Each year, we look forward to this day – not just for the opportunity to share knowledge, but for the chance to connect with you in person. It’s so valuable that you are taking the time to reflect and invest in your financial wellbeing. We’re thrilled that you’ve chosen to do that with us today!

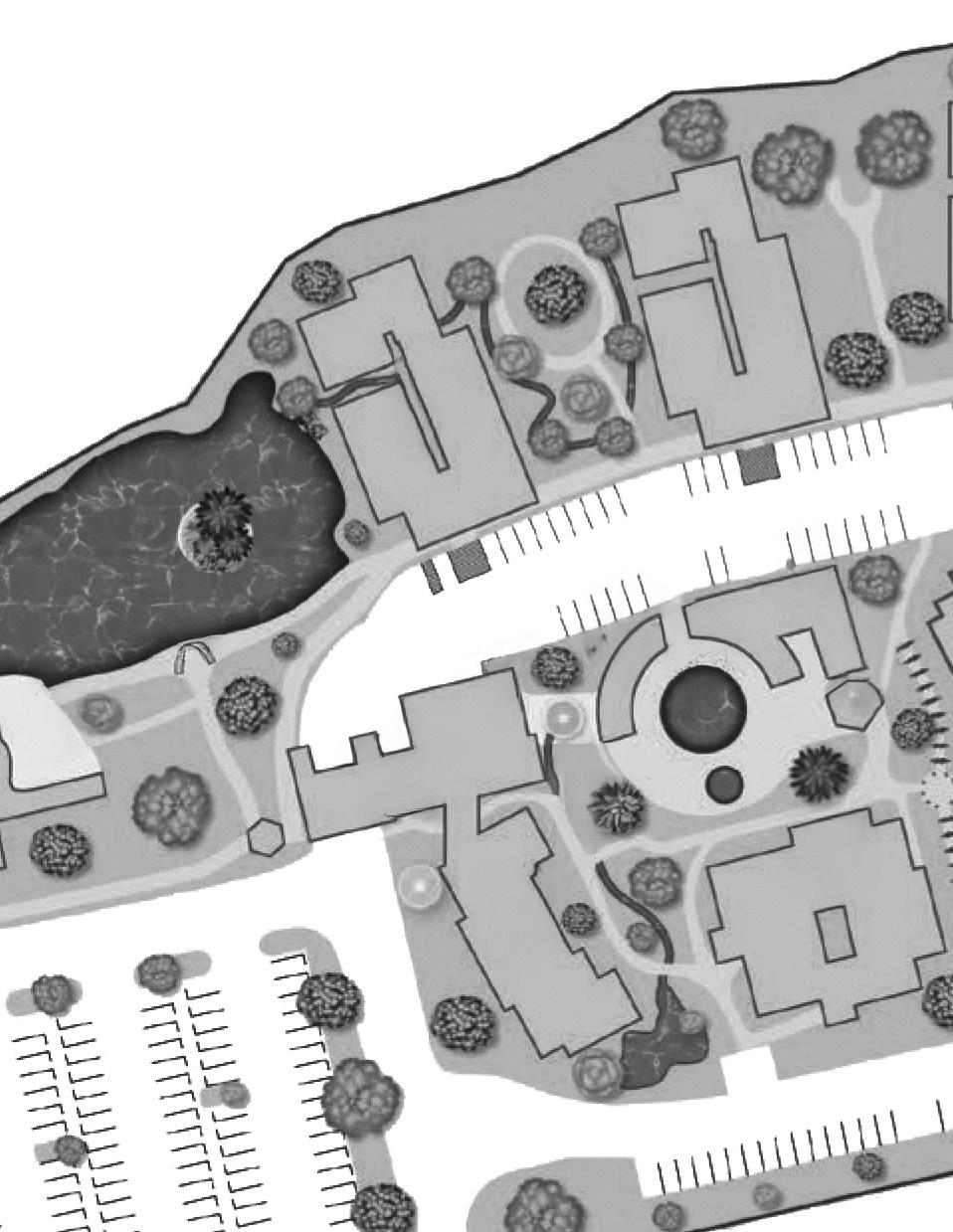

Our theme this year, Weaving the Threads of Financial Success, reflects our belief that every financial decision – from the large and strategic to the small and everyday – is part of a greater tapestry. Today’s sessions were carefully designed to offer insights from three different threads: lifestyle, innovation, and investing. Each of these themes has a dedicated room for you to explore. You’ll hear from trusted advisors, industry veterans, and passionate team members who are here to educate, and hopefully entertain along the way.

At Morton Wealth, we are proud to engage in this dialogue with our community with the goal of bringing clarity, purpose, and ultimately resilience to our financial futures. Whether you’re here today as a longtime client, a prospective investor, or an industry leader, our hope is that you leave feeling more empowered and confident in your ability to make the financial decisions that support your life goals and your legacy.

Please explore, ask questions, and engage. Use the pages ahead to discover what interests you most and map out your journey for the day. The connections you make and the ideas you gather today can become the foundation for your next great financial move.

We are so glad you’re here.

