3315 Emerald Lane, Jefferson City, Mo. 65109

Phone: 573-893-4301 • Fax: 573-893-3708

Email: maia@moagent.org

Internet: www.moagent.org

Publisher Matt Barton

Officers of MAIA

President Matt Speight, Montgomery City

President-Elect Deena James, St. Louis

Vice President Jim Neuner, Jefferson City

Secretary-Treasurer Nick Brenizer, Osage Beach

IIABA National Director Brad Greer, Chesterfield

PIA National Director Randy Smart, Marionville

Imm. Past President Dennis Luebbering, Jefferson City

Board of Directors

Region 1 Ross Ingersoll, Savannah

Region 2 Matt Alexander, St. Charles

Region 3 Holly Stark, Harrisonville

Region 4 Mark Baker, Platte City

Region 5 Rick Prather, Jefferson City

Region 6 Dave Linhardt, Chesterfield

Region 7 Paul Carcagno, Arnold

Region 8 Heath Greer, Chesterfield

Region 9 Parker Mills, Clinton

Region 10 Richard Ollis, Springfield

Region 11 David Hall, West Plains

Region 12 Lara Moffitt, Poplar Bluff

At-Large #1 Andy Reavis, Billings

At-Large #2 Clare Zanger, Ozark

At-Large #3 Jon Stahly, Cape Girardeau

Co. Rep. Dan Rodenfels, Columbia

Co. Rep. Shelly DeVore, Columbia

MAIA Staff

Chief Executive Officer Matt Barton

Chief Operating Officer Sheryl Van Leer

Director of Insurance Services Theresa Flippin, AIP, CISR

Director of Education & Events April Underwood

Assistant Director of Insurance Services Hannah Wall

Database Administrator Laura Berendzen

Accounting Specialist Paula Wolken

Customer Service Representative Sarah Wright

Marketing Coordinator Mary Feller

Administrative Assistant Leslie Powell

MISSOURI AGENT (USPS 709-210) is published bimonthly by the Missouri Association of Insurance Agents, 3315 Emerald Lane, Jefferson City, Mo. 65109, Phone: 573-8934301. Periodical postage paid at Jefferson City, Mo. and additional mailing offices.

MAIA does not necessarily endorse any of the companies advertising in this publication. Additional subscriptions are $30 per year.

Address & Other Changes

Notify Missouri Agent if you change your address, change your agency name, or drop or change producers (who are voting members of the association). Write to: Missouri Agent, 3315 Emerald Lane, Jefferson City, Mo. 65109 or email: maia@moagent.org.

POSTMASTER: Send address changes to Missouri Agent, 3315 Emerald Lane, Jefferson City, Mo. 65109. © 2025 Missouri Association of Insurance Agents

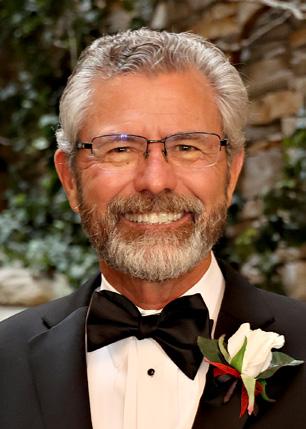

first of all, thank you to everyone for trusting me to be president of MAIA for the upcoming year. It is an honor that I do not take lightly.

MAC Summit seemed to be a huge success again this year. April and MAIA staff did a fantastic job preparing for and running the event! Kudos to them! From the golf tournament and WEWIN Brunch, to the Young Agent Event, the interesting classes and the banquet, everything seemed to run very smoothly. If you didn’t attend, please consider doing so next year. The networking that is done at these events is invaluable.

The banquet seemed to be one of the best that I have attended. Congrats to everyone that received awards! All are well-deserved!

I had the pleasure of having my father, Brent, (as past president) swear in the new board of directors. Having the event in Branson was very special to him, as my grandfather was an integral part of the dam being built in Branson, which then brought all the tourism that has made Branson what it is today.

I would also like to thank our great group of employees, as I could not do my job without each and every one of them. I would also like to thank my grandfather, Keith Duren, for joining Scott Agency over 75 years ago, and laying the path for me to follow in his footsteps. I have great memories of my first few years when he would come in the office with his walking stick and discuss “what I was working on that day.”

I would like to thank the association. Matt and staff do a great job representing us…and April and her team do a great job preparing this fantastic conference.

I want to thank all my insurance family. You know who you are! Some of us have a group text that we send ideas out to occasionally and I of course have my Keystone family that we lean on frequently to run things by. Before we look forward, it

"I won’t take this responsibility lightly, and I recognize the weight of the decisions we make and the lives we impact, and I look forward to the duties ahead of me."

Matt Speight

For those who were unable to attend MAC Summit, below is my speech, including my goals for the next 12 months. I look forward to working for you all!

First, I would like to express my heartfelt thanks to the board of directors, MAIA staff and each one of you for your trust and confidence in me. I won’t take this responsibility lightly, and I recognize the weight of the decisions we make and the lives we impact, and I look forward to the duties ahead of me.

I would also like to thank my family: my wife Sara, kids Brandon, Lauren, Tyler and Brandon’s girlfriend Hannah, and my mom and dad. This is a family business and the agency now has four generations working there, as Brandon, Lauren and Hannah have all spent time working there.

Matt Speight, President, MAIA

vision and guidance over the last year. Under your leadership, we continue to lay the foundation for continued successes. You have become a friend and I have learned a lot from you, and hope I can continue to lean on you over the next year. I expect Deena and I will work together the same way for the next 12 months.

I’d like to share with you my vision for the future of our great association, and our industry as a whole. It has been a tough five years or so in the insurance industry. The hard market has brought many challenges, many of which are still active. Over the next year, there are some key areas where I think the board and I can help

continued on page 30

We’ve been Doing the Right Thing since 1964. We are a third-generation, family-owned, independent managing general agency and wholesale insurance broker with a history of valuing and trusting business relationships. Our underwriters and brokers coordinate among specialty teams to meet the needs of multi-faceted risk opportunities, piecing each risk puzzle together for our producers.

We strive to be a premier resource through our core pillars of honesty, integrity, respect and trust.

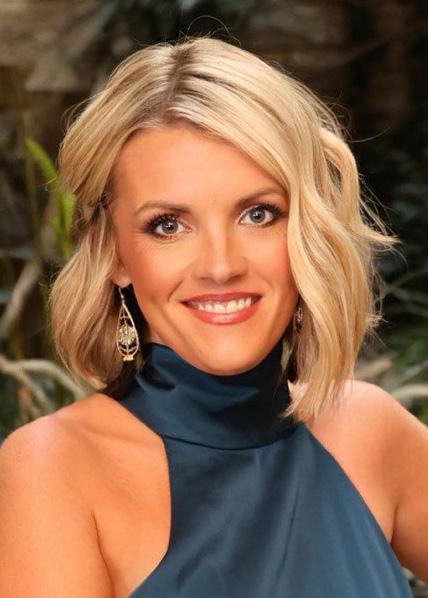

if you attended the Missouri Agents Connection (MAC) Summit in July in Branson, you were witness to a great lesson in and story of leadership in our industry. If you were not able to attend the Summit, or the banquet in particular, you really missed out on a wonderful and special moment for MAIA past president Randy Smart. A very deserving individual, Randy was presented the association’s highest honor, the E. Ellwood Willard award, during the banquet. This award, voted upon by the MAIA executive committee, is not one awarded every year and requires a unanimous vote by the committee. Upon accepting the Willard award, Randy provided heartfelt and touching comments to the attendees. I was struck (in a positive way) by numerous comments offered by Randy, but one in particular has stuck with me. He referred to the role that independent insurance agents play in their local communities. Whether it’s sponsoring little league teams, serving on the boards of non-profit entities or unselfishly giving their time to their local church or parish, independent agents are always “right there.” While I regularly see examples of this community involvement, I’ve never heard it referred to in the manner Randy described.

