9-12 February 2026

3 | DECEMBER 2025

9-12 February 2026

3 | DECEMBER 2025

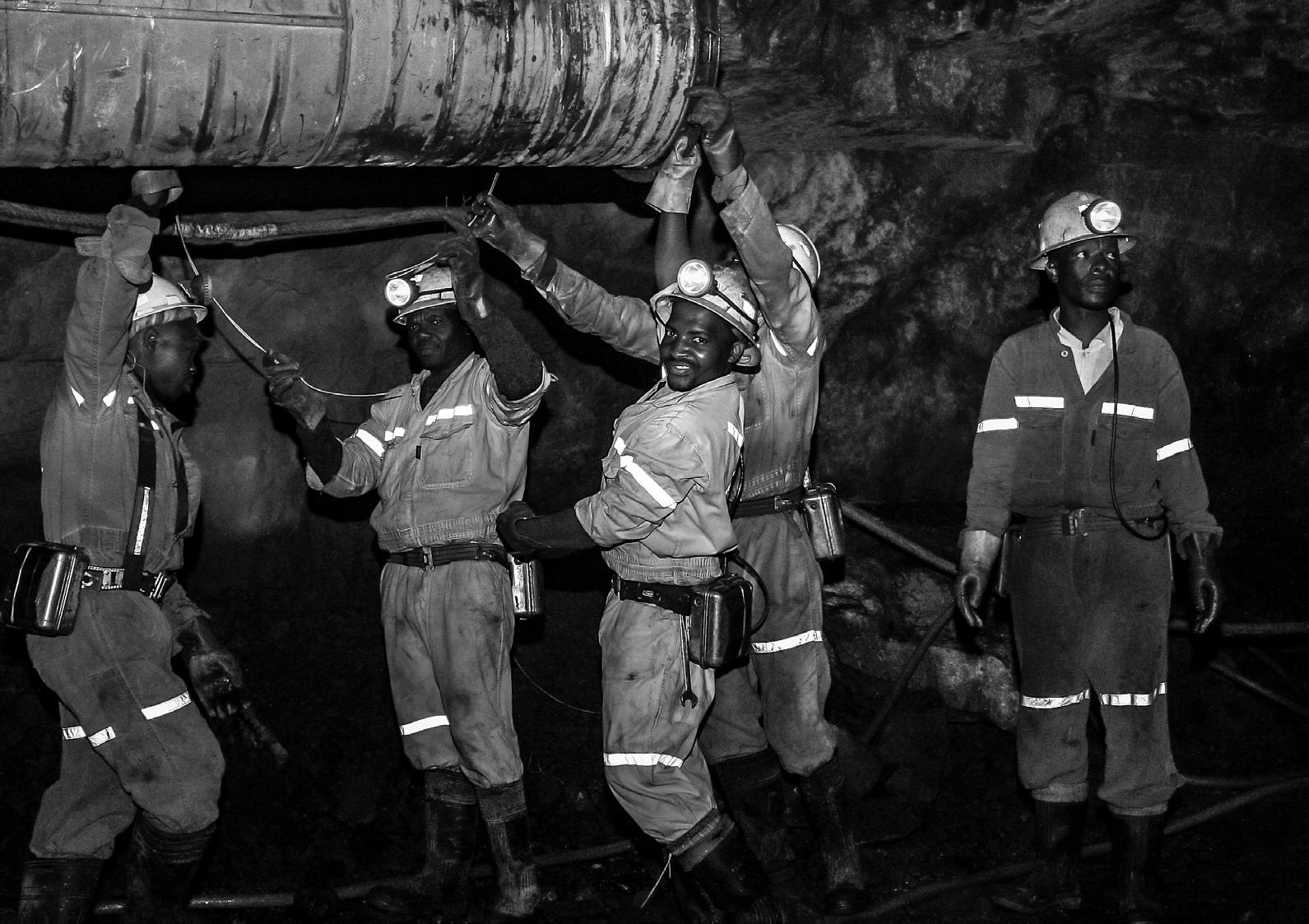

regional value chains, and green industrialization as the foundation of a new growth paradigm. These frameworks are anchored on developing industries that refine, process, and manufacture within Africa, thus creating millions of decent jobs for our youth and women, while positioning Africa as a strategic player in global clean-energy value chains.

Investment and innovation will be the defining forces of this next chapter. The long-term value of minerals can be unlocked through innovative financing models, including blended finance and other sources of capital. Green and digital technologies are driving the restructuring of productivity, responsibility, and environmental stewardship, thus de-risking investments, strengthening competitiveness, and ensuring that Africa’s mineral wealth is harnessed responsibly and equitably.

People and communities are at the heart of this transformation. The empowerment of women and youth across the mineral value chain, including in mining, processing, entrepreneurship, and green technology, is essential for transforming lives. Investing in future skills such as digital mining, sustainability analysis, engineering—including battery mineral processing—environmental management, the circular economy, and digital innovation, among others, will build a workforce ready to lead Africa’s green industrial revolution. Equally, community participation, benefit-sharing, and environmental stewardship must remain central to ensuring that mineral-driven growth translates into tangible, lasting development outcomes.

In the global race for decarbonization, Africa stands at a crossroads: embracing the opportunity and shifting the paradigm, or continuing business as usual and yet again losing the momentum. Critical green minerals in Africa hold the key to unlocking both the transition to renewable energy and the continent’s aspiration for an inclusive prosperity. Indeed, Africa accounts for a third of the world’s reserves of these minerals, including cobalt, copper, graphite, lithium, manganese, and rare earths.

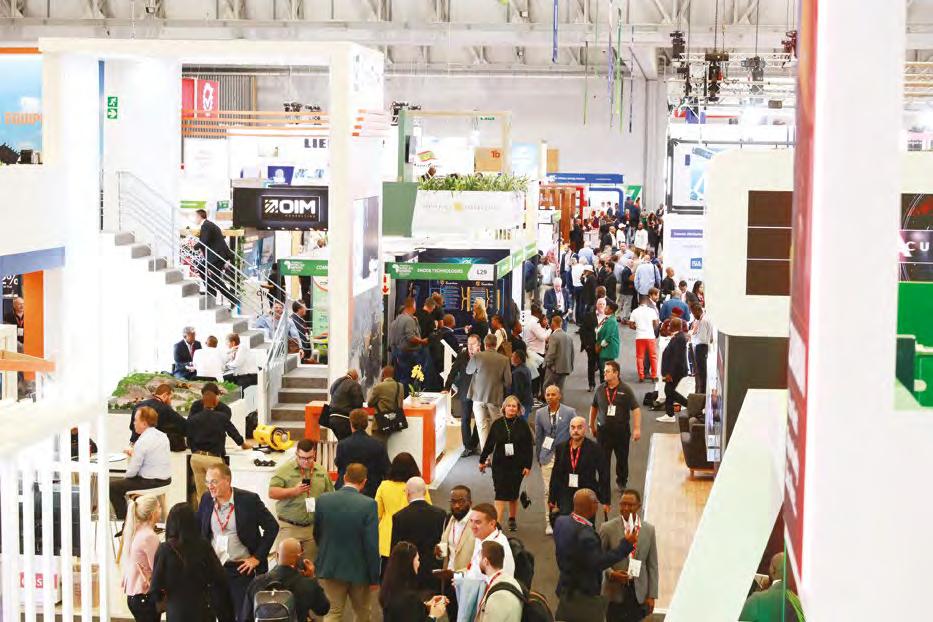

Looking ahead, Mining Indaba 2026 will serve as a catalyst for Africa’s next investment-led transformation. As the theme “Stronger Together” highlights, it will convene policymakers, investors, innovators, and thought leaders, as well as local communities, women, youth, and artisanal and small-scale miners, to forge new partnerships aligned with the AMV, the AGMS, the AfCFTA, and the SDGs, and Africa’s climate and industrialization strategies. It is time for Africa to seize this moment to change the paradigm of its mineral wealth as a springboard for sustainable energy, shared prosperity, and generational wealth creation.

Mining Indaba 2026 is not just an event; it is the heartbeat of a continent on the move, defining the future of global mining through an African lens.

Mining Indaba 2026 comes in a crucial moment: when global industries are re-assessing value chains for resilience, sustainability, and shared prosperity; and when Africa is becoming bold in its quest for growth, equity, and justice. Africa’s minerals narrative has transformed from being merely about extraction to being about shaping a new economic and social contract grounded in value creation, inclusion, and innovation.

The notion of minerals as an engine of sustainable industrialization, has been at the forefront in Africa as the continent has adopted frameworks such as the Africa Mining Vision (AMV), the African Green Minerals Strategy (AGMS), the African Continental Free Trade Area (AfCFTA), and the United Nations Sustainable Development Goals, which offer a coherent blueprint for this transformation by anchoring value addition,

Discover the next generation of mining talent innovators and young professionals who are driving Africa’s resource transformation.

