07

The brief

An insight into the news and trends shaping the region with perceptive commentary and analysis

We look at the emerging trends in transportation and logistics, including shared mobility solutions, hyperautomation and electification

Group CEO Karim Awad shares how EFG Holding has created a cohesive ecosystem of businesses that o er complete financial solutions

Whether you are looking to record, edit or manage your podcast, our fully equipped podcast and video recording studio has it all.

Editor-in-chief Obaid Humaid Al Tayer

Managing partner and group editor Ian Fairservice

Chief commercial officer Anthony Milne anthony@motivate.ae

Publisher Manish Chopra manish.chopra@motivate.ae

Editor Neesha Salian neesha.salian@motivate.ae

Digital editor Marisha Singh marisha.singh@motivate.ae

Tech editor Divsha Bhat divsha.bhat@motivate.ae

Senior feature writer Kudakwashe Muzoriwa

Kudakwashe.Muzoriwa@motivate.ae

Senior art director Freddie N. Colinares freddie@motivate.ae

Senior art director Olga Petroff olga.petroff@motivate.ae

Interviews with entrepreneurs and insights from experts on how the regional SME ecosystem is evolving

General manager – production S Sunil Kumar

Production manager Binu Purandaran

Production supervisor Venita Pinto

Group sales manager Mansi Khatwani Mansi.Khatwani@motivate.ae

Senior sales manager Sangeetha J S Sangeetha.js@motivate.ae

Group marketing manager Joelle AlBeaino joelle.albeaino@motivate.ae

Cover: Freddie N Colinares

“The completion of the fifth phase [on June 18] of the Mohammed bin Rashid Al Maktoum Solar Park takes us another major step closer to realising our vision for an economy fully powered by clean energy.”

Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai

Low-carbon solutions are products, services and technologies with a small carbon footprint that can serve as alternative energy sources or instruments for decarbonising operations and consumption. These o erings are divided into six categories: hydrogen and ammonia, carbon capture, utilisation, and storage (CCUS), bioenergy, green mobility and battery electric storage, decarbonisation technologies and renewable energy.

The possibility has not been overlooked by O&G businesses, which are developing LCS to diversify their operations and assure future revenue flow. Integrated energy companies (IECs), supermajors, international oil companies (IOCs), and national oil companies (NOCs) are all entering the game.

As the race to net zero accelerates, low-carbon solutions (LCS) are rapidly becoming the key new growth opportunity for oil and gas (O&G) production-focused enterprises. According to the International Energy Agency, achieving net zero emissions by 2050 will require annual clean energy investment worldwide to increase to around $4tn by 2030, triple the current amount of investments. Companies with the appropriate expertise stand to gain significantly.

As competition in the LCS sector intensifies, the most evolved players distinguish themselves economically and organisationally from their colleagues. Companies that prioritise enhancing the organisational capabilities of their LCS businesses will be well-positioned to capitalise on the potential. Those who do not, risk falling behind the pack.

Except for a temporary slowdown during the height of the Covid-19 pandemic in 2020 and 2021, O&G investments in LCS have increased rapidly over the past five years, and all signs indicate that the pace of investment will continue to accelerate.

For instance, news about one of the region’s NOCs building on the success of the region’s first CCUS facility, to increase its CO2 capture capacity by over 500 per cent, to approximately five million tonnes

per year by 2030. Another example of a NOC in the Middle East is the drive towards large-scale investments and building key domestic, regional, and international partnerships, to enable a stable and inclusive energy transition that meets the world’s need for energy with lower emissions.

Diving deeper, there are four distinct organisational models that companies have deployed in support of low-carbon pursuits:

Operating as centres of excellence, the LCS teams are limited to engaging in strategy and business development. Sta ed with 20 people at most, teams report to the COO or lower and have no P&L ownership. Companies that follow this model rely heavily on external stakeholders through partnerships or venturing because they have limited in-house capabilities. This is the least-mature organisational model.

The LCS teams are housed with the most relevant existing business entity. For example, CCUS is housed with the geosciences group and biofuels with retail. This approach leverages existing engineering, technology, and project execution capabilities. The LCS teams report at the COO or CFO level and have limited or no P&L ownership. Companies that adopt capability-aligned LCS entities usually don’t yet consider these activities as the core.

The LCS teams are hosted in standalone entities to ensure that their strategic agenda aligns with their markets and customers. The LCS entities have P&L ownership and o ten report directly to the CEO. In this structure, the LCS teams have primary responsibility for handling all core activities for the segment, but they may leverage other segments for some functions.

In this setup, the LCS teams operate as separate entities. They may operate under a di erent CEO and board of directors, and they are fully sta ed for operational and support functions. Companies use this model when their goal is to carve out LCS activities for divestment or to attract investors.

No matter how much progress their companies have made in the journey, CEOs and CSOs should consistently keep three priorities in mind over the next few years:

01IExplore new go-to-market strategies via new partnerships, ventures and potential inorganic acquisitions. Entering LCS markets impels companies to explore new types of partnerships across sectors. To be successful, players need to thoroughly define new partnerships and commercial models.

02 I Increase organisational flexibility to fit new low-carbon businesses. Scaling up requires companies to change their organisational structures, project development processes, and technology investment decision-making to better align with low-carbon businesses.

03IHire and upskill to scale up the business. Expanding current capabilities and skill sets to achieve commercial success in the low-carbon space entails developing existing resources and attracting new talent with deep technological, partnering, and regulatory expertise. The International Labor Organization predicts that greening the global economy will yield a net increase of 18 million jobs by 2030. Oil and gas companies must act quickly to ensure that their LCS teams have the necessary skill sets. LCS represents a brand-new frontier with tremendous development potential for O&G firms in the next years. Those who prioritise developing organisational maturity to accept such solutions will be in the best position to capitalise on this opportunity.

“EXPANDING CURRENT CAPABILITIES AND SKILL SETS TO ACHIEVE COMMERCIAL SUCCESS IN THE LOW-CARBON SPACE ENTAILS DEVELOPING EXISTING RESOURCES AND ATTRACTING NEW TALENT WITH DEEP TECHNOLOGICAL, PARTNERING AND REGULATORY EXPERTISE”Bjoern Ewers , managing director and senior partner, and Jean-Christophe Bernardini , managing director and partner, Boston Consulting Group

GREENING THE GLOBAL ECONOMY WILL YIELD A NET INCREASE OF 18 MILLION JOBS BY 2030

Sales of smartwatches, including Apple’s top selling version, have plateaued and are no longer a significant threat to the pricier end of the Swiss watch industry, according to Morgan Stanley.

That’s because the Swiss watch sector has significantly refocused on higher-end products over the past decade, boosting prices of the best timepieces to o set an overall decline in volumes, analysts led by Edouard Aubin, said in a report.

When the Apple Watch launched in 2015, it was viewed as an existential threat to an industry which

couldn’t compete with the range of health and wellness features that smartwatches can o er.

Smartwatches are still outselling the Swiss watch market by a wide margin, with Apple selling more during one quarter than the Swiss industry does in a year. Yet volumes are starting to decline for the first time since the launch of Apple Watch, with smartwatch unit sales down 17 per cent year-over-year in the fourth quarter of 2022 and Apple units falling 16 per cent.

“Overall, going forward we think the incremental negative impact of smartwatches on the Swiss watches industry will now be relatively immaterial, with the exception of some brands such as Tissot and Rado,” the Morgan Stanley analysts said.

Compound annual growth rate in the Swiss watch industry is likely to gradually converge toward

about 7 per cent in time, mirroring the personal luxury goods sector, they added.

The industry enjoyed its best year ever in 2022 by value, driven by a renaissance in demand for mechanical timepieces particularly in the US, with overall exports climbing by 11.8 per cent to CHF24.8bn ($28bn).

Morgan Stanley expects Swiss watch export volumes to rise by as many as one million units this year, though the majority of the increase will come from the Swatch Group’s MoonSwatch – the highly successful collaboration – between the Omega and Swatch brands. Morgan Stanley expects about 1.8 million MoonSwatches to be sold in 2023, up from one million in 2022.

Now priced at about CHF270, the MoonSwatch is breaking the cycle of declining volumes for cheaper, quartz-driven Swiss watches.

While the number of mechanical watches exported is down by 2.1 million units since 2014, the contraction of quartz watches is far more severe. There were 10.7 million fewer Swiss quartz watches exported in 2022 compared to 2014, Morgan Stanley estimates.

“OVERALL,

WE THINK THE INCREMENTAL NEGATIVE IMPACT OF SMARTWATCHES ON THE SWISS WATCHES INDUSTRY WILL NOW BE RELATIVELY IMMATERIAL, WITH THE EXCEPTION OF SOME BRANDS SUCH AS TISSOT AND RADO”

Globally, organisations have been making much noise on diversity, equity and inclusion (DEI) for some time, but how many of them have implemented these initiatives correctly and reaped real benefits of DEI? Enterprises that prioritise diversity and inclusion have a competitive advantage. These organisations recognise the value of a diverse workforce in driving innovation, fostering creativity and enhancing business outcomes. There is enough research evidence for this.

