P.22

FUTURE FORWARD: AI, CLOUD, AND CYBERSECURITY TRENDS THAT WILL DEFINE 2026

P.26

THE AGE OF AGENTIC AI: MICROSOFT’S AMR KAMEL ON FACTORS DRIVING UAE’S NEXT AI LEAP

P.22

FUTURE FORWARD: AI, CLOUD, AND CYBERSECURITY TRENDS THAT WILL DEFINE 2026

P.26

THE AGE OF AGENTIC AI: MICROSOFT’S AMR KAMEL ON FACTORS DRIVING UAE’S NEXT AI LEAP

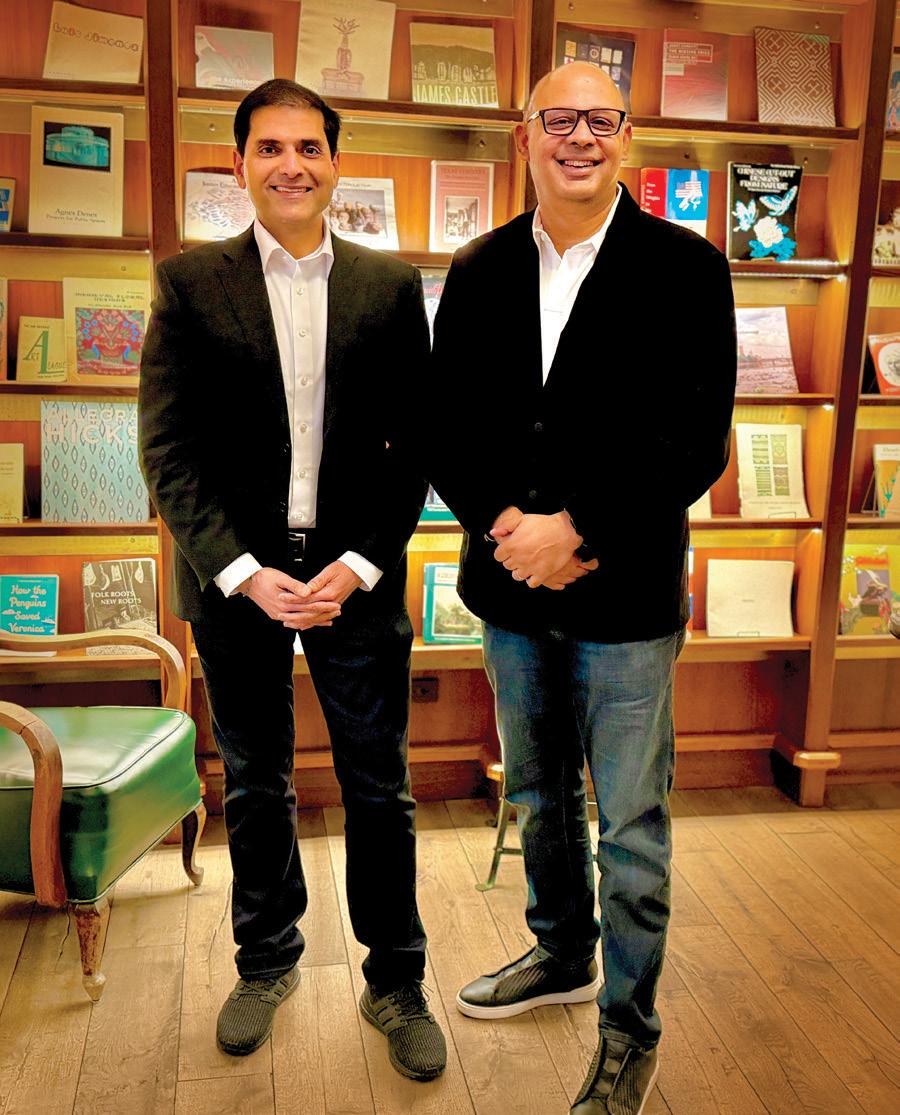

ANAND ESWARAN OF VEEAM AND REHAN JALIL OF SECURITI AI BREAK DOWN HOW THEIR NEW ALLIANCE AIMS TO RESHAPE DATA SECURITY, GOVERNANCE AND SAFE AI AT SCALE

FROM LEARNING TO LEADING: What today’s top women in the regional tech industry want you to know

Attractions

Activities

Dining

Health

Education

Entertainment

Real

Hotels

Shopping

The

How Veeam and Securiti AI’s new collaboration will redefine data security, governance and safe AI at scale

Artificial intelligence (AI) is scaling faster than infrastructure can keep up, and we’re aiming to close that gap. This expansion isn’t just about adding capacity; it’s about delivering capability, where and how it’s needed most.”

TINBOAT ARSLANOUK, CHIEF BUSINESS OFFICER –INTERNATIONAL AT

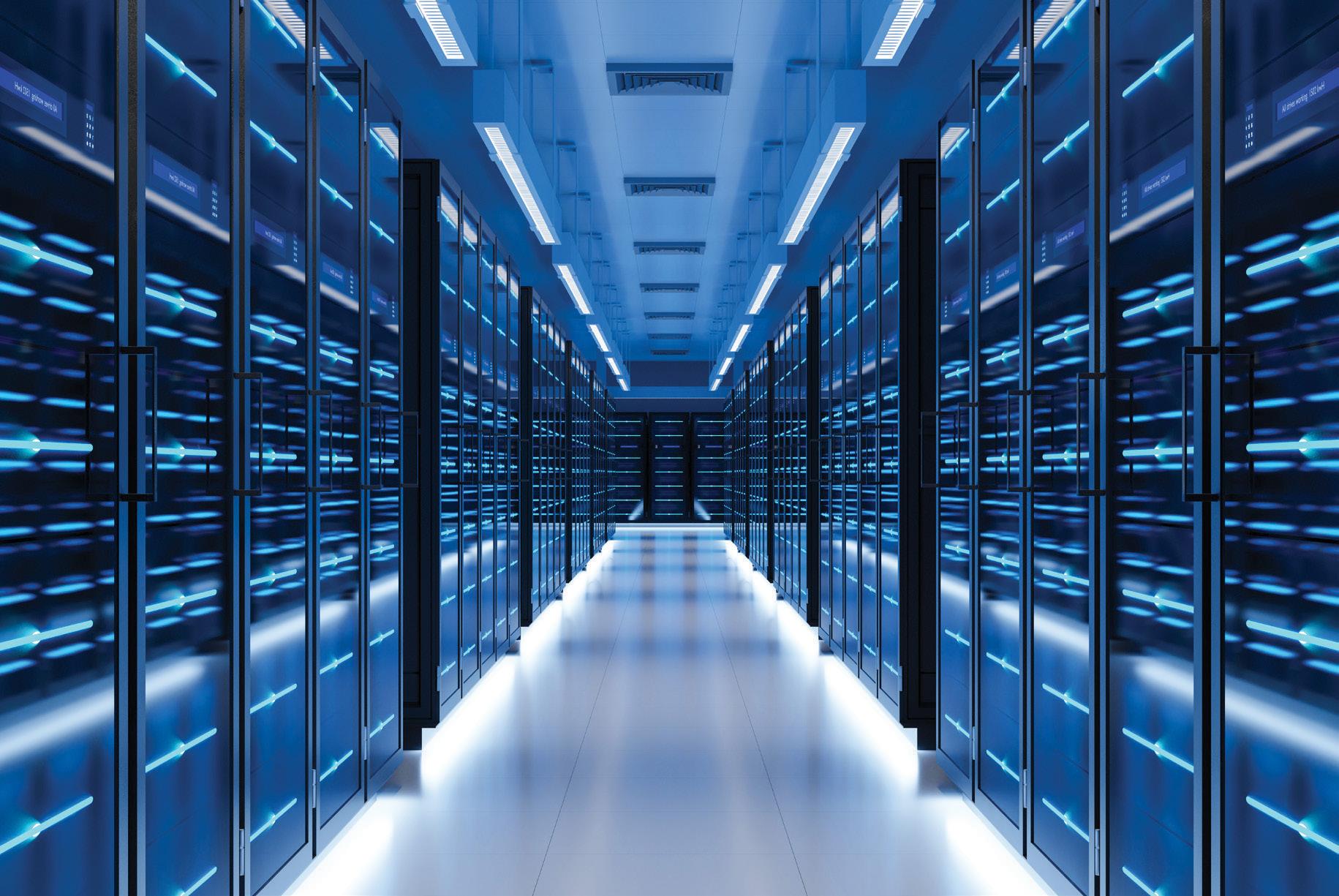

DATA CENTERS

TECH IN 2026, DECODED

Senior leaders from Tenable, SentinelOne, NTT Data, ManageEngine, BMC Helix, SANS Institute and Sophos break down the trends that will define the region’s next leap forward

Airalo’s CEO Ahmet Bahadir on rising eSIM adoption and trends shaping digital mobility

Inside the playbook of today’s top female tech leaders, and the guidance they keep coming back to

HEAD OFFICE: Media One Tower, Dubai Media City, PO Box 2331, Dubai, UAE, Tel: +971 4 427 3000, Fax: +971 4 428 2260, motivate@motivate.ae

