Join us on this business-focused journey and attend 50+ conferences focusing on our Ready to Impact program and its 4 main pillars: Paris 2024 Games, Vibrant Opportunities and Projects, Leadership and Innovation, Urban and Living Environment.

PARIS_N2_PIM Advertisement Wednesday 13 March 2024 www.mipim.com

122_CHOOSE

NEWS

Srettha Thavisin talked Thai investment

2

Thai Prime Minister 17

Finland’s former PM pushed for a green future

Sanna Marin Keynote 15

The MIPIM community came together to network

Opening Reception 07

07

34

All

Conferences

of the latest research, insights and debate

Spotted at MIPIM

Brazil’s COFECI invites delegates to meet with its leaders at 16.00 today to make tracks in Brazilian real estate. Cutting the ribbon on the stand: Marcelo Silveira de Moura (left), João Teodoro da Silva, José Augusto Viana Neto, Aida Turbow, João Eduardo Correa

All MIPIM print products are printed on paper from sustainably managed sources using printing processes that comply with the PEFC standard. DIRECTOR OF PUBLICATIONS Michel Filzi EDITORIAL DEPARTMENT Editor in Chief Isobel Lee News Editor Julian Newby Sub Editors Neil Churchman, Joanna Stephens Proof Reader Debbie Lincoln Reporters Adam Branson, Clive Bull, Benedict Cooper, Mark Faithfull, Andy Fry, Liz Morrell, Nigel Willmott Editorial Management Boutique Media International Graphic Studio StudioA Design Graphic Designers Harriet Palmer, Sunnie Newby Head of Photographers Yann Coatsaliou / 360 Media Photographers Frederic Dides, Patrick Frega, Phyrass Haidar, Olivier Houeix PRODUCTION DEPARTMENT Publishing Director Martin Screpel Publishing Manager Amrane Lamiri Printer IAPCA, Le Muy (France) Wednesday 13 March 2024 www.mipim.com Advertising contact in Cannes Maryam Grandela maryam.grandela@rxglobal.com RX France, a French joint stock company with a capital of 90,000,000 euros, having its registered offices at 52 Quai de Dion Bouton 92800 Puteaux, France, registered with the Nanterre Trade and Companies Register under no 410 219 364 - VAT number: FR92 410 219 364. Contents © 2024, RX France Market Publications. Printed on PEFC certified paper. Sanna Marin’s keynote; infrastructure insights; London opportunities; Hungarian projects; data and proptech; environmental innovation; Portugal; Japan; Oman NEWS 2 The MIPIM newsroom is located in aisle B next to the Propel Station News

the session

at

and

the most

details, expert speakers, conferences and events, to help you plan your time

MIPIM

make

Contents 05

and Luiz Fernando Barcellos

Shamel Aboul Fadl (left) and Karim Aboul Fadl from Compass Investment Holding travelled to Cannes for MIPIM

Vilma Daucione (left) from Verslo Zinios, Michael Uston of Elba Group and Goda Pereckaite-Paplauske of Verslo Zinios networked

Julie Stern (left), Christine Long and Shuxuan An of Columbia University raised a toast

Shamel Aboul Fadl (left) and Karim Aboul Fadl from Compass Investment Holding travelled to Cannes for MIPIM

Vilma Daucione (left) from Verslo Zinios, Michael Uston of Elba Group and Goda Pereckaite-Paplauske of Verslo Zinios networked

Julie Stern (left), Christine Long and Shuxuan An of Columbia University raised a toast

07 MIPIM NEWS | MARCH 13

Rustom Vickers (left) and Meryem Ibrahimi of Blueground enjoyed the reception

1 2 3 4 1 2 3 4

The MIPIM Opening Reception saw delegates catch up with old contacts and make new ones in Cannes

European Distribution Centre for Levi Strauss & Co. with 73,000 m² GFA Warehouse with fully automated intralogistics and high-quality office space

Cradle to Cradle optimized, LEED Platinum & Well Platinum certified 30,000 m²/3.5 MWp solar panels and geothermal energy system

Comprehensive initiatives to achieve whole life carbon positivity

Fusion of sustainability, functionality and aesthetics

www.deltadevelopment.eu watch our video vote

O ur Po sitive F oo tprin t W e arhouse seek s your v ote

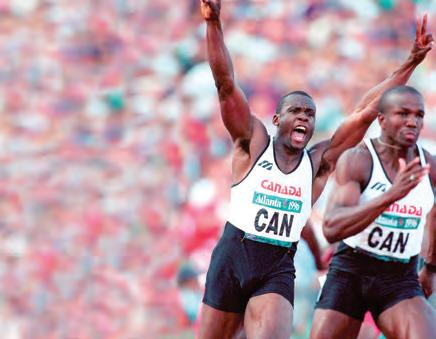

Cutting the opening ribbon: Jean-Michel Arnaud, SEMEC president (left); Klara Geywitz, German Federal Minister for Housing; Michel Filzi, CEO, RX France; Hugh Jones, CEO, RX Global; Srettha Thavisin, Prime Minister of Thailand; Sanna Marin, former Prime Minister of Finland; Guillaume Kasbarian, French Minister for Housing; Alexandra Dublanche, vice-president of the Ile de France Region; Patrick Ollier, president of Grand Paris Métropole; and Nicolas Kozubek, director, MIPIM

Cutting the opening ribbon: Jean-Michel Arnaud, SEMEC president (left); Klara Geywitz, German Federal Minister for Housing; Michel Filzi, CEO, RX France; Hugh Jones, CEO, RX Global; Srettha Thavisin, Prime Minister of Thailand; Sanna Marin, former Prime Minister of Finland; Guillaume Kasbarian, French Minister for Housing; Alexandra Dublanche, vice-president of the Ile de France Region; Patrick Ollier, president of Grand Paris Métropole; and Nicolas Kozubek, director, MIPIM

1

Industry protagonists launched MIPIM 2024 in their own inimitable style, from ribbon-cutting to speech-making, networking to business lunching

The world’s leading investors came together at the RE-Invest Summit to discuss securing capital and deploying firepower in global real estate

Delegates and delegations made sure to extend a warm ‘welcome to MIPIM!’

MIPIM director Nicolas Kozubek showed Guillaume Kasbarian, Deputy of the French National Assembly and Minister for Housing, around the Palais and grounds

2 3 4 1 2 3 4 09 MIPIM NEWS | MARCH 13

At the Hôtel Barrière Le Majestic Cannes, Sophie Hæstorp Andersen, Lord Mayor of Copenhagen, addressed the Political Leaders’ Summit

CBRE Real Estate Investment Banking

Realising potential in every dimension

€35Bn

European Real Estate Investment Banking transactions over the past 36 months

€1.34bn Logistics / Office

Advisor to TPG on its offer to acquire Intervest, a leading Belgian logistics and office REIT.

€258m Retail

Advisor to IGD on the structuring of a closedend RE fund (13 assets) managed by Prelios SGR and financed with preferred equity provided by Sixth Street and Starwood Capital.

SEK5.2bn (€466m) Community Properties

Advisor to Castlelake in connection with a newly formed SEK9.4bn JV with SBB involving a SEK5.2bn loan from Castlelake.

M&A, JVs, Public and Private Capital Markets, Recapitalisations

CBRE offers clients a unique combination of deep real estate knowledge, global institutional investor distribution, and sophisticated real estate investment banking capabilities.

€280m Industrial

Advisor to Fedrigoni on the corporate monetisation of a European industrial portfolio to W.P. Carey.

€1.7bn Fair Value Residential

Advisor to ERES, a Toronto listed-REIT with a portfolio of 158 residential properties with 6,900 units in The Netherlands, in connection with its Strategic Review.

Ongoing takeover of a public company.

Confidential Serviced Apartment

Advisor to Proprium Capital

Partners on the sale of YAYS, a serviced apartment platform, to Numa Group.

Strengthen Numa’s leading digitalised hospitality platform in the Benelux, French and Spanish markets.

cbre.com/investment-banking

IGD will receive €155m cash to repay debt and decrease its Loan to Value by 3.7%.

SBB will use the proceeds to strengthen its financial position and amortise debt.

£1.5bn Life Science

Advisor to Greater Manchester Pension Fund on a £150m strategic minority investment into Bruntwood SciTech.

Strategic investment into preeminent UK innovation and life science platform.

Confidential Live Show Arena

Advisor on the sale of an indirect controlling stake in the largest show arena in Portugal, together with a controlling stake in a top live show promotion business.

Among the largest arenas in the world in terms of annual spectators.

Sale of the largest industrial portfolio in Italy ever.

€250m Hospitality

Advisor to Avenue Capital and Meliá in connection with the sale of a 51% stake in a Spanish hotel company.

One of the largest transactions in the Spanish hospitality sector in 2023.

Largest listed residential REIT in The Netherlands.

$600m

Luxury Residential

Advisor to Dar Global plc, on its US$600m admission to the main market of the London Stock Exchange, raising US$72m.

Opening access to global capital markets for a leading developer of high-end second homes.

