P.28 SAUDI SUMMIT SHOWCASE: Highlights of our inaugural event in Saudi Arabia

P.46 THE WIO WAY: CEO Jayesh Patel on how the neobank is disrupting traditional banking

P.28 SAUDI SUMMIT SHOWCASE: Highlights of our inaugural event in Saudi Arabia

P.46 THE WIO WAY: CEO Jayesh Patel on how the neobank is disrupting traditional banking

HATEM DOWIDAR’S STRATEGY TO TRANSFORM e & INTO A GLOBAL POWERHOUSE

GULF BUSINESS AWARDS 2025 HERE’S WHO MADE IT TO OUR HONOUR LIST THIS YEAR P.36

CONTENTS / OCTOBER 2025

An insight into the news and trends shaping the region with perceptive commentary and analysis

We shine the spotlight on e&, led by GCEO Hatem Dowidar, and its transformation from a traditional telco into a tech-focused giant, driving innovation, digital growth and global expansion

Our flagship awards celebrated the region’s most dynamic companies and business leaders

Editor-in-chief Obaid Humaid Al Tayer | Managing partner and group editor Ian Fairservice

Chief commercial officer Anthony Milne anthony@motivate.ae

Publisher Manish Chopra manish.chopra@motivate.ae

Group editor Gareth van Zyl Gareth.Vanzyl@motivate.ae

Editor Neesha Salian neesha.salian@motivate.ae

Deputy editor Rajiv Pillai Rajiv.Pillai@motivate.ae

Reporter Nida Sohail Nida.Sohail@motivate.ae

Senior art director Freddie N Colinares freddie@motivate.ae

General manager – production S Sunil Kumar Production manager Binu Purandaran Assistant Production Manager Venita Pinto

Digital sales director Mario Saaiby mario.saaiby@motivate.ae

Sales manager Hitesh Kumar Hitesh.Kumar@motivate.ae

HEAD OFFICE: Media One Tower, Dubai Media City, PO Box 2331, Dubai, UAE, Tel: +971 4 427 3000, Fax: +971 4 428 2260, motivate@motivate.ae DUBAI MEDIA CITY: SD 2-94, 2nd Floor, Building 2, Dubai, UAE, Tel: +971 4 390 3550, Fax: +971 4 390 4845 ABU DHABI: PO Box 43072, UAE, Tel: +971 2 657 3490, Fax: +971 2 677 0124, motivate-adh@motivate.ae SAUDI ARABIA: Regus Offices No. 455 - 456, 4th Floor, Hamad Tower, King Fahad Road, Al Olaya, Riyadh, KSA, Tel: +966 11 834 3595 / +966 11 834 3596, motivate@motivate.ae LONDON: Acre House, 11/15 William Road, London NW1 3ER, UK, motivateuk@motivate.ae

50 and counting: Luxury footwear brand Santoni marks its 50th anniversary this year. CEO Giuseppe Santoni talks milestones, expansion and more p.54

Quiet luxury: Peserico, the Italian fashion brand known for its timeless elegance and sartorial craftsmanship, is making its presence felt in Dubai p.59

“Dubai’s vision, guided by the leadership of HH Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, has always been to shape the future of finance. The recognition [among the world’s top four cities for fintech] in the latest Global Financial Centres Index reaffirms the emirate’s position as a global force in fintech and the wider financial services sector.”

Essa Kazim, governor of DIFC

Email: info@britishchamberdubai.com

Website: britishchamberdubai.com

LinkedIn: /british-chamber-dubai

Instagram: @bccdubai

X: @BCCDonline

The British Chamber of Commerce Dubai is a membership organisation that supports companies and individuals from the UK with existing business interests in the region and those new to the UAE.

Our membership consists of British-owned, Dubai and RAK-based companies, UK registered organisations, UK passport holders and brands that support British business.

Through a considered and strategic calendar of events, the BCCD ensures high-quality networking opportunities, market knowledge sharing, valuable engagement opportunities and exclusive experiences for our members.

The BCCD provides an ecosystem that goes beyond Dubai, to the wider GCC and through the British Chambers of Commerce’s Global Business Network reaching and providing international exposure and opportunities for our members and stakeholders.

For more information, please contact the BCCD Business Team: info@britishchamberdubai.com

Founding Sponsors Annual Partners

GULF BUSINESS LIFETIME ACHIEVEMENT AWARD

Gerald Lawless

LEADER AWARDS

BANKING LEADER OF THE YEAR

Rola Abu Manneh CEO, UAE, Middle East and Pakistan, Standard Chartered

ENERGY LEADER OF THE YEAR

Rasso Bartenschlager General Manager, Al Masaood Power

HEALTHCARE LEADER OF THE YEAR

Dr. Craig R. Cook

CEO, The Brain & Performance Centre, a DP World company

HOSPITALITY LEADER OF THE YEAR

Joe Nassoura General Manager, Fairmont Dubai

INVESTMENT LEADER OF THE YEAR

Bal Krishen Rathore Chairman, Century Financial Group

GULF BUSINESS LEADER OF THE YEAR

Rola Abu Manneh CEO, UAE, Middle East and Pakistan, Standard Chartered Bank

COMPANY AWARDS

BANKING COMPANY OF THE YEAR RAKBANK

ENERGY COMPANY OF THE YEAR

GE Vernova

HEALTHCARE COMPANY OF THE YEAR

LOGISTICS LEADER OF THE YEAR

Tarek Sultan Chairman, Agility Global

REAL ESTATE LEADER OF THE YEAR

Yousuf Fakhruddin CEO, Fakhruddin Properties

RETAIL LEADER OF THE YEAR

John Hadden CEO, Alshaya Group

TECHNOLOGY LEADER OF THE YEAR

Andreas Hassellöf Founder and CEO, Ombori

TOURISM LEADER OF THE YEAR

Mohamed Abdalla Al Zaabi Group CEO, Miral Group

TRANSPORT LEADER OF THE YEAR

Aster DM Healthcare

HOSPITALITY COMPANY OF THE YEAR

FIVE Hotels and Resorts

INVESTMENT COMPANY OF THE YEAR

AIX Investment Group

LOGISTICS COMPANY OF THE YEAR

AD Ports Group

REAL ESTATE COMPANY OF THE YEAR

Adel Mardini CEO, Jetex

Refad Real Estate Investment and Development Company

RETAIL COMPANY OF THE YEAR

Dubai Duty Free

TECHNOLOGY COMPANY OF THE YEAR

Crowe Mak

TOURISM COMPANY OF THE YEAR Miral Group

TRANSPORT COMPANY OF THE YEAR

Thrifty Car Rental

GULF BUSINESS COMPANY OF THE YEAR Miral Group

EDITOR’S CHOICE COMPANY AWARDS

DIGITAL TRANSFORMATION COMPANY OF THE YEAR

Etihad Salam Telecom Company

FINTECH PROVIDER OF THE YEAR OKX

MICE PROVIDER OF THE YEAR

Tahaluf

EDITOR’S CHOICE LEADER AWARDS

LEGACY IN LEADERSHIP

Masih Imtiaz CEO, Imtiaz Developments

CROSS-BORDER BUSINESS ICON OF THE YEAR

Capt. Pradeep Singh CEO and Founder, Karma Realty Developers

DISRUPTIVE LEADER OF THE YEAR

Dr Ali Asgar Fakhruddin CEO, Sterling Group

SEE THE EVENT COVERAGE

VISIONARY LEADER OF THE YEAR

Ankur Aggarwal Chairman and Founder, BNW Developments

WOMAN LEADER OF THE YEAR

Mila Semeshkina CEO and Founder, WE Convention

DISRUPTIVE COMPANY OF THE YEAR

Ultima Chain

FAMILY BUSINESS OF THE YEAR

Al Khayyat Investments (AKI)

Tesla’s $8.5tn ambition hinges on humanoid robots, robotaxis, investor faith, and Musk’s ability to deliver on steep milestones

How can Tesla become an $8.5tn company? That’s the market valuation the electric vehicle maker would have to reach to justify CEO Elon Musk’s new pay package announced in Septmber.

Selling 100 million humanoid robots in a year could do it; creating a robotaxi network with more than 10 times the revenue of Uber might as well. And of course, investor hope is part of the equation.

Musk was given a decade to expand Tesla’s $1tn valuation into a company worth more than the combined current value of Nvidia and Microsoft, the two most valuable publicly traded companies in the world. If he succeeds, Musk, already the

best-paid CEO in the world, would receive a trillion-dollar pay package.

Musk’s new pay package was granted on September 3, but it is subject to shareholder approval in November. The board showed how and where it expects Tesla to make its money by structuring Musk’s pay package around 12 milestones that are primarily based on products and profit, as well as market capitalisation. They target enormous increases in profit as Tesla rolls out its Optimus humanoid robots and a robotaxi fleet that it hopes will be more efficient than human-driven rivals.

A lot depends on how investors value the company. Tesla, for example, is valued as a growth stock,

trading at around 75 times its earnings before interest, taxes, depreciation and amortisation, or EBITDA, even though its vehicle sales dropped last year and are likely to drop this year.

The payoff is astounding – and so are the goals. Gene Munster, managing partner at Deepwater Asset Management, broadly estimated that robotaxis and self-driving software could be worth a tillion dollars of market cap each, with cars another half a trillion. “At the end of the day, the reason why this is going to work or not work really comes down to Optimus,” he said. “It’s a fairy tale, but it’s one that could actually happen.”