CEO, Morton Wealth

Weaving purpose into every season of life

Finding Purpose in Your Golden Years 9:30 AM

10:00 AM 10:30 AM 11:00 AM 11:30 AM 12:00 PM 1:00 PM 1:30 PM 2:00 PM 2:30 PM 3:00 PM

Maximizing Your Credit Card Points

Where to Live in Retirement

What’s Your Number? Defining What You Need to Retire

How Different Generations View Wealth Making “Memory Bank” Deposits: Tips for Planning Your Next Vacation

How to Evaluate Real Estate Funds The Realities of Selling Real Estate

Shaping the future fabric of wealth

ChatGPT vs. Advisor

The Power of AI

WHY IT IS VITAL TO BE A HEALTHY SKEPTIC WITH CEO JEFF SARTI

Q&A WITH MORTON’S LEADERSHIP: A TRANSPARENT LOOK AT OUR ORGANIZATION AND VISION

A Family Meeting: Creating Shared Understanding Around Wealth

Transferring Wealth Wisely

HAPPY HOUR

Where opportunity and intention intertwine

Targeting Opportunities in Essential Housing Investments w/ Grubb Properties

Weaving Resiliency with Gold in a Volatile World w/ VanEck

From Farm to Portfolio: How Food Lending Delivers Cash Flow w/ Proterra

Building Durable Income Through Diversified Credit w/ Keystone

Off the Beaten Path: Investing in Whiskey, Marinas & More w/ Cordillera

Generating Income Through Real Estate Lending w/ Stormfield Capital

Asset-Based Lending: How It’s All About the Collateral and Downside Protection w/ WhiteHawk

Finding Opportunities in Real Estate w/ KCB

Continue reading for session details

Explore how headlines and technology are changing the investment landscape and how Morton is adapting.

These 20-minute sessions focus on the personal side of wealth to help you make smarter financial planning decisions.

Enjoy lunch then finish the day with happy hour.