Come and visit us at the Majestic Beach Restaurant, Location C17.A

Day one of MIPIM saw delegates meet and greet in novel and traditional ways, with sake ceremonies, DIY stands and lightbulb moments bringing smiles to the Palais

Stockholm said no to waste with a stand made of recycled materials. Deputy mayor Anders Österberg (left); with Invest Stockholm’s Erik Krüger and Caroline Strand

Germany’s North RhineWestphalia region is a magnet for bright sparks, NWR general manager international trade fairs, Eva Platz, told MIPIM News

Newsec Advisory’s Liza Jessen (left), Thomas Grauslund Nilesen and Aqleema Waseem Asher collected their badges as they geared up for the first day of MIPIM

On the Silesian Voivodeship stand, Mariusz Gasior represented the spirit of the region’s industrial past — and innovative future

Stockholm said no to waste with a stand made of recycled materials. Deputy mayor Anders Österberg (left); with Invest Stockholm’s Erik Krüger and Caroline Strand

Germany’s North RhineWestphalia region is a magnet for bright sparks, NWR general manager international trade fairs, Eva Platz, told MIPIM News

Newsec Advisory’s Liza Jessen (left), Thomas Grauslund Nilesen and Aqleema Waseem Asher collected their badges as they geared up for the first day of MIPIM

On the Silesian Voivodeship stand, Mariusz Gasior represented the spirit of the region’s industrial past — and innovative future

11 MIPIM NEWS | MARCH 13

Attending the Japan Pavilion’s sake ceremony were delegates Mitsuhide Motoyama (left), Chuo Nittochi Group; Kanji Matsushita, Takenaka Corporation; Yuichi Oka, Daiwa House Europe; Hideki Nose, Sumitomo Forestry; and seminar host Andrew Eborn

2 3 4 5 1 2 3 4 5

APAC’S LEADING REAL ASSET MANAGER POWERED BY THE NEW ECONOMY

With our industry-leading efforts ranging from capital raising to green initiatives and sustainable operations, ESR has set benchmarks in the industries we serve.

FUND MANAGEMENT INVESTMENT DEVELOPMENT

Find out more at ESR.COM

The team from the Administrative Capital For Urban Development, Cairo shared its opportunities with all: Areej Badr (left), Mohamed Al-Desouky, Ali Badawy; Ashraf Fatteen; Hamed Mousa, Ismail Helal; Rona ElShall (front) and Gihan Gadou

The team from the Administrative Capital For Urban Development, Cairo shared its opportunities with all: Areej Badr (left), Mohamed Al-Desouky, Ali Badawy; Ashraf Fatteen; Hamed Mousa, Ismail Helal; Rona ElShall (front) and Gihan Gadou

2

The Global Urban Festival proved a celebration of diversity, uniting delegates from all over the world

Sutcliffe’s Martin Peacock (left) and Tahreen Shad of Lovell Partnerships stopped to say hello by the Liverpool Pavilion

The Oman team from the Ministry of Housing and Urban Planning is at MIPIM to promote its latest drives: Sulaiman Al Siyabi (left); Hisham AlZubaidi and Nasser Al Siyabi

Helena Schlamberger (left), Spirit Slovenia Business Development Agency, with City of Ljubljana’s Sašo Rink, promoting the city’s natural beauty and resources

3 4 5 2 3 4 5 13 MIPIM NEWS | MARCH 13 1

Communications director for the Ville de Paris, Aurélie Sidobre, and Convivio’s Geraldine Lemoine networked in the sunshine on the sea front

THE CLIMATE crisis. AI. The Ukraine War. Gender equality. Populism. Happiness. Former Finnish Prime Minister Sanna Marin deftly covered all of these topics and more in the first keynote of MIPIM 2024 yesterday. If there was a common theme running through all of her remarks, it was the importance of locking horns with humanity’s existential challenges — because inactivity and inertia are not viable options.

As Prime Minister of Finland, Marin set the world’s most ambitious net zero targets — and she urged other countries to do the same. “I believe everyone should meet Finland’s ambition level. I know it’s hard, but we all have to set targets really high, because we can’t negotiate on issues like the climate and biodiversity. Without a green future, there is no future.”

‘Without a green future, there is no future’

Tackling the subject of AI, she argued that the public and private sector should work together more closely. “This transformation is coming, but sometimes politicians don’t get the pace of change. There are so many opportunities in AI, but politicians and businesses need to talk more. This dialogue might be hard but it will also be very fulfilling and beneficial.”

And her position was unequivocal on Ukraine. To applause from a packed Grand Auditorium, she said: “Ukraine has to win, because it is a question of democratic values. To people who live far away from the war, we need to emphasise the importance of the international rules-based order. Without these rules, we all lose.”

Asked why it makes sense for the EU to set more rigorous environmental standards for its businesses than other parts of the world, she said: “When you do things first, you create opportunities. To this audience I would say it is smart to be a front-runner in areas like green steel and green cement, in technology or in finding new ways of living.”

As Finland’s PM, Marin made great strides towards a gender-balanced society. Asked how MIPIM companies might follow suit, she said: “The answer is simple. Employ women and make sure they are at the decision-making tables. Humanity really doesn’t have the luxury of discarding half of the global population’s talent and intelligence.”

MIPIM NEWS | MARCH 13 15

Former Finland Prime Minister Sanna Marin

‘For us this is just a starter’

THAILAND is at MIPIM with the message that it is open for business and that the country will return “bigger and better” next year to showcase the investment story for the country, Prime Minister Srettha Thavisin said on a visit to the Thailand stand yesterday.

Thavisin is leader of the Pheu Thai Party and has been in office since August 2023. He said that after nearly two decades of slow GDP growth in Thailand, he was determined to accelerate economic growth and that the first stage to achieving this was a significant upgrade of the country’s infrastructure. Major projects include the opening of a new terminal at Bangkok’s Suvarnabhumi Airport, which has increased passenger capacity from 45 million to 60 million annually, plans to build two new airports in the north and the south of the country, plus a 20 km road bridge to connect the mainland with popular tourist island Koh Samui. Those projects are crucial to give real estate investors the infrastructure platform necessary to develop new schemes, the Prime Minister said. Thavisin has a real estate background and is the former CEO of Thai developer Sansiri. “I was a frequent visitor to MIPIM but this is my first time back in seven years and this time we are here mainly to understand what is going on

around the world,” he said. “However, for us this is just a starter.”

He pointed to the fact that Thailand is Asia’s fourth-largest economy and has already had success in attracting international business including Chinese EV battery manufacturing, plus US corporate giants including Amazon, Google and Microsoft. The country has also prioritised clean energy and he said that sustainability is “top of the agenda” for Thailand in how it develops its urban growth.

“Developing our real estate with high levels of sustainability and increasingly focusing on using clean energy are the two most important factors moving forwards,” he said.

Over the next 12 months the government plans to set out in more detail its strategy to create real estate investment and development opportunities around Thailand, which the country hopes to showcase at MIPIM next year.

“Thailand is a very attractive country for investment and also for multinational companies,” he said, “because for professionals coming to work here, we have excellent international schools, can offer a great lifestyle and have world-class healthcare.”

MIPIM NEWS | MARCH 13 17

Prime Minister of Thailand, Srettha Thavisin

RIBA’s Oki calls on young to help build tomorrow’s world

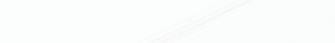

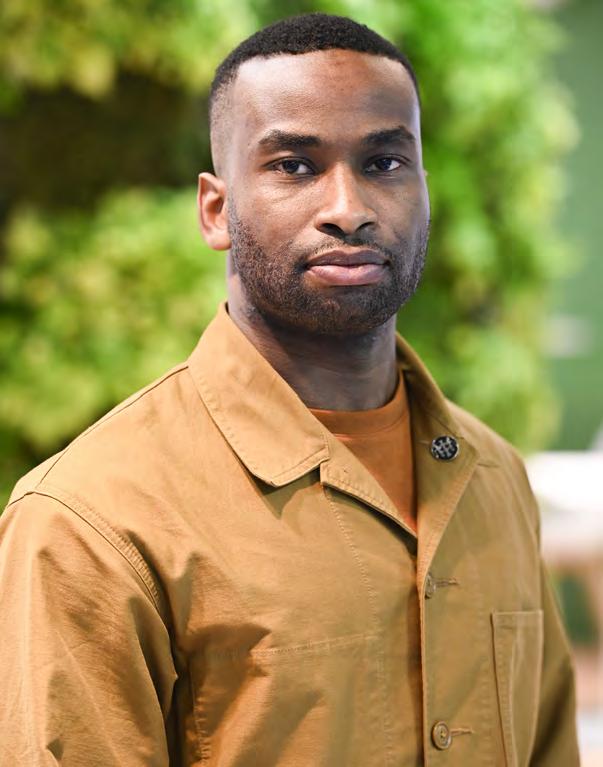

ARCHITECTS and the wider built environment need to work harder to engage with young people, according to Muyiwa Oki, the current president of the Royal Institute of British Architects (RIBA) and the youngest in its history.

“Architects play a big role in creating the built environment that we all want,” he said. “There’s inherent environmental and social value in design, but also in procurement and we have a role to play in that conversation. But I also want to say that we need to get young people involved in decision-making because the future that we’re trying to create is going to be created for the next generation.”

To that end, Oki is acting as a judge for the MIPIM Challengers initiative, which is intended to “inspire, invigorate and encourage a commitment to building sustainable, vibrant and inclusive urban environments for generations to come”, according to the organiser.