In my position, I am privy months in advance as to who will be honored during each year’s MAC Summit. Part of my job once the decisions are made by the executive committee and board of directors is to work with family, friends and co-workers to gather information about the honorees. As such, I worked with Randy’s daughter, Lauren, to obtain information about his professional and personal roles, and learn a bit more about what’s important to him. This article would be four or five pages long if I touched on all the events and causes Randy has been

involved in…and yet he continues to add to that list. To be honest, when I read the information Lauren provided me, a few thoughts crossed my mind, the first being when Randy actually sells insurance. But what stayed with me was what a wonderfully full life he has established and continues to enjoy.

In short, all of these events and causes to which he dedicates time and resources, financial and otherwise, are a great display of leadership.

That’s what independent agents do. They give to their clients and communities. They lead by giving back.

The focus of this month’s magazine is leadership, and that term means many different things to many different people. But considering the wide circle of people and entities agents work with on a regular basis, they are in a prime position to show leadership in their communities. I think back to my own childhood, some 40 years ago, and I recall insurance agencies sponsoring teams in the baseball league in which I played.

Interestingly enough, when I worked for the Missouri Department of Insurance I fielded on more than one occasion complaints from various insurance agents pertaining to their competition sponsoring sports teams. And why, you ask, would there even be a complaint about that? Some agents interpreted the anti-rebating laws in Missouri as prohibiting such a sponsorship. My view on those complaints was, “Seriously?” I always viewed that as just part of being a good community member.

How are you viewed in your community? Are you leading by giving back?

Matt Barton Chief Executive Officer, MAIA

We believe insurance should sound like a conversation, not a contract. So, we skip the jargon and meet you where you are—with tools, insights, and people who know your customers’ industries inside and out, from manufacturers and contractors to breweries and wineries.

That’s how partnerships work. And that’s how we work. Because at EMC, we’re all about Keeping insurance human®

Let’s get to know each other at emcinsurance.com

my recent attendance at the annual MAC Summit brought several issues back to mind as reminders of matters of continuing importance to producers. The presentation by Charlie Matejowsky was very interesting. While speaking generally on financial services and specifically on recent changes to various retirement-type accounts and uses, all of which are financial planning methods useful for agencies and their principals and employees, all the ideas he discussed were aimed at the central idea of insurance and risk management. Agencies deal every day with assisting clients with managing their potential exposures to risks that the clients have in their individual lives or their commercial enterprises. At the same time there are risks to agencies as well, and the financial management of the resources of the agencies are just as important as the management of risk the agency has for its operations. It’s a great reminder that risk exists for everyone and the same principles apply to managing the unexpected as well as to the management of financial resources.

additional coverage to manage the risk of a deductible on a loss that is more than the customer wants to absorb in a single time frame.

"...the financial management of the resources of the agencies are just as important as the management of risk the agency has for its operations. It’s a great reminder that risk exists for everyone and the same principles apply to managing the unexpected as well as to the management of financial resources."

Lew Melahn

Next, although I don’t sell in the marketplace like agencies do, I know from some personal experience and from many conversations with agency members, that finding great risk management and insurance coverage for property risks is very difficult today. I’ve unfortunately seen the problems that exist with percentage deductibles, particularly for wind and hail. Brock Elliott had useful options that could be used by some customers to find

And in the MAIA Education Bulletin I saw the October Fall Roadshows include a presentation by Angelynn Heavener on certificates of insurance. It seems like decades that I’ve been writing about the problems agencies face with certificates, maybe because it actually has been about two decades at least. And I’m still getting inquiries about how to handle certain requests from various parties wanting specific information in a certificate of insurance, whether warranted or not. This will be a great session for all agency personnel that deal with certificates of insurance. I’ve read the synopsis of the session and agree with everything in that outline. I plan to listen to the session just to see if there are ideas for managing unreasonable certificate requests that I haven’t thought of previously. They continue to be a source of misuse on a consistent basis. Carriers rely on certificates for a proof of insurance for audits in the calculation of premium for payroll-based premiums like workers’ compensation and some liability risks, but they show little interest in managing the use of certificates in other circumstances. That makes the certificates one of the most annoying parts of an agency’s customer service, as well as one that presents some risk if a certificate indicates coverage in an erroneous way. Every option an agency has to protect itself from this risk is worthwhile and I recommend attending this educational session.

Lewis E. Melahn, J.D.

Lewis E. Melahn is a practicing attorney who provides free legal consultation to MAIA members on a limited basis. He served as the director for the Missouri Department of Insurance from 1989-1993. You can contact Lew Melahn at 573-230-7200.

Expand Your Agency’s Impact with WalkerHughes Insurance

“The decision to join WalkerHughes wasn’t just about business growth, it was about honoring the legacy of my family and the values on which the business was built.”

Heather Wessels, Regional Director IBA joined WalkerHughes in 2024

A Forever Company

Committed to long-term growth and stability, ensuring your success for generations to come with:

Local Presence

Maintain the brick-and-mortar location and employee jobs in our communities

Employee Ownership

Own equity as a key employee or agency owner

Profit Sharing Program

Participate in a long-term incentive program built for all team members

Financial & Operational Security

Remain family and employee owned

CONTACT US for a confidential conversation about how we can grow together.

hether owned by an employer, relative, friend or neighbor, many of our personal lines clients have regular access to vehicles that they do not own and do not insure. This can be a wonderful perk.

What happens when, while using these vehicles, they become legally liable for bodily injury and/or property damage as the result of an auto accident? With owned vehicles, everyone understands the risks. Unfortunately, with regard to vehicles furnished or available for their regular use, clients and insurance professionals routinely fail to identify and address possible coverage gaps.

The personal auto policy is the mostwritten insurance policy in this country. For liability exposures, we must understand this coverage form’s definitions, insuring agreements, exclusions and conditions.

Let’s first review summaries of important definitions that must be understood when discussing liability coverage in the personal auto policy (PAP):

“We”, “us” and “our” – the company providing liability coverage

“You” and “your” – the named insured as shown in the declarations and the resident spouse of the named insured

“Family member” – a person related to “you” by blood, marriage or adoption who is a resident of “your” household

“Your covered auto” – any vehicle shown in the declarations, any vehicle that meets the definition of “newly acquired auto,” any trailer you own or any auto or trailer used as a temporary substitute for any of these vehicles because that vehicle is out of its normal use due to breakdown, repair, servicing, loss or destruction

“Insured” – as used in liability coverage includes “you” or any “family member” for the ownership, maintenance or use of any auto

Liability coverage begins with this coverage part’s insuring agreement –

A. We will pay damages for "bodily injury" or "property damage" for which any "insured" becomes legally responsible because of an auto accident. Damages include prejudgment interest awarded against the "insured". We will settle or defend, as we consider appropriate, any claim or suit asking for these damages. In addition to our limit of liability, we will pay all defense costs we incur. Our duty to settle or defend ends when our limit of liability for this coverage has been exhausted by payment of judgments or settlements. We have no duty to defend any suit or settle any claim for "bodily injury" or "property damage" not covered under this Policy. PP 00 01 09 18

The liability coverage grant is incredibly broad. We must understand that exclusions and conditions can eliminate the promises found therein.