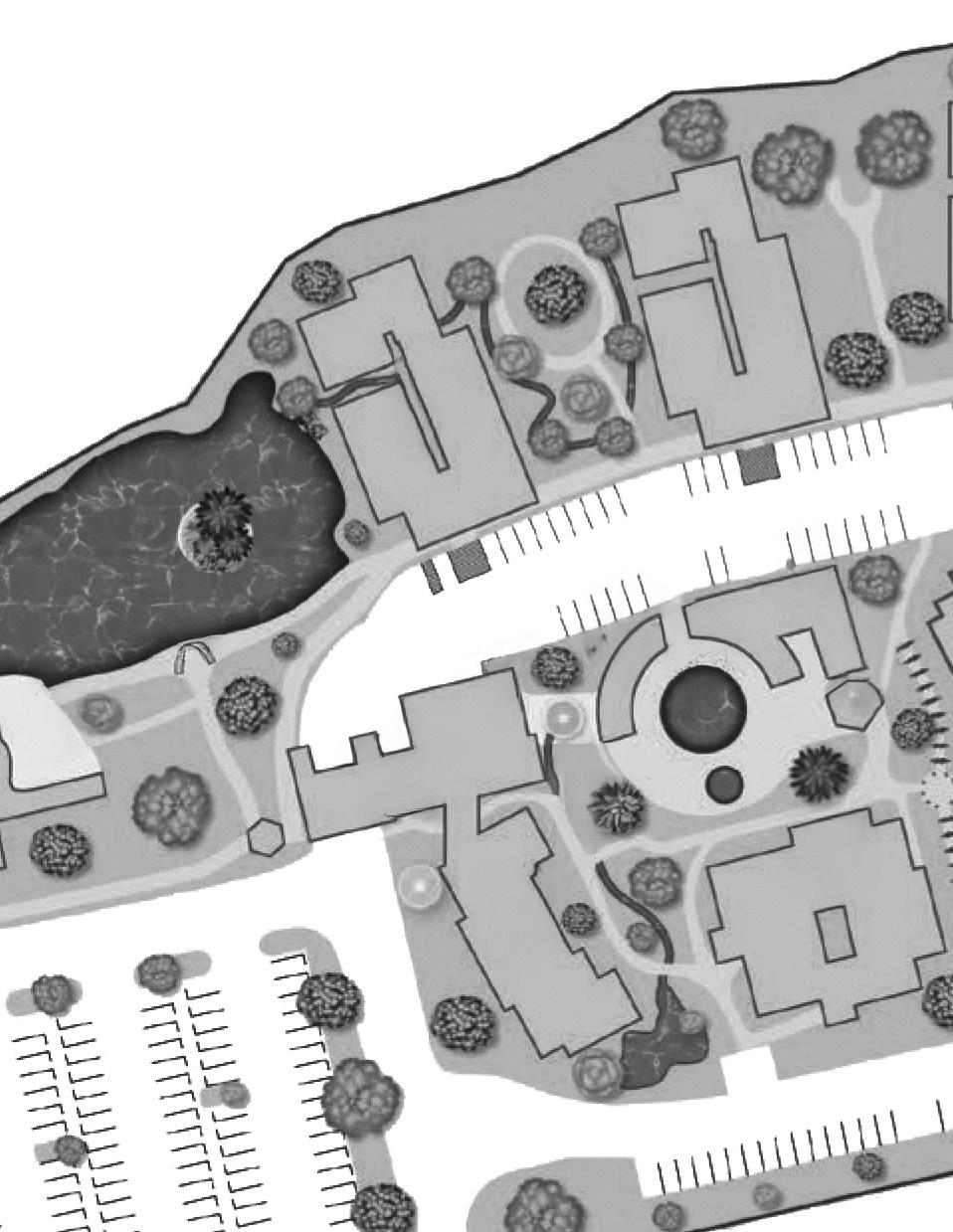

INNOVATION STAGE

INVESTING STAGE

LIFESTYLE STAGE

LUNCH & HAPPY HOUR

CHECK-IN

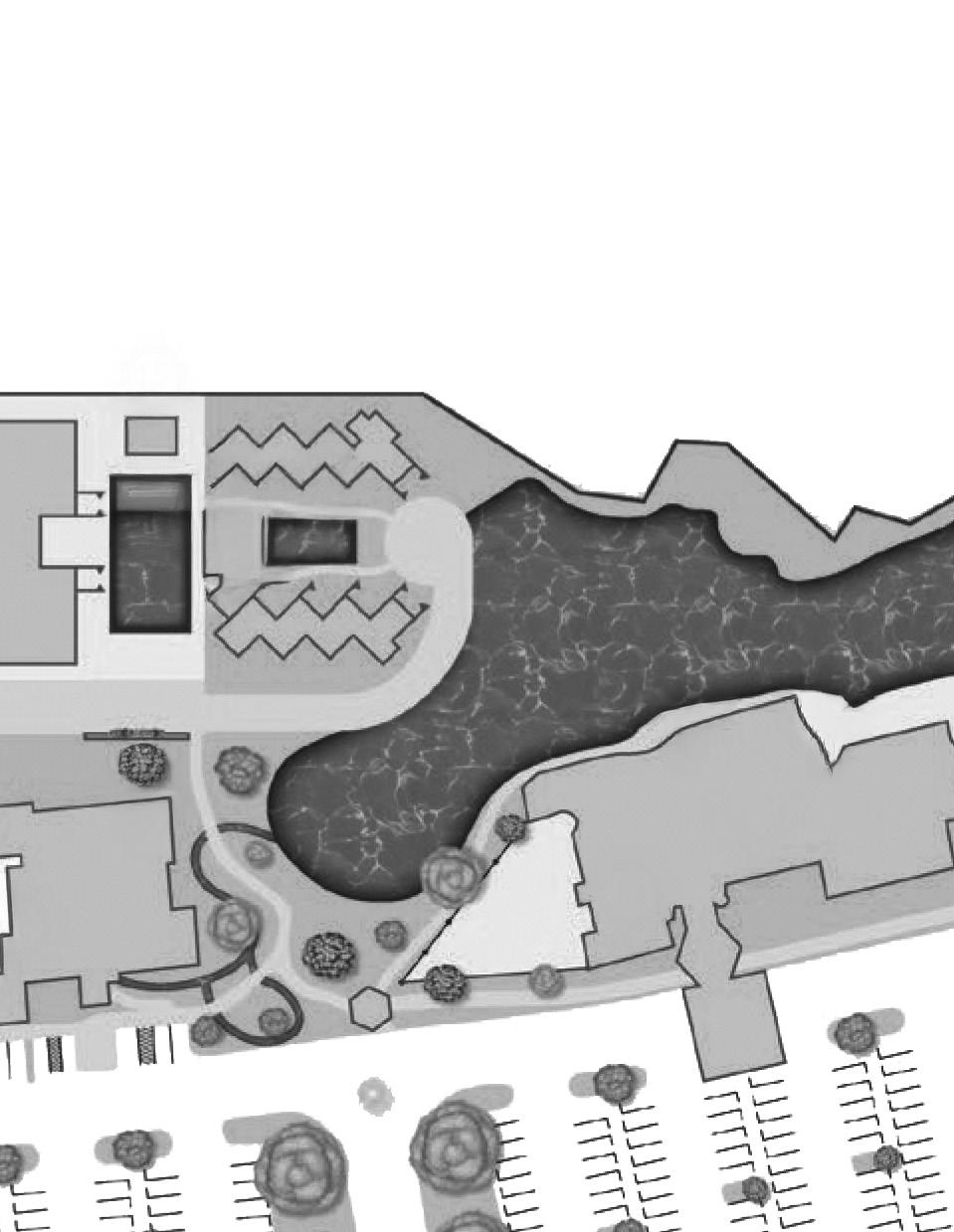

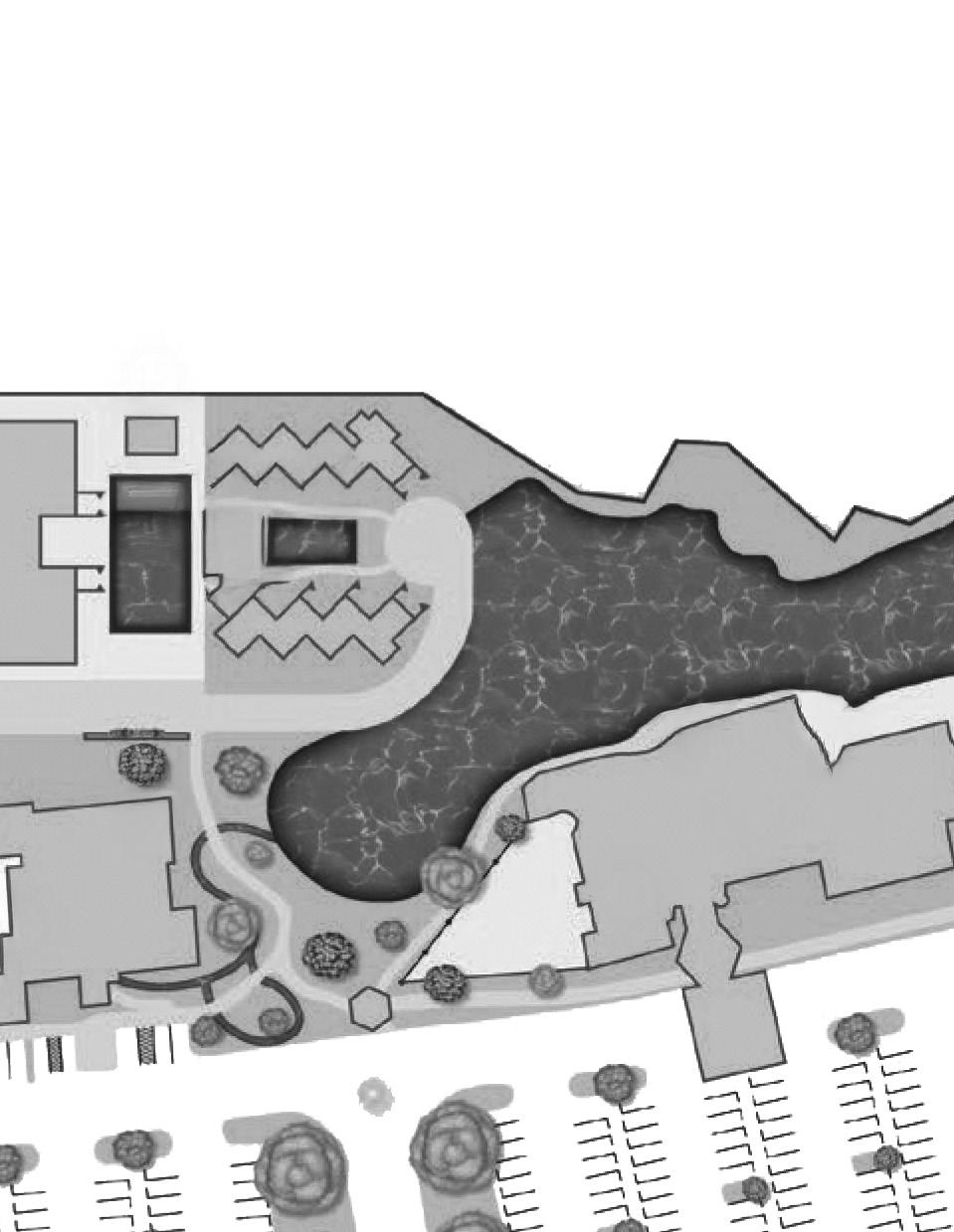

Where the experience begins. Grab your Symposium materials here. These 20-minute sessions explore growth and income strategies that support your investment goals.

Complimentary valet on your arrival.

The Innovation Stage explores how we adapt to change while staying grounded in what truly matters. In a world where artificial intelligence promises to revolutionize financial advice and speculative investing feels like the only path forward, these sessions help you think critically about which innovations serve your long-term interests and which are merely noise. You’ll witness AI and human advisors go head-to-head, hear our leadership team’s transparent vision for navigating industry disruption, and explore why returning to fundamental investing principles matters more than ever. We’ll also address the deeply personal work of wealth transfer—because innovation isn’t just about technology and markets, it’s about finding better ways to prepare the next generation and ensure your legacy reflects your values. The goal is to build the judgment needed to separate genuine progress from fleeting trends, both in your portfolio and in your family.

BEAU WIRICK Director of Financial Planning Morton Wealth

MIKE RUDOW Wealth Advisor, Partner Morton Wealth

In a world flooded with AI solutions, can a chatbot truly replace the wisdom, nuance, and relationship offered by a human financial advisor? Join us for a live, side-by-side comparison as we ask both ChatGPT and experienced advisors to answer realworld financial planning questions—streaming their responses directly for you to see. Discover where algorithms shine, where they fall short, and, most importantly, why the human touch is still essential when it comes to your wealth and life decisions

• Understand the core differences between AI-generated financial advice and expertise provided by a human advisor.

• Recognize the behavioral, emotional, and relational aspects of financial planning that AI cannot replicate.

• Gain insight into how partnering with a human advisor can help you overcome financial fears and clarify life goals.

BEAU WIRICK Director of Financial Planning Morton Wealth

STEPHEN DE MAN Vice President Dimensional Fund Advisors

Artificial Intelligence is reshaping the investment landscape— and the smartest investors are learning how to harness it. In this dynamic session, Stephen de Man will explore how AI is being utilized to enhance decision-making, uncover patterns, and inform more strategic approaches. Whether you’re curious about the future of finance or looking for practical ways to apply AI in your investment process, this session will deliver insights you can act on.