“It’s a fantastic opportunity to get this group of people under 30 to engage in the conversation and

London showcases ‘unprecedented scale’ of investment opportunities

LONDON is “united as never before” at this year’s MIPIM, according to Opportunity London CEO Jace Tyrrell. The city is presenting an “unprecedented scale” of investment opportunities totalling nearly £10bn (€11.8bn), with an estimated gross development value of £38bn. Shortly before MIPIM, Opportunity London published an investment prospectus showcasing nine major potential development schemes and flagging more than 100 possible investment sites across the UK capital, targeting

share their innovative ideas for how we can get sustainable urban development going,” Oki said. In terms of the wider net-zero carbon agenda, Oki believes that the built-environment industry is starting to step up to the challenges. But he said that it is time to come up with practical solutions and plans for hitting the 2050 target set out in the Paris Agreement. “From conversations I’ve had over the past few months in my role as president, I believe there is a concerted effort to engage with this topic, especially at the theoretical level and philosophical level,” he added. “Now it’s time to find the technical solutions.”

One solution that Oki backs is to make as much use of existing structures as possible in order to keep embodied carbon to a minimum. “I think that is a key part — it’s not the only part, but it’s a key part,” he said. He added: “Architecture is not just about designing a single building from scratch. It’s not all about using virgin materials. We can expand the scope of what an architect does. And that expansion includes asking: how do we make places using the existing buildings that we have in our cities in the UK and in most developed countries?”

sovereign wealth funds, institutional investors and family offices.

“Very often investors are presented with opportunities but without putting forward the underlying business case, so we spent a lot of time curating these projects, which really brings across the significant scale, the financial returns, the planning consents and the political backing to give investors much more confidence,” Tyrrell said. He added that the co-ordinated London approach is also dedicated to ensuring that any potential inves-

tors “share the same values and the desire to make a social impact as us”. The role of Opportunity London is also to co-ordinate with the London boroughs to help them realise their ambitions and to provide resources and expertise for local councils, particularly around housing. Tyrrell also stressed that the organisation has political backing at all levels.

“We’re very aware that capital goes wherever investors want, so we believe that presenting delivery-ready projects and opportunities is an important step in attracting investors,” he said. “We also believe that this is a model that could be replicated for cities around the UK, so it’s a potential opportunity not just for London but for the whole country.”

MIPIM NEWS | MARCH 13 19

Opportunity London’s Jace Tyrrell

RIBA’s Muyiwa Oki

Belfast is at a ‘pivot point’ in real estate growth potential

BELFAST’s wealth of opportunities for real estate investment and its appetite for growth make now the “optimal time” to invest in the city, the council’s chief executive has said. A flourishing screen and media sector, a growing science and tech scene, a healthy pipeline of commercial property development and the benefits of the city’s dual-market access to the Republic of Ireland and the UK have all contributed to Belfast’s “magnetic effect” on investors and development partners, according to John Walsh, chief executive of Belfast City Council.

Speaking to MIPIM News, Walsh said that Belfast is at a “pivot point” in terms of potential commercial property growth, boosted by inward investment coming from the Republic of Ireland, the UK and further afield. “For those considering investing in Belfast, now is the optimal time to do it,”

he added. “Land values are still relatively modest [so] we represent a really good value proposition. Some of our strengths are our reputation in terms of fintech,

cybersecurity, and health and life sciences, and our two fabulous universities. And there is demand for growth. Belfast needs to get to a new sense of maturity, so that it

can attract top talent.”

Walsh is in Cannes as part of a delegation from Belfast seeking to initiate conversations with new partners for development projects, and investors with an interest in the region. The team is highlighting a wide range of current and future development opportunities across all sectors, including residential and student accommodation.

Later this year the city will take a big step forward with the completion of multimodal transport hub Belfast Grand Central Station. Also due for completion in 2024 is a £100m (€117m) project to deliver phase two of the renowned Studio Ulster complex, close to Belfast City Airport. When it is up-and-running, the additional space will make Studio Ulster one of Europe’s major creative hubs for the screen-production industries. Belfast is also benefitting from the increased economic and political stability that has come with the restoration of the Northern Ireland Assembly in February after a two-year suspension.

UK hotels next stop for Schroders

SCHRODERS is at MIPIM to launch an operating hotels fund aimed at the UK market. The vehicle is essentially a sister fund to the company’s European operating hotels fund, which has proved to be highly successful.

“We launched the European operating hotels fund during COVID,” said Sophie van Oosterom, global head of real estate at Schroders.

“We have a team of 40 people across Europe that are able to step in and reposition a brand, launch a brand or get ready for new franchises. It’s fully flexible — the team is able to look at an asset and reposition it.” She added: “We have been very

successful. We did even better than expected when it comes to the returns and, on the basis of that success, we’re now launching a sister fund and moving into the UK. We’re taking exactly the same approach: looking at assets that are undermanaged or can be repositioned or where we can make an impact.”

Schroders is also launching its Capital Investments Outlook:

Real Estate H1 2024 this week, which forecasts an increase in transactions this year. “We see sequential opportunities arising [due to the fact that] a number of different markets have repriced

at different times,” van Oosterom said. “The UK market was the first to reprice and the Nordic markets have significantly repriced as well.” In addition, Schroders takes the view that a more stable interest-rate environment should help boost transactions. “As we understand it, interest rates are stable, or at least have peaked, with some assumptions that they will be more likely to go down than to go up,” van Oosterom said. “For the past year, that was very uncertain. Economies have responded better than I think many were expecting, given the harsh measures of the interest-rate rises.”

MIPIM NEWS | MARCH 13 21

Schroders’ Sophie van Oosterom

Belfast City Council’s John Walsh

Visit Warsaw and our Partners at stand Riviera 8 D1! 61B Koszykowa Street 00-667 Warsaw, Poland + 48 22 221 81 91 biuro@cordiahomes.com 45 Traugutta Street 50-416 Wroclaw, Poland +48 71 79 88 010 biuro@develia.pl 36 Solidarności Avenue 25-323 Kielce, Poland +48 41 3 333 333 kielce@echo.com.pl 2 Puławska Street 02-566 Warsaw, Poland +48 22 204 00 40 biuro@bbidevelopment.pl 3/5 Bankowy Square 00-950 Warsaw, Poland growwithwarsaw@um.warszawa.pl @GrowWithWarsaw 132/134 Chmielna Street 00-805 Warsaw, Poland +48 22 4877 800 info@cmteam.net

Warsaw is an open city that supports diversity. In cooperation with external partners improves the quality of life its residents. A city that evolves and responds to the changing people needs.

Contact us and our Partners directly during MIPIM. Feel free for cooperation also after event.

+

5 Ks. Skorupki Street 00-546 Warsaw, Poland +48 22 58 37 200 office@karimpol.pl

Armii Krajowej 25 Street 30-150 Cracow

+48 605 609 609 info@nohoinvestment.com

1 ONZ Roundabout 00-124 Warsaw, Poland

Robert Stachowiak, CEO SGI +48 601 337 488, robert.stachowiak@sgi.pl

1 Europejski Square 00-844 Warsaw, Poland

48 22 455 16 00 poland@ghelamco.com

12 Jana Pawła II Avenue 00-124 Warsaw, Poland +48 (22) 850 91 00 sekretariat@phnsa.pl

173 “Solidarności” Avenue 00-877 Warsaw, Poland

Adrian Karczewicz Head of Divestment CEE adrian.karczewicz@skanska.pl

5 Ks. Skorupki Street 00-546 Warsaw, Poland +48 22 58 37 200 office@karimpol.pl

Armii Krajowej 25 Street 30-150 Cracow

+48 605 609 609 info@nohoinvestment.com

1 ONZ Roundabout 00-124 Warsaw, Poland

Robert Stachowiak, CEO SGI +48 601 337 488, robert.stachowiak@sgi.pl

1 Europejski Square 00-844 Warsaw, Poland

48 22 455 16 00 poland@ghelamco.com

12 Jana Pawła II Avenue 00-124 Warsaw, Poland +48 (22) 850 91 00 sekretariat@phnsa.pl

173 “Solidarności” Avenue 00-877 Warsaw, Poland

Adrian Karczewicz Head of Divestment CEE adrian.karczewicz@skanska.pl

Investing in the Nordics?

Business Arena is the leading annual real estate event in the Nordics. This is where the investors, real estate professionals, decision makers and municipalities meet to network and do business.

VISIT BUSINESS ARENA IN:

Norway 30th May

Stockholm 18-19th September

Denmark 21st November

Finland February 2025

businessarena.nu

PANELS TAKE LONG LOOK AT LONDON MARKET ISSUES

THE LONDON Stand’s programme of conference panels kicked off with a deep dive into the UK capital’s build-to-rent and co-living markets.

Legal & General Investment Management head of residential Dan Batterton said: “Demand for single-family houses for rent is enormous but the product hasn’t been there. We did a survey that showed a lot of people like rental because it gives them flexibility.”

Quintain director of corporate communication, Harriet Pask, noted that the sector has changed since the pandemic.

“Amenity spaces we thought would be for relaxation have become more about co-working.”

Félicie Krikler, Assael Architecture director, said demand for longterm rental options has implications for building design. “If you want people to live there as long as possible, you need to think about building a sense of community.”