Musk has been betting the company on self-driving software and robotaxis for some time. Tesla currently has a small fleet of robotaxis - estimated to be about three dozen vehicles - in a part of Austin, Texas. An early Musk milestone is to have a million robotaxis in operation.

One of Tesla’s biggest fans, ARK Invest, predicted an even sunnier case well before the Musk pay package was announced. They see Tesla’s market capitalisation hitting $7tn to $10.9tn in 2029, with a Tesla robotaxi network bringing in between $603bn and $951bn of ride-hail revenue per year. Global ridehailing leader Uber, by comparison, will have revenue of $52bn this year, according to LSEG.

Tesla would start off owning and operating a robotaxi network, which would eventually be taken on by another company, ARK forecast. Tesla’s share of the ride fare would be 40-60 per cent, double that of Uber, ARK said. ARK did not include a valuation for robots in its model, although it said that could become a $24tn market.

More recently, Musk has described robots as the future, saying the Optimus humanoid robot could account for 80 per cent of Tesla’s value eventually.

If Tesla’s future depends on Optimus, it will have to sell a lot of robots – maybe more than 100 million a year, according to Reuters calculations. If Tesla’s business was only robots, that 100 million figure is what it would take to hit the top EBITDA profit target, as specified in the Musk pay package, of $400bn. Optimus is expected to be priced at around

MORE RECENTLY, MUSK HAS DESCRIBED ROBOTS AS THE FUTURE, SAYING ROBOT COULD ACCOUNT FOR 80 PER CENT OF TESLA’S VALUE EVENTUALLY

$25,000 and Tesla’s current EBITDA profit margin is around 15 per cent. For twice the profit margin, Tesla would have to sell only half as many robots.

EBITDA this year is expected to be $13bn, according to LSEG, so Tesla has a long way to go.

Much will also depend on how investors calculate Tesla’s potential at the end of the decade-long pay package. If investors were to continue pricing Tesla at 75 times EBITDA, it would take $113bn in EBITDA for Tesla to reach a $8.5tn valuation, or less than the profit goal Tesla has set in Musk’s pay package. That package has a top EBITDA of $400bn and a top market cap of $8.5tn, a multiple of 21.

ONE OF TESLA’S BIGGEST FANS, ARK INVEST, PREDICTED AN EVEN SUNNIER CASE WELL BEFORE THE MUSK PAY PACKAGE WAS ANNOUNCED. THEY SEE TESLA’S MARKET CAPITALISATION HITTING $7TN TO $10.9TN IN 2029, WITH A TESLA ROBOTAXI NETWORK BRINGING IN BETWEEN $603BN AND $951BN OF RIDE-HAIL REVENUE PER YEAR. GLOBAL RIDE-HAILING LEADER UBER, BY COMPARISON, WILL HAVE REVENUE OF $52BN THIS YEAR, ACCORDING TO LSEG.

The $400bn target was “materially more aggressive” than Morgan Stanley’s predictions on Tesla’s auto, energy and robotaxi businesses, its analysts said in a note on Sunday, adding that it “would imply substantial contributions from Optimus and other AI robot end markets currently not in our forecasts.”

Some investors welcomed the focus on the new products and said the proposed pay might help address what is ailing the company now.

“There are big operational hurdles that Tesla does need to accomplish,” said Will Rhind, CEO of global ETF issuer GraniteShares. “There are things that clearly need to be reversed, such as declining sales, et cetera. So, why not tie the CEO’s compensation to reversing some of those trends?”

Reuters

In China, business success depends on understanding cultural nuances like relationships and communication, as misunderstandings can easily derail deals

China is the market everyone wants to crack – but not everyone knows how. For Gulf executives, the stakes are especially high. China is already a top energy partner for the Middle East, its companies are global leaders in technology and infrastructure, and its vast consumer market is hungry for new ideas, products, and partnerships.

Yet, time and again, deals stumble not because of the numbers but because of misunderstandings – of culture, hierarchy, or communication style. Many executives from the Gulf have privately admitted that what looked like a “yes” in Beijing later turned out to

be a “maybe” at best, or that the real decision-maker in a Chinese delegation never actually spoke during the meeting. These are not isolated incidents – they are recurring cultural patterns.

Here’s a cheat-sheet for navigating business in the world’s most dynamic marketplace, with lessons drawn from both Chinese and Gulf experience.

In the Gulf, business thrives on ‘wasta’ — trust networks built on family, reputation, and loyalty. In China, the equivalent is guanxi. Both rely on reciprocity and shared obligations.

• Don’t rush to sign a deal. Just as in the Gulf, it’s the relationship that gets you into the room, not the contract.

• Expect introductions through trusted intermediaries to carry more weight than cold approaches.

Real-world insight: Chinese firms in Saudi Arabia often lean on royal commissions or local families for introductions – without this backing, projects rarely advance smoothly.

Both Gulf Arabs and Chinese are highcontext communicators — meaning much is left unsaid. A polite “yes, inshallah” in the Gulf or “we will consider it” in China can both mean “no”. However, research shows that Arab speakers tend to be more expressive than Chinese, making the non-verbal aspects of communication even more important.

• Pay attention to tone, pauses, or hesitation.

• Confirm understanding in writing, tactfully: “To clarify, shall we follow up next week on this?”

Pitfall: Many Gulf executives mistake a Chinese “yes” as agreement when it is only courtesy. The reverse happens too – Chinese partners can misread Gulf politeness as firm commitment.

Dr Catherine Hua Xiang is the head of East Asian languages and programme director for international relations and Chinese at the London School of Economics, and author of Bridging the Gap: An Introduction to Intercultural Communication with China

Confucian values in China and tribal/family traditions in the Gulf both mean hierarchy matters. Deals are signed at the top, not the middle.

• Always send a delegation that matches your counterpart’s seniority.

• Don’t expect a mid-level Chinese manager to commit without consulting superiors – just as a family adviser in Riyadh may not speak for the patriarch.

Case in point: A Chinese company once delayed a project in the Gulf simply because they weren’t sure “who was really in charge” – a ministry, a family conglomerate, or a royal commission. Mapping decisionmaking structures is essential on both sides.

Whether it’s a Beijing banquet or a majlis in Abu Dhabi, business talk is often secondary to ritual and hospitality.

• Present your business card with both hands, ideally with one side in Chinese.

• Don’t push business at a Chinese dinner; rapportbuilding is the real agenda.

• Equally, don’t underestimate the importance of coffee, dates, and long conversations in Gulf hospitality.

Both Gulf and Chinese partners care deeply about dignity. Causing someone to “lose face” in China or “lose honour” in the Gulf can derail years of effort.

• Never openly contradict or embarrass a counterpart.

• Critique privately and soften refusals with lternative suggestions.

• Praise in public whenever possible.

Example: A Gulf investor once publicly questioned a Chinese manager’s production figures during a meeting. The manager felt humiliated in front of his staff – cooperation cooled quickly afterward.

6

Negotiations in China can feel slow and circular, while Gulf negotiators are known for being competitive and occasionally dramatic to show resolve. The result can be mismatched expectations.

• Expect multiple rounds in China – patience is seen as commitment.

• Avoid raising your voice or showing frustration, which may be tolerated in Gulf bargaining but is seen as a loss of self-control in China.

• Contracts in China are “living documents” tied to the relationship. Build in review mechanisms rather than expecting terms to be frozen forever.

Details carry weight. Colours, symbols, and timing can affect impressions.

• Red is auspicious in China; avoid gifting clocks or umbrellas.

• In the Gulf, never offer alcohol; instead, gifts of dates or handicrafts are welcome.

• Respect local calendars: Ramadan in the Gulf and Chinese New Year in China both slow down formal business but open opportunities for cultural connection.

Neither Gulf nor Chinese executives think in quarters. Both think in generational horizons — be it sovereign wealth or ‘Belt and Road’.

• Frame proposals as long-term partnerships, not short-term wins.

• Emphasise sustainability, shared growth, and trust.

Doing business in China is not about memorising a list of dos and don’ts. It’s about mindset: patience, humility, and cultural intelligence. For Gulf executives, there is good news: you already understand the importance of trust, honour, and long-term vision – values that resonate powerfully in China.

As China and the Middle East deepen ties in energy, infrastructure, and technology, those who invest in understanding will move faster and further than those who don’t. Deals will follow, but respect comes first.

• Build trust before pushing for contracts.

• Present business cards with both hands.

• Match delegation seniority.

• Praise in public, correct in private.

• Think long-term, not short-term.

DON’T:

• Rush negotiations.

• Force people into saying “no.”

• Dismiss rituals like banquets or card exchanges.

• Cause someone to lose face in front of others.

• Treat China as just another “big market” – it is a cultural world of its own.

The Middle East is pouring billions into AI and data centres, but without communication, empathy, and conflict-resolution skills, progress risks stalling.

We often talk about artificial intelligence (AI) and the human element in terms of job displacement, ethics, or employee augmentation. Or we focus on how AI use cases should be driven by real needs rather than shiny object syndrome. Yet, there’s a missing piece in these conversations. Often overlooked are the human skills behind the scenes, particularly among the IT teams quietly powering this transformation.