• Learn how AI is transforming investment research and portfolio construction.

• Explore practical ways to use AI tools to improve efficiency and outcomes in financial planning.

IT IS VITAL TO BE A HEALTHY SKEPTIC

Jeff explores how cultural shifts, skepticism surrounding government policy, and digital distractions have reshaped the way individuals perceive value and make investment decisions. For younger investors in particular, the American dream does not feel as viable, especially in light of inflationary pressures and home affordability. So, they default to a “YOLO” (you only live once) mindset, where speculative, high-risk investments feel like the only path to prosperity. This session challenges that narrative by redefining investing as a purposeful act rooted in discipline, time, and impact. It calls for a return to fundamentals: investing in real, meaningful assets with the goal of improving lives and building lasting value. Jeff will then be joined by Meghan Pinchuk, CIO, to discuss lessons learned over the years, as well as their current worldview and how those views impact the construction of client portfolios.

• Understand the cultural and economic forces shaping investor behavior.

• Recognize the risks of the current speculative investment culture.

• Reframe the concept of investing with purpose.

Our perspective has become more clearly defined over the years, a perspective with a skeptical and questioning eye but also with a healthy dose of optimism towards the long-term solutions that we believe are possible.

Scan QR code to subscribe to Jeff’s newsletter

ASSETS UNDER MANAGEMENT TEAM MEMBERS CERTIFIED EXIT PLANNING ADVISORS (CEPA®) PRIVATE INVESTMENTS IN CLIENT PORTFOLIOS YEARS SINCE FOUNDED

In this candid conversation, Morton Wealth’s leadership team—Meghan Pinchuk, Jeff Sarti, and Stacey McKinnon—offers a transparent look at the firm’s evolution, values, and vision for the future. From Lon Morton’s decision to pass the torch in 2013 to the strategic growth and cultural development that followed, this session explores how Morton Wealth has built a purposedriven organization focused on careful expansion, independent ownership, and a thoughtful client experience. Topics will include organizational structure, leadership collaboration, investment strategy, advisor transitions, cybersecurity, and the future of financial advice. Audience members will have the opportunity to submit questions live.

• Gain insight into Morton Wealth’s leadership structure and collaborative decision-making process.

• Understand the firm’s approach to investment strategy, advisor development, and client experience.

• Learn how Morton Wealth navigates industry challenges, including advisor transitions and cybersecurity.