DUBAI MEDIA CITY: SD 2-94, 2nd Floor, Building 2, Dubai, UAE, Tel: +971 4 390 3550, Fax: +971 4 390 4845

ABU DHABI: PO Box 43072, UAE, Tel: +971 2 657 3490, Fax: +971 2 677 0124, motivate-adh@motivate.ae

SAUDI ARABIA: Regus Offices No. 455 - 456, 4th Floor, Hamad Tower, King Fahad Road, Al Olaya, Riyadh, Saudi Arabia, Tel: +966 11 834 3595 / +966 11 834 3596, motivate@motivate.ae

LONDON: Acre House, 11/15 William Road, London NW1 3ER, UK, motivateuk@motivate.ae

Cover: Freddie N. Colinares

Editor-in-chief

Obaid Humaid Al Tayer

Managing partner and group editor

Ian Fairservice

Chief commercial officer

Anthony Milne anthony@motivate.ae

Group content director

Thomas Woodgate

Thomas.Woodgate@motivate.ae

Publishing director

Manish Chopra manish.chopra@motivate.ae

EDITORIAL

Group editor

Gareth van Zyl

Gareth.Vanzyl@motivate.ae

Editor

Neesha Salian neesha@motivate.ae

Deputy editor

Rajiv Pillai

Rajiv.Pillai@motivate.ae

Reporter

Nida Sohail Nida.Sohail@motivate.ae

Senior art director

Freddie N. Colinares freddie@motivate.ae

General manager – production

S Sunil Kumar

Production manager

Binu Purandaran

Assistant production manager

Venita Pinto

SALES & MARKETING

Digital sales director

Mario Saaiby mario.saaiby@motivate.ae

Sales manager

Hitesh Kumar

Hitesh.Kumar@motivate.ae

ARTIFICIAL INTELLIGENCE HAS MOVED FROM PILOT PROJECTS TO REAL, DAY-TO-DAY PUBLIC SERVICE DELIVERY IN THE UAE. WITH AGENTIC AI NOW TAKING CENTRE STAGE, THE COUNTRY IS EDGING CLOSER TO A FULLY UNIFIED, SINGLE-PLATFORM MODEL OF GOVERNMENT

BY WILLIAM O’NEILL

he United Arab Emirates (UAE) is well known for its leadership in artificial intelligence (AI). As adoption has accelerated, government agencies have led the way. AI is being put to work across the country’s public sector in a variety of use cases. The Federal Authority for Identity, Citizenship, Customs, and Port Security (ICP) is using AI to speed up and improve the accuracy of visa applications, residency permits, and work authorisations. In healthcare, AI monitors, and even predicts, trends in health conditions. And bots and other AI tools are helping to optimise clinical operations, even assisting with diagnoses. In policing and national security, AI-driven surveillance and predictive analytics are revolutionising how authorities keep UAE cities safe. And in transport, AI is reducing congestion and enhancing citizen experiences in major cities like Abu Dhabi and Dubai. Many of these government AI projects, and others in the pipeline, leverage agentic AI. Dubai’s Department of Finance (DOF) launched

TProject ASCEND, a scalable agentic AI system that will automate the verification of transactions and other financial processes. LLM (large language model) and RAG (retrieval-augmented generation) technologies will come together to assess DOF’s internal workflows against external compliance requirements and offer actionable recommendations for revisions. The message being sent by UAE government entities is clear – agentic AI is a catalyst for accelerating the changes at the heart of government initiatives; it is not, in any way, a replacement for the visionary human leaders who are taking us there. As 2026 dawns, the UAE is in a better position than ever to deliver on its ambitious vision for government services. And it is all because of

agentic AI, which is much more than a mere advance in automation. Agentic AI has the potential to be an enabler of single-platform government, thereby eliminating the siloed systems that hold back progress. Agents are at their best when they operate in secure, integrated-data environments. The UAE has led the region in progress towards eGovernment and mGovernment. Now it has an opportunity to unify platforms – something many agencies have indicated they are eager to do. For example, in October the Ministry of Human Resources and Emiratization (MoHRE) announced an upcoming unified portal to streamline the private-sector employment journeys of Emiratis.

Consolidation of systems in the public sector will be a boon to cost efficiency and citizen satisfaction. The government can eliminate inefficiencies, including duplication of workflows. It can also begin to meet the expectations of its digital-native citizenry. Autonomous AI agents can greatly help with this transition. They can cross departmental boundaries with ease to connect previously disparate processes and data into seamless services. AI agents can combine personal, health, and tax data as required to pre-fill official forms for citizens and residents. AI agents will ensure that information always flows to the correct decision maker at the correct time and in the correct way. Governance is strengthened and compliance is guaranteed. While other governments around the world are moving slowly on agentic AI and integrated-platform government services, the progress already made in the UAE indicates that leaders here have already come to realize the multi-dimensional benefits on offer. AI agents can deliver real-time visibility into entire technology stacks, including underlying infrastructure. This ability helps in a range of sustainability areas, from waste management to power usage. Other use cases allow departmental leadership teams to ease work burdens, boosting innovation and public-facing service levels.

Agentic AI is therefore a force for reshaping public services and it continues to show its potential in live and pilot programmes. In January, when ADNOC conducted a broad-spectrum proof-of-concept with AI agents, the petrochemical giant reported a 70 per cent improvement in “accuracy in major seismic interpretation aspects” and leaps forward in “advanced reservoir monitoring and anomaly detection”. Departments that deliver services to the public can use platform consolidation, and the innovation that only comes with agentic AI, to deliver efficiencies such as those discovered in ADNOC’s POC. Environmental agencies can bring together asset-monitoring solutions with logistics data to improve waste collection and reduce congestion, both of which help to tamp down carbon emissions. Healthcare providers can resolve queries more quickly.

IN THE PUBLIC SECTOR WILL BE A BOON TO COST EFFICIENCY AND CITIZEN SATISFACTION. THE GOVERNMENT CAN ELIMINATE INEFFICIENCIES, INCLUDING DUPLICATION OF WORKFLOWS.

Schools and colleges can use workforce insights from different industries’ AI agents to plan their courses to be more impactful, leading to long-term improvements in skill levels within the labor market.

The public-sector single-platform vision has always required a level of data integration thought to be impractical. But agentic AI has opened the door to that vision. The only obstacle that remains is the lingering doubts of the public. However, UAE government ministries have shown decisive leadership and great faith in citizens in their moves to adopt AI agents. The government has shown that it recognises the importance of transparency, accountably, and social responsibility when building AI systems. If the public cannot trust a platform, then its high degree of integration will do little to guarantee its success.

Fortunately, the UAE Charter for the Development and Use of Artificial Intelligence, issued as part of the UAE Strategy for Artificial Intelligence, stresses the need for AI to deliver on “human wellbeing and progress”, safety, objectivity, privacy, transparency, human oversight, governance (including accountability), technological excellence, and inclusive access. The charter is just one of many sources of guidance the government has made available to private and government entities for the development and use of AI systems. Adopters of agentic AI should use these pillars on their journey. Agentic AI is poised to become a defining characteristic of public service for the foreseeable future. The UAE government is well positioned to set global benchmarks in this arena, as it has already shown a willingness to define its vision clearly and stress the need for citizen-centric deliverables. Its own ministries are already hard at work demolishing their silo legacies; and charters and white papers continually call for strong governance and transparency. These observations herald a bright future for the single-platform vision and broader economy.

The writer is the area VP and general manager for GCC at ServiceNow.

AVIATION IS ENGINEERED WITH BACKUPS FOR ALMOST EVERYTHING, YET ITS MOST CRITICAL NAVIGATIONAL TOOL HAS NO SAFETY NET — AND THE SURGE OF GPS INTERFERENCE IN THE GULF IS EXPOSING THAT WEAKNESS FAST

BY LUCA FERRARA

ith the ongoing geopolitical turmoil in the Middle East culminating in numerous flashpoints this year, it’s been easy to overlook the conflict raging on an invisible battlefield. GPS, critical to the region’s most vital sectors, including aviation and shipping, has become a prime target for attackers. With up to 1,500 flights per day in the region being targeted by GPSbased attacks, one might assume there are multiple redundancies in place. Yet, uncharacteristically for an industry built on layers of backup, GPS remains aviation’s single point of failure.

WThe precision and ubiquity of this system has made it indispensable not only for aviation, but also for finance, logistics, telecoms, and ride-hailing. In the Gulf region, apps like Careem or Noon would simply grind to a halt without it. Banks depend on GPS time-stamping to complete transactions. Data centres use it to keep servers aligned. Even your mobile phone clock relies on it. In short, GPS doesn’t just tell us where we are, it tells us when we are.

And it’s this ubiquity that has made it such an attractive target.

GPS signals, for all their sophistication, are fragile. They are transmitted from satellites more than 20,000 kilometers away, arriving on Earth with the strength of a 25-watt lightbulb seen from across the Atlantic.

