBAL 2021 2022 2027 Growth 21-22 CAGR 22-27 Financial assets 263.9 254.6 329.1 –3.5% 5.3% Liabilities 54.1 57.3 73.9 5.9% 5.9% Real assets 247.8 261.5 341.2 5.5% 5.5% NORTH AMERICA 2021 2022 2027 Growth 21-22 CAGR 22-27 Financial assets 126.3 116.0 146.0 –8.1% 4.7% Liabilities 19.7 21.2 26.5 7.6% 4.6% Real assets 57.3 61.2 83.2 6.8% 6.3% WESTERN EUROPE 2021 2022 2027 Growth 21-22 CAGR 22-27 Financial assets 50.4 49.0 59.2 –2.8% 3.9% Liabilities 12.2 12.7 15.0 3.8% 3.4% Real assets 61.5 63.2 75.5 2.7% 3.6%

01 Hong Kong 02 Switzerland 03 Singapore 04 US 05 UK (mainland) 06 UAE 07 Channel Islands & Isle of Man 08 Luxembourg 09 Cayman Islands 10 Bahamas 7.6% 3.0% 9.0% 3.6% 2.6% 9.6% 2.2% 3.1% 4.0% 4.3%

All fi gures in $ Trillion Average ranking based on year 2017, 2022 and 2027 bookings *A booking center is a type of offshore financial centre that mainly serves as a processing hub for international transactions. Its purpose is to facilitate the booking and settlement of financial transactions, such as cross-border trades CAGR 22-27

THE VALUE OF REAL ASSETS

– physical goods in the form of real estate, art, jewellery, premium antiques, rare wines, and the like –continued its growth trajectory by 5.5% to reach $261tn in 2022.

COMBINING BOTH FINANCIAL AND REAL ASSETS , total absolute global wealth in 2022 reached $516 tn , an increase of 1% over 2021

Representing 13.2 per cent of the Middle East and Africa’s financial wealth in 2022 and growing at a rate of 6.5 per cent per annum from 2017 to reach $1tn in 2022, the UAE’s trajectory signals the country’s strong position as one of the preferred global destinations for the wealthy. This impressive growth reflects the strong value proposition the country has developed for highnet-worth individuals.”

— Mohammad Khan, managing director and partner, at BCG

MIDDLE EAST AND AFRICA

$ 1tn 2022

Compound Annual Growth Rate (CAGR) of 5.5% in new wealth

1.3tn

gulfbusiness.com October 2023 29

THE

FINANCIAL WEALTH $

2027

UNITED ARAB EMIRATES (UAE)

Recent performances and future forecasts 2021 20 15 10 5 0 2022 2027 Growth 21-22 CAGR 22-27 Originated from ultra high net worth (UHNW) individuals worth more than $100m The influence of these individuals is anticipated to continue to remain consistent until 2027 (approximately)

