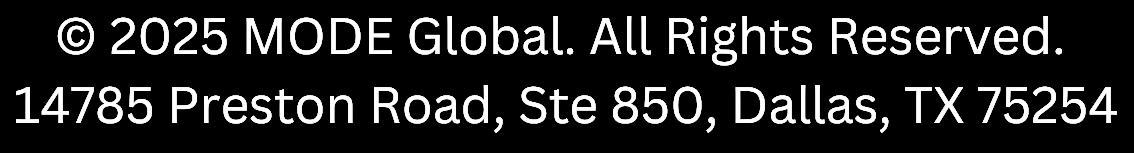

The Outbound Tender Rejections Index (OTRI) has declined following the extreme weather events that disrupted freight markets in January, settling at 5.65%. This level reflects a shipper-friendly environment, with OTRI expected to remain compressed through the remainder of the first quarter

Source: sonar.surf

National Van Spot Linehaul RPM continued its upward trajectory in January, rising $0.05 per mile year-over-year, a 3% increase; however, the broader market impact remains muted, with All-In RPM rates climbing just 1% YoY largely driven by weather-related disruptions rather than a fundamental market shift. Shippers can expect limited volatility in the truckload sector through Q1.

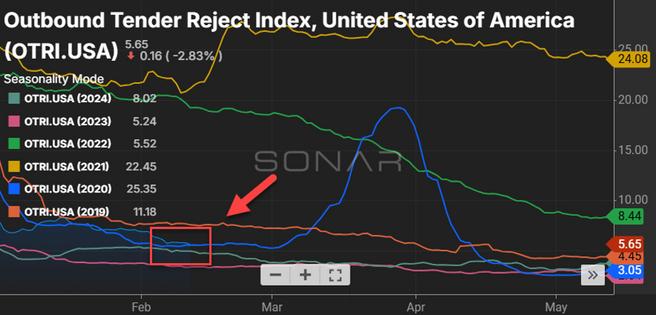

Looking ahead, FTR Intelligence forecasts a stable 2025, with linehaul rates projected to rise by less than 5% year-over-year. However, continued declines in fuel surcharges may offset these gains, keeping allin RPM rates relatively flat.

Source: ftrintel com

Source: DAT.com/trendlines

The trend of upward pricing is expected to continue throughout 2025 as demand for intermodal remains high due to international and parcel shippers increasing volumes, strong consumer demand and preemptive inventory increases to avoid potential tariffs.

Thus far in 2025, shippers have seen railroads and intermodal providers take price increases for incumbent shippers and provide higher-than-expected rates for new business. Rate reductions on bids have been less common than in previous years as we see intermodal providers unwilling to discount. Currently, the railroads have been taking increases averaging five percent on the majority of rate renewals.

CSX construction on the Howard Street Tunnel clearance project in Baltimore has begun The project has resulted in several transit changes on North/South Lanes between Florida Traffic has experienced delays of around 48 hours with the implementation of the new services.

Here are links to some top stories in the industry for you to check out:

Freight Dimensioners on Forklifts Coming to ABF

Knight Swift

Pausing LTL Acquisitions in 2025

Saia Eyes Nascar Marketing Strategy

U.S. Shippers

Bracing for NMFTA Classification Impact

The U.S. less-than-truckload (LTL) sector is poised for substantial developments in 2025, marked by significant changes with the NMFTA’s LTL classification system, anticipated growth in the second half of the year and major corporate restructuring looming in the distance.

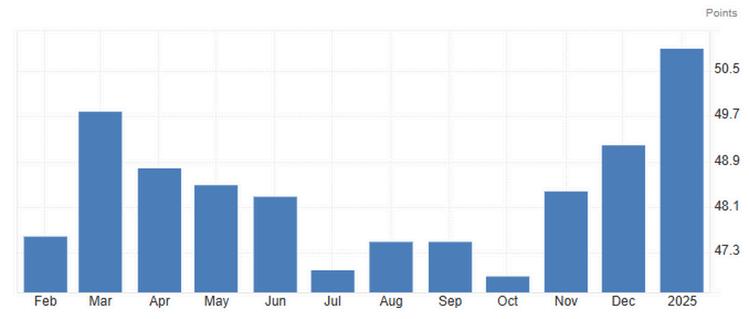

Industry experts forecast a 1-2% increase in LTL freight volumes for 2025, signaling a potential turnaround after recent market challenges. This optimism is bolstered by a resurgence in the U.S. industrial sector, with the ISM Manufacturing PMI surpassing the growth threshold of 50 in January, indicating expanding manufacturing activity and an increase in business confidence here in the U S

A pivotal development is FedEx Corporation's decision to spin off its FedEx Freight unit into a separate publicly traded company. Announced in December 2024, this move aims to unlock shareholder value and allow both entities to focus on their core competencies. The spinoff is expected to be completed within 18 months, positioning the new company as the largest publicly traded LTL carrier in North America. The emergence of an independent FedEx Freight is anticipated to intensify competition within the LTL market. Analysts suggest that this could lead to shifts in pricing strategies and operational approaches among existing carriers as they adapt to the evolving landscape.

