Economic Macro and Market Outlook

October 19, 2022

Economic/ Market Update: Macro

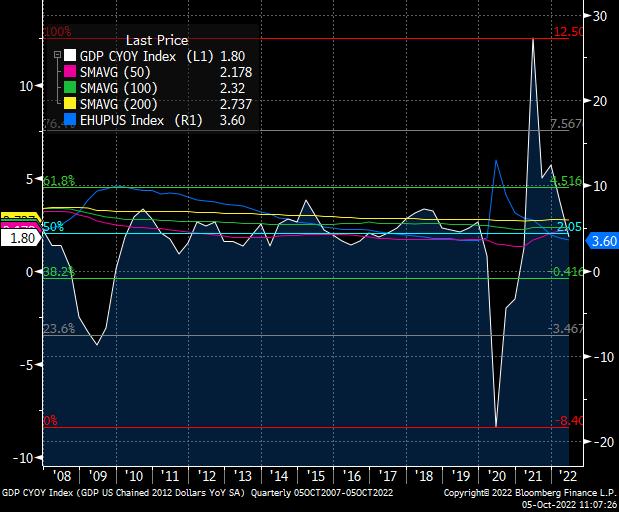

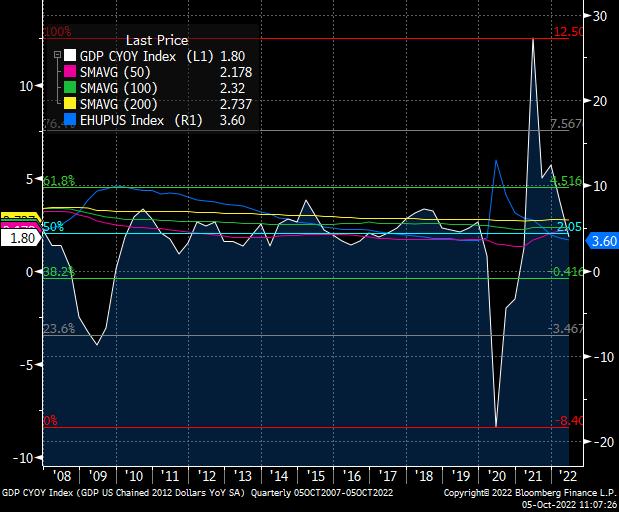

Houston Macro and Market Outlook | Oct. 2022 Since ‘08 Great Recession and through Pandemic, Gov’t agencies initiated low interest rate regimes and fiscal stimulus to push unemployment to 50-yr. lows and attempt to boost GDP growth 3Q2022 unemployment at 3.7%. Lowest rate since 1960’s St. Louis Fed, calculates natural unemployment rate to be approx. 4.0% 4.4% GDP Growth averages 1.7% over this period CY2022 GDP Growth estimated to be 1.6% after 6% GDP Growth in 2021