Meet key mining stakeholders including junior miners mid tiers majors service providers downstream buyers and government all in one place, enabling strategic engagement across the ecosystem.

Witness collaboration between governments industry and communities powering inclusive growth and lasting impact across the continent.

Connect directly with CEOs investors and policymakers where Africa’s critical mining deals partnerships and investment decisions are shaped.

Explore game changing technologies solutions that are redefining the future of mining operations and sustainability.

Build meaningful relationships that extend beyond the week, unlocking access to capital expertise and strategic influence.

Carmel Daniele Founder & CIO, CD Capital Asset Management Group

How do you assess the current commodity cycle, and what differentiates it from past ones?

Commodity cycles are defined by a deep, structural shortage of metals and minerals that are key for the period. After years of underinvestment, there is now a scarcity of critical mineral supply at a time when demand is surging due to innovations like AI, data centres, and major upgrades to global power infrastructure.

What sets this cycle apart from the previous ones is the scale and scope of the demand drivers. This is a worldwide eventit’s no longer dependent on just China - but a broader global transformation linked to the energy transition. The scope is larger as well, with supply chain security and defence at the forefront of the national agenda, resulting in government becoming more actively involved. It can be neatly summarised in a comment I heard recently at a conference; ‘if the past 25 years were about global efficiency, the next 25 years are about resilience’.

Which commodities are most undervalued today, and where do you see the strongest long-term opportunities?

Commodities such as copper, rare earths, molybdenum, antimony, and tungsten are currently undervalued despite being critical to the future economy. Copper, in particular, is essential for electrification and underpins everything from power grids to electric vehicles.

Long-term opportunities lie in positioning early within these essential supply chains, particularly as clean technologies mature and the demand for these minerals grows. This forwardlooking approach has been baked into our next Fund and will allow for value capture as the energy transition accelerates.

What convinces you that a junior exploration company is worth backing?

The decision to invest in a junior begins once a potentially viable deposit has been identified. From there, the focus is on strong geology, sound engineering, and compliance with ESG standards. CD Capital employs a disciplined investment approach, ensuring that all

technical, operational, and environmental fundamentals are rigorously evaluated and validated before advancing any opportunity. This structured methodology enables us to identify and mitigate risks early, maintain high due diligence standards, and ensure that every project aligns with long-term value creation and sustainability objectives.

What will the mining industry look like in 5 to 10 years?

I see the mining industry becoming more vertically integrated, where resource extraction, processing, and refining are all connected. Not only does this create secure supply chains, but it also helps Companies to realise further value-add.

We are already seeing nations take this approach, with Indonesia being the prime example in their nickel policies, and Companies too. A further benefit of this full supply-chain integration and visibility is also that, responsible mining groups may be able to recognise a premium on their product.

At the same time, technological advancements are transforming the sector. Automation is improving safety and productivity by reducing manual intervention, while AI-driven exploration enables faster, more accurate deposit discovery with lower costs. Low-impact extraction technologies are also further reducing emissions, water use, and land disturbance, enhancing both efficiency and sustainability.

In this new era, the most successful companies will be those that embrace technology while embedding ESG principles across their operations. By investing in local communities, ensuring workforce safety, and adopting circular economy practices, these companies will build trust and gain a competitive edge in accessing capital, permits, and partnerships.

Ultimately, vertical integration and technological innovation, in tandem with ESG excellence, will see a mining sector that is efficient, profitable, responsible, and future-ready.

What advice would you give to young women building a career in mining finance or investment?

As the mining industry continues to undergo a profound transformation, there has never been a more exciting time for women to lead, innovate, and redefine the future of this sector. Fundamentally, you should believe in the value of your perspective, as it is only through diverse voices and fresh ideas that the industry will continue to progress.

A strong foundation in the technical fundamentals of mining is essential for making sound and informed investment decisions. Developing well-rounded, practical insight into mining and processing operations by complementing analytical work with on-the-ground experience provides a true understanding of the challenges of the sector. The ability to understand both the rocks and the returns is a powerful combination, and the right mentors can help turn that knowledge into impact.

To further advance this vision, CD Capital proudly sponsors a Critical Minerals Scholarship at Imperial College London, supporting the next generation of leaders who will be central to advancing the energy transition and beyond.

Can you give us a brief overview of your company and what makes FMBR portfolio of projects compelling?

African Gold (ASX: A1G) is advancing the Didievi Gold Project in Côte d’Ivoire, anchored by the Blaffo Guetto Mineral Resource of ~989 koz within 12.4mt at 2.5 g/t Au (0.8 g/t cut-off). The appeal lies in the combination of grade, near-surface geometry, and district-scale upside across multiple targets within trucking distance of established infrastructure; ongoing drilling is designed to grow both scale and confidence. We are also progressing the early-stage Konahiri project in Côte d’Ivoire.

With the support of our largest investor, Montage Gold, we have the capacity to advance two high-quality targets in parallel.

What recent discovery or result has you most excited?

The standout is the Blaffo Guetto Mineral Resource at ~989 koz from surface. On the back of this, the >40,000-metre drill program is set to drive resource growth and deliver a steady cadence of results and market catalysts in the coming quarters.

What is your technical strategy, what work have you completed so far, and what are the key programs planned for the next 12-18 months?

So far: Didievi has 10 drill ready targets including the 989koz resource, there is two diamond drill rigs on Blaffo Guetto with two RC rigs coming in November to target the regional opportunities on the tenement.

Strategy: Systematic step-outs along strike and at depth at Blaffo Guetto, then first-pass and follow-up drilling on priority regional targets such as Pranoi and the Poku Trend; continue structural interpretation to refine targeting; progress study work to frame development options.

Next 12–18 months: Resource growth drilling, targeted RC programs on regional prospects, ongoing technical workstreams, and a scoped pathway into studies, with regular market updates as assays are received and milestones achieved.

The market still underestimates the district potential. Didievi has all the hallmarks of a multi-millionounce system.

Looking ahead, what’s the single most important milestone investors should watch for, and how does achieving it move you closer to your strategic endgame – whether that’s production, JV partnership, or acquisition?

The next Mineral Resource update at Didievi, including potential additions from regional targets, is the key milestone. Increased scale, continuity and classification upgrades are the clearest de-risking steps; they underpin the Scoping Study, keep development or partnership options open, and clarify capital intensity and potential production scenarios.

What is your current market cap and do you feel it is an accurate reflection of your company and why?

As of 5 October 2025, African Gold’s market capitalisation is approximately A$220 million. While the share price has grown over the past 12 months, we believe the market is only beginning to price in study and resource upside, strategic backing, and the potential to accelerate toward a production scenario. It likely does not yet reflect the district-scale opportunity. Delivering the next resource update, consistent drilling results, and clear study milestones should help close that gap.

Can you give us a brief overview of your company and what makes FMRB’s portfolio of projects compelling?

Falcon Metal Resources Botswana (FMRB) is a privately held exploration company pioneering Botswana’s next generation of diamond, gold, and copper discoveries.

Our diversified exploration portfolio spans three of Botswana’s most prospective mineral belts:

• Orapa Diamond Field (PL0181/2024) - A 25–54 hectare kimberlite pipe situated just 2 km northeast of Lucara’s world-renowned Karowe Mine.

• Tati Greenstone Gold Project (PL0121/2025)

- A 10.36 km² gold licence adjacent to the Mupane, Golden Eagle, and Map Nora mines within the historic Tati Belt.

Kago B. Stimela, Founder & Chairman, Falcon Metal Resources Botswana

We’re

building value the right way: strong geology first, capital markets second.

• Kalahari Copper Belt (PL0245/2025) - A 165.42 km² copper-silver licence sharing borders with the Cobre–BHP Kitlanya East earn-in, targeting the Ngwako Pan–D’kar Formation contact.

What makes our portfolio particularly compelling is its strategic proximity to producing assets, diversified commodity exposure (diamonds, gold, and copper), and our citizen-led operational model -combining Botswana ownership with international exploration discipline.

What recent discovery or result has you most excited?

Two discoveries stand out as transformative within our pipeline:

• Orapa Diamond Field Project (PL0181/2024): ee have delineated a 25–54 ha kimberlite pipe, confirmed by integrated gravity and magnetic inversions showing a steeply dipping carrotshaped geometry with depth continuity beyond 300 m. The anomaly sits along the Letlhakane–Lerala corridor, consistent with regional emplacement trends. Early results suggest strong potential for a world-class diamond-bearing body, geologically analogous to Karowe.

• Tati Greenstone Gold Project (PL0121/2025): extensive trenching and channel sampling confirm multiple quartz vein systems across the property, returning surface assays up to 26.5 g/t Au and historical intercepts of 3 m @ 5.17 g/t Au. These results reinforce our confidence in unlocking Tekwane-style free gold mineralisation within Botswana’s oldest greenstone belt.

