Northern Ireland

Northern Ireland is a great place to invest thanks to its excellent infrastructure, competitive costs, and strong growth potential.

Wales

With over 700 multinational companies established here, Wales is at the cutting-edge of technology and sustainability with new investments creating world-class infrastructure.

Scotland

With valuable business opportunities and attractive investment returns, Scotland has the perfect blend of talent, innovation, and financial resources.

North of England

Known for football, music and culture, the North of England is a global hub with a diverse regional economy and strong pipeline of large capital projects.

Midlands

At the heart of the UK’s new high speed rail line (HS2) the Midlands is a leading location for logistics and has strong demand for private rental sector (PRS) housing.

London and the South

Economic growth in cities like Bristol, Oxford, and Cambridge is increasing the need for offices, homes and infrastructure.

002v2_LINK__GDE_ASIA 6 & 7 December 2022

silver & bronze: who will win this year’s MIPIM Asia Awards? 15 One Book 18 Global capital seeks safe haven in Asia’s strong fundamentals Why megatrends are driving sector success in Asia despite headwinds Advertisement

www.mipim-asia.com Gold,

income-generating investment portfolios. We specialise in sourcing,

COMMITTED TO SERVING YOU SCALE YOUR www.focusinvest.uk P I _ _ Property Investments F Focus

REAL ESTATE PORTFOLIO resilient,

Kingdom. estate industry.

WE SUPPORT INVESTORS ACROSS A BROAD SUITE OF SERVICES

key cities with strong capital appreciation and good rental demand.

Experts in sourcing below market value and value-add assets through the UK auction houses as well as

We support investors in undertaking built-to-rent project for stable, long-term cash generation. Investment in the UK built-to-rent sector has doubled year-on-year and only expected to grow further with the growing demand for rental accommodation.

THE UNITED KINGDOM REMAINS

A HIGHLY ATTRACTIVE LOCATION FOR INTERNATIONAL REAL ESTATE INVESTORS.

Despite political and economic uncertain ties, the United Kingdom provides one of the most stable real estate markets for long-term investors; data over the past 30 years has shown strong and consistent capital growth in real estate prices.

A key challenge in the United Kingdom is the serious housing shortage. According to expected to be a shortfall of over 100,000 homes each year for the next decade, creating an imbalance in supply vs demand. This fundamental mismatch between supply and demand offers tors.

Rising population and a worrying cost of

encers in the real estate market. Like many European cities, the UK has entered ‘generation rent’, with more people choos ing or in many circumstances ostensibly forced to rent for longer.

In our view, these factors present strong opportuni ties for international real estate investors. At FPI, we take an opportunistic approach in our invest ments. We focus on core-plus and value-added strategies with a focus on the major UK cities with

cation sits at the heart of our investment philoso phy, and we are determined to help investors build resilient and income-generating portfolios.

Undertake development of new residential projects, solving UK’s affordable housing crisis. We typically

Provide full project management service to allow clients a convenient and hassle-free experience

www.focusinvest.uk

Info@focusinvest.uk

INVESTING IN UNITED KINGDOM

Connecting for success

WELCOME to the MIPIM Asia One Book, your guide to this year’s MIPIM Asia Summit, packed with insights about the state of the industry and information on Asia’s premier real estate event. We’re always thrilled to have the opportunity to meet once again in person, and there is an in credible buzz surrounding MIPIM Asia 2022 as the region continues to open up to visitors from near and far. We thank those of you that have crossed borders and scheduled the extra time necessary to do so — and antici ate re arding ou ith a ulfilling e ent Expect to hear from the region’s thought leaders, such as keynote speakers Adriel Chan, vice-chair of Hang Lung Properties, and Stephanie Lo, exe cutive director of Shui On Land, as well as a host of experts contributing their wisdom and experience. Once again, we meet at a time when the issues of the day — not least the global macro-econo mic pressures — are also impacting the real es tate markets. Yet, once again, we are ready to ex change views on the kinds of opportunities that arise hen financial head inds lo he real es

tate industr has a talent or finding the sil er lining in every cloud and we are certain that the upco ming ear ill e no different his is also a reason h e kee coming ack to Hong Kong — this diverse and forward-looking glo al cit hich has so much to offer to the orld his cit , here ro tech inno ation meets tradi tional values, where culture meets diversity, is also on the cusp of an exciting new chapter. We look forward to showcasing excellence during this edition of MIPIM Asia as we gather to hand out the prestigious MIPIM Asia Awards. Our new chair man of the Awards, Donald Choi, CEO of China chem, re orts that the ur de ated long and fier cely to whittle down more than 100 submissions across the 11 categories. And the best is yet to come as you decide who on the shortlist receives the Gold, Silver and Bronze prizes. Voting is open online and in person at the Awards Gallery so don’t miss the opportunity to make your voice heard. We also hope to see you in person for the MIPIM Asia Awards gala, which promises to be another dazzling and entertaining evening.

MIPIM ASIA ONE BOOK 2022 | EDITORIAL

Nicolas Kozubek –Head of MIPIM Markets

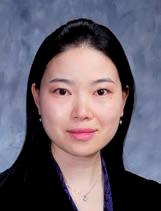

Christine Lam –Asia-Pacific Regional Director

A Gateway to Opportunities in Asia Pacific

ARCH Capital and Manulife announced in February 2022 their formation of a strategic partnership through a significant minority equity acquisition, a validation of ARCH Capital’s platform and track record.

ARCH Capital is a real estate private equity investment manager specializing in opportunistic, value-add and core/core plus strategies across major markets in Asia Pacific. Our track record includes consistently delivering superior returns and a strong alignment of interest with a management owned and operated platform.

Our partnership with Manulife aims to offer investors a comprehensive product suite across various strategies with broadened scale and geographic presence.

Website: www.archcapital.net | Contact: info@archcapital.net

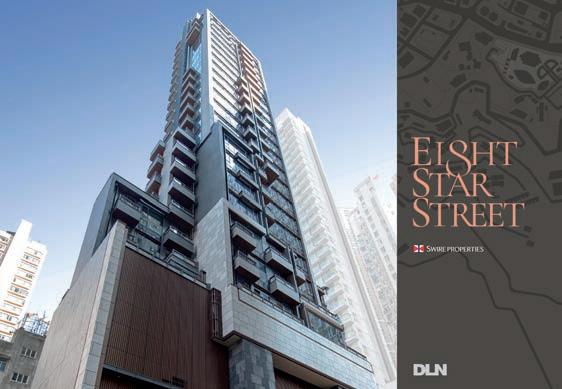

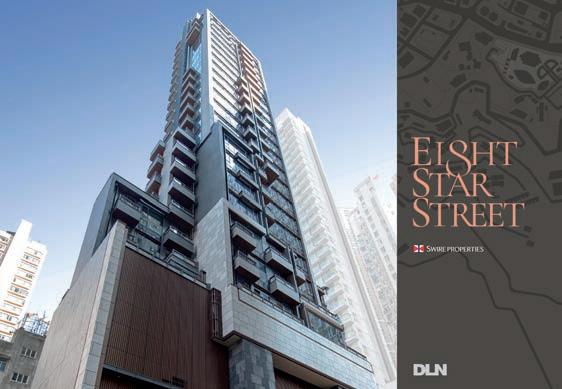

Hong Kong SAR

Sydney, Australia

$5.6 bn Total Assets Under Management and Advisory. 45 Investments so far capitalizing on increased wealth accumulation, urbanization, and increasing household formation across Asia. Our Investment Footprint

Bangkok, Thailand

Singapore

RX France, a French joint stock company with a capital of 90,000,000 euros, having its registered offices at 52 Quai de Dion Bouton 92800 Puteaux, France, registered with the Nanterre Trade and Companies Register under no410 219 364 - VAT number: FR92 410 219 364. Contents © 2022, RX France Market Publication, Publication registered 4th quarter 2022

P. 6 NEWS

Better Places - Greater Impact - Stronger Business

As delegates gather once again for APAC’s most important real estate summit, MIPIM Asia 2022 analyses the current challenges and opportunities, while delivering a forum to create better places, greater impact and stronger business

MIPIM Asia Awards preview Inbound investments

ESG New economy real estate Markets

Swathes of global capital are studying how to access Asia, as macro-economic headwinds grip economies across the world. In this climate of intense competition, what are the best investment strategies for its diverse geographies?