Economic/ Market Update: Macro

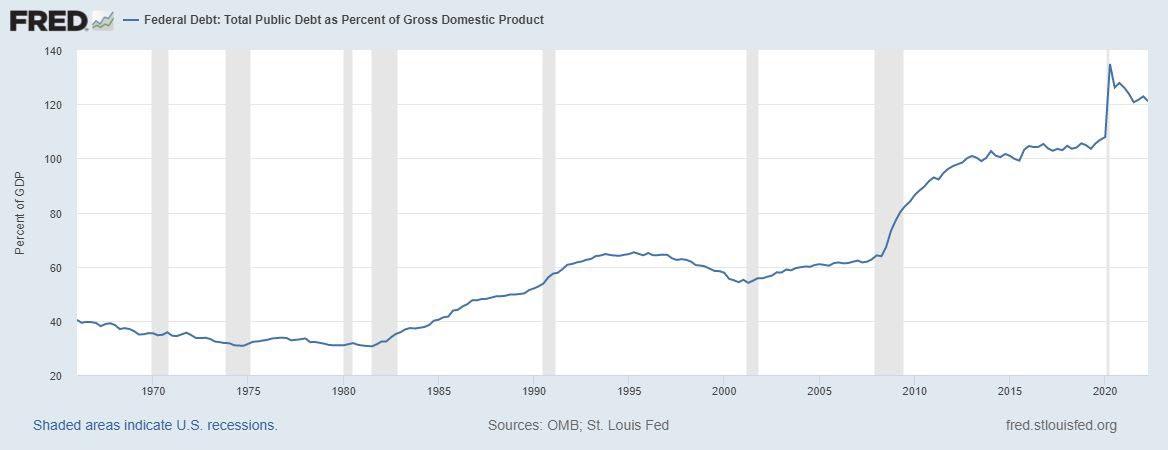

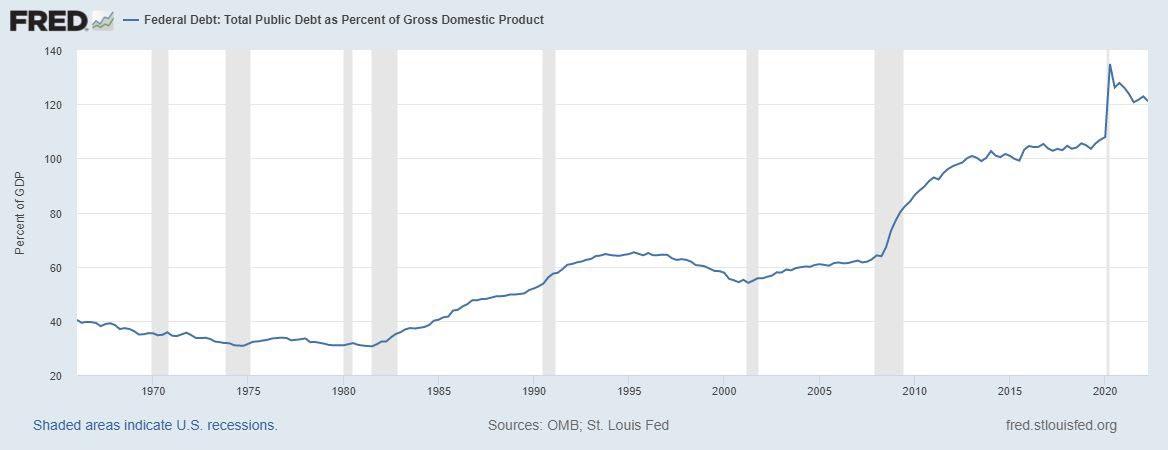

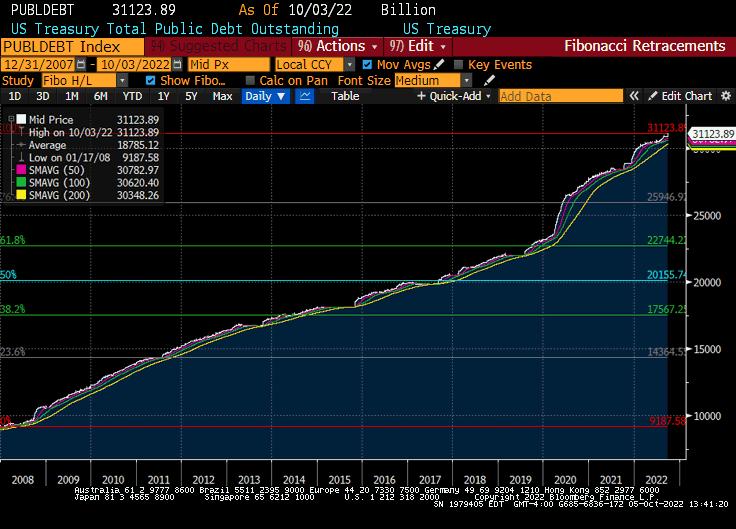

Public Debt as a % of GDP balloons from 60% before the Great Recession

To 120% of GDP following Pandemic Spending

Houston Macro and Market Outlook | Oct. 2022

Economic/ Market Update: Macro

While over-levered consumer and loose lending standards were a major cause of the great recession, Consumer exiting the Pandemic in much sounder financial position

Pandemic stimulus aids in historically low consumer credit default levels according to S&P 500/Experian Consumer Credit Default Index

Houston Macro and Market Outlook | Oct. 2022

Economic/ Market Update: Macro

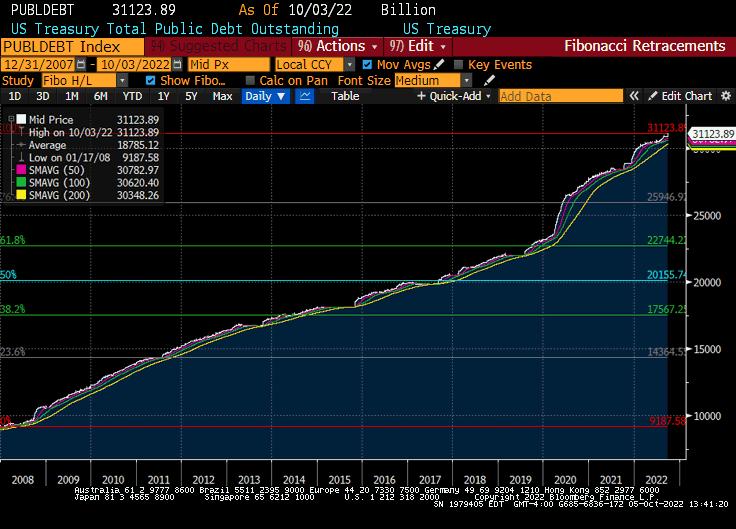

Total Gov’t debt up $21 trillion since Great Recession

Estimates for potential GDP Growth expected to fall from greater than 2% GDP growth experienced in

Cato Institute: Jack Salmon

“The impact of Public Debt on Economic Growth” For Debt to GDP levels above

potential GDP growth by -.8% to

Houston Macro and Market Outlook | Oct. 2022

2020--2024

77%-90%,

-.4%

Economic/ Market Update: Macro

Money supply grows to unprecedented 27% y/y growth during pandemic to support shutdown of the global economy and reopening of economy

Household deposits grow from $1.43 trillion in 2018 to $4.85 trillion today Did govt agencies overstimulate the economy?