Aviation, as one of the crown jewels of Gulf economies, is particularly exposed. If an aircraft loses its ability to navigate, everything else comes to a standstill. What makes this threat even more alarming is its accessibility. Disrupting GPS does not require a satellite dish or a military-grade jammer. It can be done with something

THE IMPLICATIONS ARE PROFOUND. JAMMING , THE EQUIVALENT OF “NOISE-CANCELLING HEADPHONES” FOR GPS, CAN DENY SIGNALS ENTIRELY. SPOOFING GOES FURTHER, TRICKING RECEIVERS INTO BELIEVING THEY ARE SOMEWHERE THEY ARE NOT.

the size of a walkie-talkie. This isn’t purely theoretical. In recent months, residents of the UAE have noticed their phone clocks going haywire, and pilots across the region have filed increasing reports of GPS outages. Organisations such as OpsGroup, which collates pilot feedback worldwide, have documented a sharp rise in incidents of jamming and spoofing, particularly around the Gulf. Meanwhile, public data from platforms such as GPSJam.org shows clear spikes in interference. Globally, GPS spoofing is now affecting more than 30,000 aircraft every month, posing serious risks to flight safety, rerouting, and the logistics chains that depend on reliable air cargo.

The implications are profound. Jamming, the equivalent of “noise-cancelling headphones” for GPS, can deny signals entirely. Spoofing goes further, tricking receivers into believing they are somewhere they are not. For an aircraft, that is potentially catastrophic. And given the geopolitical complexity of the region, the likelihood of these incidents escalating rather than receding is high.

Aviation has always prized redundancy. Multiple engines, multiple communication channels, multiple failbacks. But in the case of navigation, the fallback is far from perfect. Inertial navigation systems, which measure acceleration and orientation to estimate position, are accurate only for a short while. The longer the journey, the greater the deviation.

For decades, this has been aviation’s quiet secret. But with GPS interference on the rise, the industry cannot afford to sweep this issue under the carpet any longer.

If GPS is vulnerable because of its reliance on numerous external satellites orbiting thousands of kilometres away, then the ideal alternative would be one that is entirely self-reliant, immune to signals that can be jammed, spoofed, or shut down.

Remarkably, such a foundation has existed for millennia. Long before the satellite age, navigation was guided by Earth’s magnetic field. It powered the first compasses and has quietly served humanity’s need to orient itself ever since. However, because these magnetic signals are weak, noisy, and extremely difficult to interpret, they were never suitable for the

sophisticated and rigorous demands of modern air travel. That limitation no longer stands. The convergence of two transformative technologies — AI and quantum sensing — has made what was once impossible, attainable.

By combining quantum sensors sensitive enough to detect tiny variations in the Earth’s magnetic field with artificial intelligence capable of filtering out noise and recognising patterns, it is now possible to navigate in a completely new way. The approach works passively, without emitting signals that could be jammed, spoofed, or intercepted. Everything required — the sensors, processors, and maps — can be contained in a device the size of a toaster oven.

Early prototypes have already been tested by industry leaders such as Airbus and the US Air Force, where the system consistently beat the FAA’s key en route navigation standards (RNP 1 and RNP 2). In other words, it not only provides resilience when GPS is unavailable, but delivers accuracy that meets or exceeds what is expected for commercial aviation today. It is the long overdue solution to one of the airline industry’s rare single points of failure.

The Gulf has long been at the vanguard of aviation innovation. Emirates pioneered the double-decker A380 experience. Etihad set benchmarks for luxury in the sky. Qatar Airways recently announced the world’s first Starlink-equipped Boeing 777, redefining in-flight connectivity. Regional airports, from Dubai to Doha, consistently set global standards for passenger experience and operational excellence.

With such a record, the Middle East is uniquely positioned to address this urgent need for innovation in navigation. With its dense air traffic corridors, proximity to geopolitical flashpoints, and role as a global crossroads, the Gulf region already experiences nearly a third of all GPS attacks.

For the Middle East’s aviation leaders therefore, acting now to pioneer a sovereign system for navigation is not about prestige. It is about security, resilience, and continuity. The region has already proven its appetite for world firsts. The question now is whether its airlines will once again seize the opportunity to lead, charting the course for the aviation industry.

The writer is the GM of AQNav, SandboxAQ.

BY ALI NANJI

There’s a reason why the Middle East’s flagship airlines are globally renowned. When you entrust your travel to Emirates, Etihad, Riyadh Air, Qatar Airways, or any among the long list of prestigious national carriers, you’re not just booking a flight — you’re stepping into a brand that represents the future of mobility and hospitality. Everything from ticket booking to boarding feels curated, effortless, and designed with the customer in mind. You breeze through check-in, relax in the lounge, and once on board, settle into an environment where every part of your journey is carefully choreographed. Now contrast that with the typical experience of a commercial banking client in the Middle East. It’s often more check-in counter than business class lounge — fragmented, manual, and slow. For the ambitious companies driving the region’s growth, this outdated model isn’t just inconvenient. It risks becoming a serious bottleneck in a fast-moving economy. So why is commercial banking stuck in the terminal, while its clients are ready for take-off?

Retail banking has embraced digital transformation. Consumers enjoy seamless apps, instant credit approvals, and always-on services. But when that same consumer puts on their CFO hat to manage business finances in a commercial banking platform, they encounter friction at every turn — multiple logins, disconnected services, and lengthy approval cycles. That’s largely because most commercial banks still rely on traditional banking architecture, characterised by siloed, legacy systems. Payments, trade finance, cash flow management and FX all live in different systems, sometimes even across different jurisdictions. The result? A disjointed experience that’s frustrating for clients and costly to serve for banks. Even the strongest banker-client relationships are undermined when service depends on manual processes and inconsistent data. Relationship managers are left firefighting, unable to offer proactive advice or real-time insights. In the business segment — from SMBs to commercial clients — where

The writer is the regional sales director - Middle East, Backbase.

transactions are higher in volume and more complex, expectations for digital-first service are growing and the traditional model simply doesn’t scale. What banks need is a clear flight path, enabling them to elevate their commercial banking experiences.

Onboarding a commercial client is undoubtedly more complex than onboarding a retail customer. Multiple signatories, group structures, regional compliance requirements — it’s a process that needs more than just a form and a signature. But complexity doesn’t have to equal chaos. Banks can now digitise the onboarding journey without losing rigour. Intelligent document capture, automated KYC verification, and configurable workflows can reduce onboarding times dramatically while ensuring compliance. Crucially, giving relationship managers a single interface to track and manage onboarding steps means fewer dropped balls and better communication. It’s like business class check-in — a dedicated process, designed for efficiency, with the right people and tools in place to make it seamless.

Once you’re on board an aircraft, you don’t need to think about what the landing gear is doing, or whether the navigation system is talking to control surfaces. Dozens of highly complex systems are working in sync to get you from A to B safely and smoothly. That’s what clients want from commercial banking — a unified, endto-end experience where the complexity is handled in the background, and someone onboard to make the whole ride comfortable (when help is needed).

What that looks like in practice is one digital platform that brings together account management, payments, FX, trade finance, and reporting into a single, intuitive interface. Clients need real-time visibility across multiple accounts and jurisdictions. They want to initiate and approve payments securely from wherever they are, with confidence. And they increasingly expect cash flow forecasting, liquidity insights and credit options to be integrated, not bolted on. Banks that embrace composable platforms and API-driven architectures can make this possible without ripping out their core systems.

Not every passenger gets the same level of service on a flight — and that’s by design. A business traveller, a firstclass guest, and a member of the cabin crew each have different roles, access rights, and experiences. The same logic should apply to commercial banking.

Chief financial officers, treasury teams, and finance managers each need tailored levels of access. One might need full control to move funds across borders; another

may only need read-only access to account statements. Yet in many banks today, these entitlements are hardcoded or managed manually, leading to inefficiencies and sometimes even compliance risks. Modern commercial banking platforms allow businesses to configure user roles and transaction limits dynamically, without relying on custom IT interventions or frantic calls to relationship managers. That gives clients the control they need to operate securely at scale — and gives banks a more agile way to serve complex organisations.

Arriving at your destination to find hidden fees can sour even the smoothest journey. For business clients, the same frustration arises when banking fees feel unpredictable or misaligned with value received.

In today’s competitive market, banks need to rethink monetisation, not just from a revenue standpoint, but from a cost-to-serve perspective as well. With advanced billing engines and account analysis tools, banks can better align pricing models with service consumption — giving clients clarity, while uncovering opportunities for value-added offerings such as risk management, invoice financing, or advisory services. This kind of transparency doesn’t just build trust; it allows banks to deliver sustainable profitability and serve their clientele.

The Middle East has some of the most ambitious and outward-looking enterprises in the world. These firms want banking partners that match their pace — not ones still waiting for systems to sync. That doesn’t mean the human element is no longer relevant. Relationship managers remain essential to commercial banking — but they need modern tools and data-rich platforms to do their jobs effectively. It’s not about removing the personal touch; it’s about upgrading the overall journey from an economy experience to a first-class one. Progressive modernisation is how banks can achieve this. Rather than replacing core systems wholesale, banks can hollow out key functionalities from legacy platforms and rebuild them into a unified, cloud-native, microservices-based architecture. This approach introduces two critical layers: a system of engagement that delivers a seamless experience across channels, and a system of integration that simplifies backend connectivity.

