MOST POWERFUL ARABS 2023 100

P.24 FUNDING THE FUTURE: Gulf sovereign investors are playing a bigger role than ever before in the global market

P.68 25 YEARS ON... How homegrown consultancy firm Ròya International has carved a niche for itself in the region’s hospitality industry

FROM ESTABLISHED ICONS TO NEW ENTRANTS, WE PRESENT OUR FLAGSHIP ANNUAL LIST OF THE WORLD’S MOST PROMINENT AND INSPIRING ARAB PERSONALITIES

gulfbusiness.com / APRIL 2023 BD 2.10 KD 1.70 RO 2.10 SR 20 DHS 20

BY AUDEMARS PIGUET STARWHEEL

BY AUDEMARS PIGUET STARWHEEL

11.59

CODE

SEEK BEYOND

Gulf Business

An insight into the news and trends shaping the region with perceptive commentary and analysis

24

The rise and rise of GCC sovereign wealth funds

The region’s SWFs are eyeing opportunities amid global tumult, fuelled by petrodollar surpluses a ter oil prices last year reached record highs

27

100 Most Powerful Arabs 2023

Our annual list of the world’s most influential and prominent Arab men and women revealed

gulfbusiness.com 4 April 2023

06 The brief

59 Lifestyle

Watch and earn: Rise

Studio CEO Amanda Turnbull on why local content is king p.60

Glocal appeal: Gaurav Bhushan of Ennismore shares its expansion plans for the region p.63

Man on a mission: Ròya

International’s Ahmed Ramdan on hospitality trends in the GCC p.68

71

The SME Story

Interviews with entrepreneurs and insights from experts on how the regional SME ecosystem is evolving

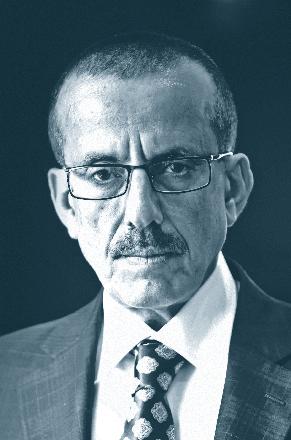

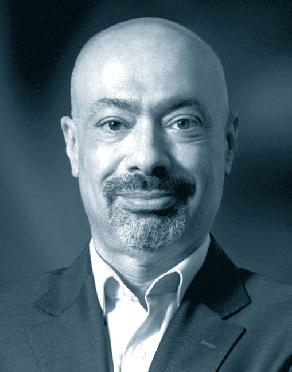

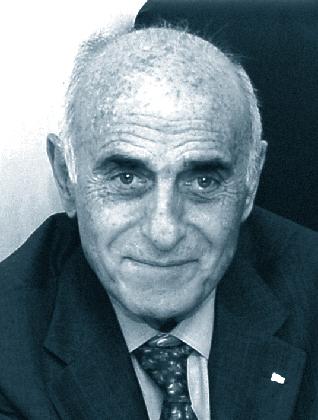

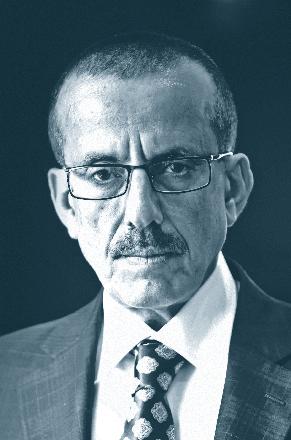

Editor-in-chief Obaid Humaid Al Tayer

Managing partner and group editor Ian Fairservice

Chief commercial officer Anthony Milne anthony@motivate.ae

Editor Neesha Salian neesha.salian@motivate.ae

Tech editor Divsha Bhat divsha.bhat@motivate.ae

Senior feature writer Kudakwashe Muzoriwa Kudakwashe.Muzoriwa@motivate.ae

Contributing editors Nusrat Ali and Zainab Mansoor

Senior art director Olga Petroff olga.petroff@motivate.ae

Art director Freddie N. Colinares freddie@motivate.ae

Cover: Freddie N Colinares

General manager – production S Sunil Kumar

Production manager Binu Purandaran

Production supervisor Venita Pinto

Digital sales director Gurjeet Kaur Gurjeet.Kaur@motivate.ae

Sales executive Sonam Sharma sonam.sharma@motivate.ae

Group marketing manager Joelle AlBeaino

joelle.albeaino@motivate.ae

gulfbusiness.com April 2023 5

“With the launch of the Dubai Economic Agenda D33, we work together as one team to achieve our leader’s vision for Dubai to be a top performing city in all sectors.”

Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of the Dubai Executive Council

HEAD OFFICE: Media One Tower, Dubai Media City, PO Box 2331, Dubai, UAE, Tel: +971 4 427 3000, Fax: +971 4 428 2260, motivate@motivate.ae DUBAI MEDIA CITY: SD 2-94, 2nd Floor, Building 2, Dubai, UAE, Tel: +971 4 390 3550, Fax: +971 4 390 4845 ABU DHABI: PO Box 43072, UAE, Tel: +971 2 677 2005, Fax: +971 2 677 0124, motivate-adh@motivate.ae LONDON: Acre House, 11/15 William Road, London NW1 3ER, UK, motivateuk@motivate.ae Follow us on social media: Linkedin: Gulf Business Facebook: GulfBusiness Twitter: @GulfBusiness Instagram: @GulfBusiness

CONTENTS / APRIL 2023

gulfbusiness.com 6 April 2023 Climate Change 07 Productivity 08 Alan’s Corner 11 Venture Capital 14 Alternative Assets 16 APR Global brands need a glocal strategy Is your company looking to expand to new markets? These vital factors should be evaluated and considered before you make the move p.09 23 The Brief THE RESURGENCE OF THE NON-OIL ECONOMY Source: PWC / Global Source Partners based on data from national statistical agencies While 2022 was the ‘year of oil’, the recovery of the non-oil economy was one of the good news stories of the year -4.8% -0.2% 3.5% 4.0% 9.4% 5.2% 6.3% -1.9% Oil and gas Non-oil private sector SAUDI ARABIA UAE QATAR BAHRAIN Change (by %) in real GDP in the four quarters to 2022 Q1 vs 2020 Q1

Air and now

It’s no secret that air pollution is a serious problem facing the world today. Just how serious? A new study on global daily levels of air pollution shows that hardly anywhere on Earth is safe from unhealthy air.

About 99.82 per cent of the global land area is exposed to levels of particulate matter 2.5 (PM2.5) –tiny particles in the air that scientists have linked to lung cancer and heart disease – above the safety limit recommended by the Word Health Organization, according to the peer-reviewed study published Monday in Lancet Planetary Health. And only 0.001 per cent of the world’s population breathes in air that is considered acceptable, the paper says.

Conducted by scientists in Australia and China, the study found that on the global level, more than 70 per cent of days in 2019 had daily PM2.5 concentrations exceeding 15 microgrammes of gaseous pollutant per cubic metre – the WHO recommended daily limit. Air quality is particularly worrisome in regions such as southern Asia and eastern Asia, where more than 90 per cent of days had PM2.5 concentrations above the 15 microgramme threshold.

While any amount of PM2.5 is harmful, scientists and regulators are typically less concerned about daily levels than they are about chronic exposure.

“I hope our study can change the minds of scientists and policymakers for the daily PM2.5 exposure,” says Yuming Guo, the lead researcher and an environmental health professor at Monash University. “Short-term exposure, particularly

sudden increase, to PM2.5 has significant health problems … If we can make every day with clean air, of course the long-term exposure of air pollution would be improved.”

While scientists and public health o cials have long been at alert to the dangers — air pollution kills 6.7 million people a year, with nearly two-thirds of the premature deaths caused by fine particulate matter — quantifying the global exposure to PM2.5 was a challenge due to a lack of pollution monitoring stations.

Guo and his coauthors overcame that challenge by marrying ground-based air pollution measurements collected from more than 5,000 monitoring stations worldwide with machine learning simulations, meteorological data and geographical factors to estimate global daily PM2.5 concentrations.

ANNUAL EXPOSURE

When it came to estimating annual exposure across all regions, the researchers found that the highest concentrations occurred in eastern Asia (50 microgrammes per cubic metre), followed by southern Asia (37 microgrammes) and northern Africa (30 microgrammes). Residents of Australia and New Zealand faced the least threat from fine particulate matter, while other regions in Oceania and southern America were also among the places with the lowest annual PM2.5 concentrations.

They also examined how air pollution changed over the two decades up to 2019. For instance, most areas in Asia, northern and sub-Saharan Africa, Oceania, and Latin America and the Caribbean experienced an increase in PM2.5 concentrations over the 20 years, driven in part by intensified wildfires. Annual PM2.5 concentrations and high PM2.5 days in Europe and northern America decreased, thanks to stricter regulations. Fine particulate matter is made up of soot from vehicles, smoke and ash from wildfires and biomass cook-stove pollution, plus sulphate aerosols from power generation and desert dust.

AIR POLLUTION ACCELERATION

ABOUT 99.82%

OF THE GLOBAL LAND AREA IS EXPOSED TO LEVELS OF PARTICULATE MATTER 2.5 (PM2.5) — TINY PARTICLES IN THE AIR THAT SCIENTISTS HAVE LINKED TO LUNG CANCER AND HEART DISEASE

The article also pointed out how levels of fine particulate matter vary depending on the season, a reflection of human activities that accelerate air pollution. For instance, northeast China and north India recorded higher PM2.5 concentrations from December to February, likely linked to an increased use of fossil fuel-burning heat generators during the winter months. South American countries such as Brazil, on the other hand, had increased concentrations between August and September, probably connected to slash-and-burn cultivation in the summer.

gulfbusiness.com April 2023 7

Bloomberg The Brief / Climate Change

ILLUSTRATION: GETTY IMAGES/SONMEZ KARAKURT

Less than 1 per cent of earth has safe levels of air pollution, finds study

Hybrid Exhaustion

Corporate leaders are stretched and stressed as never before. According to data from insurance provider Bupa Global, 96 per cent of executives in the UAE experience significant levels of mental distress, and one in five report distressing signs of burnout. Their hope: hybrid work arrangements will reduce both their workload and stress levels. Such hopes, however, may be misplaced. All too o ten hybrid work is the culprit, not the cure.

HYBRID WORK IS A DOUBLE-EDGED SWORD

We must face the harsh reality. As hybrid work models have become the most dominant form of employment, it’s become obvious that they are a double-edged sword. Yes, hybrid work can lead to

more flexibility and self-determination, but it can also “lead to new forms of (self-)exploitation,” warns Erin Kelly, Professor of Work and Organization at MIT’s Sloan School of Management. “That happens, when flexibility is merely a shorthand for being available around the clock, for being constantly on demand.”