Houston Macro and Market Outlook | Oct. 2022

Economic/ Market Update: Macro

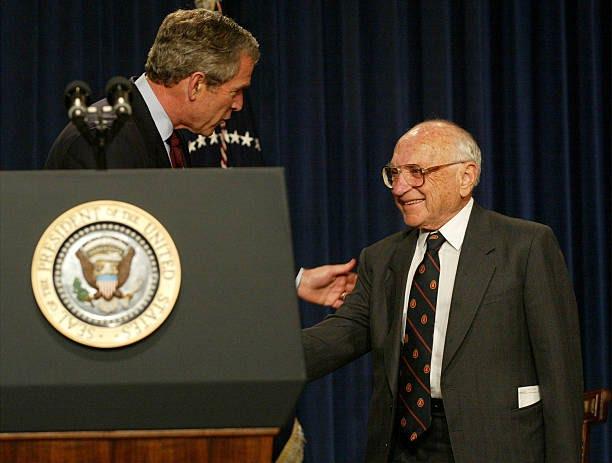

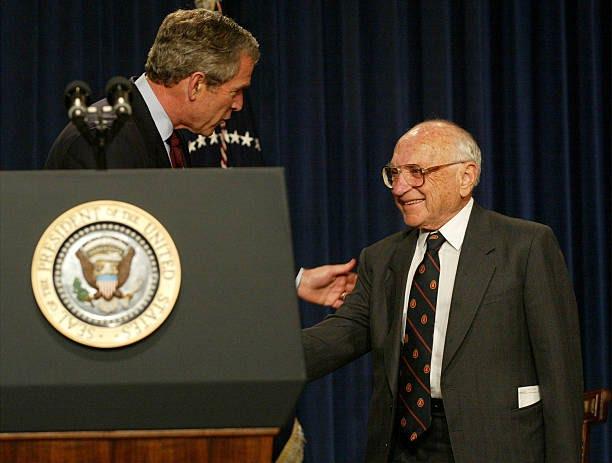

Milton Friedman

As the leader of the Chicago school of economics, and the winner of Nobel Prize in Economics in 1976, Friedman has been described by The Economist as "the most influential economist of the second half of the 20th century...possibly of all of it".

Milton Friedman: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Market

| Oct. 2022

Houston Macro and

Outlook

Economic/ Market Update: Macro

Market

Oct. 2022

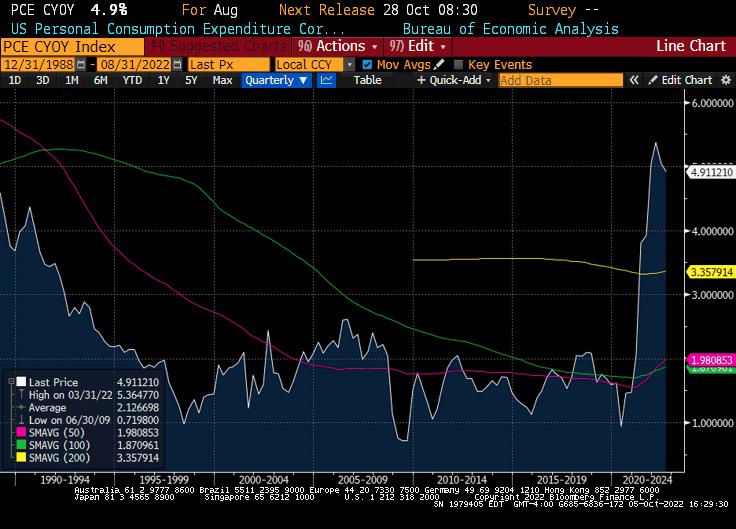

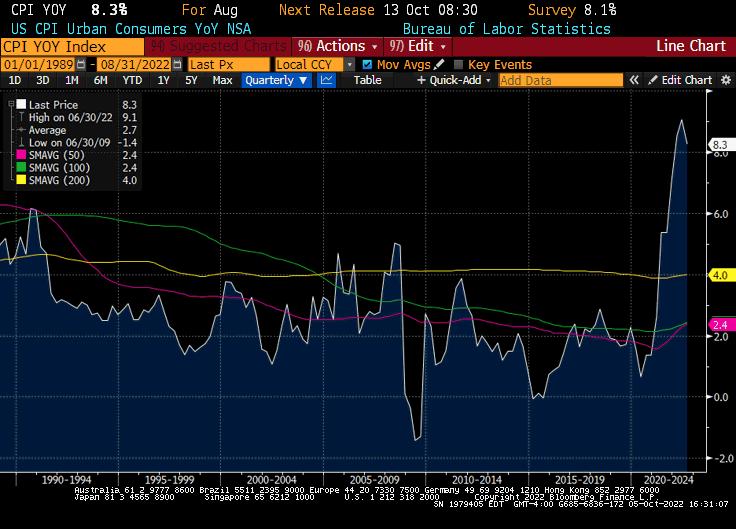

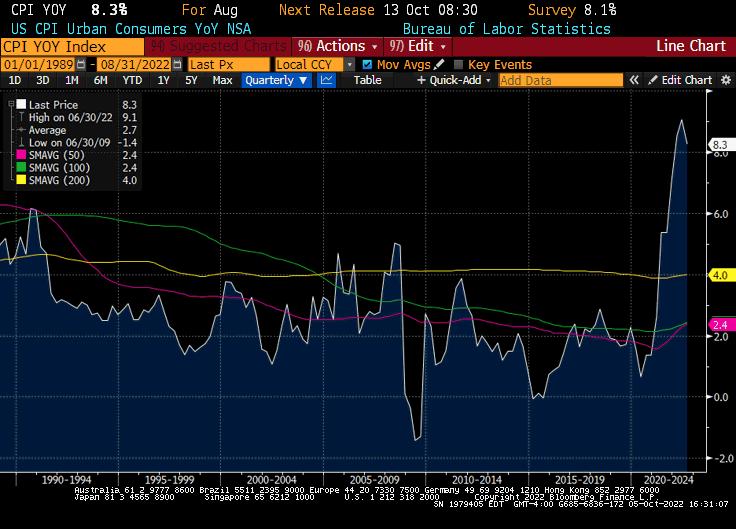

Both Inflation, measured by the Consumer Price Index (8.2% reported in September 2022)

