ISF in Darya Ganj New Delhi And Best Mutual Fund Apps in India 2025

best investment in sip, best investment in sip, best investment plan in india, best investment plan in mutual fund, best mutual funds in india, best sip investment plan, best systematic investment plan, best-sip-plan, create e mail account, debt funds, debt mutual funds, https://www.moneyisle.in/, india best mutual fund, indian stock exchange, indian stock market shares, investing in stock marketinvesting in stock marketinvesting in stock market, investment in mutual funds, investment in share market, make a new email id, market stock investment, mf calculator, mf return calculator, mutual fund calculator, mutual fund companies in india, mutual fund investment, mutual fund return calculator, mutual fund sip calculator, mutual funds in india, mutual funds types, mutual-funds, National Stock Exchange of India, Securities and Exchange Board of India, securities exchange, sip calculator, sip investment, sip investment plan, sip investment plan calculator, sip investment return calculator, sip mutual fund, sip plan calculator, sip return calculator, stock exchange investment, stock exchange investment, stock exchange investmentstock exchange investment, stock market, stock market and trading, stock market share prices, stock market

trading, systematic investment plan calculator, top 5 mutual funds in india, trading account, Uncategorized

best card for teenagers, best credit card for teenagers, best credit card for teenagers, best investment in sip, best investment in sip, best investment plan in india, best investment plan in mutual fund, best long term mutual funds for sip, best mutual fund for sip, best mutual funds in india, best mutual funds to invest, best sip investment plan, best systematic investment plan, best-sip-plan, create e mail account, debt funds, debt mutual funds, demat refer and earn, demat refer and earn, https://www.moneyisle.in/, india best mutual fund, indian stock exchange, indian stock market price, indian stock market shares, invest in equity market, invest in mutual funds, investing in stock market company in india, investing in stock marketinvesting in stock marketinvesting in stock market, investment in mutual funds, investment in share market, isf securities, isf securities, make a new email id, market stock investment, mf calculator, mf return calculator, mf return calculator, mutual fund calculator, mutual fund companies in india, mutual fund investment, mutual fund investment app, mutual fund return calculator, mutual fund sip calculator, mutual funds in india, mutual funds to invest in india, mutual funds types, mutual-funds, National Stock Exchange of India, primarket, Securities and Exchange Board of India, securities exchange, share market investment in india, share market online trading in india, sip calculator, sip investment, sip investment plan, sip investment plan calculator, sip investment plans, sip investment return calculator, sip mutual fund, sip plan calculator, sip return calculator, sip-calculator-online, stock exchange investment, stock exchange investment, stock exchange investmentstock exchange investment, stock market, stock market and trading, stock market company in india, stock market in india, stock market investment in india, stock market share prices, stock market trading, systematic investment plan calculator, top 5 mutual funds in india, trading account

In 2025, India’s investment landscape is rapidly evolving, offering a variety of opportunities for both seasoned and new investors. Among these opportunities, ISF (Specialized Investment Fund) is gaining attention,

especially in hubs like Darya Ganj, New Delhi, where financial service providers are helping investors explore smarter wealth-building avenues.

In this guide, we will cover what ISF is, how it benefits retail investors, and explore isf in darya ganj new delhi the best long-term investment options in India, top mutual fund apps, and blogs for stock market beginners.

What is ISF (Specialized Investment Fund)?

A Specialized Investment Fund (ISF) is a flexible investment vehicle that allows fund managers to pool money from various investors to invest across a wide range of asset classes like equities, bonds, real estate, startups, and more. Traditionally available in international markets, ISFs are now being approved for Indian retail investors by Mutual Fund AMCs (Asset Management Companies) in 2025.

Key Features of ISF:

● Allows diversified investments beyond regular mutual funds

● Professionally managed

● Risk-managed across sectors

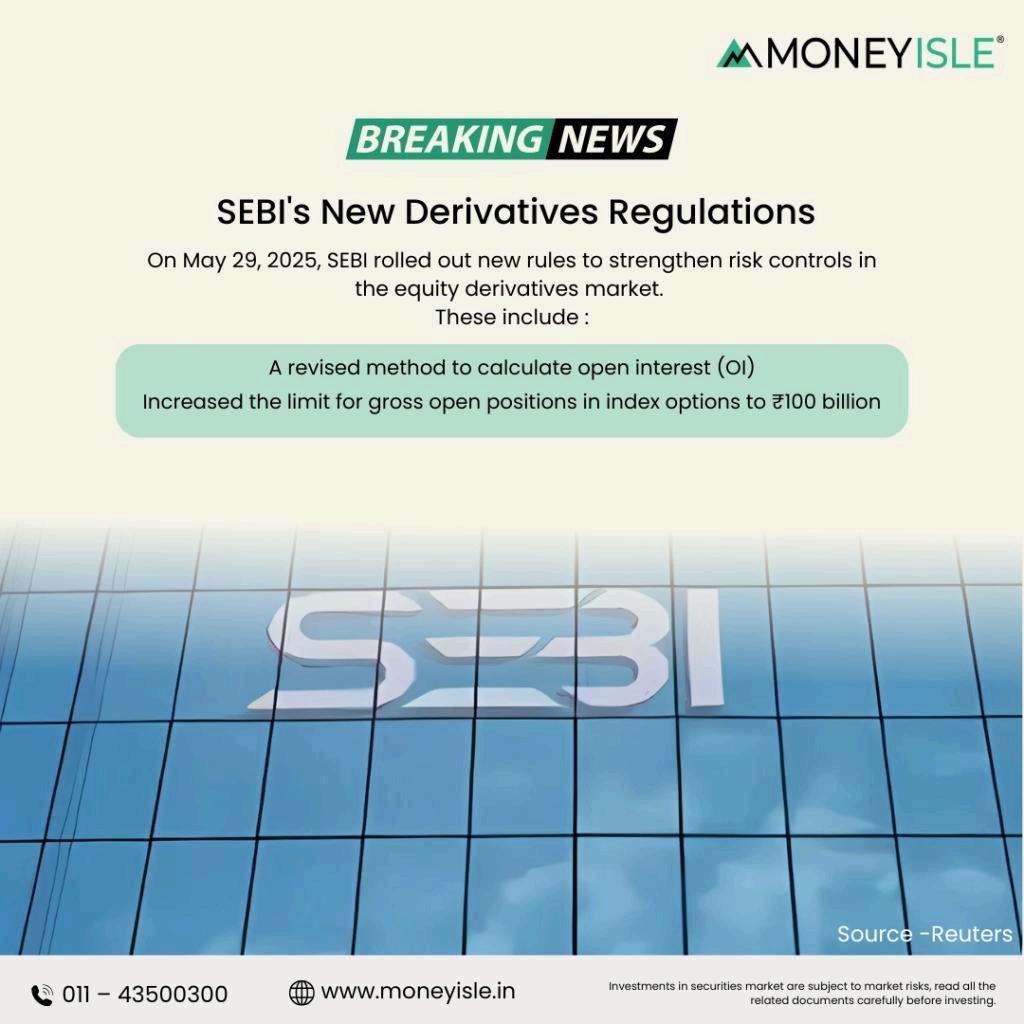

● Now available to Indian retail investors under SEBI regulation

These funds are often housed in financial hubs like Darya

Ganj in New Delhi, where reputed financial advisors assist investors in onboarding and portfolio management.

ISF in Darya Ganj, New Delhi

Darya Ganj, a bustling financial zone in the heart of Delhi, is emerging as a go-to location for financial consultancy firms, mutual fund distributors, and wealth managers offering ISF solutions. With increasing awareness, local investors and NRIs are exploring ISF as a tool for strategic, long-term wealth creation.

You can visit financial service providers in Darya Ganj who:

● Help you invest in ISF funds

● Offer ISF onboarding via WhatsApp eKYC and digital documentation

● Provide periodic Best Mutual Fund Apps in India 2025 investment portfolio reviews

Best Investment Plans in India – 2025

In addition to ISF, investors can explore the following top investment plans in India based on their financial goals:

1. Public Provident Fund (PPF)

● Government-backed

● Interest ~7.1% p.a.

● Tax benefits under Section 80C

2. Mutual Funds via SIP

● Equity, Debt, Hybrid options

● SIPs help build wealth slowly and consistently

● Great for salaried individuals and young investors

3. National Pension System (NPS)

● Low cost retirement fund

● Tax benefit up to ₹2 lakh under 80C and 80CCD

● Partial withdrawal allowed after 10 years

4. Specialized Investment Funds (ISF)

● Best for diversified long-term growth

● Ideal for HNIs and experienced investors looking to expand portfolio beyond mutual funds

5. Equity Shares via Demat

● Higher returns but higher risk

● Best for investors who Brokerage in Darya Ganj Delhi understand market movements

Here are the top mutual fund apps making investing easy and accessible for Indian investors:

App Name Features

Groww

User-friendly UI, SIP tracking, direct MF plans

Zerodha Coin Zero commission, integrated with Zerodha demat

Paytm Money

ET Money

In-depth analysis, easy onboarding

Goal-based investment plans, tax-saving tips

Kuvera Family portfolio tracking, no commission

These apps offer features like SIP calculators, performance trackers, and fund recommendations.

Best Performing Mutual Funds in India (2025)

Mutual funds continue to dominate the retail investment scene due to their diversified and professionally managed structure. Top-performing funds in 2025 include:

● Axis Small Cap Fund

● ICICI Prudential Technology Fund

● Mirae Asset Large Cap Fund

● Quant Active Fund

● HDFC Mid Cap Opportunities Fund

These funds have shown 10–20% average returns over the past few years and are managed by reputed fund houses.