FROM DIGITAL OVERLOAD TO EXHAUSTION

Yet, being constantly on demand is the new normal for too many leaders in the hybrid workplace: a brief chat message here, a quick ping there, a subordinate is calling to request urgent advice. And all while heading into the next virtual meeting. This is the executive grind I have witnessed as a productivity expert over the last three years. Hybrid work arrangements significantly add to the digital overload executives face on a daily. Not least because leaders are tasked with managing more fluid and more complex team constellations which increase their load in coordinating and structuring work. Is it then really a wonder that such arrangements are a major contributor to executive exhaustion?

IT DOESN’T HAVE TO BE THAT WAY

However, there is a silver lining: Hybrid work is what we make of it. Corporations and executive leaders can shape the rules of the game. To do so e ectively, they need to follow three fundamental rules:

Rule 1: Manage

attention instead of time

Attention is the new currency. Leaders need to primarily manage attention, not time, in the hybrid workplace. Doing more in less time simply doesn’t cut it anymore. Instead, executive productivity and success are primarily determined by how e ectively leaders can focus their attention on deep work. According to Cal Newport, an expert on technology and culture who popularised the term, deep work encompasses “activities that happen at the upper boundary of your cognitive abilities” and thus need to be “performed in a state of distractionfree concentration.” While deep work has grown increasingly important to generate value in the information economy, leaders’ abilities to perform

gulfbusiness.com 8 April 2023

The Brief / Productivity COMMENT

Executive leaders are more exhausted than ever – and hybrid work could be the culprit

ILLUSTRATION: GETTY IMAGES/ZHUWEIYI49

“Flexibility is merely a shorthand for being available around the clock, for being constantly on demand”

CONSTANT AVAILABILITY AND INSTANT REPLIES CAN QUICKLY BECOME THE UNSPOKEN NORMS IN TEAMS AND ORGANISATIONS

such work is decreasing in an ever-expanding sea of digital noise. By now, we are losing 28 per cent of our working time to distractions, according to The Economist Intelligence Unit. To protect their attention and their well-being, executives need to ruthlessly cut through the noise.

Rule 2:

Keep your frenemies at bay

Digital collaboration and communication tools such as Zoom, Slack and instant messengers such as Microsoft Teams are simultaneously our workplace friends and enemies. On the one hand, they allow teams and units to work remotely and asynchronously. On the other, they are by far the biggest distraction to leaders’ workdays. Being constantly reachable is like being a barista who spends all day taking orders, rather than preparing actual coffee. Taking orders is only a means to an end. The same holds true for Zoom, Teams and Slack. Leaders need to limit the time they are available across digital channels. They need to follow the barista principle: Limit your orders to make premium coffee.

Rule 3:

Negotiate availability and reaction times

Constant availability and instant replies can quickly become the unspoken norms in teams and organisations. Executives and employees can feel that they must be constantly present and visible on communication channels, notes Kelly. To avoid a vicious cycle of digital overload, leaders need to negotiate collaboration and response times with their teams and ask the uncomfortable question: “Why does it not feel safe to keep the instant messenger on red?” Executives are neither shirking their work nor responsibilities by setting digital limits. Instead, they’re allowing themselves and their employees to make space for what matters.

Implementing these three rules is not an easy process. It is both time-consuming and involves several iterations. But leaders who chose to ignore the effects of hybrid work on wellbeing do so at their peril. Let’s get hybrid work on a healthier footing – for executives, their employees, and their companies.

Global brands need a glocal strategy

Branding internationally can be a complex and challenging process, and it’s a crucial consideration for companies that want to expand their reach and increase their revenue. Any textbook approach will tell us that the ingredients for success include a combination of cultural sensitivity, appropriate linguistic adaptation, legal compliance, market research and consistency.

Let’s take a look through some of the pitfalls experienced by companies who have had to overcome the hurdles they encountered during regional expansion.

01. Cultural sensitivity: The importance of understanding local customs and values, respecting and adapting branding and marketing materials to align.

In the 1980s and 1990s, McDonald’s attempted to enter the Italian market, but faced strong resistance from local restaurant owners and consumer groups who saw the company as a symbol of American cultural imperialism. These groups accused McDonald’s of not respecting Italian culinary traditions and using low-quality ingredients.

McDonald’s also faced legal challenges, as the Italian government passed a series of laws aimed at protecting traditional Italian cuisine and restricting the expansion of fast-food chains. These laws included regulations on the

gulfbusiness.com April 2023 9

The Brief / Brand Strategy COMMENT

To be relevant and appealing on a local level, international brands must tap into the power of glocalisation

ILLUSTRATION: GETTY IMAGES/CSA IMAGES

Oriana

Moufarrige, entrepreneur and marketing professional, specialising in luxury, digital, brand image and international retail expansion

Mark T Fliegauf, executive director at Think Productive (West & South Asia) and a practitioner fellow in Hybrid Work at the Berlin Social Science Center

COMMENT

use of specific ingredients such as olive oil, and the requirement for fast-food chains to clearly display the origin of their ingredients. McDonald’s had to make significant changes to its business model in Italy. The company had to adapt its menu to include more traditional Italian dishes, such as pasta and panini, and was made to source ingredients from local suppliers. They made a shift to invest in advertising campaigns that highlighted the quality of their ingredients, and the company’s efforts to respect Italian culinary traditions.

Despite these efforts, the chain struggled to gain a foothold in the Italian market, and it wasn’t until the late 2000s that the company began to see significant growth in the country.

local bottling plants and their efforts towards embracing sustainable practices.

Despite these efforts, Coca-Cola still struggled to gain market share in India and it wasn’t until the early 2000s that the company began to see significant growth in the country demonstrating the importance of conducting thorough research as an essential component to the planning of market expansion.

03. Consider timing and implantation strategy: Armed with an awareness of the market you are entering, timing is everything. There are ways (and ways) of bringing a brand to a new market.

established a strong presence in the country. However, in 2018 the brand faced a significant setback due to a controversial marketing campaign and social media posts that were viewed as racist and culturally insensitive by the Chinese consumers.

The campaign included a video of a western model eating a plate of pasta with relish — then a Chinese model attempting, with difficulty — to do the same with a pair of chopsticks. What had seemed like a light touch of humour to the Italians proved to be deeply offensive to their host nation and the ad was seen as mocking and demeaning. The backlash was severe, with many Chinese consumers and celebrities boycotting the brand, propagating the call on social media and so it snowballed.

Another brand facing difficulty integrating into a new market is CocaCola. The company initially entered the Indian market in the 1950s, but due to government regulations, was forced to leave the market in 1977. On re-entering the Indian market in the 1980s, they faced cultural and societal challenges. One major issue was that in India there was a chronic lack of access to clean drinking water, so the idea of purchasing a sugary drink was unappealing. Additionally, traditional Indian drinks such as ‘lassi’ and ‘chai’ were deeply ingrained in the culture, making it difficult for Coca-Cola to compete.

Coca-Cola also faced backlash from the Indian government and some consumers for their use of excessive amounts of water in their bottling process, which was seen as wasteful in a country where water was scarce.

To address these challenges, Coca-Cola launched a campaign to promote their brand as a symbol of modernisation and global integration, while also addressing the water usage issue. They started building water-treatment plants and promoting water conservation. Their product offer was expanded to offer smaller packaging sizes at more affordable prices and the brand created ads that highlighted their

Swedish fast-fashion retailer H&M first entered the Chinese market in 2007, rapidly expanding their footprint to over 400 stores in the country. Chinese consumers had started to shift their preferences towards more premium and luxury brands, and away from fastfashion retailers. Competition in the low priced positioning market was fierce with an already established roster of other international and local fashion brands dominating and enjoying a loyal following.

Additionally, H&M in China faced criticism for its perceived lack of cultural sensitivity and lifestyle in the market. Some Chinese consumers felt that the company’s clothing designs were not tailored to Chinese body types and preferences, and that the company was not making enough of an effort to incorporate traditional Chinese elements into its designs.

04. Once you’re in, it’s not over. Continued flexing of cultural awareness is crucial. Even after 20 years of exposure in a market outside your own, don’t overestimate the degree to which your brand has been accepted and embraced.

Dolce & Gabbana, the Italian luxury fashion giant first entered the Chinese market in the noughties and quickly

The Chinese government took action through their Cyberspace Administration announcing an investigation into the social media posts, and retailers in the country began removing Dolce & Gabbana products from their shelves.

To address the crisis, Dolce & Gabbana issued a public apology and pulled the controversial marketing campaign. They also made efforts to repair the relationship with the Chinese market, engaging with key opinion leaders and influencers in the country, and highlighting the brand’s commitment to diversity and inclusivity.

However, the damage had been done and the brand faced significant loss of sales in China and also faced a setback in their reputation.

The potential consequences of not maintaining awareness of finely tuned cultural attitudes can have a costly fallout and with the power of social media, negative perceptions and criticism can be magnified at an alarming pace.

In summary, navigate regional expansion by emulating the integrity of local tradition, sensitivity, integrity and lifestyle. In keeping an eye on your own brand identity and communications consistencies, you’ll mirror the values that underpin the market you are entering. Then keep going taking the time to make checks every step of the way, as resting on laurels doesn’t work and overconfidence can be a damaging thing too, even 18 years in.

gulfbusiness.com 10 April 2023

The Brief / Brand Strategy

02. Know your market: The importance of understanding the local socio economic climate and environmental issues.

“The potential consequences of not maintaining awareness of finely tuned cultural attitudes can have a costly fallout and with the power of social media, negative perceptions and criticism can be magnified at an alarming pace”

Alan’s Corner

Alan O’Neill Managing director of Kara, change consultant and speaker

Alan O’Neill Managing director of Kara, change consultant and speaker

Imitation versus innovation

rest is history. A specialist in user experience he also invented the scroll bar and mouse-click, where the cursor could be placed anywhere on the screen with the help of a mouse.

Although ‘copy and paste’ was a revolutionary concept back then, we all ‘copy and paste’ ideas and business models all the time. Let me share some examples that you might like to ‘copy and paste’ into your business.

People: An essential ingredient for delivering your strategy is an e ective organisation structure. You need a structure with clear reporting lines and accountabilities. If you haven’t revisited your structure chart recently, it might be worth refreshing it now and ‘copying and pasting’ the best bits from others. Are there any changes to your model that might prompt a restructure? Have you any acquisitions or divestments in your pipeline? Do you have any pending changes to your customer target market, your product mix or route to market?