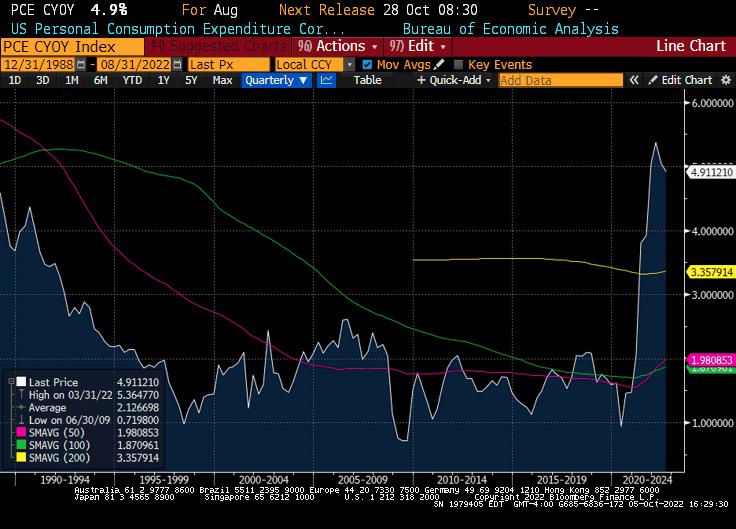

Fed’s preferred gauge, Personal Consumption Expenditures (4.9% August 2022)

At levels not seen since the 1980’s “Operation Liftoff” begins with Fed’s Interest hiking efforts initiated in the 1Q2022

Houston Macro and

Outlook |

Economic/ Market Update: Rates Houston Macro and Market Outlook | Oct. 2022 Fed Funds Median Estimate 4.25%-4.50% 2022, 4.50%-4.75% 2023, 3.75%-4.00% 2024, 2.5% longer-term Bond Market (Fed Funds Futures) 4.25% 2022, 4.25% 2023 3.75%% 2024 1Q2022 terminal Fed Funds Estimates were at 2.75%

Economic/ Market Update: Fixed Income

10-year treasury rates at levels last seen in 2009 and equaling levels prior to the high inflationary environment of the 1970’s to 1990’s

Weaker China, Europe, and forecasts for forward US growth potential suggest rates will move lower once current inflation is corrected

