President Claire Larson Woodside Homes of Utah LLC

First Vice President J. Scott Colemere Colemere Realty Assoc.

Second Vice President Morelza Boratzuk RealtyPath (South Valley)

Treasurer Jenni Barber Berkshire Hathaway (North SL)

Past President

Dawn Stevens Real Broker, LLC (Canyons Luxury)

CEO Curtis Bullock

DIRECTORS

Jodie Osofsky

Summit Sotheby's Int'l Realty

Janice Smith CB Realty (Union Heights)

Eric Santistevan Engel & Volkers (Holladay)

Kristel Gough Summit Sotheby's (Draper)

Lori Khodadad CB Realty (Union Heights)

Kim Farber Eleven11 Real Estate LLC

Russ Orchard Century 21 Everest

Donna Pozzuoli BHHS UP (N. Salt Lake) Mo Aller Equity RE (Advantage)

Linda Mascher Realtypath LLC (Advisors)

Sheri Linn Ramsay Real Broker, LLC

Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com

Managing Editor Dave Anderton

Publisher Mills Publishing, Inc. www.millspub.com

President Dan Miller

Office Administrator Cynthia Bell Snow

Art Director Jackie Medina

Graphic Design

Ken Magleby Patrick Witmer Sales Staff Paula Bell Dan Miller

Salt Lake Board: (801) 542-8840 e-mail: dave@saltlakeboard.com Web Site: www.slrealtors.com

The Ritz-Carlton Leadership Center is renowned for its focus on creating legendary client experiences. This year, we celebrated the recipients of the Realtor® 500, with Kavita Coomar, who shared invaluable best practices. For real estate agents, adopting this philosophy can elevate the home buying and selling journey into something truly exceptional.

Personalized Service – The Ritz-Carlton trains its employees to anticipate client needs before they even ask. Realtors® can do the same by understanding client preferences, timelines, and emotions, ensuring a seamless and stressfree process.

Attention to Detail – Small touches, such as a welcome gift for buyers at closing or a detailed home preparation guide for sellers, create memorable experiences.

Empathy and Emotional Connection – Buying a home is deeply personal. Like Ritz-Carlton employees who make guests feel valued, Realtors® should build trust through active listening, thoughtful communication, and genuine care.

Elevating a Realtor’s® Personal

Consistency in Excellence – Just as Ritz-Carlton maintains high service standards, Realtors® should consistently provide top-tier customer service, whether working with first-time buyers or luxury home clients.

Professionalism and Expertise – Positioning yourself as a trusted advisor, not just a salesperson, strengthens your brand. Stay informed on market trends, negotiation strategies, and cutting-edge tools.

Memorable Moments – Ritz-Carlton is known for turning small interactions into unforgettable experiences. Realtors® can achieve this by celebrating client milestones, personalizing recommendations, and offering conciergelevel service.

Community Engagement – The Ritz-Carlton brand is synonymous with exclusivity and trust. Realtors® can enhance their brand by engaging in local events, sharing valuable insights, and positioning themselves as market experts.

, as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

OFFICIAL PUBLICATION OF THE SALT LAKE BOARD OF REALTORS

By incorporating these principles, Realtors® can stand out in a crowded market, build lasting relationships, and turn every transaction into a fivestar experience—just like the Ritz-Carlton.

Claire Larson President

Home sales of all housing types across Salt Lake County rose to 12,331 units in 2024, marking a 7% increase from the 11,540 units sold in 2023, according to UtahRealEstate. com. Despite this growth, sales remain sluggish due to higher home prices and mortgage interest rates. The 2024 sales figure is comparable to those seen in 2011–2012.

Source: UtahRealEstate.com

Less than half of homebuyers on the Wasatch Front in 2024 paid under $500,000 for a home (across all housing types). That’s a sharp decline from just four years earlier when 81% of home purchases were below the halfmillion-dollar mark. Additionally, 7% of all homes sold in 2024 closed at $1 million or more, up from just 2% in 2020. The sharp reduction in the percentage of homes selling under $500,000 indicates substantial price growth, making it harder for buyers— especially first-time buyers—to find affordable options.

Almost 90% of metro markets (201 out of 226, or 89%) experienced home price increases in the fourth quarter of 2024, as the 30-year fixed mortgage rate ranged from 6.12% to 6.85%, according to the National Association of Realtors®’ latest quarterly report. Fourteen percent of the 226 tracked metro areas posted double-digit price gains over the same period, up from 7% in the third quarter.

The Salt Lake City metropolitan area had a median single-family home price of $570,500 in the fourth quarter, making it the 29th most expensive metro area out of 226 in the U.S. During this period, home prices in Salt Lake increased by 5.5% year over year. The San JoseSunnyvale-Santa Clara metro market had the most expensive homes at $1.920 million.

“Record-high home prices and the accompanying housing wealth gains are definitely good news for property owners,” said NAR Chief Economist Lawrence Yun. “However, renters who are looking to transition into homeownership face significant hurdles.”

Compared to one year ago, the national median single-family existing-home price elevated 4.8% to $410,100. In the previous quarter, the year-over-year national median price increased 3.2%. In the past five years, from 2019 to 2024, the median home price rose by 49.9%.

The top 10 metro areas with the largest year-over-year median price increases, which can be influenced by the types of homes sold during the quarter, all experienced gains of at least 14.9%.

Source: UtahRealEstate.com

Resort-like Amenitites! Clubhouse with a gym, kitchen, gathering space; outdoor pool, hot tub and pickleball court.

Thoughtfully designed floor plans that feature all main floor living, no-step entry villas, spacious layout with plenty of storage, two suites, with the primary featuring a no-step shower.

