We have potentially seen the bottom of U.S. TL Spot rates in the post-pandemic market. Two key indicators for this are FreightWaves National Outbound Tender Reject Index (OTRI) and the DAT National Spot Rates

The OTRI measures the number of times carriers reject tenders being sent to them on a multitude of TMS platforms. As OTRI climbs, it has a direct correlation to the volume of loads in the spot market. We’ve observed a direct correlation in the past between increases in OTRI leading to increased spot volumes and ultimately increased spot rates. We saw a jump toward the end of June and the beginning of July, presumably due to the holidays. They have dropped since but remain elevated in comparison to the majority of Q2. A promising sign that the bottom of the market could have been reached.

Another key indicator of the overall spot market is the DAT National Spot Rates Van and Reefer TL shipments make up the majority of OTR shipments in the U.S. DAT’s National Van and National Reefer Rates have seen increases in both June and July. These slight increases are promising statistics that could indicate we are now on the upswing from the bottom of the post-pandemic market.

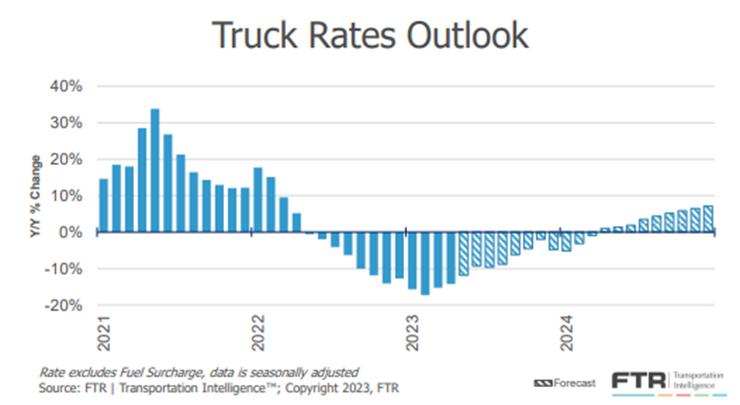

When the TL market is going to flip continues to be a moving target. Many industry experts believe that will take place in 2024, assuming no major global events expedite this. This is good news for shippers as they can expect to maintain relatively low rate volatility on spot freight and decreased contracted rates from previous years.

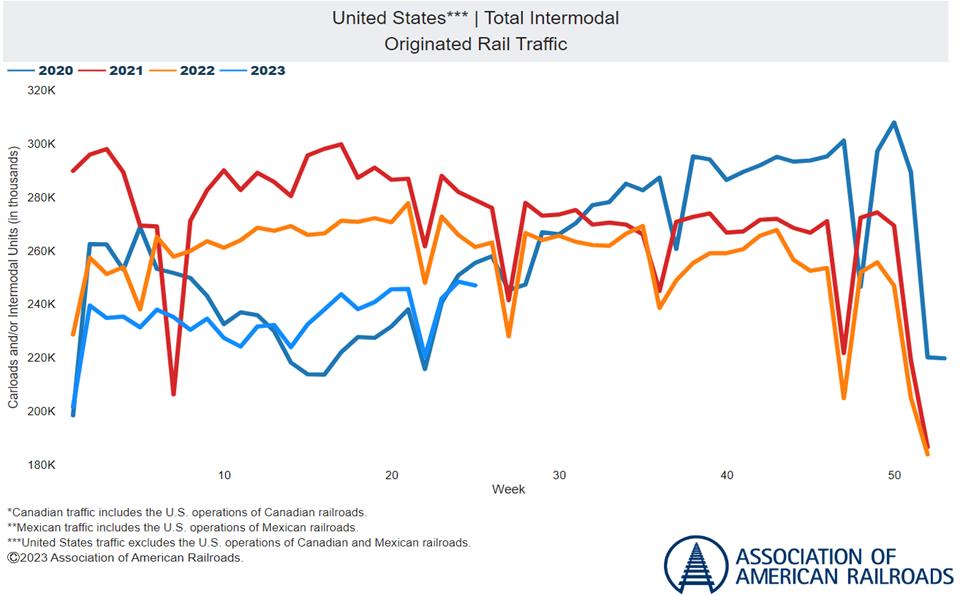

The Intermodal landscape has faced continuous challenges throughout the first half of 2023 seeing one sizable intermodal refrigerated carrier, Tiger Cool Express, shut down in late June. As a result of the drop in volume, rail carriers have been looking to introduce new domestic intermodal lanes that has potential to bring positive results in late 2023 and 2024.

