The OTRI, which measures carrier tender rejections across some of the largest TMS providers in the transportation industry, remains stable below 5% rejections. This is a good indicator that supply and demand is at a relative equilibrium within the current economic factors.

Source: sonar.surf

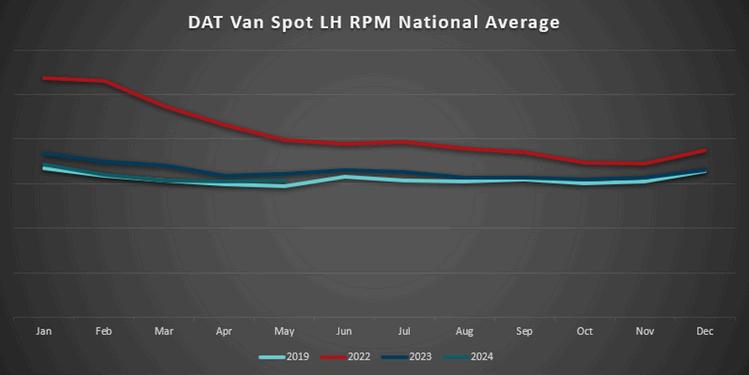

Similarly, the DAT National Spot Rate Per Mile Linehaul Average remains subdued. It is currently below 2023 numbers year-over-year, with only a slight increase compared to 2019 levels. In 2019 and 2023, we saw the seasonal increase in May that led to a new, slightly elevated, bottom of the spot market. With observed rate increases from areas with seasonal produce, and the increased rates from DOT Blitz week, we are expecting this year to follow a similar pattern.

Looking ahead, the TL market's challenges will close out Q2 and persist into Q3. There are beliefs that the market will flip, from a year-over-year (YoY) perspective, during late Q3 or early Q4. Although we could see YoY increases, they aren’t projected to be a significant jump like we saw with the E-Log mandate in 2018 or the pandemic in 2020. Outside of typical seasonal rate spikes, we should continue to see stable market prices for carriers and customers alike.

Spot rates still looking to bounce from bottom

$1.99

Source: DAT.com/trendlines

Source: ftrintel.com

Union Pacific Cuts 24+ Hours on Los Angeles to Chicago Route

Union Pacific announced improvements for their domestic service between Los Angeles and Chicago, which eliminates 24+ hours from their prior service. This service improvement applies to local and interchanged freight.

The Surface Transportation Board announced the retirement of Chairman Martin J. Oberman after five years at the STB including three years as its leader. Following Chairman Oberman’s retirement, it has been announced that President Joe Biden plans to nominate STB member, Robert Primus, as the next Chairman.

Activist investors Ancora’s attempt to take over the board of Norfolk Southern was rejected by a shareholder vote, which resulted in only three changes to their Board

CSX and STG Logistics increased their partnership to include STG facilitating the drayage services, which support CSX’s door-to-door product CSX RailPlus.

Here are links to some top stories in the industry for you to check out:

SAIA Q1 2024 financials released

TFI profits plummet in Q1

Shawn Stewart joins Forward Air as CEO

FedEx sheds 1% of its door count with recent terminal closures

SAIA appoints Batteh as new CFO

On a sequential basis quarter-over-quarter, we are seeing LTL volumes and shipment characteristics improving but continue to find ourselves in a weak environment whereby shipments are much smaller (lighter) from a year-overyear standpoint Underlying drivers of the U S ISM manufacturing index remain dull halfway through Q2 2024 and industrial production, although improving modestly, continues to be lackluster

After only one month in expansion territory, the United States ISM Manufacturing Purchasing Managers Index (PMI) dropped to 49.2 in April versus 50.3 in March. April’s index missed market expectations of 49.9 and places us back into contraction territory. Indexes for 17 of the last 18 months have been in contraction and business confidence in the U.S. continues to be stagnant. The slide in April is reflective of contraction regarding manufacturing’s backlog of orders, employment, inventories, supplier deliveries and new orders.