Mayar Abdulhadi, Real Broker

Vania Acevedo Ochoa, Keller Williams

Andrew Adams, Ask Andrew RE

Jazmin Adamson, Align Complete RE

Sammie Aguilera, Keller Williams

Emmanuel Aguirre, Realtypath

John Aguirre, Coldwell Banker

Scott Allen, Allen & Associates

Sally Alley, White Oak Real Estate

Brock Andersen, Berkshire Hathaway

Bryce Anderson, Intermountain Properties

David Anderson, A5 Real Estate

Lance Anderson, Jason Mitchell RE

Lori Anderson, Windermere

Dorthy Androulidakis, Summit Sotheby’s

Stephanie Aragon, Realty ONE Group

John Armstrong, Ari Realty

Kenya Arnett, Keller Williams

Stephanie Arrasi, Berkshire Hathaway

Tricia Ashby, Move Utah Real Estate

Camara Ayers, Woodside Homes of Utah

Brian Babb, Equity Real Estate

David Bachman, Keller Williams

Jeremy Back, Wasatch Residential Services

Elda Baker, Wise Choice Real Estate

Zack Baker, Century 21 Everest

Zula Balchinpurev, Keller Williams

Rajavi Bandalapalli, Realtypath

Adam Bangerter, Bangerter Real Estate

Christine Bangerter, Mansell Real Estate

John Baque, Berkshire Hathaway

Maria Barraza-Rodriguez, Conrad Cruz RE

Flor Barrera, Real Team Realty

Steven Barton, Equity Real Estate

Karina Bassett, Fathom Realty

Jerome Bennett, Realty Experts

Whitney Benson, Real Broker

Roger Berg, Real Estate with Roger

David Bergstedt, Bergstedt Real Estate

Leigh Anne Bernal, Homeworks Property Lab

Andy Bhatia, Royal Brokers

Ryan Birdsley, Surv Real Estate

Lauren Bishop, Real Estate Essentials

Lisa Blakemore, Blakemore Real Estate

Jillian Blakley, Lennar Homes of Utah

Nestor Boada Cardozo, Real Broker

Angela Bobowski, Weekley Homes

Jared Booth, Colliers International

Sarah Boren, Realtypath

Kevin Borland, Equity Real Estate

Miriem Boss, Windermere

Liv Bostwick, Engel & Volkers Salt Lake

Tammy Brady, Lennar Homes of Utah

Amber Briem, Blakemore Real Estate

Jim Bringhurst, Windermere

Samuel Brinton, Redfin Corporation

Robyn Buckwalter, Keller Williams

Erica Buehler, Cindy Wood Realty Partners

Danna Bui-Negrete, Distinction Real Estate

Zach Bunker, Century 21 Everest

Abril Burgoyne, Real Estate Essentials

Cameron Burnside, Keller Williams

Linda Burtch, Keller Williams

Brett Butler, Berkshire Hathaway

Sean Buttars, Real Estate Essentials

Lori Butterfield, Realtypath

Jennifer Call, ERA Brokers Consolidated

Brandon Calton, RE/MAX Associates

Annie Cannon, Keller Williams

Ryan Cannon, Keller Williams

Joel Carson, Utah Real Estate

Luis Carter, Realty ONE Group

Michael Carter, RanLife Real Estate

Robert Carter, D.R. Horton

Heidi Castain, Century 21 Everest

Kim Chatterton, Coldwell Banker

Evan Child, Double Edge Real Estate

Melissa Chiz, D.R. Horton

Aaron Christensen, Century 21 Everest

Amy Clark, Century 21 Everest

Terry Clark, Ivory Homes

Peter Clark, Windermere

Eryn Clarke, Lennar Homes of Utah

Brian Clinger, Coldwell Banker

Nicole Cloward, REMAX Complete

Humberto Coello, Edge Realty

Michael Coello, Edge Realty

Bryan Colemere, Colemere Realty

Melissa Collings, REMAX Complete

Mason Conley, Keller Williams

Terry Cononelos, Masters Utah RE

Dana Conway, Keller Williams

Dean Cotter, Redfin Corporation

Vince Craig, Craig Realty

Donna Crawley, Real Broker

Traci Crockett, Keller Williams

Hunter Curtis, Utah Real Estate

Rikki Curtis, Realty ONE Group

Bob Cusick, Realtypath

Christina Dalton, Coldwell Banker

Ryan Dastrup, NRE

Lauri Davey, Summit Sotheby’s

Jonathan Day, Homie Broker

Babs De Lay, Urban Utah Homes

Chandler Dean, D.R. Horton

Leanna Deherrera, Equity Real Estate

Jesus Delarosa, Realty ONE Group

Hector Delgado, Innova Realty

Tyler Demars, Keller Williams

Adam Derfler, Century 21 Everest

Aki Derzon, Innova Realty

Janie Despain, Garbett Homes

Kristin Deveraux, Vox Real Estate

Steven DeYoung, Equity Real Estate

Jesus Diaz, Century Communities

Lisa Dimond, Windermere

Campbell Dosch, Redfin Corporation

John Dowdle, Destination Real Estate

Monica Draper, Windermere

Abbey Drummond, Windermere

Miriam Drury, Century 21 Everest

Jeron DuPaix, Ivie Avenue Real Estate

Parker Eads, Edge Realty

Daryn Edmunds, High Road Properties

Blake Edwards, Summit Sotheby’s

Michael Egan, Windermere

Missy Elardi, Unity Group Real Estate

Erin Eldredge, Summit Sotheby’s

Jason Eldredge, Equity Real Estate

Connie Elliott, Windermere

Cody Emery, Summit Sotheby’s

Trent Escandon, Equity Real Estate

Greg Fabiano, Dwellings Real Estate

Serina Fallon, D.R. Horton

Whitney Fautin, Summit Sotheby’s

Kelly Favero, Keller Williams

Todd Feld, Coldwell Banker

Peter Felis, Berkshire Hathaway

Tara Ferguson, D.R. Horton

Phil Flanders, Homie Broker

Kelton Flinders, D.R. Horton

William Floor, Netlogix Realty

Eric Fontana, Omada Real Estate

Natasha Forbes, D.R. Horton

Spencer Ford, Real Broker

Adam Frenza, Windermere

Eric Garcia, Property Starz Real Estate

Lance Garrett, Homie Broker

Pedro Garrido Pargas, Keller Williams

Jennifer Gaskill, The Group Real Estate

Lori Gee, Keller Williams

Christopher Gerac, Real Broker

Jenna Gianneschi, Real Broker

Amy Gibbons, Keller Williams

Jennifer Gilchrist, Keller Williams

Neil Glover, Coldwell Banker

Wesley Goldberg, RANLife Real Estate

Ruben Gomez, Keller Williams

Nick Gonzalez, Keller Williams

Clint Goode, Windermere

Joseph Gordon, Gordon Real Estate

Kristel Gough, Summit Sotheby’s

Stephanie Grable, Omada Real Estate

Kat Granderath, Real Broker

Sky Grant, Wright Realty

Rachel Green, Real Broker

Dani Griffith, The Agency Salt Lake City

Heather Groom, Keller Williams

Kristina Gross, Redfin Corporation

Wade Gulden, Real Broker

Andy Gunther, Futr. Commercial Advisors

Michael Gura, Mansell Real Estate

Tyler Gurr, Gurr Real Estate Utah

Danielle Hagemeister, Lennar Homes of Utah

Lore Hagen, Lennar Homes of Utah

Joel Hair, Ulrich Realtors®

Casey Halliday, Windermere

Mike Hancock, Century 21 Everest

Brad Hansen, Windermere

Jared Hansen, Keller Williams

Johnny Hansen, Edge Realty

Jordan Hansen, Real Broker

Karen Hansen, Keller Williams

Isaac Hanson, S H Realty

Scott Hardey, Hardey Realty Group

James Harvey, Latitude 40 Properties

Floyd Hatch, IRG

Craig Hawker, Action Team Realty

Kaetlyn Hawkins, D.R. Horton

Emily Hayes, Keller Williams

Heather Heine, Woodside Homes of Utah

Hailey Hendricks, Toll Brothers Real Estate

Lori Ann Hendry, Windermere

Michael Heslop, Jupidoor

Sara Hiatt, Keller Williams

Tyler Higgins, Century 21 Everest

Monique Higginson, Market Source RE

Erik Higley, Berkshire Hathaway

Kelcee Hilderman, Real Estate Essentials

Malarie Hill, Six Star Real Estate

Andrew Ho, Unity Group Real Estate

Troy Hodell, NRE

Sarah Hoffmann, D.R. Horton

Alicia Holdaway, Summit Sotheby’s

Michael Hooper, Hooper Homes

Jennifer Horner, Masters Utah RE

Jonah Hornsby, Align Complete RE

Tara Horton, CW Group Real Estate

Dawn Houghton, Coldwell Banker

Heather Houston, Unity Group Real Estate

Rick Huggins, Woodside Homes of Utah

Tiffany Hull, Woodside Homes of Utah

Bryan Hurd, Real Broker

Justin Hurd, Keller Williams

Scott Hurd, Keller Williams

Adam Icenogle, Homie Broker

Carissa Irving, Aspen Leaf Realty

Julie Israelsen, Advantage Real Estate

Brian Jensen, Summit Sotheby’s

Robin Jensen, Team Jensen Real Estate

David Jenson, Ulrich Realtors®

Stacy Johansen, Real Estate Essentials

Doyle Johnson, Koen Johnson Realty

Steven Johnson, RE/MAX Associates

Lacey Jolley, D.R. Horton

Jason Judd, Keller Williams

Jeff Justice, Summit Sotheby’s

Jessica Kaneen, Keller Williams

Alen Kantarevic, Realty ONE Group

John Katsanevas, Jason Mitchell RE

Lindsay Kaufman, Black Diamond RE

Alicia Keller, Keller Williams

Tiffany Kennard, Edge Real Estate

Jenn Kikel-Lynn, K Real Estate

Nate Kingdon, Hamlet Homes

Jeff Kirk, Edge Realty

Adam Kirkham, Summit Sotheby’s

Carolyn Kirkham, Summit Sotheby’s

Ryan Kirkham, Summit Sotheby’s

Caleb Kleber, D.R. Horton

Parker Knight, Realtypath

Mariah Koehle, EXP Realty

Thomas Kreifeldt, Action Team Realty

Keri Kroneberger, D.R. Horton

Jessica Kurowski Lippincott, Redfin Corp.