By eliminating silos and reducing complexity, banks can shift from fragmented service delivery to customer journey-led experiences. It’s a transformation that drives agility, reduces operating costs, and most importantly — ensures long-term value without disrupting day-to-day operations.

Because the next generation of business clients isn’t just looking for service — they’re expecting excellence. And just like in aviation, loyalty in banking is earned at every touchpoint.

RESILIENCE IN 2025 IS NOT ABOUT PREDICTING THE NEXT CRISIS. IT IS ABOUT PROVING THAT YOU CAN WITHSTAND IT, WITH DATA THAT INVESTORS CAN TRUST, INSIGHTS THAT ARE TIMELY, AND DECISIONS THAT ARE VISIBLE

BY RAJIV MIRWANI

igital readiness means having information that is trusted, visible, and actionable, so that when volatility hits, market participants can respond with speed and confidence. In the GCC today, that readiness is becoming the checkpoint for investor trust. Consider Saudi Arabia. In the second quarter of 2025, foreign investors outside the GCC accounted for a record 35 per cent of equity buying in Saudi markets, according to Bloomberg Intelligence. That reflected more than valuations alone. It suggested that reforms and greater market transparency are beginning to pay off.

Capital is also flowing into younger firms. According to regional venture platform MAGNiTT, startups across the Middle East raised about $1.35bn in venture funding in the first half of 2025, nearly double the level of the previous year, even as global venture investment slowed. Analysts point to factors such as government support and larger deals, but the resilience also reflects — in my view — a sharper focus on credibility, clarity of strategy, and risk discipline.

These flows highlight what digital readiness delivers. It is not about installing new systems or chasing efficiency. It is about giving decision-makers the ability to see exposures in real time, test how shocks would affect them, and communicate that analysis to investors before confidence erodes. Markets reward visibility. When companies can show how they are positioned for a sudden rate hike or an oil price swing, investors stay invested. When that

clarity is missing, volatility is punished with higher capital costs.

The Gulf’s market infrastructure is moving in the right direction. Saudi Arabia is making it easier for foreign investors to participate directly and is allowing depositary receipts to broaden access.

The UAE continues to advance the Digital Dirham project and the mBridge initiative, signalling its intent to make settlement faster, more secure, and better aligned with the needs of global markets. Regulators in Abu Dhabi and Dubai are tightening disclosure standards and raising the bar for compliance. Each of these reforms signals that information will be more timely, more consistent, and more reliable.

Companies preparing for IPOs have started to adapt to this reality. Boards are running scenario exercises before going to market. Reporting practices are aligning with international norms. Disclosures are more detailed and more frequent. These steps are not about box-ticking. They show investors that management teams understand volatility and are prepared to manage it.

CAPITAL IS ALSO FLOWING INTO YOUNGER FIRMS. ACCORDING TO REGIONAL VENTURE PLATFORM MAGNITT, STARTUPS ACROSS THE MIDDLE EAST RAISED ABOUT $1.35BN IN VENTURE FUNDING IN THE FIRST HALF OF 2025, NEARLY DOUBLE THE LEVEL OF THE PREVIOUS YEAR, EVEN AS GLOBAL VENTURE INVESTMENT SLOWED. Pic:

From my own experience, organisations that embed information into governance rather than treating it as an afterthought endure shocks better and maintain credibility with stakeholders.

The GCC now has the opportunity to set the benchmark for how emerging markets translate ambition into investor confidence.

Resilience in 2025 is not about predicting the next crisis. It is about proving that you can withstand it, with data that investors can trust, insights that are timely, and decisions that are visible. For the Gulf, digital readiness is no longer an aspiration. It is the foundation for sustaining capital flows and building markets that global investors believe in.

The writer is the head of business for the Middle East & Africa, Bloomberg LP.

financial hubs that hold value, facilitate payments, and connect seamlessly with both local and international beneficiaries.

3. Financial inclusion through mobile money

FINTECH IS MOVING FAST TOWARD REAL TIME, OPEN AND PERSONALISED MONEY MOVEMENT, WITH DIGITAL WALLETS AT THE CENTRE, SAYS THE WHIZMO CEO

BY ERIC KAROBIA

rom real-time payments and super wallets to open finance and hyperpersonalisation, here’s how financial technology is evolving in the UAE and beyond — turning digital wallets into engines of inclusion, speed and trust.

1. Real time as the new baseline

Speed is no longer a premium feature. It is an expectation. In 2023, real time payments accounted for about 19 per cent of all electronic transactions worldwide and are projected to reach more than 27 per cent by 2028. In the UAE, this expectation is magnified by a population deeply engaged in internet-driven lifestyles and accustomed to digital convenience. However, this shift represents more than convenience alone. It improves cash flow for small businesses, reduces friction in commerce, and raises user trust when funds arrive within seconds.

2. The rise of all-in-one super wallets

Financial apps are moving beyond single-purpose wallets to become comprehensive platforms. From bill payments and peer-to-peer transfers to international transfers and merchant acceptance, the trend is towards consolidation of services in a single application.

In markets like the UAE, where consumers interact daily with multiple service providers, this integration reduces friction and simplifies financial management.Super wallets are evolving into everyday

Globally, over 1.4 billion adults still remain outside the formal banking system. Mobile money continues to bridge this gap by offering accessible, account-like services through smartphones. The UAE, with its diverse population of residents and migrant workers, reflects this global need for safe, affordable, and reliable digital access to funds, esp. for the unbanked and underserved segments. For instance, international money transfers is a lifeline for many households, and financial apps that provide secure cross-border transfers with transparent pricing play a crucial role in enabling inclusion.

4.Open finance takes hold in the UAE

The UAE is moving decisively toward secure data portability. The Central Bank’s Open Finance Regulation and trust framework creates the conditions for licensed players to share customer-permissioned data through standardised APIs. For consumers, this means better comparisons, more tailored offers, and easier switching. For innovators, it reduces integration costs and accelerates new product development. Responsible data sharing, with clear guardrails, is emerging as the cornerstone of future financial design.

5. Hyper-personalisation as the new differentiator

We are entering an era of hyper-personalisation in financial services, where consumers increasingly expect more than standardised offerings. They want tools that recognise their individual patterns, goals, and preferences. Financial apps that provide contextual alerts, tailored recommendations, and meaningful insights elevate themselves from transactional utilities to trusted financial companions. In the UAE, where customers are digitally savvy and accustomed to seamless experiences in other sectors such as retail and travel, the same expectation now applies to finance. The ability to deliver relevant, personalised interactions will be a defining measure of customer loyalty and engagement.

6. Cross-border flows go digital and mainstream

The UAE’s economy is uniquely global, built on a workforce and families connected across borders. Officially recorded international transfers to low- and middle-income countries reached about $685bn in 2024, growing faster than expected. Digital rails and mobile money solutions are steadily replacing cash counters and paper forms. The most trusted solutions are those that combine transparent FX pricing, instant tracking, and compliance by design, while speaking the languages and serving the corridors that matter most to residents.

AS GLOBAL WEALTH CREATION ENTERS A NEW ERA OF HIGHER RATES, FRAGMENTED GROWTH, AND RAPID TECHNOLOGICAL DISRUPTION, GULF INVESTORS ARE RETHINKING HOW TO BALANCE RESILIENCE, RISK AND PURPOSE

BY SHIVKUMAR ROHIRA

lobal wealth creation is entering a structural realignment. The forces that shaped the past decade abundant liquidity, synchronised growth, and ultralow interest rates have given way to a world defined by costlier capital, technological disruption, and diverging policy regimes. For Gulf investors, this shift demands not only portfolio rebalancing but also a more profound re-examination of risk, resilience, and return in an age of geopolitical and macroeconomic complexity.

Global growth has become asymmetric. The US economy continues to outperform, supported by fiscal spending and consumer demand; Europe remains constrained by weak productivity and energy costs; and China is re-engineering its growth model amid property-sector headwinds. Emerging markets are equally divided -India and Southeast Asia benefit from supply-chain diversification, while others struggle with debt sustainability. This fragmentation has strategic implications. Correlations across regions and asset classes are weakening, restoring the value of active

management and regional specialisation. The postpandemic normalisation of interest rates has also recalibrated risk-free returns: 10-year US Treasuries, once yielding below 1 per cent, now offer yields above 4 per cent, forcing investors to reconsider the balance between growth and income.

Artificial intelligence (AI), automation and digital infrastructure are reshaping productivity, capital allocation, and valuation frameworks. Equity markets have already priced in an “AI premium” in sectors such as semiconductors and cloud computing. Yet, beneath the surface lies a wider technological diffusion: from energy storage and climate tech to tokenised assets and algorithmic wealth platforms.

For wealth managers, technology is not just an investment theme it is a strategic enabler. Predictive analytics and behavioural data now inform personalised asset allocation; blockchain is enhancing transparency in private markets; and digital-first platforms are redefining how clients interact with advisory services. The winners in this transformation will be investors who can integrate these innovations without losing sight of governance and long-term fundamentals.