Product: I was working recently with a convenience chain retailer, to help them develop a new strategy. During the initial discovery phase, I felt that their stores were quite mundane and almost boring. Each one was pretty much a ‘copy and paste’ of a centrally designed model, which of course is typical for any large chain.

Over and above the ‘copy and paste’ strategy, we also encouraged each store to examine its competitive positioning in its local market. We challenged each one to reconsider its product mix and to ask what it could ‘own’ in its locale. What would make them become the ‘go-to-guy’? In one retailer’s case, it now prioritises flowers and has a USP of o ering the ‘best fresh flowers’ in the area. That gives that retailer something di erent to shout about and exploit as a footfall driver.

Can copying ideas be more valuable than inventing something new? We look and the pros and cons

Up to a few weeks ago, I had never heard of the name Larry Tesler. But when I read his obituary recently, I now tip my hat to him. You and I benefit enormously from his work, as it was he that invented the ‘cut/copy and paste’ commands on our various devices.

Tesler was also the man who had the counterculture vision that computers should be available to everyone. Steve Jobs ‘discovered’ him in 1974 and the

Route to market: I recently met a very ambitious young person who has a passion for fashion. She has developed a beautiful range of tote bags made from various materials, that can be personalised with all sorts of motifs. She ‘copied and pasted’ from the traditional industry route to market and has managed to sell directly to independent retailers. The challenge for her now is to scale up and to get her products listed in larger international department stores. The problem is that because she’s a small business, she’s just not relevant enough to warrant the buyer’s time and the cost of setting up a new supplier account.

This presents two options in my view. One is to find distributors to service big accounts on her

gulfbusiness.com April 2023 11 The Brief / Alan’s Corner

ILLUSTRATION: GETTY IMAGES/CARGO

The Brief / Alan’s Corner

COMMENT

behalf, provided she has enough margin to allow for them to make a profit. Alternatively, a di erent route to market is to sell directly on-line. This will achieve higher margin, thereby giving her money to spend on marketing.

Brand development: There is so much hype and activity today on social media, that businesses feel enormous pressure to have a strong online presence. Yes for sure, it’s worth checking out the competition and ‘copying and pasting’ some norms in your industry. But don’t forget that ‘likes’ are a vanity play unless they convert to sales.

I do understand this digital drive but don’t forget there is value in traditional marketing. It hasn’t gone away you know! Whether it’s paid or earned, advertising, sponsorship, promotions and PR are still very strong pillars of the marketing mix.

Margin: Another negative example is a food company that continues to operate with a ‘copy and paste’ approach to margin. Margin of 25 per cent has

WHY DO WE ALWAYS HAVE TO WORK IN ROUND NUMBERS? AFTER ALL, WITH SALES OF FIFTY MILLION EURO, EVERY HALF PERCENTAGE POINT OF MARGIN EQUATES TO A QUARTER OF A MILLION EURO LANDING STRAIGHT ONTO THE BOTTOM LINE

been the established norm in this industry for years and years, but costs continue to grow at a steeper trajectory than margin. Insurance costs, payroll and supply chain all take bigger chunks than before. I have challenged this client to aim for 27.5 per cent margin. I know it’s an odd number but I’m making a point. Why do we always have to work in round numbers? A ter all, with sales of fi ty million euro, every half percentage point of margin equates to a quarter of a million euro landing straight onto the bottom line.

THE LAST WORD

Plagiarism is an unfortunate outcome of this ‘cut/ copy and paste’ technology, so be careful. What I’m describing here is about being sensible and appropriate. But more importantly, don’t forget that one of the other great advantages — and probably the best part of Larry Tesler’s breakthrough, is the ability to edit a ter ‘copying and pasting’. Use the edit function wisely as you select ideas and business models for your business.

12 April 2023

COMMENT

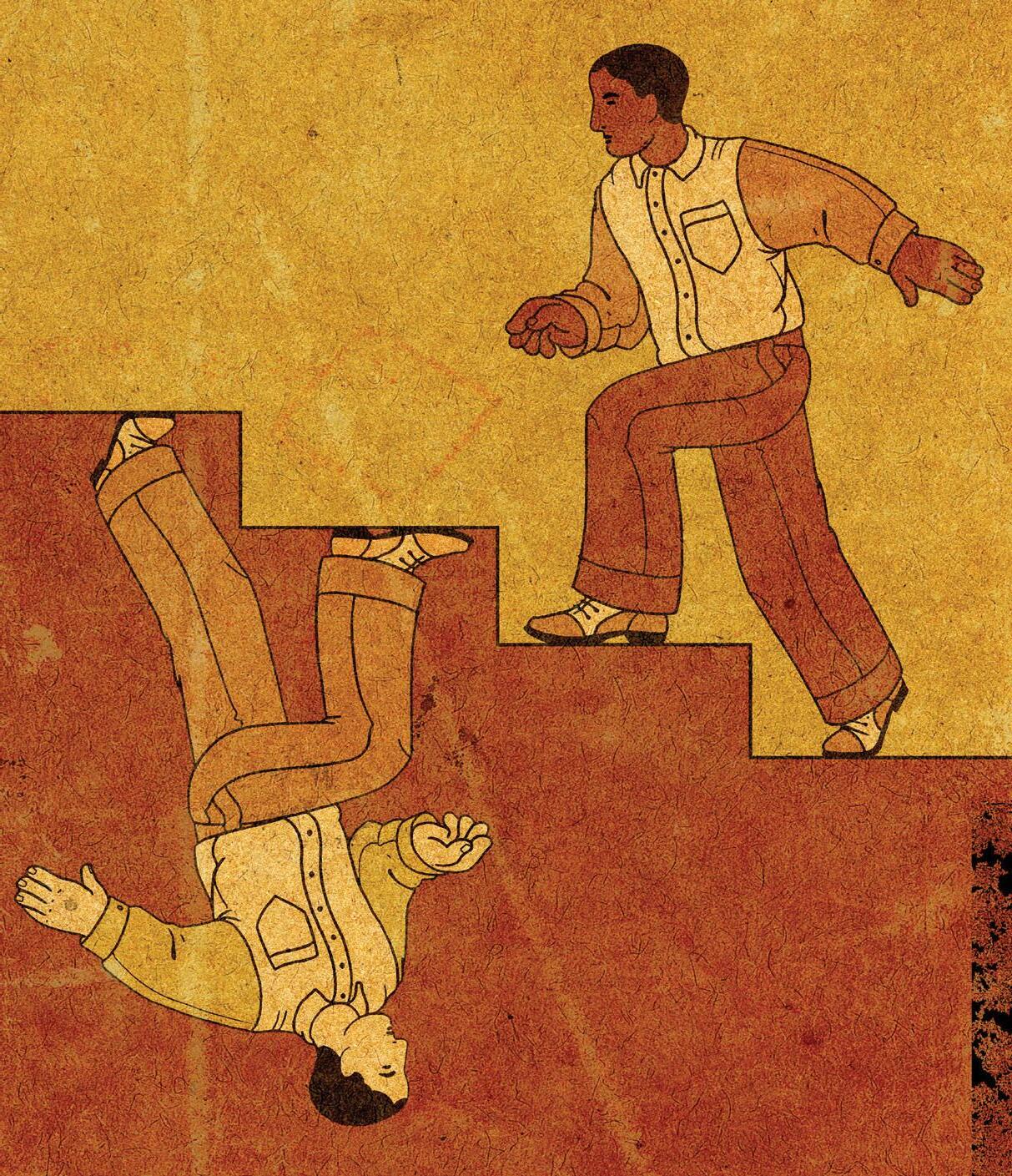

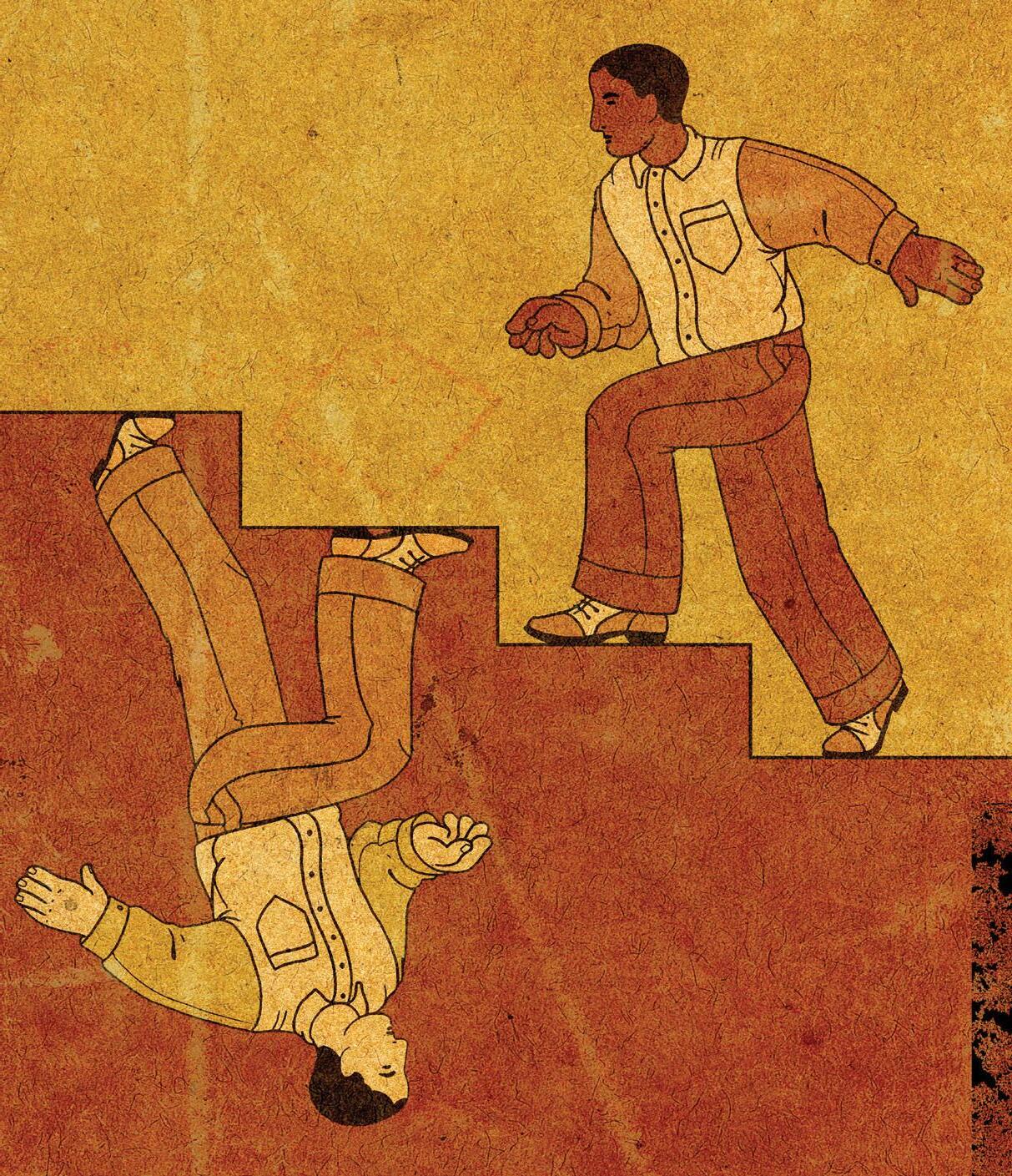

Why mentoring makes a di erence

Make it an assignment. If mentoring is everyone’s business, it becomes no one’s, so the nominating committee should designate a board veteran to formally serve as ‘concierge’. As part of a proper new member orientation programme, include an outline of items the mentor should cover with the newbie. Vague ideas typically don’t result in any benefit, but checklists do.