Why does this matter more than ever? Because across the region, AI initiatives are accelerating at pace. In recent months alone, headlines have heralded multi-billion-dollar investments and landmark joint ventures. From AI research hubs to sprawling data centre builds, the Middle East is laying the groundwork for a tech-driven future. But amid all

this momentum, it’s equally important to consider the human capability required to ensure these efforts deliver real value. All the advanced infrastructure, algorithms, and analytics tools in the world won’t amount to much if the people managing them can’t communicate clearly, build trust, or navigate challenges.

Whether you’re a startup scaling fast, a small or mediumsized business modernising operations, or a large enterprise undergoing digital transformation, your success with AI will depend as much, or more, on people, as it does on platforms. Take, for instance, a company deploying AI-powered customer tools. If the IT team can’t articulate the system’s value in plain terms, anticipate concerns, or respond thoughtfully to pushback, the rollout is likely to stall. Similarly, during a security incident, AI tools might rapidly detect the breach; however, clear updates, calm leadership, and the ability to align different stakeholders under pressure will play an equally important role in impact containment.

This is why three foundational soft skills must be prioritised alongside technical training. These aren’t secondary skills or nice-to-haves. They’re essential capabilities that enable human-centred transformation, helping turn innovation into impact.

In a region where digital literacy varies widely across industries and roles, clear communication is not only helpful, it’s critical. Tech professionals must be able to bridge the gap between technical accuracy and accessible language, adapting their style to the needs of nontechnical colleagues without compromising on clarity. Misunderstandings are often the result of assumptions, not incompetence. A developer might walk through a dashboard using layers of acronyms and jargon, unintentionally alienating colleagues who need the context explained in more familiar terms.

Effective communicators adjust their tone and delivery based on who they’re speaking to and the situation at hand. In a diverse region such as the Middle East, where teams often span languages,

cultures, and work styles, this includes being sensitive to nonverbal cues, levels of formality, and cultural nuance. Communication isn’t entirely about having the right answers; it’s also about making sure those answers land.

Another example where clear communication and logical thinking are required is the use of generative AI (GenAI) prompts. When prompting a GenAI large language model, the prompt should use precise language with logical cohesion to return a result that is useful and informative, similar to how an SQL query requires well-considered ‘JOIN’ and ‘WHERE’ clauses. In these situations, the ideal approach is to carefully evaluate how to best inform the AI of the results you want, which requires the key soft skills of critical thinking and wordcraft.

Imagine if the great Arab poet Al-Mutanabbi, in his Ode to Sayf al-Dawla asked a GenAI programme to create an image from this line, but instead of “teeth”, used “mouth”:

If you see the lion bare his teeth, do not think the lion is smiling.

With less precise language, it was highly likely for AI to return an image of a lion roaring, or licking its paw, or simply panting in the heat. Because of imprecise language, AI must make its own assumptions, which can often miss the mark.

While AI is intended to enhance productivity and outcomes, it often introduces disruption, which can make people uneasy. Empathy helps leaders and IT professionals understand this emotional response and support people through change. Sometimes, this means acknowledging frustration during a tricky rollout or taking the time to listen to feedback without becoming defensive. These small gestures build confidence and engagement over time, making future change easier to manage.

Empathy becomes all the more important when roles are affected by automation or digital shifts. If someone is worried their responsibilities will shrink or disappear, telling them to “embrace the future” won’t help. What does help is open dialogue, reassurance, and support in developing new skills. People are more likely to trust the technology when they trust the intent behind it, and trust is built on empathy.

Every digital project, no matter how well planned,

Kevin Kline is the technical evangelist, databases at SolarWinds

will encounter friction. Misaligned expectations, evolving requirements, or communication breakdowns can all lead to conflict. The key difference between a minor setback and a major derailment is how the conflict is handled. Yet many technically minded professionals are more comfortable solving code-level problems than engaging with emotionally charged conversations.

Conflict resolution, like any skill, can be developed. It starts with self-awareness, a willingness to listen, and a focus on shared outcomes, not individual frustrations. In Middle Eastern work cultures, where hierarchy and indirectness can influence how feedback is given and received, this also means applying emotional intelligence and cultural sensitivity to tough conversations. Whether it’s choosing the right moment, softening the tone, or involving a mediator, the goal is always the same: to move forward with mutual respect and clear direction.

So, how can organisations start embedding these vital skills in their workforce? The first step is treating soft skills as core competencies, not extras. They should be woven into training programmes, onboarding processes, and ongoing learning initiatives. Role-playing scenarios, mentoring, and peer feedback are practical ways to encourage this growth without needing extravagant resources.

Equally important is the role of leadership. When senior IT and business leaders model calm communication, active listening, and thoughtful conflict management, they set a tone for the rest of the team to follow. Culture change doesn’t happen overnight, but it starts with what’s valued and rewarded. If interpersonal skills are never considered during reviews or promotions, they’ll always take a back seat. It’s time to recognise the professionals who not only build great systems but also build trust and collaboration within their teams.

The Middle East’s AI investments, from hyperscale data centres to national AI strategies, are bold and visionary. But these initiatives will only be as effective as the people entrusted with bringing them to life. Technology, after all, is only a tool. Its real impact depends on how it’s used and by whom.

Soft skills may not feature in news headlines or line items on procurement budgets, but they’re what turn potential into performance. In an era of smart machines and smarter infrastructure, it’s the human layer that will determine whether the region’s AI ambitions truly deliver on their promise.

Dubai’s success in real estate tokenisation is driven by proactive regulatory sponsorship, robust infrastructure, strategic planning, and strong public-private collaboration

As blockchain technology matures, the focus is shifting from speculation to real utility. Real-world asset tokenisation is central to this shift, offering the potential to radically improve how assets are issued, traded, and settled through greater transparency, efficiency, and liquidity.

At Ripple, we view tokenisation as one of the most powerful drivers of real-world blockchain adoption, with the potential to profoundly change the way global financial markets operate in the future. Our recent report with BCG projects the tokenised asset market to grow from $0.6tn today to a staggering $18.9tn by 2033. But to get there, we need more than technology. We need clarity and trust.

Despite strong interest, tokenised assets still represent a fraction of traditional financial markets, largely due to legal and operational uncertainties. That’s why the Dubai Land Department (DLD)’s real estate tokenisation pilot, delivered in collaboration with the Virtual Assets Regulatory Authority (VARA), marks such a breakthrough. By pioneering an on-chain title deed registry, the DLD has lowered entry barriers for investors and enabled innovators like Ctrl Alt and Prypco to reimagine real estate investment on public

blockchains like the XRP Ledger (XRPL). The market response speaks for itself: the second property sold out in under two minutes.

Tokenisation has not been without its challenges. The core challenge is legal: a token cannot unlock its full value unless it clearly confers immutable rights that are recognised by law. Most tokenisation efforts to date sidestep this by mirroring off-chain financial instruments – bonds, money market funds, treasuries – on blockchain, rather than embedding legal rights directly into tokens.

This workaround has limitations, especially for tangible real-world assets like real estate. Tokenising a property title deed is only useful if it eliminates the friction of reconciling on-chain tokens with off-chain legal records. Without legal certainty, investors hesitate, and the promise of instant, final transfer of rights remains out of reach.

Operational challenges compound the issue. Any system supporting real-world tokenisation must balance open participation with compliance requirements, especially anti-money laundering (AML) and

know your customer (KYC) rules. Ensuring efficient distribution, secondary market liquidity, and investor trust are all core issues that depend on robust infrastructure and regulatory buy-in.

Dubai’s real estate tokenisation pilot has been a turning point because it tackles these issues head-on. The DLD created a legally recognised, on-chain property title, eliminating the need for an off-chain deed. This simplifies ownership transfers and makes fractional real estate investment more accessible.

With close collaboration by the regulator VARA, foresight by DLD and private sector innovation from Ctrl Alt and Prypco, the pilot represents a full-stack effort. It enables real estate investment from as little as Dhs2,000, drawing in a new class of investors and injecting fresh value into the real estate sector. And building on the XRPL, a permissionless blockchain with infrastructure for permissioned domains, uniquely allows both broad market access and strong compliance controls.

Dubai’s approach is truly pioneering. Under this umbrella of regulatory clarity, many projects previously considered difficult to achieve are closer to becoming an attainable reality. And it is one of the few global jurisdictions where a pilot like this could take off in the way it has, thanks to detailed planning, the Dubai Government’s strategic foresight about crypto’s potential and progressive regulation that are now yielding rewards. There are four key lessons that other policymakers and innovators can take from this pilot:

01 Regulatory sponsorship is paramount Innovation isn’t just a private-sector function. Just as technology continues to innovate, regulators must also evolve in their approach. The DLD and VARA went beyond permitting tokenisation; they helped shape it, resolving key legal questions about title and ownership. That kind of clarity builds trust, and trust is the bedrock of adoption. With this model, Dubai shows that a proactive, innovative

DUBAI’S APPROACH IS TRULY PIONEERING. UNDER THIS UMBRELLA OF REGULATORY CLARITY, MANY PROJECTS PREVIOUSLY CONSIDERED DIFFICULT TO ACHIEVE ARE CLOSER TO BECOMING AN ATTAINABLE REALITY.

and well-regulated approach can enhance both market stability and consumer welfare.

02 Infrastructure matters

Ctrl Alt leveraged Ripple’s banking-grade custody solution to assist Ctrl Alt in meeting VARA’s requirements. Furthermore, by issuing tokens on the XRPL, the pilot leveraged the wider pool of liquidity that comes with a permissionless ledger, while still allowing for permissioned protocols, facilitating built-in compliance. These infrastructure fundamentals are a must for building trust and judging by the recordbreaking uptake in the last release, consumers recognise that.