Exclusions exist in PAP liability for two reasons:

1. Underwriting: “Insureds” may engage in unacceptable activities or the type of vehicle and/or its use may present unacceptable risk.

2. Pricing: Actuaries may simply not allow the acceptance of some risks without additional premium. These situations are routinely addressed with endorsements. For vehicles furnished or available for regular use, an exclusion that affects those identified as “you” and

Sam Bennett, CIC, AFIS, CPRM, TRIP, CRIS, CPIA

MAIA Coverage Advisory Committee, Harrison Agency, Inc.

If you encounter any issues with policy forms, coverage gaps or problematic language, please report them to MAIA’s Coverage Advisory Committee so they can work on getting them corrected through their discussions with ISO, NCCI and ACORD.

why is it vital for you to audit your agency regularly? Auditing will help you identify errors in your files and help ensure your staff is adhering to agency policies and procedures while maintaining a high level of documentation quality.

• This can help to reduce your agency’s exposure to E&O claims while improving efficiency and customer satisfaction.

• You can identify areas where employees may lack understanding and provide them with additional training.

• It demonstrates to the staff that they will be held accountable if they are not adhering to agency expectations. Employees not meeting the agency’s expectations increase the potential for an E&O issue to arise.

Who should conduct the audits? This will largely depend on the size of the agency and quantity of files to be reviewed. However, individuals should have sufficient experience with the material they will review and have been provided with training on the audit process.

How many files should be reviewed? This will vary depending on the work performed and the frequency of the audits. A benchmark of 10% is a place to start – but you must consider what makes the most sense for your agency. For newer or less experienced staff, a higher number of files should be reviewed. This will help identify areas where additional training may be needed. However, even experienced staff members can make errors, so include them in the process.

How often should files be reviewed? Perform audits monthly, if possible, to quickly identify any emerging issues or need for additional training.

What areas of the agency should be audited? Because your agency likely consists of numerous disciplines – such as marketing, customer service, sales, accounting, etc. –ensure that each of these areas is reviewed. Each has procedures that, if disregarded or not performed properly, could cause problems for the agency.

Analyze the results for individual

employees and for the agency once the audits have been completed. Do specific areas/individuals stand out? Do your policies and procedures need modifications for clarity? Is additional training necessary? Advise employees who performed well and thank them for their efforts and commitment. For those that are not performing well, meet with them to better understand the reasons and help them improve.

There are two ways to find out if your staff isn't meeting the job expectations: perform audits or wait for an E&O claim to develop. While performing audits takes commitment and time, it is more cost effective than the alternative.

8 Steps to Take When Auditing Your Agency

1. Determine the workflow or process to be evaluated.

2. Identify the steps in the workflow or process as it is intended (make it fit your organization).

a. Match to your policy, or

b. Match to information expected to be gathered on new accounts, or

c. Non-compliance with an established process

3. Determine the review period. You may choose to begin by reviewing 30 files or 10% of total volume for an initial sampling. For best results, perform the workflow review regularly.

4. Identify if there are any reports that can be run within your agency management system that can assist with your auditing process.

5. Have a staff member who’s removed from the process evaluate the steps in the process.

6. Analyze results. Identify gaps in which the actual practice did not meet the intended workflow.

7. Provide real-time feedback to employees on their performance and any gaps in expected performance identified in the audit.

8. Develop an action plan to improve any areas of non-compliance.

They’re not just workers. They’re people.

Injuries happen — even when a business does everything right. With West Bend workers’ compensation coverage, you not only help protect your client’s business, but you also give them peace of mind that their people are being cared for.

We help you deliver the coverage your clients need with the service they deserve.

That’s the power of The Silver Lining® .

The Worst Brings Out Our Best®.

it’s a financial strategy that allows businesses to pay their property/casualty insurance premiums over a period of time rather than in a lump sum. It is a way to use other people’s money to take advantage of a great cash management option. With the innovation of direct billing platforms, we’ve seen a reduced need for premium financing in general, yet it continues to be an integral and vital part of the property and casualty insurance world. As long as agency bill exists, premium financing will be there to answer that need. What is new in the premium financing industry that has been static for years? The industry was born sometime around 1935, then began to take off in the mid-1950s. For decades, premium financing remained virtually unchanged. In the last handful of years that static state has changed significantly. Now we see new services to answer agency wants and needs, such as integration, fully electronic collection of signature and payment to include not only premium financing down payments but also annual pay-in-full clients. We strive to offer a product that is user-friendly and seamless, while at the same time fully serving the agency with ease-of-use products and everincreasing efficiency.

What factors should you consider when choosing a premium financing partner? First and foremost, customer service! Precisely what services are provided? What services do you expect to receive from your provider? Do you know what supplemental services are available? They vary from provider to provider – you need to ask! Examples may include, but are not limited to: How is the processing done? Who creates the agreement? Who collects the down payment? What is the timing of funds disbursement? Where will the funds be dispersed? Will it integrate with your agency management system?

You also may want to ask what additional services the provider will offer to your clients:

When is the late fee incurred? How are the insured and agency notified of pending cancellations? Are there any options for delaying the cancellation? What if the insured cannot make the required payment? What technology is available? Benefits may include supplemental services such as reminder phone calls to alert the insured to a missed payment, or an extended grace period that lowers the overall cost of the loan by virtue of less late fees. How do the services offered serve you and your client? What helps the insured, helps the agency. How do those services compare to other providers you may be considering? How accessible is your key contact at the provider? Can you reach them in 15 minutes?

An important consideration, particularly for those agencies that process more than two or three finance agreements each month, is integration. Integration helps to ensure a dynamic distribution strategy with the goal of improving overall efficiency. Each product comes with its own pros and cons that constantly evolve and improve. The agency will need to align those services with their specific workflow needs.

Revenue sharing is another consideration. continued on page 31

mAIA, among our peer associations in other states, has a very good track record of working with the Missouri legislature on laws that benefit our clients, making sure that insurance continues to be available and affordable in Missouri. Unfortunately, as you may be aware, we have not been as successful recently with regard to tort reform.

While the cost of property insurance is foremost for the average person due to wind and hail concerns, there is a growing crisis in liability insurance. Certain classes are no longer available in standard markets, resulting in price increases up to 10 times the prior year premium; high umbrella limits are increasingly difficult to obtain. The cause is not reckless Missourians, but our court system, whose rules are largely set by the legislature, whose members’ campaigns are increasingly funded by trial attorneys.

bag if they have deep pockets. Juries cannot be informed that the plaintiff’s attorney will reap a high percentage of damages awarded, or that a third party – sometimes even hostile foreign governments – are funding the plaintiff’s legal expenses as an investment. There are other issues I couldn’t begin to explain in an article this size. Obviously, the goal is a balanced system where wronged parties are compensated fairly, and the costs of those damages are predictable.

"Obviously, the goal is a balanced system where wronged parties are compensated fairly, and the costs of those damages are predictable."