What is your technical strategy, what work have you completed so far, and what are the key programs planned for the next 12–18 months?

Our exploration strategy is data-driven, phased, and scalable across all projects:

Orapa Diamond Field (PL0181/2024)

• Completion of 3D geophysical modelling and target definition of a 25 ha pipe.

• 600 m drill rig procured; maiden drilling program scheduled for late 2025 to evaluate diamond grade, size distribution, and microdiamond content.

• Follow-up bulk sampling and mini-plant testing planned to confirm grade and recovery efficiency.

Tati Greenstone Gold (PL0121/2025)

• Ongoing trenching, mapping, and sampling to refine near-surface targets.

• Preparation for Phase 1 drilling aimed at delineating high-grade shoots within quartz veins.

• Metallurgical tests to evaluate recovery characteristics of free gold.

Kalahari Copper Belt (PL0245/2025)

• Three-year, US$13 million exploration blueprint mirroring regional best practice :

• Year 1: Mapping, soil sampling (1,500 samples), and ground magnetics (50 km²).

• Year 2: IP/CSAMT surveys (10 line km) and 1,000 m of RC drilling.

• Year 3: Infill drilling (2,000 m) and JORCcompliant resource modelling.

Looking ahead, what’s the single most important milestone investors should watch for, and how does achieving it move you closer to your strategic endgame?

Our maiden diamond drilling program at Orapa (late 2025) is the key catalyst. Success here would confirm a new kimberlite discovery in Botswana’s most prolific diamond field, validating our exploration model and positioning FMRB as a next-generation diamond producer.

This milestone also accelerates our broader vertical integration strategy, linking exploration (FMRB) with trading through Okavango Blue Diamonds, a PSDL-licensed entity (valid until 2030) with access to local auctions and global trading platforms. Together, they anchor our long-term vision of becoming a fully integrated producer-trader of Botswana-origin diamonds.

Are there plans to go public in the near term?

FMRB remains privately held as we prioritise technical progress and de-risking our assets. However, we are actively preparing for a structured capital pathway - including potential joint ventures, earn-in partnerships, or a public listing once key milestones such as the Orapa maiden drill results and KCB resource definition are achieved.

Our focus remains clear: build discovery value first, then scale responsibly with the right partners at the right time.

Peter Bird, Managing Director & Chief Executive Officer, Akora Resources

Can you give us a brief overview of your company and what makes AKORA’s projects compelling?

AKORA Resources (ASX : AKO) is a mineral exploration and development Company focused on high quality iron ore assets in Madagascar. We currently hold approx. 308km2 of tenements across four project areas:

• Bekisopa (our flagship project)

• Satrokala

• Tratramarina

• Ambodilafa

What makes AKORA a compelling investment story is a combination of near term cash flow potential, high grade, low capital and operating costs with Bekisopa, our starter project, being a generational project with optionality to transition from a Direct Ship Ore (DSO) project to a high grade long life iron ore concentrate project. Underpinning this is a pipeline of other iron ore and mineral projects:

• Bekisopa Project: The Company delivered a Pre-Feasibility Study (PFS) in March 2025 for a 2Mtpa DSO starter project. The PFS delivered very attractive economics (NPV10 US$147m, IRR 86%, Capital Costs US$60m, capital back ~ 1.8yrs with an initial Life of Mine ~6yrs with high probability of extension through exploration and optimisation and project cash flows of US$310m, C1 cash costs US$42/t with an assumed Iron Ore price of US$100/t).

• High Grade Ore, Low Impurity and Simple Metallurgy: Mine plan is based on shallow weathered ore zones that do not require drill & blast, reducing mining cost and execution risk.

• Scalable Upside: The Stage 1 DSO project there is significant potential to extend the DSO before the project transitions to a high grade +67% Fe magnetite concentrate production for DRI/EAF steel makers using cash flow generated from the Stage 1 DSO.

• Government and Community Support: The Bekisopa project has been identified by the Madagascan Government a project of significance, and we are currently coordinating with infrastructure investments (roads and ports) to reduce the project delivery and execution risk.

In summary, the AKORA portfolio provides a near term de-risked DSO pathway to cash flow with a broader iron ore exploration and development portfolio to underpin value and growth.

What recent discovery or result has you most excited?

The most exciting result for the Company has been the delivery of the PFS and updated resource statement in 2025. This confirmed the thoughts of the Board that the Bekisopa project is a generational project with significant upside potential. With compelling economics this enables the Company to seek a value accretive pathway forward. The mineral resource is a very high grade resource with low impurities. The near surface DSO component allows the Company to mine without drill and blast with an exceptional strip ratio of 0.52:1 (waste : ore):

• The Direct Shipping Ore (DSO) component of the resource (i.e. near surface material) shows strong tonnage and continuity with only 40% of the known strike drilled.

• Earlier metallurgical test work validates soft free dig, low abrasion, easily crushable ore, which supports lower operating costs.

• With further exploration underway (a trenching program) to expand the shallow footprint reinforces our confidence in extending the resource footprint.

Taken together, the resource upgrade materially increases our optionality, pushes out more of the resource into the high confidence ‘Indicated’ category, and improves the leverage of the project’s economics.

What is your technical strategy, what work have you completed so far, and what are the key programs planned for the next 12-18 months?

Technical / strategic approach:

The technical / strategy is to adopt a multi staged development pathway, commencing with a simple DSO operation to deliver high margin, low risk and low capital cost project to generate cash flows for an initial 6 years and with a high probability to extend this beyond 6-8 years with exploration. Then follow the Stage One DSO with the Stage Two high grade iron concentrate production. Stage Two would be largely funded through the cash flows generated from Stage One.

Work completed to date (to 2025):

• Delivered a full Bekisopa PFS for a 2 Mtpa DSO operation, with a low entry capital cost base of US$60.6m (including 15 % contingency) and strong project cash flows of US$310m over an initial six year life of mine.

• E xpanded and updated mineral resource base for the PFS of 10.6 Mt, with 8.5 Mt in Indicated Resource status.

• Completed geotechnical drilling (8 holes, 400 m) across the planned DSO zones, confirming the weathered zones are amenable to ripping rather than requiring drilling and blasting, resulting in reduced mining costs and an improved risk profile for the project.

• Road engineering and route design work (Bekisopa → Satrokala → RN7 national highway) from the site to the main national highway, base materials sourcing, and optimising alignment to reduce capital cost.

• Metallurgical test work confirming that ore is soft, low abrasion, and capable of producing Lump (61.8 % Fe average) and Fines (61.4 % Fe average) blends.

• Commencement of a trenching program to expand near surface DSO potential.

Key programs and milestones planned 12–18 months ahead:

• Definitive Feasibility Study (DFS) and detailed engineering work for Bekisopa DSO project

• Environmental & Social Impact Assessment (ESIA), permitting and licensing (mining licence applications)

• Further infill and extensional drilling (especially in shallow zones) to convert Inferred to Indicated and expand resource

• Metallurgical optimisation / upgrade test work to assess concentrate / magnetite circuits (targeting +67 % Fe concentrate) for future phases

• Infrastructure development and negotiations — finalise road, river crossing, port access, logistics, cost modelling

• Strategic partner / JV / offtake engagement to secure funding, customer contracts, and reduce execution risk

• Financial close and progression towards Final Investment Decision (FID) (target mid-2026)

Looking ahead, what’s the single most important milestone investors should watch for, and how does achieving it move you closer to your strategic endgame – whether that’s production, JV partnership, or acquisition?

The important milestones that the investors should be looking out for is: the Board’s decision on Final Investment Decision (FID) for Bekisopa Stage 1, this will initiate the project financing process. Along side this would be the possibility of a strategic partner to assist the Company to unlock significant value for the project and the greater portfolio.

The importance of FID means from a project economics and viability perspective AKORA’s internal and external due diligence, engineering, permitting and financing have been significantly derisked to seek the commitment of capital towards the project. This then puts the Company on a pathway from explorer to developer to operator with first production envisaged in H2 2027.

What investors can expect going forward?

Investors can reasonably expect a strong news flow over the near to medium term:

• Upside and Fair Value Revaluation Potential: AKORA is currently trading at a significant discount to the intrinsic value of its core asset. The market capitalisation is less than 5% of the Bekisopa Project NPV. With strong exploration results and progression towards FID and the potential of a strategic partner the Company is looking to bridge the value gap.

• Project execution derisking: As we deliver the Feasibility Study, complete permitting, secure FID, secure project financing, each step should reduce project execution risk and our stock should see a re-rate valuation multiples.

• Near term news flow: Expect regular updates on exploration works, community programs, technical work, infrastructure planning work and various ESG works initiatives all designed for project development.

