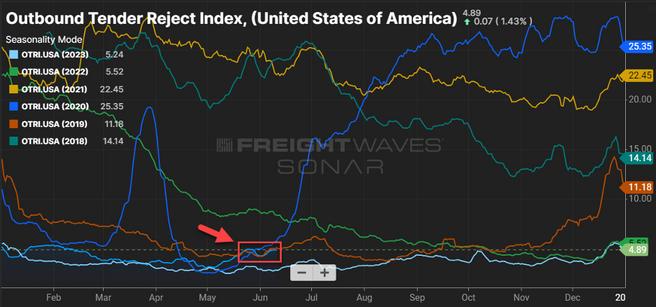

The OTRI, which measures carrier tender rejections across some of the largest TMS providers in the transportation industry, has climbed to 2019 levels and is closely following that trend. This is a promising sign that the market could be coming out of its downward trajectory. Unfortunately, 2019 was a bear market, and returning to those levels does not alleviate many of the challenges carriers have been facing.

Source: sonar surf

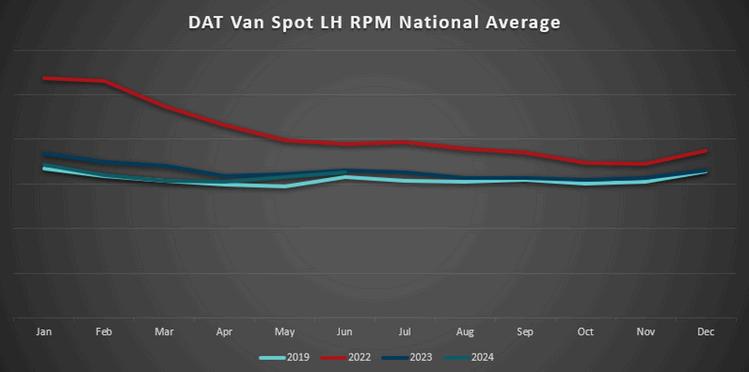

It appears that DOT Blitz week gave the carrier market a much-needed stimulus to increase revenues This is illustrated by the DAT National Spot Rate Per Mile Linehaul Average Similar to OTRI, rates have climbed They are getting very close to eclipsing 2023 levels from a YoY perspective. Rates are forecasted to closely follow the 2023 trendline for the remainder of Q3.

The TL Rate and Market Outlook have not seen any significant changes over the past month. Although we have seen the seasonal increase in rates, we continue to expect the market to slightly underperform 2023 levels for the remainder of Q3. Outside of spot increases surrounding Q3 holidays, shippers should be able to enjoy a stable cost environment.

Source: ftrintel.com

Spot market settles post-holiday

Source: DAT.com/trendlines

The Canadian government and the union representing more than 9,000 Canada Border Services Agency (CBSA) workers reached a tentative agreement Tuesday, June 11, that ends the threat of a work stoppage on Friday, June 14, officials said. The Public Service Alliance of Canada (PSAC), which represents CBSA workers, had said a strike would begin at 12:01 a.m. on Friday if an agreement was not reached with the CBSA and Treasury Board. CBSA workers are also represented by the Customs and Immigration Union. Full details of the agreement will be announced Thursday. A ratification vote will be scheduled in the coming days after details of the agreement are released, union officials said If the agreement is ratified, the renewed collective agreement will apply to approximately 11,000 employees, the Treasury Board said Along with customs and immigration officers, CBSA personnel include intelligence officers, investigators and non-uniformed staff.

Keith Creel, former Canadian Pacific leader, now president and CEO of Canadian Pacific Kansas City (CPKC) stated, “We uniquely, only and solely bring three nations together – it’s never been done before. I would suggest it will never be done again.” Combining the 140year-old CP and the more than 130-year-old KCS created the only single-line rail network in North America that connects Canada, the United States and Mexico. CPKC is the only East-West railroad that runs between the U.S. Northeast and Atlantic Canada to Texas and Mexico, and to the upper U S Midwest from Mexico, Texas and Louisiana The Class I’s 20,000-mile network reaches some points that no other large railroad can match in terms of strategic port facility access and gateways with short lines and other Class Is.