A McKinsey study found that companies with more diverse executive teams outperformed their industry peers in terms of profitability and financial performance. Research published by Harvard Business Review (HBR) also found a positive correlation between diversity and innovation, with diverse teams generating more innovative ideas and better business outcomes.

Diversity, equity and inclusion initiatives contribute to higher levels of employee engagement, satisfaction and retention. According to a Deloitte survey, employees who feel included and valued are more engaged and demonstrate a stronger commitment to their organisations. Another study by global non-profit think tank Coqual (formerly the Center for Talent Innovation) found that employees

in inclusive workplaces are more likely to stay with their current employer and be more productive.

Diverse teams lead to better decisionmaking. Research published in the HBR says that diverse and inclusive organisations are better positioned to understand and cater to diverse customer needs. Boston Consulting Group also found that companies with more diverse management teams had higher levels of innovation and captured a larger share of the market.

However, the specific outcomes of DEI initiatives vary depending on factors such as organisational context, implementation strategies, and ongoing commitment. Creating a truly inclusive workplace is not easy. It requires a commitment from top leadership, as well as a willingness to change the way that people think about and interact with each other.

There are a number of organisations that have done a good job of implementing DEI initiatives. Accenture has a long history of commitment to diversity and inclusion. In 2022, it was ranked number one on DiversityInc’s Top 50 Companies for Diversity. Johnson & Johnson, which is second on the list, has a strong commitment to diversity. The third place belongs to Kaiser Permanente, a healthcare company.

Leadership commitment is essential. Leadership plays a pivotal role in driving DEI. When leaders actively support and promote diversity initiatives, it sends a clear message throughout the organisation. These organisations establish policies and practices that remove biases, promote equal opportunities, and create a level playing field for all employees. This includes fair hiring processes, transparent performance evaluations, and equitable compensation structures.

Diversity and inclusion are not just about race and ethnicity. Diversity and inclusion encompasses a wide range of factors, including race, ethnicity, gender, age, disability and religion. Organisations need to be inclusive of all employees, regardless of their background.

DEI initiatives should be ongoing. DEI is not a one-time project. It is an ongoing process that requires continuous e ort. Organisations need to be committed to creating a culture of inclusion and to continuously evaluating these initiatives.

Data can be used to track progress and identify

According to research, companies with more diverse management teams had higher levels of performance and innovationILLUSTRATION: GETTY IMAGES/ANNASPOKA Dr M Muneer, co-founder of the nonprofit Medici Institute

areas for improvement. Organisations can use data to track their progress on DEI and identify areas where they can improve. This data can be used to set goals, measure progress, and identify areas for improvement.

DEI training can help to raise awareness of issues and promote inclusive behaviour. Organisations should provide such training to all employees and the training should cover topics such as unconscious bias, microaggressions, and inclusive communication.

Employee resource groups (ERGs) can play a valuable role in promoting DEI. ERGs are employeeled groups that provide support and networking opportunities for employees from underrepresented groups. These groups can play a valuable role in promoting DEI by raising awareness of issues, providing a safe space for employees to share their experiences, and advocating for change.

Pay equity is important for creating a fair and inclusive workplace. Organisations should ensure that all employees are paid fairly, regardless of their gender, race, ethnicity or other protected characteristics.

Work-life balance is essential for attracting and retaining employees from a variety of backgrounds. Organisations should o er flexible work arrangements and other benefits that help employees balance their work and personal lives.

Open communication is critical for creating a culture of inclusion. Organisations should create a culture of open communication where employees feel comfortable sharing their ideas and concerns. This can help to identify and address any potential barriers to diversity and inclusion.

In addition to the above, setting clear goals and metrics to measure progress are also important for proper implementation. By following these best practices, GCC companies can progress fast in their DEI journey. Here are some additional tips for them:

01 Partner with local organisations: There are a number of local organisations that can help GCC companies with their DEI e orts. These organisations can provide training, resources, and support.

02 Be transparent: Enterprises here should be transparent about their DEI e orts. This means publishing data on diversity and inclusion, as well as sharing stories about the impact of such initiatives.

03 Celebrate diversity: Business leaders in GCC should celebrate diversity in the workplace through hosting events, creating employee resource groups, and recognising employees for their contributions.

Alan O’Neill Managing director of Kara, change consultant and speaker

Alan O’Neill Managing director of Kara, change consultant and speaker

At a recent strategy refresh meeting, the team and I were exploring goals for the year ahead. Since the spike in online activity during Covid-19, we’ve been giving more airtime to digital. Based on his team’s experiences with online activities, the sales director had a lot to say about our IT platform, its functionality and challenges. The system wasn’t perfect and it was causing frustrations internally as well as among customers. However, the IT director reacted badly to the feedback. She became defensive and took the comments personally, exacerbating the conflict.

Cut to another scenario with a di erent client: I was aware that an important project was running behind schedule. The project owner was highly stressed about it and told me in advance what the obstacles were. Essential ingredients coming from the Far East were both late and more expensive than what was budgeted for. I expected him to raise this issue at a forthcoming meeting, but he didn’t. When I enquired later, he told me that he wasn’t comfortable being yelled at in front of people by the supply chain director, who he claimed was a bully. This is another example of conflict but avoided on this occasion.

I listened to a recent interview with Dr Deborah Birx, the White House Coronavirus Response Coordinator under President Donald Trump. She described the tension and misinformation that was touted during her time on the team and of course, her reaction to Trump’s ‘inject bleach’ suggestion is public knowledge. Because she told her truth to the nation, she faced the brunt of it. We also know how all of that panned out.

While my examples might be different, I’ve no doubt that these scenarios are real for many. Conflict is not just disagreement. Conflict arises when differences of opinion become protracted. When it arises, or when it is avoided or not handled effectively, it can lead to all sorts of missed deadlines. It also leads to poor morale, low engagement and unnecessary stress.

Conflict is a natural and normal part of our lives. After all, we can’t all possibly be compatible and agree on everything. We all have our own thinking styles, opinions, preferences, attitudes, perceptions and behavioural responses. I like Robert de Niro, you might prefer Tom Hanks. I like Germany, you might prefer France. I might prioritise investment in IT, you might believe that we should hire more salespeople. I might want to expand into a new territory and you might prefer to add more products to the portfolio instead. My understanding of the cause of a problem may well be different to yours.

Somehow, our organisation culture needs to reflect these differences, where healthy conflict is encouraged and enabled. Without effective conflict, groupthink can emerge. Groupthink happens when discussions in a group setting go unchallenged, leading to poor-quality decision-making.

The key to successful conflict resolution is always communication.

Manage your emotions. Control your tone and keep a level voice. Shouting will get you nowhere. Feelings of anger, hurt or sadness are sometimes unavoidable. While it’s okay to let the other party know how you feel, don’t expect them to react with sympathy. Using it as a tactic to win them over seldom works.

CHOOSE YOUR WORDS CAREFULLY IF YOU DON’T AGREE. ‘I DISAGREE WITH YOU’ OR ‘YOU’RE WRONG’ ARE MUCH MORE CONTENTIOUS THAN ‘I SEE IT DIFFERENTLY’

Listen to understand. Take time to understand the other party’s point of view. Ask questions and listen carefully without interruption. Ask even more questions for clarity, rather than to catch them out. Accept that it’s okay for others to have a different perspective from you.

Disagree kindly. Articulate your point of view clearly and concisely. Choose your words carefully if you don’t agree. ‘I disagree with you’ or ‘you’re wrong’ are much more contentious than ‘I see it differently’. With the latter, you’re owning it rather than being accusatory.

Agree to differ. Offer your point of view, but focus on practical issues, not abstract ones. ‘I think we should explore a new territory, because...’ is much more meaningful than ‘I think we should expand’. Find the areas of agreement and acknowledge them. If you still cannot agree after reasoning, then agree to differ, and let it go.

Apologise. If you are clearly wrong, then admit it. Don’t hesitate to accept your faults and be the first to apologise. Humility often goes a long way in rebuilding a relationship.

Think win-win. Have a mindset that leads to a win for both parties. What goes around often comes around. If one party feels they have unfairly lost the argument, they just may seek retribution at some other time.

For this article, I’ve concentrated on managing conflict between two peers, where hierarchy is not an issue. But of course, conflict might also occur between you and your boss. Now that can be difficult. We can only hope that your boss is a mature and confident person who is mature enough to be able to acknowledge differences, or even admit to being wrong. Otherwise, you need to be proactive and find the opportunity to deal with it. Use the organisation’s goals and values to support you. Company values determine how you should behave in given situations, so refresh them in advance. And if you link your point of view to a previously agreed business objective, that should also help.