To navigate the anticipated growth and heightened competition, as well as navigating the upcoming NMFTA classification changes, LTL carriers are expected to invest in technological innovations aimed at enhancing operational efficiency. Adopting advanced technologies and optimizing supply chain processes will be crucial for carriers and shippers alike who strive to maintain profitability and meet evolving customer expectations.

The U.S. national average cost per gallon for on highway diesel in the month of January 2025 came in at $3.634, which is $.14 or 4% higher than the December 2024 average of $3.494. The U S national average in January of 2024 was $3 854, which is $ 22 or 5 7% more than January 2025 We start the first week of February 2025 off at $3.66 per gallon for the U.S. national average.

UPS-USPSContractExpirationandChangestoSurePost andMailInnovations

KeyInsights:

UPS-USPSParcelSelectcontractexpiredonJanuary1,2025, leadingUPStofullyinsourceSurePostdeliveries.

ImpactonSurePost:

LossofAPO/FPOandP.O.Boxdeliveryservicewithno advancenotice.

Rateincreasesof9.9%forSurePostservicesasofJanuary13.

DeliveryAreaSurcharges(DAS)andExtendedDeliveryArea Surcharges(EDAS)increasedby60%+,affectingruraland remotedeliveries.

MailInnovationssawa25%+ratehikewithonlyoneweek’s notice,increasingcostsforlightweightparcels.

KeyTakeaway:

Shippersmustreconsiderfinal-miledeliverystrategiesandevaluate alternativeslikeregionalcarriersorhybriddeliverymodels.

TrumpTariffsandDeMinimisTradeExemptionChanges

KeyInsights:

PresidentTrumpdelayedtheplannedendofthedeminimistradeexemption($800thresholdforduty-free imports),citingtheneedforastructuredphase-out.

Theexemptionprimarilybenefitslow-costChineseimports,affectingretailerslikeShein,TemuandsmallU.S. businessesrelyingondirect-from-Chinashipments.

Potentiallong-termimpact:Increasedcustomsenforcement,newcompliancerequirementsandrisingcostsfor cross-bordere-commerce.

KeyTakeaway:

Shippersandretailersshouldprepareforpossiblepolicyshiftsthatcouldincreaseimportcostsanddisrupt internationalsupplychains.

UPSAnnouncementtoCutAmazonRevenueVolumeby50%

KeyInsights:

OnJanuary30,2025,UPSannouncedplanstocutitsAmazonvolumebyover50%by2026,reducing dependencyonAmazon’sbusiness.

UPSaimstoprioritizehigh-marginbusinesssegmentslikehealthcarelogisticsandpremiumdeliveryservices ratherthanlower-marginAmazonshipments

ThemovereflectsAmazon’scontinuedexpansionofitsownlogisticsnetwork,makingitbothamajorcustomer andgrowingcompetitortoUPSandFedEx

KeyTakeaway:

Amazon’slogisticsindependenceisreshapingtheparcelindustry shippersshouldevaluatealternativesand diversifycarrierpartnerships

USPSChanging/EndingItsConsolidatorStrategy

KeyInsights:

USPSreaffirmeditscommitmenttoshiftingitsconsolidatorstrategy,impactingparceldeliverydynamics. Themoveisdesignedtoincreasecompetitivenessandstreamlineoperations,potentiallyreducingpartnerships withtraditionalparcelconsolidators.

Potentialoutcomes:

HighercostsforshippersthatreliedonUSPSconsolidatorservices.

GreaterrelianceonprivatecarrierslikeUPS,FedExandregionalcouriersforlast-milesolutions.

KeyTakeaway:

BusinessesthatdependonUSPSconsolidatorsshouldassessalternativeshippingoptionsandnegotiatenew carrieragreements.

AggressiveDiscountingbyUPSandFedEx

KeyInsights:

BothUPSandFedExhaveimplementedaggressivediscountingstrategiestoretainandattractshippersin responsetomarketshifts.

Keydrivers:

IntensifyingcompetitionfromAmazon’slogisticsexpansion. Customerbacklashfromrecentratehikes(e.g.,UPSSurePostincreases,FedEx’s5.9%GRI).

