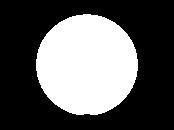

The OTRI, which measures carrier tender rejections across some of the largest TMS providers in the transportation industry, has plateaued near 2023 levels. This is a good indicator that the TL transportation industry is still in a bear market. Due to this, the delta on the rate increases for the upcoming produce season will be much more constrained than we saw during the bull markets of 2018 and the pandemic.

Source: sonar.surf

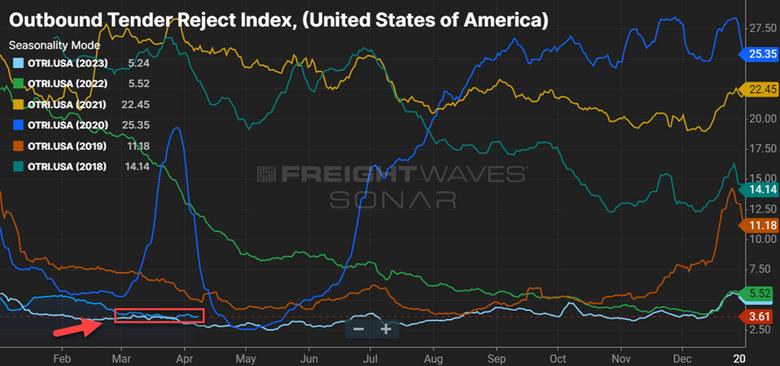

Another indicator on the current state of the TL market is the DAT Spot National Rate Per Mile Linehaul Average, which is almost identical to 2019 levels Early April trends are showing a slight elevation from 2019 LH rates putting the average closer to 2023 LH Rates YoY Projections are that rates should continue to remain between 2019 and 2023 rates for April and early May

The rate outlook for Q2 is still projected to underperform 2023 year-over-year. This is unfortunate news for many transportation providers, as bankruptcies continue to be reported in the news; however, there are market experts, such as FTR, who are showing a light at the end of the tunnel with a year-over-year market flip occurring in August.

Source: ftrintel.com

Spot market capacity continues to tighten

Source: DAT com/trendlines

U.S. Army Corp of Engineers (USACE) officials said in a press release that a limited access channel, 280 feet wide and 35 feet deep, would open at the port by the end of April This channel would support one-way traffic in and out of the Port of Baltimore for barge container service and some roll on/roll off vessels that move automobiles and farm equipment to and from the port, they said. USACE engineers are aiming to reopen the permanent, 700-footwide by 50-foot-deep federal navigation channel by the end of May, restoring port access to normal capacity.

On March 15, the United States District Court for the Southern District of California denied the California Trucking Association’s (CTA) claims that California’s AB 5 test for worker status determination cannot be enforced against the trucking industry. AB 5 requires the application of the “ABC test” to determine if workers in California are employees or independent contractors for purposes of the Labor Code, the Unemployment Insurance Code and the Industrial Welfare Commission (IWC) wage orders. The court found that AB 5 has no discriminatory intent or effect that would favor California truckers, and without that, courts should generally not engage in a weighing of benefits versus burdens. MODE Global is continuously monitoring AB 5 and its ongoing legal challenges.

The U.S. Department of Transportation’s Federal Railroad Administration (FRA) has issued a final rule establishing minimum safety requirements for the size of train crews, which mandates two-person crews for freight trains in the U S The newly enacted rule mandates that a second crewmember is on all trains “to enhance safety in the rail industry,” according to the statement from the FRA Additionally, the FRA noted, “A second crewmember performs important safety functions that could be lost when reducing crew size to a single person. Without the final rule, railroads could initiate single-crew operations without performing a rigorous risk assessment, mitigating known risks, or even notifying FRA.”

Intermodal traffic continues to drive up total

U S rail volume During the week ending March 16, U.S. railroad carloads dipped 0.6% to 219,586, but their intermodal volume increased 13.8% to 255,010 units compared to the same period in 2023 (per Association of American Railroads data). Total U.S. rail traffic for the same week reached 474,596 carloads and intermodal units, which is an increase of 6.7% year over year

Here are links to some top stories in the industry for you to check out:

TFI International adds 31 terminals to its North America network via Hercules Forwarding acquisition Saia and Fletes Mexico’s Carga Express announce U.S.-Mexico cross border partnership

FedEx reports fiscal Q3 2024 results, cites decreased freight results due to lower fuel surcharges and declines in shipment count and weight per shipment

Yellow’s $137M lawsuits against Teamsters dropped by federal court in Kansas

The run is over! After 16 consecutive months of declines in U S manufacturing activity, the United States ISM Manufacturing Purchasing Managers Index (PMI) rose to 50.3 in March from 47.8 in February, which beat market expectations of 48.4 and places us into expansion territory. Positive trends regarding freight demand are attributed to increases in production, new orders and continued expansion in new export orders and imports. On the other side of the coin, industrial production in the U.S. slid -.23% YoY in February 2024. The demand for LTL services is still noticeably soft and many carriers are searching for the right volumes – and freight profiles – to fill the gaps as the market recovers.