“FEELINGS OF ANGER, HURT OR SADNESS ARE SOMETIMES UNAVOIDABLE. WHILE IT’S OKAY TO LET THE OTHER PARTY KNOW HOW YOU FEEL, DON’T EXPECT THEM TO REACT WITH SYMPATHY. USING IT AS A TACTIC TO WIN THEM OVER SELDOM WORKS”Rehan Khan, principal consultant for BT and a novelist

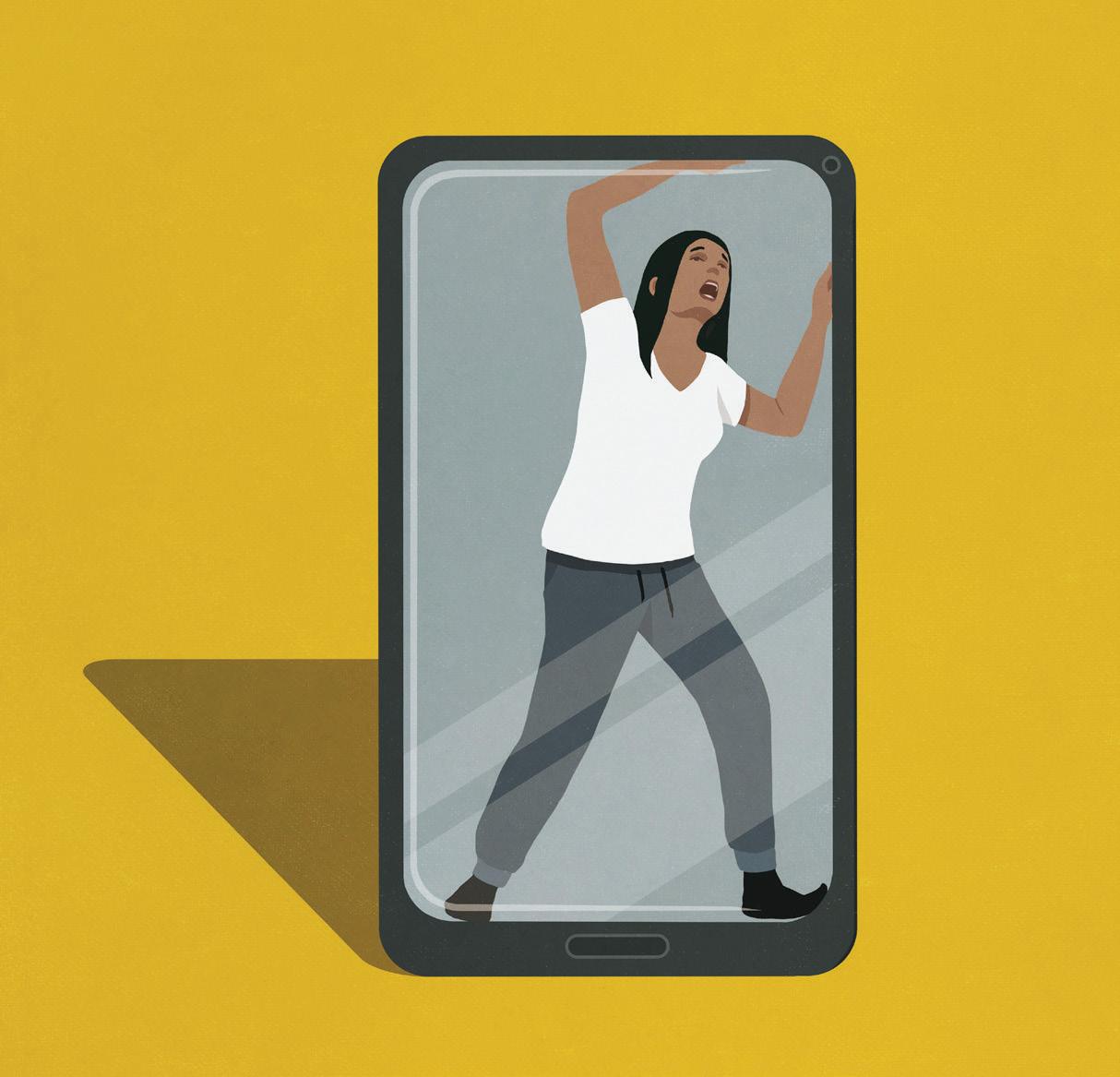

hasty and more demanding, seeking immediate gratification and abandoning information sources that do not deliver instantly.

Likewise, when we send a WhatsApp message and it’s not read or responded to immediately, we start to have dark thoughts about the other person – “Are they deliberately ignoring me?”, “Did I upset them?” Or when we comment on someone’s LinkedIn post and they don’t reply back immediately, we feel slighted: “Was my comment not smart enough for them?”.

Of course, the classic one is when the boss sends a group email, and after the first-person comments there is an expectation that you also need to jump in with your two-bits-worth. In other words, stop whatever you are doing, fracturing your thought process, so that you can make some trite comment and stay on the good side of your manager.

We seem to be hastier at work. Observe a random group of colleagues in the office and you’ll notice they have a habit of checking their phones every three to five minutes, irrespective of what else they might be doing at the time. Unfortunately, haste creates an attitude of impatience and immediacy.

One study collected server data from 23 million online video views. The results showed that on average viewers began to discard the video they were waiting for if it took longer than two seconds to buffer.

In addition, for every second of delay, 6 per cent more viewers clicked on something else. In other words, a ten-second delay would cause two-thirds of the viewers to abandon the video and forage for another information source.

Online retailers were always mindful of the “four second rule”, which was the time a typical online shopper was willing to wait for a website to download. This has now been compressed to a “half-second” rule, another example of how we have become

RULE’ WHICH WAS THE TIME A TYPICAL ONLINE SHOPPER WAS WILLING TO WAIT FOR A WEBSITE TO DOWNLOAD HAS NOW BEEN COMPRESSED TO THE ‘HALF-SECOND’ RULE

Unfortunately, this is the reign of quantity and not quality. Typically, it would take 10 minutes to read the context of the email and respond to it and then another 15-20 minutes to get back to the same level of depth you were at before you got distracted.

The problem with this level of expectation is that more and more work communications is shifting from the real to the virtual world, and so we will encounter an increase in levels of anxiety. We will continue to feel worse, the hastier we become.

Communications technology seems to present us with the immediacy we crave, it takes us away from where we are, and offers us wider connections. In one study the simple presence of a mobile phone and what it offers – disappearing into an online world of dopamine hits and making social connections – was a source of distraction leading to negative consequences in social and work settings. Another study carried out by the University of Essex concluded that, “the mere presence of mobile phones inhibited the development of interpersonal closeness and trust and reduced the extent to which individuals felt empathy and understanding from their partners.” The researchers also found that when the mobile phone was replaced by a paper notepad it improved these same feelings.

Of course, it’s difficult to move around without a mobile phone, but we can certainly remove it from our visual field when we are meeting someone or doing something important at work, otherwise we will constantly be drawn to it. In addition, we can either continue to demand speed, and so grow ever more hasty, or we can learn to slow down a little, reflect a bit more and make better quality decisions with how and where we spend our time.

While technology offers wider connections, the quantity of these associations leaves people feeling qualitatively emptyILLUSTRATION: GETTY IMAGES/MALTE MUELLER

As the world’s attention increasingly turns toward emerging economies, Africa stands at the centre, drawing significant interest as an investment landscape and continent for ambitious vision and action. It is the last remaining frontier market in terms of dynamics and growth and it’s also an increasingly essential one.

The UAE has emerged as an important player and driver of that investment growth. From a regional standpoint, between January 2016 and July 2021, UAE investment into sub-Saharan Africa represented 88 per cent of the GCC total during that period.

In the last three decades there has been a surge in foreign direct investment, and the UAE’s role in African development and its historic relationship with the continent – notably its investment flows – have positioned it favourably among global and regional peers.

Compared to other investors such as China and Europe, the UAE offers strong competitive advantages as an investor in the continent.

The proximity of sub-Saharan Africa to the GCC speaks to regional multilateralism; because of that proximity, they are and will continue to be a significant investment partner. There’s also no historical baggage that hinders or taints commercial activity on the continent.

Key sectors in Africa that GCC country investors are targetting include energy and infrastructure, logistics and transportation, and agriculture. The UAE’s involvement in those sectors has delivered wideranging benefits. By empowering local communities, promoting knowledge exchange and fostering entrepreneurship, the UAE has become an important catalyst for positive change.

The continent has shallow industrial capacity, and the absence of heavy industry is down to a shortage of sufficient power. Partnering with state-owned companies (SOCs) in various countries, including South Africa and Kenya, reflects the recent increasing interest for the private sector to participate. Energy,

infrastructure and power are key factors. In some African countries including Kenya, Ethiopia, Ghana, Senegal and Rwanda, the current and proposed ways to provide access to modern energy services must outpace population growth.

One-in-two people added to the world population between now and 2040 are set to be African – but more than two-thirds of people without access to electricity in the world currently live in sub-Saharan Africa.

Africa’s growing energy and infrastructure requirements align with the goals of GCC investors, as well as overall visions and governmental plans for GCC countries.

The UAE’s sovereign wealth funds and other institutional investors have substantial financial resources and the capacity to undertake large-scale investments. This growing requirement presents attractive investment opportunities for energy, banking, telecommunications, manufacturing, affordable housing, and agriculture.

The ongoing commitment to enhancing food and water security in Africa has also proven instrumental in ensuring sustainable development and addressing growing challenges.