Investing in Mainland China Investing in Hong Kong Investing in Japan Outbound investments

MIPIM ASIA 2022 PRACTICAL GUIDE

MIPIM Asia Summit sponsors MIPIM Asia Awards – Finalists 2022 Participants list

PROGRAMME

OF PUBLICATIONS

EDITORIAL DEPARTMENT: Editor

Chief

Editor

Proof Reader

Editorial

Editions Graphic

Design

Designers

PRODUCTION DEPARTMENT:

One Book

CONFERENCES & EVENTS

P. 73 DIRECTOR

Michel Filzi

in

Isobel Lee Sub

Isobel Lee

Debbie Lincoln

Management Boutique

Studio StudioA

Graphic

Sunnie Newby, Harriet Palmer

Publishing Director Martin Screpel Publishing Manager Amrane Lamiri Printer Encre de Chine, Hong Kong (China) December 2022 www.mipim-asia.com

P. 18 P. 27

MIPIM ASIA ONE BOOK CONTENTS P. 15

P. 41 P. 49 P. 63 P. 15 P. 18 P. 20 P. 24 P. 27 P. 30 P. 33 P. 37

Focus on ESG targets to ‘play the long game’

IN CURRENT conditions, real estate investors in Asia should “play the long game”, according to Louise Kavanagh, Nuveen’s chief in estment officer and head o sia acific here re main pockets of interesting opportunities but price ex pectation will need to be recalibrated in light of rising borrowing costs and growth risks, she added er the near term, investors should focus on the fundamental dynamics of sub-locations in structurally robust cities and into relatively nascent sec tors with untapped growth

o ortunities

Even if deals are slowing, property professionals can still act decisively in one area — that of environmental, so cial and governance (ESG) targets, Ka anagh said n our view, ESG has evolved to the point of being central to strategy and will continue to e a riorit e see a conti nued prioritisation of ESG as being defensive to protect alue hilst offering o ortu nities to unlock, add value in a tightening market n cer tain territories, an evolution of these priorities may also create ros ects n land

APAC investors seek right asset balance

ARMED with the lessons of and in an e ol ing macro-economic climate, real estate investors are seeking to “steer a course between traditional property types and new economy as sets”, according to Richard Yue, chief executive and founder of pan-Asian invest ment management firm rch a ital Yue said: “There is no onesi e fits all strateg radi tional asset classes for real estate are still appealing, but human behaviour has ad usted ecause o There is plenty of growth

in digitally-driven assets, but you still have to take a thoughtful and tailored ap proach and not be overly pessimistic about traditional ro ert t es

‘Across Asia, for example, retail and offices ha e conti nued to perform well, pro bably due to factors such as population density and the fact that our markets are not lagued o er su l e ha e een ursuing suc cessful strategies in parts of Asia, including Thailand, Taiwan and the Philippines, which are seeing conside rable demographic growth

and doing well despite the usual related disru tions e ha e also een active in Hong Kong, Singa ore and ustralia ur local presence and insights make us a good partner for global ca ital in the region

Yue set up Arch Capital in 2006 after pioneering regio nal real estate investment in Asia during a career at oda the lat orm in vests in the opportunistic, value-add and core/corelus strategies

scarce Singapore, increa sing focus on ESG activities will likely boost long-term occupier demand for prime offices, she said ooking at other niches, “Japan senior living still provides a unique window of opportunity to tap into a slowly maturing sector with long-term tenant demand” while in Australia, “build-to-rent and student accommodation remains well-underpinned by suppor ti e demogra hics

Ka anagh concluded er the longer term, sia acific is well-placed to ride out the storm, and for global inves tors looking to diversify into the region, the more resilient near-term fundamentals and robust long-term structural trends should help position in estors ell or the uture

term ne ould ha e diffi culty to have a thoughtfully constructed Asian portfolio without a large country like hina, ue added

“The geopolitical situa tion is also affecting in estor sentiment in sia China is going through some difficult times ut it ill come ack e are cau tious in the short term but we are positive about Chi na for the medium and long

nal real estate investment are tious in the short term but we are positive about Chi na for the medium and long

NEWS

Nuveen’s Louise Kavanagh

6 MIPIM Asia One Book 2022

Arch Capital’s Richard Yue

Opportunity knocks in Japan

s lo cost o financing and ro ust office market re resent a ma or o ortunit or real estate in estors, ac cording to ai, and , eal state sia a an is an anomal right no , ai said ur recent office deal in okohama as financed at around on a ig m ac uisition ou can t reall do that in an other sian markets at the moment so e do see a lot o in estors iling into a an ccording to the firm s re search, o local em lo ees ha e returned to the ork lace in a an in a re ection o its strong cor o rate culture outh Korea is another sta le office market, thanks to the dominance o tech firms and an o erall de ficit in su l , he added es ite head inds across

the region, e are er much ocused on megatrends ost emogra hic changes ha e created ne in estment angles or exa

m le, in oth a an and us tralia, oung ro essionals are struggling to get on the housing ladder o, o er the last e ears, e ha e een accumulating a ort olio o multi amil housing hich is currentl orth around n n ustralia, e e created a m u to rent en ture ith o us to ca italise on this trend

ccording to ai, migra tion and ustralia s attrac ti eness to o erseas stu dents are also oosting the countr s credentials hile e do see a declining o ulation trend in a an, ustralia s gate a cities are ex eriencing different d namics rom dne to el ourne, an erra to ris ane, oung eo le are mo ing into ur an areas and the need housing

Ivanhoe finds student partners

s anhoe am ridge has committed n m to the ca e ore rogram, a enture holding the largest student housing ort olio in ustralia, ith uildings and o er , eds ther in estors include , l lian , ou in est and ost o the ro erties are in dne and el ourne anhoe am ridge s co head o sia acific, eorge gethen said his in est ment allo s us to artici ate in the institutionalisation o the li ing sector in and su ort the ro ision o ell managed, high ualit housing or students

he student housing sec tor in ustralia has seen a strong reco er , ollo ing the re o ening o international orders in e ruar gethen added he ex o sure to the ca e ore ro

gram ill di ersi our ort olio ith de ensi e cash o s that are dri en the a oura le demogra hics in the region and the demand or ualit educa tion in ustralia

Hang Lung and LVMH launch sustainable tie-up

Hang ung ro erties and luxur leader H ha e launched a ne artnershi to colla orate on sustaina ilit initiati es across mainland hina he ioneering tie u reimagines the relationshi et een ro ert o ners and leading retail rands on sustaina ilit anning Hang ung s ort olio o ro erties across se en cities in mainland hina, the artnershi engages H rands occu ing o er retail s aces across more than , s m he firms ill ocus on climate resilience, resource management, ell eing, sustaina le transactions, and sustaina ilit communication, e ents and rogress re ie s aid driel han, Hang ung ro erties ice chair Hang ung and H are excited to launch this ground reaking artnershi , le eraging our strategic relationshi to hel ensure a sustaina le uture or the orld, hile ro iding uni ue ex eriences to our customers

NEWS

7 MIPIM Asia One Book 2022

M&G’s Centropolis o ce scheme in Seoul

Hang Lung Properties’ Adriel Chan

The Scape assets are mostly in Sydney and Melbourne

Northern Ireland

Northern Ireland is a great place to invest thanks to its excellent infrastructure, competitive costs, and strong growth potential.

Wales

With over 700 multinational companies established here, Wales is at the cutting-edge of technology and sustainability with new investments creating world-class infrastructure.

Scotland

With valuable business opportunities and attractive investment returns, Scotland has the perfect blend of talent, innovation, and financial resources.

North of England

Known for football, music and culture, the North of England is a global hub with a diverse regional economy and strong pipeline of large capital projects.

Midlands

At the heart of the UK’s new high speed rail line (HS2) the Midlands is a leading location for logistics and has strong demand for private rental sector (PRS) housing.

London and the South

Economic growth in cities like Bristol, Oxford, and Cambridge is increasing the need for offices, homes and infrastructure.

UK beckons for Asian investors

INVESTORS in Asia have significant o ortunities to artner on real estate and in rastructure schemes across the K, according to rian a idson , consul ge neral to Hong Kong he sector is redicted to gro strongl in the coming ears, dri en the need to increase housing su l , a idson said he K is taking ste s to increase the deli er o mixed use schemes and all t es o re sidential uildings, including uild to rent and student ac commodation

Ke to the K s a roach is a commitment to tackling ine ualit et een the re gions, or le elling u , he added he go ernment is su orting this aim ia arious unding schemes, ith o er n n

alread a arded or local in rastructure ur an regene ration ro ects and cultural assets second a e o unding ill e announced the end o urthermore, the K is su

orting the deli er o re sidential ro ert through Homes ngland, ro iding unding to unlock ro nfield sites or ma or regeneration ro ects , he said nder inning the latest lans or the uilt en ironment is a strong commitment to sus taina ilit he K recentl handed o er the residenc o the nited ations limate hange on erence, ol lo ing last ear s success ul summit in lasgo here significant rogress as made Ho e er, ork continues at ace to cut our emissions and meet our net ero goal rom this ear, ne stan dards ill reduce car on emissions rom ne uil dings almost a third, and rom ne uildings ill need to e net ero read