• C ash flow transition: Once in production, investors will begin to see operating cash flows, enabling self-funding of Stage Two expansion.

• Portfolio Growth and Project Pipeline: Beyond Bekisopa, our other iron ore tenements (Satrokala, Tratramarina, Ambodilafa) offer exploration upside that may provide new discoveries or feed / growth to the Bekisopa Project.

Investors should expect a progression from de-risking → revaluation → growth toward production, backed by operational milestones, a strong economic base, and optionality from additional iron ore assets.

Can you give us a brief overview of your company and what makes Akobo compelling?

Akobo Minerals is a Scandinavian-based gold producer and exploration company operating in Ethiopia’s Gambela region, one of the country’s most gold-rich areas. Our flagship project, the Segele mine, is among the highest-grade gold deposits globally, and the first new international mine to open in Ethiopia since 1993. What sets us apart is our proven ability to transition from exploration to production. We are wellpositioned to scale operations and pursue our vision of becoming a leading gold producer in Ethiopia.

What recent discovery or result has you most excited?

We are particularly excited about the commencement of gold production at our Segele mine. The highgrade nature of the deposit has been confirmed, and our operations are now generating sufficient cash flow to cover our operating expenses. Additionally, the strategic investment from Ethiopian Investment Holdings enhances our financial stability and supports our growth initiatives.

What is your strategy, what work have you completed so far, and what are the key programs planned for the next 12–18 months?

Our strategy is to leverage our expertise and the highgrade nature of our existing project to expand into other minerals and metals. So far, we’ve completed exploration, resource definition, and development at our core project. The most important program over the next 12–18 months is the development of our new vertical shaft, which we expect to be operational around year-end. This will significantly increase

tonnage and revenues, taking production from 6–8 kilograms per month to around 50 kilograms per month. In parallel, we will continue advancing new exploration targets and evaluating opportunities to diversify our resource base, while maintaining a focus on operational efficiency and sustainability.

Looking ahead, what’s the single most important milestone investors should watch for, and how does achieving it move you closer to your strategic endgame?

The key milestone to watch is the completion of our new shaft at the Segele mine. This development will unlock deeper ore zones, increase production capacity, and enable further exploration. Achieving this milestone will significantly advance our goal of scaling operations and establishing Akobo as a leading, diversified miner in Ethiopia.

Investors can expect steady progress in both exploration and development, with a focus on sustainable growth and operational excellence. We are looking to build a portfolio of assets ranging from cash-producing mines to semi-developed projects and greenfield opportunities. Beyond gold, we will also explore other minerals and metals to diversify our business. Additionally, we are starting to develop an aggregator model aimed at supporting the regional and local artisanal mining sector. This will help improve working conditions, ensure fair payments, increase recovery, and create stronger, more sustainable local operations. All of this is designed to deliver long-term value and move us closer to our vision of becoming a leading, diversified miner in Ethiopia.

Our transition from explorer to producer proves our capability. Now we are focused on scaling, diversifying, and delivering long term value.

As markets rebalance and capital hunts for resilient long-term value, Mining Indaba 2026 is becoming the anchor point where Africa’s geological strength meets global dealmaking momentum.

MI26 is not just a gathering. It is a reset. Investors are refining strategies, companies are positioning for multi cycle growth, and governments are accelerating partnerships that will define the next decade.

“Africa represents the next wave of discovery from gold and silver to oil, gas, nickel, zinc, uranium and coal. The opportunities are extraordinary for investors who do the work.” Rick Rule

• Gold long term upside

• Silver tightening supply and demand gap

• Nickel and zinc undervalued but primed for a rebound

• Uranium backed by unprecedented contract stability

• Coal selective operators still generating outsized returns

Africa remains underexplored undervalued and misunderstood but full of upside.

The next five years will be extremely kind to investors who do the work.

Juniors especially those with African assets will reward discipline and insight.

Rick Rule, President & CEO, Rule Investment Media

The investment ecosystem at MI26 is engineered for outcomes. It brings global capital, frontier projects and strategic partners into one highperformance space designed to accelerate decisions and catalyse growth.

Arina Biguna, Senior Investor Relations Manager at Mining

Indaba.

MI26’s investment ecosystem includes:

Explorers Showcase

Forty exploration stage African companies with early-stage.

Junior Mining Showcase

Seventeen African focused junior miners positioned for growth.

Investment Lounge

A private environment designed for real dealmaking.

Curated Investment Programme

Investor led discussions for asset managers PE firms sovereign funds family offices and specialist investors.

The MI26 agenda aligns directly with investor priorities including:

• Africa’s role in global critical minerals

• Energy security and oil and gas

• The evolving risk landscape for juniors

• The resurgence of coal in selective markets

For investors planning the next five-to-ten-year cycle MI26 offers clarity access and deal flow.

With supply tightening demand rising and geopolitics reshaping global trade African resources are not just competitive. They are essential.

Explore the MI26 Investment Programme and secure your position at the centre of Africa’s mining future.

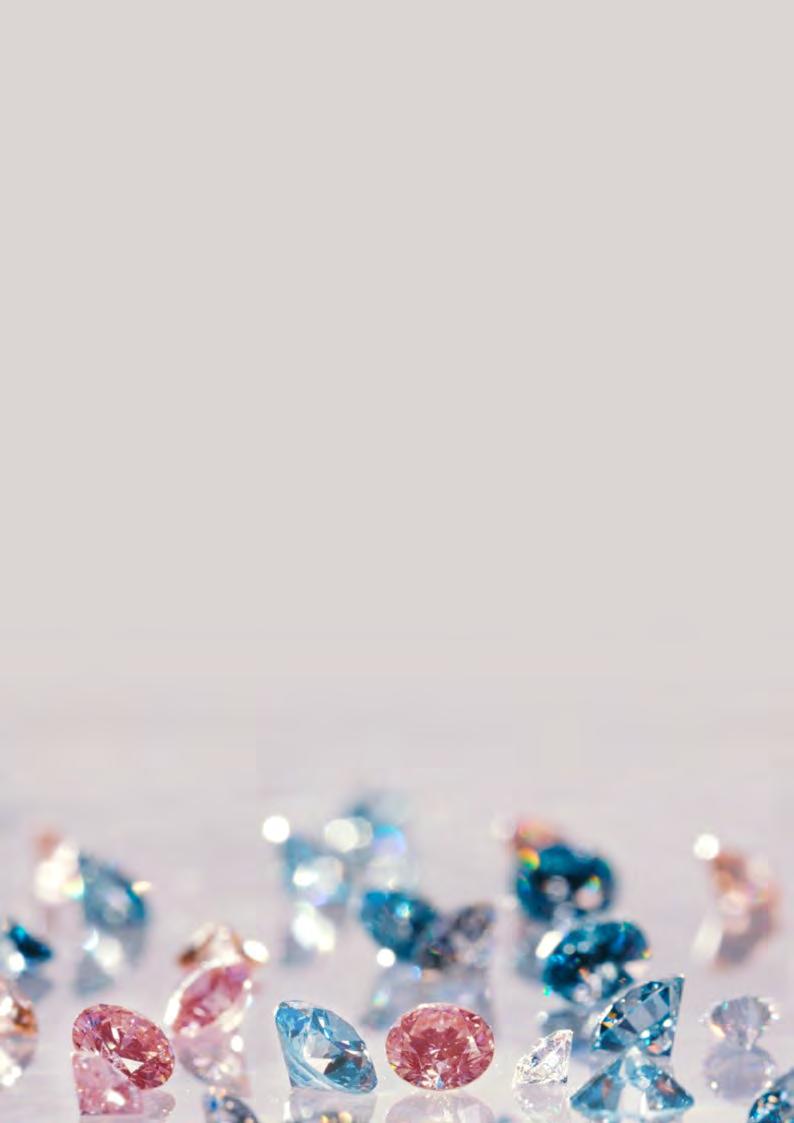

Botswana is not ready to give up on diamonds, even if mining companies are, as the government readies a bid for a controlling stake in diamond giant De Beers.

And a late entry to the negotiations by Angola complicates this contentious transaction even more.

Botswana’s president, Duma Boko, said the government is ready to buy a controlling stake in De Beers by the end of October.

“We are more than ready for the transaction and we’ve said the transaction must be concluded by the end of October,” Boko said. “It’s a matter of economic sovereignty for Botswana.”

The Botswanan government already holds a 15% stake in De Beers, with the balance held by the diversified miner Anglo American.

Anglo last year announced plans to divest its 85% stake in the diamond giant, as part of a broader restructure designed to fend off a takeover from rival miner BHP.

De Beers sources about 70% of its rough diamonds from Botswana, through its subsidiary Debswana, a joint venture with the Botswanan government.