The Gulf imports 85 per cent of its basic food requirements; with a focus on food security, the UAE’s investments in African agriculture will drive mutual economic growth and create trade opportunities in the region in addition to accelerating the advancement of local food production methods and technologies across the continent, East Africa being to date the region in which the UAE has invested the most through buying and/or leasing land from private businesses and foreign government

OF

IT

$25bn

contracts. As an example, a recent survey by the Dubai Chamber of Commerce saw 61 per cent of respondents say agriculture represented the most lucrative area for investment in sub-Saharan Africa. Empowering African communities and providing opportunities for thousands of individuals has resulted in the transfer of technology and skills contributing to a boost in local capabilities, driven innovation, and facilitated knowledge sharing. The long-term hand-up-not-a-hand-out approach goes as far as to include initiatives such as offering scholarships to African students, enabling them to pursue higher education at UAE-based universities.

However, no investment comes without its challenges (including regulatory), but the good news is that they are being addressed in country by policymakers. Overcoming these challenges will continue to require strong partnerships, mutual understanding, trust, and innovative approaches to address specific market dynamics; collaboration with people and institutions on the ground is essential.

Globally, one could almost say that we have evolved from the Western to the Asian Century. To that effect, UAE-Africa relations are growing stronger as more partnerships are formed and the outlook for the UAE’s economic ties with African countries evolves, it is estimated that the UAE’s total non-oil trade with Africa is now worth $25bn per annum.

With a focus on sustainable development and inclusive growth, the UAE’s impact on African economies will continue to contribute positively to economic prosperity and global integration, fostering a mutually beneficial relationship between the UAE, wider GCC and African nations, in a strong win-win dynamic.

“AFRICA’S GROWING ENERGY AND INFRASTRUCTURE REQUIREMENTS ALIGN WITH THE GOALS OF GCC INVESTORS, AS WELL AS OVERALL VISIONS AND GOVERNMENTAL PLANS FOR GCC COUNTRIES. THE UAE’S SOVEREIGN WEALTH FUNDS AND OTHER INSTITUTIONAL INVESTORS HAVE SUBSTANTIAL FINANCIAL RESOURCES AND THE CAPACITY TO UNDERTAKE LARGE-SCALE INVESTMENTS”

IS ESTIMATED THAT THE UAE’S TOTAL NON-OIL TRADE WITH AFRICA IS NOW WORTH

ITS BASIC FOOD REQUIREMENTS FROM AFRICA; WITH A FOCUS ON FOOD SECURITY

per annum

THE GULF IMPORTS 85%

Banks are unusual businesses. They hold a lot of sensitive financial information about clients that they do not sell on. Firms such as big retailers, on the other hand, which collect a lot of customer data through schemes like loyalty cards, routinely market the data. It’s very valuable. Banks, though, keep customer data strictly private – between the customer and their bank – or at least they did until now.

Now regulators around the world, including those in the Middle East and Africa (MENA) region are accelerating the introduction of so-called ‘open banking’. Open banking requires banks to set up application programming interfaces (APIs) that allow customers to share their personal account data with third-party service providers if they choose to do so. As things stand, banks are not remunerated for setting up and running the APIs, though so-called premium APIs may be introduced over time.

The idea behind open banking is that third-party financial firms – both banks and fintechs – will be able to mine the shared data to offer customers cheap, personalised and innovative services. Examples include account to account payments that have no need for card intermediaries. Regulators expect open banking

How open banking can give regional banks in MENA the opportunity to expand their ecosystems, reach and balance sheets

to lead, over time, to a new ecosystem of exciting and cost-effective financial products – especially when open banking is extended to include data from other financial services firms, such as insurers, in so-called ‘open finance’. Not all open banking regulations in the MENA region are at the same stage. Qatar, for example, plans to implement its open banking framework by 2026 while the local pioneer, Bahrain, launched its open banking regulations in October 2020 and is already moving toward open finance. Bahrain is also a leader in building a fintech ecosystem. It has set up a digital sandbox – a ‘safe space’ – in which providers can try out new ideas to ensure that they’re both good for consumers, and compliant with regulations, before they go live. Saudi Arabia is another frontrunner with the Open Banking Lab, which is part of the Financial Sector Development Program (FSDP) under Saudi Vision 2030.

THE UAE BANKS FEDERATION RECENTLY ANNOUNCED THAT IT HAS SEEN A

Alex Fraser, chief executive, The London Institute of Banking & FinanceAt first glance, allowing third party service providers to enter the retail financial services market looks potentially damaging for banks – especially banks in regional areas with limited corporate business. And if it’s not good for banks, could open banking be a threat to growth and financial stability? After all, it is banks that carry out maturity transformation – the essential service that turns short-term deposits into long-term investment.

But the contradiction is only apparent. The aim of the regulators is to have open banking increase the overall economic pie, which would clearly benefit banks. And banks won’t just be giving other firms access to data – they will also get access to data they would otherwise not have had, which they can use to improve their own performance. For example, banks could use data from other financial firms to improve credit risk assessments – both for lending to consumers and to SMEs.

There is a further important strand to open banking that should help regional financial institutions: financial education. Open banking is, fundamentally, about breaking up data silos to let innovation blossom. Innovators can use the data to develop new services and new approaches to finance that enhance the essential services that only banks provide. Indeed, the Saudi Central Bank says that the “most prominent” objective of open banking is “educating individuals and inspiring them to develop their knowledge and skills in the fintech field”.

Those new services will also be available to everyone – including those SMEs and consumers who may not currently feel that they need, or can afford, banking services. Again, that has the potential to boost regional banks.

There are several reasons why open banking is a game-changer for banks as well as fintechs. First, digital channels are cheaper for banks to support than physical branches. Second, a bigger range of fintech apps can help banks offer new services that support the financially excluded, such as educational and budgeting apps. Third, once people become part of the formal financial system, they can start to save, and to borrow from banks to invest, in a way that creates a positive economic cycle.

And there is plenty of inclusion work for banks to do. For example, the MENA region overall has a relatively high proportion of unbanked adults – just shy of 50 per cent, according to the World Bank. There is also a relatively low use of digital payments at around 40 per cent. Clearly, those statistics vary greatly from country to country. The UAE Banks

“THE IDEA BEHIND OPEN BANKING IS THAT THIRD-PARTY FINANCIAL FIRMS – BOTH BANKS AND FINTECHS – WILL BE ABLE TO MINE THE SHARED DATA TO OFFER CUSTOMERS CHEAP, PERSONALISED AND INNOVATIVE SERVICES. EXAMPLES INCLUDE ACCOUNT TO ACCOUNT PAYMENTS THAT HAVE NO NEED FOR CARD INTERMEDIARIES”

DOUBLING IN THE USE OF DIGITAL CHANNELS

OPEN BANKING –AND INNOVATIVE FINTECH – CAN HELP BANKS SUPPORT AND INCLUDE EVERYONE

Federation, for example, recently announced that it has seen a doubling in the use of digital channels. The essential point, though, is that open banking –and innovative fintech – can help banks support and include everyone.

Regulators in the region have already given the green light to new fintechs that promise to expand the formal financial system and increase financial capability. One example is Tamam, a Shariah-compliant digital microfinance firm in Saudi Arabia, which is a subsidiary of the telecom company Zain, and which came out of the central bank’s regulatory sandbox. Another is Hakbah, a Saudi-based fintech savings club – which has just raised its first round of institutional capital – and aims to digitise the rotating savings and credit association market in Saudi Arabia and in the wider region. Hakbah, too, is a sandbox alumnus.

As consumers and SMEs see the benefits of such apps, the amount of financial data available online will only grow – further boosting the benefits of open banking. Yes, regional banks will be sharing data that, previously, only they could use. But open banking can increase financial inclusion, financial knowledge and financial innovation – all of which will mean more demand for bank services – and increased economic growth.

As the year progresses, emerging economies led by India are expected to grow at 3.9 per cent, with the Middle East, Central Asia and Sub Saharan Africa expected to grow at an average of 3.3 per cent

The year 2023 has brought in a whole lot of surprises for the markets. It started with heightened anxiety about further market price action and the inflation trajectory. As the year has progressed, we’ve seen market complacency dominate the overall high inflation rhetoric.

The recent so tening in US inflation numbers has supported the expectations of the peak in inflation and the corresponding prime lending rates. Although some might still argue about the over-optimistic frontrunning of the interest rate expectations, the recent data points to a probable so tening in the overall global economic activity.

With the disappointment of the much-anticipated China reopening of trade, markets have come to their senses regarding the limits of the hypergrowth fuelled narrative.

“REGULATORS IN THE REGION HAVE ALREADY GIVEN THE GREEN LIGHT TO NEW FINTECHS THAT PROMISE TO EXPAND THE FORMAL FINANCIAL SYSTEM AND INCREASE FINANCIAL CAPABILITY”

The service sector remains bright in the otherwise faltering economic growth outlook. As seen from the chart above, there is a growing disconnect between the two sectors.