The pilot was the product of extensive preparation, both technically and legally. There were countless reasons it might never have taken off, but the effort put into mitigating the majority of associated risks before the pilot›s launch was key to its successful debut. With real estate in particular, a level of professional property management must exist to realise yield and maintain upkeep, regardless of the property›s ownership structure. This was clearly addressed during the pilot›s launch. The tokens were integrated into DLD’s existing traditional ownership systems, ensuring a seamless experience that removed friction for users.

The partnership between DLD and VARA shows what’s possible when government entities align. The same principle applies to public-private sector collaboration. Coordination across sectors and a willingness to work through legal and operational complexity together is what truly sets successful markets apart, accelerating innovation and adoption in this transformative space.

Dubai’s pilot doesn’t solve every challenge, but it offers a compelling template that other jurisdictions can study and build upon. As more asset classes –from real estate to equities – explore tokenisation, the demand for regulatory clarity and robust infrastructure will only grow. Dubai has shown how to lead from the front. The question now is: who will follow?

From geopolitical shocks to regulatory shifts, Raymond Kairouz, GM of UAE at Chedid Re, explains how resilience means staying power, not short-term playbooks

For an industry built on guaranteeing resilience, its own has been put to the test repeatedly, severely, and differently in nearly every global market. From geopolitical instability to inflationary pressures to regulatory growing pains, there have been plenty of reasons and motives to retreat from (re)insurance – in the region as much as elsewhere. Where others did just that, we consolidated and doubled down.

Markets defined by volatility demand a long-term playbook that is invested in their continuity, grounded in regulatory agility, and enabled by portfolio versatility. Over the last decade, many reinsurance players in the region have responded in kind to boom-bust cycles; they would enter, exit, and re-enter, largely placing sentiment over strategy. This short-termism has created gaps in local service delivery and, sometimes, even put regulatory trust at stake. Operating across different political, economic, and sociocultural landscapes requires a level of commitment that cannot be outsourced or short-lived. It’s why we invest in people and platforms, but most importantly, presence.

Chedid Re’s timeline of staying power is proof that resilience is as much about timing and trust as it is about capital or compliance. With each expansionary move, our goal has remained clear and become clearer: establish early, operate locally, and stay long enough to scale responsibly. In the UAE, where we’ve

planted deep roots since 2007 and launched our DIFC subsidiary in 2024, our focus has been on cross-border innovation, collaboration, and expansion. In Saudi Arabia, where we established our office in 2010 and then our regional headquarters in 2023, we’ve built on a different kind of momentum, led by vision first, volume potential next.

The truth is, where market nuances and dynamics come into play, there is not one single definition of resilience. In one market, it looks like cautious and conservative growth. In another, it’s about simply standing your ground. And in others, it’s about scaling fast and furious. From our vantage point, with exposure to nearly every kind of operating climate across Europe, the Middle East, Africa, and parts of Asia, it’s clear that resilience is becoming more situational and less static.

This realisation, tough as it is, requires the local expertise to predict and experience to preempt. Our local teams have consistently identified regulatory shifts, anticipated compliance developments, and flagged emerging risks ahead of the market. Rather than ‘plugand-play’ models exported from headquarters, we’ve adapted our brokerage and claims strategies to market-level risk understanding – whether that’s political upheaval, energy exposure, or foreign exchange volatility. This means, for instance, reengineering placement strategies at speed, or retaining

underwriting capacity through policy structures that can help mitigate currency swings. And it most certainly, almost always, means clearing licensing hurdles and reshaping how coverage is placed to comply with local rules.

The ability to operate compliantly and grow competitively is often overlooked and understated in our industry. Our network in more than 85 countries is supported by a governance model aligned with international best practices and regional nuances. This depth of regulatory understanding is what sets us apart in markets like the UAE, where we’re fully licensed under the DFSA, one of the region’s most stringent and forwardlooking frameworks. It’s also why we’ve strengthened our boards and leadership teams with experienced advisors and industry veterans, reinforcing our compliance and governance frameworks across jurisdictions. But you don’t last long here only by mastering reinsurance and regulations. You do it by also understanding risk and boardroom priorities in every sector you secure. What audit committees need. How corporates think about capital adequacy. Where shareholders see exposure. Resilience for any reinsurance broker today is about knowing everyone else’s business as well as they do their own. In practical terms, this means advising on business continuity, capital efficiency, and regulatory alignment as expertly as we do on coverage gaps.

Now, as we expand and reinforce our presence in new and existing markets, our goal is to build credibility and capacity for the long term. While the same operational DNA that has worked for us in other markets applies – local knowledge, governance-first approach, and specialised expertise – we know the rules may and will be entirely different in other fast-growing but complex regions. We’ll bring the lessons of the past two-plus decades, but never the same strategy or playbook.

Sometimes, the opportunity lies in striking while the iron is hot. Other times, it’s about seeing long-term potential in short-term volatility. But it’s always, always about knowing how to stay there once you’re there. That’s the heart of resilience. And that’s our commitment to our clients, our partners, and our markets.

OCTOBER 2025

CAMPAIGN SAUDI BRIEFING (RIYADH, KSA) Media & Marketing

FEBRUARY 2026

CAMPAIGN BREAKFAST BRIEFING (DUBAI, UAE) Ramadan Advertising & The Year Ahead

NOVEMBER 2025

CAMPAIGN BREAKFAST BRIEFING (DUBAI, UAE) Out of Home 2026

DECEMBER 2025

CAMPAIGN AGENCY OF THE YEAR MIDDLE EAST AWARDS (DUBAI, UAE)

Regional CISOs turn to ‘vulnerability debt’ to quantify cybersecurity risks in financial terms, helping boards prioritise urgent patches

Software vulnerabilities remain favored paths for threat actors. IBM’s X Force Threat Intelligence Index for 2025 showed that in the previous year, around one in four incidents across critical sectors involved exploited vulnerabilities. IBM’s study is based on a daily tally of 150 billion security events in more than 130 countries including the UAE, where earlier this year the Cyber Security Council alerted the nation to the presence of more than 223,800 domestically hosted vulnerable assets. In its report, the council also raised concerns that half of observed critical vulnerabilities had remained unaddressed for more than five years.

Outdated systems and slow patching cycles leave organisations exposed as new issues are discovered

and legacy ones remain unpatched. Security leaders must balance labour, tools, and budgets to cover an expanding attack surface and an increasingly sophisticated threat landscape. Trying to find all of an organisation’s weak points can be difficult enough, but once flagged, security teams may find they are not getting the support they need to patch even critical vulnerabilities.

In trying to make the case for action, CISOs are starting to rely on the concept of vulnerability debt. Software development teams will often talk about technical debt as the projected cost of future changes resulting from the cheap shortcuts taken today. Vulnerability debt measures the cost of fixing security gaps. But calculating a figure that will be meaningful to decision makers is a challenge.

We must begin with a comprehensive, up-to-date asset list. While tools exist for auto-discovery of IT assets, most CISOs will struggle to reach the necessary level of detail that can lead to an accurate figure for vulnerability debt. We must also consider

that not all debt is the same. Just as payment terms for credit cards vary from those of long-term mortgages, CISOs will have to establish which issues must be addressed immediately and which can be treated as longer-term issues. Such determinations will include assessments that range from high-impact issues that are easy to address versus low-impact issues that are more complex to resolve.

While threat intelligence will be critical, organizations must focus on what impacts their own ecosystem. For example, the US Department of Commerce’s National Institute of Standards and Technology (NIST) is developing a new likely exploited vulnerabilities (LEV) metric that will estimate the probability that a given vulnerability has already been exploited in the real world. But this metric must be taken in the context of likely impact on your organisation.

Once a list of critical issues has been compiled, CISOs must also quantify what work needs to be done to deploy fixes or introduce remediation measures. This will often require coordination with other teams if only to select the least impactful period of downtime.

To get an accurate figure for vulnerability debt, the CISO must also carry out cyber risk quantification (CRQ). This metric combines lump and ongoing costs for each issue with the probability that it is successfully exploited. Of course, probabilities are, by definition, an attempt to quantify uncertainty, which means inaccuracy is unavoidable. Security operations centres work with these uncertainties daily to understand and categorise new vulnerabilities. The imperfections in CRQ and IT asset information may be difficult to eliminate, especially because of the swelling complexity of modern IT environments, but these approaches are still the best way to quantify risk within these environments. Over time, accuracy will improve in all measurements, leading to a greatly improved view of the risk surface.

FINANCE EXECUTIVES MAY BE MORE OPEN TO A MILLION-DIRHAM BUDGET TO FIX A VULNERABILITY ONCE THEY LEARN THAT THEIR INACTION MAY LEAVE THEM OPEN TO REGULATORY PENALTIES IN THE TENS OF MILLIONS.

Hadi

Jaafarawi is the regional VP, Middle East and Africa, Qualys

ONCE A LIST OF CRITICAL ISSUES HAS BEEN COMPILED, CISOS MUST ALSO QUANTIFY WHAT WORK NEEDS TO BE DONE TO DEPLOY FIXES OR INTRODUCE REMEDIATION MEASURES. THIS WILL OFTEN REQUIRE COORDINATION WITH OTHER TEAMS IF ONLY TO SELECT THE LEAST IMPACTFUL PERIOD OF DOWNTIME.