Tony Becker

“Tort reform” is a blanket term and includes a long list of complicated issues, but generally refers to attempts to improve the litigation landscape. Collectively, these add up to an additional cost that is passed on to each and every Missourian, whether directly or via increased overhead costs for the businesses that we patronize. A ”tort” is a wrongful act committed by one party that damages another party and leads to civil liability; as most people don’t know what a “tort” is, I’m going to encourage us to use a simpler phrase, like “lawyer tax,” to characterize this problem.

For instance: Missouri has an abnormally long statute of limitations, five years, for the vast majority of civil court cases. We have a standard for “contributory negligence” that frequently leaves a minimally involved party holding the

MAIA’s board of directors made a very significant financial commitment at its May meeting toward attacking this problem from a new angle. By the time you read this, we will have put out an RFP for a specialist lobbying/ campaign firm to supplement BurtonLiese, who continues to do a great job on routine legislative issues. We are meeting with other trade associations including insurance carriers, as well as trucking, hospitality and other industries that are affected by this growing crisis.

To combat the misinformation out there on this topic, we need statistical data from carriers, as well as memorable stories of how these claims can spiral out of control. (These reports are often difficult to obtain because they’re frequently in litigation, or subject to nondisclosure after the case is settled.)

Outgoing MAIA president Dennis Luebbering gave me a presidential citation at the MAC Summit for, among other things, my service in chairing this task force. That award was appreciated, but probably not deserved… yet. But I don’t like to lose. With YOUR HELP to raise awareness of this issue among your business clients and your state senators and representatives, and the combined resources of our industry and others, we can and must win this fight on behalf of our clients.

Tony Becker, CIC, CRM Chair, MAIA Tort Reform Task Force, Custom Insurance Services, Crystal City

PRESIDENT Matt Speight Scott Agency

Montgomery City mspeight@scottagency. net

PRESIDENT-ELECT

Deena James St. Louis Insurance Services, LLC

Manchester deenajames@ stlouisinsuranceservices.com

VICE PRESIDENT

Jim Neuner

Winter-Dent & Company

Jefferson City jim.neuner@winter-dent.com

Secretary/Treasurer

Nick Brenizer

Golden Rule Insurance Agency Osage Beach nick@goldenruleinsurance.com

IIABA NATIONAL DIRECTOR

Brad Greer

Arnold Insurance

Chesterfield brad@myarnoldteam.com

PIA NATIONAL DIRECTOR

Randy Smart

Smart Insurance Agency

Marionville rsmart@ smartinsuranceagency. com

REGION 1

Ross Ingersoll Ingersoll Insurance Agency

Savannah ross@ingersollinsurance. com

REGION 4

Mark Baker

JBLB Insurance Group

Platte City mark@jblbinsurance. com

REGION 2

Matt Alexander

Alexander Insurance Agency, LLC

Saint Charles matt@alexins.com

IMMEDIATE PAST PRESIDENT

Dennis Luebbering Luebbering Insurance Agency

Jefferson City dennis@li-ins.com

REGION 5

Rick Prather

Acrisure Midwest Jefferson City rprather@acrisure.com

REGION 6

Dave Linhardt

Charles L Crane Agency Company

Chesterfield

dlinhardt@craneagency. com

REGION 7

Paul Carcagno

Arnold pcarcagno@ bankwithsouthern.com

REGION 8

Heath Greer

Arnold Insurance

Chesterfield

heath@myarnoldteam. com

REGION 3

Holly Stark

Stafford-Leavitt Insurance

Harrisonville holly@staffordagency. com

REGION 9

Parker Mills

Fortress

Clinton parker@ thefortressinsurance.com

REGION 10

Richard Ollis Ollis/Akers/Arney Springfield richard.ollis@ollisaa. com

REGION 11

David Hall Ozark Hills Insurance West Plains david@ ozarkhillsinsurance.com

REGION 12

Lara Moffitt MHJ Insurance Agency Poplar Bluff lmoffitt@mhjinsurance. com

At-Large 1

Andy Reavis Missouri Insurance Services, LLC Billings areavis000@gmail.com

At-Large 2

Clare Zanger Rich & Cartmill Ozark czanger@rcins.com

At-Large 3

Jon Stahly WE Walker-Lakenan Cape Girardeau jstahly@wewalker.com

Past presidents in attendance for the installation banquet

How did you get involved in the insurance business? I was raised in the insurance business, but had never really thought about working in the industry until I started working at a regional insurance company in college.

How did you first get involved with MAIA? I became active in Young Agents as soon as I started with the agency.

What is the greatest benefit you have received from being active with MAIA? Making lifelong friends in the industry. Some of my closest friends in the industry I would not know as well if not for MAIA.

What is your educational background? I graduated from Montgomery County R-II High School and then University of Missouri in Columbia.

What was your first job? I mowed lawns, but my first “real” job was a teller at First Bank.

Who has had the biggest influence on your career? My parents and my grandpa. Some of my best memories were Grandpa coming in the office every day with his cane either before or after lunch at the Senior Center.

Are you married? Yes, Sara and I have been married for 22 great years. Do you have any children? 3 – Brandon (20), Lauren (18) and Tyler (15).

Do you have any pets? Tell us about them. 2 golden retrievers – Sophie and her daughter, Sadie.

What are your favorites? Food – Pizza Color – Blue Music – ‘90s rock TV show – “Friends” Movie – “Dumb & Dumber”

What do you see as some of the biggest issues facing Missouri’s independent agents today? Hard market, large renewal increases and tort reform.

What are some of your goals this year? Continue to grow the agency at an above-average pace.

What advice would you give someone starting a career in insurance? Work hard and believe in yourself. Put the work in and it will pay off.

What celebrity would you most like to meet? Bo Jackson, my all-time

favorite athlete.

What is your most memorable travel experience? Traveling to Montana with my grandpa as a kid.

What are you really bad at that you’d love to be great at? Singing

Do you have any phobias? Snakes

What are some of the crazy fads you and your friends went through? Tall white socks with stripes, tight rolled jeans, frosted tips hair.

Marissa Dirnberger VanGennip Insurance & Financial Services

The Young Agent of the Year Award is given to an agent who is 40 or younger who has demonstrated dedication to this profession by involvement in local, state or national activities; who has made personal efforts to further themselves as an insurance professional; and who is involved in their community

Marissa is the owner of VanGennip Insurance & Financial Services. She graduated from Leopold High School in 2008 and went on to get her Bachelor of Science in business administration from Southeast Missouri State University in 2013. When she started her agency in 2018, she imagined an agency where the client would come first. She wanted to help clients prepare for the unexpected and help lessen the traumatic effects of uncontrollable events that happen in life. Her business is based on honesty and integrity where they value their relationship with their clients.

Travelers Insurance

The Top Partner Award is given to a company with a strong commitment to the independent agency system and one that supports MAIA.

Founded over 170 years ago, Travelers Insurance has earned a reputation as one of the best property-casualty insurers in the industry because they focus on taking care of their customers.