Houston Macro and Market Outlook | Oct. 2022

Economic/ Market Update: Fixed Income

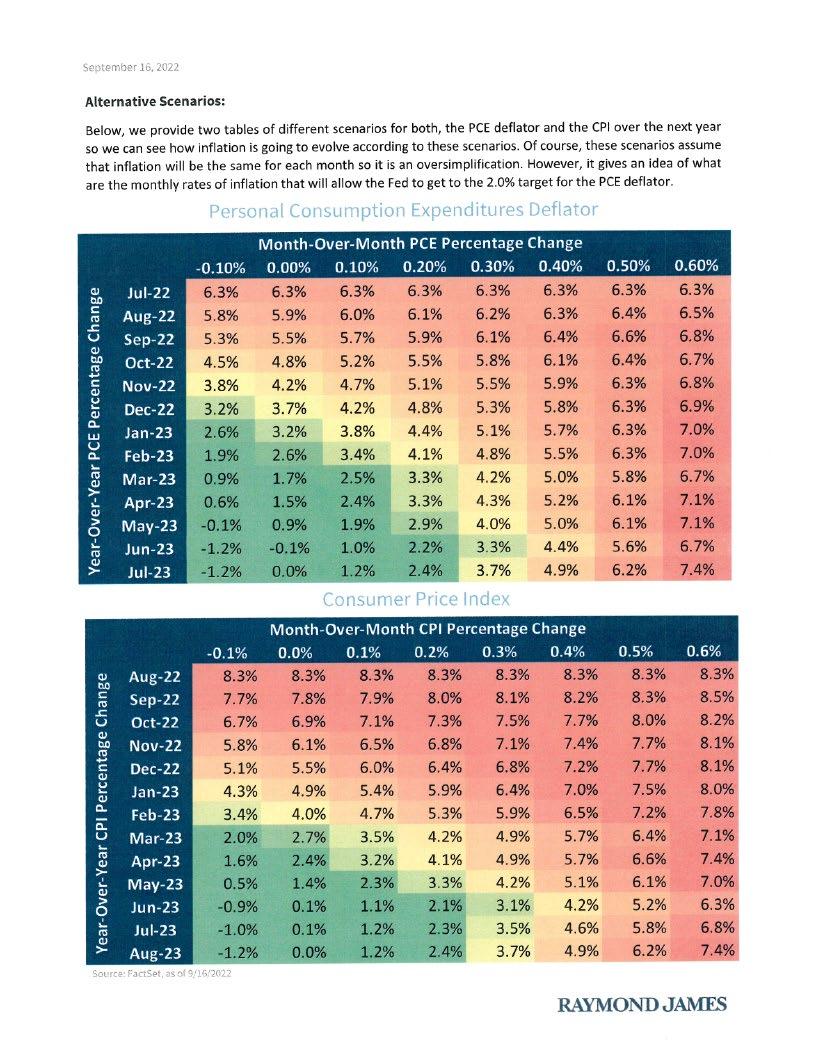

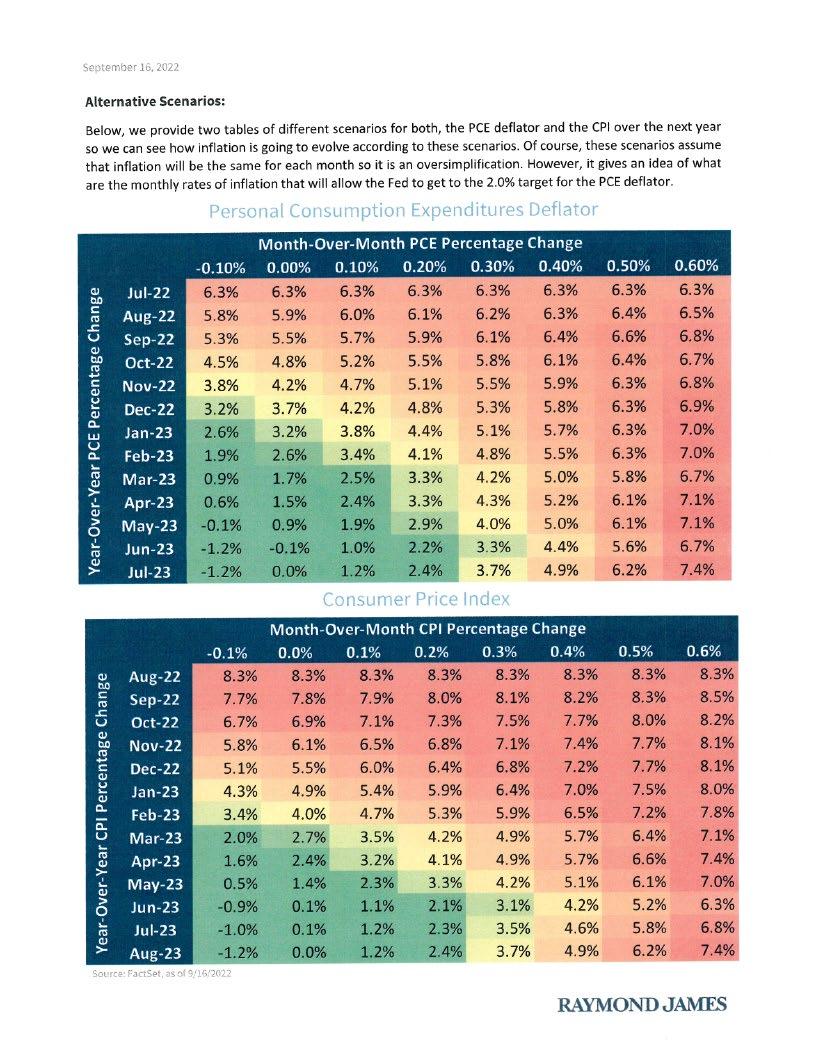

Fed’s preferred inflation gauge, PCE Deflator, posted .3% m/m inflation in July and August. PCE ex food and energy was 4.9% y/y for August

5-month Average PCE was .42% m/m inflation September CPI was .4% m/m inflation

Need to see .2% m/m inflation rates to see inflation fall below 3% by 2023 year-end

Current m/m inflation rates at .3%- .4% would push the 2% inflation target out to 2024

Bottomline, inflation closer to 2% is feasible by late 2023 to late 2024, barring no persistent energy shocks i.e. Ukrainian conflict not in models