The focus for security leaders must be explaining cyber risk to non-technical audiences through the lens of business cost. Vulnerability debt is a dirham figure. The decision-making audience – the board and senior executives – must be able to view the cyber status quo in terms of disruption to their sphere of responsibility. Overall cash values will be useful but tying critical risks to incidents must include impact on a departmental level. If the story is well told, the CISO will gain allies among management positions who may, for example, become more amenable to downtime for patching. And finance executives may be more open to a milliondirham budget to fix a vulnerability once they learn that their inaction may leave them open to regulatory penalties in the tens of millions.

Vulnerability debt figures are difficult to achieve but pay dividends. Those who must decide whether to invest in patching need numbers if they are to weigh action against inaction. Once they see realworld costs against each path, they will see the wisdom in taking steps towards a stronger security posture. Figures must therefore have enough detail to allow business stakeholders to see the potential risks and what is necessary to address them. When organsational risk is transparent it becomes easier to make arguments for more downtime and more investment, including cyber insurance for risks that are outside the SOC’s control. Vulnerability debt paints the right picture of risk, financial impact, and response capabilities to provide direction for the decision makers who greenlight the necessary actions. As a narrative concept, vulnerability debt is priceless.

Amid 2025’s market volatility and geopolitical tensions, a new strategic allocation framework by Bank of Singapore uses robust optimisation, scenario simulations, and tailored alternatives to build resilient, diversified portfolios

This year has been marked by heightened volatility and deepening uncertainty. With unresolved tariff negotiations and ongoing geopolitical conflicts, markets have responded with sharp fluctuations. In April, the VIX – a key measure of market volatility – spiked to its highest level since the Covid19 pandemic. Since 2022, both equities and bonds have more frequently posted negative returns in tandem, a rare and troubling trend. In this environment, traditional portfolio construction methods are being tested. We believe a new approach is needed – one that embraces uncertainty.

To help our clients build more resilient portfolios, a new strategic asset allocation framework was introduced in July 2025, the result of a year-long study and stress testing of over 120,000 portfolios. It is designed to deliver more stable returns across market

cycles by directly incorporating uncertainty into the portfolio design process.

The new framework introduces three major enhancements that set it apart from traditional approaches: First, we have adopted a technique called robust optimisation, used by institutional investors and quantitative hedge funds. This is the first time an Asian private bank has applied it to strategic asset allocation. Unlike more widely used approaches such as meanvariance optimisation (MVO) or market cap-weighted benchmarks, robust optimisation accounts for uncertainty in expected returns and naturally leads to more

Dr Owi S Ruivivar is the chief portfolio strategist at Bank of Singapore

diversified portfolios – without the need for artificial constraints.

Second, we developed a proprietary simulation engine to test how portfolios perform under a wide range of market scenarios. This engine, built over several months, uses a mix of machine learning and heuristic techniques to guarantee diversity of outcomes and refine portfolio construction. While simulation engines are rarely used in private banking due to their complexity, we saw it as essential to building a framework that is both rigorous and practical.

Third, we also introduced a more tailored approach to alternative investments. Based on client objectives – whether income, capital accumulation, or a mix – we provide detailed recommendations across private equity, private credit, hedge funds, and real assets. While robust optimisation isn’t yet applicable to alternatives due to limited data, we’re monitoring developments closely and are open to integrating it in the future.

This framework reflects a broader shift in investor expectations. Clients today are more sophisticated and seek portfolio-led solutions tailored to their goals, risk appetite, and market outlook. Our approach encourages “portfolio thinking” – evaluating each investment by its contribution to overall portfolio risk and return, rather than in isolation. Relationship managers and investment advisors use the framework to evaluate client portfolios, which are structured into two parts: the anchor and the enhancement. The anchor portfolio – comprising cash, public markets, gold, and alternatives – is the main risk-bearing component, with robust optimisation applied to the public markets segment. The enhancement portfolio allows for more idiosyncratic or concentrated exposures based on client preferences.

Ultimately, our goal is to help our clients think more like institutional investors – embracing diversification, managing risk holistically, and building portfolios that are resilient in the face of uncertainty. With the right tools, data, and expertise, we believe this is the right time to make that shift.

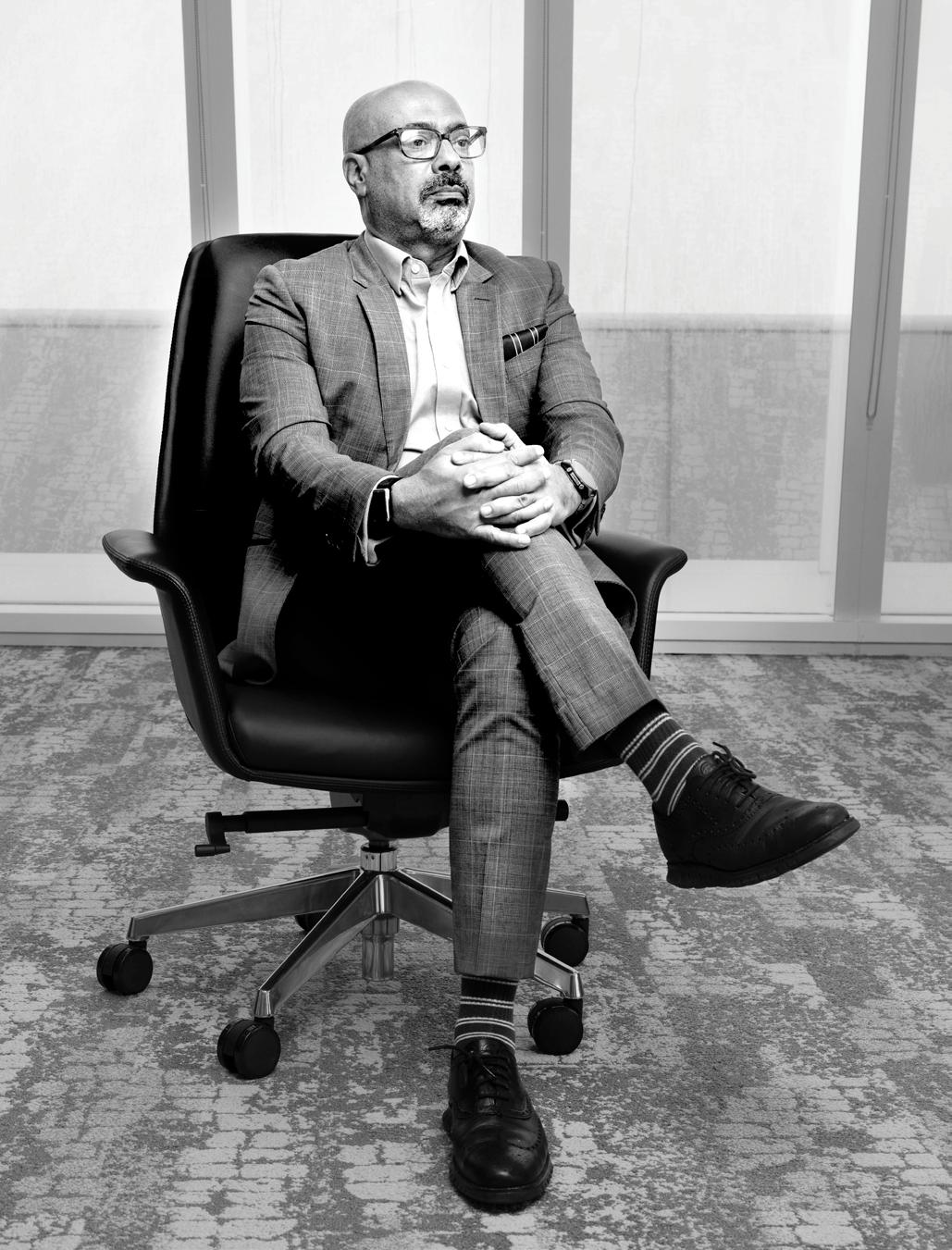

WORDS: NEESHA SALIAN | PHOTOS: MARK MATHEW FROM REINVENTION TO INNOVATION

From transforming a telecom operator into a global technology group, Hatem Dowidar has made e& one of the UAE’s most ambitious players on the global stage. In this conversation, he reflects on the pillars guiding its growth, the balance between innovation and integrity, and what it takes to lead a company through rapid change

At 10am on a Monday, Dubai’s sun blazes with relentless intensity, mirroring the city’s pulse. From e&’s Al Kifaf headquarters, the city unfolds: Burj Khalifa piercing the sky, the Dubai Metro slicing through the sprawl, and streets alive with motion. Every view reflects Dubai’s ethos: innovation, ambition, action.

Hatem Dowidar, e&’s group CEO, enters his office composed, his presence fronts a strategic mind that has earned him a reputation globally as both a visionary and disruptor. Taking the leadership role in 2020, he launched a bold transformation in 2022, prioritising tech innovation, diversification and global expansion.

“When I became group CEO in 2020, it was clear the traditional telecom model had slowed down globally. With spectrum, infrastructure, and technology demands accelerating, standing still would have meant falling behind. We faced a simple choice: defend the past or redesign the future. We chose reinvention — and set e& on a new path built around growth, innovation, and value creation.”

That reinvention led to the 2022 rebrand from Etisalat to e&, with “Go for More” as a rallying cry. More than a brand positioning, it marked a pivot from traditional telecom to a tech-driven digital leader, now active in 38 countries and serving 198 million customers across AI, fintech, and digital services.