Effortstosecurelong-termcontractsandlockinvolumebeforefurtherindustrydisruptions. Someshippersarereportinglarger-than-usualdiscountsonbulkcontracts,particularlyforhigh-volumeand enterprisecustomers.

KeyTakeaway:

NowisanopportunetimeforshipperstorenegotiatecontractswithUPSandFedExtosecurebetterpricingand terms.

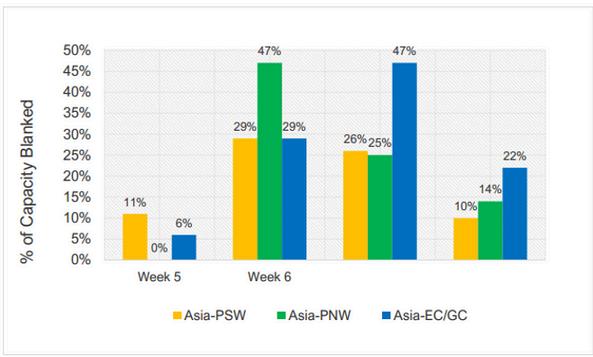

Capacity: Post-Chinese New Year blank sailings over 350,000 TEU in the first two weeks of February.

Volume: Soft through mid-February as China shuts down for Lunar New Year holiday.

Rates: Moving into February rates continued to slide back to December levels

Trump Tariffs: February 1 announcement of significant tariffs on Canada/Mexico manufactured goods.

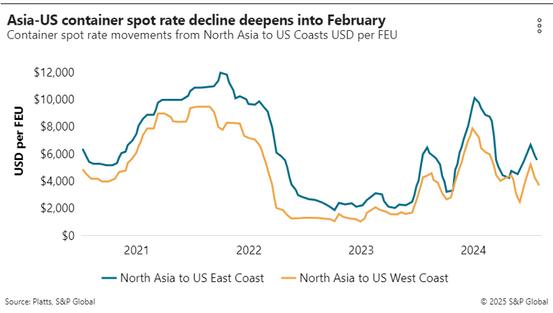

Trans-Pacific container rates slid back moving into February as Chinese manufacturing and logistics activity wound down for the Lunar New Year holiday, which started on January 29 and ran through February 12.

Average FAK rates between Asia and the U.S. had fallen for a third straight week leading into the Lunar New Year holiday. It is the first time in recent history that the period leading up to the Lunar New Year saw rates actually decline. In this case, rates have retreated to December levels, essentially wiping out the gains made with the January 1 GRI. Asia to the U.S. West Coast rates have lost the most ground.

Asia to the U.S. West Coast rates fell 7% to $4,938 per FEU for the week ending January 24, just prior to the holiday shut down. Asia to the U.S. East Coast prices declined 1% to $6,656 per FEU.

This uncharacteristic slide in Trans-Pacific rates seems to confirm that ocean carriers perhaps overestimated and overpriced the January demand It is likely the carriers were expecting disruptions from the potential ILA strike or the new administration taking a more immediate position on tariffs. However, by reducing pre-holiday rate levels the carriers we also able to build sustainable roll pools at origins for post-holiday sailings.

It is important to recognize that Trans-Pacific rates are currently still more than double 2019 levels for the same period. The major contributing factor here is the continued Red Sea diversions, which continue to absorb significant capacity across the entire ocean transportation landscape

With China coming back to full operations in mid-February, and blank sailings tapering down, overall capacity seems to be available in the near term. The current restructuring of the carrier alliances is causing a short-term capacity shift in the Trans-Pacific trade, giving importers/cargo owners about 20% more functional capacity in February compared with a year ago but still 8% less than in January, according to analysts

Overall, forecasted blank sailings remain rather conservative for the post-Lunar New Year balance of February. With all the temporary market influences dropping off by the end of Q1, analysts feel that Trans-Pacific capacity will most likely stabilize to “normal” levels moving into the second quarter

Source:

M+R Spedag Group

Some good news on the global capacity front, the recent announcement of a ceasefire between Israel and Hamas followed by the Houthi rebels’ halt of attacks on non-Israeli-owned vessels in the Red Sea has sparked hope that services routed away from Red Sea transit will soon return

The announced six-week phase one Israel-Hamas ceasefire is now into its second week and the Houthis have paused attacks on passing vessels so far, carriers – with some limited exceptions – will potentially open the door to resume Red Sea traffic routed through the Suez Canal. With some carriers resuming the normal and shorter routing (compared to sailing around Southern Africa), vessel utilizations and ultimately capacities should improve.