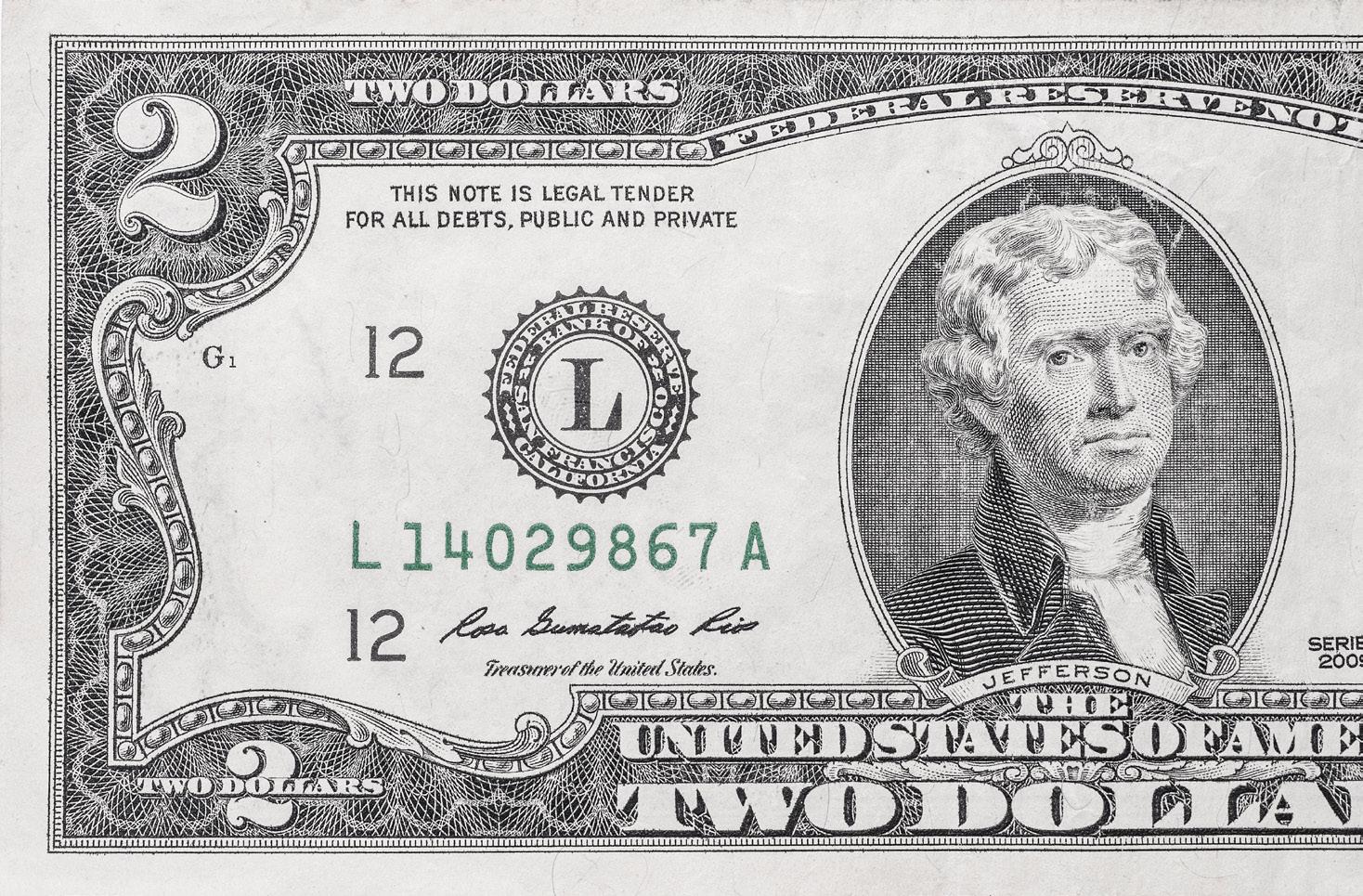

In 1864, Hartford businessman James Batterson met a local banker, James E. Bolter. Batterson and several townsmen were organizing a company to introduce accident insurance to the United States. Bolter asked Batterson how much he would charge to insure him for his four-block walk home. “Two cents,” Batterson said. Today, that two-cent “premium” is a souvenir treasured by the carrier. Batterson went on to serve as president of the company from 1864 until his death in 1901.

After recognizing the need for a local insurance company to deal with the increasing threat of fire, Alexander Wilkin and 16 other St. Paul businessmen established the St. Paul Fire and Marine Insurance Company, which formed the St. Paul Companies, Inc. in 1968.

The St. Paul Companies and Travelers merged in 2004, to form one of the largest property-casualty insurers and financial services firms: The St. Paul Travelers Companies, Inc., now The Travelers Companies, Inc.

Presidential Citations are given on behalf of the association's president to individuals for outstanding contributions to the association.

Tony Becker

Custom Insurance Services

Tony served on the MAIA board of directors from May 2017 through August 2025, and currently chairs both the Membership Engagement Committee and the Tort Reform Task Force.

Henry Powers

VIAA

Henry and VIAA contribute to the growth of membership and provided information that helped guide the board of directors in forming the Tort Reform Task Force.

Heath Greer

Arnold Insurance

Heath, as chair of the Government and Industry Relations Committee, has kept the board of directors informed regarding issues that affect both our industry and the consumer. His insights were crucial in helping form the Tort Reform Task Force.

Award

Randy Smart

Smart Insurance Agency

The E. Ellwood Willard Outstanding Service Award is a special award of the executive committee given to an individual who has provided outstanding service to the association over a period of time. This award is one that is not given every year.

Randy has continually given back to this association, the industry and his local community. He has served on nearly every committee within the association, graciously giving of his time for the betterment of the industry, all while being an active part in the lives of his two kids and five grandkids. He is a past president of the association, and is currently MAIA's PIA National Director.

He is an active member of his church and his community, supporting a multitude of organizations too numerous to mention here with his time, money and expertise.

Randy and his wife, Gayle, will celebrate 50 years of marriage next year. Together, they own and operate Smart Insurance Agency in Marionville, along with their daughter and son-in-law.

The Insurance Person of the Year Award is presented to an individual who has significantly contributed to the American Agency System within the state of Missouri.

Heath holds an MIS degree from Maryville University. He and his father are shareholders and manage a significant book of business at Arnold Insurance, a Keystone Agency Partner platform agency. He joined his father in the insurance industry following an executive career in the IT world with a publicly traded international firm.

With a strategic mindset and a track record of operational excellence, Heath has worked tirelessly to bring the legislative process out of the Government and Industry Relations Committee that he chairs and into the focus of the MAIA membership as a whole. He previously served on the St. Louis Independent Agents Association board of directors and as president.

The Committee of the Year is presented to MAIA committees for their outstanding contributions to the association.

In 2024, this committee was formed with a vision to champion the growth and empowerment of women in the industry. Born from a collective recognition of the need for enhanced networking opportunities and resources for women, their mission was to cultivate an environment where women can thrive and inspire one another.

A highlight of the committee's initiatives was the introduction of a brunch during the annual MAC Summit. The enthusiasm surrounding the brunch was overwhelming, propelling the committee to envision a more expansive initiative: a retreat scheduled for 2026.

The Company Representative of the Year Award is given to an individual who conducts the majority of his/ her business in Missouri and who has done the most to promote MAIA, foster better company/agency relations, produce new business and/or help agents give their clients the best service in the industry.

Curtis Hicks began his journey in Missouri as a commercial underwriter. His skill and drive led him to his company’s home office in Lansing, Michigan, where he was entrusted with some of the largest accounts in the company. But when the opportunity arose to return to his roots in St. Louis, he didn’t hesitate.