IHG Hotels & Resorts lands in Patong, Thailand

QuadReal bets on Korean sheds

real estate firm uad eal ro ert rou and an sia ocused und manager sia n est ment anagement ha e or med a rogrammatic oint enture to de elo logistics assets in Korea he artners ill ca italise on the a oura le structural dri ers under inning demand or logistics s ace in outh Korea, including accelerating e commerce enetration and an acute shortage o rade tenant accommodation uad eal ill ro ide the ma orit o ca ital ith the team res onsi le or ori

ginating, de elo ing and o e rating the assets eter Kim, managing direc tor sia at uad eal said lo al logistics market un damentals remain com el ling, dri en su l chain reconfiguration re uirements and the gro th o omni chan nel retail n outh Korea, e continue to itness the interrelation et een e commerce led occu ational demand and a shortage o rade s ace in roximit to dominant ur an centres, hich is ore cast to under in rental and ca ital gro th

H H esorts ill ring its ignette ollection rand to the each destination o atong, hailand, in mid he sustaina ilit ocused inso esort huket ill e H s ourth o ened or i eline ignette ollection ro ert in hailand, ollo ing the launch o its th and ne est rand last ear uilt mainl through the use o ooden materials, the luxur esca e ill e integrated into its hillside surroundings, according to H s ao arin han rakaisi, director, de elo ment, outh ast sia and Korea t s antastic to ork ith irst time artner inso esort o to o en our ourth ignette ollection hotel in hailand e see a demand or authentic and ex eriential ex eriences, and ith the s otlight on en ironmental and social issues, meaning ul and res onsi le sta s, he said

NEWS

9 MIPIM Asia One Book 2022

Brian Davidson, consul general to Hong Kong

Dinso Resort Phuket, IHG’s Vignette Collection

QuadReal’s Peter Kim

MSCI Real Assets drives industry transparency

©2022 MSCI Inc. All rights reserved. Gain access to granular data and market insights

macro, across

and Income Risk, Performance

Due

Drive transparency and make confident decisions, at scale, across the investment process.

Real Assets provides the global, interconnected

the investable real estate universe with our market insights, portfolio management tools and real asset indexes.

from the micro to the

Climate

and

Diligence.

MSCI

view of

For more information, please contact realestate@msci.com or visit msci.com/real-assets MSCI Real Capital Analytics • MSCI Datscha

Good value opportunities returning to real estate

REAL estate transactions have hit a slump in Asia-Pa cific, but dealmaking op portunities may be around the corner, according to David Green-Morgan, glo bal head of real assets re search at MSCI. “Deals are down almost 40% in the third quar ter compared to the same period last year, and 16% lower year-todate,” Green-Morgan said. “The weakness has come through in the last three months. China and South Korea have gone into de

cline the quickest, along side Japan. Singapore remains the standout mar ket in terms of growth, but partly because it had such a weak 2021.”

Yet should the sluggish deal environment translate into repricing, Green-Mor gan thinks that capital will be poised to pick up bar gains. “A number of invest ment groups haven’t been as active in recent times as pricing was very high and competition significant. They will now be looking out for opportunities,

Geoscience HQ sale marks record Canberra deal

REAL IS, the property in vestment arm of German lender BayernLB, has sold the headquarters buil ding of Geoscience Aus tralia in Canberra to local property investor Charter Hall. The deal volume was AUS$363.5m (€235.7m).

he ull let office com lex, built in 1997 by the Austra lian government, is located at 101 Jerrabomberra Ave nue and consists of a main building and an annex. It has a total rental area of ap proximately 32,660 sq m, ith , s m o office space and 7,107 sq m of

life science area. There are also 652 car parking spaces and a childcare centre that occupies an area of around 766 sq m. “The sale of the

decided that now is a good few

tion, and they are likely to stick to their guns. “Those

rage and data centres are whole seems to be over.”

pared to the global

whether that be forced sales, or funds that have decided that now is a good moment to exit assets. The final quarter will be key.” A few landlords are less af fected by the current situa tion, and they are likely to stick to their guns. “Those in assets like self-sto rage and data centres are looking much longer term. However, the heyday for logistics and industrial as a whole seems to be over.” He added: “Com pared to the global financial crisis, this

time the financial sector is in good shape. We may see some groups shift from being buyers of real estate to being more active lenders.”

Geoscience headquarters building was the largest deal ever seen in the history of Canberra,“ said Michael Wecke, managing director at Real IS Australia.

The Geoscience headquar ters property is located in the heart of Symonston, at the southern edge of the city of Canberra and about se ven kilometres from the cen tral business district (CBD).

“The property was pur chased in 2007, when we launched our Bayernfonds Australien 2. The sale of the property is part of the planned divestment within the frame of our long-term investment strategy,” said Axel Schulz, global head of investment manage ment at Real IS. Colliers and JLL advised Real IS on the transaction.

NEWS

11 MIPIM Asia One Book 2022

MSCI’s David Green-Morgan

The Geoscience headquarters in Canberra

A design for life

The MIPIM Asia Awards are back with a new president of the jury, Donald Choi, CEO Chinachem Group, who shares his thoughts on real estate’s X-factor

The MIPIM Asia Awards are back for 2022, and according to the new Awards chairman, Donald Choi, CEO of leading property developer China chem Group, this year’s jury debated long and hard to de cide among over 100 entries across the 11 categories.

However, the overall winners ha e finall een selected, with the recipients of the Gold, Silver and Bronze awar ds set to be decided by the MIPIM Asia community both during the MIPIM Asia Sum mit and o er the final da s o the online ballot. As has be come customary, those prizes will be distributed at a dazzling grand gala on the last day of MIPIM Asia.

Choi has taken over as jury

chairman from Allianz Real Estate global CEO François Trausch, who nevertheless remains on the expert panel. In approaching his new role, Choi says that several key pil lars emerged when creating the criteria for award-winning projects. “As has been the case with past Awards, we decided to once again look for innovative ideas that de monstrate how real estate has improved and continues to make a contribution to the community.”

He adds: “Sustainability and conservation of the natural and cultural environment have been on the agenda for a while, and this is so mething we have continued to look for. Carbon footprint

matters. Overall, we decided to look at how a project can both enhance the environ ment and provide business with a competitive edge to be successful.”

Choi knows a thing or two about real estate. As head o a firm ith a ro ert e digree dating back to the 1960s, whose multiple assets shape the skyline of Hong Kong, Choi says that his ul timate goal has always been to make Hong Kong a better place to live, work and raise its next generations.

“Right now, we’re working on two very exciting projects, one of which is at Causeway Bay in joint venture with Hysan,” he says. “We are building a very high-quality workplace for the next gene ration of talent covering over 1 million square feet. It’s not ust a out traditional office space, as we will also have plenty of common space with cultural activities, plus retail at the base of the tower.” Ano

The MIPIM Asia Awards gala dinner is a vibrant event celebrating the projects shaping Asia’s cities

MIPIM ASIA AWARDS 2022 15 MIPIM Asia One Book 2022

Chinachem’s Donald Choi

ther key project is what Choi calls a “new business hub for the 21st century” located at the Tung Chung New Town extension. “Situated close to Hong Kong airport, it is going to be very much integrated into the airport city economy and is right near the Hong Kong Zhuhai-Macau Bridge linking Hong Kong with the Greater Bay Area (GBA). So, it’s really a GBA gateway and is going to play a very im ortant role t s the first commercial workplace deve lopment in the area and has a state-of-the-art data centre, plus a commercial podium to support the area’s new re sidential population.”

n deciding the finalists or this year’s MIPIM Asia Awar ds, Choi says that he and 16-strong jury ultimately fo cused on projects that suc cessfully combine a long-term vision with meeting society’s near-term goals including environmental, social and go vernance (ESG) targets. “ESG is so important,” Choi underlines ot onl or finan cial returns, but also for its im pact on the place in which the project is situated. The team behind any building needs to e sufficientl isionar to make a project enjoyable for all walks of people, while also satisfying their customers.”

his ear s ictorious firms include an impressive array of talents improving city sky lines across sia acific he categories make space for every kind of project to be

sho cased, rom offices to hotels, from civic buildings to massive mixed-use deve lopments. For example, the Best Futura Mega Project is open to schemes with a total surface area that ex ceeds 200,000 sq m, and allow the user to peek into what the future might hold. Entries include exciting ur ban concepts characterised by distinctive architectural, innovative and environmental qualities.

This year’s shortlisted winners in this category comprise Ba ker Circle, developed by Hen derson Land Development Company and designed by architect Kohn Pedersen Fox Associates, a stunning scheme located in Hong Kong. The centrally-located mega urban renewal project consists of seven sites sepa rated by public streets and lanes, with a mandate to re vitalise the old and connect it with the new. With the beau tification o existing streets and lanes and constructions of new shops at the podiums, it will see a new and vibrant urban streetscape created for the general public. In ad dition, the tower portions will be developed into 3,000 luxu rious boutique apartments. nother finalist in the same category is the 11 Skies sche me, developed by New World Development Company and designed by architectural practice Lead8. Located at SkyCity, the mixed-use sche me has been designed as a major Hong Kong hub for re

tail, dining and entertainment and is also set to e the first of its kind to integrate work places for GBA enterprises. The development is expec ted to completely transform the land next to Hong Kong International Airport, while acting as a super-regional connector accessible by air, sea, and land. Its unique mix means that it is likely to play a key role in the future growth of the GBA.