Don’t assume that mentoring is a oneway process. A first item for the mentor is to ask what the mentee wants to know, unanswered questions, and what sort of a learning process will be most e ective. This can shape another checklist, but this one for both the mentor and the mentee. Also, seek some more general thoughts from the new director on what she or he hopes to gain and learn from this new board experience.

Start as soon as feasible. The mentor shouldn’t wait until the day of the first board meeting to connect. Along with phone calls and messaging, schedule lunch or at least a cup of co ee for face-to-face familiarity. As a mentor, think back to things you didn’t know before your first board meeting, and what could have made you more comfortable.

Introduce the mentee to others. At the mentee’s first board meeting, work with the chair to host and introduce the new director. Typically the chair o ers introductions, but there is no reason why the mentor can’t add some personal input that other directors aren’t familiar with. Don’t hesitate to talk about the skills – give the message that your board is lucky to have this newbie.

When it comes to onboarding new board members, mentoring can play an important role. A mentor can provide guidance, insight, and support, as the new member gets up to speed with his or her role and responsibilities. They can also help the new member navigate the culture, understand the goals and objectives, and connect with other key stakeholders.

When selecting a mentor, it’s important to choose someone who has experience and

expertise in the area you’d like the new board member to focus on. The mentor should have good interpersonal skills and be able to communicate e ectively.

Overall, mentoring is supposed to help ensure a smooth transition for new board members and set them up for success in their role, typically it fails on the follow through. We advise novice directors to seek a mentor, and encourage the board itself to assign one, but what next? What makes up an e ective board mentoring action plan?

Post meeting, schedule a debriefing with the fledgling member. What were the first impressions? What things seemed most unfamiliar, and need further preparation? What observations on board chemistry, meeting flow and operations? This reverse mentoring is valuable – you have someone seeing how your board works with fresh eyes, and who usually has some outside board experience of their own. Share these valuable insights with the board chair and management.

gulfbusiness.com April 2023 13

The Brief / Training

ILLUSTRATION: GETTY IMAGES/JOHNWOODCOCK

Ralph Ward, global board advisor, coach and publisher, and Dr M Muneer, consultant, author, co-founder of the non-profit Medici Institute

Mentoring could help ensure a smooth transition for new board members and set them up for success in their role

As much as possible, the mentor should also o er the above support, liaison and follow up for committees the new member serves. Most tactical board work happens at the committee level now, and orienting new members to this crucial role is o ten overlooked. Work with committee chairs to shape a good orientation plan for each of these, particularly those with complex portfolios, such as audit or compensation.

Here are some best practices for board mentoring:

01. Define the mentoring relationship: Establish clear and specific goals for this such as learning about the enterprise, connections with other board members, or gaining expertise in a specific area.

02. Match the right mentor and mentee: The mentor and mentee should complement each other’s strengths, experience, and goals.

03. Regular communication: Schedule regular check-ins between the mentor and mentee to monitor progress and provide feedback.

04. Provide access to resources: Provide resources such as enterprise financials, charter, key issues, and connections to key stakeholders.

05. Encourage open communication: The mentee should feel comfortable asking questions and receiving constructive feedback, and the mentor should provide clear and actionable advice.

06. Encourage professional development: Encourage the mentee to attend training and professional development opportunities such as conferences and workshops to enhance their skills and knowledge.

07. Celebrate success: Celebrate the mentee’s achievements and progress, both big and small, throughout the mentoring relationship.

08. Evaluate the mentoring relationship: Regularly evaluate the mentoring relationship to ensure it is meeting the goals and expectations of both of them.

AN OASIS OF INVESTMENT OPPORTUNITIES

The venture capital market may have plummeted last year, but the Middle East and Africa (MENA) has witnessed a flurry of activity as deals dry up in other parts of the world. A ter a record-shattering 2021, the world entered a parallel universe of investor caution last year amid a slowing global economy, geopolitical tensions and steep valuation resets that fuelled mass layo s across the tech industry.

The story is di erent in the Middle East – home to some of the world’s biggest sovereign wealth funds – where investors are flush with cash from last year’s oil boom. Similarly, GCC countries have done well thus far in supporting small and medium-sized enterprises (SMEs),

a sector that is central to governments’ economic diversification and job creation strategies.

MAGNiTT, a Dubai-based research firm, said that though there was a decline in funding and deals in the last quarter of 2022, the latest data shows sustained levels of funding and a steady number of transactions in the Middle East, Africa, Pakistan and Turkiye (MEAPT) region.

Dealmaking in the Middle East is being led by the UAE, which accounted for nearly 50 per cent of the total venture funding between 2018 and 2022. S&P Global attributed the growth in venture funding in the Middle East to the growing technology adoption and the shi t from high dependence on oil revenues, which

gulfbusiness.com 14 April 2023

The Brief / Training

ILLUSTRATION: GETTY IMAGES/FANATIC STUDIO

The drive for economic diversification and statebacked initiatives together with financial support for startups is fuelling Middle East’s venture capital industry, finds Kudakwashe Muzoriwa

is creating investment opportunities and attracting global venture capital firms to the region.

The Middle East is emerging as a bright spot for venture capital investments, as the regional outlook looks promising driven by robust oil prices, fiscal surpluses from hydrocarbon receipts and ongoing economic diversification programmes.

Signalling a positive outlook, thanks to the region’s growing appetite for innovative technologies, the fintech sector is expected to retain the lion’s share of venture capital investments going into 2023.

What is driving growth?

State support for startups and entrepreneurs is driving the establishment of venture hubs in some Middle Eastern countries such as the UAE, the biggest beneficiary of venture funding over the last four years. Egypt, Jordan and Saudi Arabia have followed the same strategy and they are second, third and fourth respectively.

Last year was one of the best for emerging venture markets, with funding exceeding $7bn in a row, even as markets such as Southeast Asia struggled with tight liquidity due to high-interest rates – part of central banks’ broader strategies to bring inflation down to sustainable levels.

Despite the turbulence in the emerging markets, MENA-based startups attracted significant interest from investors as funding levels crossed the $3bn mark led

by a 72 per cent increase in funding for Saudi Arabian firms and an increase in transactions that were closed in Egypt.

Countries such as the UAE and Saudi Arabia have recognised the importance of venture debt and building on those achievements in the GCC, hence the region will remain a vibrant player in the global venture capital market. “There is substantial evidence that accelerators, incubators, corporate innovators and government-led initiatives play an essential role in the growth of companies,” said PwC.

Government-led initiatives such as Abu Dhabi’s Hub71, Dubai’s Dtec and DIFC Fintech have therefore bolstered the growth of the venture capital industry in the region. State-sponsored events such as Biban, Saudi Arabia’s largest startup and entrepreneurship conference, are equally contributing to the growth of MENA’s venture capital ecosystem by connecting ideas with capital.

The MENA region’s tech-savvy population of Gen Z, Millennials and Gen X coupled with its high smartphone penetration rate makes the region a fertile ground for digital solutions. The increased adoption of e-commerce and fintech solutions over the years haS accelerated the growth of the startup ecosystems as investors are attracted by success stories from home-grown companies such as Careem,

$541m TOTAL VC DEBT BY SECTOR (2018-2022) $332 $69 $50 $32 $25 $17 $16

Souq.com, Swvl and music streaming platform Anghami.

Indian consultancy firm Redseer projected that MENA’s digital economy will hit $100bn by 2023, up from around $45bn in 2020, as the “robust enabling logistics coupled with strong regulatory backing will propel sectors such as e-tail, travel, edtech, fintech and healthtech.

“Fintech continues to dominate venture investments with $332m, 61 per cent of total venture debt funding, raised between 2018 and 2022, followed by e-commerce, transport and logistics, enterprise so tware and healthcare.”

The shape of things to come

While concerns over high interest rates and a looming recession have impacted global venture investments, the MENA region is an increasingly attractive emerging market. State investors including Public Investment Fund and Mubadala Investment Company have ploughed millions of dollars into startup firms to drive economic diversification and create employment for the region’s youthful population.

Local venture capital firms such as Wamda, Middle East Venture Capital, Saudi-based STV and Sharooq Partners are also bullish about the outlook and they are on the lookout for deals as they seek to grow the Middle East’s Silicon Valley.

Regional financial hubs such as Dubai International Financial Center and King Abdullah Financial District have emerged as favoured destinations for venture capital firms that are being drawn by the ease of doing business.

Global venture capital firms have been trooping into the region to tap into its growth opportunities. YCombinator, Sequoia Capital and Techstars are among the global venture capital firms that have opened their doors for business in the region in recent years.