ERIC SELTER Executive VP, Partner Morton Wealth

PRISCILLA BREHM Wealth Advisor Morton Wealth

CHRIS GALESKI Director of Growth and Advice, Partner Morton Wealth

Money and wealth are often taboo topics within families—yet 82% of parents wish they had talked about money with their kids, and only 44% actually did. In this session, three Morton Wealth advisors share real-life “war stories” from their work with families navigating the emotional and practical aspects of wealth transfer. With no one-size-fits-all approach, you’ll hear strategies for setting up meaningful family meetings, defining success, and preparing the next generation to receive and manage wealth. These conversations can be challenging, but they also have the power to bring families closer together.

• Learn how to structure and initiate effective family meetings around wealth.

• Discover key questions that foster transparency, alignment, and shared values.

• Understand common challenges—like unequal distributions and legacy planning—and how to navigate them.

• Explore ways to empower the next generation through education and inclusion.

PATRICE BENING

Wealth Advisor, Partner

Morton Wealth

BRIAN STANDING

Wealth Planner

Morton Wealth

By popular demand, Brian H. Standing, Wealth Planner, is back for a dynamic session exploring the art and strategy of transferring wealth with intention. Whether you’re planning gifts during your lifetime or shaping your legacy for future generations, this session will challenge conventional thinking and offer practical tools to ensure your wealth supports not just financial goals, but personal values and family harmony. Through real-life stories and professional insights, you’ll learn how to avoid common pitfalls and create a more successful legacy.

• Evaluate the pros and cons of lifetime gifting and understand how timing affects the usefulness and emotional impact of wealth transfers.

• Identify potential strategies for protecting gifted or inherited assets, including the use of trusts to preserve autonomy and shield against external risks.

• Understand the psychological and relational dynamics of giving to responsible vs. irresponsible beneficiaries, and how to tailor structures accordingly.

• Assess trustee options and distribution models to balance control, flexibility, and family relationships.

The Lifestyle Stage recognizes that wealth without intentional living is just accumulation. These sessions address the deeply personal questions that successful people face but rarely discuss openly: How do you transition from building wealth to living with it purposefully? What does it mean to prepare not just financially for retirement, but emotionally and relationally? Where should you live, and how do you find renewed purpose in your golden years? We’ll also explore how real estate ownership—often seen as a cornerstone of wealth—can become a source of stress and complexity that limits your freedom. From understanding the hidden costs and emotional burden of holding property to discovering how real estate funds might offer exposure without the management headaches, these sessions help you think critically about whether direct ownership still serves your lifestyle goals. And because wealth should enable experiences that matter, you’ll hear strategies for planning meaningful travel and maximizing the rewards that make it possible. The focus isn’t on financial products alone, but on the human decisions that determine whether your success becomes a source of fulfillment or constraint.

KEVIN REX

Wealth Advisor, Partner Morton Wealth

NICK CIRBO Senior Advisor Consultant Invesco

NICOLE REX Founder Watermark Life

JULIA CIRBO Co-founder NOW Collective

Travel isn’t just about taking time off—it’s about creating meaningful experiences that reward hard work, deepen relationships, and inspire personal growth. In this session, two couples share how they plan vacations to maximize joy, balance career responsibilities, and stay connected to what matters most. From finding travel inspiration to navigating logistics and choosing destinations, you’ll hear stories of favorite trips and practical tips for making travel a fulfilling part of life.

• Discover strategies for planning travel that align with personal and professional goals.

• Learn how to find inspiration and choose destinations that create lasting memories.

• Explore ways to balance career demands with the need for rest and adventure.

• Understand the value of travel as a reward, reset, and source of connection.

PATRICE BENING

Wealth Advisor, Partner Morton Wealth

GREG EISENMAN Area Senior VP Gallagher

Most travelers say they couldn’t travel the same way—or at all—without credit card points. Yet, many people aren’t utilizing rewards to their full potential. Do you have the right card for your lifestyle? Are you using it strategically, or just collecting points passively? Do you know how to stack rewards, time your spending, or unlock hidden redemption options? With generational gaps in usage and families increasingly relying on points for meaningful travel, it’s time to rethink how we earn and spend.

• Understand the strategic value of credit card points.

• Identify common mistakes and overlooked opportunities.

• Evaluate the cost-benefit of premium credit cards.

• Apply personal and business strategies to maximize rewards.

STACEY MCKINNON

COO, CMO, Partner Morton Wealth

JASON NAIMAN Retired Advisor Morton Wealth

Retirement brings freedom—but also big decisions. In this session, Stacey McKinnon interviews former Morton Wealth advisor Jason Naiman about one of the most personal and impactful choices retirees face: where to live. Jason shares his own journey, including the surprises of retirement, the emotional and practical considerations of leaving a longtime home, and the pros and cons of senior living communities like University Village and Wisteria. The conversation will explore financial implications, lifestyle trade-offs, and how to align your living situation with your vision for the next chapter.

• Understand the emotional and logistical factors involved in leaving a longtime home.

• Learn about different senior living options, from independent communities to full-service facilities.

• Explore the financial considerations of relocating in retirement.

• Gain insight into how lifestyle, community, and personal goals shape retirement housing decisions.

LIZ DIETZ Founder Love of Aging

PRISCILLA BREHM Wealth Advisor Morton Wealth

JOE SEETOO Wealth Advisor, Partner Morton Wealth

Of all the changes we face in our lives, retirement can either be the most rewarding or the most stressful. Which direction your retirement takes depends in large part on two things over which you have control: Are you financially ready? And, are you mentally ready? To get the most life out of your golden years, finding a renewed purpose is essential.

• Think of retirement not as an ending, but as a new beginning.

• Learn the meaning of “ikigai” and how it can change your golden years.

• Hear stories of how retirement can be different for women and men.

• Identify how to engage in social activities that keep you connected.