Misael Lanza, Edge Realty

Amie Larsen, Deluxe Utah Real Estate

Clint Larsen, Lennar Homes of Utah

Adam Larson, Larson & Company

Sam Larson, Larson & Company

Kim Lau, Keystone Brokerage

Katherine Laub, Homie Broker

Braden Lawson, Sun Key Realty

Trey Leonard, Engel & Volkers

Ava Lieb, Homie Broker

Rebecca Lima, Real Broker

Mike Lindsay, Coldwell Banker

Ashley Lindsey, Keller Williams

Melissa Lipani, Homeworks Property Lab

Tanner Litchfield, Real Broker

Semisi Livai, Equity Real Estate

Julie Livers, Berkshire Hathaway

Audra Lloyd, Real Estate Essentials

Kim Loc, Presidio Real Estate

Stacy Lockhart, Keller Williams

Daniel Lopez, Redfin Corporation

Tamara Loscher, Keller Williams

Christiaan Loveless, D.R. Horton

Christina Lovell, NRE

Creighton Lowe, Summit Sotheby’s

Jan Lowe, Windermere

Dao Ly, Distinction Real Estate

Monterey Lysy, Edge Realty

Adrian Maco, Summit Sotheby’s

Kenneth Maddy, Wright Realty

Alicia Madsen, Century 21 Everest

Juan Magana, Windermere

Cherie Major, Windermere

Tuiono Malakai, Equity Real Estate

Linda Mandrow, Coldwell Banker

Brenda Manookin, Redfin Corporation

Darren Mansell, Mansell Real Estate

Nicholas Manville, Century 21 Everest

Sue Mark-Lunde, Chapman Richards

Patrea Marolf, Keller Williams

Susie Martindale, Masters Utah RE

Abinadi Martinez, Real Team Realty

Lisa Martinez, Realty ONE Group

Ricky Martinez, Masters Utah RE

Scott Maruri, Keller Williams

Jennifer Mascaro, The Mascaro Group

Rylar Masco, Utah Key Real Estate

Tonja Masina, Paradise Real Estate

Harris Mata’afa, EXIT Realty Success

Gina McBride, Regal Homes Realty

Kathy McCabe, Align Complete RE

Paul McKinney, Fieldstone Realty

Christen McLam, Meritage Homes of Utah

Lauren McMullin, Coldwell Banker

Sarah McNamara, Summit Sotheby’s

Andrew McNeil, Windermere

Jordan McQueen, Keller Williams

Carolee Mecham, Cannon & Company

Connor Mecham, Cannon & Company

Jake Melton, Utah Key Real Estate

Heather Mercer, Century 21 Everest

Andrew Merrill, Redfin Corporation

Scott Merrill, RANLife Real Estate

Angelina Mertlich, Realtypath

Genene Miles, Davis Coleman Realty

Scott Miller, EXIT Realty Success

Joshua Mills, NRE

Amber Milton, Century 21 Everest

Daniel Moench, Century 21 Everest

Chelise Monson, Woodside Homes of Utah

Kenneth Montague, Omada Real Estate

Jose Montenegro Socorro, TMG Realty

Ab Moreno, Omada Real Estate

Jeffrey Morris, Keller Williams

Martha Morris, Summit Sotheby’s

Rodney Moser, NextHome Navigator

Scott Murray, EXP Realty

Ivan Navincopa, Blue Key Realty

Robert Naylor, Century 21 Everest

Leslie Neebling, Coldwell Banker

Taylor Neill, Edge Realty

Angie Nelden, Summit Sotheby’s

Charles Nelson, Jason Mitchell RE

Matthew Nelson, Keyrenter Real Estate

Andrea Newby, Zander Real Estate Team

Kristi Nicholl Durrant, Coldwell Banker

Trish Nichols, Berkshire Hathaway

Evan Nielsen, Century Communities

Jason Nielsen, Utah Select Realty

Karly Nielsen, Niche Homes

Lisa Ninow, Stone Edge Real Estate

Robert Ninow, Stone Edge Real Estate

Debbie Nisson, Berkshire Hathaway

Dan Nix, Coldwell Banker

Brian Noel, Century 21 Everest

Steven O’Donnell, Equity Real Estate

April Oaks, Century 21 Everest

Katie Olsen, Coldwell Banker

Kim Orlandini, Keller Williams

Lisa Orme, Davis Coleman Realty

Gabriela Orona, Presidio Real Estate

Richard Ortiz, RANLife Real Estate

Jodie Osofsky, Summit Sotheby’s

Stephen Ostler, EXP Realty

Mark Overdevest, Summit Sotheby’s

Loreana Pachano, Real Broker

Felipe Pacheco, Forte Real Estate

Shartel Palmer, Lennar Homes of Utah

Cheri Palsson, Equity Real Estate

Tara Paras, Paras Real Estate

Kristie Paraspolo, Sovereign Properties

Jose Paredes Rodriguez, Equity Real Estate

Marietta Paredes-Munier, McArthur Realty

Ashley Park, Plumb & Company

Anna Parker, Keller Williams

Holly Parkin, United Real Estate Advantage

Jhoan Parra, Innova Realty

Tyler Parrish, Align Complete

Micah Pearson, Realtypath

Haley Peart Johnson, Redfin Corporation

Sheri Peck, Century 21 Everest

Alexandria Pedroni, Utah Real Estate

Jacquelin Perry, Summit Sotheby’s

Michael Perry, Real Broker

Annabel Peterson, Equity Real Estate

Ryan Pettit, Keller Williams

Bear Phelps, Keller Williams

Joe Pierson, Real Broker

Mafer Pino-Deyevara, Presidio Real Estate

Jakie Pizana, Equity Real Estate

Bob Plumb, Plumb & Company

Joan Pok, Realty ONE Group

Susan Poulin, Summit Sotheby’s

Landen Powell, Real Broker

Derek Power, EXIT Realty Success

Maura Powers, Berkshire Hathaway

Greg Preston, Real Broker

Regina Price, Primed Real Estate

Karma Ramsey, The Group Real Estate

Talmage Rawlings, Edge Realty

Joe Reardon, Keller Williams

Allison Reemsnyder, Berkshire Hathaway

Hector Retamales, Real Team Realty

Dale Rex, Black Sign Real Estate

Timothy Reynolds, Fathom Realty

Phil Richardson, Berkshire Hathaway

Morgan Ricks, Mountainland Realty

Scott Robbins, Summit Sotheby’s

We would like to recognize the following individuals for being named REALTOR® 500 Top Producers out of over 10,000 agents in the Salt Lake Board of Realtors. Thank you for being irreplaceable members of our company and congratulations again on your accomplishments!

Jordon Roberts, D.R. Horton

Dakota Robison, Holmes Homes Realty

Dave Robison, goBE LLC

Gloria Rodriguez, Real Estate Essentials

Ashley Rolfe, Alliance Residential

Sydney Rosenblatt, Keller Williams

Hyrum Rosquist, Keller Williams

Bob Ross, Homie Broker

James Roth, Real Broker

Merilee Rowley, Selling Salt Lake

Heather Roxburgh, Real Broker

Shane Roxburgh, Real Broker

Joshua Rudder, Homie Broker

Angel Ruiz, Distinction Real Estate

Dave Ruprecht, Berkshire Hathaway

David Salazar, NRE

Steven Salazar, NRE

Pablo Sanchez, Equity Real Estate

Jamie Schaub, Toll Brothers Real Estate

Tiffiny Schindler, Woodside Homes of Utah

Christina Schmidt, Coldwell Banker

Steve Schoonover, Century 21 Everest

Linda Secrist, Berkshire Hathaway

Austin Seegmiller, NRE

Brett Sellick, Summit Sotheby’s

Gian Sexsmith, Coldwell Banker

Prakash Shah, Equity Real Estate

Kamee Shrope, Engel & Volkers

Laurel Simmons, Summit Sotheby’s

Zack Simpkins, Meritage Homes of Utah

Scott Simpson, Summit Sotheby’s

Meredith Sinclair, Summit Sotheby’s

Joshua Skousen, Century 21 Everest

Braydon Slauson, RANLife Real Estate

Hannah Smith, Real Broker

Janice Smith, Coldwell Banker

Matthew Sprunt, Utah Home Central

Alisha Staten, Berkshire Hathaway

Scott Steadman, Windermere

Cody Steck, Real Broker

Scott Steele, Signature Real Estate Utah

Sean Steinman, Summit Sotheby’s

Tyler Stevens, Smart Move Advantage

Stephanie Stewart, The Group Real Estate

Michael Stone, Lennar Homes of Utah

Max Strayer, Windermere

Greg Summerhays, Chapman Richards

Brian Summers, Century 21 Wasatch Life

Rich Summers, Keller Williams

Gary Sundwall, Keller Williams

Brady Tanner, Prime Residential Brokers

Devin Tanner, Real Estate Essentials

Tori Tarver, Keller Williams

Darian Taylor, Real Broker

Lincoln Taylor, Real Broker

James Telaroli, Axis Realty

Dan Tencza, Richmond American Homes

Christy Terrill, Equity Real Estate

Jessica Terry, Century 21 Everest

Darin Thomas, Real Broker

Trevor Thompson, Equity Real Estate

Brandy Tilo, Utah Real Estate

Tess Timothy, Lennar Homes of Utah

Kelly Tita, Selling Salt Lake

Dian Tomko, Toll Brothers Real Estate

Marcella Torrez, Ascent Real Estate Group

Carlos Tovar, Realtypath

Brian Tripoli, Cityhome Collective

Shelly Tripp, Coldwell Banker

Annie Trujillo, Keller Williams

Kyle Tucker, Real Broker

Anne Tuckett, Eleven11 Real Estate

Joseph Tuenge, Crowhop

Solo Tuiaki, Surv Real Estate

Mony Ty, Summit Sotheby’s

Julia Uberty, Windermere

Justin Udy, Century 21 Everest

Mike Ulrich, Ulrich Realtors®

Roberth Uribe Sanguino, Utah Key RE

Cori Vanderbeek, Intermountain Properties

Tricia Vanderkooi, Summit Sotheby’s

Danielle Vaughns, Keller Williams

Amy Volcic, Summit Sotheby’s

Gigi Volk, D.R. Horton

Chad Wagstaff, Century 21 Everest

Brandon Watson, Edge Realty

Jackie Weig, Redfin Corporation

Jason West, Century 21 Everest

Cindy White, Berkshire Hathaway

Tracy White, Weekley Homes

Craig Whiting, Prime Real Estate Experts

Kaitlyn Whittle, Medlink Real Estate

Garritt Wilkey, 1st Class Real Estate Partners

Lisa Willden, Peterson Homes

Scott Willey, Real Broker

Jessica Williams, Presidio Real Estate

Jim Williams, Williams Realty PC

Kari Williams, Holmes Homes Realty

Spencer Wilson, Equity Summit Group PC

Lori Wilson-Jewett, CDA Properties Inc

Bree Winegar, Cannon & Company

David Winters, RE/MAX Associates

David Wiser, Keller Williams

Robert Wolf, Keller Williams

Michael Wolters, Keller Williams

Hannah Womack, Lennar Homes of Utah

Nataly Wood, Realtypath

Lisa Woodbury, Windermere

Trent Woolston, Chapman Richards

Michael Wright, Upside Real Estate

Dandan Yang, Coldwell Banker

Jennifer Yeo, Presidio Real Estate

Luke Zander, Zander Real Estate Team

Tamara Zander, Zander Real Estate Team

Pablo Zepeda, Visionary Real Estate

We are so grateful to our valued realtor partners. Your expertise and commitment have been crucial in facilitating successful transactions and fulfilling the dreams of many. We deeply appreciate your partnership and look forward to achieving continued success together.