Houston Macro

Market

Oct. 2022

and

Outlook |

Economic/ Market Update: Fixed Income

Market

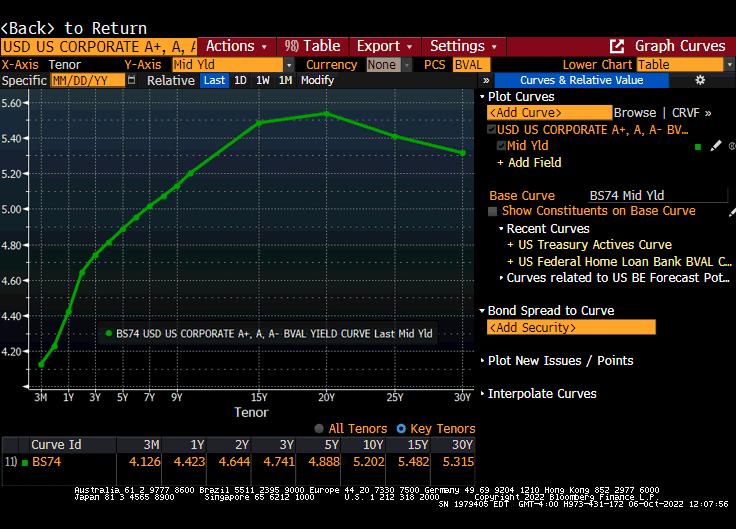

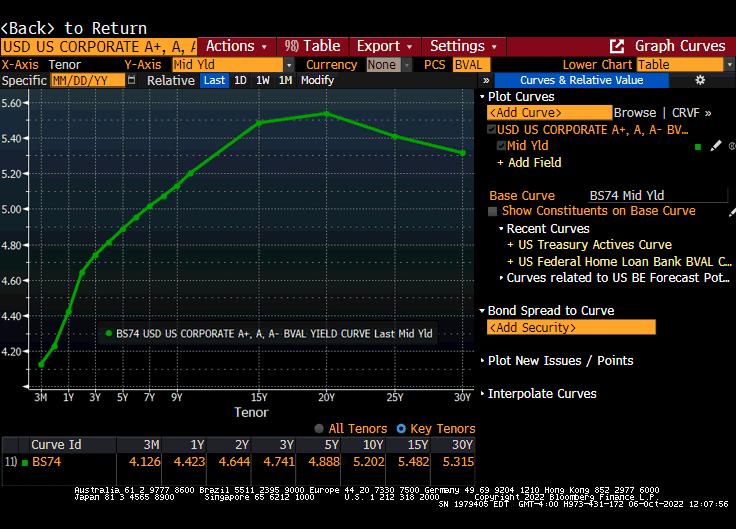

Corporate investment grade bond yields, even on the short end, should begin outpacing inflation by early 2023

Corporate bond yields are attractive by historical standards, barring the inflationary periods between the 1970-1990’s

2022

Low interest rate investment strategies and the TINA (There is no Alternative to Equities)investment strategies are changing at current yields for those concerned with a slowing economy and probability of recession

Houston Macro and

Outlook | Oct.