Vilnius targets big Tech City project at next-gen startups

VILNIUS District Municipality is looking to attract the next generation of technology companies to set up in the Lithuanian capital as it plans for its future development after significant land reform, according to the city’s chief architect.

“We’re really inviting young specialists like startups, fintechs and proptechs to establish themselves in Vilnius because the ecosystem is really very friendly,” said Laura Kairiene, chief architect of Vilnius. “We’re creating the spaces where they can work and live.”

The Tech City project, for instance, will be the biggest development aimed directly at startups in Europe, according to Kairiene. “It’s a former industrial area that we’re converting for offices and co-living,” she said. “It will be like a city within the city.”

The Tech City site is one of many Soviet-era industrial areas the city

authority is keen to regenerate. “We’re planning competitions for architects and also inviting investors [to take part],” Kairiene said. Such activity is only possible due to the fact that land reform in Vilnius is approaching completion more than 30 years after Lithuania’s independence from the Soviet Union. During the Soviet era all land was owned by the state.

“We’re finalising our land reform,” Kairiene said. “In two years’ time, we will have land as a city. Now is the time for planning our territories. We have this two-year window to plan it and then we can immediately go out and say ‘look at these investment opportunities’. “We have locations that we believe are very interesting with the potential for redevelopment. They will become vibrant city spaces. We can open up new locations and will be investing in social infrastructure.”

Focus on Manitoba’s hub potential

A DELEGATION from Canada is at MIPIM this week with the aim of putting the province of Manitoba and its capital city Winnipeg on the world stage.

“We have a central location in North America, and so we’re a prime logistic and transportation hub,” said Frédéric Chieux, foreign direct investment manager for Europe, for the city of Winnipeg. “North America is always organised in north to south corridors. We are the north entrance of the middle of the continent, which covers the biggest industry, especially in the US. So we are here just to make sure that you can tap into that market, especially when you come from Europe, Africa or Asia, and you want to attack the North American market.”

Margot Cathcart, president and CEO of Rural Manitoba Economic Development Corporation was keen to emphasise opportunities

outside urban areas as well.

“There’s a lot of activity happening in rural areas, and they’re often overlooked from an investment perspective. I can think of a number of projects on that logistics front where we’re simply not growing because we need more warehousing and distribution space in the rural areas to be able to accommodate

the local growth,” she said. Chieux added that the goal was not necessarily to compete with the US, but to work with it. “The US is 10 times bigger than Canada in terms of population and economic impact. So you come to Canada not only to address the Canadian market, but also to address the American market,” he said.

Vilnius chief architect Laura Kairiene

Vilnius chief architect Laura Kairiene

25 MIPIM NEWS | MARCH 13

Frédéric Chieux, foreign direct investment manager for Europe, for the city of Winnipeg and Margot Cathcart, president and CEO of Rural Manitoba Economic Development Corporation

Panellists discuss build-to-let in London

MIPIM Awards VOTE for your favourite project Onsite: From Tuesday 12 March (9.00) to Thursday 14 March (Noon) At the Awards Gallery, Palais -1 mipimawards.com Scan the QR Code to cast your vote online MIPIM ® is a registered trademark of RX FranceAll rights reserved.

Oman aims high with ambitious Mountain Destination project

FOR A first-time participant at MIPIM, the Sultanate of Oman’s Ministry of Housing and Urban Planning has no lack of ambition.

It is looking for investors for two multi-billion projects: Mountain Destination, a new town and resort in the Hajar Mountains; and its Downtown regeneration plan for the capital, Muscat.

“Both projects already have government-funded infrastructure, design and land acquisition. Now we need investors and developers,” said Dr Khalfan Al Shueili, Oman’s minister of housing and urban planning.

The $2.4bn (€2.19bn) Mountain Destination project is sited at 2,400 metres on Jabal al Akhdar, known as the Green Mountain.

Masterplanned by AtkinsRealis, in consultation with local com-

munities, it is expected to attract a residential population of 8,000, with 2,350 overnight and 2,000 daily visitors.

Al Shueili also pointed out that, for first time with this kind of project, the freehold ownership of property will be permitted.

One key attraction is the 22°C average annual temperature, with temperatures staying at least 15°C lower than in other parts of the country — not insignificant when temperatures elsewhere in the country can reach 40°C or even 50°C.

There will also be a number of activities — and non-activities.

“We will have a lot of activities for families, including sports, such as high-altitude training, mountain biking and rock climbing,” Al Shueili said. In addition, there will be a variety of experiences, includ-

ing a hotel on a cliff edge over a 1 km-deep canyon, property in an existing wadi and a conservation area for stargazing.

The 3.6 million sq m Al Khuwair Downtown project is a waterfront site in the centre of the city, consisting of both reclaimed land and redesignated land, such as an old power station. A population of 60,000 is proposed, with some buildings of 35-40 floors. There will be a mix of residential, office and retail, along with facilities including a park, health centre and educational institutions.

At MIPIM, Al Shueili is also promoting interest in the Oman Vision 2040, a spatial programme for the development of the country, with a pipeline of projects. “We hope that will attract longterm investors,” he added.

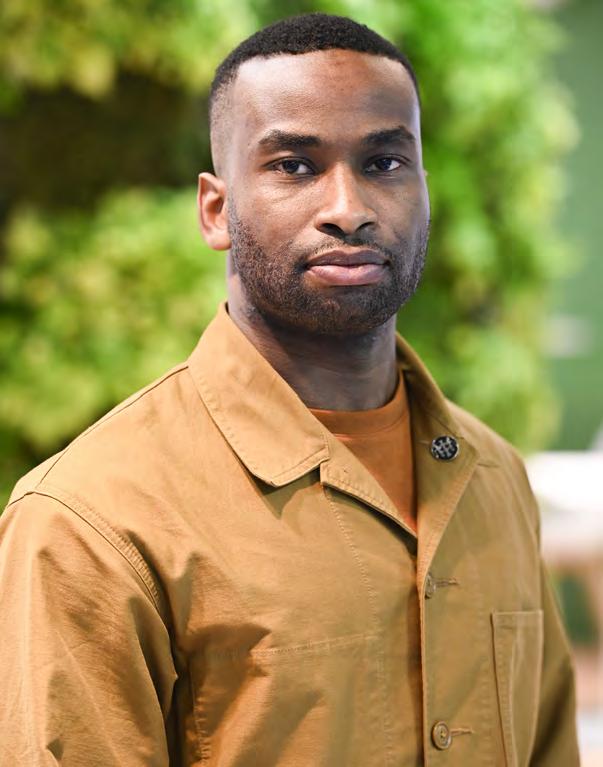

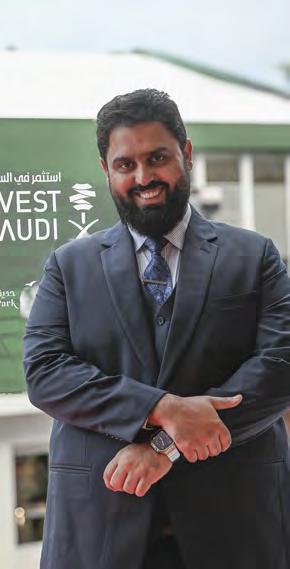

‘Giga projects’ on offer in Saudi Arabia

INVEST Saudi is back at MIPIM for the third time with its largest ever delegation across three pavilions.

“It showcases our commitment to partner with the world, our ambitions and our innovation across giga projects,” said Fahad Alhashem, assistant deputy minister of investment development, service sectors, at MISA’s Invest Saudi.

Saudi Arabia’s national investment promotion platform will host a series of panel sessions and presentations featuring leading figures from the Saudi government and industry, including the Saudi Architecture and Design Commission, the Public Investment Fund, Diriyah Company, King Salman Park Foundation and New Murabba. “The Real Es -

tate General Authority will talk about how they are regulating the market and improving property registry, brokerage, asset management and facility management,” Alhashem added. With more than a million trees being planted, King Salman Park will eventually be four times the size of Central Park in New York. “Imagine building a park in the middle of the desert. It will really showcase our commitment to net zero and our push to reduce carbon emissions,” Alhashem said.

The Diriyah development is another huge scheme in the birthplace of the Kingdom of Saudi Arabia and its foremost historical, cultural and lifestyle destination. By 2030, the 14 sq km site

will feature 38 hotels, more than 100 restaurants and multiple educational institutions. “The Diriyah project is dear to our hearts,” Alhashem said. “It holds strong significance in the history of the kingdom and it’s also an iconic and truly inspiring project in the middle of the city.”

The Saudi market has been growing rapidly and is set to reach record levels as the government’s Vision 2030 plan unfolds. “We are not yet there yet.” Alhashem said. “We have not seen a peak. It’s important that everybody knows they are welcome to be part of this growth. We want companies to come and visit us, look at the opportunities and also take a step forward. And we’ll be there to help and assist them.”

MIPIM NEWS | MARCH 13 27

Invest Saudi’s Fahad Alhashem

Oman minister Dr Khalfan Al Shueili

How can a cultural renaissance boost a city’s digital visibility?

As the leading communications agency for the BUILT ENVIRONMENT, we’re here to help.