While manufacturers across the globe have pointed out persistent price pressures on account of past inflation, service sector firms are somewhat at ease and looking beyond the current high inflation prints.

Factually, wage increases in major developed economies, including US, Germany and Japan, have helped defend against the onslaught of high inflation. The global economy, however, runs a high risk of another round of spike in goods inflation.

The US core inflation numbers are still near the 5 per cent mark and seem stickier. Similar is the case for the EU as well as the UK. The goods inflation spike will further complicate the ongoing market narrative. If history is any guide, goods inflation has typically been closely linked to energy commodity prices.

This is a sign of caution as the current profile of energy prices suggests we are not yet out of the woods to counter the overall inflation threat.

The one central narrative currently in play is the vast disconnect between the prospective economic conditions and the equity market’s performance. Based on leading economic indicators, we are at the onset of a slowdown. Ironically, markets seem more focused on the anticipated rate cuts amidst a probable slowdown/recessionary cycle. The artificial intelligence (AI)-fuelled rally in US tech stocks is enjoying its momentum trade for now. This has generally propped up the overall equity markets investment sentiment.

The latest Germany and Eurozone GDP data saw both economies slipping into technical recession territory. Whether or not the global economies slip into recession, some moderation in overall growth is expected. In its latest forecasts, IMF now sees the global GDP slipping to the 2.8 per cent range for this year, below the 2022 advance estimates of 3.4 per cent.

Interestingly, advanced economies are likely to lead the overall decline, with the GDP dropping to 1.3 per cent this year, below the 2022 number of 2.7 per cent. Emerging economies led by India are expected

to grow at 3.9 per cent. Middle East, Central Asia and Sub Sahara Africa are expected to grow an average of 3.3 per cent for 2023 (see table above).

Amongst GCC nations, the UAE is expected to be the bright spot over the next 18 months. The nation’s diversification plans and rational changes in the core business and social laws are boosting the nation’s growth prospects to much extent.

Eurozone, too late to start with the interest rate hike cycle, is now eyeing year-end terminal rates at 4 per cent. The UK is the worst a ected by the ongoing inflation spike as the central bank is expected to fight a big battle against inflation. For the UK, markets are eyeing 125 basis points plus rate hikes by the year end.

Interest rate trajectory: The latest statements from US Fed Chair Jerome Powell suggest an even higher rise in the US interest rate. This comes even as markets expect the Federal Open Market Committee to hold the current rate longer.

While the Fed has been the most aggressive in raising interest rates, the inflation gauges being tracked by it are still 2x of the current inflation target of 2 per cent.

Major emerging market economies India and China are sitting in a comfortable position with the overall downtrend in inflationary trends. China, in fact, just announced a cut to its base prime lending rates in June.

US tech likely to hold onto the momentum led by AI boom: Investors have already frontloaded the rise

Dubai equity markets: Gains to continue for the year Stellar gains in banking and utility names have supported the rise in Dubai’s benchmark equity index. The emirate is enjoying tailwinds from its vivid and robust economic model that has served to equally cater to all classes and masses. Dubai equities are expected to continue their momentum gains for the remainder of the year.

of AI and the peak in US interest and inflation rates. This has come in the form of sky-high valuations in the top mega-cap names. We could see some profit booking in these names with the valuations so high. However, the price correction, should it happen, could be short-lived.

The hunt for excess returns post-Covid era has become a new norm. Legacy names in this category, including cryptos and tech, will garner much of the market attention.

US and EU long-term bond futures could ride the wave of dovish hold: The short-term interest rates in the US and EU remain elevated, thereby pressuring the long end of the curve.

With inversion now the new norm, watch out for a complete dovish hold by US and EU. Should this event coincide with a US recession, demand for longduration bonds could likely increase.

Gold and energy: Gold rates have undergone a correction from its triple-top resistance zone of $2,050 - $2,100. The ongoing bearish consolidation pattern in the precious metal suggests a further downside play. Much of the euphoria surrounding the previous gold rally has evaporated. Two major tailwind factors, including physical central bank buying and upside consolidation in the euro, have lost much of their impact on gold prices.

Manchester City’s midfielder Ilkay Gundogan (C) lifts the trophy, as they celebrate after winning the UEFA Champions League final against Inter Milan at the Ataturk Olympic Stadium in Istanbul on June 10. Manchester City FC rounded off a spectacular season by winning the UEFA Champions League. The football club beat Inter Milan to lift the trophy for the first time. The 2022-23 season was the club’s most successful, as it swept the Premier League.

EFG HOLDING’S NEW SLOGAN ‘REALIZE MORE’ REFLECTS THE COMPANY’S GROWTH STRATEGY INTO A FUTUREFORWARD FINANCIAL INSTITUTION THAT SERVES PEOPLE OF ALL INCOME LEVELS AND COMPANIES OF ALL SIZES THROUGH THE EXPERTISE OF ITS MORE THAN 7,100 EMPLOYEES AND DIVERSE OFFERINGS

FG Holding has earned a coveted spot among global fi nancial heavyweights, having participated in 10 initial public o erings (IPOs) worth a whopping $12.7bn in 2022. More recently, the group took another significant step, successfully unveiling a new brand identity from EFG Hermes to EFG Holding.

The transformation is another strategic move to cement its influence across frontier and emerging markets (FEM). Today, the company has established three verticals: EFG Hermes, the investment bank; EFG Finance, the non-bank financial institutions (NBFI) platform and aiBANK, the commercial bank.

“It’s the optimal time to transform our brand to capture the breadth and magnitude of our product and service universe as well as reflect the resilience of our growth strategy,” Karim Awad, group CEO of EFG Holding, said at the time of rebranding in May.

Awad is the man setting the tone for the company’s transformation journey. Since taking the helm in 2013, EFG Holding has evolved into a trailblazing financial institution with a universal bank in Egypt and the leading investment bank franchise in FEM.

The company has grown substantially across four decades, driven by organic growth, innovation, mergers and acquisitions, and market dominance.

With a footprint spanning 12 countries across four continents and capital base of $0.8bn (EGP25.1bn), Awad’s vision for the group is to be the preferred financial services partner for its clients, consistently o ering them the best-in-class, end-to-end financial services.

“This is something that we will hopefully start within our core market and then expand to the other markets we are currently present in,” Awad reveals.

Though the group has faced its fair share of challenges in its core market over the years, Awad is highly bullish about Egypt’s medium-to-long-term prospects, whether in capital markets or non-bank financial services.

“We invested EGP2.55bn of our capital in a commercial bank in Egypt in 2021 because we believed in the country’s future prospects even in challenging times a ter Covid-19.”

EFG Holding has grown from strength to strength under Awad’s stewardship, having started as a pure-play investment bank, providing corporate advisory services, securities brokerage, research, asset management and private equity in Egypt, and then moved into other markets while expanding its product and service o ering to include nonbanking financial services and a commercial bank.

The group stepped up the gears nearly two years a ter Awad assumed the reins. It launched its NBFI platform in 2015 and acquired its microfinance player, Tanmeyah, a year later.

“The group started taking a slightly di erent strategy in 2015

when we established our NBFI platform and then towards the end of 2021 when we partially acquired the commercial bank,” says Awad. “So, with the massive changes the group has gone through, we have outgrown beyond an investment bank model.”

To spearhead its transformation and re-direct resources towards this goal, EFG Holding decided to exit non-core assets, including divesting its majority stake in the Lebanese bank, Crédit Libanais, in 2016 – a move that marked a significant pivot in its business and operations.

In December 2017, the group founded valU, which started as a buy now, pay later (BNPL) fintech platform and grew over the years to become a holistic lifestyleenabling solution, the Middle East region’s first platform of its kind, o ering convenient payment options to a wide network of retail, e-commerce and small-to-medium enterprises across a diverse array of categories, including home appliances, electronics, healthcare and education.

Furthermore, the group acquired a 51 per cent stake in aiBANK in November 2021, marking a strategic entry into Egypt’s dynamic commercial banking sector and transforming into a universal bank with a FEM-focused investment bank, commercial bank and successful NBFI platform. Owning a commercial bank in its home market

EFG HOLDING HAS A CURRENT FOOTPRINT SPANNING 12 COUNTRIES ACROSS FOUR CONTINENTS AND CAPITAL BASE OF

$0.8BN (EGP25.1BN)

Awad’s vision for the group is to be the preferred financial services partner for its clients, consistently o ering them the best-in-class, end-toend financial services

means EFG Holding has created a business model that can provide its Egyptian clients with a comprehensive platform for financial services and withstand the volatility in the capital markets EFG Holding operates in.

While headquartered in Egypt, EFG Holding’s new slogan, ‘Realize More’ reflects the company’s growth strategy into a future-forward financial institution that serves people of all income levels and companies of all sizes through the expertise of its more than 7,100 employees and diverse o erings.

“The investment bank will continue to be core to our operations and will take a lot of our focus and bandwidth going forward,” reveals Awad. “But we also felt that our other businesses and their additions, and the synergies they have created for the company need to be showcased more clearly to the market,” he says, explaining the rationale behind the rebranding and new slogan.