“The rebrand was a cultural shift,” Dowidar says. “It pushed our teams to think beyond telecom and embrace a digital future.” The results followed: in 2023, e&’s portfolio was valued at over $14bn, earning a AAA brand rating. By 2024, it was the Middle East’s fastest-growing tech brand, and in 2025, it claimed the title of ‘World’s Fastest Growing Brand’ with a brand portfolio and investment value exceeding $20bn.

Building on this momentum, e& has made diversification a cornerstone of its strategy. Through e& life, the company has expanded digital lifestyles via platforms like evision, the MENA region’s largest content aggregator. In 2023, evision launched STARZ ON, a free AI-powered streaming service featuring regional, Hollywood, Bollywood, Arabic, French, and sports content. Partnerships such as the deal with Shahid strengthen premium entertainment access. e& also supports esports through collaborations with BLAST Premier and Arena Esports, an esports ecosystem powered by e&.

In fintech, e& money became the UAE’s top app by active users, simplifying payments and expanding global remittances through partnerships like MoneyGram and financial inclusion through its partnership with the Ministry of Human Resources and Emiratisation (MoHRE) to provide wage protection services via the e& money platform. The $400m acquisition of Careem’s Super App in 2023 further extended digital finance, micro-mobility, and app-based lifestyle services across the region.

Meanwhile, e& enterprise delivers solutions in cloud, AI, IoT and cybersecurity,

We faced a simple choice: defend the past or redesign the future. We chose reinvention — and set e& on a new path built around growth, innovation, and value creation.”

highlighted by a $1bn-plus AWS alliance to accelerate regional digital transformation. e& capital invests in startups that redefine industries and shape the future, both regionally and globally.

Every initiative moved the company forward — some through outcomes, others through lessons. “Sometimes the tech adoption curve wasn’t there, or the infrastructure wasn’t ready,” Dowidar says. “In these cases, what’s important to learn is when to push and when to pull back.”

Early fintech ventures highlighted the need for regulatory alignment, while entertainment projects offered insights into user engagement. Across these experiences, e& learned to balance innovation with pragmatism. “Not everything will be bulletproof, and that’s okay. What matters is having the wisdom and foresight to know when to pause, pivot, and channel focus into what’s truly working,” he explains.

Significant milestones include the October 2024 acquisition of a controlling stake in PPF Telecom Group (now e& PPF Telecom Group), expanding operations to 38 countries, and the March 2024 $6bn pledge to enhance connectivity across 16 countries in Africa, Asia, and the Middle East.

Operating in emerging markets presents challenges such as currency swings and inflation, but Dowidar sees these as opportunities to build resilient strategies, diversify revenues, and reinvest in long-term infrastructure. H1 2025 results reflect this: e& reported a 60.7 per cent jump in consolidated net profit to Dhs8.8bn, while expansion continued with the opening of e& Wholesale Americas in Miami.

Making the decision to diversify and pivot is treated strategically, says Dowidar, explaining that every decision at e& is measured against four questions: Does it strengthen the connectivity core? Does it accelerate digitalisation? Does it diversify the portfolio? Does it advance sustainability?

He explains: “This framework keeps us disciplined and ensures we’re building long-term value.”

Through this lens, every initiative is evaluated not just for immediate returns but for its contribution to a resilient, diversified, and sustainable digital ecosystem.

The UAE sovereign cloud partnership with AWS exemplifies this approach, supporting public sector digital transformation while reinforcing e&’s core capabilities. Similarly, the edge network partnership with Qualcomm integrates innovation, connectivity, and digitalisation, while collaborating with IBM to launch an AI Governance Platform and various AI-focused MoUs further advance e&’s role as a tech-driven enabler across industries.

These moves, along with a growing stake in the UK telecom sector via Vodafone, demonstrate e&’s commitment to disciplined, future-focused expansion — investments that are measured not just by immediate returns but by their ability to reinforce the company’s strategic pillars.

Early investments in 5G allowed e& to lead in advanced technologies like network slicing and edge computing. Looking ahead, the company is preparing for quantum risks to encryption. Partnerships with Microsoft and the acquisition of GlassHouse further embed AI and cloud capabilities across e&’s portfolio.

“Technology moves faster than any of us, but if your teams can’t keep up, innovation dies on the vine and you’ll burn out before you scale,” Dowidar notes. To address this, e& has launched the AI Academy and AI Graduate Programme, along with experiential initiatives like Excelerate&, giving teams hands-on exposure at Ericsson’s headquarters in Sweden. By cultivating internal talent, e& ensures innovation scales sustainably without over-reliance on external hires.

THE $400M ACQUISITION OF CAREEM’S SUPER APP IN 2023 FURTHER EXTENDED DIGITAL FINANCE, MICRO-MOBILITY, AND APP-BASED LIFESTYLE SERVICES ACROSS THE REGION

However, large-scale digital transformation, Dowidar emphasises, cannot happen in isolation. Partnerships with governments allow scale, whether through sovereign cloud infrastructure, smart city platforms, or digital inclusion initiatives. The UAE sovereign cloud with AWS, which is endorsed by UAE Cyber Security Council, underscores how public-private alignment accelerates impact.

Further collaborations extend to the Ministry of Industry and Advanced Technology for industrial digitisation, iscore in Egypt for AI-powered credit risk management, and the UAE Cyber Security Council to develop unmanned traffic management systems.

“Partnering with governments is how you scale. Whether that’s sovereign cloud infrastructure, smart city platforms, or digital inclusion, scale comes when public sector priorities and private sector capabilities align,” Dowidar says. “Success requires shared vision, clear mandate, and both sides’ willingness and ability to move fast together.”

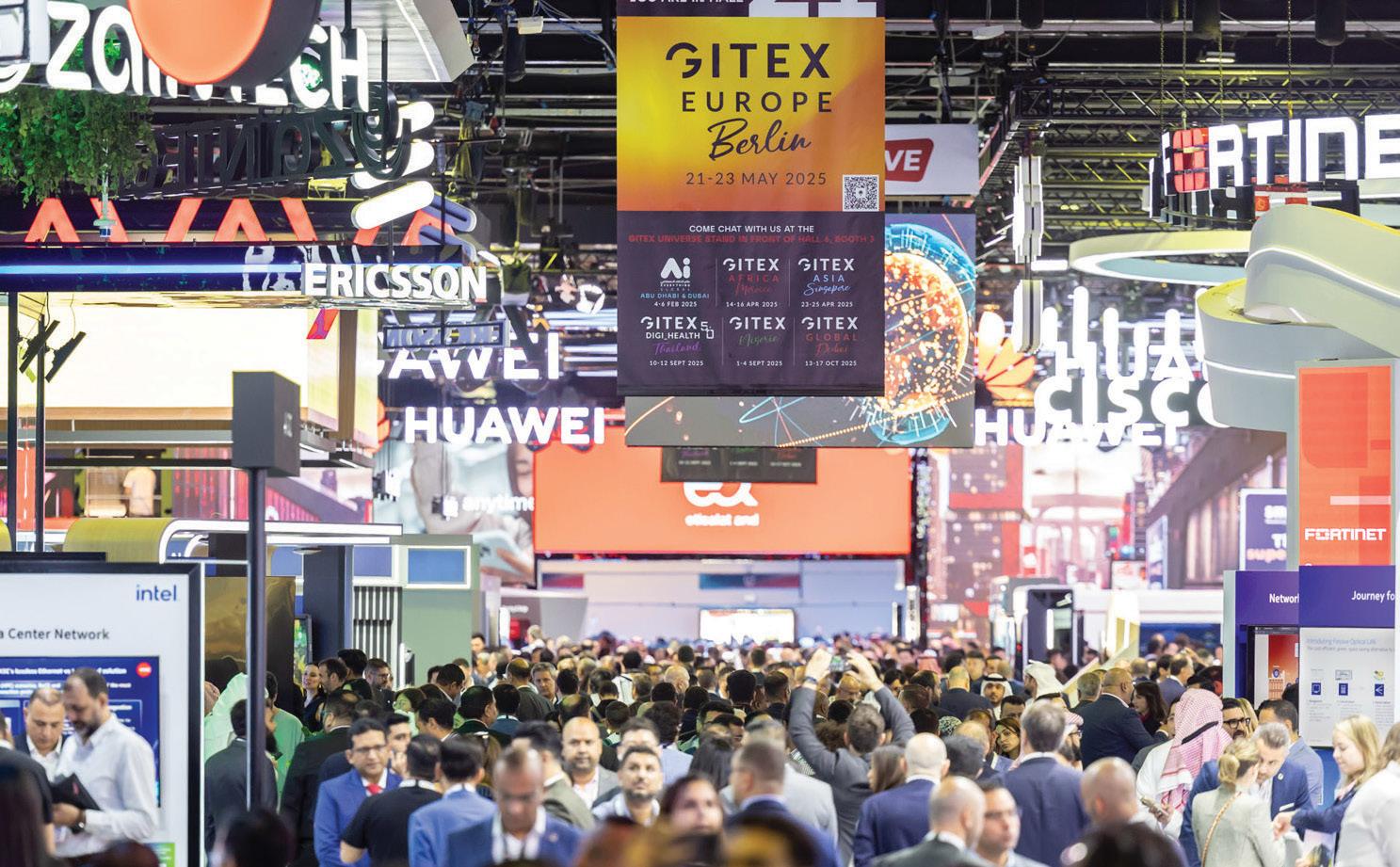

Looking ahead to GITEX Global 2025, e& is focused on showcasing AI that delivers tangible, real-world impact. Dowidar says: “Last year, our focus was on showing AI in action, making it tangible rather than theoretical. This year, we’re going further — more industries, more communities, more scale. We’re less interested in adding to the AI hype, and more focused on proving what it can do in practice.”