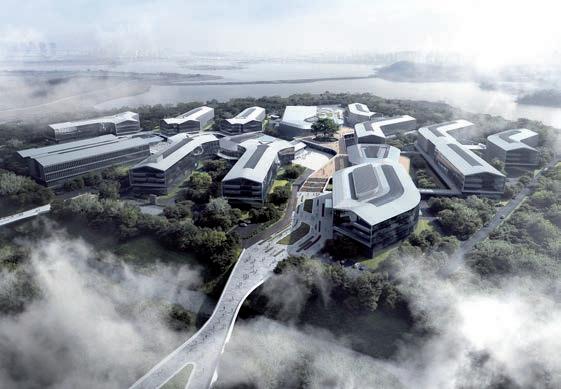

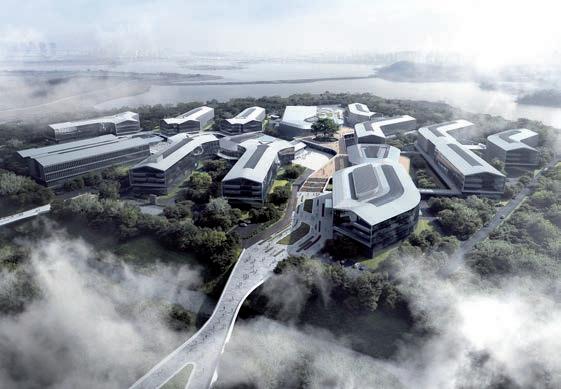

he third finalist in this cate gory, and also vying for Gold, is the Hangzhou Alibaba DAMO Academy in the Nan hu Science Centre District in Yuhang — the heart of Hangzhou city’s science and technology incubator triad. Adjacent to the South Lake Light Rail Station, the project has abundant landscape re sources and lush vegetation, surrounded by the Nanhu Wetland Park. With a total area of 228,100 sq m, the ro ect is dri en scientific research and technological inno ation s the first head quarters of Alibaba DAMO Academy, the design inte grates offices, research la o ratories, visitors and exhibition centres, and ancillary facili ties, to create a world-class scientific research institute on the banks of Nanhu Lake.

MIPIM Asia 2022

Wednesday, December 7 MIPIM Asia 2022 Awards Ceremony & Gala Dinner 18.30-20.00

Henderson Land’s Baker Circle is another Best Futura Mega Project finalist

Lead8’s visionary mixed-use scheme, 11 SKIES

The Hangzhou Alibaba DAMO Academy in the Nanhu Science Centre District in Yuhang

Henderson Land’s Baker Circle is another Best Futura Mega Project finalist

Lead8’s visionary mixed-use scheme, 11 SKIES

The Hangzhou Alibaba DAMO Academy in the Nanhu Science Centre District in Yuhang

17 MIPIM Asia One Book 2022

MIPIM ASIA AWARDS 2022

Last year’s MIPIM Asia Awards’ winners

Sizing up opportunities

Despite the real estate industry facing a set of global macro-economic headwinds, Asia’s diversity means that smart investors can still pursue returns across a range of strategies

H ca ital o s seeking sa e ha en o ortunities across sia ma e acing challenges, the region s most ex erienced in estors ha e identified strategies to ride out the storm

ising interest rates, es e ciall in Hong Kong, ou th Korea and ustralia, are affecting the real estate markets, hile extended lockdo ns in hina ha e slo ed do n its econom , im acting offices and retail in articular, sa s uchad hiaranussati, ounder o a ital artners nl data centres and logistics are reall eathering the storm there ean hile, a an and inga ore ma e a little more sheltered, ut the

currencies are ulnera le n the u side, com ared to uro e, e don t ha e a ar on our doorste es ite hiaranussati reco gnising the region s eak s ots, he still elie es that ca ital targeting sia can find interesting o ortuni ties t a ital e e een ser ing institutional in estors or almost ears and e kno ho to res ond to olatilit he region is uite uni ue, ut e ha e uilt our re utation as a sa e air o hands rom logistics in hina, to hos italit in a an, e e een a le to generate im ressi e returns e ha e an interesting senior li ing strateg in ris ane and

old oast, ustralia, and a an sian data centre lat orm e continue to look at ne o ortunities emerging rom the digital industries or hiaranussati, there is still a lace or different risk a etites e ha e a core lus strateg and also o ortunistic alue add tends to e or se arate mandates n the near term, in reaction to olatilit and rising in terest rates, there ma e more challenges in the core and core lus s ace Ho e er, in the long term, these are sa e assets to ha e in a ort olio ore and core lus assets ha e seen ca rates com ress i the iden ack out and there is alue correction, and ou are ith the right manager, this could e an o ortunit to secure attracti e assets hich ill deli er enhanced returns on a risk ad usted asis Ho e er, those deals ma not e immediate e are in a hase o rice disco er

SC Capital has achieved success in a variety of asset classes, including this retirement village in Brisbane

SC Capital has achieved success in a variety of asset classes, including this retirement village in Brisbane

INBOUND INVESTMENTS 18 MIPIM Asia One Book 2022

SC Capital Partners’ Suchad Chiaranussati

at the moment, so hile the ga remains et een u er and seller ex ectations, it s es eciall im ortant to in est ith a ro en und manager

Hines sia s , a a ler, agrees that ex e rience is essential hen steering a ath et een emerging and mature mar kets in the region t s a alance o risk and returns and here e think e can generate the most al ha or our in estors, a ler sa s merging markets can ro ide greater returns ut o ten ith greater risk n es ting in gate a cities is the ulk o hat e do, and the also ro ide com elling o ortunities or a ler, the ke is iden ti ing here the firm can ge nerate the est risk ad usted returns or exam le, ith our most recent o ening o an office in ietnam, e see a significant o ortu nit e see strong manu acturing and su l chain undamentals cou led ith a desire o man occu iers to urther di ersi themsel es throughout the region

a oura le ietnamese demogra hics and strong economic gro th ros ects also oint to reasons or our entr inall , there is a desire some o our ca ital artners to in est in H and Hanoi and e are keen to orm strategic artnershi s ith them

Hines usiness cur rentl o erates in six coun tries across office loca tions ith in estments in more than cities, u and do n the risk s ectrum in all the roduct t es , accor ding to a ler alan cing markets and geogra hies, e can ro ide our in estor o tions de ending on here the ant to e on

the risk cur e erha s unsur risingl , acti e asset management remains essential im l ra ing or rent gro th is ne er a good strateg , he sa s n an in estment, e must ha e multi le dials to turn at the asset le el hese dials must e e ond the eta in the market rent gro th, de t costs and ca rates e look closel as to ho e can create alue a ler adds a telling anec dote ecentl , as isi ting our team in Korea and touring a local asset he ere outlining the areas o al ha at the asset le el call this the nitt gritt o our usiness his s ecific lan included a re resh o o com mon areas lo ies, rest rooms, corridors, ground lane , an ex ansion o here a ter anal sing the uilding lans and ne eoul code, e ound e could ex and the cur tain all erimeter and add around to the uilding , adding ne exterior digital signage or ad sales, changing a roo to smoking to roo to outdoor tenant lounge, and reorienting and ex anding the ground oor retail lane

hese im ro ements ill allo us to ca ture higher rents hen the ork is com lete, regardless o hich direction the market goes inall , the team is ocusing on arious o erational car on reduction strategies to lo er the car on o erational oot rint

nother glo al ers ecti e on the region comes rom aurent ac uemin, head o sia acific at lts, ho as ormerl the firm s head o uro ean transac tions uro e, a o

com arison, is eas to tra el around and most countries are uro denominated n sia, e er thing is urther a art and currenc risk is significant, hile the regu lator rame ork changes re uentl rom countr to countr s a core in es tor, o tions in sia are re lati el narro , articularl ith the resent head inds in Hong Kong, ustralia and e en outh Korea ur core strateg currentl ocuses on a an, ustralia and outh Korea ith a re erence or logistics and li ing assets eal state is ano ther uro e head uartered la er hich has ound suc cess in sia in recent ears lo al head o eal state on ro n sa s rom a usiness ers ec ti e, e see it as a strong gro th market or us s each kind o crisis comes and goes, sia is the mar ket ith the iggest under l ing gro th and the most ro ust undamentals t s reall not as olatile as the est hile and in terest rate hikes are ringing olatilit in sia as ell, e eel that there are ros ects or economic gro th, and all signs suggest that glo al in estors ill look at sia ith greater scrutin in the co ming ears

MIPIM ASIA 2022

Tuesday, December 6, 13.30-14.00

Keynote – The Leaders Perspective: Where Do We Go From Here?, Part 1

Wednesday, December 7, 11.15-12.00

Inbound Investments: What’s Hot And What’s Not?