True to his word, EFG Holding’s business model has significantly evolved over the years and the goal is to o er a full suite of financial services across the group’s diversified client base while creating value for the shareholders. At home, the group is driving financial inclusion and digital transformation strategy. It o ers its clients lifestyle-enabling fintech solution (valU), microfinance (Tanmeyah), leasing and factoring (EFG Corp-Solutions), insurance (Kaf Insurance), e-payments (PayTabs Egypt) and mortgage finance (Bedaya).

“To give you an idea of our portfolio in Egypt, we provide investment banking, asset management, private equity, research securities brokerage services and clients can trade through our online trading platform, EFG Hermes One. You can get a mortgage with Bedaya, access insurance services through Kaf Insurance, make purchases and pay for them later over time, save, invest,

get instant cash redemptions with valU and utilise commercial banking services of aiBANK,” says Awad.

As he continues full steam ahead with his expansion plans, Awad says the group will be on the constant lookout for new value-added products and services to diversify its o erings. “SME lending in Egypt is an interesting field for us, and we are currently studying other interesting securities brokerage products,” he reveals.

There is a structured products desk that the group added several years ago, and it is currently o ering the group’s client base new products to invest in, in addition to pure equities, he adds.

We provide investment banking, asset management, private equity, research securities brokerage services and clients can trade through our online trading platform, EFG Hermes One. You can get a mortgage with Bedaya, access insurance services through Kaf Insurance, make purchases and pay for them later over time, save, invest, get instant cash redemptions with valU and utilise commercial banking services of aiBANK”

THE GROUP ACQUIRED A 51 PER CENT STAKE IN AIBANK IN NOVEMBER 2021

Geographically, Awad says: “EFG Hermes is looking to boost its operations and presence in the UAE and Saudi Arabia, which are markets that continue to be of extreme focus for us going forward.”

“Saudi Arabia is a market we intend to double down on, whether in terms of further investments or moving more human resources over there,” he adds. Awad believes in the long-term prospects of the Saudi market and he feels that EFG Hermes is well-positioned to leverage the country’s economic transformation under Vision 2030.

Awad adds: “The UAE has performed super well over the years and we believe that the country’s leadership continues to provide opportunities for capital markets to grow, whether in Abu Dhabi or Dubai.”

EFG Hermes is one of the first foreign-licensed banks to participate in the Emirates’ capital markets, having set up operations in Dubai in 2002. It was licensed by the Dubai Financial Services Authority as an authorised firm in the Dubai International Financial Centre in 2005.

Over the years, EFG Holding has made the headlines

for all good reasons, as Awad is ushering the group on a transformational journey like no other. The group’s investment bank (EFG Hermes) entered 2023 on a stronger footing, having closed four historical IPOs, including the $2.5bn IPO of ADNOC Gas, the $244m public o ering of Oman’s Abraj Energy services on Muscat Stock Exchange, Al Ansari Exchange’s $210.5m o ering on the Dubai Financial Market and the $769m listing of ADNOC L&S last month.

“We pride ourselves on being our clients’ preferred partner; when we perform business for a client, they usually come back to us again on future deals,” Awad notes while stressing that this is evident in a variety of transactions that EFG Hermes has closed in the region involving recurring clients.

The year 2023 continues to have a promising IPO pipeline, thanks to several capital markets initiatives implemented across the region and the group CEO believes the best is yet to come.

“Whether it is on IPOs, mergers and acquisitions or debt capital markets, the idea is we stay very close to our core clients going forward,” he pledges.

On the other side of the business, EFG Hermes concluded advisory on Premium International for Credit Services’ EGP193.7m securitised bond o ering in March and Hermes Securities Brokerage’s EGP250m senior unsecured short-term note in April.

The company defied growing inflationary pressures and currency devaluation in Egypt, more than doubling its bottom line in Q1 2023. Its revenues surged by 129 per cent year-on-year (YoY) amounting to EGP4.5bn, driven by the investment bank and commercial bank verticals as well as growth in treasury operations.

EFG Holding’s net profit a ter tax and minority interest soared 157 per cent YoY amounting to EGP885m during the same period under review while net operating profit rose by 99 per cent to reach EGP 1.5bn.

Despite an impressive first quarter, Awad says EFG Holding continues to be bullish about business prospects

The UAE has performed super well over the years and we believe that the country’s leadership continues to provide opportunities for capital markets to grow, whether in Abu Dhabi or Dubai"

• IN DECEMBER 2017, THE GROUP FOUNDED VALU, WHICH STARTED AS A BNPL FINTECH PLATFORM AND HAS EVOLVED INTO A HOLISTIC LIFESTYLEENABLING SOLUTION

• VALU OFFERS CONVENIENT AND CUSTOMISABLE FINANCING SOLUTIONS FOR UP TO 60 MONTHS, VIA 5,000 POINTS OF SALE AND OVER 700 WEBSITES AND APPS.

• MORE ONE MILLION TRANSACTIONS WERE COMPLETED THROUGH THE APP DURING FY2022

In today’s digital-first world, institutions should be remodelling their approaches to succeed. EFG Holding has allocated substantial capital expenditures towards innovating its digital o erings to quickly bring new products to the market.

“We are continuously focusing on improving our tech capabilities across our entire portfolio and o ering intuitive and seamless products and services to our clients,” Awad reveals.

EGP4.5BN

• EFG HOLDING'S REVENUES SURGED BY 129 PER CENT YOY DRIVEN BY THE INVESTMENT BANK, COMMERCIAL BANK VERTICALS AND GROWTH IN TREASURY OPERATIONS

and its profitability to boost shareholder value. The group seeks to position itself among the top five players in the markets it operates in and the products and services universe it o ers.

Awad says the group plans to expand into other markets to grow the business’s profit responsibly, “which is our core belief and something that we take very seriously". Hence, EFG Hermes is the first Egyptian financial services corporation that signed the United Nations Principles for Responsible Investment.

EFG Holding is significantly investing in valU, a leading lifestyle-enabling fintech platform, while incorporating more value-added services into its microfinance business. The company’s BNPL platform o ers convenient and customisable financing solutions for up to 60 months, via 5,000 points of sale and over 700 websites and apps, and has financed 568,000 customers and completed over one million transactions through the app during FY2022. “valU is one of the brands that EFG Holding created over the past few years and we are pleased with its development, having started as a small idea in 2017,” observes Awad.

The platform has forged a series of partnerships with prominent players including Amazon, Samsung, IKEA Majid Al Futtaim, Carrefour, Azadea, Noon, and Jumia, as well as multi-brand automotive dealer ELTarek Automotive as well as.

In January, valU also unveiled its direct selling and delivery service through WhatsApp to enhance the customer experience and simplify the customers’ digital journey by providing seamless access to all information at their fingertips.

The lifestyle-enabling fintech platform has done exceptionally well in Egypt, paving the way for other fintech startups that were founded a ter its launch.

Awad believes that valU is ready to expand into other markets. However, the timing is something that will be considered.

“Today, valU has grown exponentially as a lifestyle-enabling fintech powerhouse with access to industry-leading retailers in the Egyptian market. The platform has expanded its products and services portfolio to o er investment products, an instant cash redemption program, and savings solutions through the AZ valU fund, Sha2labaz, and Akeed, respectively,” says Awad.

On the brokerage front, EFG Hermes has partnered with Microso t to launch its Direct Market Access platform on Azure. The platform enables clients to capitalize on compelling trading prospects swi tly and seamlessly by streamlining the process of taking bids.

Powered with the new transformation strategy, EFG Holding seeks to ‘Realize More’ of its goal to build an ecosystem of businesses that work seamlessly together to provide clients with end-to-end financial solutions while positively impacting societies, economies, and the environment.

IN JANUARY, VALU UNVEILED ITS DIRECT SELLING AND DELIVERY SERVICE THROUGH WHATSAPP TO ENHANCE CUSTOMER EXPERIENCE AND SIMPLIFY THE CUSTOMERS’ DIGITAL JOURNEY BY PROVIDING SEAMLESS ACCESS TO INFORMATION AT THEIR FINGERTIPS

We pride ourselves on being our clients’ preferred partner; when we perform business for a client, they usually come back to us again on future deals"

Talal Moafaq Al Gaddah, senior executive vice chairman of MAG, shines the spotlight on the group’s new and exclusive development, Keturah Reserve, and shares the positive impact that bio living can have on the physical, mental and emotional health of residents

Sustainability-themed trends are transforming the real estate sector, driven by evolving investor preferences, technological advancements, shifting demographics and the growing imperative to respond to climate change.

Dubai is seeing an increase in sustainable and eco-friendly developments, catalysed by initiatives such as the Dubai Land Department’s efforts to enhance transparency, visa reforms and robust economic growth. The climate-focused COP28 conference, which is taking place in the emirate later this year, is further accelerating this momentum.

In today’s market, consumers are more inclined towards developers who adhere to global sustainability standards and integrate eco-friendly features in their projects. This trend necessitates that we, as responsible developers, demonstrate our commitment to sustainable

practices. This entails the creation of lowcarbon, resilient buildings that leverage sustainable elements such as solar panels and energy-efficient appliances.