William Clarke Deputy Editor, Mining Journal

The diamond industry is experiencing a generational upheaval, as cheap synthetic diamonds have flooded the market in recent years. There is now extreme uncertainty as to the entire future of diamond mining.

In the first half of 2025, De Beers reported a $189 million loss, compared to a $300 million profit a year earlier, after revenues dropped 10%.

This uncertainty has slowed the sale of De Beers, as buyers have proved hard to find. Since the planned sale was announced in 2024 Anglo has announced a series of write offs of De Beers’ book value, which now stands at $4.1 billion in February.

But despite the markets, Botswana has little choice but to remain all-in on diamonds.

Stewardship of its diamond industry has been a key plank in Botswana’s economic policy, which has made it the richest country per capita in southern Africa.

In 2019 Debswana accounted for a third of Botswana’s GDP, although that has shrunk in recent years as the diamond sector weakens.

Botswana is not the only African nation betting on diamonds, as Angola has now submitted a bid for a minority stake in De Beers.

Endiama, the country’s national diamond company, had submitted a fully financed offer to acquire a minority stake in the company.

Angola and De Beers have a joint venture to explore for diamonds in the company, although there is currently no production.

Botswana first announced its intention to increase its stake in 2024, weeks after the planned sale was announced.

Speaking to news wire Bloomberg, then president Mokgweetsi Masisi said the government would increase its interest and added that he expected the government to play a central role in selecting a new investor to replace Anglo at De Beers.

This is the latest in a longer term move by Botswana to increase control of diamond production.

In October last year, De Beers signed a ten-year sales deal with the Botswana government for Debswana’s mining production, with a 25-year extension to mining licences through 2054

The board of Debswana approved a $1 billion investment at the Jwaneng underground project in January. The investment will pave the way for a key development phase of Jwaneng, as it intends to transition from open pit to underground operations.

The deal increased the proportion of diamonds going to the state-owned trading business Okavango Diamond Company to 30%, compared to the 25% share taken previously, with that share rising to 50% over time.

In 2023 Botswana announced a strategic partnership with Belgian diamond trader HB Antwerp, taking a 24% equity stake in the latter.

The government at the time planned to increase this to a controlling stake in HB Antwerp, although that process has since foundered.

By Victoria BackhausJerling is CEO of the African Association of Automotive Manufacturers (AAAM).

Africa stands at a defining moment in its industrial evolution. For too long, the continent has exported raw minerals and imported finished goods, forfeiting the immense value that lies in transforming its resources locally. Today, as the world accelerates toward sustainability and green mobility, Africa has the opportunity to rewrite this narrative, by aligning its mining and manufacturing sectors to drive a new era of shared growth, innovation and resilience.

The continent’s abundant mineral wealth – for example, lithium, cobalt, manganese, nickel and copper – forms the backbone of the global transition to new energy and sustainable mobility. Yet, without strong manufacturing linkages, Africa risks remaining a supplier of raw materials rather than a creator of industrial and social value. By fostering collaboration between mining and automotive manufacturing, Africa can build integrated value chains that create jobs, enable technology transfer and spur inclusive industrialisation across multiple forms of mobility, from battery-electric to hybrid and hydrogen fuel-cell vehicles.

This vision is not theoretical. Countries like South Africa, Morocco and Egypt already have established automotive sectors while other key African states like Egypt, Ghana, Côte d’Ivoire, Kenya and Nigeria have advanced automotive policy discussions. When connected with mineral-rich economies such as the Democratic Republic of Congo, Zambia, and regions within the ambit of Southern Africa Customs Union (SACU), a powerful continental ecosystem emerges, one capable of producing everything from battery precursors to finished electric vehicles.

The global race towards carbon neutrality demands that Africa’s industrial growth be both green and inclusive. New energy vehicles (NEVs), renewable energy and circular manufacturing processes are redefining what sustainable industry means. Africa’s access to renewable energy sources such as solar, wind and hydro gives it a natural advantage in building low-emission industrial zones.

By investing in green technology and local innovation, we can create industries that meet global standards while responding to local realities. This includes nurturing start-ups, research partnerships and skills development programs that empower African engineers, scientists, policy makers and entrepreneurs to lead in future technologies.

The African Continental Free Trade Area (AfCFTA) presents a huge opportunity to scale these ambitions. By harmonising standards, reducing tariffs and facilitating cross-border trade, the AfCFTA can enable regional value chains that make Africa a globally competitive manufacturing hub.

Imagine a regional manufacturing ecosystem where lithium extracted in Zimbabwe powers battery cell production in Kenya, and automotive-grade copper rods from Zambia’s refineries are transformed into motor windings, wiring harnesses, and charging infrastructure components across the continent. Steel and aluminium processed in South Africa feed into

component and body part manufacturing in Ghana and Morocco, while electronics and control systems are assembled in regional industrial hubs. Together, these interlinked value chains form the foundation of Africa’s future mobility industries – not just assembling vehicles, but building the entire supply base that underpins them. This is more than an economic vision; it is a blueprint for industrial self-sufficiency, technological capability, and continental resilience.

Such transformation requires visionary partnerships between governments, the private sector and development institutions. Policy alignment, infrastructure investment and capacity building are critical. Just as important is the empowerment of local talent, ensuring that Africa’s youth and women are not only participants but leaders in this industrial revolution.

Africa must act with urgency. Prioritising investments in sustainable mining, vehicle and component manufacturing, as well as skills development will define our role in the global mobility and resource value chain. Collaboration across borders, sectors and industries is our greatest asset. By aligning mining and automotive manufacturing, Africa can transform its natural wealth into lasting prosperity. The world’s mobility revolution needs Africa, but the question is whether we will seize this moment to lead it.

Africa is entering a defining chapter where our mineral wealth can fuel not only global supply chains but also our own industrial transformation.

The Downstream Buyer Programme at Mining Indaba exists for this purpose: to turn Africa’s critical minerals into catalytic partnerships that build factories, value chains, and futures on the continent.

This is where upstream meets downstream. Where resource potential becomes industrial capability. And where the MI26 theme Stronger Together: Progress Through Partnerships shifts from promise to action.

Each year, we witness the mining, automotive, battery, and manufacturing sectors converge in ways that were unimaginable a decade ago. Original equipment manufacturers, battery producers, component manufacturers, and industrial processors sit across the table from African mining companies not for introductions but for genuine alignment on supply, technology, processing, and long term investment.

Mining Indaba stands apart because it convenes the entire ecosystem in one space: mining, energy, infrastructure, finance, research, and

Our greatest resource isn’t underground—it’s the partnerships that turn Africa’s minerals into meaningful, industrial opportunity. The Downstream Buyer Programme is where that transformation begins.

Laura Nicholson

manufacturing. It is where investors meet innovators, where policy meets execution, and where Africa’s resource story evolves into an industrial one.

We connect global technology leaders with African industrial players, enabling genuine technology transfer from automation to mineral processing, from digitalisation to advanced manufacturing. These exchanges accelerate Africa’s journey toward sustainable, high tech, value added growth.

The vision is clear. A continent where critical minerals do not leave as raw exports but power battery plants, vehicle components, and renewable infrastructure built on African soil. Mining Indaba will continue driving this shift by aligning policy, capital, capability, and collaboration to support Africa’s transformation from extraction to industrialisation.

Progress is never a solo act.

Progress is built together.

Unplanned maintenance now accounts for 60% of total mine maintenance spending. Innovative solutions – specifically deploying the right Generative AI (GenAI) tools - can bring down those costs.

When mines deploy predictive maintenance systems, they tend to do so in isolation and rely on static thresholds. This lack of integration limits visibility and prevents coordinated responses, which erodes productivity and efficiency. According to recent research by Boston Consulting Group (BCG), the right GenAI tools can transform predictive capabilities and cut costs by 10%. That’s because, unlike traditional, fixed schedule methods based

Even the most advanced diagnostics fall short if parts are not available. Delays in remote sites can halt production, but excess stock will tie up working capital. Our work with mining companies often reveals costly instances of reactive ordering, low inventory turnover, and weak integration between planning and procurement. GenAI addresses this by connecting asset health forecasts with real-time inventory, supplier lead times, and planned maintenance windows. Value is derived from ensuring optimal inventory of the right parts, purchased at the right time and price, to support planned and unplanned maintenance.

Field technicians are on the front lines when it comes to maintenance but are often underserved. They face complex repair issues, incomplete documentation, and inconsistent knowledge sharing - especially in multi-site operations. At BCG Platinion, our specialists have designed a conversational GenAI agent specifically for field technicians, capable of translating complex fault codes into actionable steps, leveraging historical data, and identifying relevant OEM guidance, effectively providing synthesised, assetspecific support on fault identification and resolution .