KEVIN REX

Wealth Advisor, Partner Morton Wealth

JOE SEETOO

Wealth Advisor, Partner Morton Wealth

CHRIS GALESKI Director of Growth and Advice, Partner Morton Wealth

Retirement planning is not one-size-fits-all. In this engaging session, we’ll explore how defining your “number” — the amount of money you need to retire — varies dramatically depending on your career path, generation, and life goals. Whether you’re a business owner navigating complex deal structures or an employee seeking clarity on future needs, this session will help you understand the key factors that shape your financial future.

• Learn how financial planning software can help quantify retirement goals and provide insight into key decisions.

• Explore the complexities business owners face, including valuation, deal structure, and continuity planning, when defining their retirement number.

• Understand generational differences in retirement priorities — from lifestyle-focused younger generations to healthcare-conscious retirees.

• Gain actionable insights to start defining their own retirement number, regardless of career stage or financial background.

AUSTIN OVERHOLT Wealth Advisor Morton Wealth

SOPHIE LEAHY Wealth Advisor Morton Wealth

BEAU WIRICK Director of Financial Planning Morton Wealth

Why do some people see wealth as security, while others see it as freedom or impact? In this session, we will explore how Boomers, Gen X, Millennials, and Gen Z each approach money, savings, and retirement through their own generational lens shaped by culture, technology, and life experience. You will gain insights not only into others’ financial mindsets but also your own. Whether you’re planning your future, raising kids, or have co-workers who are of a different generation, this session will help you better understand and connect across generational lines.

• Understand how generational experiences shape financial attitudes and behaviors.

• Recognize the diversity of financial goals across generations.

• Foster meaningful conversations that build empathy and understanding across age groups.

• Identify opportunities to bridge generational gaps in financial literacy and planning.

KEVIN REX

Wealth Advisor, Partner

Morton Wealth

STACEY MCKINNON

COO, CMO, Partner

Morton Wealth

Selling real estate in today’s environment is rarely simple. From tenant rights and deferred maintenance to family dynamics and shifting market conditions, property owners face a range of challenges. This session will explore some of the true costs and complexities of holding real estate, including opportunity costs, tax implications, and navigating local regulations. You’ll also learn what it takes to go to market successfully: choosing the right agent, understanding seasonality, and assembling the right team. Whether you’re advising someone else or managing your own property, this session is designed to help you make informed, strategic decisions.

• Understand the financial, emotional, and regulatory challenges of selling real estate.

• Evaluate the opportunity cost of holding vs. selling property in today’s market.

• Learn how to prepare a property for sale, including agent selection and team coordination.

• Explore key tax considerations such as depreciation, 1031 exchanges, and reinvestment strategies.

CHRIS GALESKI Director of Growth and Advice, Partner Morton Wealth

MEGHAN PINCHUK CIO, Partner Morton Wealth

Real estate funds can be a powerful gateway to property investing — but not all funds are created equal. In this session, we’ll pull back the curtain on how these funds are built, what makes a manager worth backing, and how to spot warning signs before you commit capital. Whether you’re comparing fund investing to direct ownership or trying to understand different fee structures and manager incentives, this session will give you the tools to ask smarter questions and make more confident decisions. We’ll also explore realworld examples of what can go wrong — and how to protect yourself when things do.

• Explore how real estate funds can offer diversified access to property investments, and compare their advantages and limitations versus direct ownership.

• Learn how fund construction — including liquidity terms, capital calls, and governance — can impact investor outcomes and risk exposure.

• Examine real-world scenarios where fund structures or manager decisions led to underperformance or loss, and learn how to spot warning signs early.

• Build a deeper understanding of the risks inherent in real estate funds — from market cycles and leverage to operational missteps — and the steps to mitigate them.

The Investment Stage is built around the belief that the best growth and income opportunities often exist beyond what’s commonly available or widely understood. While most investors build portfolios from the same menu of options, these sessions explore strategies that institutions have used for years but aren’t typically accessible to individuals—from income-generating real estate and private credit to growth-focused alternatives like private equity and gold. The emphasis isn’t on chasing the highest returns or abandoning income for growth, but on understanding how diversified approaches can deliver both consistent cash flow and long-term appreciation. These conversations help you think strategically about building wealth that works for you today while maintaining the discipline needed for tomorrow.

In a world defined by soundbites and quick fixes, we pride ourselves on staying focused on the big picture. Focused on our goal of both protecting and growing our clients’ wealth through strong as well as difficult economic environments. We accomplish this by asking hard questions, challenging conventional thinking, and staying grounded in our core investment principles.

Our investment philosophy centers around these investment principles of risk management, true diversification and cash flow – not because they’re trendy, but because they’re enduring. These pillars help us build portfolios with a focus on resiliency and alignment with our clients’ goals.

I look forward to sharing how we apply these principles in today’s complex environment, and more importantly, how we can help you feel confident and secure in your financial journey.

Chief Investment Officer, Morton Wealth

U.S. STOCKS

Traditional stocks and bonds are not the only path when it comes to investing. Since Morton Wealth’s founding in the early 1980s, we have been committed to providing clients with access to a diverse range of “alternative” investments—opportunities often unavailable to everyday investors. These alternative assets can help play a crucial role in lowering volatility, enhancing diversification, and increasing cash flow. REAL ESTATE LENDING

INTERNATIONAL STOCKS

PRIVATE EQUITY

OPPORTUNISTIC BONDS

DIVERSIFIED LENDING COMMODITIES

SHORT-TERM BONDS

MEGHAN PINCHUK CIO, Partner Morton Wealth

CLAY GRUBB CEO

Grubb Properties

In a time of rising interest rates, shifting demand, and evolving urban dynamics, real estate investors face a complex landscape. In this session, Meghan Pinchuk will interview Clay Grubb, CEO of Grubb Properties, to discuss how his firm is responding to today’s challenges. With nearly 60 years of experience and a vertically integrated platform, Grubb Properties focuses on building “essential housing” communities through its Link Apartments® brand. Clay will share insights on navigating market volatility, managing risk, and how to position real estate portfolios with the goal of longterm success amid one of the most dynamic periods in real estate history.