As reported in Transport Topics, government officials, public agencies and business interests are warning the U S Environmental Protection Agency that approving California’s rule to outlaw diesel locomotives will harm the nation’s interconnected rail system Such a move, they assert, would disrupt the supply chain, close businesses and force prices to skyrocket. At issue is the “In-Use Locomotive Regulation” by the California Air Resources Board to outlaw diesel emission locomotives. The law, applying to operators of freight linehaul, switch, industrial, passenger and historic locomotives, has several components such as an idling requirement for locomotive shutdowns after idling for 30 minutes. It also says in six years no locomotives older than 23 years can operate in California except zero-emission ones. Locomotive operators must create annual “spending accounts” starting July 1, 2026, to pay into a restricted trust estimating health costs attributable to their locomotive emissions released the previous year. Also, operators must submit yearly administrative paperwork and pay $175 per locomotive along with annual reports to ensure compliance. The U.S. Small Business Administration noted: “Short-line railroads are mostly Class III railroads and small businesses employing fewer than 30 people. While Class I railroads may be able to absorb the costs associated with the In-Use Locomotive Rule, Class II and III railroads will not be able to do so. CARB admits these costs could drive smaller railroads out of business.”

Here are links to some top stories in the industry for you to check out:

Yellow liquidation extended

Midwest Express and Sterling enter partnership

SAIA continues to capture market share above the competition

Forward Air board gets raise amidst Omni acquisition controversy

As we round out Q2 2024, we’ve seen a consistent theme throughout the year: Business confidence in U.S. manufacturing is contracting (still), and U S industrial production has been uninspiring at best And while several publicly traded LTL carriers are reporting YoY gains in shipments and tonnage via mid quarter updates in May, they also continue to report lighter weighted shipments, signaling smaller order sizes for their customers It is also likely that heavier weighted LTL shipments and/or volume LTL shipments are shifting into the truckload market as LTL rates continue to increase against historically low truckload rates.

The United States ISM Manufacturing Purchasing Managers Index (PMI) for May came in at 48.7, which fell short of market expectations of 50 (flat). This marks the second consecutive month in contraction territory after a brief and modest taste of expansion in March. Trading Economics global macro models and analysts’ expectations suggest that business confidence will increase to 51 by the end of June. Fingers crossed as we’ve only seen one positive month (March 2024) dating back to September 2022!

Source: Trading Economics & Institute for Supply Management

Industrial Production in the U.S. contracted -.4% YoY in April 2024 and is down from March’s modest .1% increase. June is forecasted to land us at 1.2% increase YoY, with momentum expected to persist through the end of 2024.

Source: Federal Reserve; Forecast by Witte Econometrics, FTR Transportation Intelligence

We are almost through the first half of 2024, and anyone who bet that LTL pricing would continue to increase throughout 2024 would be up on that bet at this point Contract rates are continuing to increase at a mid-single digit clip in concert with their renewal dates, and transactional rates are largely holding at elevated levels We are seeing some carriers making strategic adjustments to transactional rates to attract volumes in certain markets, but not at the level we may have seen if Yellow had not shut its doors. If you have been taking advantage of the ABF dynamic pricing available since Q3 2023, you’ve likely had some sticker shock as of late and possibly even moved your business elsewhere. Based on ABF’s mid-Q2 2024 update, it would appear they are focused on improving yield (CWT or price per 100 lbs.) and are willing to sacrifice market share to do so. Through the first two months of the quarter, ABF’s yield has increased approximately 25% while revenue, shipments, weight/shipment and tonnage all declined.

The PPI for Long Haul LTL, which gauges average prices paid to transportation service providers, came in at 416.344 for April. This is 31.641 points or 8.2% higher than April 2023’s index of 384.703 and .6% higher than March 2024 index of 413.884.

Source: U.S. Bureau of Labor Statistics

The U.S. National average cost per gallon for on highway diesel in the month of May came in at $3.822, which is $.18 or 4.5% lower than April’s average of $4.002. The U.S. National average has dropped eight consecutive weeks since we hit $4.061 per gallon on April 8, and we started the month of June at $3.726 per gallon.

Strategic Shifts in SMB Focus: UPS and FedEx are intensifying efforts to capture small- and medium-sized business (SMB) customers, who are driving profitable volume growth in the business-to-consumer delivery sector. SMB deliveries are more lucrative compared to large-scale customer shipments.

UPS Initiatives for SMBs: UPS is leveraging its integrated network, has improved customer service capabilities and implemented AI-enabled chatbots to enhance service for SMBs. The company’s Digital Access Program and Deal Manager tool are key components in closing SMB deals faster. UPS aims to increase the SMB share of its U.S. volume to 40%.