Transport & Logistics

2018 IN MILLIONS SOURCE:

industries

gulfbusiness.com April 2023 15 The Brief / Venture Capital

FUNDING

– 2022 Fintech

Other

Startups and SMEs need funding to grow and Middle Eastern countries are facilitating the growth of a sustainable venture capital industry. The confluence of the region’s digitally connected population, state-backed structural reforms and the abundance of liquid capital have created the ideal conditions for a thriving venture capital ecosystem. Agriculture e-commerce Media & Ent. Sustainability

MAGNITT

THE YEAR 2022 WAS ONE OF THE BEST YEARS FOR EMERGING VENTURE MARKETS WITH FUNDING EXCEEDING $7BN IN A ROW

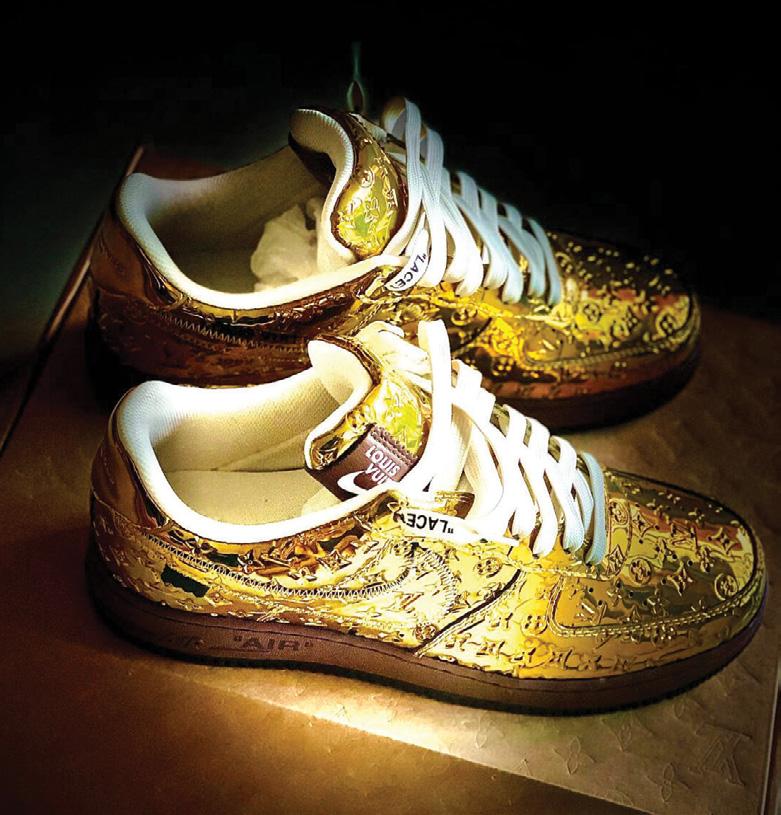

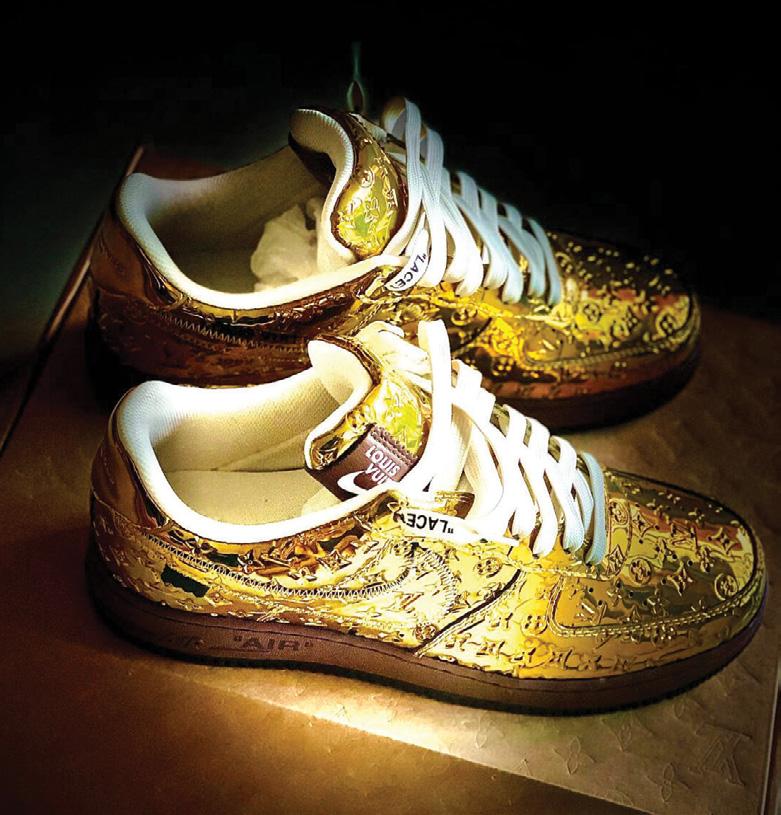

The age of sneakernomics

In December last year, Dubai witnessed the global launch of a special edition sneaker: Nike SB Dunk Low Concepts Orange Lobster. Dubai was among the first cities where the coveted sneaker was launched in the world. Avid sneakerheads queued up 48 hours before the launch to grab these pairs. Today, a couple of months later, the same pair goes for over $1,000 –a sweet 400 per cent return over 60 days.

This is nothing new. In 2002, Nike collaborated with a well-known skateboarder to produce a range of sneakers called the Nike SB Dunk Low Reese Forbes Denims. Each pair was priced at $65, with only 444 available worldwide. Fast forward two decades and the same sneakers are being sold north of $29,000 per pair on StockX, a reputable reseller. The collector/owner of the said pair will rake in returns that defy patterns of conventional asset classes and investments. That begs the questions: What led to such a windfall? Is it the rarity of frayed denim textures on shoes? Nike’s reputation? Perhaps the induced scarcity?

The ‘economics’ answer: A bit of everything. But if the same questions were posed to any of the thousand

sneakerheads congregating at sneakers’ conventions, the answers would be more culturally influenced.

For many, sneakers are an identity, a passion they picked up along the way, or just pop-culture paraphernalia. However, for some, they have metamorphosed into an alternative asset class to invest in. The traction of sneakers as an investment instrument is such that the likes of Sotheby’s auction them with pomp and promotions. So, what’s paved the way for the age of ‘sneakernomics’.

The demand-supply dynamics of sneakers

Sneakers are not like gold or silver – inherently scarce bullion assets. So, the majority of sneakers in existence today are mass-marketed and worn by people merely as shoes. Conversely, an investmentgrade sneaker is characterised by robust demandsupply dynamics. The lower the supply or rarer the range of sneakers, the higher the demand, and vice-versa.

However, short-supply sneakers from a relatively unknown brand with no celebrity affiliation cannot generate demand. So, brand reputation and

gulfbusiness.com 16 April 2023 The Brief / Alternative Assets

From everyday wear to an alternative asset class, we look at the transformation of sneakers

COMMENT ILLUSTRATION:

GETTY IMAGES/BEN GRIB DESIGN

induced scarcity are prerequisites for any sneakers to find investment value and appreciation with time. Unlike induced-scarcity asset classes such as cryptocurrencies, sneakers are tangible, because of which their value will appreciate with inflation and supply-chain disruptions.

That said, the meteoric rise of Nike’s Denim range is not as prevalent as investors would hope. In fact, a valuation of a sneakers range could nosedive a ter supply outstrips demand – which was exemplified by Adidas Yeezy sneakers a ter collaborator Kanye West decided to ramp up production to enhance access. Likewise, certain sneakers from reputable brands have witnessed skyrocketing prices because of a fan frenzy for months leading up to the launches. As o ten as not, brands perpetuate the ‘hype’ on social media and in sneakerhead communities to orchestrate pent-up demand.

As a result, it is not uncommon to see fans queue before the stores on launch days. Brands also strategise for the new sneakers’ long-term demand, ensuring a cap on how many pairs a single buyer can procure. While the same rule sets apply online, the demand tends to be relatively higher due to more access, leading to server crashes. It is a winwin situation because, for brands, they translate to more frenzy and a long-term outlook for the launched sneakers and, for buyers, the value of their investments appreciates instantly.

As the word is out and the frenzy is documented online, the said sneakers will be in demand for a long time.

Sneakers, like stocks, are sensitive to many factors

While investment-grade sneakers have provided good returns over the years, the asset class continues to be a niche and possibly will never become mainstream. Therein lies its charm because, unlike stocks, sneakers’ prospects hinge on “perceived value” – investors’ own perceptions of a sneaker’s

merit or desirability to them. Typically, a limitededition product from a reputable brand must be in unused condition to retain value. An exception is if it is worn by a celebrity.

In fact, it is safe to say that sneakers’ evolution into an asset class was initially fuelled by celebrity endorsements, particularly from larger-than-life basketballers such as Michael Jordan. The ‘sneakers culture’ emanated during Jordan’s zenith in 1985, with the launch of Air Jordan 1, coinciding with the rapid rise of hip-hop.

Artists such as RunDMC collaborated with Adidas Superclub to tap into the burgeoning trend. While ‘Jordans’ have been popular through the decades, they witnessed an upswing following the release of Michael Jordan’s Netflix documentary, The Last Dance, two years ago. Likewise, the unfortunate demise of star Louis Vuitton designer Virgil Abloh saw an immediate spike in all his sneaker creations.

Today, some sneakers also follow art market dynamics. When Kanye West switched sides from Nike to Adidas, the Nike Red October from the original Yeezy line became a coveted piece of art – a good dead stock (unused, untried) pair can fetch over $20,000. That is to say, sneakers – like stocks – are driven by consumer sentiments. So, it is advisable to read and time the market well before splurging on sneakers, which, as o ten as not, tend to be expensive. Like any investment instrument, sneaker reselling requires a strong understanding of the brands, authenticity, and appraisal mechanisms. The lexicon alone – PADS (passed as dead stock), DSWT (dead stock with tag), etc – will take time to get acquainted with, whereas actual transactions could run into further complexities.

Yet, by 2030, the sneakers resale market is projected to grow to $30bn from the current $10bn. The primary rationale behind such bold projections is that sneakers do not follow conventional market economics; they are driven rather by a community spirit – an unconditional desire among sneakerheads to own, associate with, and promote a thing as simple and utilitarian as shoes. And if such a passion is known to lead somewhere, it is success.

gulfbusiness.com April 2023 17

BY

“UNLIKE INDUCED-SCARCITY ASSET CLASSES SUCH AS CRYPTOCURRENCIES, SNEAKERS ARE TANGIBLE, BECAUSE OF WHICH THEIR VALUE WILL APPRECIATE WITH INFLATION AND SUPPLY-CHAIN DISRUPTIONS”

2030, THE SNEAKERS RESALE MARKET IS PROJECTED TO GROW TO $30BN FROM THE CURRENT $10BN

Atul Hegde, founder of YAAP, a tech and data-led content company

$30BN $10BN 2030 2023

Nike Louis Vuitton Air Force 1 sneakersone of the author’s prized possessions

Healthy investments

Are deals and valuations resilient for the healthtech sector in 2023?

Digital technologies have become even more integral to daily life, and innovation in the digital healthcare sphere has progressed at unprecedented scale. However, in 2022, we saw “growth at all costs” give way to strong unit economics and judicious bottom lines. This trend of cautionary investments is expected to strengthen in 2023 with FOMO (fear of missing out) investing vanishing.

Significant investments were made in the healthcare sector during the pandemic leading to high valuations, however one of the key questions remains - how many of those valuations will stand the test of time?