GenAI can help tackle the talent challenge in the mining space by embedding learning into operations, providing junior team members with guidance while saving experts time to focus on high-value work. These applications of GenAI also reduce human error and operational risk significantly by providing step-by-step guidance, flagging safety concerns, and addressing problematic conditions before they escalate. The result is more consistent field decisions and a more agile, confident and safe workforce.

Taking the GenAI jump does not require digitally advanced operations, the key is just getting started. On the journey towards the autonomous maintenance ecosystems of the future, this is a crucial step.

Perfect data foundations and digitally advanced operations are not required to begin reaping the rewards of GenAI integration. Even mines with low digital maturity using a tier-one Enterprise Asset Management (EAM) system can adopt modular, pragmatic GenAI solutions that quickly demonstrate their value.

However, two fundamental elements need to be in place. The first is organisational readiness: aligned leadership and visible support from the top; building trust and localised change-management; a digital enablement culture that promotes usability; incentives for adoption linked to KPIs. The second is certain technical foundations: cloud connection; network infrastructure; lightweight event bus or middleware for monitoring and alerts across platforms; about 12-24 months of maintenance data; security and access control.

Performance gains are enhanced when integration has been carried out end-to-end. At BCG and BCG Platinion, we have successfully integrated GenAI platforms with ERP (Enterprise Resource Planning), EAM, and OT (Operational Technology) systems for major mining organisations.

GenAI in mining is not a distant aspiration. Modular, mine-ready solutions are already available that deliver operational impact in complex, remote, and resource-constrained environments. Mining company leaders looking to unlock value from GenAI in operations can start with intent, alignment, and a plan, rather than waiting for the perfect conditions.

Mining’s next frontier is autonomous co-ordination. GenAI is already improving diagnostics, inventory, and technician workflows, but agentic AI will go further by scheduling interventions, placing orders, and intuitively escalating issues at the right moments. on legacy telemetry data, GenAI solutions can synthesise structured and unstructured data to perform smart diagnostics, support real-time parts ordering, or augment in-field support.

The differentiator is GenAI’s ability to interpret patterns and contextualise valuable outputs from vast datasets. An orchestration layer powered by the right technology can process information from every sensor feed and every set of technician notes seamlessly, and across sites. Using this approach, we have seen mining companies increase fleet availability by 15% within six months, improve technician job effectiveness and optimise technician job durations by up to 20%.

Mining is at a crossroads. Optimizing across the value chain and across the lifecycle for the many different goals and constraints now exceeds human capacity and capability. Miners must optimize operations for profitability, productivity, labor, and reserves, as well as for safety, health, and environmental outcomes. Miners must operate sustainability across emissions, water, waste, and ecosystems and preserve their license to operate, while securing against cyber-threats. Such optimization cannot be done with pencil and paper, manually updated status boards, scattered spreadsheets, or even a handful of siloed industry-specific applications.

New digital technologies, which leverage artificial intelligence and enterprise optimization capabilities, are key to transforming these supply chains. With improved supply chains, miners and their partners are taking mine-to-market to near-real-time levels and creating open mining ecosystems and platforms.

The mining industry plays a dual role in energy transition. It is a major energy user, consuming 10% of the world’s energy. So, its first role is to reduce energy consumption and better manage energy use in operations. The world must reduce its annual CO2eq emissions from 50 giga-tonnes (metric tons) per year to net-zero by 2050 to avoid catastrophic climate consequences. So, mining’s second role is to provide Climate-Smart minerals for clean

Joseph Starwood, Director, Mining Industry, Microsoft

renewable energy as quickly and cost-effectively as possible. Mining operations are leveraging data and utilizing advanced analytics to reduce energy consumption in energy-intensive processes. Some are transitioning to clean electric powered vehicles and are exploring hydrogen-fueled vehicles. Others are utilizing regenerative charging on electric vehicles and are building solar and wind farms. And most are employing sensors and energy management software to drive efficiency across their operations. Miners must adjust to rapidly increasing mineral demand, changing commodity demand mix, and price volatility. Supply chains, already reeling from disruptions, will be stretched to their limits. Digital solutions will play a key role in demand forecasting, commodity pricing, adaptive planning and scheduling, portfolio management, logistics, and more.

Showcase your brand to the world’s mining leaders

Exhibitor and sponsorship opportunities available

ENQUIRE NOW

F ind out how your company can get involved today

Shared vision, shared goals

Mkhululi Nkosilamandla Ncube

Programmes Officer

African Minerals

Development Centre (AMDC)

Strategic partnerships in Africa’s minerals sector under the Mining Indaba 2026 theme “Stronger Together: Progress Through Partnership” highlights the need for collaboration across the entire minerals development value chain and related infrastructure development. From financing to industrialised infrastructure and socio-economic transformation on the backbone of minerals development. This resonates with the Africa Mining Vision(AMV) tenets and its continuously maturing set of implementation tools. This theme brings out and urges the showcasing of existing and/or necessary collaborative efforts at value chain segments across institutions, policy and implementation landscapes to achieve the AMV. It underscores the urgency of drawing synergies among stakeholders, from mining companies of all sizes, governments, investors, technology providers, and communities to overcome challenges and unlock opportunities for sustainable growth and beneficiation.

The latest of the AMV implementation tools is the fresh 2025 African Green Minerals Strategy (AGMS) which, together with another tool, the African Minerals and Energy Resource Classification framework that incorporates the Pan African Public Reporting Standard for Minerals and Energy Resources (jointly referred to as AMREC-PARC) are aligned with the United Nations Secretary General’s Panel on critical energy transition minerals. The AGMS provides a roadmap for sustainable industrialization and inclusive growth through integrated value chains starting all the way from exploration. As a distillate of the AMV, the AGMS aims to move beyond raw mineral exports toward local value addition, job creation, and economic diversification. It focuses on advancing mineral development, people and technology capability building, infrastructure enhancement, and climate resilience.

Mining Indaba 2026 emphasizes five pillars for strategic partnerships. Each of these pillars can be cross-referenced to interfacing with AMV implementation tools, pillars and initiatives as follows: Capital mobilization(domestic and beyond) -> AMREC-PARC; Infrastructure enhancement (transport, energy, and logistics) -> AMREC-PARC and AMV Private Sector Compact; Buyer-seller alignment for a buyer-driven market -> GMIS and AMREC-PARC as to chart price reporting infrastructure in-continent; Skills development (including emerging technologies) -> the African Mining Skills Initiative and the PARC training guidelines; Governance improvements to increase investor confidence and sector stability -> the African Minerals Governance Framework (AMGF) and Country Mining Vision(CMV) guidebook.

Infrastructure development is a critical area for achieving minerals development in-continent, aiming to improve transportation networks and reduce mining energy costs that represent a significant portion of operational expenses that may stretch to up to 40%. As such it is befitting that 10

years after its launch at Mining Indaba 20216, the AMV Private Sector Compact and the theme for Mining Indaba 2026 - dovetail with a revamp of an enhanced compact with much more practicable and discernible partnerships whose follow-up will include having a series of partnered activities and initiatives that support the delivery of these intended partnership outcomes. Impact through partnerships is meant to be seen as the value of having been part of Mining Indaba 2026 and beyond.

Promotion of a vision where stronger partnerships unlock investment, innovation, and equitable socio-economic benefits— transforming Africa into co-leadership positions in the global minerals development space has been well underway with increasing strategic partnerships that foster collaboration to build continental integrated value chains and infrastructure i.e. the African Continental Free Trade Agreement, the Continental Master Plan and the upcoming ASM continental strategy; Mobilize capital i.e. the budding of multi-pronged financing mechanisms for in-continent value addition; Develop skills i.e. the ongoing capacity building and training initiatives that are being ramped up in-continent on the AMV and its tools; Enhance governance i.e. the ongoing country AMGF assessments across the 5 regions of the continent; and ensuring sustainable benefits across Africa’s mineral development sector value chains whilst building both hard and soft infrastructure e.g. the civil society push for engagements and interrogation of the same, to position the continent and its citizenry as part of the global locus in minerals value chains and their related infrastructure.

Africa is stepping into a defining moment. The continent’s mineral endowment is no longer viewed as static resource wealth; it is now the strategic engine behind industrialisation, energy security, and long-term economic transformation. Mining Indaba 2026 will be the catalytic point where policymakers, investors, and industry leaders stop admiring the opportunity and start executing it.

Cross border collaboration is tightening across the continent, with governments moving in lockstep to harmonise regulation, unlock capital flows, and build resilient value chains. This shift is not theoretical. It is operational, tactical, and increasingly aligned to a shared ambition to convert mineral potential into sustainable, investable growth.