“Our core strategy currently focuses on Japan, Australia and South Korea with a preference for logistics and living assets”

Laurent Jacquemin

INBOUND INVESTMENTS 19 MIPIM Asia One Book 2022

An AXA IM Alts‘ purpo se-built stu dent block in Greater Tokyo

Making greener choices

Across APAC, the real estate community is rising to the challenge of mitigating climate change by embedding sustainable solutions in corporate practice

NOVEMBER’s COP27, the decision-making forum of the United Nations Framework Convention on Climate Change (UNFCCC), served as another concrete remin der of the challenges facing the planet. Yet many of its dire warnings — from extre me weather events to global warming — have already become an everyday expe rience. Thankfully, real estate industry leaders across Asia are continuing to future-proof their portfolios in line with en vironmental, social and go vernance (ESG) targets and take responsibility for proper ty’s environmental impact.

Link REIT, the largest real estate investment trust in sia, is one such firm

George Hongchoy says: “As a real estate asset investor and manager, ESG is at the heart of Link’s operations. We have ESG in our DNA. It is also an important factor in our investment decisions as well as asset management — we believe our business can only be sustainable if we successfully integrate ESG factors across our business operations.”

In terms of Link’s approach to in estment and financing ro ects, the firm is a signator o the Principles of Responsible Investment. “In potential ac quisitions, our Responsible Investment Policy requires due diligence on a building’s technical and environmental performance and the status

o green uilding certifica tion,” Hongchoy adds. “We prioritise acquiring buildings ith existing certifications or put in place post-acquisition asset enhancement and cer tification lans ink also ecame the first listed issuer of green bonds in Hong Kong in 2016. “To date, we have transacted over HK$27bn (€3.34bn) in sus taina le finance transactions, including sustainability-linked loans and green conver tible bonds. As of the end of March 2022, over one-third of our outstanding bond and loan facilities are tied to our sustainability performance.” Link’s commitment to sus tainability continues across its asset management ope rations, which prioritise green and “healthy” buil dings. Hongchoy says: “In 2021/22, our green building certification co erage across our retail, office and logistics portfolio reached 86.5%, up from 71.2% a year ago. In

Lead8’s award-winning The Ring shopping mall in Chongqing has been praised for its biophilic design

Link REIT’s

ESG 20 MIPIM Asia One Book 2022

George Hongchoy

Hong Kong alone, we have 53 green buildings. We aim to reach 100% by 2025/26.”

nother leader in the field is Canada’s Ivanhoe Cam bridge, which makes sure that its global operations — including its APAC portfolio align ith the firm s commitments. For George gethen, the firm s co head, this approach makes good business sense. “We are convinced of our duty to have a positive impact on the environment and be lieve sustainable investment is more rofita le o er the long term, he sa s he firm has committed to reducing its global portfolio’s carbon intensity by 35% within 2025, compared to 2017, and has pledged to make all new de velopments net carbon zero from 2025. The entire port folio will be net carbon zero by 2040, according to plans.

gethen notes that the firm s approach varies across Asia to some degree, as govern ments take a different a proach to facilitating access to green energy, although the firm im oses its o n high de sign standards everywhere.

ne as ect the firm can ull control is its commitment to progress. “We invest in prop tech globally, and in Asia too we look to identify techno logies that improve the sus tainability of our assets. The talent is certainly there in the marketplace.”

Yet while building brandnew, sustainable assets is an obvious way to fasttrack change, the industry’s greatest challenge is finding a solution for older buildings. Agethen says: “Across Asia, the sector that has the most potential for asset impro ement is ro a l office Those in a 30-50 year range can usually be upgraded with the right amount of ef

fort. Industrial meanwhile has a lot of roof space, so there is room for solar panels and energy generation.”

Simon Chua, co-founder and executive director of architectural firm ead , says: “The goal for all cities should be to enhance sus tainability and environmental protection. Transforming and adapting the current building stock, especially in prime lo cations, is an incredible way to achieve this.

ffecti e trans ormation should consider the needs of society. In Hong Kong, for exam le, e ha e an affor dable housing shortage and a continuing disappearance of old buildings. Could va cated schools be repurpo sed into afforda le housing ould retrofitting existing de velopments help us to alle viate the shortage faster and more efficientl

For Chua, the answer lies in the creative sector collabo rating with the government and developers to better serve the needs of society. “For governments, leading by example is a powerful way to create change. For designers, our priority should consider not only how to ada t a s ace to fit ith cur rent demand, but also en sure further adaptation in the future. Flexibility is the key to better and more resilient ur ban design.”

Another key driver of change is tenant behaviour. Chua says: “We also see from the occupier side that the more demand for ESG, the more incentive for supply. Despite the macroeconomic head winds, I believe there is a collective desire to move forward in a more sustai nable way than we have in the past.”

Hongchoy agrees. “It is fairly

clear that tenant demand is dri en a ight to ualit after the pandemic,” he says. “A report by the World Green Building Council (WGBC) has shown that green buildings tend to have higher sales prices, higher rental, higher lease rates, lower operating expenses, and higher occu pancy than other buildings.

According to the WGBC, green certified uildings can command up to 14% higher rental prices than non-green certified uildings

For Hongchoy, the next challenge will be identifying those parts of real estate which are still trailing behind. He adds: “Over the past de cade or so, Link has spent over HK$9bn on 92 asset enhancement projects to re vitalise our community com mercial facilities to improve the environment and en hance customer experience.

“While we have just comple ted an asset enhancement project in Hong Kong’s Tak Tin fresh market a couple of months ago, we completed two more fresh markets as set enhancement projects in Hong Kong just recently. To date, out of 52 fresh mar kets at Link, 81% or 42 fresh markets have had asset en hancement.

He concludes: “We have also commenced our second Mainland China asset enhan cement project in Happy Val ley in Guangzhou. We will be incorporating a wide range of features to enhance the sustainability performance of these assets to ensure they are future-proofed.”

MIPIM ASIA 2022

Tuesday, December 6, 14.45-15.30

Outbound Investments: What’s The Best Bet?

Ivanhoe Cambridge’s George Agethen

ESG 21 MIPIM Asia One Book 2022

Link REIT has recently completed the sustainable enhancement of Hong Kong’s Tak Tin fresh market

“Despite the macroeconomic headwinds, I believe there is a collective desire to move forward in a more sustainable way than we have in the past”

Simon Chua

The building blocks of success

AS CENTRAL banks around the world make tough inte rest-rate decisions to tame rising in ation, real estate specialists across Asia-Pa cific are refining their asset class selection in line with re cent megatrends. While the macro-economic headwinds are sector agnostic to some extent, the smartest in es tors know that a few property t es are likel to ro e more resilient o er the time to come

The so-called ‘new economy’ asset classes, including logis tics, data centres and multi a mil ro erties ha e dis la ed ositi e demand d namics in the past few years and a ro ust income rofile thanks to their ‘mission-critical’ role in society. And although their alues ma e correcting in some markets around the orld, that is not the case e e r here, according to Hank

Hsu, co ounder and o Forest Logistics Properties. erall, logistics real estate is still one of the best perfor ming asset classes in hina, dri en the largest e com merce sales from the world’s second largest econom , Hsu sa s e do elie e that as pandemic controls are gra duall eased, hina, as the world’s largest consumption and manu acturing countr , ill ex erience e en greater growth in rental growth and ca ital alue

orest ogistics, hich o cuses on ainland hina, has already been a part of the asset class’s success story o er the ast e ears, des ite, or erha s ecause o the a retail sales e ol ed during the pandemic.

nder hina s ero olic and mo ement restric tions, e commerce and on

line retail sales increased ra idl , e idenced this ear s ingles a sho ing esti al, with total e-commerce tran saction olume exceeding a thousand illion uan, he sa s n articular, li e road cast e-commerce sales during the esti al ha e more than doubled compared to last ear hese figures sho that the Chinese consumer mar ket is in high demand, and the demand for warehouse space ill continue to rise

Another dynamic asset class in sia is that o data centres, which continue to attract in estor interest or their sta le returns and counter-cyclical strength. The world’s largest alternati e in estment firm, lackstone, announced the launch in mid o em er o its first holl o ned data centre lat orm in sia acific u ed umina loudin ra, the platform will be owned and managed by Blackstone’s real estate and tactical opportu nities unds, ith nil edd ,

Sectors which have benefitted from recent megatrends may still drive success, despite the arrival of macroeconomic headwinds

Forest Logistics has created a winning strategy in logistics with schemes such as this Shanghai facility