In the current climate of top line pressure and funding shortages, healthtech firms can no longer solely rely on private equity (PE) support, having to find new ways to continue to grow their businesses. Companies will need to assess whether they have enough money and technology backbone to o er more to their existing customer base, or enough resources to cater to a new audience. Failing that their options will be to cut costs or look to the M&A (mergers and acquisitions) market. Over the past three

years, it seemed like a safe bet to bank on the digital acceleration and innovative solutions in healthcare as secular trends drive successful investments. Assets at the intersection of these two trends saw their valuations rise to very high levels. During the pandemic a significant amount of dry powder was used to fund startups; and only a select few in the biotech and healthtech sector accelerated to the IPO stage. As per Refinitiv data, in the biotech sector, globally there were 152 offerings in 2021 that had raised over $25bn; however, this plummeted to 47 IPOs last year which raised a total of about $4bn. Globally, IPOs across all sectors nosedived in 2022 a ter a blockbuster 2021, as aggressive interest rate hikes by central banks to curb inflation put an end to the era of ‘cheap’ money.

In recent months, we have witnessed that major players in the tech industry have su ered a market collapse and some companies have indeed lost value, but most of them have had to face a significant downfall, including healthtech companies. The market currently is recessionary, and funding from backers is not as easy to come by,

especially as the cost of capital is expensive and the availability of debt is going down. Supply chain challenges, inflation, interest rate hikes and investor pullback reversed investment momentum, and the valuations are not what they used to be.

RETURN TO PRE-PANDEMIC LEVELS

Due to the Covid-19 pandemic, this particular asset group became very expensive, in turn becoming less attractive to corporates. Now that valuations are returning to prepandemic levels, corporate M&A is on the rise again as corporates recognise an opportunity to acquire cheaper assets while still building synergies with the rest of their business. This will lead to better outcomes for patients, providers, practitioners and ultimately the investors. Healthech firms that need support in terms of cash runway, will look to acquisitions as a path forward, if it feels right.

TRENDS THIS YEAR

Evidently, the digital health industry is shi ting away from point solutions to platform companies. An evolution of consolidation could trigger a ‘vertical rethinking’ and could drive M&A deals and startup innovation. As we go forward, we believe more end-to-end integrated platforms that combine and deliver people centric care in a unified manner are going to be essential. Overall, it may fuel social impact and generate better solutions for healthcare payors, providers and regulators thus improving patient experience and igniting value and outcome-based care. There will also be more integration at an industrial scale as more corporates will be acquiring innovative assets.

Market watchers predict a more robust year for biotech and healthtech deals despite buyers losing access to previously cheap financing that had promoted record M&A activity globally. In this fast paced and complex merger space within the sector, corporate and PE organisations will need to be armed with more than just due diligence and deal support. Deal execution requires keen insights, deep due diligence, strategy that aligns with the buyer and an ability to create value along the complete lifecycle of the acquired target.

gulfbusiness.com 18 April 2023

The Brief / M&A

ILLUSTRATION: GETTY IMAGES/SORBETTO

COMMENT

Jean Laurent Poitou, head of Digital, EMEA and Ali Ayach, senior director with Alvarez & Marsal

Mohammed bin Rashid Al Maktoum

A compilation of quotes from His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai.

Covering the four main themes of Nation, Leadership, Positivity and Life, this collection of quotes by Sheikh Mohammed defines a major part of his vision and thoughts as a statesman.

AVAILABLE AT ALL MAJOR RETAILERS AND ON BOOKSARABIA.COM MOTIVATEBOOKS MOTIVATEBOOKS MOTIVATE_BOOKS www.motivatemedia.com

Strong momentum

INITIAL PUBLIC OFFERINGS (IPOs) ACROSS THE MIDDLE EAST AND NORTH AFRICA RECORDED PROMISING GROWTH IN 2022, WITH A POSITIVE OUTLOOK FOR THE CURRENT YEAR

DESPITE GLOBAL CHALLENGES, STRONG GROWTH FOR THE NON-OIL SECTOR WILL ENSURE THAT THE UAE REMAINS RESILIENT

GCC IPOs (2019-22)

NOTES: IPOs, including REIT listings, have been considered in each quarter based on the listing date SOURCES: Refinitiv Eikon, S&P Capital IQ

MENA IPOS HAD A STELLAR 2022, WITH INTEREST AND LIQUIDITY IN THE REGION CONTINUING TO GO AGAINST GLOBAL TRENDS. 2023 WILL BE THE YEAR TO WATCH WITH A HEALTHY IPO PIPELINE ACROSS THE REGION AGAINST A BACKDROP OF A CHALLENGING AND VOLATILE GLOBAL ECONOMIC ENVIRONMENT”

— Brad Watson, EY MENA Strategy and Transactions Leader

The year 2022 marked a record year for MENA IPOs with a year-on-year growth of in total proceeds raised from both state-owned and private companies

179%

gulfbusiness.com 20 April 2023 The Brief / Infographics

20 7,Proceeds ($m) Number of IPOs SOURCES: Refinitiv Eikon, S&P Capital IQ $m Number of IPOs 10,000 8,000 6,000 4,000 2,000 20 15 10 5 0 15 9,230 7 9 3,958 Q1 22 Q2 22 Q3 22 Q4 22 7,262 1,524 MENA IPO activity - 2022 REITs: REAL ESTATE INVESTMENT TRUSTS ALL DATA ARE NORMALISED TO A SCALE OF 0 TO 100, WITH 100 THE BEST SCORE

$m Number of IPOs 35,000 28,000 21,000 14,000 7,000 50 40 30 20 10 0 33,033 2019 2020 1 2021 2022 Proceeds ($m) REITs listed Number of IPOs 12 7 17 47 2 1 2 1,776 7,292 21,783

MENA IPO overview

2022 IPO activity

KEY FACTORS TO

Sources: EY analysis, Dealogic / NOTE: 2022 refers to the full calendar year and covers completed IPOs from January 1 to December 5, 2022, plus expected IPOs by 31 December 2022 (forecasted as of December 5, 2022)

EMEIA exchanges

gulfbusiness.com April 2023 21

CONSIDER

IPO CANDIDATES SOURCE: MENA IPO EYE: Q4 2022 AND YEAR-END REPORT SPAC: SPECIAL PURPOSE ACQUISITION COMPANY / EMEIA: EUROPE, THE MIDDLE EAST, INDIA AND AFRICA

SOVEREIGN WEALTH FUND INSTITUTE

FOR

SOURCE:

#06 SAUDI ARABIA Saudi Arabia’s Public Investment Fund (PIF) recently maintained the sixth spot in the list of TOP SOVEREIGN wealth funds in the world Q4 2022 20 IPOs $7.3bn proceeds Change q-o-q +54% IPOs +29% proceeds Change y-o-y +143% IPOs +179% proceeds Total 2022 51 IPOs $22bn proceeds NOTES: Quarter-on-quarter change reflects Q4 2021 versus Q4 2022 GLOBAL 2022 2021 Percentage change Number of IPOs 1,333 2,436 -45% Proceeds ($bn) 179.5 459.9 -61% AMERICAS 2022 2021 Percentage change Number of IPOs 130 532 -76% Proceeds ($bn) 9 174.5 -95% ASIA-PACIFIC 2022 2021 Percentage change Number of IPOs 845 1,148 -26% Proceeds ($bn) 120.6 175.4 -31% EMEIA 2022 2021 Percentage change Number of IPOs 358 756 -53% Proceeds ($bn) 49.9 110 -55%

Inflation and interest rates Government policies and regulations Recovery of economic

Geopolitical tensions or situations ESG agenda The Covid-19 pandemic SPAC IPO Number Proceeds $m Stock exchange 2022 2021 2022 2021 London (Main and AIM) 14 9 721 385 Euronext (Amsterdam, Paris) 3 20 609 5,408 Deutsche Börse 2 4 363 1,111 Abu Dhabi (ADX) 1 0 100 0 Czech Republic Prague (PSE) 1 0 23 0 Sweden Spotlight 2 1 5 3 NASDAQ OMX and First North (Stockholm, Helsinki) 0 6 0 1,154 Others 0 4 0 866 Total 23 44 1,821 8,927

activities

A royal wedding: Princess Iman Bint Abdullah II of Jordan and Jameel Alexander

Thermiotis are welcomed as they take their first steps as a wedded couple. The wedding took place on March 12, in Amman, Jordan.

Lightbox gulfbusiness.com 22 April 2023

The Brief /

gulfbusiness.com April 2023 23

PHOTO: HANDOUT/JORDANIAN ROYAL COURT/GETTY IMAGES

MORE THAN JUST AN OIL STORY

THE REGION’S SOVEREIGN INVESTORS ARE BROADENING THEIR INVESTMENTS IN VARIOUS SECTORS INCLUDING HEALTHCARE, TECHNOLOGY, PRIVATE EQUITY AND HEDGE FUNDS AS PART OF A DIVERSIFICATION STRATEGY AWAY FROM OIL AND GAS

WORDS: KUDAKWASHE MUZORIWA

The GCC is expected to buck the global recession with its real GDP projected to moderate from 6.1 per cent in 2022 to 3.4 per cent this year.

The oil-rich Gulf economies have grown in relevance over the year, as they have emerged as new bankers to the world and the go-to investors for distressed western assets desperate to raise fresh capital.

Global SWF said the investment momentum by wealth funds that are not from oil-rich countries such as China, Singapore or Korea is ominous. However, the position and momentum of Middle Eastern state investors, especially in the oil-rich GCC, are much better, driven by an average oil price of $99/barrel in 2022 and the currencies’ peg to the dollar.

The region is home to some of the world’s largest sovereign wealth funds (SWF) with more than $3.7tn

in total assets under management (AUM), according to Global SWF – an amount that exceeds the UK’s 2022 GDP.

“As investment arms of any sovereign nation responsible for managing and investing the nation’s wealth in domestic and international markets, sovereign wealth funds play a vital role in the generation of wealth, employment, value creation and the overall sustainability of a global economy,” said Deloitte.

Gone are the days when Gulf investors had a reputation for investing in trophy assets such as Manhattan real estate and Harrods department store. This time round dealmakers say the funds have grown more proactive and strategic when it comes to global investments.

Global dealmakers

The wave of dealmaking by the Gulf sovereign investors began with the outbreak of the Covid-19 pandemic. Once sleepy government holding companies,

FEATURES / GCC SOVEREIGN WEALTH FUNDS gulfbusiness.com 24 April 2023

MUBADALA HAS ALREADY DEPLOYED ABOUT HALF OF THE INVESTMENTS BUILDING ON ITS PLEDGE TO INJECT $978.3M INTO THE UK’S LIFE SCIENCE SECTOR

the funds are emerging as investment vehicles with global ambitions.