6.8 10.6 12.0 18.2 12.9% 8.7% 1.1 1.3 1.8 10% 7.9% 7.3 10.6 7.5% 7.7%

25% OF UAE'S FINANCIAL WEALTH

REAL

FINANCIAL ASSETS LIABILITIES

ASSETS

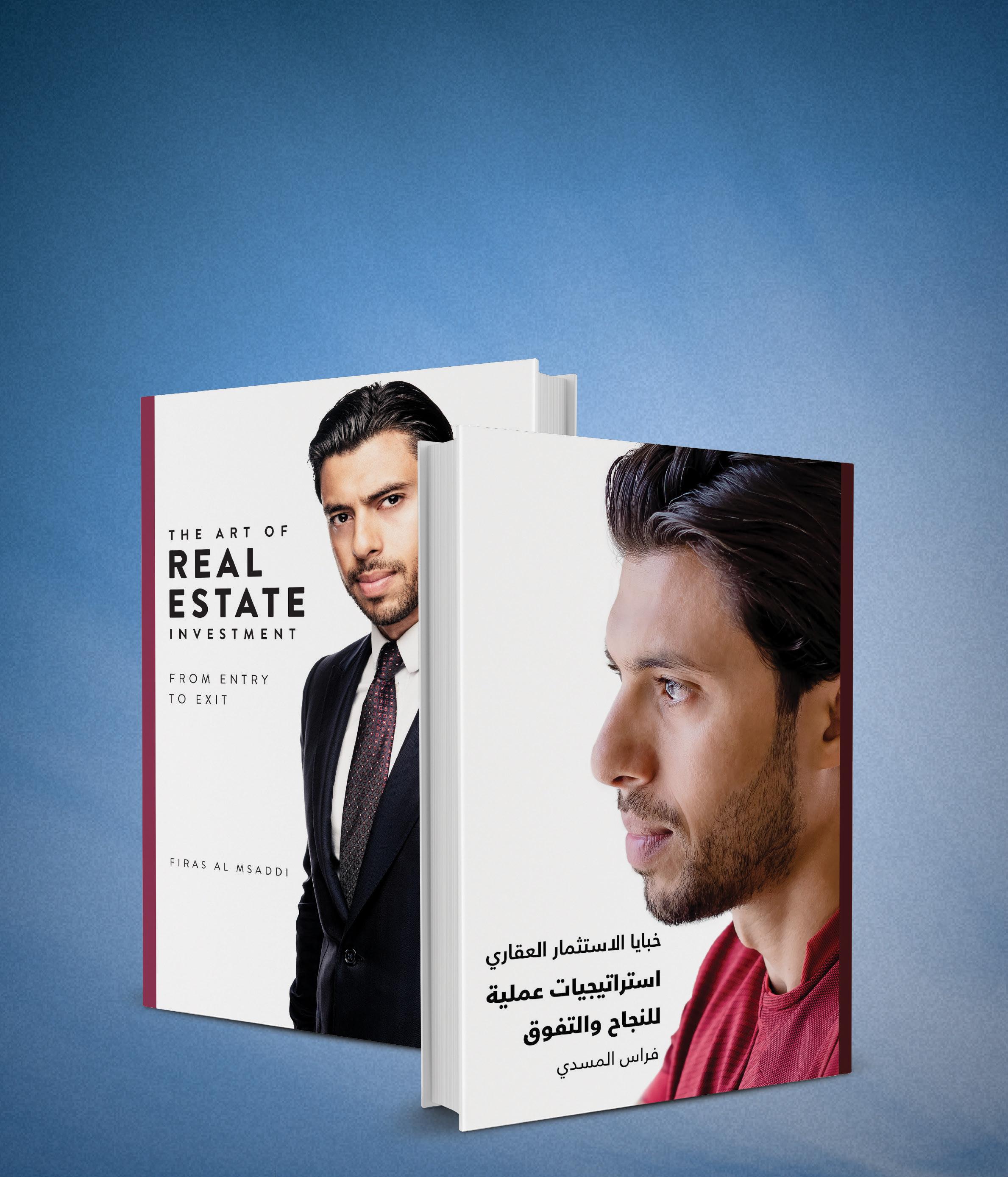

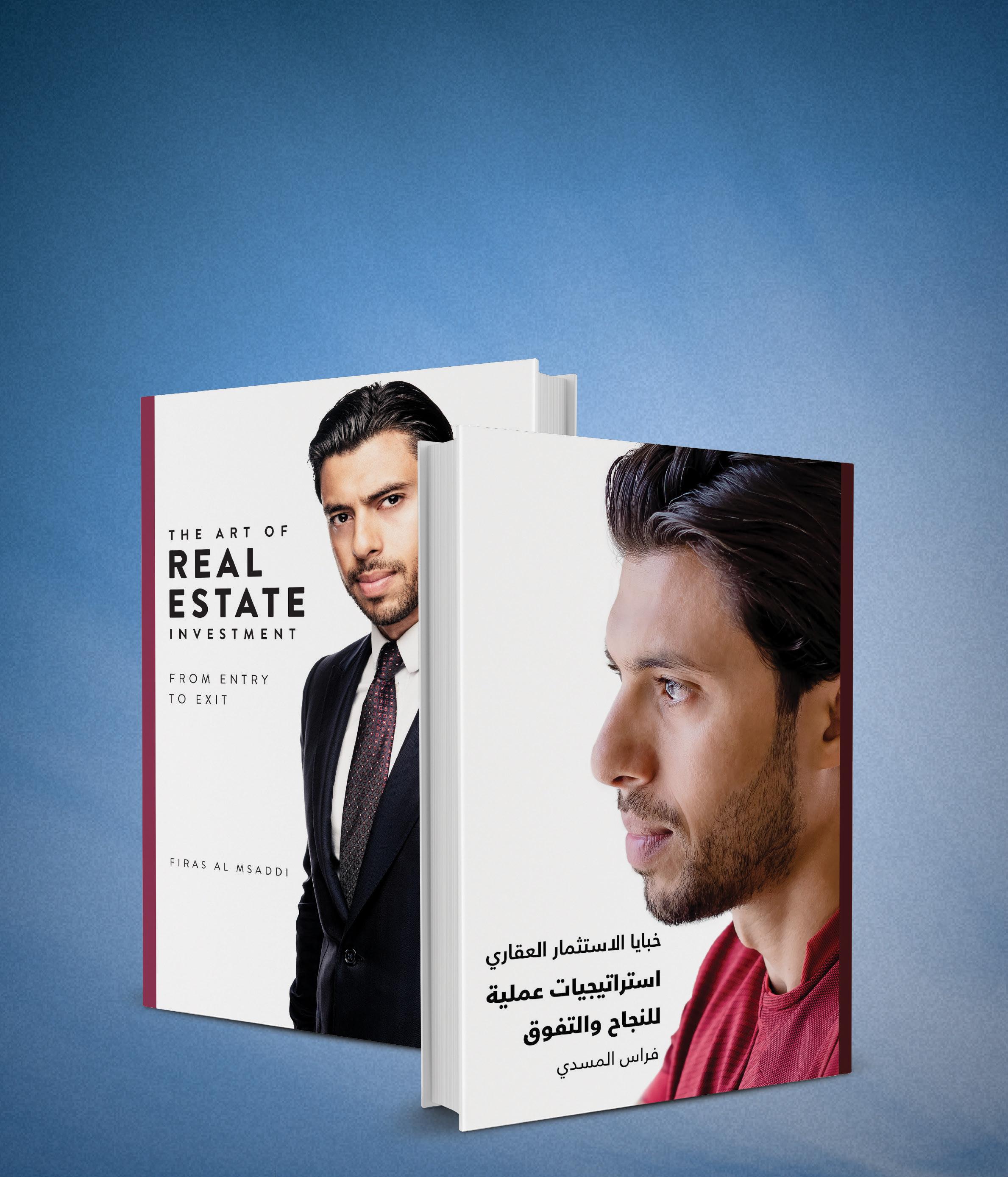

gulfbusiness.com 30 October 2023 A STRONG FOUNDATION SHITIJ KAPOOR , CEO AND FOUNDER OF LUXURY CONCIERGE REAL ESTATE, SHARES HOW HIS COMPANY’S SUCCESS IS BUILT ON STRONG DEVELOPER PARTNERSHIPS, CORE VALUES AND A THRIVING RELATIONSHIP WITH INVESTORS WORDS KUDAKWASHE MUZORIWA PHOTOS AHMED ABDELWAHAB COVER STORY

gulfbusiness.com October 2023 31

Iam amazed every day at how Dubai’s stunning urban landscape keeps evolving,” says Shitij Kapoor, founder and CEO of Luxury Concierge Real Estate’s (LCRE). Looking at the emirate’s stunning skyline from the vantage point of his office at Opus Tower in Business Bay, Kapoor extols the pace at which the city has been developing, revealing iconic buildings and architectural landmarks that have strategically positioned the emirate among the world’s most cosmopolitan cities such as London, Tokyo, New York and Singapore.

“Dubai’s real estate market continues to achieve outstanding historical performance and sustainable growth, with record transaction values month-over-month in line with expanding investors’ choices and options to invest in the city,” shares Kapoor, a serial entrepreneur and key figure in the emirate’s real estate sector for over a decade and a half.

Kapoor attributes the upward trend seen over the past three years to Dubai’s dynamic economy, vibrant lifestyle, strategic location, favourable tax regime, exceptional infrastructure, world-class healthcare facilities, safe environment and the allure of the Golden Visa programme. “These factors have collectively drawn high-net-worth individuals (HNWIs) and wealthy investors to the region, surpassing expectations.”