Investor behaviour has evolved in tandem with global volatility. Across the GCC, a younger generation of wealth holders is emerging digitally fluent, globally connected, and purpose-driven. Surveys show that over 70 per cent of high-net-worth investors under 40 in the region now prioritise sustainability and social impact alongside financial performance.

This shift is reshaping product design. The earlier ESG wave often criticised for being overly thematic is giving way to quantifiable impact investing. Investors are demanding evidence of measurable returns from green infrastructure, renewable energy, and socialhousing funds. Family offices are aligning portfolios with national transformation agendas such as Saudi Vision 2030 and the UAE Net-Zero 2050 strategy, creating a feedback loop between public policy and private capital.

The future of wealth management will revolve around three imperatives: personalisation, integration, and transparency. Personalisation will deepen through data-driven advisory. AI-based modelling can simulate

multi-scenario portfolio outcomes in real time, tailoring asset mixes to client objectives and liquidity horizons. Integration will bridge public and private markets. Investors are increasingly combining listed equities with direct stakes in private credit, venture capital, and infrastructure to capture differentiated alpha.

Transparency will define client relationships. In a world of abundant information, the advisory edge lies in clarity – communicating risk, fees, and strategy outcomes with institutional discipline.

For Gulf investors, this evolution coincides with regional reforms that are strengthening capital-market infrastructure and encouraging onshore wealth management. The introduction of family-office regulations, fintech sandboxes, and sustainable-finance frameworks across Abu Dhabi, Dubai and Riyadh signals a new era of investor confidence and sophistication.

The coming years will reward strategic agility. Three priorities stand out:

Rebalance toward tangible assets and private markets. Infrastructure, logistics, and energy transition projects offer inflation protection and long-duration visibility — key in a higher-rate world.

Embed optionality in portfolio design. Liquidity buffers and flexible mandates enable investors to reposition quickly as macro conditions evolve.

Reframe sustainability as ‘alpha’, not altruism. Decarbonisation and resource efficiency are not peripheral themes; they represent the next structural growth frontier.

The decade ahead will be defined by how effectively investors translate uncertainty into strategy. Wealth creation will depend less on passive exposure and more on insight — understanding where structural growth will emerge and how to capture it responsibly. For the Gulf’s investors, the opportunity is twofold: to deploy capital globally with precision, and to anchor it locally in alignment with the region’s transformation agendas. The integration of technology, sustainability, and disciplined diversification will define the next generation of successful portfolios.In this multi-polar world, wealth management is no longer just about preservation it is about purpose, adaptability, and informed conviction.

The writer is the CEO, EMEA, Klay Group.

INVESTOR BEHAVIOUR HAS EVOLVED IN TANDEM WITH GLOBAL VOLATILITY. ACROSS THE GCC, A YOUNGER GENERATION OF WEALTH HOLDERS IS EMERGING DIGITALLY FLUENT, GLOBALLY CONNECTED, AND PURPOSE- DRIVEN.

Emerging markets are equally divided -India and Southeast Asia benefit from supply-chain diversification, while others struggle with debt sustainability

HOW VEEAM’S AGREEMENT TO ACQUIRE SECURITI AI AIMS TO REDEFINE RESILIENCE, GOVERNANCE, AND TRUST IN THE AGE OF ARTIFICIAL INTELLIGENCE

WORDS TEAM GULF BUSINESS

When Veeam announced a definitive agreement to acquire California-based Securiti AI, it signalled a new era for artificial intelligence (AI). It unites the global leader in data resilience with the leader in data security posture management (DSPM), data access governance, AI security, and privacy - addressing one of the biggest challenges facing enterprises today: how to accelerate safe AI at scale.

Veeam is hosting a special event at the Jumeirah Burj Al Arab hotel in Dubai on December 18, where top executives from both companies will be present, including Anand Eswaran, CEO of Veeam, and Rehan Jalil, CEO of Securiti AI. At this gathering, regional IT leaders and decision-makers will gain in-depth insight into the partnership, its strategic importance, and how the two companies unite to deliver a trusted data platform, designed to help organisations navigate and accelerate AI adoption safely in today’s data-driven world.

Since the dawn of the digital era, organisations have struggled with limited visibility, trust, and resilience of their data. The rise of AI has brought these issues into sharp focus. Today, all organisational data - structured and unstructured - is accessed, combined, and acted upon at machine speed. Unstructured information that

once sat idle in archives or file shares now powers AI copilots, agents, and generative models in real time. With AI, organisations need complete visibility of all their data: where it resides, who can access it, and whether it is protected and recoverable.

Every business is now a software business powered by data - structured data such as applications and databases, and unstructured data such as documents, PDFs, chats, images, and logs. While unstructured data was historically passive, AI enables new value from this data. Yet most organisations don’t know what data they have, where it is located, who can access it, and how it is being used. You cannot secure or govern what you cannot see.

Trust is another critical issue. AI projects fail or stall - 80–90 per cent of the time - not because models are flawed, but because data is incomplete, inconsistent, or non-compliant. Security, privacy, and compliance teams often operate in silos, and policies built for human speed cannot keep pace with AI.

THREE CRITICAL GAPS - visibility, trust, and resilience - define the data economy today. They are symptoms of a deeper problem: fragmentation across data, identity, policy, and protection. AI is the accelerant, magnifying both opportunities and risks. Routine weaknesses have become enterprise-level vulnerabilities.

SECURITY RISK IS ESCALATING. NEARLY 70 PER CENT OF ORGANISATIONS WERE HIT BY RANSOMWARE LAST YEAR, AND ATTACK SPEEDS ARE ACCELERATING.

Data resilience must evolve from simply restoring information to validating that data, models, agents, and embeddings are clean - and restoring only what is safe.

Successful AI requires identity, privacy, and policy information to travel with the data - from creation, to backup, to the AI pipeline - with enforcement at the same speed as AI. Without this, organisations face risks ranging from bad data impacting AI models, to external threats such as prompt-injection leaks, model poisoning, and accidental exposure of regulated data.

RESILIENCE IN AN AI WORLD Security risk is escalating. Nearly 70 per cent

of organisations were hit by ransomware last year, and attack speeds are accelerating. AI also enables attackers to automate and scale exploits. Inside businesses, unchecked autonomous AI agents can propagate bad data or drift models at machine speed. Data resilience must evolve from simply restoring information to validating that data, models, agents, and embeddings are clean - and restoring only what is safe.

Three critical gaps - visibility, trust, and resiliencedefine the data economy today. They are symptoms of a deeper problem: fragmentation across data, identity, policy, and protection. AI is the accelerant, magnifying both opportunities and risks. Routine weaknesses have become enterprise-level vulnerabilities. Organisations must now see all their data, secure everything, and recover anything at machine speed.

As AI adoption accelerates across industries, enterprises face a challenge: how to innovate quickly while maintaining compliance, governance, and security. The Middle East exemplifies this challenge. Governments and enterprises are embracing cloud, automation, and AI at unprecedented speed - while meeting stringent data-sovereignty and privacy obligations.

Veeam, long recognised as the global leader in data resilience from backup, to recovery, and ransomware protection, is focused on solving this dilemma. By acquiring Securiti AI, Veeam is bringing together a unified platform that encompasses an organisation’s entire data estate, while ensuring it’s protected, governed and managed - creating the foundation for trusted AI.

VEEAM’S CHANNEL-DRIVEN MODEL will continue in the AI era, with new certifications, joint solution bundles, and region-specific programmes to help partners deliver integrated resilience and AI trust solutions. This enables managed service providers and system integrators to move beyond reactive protection toward proactive AI enablement.

IDC FORECASTS AI SPENDING IN THE REGION TO EXCEED $6BN BY 2026, UNDERSCORING THE URGENCY FOR TRUSTED AI SOLUTIONS

This move reflects the rapid acceleration of AI adoption and the challenges of ensuring the right trusted data is available to power it. Veeam is expanding its trusted data resilience capabilities and integrating Securiti AI’s DSPM, privacy automation, and AI trust technologies. Together, they will deliver a unified control plane that protects and governs data, enabling safe and scalable AI innovation. This approach eliminates the perceived

trade-off between speed and risk, positioning resilience and governance as complementary pillars. It’s a natural evolution for Securiti AI, combining robust data resilience with advanced security and governance. The integrated platform will offer a single command centre for managing resilience, DSPM, privacy, governance, and AI trust across the entire data estate - unlocking AI’s potential while maintaining compliance and mitigating risk.

Together they offer customers visibility and control over their data while ensuring it’s protected and can be recovered no matter what happens. Customers can have security, governance, and resilience at the heart of AI projects from the outset, ensuring rapid rollback and integrity validation when anomalies occur. Safety becomes an enabler of innovation, not a constraint.

Backup and recovery workflows will integrate seamlessly with DSPM policies, validating posture, permissions, and compliance before data is backed up or used for AI, establishing trusted AI at scale.