NEW ECONOMY REAL ESTATE 24 MIPIM Asia One Book 2022

Forest Logistics’ Hank Hsu

formerly head of global cloud in rastructure at icroso t, un eiled as its glo al to lead strateg , ex ansion and growth across the region. Reddy says: “The data-centre sector is anchored by strong demand for data creation and storage around the orld, ar ticularl in ndia here man o the fastest-growing compa nies are ased

While Lumina has initially launched with two largescale i eline assets in ndia, it plans to quickly expand into other sian markets Ho e er, its ndian ocus makes economic sense, conside ring that the country’s da ta-centre market is predicted to surpass $10bn (€9.7bn) by 2027. Blackstone’s global experience in data centres and asset management acuity is expected to be ano ther point of strength.

he firm s narro ocus un derlines a further key to suc cess in these markets — the need to be geographically selecti e Hsu sa s that this quality has helped Forest ogistics refine its strate gy in recent years. “We are er disci lined in choosing in estment locations and focusing on logistics hubs and ro incial ca ital cities located in the angt e i er elta and reater a rea hese areas are ene fitting rom the high concen tration of population and ma nufacturing bases with robust demand of modern logistics acilities, he sa s urthermore, or Hsu, the ke to generating risk-adjusted re turns in the logistics sector is an acti e asset management approach. “Forest has a pro fessional asset management team to monitor and manage our portfolio. We not only ac celerate asset ex ansion, ut also ocus on acti e asset ma nagement to maximise portfo

lio alue and return on in est ment o e com etiti e in this usiness, e need to differen tiate oursel es in e er ste through in estment c cles

From a land acquisition pers ecti e, due to the hinese go ernment s restricti e land su l olic , it has e come more difficult to ur chase suitable sites for lo gistics de elo ments in the countr et Hsu sa s that Forest has still been able to acquire some of the best lo cated sites at below market entr costs, thanks to its re putation and track record. ean hile, the occu ier landscape in China remains rich, di erse and gro ing s, e commerce, retai lers and manufacturers are the main logistics occu iers, with 3PLs and e-commerce together accounting for more than two-thirds of logistics arehouses, ith gro ing manufacturing and cold sto rage sectors, Hsu sa s e e also noticed an in crease in the size of high-tech manu acturers, ho ha e higher requirements in terms of the timeliness and secu rity of the supply chain. To im ro e efficienc , the are usually willing to pay higher rents and choose high-stan dard arehouses oda , the most manufacturing demand is concentrated in East China and the ne as ect that kee s te nants coming back to Fo rest schemes is their built-in tech ll orest arks ha e enabled digitalised property management, allo ing us to isualise all o erations and significantl reduce o erating costs, resulting in higher ields, Hsu sa s and en ironmental protection are also incorpo rated into our processes. We initiated solar-panel pro

grammes on the roof of our acilities, reducing electricit costs. When the circums tances allo ed, e ha e also complied with and applied or old standards in some o the ro ects e ha e uilt, or exam le, our ei ing ir ort ro ect, hich is old certified

While progress in matters of sustainability is key for the sector, architects ead , mean hile, see the oten tial for these ‘big boxes’ to e ol e still urther imon hua, ead s co ounder and executi e director, sa s ata centres and logistics arehouses ha e a re uta tion for not contributing much to a cit s ur an en ironment n the uture, ho e er, could these large-scale assets de centralise and form part of our mixed-use programming? Could they exist as smaller satellite centres that can be in tegrated into de elo ments hua adds see this as a more compelling proposition that would reduce the need to create more large scale, single-use buildings. Mixeduse de elo ments are inhe rentl sustaina le, using re sources more efficientl , and could offer a more attracti e opportunity for these essen tial ro ects

MIPIM ASIA 2022

Tuesday, December 6, 16.00-16.45

Interest Rates And Capital Raising: What Strategies Could You Employ?

Tuesday, December 6, 16.45-17.30

Better places: Work, Live And Play

Wednesday, December 7, 12.00-12.45

Alternative Investments: What Will Excite You Next?

NEW ECONOMY REAL ESTATE

Forest Logistics’ Chengdu site

25 MIPIM Asia One Book 2022

Lead8’s Simon Chua

“Logistics real estate is still one of the best performing asset classes in China, driven by the largest e-commerce sales from the world’s second largest economy”

Hank Hsu

Transforming our Future

11 SKIES is Hong Kong’s largest experiential retail, dining, entertainment and commercial landmark and has been sustainably designed to achieve LEED Platinum Precertification, WELL Building Standard Platinum Precertification and BEAM Plus (New Buildings) v1.2 Provisional Platinum.

www.lead8.com Architecture | Interiors | Masterplanning |

+ Graphics

Branding

The right ingredients

China’s most successful real estate developers are forging ahead with defensive strategies covering a range of uses to build future-proof portfolios

WHILE property markets everywhere are being im pacted by macro-economic headwinds, smart investors are still carving out success ful strategies with one eye on the long-term picture.

hong ang rou , a firm based in Shanghai, is one such company, as CEO and co-founder Henry Cheng ex lains he firm, hich specialises in mixed-use projects with retail as a key component, has become an expert in getting the blend of uses right.

“Chongbang’s retail real es tate is er different rom that of most others,” Cheng says. “It is branded Life Hubs, meaning centres of living. All Life Hubs have a retail and

office com onent, and some have residential and hotel as well. The retail compo nent normally comprises 10 trade mixes. Five are referred to as ‘old retail’ — sale of merchandise, food and be verage, entertainment, edu cation (for both children and adults and ellness and fi e as ‘new retail’ — tourism, culture, technology, ecology and environment.”

What makes this formula different rom traditional retail schemes is both the empha sis on a range of usage types and the seamless integration of e-commerce. “Normally, the sale of merchandise only accounts for some 30% of the gross oor area o the re tail component,” Cheng says.

day concept — 24 real hours and 24 spent in the virtual world. Even today, we spend half our time in the virtual world. We have to align this with also celebration our his tory and traditions — I call it the re italisation o the fittest

Chongbang’s Life Hub at Bund Central in Shanghai represents a compelling mix of services

INVESTING IN CHINA

Hines’ Ray Lawler

27 MIPIM Asia One Book 2022

Chongbang’s Henry Cheng

PERE GLOBAL AWARDS RECOGNITION

Other future megatrends such as the further enhan cement of ESG and digital living are also something we should all try to master.”

Chongbang’s successful for mula has attracted interna tional partners in the past in cluding Ivanhoe Cambridge, APG and GIC. It is unsur prising that overseas capital often seeks a local partner in China as it can be perceived as a difficult market to na i gate. Cheng says: “China is certainly a big and diverse country. It has a political cy cle e er fi e ears and a new cycle just started in October. We are also reco gnised for commitment to excellence — we have four centres hich are certified LEED Platinum for mana gement and maintenance which is incredibly hard to achieve. We are striving to make China more beautiful in the future.”

Justin Chiu, executive direc tor of CK Asset Holdings, also sees an opportunity to develop imaginative and outstanding projects in Chi na. For Chiu, the secret in recent times has been fo cusing on the needs of the local o ulation n the first year of COVID, China’s ze ro-COVID policy was actual ly successful in protecting businesses and helping ci ties run as usual. It got more difficult in and as lockdowns continued to close entire districts. But nevertheless, non-discretio nary retail and stores ser ving local needs remained robust. Equally, while hotels haven’t been able to rely on tourism o s, t o and three-star hotels have been full due to domestic Chinese business and tourism travel, allowing both room rates and occupancy rates to re main stable.”

Lai Sun Group is another firm hich has recorded suc cesses in China. Like many of its peers, its strategy relies on a broad mix of usages to maintain income o s he Fook Aun, deputy chairman, says: “We have a mixed port folio, from residential deve lopments for sale and lease to offices, hotels, ser iced apartments and retail malls. We are currently in Shanghai, Guangzhou, Zhongshan and Hengqin island, adjacent to Macao, all places where we have a long operating history.” Macao and its surrounding environs are particularly in teresting, thanks to the city’s premium on land and the surrounding development opportunities. “Hengqin is a special economic zone which will be eventually ad ministered by Macao and complements the region’s development,” Chew says. “Macao doesn’t have any more land for expansion — that’s where Hengqin comes in.” While Macao is famous for its casinos and giant malls on the Cotai Strip, the original plan was for an even more rounded commercial offer, including outlet malls and duty-free boutiques. “Hengqin has been desi gnated as development land to extend the area’s com mercial offer e ha e also developed a major leisure offer there he himelong Ocean Kingdom is one of the largest theme parks in the world and features the globe’s biggest oceanarium. “Our megaproject there in cludes the Hyatt Regency Hotel, a Lionsgate Enter tainment World movie-the med interactive experience, a National Geographic Ulti mate Explorer entertainment centre, and Real Madrid ex perience.” Chew believes that after COVID, tourists will

megatrends such as further enhancement of ESG and digital living are something we should all try to master”

return to make this a dyna mic prospect. Another international player with a dynamic Chinese real estate strategy is the pri vately owned Hines Group, headquartered in Houston, US. Asia CEO, Ray Lawler says: “We entered China in the 1990s as a ground-up developer, initially focused on for-sale residential in Beijing. Since then, we’ve added Shanghai, Hong Kong and the Shenzhen-Guangzhou Greater Bay Area. Our port folio has expanded to include co li ing, next gen office, re tail and cold logistics.”