• Understand the current challenges facing real estate, including interest rate pressure, office market distress, and volatile construction costs.

• Gain insight into lessons learned through macro shocks like COVID and rising inflation.

• Explore the role of essential housing in addressing affordability gaps and demographic shifts.

AXEL MERK President Merk Investments

SASAN FAIZ Managing Director of Investments, Partner Morton Wealth

In an era of inflation, currency volatility, and geopolitical uncertainty, gold has reemerged as a critical asset when designing portfolios for long-term resilience. At Morton Wealth, we’ve maintained a strategic allocation to gold for over a decade, viewing it as a hard reserve currency and a hedge against the erosion of purchasing power. In this session, we’ll explore why gold continues to play a vital role in diversified portfolios and how investors can access it more efficiently. Axel Merk, manager of the VanEck Merk Gold ETF (OUNZ), will share insights into the unique features of this fund, including its ability to convert ETF shares into physical gold. Whether you’re curious about gold’s role in modern portfolios or want to understand the mechanics of delivery and storage, this session will offer both strategic and practical takeaways.

• Learn why we believe gold remains a powerful hedge against inflation and currency risk.

• Understand the benefits of owning “allocated” gold and how OUNZ enables physical delivery.

• Explore how gold fits into a resilient, long-term investment strategy.

RICH GAMMILL Managing Partner Proterra Investment Partners

ERIC SELTER Executive VP, Partner Morton Wealth

Join us for an exclusive interview with the team behind Proterra, a private lending platform focused on middle-market food and beverage companies across North America. Proterra seeks to provide its investors with consistent cash flow while avoiding the volatility of traditional markets—making it a compelling bond substitute with less exposure to interest rate and duration risk. In this session, we’ll explore how Proterra identifies lending opportunities, structures deals, and manages risk in a sector that touches every part of the food value chain.

• Understand how Proterra generates income through private lending in the food and beverage sector.

• Learn why this strategy offers low correlation to public markets and can avoid many traditional bond risks.

• Explore how Proterra structures deals to support business growth while focusing on protecting investor capital.

MICHAEL GROSSLIGHT

Client Relationship Specialist Morton Wealth

BRAD ALLEN Managing Partner

Keystone National Group

This session offers a behind-the-scenes look at how Keystone generates consistent income through private credit strategies. You’ll learn how the fund navigates today’s economic challenges, what makes its strategy unique, and what investors should know about performance, risks, and opportunities. Whether you’re new to private credit or looking to deepen your understanding, this session will provide practical insights in plain language (no jargon required).

• Understand the core strategy behind Keystone’s private credit strategy.

• Learn the fund’s approach to generating returns and managing risk.

• Hear how Keystone has responded to recent macroeconomic shifts, including tariff and inflationary pressures.

• Discover what sets Keystone apart from other income-focused investment options.

ASHLEY MARKS Co-founder Cordillera Investment Partners

SASAN FAIZ Managing Director of Investments, Partner Morton Wealth

In a world where traditional private equity has become crowded and commoditized, Cordillera Investment Partners is redefining the space by focusing on niche, noncorrelated assets. From whiskey aging and boat marinas to wireless spectrum and environmental credits, these investments can offer unique opportunities for diversification and outsized returns. In this session, Ashley Marks will share how Cordillera sources and structures deals in overlooked sectors and why being early to an idea can be a powerful advantage. You’ll learn how their direct investing platform leverages deep networks and creative partnerships to uncover value where others aren’t looking.

• Discover how niche assets can offer diversification and compelling returns.

• Learn how Cordillera identifies and structures deals in overlooked sectors.

• Explore real examples—from whiskey barrels to marinas—that redefine alternative investing.

IAN RENNICK

Financial Planning Advisor Morton Wealth

WESLEY CARPENTER Founder Stormfield Capital, LLC

Real estate lending remains a key investment area but faces headwinds from rising interest rates, tighter credit conditions, and refinancing challenges—especially in sectors like office and retail. Traditional lenders are retreating, creating opportunities for private lenders who emphasize conservative underwriting, smaller loan sizes, and disciplined risk management to navigate the current environment effectively. The Stormfield management team will discuss how, through thoughtful portfolio construction and risk mitigation practice, they have been able to address many of these challenges.

• Understand the key differentiators of resilient real estate lending strategies and how they navigate market volatility.

• Evaluate the operational implications of managing smaller loan balances and the reasons why these smaller loans may represent a unique opportunity in the current environment.

• Examine structured approaches to managing loans in delinquency and how Stormfield may be able to generate positive returns even when loans are challenged.

MIKE RUDOW Wealth Advisor, Partner Morton Wealth

JOHN AHN CEO WhiteHawk Capital

Explore the world of private credit with WhiteHawk Capital Partners—a leader in assetbased lending for middle-market companies. Join this interactive session to learn how WhiteHawk structures deals with the goal of delivering steady income, mitigating traditional bond market risks, and providing investors with resilient, uncorrelated returns. We’ll interview the WhiteHawk team about their approach to underwriting, creative financing, and portfolio construction, revealing why this strategy can be a compelling bond alternative for today’s environment.

• See how WhiteHawk’s asset-based lending can generate reliable income for investors.

• Understand WhiteHawk’s unique approach to prioritizing assets as opposed to cash flow when assessing a borrower and how this bias can result in enhanced downside protection.

• Explore WhiteHawk’s process for managing risk across industries.

• Learn where private credit fits as a high-yield, bond alternative in client portfolios.