Industry analysts endorse this integration, noting that it bridges gaps between security, governance, compliance, and resilience. By providing context-rich insights into data usage and access, the combined solution enables proactive risk defence, compliance assurance, and robust governance.

AI trust means confidence that data is accurate, compliant, and safe for AI use. In practice, this involves lineage tracking, consent enforcement, and risk detection - ensuring AI models operate on governed, resilient data and reducing operational and reputational risks.

The Middle East is advancing rapidly in digital transformation, cloud adoption, and AI deployment, supported by strong regulatory frameworks. Enterprises seek to innovate quickly while meeting compliance and sovereignty requirements. The combined Veeam–Securiti AI solution addresses these needs by delivering integrated resilience and governance, enabling organisations to move fast without creating risk.

Governments across the Gulf have introduced national AI strategies and data-protection frameworks, while sectors such as banking, energy, and telecom invest heavily in predictive analytics and generative AI. IDC forecasts AI spending in the region to exceed $6bn by 2026, underscoring the urgency for trusted AI solutions.

Hybrid environments present complex challenges for data sovereignty. The integrated platform offers visibility and control across on-premises, cloud, and SaaS environments, enforcing local compliance policies, while maintaining resilience and AI readiness. Early use cases in finance and government show how combining DSPM with immutable backups reduces risk and accelerates innovation.

Veeam’s channel-driven model will continue in the AI era, with new certifications, joint solution bundles, and region-specific programmes to help partners deliver integrated resilience and AI trust solutions. This enables managed service

providers and system integrators to move beyond reactive protection toward proactive AI enablement.

The acquisition anticipates emerging regulations such as the EU’s Digital Operational Resilience Act (DORA) and GCC data-sovereignty laws. Automated privacy checks and auditable governance workflows will allow enterprises to demonstrate compliance with evolving standards. Future dashboards will provide regulators with visibility into AI governance, lineage, and risk.

The unified control plane combining resilience, DSPM, privacy, and AI trust differentiates Veeam in a crowded market. Customers benefit from reduced incidents, faster recovery, and safer AI launches, while procurement teams can consolidate spend and lower total cost of ownership.

As nations across the Middle East invest in AI research, smart-city initiatives, and sovereign-cloud infrastructure, trusted data and resilient systems are becoming strategic differentiators. The combined Veeam and Securiti AI platform aims to lead this transformation, enabling organisations to innovate confidently and compliantly. For enterprises across the region, trusted AI is no longer optional - it is the foundation for sustainable digital progress.

MIDDLE EAST TECH TRENDS 2026

AS THE MIDDLE EAST EMBRACES AN ERA OF RAPID DIGITAL TRANSFORMATION, INDUSTRY LEADERS OUTLINE THE KEY TECHNOLOGY AND CYBERSECURITY TRENDS SET TO DEFINE 2026

By Neesha Salian

THE REGION’S business landscape is entering a transformative phase, driven by AI, cloud computing, automation, and data-driven innovation. Leaders across technology and cybersecurity are being asked two central questions: What key technology trends will shape business growth and digital transformation in the Middle East in 2026? And as digital ecosystems expand and AI adoption accelerates, what are the most critical cybersecurity challenges and priorities for Middle East organisations in 2026? The following insights from senior executives at Tenable, SentinelOne, NTT Data, ManageEngine, BMC Helix, SANS Institute, and Sophos shed light on the trends and strategies that will define the coming year.

The Middle East is navigating a critical phase of hyper-digitalisation, with the next few years being defined by interconnected technology trends that align directly with ambitious national agendas like the Dubai Economic Agenda ‘D33’.

By 2026, the primary drivers of growth will be the rapid integration of advanced agentic AI and automation across critical sectors, alongside the widespread adoption of hybrid cloud platforms to power data-driven innovation and smart city infrastructure. These pillars of progress, including cloud, IoT, and AI systems, are key to realising the goal of doubling Dubai’s economy.

However, this ambition introduces a major new challenge as it exponentially expands the digital attack surface. Cyber criminals are actively exploiting the same digital foundations that fuel the region’s success. Protecting this progress is more than just a technology issue; it’s an essential priority, and as emerging technologies further become embedded into the fabric of society, the impact of cyber events will exponentially increase.

The conventional cybersecurity strategy that has dominated the industry for the last two decades is now obsolete. The rise of artificial intelligence necessitates the adoption of a completely different methodology and discipline.

Tenable champions a transition from responsive, damage-control tactics, which they liken to ‘firefighting’, or a preemptive security posture known as exposure management, or ‘fireproofing.’ Exposure management offers a single, unified perspective of the entire contemporary attack surface, encompassing

every domain from cloud environments and traditional IT systems to identity issues in AI platforms and operational technology (OT). This comprehensive visibility empowers organisations to accurately prioritise and remediate the most critical vulnerabilities before a successful breach can ever materialise.

By embedding proactive cyber resilience and following exposure management best practices early into the adoption of new technologies, the Middle East can preemptively block the paths attackers could take and prevent population-impacting events from occurring. This forward-thinking, preemptive stance is the only viable path forward to fundamentally overhaul our digital defences and ensure a secure and thriving future for the digital economy.

In 2026, the Middle East will be poised for remarkable digital acceleration driven by several converging trends. AI will move from experimentation into production at scale. We’re seeing regional organisations shift from asking ‘should we use AI?’ to ‘how do we secure and scale AI?’ This means embedding intelligence into every business process, from customer service to supply chain optimisation.

Cloud adoption will accelerate dramatically, particularly in hybrid and multi-cloud strategies. Organisations across the Gulf are realising that cloud isn’t just about cost savings but also about agility and innovation speed. The

MIDDLE EAST ORGANISATIONS ARE FACING A PERFECT STORM IN 2026. AS THEY RAPIDLY DIGITISE AND EMBRACE AI, ATTACKERS ARE USING THOSE SAME AI CAPABILITIES TO LAUNCH FASTER, MORE SOPHISTICATED ATTACKS.”

ability to bring new capabilities in days rather than months becomes a competitive advantage.

Automation will be the great equaliser. With talent shortages across the region, companies that automate routine tasks will free their people for strategising. This is especially critical in areas such as cybersecurity operations, where threats move fast.

Data-driven decision-making will separate leaders from followers. Organisations sitting on data goldmines will deploy analytics and AI to extract real-time insights that drive strategy. The critical thread connecting these trends? Security must be built in from day one, not bolted on afterwards. As attack surfaces expand, autonomous security becomes non-negotiable for sustainable growth.

Middle East organisations are facing a perfect storm in 2026. As they rapidly digitise and embrace AI, attackers are using those same AI capabilities to launch faster, more sophisticated attacks. The biggest challenge is speed. Traditional security tools cannot keep up with AIpowered threats that adapt in real time. Critical infrastructure is particularly vulnerable. Energy, finance, and government sectors are prime targets, and the region’s accelerated digital transformation has dramatically expanded the attack surface.

Human-driven processes are too slow. Enterprises need AI-powered platforms that detect and respond to threats instantly, without waiting for human analysis. Siloed tools create blind spots. A single platform covering endpoints, cloud, and identity is essential.

Organisations that thrive will be those that embrace AI not just for business innovation, but as the foundation of their security strategy. In 2026, automated defence isn’t optional anymore; it is a necessity.

The region is moving from pilots to real execution, and 2026 will be a year where technology becomes deeply embedded in national and corporate strategies. AI will move into mainstream operations with agent-based systems, predictive automation, and AI-native architectures across public sector, finance, energy, and healthcare. Leaders will focus less on ‘AI initiatives’ and more on measurable productivity, faster decision-making, and redesigned customer experiences.

Cloud adoption will deepen with hybrid and sovereign architectures aligned to data residency and national digital agendas. The UAE and Saudi Arabia continue to lead, supported by hyperscaler expansion and a maturing regional data centre ecosystem. Automation will evolve from workflow efficiency to true autonomous operations in IT, cybersecurity and service delivery. Data will remain the core competitive asset, with organisations investing in real-time intelligence, trusted data platforms, and strong governance. The edge will go to companies that industrialise these capabilities quickly and build talent that knows how to run them.

The region’s greatest cybersecurity challenge will be maintaining trust in an era of intelligent automation. The convergence of cloud, IoT, and AI has expanded digital borders, creating unprecedented opportunities but also exposing new vulnerabilities that traditional security models can’t contain. The rise of AI-powered attacks, data manipulation, and deepfake-driven disinformation will redefine how we think about digital risk.

Organisations must embrace AI-enabled defence strategies that learn, adapt, and respond in real time. Embedding cybersecurity thinking into every stage of innovation—’secure transformation’— is essential. Investing in local talent, sharing intelligence across borders, and aligning with national visions for digital resilience will determine the region’s collective strength.

Cybersecurity in 2026 will be less about building walls and more about building confidence — in systems, data, and the people who drive digital transformation responsibly.

By 2026, the Middle East will be buzzing with real digital momentum. AI and machine learning will no longer be buzzwords; they will shape everyday business, helping organisations predict trends, improve services, and build deeper customer connections. Cloud and hybrid infrastructure will give organisations flexibility to scale rapidly while ensuring data security and compliance. Automation will

take over routine work, allowing people to focus on strategy and creativity.