Building upon these narratives, at MAG, we have cultivated an understanding that we must lead and embrace change with the ongoing evolution of sustainability trends in the real estate sector. This enabled us to redefine the future of real estate in Dubai: it is not just about creating physical spaces but about providing unique, transformational living experiences.

In response, we introduced ‘Keturah,’ an innovative concept that harmoniously blends luxury, wellbeing, real estate and hospitality to revolutionise living standards in Dubai’s real estate sector.

Keturah Reserve is more than a concept; it is a meticulously designed ecosystem promoting healthier living and inspiring lifestyle transformations. Keturah embodies the perfect fusion of sustainability and luxury living through energy-efficient

designs, sustainable building materials, comprehensive wellness amenities and superior hospitality services.

This commitment to innovative and sustainable living solutions reinforces our position as an industry leader in tune with the evolving needs and aspirations of contemporary real estate investors and well-learned residents. As sustainability plays a pivotal force in the real estate market, we foresee our projects becoming benchmarks, setting a new precedent for sustainable, healthy and inspiring living spaces across the UAE and beyond.

Dubai’s real estate sector has shown a deep commitment to sustainability, incorporating it as a core element in its decision-making processes. The foundation for this strategic shift was laid with the introduction of the ‘Green Building Regulations and Specifications’ in 2011. This embrace of sustainability also extends

to the emirate’s long-term strategic goals. For example, Dubai Vision 2021 outlined certain KPIs toward transforming itself into a sustainable urban environment, with ambitious targets like sourcing 75 per cent of its total power output from clean energy by 2050, which underscores Dubai’s intent to embed sustainability in its infrastructure and real estate developments, signifying a tangible shift towards eco-conscious decision-making.

Alongside sustainability, technological innovation has also been at the forefront of Dubai’s real estate sector evolution. The sector has quickly adopted new technologies to enhance transparency, efficiency, and customer experience. A prime example is the real estate self-transaction platform (REST) by the Dubai Land Department.

The REST platform facilitates secure and efficient property transactions. This broadens investor participation in Dubai’s real estate market by providing an additional, flexible payment option, which exemplifies digital transformation. This has led us to forge a strategic partnership with CoinMENA to accept cryptocurrency transactions through

its state-of-the-art platform, which is a strategic step for us to address current market dynamics and meet the increasing demands of our valued investors, who aim to convert their profitable gains into tangible assets using digital currency.

Tell us about Keturah Reserve’s ‘bio living’ offering. How does it enhance the living experience for residents?

As a pragmatic real estate developer, our strategic decision to develop the bioliving concept responds to the growing consumer demand for healthier, more sustainable living spaces. The concept provides a distinct selling proposition, setting us apart in this competitive market. This strategy ensures we are in sync with the broader global trend towards sustainable living and green development. Our adoption of the bioliving concept also marks a significant milestone in the real estate industry’s transition towards sustainability.

As these trends redefine the future of the real estate landscape, we foresee properties integrating such concepts gaining stronger appeal, thereby bolstering our market prominence and steering the industry forward.

Bio living is rooted in ‘biophilic’ design, architecture and interior design conceived to incorporate nature into the built environment to improve its occupants’ physical, mental and emotional health. Bio living at Keturah Reserve creates the perfect synergy between the interior design, architecture and landscape, completely respecting the surrounding ecosystem.

It is the first residential development in the Middle East to immerse

residents in nature through ‘bio living’ to improve its occupants’ physical, mental and emotional wellbeing.

Both the interiors and architecture are crafted from the same raw materials and colours to subtly merge the architecture with the surrounding desert landscape. Travertine, wood and bronze link the inside with the outside. The restrained colour palette of bleached bone, champagne and bronze further introduces the natural landscape inside the home. Lush growing nature is visible from every vista, including olive trees, palm trees, green walls, balcony planters and rooftop gardens.

Lastly, our adoption of the bio living concept marks a significant milestone in the real estate industry’s transition towards sustainability. It encourages the wider industry to adopt sustainable practices, raising the bar for future developments across Dubai.

What sets Keturah Reserve apart from other residential developments in the region?

An exclusive and innovative Dhs3bn residential development, Keturah Reserve is located in Meydan, one of Dubai’s most sought-after and exclusive residential areas.

It will feature 93 townhouses, 90 villas, 540 units across six apartment block buildings, and eight penthouse apartments. The project is the first residential development in the Middle East to immerse residents in nature through bio living to improve its occupants’ physical, mental and emotional wellbeing.

Keturah Reserve’s homes are angled to capture and maximise natural daylight, gently diffusing it throughout the interior without heat or glare; double-volume interior spaces increase the flow of naturally cooled air, reducing the need for air conditioning. The open-plan spaces are also designed without corridors or hallways, with custom-designed furniture and fixtures produced for each space to optimise the flow of the passage.

It is also the only residential development in Dubai with a direct nine-minute link to Downtown, with four separate exits onto the city’s main roads: Sheikh Zayed Road, Al Khail Road, Dubai Al Ain Road and Al Meydan Road.

AFTER A STRONG PERFORMANCE LAST YEAR, THE GCC REGION IS SET TO SEE MORE ACTIVITY IN ITS CAPITAL MARKETS IN THE MEDIUM TERM

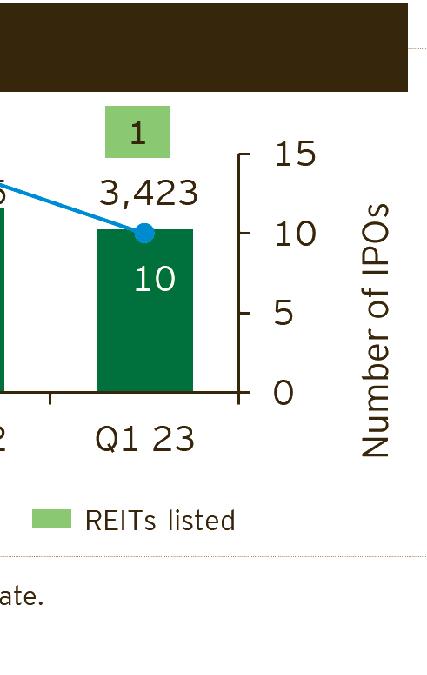

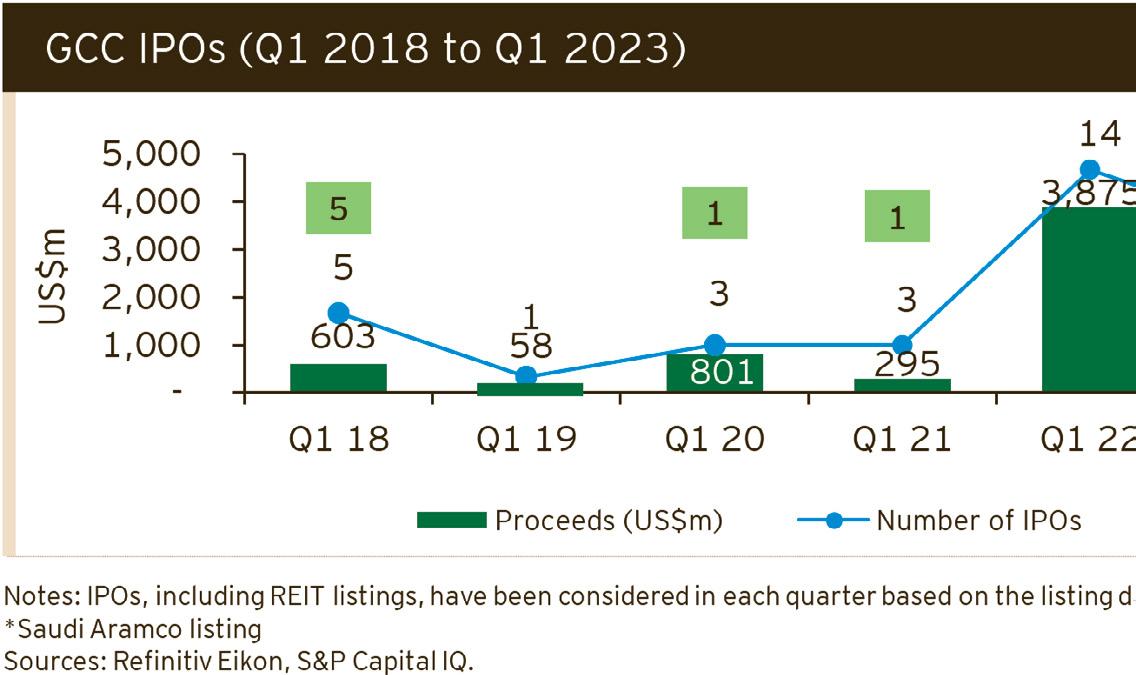

The GCC finished 2022 as one of the few bright spots in global initial public o ering (IPO) markets. This trend has continued so far this year with companies in the region raising $3.4bn from 10 o erings in Q1 2023, according to the latest data from EY. According to Kamco Invest’s projections in January, the pipeline for announced and rumoured public o erings could range between 27 and 39 companies throughout 2023. “Q1 2022 and Q1 2023 are by far the best performing quarters by IPO proceeds which the GCC has ever experienced up until now,” says Muhammad Hassan, capital markets leader at PwC Middle East.