Source: Trading Economics & Institute for Supply Management

Industrial Production in the U.S. was flat year-over-year in March 2024 but up slightly from February’s -3% slide back into contraction territory. While we are cautiously optimistic about Q2 2024, Q1 2024 marks the second consecutive quarter of declines in U.S. manufacturing. Industrial production within the U.S. gauges the output of businesses within the industrial sector of the economy. Manufacturing reigns supreme, constituting 78% of total production. Within manufacturing, the top segments include:

Chemicals (12%)

Food, Drink and Tobacco (11%)

Machinery (6%)

Fabricated Metal Products (6%)

Computer and Electronic Products (6%)

Motor Vehicles and Parts (6%)

Mining and Quarrying (11%)

Utilities (11%)

*Source: Federal Reserve; Forecast by Witte Econometrics, FTR Transportation Intelligence

LTL pricing continues to hold historic highs through the first half of Q2 2024 This is no surprise, even against challenging economic conditions, as the top 10 LTL carriers in the U S effectively control around 65% of the market share - the top 25 accounting for over 90% - and they are all on the same page regarding yield improvement initiatives. The top LTL carriers are investing in their network infrastructure, technology and assets, while also contending with inflationary pressures driving the costs of doing business up. It’s a carrier market and leverage is expected to remain, if not increase, through 2024.

The PPI for Long Haul LTL, which gauges average prices paid to transportation service providers, came in at $413.884 for March. This is 20.49 points or 5.2% higher than March 2023’s index of 393.394 and .5% higher than February 2024 index of 411.772. As you can see from the below PPI graph dating back to 2008, we reached new historical highs during the COVID years. And while we were on a downward trend following the pandemic, the Yellow exit in July of 2023 caused the PPI to increase around 10% and the index has remained over 400 since then.

The U.S. national average cost per gallon for onhighway diesel continues to be rather stable into Q2 2024, with slight reductions in cost since midApril. April 2024’s monthly average cost per gallon came in at $4.002, which is $.02 or .5% lower than March 2024’s average cost per gallon of $4.022. Two weeks into May, we find the U.S. national average cost per gallon sitting at $3.848.

*Source: Bureau of Labor Statistics; Analysis by FTR Transportation Intelligence

UPS and FedEx Strategies for SMB Market: UPS and FedEx are intensifying efforts to capture a larger share of the Small and Medium Business (SMB) segment, which is becoming increasingly profitable amidst a market shift where major customers are insourcing deliveries SMBs prioritize simplicity, reliability and cost efficiency when choosing delivery providers, prompting UPS to emphasize its integrated network and customer service enhancements. FedEx, on the other hand, is merging its Ground and Express networks to enhance SMB interactions through streamlined operations and the introduction of the fdx platform. Both companies face stiff competition not only from each other but also from Amazon's growing logistics capabilities and alternative carriers like the U.S. Postal Service (USPS) in a soft demand environment.

Competition with Amazon and USPS: Amazon's expanding parcel delivery and logistics operations pose a significant threat to UPS and FedEx in attracting SMB shippers, as Amazon provides comprehensive fulfillment and shipping solutions for third-party sellers. Additionally, both UPS and FedEx face competition from alternative carriers like USPS, which is raising rates for its Parcel Select offering by an average of 25%. This rate hike aims to encourage consolidators to bring packages further upstream in USPS's network, impacting major shippers and consolidators like DHL eCommerce and Pitney Bowes. Despite the rate increase, USPS anticipates only a modest revenue increase by fiscal year 2025, with potential negotiation impacts on consolidators seeking lower rates.

Rates: Trans-Pacific rate surges moving into May – contracts and spot rates increasing

Volume: Volumes picking up and moving more toward a “normal” seasonal flow

Supply: Current capacity constraints from blank/voided sailings not keeping up with demand

As U.S. import container volume from Asia grows month-over-month, capacity has remained in a static state over the same period. Limited space availability and continued blank sailings have resulted in space and empty container shortages in Asia. Similarly, rates increased on May 1 to their highest levels since mid/late January, approximately $1,500-$2,000 per FEU higher than in late April.