Learn how you can become an Ivory Preferred Realtor by Scanning the QR Code

VIP Realtor Events:

Great networking opportunities to meet Ivory Sales Consultants and other realtor’s.

First to know about New Releases:

Be among the first to know about new neighborhoods, floor plans, special offers, and other opportunities.

Exclusive Online Realtor Portal:

Easy access to our available home inventory and other resources to help you sell more new homes.

A Review and Forecast: The Salt Lake County Residential Real Estate Market, 2024-2025

By James Wood

Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute,DavidEcclesSchoolofBusinessattheUniversity of Utah. Commissioned by the Salt Lake Board of Realtors®

outstripped supply, and prices rose. Other factors pushing up prices included escalating land prices, local ordinances and codes, and material and labor costs. But a price correction is underway. In the past two years, the median price of a single-family home in Salt Lake County has increased by about 1%, from $606,000 in 2022 to $610,000 in 2024. And for condominiums (including town homes and twin homes) the median sales price is down about 1% in two years, from $430,000 to $425,500 (Figure 1).

A Review and Forecast: The Salt Lake County Residential Real Estate Market, 2024-2025

Figure 1

By James Wood

Median Sales Price of Homes, Salt Lake County

Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute, David Eccles School of Business at the University of Utah. Commissioned by the Salt Lake Board of Realtors®.

1. Prices Stable But at Elevated Levels

A Review and Forecast:

The Salt Lake County Residential Real Estate Market, 2024-2025

By James Wood

Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute,DavidEcclesSchoolofBusinessattheUniversity of Utah. Commissioned by the Salt Lake Board of Realtors®

Housing prices in the Salt Lake-Tooele Metropolitan Area rank among the highest in the country. Only 27 of 227 metropolitan areas have higher prices. High prices and rankings are not limited to the Salt Lake-Tooele metro area. The state’s other three metro areas (St. George, Provo-Orem, and Ogden-Clearfield) all rank among the highest priced housing markets (Table 1).

Housing prices in the Salt Lake-Tooele Metropolitan Area rank among the highest in the country. Only 27 of 227 metropolitan areas have higher prices. High prices and rankings are not limited to the Salt Lake-Tooele metro area. The state’s other three metro areas (St. George, Provo-Orem, and Ogden-Clearfield) all rank among the highest priced housing markets (Table 1).

Table 1

Table 1

Median Sales Price of Single-Family Homes in Utah’s Major Metropolitan Areas (Third Quarter 2024)

Median Sales Price of Single-Family Homes in Utah’s Major Metropolitan Areas (Third Quarter 2024)

Housing prices in the Salt Lake-Tooele Metropolitan Area rank among the highest in the country. Only 27 of 227 metropolitan areas have higher prices. High prices and rankings are not limited to the Salt Lake-Tooele metro area. The state’s other three metro areas (St. George, Provo-Orem, and Ogden-Clearfield) all rank among the highest priced housing markets (Table 1).

Table 1

Source: National Association of Realtors®, Median Sales Price of Existing Single-Family Homes for Metropolitan Areas, Third Quarter 2024.

Median Sales Price of Single-Family Homes in Utah’s Major Metropolitan Areas (Third Quarter 2024)

Source: National Association of Realtors®, Median Sales Price of Existing Single-Family Homes for Metropolitan Areas, Third Quarter 2024.

Why are housing prices so high in Utah? Indeed, the state’s rapid demographic and economic growthfrom 2010 to 2022 played a leading role as demand outstripped supply, and prices rose. Other factors pushing

Why are housing prices so high in Utah? Indeed, the state’s rapid demographic and economic growth from 2010 to 2022 played a leading role as demand

outstripped supply, and prices rose. Other factors pushing up prices included escalating land prices, local ordinances and codes, and material and labor costs. But a price correction is underway. In the past two years, the median price of a single-family home in Salt Lake County has increased by about 1%, from $606,000 in 2022 to $610,000 in 2024. And for condominiums (including town homes and twin homes) the median sales price is down about 1% in two years, from $430,000 to $425,500 (Figure 1).

up prices included escalating land prices, local ordinances and codes, and material and labor costs. But a price correction is underway. In the past two years, the median price of a single-family home in Salt Lake County has increased by about 1%, from $606,000 in 2022 to $610,000 in 2024. And for condominiums (including town homes and twin homes) the median sales price is down about 1% in two years, from $430,000 to $425,500 (Figure 1).

Figure 1

Figure 1

Source: UtahRealEstate.com

Median Sales Price of Homes, Salt Lake County

Median Sales Price of Homes, Salt Lake County

Source: UtahRealEstate.com

Source: UtahRealEstate.com

A pause in price gains was predictable after the sharp, record-breaking 40% spike in prices from 2020 to 2022. Yet despite the recent breather in price increases, the mortgage payment on the median-priced home continues to exclude many would-be buyers from homeownership.

A pause in price gains was predictable after the sharp, record-breaking 40% spike in prices from 2020 to 2022. Yet despite the recent breather in price increases, the mortgage payment on the median-priced home continues to exclude many would-be buyers from homeownership. For instance, in the fourth quarter of 2024, the monthly mortgage payment for the median-

A pause in price gains was predictable after the sharp, record-breaking 40% spike in prices from 2020 to 2022. Yet despite the recent breather in price increases, the mortgage payment on the median-priced home continues to exclude many would-be buyers from homeownership. For instance, in the fourth quarter of 2024, the monthly mortgage payment for the medianpriced single-family home totaled $4,674 (Table 2). This monthly payment assumes a 5% downpayment and uses the fourth quarter average mortgage rate of 6.63%. The annual income required to finance the home totals a whopping $186,960, assuming the mortgage payment represents 30% of household income. The monthly mortgage payment for the median-priced condominium amounts to $3,284, 30% less than the single-family home. The income required to finance the purchase of the median-priced condominium totals $131,360.

“Why are housing prices so high in Utah? Indeed, the state’s rapid demographic and economic growth from 2010 to 2022 played a leading role as demand outstripped supply, and prices rose... But a price correction is underway.”

For instance, in the fourth quarter of 2024, the monthly mortgage payment for the median-priced single-family home totaled $4,674 (Table 2). This monthly payment assumes a 5% downpayment and uses the fourth quarter average mortgage rate of 6.63%. The annual income required to finance the home totals a whopping $186,960, assuming the mortgage payment represents 30% of household income. The monthly mortgage payment for the median-priced condominium amounts to $3,284, 30% less than the single-family home. The income required to finance the purchase of the median-priced condominium totals $131,360.

“Why are housing prices so high in Utah? Indeed, the state’s rapid demographic and economic growth from 2010 to 2022 played a leading role as demand outstripped supply, and prices rose... But a price correction is underway.”

Table 2

Table 2

Monthly Mortgage Payment for Median-Priced Homes, Salt Lake County (Fourth Quarter 2024)

Table 2

Monthly Mortgage Payment for Median-Priced Homes, Salt Lake County (Fourth Quarter 2024)

Monthly Mortgage Payment for Median-Priced Homes, Salt Lake County (Fourth Quarter 2024)

Source: UtahRealEstate.com and Freddie Mac

Source: UtahRealEstate.com and Freddie Mac

Source: UtahRealEstate.com and Freddie Mac

Financing the typical single-family home or condominium requires household income well above the median of $101,000 for Salt Lake County (Federal Reserve Bank

Financing the typical single-family home or condominium requires household income well above the median of $101,000 for Salt Lake County (Federal Reserve Bank of St. Louis). Thus, homeownership opportunities for most first-time homebuyers are limited to homes priced below $500,000 or even $400,000. Nearly one in four single-family homes sold for less than $500,000, a total of 2,158 homes (Table 3). Only 6% of single-family homes sold were priced below $400,000. Affordability improves with condominiums. Forty percent of the condominiums sold were priced below $400,000, a total of 1,515 units. But even buying a condominium priced at $300,000 entails a relatively high household income. At current mortgage rates, the purchase of a $300,000 condominium would require an income of around $90,000 to qualify, as well as a $15,000 down payment. At the other end of the price spectrum, 12% of single-family homes sold in Salt Lake County in 2024 were priced above one million dollars, while only 2% of condominium sales exceeded a million dollars.