Zeinab El-Sayed, Head of Government Partnerships, Mining Indaba

The 2026 Intergovernmental Summit is the central driver of this collective effort. Purposebuilt to advance continental alignment, the IGS will spotlight how African governments are coordinating infrastructure plans, modernising regulatory systems, and strengthening sustainable investment frameworks. It will tackle critical questions including how close Africa is to genuine regional and continental integration, how the continent can future-proof strategic corridors amid shifting geopolitics, and how to close the transmission infrastructure gap to power mining and industrial growth. The agenda will also explore whether global instability has improved Africa’s relative attractiveness to investors and how formalising artisanal and small-scale mining can

unlock greater value addition. Through these discussions, the IGS will bring stakeholders to unpack the partnerships Africa needs to compete on a global scale.Alongside it, the Ministerial Symposium returns as the flagship platform shaping Africa’s mining future. Strictly by invitation, the 2026 edition Banking on Africa Mobilising Capital Through Partnership will convene ministers, sovereign investors, development financiers, and global mining CEOs for a day of strategic engagement designed to move conversations into delivery. This year’s programme focuses on aligning national and continental strategies, scaling new financing models, and accelerating energy and infrastructure cooperation across borders. The direction is clear no more fragmented progress, no more isolated policymaking.

From critical minerals to beneficiation, from trade corridors to integrated power systems, Africa is positioning itself as a global leader rather than a raw exporter.

MI26 will serve as the continental pivot point. It is where policy alignment strengthens investor confidence. It is where collaboration matures into tangible progress. And it is where Africa demonstrates that shared ambition delivers measurable impact.

Exxaro Resources has bought control of two renewable energy facilities nearly doubling the net operating capacity of subsidiary Cennergi.

Cennergi will have a net operating capacity of 317MW by dint of its R1.8bn acquisition of majority stakes in the 138MW Gouda Wind Farm and the 75MW Sishen Solar Facility. Ben Magara, CEO of Exxaro said on Thursday the deals strengthened his firm’s claim to be a “natural resources champion”.

The transaction also accelerates Exxaro’s ambitions to have 1.6GW in managed net renewable energy capacity by 2030. Shares in the company edged down just under 1% in Johannesburg, but have gained 11% so far this year.

The facilities were bought from Acciona Energía and include the operations and maintenance company that runs the facilities. The assets were projects procured in terms of South Africa’s renewable energy auction process, in the second bid window. Power purchase agreements with Eskom from both are for 20 years.

Cennergi has a further 180MW in renewable power under construction, Exxaro said. The closing date for Thursday’s transaction announcement is in the first half of 2026, subject to approvals.

Exxaro is one of South Africa’s largest coal producers. It sold 13.2 million tons to Eskom for the first six months of its 2025 financial year and exported a further 3.4Mt.

By David McKay, Miningmx

This is the second major renewable energy announcement by a coal producer this week. On Wednesday, Seriti Resources’s Seriti Green handed over a R1bn transmission station to Eskom after an 18-month construction programme. This will enable the first phase of one of South Africa’s largest renewable energy developments to begin feeding power into the national grid, Seriti Green said.

The Vunumoya Main Transmission Station in Mpumalanga became fully operational this week, allowing 155 megawatts of wind energy from Seriti Green’s Ummbila Emoyeni One Wind Energy Facility to enter the system ahead of the original March 2026 schedule. Power delivery commenced on 28 November.

The industrial power of platinum group metals (PGMs) is well known, but with the market in transition, myths around scarcity and expense are holding us back from maximising the potential of these exceptional metals.

Platinum Group Metals (PGMs) are unsung heroes of our industrial world. They are the only viable option in a number of technologies because of their unmatched performance and durability in extreme environments. To name a few examples: only PGMs can be used in catalytic converters to reduce harmful emissions efficiently in the short time exhaust gases pass through it. Only PGMs can withstand the high temperatures of an aircraft jet engine. Only PGMs can catalyse critical drug synthesis steps, likely being used in just over 80% of the new small molecule drugs approved by the FDA in 2023 (according to a Johnson Matthey analysis).

Unfortunately, despite these strengths, further use of PGMs is hampered by misplaced fears around their rarity and cost. Scientists and researchers often try to replace PGMs with more ‘earth-abundant’ metals like nickel, believing that the perceived sustainability and lower initial cost justify the performance trade-off.

Marge Ryan PGM Advocacy & Market Development Manager, Johnson Matthey

In reality, sources of PGM supply are well established and sufficient for the future. Exceptionally high rates of recycling – with no loss in performance or efficiency versus primary metal – and the fact PGMs are typically used in very small volumes to achieve the desired effect, means more efforts should be focused on developing PGM-based innovations where they are needed, rather than trying to avoid them.

The opportunity for greater PGM use in new markets is being created by the policy-driven decline of internal combustion engine vehicle production.

Catalytic converters have accounted for more than 60% of PGM demand in recent years, but that will change. This should be welcomed by innovators who can take advantage of this shift in demand and harness the powers of PGMs for new technologies.

To mitigate concerns around cost and sourcing, reassurance can be taken from the established nature of PGM supplies and recycling, the maturity of responsible sourcing in the industry, and the high efficiency with which the metals are used.

The transition within the PGM market is also an opportunity for collaboration. The PGM industry has a long history of partnering and supporting PGM market development, and such partnerships should once again prove fruitful in unlocking the potential here. Closer ties between producers, universities, and industry could ignite the development of vital solutions for complex technological challenges that only these unique metals can solve. Creating new markets will have the positive, knock-on effect of stimulating ongoing investment in PGM supply chains, bolstering the availability of these metals and supporting their vital use in essential technologies for decades to come.

While PGMs are ‘rare’, they are not scarce. They are ready for new markets. This is an exciting time for the industry that should be viewed through a lens of opportunity, not fear. This is our chance to innovate and apply these powerful metals to solve more of the world’s most urgent and complex challenges.

Africa is now well positioned to lead the next global industrial era, moving far beyond its traditional role as just a raw materials supplier. The continent’s vast endowments of critical minerals, raw material strategically essential to modern energy systems and digital technologies, gives it unique influence to become a central actor in defining the global critical minerals value chain.

With worldwide demand for these essential resources projected to more than double by 2040, secure access to minerals like cobalt, copper, lithium, manganese, and platinum group metals has become a matter of national strategic importance for most economies. These materials are the foundation of 21st-century economic power, enabling everything from electric vehicles and solar panels to data centres and smartphones.

These are the findings contained in our latest report in our BCG Africa Series, titled Africa’s Critical Minerals Moment: A Strategic Blueprint for Sovereign, Sustainable, and Scalable Growth, outlining how African nations can leverage their

vast mineral endowments to move beyond traditional extraction economic models and capture significantly greater value across the entire mining-to-manufacturing value chain.

Africa’s opportunity is not merely about extraction; it is about industrial transformation. By capturing significantly greater value across the entire miningto-manufacturing chain, African nations can position themselves as essential, high-value partners in global clean energy and digital infrastructure development.

This transition promises powerful economic outcomes that stabilise and accelerate global clean energy efforts. For every $1 billion invested in mining and processing activities on the continent, the economic ripple effects are substantial, with a potential to create approximately 3,000 to 6,000 direct, indirect, and induced jobs. The investment could contribute $210 million to $280 million annually to the continent’s GDP. Furthermore, these activities could generate $70 million to $100 million in annual incremental government revenue and drive $100 million in regional infrastructure development.

A coordinated, continental approach to development is the key to maximising this strategic advantage. While current mining activity remains concentrated, particularly in the Southern African Development Community region (SADC), this presents an opportunity to design new industrial capacity with essential modern standards like sustainability and traceability built in from the start.

Regional integration is essential for building resilient value chains that extend beyond raw material extraction. Existing economic blocs such as SADC, ECOWAS, and the EAC provide ready-made platforms for aligning policies and coordinating infrastructure development. A strong example of this is the Battery Minerals Corridor between the Democratic Republic of Congo and Zambia, which links cobalt and copper extraction to regional processing, ensuring that more value stays within the continent.

Attracting credible investment is equally important. African governments need to create investor-friendly environments by simplifying regulatory frameworks, speeding up permitting processes, and embedding strong ESG standards. Namibia’s success in securing international partnerships through policy reforms and ESG commitments illustrates how credibility can unlock significant foreign investment.

Finally, forging strategic global alliances will be key to securing long-term demand, accessing the technical expertise, and financing needed to scale up. Morocco’s emergence as a global hub for phosphatebased battery materials, driven by partnerships with the European Union and China, shows how African countries can position themselves as indispensable players in the global clean energy transition.

This is Africa’s critical decade. The global context reinforces the urgency of action, as the window of maximum leverage is open right now. Unlike other regions constrained by legacy infrastructure, African nations can leapfrog by building modern, transparent, and digitally enabled value chains from the ground up, as demonstrated by Rwanda’s pioneering digital traceability systems for tantalum exports.