To access the sixth edition of EUROPE’S MOST TALKED ABOUT CITIES and learn more about our specialised City Strategy Unit go to

ING-MEDIA.COM @INGMEDIA ING IS THE GLOBAL COMMUNICATIONS PARTNER FOR MIPIM

FOREIGN CASH BOOST FOR HUNGARY LOGISTICS SECTOR

HUNGARY has performed incredibly well at attracting FDI, with large corporates setting up their new manufacturing plants in the country, primarily linked to emobility, according to Infogroup owner Ádám Székely.

This is partly through direct OEM investment, and partly through suppliers and third-party logistics operations. There has been notable growth in regional markets, and the industrial boom will be characterised by tailor-made, build-to-suit (BTS) developments in the near future, he said, adding that he was confident that the market would expand further.

“Tenants are far more concerned about the quality of space and ESG, which generates more focus on green solutions and extra investments from developers on sustainable and long-term solutions,” he said. “BTS is a key factor in the current market, however that requires proactive developers, who purchase, prepare and design property solutions.”

HelloParks looks to neighbouring countries for international growth

HUNGARY’s industrial property development sector is expanding rapidly thanks to its increased exposure to the countries in the east of Europe and the steady inflow of foreign direct investments.

That is the view of Rudolf Nemes, CEO and co-founding partner of sustainable real estate development company HelloParks, who said that this has had many beneficial effects on the industry, with accelerated

industrialisation, a favourable regulatory environment, the presence of skilled labour locally and sourcing further talent from abroad all playing a crucial role in this.

“In addition, Hungary is geographically well-located and has a positive nearshoring outlook; therefore, non-European businesses have great potential to carry out European manufacturing activities at highly competitive, cost-effi-

cient prices,” he said.

This has created favourable conditions for the sector to grow longterm, although he said he anticipated that the volume of speculative development will decrease as a proportion of the total market. Although HelloParks does not currently have a build-to-suit (BTS) standalone development in progress, the company is looking to create such development in the future.

“We have been dedicated exclusively to developing energy-efficient and sustainable industrial buildings from the beginning. It is now clear that there is a massive demand for such forward-looking buildings,” he said. “We have been chosen by some of the biggest international and global companies because our state-of-the-art buildings can be run on up to 50% less energy than a standard industrial complex built just a few years ago.”

At MIPIM the company is showcasing its development work in Hungary and promoting its international expansion plans.

BTS and spec build needs to be balanced

NOAH Steinberg, chairman and CEO of the Wing Group and chairman of the supervisory boards of Echo Investment in Poland and Bauwert in Germany, believes that the right mix of both build-to-suit (BTS) and speculative development is key to the growth of the Hungarian logistics sector.

“We are committed to serving individual requests in addition to market needs for immediate expansion or standard solutions. Over the past two decades we have built up expertise in customised solutions, we have provided BTS warehouse solutions for GE, Philip Morris, Phoenix Pharma, Wizz Air and fulfilment services provider Webship -

py, among others,” Steinberg said. The company has also concluded a long-term, circa 10,000 sq m BTS agreement with a major CEE parcel logistics group, which has nearly 3,000 pick-up points in Hungary.

Present in three countries — Hungary, Poland and Germany — through its ownership of Echo Investment and Bauwert, Wing’s industrial property portfolio totals nearly 300,000 sq m, plus an additional 370,000 sq m of development potential.

“The inflow of FDI is stimulating the activities of professional real estate developers and attracting significant international attention from investors,” he added.

HelloParks’ Rudolf Nemes

HelloParks’ Rudolf Nemes

Group, Echo Investment and Bauwert’s

29 MIPIM NEWS | MARCH 13

Wing

Noah Steinberg

Infogroup’s Ádám Székely

The MIPIM Sustainability Pledge

As the flagship event for the international real estate industry, MIPIM takes its responsibilities seriously and intend to lead by example with a series of concrete commitments.

We are inviting exhibitors to join us in becoming the very first signatories of an ambitious MIPIM Sustainability Pledge.

Signatories agree to 5 commitments

Low carbon transportation

Greener stands

#1

Ensure that 50% of your delegation travels using low-carbon options in 2024 (train, car-pooling, etc.), and increase this proportion to 75% by 2026.

#2

Measure the overall carbon footprint of your delegation’s travel to the show.

#3

Implement at least 3 of the following 5 measures by 2024:

Use more than 90% (by weight) of reused, reusable or recycled materials in the design of your stand; and take into account the second life or end-of-life of construction elements (reuse, donation, overcycling, recycling).

Use only recycled or recyclable materials, without PVC or solvents, and with vegetable or water-based inks for all signage.

Rent all furniture, plants and decorations.

Eliminate single-use products and consumables (gifts, gadgets, plastic bottles, flyers, etc).

Ensure that 100% of your waste is sorted and recycled.

The subsequent aim will be to comply with all these measures in 2025.

Active engagement with the values of diversity, equity and inclusion

#4

Ensure at least one-third of female speakers in sessions with more than 2 speakers (on your stand or in a conference room).

#5

Monitor the number of female participants in your delegation at MIPIM and identify female talents in your organisation, in order to increase the proportion of women by 20% each year until parity is achieved.

‘Keep calm’ and keep focus on premium real estate in core markets

NOW IS the time to be actively investing in premium real estate, according to Holger Matheis, CEO of Swiss Life Asset Managers in Germany. Speaking to MIPIM News, he said: “Some other investors are quite reluctant, but we see good opportunities.”

Matheis said Swiss Life Asset Managers is not unduly worried by the negative mood triggered by high inflation and interest rates: “The difference between us and a lot of other investors is that we take a long-term perspective. The market sometimes drops and sometimes rises, so you need to keep calm. If you stay focused on good properties in core areas and

segments, which have high ESG standards, it’s worth investing.”

Swiss Life’s core markets are Switzerland, France, Germany and the UK, but the company has recently expanded into the Nordics and Italy, Berlin-based Matheis said, with Spain a potential future target. In January 2024, the company acquired Sweden-based Wilfast Förvaltning, which will operate under the Swiss Life brand going forward.

A long-standing business partner, Wilfast manages real estate in Sweden, Denmark and Finland with an underlying value of €1.8bn.

In terms of priority segments, Matheis said: “We have a lot of experience in residential and we know there is huge demand in that area across Europe, because high interest rates mean that people cannot afford properties. But that will change.”

Swiss Life is also focusing on expanding areas, such as core-plus office buildings, life sciences, light industrial and logistics. “At the end of last year, we agreed an important joint venture with LaSalle Investment in the German logistics market,” Matheis said.

As for Swiss Life’s MIPIM priorities, Matheis added: “Most of my time will be spent talking to investors about the market, but we are also looking for partners on the equity side — wherever they come from. I will also be having a lot of meetings with banks. When I get time, I go to conference sessions to get a feeling for the international market.”

Real IS finds new purpose in repurposing existing assets

REFURBISHING a historic Haussmann property in the centre of Paris is about as challenging as it gets, but just such repurposing of existing properties is one way in which the German real estate company Real IS is meeting current market uncertainties.

Traditional outside, modern inside would also be a good description of the company.

Real IS is the real estate investment arm of BayernLB, the seventh largest financial institution in Germany and part of the Sparkassen network of public banks, which together make up the largest financial group in both Germany and Europe.

“There is a growing demand for renewing office spaces to make them attractive to employees or lose them to home working, with the loss of team spirit and creativity that goes with it,” said Christine Bernhofer, who will take over as CEO of Real IS when the current CEO, Jochen Schenk, retires in October.

Schenk pointed to another successful conversion, aimed at prolonging the life of a building and meeting climate targets to cut emissions and energy use. Real IS converted an ageing shopping centre in Berlin with redundant space, which involved replacing half the retail area with offices and turning the remainder space into a neighbourhood shopping centre.

An estimated 32 million tonnes of CO2 have been saved.

“We are now experts in manag -

ing this kind of green conversion,” Schenk added.

Other new lines of business for Real IS include setting up asset-management funds for properties held by pension funds facing growing regulation, and expanding into other territories. In Portugal, Real IS has just made its first €85m investment and, in Australia, it has, over recent years, built up a €1bn portfolio, mainly of state properties — including the federal police building in Canberra. Real IS now has a branch there. Meanwhile, come October, Schenk will not be lost to the industry: he will continue his work as vice-president of German Property Federation ZIA.

31 MIPIM NEWS | MARCH 13

Swiss Life Asset Managers’ Holger Matheis

Real IS’ Jochen Schenk

atMIPIM2024 12-15 March 2024 LEARN MORE #EGatMIPIM EG is returning to MIPIM to help you make sense of what’s important at this year’s event Get in touch with our team to make the most of your time at MIPIM 2024 Chanté Bohitige Reporter 07816 266 695 chante.bohitige@eg.co.uk Tim Burke Deputy editor 07971 717 143 tim.burke@eg.co.uk Caroline Cooper Key account manager 07758 074 214 caroline.cooper@eg.co.uk Evelina Grecenko Reporter 07866 823 227 evelina.grecenko@eg.co.uk Rebecca Levett Head of commercial partnerships 07747 461 545 rebecca.levett@eg.co.uk Samantha McClary Editor 07917 080 429 samantha.mcclary @eg.co.uk Sean Norris Managing director 07966 283 365 sean.norris@eg.co.uk Natalie Roberts Head of events 07814 207 667 natalie.roberts@eg.co.uk David Salisbury Commercial director 07917 077 512 david.salisbury@eg.co.uk Akanksha Soni Reporter 07977 598 112 akanksha.soni@eg.co.uk Lawrence Thompson Sales manager 07980 778 079 lawrence.thompson @eg.co.uk Pui-Guan Man News editor 07970 779 104 pui-guan.man@eg.co.uk LNRS Data Services is an accredited CPD content provider. Attending this event will count towards your CPD hours

NEWMARK UNVEILS NEW FRENCH TEAM

NEW YORK-based real estate consultancy Newmark has opened the doors to its new Paris office and unveiled a raft of appointments with expertise in the French market.