With 10 years at Auto-Owners Insurance, he brings a deep and well-rounded background to his role as marketing representative. The last three years, he has served in the field, where his commercial underwriting expertise has been an asset to agencies navigating the challenges of complex accounts in a complex market.

What sets him apart is his integrity, candor and commitment to doing things the right way. Curtis Hicks is not just a trusted advisor to his agencies—he is a true partner in their success.

are you getting tired of trying to explain to your clients why their insurance premiums have risen so much? Or why some coverages are increasingly hard to find markets for? You’re certainly not alone. While there are several reasons for the increasing premiums and shrinking markets, one of the major contributing factors is legal system abuse. Frivolous lawsuits and inflated claims are adding billions of dollars to insurance costs—and most consumers don’t know it. In fact, one study shows that legal system abuse costs the average American family an additional $5,135 per year. What family couldn’t put that money to better use?

In an effort to help agents address this issue with clients, Trusted Choice has developed the Legal System Abuse Toolkit. This resource gives you simple ways to educate clients, explain rising costs and advocate for common-sense legal reforms—helping protect both your customers and your business. Members can download the toolkit at https:// lp.independentagent.com/legal-system-abuse

One of the major contributors to legal

system abuse is the rise of third-party litigation funding (TPLF). TPLF allows investors with no direct involvement in the legal dispute to provide funding for a lawsuit in exchange for a share of any settlement or judgement. Because many TPLF agreements are structured to qualify for capital gains treatment, the third-party funders typically pay a lower tax rate on their proceeds than does the plaintiff (the actual injured party), who typically must pay ordinary income tax rates on any taxable awards they receive. Because of the current tax treatment, TPLF is particularly enticing to foreign investors, who often end up paying no taxes on their proceeds. In many cases, the third-party funders ultimately receive more money from the lawsuit than does the plaintiff. Additionally, these individuals and entities often hail from nations not otherwise on favorable diplomatic terms with the United States, thus posing a possible national security issue.

The Big “I” has been lobbying to both close this tax loophole, as well as increase the transparency of TPLF by requiring disclosure of such funding to parties or potential parties to a trial in order to reduce frivolous lawsuits, reduce settlement costs and improve the integrity of the legal system.

As originally drafted, the Senate version of the One Big Beautiful Bill Act would have subjected third-party litigation funders to a new tax and also specified that TPLF proceeds do not qualify for capital gains treatment, thus closing the loophole that allows foreign investors to avoid U.S. taxes. Unfortunately, this provision was removed by the Senate parliamentarian for failing to meet a procedural requirement.

Though the TPLF provision did not make it into the final One Big Beautiful Bill Act (“the act”), there is good news for many of our member agencies. Probably most importantly, it extends the tax reforms that were initially passed by Congress in 2017 and makes permanent the 20% tax deduction for income derived from pass-through entities, which otherwise would have expired at the end of

Download the Legal System Abuse Toolkit at https://lp.independentagent. com/legal-system-abuse

this year. It is estimated that a vast majority of MAIA member agencies operate as pass-through entities, and the Big “I” Government Affairs team has been working diligently for years to make sure those tax cuts became permanent. Another provision of the bill reinstates the annual administrative and operating (A&O) inflation adjustment for crop agents beginning with the 2026 reinsurance year. This inflation adjustment will provide significant relief to crop insurance agents who have had their commissions effectively cut for almost a decade. Reinstating the annual inflation adjustment has been a priority of The National Association of Professional Insurance Agents (PIA) since the Risk Management Agency stopped making annual inflation adjustments to the A&O subsidy cap in 2016, effectively cutting agent crop insurance commissions. Crop insurance is vitally important to the American farming system and this allows professional insurance agents to be compensated for their work.

The Big “I” will continue to work on other avenues to curb the abuse of TPLF, as well as other tort reform measures that will improve the legal landscape. To be effective – like they were with the 20% tax deduction for passthrough entities – they need our help. If you haven’t made your contribution to InsurPac yet this year, please take a moment and do it now. In fact, the provisions included in the act likely more than pay for your contribution.

continued from page 11

“your” must be addressed. A very important endorsement can be used to ‘buy back’ coverage, but the insurance professional must understand when and how to use it.

PART A – LIABILITY COVERAGE

B. We do not provide Liability Coverage for the ownership, maintenance or use of:

2. Any vehicle, other than "your covered auto", which is:

a. Owned by you; or

b. Furnished or available for your regular use.

This exclusion is quite sensible. The definition of “your covered auto” includes any vehicle shown in the declarations and well as a “newly acquired auto.” These vehicles undergo underwriting scrutiny and premium is developed. Any other vehicles owned by, or furnished or available for regular use, have not been underwritten –nor has premium been collected.

Please note that if this exclusion applies to any “you” it applies to all those who meet the definition of “you.” For example, if Joe and May are named insureds, they are both “you” by definition. If May has an employerowned vehicle provided for her regular use, the exclusion would apply to both May and Joe – even if the vehicle is not technically provided for Joe’s regular use.

Likely, May’s employer has secured liability coverage on the vehicle. But, what if the limits are insufficient or an exclusion (for example, pollution or fellow employee) or problematic condition eliminates coverage (and defense) after an auto accident? If that vehicle is insured on a Business Auto Coverage Form (BAP), it is likely that May is an insured on that policy as she has likely been afforded permission by the BAP’s named insured. But, what about Joe? He may or may not be an insured on the BAP when he is using the vehicle.

What about a vehicle owned by Joe’s elderly Aunt Sadie who lives across town? Joe may routinely use the vehicle to run errands for her or take her to church and doctor appointments – so much so that Joe has a key to Aunt Sadie’s car on his key ring. Would that vehicle be considered furnished or available for Joe’s regular use? What if Aunt Sadie forgets to pay her PAP insurance premium? If Joe were at fault in an auto accident in that vehicle, and there is no insurance on the car itself, would this exclusion prove problematic for Joe on his own PAP? The answer is yes. No coverage. No defense. Ouch.

How can we address this exclusion?

Extended Non-Owned Coverage – Vehicles Furnished or Available for Regular Use (PP continued on page 38

yber liability insurance is no longer a “new” coverage, and hopefully it is something every agency is offering to every client. Being a technology-driven coverage, however, does make it one of the fastest-changing types of insurance available, which makes it difficult for the average agent to become (and remain) an “expert” on the coverage. Cybercrime has become its own industry, and the tactics employed by hackers are constantly evolving – including incorporating the use of AI into their attacks. This makes it increasingly difficult for businesses to prevent breaches even with significant cybersecurity measures in place.

Due to the amount of personally identifiable information insurance agencies collect, they are frequent targets of hackers. Because there are so many different types of cyberattacks, you need to make sure your agency has a robust cyber policy in place to protect your agency, your clients and your livelihood. Are you endorsing your cyber coverage onto another policy? Did you purchase your cyber policy based on price? If so, you likely need to take a close look at what your policy covers…and more importantly,

what it doesn’t cover.

Beazley is routinely named a top cyber carrier in the nation, and MAIA has partnered with Arlington/Roe to offer our members the Beazley Cyber Secure policy, which provides comprehensive coverage, varied limit options and affordable rates in a pre-set slot-rate program for members that qualify.