Data-driven innovation will fuel smarter decisions and unlock new opportunities across industries. Backed by national visions like Saudi Vision 2030 and the UAE’s digital-first agenda, the region is shaping its own tech identity — agile, ambitious, and ready to lead in the next wave of digital growth.

Cybersecurity in the Middle East will be a top priority as AI becomes deeply embedded in business. AI-enabled cyber threats will grow more sophisticated as attackers leverage intelligent tools to bypass defences. Managing security across hybrid and multi-cloud environments will demand greater visibility and unified control. With more connected devices, IoT and OT vulnerabilities will be a concern, especially in BFSI, energy, manufacturing, and smart city projects.

Data privacy and compliance will remain in focus as regulations evolve and cross-border data flows increase. Organisations must shift from reacting to attacks to anticipating and outsmarting them.

SALMAN KAZMI

AREA VP, META, BMC HELIX

In 2026, business growth across the Middle East will be powered by the intersection of AI, coud and automation, with an emphasis on intelligent service operations. The shift to hybrid- and multi-cloud architectures will continue, unlocking new revenue streams via predictive service delivery, self-healing operations, and real-time insights. As digital ecosystems deepen and AI adoption broadens,

organisations must prioritise resilient and observability-driven security models. Critical challenges include managing threat exposure across distributed services, securing training and operational data for AI agents, and maintaining visibility across complex, hyper-connected services. A unified approach to service, operations, and security is key, enabling teams to detect anomalies, respond faster, and protect business continuity.

CERTIFIED INSTRUCTOR, SANS INSTITUTE

AI adoption is expanding rapidly. Organisations deploying AI-powered applications must secure new components — models, agents, and data pipelines — adding complexity to existing defences. Whether fine-tuning their own models or relying on providers like OpenAI, security teams must address supply chain risks, privacy concerns, and AI-specific threats.

Hosting choices are critical. Local deployment can be costly, while cloudhosted models offer scalability but increase dependence on cloud platforms. AI is also enhancing cybersecurity operations, creating space for innovation among startups and open-source contributors.

DIRECTOR, GLOBAL FIELD CISO, SOPHOS

The primary impact of AI on cyber criminals is acceleration. Phishing, malware obfuscation, and lateral movement within networks now happen faster. The cost of incidents rises with the time attackers have inside networks, and AI reduces that time dramatically. Defenders must shift to a prevention-oriented mindset, focusing on phishing-resistant authentication methods, such as passkeys, and expediting threat hunts where necessary.

HOSTING CHOICES ARE CRITICAL. LOCAL DEPLOYMENT CAN BE COSTLY, WHILE CLOUD-HOSTED MODELS OFFER SCALABILITY BUT INCREASE DEPENDENCE ON CLOUD PLATFORMS. AI IS ALSO ENHANCING CYBERSECURITY

OPERATIONS, CREATING SPACE FOR INNOVATION AMONG STARTUPS AND OPEN-SOURCE CONTRIBUTORS.”

The GM of Microsoft UAE discusses the company’s mission to democratise AI access and the strategic importance of partnerships

By Neesha Salian

Microsoft’s commitment to the UAE’s AI transformation took centre stage at the recent GITEX GLOBAL 2025, where the tech giant unveiled a suite of initiatives designed to embed artificial intelligence across education, industry, and government. At the company’s AI Tour held in Dubai earlier this month, Microsoft announced the expansion of its Elevate UAE skilling programme, targeting over 250,000 students, educators, and government employees by the end of 2027.

The initiative will embed AI literacy and handson training across educational institutions, including 100,000 students in GEMS private schools, while offering sustained programmes and partnerships with cuttingedge AI tools. The AI Tour brought together leaders from education, technology, and industry to explore how AI can drive innovation, productivity, and sustainable growth, showcasing keynote sessions and real-world case studies that demonstrated how organisations are translating AI potential into tangible impact.

Microsoft also reinforced its commitment to the UAE through its $15bn investment in the nation’s AI ecosystem, focusing on technology, talent, and trust to strengthen the country’s long-term vision for innovation, education, and inclusive growth.

Here, Amr Kamel, GM of Microsoft UAE, discusses the company’s mission to democratise AI access, the strategic importance of partnerships like the one with G42, and what visitors experienced at Microsoft’s GITEX presence, including the emphasis on agentic AI, skills enablement, and empowering every individual and organisation to achieve more in an AI-native economy.

Since you’ve taken up the role, how are you aligning your plans with Microsoft’s global mission and the local focus here in the UAE?

I think one of the things that really drives and guides everything we do in Microsoft is our mission, which is to empower every person and every organisation on the planet to achieve more.

While it’s a global vision, it’s very true in current times as well, especially with everything we see with AI. So, from a UAE perspective, that’s exactly our mission ahead of us: empowering every person and every organisation with AI to achieve more. And we really mean it with the word “person” — every resident, every citizen, and every organisation of all sizes, small and medium, government, you name it.

I think it’s so inspiring to see how the UAE, nationwide, is embracing AI at all different levels of the stack in a way that’s really inspiring and inspiring the company to do more with the UAE and in the UAE. One of the things we announced around bringing Copilot in-country processing, but also the outcomes that we see from some of these use cases — we see that through this partnership with the incredible vision and the ability to execute from the UAE with turning these promises into actions. And we’re moving from not only embracing AI to creating AI from the UAE to the world.

There are a lot of partnerships that Microsoft has signed — some at GITEX GLOBAL, some before, with G42 and government entities. What is the strategy that drives that?

If we want to be true to democratisng access to AI, to make sure that no one is left behind, there’s no way but partnerships and many different ecosystems. It will take a joint efforts to build that.

A great example is exactly our strategic partnership with G42, because it cuts across so many levels to make sure that nobody is left behind. It means we need that infrastructure with a global scale, right? Which means we need partnerships like this to make sure that we’re building responsible AI that’s inclusive. You need partnerships that drive what it means in terms of responsible standards for AI and security to make sure that there is this global access. You need also applications and platforms that scale while you have the right security boundaries.

And I think here in the UAE, we are lucky to see these nationwide examples of this — from applications like TAMM, where 1,100 government services are already automated, empowered and enabled by AI

or how the Department of Health is embracing AI. And there are so many examples in between.

At GITEX GLOBAL, everybody was very excited about Microsoft’s presence. And this was your first GITEX in this role. What did you showcase?

I think there were four key standout features at GITEX GLOBAL this year.

First, there was a thought leadership element around agentic AI. And the intention for us at GITEX was way beyond just a technology exhibition. It was truly a platform to showcase the roadmap and what’s coming ahead and to work through the ecosystem. That’s why this one was so important in terms of cutting-edge technology — to show the AI-powered future, what it means to have this agentic AI, and how executives, employees, government officials, you name it, can make use of such technology.

Then there was an element around partnerships. We were honoured to have 37 of our business partners who were together with us that had built on top of the platform. So that would have been my second stop for visitors.

They could go past our departments because they were — this is the beauty of partnerships — very specialised, very specific solutions that fix very specific problems or help get certain outcomes.

Then the third stop: skills. This is where visitors could find a whole track of how we’re enabling skills on different technical topics.

And last but not least was back to the mission. With our Copilot+ PCs or Surface Copilot+ PCs , that was the point where individuals could get their hands around the power of AI and access to AI.

There’s obviously a lot of opportunities that you’ve been tapping. In terms of challenges — the skill gap, the talent gap, developing skill sets — how is Microsoft enabling and empowering local economies to address that?

This is a great question. Because if you think back to the access of AI and what are the different pillars, infrastructure is one, skills is another. Because at the end of the day, it boils down to our capability and the human capital to embrace AI and maximise the use of this to enhance our capability. And to do this effectively, you need to enable skills at scale.

Tell us about the values that drive you. Empowerment becomes super important. And I think it’s a notion that is very much in the DNA of us as a company, a notion of having a culture of empowerment so that everybody can bring their A game to the job. There is an environment and culture that enables everyone to be at their best the way they are. So that’s important. That’s something for me as a value that I think of every day.

Personally, for me, there’s so much inspiration in the vision we talked about and in what we’re doing every day to shape such a future.

I think it’s so rewarding when you work with governments, with different organisations and see that some of these use cases are yielding results and outcomes that help every individual — be it a learner, be it a patient, or a resident who wants to have a service. It’s such a fulfilling feeling, to be honest. And that’s where the inspiration keeps going.

MICROSOFT ALSO REINFORCED ITS COMMITMENT TO THE UAE THROUGH ITS $15BN INVESTMENT IN THE NATION’S AI ECOSYSTEM

IF WE WANT TO BE TRUE TO DEMOCRATISNG ACCESS TO AI, TO MAKE SURE THAT NO ONE IS LEFT BEHIND, THERE’S NO WAY BUT PARTNERSHIPS AND MANY DIFFERENT ECOSYSTEMS. IT WILL TAKE A JOINT EFFORTS TO BUILD THAT. A GREAT EXAMPLE IS EXACTLY OUR STRATEGIC PARTNERSHIP WITH G42, BECAUSE IT CUTS ACROSS SO MANY LEVELS TO MAKE SURE THAT NOBODY IS LEFT BEHIND.”