Financing the typical single-family home or condominium requires household income well above the median of $101,000 for Salt Lake County (Federal Reserve Bank of St. Louis). Thus, homeownership opportunities for most first-time homebuyers are limited to homes priced below $500,000 or even $400,000. Nearly one in four single-family homes sold for less than $500,000, a total of 2,158 homes (Table 3). Only 6% of single-family homes sold were priced below $400,000. Affordability improves with condominiums. Forty percent of the condominiums sold were priced below $400,000, a total of 1,515 units. But even buying a condominium priced at $300,000 entails a relatively high household income. At current mortgage rates, the purchase of a $300,000 condominium would require an income of around $90,000 to qualify, as well as a $15,000 down payment. At the other end of the price spectrum, 12% of single-family homes sold in Salt Lake County in 2024 were priced above one million dollars, while only 2% of condominium sales exceeded a million dollars.

of St. Louis). Thus, homeownership opportunities for most first-time homebuyers are limited to homes priced below $500,000 or even $400,000. Nearly one in four single-family homes sold for less than $500,000, a total of 2,158 homes (Table 3). Only 6% of single-family homes sold were priced below $400,000. Affordability improves with condominiums. Forty percent of the condominiums sold were priced below $400,000, a total of 1,515 units. But even buying a condominium priced at $300,000 entails a relatively high household income. At current mortgage rates, the purchase of a $300,000 condominium would require an income of around $90,000 to qualify, as well as a $15,000 down payment. At the other end of the price spectrum, 12% of single-family homes sold in Salt Lake County in 2024 were priced above one million dollars, while only 2% of condominium sales exceeded a million dollars.

Home Sales by Selected Price Range, 2024 (Salt Lake County)

Table 3

Table 3

Home Sales by Selected Price Range, 2024 (Salt Lake County)

*Includes Town Homes and Twin Homes.

*Includes Town Homes and Twin Homes.

Source: UtahRealEstate.com

Source: UtahRealEstate.com

*Includes Town Homes and Twin Homes. Source: UtahRealEstate.com

multiple affordability rating of 3.0 to 3.9 signifies a moderately unaffordable market, whereas a ratio of 5.1 or higher denotes a severely unaffordable market (Table 4).

Table 4

Median Multiple Ratio

Source: UtahRealEstate.com and US Census Bureau, American Community Survey

Source: Demographia International Housing Affordability

Since 2014, housing affordability has declined In Utah’s five major housing markets. The median multiple ratios for 2024 deem Washington and Salt Lake counties severely unaffordable, with ratios above 5.1, and Weber, Davis, and Utah counties as seriously unaffordable, with ratios between 4.1 and 5.0. Ten years ago, four of the five markets were considered moderately unaffordable with ratios below 4.1. Only Washington County, with a ratio of 4.1, was borderline seriously unaffordable (Figure 2).

Despite the cooling of price increases, housing affordability remains a serious issue for both buyers and sellers. An often-used measure, the median multiple ratio, illustrates the affordability challenge. The ratio measures the severity of housing affordability by dividing the median sales price of a home by the median household income. A median multiple affordability rating of 3.0 to 3.9 signifies a moderately unaffordable market, whereas a ratio of 5.1 or higher denotes a severely unaffordable market (Table 4).

Despite the cooling of price increases, housing affordability remains a serious issue for both buyers and sellers. An often-used measure, the median multiple ratio, illustrates the affordability challenge. The ratio measures the severity of housing affordability by dividing the median sales price of a home by the median household income. A median multiple affordability rating of 3.0 to 3.9 signifies a moderately unaffordable market, whereas a ratio of 5.1 or higher denotes a severely unaffordable market (Table 4).

AFFORDABILITY increases, housing issue for both buyers measure, the median affordability challenge. severity of housing median sales price of a income. A median to 3.9 signifies a whereas a ratio severely unaffordable Ratio

2

The historic 40% increase in prices from 2020 to 2022 and the doubling of the mortgage rate in 2022, from 3% to over 6%, have combined to dampen housing demand. Sales of existing homes in Salt Lake County have fallen from a high of 19,041 in 2020 to 12,070 in 2024 (Figure 3), a level of sales equivalent to the 2011 market, then a market just emerging from the impact of the Great Recession.

Median Multiple Ratio for Major Housing Markets in Utah

demand. Sales of existing homes in Salt Lake County have fallen from a high of 19,041 in 2020 to 12,070 in 2024 (Figure 3), a level of sales equivalent to the 2011 market, then a market just emerging from the impact of the Great Recession.

Figure 3

Figure 3

Sales of Existing Homes in Salt Lake County

Sales of Existing Homes in Salt Lake County

Source: UtahRealEstate.com and US Census Bureau, American Community Survey

Table 4

Table 4

Median Multiple Ratio

Median Multiple Ratio

Source: Demographia International Housing Affordability

Source: Demographia International Housing Affordability

Since 2014, housing affordability has declined In Utah’s five major housing markets. The median multiple ratios for 2024 deem Washington and Salt Lake counties severely unaffordable, with ratios above 5.1, and Weber, Davis, and Utah counties as seriously unaffordable, with ratios between 4.1 and 5.0. Ten years ago, four of the five markets were considered moderately unaffordable with ratios below 4.1. Only Washington County, with a ratio of 4.1, was borderline seriously unaffordable (Figure 2).

Figure 2

Figure 2

The decline in affordability has caused a significant shift in housing demand from single-family homes to more affordable condominiums. In 2010, condominiums accounted for 17% of existing home sales, 1,765 units (Figure 4). By 2024, condominiums’ share of existing home sales was nearly 31%, 3,716 units. Condominiums now represent almost one out of every three existing homes sold in Salt Lake County.

The historic 40% increase in prices from 2020 to 2022 and the doubling of the mortgage rate in 2022, from 3% to over 6%, have combined to dampen housing demand. Sales of existing homes in Salt Lake County have fallen from a high of 19,041 in 2020 to 12,070 in 2024 (Figure 3), a level of sales equivalent to the 2011 market, then a market just emerging from the impact of the Great Recession.

Source: UtahRealEstate.com

Source: UtahRealEstate.com

Figure 3

Sales of Existing Homes in Salt Lake County

Since 2014, housing affordability has declined In Utah’s five major housing markets. The median multiple ratios for 2024 deem Washington and Salt Lake counties severely unaffordable, with ratios above 5.1, and Weber, Davis, and Utah counties as seriously unaffordable, with ratios between 4.1 and 5.0. Ten years ago, four of the five markets were considered moderately unaffordable with ratios below 4.1. Only Washington County, with a ratio of 4.1, was borderline seriously unaffordable (Figure 2).

Median Multiple Ratio for Major Housing Markets in Utah

Median Multiple Ratio for Major Housing Markets in Utah

Source: UtahRealEstate.com and US Census Bureau, American Community Survey

Source: UtahRealEstate.com and US Census Bureau, American Community Survey

The historic 40% increase in prices from 2020 to 2022 and the doubling of the mortgage rate in 2022, from 3% to over 6%, have combined to dampen housing

The historic 40% increase in prices from 2020 to 2022 and the doubling of the mortgage rate in 2022, from 3% to over 6%, have combined to dampen housing demand. Sales of existing homes in Salt Lake County

The decline in affordability has caused a significant shift in housing demand from single-family homes to more affordable condominiums. In 2010, condominiums accounted for 17% of existing home sales, 1,765 units (Figure 4). By 2024, condominiums’ share of existing home sales was nearly 31%, 3,716 units. Condominiums now represent almost one out of every three existing homes sold in Salt Lake County.

“Condominiums now represent almost one out of every three existing homes sold in Salt Lake County.”

4

Figure 4

Sales of Existing Homes by Type of Home, Utah

Sales of Existing Homes by Type of Home, Utah

Source: UtahRealEstate.com

Source: UtahRealEstate.com

The Lingering Impact of 2020-2021 — The historically low interest rates of 2020 and 2021—averaging 3.1% over 24 months—produced a 43% increase in housing prices, the largest two-year increase in Salt Lake county’s real estate history. The median sales price rose from $425,500 in 2020 to $606,000 in 2022.

The Lingering Impact of 2020-2021 — The historically low interest rates of 2020 and 2021—averaging 3.1% over 24 months—produced a 43% increase in housing prices, the largest two-year increase in Salt Lake county’s real estate history. The median sales price rose from $425,500 in 2020 to $606,000 in 2022.

caused a significant single-family homes condominiums. In 2010, of existing home 2024, condominiums’ nearly 31%, 3,716 represent almost one out Salt Lake County.

Two years later, real estate sales and prices still reflect the excesses of that brief, unsustainable interlude. The median sales price in 2024 is up only 1% over 2022, and sales have dropped to their lowest level in 14 years. In past years, mortgage rates have been as high or higher than 6%-7%, but in those years, housing prices were much lower, hence, affordability was not much of an issue. The long shadow of the 2020-2022 market and affordability will soften housing price increases and sales for another two to three years.