Some of the benefits of the Beazley policy include:

• HIPAA compliance tools

• Step-by-step procedures for compliance

• Newsletters

• Data breach coach to help with notification

• Forensic investigators

• Privacy counsel

• Call center

• Credit restoration services

• Online compliance materials

• Staff training programs

• Expert online support

• Regulatory fines and penalties

• Public relations firm

• Notification costs outside limit of liability

• Credit monitoring

• Security and privacy liability

To obtain a quote or to find out more about the Beazley policy, visit www.moagent.org/cyber, email insurance@ moagent.org or call 573-893-4301 to speak to one of our insurance department staff.

• Business email compromise and funds transfer fraud make up 60% of all cyber claims

• Smaller businesses (those with under $25M in revenue) made up 64% of claims last year

• The average cost of a ransomware event (including the business interruption and recovery costs) is $292,000

continued from page 5

MAIA have an even more meaningful impact: First, very frequently MAIA employees and we board members hear, “What does the association do for me?” very similar to what I hear being involved in our local Chamber of Commerce, when we hear, “What does the Chamber do for me?”

I want to emphasize the benefits that the association offers to all of us. Many of us take advantage of a multitude of offerings, but many agents only join MAIA for E&O coverage, or other insurance offerings. We recently took a survey of board members on what offerings they use and we also discussed other ideas to offer to our membership, so hopefully more to come on that over the next few months.

Secondly, the legal climate in Missouri has made it a struggle for some insurance carriers to continue to do business in the state. Matt Barton, Chris Leise and Larry Case work very hard in discussions at the Capitol on a regular basis. Tort reform is going to be a very big topic for all of us in this room over the next year. Matt, Chris, Larry and the board are going to work very hard to keep things moving in the right direction for us in

Jefferson City (and D.C. as well).

I would like to end with asking each of you to make a difference in the association. Attend an event that you haven’t attended before, especially Day at the Capitol in Jefferson City, or even better, the IIABA Legislative Conference in Washington, D.C. I have been to D.C. several times and have even taken each of my children. If you can’t make it to D.C., reach out to your senator or representative, and discuss the insurance issues that are important to you. Contributing to InsurPac and MAPAC is very important, but so is letting the legislature know what is important to you and why.

See page 20 to get to know more about MAIA's new president!

continued from page 15

Insurance carrier partners often offer to share with the agency their profit on your customer base…is your premium financing partner sharing with you their profit on your customer base? You should ask.

There are many premium financing partners to choose from. Some providers offer no more than basic loan agreement processing. Others offer certain partnering benefits; this is a consideration to review and evaluate.

Last but certainly not least, you will want to consider the provider’s reputation for being a great relationship-building partner. This can easily be one of the most important things to consider in the premium financing partner you choose. Sometimes unexpected things happen. Will the premium financing partner you chose be quick to respond with a solution? Does the partner you chose value partner relationships, and evidence that by offering solutions? How will your partner respond to an unusual request when you need them?

Unique features can also be offered above and beyond the basic loan processing service.

A few to consider are their cancellation prevention policy – do they offer extended grace periods, or even split payment options?

Technology is growing so quickly and expanding to a point we never imagined even a few years ago. It is a dynamic element of our industry. Just when you think you have seen the best tech yet – out rolls something better! We now routinely see integration with your management system, fully electronic collection of signature and down payment but also annual pay-in-full clients. We are happy to deliver the most efficient way of doing business.

In summation, today you have choices! Check around.

Columbia Insurance Earns National Recognition for Outstanding Culture

Columbia Insurance earned recognition as a 2024 Employee Experience Top Performer from DecisionWise, a global leader in employee engagement and feedback solutions.

Columbia is one of seven in an elite list of medium-sized companies to receive this award.

The annual honor goes to organizations with survey results ranking in the top 10% of DecisionWise’s global database. Based entirely on employee feedback, it reflects Columbia’s commitment to fostering a workplace culture where employees feel valued, supported and empowered to grow.

“This recognition is especially meaningful because it comes directly from our employees,”

said Todd Ruthruff, Columbia’s president and chief executive officer. “We believe that when people thrive, business thrives. This award affirms the strength of our culture and the dedication of our team.”

Since 1996 DecisionWise has surveyed employees worldwide measuring key drivers of engagement, retention and enthusiasm. Columbia’s inclusion among the top performers highlights its success in creating an environment where employees are not only engaged but inspired.

“Our people are the heart of Columbia Insurance,” said Julie Rinehart, vice president of human resources. “We’re proud of the culture we’ve built together—one that encourages collaboration, celebrates growth and puts people first.”

JM Wilson has been acquired by Ryan Specialty, a widely respected international organization with a commitment to service and integrity. JM Wilson will be joining the RT Specialty brand within Ryan Specialty.

As a third-generation, family-owned business, JM Wilson always believed in building strong relationships and doing right by their customers. That won’t change. Agents will continue working with the same team of underwriters they know and trust. What will change is the opportunity this brings for both employees and customers. By joining forces with RT Specialty, underwriters and support teams will now have access to greater resources and tools that will help to serve their clients even better.

In the short term, you’ll continue to see RT Specialty / JM Wilson on communications and materials. Over time, that will transition to RT Specialty.

After 50 years in the business, JM Wilson president David Wilson is retiring. “It’s been the honor of a lifetime to carry on the legacy my grandfather began and to work alongside such dedicated employees, trusted carriers and dedicated insurance agents,” Wilson said. “I’m incredibly proud of what we’ve built together, and I’m confident the future is bright under the leadership of RT Specialty.”

As Chris-Leef General Agency prepares to celebrate their 40th anniversary next year, they are introducing a new logo and a fresh look, centered around a message that captures their ongoing commitment to their partners. More than just a rebrand, it is a promise to continue serving their clients with the same values that have guided them from the start, while evolving to meet the needs of an ever-changing industry.

Columbia Insurance is excited to announce that AM Best, a global credit rating agency, affirmed Columbia Insurance’s Financial Strength rating of A- (Excellent) and has improved their outlook from stable to positive. AM Best also confirmed the Long-Term Issuer Credit Rating of “a-” (Excellent).

This noteworthy development underscores that Columbia’s family of companies has a strong financial foundation and recognizes the success of its forward-thinking strategies.

“This is a great moment for all of us at

Columbia,” said Todd Ruthruff, president and chief executive officer. “The positive outlook from AM Best is a reflection of the discipline, innovation and passion our team brings to everything we do. It signals to our customers that we’re strong, and we’re getting stronger.”

AM Best’s decision highlights Columbia’s improved operating performance, driven by refined underwriting and a more diversified portfolio. These efforts have delivered solid results over the past two years and into early 2025.

First Mid Insurance Group’s Senior Solutions Division Receives Million Dollar Agency Award

First Mid Insurance Group’s Senior Solutions division, which assists Medicare beneficiaries and seniors with their health insurance needs, received the 2024 Million Dollar Producers Award from Senior Marketing Specialists. In addition, they were recognized for impacting 1,019 lives in 2024 through service and sales to their customers.

“This recognition is a meaningful reflection

of the commitment of our Senior Solutions team to serving clients with integrity, care and expertise—especially the seniors who rely on us in our communities,” said Clay Dean, CEO of First Mid Insurance Group. “We remain committed to helping individuals navigate their Medicare options with confidence and clarity. Our continued partnership with Senior Marketing Specialists is extremely valuable and we are grateful for the trust placed in us by both our clients and partners.”

Senior Marketing Specialists works with nearly 10,000 agents nationwide. Receiving this award recognizes First Mid Insurance Group as part of the top 1% of an elite group of advisors that help more people choose the right insurance benefits for themselves.