Among the new hires are noted industry figures François Blin, formerly of JLL, and Emmanuel Frénot from CBRE, who will lead the fledgling office and its growing staff, and focus on the firm’s capital-markets activity.

Blin will serve as chief business officer, while Frénot joins as deputy chief business officer.

Newmark has also recruited Antoine Salmon and Vianney d’Ersu, both formerly of Knight Frank, as co-heads of retail leasing. Jérôme de Laboulaye, who has moved over from CBRE Capital Markets France, has been named as managing director.

Newmark has chosen a site on the Boulevard Haussmann in the 9th arrondissement of Paris.

Decarbonise residential now or get ready to pay the price

THE RESIDENTIAL investment sector needs to wake up to the financial imperative of decarbonising housing or risk the cost of carbon-emission reduction rising far higher in the future, warned Xavier Jongen, Catella’s managing director of residential investment management. He was concerned that the current challenges over high inter -

est rates, inflation and global supply-chain problems have led many investors to “kick the can down the road”. But in the longer term, this will cost the industry far more to solve, he said.

“Residential is a key piece of the puzzle and investors globally need to prioritise decarbonising their portfolios, because the sector is responsible for around 26% of all

emissions,” he said. “What we need to do is work out how to balance decarbonisation while maintaining acceptable costs for occupiers and continuing economic growth.” To coincide with Monday’s Housing Matters! half-day summit, Catella published a special report called European Residential Vision 2024, which argues for the need to focus on mitigation to achieve decarbonisation.

“Mitigation is crucial because as we substitute old technologies such as gas heating with more sustainable options, such as heat pumps, we get a positive multiplier effect and the simple fact is that adaptation will never be cheaper than it is today. If we leave things longer, the costs will be higher and it is longterm investors and pension funds that will pay the price,” he said. Jongen added: “My concern is that progress is actually slowing at the moment and we must get the industry to understand that it needs to act now.”

Ditch debt for sale and leaseback

INFLATION and interest-rate trends will continue to be key factors this year, according to Christopher Mertlitz, W. P. Carey’s managing director and head of European investments. “We do not see interest-rate cuts soon and therefore expect the financing environment to remain challenging,” he said. “However, depending on the market and asset class, there are indications that prices are beginning to bottom out.”

Within this environment, “the sale/leaseback model remains attractive compared to debt, providing a liquidity solution for companies in need of capital”, Mertlitz added. “Companies can

invest this capital in key objectives such as financing expansions, acquisitions or R&D.”

As for trends within sale and leaseback, he said: “Last year, we noted a growing interest from private-equity firms in sale/ leaseback solutions. We expect this trend to continue in 2024.”

By sector, W. P. Carey sees opportunities in manufacturing, logistics, food production and food retail. “We feel optimistic about manufacturing and logistics, having completed the sale/ leaseback of 16 facilities across Italy, Spain and Germany, net leased to Fedrigoni Group,” Mertlitz said.

Catella’s Xavier Jongen

Catella’s Xavier Jongen

33 MIPIM NEWS | MARCH 13

W. P. Carey’s Christopher Mertlitz

Emmanuel Frénot

François Blin

2024

Conferences & Events

16.20 - 18.00

Debussy Room & Salon Croisette

Exclusive sponsor

By invitation only

14.10 - 15.40

Verrière Californie

Equality of opportunities in Real Estate

Open to all

09.55 - 10.55

The long tail of geopolitical and energy shocks: Impacts and effective strategies for cities and real estate

10.10 - 13.00

The Residential workshop: Shaping the Future of Living Spaces

10.10 - 11.10

Funding Our Future: Navigating Net Zero Finance

Sponsored by

11.15 - 12.15

Trends in U.S.

Real Estate and Capital Markets

Organised by

Content partner

Residential Programme Partner

14.10 - 15.10

AI and real estate: How can it be used properly, what are the implications, how revolutionary will it be?

Sponsored by

15.40 - 16.40

Doing business with purpose

Sponsored by

Sponsored by

17.10 - 18.40

The Italian market in 2024: trends and perspectives, opportunities and projects

14.10 - 15.10

The Future of Life Sciences Real Estate: Navigating New Frontiers

11.40 - 12.40

Clean Energy Frontiers: Navigating Investment and Innovation

Sponsored by

10.10 - 10.40

BUFA to Atelier Gardens: A Sustainable Campus Transformation

10.40 - 11.10

Positive Footprint Wearhouse - The future of logistics

Organised by

11.40 - 13.10

The Italian way ahead. Major Italian regeneration projects come to life

09.30 - 10.30

Trojena, from Masterplan to Development - Building and Funding a World-Class Mountain Destination in NEOM

Organised by

09.30 - 10.30

Europe’s Green Economy: how greener cities can be the key to future prosperity

Organised by

11.00 - 12.00

11.00 - 12.30

Global Solutions

Organised by

Exclusive sponsor

11.00

Accueil des participants

11.15

Organised by

Prises de parole

By invitation only

14.10 - 15.10

14.10 - 15.10

14.10 - 15.10

Urban Evolution: Building Resilient Net Zero Cities

Sponsored by

15.40 - 16.40

15.40 - 18.10

The Logistics Workshop - From the grey, white to green swan

Décarboner le futur : L’immobilier peut-il relever le défi de la neutralité carbone ?

Organised by

17.10 - 18.10

Content Partners

Organised by

Charting the Path to Net Zero: What Building Owners Learned Using the Green Globes Journey to Net Zero Program

Organised by

Ensuring Measurement Authenticity: Strategies to Counter Greenwashing and Comply with New Regulations

15.40 - 16.40

Beyond ESG Fatigue: How ESG Enhances Value and Expands Financing Opportunities

Sponsored by

17.10 - 18.10

Biotope is the new tech

Sponsored by

Silesia Summit: the Katowice Metropolis as a magnet for talent, innovation and investment

Under the Patronage of

12.30 - 15.00

Exclusive sponsor

12.30

Déjeuner d’échange entre élus et experts

14.30 Café avec la presse

By invitation only

15.40 - 16.40

Barcelona Catalonia: The Science & the City

Organised by

17.00 - 18.00

Architectes : vos questions d’assurance en France et à l’international

Organised by

18.00 - 19.00

Projets Franco-Saoudiens : Construire l’avenir ensemble

Organised by

17.10 - 18.10

Actifs industriels, tertiaires, logements : les acteurs publics face au défi de la résilience

Organised by

Palais 5 Palais 3 Palais -1 Palais 3 Palais 3 Palais 3 GOLD SPONSOR RTZ PARTNER

C14

Palais 3

09.40 - 10.40

Invest in Japan: What dynamics are driving the revitalization and evolution of the Japanese real estate market?

11.10 - 12.10

Navigating Growth in the CEE Region: Trends, Opportunities, and Innovations

Sponsored by

12.40 - 13.40

Moving towards to new urban developments and asset types

Organised by

14.10 - 15.10

German Real Estate: Unlocking Value and Capitalizing on Opportunities in the Shifting Landscape

Sponsored by

15.40 - 16.40

Nordic Real Estate: Leading in ESG, Technology, and Investment Opportunities

17.10 - 17.40

Partner Session

Une alliance publique privée inédite pour intensifier l’usage de la ville existante et à venir

18.10 - 19.40

Portugal Conference & Cocktail

Organised by

Wednesday 13 March

Palais 1

UK STAGE PARTNER

08.30 - 10.00

BPF UK Investor Breakfast

10.00 - 10.45

The Impact of Major Sporting and Cultural Events

10.45 - 10.50

Swimipim

11.00 - 11.45

City Centres - Do or Die

12.00 - 12.20

Fireside chat: What is the money doing?

13.00 - 13.30

London 2024: Politics, polling and a tale of two elections

14.00 - 14.45

Real Estate Balance Presentation and Panel

Sponsored by

15.00 - 15.45

How is London going to keep its cool? Exploring ecosystem resilience to urban uncool

Sponsored by

16.00 - 16.45

Where are London’s life sciences hubs?