By Neesha Salian

Abu Dhabi Securities Exchange (ADX) made a strong return to GITEX GLOBAL this year, underscoring its commitment to Abu Dhabi’s digital transformation goals. The exchange unveiled three major AI-driven solutions designed to simplify investor interactions, streamline internal operations, and enhance accessibility through the TAMM platform. In this conversation, Marios Kampouridis, chief technology and digital officer (CTDO) discusses how ADX is positioning itself

as a digital-first exchange, balancing innovation with regulatory rigor, and embracing AI’s transformative potential.

ADX was at GITEX GLOBAL after many years. What was the key focus of your presence, and how does it align with Abu Dhabi’s digital strategy?

It’s been great for ADX. We are very proud to announce three new AI initiatives that have come to the market. These initiatives are very much in sync with Abu Dhabi’s digital strategy. Our goal is to launch solutions for investors and issuers to make their lives easier and position the exchange as a digital-first, key hub.

You unveiled three specific AI solutions at the tech event. Can you run us through the key function of each of these tools?

We launched the three following tools that provide

friendliness, ease of use, and more insightful detail for all stakeholders.

AI Financial Insights: This tool takes lengthy financial statements (sometimes more than 100 pages) and uses an AI agent to talk through the key points, highlighting specific references in the document. A major advantage is that you can pause the agent and ask any question, such as comparing net revenue across different years, cutting analysis time from hours to minutes.

AI Court Order Agent: Used by our post-trade teams internally, this solution addresses the significant overhead of processing court orders. The agent can analyse the court order, take action, email the concerned party, and close the case in just five minutes, dramatically down from the usual 30 minutes.

TAMM for ADX Investors: We’re integrating with TAMM, Abu Dhabi’s unified government services platform. As an investor, you will be able to start trading, see your specific portfolio status and, in the longer term, subscribe to IPOs. Non-investors can also create an account. Crucially, you can query an AI agent within TAMM for an insightful knowledge base, comparing your portfolio versus the market or specific assets versus others.

As you roll out these powerful tools, how does ADX balance the need for rapid innovation with stringent security and regulatory considerations?

We are always very close with both the regulator and our security team. We use spring-based methodologies that ensure security is at the heart of everything we do daily. We do not leave the security assessment for the end; instead, we work with security at every milestone, allowing us to continuously improve and stay in line with the necessary standards.

As a CTDO, what is your perspective on how AI will change the landscape of traditional jobs and business in the coming years?

AI is here to stay, and I don’t believe this is a bubble

I BELIEVE THAT IN A VERY SMALL NUMBER OF YEARS — SINGLE DIGITS — WE WILL SEE ROUTINE AND MUNDANE TRADITIONAL JOBS START TO BE DONE BETTER THROUGH AI. THIS WILL ALLOW HUMANS TO FOCUS ON LESS MUNDANE TASKS, ELEVATING BUSINESS OUTPUT.”

THE AGENT CAN ANALYSE THE COURT ORDER, TAKE ACTION, EMAIL THE CONCERNED PARTY, AND CLOSE THE CASE IN JUST FIVE MINUTES, DRAMATICALLY DOWN FROM THE USUAL 30 MINUTES

like the early 2000s, as the technology is being proven daily with use cases that make a serious impact on productivity. I believe that in a very small number of years — single digits — we will see routine and mundane traditional jobs start to be done better through AI. This will allow humans to focus on less mundane tasks, elevating business output.

Where do you see the biggest challenges or negatives in the current deployment of AI for a financial institution?

One major challenge is that while AI can deliver something I might traditionally take a month to do in five minutes, it’s often “not mature enough” to deliver it exactly how I need it, especially concerning security and regulation. This creates significant overhead because it takes more time to “clean up” after it. We have to ‘babysit it’ to ensure the code quality is up to standard for financial applications.

What is your vision for helping ADX be seen as a digital-first exchange globally?

Our job remains finance and exchange, and we take great pride in our history and what we’ve achieved over the last 25 years. Over the last three years, we have brought ADX to the forefront using cutting-edge trading engines and platforms. My biggest focus now is to keep up with the traditional way of being in business while continuously putting in innovative and productive solutions to help my teams and the business produce better products in the coming years.

Finally, what is the one phrase that always brings you focus the pace of things gets frenetic? Look at the foundation and remember the fundamentals — it always pays off.

Tinboat Arslanouk , chief business officer – International at Khazna Data Centers, explains how the company is positioning itself as the foundational layer of the AI era and what sovereignty means in the context of hyperscale infrastructure

By Neesha Salian

CHIEF BUSINESS OFFICER – INTERNATIONAL

Khazna Data Centers has committed to one of the region’s most ambitious infrastructure expansions, announcing at GITEX GLOBAL 2025 plans to add over 1 gigawatt of hyperscale capacity by 2030 across multiple countries.

Backed by a $2.62bn financing facility from Abu Dhabi Commercial Bank (ADCB) and First Abu Dhabi Bank (FAB), the UAE-based operator is targeting strategic markets including Saudi Arabia, Italy, Turkey, and Southeast Asia as nations race to build sovereign, AI-optimized digital infrastructure.

The expansion comes as artificial intelligence workloads drive unprecedented demand for data centre capacity, with governments increasingly prioritising national control over compute resources and data governance. Khazna is already delivering infrastructure for Stargate UAE and partnering with Microsoft to support sovereign AI use cases across the region.

Sustainability anchors the buildout: Khazna’s facilities integrate nuclear, photovoltaic, and concentrated solar power (CSP), achieve LEED Gold certification, and deploy advanced cooling systems including water reuse and adiabatic technologies to reduce power and water consumption. The company’s decarbonisation trajectory aligns with the UAE’s net-zero target by 2050.

In this interview, Tinboat Arslanouk, chief business officer – International at Khazna Data Centers, explains how the company is positioning itself as the foundational layer of the AI era, what sovereignty means in the context of hyperscale infrastructure, and why the decisions made today about where and how data centres are built will shape the global digital economy for decades.

You announced at GITEX GLOBAL 2025 a major expansion adding over 1GW of hyperscale capacity

by 2030 across multiple countries, backed by a $2.62bn financing facility from ADCB and FAB. What prompted this ambitious growth trajectory, and why is now the pivotal moment for Khazna to scale globally into markets like Saudi Arabia, Italy, Turkey, and Southeast Asia?

Artificial intelligence (AI) is scaling faster than infrastructure can keep up, and we’re aiming to close that gap. This expansion isn’t just about adding capacity; it’s about delivering capability, where and how it’s needed most.

We’re seeing clear demand at the national level for sovereign, AI-optimised infrastructure that can be trusted. And it needs to be delivered quickly, built sustainably, and designed to evolve. We have demonstrated experience here. The financing facility gives us the agility to move decisively into strategic markets. We’re looking at regions that are accelerating toward a more digital, AI-native economy, but need the foundational infrastructure to get there. We’re uniquely positioned to deliver that, and we’re helping nations build the base layer of their next economies.

Your mission is to deliver “resilient, sustainable, and sovereign-ready AI infrastructure”. Can you explain what sovereignty means in this context, and how Khazna’s infrastructure is specifically engineered to enable the UAE and other nations to build AI-native economies while maintaining data control and security?

Sovereignty, in the context of AI infrastructure, means more than just where the data sits. It’s about who governs it, who controls the compute, and who sets the rules. As nations accelerate their AI strategies, they’re realising that true digital independence requires physical infrastructure they can trust and control. That’s where we come in. Our facilities are engineered for sovereign readiness from day one. That means full data jurisdiction, secure architecture, and operational transparency. We design, build, and operate our infrastructure end-to-end, which gives our clients the confidence that their most sensitive workloads remain under national governance. For many countries, this is becoming a strategic priority.

Sustainability is central to your expansion — your facilities use nuclear, photovoltaic, and CSP solar power, achieve LEED Gold standards, and employ advanced cooling systems. Given that data

centres are energy-intensive, how are you balancing rapid capacity growth with environmental responsibility, and what’s your renewable energy target across all operations?

Growth without responsibility isn’t an option. As we scale to meet AI demand, we’re engineering efficiency into every layer of our infrastructure. So that’s from the energy we source to the way we cool our systems. Our facilities are built to run leaner, smarter, and cleaner. Our overall goal is line with the UAE’s national goal of net zero by 2050. And as the country’s grid decarbonises, we are decarbonising with it.

We are already achieving LEED Gold across our campuses, and our facilities integrate water reuse, closed-loop cooling, and adiabatic systems to drastically cut both power and water consumption. Our goal is simple: build infrastructure that can support the future of AI without compromising the future of the planet.

You’re delivering the infrastructure layer for Stargate UAE and working with Microsoft to support AI use cases. How critical is partnership and knowledge transfer in accelerating AI adoption across enterprises and governments in the region, and what role does training and talent development play in your ecosystem?