Henry Cheng

For Lawler, although Hines’ asset class experience is broad and they are active all over Asia, there is value in developing niches. He adds: “We’re focused on a few key areas. These in clude attainable housing — for us tech-driven rental for the young urban generation, focusing on community and shared experience. Also, life science and R&D, speciali sing in value-add and deve lopment strategies for inno vation-driven research and lab space. We also focus on corporate partnerships — ESG-led acquisitions and developments where we can bring best-in-class as set management.” He adds: “Finally, in markets like Hong Kong that have faced unprecedented headwinds, we’re focused on disloca tion for conversions — ac quiring distressed retail, hotel or commercial assets that we can transform for innovative use.”

MIPIM Asia 2022

Wednesday, December 7, 14.45-15.30

China: How Best To Navigate The Real Estate Investment Market?

“Future

INVESTING IN CHINA 29 MIPIM Asia One Book 2022

Hines’ One Museum Place in Shanghai is an impressive addition to the city’s skyline

Developers aim high

The most successful developers in vibrant Hong Kong are showing that its limited land footprint and older stock represent unique opportunities for success

THE VIBRANT economy of Hong Kong is closely aligned with its resilient real estate markets. Although global conditions have compli cated the macro-economic outlook, Hong Kong’s most successful developers are focusing on the long-term picture to carve out success. “The residential market in Hong Kong remains robust. Every project that we have put up for sale does well,” says Justin Chiu, executive director of CK Asset Hol dings. “Due to the economic situation and COVID, on the other hand, retail has suffe red many setbacks and the office market in Hong Kong is still under pressure.”

Looking at the merits of

the residential market, Chiu notes that his firm has ex celled in the development of appealing apartments despite the city’s premium on space. “Even though unit sizes are very small, as a developer, we know how to make it a comfortable home for everyone. This means creating more lifestyle fea tures and emphasising the estate’s common areas. Landscaping has become a major theme in residential developments. There is also an emphasis on taking en vironmental, social and go vernance (ESG) factors into consideration as green de velopments are preferred — paying attention to water use and how waste is recycled

as well. The prevalence of high-tech property manage ment services in Hong Kong improves the experience for residents, making Hong Kong one of the premier ci ties in Asia for residential ma nagement.”

Donald Choi, CEO of China chem, also sees opportuni ties in Hong Kong’s high-rise market. “Hong Kong land resources are very precious,” Choi says. “Developers have been working with the government as well as the community to make best use of the land available in terms of high-density development.

“As a high-density city, Hong Kong is very much about ver tical urbanism, but it’s a new kind of human-centric urban design form. Despite being high-rise, we can create a lot of amenities in these kinds of schemes, including sky gardens and podium ter races. Some highly unique design solutions have re sulted from the challenges.”

CK Asset Holdings’ sought-after residential scheme at 21 Borrett Road, Hong Kong

CK Asset Holdings’

CK Asset Holdings’ sought-after residential scheme at 21 Borrett Road, Hong Kong

CK Asset Holdings’

INVESTING IN HONG KONG 30 MIPIM Asia One Book 2022

Justin Chiu

He adds: “Hong Kong is also in a position to increase and accelerate the residential unit supply. There’s still a very ro bust local demand for quality housing that goes beyond government programmes.”

A further challenge exists in the city’s extensive standing stock, but Choi also sees op portunities here. “Hong Kong is a city which is aging twice over. Not only in terms of its population, but also because its building stock is aging fast. In recent times, there have been many urban re newal projects of existing fa cilities. So, our development drives can help improve city environments and update the quality of life.”

Hong Kong group Lai Sun is another firm hich sees opportunities in the residen tial sector. Deputy chairman, Chew Fook Aun, says: “Re sidential shortages in Hong Kong have deepened in re cent years. In the 1990s, the private sector was construc ting 25-30,000 units per year for public housing needs. Today, that’s down to 1015,000 units which partly explains the high cost of apartments in the city and government attempts to re medy this. “With interest rates rising, the local authorities can now catch their breath as potential buyers are taking a wait-and-see attitude and overall demand is falling. This won’t be the case forever, however and there’s still a si gnificant under su l lso, the re-opening of the border with China sees professio nals that need to work here looking for housing too. Ac cordingly, there are ongoing calls to lift the double stamp duty on non-permanent re sidents such as expats and Mainland Chinese nationals, which could further increase demand.”

Although the fortunes of re tail real estate have changed in the last few years, due to the impact of e-commerce and COVID, some develo pers and investors still see potential in this asset class.

Link REIT, for example, re gards non-discretionary re tail assets in Hong Kong as its core business, according to CEO George Hongchoy. “They are extremely resilient, and they lend strengths and stability to our portfolio ove rall,” he says. “Most assets of Link’s non-discretionary retail portfolio in Hong Kong are directly connected to large housing estates and public transportation hubs. These community commer cial acilities ulfil millions o citizens’ needs for daily ne cessities while also serving as peoples’ ‘extended living rooms’ and providing them with public spaces for social interaction.

“Many residential units in Hong Kong are small. Shop pers have their daily meals and meet their friends at our malls, providing a solid foun dation of non-discretionary demand for the products and ser ices offered there t is the asset class in which we have the deepest expertise.”

oing or ard, the firm s goal is to pursue further growth and reduce risk. Hongchoy adds: “Our strategy in Hong Kong is part of our strate gy for APAC — focusing on non-discretionary retail and logistics and being selective or office e ill consider capital recycling through capital partnership and opti mise the Hong Kong expo sure as part of ongoing ex ansion he firm also on the tender o a non office commercial-use land parcel in Hong Kong’s Kwun Tong in August of this year, which will enable Link to develop a

“As a high-density city, Hong Kong is very much about vertical urbanism, but it’s a new kind of human-centric, urban design form”

community commercial faci lit rom scratch or the first time incorporating best-inclass sustainability practices.

Chiu agrees that some as pects of retail investment are more promising than others.

“There are two main types of retail centres, those aimed at tourists and community malls. The latter are doing relatively well as they provi de day-to-day necessities to local residents. However, the slowdown in the economy means that people are spen ding less, and the ongoing health restrictions have also affected the ood and e e rage (F&B) industries.”

He adds: “Rents have come down by as much as 50% in many retail locations and as sets are trading less and less.” Chiu’s secret formula for dealing with market cycles comprises “a touch of crea tivity, and thinking outside the ox His firm has suc cess ull o oaded a num er of residential developments directly to funds, foreseeing that sales to individuals will continue to slow in a high interest rate environment. “Even when I really like a de velopment, I try to sell it as soon as possible to recycle cash. Some of my creative solutions include combining units into much bigger, luxu ry apartments so they catch peoples’ attention and even hit the newspaper headlines. ou al a s ha e to find our competitive edge — which includes getting the price right — and I’m not afraid of the odd gimmick!” Chiu says.

MIPIM ASIA 2022

Wednesday, December 7, 14.00-14.45

Hong Kong: Rebuilding Its Asia World City’s Reputation

Donald Choi

INVESTING IN HONG KONG 31 MIPIM Asia One Book 2022

Link REIT’s Tak Tin market reopened this summer in Hong Kong, after a four-month enhancement programme to make the market brighter and more spacious

•

•

•

©2020 Yardi Systems, Inc. All Rights Reserved. Yardi, the Yardi logo, and all Yardi product names are trademarks of Yardi Systems, Inc. (800) 866-1144 Learn with us at yardi.com/webinars Get the details ©2022 Yardi Systems, Inc. All Rights Reserved. Yardi, the Yardi logo, and all Yardi product names are trademarks of Yardi Systems, Inc. Get the details APACSales@Yardi.com | Singapore +65 6369 9713 Hong Kong +852 3615 0830 | China +86 21 8013 5007 Increase visibility, reduce risk & enable team collaboration “Leverage the complete Yardi Elevate Suite to gain in-depth operational data, streamline revenue and expense forecasting and enhance portfolio management.” •Lease Manager - Understand portfolio health and manage tenant risk

Deal Manager - Close more deals faster, with a dynamic leasing solution

Manager - Accurately forecast portfolio health

•

• Forecast

projects on time and on budget

Construction Manager - Keep construction

across your portfolio

Facility Manager - Gain complete oversight of maintenance

your customer

to boost efficiency

Retail Manager - Visualise

relationships

Beating the markets

As inflation and interest rates soar around the globe, Japan remains an anomaly. Expert investors debate the best strategies for capitalising on the current outlook