Their interest is not limited to just luxury real estate, he adds. “Dubai’s real estate market offers compelling investment opportunities, catering to different preferences. From

the luxury property market to commercial spaces to hospitality, the range ensures that potential investors can align their choices with their investment objectives.

“I am very optimistic that these trends will not abate anytime soon.”

Kapoor’s confidence is not misplaced. Global property consultancy firm, Knight Frank, recently revealed that Dubai’s luxury property prices surged by 48.8 per cent in 12 months to June 2023, maintaining its top ranking for the eighth consecutive quarter.

According to the property consultancy firm, prices in Dubai skyrocketed 225 per cent since hitting a pandemic low during the third quarter of 2020.

This growth promises to continue into Q4 after transaction values hit a record Dhs283bn in the first six months of the year.

LCRE, one of Dubai’s leading real estate agencies, has benefitted from these developments. The company raked in Dhs1.5bn in sales so far this year, building on its stellar record in 2021, when it recorded Dhs1.3bn in sales and achieved even greater success with Dhs1.7bn in sales last year.

gulfbusiness.com 32 October 2023

“The going has not always been this good,” reminisces Kapoor, who has had a long but interesting road to his current position at the helm of LCRE.

THE START OF A JOURNEY

Kapoor began his career journey in 2002 when he ventured into the hospitality industry back in India, a move that laid the foundation for his interest in business before he moved to Dubai.

“I entered Dubai’s real estate sector in 2007, following which we faced challenging times during the 2008-09 Lehman Brothers crash,” he says.

Undeterred by the global financial crisis, Kapoor founded LCRE in 2010 to establish a high-value company that nurtures strong relationships with prominent developers while cultivating his vision for a luxury brokerage firm.

“LCRE was founded on the ambition to leverage Dubai’s thriving luxury segment and forge strong holds with all major developers that give us and our clients the advantage of exclusive access and early information on upcoming launches,” he says.

LCRE’s growth has been exponential over the years, particularly between 2016 and 2020, when it opened three o ces in Dubai’s prime locations to cater to the growing demand from buyers and investors alike.

PREMIUM PARTNERS

The company has maintained its position as a top broker for premium developers such as Emaar Properties from 2018 to 2023, DAMAC Properties from 2017 to 2023, and Sobha Realty from 2020 to 2023.

“We are doubling down on our network of developer partnerships while strengthening our position as a top broker in the country to advance customer service and tailor-made solutions to meet the diverse needs of our clients,” says Kapoor.

The partnership with Emaar is the cornerstone of the company’s success. “As the most recognised real estate agency, the collaboration allows us to o er our clients exclusive access to Emaar’s premium developments, ensuring they have access to some of the most sought-a ter properties in Dubai.”

Kapoor highlights that the partnership bolsters LCRE’s reputation for excellence and reliability while instilling confidence in clients. Furthermore, it enables the company to provide valuable insights into Emaar’s diverse portfolio, allowing investors to make well-informed decisions.

“Ultimately, our collaboration with Emaar cements our position as a trusted and leading agency in the Dubai real estate market,” adds Kapoor.

LCRE TOUCHED DHS1.3 BN IN SALES IN 2021. IN 2022, IT ACHIEVED EVEN GREATER SUCCESS WITH DHS1.7 BN IN SALES. NOTABLY, LCRE HAS REACHED DHS1.5 BN IN SALES IN 2023 AS OF SEPTEMBER 1

Kapoor is setting the tone for LCRE’s growth strategy to further elevate the firm’s profile in UAE’s competitive property market.

He adds that in addition to all the steps he’s taken to expand the business, the foundation of the company’s success lies in LCRE’s core values, which are transparency and integrity.

“To uphold these principles, we are leveraging innovative technologies such as artificial intelligence and machine learning across our portfolio,” says Kapoor. “These technologies enable us to provide clients with data-driven insights, helping them make informed decisions.”

We are doubling down on our network of developer partnerships while strengthening our position as a top broker in the country to advance customer service and tailor-made solutions to meet the diverse needs of our clients”

gulfbusiness.com October 2023 33 COVER STORY