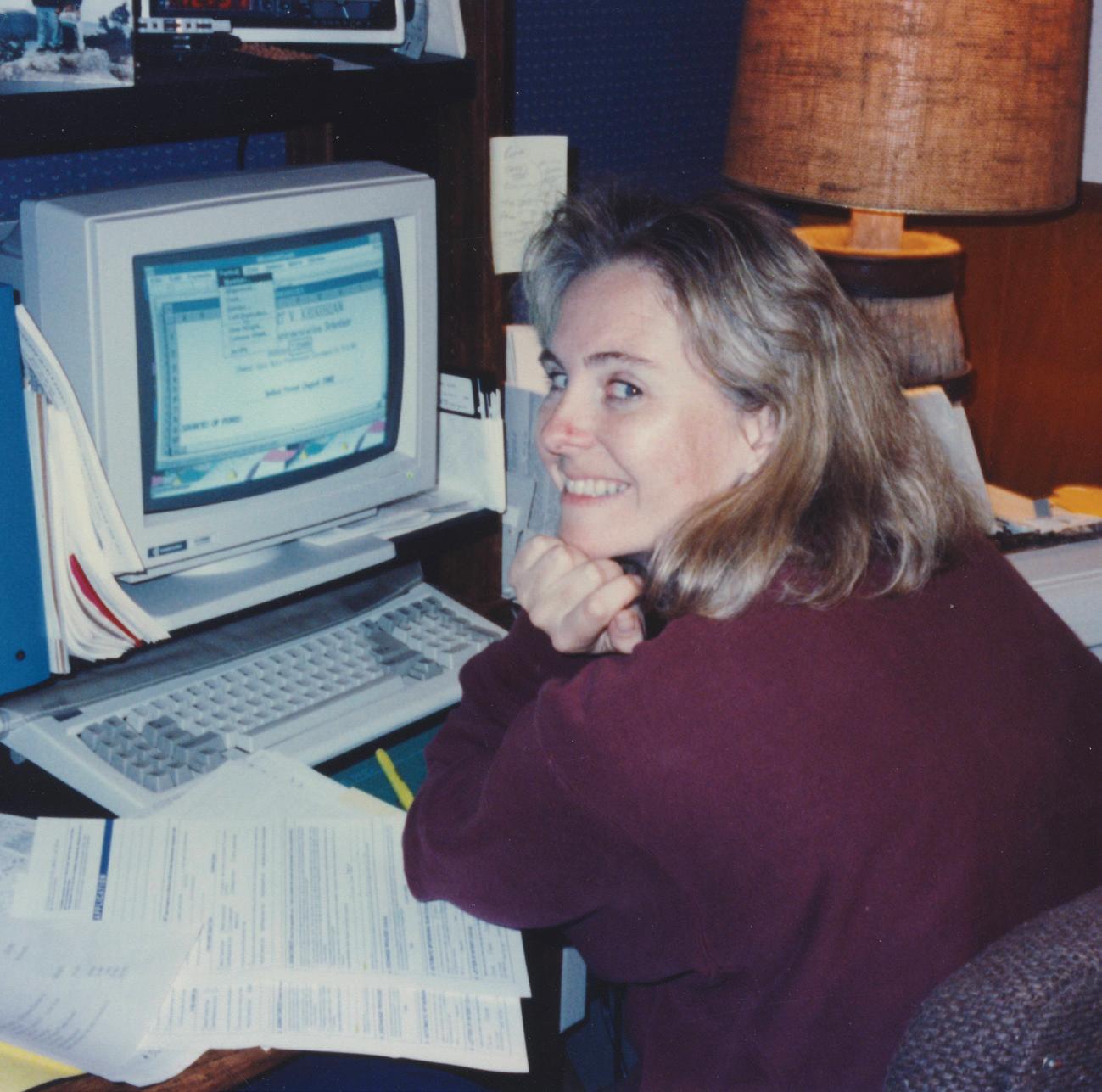

IAG Wealth Partners, founded by Lori Watt, helps clients of all ages plan for the future.

For most of us, the phrase “wealth management” conjures up the image of numbers on a screen.

But at IAG Wealth Partners, the work stretches far beyond just facts and figures. It’s about guiding and supporting people through all stages of life.

O ver her 45 years in the industry, Lori Watt, the founder, president and CEO of IAG, has seen clients of all ages come to her firm looking to set themselves up for long-term financial success. But in recent years, she has noticed more people reaching out earlier than ever before – in their 20s and 30s – either for a complete financial strategy or simply for insight and advice.

Watt noted that while some general answers about finance can be found online, most people want personal insights that reflect their own goals and financial statuses. “We make sure we’re considering both their goals and their emotions,” she says. “Even young adults are seeing the benefits of meeting with an advisor to make sure they’re starting off on the right track.”

For younger clients, that often means planning for milestones such as buying homes, taking dream vacations, making a move and paying down debt. Retirement may be distant, but according to Watt, laying an early foundation helps people stay on track when long-term planning becomes more urgent. As clients get closer to retirement, the questions shift, Watt explains. “Clients are asking if they have enough saved, if their money is in the right places, where their income will come from, and what the tax impact will be. Those concerns feel much more immediate.”

When those questions pop up, the one-on-one connection with an IAG advisor can be paramount. “When clients get clarity on where they stand, they have the confidence to navigate unexpected changes and move forward.”

Market swings are an inevitable part of investing, but Watt notes that clients today seem less rattled than in years past. Technology plays an important role in that clarity. IAG clients have access to the firm’s Wealth Vision dashboard, an online tool that consolidates accounts, assets

and liabilities in one place. The platform allows clients to link outside accounts, such as checking, savings or 401(k)s, alongside their long-term financial plan.

“It can be their one login every day to see a full picture of their financial situation,” Watt explains.

“That visibility often helps ease anxieties during volatile times. Even when there’s a major market correction, clients can see for themselves that it doesn’t usually have a significant longterm impact,” Watt says. “That perspective brings confidence.” ◆

N19 W24200 Riverwood Dr., Suite 150, Pewaukee 262-446-8150

iagwealthpartners.com