The European Investment Bank said the investment strategy of the GCC sovereign funds is to maximise returns on investment and in some cases perform synergies or acquire capabilities that can be deployed in the home countries.

Buoyed with cash a ter oil prices surged to record highs in 2022, Gulf sovereign investors are hunting for opportunities amid volatility in global markets.

GCC state-owned investors spent a combined $89bn on investments last year, double the previous year, Global SWF said in its 2023 annual report, while noting that a colossal $51.6bn of that amount went into Europe and North America.

Saudi Arabia’s Public Investment Fund (PIF) has shi ted its investment strategy over the years to focus mainly on exchange-traded funds (ETFs), technology and gaming stocks. PIF’s largest public holding is a 63 per cent stake in electric carmaker Lucid Motors.

The fund’s US equity holdings grew last year, driven by an additional $7.6bn that was invested in major corporations including the big four technology firms – Google parent Alphabet, e-commerce giant Amazon, Microso t and Facebook’s Meta.

ADIA, Abu Dhabi’s most traditional and conservative wealth fund, has been investing at a high velocity. The fund jointly acquired a 72.5 per cent stake in VTG, Europe’s biggest railcar lessor, in June 2022 for an enterprise value of $7.5bn.

Mubadala is making huge bets on computer so tware, hardware and biopharmaceuticals. The fund invested an estimated $30bn in 2021 and committed to investing $12.2bn in the UK over the next five years. Mubadala has already deployed about half of the investments building on its pledge to invest $978.3m in the UK’s life science sector.

THE INVESTMENT STRATEGY OF THE GCC SOVEREIGN WEALTH FUNDS IS TO MAXIMISE RETURNS ON INVESTMENT AND IN SOME CASES PERFORM SYNERGIES AND/OR ACQUIRE CAPABILITIES THAT CAN BE DEPLOYED IN THE HOME COUNTRY TO BUILD NEW INDUSTRY CAPABILITIES”

— THE EUROPEAN INVESTMENT BANK

GLOBAL SWF ESTIMATES THAT QIA’S OVERALL PORTFOLIO IS SPLIT INTO

Meanwhile, Abu Dhabi’s ADQ has been on an acquisition spree in the emerging and frontier markets. It acquired stakes in five publicly-traded Egyptian companies including Commercial International Bank worth $1.8bn in April 2022. The state investor also joined hands with the Oman Investment Authority (OIA) to explore investment opportunities valued at $8.2bn in the sultanate.

Since its establishment in 2005, Qatar Investment Authority (QIA) has been known for being one of the most active GCC dealmakers. Global SWF estimates that QIA’s overall portfolio is split into 40 per cent Europe, 20 per cent Americas, 27 per cent Qatar and 13 per cent the rest of the world. The fund invested $3.2bn in Europe, including 10 per cent in Germany’s power producer RWE and $1.7bn in the US, including a stake in tech company AIT.

Driving diversification

Sovereign investors in the Gulf region continue to increase in number, size, variety and scope. The state investors are the engines that are driving the transformation of their respective economies in preparation for life a ter oil.

PwC said sovereign funds are not just passive actors, but they are actively contributing to the transformation of their domestic economies.

With a target to manage $1tn assets by 2025 and $3tn by 2030, PIF is the vehicle for Saudi Arabia’s Vision 2030 economic blueprint. The Saudi fund is significantly investing in large initiatives that have not yet been capitalised into its balance sheet. PIF is tasked with stimulating inward investment, accessing new technologies, developing local industries and addressing underemployment.

PIF is funding a host of new cities in the desert including the $500bn futuristic NEOM city, the Red Sea Development Company’s mega tourism project and the Qiddiya entertainment park. Saudi Arabia unveiled a new national carrier, a wholly owned

FEATURES / GCC SOVEREIGN WEALTH FUNDS gulfbusiness.com April 2023 25

ABU DHABI INVESTORS ARE COVERING ALL BASES WITH ADIA MOST ACTIVE IN NORTH AMERICA, MUBADALA INVESTING MORE IN EUROPE IN 2022 AND ADQ INVESTING ACROSS EMERGING MARKETS”

— GLOBAL SWF

40% Europe 20% Americas 27% Qatar 13% Others

LARGEST DEALS OF GCC SWFS IN ‘WESTERN’ ASSETS

FUND ASSET HQ COINVESTOR VALUE

ADIA Ardian Funds France Ardian $6bn

ADIA VTG AG Germany GIP $2.6bn

Mubadala Skyborn Renewables Germany PIF $2.5bn

ADIA Zendesk US GIC, H&F, PA $2.5bn

QIA RWE AG Germany - $2.4bn

ADIA Climate Technology US Blackstone $2.4bn

KIA Direct Chassis Inc US GIC, OMERS $1.5bn

Mubadala Envirotainer Sweden EQT $1.5bn

PIF Savvy: ESL,FACEIT US - $1.5bn

ADIA Merchants Fleet US Bain Capital $1.3bn

Mubadala Pharma Intelligence UK WP $1.2bn

PIF Embracer Sweden - $1.1bn

ADQ Vistria US Vistria $1bn

ADIA Landmark JV US Landmark $1bn

ADIA Apollo S3 US Apollo $1bn

ADIA Rockpoint JV US Rockpoint $1bn

PIF company, in March. Riyadh Air is expected to add $20bn to the country’s non-oil GDP growth and create more than 200,000 jobs both directly and indirectly. The fund is pursuing a two-pronged strategy – building an international portfolio of investments while investing locally in giga projects that will help to reduce Saudi Arabia’s reliance on oil revenues.

The trend of rising domestic investments in the GCC is likely to be sustained by the emergence of new strategic funds with the mission to attract foreign investors into local markets and increased activity of some of the existing funds.

Oman merged its two wealth funds into one entity, OIA, in 2020. The fund’s assets surged to $41.5bn in 2022 and it inaugurated 10 strategic projects worth $1.95bn across the sultanate in partnership with domestic and foreign investors to mark the country’s national day in November 2022.

RIYADH AIR IS EXPECTED TO ADD $20BN TO THE COUNTRY’S NON-OIL GDP GROWTH AND CREATE MORE THAN 200,000 JOBS BOTH DIRECTLY AND INDIRECTLY

WITH $300BN AUM, ICD’S AVIATION PORTFOLIO INCLUDES THE EMIRATES GROUP, FLYDUBAI AND DUBAI AEROSPACE ENTERPRISE

OMAN MERGED ITS TWO WEALTH FUNDS INTO ONE ENTITY, OIA, IN 2020. THE FUND’S ASSETS SURGED TO $41.5BN IN 2022

The bulk of OIA’s investments are in the sultanate, which makes up 61.5 per cent of its portfolio. GCC strategic funds that have large portfolios of domestic assets such as Mubadala and ADQ in Abu Dhabi, Investment Corporation of Dubai (ICD) and Mumtalakat in Bahrain are not expected to suffer losses in the medium-term due to their limited exposure to upheaval in the global markets.

With $300bn AUM, ICD’s aviation portfolio includes the Emirates Group, flydubai and Dubai Aerospace Enterprise. The fund is the principal investment arm of the Dubai government and holds stakes in Emirates NBD, Dubai Islamic Bank, Emaar Properties and Emirates National Oil Company. The fund reported record revenues of Dhs121.1bn in H1 2022 and net profits of Dhs14.8bn.

Flush with cash after the latest oil boom, GCC state investors are expected to be busy in 2023 as the slowing global economy and the turmoil in the financial services sector are accelerating a pivot towards other sectors including healthcare and technology. The funds are likely to be driving forward with the pursuit of ‘cheap’ assets in the US and Europe, chasing deals across all sectors.

FEATURES / GCC SOVEREIGN WEALTH FUNDS gulfbusiness.com 26 April 2023

Source: Global SWF

THE

H1

AND NET PROFITS

DHS14.8BN

FUND REPORTED RECORD REVENUES OF DHS121.1BN IN

2022

OF

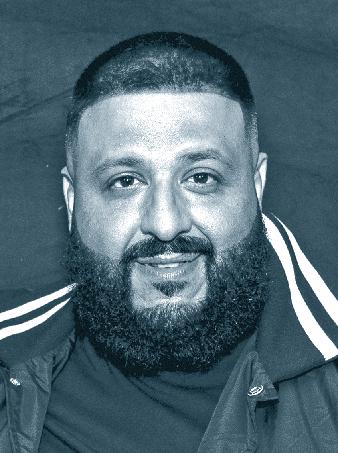

SPECIAL REPORT

The past 12 months have been truly momentous for the Arab world, from the building of some of the world’s most ambitious infrastructure projects to the hosting of two consecutive UN Climate Change Conferences (COPs) and a listing boom that saw Middle East IPOs fetching more than $18bn.

The Gulf region remains relatively insulated from the confluence of a slowing global economy, geopolitical tensions and volatility in the financial markets, with real GDP growth expected to moderate from 6.1 per cent in 2022 to 3.4 per cent in 2023, according to the International Monetary Fund.

The region is expected to deliver its strongest economic growth in a decade, underscoring the performance of sovereign wealth funds and accelerated investments in

technology, sustainability, advanced industrial manufacturing and tourism.

This year’s power list honours Arab leaders driving and shaping this growth. They range from astute business leaders to notable personalities in industry, sports, entertainment, and culture from across the region and beyond.

Arabs reached new heights in 2022 from space exploration to summiting the tallest mountain in the world and topping entertainment charts. Our female power listers continue to shatter the glass ceiling in the boardroom and beyond. This year, we welcome 12 new entrants to the list – they have made their mark with exemplary contributions across various fields. We also have upward and downward shifts among the honour roll, with a few exiting the list.

Read on to discover who made it to our list...

METHODOLOGY Gulf Business looked at the events of 2022-23 and rated each individual case on the basis of four criteria: financial capital, human capital, expansion plans and level of personal fame. In general, Gulf Business has excluded politicians and royalty, unless the contenders have a strong leaning towards business activity. We have included Arabs from across the world.