All Class 1 railroads' (RRs) service has improved in the first half of 2023, and the newly combined Canadian Pacific Kansas City is not only providing new service lanes, but indirectly impacting other RRs as they are forced to shift and address new service and lanes.

By P/L Leader

According to Railway Age domestic intermodal rates are down 10%-15% for existing customers, and as much as 25%-30% in order to win new customers. Railroads in general were slow to adjust pricing in late '22 and early '23. While the current trend is moving in the right direction, the overall volume is simply not in the marketplace when compared to the low OTR spot rates.

We expect Intermodal volumes to trend against 2019 levels for the rest of 2023, which will be far off from the levels experienced over the previous three years. At this point in time, we do not anticipate any peak season surcharges from the railroads.

There has been a lot of speculation around whether the International Brotherhood of Teamsters (IBT) would allow Yellow to fall into liquidation or bankruptcy The IBT has insisted they’ve conceded enough over the years, and it is up to Yellow to save themselves, while Yellow pleads for the two to sit down and iron out the wrinkles associated with the items in contention before they burn through the remainder of their cash.

Yellow’s cash supply was expected to last through mid-August based on communication from Yellow directly to the IBT back in June of this year. According to sources close to the ongoing situation and confirmed in this Wall Street Journal article from July, 2023 (Trucker Yellow Wins Reprieve from Lenders, Including U.S. Government), Yellow has secured a reprieve from its lenders, including Apollo Global Management (owed $567M due June 2024) and the U.S. government ($700M loan due September 2024), which lifts certain financial requirements allowing Yellow additional runway into the fourth quarter of 2023

Now the question becomes, will the IBT further respond to the recently filed $137M lawsuit by Yellow and sit down at the negotiation table to complete a deal that keeps 22,000+ union workers employed by the carrier? For continued updates from the carrier, please visit this website or scan the QR code.

In 2023, we’ve seen most LTL carriers communicating YoY volumetric and tonnage per day declines ranging from the high single digits to low double digits. As industrial production (IP) improves, nearshoring grows in popularity, retail/e-commerce continues to increase LTL demand and as shippers work to evolve with the ever-changing consumer expectations, we anticipate some recovery potentially coming late in 2023. Full-year 2023 outlook is projected to be around -2% to -4% YoY.

Despite the YoY softening being reported by LTL carriers on shipments and tonnage per day, we’ve seen the LTL carriers continue to exercise pricing discipline thus far in 2023. We anticipate that LTL carriers will continue to seek contract rate increases on existing business – although likely at a reduced percentage compared to recent years – to partially offset the increase in costs associated with running an LTL operation. Freight offering unfavorable freight profiles – i.e., overlength freight, high liability commodities, etc. – will continue to be under a microscope as carriers expect to maintain an equitable position on freight that increases their risk and that doesn’t easily flow through their network of terminals/service centers

On the flip side, and as carriers continue to seek equilibrium within their own respective and everchanging networks, we anticipate carriers to aggressively target volumes moving within the direct geographical areas and lanes needing additional market share by providing rate reductions to increase their share of wallet with existing customers or offering aggressive rates to attract new customers and volumes into the network. Overall, rates are expected to gradually decline throughout the remainder of 2023.

Based on the announced and implemented July 1 GRI, transpacific ocean rates moved upward slightly to the U.S. West and East Coasts; however, based on struggling demand/volumes most ocean carriers are already adjusting the new rates back down just days after the GRI

Volumes from Asia to U.S. are expected to remain steady in July, which may give carriers more confidence to attempt a second GRI on July 15; however, rates will likely settle back below their July 1 levels as carriers keep an eye on July volumes and monitor the labor situation on the west coast of Canada. Under an extended strike, more acute capacity actions and cargo diversions could cause rates to momentarily stabilize and even increase further as vessel – and container – backlog builds.