There are a host of reasons why IPO markets in the region outperformed other geographies such as the relative resilience and immunity to global geopolitical events that drove passive index flows and index compiler weightings in favour of GCC stock exchanges.

Zahir Sabur, senior associate, Global Corporate at Reed Smith says the reforms being implemented in the UAE have had the desired e ect of increasing not only the number of listings on both the Dubai Financial Markets (DFM) and Abu Dhabi Securities Exchange (ADX), but have also raised the markets’ international profile.

“The net result is that not only has liquidity improved and domestic institutions actively pursued IPOs, but a number of our international clients are now becoming increasingly interested in a dual-listing of their securities on a UAE exchange to complement their main listing on the New York Stock Exchange, London Stock Exchange or other international markets,” says Sabur.

The GCC’s weight in the MSCI Emerging Markets Index has also increased from 1.6 per cent in 2016 to 7.7 per cent in 2022, driven by several capital markets reforms such as IPOs, privatisation and increasing foreign ownership limits.

“There are many positives in the region that will continue to support investor confidence – Saudi Arabia is a key driving force with so much investment taking place, but we are also seeing encouraging signs of additional capital markets activity in other parts of the region,” says Gregory Hughes, EY MENA IPO and Transaction Diligence leader.

Overall, there are signs of growing optimism in the second half of the year and the number of companies that plan to list in 2023 reflects investor confidence in GCC stock markets. GCC economies continue to be resilient to elevated macroeconomic risks as high oil prices, investor inflows and strong demand for share sales have resulted in an IPO boom. “While we expect the trajectory of

interest rate hikes, geopolitical tensions and secondary stock market volatility and oil price volatility to continue to remain risks in 2023, it is worth noting that the prevalence of these factors did not stop strong IPO activity in 2022,” Kamco Invest stated in a report.

The GCC’s stock markets have carried on strongly thus far with a significant amount of IPO activity against a background of diminishing activities in global capital markets to generate the secondhighest H1 proceeds since 2015.

Industry experts say investors in the region consider shares of well-known companies, especially state-backed, as an excellent way to diversify their investments from real estate – a sector that is hugely subject to swings in demand and supply, and bank deposits that yield low returns.

ADNOC Group’s maritime logistics unit soared more than 50 per cent on its trading debut in Abu Dhabi earlier in June a ter its $769m IPO drew overwhelming investor demand, with $125bn in overall orders.

Sabur says certain listings on GCC markets appear to have been undervalued by the bookrunners and o ten IPOs

have been oversubscribed, all of which point to real confidence in the markets.

ADNOC L&S listing is the latest in a string of IPOs that ADNOC has carried out over the years as state-backed entities are stepping up e orts to boost domestic equity markets while helping governments to diversify their economies away from reliance on oil revenues.

The energy group raised $2.5bn from the listing of its gas business, ADNOC Gas, in March. The deal stood out for the region with the highest proceeds globally for the first quarter of the year. Abu Dhabi is set to welcome eight more listings this year a ter ADNOC pulled o the world’s biggest listing so far in 2023.

Similarly, Al Ansari Financial Services’ o ering on the DFM, the emirate’s first in 2023, demonstrated the continued appetite for GCC IPOs at a time when recession concerns, inflation and high interest rates have damped investor sentiment in the global market. Al Ansari sold 750 million shares in the o ering, equivalent to 10 per cent of the company’s paid-up capital, to raise $210m.

PwC also noted that the UAE market has been particularly active, accounting for over 90 per cent of the GCC IPO proceeds ($3bn) from two IPOs in the first quarter while Saudi Arabia dominated in terms of volume.

Saudi Arabia’s generic drugmaker Jamjoom Pharma raised $336m in May ahead of its trading debut in Riyadh in what is set to be the kingdom’s biggest IPO for the year. Another Saudi company, First Milling Company’s $266m IPO received bids worth SAR68.8bn from investors, about 69 times more than was available to them amid a boom in the kingdom’s share o erings. Saudi Arabia’s Morabaha Financing Company also plans to raise $83.4m from the sale of a 30 per cent stake or 21.4 million shares via IPO. Meanwhile, the $244m

A NUMBER OF OUR INTERNATIONAL CLIENTS ARE NOW BECOMING INCREASINGLY INTERESTED IN A DUAL-LISTING OF THEIR SECURITIES ON A UAE EXCHANGE TO COMPLEMENT THEIR MAIN LISTING ON THE NEW YORK STOCK EXCHANGE, LONDON STOCK EXCHANGE OR OTHER INTERNATIONAL MARKETS”

IPO of Abraj Energy Services is the largest listing on the Muscat Stock Exchange (MSX) since 2010. PwC said the listing of Abraj Energy is a manifestation of the Oman Investment Authority’s initiatives that are aimed at encouraging IPO activities on the local exchange by privatising government investments.

“Whilst historically there may have been a view that the Gulf region was not a mature economic jurisdiction, the past few years of positive growth and returns on regionally-listed securities has led to more institutional money finding its way to the GCC,” adds Sabur.

The GCC will continue to generate interest for its strong, distinctive businesses and family o ce listings from international investors, given their competitive positioning and established reach in the market.

The Gulf region is experiencing a favourable climate for IPO issuances, and indications point to this trend continuing in the medium term, as the implementation of capital markets reforms stimulate listing activity are starting to yield results.

“The outlook remains positive for IPOs in the MENA region,” Hughes says, adding that there are multiple transactions that will likely convert in the next 12 to 24 months with listings in various geographies across sectors and of varying shapes and sizes.

Qatar’s $275m market-maker programme is the latest in a string of initiatives that are being implemented

across the Gulf region to support private and state-owned entities on their path to IPO. Qatar’s initiative will run over the next five years and the country’s wealth fund said it o ers an economic incentive by way of a rebate to lower trading costs for established market makers.

Qatar Stock Exchange is working to increase listings and introduce more exchange-traded funds and derivatives as the stock market is preparing to welcome its first public o ering in almost three years. The exchange missed out on a listing frenzy that made the GCC an IPO oasis in a desert of dried-up deals.

Saudi Exchange, ADX and DFM have unveiled an array of initiatives including flexibility on the minimum stake size required for share sales and promised to reduce or wave o listing fees in a bid to encourage more domestic listings.

“Generally, we have seen more appetite internationally for secondary listings to take place on either ADX or DFM, as opposed to markets in the rest of the

GCC,” Sabur says, adding that with Saudi Arabia’s ambition for the Tadawul to be amongst the top exchanges in the world, they would anticipate further government-led promotion of the Saudi Exchange.

Abu Dhabi launched a $1.4bn IPO fund in October 2021 to incentivise private companies to list on the ADX. The IPO fund will be reportedly overseen by the Supreme Council for Financial and Economic Affairs, managed by the Abu Dhabi Department of Economic Development and it will invest in five to ten private companies per year. The exchange also reduced trading commissions by 50 per cent and extended trading hours by one hour to enhance market liquidity and attract foreign investors. The Abu Dhabi exchange is expanding partnerships with other exchanges and increasing its institutional investor base through Tabadul Hub, a platform that currently counts Bahrain Bourse, Astana International Exchange and MSX among its members.

Dubai approved the establishment of a $545m market-maker fund in November 2021. The emirate also launched a Dhs1bn fund to encourage tech companies to list on DFM. The Dubai government listed five of the 10 committed government and state-owned companies in 2022. PwC said Dubai’s D33 Economic Agenda will likely lead to additional capital raising activities.

“We expect the privatisation of stateowned assets to continue – for instance, six of Dubai’s planned state-owned listings as announced in November 2021 are yet to take place,” adds Hassan.

Hassan also expects the recent IPOs of private businesses in the UAE and Saudi Arabia to accelerate the listing of non-state-owned entities and family businesses, driven by the recent highprofile events in the region, such as the Expo 2020 and the FIFA World Cup, which helped bring global investors’ attention to the region. For the time being, the GCC pipeline looks positive with several companies announcing their intention to go public. Governments and private companies are also keen to sell equity while there is strong interest in the region.

WE EXPECT THE PRIVATISATION OF STATE-OWNED ASSETS TO CONTINUE – FOR INSTANCE, SIX OF DUBAI’S PLANNED STATE-OWNED LISTINGS AS ANNOUNCED IN NOVEMBER 2021 ARE YET TO TAKE PLACE”

WE EXPLORE HOW THE MIDDLE EAST REGION IS EMBRACING ESPORTS AND GAMING AS A SIGNIFICANT CULTURAL AND ECONOMIC FORCE

WORDS DIVSHA BHAT

OVER THE PAST DECADE, the Middle East has witnessed a remarkable surge in the growth of esports and gaming, transforming the region into a thriving hub. This burgeoning industry has captivated the region’s youth, attracting both players and spectators, and has garnered significant attention from investors, sponsors and organisations alike.