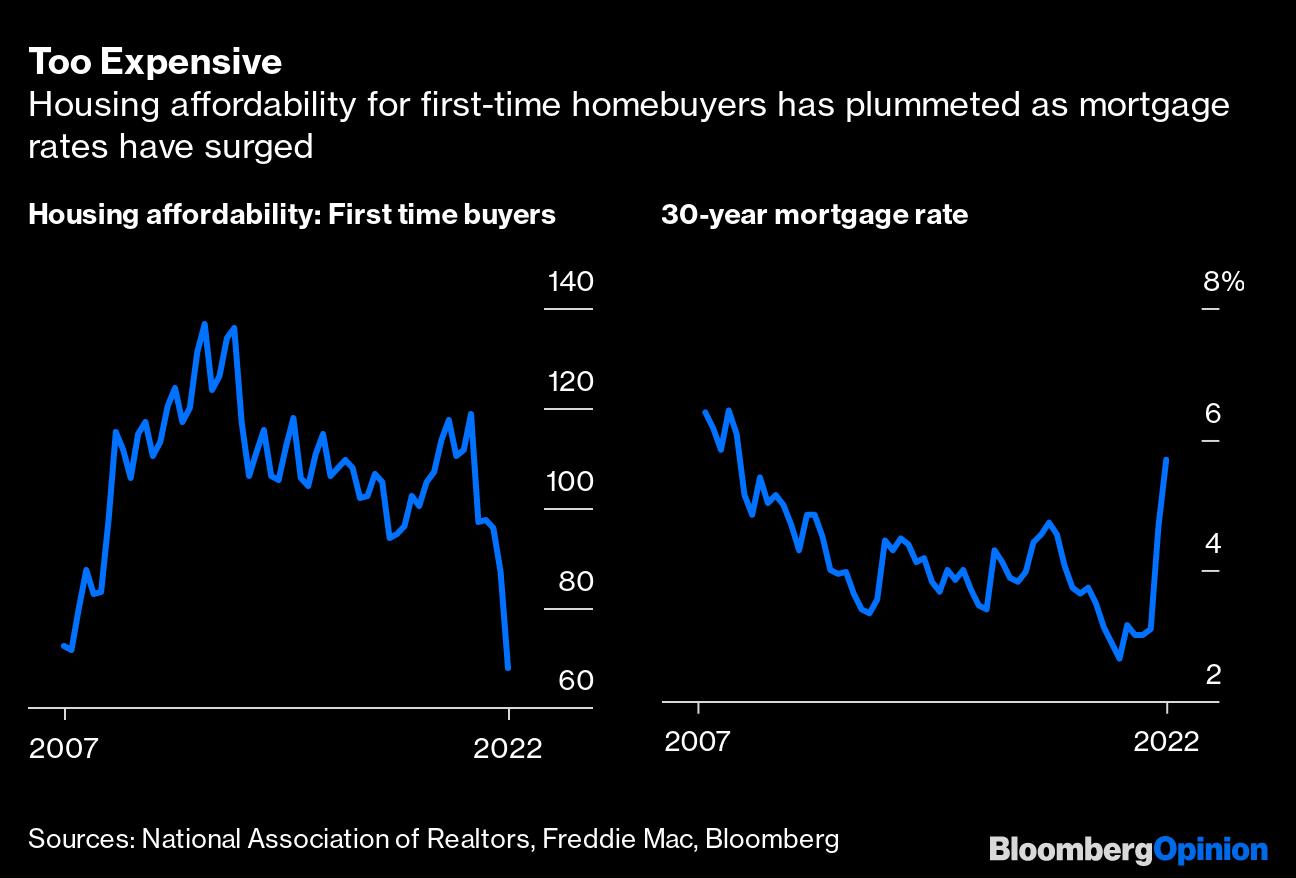

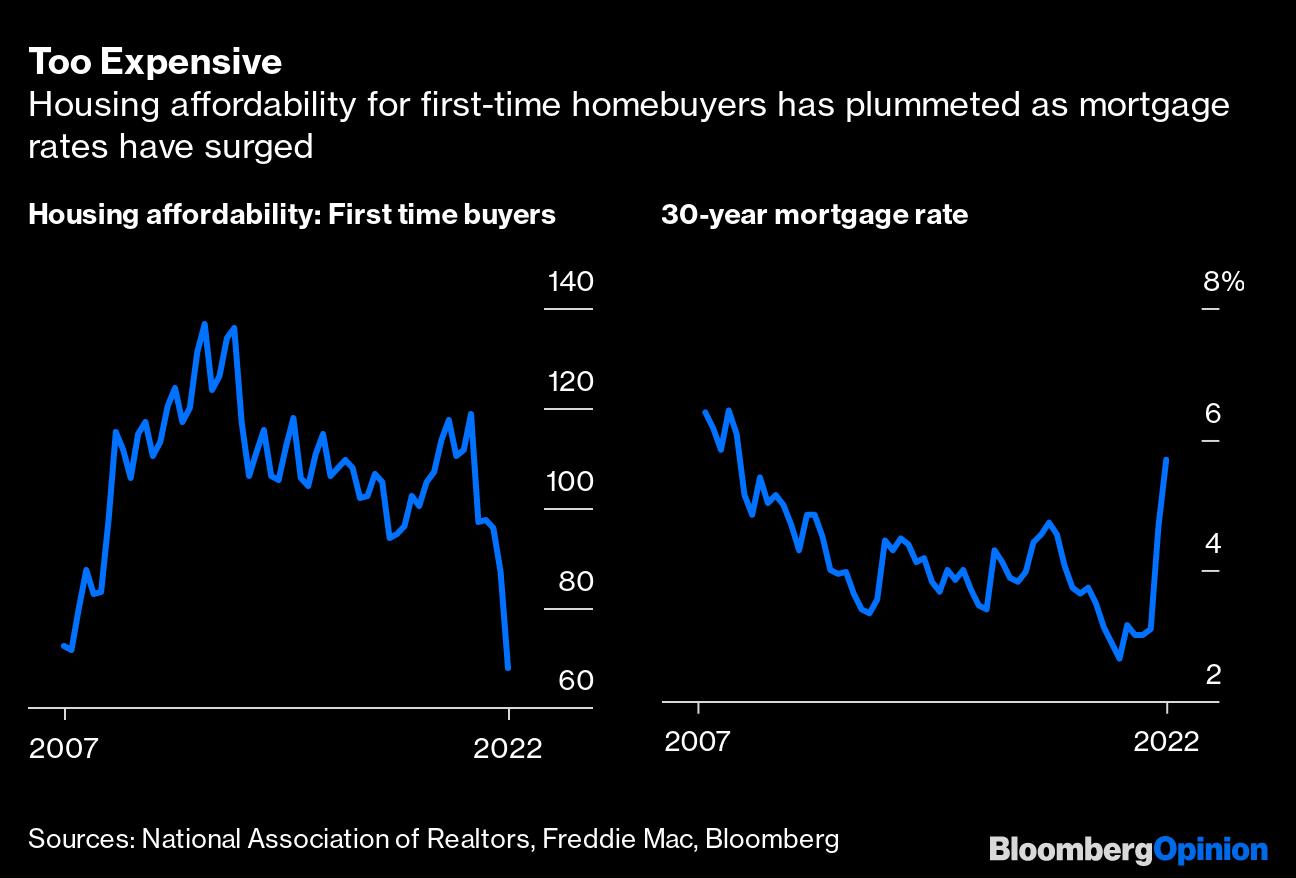

Economic/ Market Update: Houston Housing

Houston Macro and Market Outlook | Oct. 2022 Housing most interest rate sensitive area of economy Current Population Growth: 69,094 new residents per yr. Houston Housing Inventory: 2.5 months vs. avg healthy market considered to be 5-6 mos. (All available homes for sale in Houston market selling in 65 days), up from 1.5 months in March of 2022 September 2018: $218,950 median sales price, principal and Interest on 30yr. loan @ 4.57% = $1,119/ mo. September 2022: $348,740 median sales price, principal and interest on 30 yr. loan @ 7.06%= $2,334/mo. Houston single family home sales fell 16.9% year-over-year in August to levels closer to the pre-pandemic pace Source: Houston Association of Realtors and Greater Houston Partnership