BRUCE TYSON

Wealth Advisor, Partner Morton Wealth

PETER KNELL President KCB Real Estate

Is there a better way to navigate the challenges of real estate investing? Is there a methodology for consistently uncovering value in overlooked segments of the property markets? Join us for a conversation with Peter Knell, whose KCB family office seeks to create value through its deep national network of local partners, institutional-level due diligence, and expertise in repositioning and renovating properties.

• Discover how KCB identifies undervalued real estate opportunities in underserved market segments.

• Understand the depth of due diligence required to mitigate risk and validate investment potential.

• Learn how long-term local partnerships can enhance national deal sourcing and market insight.

• Compare value-add strategies with new construction to assess where each creates the most value.

FINANCIAL SUCCESS DOESN’T HAPPEN ALL AT ONCE. IT’S WOVEN OVER TIME. HERE ARE THE KEY THREADS TO CONSIDER.

Your financial habits now shape your long-term security.

• Set and automate long-term savings goals (e.g., 15–20% of income)

• Create an emergency fund (3–6 months of expenses)

• Maximize retirement contributions (401(k), Roth IRA)

Your earnings typically peak—make those dollars work for you.

• Revisit your financial plan: Are your goals still aligned?

Begin legacy planning and educate children on financial literacy

Evaluate investment diversification (alternatives, tax strategies)

Prioritize insurance updates: income replacement, long-term care options

Plan for children’s education (529 plans or alternatives)

Review estate documents with

The transition window—tighten the threads and reduce risk.

• Create a retirement income plan: cash flow modeling & social security strategy

• Reduce exposure to concentrated assets (company stock, illiquid real estate)

• Run tax projections: Roth conversions, charitable planning

• Think through exit planning (if a business owner)

• Discuss aging parent care and estate coordination

• Start envisioning your “next chapter”: purpose, lifestyle, legacy

Shift from building wealth to sustaining and sharing it.

• Activate retirement income strategies: pensions, annuities, RMDs

• Finalize Social Security filing strategy

• Healthcare planning (Medicare, long-term care)

• Build a legacy plan: how do you want to be remembered?

• Explore philanthropic goals and giving vehicles (DAFs, CRTs)

• Reassess risk tolerance and portfolio management

Prioritize peace of mind, legacy clarity, and efficient wealth transfer.

• Take Required Minimum Distributions (RMDs)

• Manage tax implications of distributions

• Review and update estate plan

• Communicate legacy intentions with heirs

• Consider gifting strategies

• Enjoy your wealth

Our signature offering is designed to curate a plan for our client’s financial future and invest in a way that focuses on how they can get the most life out of their wealth. To achieve this level of confidence, we use a simple equation: Right Mindset + Right Strategy = A Better Investor. We work with our clients to define what is important to them, align their financial plan with their values, create a team of advisors to develop strategies on their behalf, and source a collection of investment opportunities that focus on growing their wealth.

Building and running a business is hard. We’ve found that a lot of owners feel burnt out and uncertain about what the future holds for the business. This is why we created the Strategist offering. To help owners build more transferable value for their business so that they can maximize their potential return on investment. Instead of feeling nervous about what will happen, our clients feel excited about their future and have a clear vision of what life looks like after the business.

Our Modearn® offering will remind you of a concierge doctor, but with proactive planning and advice sprinkled in throughout the year. This model focuses on how to save time while providing advice needed in a timely fashion. We’ll help clients build a spending strategy, design a portfolio, protect their net worth through insurance and estate strategies, provide advice on credit cards, develop a debt management strategy, maximize their benefits, look for tax saving opportunities and provide education that leads to quality investment decisions.

Hosted by Wealth Advisor Chris Galeski, The Financial Commute is a weekly podcast that gives the rundown on what’s going on in the current market, how it affects you, and what you can do about it – all designed to fit into your commute. Each week, Chris welcomes an expert guest, including Morton Wealth advisors, fund managers, and investment analysts, to break down complex financial topics. Our goal for this podcast is to provide you with the tools to help you navigate this challenging environment, leading to a path of more confident investing.

linkedin.com/in/chrisgaleski/

@morton_wealth

The Financial Commute

Couchside Conversations is a Modearn® video series of real conversations to empower you to enjoy the experiences of today while planning for your future. Conducting healthy conversations around things like sharing finances in a relationship, buying a vacation home, or managing the costs of raising kids can be challenging, but with the right tools, it’s possible.

@modearnbymorton

@modearn_by_morton

Couchside Conversations

Scan the QR code or visit bit.ly/mortonintroductorycall to schedule a call with an advisor today.

Morton Capital Management, LLC dba Morton Wealth (“Morton”) is an Investment Advisor registered with the U.S. Securities & Exchange Commission. Registration does not imply a certain level of skill or training.

Information presented is provided solely for educational purposes and does not constitute an offer or solicitation with respect to the purchase of any security or asset class. These presentations do not take into account the specific investment objectives, financial situation or particular needs of any specific person. They are subject to change without notice and should not be relied on for investment advice. You should consult with your attorney, finance professional or accountant before implementing any transactions and/or strategies concerning your finances.

The views expressed in these presentations are the independent observations and views of the speaker and not, necessarily, of Morton Wealth. Presentation at a Morton event does not constitute an endorsement of the presenter’s views, products or services.

References to specific investments are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. Many of the investment opportunities discussed are only available to eligible clients and can only be made after careful review and completion of the applicable Offering Documents. Each investment opportunity is unique, and it is not known whether the same or similar type of opportunity will be available in the future. It should not be assumed that Morton will make investment recommendations in the future that are consistent with the views expressed herein.

Although the information contained herein is from sources deemed to be reliable, Morton makes no representation as to the adequacy, accuracy or completeness of such information and it has accepted the information without further verification.

There is no guarantee that the investment objective of any of the strategies discussed will be achieved. Past performance is no guarantee of future results. All investments involve risk, including the loss of principal.