Two years later, real estate sales and prices still reflect the excesses of that brief, unsustainable interlude. The median sales price in 2024 is up only 1% over 2022, and sales have dropped to their lowest level in 14 years. In past years, mortgage rates have been as high or higher than 6%-7%, but in those years, housing prices were much lower, hence, affordability was not much of an issue. The long shadow of the 2020-2022 market and affordability will soften housing price increases and sales for another two to three years.

Supply Conditions Ease Price Pressures — As the market adjusts to relatively high mortgage rates and stubbornly high prices, two important real estate indicators point to less upward pressure on prices.

listings. Over 70% of mortgage borrowers have interest rates below 5%. Consequently, the prevailing notion has been, many owners would be reluctant to give up their low interest rates, thereby suppressing the level of listings. In 2024, however, there’s little evidence of a widespread unwillingness by sellers to enter the market.

Figure 6

Figure 6

IN 2025

The historically low 2021—averaging 3.1% over 24 housing prices, the county’s real estate from $425,500 in 2020

Next, the average active listings by month for Salt Lake County show the level of listings in 2024 to be slightly higher than the five-year average. (Figure 6 shows 2017-2020, 2023. The COVID-19 years of 2021 and 2022 were not included in the calculation of the monthly average, due to the extremely low level of listings in those two years. These years were outliers, suppressing the average, thus producing misleading comparative data.) The level of listings indicates that sellers are willing to enter the market, thus producing a good supply of available homes and relieving upward pressure on prices. The listing data runs counter to the anticipated lower levels of listings. Over 70% of mortgage borrowers have interest rates below 5%. Consequently, the prevailing notion has been, many owners would be reluctant to give up their low interest rates, thereby suppressing the level of listings. In 2024, however, there’s little evidence of a widespread unwillingness by sellers to enter the market.

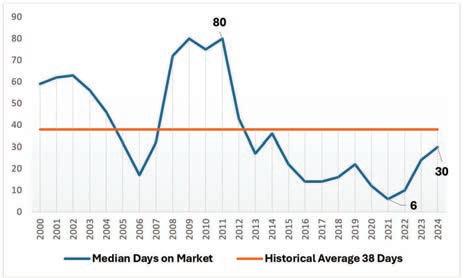

First, the median days on market (MDOM) from listing to contract has increased from six days in 2021 to 30 days in 2024 (Figure 5). The 25-year average for MDOM is 38 days, a level roughly consistent with current sales conditions.

As the market adjusts to relatively high mortgage rates and stubbornly high prices, two important real estate indicators point to less upward pressure on prices. First, the median days on market (MDOM) from listing to contract has increased from six days in 2021 to 30 days in 2024 (Figure 5). The 25-year average for MDOM is 38 days, a level roughly consistent with current sales conditions.

Figure 5

Figure 5

Median Days on Market, Salt Lake County

Median Days on Market, Salt Lake County

Source: UtahRealEstate.com

Source: UtahRealEstate.com

Figure 6

Average Active Listing by Month, Salt Lake County

Next, the average active listings by month for Salt Lake County show the level of listings in 2024 to be slightly higher than the five-year average. (Figure 6 shows 20172020, 2023. The COVID-19 years of 2021 and 2022 were not included in the calculation of the monthly average, due to the extremely low level of listings in those two years. These years were outliers, suppressing the average, thus producing misleading comparative data.) The level of listings indicates that sellers are willing to enter the market, thus producing a good supply of available homes and relieving upward pressure on prices. The listing data runs counter to the anticipated lower levels of listings. Over 70% of mortgage borrowers have interest rates below 5%. Consequently, the prevailing notion has been, many owners would be reluctant to give up their low interest rates, thereby suppressing the level of listings. In 2024, however, there’s little evidence of a widespread unwillingness by sellers to enter the market.

Average Active Listing by Month, Salt Lake County

Average Active Listing by Month, Salt Lake County

Source: Realtor.com, Housing Inventory, Active Listing Count in Salt Lake County, Retrieved from Federal Reserve Economic Data (FRED) Federal Reserve Bank of St. Louis. 6

Source: Realtor.com, Housing Inventory, Active Listing Count in Salt Lake County, Retrieved from Federal Reserve Economic Data (FRED) Federal Reserve Bank of St. Louis.

Housing Demand Tempered Due to Lower Levels of Employment Growth and Net Migration –Uncharacteristically, Utah’s recent employment growth rate has fallen to the national rate, (Table 5).

Housing Demand Tempered Due to Lower Levels of Employment Growth and Net Migration – Uncharacteristically, Utah’s recent employment growth rate has fallen to the national rate, (Table 5).

Table 5

Table 5

Year Over Percent Change in Non-Farm Employment

Year Over Percent Change in Non-Farm Employment

Source: U.S. Bureau of Labor Statistics

Source: U.S. Bureau of Labor Statistics

Historically, Utah’s 50-year annual average employment growth rate of 2.83% is almost double the national rate of 1.41%. In the past three years, however, Utah’s employment growth has slowed, which has reduced net migration, an important component of housing demand. Job opportunities drive migration. Net migration has dropped from 35,000 persons two years ago to 26,000 in 2024. That’s a loss in housing demand of 3,000-4,000 housing units. Net migration is expected to trend lower as employment growth continues to decline. By 2026, the forecast for statewide job growth totals 14,000, far below the typical year’s growth of 40,000 to 50,000 jobs. Are the lower rates of employment growth and net migration due to Utah’s high housing prices? Probably, at least in part.

Little Change Expected in Mortgage Rates — Mortgage rate projections for the next 24 months show rates stuck above 6% but below 7% (Table 6).

Historically, Utah’s 50-year annual average employment growth rate of 2.83% is almost double the national rate of 1.41%. In the past three years, however, Utah’s employment growth has slowed, which has reduced net migration, an important component of housing demand. Job opportunities drive migration. Net migration has dropped from 35,000 persons two years ago to 26,000 in 2024. That’s a loss in housing demand of 3,000-4,000 housing units. Net migration is expected to trend lower as employment growth continues to decline. By 2026, the forecast for statewide job growth totals 14,000, far below the typical year’s growth of 40,000 to 50,000 jobs. Are the lower rates of employment growth and

We invite you to introduce your clients to Sandy’s first 55+ Independent Living cottages with month-to-month rentals! These exclusive twin homes range from 1,500 to 2,300 sf and feature 2 bedrooms, 2 baths, an office/den, fireplace, double car garage, and front/back yards—all maintained by Cedarwood at Sandy. Your clients will enjoy spacious, zerotransition homes with senior living amenities, including 24/7 emergency services, chef-prepared meals, housekeeping, Life Enrichment programming, gardens, outdoor spaces, and a clubhouse—offering a maintenance-free lifestyle they’ll love.

10970 South 700 East, Sandy, UT 84070 | lifeatcedarwood.com

Table 6

Table 6

Mortgage Rate Forecast, 2025, 2026

Rate Forecast, 2025, 2026 policies will have on inflation, labor costs, fiscal policy, and, inevitably, bond market yields. Bond market yields are the overriding factor determining mortgage rates.

Mortgage rates are affected by several factors beyond the Federal Reserve’s monetary policy. The benchmark for mortgage rates is the 10-year treasury yield, which runs a little over 2% below mortgage rates. When the 10-year treasury rate goes up, mortgage rates tend to follow and vice versa. The 10-year rate reflects the bond market’s expectations regarding the Federal Reserve’s monetary policy, fiscal policy, inflation outlook, trade policy, consumer sentiment, the job market, etc.

At present, uncertainty reigns in financial markets. It’s too early to tell what impact the Trump administration’s policies will have on inflation, labor costs, fiscal policy, and, inevitably, bond market yields. Bond market yields are the overriding factor determining mortgage rates.

Mortgage rates are affected by several factors beyond the Federal Reserve’s monetary policy. The benchmark for mortgage rates is the 10-year treasury yield, which runs a little over 2% below mortgage rates. When the 10-year treasury rate goes up, mortgage rates tend to follow and vice versa. The 10-year rate reflects the bond market’s expectations regarding the Federal Reserve’s monetary policy, fiscal policy, inflation outlook, trade policy, consumer sentiment, the job market, etc.

4. Outlook Summary for the Salt Lake Market, 2025

• Demographic and economic growth will be a bit slower.

• The decline in housing affordability due to the excesses of the 2020-2022 market will continue to challenge home sales.

• Sales will see a modest increase led by an 8% uptick in condominium sales to 4,000 units and a 3% increase in single-family sales to 8,600 units.

● Demographic and economic growth will be a bit slower.

• Mortgage rates will fluctuate between 6% and 7%.

• Upward pressure on prices will ease with the increase of listings.

● The decline in housing affordability due to the excesses of the 2020-2022 market will continue to challenge home sales.

• The median sales price of a single-family home in Salt Lake County will increase to $620,000, a 2% increase, while the median price of a condominium will increase by 6% to $450,000. The combined price increase for homes and condominiums will be 3.3%.

● Sales will see a modest increase led by an 8% uptick in condominium sales to 4,000 units and a 3% increase in single-family sales to 8,600 units.