Source: Trading Economics & Institute for Supply Management

Pricing:

LTL pricing is steadily increasing low to mid-single digits, as anticipated. We’d expect that number to continually increase as the market recovers, and as we head into the second and third quarters – historically known to produce higher LTL demand.

LTL carriers are also doubling down on real estate investments in a bid to “say yes, more.” XPO, SAIA, Estes, KnightSwift and several others scooped up desirable real estate through the auctions of previously owned Yellow terminals. We are also seeing other major players such as Old Dominion and Southeastern Freight Lines expanding their door counts to support increased volumetric throughput as well All of this, obviously, is quite expensive and will further support a strong carrier pricing environment as we navigate the cycles to come

The PPI for Long Haul LTL continues trending upward and to 411.772 for February 2024; which is 13.374 points or 3.4% higher than February 2023’s index of ~398.398 and .8% higher than January 2024 index of ~408.425.

Source: U.S. Bureau of Labor Statistics

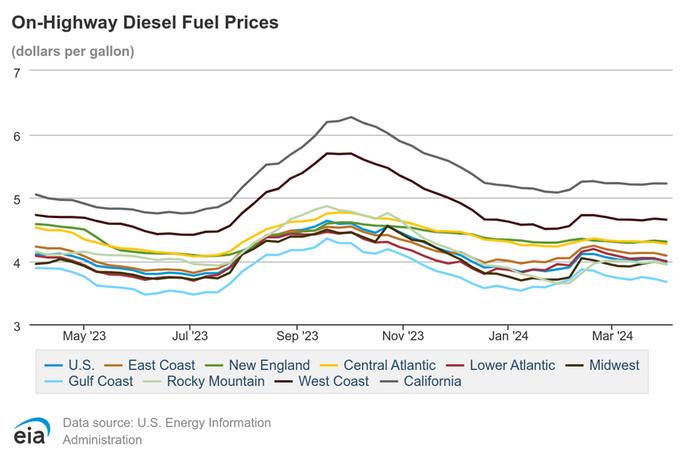

Fuel:

The U S national average cost per gallon for on highway diesel has been rather stable since the last week of February.

March 2024’s monthly average cost per gallon came in at $4.022, which is $.022 or .5% lower than February 2024’s average cost per gallon of $4.044. We start the month of April off with the U.S. average cost per gallon at $3.996.

UPS Wins USPS Contract from FedEx: UPS secured a significant multi-year contract with the U S Postal Service (USPS) to become its primary air cargo provider, replacing FedEx, which had held the contract for more than 20 years. The financial terms were not disclosed, but UPS described the award as "significant." This transition was seen as beneficial for all parties involved, with FedEx able to refocus on cost control and UPS leveraging its integrated air and ground network.

Impact on FedEx: FedEx's loss of the USPS contract (worth over $1.5 billion annually) allows the company to aggressively pursue its strategic initiative to control costs and streamline its air network. This change aligns with FedEx's broader plan to consolidate operations and achieve significant efficiency gains

Industry Analysis: Experts view the contract shift as mutually beneficial. FedEx's restructuring efforts, including fleet consolidation and operational redesign, are expected to improve profit margins for its Express unit post-contract loss.

UPS's Strategy and Operational Advantages: UPS, with its integrated air and ground network, aims to maximize efficiency and profitability from the USPS contract. Leveraging its existing infrastructure, UPS plans to utilize its linehaul fleet to support air cargo volumes, potentially reducing the need for additional aircraft.

Market Reactions and Employment Impact: UPS's stock rose following the contract announcement, while FedEx's stock declined. The transition may affect approximately 300 FedEx pilots, reflecting broader changes in the air cargo market and operational adjustments within both companies.

In summary, the shift in the USPS contract from FedEx to UPS reflects strategic realignments within the air cargo industry, with UPS poised to capitalize on its integrated network while FedEx focuses on cost savings and operational efficiency. This transition underscores broader trends in parcel delivery, including changes in consumer behavior and evolving operational strategies across major logistics providers.

Rates: Asia to U.S. spot rates down again moving into April but Baltimore bridge disruption could impact U.S.

East Coast rate levels by end of April

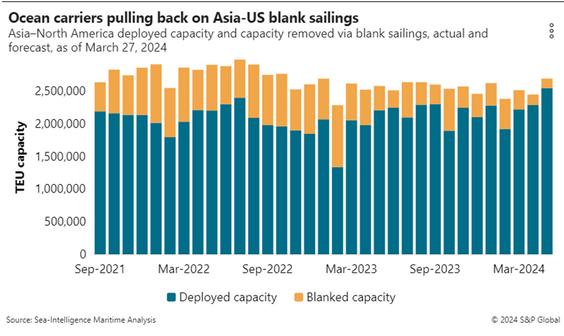

Supply: Capacity from ocean carriers improving as blank sailing programs decreasing

Demand: LA/Long Beach port volumes in more of a “peak” situation while East Coast demand softer

Operational: Baltimore bridge collapse/port closure will cause more schedule and cargo disruptions

Eastbound Trans-Pacific Ocean container spot rates lost ground again during the first week of April as container ship capacity in the trade recovers and volumes reset at a lower level than they were pre-Chinese New Year.