However, some ocean carriers have openly stated they will only return to normal Red Sea transits “when it is safe to do so,” despite an announcement by Yemen’s Houthi militants that they will limit their attacks on shipping to Israel-affiliated vessels

As much as the ocean carriers have hoped for a return to Red Sea transits, the consensus among analysts is that it will start with a period of supply chain disruption as ship schedules are changed and vessels are repositioned, followed by a capacity surge in the global trade lanes. As reported previously, ocean carriers have continued to order and take possession of new vessels and that trend for 2025 and years to follow has not changed.

Overall volumes for the Asia to U.S. trade were underwhelming moving through January, especially in the run-up to the annual Chinese Lunar New Year shutdown Importers did front load some volumes based on the fear of the potential labor union strike as well as uncertainty with the new administration taking office, but overall those volumes did not reach levels of previous years' pre-Lunar New Year pushes

It is expected that market demand and an influx of new orders should resume fully starting in the second week of February when factories and workers are back online.

The one wild card that could potentially cause an increase in U.S. import volumes is if the Trump Administration announces large tariffs on key trading partners like China (as was the case in his last administration). If that action is taken, it would likely take effect later in the spring. At that point, as in the past, there will be a significant push to front-load orders to beat the implementation date.

On February 1, 2025, President Donald Trump announced the imposition of significant tariffs on imports from Mexico, Canada and China. The executive orders stipulate a 25% tariff on all goods from Mexico and Canada, with the exception of Canadian energy exports, which are subject to a 10% tariff. Additionally, a 10% tariff is set for all imports from China.

These tariffs were originally scheduled to be implemented on February 1 but were delayed by a month to allow both neighboring countries to enhance border security measures aimed at addressing the concerns raised by the U.S. administration.

There seem to be two primary reasons for these actions:

National Security Concerns: The U S government cited the need to protect national security as a basis for these trade measures

Combatting Illegal Immigration and Drug Trafficking: The administration expressed concerns over illegal immigration and the trafficking of fentanyl and other drugs into the United States, particularly through the southern border with Mexico and the northern border with Canada.

The broad approach of this plan is an escalation from Trump’s previous targeted tariffs during his first term. The president has framed these measures as a response to what he perceives as inadequate efforts by Mexico and Canada to slow the flow of illegal immigrants and drugs into the United States.

The potential impact of 25% tariffs on Mexican and Canadian goods would likely have significant and far-reaching effects across several fronts. The automotive industry, with intricate supply chains across all three countries under NAFTA and the USMCA, would be particularly hard-hit. Cars and car parts often cross borders multiple times during production, meaning that a 25% tariff could compound into much higher costs for finished vehicles. This could lead to significant price increases for consumers in all three countries.

Other business sectors like home goods, appliances, furniture and electronics could face major disruptions as well. Many American companies rely on Mexican and Canadian inputs for their products, and a 25% increase in costs would force them to either absorb lower profits or pass the costs on to consumers with price increases.

The food industry could also be impacted. Mexico is a major supplier of fresh fruits and vegetables to the U.S. especially during winter A tariff increase could impact not only grocery stores but also restaurants and the hospitality industry

Another significant impact could come in the form of retaliation from both Canada and Mexico relative to U S made products moving into those countries. Those countermeasures could worsen the economic impact and potentially start a broader trade war, complicating trade relations between all three countries.

As in the previous Trump administration, China has again been included in the scope along with Canada and Mexico. Below is a summary of the details:

All products from China will be subject to a 10 percent tariff.

The current rates of duty established by the new plan are in addition to any other duties applicable to these goods, including the existing Section 301 tariffs on imports from China.

All tariffs imposed in the current plan for China went into effect with respect to goods entered for consumption or withdrawn from warehouse for consumption on or after 12:01 a.m. Eastern time on February 4, 2025.

Goods from China loaded or in transit before February 1, 2025, may be exempt if certified to CBP as specified in the forthcoming Federal Register notice

President Trump also announced his intent to target the European Union tariffs The administration specifically referenced the EU’s reluctance to accept American agricultural products, EU barriers to bringing goods into Europe and the U.S. trade deficit with the EU as the primary reasons because they unfairly burden U.S. business.

Many trade analysts feel that because of the potentially severe consequences, these tariffs are unlikely to remain in force for long, if they are ever activated at all. There are several reasons for skepticism.

There are many who view even the threat of the imposition of tariffs as an effective tool to change specific behaviors or policies. Trump’s history of employing threats as a negotiating tactic suggests that this might be another attempt to gain political traction on border protection and drug trafficking. He has often scaled back or accepted less stringent concessions, so these tariff actions may simply be a strategic move to gain leverage.

While Trump’s tariff threats have created shockwaves through North America businesses, the extreme nature of the proposed measures makes their long-term implementation (as currently proposed) somewhat unlikely. These moves may simply be focused as the initial statement leading to deeper negotiations related to border security and drug trafficking