Initiatives such as Qualcomm and e&’s AI at the Edge illustrate this philosophy. By embedding AI directly into edge networks, e& is enabling industries, from manufacturing to logistics, to harness real-time insights, improve efficiency, and drive smarter, safer decision-making.

The company’s enterprise collaborations, including e& enterprise and Microsoft, further highlight the drive to adopt AI at scale, bringing the benefits of advanced analytics and machine learning to a wider business ecosystem in the UAE.

Last year, our focus was on showing AI in action, making it tangible rather than theoretical. This year, we’re going further — more industries, more communities, more scale.”

As e& shapes the UAE’s digital future, Dowidar reflects: “Integrity is the most valuable currency a leader can have. Progress isn’t about moving fast; it’s about moving in the right direction. Surround yourself with people you trust, dare them to be bold, and you’ll achieve far more together than you ever could alone.”

For emerging leaders, his lessons underscore vision, discipline, and human focus. At e&, innovation is vital, but teams empowered to take risks and learn remain the company’s greatest asset.

“What we’ve really focused on is putting the customer at the centre — whether that’s an individual, a corporate, a small business, or a government entity. We aim to be a one-stop partner for all their technology needs. For decades, we have delivered connectivity and entertainment on demand.

Today, we’re adding services that meet the needs of a fast-changing world: enterprise solutions like cloud, IoT, cybersecurity, and now AI-as-aservice. Many businesses can’t hire a chief AI officer or build an AI team, so

we do that for them. For individuals, it’s about connectivity, entertainment, our super app partnerships, loyalty programmes like Smiles, and financial tools like e& money. It’s a comprehensive ecosystem designed around daily needs.

Two things. First, it’s the responsibility toward all our stakeholders: customers, employees, and shareholders. Making the company a success is both a privilege and a challenge, and the drive to do a little better every day is exciting.

Second, it’s about reshaping an industry I’ve been in for more than 30 years. Telecom has long been seen as a utility, just about connectivity. We’re repositioning it as the hub of all digital needs, back at the centre of technology where it belongs.

For me, leadership is about the “&” in our name; choosing “and” rather than “or.” Too many companies think they must pick between growth or profitability, telecom or tech. We look at how to combine opportunities, to go for more, not less. It’s about keeping an expansive mindset and encouraging the team to pursue multiple avenues for growth and service.

Challenges are inevitable, whether you’re running a small company, a large corporation, or just navigating life. The key is to understand the real impact of the challenge and what it takes to overcome it. Sometimes you go straight through it, sometimes you must go around it. The first step is always clarity; knowing exactly what you’re facing.

It’s about going for more and creating a legacy. e& has been around for 50 years, which is old in telecom terms. The real question is: what are we building today that will keep this company thriving for the next 100 years? That’s the perspective that drives me.

I believe every day has one thing that matters most. Many people create long to-do lists, but usually, one task will account for 90 per cent of success. Identifying that priority and focusing on it, even if it means dropping everything else, is how I manage my time and ensure progress.

OVER 130 ATTENDEES LISTENED TO DISCUSSIONS FOCUSED ON INNOVATION, REGULATORY REFORM, PUBLIC–PRIVATE COLLABORATION AND INVESTMENT SECTORS DRIVING GROWTH IN THE KINGDOM

BY GARETH VAN ZYL

Saudi Arabia’s rapid transformation under Vision 2030 took centre stage at the first-ever Gulf Business Saudi Business and Investment Summit, held on September 3 at the Sheraton Riyadh Hotel & Towers.

The event brought together influential leaders from government, business, and international organisations to explore how the kingdom is translating its bold vision into tangible results.

More than 130 attendees listened to discussions focused on innovation, regulatory reform, public–private collaboration and investment sectors driving diversification and sustainable growth.

SETTING THE TONE: OPENING REMARKS

The morning opened with a welcome address from Manish Chopra, publisher of Gulf Business, who highlighted the

significance of the summit taking place at a pivotal moment in Saudi Arabia’s economic journey. “It’s exciting to bring our platform here at such a transformative time, as the kingdom fast-tracks its development under Vision 2030,” said Chopra. “We hope today’s discussions will inspire and inform, showcasing the opportunities shaping the kingdom’s future.”

Gareth van Zyl, group editor of Gulf Business, followed with a speech underlining the pace of Saudi Arabia’s change.

“Saudi Arabia is on the move,” van Zyl said. “From mega-projects like the Riyadh Metro to the upcoming Expo 2030 and the 2034 FIFA World Cup, the Kingdom is transforming at an extraordinary speed. The Saudi story is growing, getting bigger and more exciting by the day.”

He added: “With our summit today, we’re bringing together diverse voices

to tell the story of this transformation and to explore the practical pathways for companies looking to enter or expand in this dynamic market.”

The first keynote of the day was delivered by Michael Champion, CEO of Tahaluf, who revealed staggering growth figures for the Kingdom’s events sector.

Champion outlined how Tahaluf — joint venture partnership between Informa, the world’s largest trade show

organiser, the Saudi Federation for Cybersecurity, Programming and Drones (SAFCSP), and the Events Investment Fund (EIF) – had helped create worldleading events like LEAP, Black Hat MEA, and Cityscape Global.

“In just three years, our events have generated $17.6bn of economic impact for Saudi Arabia – a bigger contribution than the Qatar FIFA World Cup,” he said.

“More than 100,000 international visitors will fly in for our events this year, creating powerful soft power for the Kingdom and positioning Saudi Arabia as a serious global business hub.”

Champion highlighted the unique public–private collaboration that enabled this rapid growth.

“The only way to grow at this scale is to align closely with government partners and create a marketplace where global companies know they’ll meet the complete tapestry of buyers here in the kingdom.”

Champion highlighted the multibillion dollar impact that Tahaluf has had on the Saudi Arabian economy.

He also shared the company’s extraordinary trajectory.

“In 2022, we had a footprint of just 100,000 square metres for our events. By the end of 2025, we’ll reach 700,000

square metres – the equivalent of 17 Wembley stadiums. That’s how fast this sector is scaling.”

Champion announced plans to take Saudi-made event brands international, with the first overseas launch set for Hong Kong in 2026.

The first majlis session, moderated by Annabelle Mander, executive vice president of Tahaluf, examined how Saudi Arabia’s key sectors are advancing Vision 2030 goals.

SPEAKERS INCLUDED:

Saud Adham, director of policy and innovation, ministry of culture, Saudi Arabia

Abhay Bhargava, managing director, Frost & Sullivan Middle East

Patrick Samaha, partner, public sector practice, Kearney Middle East and Africa

Turki Alsubaihi, chief executive officer, public transport, SAPTCO Group Adham emphasised the power of Saudi Arabia’s youthful population.

“Over 70 per cent of Saudi’s population is under 35: a generation hungry for cultural authenticity. We’re channelling this energy to make culture a key driver of our economy,” he said.

Bhargava focused on the country’s evolving investor landscape: “Saudi Arabia has rapidly evolved to meet investor needs across funding, infrastructure, regulations, market access and supply chains – while leveraging its own strengths to attract global capital.”

Samaha, meanwhile, spotlighted digital transformation across government institutions. “Saudi isn’t just digitising services: it’s creating global benchmarks with one-stop platforms and robust data governance that build trust and confidence for both citizens and international investors,” he added.

For Alsubaihi, he highlighted how public transport plays a pivotal role in enhancing quality of life, as witnessed by the launch of the GCC’s largest metro train network.

“The Riyadh Metro is not just a transport project, it’s a lifestyle change. In less than nine months, we’ve moved 100 million passengers, transforming how the city moves.”

“OVER 70 PER CENT OF SAUDI’S POPULATION IS UNDER 35: A GENERATION HUNGRY FOR CULTURAL AUTHENTICITY."

Moderated by Gareth van Zyl, group editor of GulfBusiness, the second majlis session explored emerging opportunities and policy frameworks shaping the next phase of Saudi Arabia’s growth.

SPEAKERS INCLUDED:

Jasem Alanizy, partner, corporate finance, Addleshaw Goddard

Osama AlZoubi, vice president, Phosphorus Cybersecurity

Seton Vermaak, principal consultant, MRM MENAT

Javier Carinena, principal, energy and process industries practice, Kearney Middle East & Africa

Najla Najm, Middle East careers leader, Mercer

Alanizy pointed to momentum in education and financial services. “The education sector is seeing huge momentum, with regulators actively welcoming foreign partnerships and ownership – a transformation unthinkable just a few years ago,” he added.

AlZoubi stressed the importance of cyber security: “Cybersecurity is the foundation of Vision 2030’s giga-projects. Many solutions didn’t exist globally – we had to create them here to protect the world’s most ambitious developments.”

Vermaak highlighted the role of data in tourism and business growth.

“Data is the new currency,” Vermaak

said. “By using it ethically and strategically, Saudi Arabia can deliver personalised, world-class experiences for every visitor and citizen.”