Economic/ Market Update: Houston CRE

Houston Macro and Market Outlook | Oct.2022 Multifamily less robust than national averages as Houston single family affordability better than many large metro areas Office still a buyer’s market as companies are relocating from downtown to West and North Houston Industrial and Retail remain fairly balanced Houston cap rates all remain above national averages 1Q 2022 Cap Rate % National Average 1Q 2022 Cap Rate % Houston Cap Rate Difference National vs. Houston 1Q 2022 Vacancy % National Avg. Vacancy % Houston 1Q2021 y/y Rent Growth Avg. Top 18 Markets By Total Units Y/Y Rent Growth Houston Multifamily 5.1% 5.4% 0.30% 4.9% 7.8% 11.4% 9.5% Office 7.0% 7.9% 0.90% 12.2% 18.7% 0.8% -0.3% Industrial 6.3% 6.5% 0.20% 4.1% 6.3% 11.0% 5.5% Retail 6.8% 7.0% 0.15% 4.5% 5.4% 3.9% 3.4% Source: National Assoc. of Realtors Houston Commercial Real Estate Fundamentals

Economic/ Market Update: Equity

Houston Macro and Market Outlook | Oct. 2022 Since pandemic bottom (3/31/20), equities still up 46% with S&P 500 earnings up 39% from pre-pandemic y/e 2019 levels 2020 Pandemic bottom occurred at 15X forward S&P 500 Earnings with 2020 earnings falling 14% from 2019

Economic/ Market Update:Equity

Houston Macro and Market Outlook | Oct. 2022 S&P 500 forward eps. forecasts have yet to adjust to slowing economic conditions While Wall Steet equity strategists have grown more concerned of the future path of earnings Individual equity analyst have not cut numbers Markets, by price action this year, have approx. 10% eps contraction discounted

Economic/ Market Update: Equity

Market experiencing market valuation correction due to uncertainty of

tightening and rising rates

Not discounting severe economic recession scenarios yet

Houston Macro and Market Outlook | Oct. 2022

Fed

Y/E 2022 S&P Earnings multiple, currently at 16.08X, still more expensive than last 11 bear markets We become more constructive on the equity market below 15X earnings

Economic/ Market Update: Equity

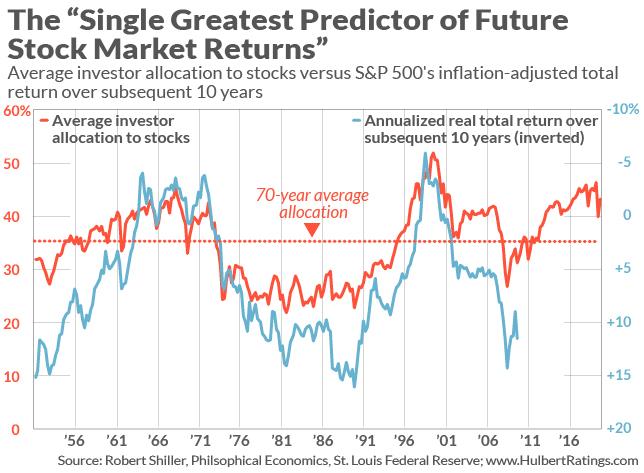

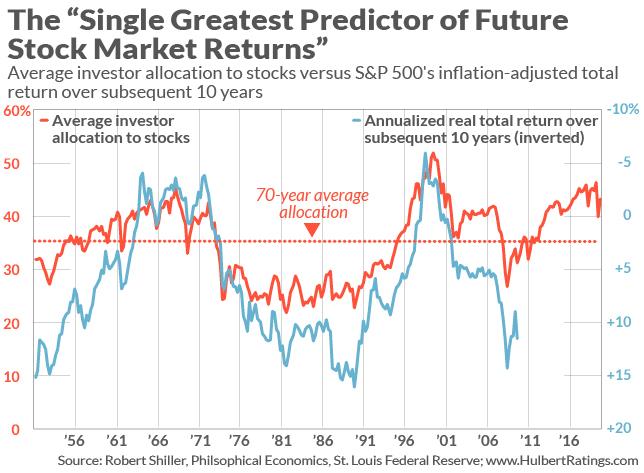

Higher rates, higher inflation, slowing economic conditions, less fiscal and monetary support after spending on 2008 housing collapse and pandemic, Questions whether the next decade will match the returns from the prior decade.

Houston Macro and Market Outlook | Oct. 2022

Economic/ Market Update: Equity

2022

If the next decade offers lower returns for equities,

History suggests fundamentals, such as P/E ratios and dividend yield/ dividend growth strategies will be a larger contributor to total returns for stocks

Average since 1930: 40% of equity markets total return attributable to dividends

Source: Hartford Funds

Houston Macro and Market Outlook | Oct.

Economic/ Market Update: Contacts

Wayne Madsen

Vice President

Wealth Management &

Darren King, CFA

Vice President

Investment Officer

Houston Macro and Market Outlook | Oct. 2022

Executive

Director of

Trust 409.632.5435 wmadsen@moodybank.com

Senior

Chief

409.632.5237 dking@moodybank.com

Economic/ Market Update: Disclosures

The strategy provided in this presentation reflects analysis of fundamental, macroeconomic, and quantitative data to provide investment analysis with respect to securities markets. The overview in this report is provided for informational purposes and does not constitute an offer for any security or investment advisory services. The report is not intended to provide individual investment advice. The investments discussed in this report may not be suitable for all investors. Investors should consult with their financial advisor. Investments involve numerous risks including market risk,, default risk, and liquidity risk.

Houston Macro and Market Outlook | Oct. 2022