IN A world where central banks are raising interest rates to cur in ation, the Bank of Japan has taken a different ath lthough the countr s current in ation rate o around is higher than the central ank s target, it still com ares ell to the ma orit o the orld s ke economies, ermitting a do ish tilt a an re o e ned its orders more slo l than man other countries ollo ing the andemic, and a mix o go ernment rice controls and an ageing po pulation have also kept the econom on an e en keel t s unsur rising, then, that for real estate investors scouring the globe for unique o ortunities, a an looks

com elling right no aurent ac uemin, head o sia acific at lts, is a ig elie er in the mar ket ok o is the largest o fice market in the orld and continues to display very strong d namics, he sa s he lo interest rates make it something o a sa e ha en in sia and also make the market rett uni ue e remain er acti e in a an and in act, it has een one o our most suc cess ul sian markets since e ha e some n committed to a an toda Although rental growth is li mited, the cost o financing has remained er lo , and there is a general willingness to lend

he office market has conti nued to er orm ro ustl or a num er o reasons, not least a an s t ical remium on space in the residential sec tor, hich has ke t ork lace attendance high, cou led with a traditional outlook on the cor orate orld ac uemin is also im ressed ith the undamentals o a an s multi amil market a an is one o the e mar kets in Asia where residential is very developed as an ins titutional asset class, hile retaining lent o otential ean hile, retail has een resilient as e commerce growth is still relatively low com ared to other sian markets e ha e een trying to diversify our strate gy to include logistics and data centres, hile oth stu dent housing and senior li ing are com elling a an s aging population will require a range of solutions for its elderl olk, hile the o u larity of Japan’s universities

INVESTING IN JAPAN 33 MIPIM Asia One Book 2022

AXA IM Alts has reached new heights with assets including the Zeus Nishi Umeda residential scheme in Osaka

AXA IM Alts’

Laurent Jacquemin

\ MIPIM AWARDS 2023 THURSDAY MARCH 16 PALAIS DES FESTIVAL, CANNES ln the business of building businesses Built by mipimawards.com The MIPIM Awards celebrate the most useful, visionary and sustainable buildings in the world.

and an interest in learning the language keeps student num ers high t is ortunate that Alts has good connections in Japan to source and secure in estment o ortunities as com etition rom other glo al la ers has een ram ing u in recent ears

nother ell esta lished in estment house in the re gion, Hines, a ointed a new country head of Japan last ear, on anaka, ho has more than ears o ex erience in a anese real estate oda , anaka sees evidence of the positive fun damentals continuing a an offers international in estors oth income and ca ital gro th o ortunities he a anese en ersus the dollar is at a ear

lo , in ation remains mode rate and pressure to increase interest rates is muted com ared to other econo mies, he sa s, adding he Japanese banking sector is healthy and continues to offer attracti e financing to real estate in estments, ge nerating cash on cash ields o or more he in est ment market is dee and li uid, ith the largest u lic and ri ate sector in , and transaction o lumes ha e remained stead throughout the andemic ooking ahead, as a an

re o ens the orders to i sitors, e ex ect to see a surge in consumer s ending, dramatic im ro ement in hos italit sector undamen tals and a new wave of Asian high net orth in estment in residential ro ert ike man in estors, Hines has found success in logistics in estments o er recent times anaka sa s ike other economies, during the andemic, e commerce gre ra idl , stimulating su stantial demand or modern logistics acilities n res onse, oth Japanese and foreign deve lopers are developing logistics ro erties in the ma or metro olitan areas Despite values being slashed else here, anaka sa s the industrial market here re mains relati el sta le, thanks to good occu ier metrics he current su l i eline in reater ok o is estimated at around million s m, he sa s es ite the record high su l , e see conti nued demand or s ace rom a anese manu acturers and s, ecause the existing stock is inefficient and out dated n addition, due to glo al su l chain disru tions, domestic manu acturers are onshoring more in entor in these modern arehouses ith the chea en, e e lie e that more hi tech manu facturing could shift back to locations in a an n exa m le is the n on oint enture to uild a semi conductor fabrication plant in K ushu ith su ort rom the a anese go ernment a ital artners is ano ther firm that has car ed out a successful Japanese niche, according to the firm s ounder, uchad hiaranus sati s a grou , e ha e built an outstanding track record in a an hos italit , he sa s he enign interest

rate en ironment in a an is er attracti e, and outlook or the sector remains o siti e es ite international border closure due to the andemic, e ere a le to er orm relati el ell, and the return of overseas guests will further boost the sector he other as ect o our strateg is to im ro e existing assets across a an an hos italit assets are managed inefficientl , so there are opportunities to im ro e their er ormance by analysing the under l ing o erational metrics doing so, e no longer ha e to rel exclusi el on the ri cing mechanism to achie e returns, hich is a in in or us and our in estors

One last aspect in which Japan is catching up is its a roach to en ironmental, social and governance (ESG) targets or man ears, u sinesses in Japan didn’t see this as a riorit here s no ollution in ok o, and u lic trans ort orks ell oda , there is a greater unders tanding o its glo al im or tance, sa s ac uemin anaka adds n recent ears, almost all listed managers o tained ualification to meet re ui rements rom their sharehol ders, articularl uro ean e uit in estment managers t the same time, a anese institutions such as the De elo ment ank o a an, developed a green building standard, reen uil ding, hich has een idel ado ted local de elo ers , the largest ension und in the orld, regards as a critical com onent o their in estment olic he ha e disseminated reporting criteria for portfo lio com anies as ell as or real estate and infrastructure und managers

“With the cheap yen, we believe that more hi-tech manufacturing could shift back to locations in Japan”

Jon Tanaka

INVESTING IN JAPAN 35 MIPIM Asia One Book 2022

AXA IM Alts’ Roppongi Tokyo o ce scheme

Hines’

Jon Tanaka

MIPIM 2023 Better Places. Greater Impact. Stronger Business. 14-17 MARCH 2023 CANNES, FRANCE www.mipim.com ln the business of building businesses Built by

A rainbow of possibilities

Savvy Asian investors are leading the way overseas with smart diversification strategies, despite currency complexities and a shifting global outlook

LAI SUN Development, the real estate arm of Hong Kong conglomerate, Lai Sun Group, may have started small in London, but is today a paradigm of how to invest in the UK capital. Deputy chairman, Chew Fook Aun, says: “London for us was a question of opportunity. In 2011, we purchased a small office in ueen treet or £27m (€31m), which we re furbished, leased and sold for £55m. After that success, we looked again at the market, which brought us to Leadenhall.” Today Lai Sun is well known in London as the developer behind what will be the third highest skyscraper in the city, The Diamond, designed by Skidmore, Owings & Merrill.

But this project was also the result of a series of incremen tal business deals. In 2013, the firm as resented ith an opportunity to purchase 107 Leadenhall, a freehold commercial property over se en oors com rising some 146,600 sq ft (13,620 sq m) o office accommodation i tuated in the shadow of 30 St Mary Axe, commonly known as The Gherkin, it was in the perfect location to deve lop something bigger. Chew adds: “We ended up buying 107 Leadenhall plus num bers 100 and 106, spending around £198m on all three. The interest rate on the loan was around 2.5% while the rental yield was 5-5.5%. gi ving us positive carry to pay

down the loan.

“We saw an opportunity to amalgamate the three sites and create a new, iconic to er or the cit offering million s t o remium office accommodation in total.”

While planning permission for the scheme was granted in 2018, the interim years — including the interruptions of COVID — inspired a design overhaul. Chew says: “Today, it makes more sense to build a tower which is net-zero carbon, taking into account the sustainable ambitions of Fortune 500 companies. To this end, we submitted an amended planning applica tion in August and the pro ject is already creating quite a buzz. CBRE and Knight Frank are our leasing agents and are already reporting in terest,” he adds. If all goes to plan, construction will start in 2024, with the project com pleting in 2028 at a total cost of around £720m.

Lai Sun Group isn’t the only Asian investor that is betting

The acquisition of Kaleidoscope in London has proved a colourful addition to Chinachem’s portfolio

The acquisition of Kaleidoscope in London has proved a colourful addition to Chinachem’s portfolio

OUTBOUND INVESTMENTS 37 MIPIM Asia One Book 2022

Lai Sun Group’s Chew Fook Aun

on London. Hong Kongbased CK Asset Holdings has been investing for some time in residential developments in the capital. Says execu tive director Justin Chiu: “We are looking at where we can contribute to what the city needs, as well as make a rofit hat means understan ding how the market works. For example, in the UK, you don’t have to pay a premium for the change-of-use of a site, which I think is a good thing. But when you rede

“Today, it makes more sense to build a tower which is net-zero carbon, taking into account the sustainable ambitions of Fortune 500 companies”

urr o international interest “The relatively weak pound makes these apartments in teresting to Asian investors who are looking at the UK capital,” Chiu says. “Curren c uctuations don t al a s work in a developer’s favour, but right now, London is a compelling opportunity also for this reason.”

Chew Fook Aun