Several large U S retailers in April signed 2024-25 service contracts for the eastbound Trans-Pacific trade with rates that are about 12-17% higher than the 2023-24 contracts. Also of note is that mid-size U.S. importers who haven’t finalized 2024-2025 service contracts risk seeing spot rates that could be up to two to two and a half times higher than current contract levels.

Spot rates in the eastbound Trans-Pacific are likely to increase more than $1,000 per FEU based on May 1 GRIs filed in April by most of the ocean carriers. Carriers and NVOCCs expect these rate increases to hold in the short term as vessels leaving Asia are expected to remain mostly full well into May.

First-half 2024 overall containerized U.S. imports are expected to total 11.7 million TEUs, which represents an 11% year-over-year increase. U.S. imports rose 8.3% in January and 26.4% in February, and it is likely similar gains could continue through August.

U.S. import container volume from Asia continues to show month-over-month growth, but capacity has remained static over this same period Limited availability of tonnage and continued strategic blank sailings by carriers have created some notable backlog issues with many of the main Asia to U S trade lanes being at full capacity

Space on vessels leaving Asia has become increasingly tighter in recent weeks, and there are some reports of containers being rolled to later voyages in select lanes.

Some trade analysts feel that factories in China saw some increases in purchase orders through April expect strong U S imports to continue through May Having cleared the inventory overhang that had congested warehouses over the past two years, retailers may be returning to normal seasonal restocking.

Carriers have continued with aggressive volumes of blank sailings which will likely continue through May The Ocean Alliance is leading the charge with over 40% of its AsiaPSW capacity canceled going into May – a total of 85,000 TEU. Capacity management is less severe in the Asia-PNW and Asia-East Coast lanes; however, the Ocean Alliance has blanked nearly 45% of their early May capacity on the Asia-PNW lane and 32% in the Asia-East Coast trade.

The below graph shows the total percentage of capacity being voided moving into mid-May.

*Source: M+R Spedag Group

Alphaliner has reported that 41 new vessels with a capacity of 260,000 TEUs were delivered in March, and another 50 new ships with 333,000 TEUs of capacity were added in April But even though 1 million TEUs of capacity has been delivered since the start of the year, the overall functional capacity has remained rather tight The primary reasons for that are due to the ongoing backlog issues in the Red Sea and the resulting longer transits around Southern Africa

Many analysts feel that once the Red Sea situation stabilizes and returns to a more normal stable state, this new vessel overcapacity will lead to a significant threat of a spot market rate collapse in all global trade lanes, most notably Asia to Europe.

The graph shows the current “on order” percentages for the top 10 ocean carriers through 2025 This represents the new vessel capacity that these carriers have ordered but not yet taken possession.

The increases in rates on May 1 have most likely set a precedent for additional rate increases in May, with carriers possibly aiming for more on May 15. Notable blank sailings are likely to continue through May, which will likely maintain some level of backlogs in bookings. It is possible it could take several weeks to clear and thus it seems probable that rates could remain elevated for the near future.

While rates may settle slightly lower than those seen on May 1 as carriers adjust to the market, a significant decrease is not expected moving into June; however, rates to certain destinations like the U S East Coast, PNW and Western Canada gateway may remain slightly lower due to lower utilization compared to LA/LB volumes

The Panama Canal situation seems to have stabilized substantially and operations are nearly back to normal. Panama Canal Authority (ACP) has announced some routine maintenance work at the Gatun locks from May 7–15, reducing transit capacity from 20 slots to 17 per day at the Panamax locks for the duration of the work. Following completion, ACP will increase the number of transits from 24 to 32 as water levels have continued to improve, reducing the effect of the sustained drought on the canal’s capacity. The increase in slots will still be shy of the normal operating capacity of 36.