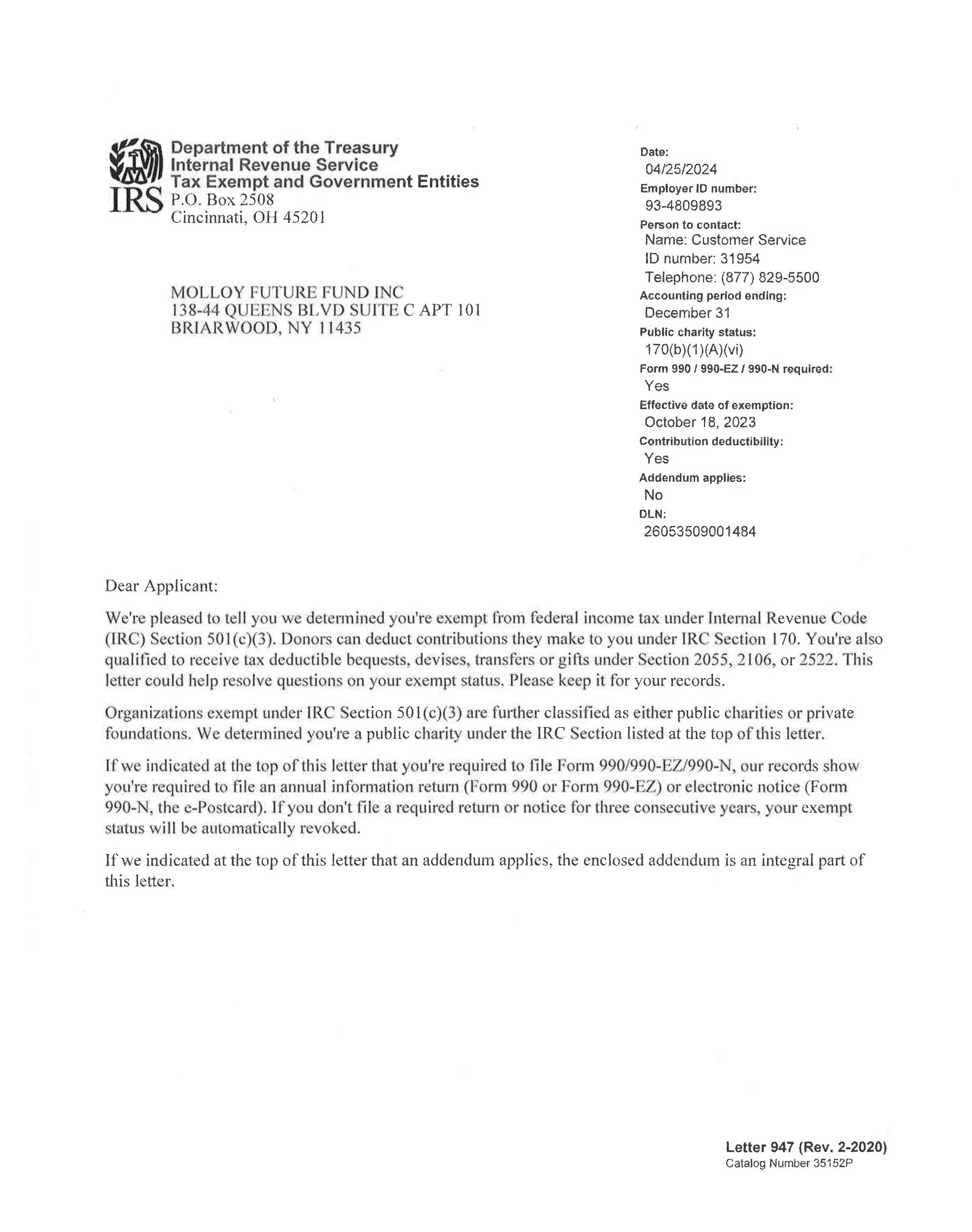

Department of the Treasury

and Government Entities

P.O. Box 2508

Cincinnati, OH 45201

MOLLOY •UTURE FUND INC

138-44 QU •• N ' BLVD SUIT CAPT 101 BRIARWOOD, NY 11435

Date: 04/25/2024

Employer ID number: 93-4809893

Person to contact: Name: Customer Service ID number: 31954 Telephone: (877) 829-5500

Accounting period ending: December 31

Public charity status: 170(b)(1 )(A)(vi)

Form 990 I 990-EZ I 990-N required: Yes

Effective date of exemption: October 18, 2023

Contribution deductibility: Yes

Addendum applies: No

DLN: 26053509001484

Dear Applicant:

We're pleased l tell you we deL n nined you're exempt from federal inc me ta under Int rnal Revenue C de (IRC) Section 50'1 (c (3) Donors can dedu t contribution lhey make to yoll under lR e tion 170. You're al s o qualified to rec i e lax deductible bequ sts de ise transfers or gifts under ction 2055 2106, or 2522. This letter cou ld h Ip reso lve que tion on your exempt statu Pl ·ase keep it for your records.

O rganiz~ition s exempt under IRC ection 501(c) 3) are further classifi d as either public ' hariti s or private found.itions We determ ined you're a public charily under the IRC ection listed at the to 1 of this letter.

If 'i indicated at lhe top f thi letter that you're required to fi le Form 990 / 990-EZ/990- our records sho you're required t file an annual iff{1 rmation r turn (Form 990 or Form 990- ,Z) or e lectronic notice (Form 990-N the -Po tea rd). J f y u don't file a required return or n tice for three con ecutive years your exempt tatus will be automatically revoked.

If we indicated at the top of this letter that an addendum applies, the enclosed addendum is an integral part of this letter.

For important information about your responsibilitie as a tax-exempt organization . go to www.irs.gov/charities. Enter "4221-PC" in the search bar to vie Publication 4221-P ompliance Guide for 50l(c)(3) Public Charities, which describes your recordkeeping, reporting, and disclosure requirements.

We sent a copy of this letter to your representative as indicated in your power of attorney.

Sincerely, ~4.,.pl~

Stephen A. Martin Director, Exempt Organizations Rulings and Agreements