• And finally, the above forecast of sales and prices reflects an expectation of mortgage rates between 6% and 7%. A move in rates above 7% or below 6% could substantially change the forecast for sales and prices.

● Mortgage rates will fluctuate between 6% and 7%.

● Upward pressure on prices will ease with the increase of listings.

Good luck and have a prosperous 2025!

● The median sales price of a single-family home in Salt Lake County will increase to $620,000, a 2% increase, while the median price of a condominium will increase by 6% to $450,000. The combined price increase for homes and condominiums will be 3.3%.

● And finally, the above forecast of sales and prices reflects an expectation of mortgage rates between 6% and 7%. A move in rates above 7% or below 6% could substantially change the forecast for sales and prices.

Good luck and have a prosperous 2025!

Condominium sales in Salt Lake County are predicted to rise by 8% this year, while single-family home sales are forecasted to increase by 3%.

By Dave Anderton

The Salt Lake Board of Realtors® recently hosted its annual Economic Forecast event, featuring insights from leading experts, including James Wood, Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute, and Lawrence Yun, Chief Economist of the National Association of Realtors®.

Wood highlighted that the overheated asset markets of 2020–2022 contributed to today’s high inflation, rising home prices, and elevated mortgage rates. As a result, home price growth has moderated. As of the fourth quarter of 2024, the Salt Lake metro area ranked 29th in highest single-family home prices among 226 U.S. metros, according to the National Association of Realtors®. During this period, home prices in Salt Lake increased by 5.5% year over year.

“We are now in a hangover period from those anomalous years,” Wood said. “In 2021 alone, Salt Lake County home prices jumped $108,000—a 25% increase.”

Looking ahead, Wood projected that demographic and economic growth will slow in 2025, while declining housing affordability—driven by the excesses of the 2020–2022 market—will continue to challenge home sales. Despite these headwinds, condominium sales in Salt Lake County are expected to rise by 8% this year, while single-family home sales are forecasted to increase by 3%.

The median sales price of a single-family home in Salt Lake County is projected to reach $620,000, a 2% increase, while the median condominium price is expected to rise by 6% to $450,000. The combined price increase for homes and condominiums is anticipated to be 3.3%.

Yun noted that nationwide home sales have struggled over the past two years due to mortgage rates remaining just below 7%. However, homebuilders— who account for about 10% of all sales—have seen their

(continued on page 38)

Building diverse revenue streams means your bottom line can withstand fewer sales.

By Dina Cheney

In today’s market, some brokerages are finding themselves at a crossroads. “Our margins have nearly evaporated,” said Florida-based Ben Schachter, broker and president at The Signature Real Estate Companies. Sellers are negotiating for lower compensation and real estate professionals are optimizing their commission structures. Though it’s always been important, brokers are finding that creating additional revenue streams and reducing expenses are more important than ever. Schachter and other brokers aren’t new to the need for diverse revenue streams, though, and their experience is proving useful in the current market. The following are broker-tested options for building new revenue sources to support the bottom line.

Twelve years ago in South Florida, the market was slow. Noting how often businesses who relied on agent referrals were soliciting his brokerage, Schachter guessed many would pay to get in front of agents. So, he created the South Florida Realty Expo to convene as many as possible, keeping the branding generic and making admission free. Then he kept his costs low. Since country clubs depend on real estate professionals to bring them new members, one quickly agreed to host the event for free. To spread the word, Schachter bartered booth space for ad space with local newspapers. Then, he tasked a few of his agents with selling sponsorships, booths and speaking slots (they received commissions on sales).

In the end, 250 practitioners attended, 45 companies bought booths and the expo earned $15,000 in revenue. Since then, Schachter has hosted three more expos. The most recent one drew 3,000 agents, 150

companies bought booths, and the expo generated $100,000 in revenue. Along with making money, these events have built Signature’s relationships with vendors.

Following the same logic, Schachter realized companies would pay to pitch his 1400 agents, beyond just bringing them breakfast or lunch. So, he established an annual “preferred vendor” subscription program. To participate, they’re first vetted by Schachter. If they pass the test, they pay his brokerage an annual fee. In return, they receive the full Signature agent contact list, access to all Signature events and the chance to visit Signature offices to pitch his agents (they can pay an extra fee for a premium speaking slot at the company’s annual meeting). Plus, they’re listed as a “preferred vendor” on the Signature homepage. About 60 companies currently participate.

Schachter devised another way to earn income from businesses: he offered some vendors the chance to “graduate” from preferred vendor to exclusive vendor partnership status, where they’d become Signature affiliates. His arrangement with each company is different, and he’s careful to adhere to the Real Estate Settlement Procedures Act (RESPA)—regulations protecting consumers during real estate transactions. But a common model is a licensing partnership where each vendor carries the Signature name and benefits from the company’s marketing expertise. Over time, Signature has grown its network of affiliate companies to a dozen, one in each category, including title insurance, pools and construction. In 2024, proceeds

from these affiliate businesses accounted for about 50% of Signature’s net income.

Last February, Florida-based Steve Snider, managing broker at One Sotheby’s Realty, closed one of his offices, even though it was profitable and home to 10 of his agents. The space was costing him “a few hundred thousand dollars” a year and Snider was particularly keen on making changes to keep costs low. With $20,000 of the money he saved, Snider upgraded the conference room in one of his other offices to help his brokerage land a developer client. The developer was shopping for a real estate firm with an appealing space that could be used as a sales office. Swapping out the furniture, framing the TV and adding a chandelier and drapes did the trick, and Snider’s brokerage signed the developer.

During a downturn a few years ago, Rhode Islandbased Ron Phipps, owner of Phipps Consulting LLC, assessed his expenses. He was disappointed to learn that annually, his brokerage was generating $40,000 in revenue from leads it was purchasing for $60,000. So, he refocused his marketing efforts on the clientele his brokerage had served for the past three decades. In one campaign, he and his agents sent emails and snail mail to residents of a 35-home neighborhood where they’d been involved in 25 of the sales. In handwritten “thank you” notes, they recognized the area as one of their success stories and invited residents to reach out if they or their contacts were ready to make a move. Then they called to follow up. Within 36 months, they’d secured five listings from this effort.

“We real estate professionals keep thinking we need to spend a lot of money to get tangible outcomes,” Phipps said. “But we already have the relationships and need to lean into them, to remind legacy customers how hard we work and the value we bring. Focus on the people who know, love and trust you, and scale that.”

As a professional writer for 20-plus years, Dina Cheney has authored six books for a number of publishers.

Salt Lake County Home Sales (continued from page 34

sales rebound to pre-pandemic levels. Nationally, monthly home sales began increasing in October of last year, with year-over-year growth continuing in November, December, and January.

Inventory, Yun said, has turned a corner as listings are rising. There are roughly 88 million homeowners across the country, 35 million of whom have no mortgage. “There are many people who don’t have any mortgages, and they can move at any time,” he said.

Yun added that in 2024, the median net worth of a homeowner was $415,000, compared to just $10,000 for a renter. “You have to own property if you want to be in the wealth-accumulating class,” he said.

“Even at a higher interest rate, we are seeing a bit more activity because inventory levels have started to recover,” Yun said. “If we can find a way to contain the national debt, mortgage rates could potentially dip below 6%.”

Nationwide, Yun predicted that existing home sales will rise by 9% this year, with Utah expected to outperform the national average. “The conditions for more home sales are clearly developing,” he said. “I anticipate mortgage rates will range from 6.5% to 6% after we pass through the spring homebuying season.”

Dave Anderton is the communications director for the Salt Lake Board of Realtors®.

The Salt Lake Board of Realtors® is the Wasatch Front’s voice of real estate and the No. 1 source for housing market information. The Salt Lake Board of Realtors® is the largest shareholder of UtahRealEstate.com, one of the leading Multiple Listing Services (MLS) in the United States. Since 1917, the Salt Lake Board of Realtors® has been a leader in promoting homeownership and protecting private property rights. The Salt Lake Board of Realtors® empowers its members to better serve the public by providing continuing education, advocacy, and a professional code of ethics.

Free Thermal Imaging & Radon Testing With Every Inspection

Founded in 1994, UtahRealEstate.com is the leading provider of real estate technology in Utah and one of the largest multiple listing services in the United States. The company provides one of the topranked real estate websites in the country, serving more than 8 million consumers each year. It also provides multiple listing services to approximately 20,000 real estate professionals, accounting for nearly 97% of all Realtors® in the state of Utah.

Summit Sotheby’s International Realty wishes to congratulate our exceptional Global Real Estate Advisors named in the Salt Lake Board of Realtors® top 500 for 2025. Congratulations

Summit Sotheby’s International Realty wishes to congratulate our exceptional Global Real Estate Advisors named in the Salt Lake Board of Realtors® top 500 for 2025.