Carinena, who spoke about how AI is transforming the manufacturing landscape, urged manufacturers to act quickly on this technology. “We’re no longer at the start of the AI era. Companies must act now to integrate AI into their operations or risk being left behind,” he said.

Najm underscored the need for workforce upskilling: “In today’s world, digital skills are as fundamental as literacy. For Saudi’s workforce, these skills are the foundation for success.”

The final panel of the day, moderated by Ravi K Ranjan, founder and chief executive officer, Silk Route, and former curator and business advisor, Shark Tank India, explored what it takes for global companies to succeed in Saudi Arabia.

SPEAKERS INCLUDED:

Maher Abou Nasr, managing director, IHG Hotels & Resorts, Saudi Arabia

Main Canaan, general manager, GE Aerospace Middle East

Tarek Miknas, chief executive officer, FP7McCann MENAT

Abou Nasr highlighted Saudi Arabia’s tourism boom: “Saudi Arabia hit its 2030 tourism target in 2023 – seven years early. Demand is soaring, and we’re

bringing new brands and experiences to match this growth.”

Canaan spoke on building local aerospace capabilities: “Vision 2030 isn’t just about buying aircraft – it’s about building local capability. More than half our workforce in the Kingdom are Saudis operating at world-class aviation standards.”

Miknas emphasised the importance of authentic storytelling: “The most

“SAUDI ARABIA HIT ITS 2030 TOURISM TARGET IN 2023 — SEVEN YEARS EARLY. DEMAND IS SOARING, AND WE’RE BRINGING NEW BRANDS AND EXPERIENCES TO MATCH THIS GROWTH.”

powerful campaigns in Saudi Arabia are rooted in authenticity. Global strategies only work when they are built on genuine local voices and understanding.”

The summit concluded with a high-level networking lunch and the presentation of the inaugural Gamechanger Awards, recognising leaders driving transformation in connectivity, cybersecurity, and aviation technology.

As Saudi Arabia accelerates its Vision 2030 ambitions, the conversations at the Gulf Business – Saudi Business and Investment Summit underscored the Kingdom’s appeal as a destination for innovation, investment, and collaboration.

With record foreign investment, booming sectors like tourism and technology, and a clear pathway for business growth, Saudi Arabia is not just transforming itself – it’s shaping the future of the region.

Cariva, backed by 50 years of UAE automotive legacy, is transforming the used car market with transparency, trust, and innovation

In the heart of Dubai, where gleaming showrooms rise beside highways lined with the latest models, a quiet revolution is taking shape. It doesn’t roar like a sports car engine -- it rises steadily, the way trust does. And the brand behind it is Cariva, a fresh name in the used car market, but one backed by 50 years of automotive legacy through one of the UAE’s most established business groups.

For decades, buying a pre-owned car has been a transaction clouded with hesitation. Questions about hidden repairs, patchy service histories, or unreliable warranties have long made the market a breeding ground for skepticism. Cariva has stepped into this space not just to sell cars, but to change how people feel about buying them.

“For us, it’s about creating an experience where people can move forward with confidence, not hesitation,” says Harshvardhan Singh, head of Business at Cariva. “Confidence, affordability and trust aren’t buzzwords for us they’re the foundation of our model.”

Cariva may be a startup by structure, but its roots run deep. With the strength of years of automotive expertise behind it, the company blends the agility of a new brand with the wisdom of an established

industry powerhouse. That combination makes Cariva unique: nimble enough to disrupt, solid enough to reassure.

Transparency is at the core of its promise. Every vehicle comes with a complete and verifiable service history, stripping away the guesswork that has often left buyers second-guessing. Paired with agency warranties directly from original equipment manufacturers, Cariva ensures customers drive away with the same confidence they would when buying new without the price tag.

Buying a used car is rarely a one-step decision. Understanding this, Cariva has partnered with major banks to provide flexible financing options, including zero downpayment support for eligible buyers. And because no driver should hit the road unprotected, the brand has also aligned with leading insurance companies to give clients seamless access to coverage.

It’s an ecosystem approach: not just selling cars, but ensuring the full journey – from paperwork to peace of mind – is as smooth as possible.

If Cariva’s mission is to transform trust, then its most disruptive innovation may well be the drive now, buy later (DNBL) programme. A world first, DNBL allows customers to live with a car for a few weeks before deciding whether to buy.

It’s not a gimmick. It’s a statement: Cariva is confident enough in its cars to let customers test them in real life – school runs, commutes, road trips – before asking for commitment. For an industry long plagued by buyer’s remorse, DNBL could be the antidote.

“Trust isn’t built in a showroom. It’s built when you realise, that the car feels right for you and your family. That’s the experience we want to deliver,” Singh says.

At its core, Cariva isn’t just about cars. It’s about people, about giving families, young professionals, and first-time buyers the ability to move forward in life without the shadow of doubt hanging over their purchase. In a city like Dubai, where mobility means opportunity, that confidence is invaluable.

The disruption here isn’t flashy. It’s quiet, intentional, and deeply human. By reshaping the rules of trust, Cariva isn’t just another player in the used car market, it’s rewriting the playbook altogether.

In a business landscape where many startups chase speed and scale, Cariva is chasing something rarer: peace of mind. And if trust truly is the most valuable currency in business, then Cariva may have already secured pole position.

For us, it’s about creating an experience where people can move forward with confidence, not hesitation.”

With the We Proudly Serve Starbucks Coffee Programme, Nestlé Professional is helping four- and five-star hotels across MENA elevate guest satisfaction with an iconic global brand

In today’s hospitality world, guests expect far more than just a comfortable bed or seamless check-in. They seek memorable experiences, thoughtful details, and a sense of connection to brands they already know and trust. For premium hotels across the Middle East and North Africa, one of the most powerful ways to deliver on these expectations comes in a cup.

Nestlé Professional, the out-of-home division of Nestlé, is behind the exclusive distribution of the ‘We Proudly Serve Starbucks Coffee Programme’, a premium solution tailored specifically for four- and five-star properties. The concept is straightforward but transformative: bring the globally recognised Starbucks coffeehouse experience into hotels, under the hotel’s own café identity.

The We Proudly Serve Starbucks Coffee Programme is already in place at leading hotels across the MENA region, where it has proven to be a strong driver of guest satisfaction.

Well-travelled, brand-conscious guests perceive higher value, satisfaction scores

improve, and the association with a globally trusted brand reinforces the sense of quality and care.

The We Proudly Serve Starbucks Coffee Programme isn’t simply about supplying beans or machines. It’s a complete end-toend solution that enables hotel staff to serve handcrafted Starbucks beverages to the same standard that guests would expect in a dedicated coffeehouse.

From Cappuccinos and Flat Whites to iconic favourites like the Iced Shaken White Chocolate Mocha and Cold Frappuccino blended beverages, every drink is made using Starbucks 100 per cent Arabica

beans. Hotels can choose between Dark Roast and Blonde Roast blends, offering consistent quality across the board. Seasonal campaigns, such as the muchloved Toffee Nut Latte, also refresh the menu throughout the year, helping hotels keep their offerings relevant and engaging.

For guests, it means the comfort of enjoying their favourite Starbucks beverages, whether in the lobby, at breakfast, or while relaxing in a guest lounge. It’s a solution that is equal parts operationally efficient and emotionally resonant.

As a turnkey solution that blends seamlessly into their service model, the We Proudly Serve Starbucks Coffee Programme makes it easy for hotels to deliver a premium, consistent experience with minimal operational complexity while also strengthening their brand promise.

Nestlé Professional provides branded equipment, servicing, quality audits, and a full suite of marketing assets to ensure consistency. Just as importantly, staff receive barista training to prepare and serve drinks with the same attention to detail and passion that customers associate with the Starbucks name.

For hotel decision-makers, the message is clear, the We Proudly Serve Starbucks Coffee Programme isn’t just about offering coffee, it’s about offering guests a taste of the experience they love, right where they least expect it.

THE 13TH EDITION OF THE AWARDS HONOURED THE COMPANIES AND LEADERS SHAPING THE REGION’S ECONOMIC LANDSCAPE

The Gulf Business Awards 2025 took place on September 24 at The Westin Dubai Mina Seyahi Beach Resort & Marina, recognising the best in business. Now in its 13th year, the event once again cemented its reputation as the region’s premier platform for celebrating innovation, resilience, leadership, and excellence across industries.

With more than 350 of the Gulf’s most influential executives, entrepreneurs, and decision-makers in attendance, the evening was a celebration not only of the winners, but of the remarkable progress and transformation taking place across the region’s business landscape.

The Westin Dubai Mina Seyahi provided the backdrop for an evening of recognition and networking. Guests were welcomed to a

Over more than a decade, these awards have become a benchmark for excellence, spotlighting the visionaries, trailblazers and companies shaping the region’s future.”

red-carpet reception before gathering for a gala dinner that combined fine dining with thought-provoking conversations. The setting underscored the prestige of the Gulf Business Awards, elevating the sense of occasion for honourees, judges, and attendees alike.

As always, the highlight of the night was the announcement of the award winners across company and leadership categories spanning banking, real estate, healthcare, technology, tourism, energy, and more.

Among the evening’s most celebrated honourees was Gerald Lawless, executive and former CEO of Jumeirah Group, who received the Lifetime Achievement Award. Lawless was recognised for his

decades-long impact on the hospitality sector and his role in shaping Dubai into a global tourism and leisure hub.