Africa’s mineral riches are not merely a competitive advantage; they represent a strategic one. By advancing coordinated continental action, using frameworks like the African Continental Free Trade Area, African leaders must act decisively to transform potential into tangible economic benefit. The choices made now will decide whether the continent remains a raw inputs supplier or becomes a strategic actor defining the terms of global engagement, thereby driving and sustaining global growth.

For decades, Empresa Nacional de Diamantes de Angola (ENDIAMA EP) has stood as one of the defining pillars of Angola’s economy and a central force in the national diamond subsector. Known primarily for prospecting, exploration, and the marketing of rough diamonds, ENDIAMA EP is now driving a bold transformation built on diversification, modernization, and full value chain integration.

In an increasingly demanding global market where competitiveness hinges on value addition and advanced production capabilities, ENDIAMA EP has outlined a clear journey. The company is evolving from a producer of rough diamonds to a diversified minerals player, expanding into segments such as gold, cutting, and jewellery manufacturing. This future reflects a belief that Angola’s mineral wealth must translate into domestic value creation, industrial growth, and meaningful employment.

A landmark milestone in this transformation is the development of ENDIAMA EP’s first gold refinery. Its inauguration will usher in a new chapter for Angola’s mineral resources industry. The refinery will refine domestically produced gold to international purity standards and support the creation of a unified industrial ecosystem that brings gold and diamonds together for jewellery production within the country.

Diamond cutting, traditionally dominated by international centers, is a strategic priority for ENDIAMA EP. The company is forging technical and financial partnerships with global specialists to establish state of the art cutting facilities. These units, combined with a network of additional advanced factories planned across the country, will house world class technologies and highly skilled professionals. This is a decisive step toward increasing domestic

value addition and positioning the Diamond of Angola brand more competitively on the global stage.

ENDIAMA EP is working to stimulate the transition into jewellery production, with a strong focus on human capital development. The company recognizes that the sustainability of any industrial strategy depends on people, skills, and innovation.

ENDIAMA EP’s long-term vision for the diamond and precious metals market extends far beyond increasing production. It is building an integrated value chain that begins with mining, advances through cutting and refining, and culminates in jewellery manufacturing that reflects Angolan identity and global ambition. The company aims to position Angola as a center of excellence in diamonds and precious metals, driving wealth creation, innovation, and international recognition.

This moment marks a historic shift for ENDIAMA EP. Guided by a clear strategy, targeted investments, and strong partnerships, the company is redefining its role in the mineral resources sector. ENDIAMA EP is emerging not only as a mining enterprise but also as a symbol of national modernization, value creation, and global relevance.

The future has already begun. And it is being shaped with precision, purpose, and ambition.

By Dominic Piper, Australia’s Paydirt

Southern Africa’s largest battery minerals mine is back in operation and its owner is confident of achieving a new era of success on the global stage.

ASX-listed Syrah Resources Ltd discovered and developed the Balama graphite mine in Mozambique at the beginning of the 2010s during the height of the last graphite boom. However, with the market for the critical anode material experiencing a prolonged slump over the last seven years, Syrah has struggled to define its position in the supply chain.

Its efforts have been further complicated by local and international politics. Postelection demonstrations made it impossible for Syrah to switch Balama back on earlier this year. Meanwhile, international trade strife has set back the company’s downstream ambitions at its Vidalia active anode material (AAM) facility in New York State.

However, with grassroots politic problems in Mozambique and international trade strife in the US, Syrah managing director Shaun Verner has found himself trying to navigate a path through several unstable situations.

The chances of safe passage appear to be increasing, however. Post-election political tensions in Mozambique have eased in recent months with demonstrations subsiding and in the US government investigations could make domestic production more competitive with Chinese imports.

The situation has calmed enough for Syrah to switch Balama back on after nearly a year on ice. The September quarter saw the operation produce 26,000t of graphite concentrate and sell 24,000t, reducing its negative cashflow performance from $US21 million to $US3 million quarter-on-quarter.

The mine operated for a sixweek period in the quarter, with Syrah planning to continue on the campaign basis for the foreseeable future.

“Balama is the largest operation in the market and can dramatically impact the market balance,” Verner said. “We would move to continual, consistent production as the market dictates, so as not to overwhelm it.” Verner said the restart after the nine-month hiatus had gone well but he expected further improvement in the December quarter after blowing away the final few cobwebs.

“Recoveries have not been exactly where we wanted them but the second campaign now under way is getting back to where we want it and will match the market,” he said. “We have resolved the issues and we have continued to mine and expect grade and recoveries to improve as we blend newly mined material with the older material.”

Syrah had delayed the restart while post-election demonstrations continued in the country and local opposition to the operation tapped into that mood. Verner said President Daniel Chapo was now in a more secure position and instability had eased at both national and provincial level.

“The national situation has improved immensely since March,” he said. “It took some months after his inauguration in January for the challenges to the result to subside, but now there is a move towards stability.

“Our host province still has challenges to security but it is not impacting Balama and we have support from the Government. At the community level, some of the issues were conflated with the national demonstrations in some ways but these are also improving.

“We have agreed a supplementary resettlement payment to some of the disaffected community members who had felt hard done by after the resettlement legislation changed halfway through the process.”

Verner said Chapo’s experience with the resource sector during his time in provincial politics meant he understood and was supportive of further development in the country.

“The President and the Minister for Minerals are super focused on resource development in the country and providing the stability, both in legislative framework and security, as an incentive,” he said. “There are still challenges around infrastructure, economic development, etc but if the Government can provide incentive to attract development, there are lots of opportunities within Mozambique.”

The official sector has consistently been a net buyer of bullion every year since 2010. Between 2010 and 2021, these net purchases averaged 481t per annum, representing 11% of global gold demand. This trend saw a marked shift in 2022 following Russia’s invasion of Ukraine. The impact of US sanctions on Russia and the perceived weaponisation of the dollar prompted many nations to reassess the risks associated with dollar-dominated international reserves. A worsening US fiscal outlook further intensified the focus on de-dollarisation.

Against this backdrop, net official sector purchases exceeded 1,000t for the first time in 2022 and have since remained elevated. With an annual average of 1,073t, the official sector accounted for 23% of global gold demand between 2022 and 2024. More significantly, this strong and sustained demand played a pivotal role in supporting the gold rally.

In 2025, however, the pace of official sector acquisitions has slowed. Net purchases declined for two consecutive quarters, reaching 172t in Q2.25, making it the lowest quarterly figure since Q2.22, when central banks began accelerating their gold

By Junlu Liang, Senior Analyst

acquisitions. Although net purchases rebounded to 220t in Q3.25, the total for the first nine months of the year was still 13% lower than the same period in the previous year. Among publicly disclosed buyers, most purchases were made by regular participants in recent years, notably China, Poland, and Turkey.

This moderation is largely attributable to the sharp rise in gold prices and increased financial market volatility throughout 2025, which has led reserve managers to adopt a more cautious approach. Importantly, even with a slower rate of buying, gold’s exceptional price performance has naturally increased its share in international reserves, reducing the urgency for further diversification.

Despite the deceleration, the year-to-date total for 2025 remains elevated by historical standards. In essence, the ongoing desire to reduce exposure to dollar-denominated assets continues to drive central banks towards alternative holdings. Furthermore, President Trump’s unpredictable policy stance, his repeated criticism of Federal Reserve Chair Powell, and the deteriorating US fiscal outlook have all eroded confidence in the US dollar and Treasuries as safe-haven assets. Heightened geopolitical tensions have further diminished the appeal of US assets.

Reflecting these concerns, the latest IMF survey reveals that the share of US dollar holdings in allocated foreign exchange reserves fell to 56.3% by end-June 2025, a new low since records began in 1999. Over this period, the surge in gold prices and continued growth in central bank holdings have led to a rising share of gold in global official reserves. Having overtaken the euro to become the second-largest reserve asset in 2024, gold’s share rose further, approaching 25% by end-June.

The drive towards de-dollarisation also explains the limited gold disposals by central banks, despite

the metal’s strong price performance. Most official sector sales in 2025 to date have come from countries that were active buyers in previous years. Rather than passively holding gold, some central banks have adopted a more active management strategy, maintaining gold’s share around a target level. With prices rising, it is unsurprising to see some liquidations as these countries rebalance their portfolios.

Looking ahead, with economic and geopolitical uncertainties likely to remain elevated, de-dollarisation is expected to remain a key consideration for many reserve managers. Gold is well positioned to benefit from this trend. That said, the impact of rising prices cannot be ignored, as some reserve managers may view current price levels as too high for fresh acquisitions. On balance, we expect net official sector purchases in 2025 to total around 800t. While this represents a modest slowdown following three years of exceptional demand, buying remains elevated by historical standards. Moreover, healthy levels of official sector demand are likely to continue providing solid price support for the foreseeable future.