The Springfield Business Journal recently honored Ollis/Akers/Arney, Springfield, with an Economic Impact Award. These awards are given to organizations who demonstrate a commitment to their communities. Nominations are submitted from across the community, and the businesses are scored on financial performance, community involvement and impact on the region.

Ollis/Akers/Arney was honored in the 75+ years in business category, having been founded in 1885. “We’re really proud of the fact that we were founded right here in Springfield, Missouri," said Richard Ollis, CEO. “We continue to serve southwest Missouri in about a four-state region around us and that’s really important to us.”

The agency supports more than 35 charities, and team members are given eight hours of leave annually for volunteer work. “The community is where we live, work and obviously earn a living,” Ollis says, “and it’s a responsibility to give back to that community.”

Apogee Insurance Solutions

WalkerHughes Insurance (“WalkerHughes”), a privately held, founder-led retail insurance brokerage headquartered in Indianapolis, Indiana, has aquired Apogee Insurance Solutions, LLC (“Apogee”), a St. Peters,

Missouri-based insurance agency, to its growing Missouri platform. This marks WalkerHughes’ second acquisition in Missouri and a continued step forward in its regional expansion strategy.

Apogee, which specializes in personal lines and commercial insurance, has served the St. Louis metro area with a strong reputation for client service and community commitment. With the agency’s owner, Kyle Heywood, exiting the business, long-time team members Jessica Grotewiel and Amanda Knott will remain in place, ensuring continuity and trusted service for clients. Both bring nearly two decades of combined experience and will be integrated into the WalkerHughes Missouri operations.

“The momentum in Missouri is incredible, and welcoming Apogee is another exciting step forward,” said Heather Wessels, regional director at WalkerHughes. “Each new partnership strengthens our presence in the region, honors the legacy of local agency leaders, and reaffirms our commitment to building lasting relationships within

the communities we serve. We’re thrilled to welcome the Apogee team to the WalkerHughes family.”

The integration of the Apogee team with the WalkerHughes Missouri office will strengthen service offerings across the region and deepen the organization’s impact within the communities it serves.

Centered Insurance Partners LLC, Chip Smith, St. Louis

Just Insurance, De’Ondre Ross, St. Louis Strange Insurance Agency LLC, Lisa Lightfoot, Ironton

Do you have news you want to share about your organization in the Missouri Agent magazine?

Send your news to: marketing@moagent.org

Tyler Cook, Crystal City, Mo., refusal to renew license

Evercare Direct, St. Charles, Mo., voluntary forfeiture of $7,500

Damenion Freeman, Aurora, Ill, voluntary license surrender

John K. Miller, Salt Lake City, Utah, voluntary license surrender

Jolene Kat Rounkles, St. Joseph, Mo., refusal to issue license

Hartford Casualty Insurance Company, Property & Casualty Insurance Company of Hartford and Trumbull Insurance Company, Hartford, Conn., stipulation of settlement and voluntary forfeiture of $30,000

Hartford Insurance Company of the Southeast, Hartford, Conn., stipulation of settlement

American Automobile Insurance Company,

Chicago, Ill., examination report adopted with curative action ordered

Cigna Dental Health of Missouri Inc., Sunrise, Fla., examination report adopted with curative action ordered

Cigna Healthcare of St. Louis Inc., Bloomfield, Conn., examination report adopted with curative action ordered

Essent Title Insurance, Inc., Radnor, Pa., examination report adopted with curative action ordered

Farmers Mutual Insurance Company Linn County, Meadville, Mo., examination report adopted with curative action ordered

Kansas City Life Insurance Company, Kansas City, Mo., examination report adopted with curative action ordered

Missouri Doctors Mutual Insurance Company, St. Joseph, Mo., examination report adopted with curative action ordered

Old American Insurance Company, Kansas City, Mo., examination report adopted with curative action ordered

Old Reliable Casualty Company, Chesterfield, Mo., examination report adopted with curative action ordered

Ozark National Life Insurance Company, Kansas City, Mo., examination report adopted with curative action ordered

Provider Partners Health Plan of Missouri Inc., Columbia, Md., examination report adopted with curative action ordered

Safety National Casualty Corporation, St. Louis, Mo., examination report adopted with curative action ordered

Texas County Mutual Insurance Company, Licking, Mo., examination report adopted with curative action ordered

The Reliable Life Insurance Company, Chesterfield, Mo., examination report adopted with curative action ordered

United Dental Care of Missouri Inc., Wellesley Hills, Mass., examination report adopted with curative action ordered

United Mutual Insurance Company, Washington, Mo., examination report adopted with curative action ordered

We would like to thank the following members who have served on the MAIA board of directors. We appreciate the time and effort they have dedicated to the board and MAIA. As a membership organization, input from industry professionals is crucial to ensuring MAIA understands the issues agencies face every day, and is able to focus its resources where they are most needed.

• Darin Banner, CIC, Acrisure Midwest, Region 10 Director, 2017-2020; Executive Committee, 2020-2025

• Jeremy Anderson, Anderson & Green Insurance Agency, Region 12 Director, 20172025

• Tony Becker, CIC, CRM, Custom Insurance Services, Region 6 Director, 2017-2025

• Tracey Hagy-Kelly, CIC, SBCS, The Hartford, Company Representative, 2024-2025

• Amber Truskowski, UBIC, Company Representative, 2024-2025

MAIA would like to thank all of those who expressed interest in serving on an IIABA committee or board for the upcoming year. The following individuals were appointed to serve:

• Karen O’Connor Corrigan, O’Connor Insurance Agency, Chair, Technical Affairs Committee

• Kathy Conley-Jones, Kathy Conley-Jones Consults, LLC, Invest Board of Trustees

• Brad Greer, Arnold Insurance, Government Affairs Committee

• Katy Stewart, Ollis/Akers/Arney, Council for Best Practices

• Matt Barton, Missouri Association of Insurance Agents, InsurPac Board of Trustees

• Sheryl Van Leer, Missouri Association of Insurance Agents, Cooperative Technology Committee

continued from page 28

03 06) could be used for these exposures. This endorsement requires the name of an individual (either Joe or May) and then allows for an indication, by checking a box in the endorsement, that “family members,” including the named individual’s spouse, are afforded the endorsement’s coverages. This endorsement is only helpful for a vehicle furnished or available for your regular use. It does not address exposures associated with vehicles owned by or furnished or available for a “family member’s” regular use.

The insurance professional must identify their clients’ exposures and then must address those exposures with proper policies, endorsements and limits of insurance. The blessing that may come with availability of non-owned vehicles can become a curse if risk is not properly financed.

New hire bundles (no CE)

• Introduction to the Insurance Industry

• Insurance Industry and Coverage Introduction

• Insurance and Business Skills Basics for the Intern CE-approved bundles

• Introduction to Employee Benefits Insurance Basics

• Employee Benefits Basics: Introduction to Ancillary Lines

• Employee Benefits: Health Insurance Basics

• Commercial Lines Coverage Basics

• Personal Lines Coverage Basics

Other bundles available in the areas of

• Communication & Negotiation

• Client Management

• Leadership

• Recruiting & Hiring

• Risk Management

• Sales

To register for any of these classes or to see the amount and type of CE each class qualifies for, visit myagencycampus.com

code MAC20 at checkout for 20% discount.

These companies