FedEx Network Overhaul: FedEx is merging its Ground and Express networks to streamline operations and eliminate separate pickups, benefiting SMBs. The introduction of the fdx platform aims to offer end-to-end solutions for e-commerce merchants, improving visibility and operational efficiency for SMBs.

Amazon's Competitive Threat: Amazon's growing logistics capabilities and fulfillment services for third-party sellers pose a significant challenge to both UPS and FedEx in attracting SMB customers The rapid growth of SMB sales on Amazon’s marketplace highlights the competitive pressure in the delivery market

Market Landscape and Competitors: Beyond UPS and FedEx, other players like the U.S. Postal Service and alternative carriers are also vying for SMB volume, offering new services and expanding their reach amidst a soft demand environment.

OnTrac's Evolution: OnTrac is transitioning from a regional carrier to a national player by adopting strategies similar to UPS. This includes mimicking UPS’s pricing structure, expanding service offerings and making strategic hires from UPS and other major retailers OnTrac is also shifting its narrative to support its transformation into a national carrier, promoting carrier consolidation in a shipper's market.

Rates: Trans-Pacific rates soaring – “premium” levels now more prevalent to ensure space

Volume: Import volumes up significantly in May/June – Peak season came very early

Supply: Available capacity stagnating – Red Sea diversions and backlogs in Asia as primary causes

Key Topic: ILA-USMX stalled with less than four months until contract expiration

Moving into June, import rates from Asia to the U.S. West Coast were $6,200 per FEU. That’s up from the index rate $2,800 per FEU on April 5. The East Coast spot rate of $7,300 per FEU is more than double the rate of $3,240 per FEU from two months ago. These levels have spiked with the implemented general rate increases of $1,000per-FEU on May 1, May 15 and June 1

As reported previously, carriers also plan to apply Peak Season Surcharges (PSS) on U S import cargo ranging from $600 to $1,200 per FEU There is also a potential additional PSS of $400 for June 15, all of which represent a substantial rate increase in just a two-week period.

Recently a few ocean carriers have quietly been reintroducing the “Premium” rates that became very commonplace during the COVID era volume and rate surge. The “Premium” levels being promoted now are in the $9,000-12,000 per FEU range. These rates are being proposed with a “loose” guarantee of space, well ahead of regular spot rate levels but also with a penalty for cancellation.

Larger BCOs seem to be benefiting from some direct carrier support and contract discipline. Many large BCOs typically build in “No PSS” clauses into their contracts; however, given the current seasonal increases in demand for many larger importers e g , major retailers, the struggle now is trying to get volume onboard in a very tight capacity market

Analysts and supply chain consultants have reported that many BCOs are adopting a blended approach whereby they book as much as they can on fixed rates (based on their weekly MQC allocation) and then effectively move the balance on FAK/spot rates.

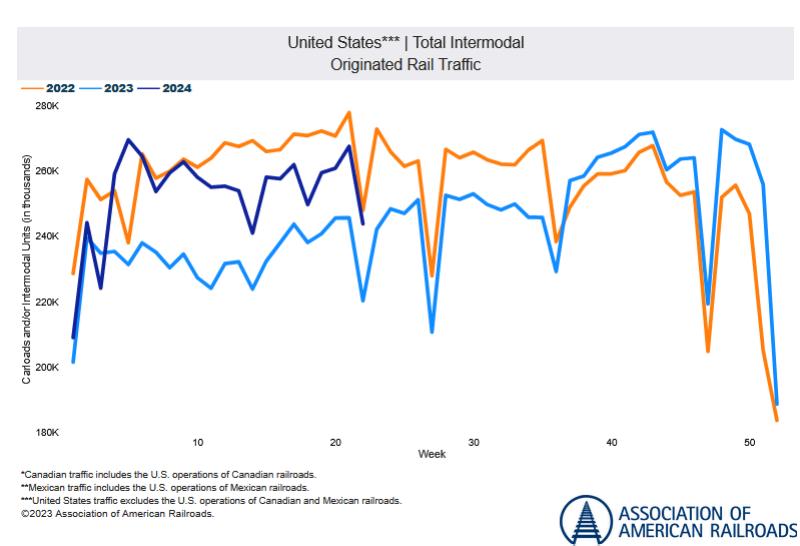

Peak season in the transpacific trade has come remarkably early in 2024, with early holiday, e.g., Halloween, exports from Asia already wrapping up and now Christmas season following shortly behind that. Containerized imports from Asia grew by 13% year-over-year in May.