Closed door event

Sponsored by

By invitation only

10.15 - 10.35

Official UK stage opening and keynote address

10.50 - 11.30

Driving investment into the UK property market: Creating the right policy environment

11.45 - 12.25

UK Investment Zones - Building the innovation economy

14.00 - 15.40

UKCAP city investor panel discussion and reception - A collective approach to attract large scale investment partnerships

Organised by

By invitation only

15.55 - 16.35

Transformational infrastructure to help realise UK cities of tomorrow

16.50 - 17.30

17.00 - 19.00

RIBA Reception Planning for the future: delivering high-quality, sustainable homes

Sponsored by

Making UK housing more affordable

17.30 - 19.30

BPF Building our Future Drinks Reception

Sponsored by

Palais 4

09.45 - 10.40

Mons 2035 - Ambitious projects for a dynamic City

10.45 - 11.40

Past simple / Compound future - with/against/on the existing

Organised by

11.45 - 12.40

Charleroi Metropole: The circular economy and energy efficiency at the service of our region’s development

Organised by

16.00 - 16.55

Circular Liege - New way of building

Palais 5

08.30 - 10.30

Networking Breakfast

Organised by

By invitation only

11.00 - 12.00

The Productive and Inclusive City - From Idea to Reality

Organised by

12.30 - 13.30

How is ESG impacting asset value?

Organised by

14.10 - 15.40

Equality of opportunities in Real Estate

Find out more about all our speakers in the Speakers Directory

Open to all

16.40 - 18.10

CREW Network Cocktail

Organised by

By invitation only

18.40 - 19.40

Italian Networking Cocktail by ITA (Italian Trade Agency)

Organised by

Find out more about the conference programme

Sessions with an orange frame are not to be missed sessions

Check the conference rooms plan

businessimmo.com New March issue #203 Exclusive news about France’s real estate ecosystem Discover

Logistics investors are looking for stability in interest rates

RENTAL growth will continue to outperform other real estate sectors, while capital values will begin to stabilise and recover given that the underlying fundamentals remain compelling for logistics, according to Paul Rodger, managing director of real estate investor Burstone Europe. He said that with very little new supply of Grade A, sustainable warehousing being delivered, and occupiers in a huge range of businesses requiring efficient and well-located supply chain networks, he expected there to be an influx of capital to the warehousing and logistics market “as soon as investors have a clear line of sight to interest rates reducing, even if only marginally”.

“Everyone has been talking about

Post-COVID

the bifurcation of the office market — 2024 will be the year when we see real bifurcation in the logistics market, driven by a

mixture of regulation, investors demand and tenant obligations,” he added.

Rodger said that at a macro level, investors will be looking for signs that improving sentiment, driven by a more stable interest rate backdrop, will become a more permanent scenario.

“The market in general still feels quite muted, with cautious capital and transaction volumes not really picking up, and the tone coming from the ECB becoming a little more hawkish in recent weeks,” he said.

“MIPIM last year was dominated by the banking issues in the US and then Europe,” he added.

“And I suspect that the finance markets, and in particular how much lending appetite there is,

will be a hot topic this year.”

Looking at the logistics sector, investors are watching to see how prevailing tenant demand reacts to increased funding, occupational and labour costs and if they seek to consolidate costs and ultimately warehouse space as a result, he cautioned.

Rodger also pointed to the US election at the end of this year, and speculated that the industry will be looking out for the extent to which it could impact markets in Europe.

Turning to MIPIM, Rodger said: “As a pan-European business, any event that brings our stakeholders, tenants and consultants together is helpful and we can achieve as much in a couple of days as we would in a couple of months.”

He added that being here enables him to “see the tone of the market in a clear way”.

working patterns having a ‘knock-on’ effect on real estate

THE IMPACT of the pandemic on working patterns and real estate needs is ongoing and continues to shape the industry, according to Allison English, deputy CEO at workplace data specialist Leesman, who is at MIPIM for the first time.

“En masse hybrid working has transformed work patterns, so I expect a lot of discussion around the knock-on effect on real estate,” she said. “Companies are looking to stabilise their hybrid working approach and many are downsizing or relocating, which will undoubtedly have a significant impact on the commercial real estate industry and likely reshape cities.”

She added: “The dust is still settling and many organisations are

unsure how much real estate they need given variables like hybrid working, economic and political factors, ESG initiatives, labour market fluctuations and so on.”

All of which is generating activity in the market, English said.

“Some who quickly shed space during the pandemic are contemplating expanding and those in ‘wait and see’ mode will start making moves,” she said.

“More organisations will be focusing on quality alongside flexibility and agility to avoid being stuck with surplus, sub-par real estate,” she added.

Ultimately, however, English urged that companies should concentrate on the work that their employees need to do rather than where exactly they do it.

“The phrase ‘RTO’ [return to office] has been retired — permanently,” she said.

“The focus instead is on the ‘what’ and ‘how’ of work, rather than the ‘where’. Maybe it’s a hope rather than a prediction, but we should move beyond banal attendance targets.”

It’s a debate that English hopes to have while attending MIPIM.

“I’m of course looking forward to catching up in person with contacts old and new and hearing what others are thinking and doing,” she said.

“MIPIM will be a great opportunity to discuss the latest insights in the real estate industry and especially to share ideas about how to solve some of the sector’s most pressing challenges.”

37 MIPIM NEWS | MARCH 13

Burstone Europe’s Paul Rodger

Leesman’s Allison English

Waste minimisation Carbon footprint reduction Diversity, equity and inclusion A positive social impact Learn more about our initiatives on mipim.com mipim.com MIPIM 2024 is our most sustainable exhibition to date distinguished by four main engagements to making MIPIM cleaner, greener, more diverse and more equitable. MIPIM ® is a registered trademark of RX FranceAll rights reserved.

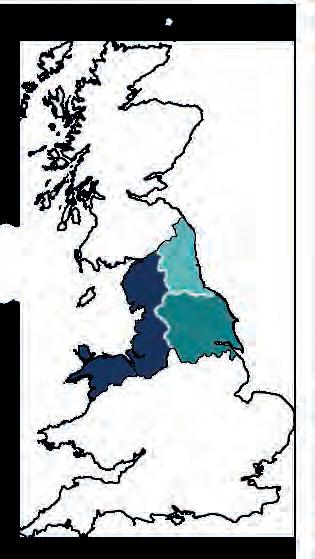

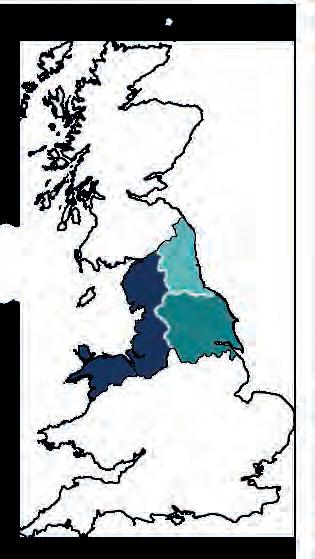

Leeds

MIDDLESBROUGH

Liverpool

PRESTON

Subscribe for free at placenorth.co.uk Trustworthy investment news, in-depth analysis, and the latest updates on key developments across the North of England and North Wales

MANCHESTER

SHEFFIELD NEWCASTLE CHESTER SUNDERLAND York

WOOD IS GOOD FOR FUTURE, BYWATER SAYS

DEVELOPERS need to prioritise the use of wood in design and construction to meet carbon reduction targets, according to Theo Michell, principal at Bywater Properties.

Bywater is currently on site with a timber office building in Vauxhall, London, alongside the Sumitomo Forestry Company (SFC), — originally on board to fund the project, but which subsequently acquired a substantial stake in Bywater. “Everything going forward will be with SFC and will have a mass timber element to it,” Michell said.

Bywater recently bought a site in Soho, London, and has applied for planning permission for another in the city’s Clerkenwell area. It has similar plans in central Manchester.

“Those are older buildings where we’re building with mass timber on top,” Michell said. “I’d say 90% or more of what we’re looking at is about retaining existing structures and adding to them with timber.”

The approach is popular with occupiers and their employees. “Not only is there a drive for occupiers to find buildings that meet sustainability ambitions, there are also themes around worker retention and demonstrating to staff that your business is aligned with the goals they care about,” Michell said.

“There is also the beginnings of some solid research around issues to do with mental health and the positive benefits of working in a timber environment.”

MRP is in Cannes to develop key Belfast regeneration plan

DEVELOPER and investor MRP is attending MIPIM this year primarily to promote opportunities at the huge Weaver’s Cross regeneration project in Belfast, Northern Ireland, on which MRP is working as master developer. Paul Beacom, the company’s development director describes the project as a “generational” opportunity.

The site is anchored by Belfast

Grand Central Station, which, when completed later this year, will be the biggest transport interchange on the island of Ireland and should substantially improve connections between Dublin and Belfast, not least by bringing passengers making the northern journey into the very centre of the city.

Currently, the wider area has outline planning permission for

1.3 million sq ft (121,000 sq m) of mixed-use office, life sciences, residential, student housing, hotels and retail/leisure space. “We are already working hard trying to identify investors, foreign occupiers and so on,” Beacom said.

“The station itself will complete later on this year and then there will be about 12 months of public realm works surrounding the station. So, we are looking to be on site as early as the end of next year with as many uses as we can.”

In addition, MRP is in Cannes to support the Belfast stand and to make the case for investment across Northern Ireland now that the government there has been restored.

“It’s brilliant,” Beacom said. “Both government and business can promote the benefits of the framework agreement. That means we have access to both the EU and GB [Great Britain] markets. If you’re a life-sciences company, for instance, you can access both markets with a single licence.”