28 SPECIAL REPORT

Origin: Saudi Arabia Residence: Saudi Arabia Sector: Diversified 2022 rank: 1

Yasir Al-Rumayyan Chairman, Aramco/governor, Public Investment Fund

Yasir Al-Rumayyan, governor of Saudi Arabia’s Public Investment Fund, has had an enterprising year, steering the sovereign wealth fund’s strategy to diversify the kingdom’s economy and investment in growth sectors. The fund launched several companies to develop the local economic landscape, as well as established investment firms to seek opportunities across the MENA region. Besides its giga-projects, the fund set up Ceer, the kingdom’s first electric vehicle brand by virtue of a JV with Foxconn. Meanwhile, oil giant Aramco, of which Al-Rumayyan is chairman, is targeting to increase its production capacity to 13 million barrels a day by 2027. It also aims to build a petrochemical complex in the kingdom, in partnership with French company TotalEnergies. Al-Rumayyan, who serves on the boards of Uber and Reliance Industries Limited, will also chair new national carrier Riyadh Air.

29 SPECIAL REPORT

01

Photo courtesy: Aramco

Origin: UAE Residence: UAE

Sector: Energy 2022 rank: 2

Dr Sultan Al Jaber

Managing director and group CEO, ADNOC

Having led state-owned Abu Dhabi National Oil Company (ADNOC) through key initiatives and achievements, Dr Sultan Al Jaber has retained the second slot on our list. The energy giant announced the discoveries of offshore natural gas resources, awarded contracts to expand production capacity and dispatched its first shipment of low-carbon ammonia to Germany in 2022.

The UAE’s Minister of Industry and Advanced Technology, Dr Al Jaber was named President-Designate of the COP28 climate summit to be held in the UAE later this year, following ADNOC’s announcement that it has earmarked a total of $15bn for decarbonisation projects by 2030.

The company also delivered the first-ever liquefied natural gas (LNG) cargo from the Middle East to Germany in February. Dr Al Jaber also chairs clean energy company Masdar as well.

Origin: UAE Residence: UAE Sector: Diversified 2022 rank: 3

HH Sheikh Ahmed bin Saeed

Al Maktoum

Chairman and chief executive, Emirates Group/ chairman, Emirates NBD

Sheikh Ahmed is a man of many roles, all of which he fulfills with remarkable ease. As chairman of Dubai carrier Emirates, he oversaw the group swing to a halfyear net profit of $1.2bn for FY 2022-23. In a year that was filled with hope for the aviation sector, Emirates flew 20 million passengers between April 1 and September 30, 2022, unveiled its Premium Economy cabin on select routes as well as ramped up flights last year. Meanwhile, Dubai-based lender Emirates NBD, of which Sheikh Ahmed is chairman, reported a 40 per cent rise in net profit last year. Besides chairing Dubai Airports and Expo City Dubai Authority, Sheikh Ahmed is also the president of Dubai Civil Aviation Authority.

30 SPECIAL REPORT

03

02

Spearheading state-owned QatarEnergy’s growth strategy and developments, Saad Sherida Al-Kaabi continues to play a critical role in the country’s economic growth. The energy giant roped in international partners for its North Field Expansion project, which aims to raise Qatar’s liquefied natural gas (LNG) production capacity.

It inked a 27-year deal to supply LNG to China as well as acquired a 30 per cent interest in two offshore exploration blocks in Lebanon. Al-Kaabi was appointed president and CEO of QatarEnergy in 2016, and additionally, as Minister of State for Energy Affairs in 2018. Al-Kaabi, who is also the chairman and MD of Industries Qatar, sits on the board of Qatar Investment Authority.

With $284bn in assets under management and interests spanning multiple sectors and asset classes, Mubadala Investment Company, led by Al Mubarak, is championing Abu Dhabi’s economic diversification agenda.

In 2022, Mubadala acquired a stake in Skyborn Renewables, the world’s largest private offshore wind developer, as well as inked a MoU to advance sustainable mobility in Abu Dhabi and the Middle East region.

In February, it signed an agreement with Oman and Etihad Rail Company to develop the 303km railway network connecting the UAE with Oman. In addition to spearheading Mubadala, Al Mubarak chairs the Emirates Nuclear Energy Corporation, Abu Dhabi Commercial Bank and Emirates Global Aluminium. Al Mubarak is also a member of the Abu Dhabi Executive Council.

31 SPECIAL REPORT

05 04

Origin: UAE Residence: UAE Sector: Diversified 2022 rank: 5

Origin: Qatar Residence: Qatar Sector: Energy 2022 rank: 4

Khaldoon Khalifa Al Mubarak

Managing director and group CEO, Mubadala Investment Company

Saad Sherida Al-Kaabi

President and CEO, QatarEnergy/chairman and MD, Industries Qatar

Origin: Saudi Arabia Residence: Saudi Arabia

Sector: Energy 2022 rank: 6

Amin Naseer

President and CEO, Aramco

“All of us have a vested interest in climate protection. And investing in conventional sources does not mean that alternative energy sources and technologies should be ignored,” Amin Nasser, CEO of oil giant Aramco, said at the Schlumberger Digital Forum 2022. In October last year, the company announced a $1.5bn sustainability fund to invest in technology that would support an inclusive energy transition, as well as unveiled plans to establish an innovation hub in Riyadh alongside tech company IBM. Aramco also reported a 46.5 per cent rise in net profit for 2022, totalling $161bn – its highest annual profit as a listed company.

08

Origin: Lebanon/ Mexico

Residence: Mexico

Sector: Telecoms

2022 rank: 7

The son of Lebanese immigrants, Helú incorporated his first venture Inversora Bursátil, a stock brokerage, in 1965. With an estimated net worth of around $85.3bn, the octogenarian business magnate and philanthropist is the founder of Grupo Carso, which is involved in the industrial, retail, energy and construction sectors. He is also an honorary chairman of América Móvil, the Mexican telecom giant, which reported $744.8m in net profit and $11.74bn in revenue for the fourth quarter of 2022. Helú has served as the vice president of the Mexican Stock Exchange and as president of the Mexican Association of Brokerage Houses.

Origin: UAE

Residence: UAE

Sector: Real Estate/ Retail

2022 rank: 8

Mohamed Alabbar Founder, Emaar/noon.com

Alabbar founded Emaar in 1997 and under his direction, the company has grown tremendously. In 2022, Emaar group property sales stood at $9.5bn, while its net profit rose 80 per cent year-on-year to reach $1.9bn. Besides proving his mettle on Dubai’s real estate landscape, Alabbar’s business interests range from e-commerce platform noon.com to digital lender Zand Bank, of which Alabbar is chairman. He received as much as $900m from Americana’s IPO in December 2022 and his remaining stake is now valued at $1.98bn, based on the offer price. He also heads Alabbar Enterprises, through which he holds a stake in the Yoox Net-A-Porter Group.

Origin: Saudi Arabia

Residence: Saudi Arabia

Sector: Finance 2022 rank: 10

HRH Prince Alwaleed bin Talal bin Abdulaziz

Al Saud

Chairman, Kingdom Holding Company

In 2022, Saudi Arabia’s PIF purchased a 16.87 per cent stake in Kingdom Holding Company (KHC) from billionaire businessman and chairman Prince Alwaleed for $1.51bn. Meanwhile, KHC announced an investment of £232.9m ($276m) in UK’s Phoenix Group in 2022, and led a Series C funding round for Saudi grocery delivery startup Nana earlier this year.

Alwaleed Philanthropies, the humanitarian organisation that Prince Alwaleed chairs, has spent more than $4.4bn on social welfare, and has initiated over 1,000 projects in more than 189 countries for over four decades.

32 SPECIAL REPORT

07

Carlos Slim Helú

Honorary chairman, América Móvil

09

06

Origin: UAE

Residence: UAE

Sector: Energy

2022 rank: 11

Sarah bint Yousif Al Amiri Chairwoman,

UAE Space Agency

Origin: UAE

Residence: UAE

Sector: Space

2022 rank: 9

Emirates Nuclear Energy Corporation (ENEC), headed by Al Hammadi, is not only contributing to the country’s net zero by 2050 target, but is also delivering energy security and powering sustainable growth.

In February, ENEC announced that unit 3 of the Barakah plant started commercial operations, adding 1,400MW of clean electricity to the national grid. The Barakah plant is the first peaceful nuclear energy plant to be developed in the Arab world, and when fully operational, will prevent 22.4 million tonnes of carbon emissions every year.

Origin: Qatar

Residence: Qatar

Sector: Diversified 2022 rank: 16

The UAE Space Agency aims to support and foster the country’s space capabilities and drive progress. At its helm is chairperson Al Amiri, who is steering its growth and missions. Last year, the agency signed a MoU with the Philippine Space Agency to enhance cooperation in scientific research, space exploration and knowledge exchange. It also inked an agreement with Bayanat to develop a geospatial analytics platform for the space data centre.

Al Amiri, who is the Minister of State for Public Education and Advanced Technology, will be a driving force in enhancing advanced sciences and their contribution to the national economy.

Origin: UAE

Residence: UAE

Sector: Logistics

2022 rank: 12

In November last year, Sulayem announced that DP World would invest up to $500m to cut carbon emissions from its operations over the next five years. The state-owned ports operator ranked fifth in the world in 2022 by total value of direct investments allocated to the overseas logistics services sector.

DP World has invested more than $10bn (Dhs37.3bn) in the global logistics sector since 2012, making it one of the top five overseas investors in this period.

The company also teamed up with shipping services provider Maersk to improve operational efficiencies and collaborate on decarbonising. Meanwhile, DP World was named as an official partner of McLaren Formula 1 Team in February this year. Sulayem, who is leading the company’s growth and expansion, is also the chairman of Dubai’s Ports, Customs and Free Zone Corporation.

Al-Mahmoud was appointed CEO of Qatar Investment Authority (QIA) in 2018 and has since overseen one of the world’s largest sovereign wealth funds, which currently manages $475bn in assets, according to the Sovereign Wealth Fund Institute.

QIA continues to grow its involvement overseas. In Q1 2023, QIA participated in the inaugural $1.5bn private equity fund of Ariel Alternatives, Project Black. The US-based fund will invest in consumer retail, energy and infrastructure, financial services, tech and healthcare. It also invested $150m in The North Road Company, the global, multi-genre studio based out of Los Angeles.

He has helped steer the fund’s strategy to focus more on diversification and investments with ESG goals, as well as guided the adoption of a new operating model. Prior to his appointment at QIA, Al-Mahmoud was the CEO of Qatar Museums. He is also the vice chairman of Qatar Stock Exchange and national carrier Qatar Airways. Additionally, he is a member of the supervisory board of Volkswagen as well as a board member of Qatar National Bank.

33 SPECIAL REPORT

12

10 13 11

Mohamed Al Hammadi

Managing director and CEO, Emirates Nuclear Energy Corporation

Mansoor Ebrahim Al-Mahmoud CEO, Qatar Investment Authority

Sultan Ahmed bin Sulayem Group chairman and CEO, DP World

Origin: UAE Residence: UAE

Sector: Finance

2022 rank: 17