Market rates for Asia to U.S. imports were showing some signs of stability in late March as spot rate “dealmaking” cooled off and as FAK rates have now caught-up with spot-rate levels; however, even with stronger volumes going into the West Coast ports from Asia, overall rates dipped again

The Freightos Baltic Daily Index spot rate for China to the West Coast of North America fell from $3,620 per fortyfoot equivalent unit to $2,976 per FEU this week, a drop of 17.8%. These rates have come down more than 36% since March 1 as ocean carriers’ networks have adjusted and capacity has loosened up during the Red Sea crisis.

Source: Freightwaves SONAR)

These dynamics may shift however, as the trade now starts to absorb the latest operational setback with the collision of the Maersk Dali with the Francis Scott Key Bridge in Baltimore and the resulting collapse of the bridge into the Patapsco River. With Baltimore terminals inaccessible for what carriers are estimating to be months ahead –the ripple effects could extend well beyond other east coast ports It is possible that as Baltimore bound cargo demand gets re-routed to NY/NJ or Norfolk, rates in those lanes could see some short-term increases.

U.S. export rates (the backhaul or westbound lane on the Trans-Pacific) are also very low moving into April (~ $200 per FEU), according to the Freightos Baltic Daily Index. U.S. export shippers moving goods from the West Coast back to China are seeing the lowest rates they’ve seen in years. Drewry’s World Container Index shows a rate of $691 per FEU from Los Angeles to Shanghai, which is currently about half of what it was in the summer of 2022 but still remains above pre-pandemic levels

As mentioned in earlier updates, the longer transit times carriers are dealing with due to the Red Sea disruptions (longer voyages around the Cape of Good Hope) have led to a need to deploy additional capacity. That extra capacity is seemingly coming from the “blank sailing” programs widely used by the ocean carriers over the last two to three years.

In March, carriers blank sailings equaled 11.7% of total vessel capacity from Asia to the U.S. West and East coasts, down from 21 5% in the same month last year and 29% in March 2022, according to Sea-Intelligence data In February, carriers blanked 19.4% of capacity, down from 41.5% in 2023 and 29.6% in 2022.

The capacity improvements, although helpful, are primarily driven by the carriers trying to offset the longer transit times and vessels being occupied longer and not necessarily due to higher volumes of freight. Carriers are once again using a more short-term view of the deployment of blank sailings. So, some caution may be prudent in evaluating longer-term blank sailing forecasts or trends from ocean carriers.

As most everyone should be aware, on March 26, around 1:30 a.m., the MV Dali, a Singapore-flagged ship, smashed into a bridge pillar as it was leaving the port The vessel was carrying around 4,900 containers and collided with the bridge. The ship was under pilotage when the incident occurred. Within a matter of seconds, the entire bridge collapsed.

Construction workers were repairing potholes on the bridge when it collapsed. Maryland Transportation Secretary Paul Wiedefeld said authorities searched for eight people, believed to be involved with the construction work. Two men were rescued while three bodies were recovered in subsequent days, and the other three remain missing.

This event has had a ripple effect in the supply chain as Baltimore is the busiest U.S. port for car shipments and the largest U S port by volume for handling farm and construction machinery It is also the second-biggest port for U S coal exports.

The impacts on the supply chain are significant, especially for those industries that have large container volumes going through the Port of Baltimore. The automotive industry is one of those, with several major automakers being affected. Disruptions to manufacturing are expected in the automobile market until companies can establish new transport options through neighboring ports.

While the automobile industry might be the most impacted, the port is one of the 15 largest in the U S and handled over $80 billion in freight in 2023 This freight will likely have to bypass the Port of Baltimore until the area is cleared. It is likely that these containers will be discharged at the nearest port. Customers will likely have the option to choose to dray containers from the port of discharge to their final locations, or the ocean carriers will be responsible for getting these containers to the Port of Baltimore for customers to pick up at the planned location.

The Port of Baltimore is preparing workarounds to start handling containers and other ocean freight on a limited basis within the next four weeks ahead of a planned full reopening to vessel traffic by the end of May. Meanwhile, other ports along the U.S. East Coast continue to process diverted Baltimore-bound cargo with little to no impact on their operations E i hi di i l t d f t hi d i Baltimore’s closure

It is likely that some of the decreases seen in the Asia to U.S. spot market will slow; however, it seems momentum could be building for a potential mid- or late-April increase. As the overall market evaluates the commercial and operational impact of an unnavigable Baltimore port for at least the coming weeks, market rates should remain relatively stable with perhaps some softening of rates to the Pacific Northwest and inland points like Chicago. Rates to the U S West Coast and southern inland points should remain rather firm through April as load factors remain strong.

The potential impact from the closure of Port of Baltimore is multi-faceted – on one hand, carriers will likely see increased bookings to New York/New Jersey, Norfolk, and perhaps even west coast and IPI destinations. But, there is also the strong possibility of congestion at these alternate ports along with shortages of chassis, backups and even trucking shortages. So, it is still too early to know how much of a disruption the Baltimore issue will be.