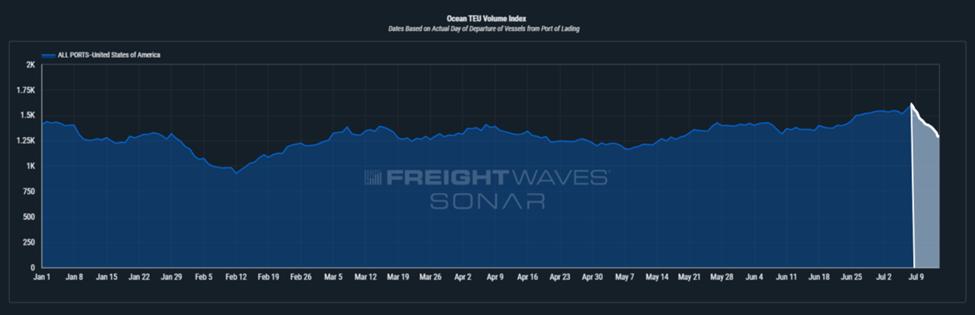

Ocean volumes during the first half of 2023 have basically followed the trajectory of 2019 levels (blue line above) Most analysts feel this trend will continue into the final quarter of 2023 It is at that point where many analysts are predicting a new floor level for rates that fall below the 2019 trend concept. This downward shift could result in significant declines. The chart above illustrates some potential scenarios based on varying levels of decline below the 2019 trend across the top 10 U.S. ports.

If volumes indeed decline and follow the projections for the second half of 2023, then it is possible that ocean container spot rates could reach new lows as well. As seen in the chart below, the floor in 2023 puts ocean container spot rates between $1,000-$1,700 from Asia to the U.S. West Coast and $2,000-$2,550 from Asia to the U.S. East Coast, according to the Freightos Index.

If volumes were to remain relatively flat for the remainder of 2023, then it is reasonable to assume that ocean container spot rates could find some level of balance similar to what happened in 2019. But with current economic headwinds and the volume decline scenarios outlined previously, it is clear there will be downward pressure on the rates overall. This is where we could see a new low for ocean spot rates.

Western Canada ILWU served a strike notice on July 1, and since then there have been no operations in either Vancouver or Prince Rupert port facilities Rail restrictions are also in place due to the labor strike No outbound/inbound cargo is currently moving CMA and other carriers are reviewing options to divert freight to Seattle on a case-by-case basis.

CN Railroad has issued warnings that a stoppage like this will likely create disruptions that could take weeks or even months to correct because of the integrated nature of port and rail corridors. Norfolk Southern has also notified their customer that their operations could be impacted based on interline agreements and service links with both the CN and Canadian Pacific.

Most industry and economic analysts predicted a very weak peak import season for 2023. All indications thus far have shown those predictions to be correct What was not necessarily predicted was the very short duration of this year’s peak. The Freight Waves SONAR graph below shows the expected volume peak, which in terms of volume shows a YTD high volume; however, more real-time data seems to indicate a sharp decline in just the first week or two after the peak.

In addition to the weak demand, container lines have a significant number of new vessels starting in August and September. Per the Journal of Commerce, “the number of new trans-Pacific ships expected in August and September is kicking off a wave of double-digit supply growth for the global container ship fleet that is expected to last into 2024 All told, the container ship fleet is expected to add another 2 5M twenty-foot equivalent units (TEUs) of capacity this year and 3 9M TEUs next year ”

Based on the fact that major U.S. importers are still struggling with excessive inventory levels and a sustained shift in consumer spending patterns, U.S. importers are expected to use caution in bringing in new volumes during the second half. This cautious approach, coupled with weakening global macroeconomic factors and significant capacity gains, increases the risks of declining containerized import volumes.