January-May 2024 containerized import volume from Asia is just 11% below the same period in 2022 when the COVID rush was in full swing Asia-U S West Coast rates were well over $7,000 per FEU And today in stark comparison, Asia-U S West Coast rates are also surging above the $7,000 per FEU level

This unexpected strong demand for imports is being fueled largely by China, which is flooding the U.S. market with e-commerce merchandise, retail and solar panels ahead of anticipated tariffs later this year. With the upcoming election, economists feel that U.S. importers may have some additional incentive to move goods before possible higher tariffs take hold.

Barring any quick resumption of regular transits through the Suez Canal, the current market environment is expected to last at least through August. Some sources say the strong demand and elevated freight rates could easily last through the Golden Week holidays in Asia, which occur in the first week of October.

Functional capacity growth is mostly stagnating and actually shrunk in May, down 1 2% compared to May 2023 As reported previously, the blank sailing programs used by carriers has essentially disappeared, as shown in the below graph. Unused/idle global vessel capacity is currently less than 1%, according Alphaliner.

However, vessel diversions resulting from the disruptions in the Red Sea are having a more profound impact. These longer sailing routes demand more capacity than the global trade can provide right now.

Source: M+R Spedag Group

Additionally, carriers in the transpacific continue to dig out from booking backlogs in Asia caused by blank sailings in the first four to five months of 2024.

Capacity is, however, stabilizing with several carriers deploying extra loader vessels now emerging in June – but load factors are still strong as demand escalates and carriers continue to increase rates. Until there is some degree of normalcy in regular Suez Canal transits, carrier executives expect capacity to remain tight until at least Golden Week in October. That’s despite another 1.8 million TEUs set to be delivered in the second half of the year, according to Alphaliner. So far this year, 1.3 million TEUs of capacity has been deployed globally.

Vessel capacity is definitely at a premium, as reflected by container ship charter rates jumping 10% week to week in late May, the largest weekly increase since August 2021. Vessel charter (on hire/leased vessels) tends to jump when carrier seek out additional leased capacity.

Container shortages are also becoming acute throughout most of Asia

On a positive note, the opening of the Fort McHenry Limited Access Channel in Baltimore will allow services to resume direct calls starting with early June departures from Asia This should allow for some additional East Coast capacity.

Carriers will likely continue to face backlogs in Asia, and this will ensure ships remain full for the next several weeks and possibly months, despite improved overall capacity. Net capacity will increase throughout June as extra loaders are deployed and potential new players enter the market (as they did in the COVID era).

Still, the traditional Christmas peak season should start in mid- to late-June and carriers will likely continue increasing rates, like they did in May. Premium rate offerings, between $1,000 to $4,000 per FEU higher than FAK/spot rates, may become more popular in June/July as shippers try to manage space shortages and increased seasonal volumes Container shortages will continue to become a problem in the Asia to U S trade as container repositioning cycles remain longer than usual due to the Red Sea longer transits

By July/August it is entirely possible that transpacific import rates will climb to within 10% (or perhaps even single digits) of the COVID era rate levels of July 2022.

The International Longshoremen’s Association (ILA) cancelled negotiations with the United States Maritime Alliance citing that terminals were discovered to be in violation of the current agreement with their use of automation. The ILA directly identified the APM Terminal in Mobile, Alabama, for using an “Auto Gate system, which processes trucks without ILA labor.” The ILA will not return to the table to continue negotiations of the new master contract (due to expire on September 30, 2024) until the issue is resolved.

While Maersk, owner of the APM terminals, advises that they are in compliance with the existing agreement, the ILA is taking a hard stance on this issue as it is a key discussion point in the current negotiations ILA President Harold J Daggett came out in 2021 when the ILWU was negotiating their contract, and he took a firm line stating, “we will continue to negotiate for no automation, or automated equipment at ILA ports And we are going to demand no semi-automated equipment be allowed The ILA has learned that even allowing semi-automated equipment is the path for companies to slowly eliminate our jobs.”

As the U.S. struggles to keep up with automation of its global counterparts, the efficiencies of the U.S. suffer, which threatens continuity of supply chains. As the negotiations continue to develop, it will be important to keep a watchful eye on the aspects of automation in the future contract, and ultimately, see if that impacts utilization of East/Gulf coast ports versus a further developing West Coast.