Cash squeeze ‘will boost build quality’

THE INCREASED costs of financing will see an end to substandard developments and instead a return to quality, according to Jason Taylor, head of portfolio management at HansaInvest Real Assets.

“The finance was cheap — in some cases too cheap — and this environment promoted some developments that weren’t always good. It will shift more to quality again now,” Taylor said.

He added that the sector was at a turning point. “It will be interesting to see how money will be invested. You won’t see so many new developments — for exam -

ple, our focus will also be to reinvest in existing buildings we already have,” he said. This will include refurbishment on two sites in Paris and Edinburgh. Taylor said the shift would bring new opportunities, particularly in areas such as residential and logistics, as well as ESG, in which HansaInvest has focused its funds in the past couple of years and which it wants to continue to grow.

The company most recently launched a new ESG focused fund, Hansa German Social, targeted at children’s daycare, senior housing and community retail.

MRP’s Paul Beacom

MRP’s Paul Beacom

41 MIPIM NEWS | MARCH 13

HansaInvest Real Assets’ Jason Taylor

BUILDING NEW PERSPECTIVES.

SOPHISTICATED, DETAILED, CRITICAL AND INSPIRING.

DIGITAL ACCESS, NEWSLETTER, ONLINE-PORTAL, PODCAST & APP

Pinto sees ‘opportunity on the horizon’ despite many challenges ahead

THE IMPACT of interest-rate fluctuations and inflation on European real estate investment strategies and property valuations, as well as the role of sustainability, are top of Sonae Sierra’s MIPIM agenda, according to Patricia Pinto, director of investor relations.

“We will discuss and explore how the uncertainty surrounding interest-rate fluctuations and inflation is altering market dynamics and influencing investment strategies,” she said. “As we continue to navigate through the economic landscape in Europe, we anticipate that the real estate industry, particularly in the global context, will continue to face significant challenges.” However, some challenges also offer business opportunities, Pinto said. “Despite these adverse conditions, we are also witnessing some positive signs,” she said, adding that, with the anticipated decrease in borrowing costs and inflation slowing, “there’s a growing sense of opportunity on the horizon”.

To navigate this, Pinto said a relationship of trust with an investment-management partner is increasingly important. “The most crucial aspect is finding a partner with a strong background in asset management and a proven track record, emphasising transparency and effective communication,” she added. “Collaborating with business partners will be vital, highlighting the significance of cultivating strong relationships and synergies with other industry players to effectively address the current challenges. Maintaining a focus on long-term value is also imperative, requiring robust investment strategies, active asset management and the ability to anticipate changes in the economic, social and digital landscape.”

Sustainability also remains a “significant concern” for the sector, Pinto said, adding: “Adapting to new requirements, such as ESG goals, will be essential for success in the industry.”

Pinto noted that, at Sonae Sierra, sustainability has been a core priority since the Nineties. “We’re not just discussing it or beginning to act,” she said. “We have always been at the forefront of it. Our dedication to ESG practices over the years [has resulted in] recognition from industry leaders, including the Science Based Targets initiative and GRESB.”

But she said the company would guard against complacency: “While I take pride in these achievements, I also feel the weight of responsibility that comes with them.”

In conclusion, Pinto said Sonae Sierra has three goals for 2024: “We aim to further strengthen our partnerships, enhance our sustainability initiatives and continue to deliver value to our investors through strategic investment and asset-management practices.”

Magnum Estate Projects – Luxury life and vacation in Bali

In recent years, one of the fastest-growing trends in tourism is vacationing on the island of Bali, Indonesia. It's no surprise, considering Bali's stunning nature, vibrant culture, unique beaches, majestic volcanoes, and, importantly, well-deve oped infrastructure. All these attractions are available to numerous tourists year-round.

Sonae Sierra’s Patricia Pinto

Sonae Sierra’s Patricia Pinto

Explore our presence at the MIPIM Pavilion P-1.K12.

Magnum Estate, a property management company, is creating a luxurious experience in Bali that mirrors European comfort standards. Their development projects are coined as the 'black caviar of elite vacations,' with eleven premium residential complexes tailored to the refined preferences of European tourists accustomed to comfort.

Magnum Estate, the leading development company and the largest builder on Bali Island, Indonesia, is participating in MIPIM 2024. The company is currently building 11 premium complexes, and plans to launch 5 of them in 2024, aiming to establish them as iconic landmarks for the island.

Supplément spécial immobilier 9 bonnes raisons d’acheter La Tribune Dimanche IMMOBILIER 9 SOLUTIONS POUR SORTIR DE LA CRISE MIPIM P. 2 Le marché à la recherche de nouveaux équilibres dans un contexte de taux d’intérêt élevés GOUVERNEMENT P. 3 Les projets du ministre du Logement, Guillaume Kasbarian, pour booster la construction FINANCEMENT P. 4 De nouvelles pistes pour que les banques réveillent le marché du crédit RÉGIONS P. 8 Notre Tour de France des meilleures innovations pour relancer l’accession FUTURS SUPPLÉMENT DE LA TRIBUNE DIMANCHE 10 MARS 2024 ILLUSTRATION ISABEL ESPANOL SUPPLÉMENT AU NUMÉRO 23 DE LA TRIBUNE DIMANCHE DU 10 MARS 2024 NE PEUT ÊTRE VENDU SÉPARÉMENT - LATRIBUNE.FR En vente à Cannes toute cette semaine Spécial MIPIM

Japan turns focus on ESG and inclusive urban policy-making

SACHIO Muto, director of urban policy at Japan’s Ministry of Land, Infrastructure, Transport and Tourism, is heading the government’s delegation to MIPIM this year. “In my presentation, the first thing I want to talk about is digitalisation,” he said, and specifically, a data storage and access tool called Plateau, which the government has devised to help people understand its various schemes for urban development and disaster-planning, using 3D technology.

“The profiles on Plateau are based on data we’ve gathered from 200 cities,” Muto added. “We will expand these models to 500 cities in three years. Since last year we’ve been offering this data to an international audience and have already made some presentations about it

in forums like the UN-Habitat, the G7 meeting and an OECD infrastructure conference.

“Plateau is useful to get more participants involved in infrastructure development, including young peo -

ple and the elderly, who can use it to understand our ideas more easily. It’s important because our urban policy should be more inclusive.”

Muto also wants to focus on green transformation. “We need more green spaces in places like Tokyo,” he said, especially given the reality that summers in Japan will likely become hotter in the future. “The problem is we don’t have much funding for those green spaces and need private investment to augment legislation, as well as developing schemes for evaluating biodiversity and liveability.”

As part of its plans, the ministry is promoting a Horticultural Expo in a suburb of Yokohama in 2027. “I especially want to present this idea to European participants at MIPIM in the hopes that they will

attend the Expo and participate in the exhibitions,” he said.

Another theme that Muto believes will interest foreign investors is disaster resilience, of which earthquake-prone Japan has extensive experience. “Several private companies will make presentations on resilience,” he said. “That includes not only building resilience, but reconstruction — things like setting up shelters and housing following a disaster — and relocation.”

Other key topics include transit-oriented development, sustainable construction practices, and Japan’s labour shortage. “I think it’s important that we have an exchange of knowledge regarding digitalisation and system-making,” he said. “I want more international feedback about the Japanese experience and I hope we can find more collaborators from the international community to co-operate on realistic schemes for redevelopment.”

45 MIPIM NEWS | MARCH 13 113_MINDSHARE UR_N1a3_PIM

Sachio Muto

Find out more www.perenews.com Award-winning insights of industry developments & GP/LP relationships In-depth analysis & research of the private real estate market Deep dives & commentary on the RE investing landscape, with funds in market & activity Comprehensive coverage of the world’s private real estate capital markets

The property leaders’ summit in Asia Pacific

3-4 December 2024

Grand Hyatt, Hong Kong

mipimasia.com MIPIM ® is a registered trademark of RX FranceAll rights reserved.

Accessibility Cross-mediality Visibility Visible on the German Real Estate Market. Advertising in the IZ world. 8,700* print contacts and 44,000 daily newsletter contacts** *IVW 3/2023; **Publisher‘s information More information of our advertising materials on media-en.iz.de JAHRESKONGRESS CRADLETO CRADLE INVESTMENTS Investoren,aufnach Großbritannien! ENGLISCHFÜRIMMOBILIENPROFIS AlleTitelderIZ-EditionfindenSieunterwww.dfv-fachbuch.de/507-immobilien I N V E S T Mren, roßbritann CH FÜR LS estoInv G –Visit us! Riviera Hall R7.G20 (Frankfurt RheinMain)

WELCOMES TWO MANHATTAN WEST

ARCHITECTURAL firm Skidmore, Owings & Merrill (SOM) and Brookfield Properties have completed Two Manhattan West, a LEED Gold-targeting office tower located on the corner of Ninth Avenue and West 31st Street in New York City. The project brings 2 million sq ft (186,000 sq m) of new office space to Manhattan West, built above active railroad tracks on the city’s West Side. The completion marks the final chapter in the development of the new Manhattan West neighbourhood, as part of a larger revitalisation of this area of New York City. Two Manhattan West joins its counterpart, One Manhattan West, a tower completed in 2019, along with four other buildings — three designed by SOM and all but one engineered by SOM — that bring extensive public space, offices, residences, hospitality and retail to a previously undeveloped district.