Dorthy Androulidakis

Lauri Davey

Blake Edwards

Erin Eldredge

Cody Emery

Whitney Fautin

Kristel Gough

Alicia Holdaway

Brian Jensen

Jeff Justice

Adam Kirkham

Carolyn Kirkham

Ryan Kirkham

Creighton Lowe

Adrian Maco

Sarah McNamara

Martha Morris

Angie Nelden

Jodie Osofsky

Mark Overdevest

Jacquelin Perry

Susan Poulin

Scott Robbins

Brett Sellick

Laurel Simmons

Scott Simpson

Mimi Sinclair

Sean Steinman

Mony Ty

Tricia VanderKooi

Amy Volcic-Price

90 + Support Staff

18,173

Marketing Designs Executed for Summit Sotheby's International Realty Advisors in 2024

46,000

Images and Videos Delivered in 2024 for Summit Sotheby's International Realty Advisors and Their Clients

1 Truly Global Brand

At Summit Sotheby's International Realty, we believe in a full-service partnership with our sales associates. The goal? Provide support that ranges from world-class marketing to concierge level transaction management, enabling our advisors to reach and exceed their personal GCI goals by spending more time in their businesses.

Members of the Salt Lake Board of Realtors® enjoyed an exciting afternoon of basketball skills competitions on the Utah Jazz court at the Delta Center in downtown Salt Lake City. To participate, members made a voluntary minimum investment of $15 per game, which counted toward their contribution to the Realtors® Political Action Committee (RPAC). The event featured a variety of contests, including a three-point shootout, free-throw competition, speed shootout, and a half-court shot challenge. RPAC-supported candidates are chosen not based on political affiliation or ideology but solely on their commitment to real estate issues. Through RPAC, Realtors® raise and invest funds to support candidates who understand and advocate for policies that benefit the real estate industry. These efforts are made possible through voluntary contributions from Realtors®.

Tuesday, April 15, 2025

8:30 AM - 4:00 PM

Mountain America Expo Center 9575 S State Street Sandy, UT

The RHA Education Conference and Trade Show is the State's LARGEST event for individuals involved in Rental Housing

SCAN ME TO REGISTER

New Listings Surge, But Home Sales Lag in Salt Lake County

Home sales in Salt Lake County got off to a slow start in January, with just 669 units sold across all housing types—single-family homes, condominiums, townhomes, twin homes, and recreational cabins. This marks a nearly 8% decline from the 726 units sold in January 2024.

The sluggish start follows the Salt Lake Board of Realtors® Housing Forecast, which predicts a slowdown in demographic and economic growth in 2025. Meanwhile, declining housing affordability—driven by the excesses of the 2020–2022 market—continues to challenge home sales. Despite these headwinds, single-family home sales are projected to rise by 3% this year, while condominium sales in Salt Lake County are expected to grow by 8%.

Prices Climb Despite Lower Sales

While sales declined, home prices continued to rise. The median sales price of a single-family home in Salt Lake County increased to $585,000, reflecting a 4.28% year-over-year gain. Multi-family home prices also climbed, reaching $420,500, up 3.83% from last year.

Neighboring Davis County saw even sharper price increases, with single-family home prices rising 8.74% year over year, while multi-family homes surged 10.78%.

Market Activity: Listings Surge, Days on Market Increase Slightly

The typical home for sale in Salt Lake County in January spent 44 days on the market before closing, up slightly from 43 days a year ago.

New listings surged, reaching 1,236 homes, a 15.41% increase from 1,071 in January 2024. However, pending sales (homes under contract) dropped to 978, an 11.97% decline from 1,111 last year.

National Market Trends: Sales Decline, Inventory Grows

Across the U.S., total existing-home sales—which include single-family homes, townhomes, condominiums, and co-ops—fell 4.9% from December to a seasonally adjusted annual rate of 4.08 million units in January. However, on a year-over-year basis, sales improved by 2%, up from 4 million units in January 2024.

Meanwhile, total housing inventory at the end of January stood at 1.18 million units, reflecting a 3.5% increase from December and a 16.8% jump from January 2024 (when inventory stood at 1.01 million units). The unsold inventory supply reached 3.5 months at the current sales pace, up from 3.2 months in December and 3.0 months in January 2024.

Mortgage Rates and Affordability: A Continuing Challenge

“Mortgage rates have refused to budge for several months despite multiple rounds of short-term interest rate cuts by the Federal Reserve,” said Lawrence Yun, Chief Economist for the National Association of Realtors (NAR). “When combined with elevated home prices, housing affordability remains a major challenge.”

Despite the rise in inventory, Yun noted that higher supply alone won’t be enough to drive affordability. He added: “More housing supply allows strongly qualified buyers to enter the market. But for many consumers, both increased inventory and lower mortgage rates are necessary for them to purchase a different home or become first-time homeowners.”

“Mortgage rates have refused to budge for several months despite multiple rounds of short-term interest rate cuts by the Federal Reserve.”

Lawrence Yun

Chief Economist National Association of Realtors®

Pamela Abbott

Barton Allan

Judy Allen

Suzanne Allred

George Anastasopoulos

Brent Anderson

Clay Anderson

Diane Anderson

Kay Ashton

Sue Avalos

Margaret Averett

Laurence Bailess

Les Bailey

Brent Barnum

Veda Barrie-Weatherbee

Edward Belka

Ken Bell

Raymond Bennett

Richard C. Bennion

Steven Benton

Gregg Bohling

Russell Booth

Virginia Bostrum

Robert Bowles

Mary Ann Brady

Janet Brennan

Steve Brown

Stephen Bryant

Barbara Burt

Hedy Calabrese

Gregory Call

Gary Cannon

Tracey Cannon

Julie Carli

Carol Cetraro

Scott Chapman

Garn Christensen

Byron Christiansen

David Clark

Deborah Clark

Terry Cononelos

Jeffery Cook

Philip Craig

Dan Davis

Robert Davis

Brian De Haan

Babs De Lay

Lynn Despain

Jerard Dinkelman

Darlene Dipo

Sally Domichel

Rebecca Duberow

James Dunn

Randy Eagar

Carol Edgmon

Douglas Edmunds

Michael Evertsen

Bijan Fakjrieh

Robert Farnsworth

Alan Ferguson

Jack Fisher

Gale Frandsen

David Frederickson

Howard Freiss

Brent Gardner

Heidi Gardner

Paul Gardner

Linda Geer

Sheila Gelman

J. Carolyn Gezon

Larry Gray

Richard Grow

D. Brent Gudgell

Klaire Gunn

James Haines

John Hamilton

Mark Handy

Grant Harrison

Stephen Haslam

Michael Hatch

Thomas Haycock

Bill Heiner

Jeffrey Helotes

Marvin Hendrickson

Terry Hill-Black

Lynda Hobson

Ted Holmberg

Sheryl Holmes

Rhys Horman

Carol Howell

Gary Huntsman

Blake Ingram

Kent Ingram

Esther Israelson

Jackson Jensen

Kevin Jensen

Ron Jenson

Jeffrey Jonas

Steve Judd

David Kenney

Kay Kenyon

Henry Kesler

Douglas Knight

Peggy Knight

Wayne Knudsen

Karl Koenig

Randall Krantz

Leah Krueger

Kathryn Kunkel

Gary Larson

Teresa Larson

Vann Larson

Fred Law

Michael Lawrence

Clark Layton

Shauna Leake

Kaye LeCheminant

Daniel Lindberg

Michael Lindsay

Martin Lingwall

Mildred Llewelyn

Don Louie

Ted Makris

Margaret Malherbe

Al Mansell

David Mansell

Dennis Marchant

Susan Mark-Lunde

Paul Markosian

Ronnald Marshall

Susie Martindale

Christopher McCandless

Curtis McDougal

Miriam McFadden

John McGee

Russell McKague

Andrew McNeil

Margene Wrigley

Henry Youngstrom

Elizabeth Memmott

Uwe Michel

Gordon Milar

Kyle Miller

Preston Miller

David Moench

Richard Moffat

Gary Monk

H.Craig Moody

Randal Moore

Thomas Morgan

Thomas Mulock

Charles Mulford

Melanie Mumford

Jacqueline Nicholl

John Nielson

Michael Nielson

Robyn Nielson

Van Nielson

Victor Oishi

Joseph Olschewski

Brent Parsons

Joan Pate

Yvonne Pauls

Derk Pehrson

Douglas Pell

Robert Plumb

Noel Quinton

Helen Rappaport

David Read

George Richards

W. Kalmar Robbins

Stan Rock

Emilie Rogan

John Romney

Marie Rosol

Christopher Ross

David Sampson

Mark Schneggenburger

Gary Shiner

Jeff Sidwell

Kent Singleton

Debra Sjoblom

Elizabeth Smith

Kenneth Smith

Rick Smith

Skip Smith

Jeffrey Snelling

Lorenzo Spencer

Kenneth Sperling

Anna Grace Sperry

Robert Spicer

Trudi Stark

Lee Stern

Sandra Straley

Gary Strang

John Strasser

Kevin Strong

Thomas Swallow

Sonny Tangaro

Joan Taylor

Rosanne Terry

Martin Vander Veur

Craig Vierig

Peter Vietti

Hilea Walker

H. Blaine Walker

Richar dWalter

Dana Walton

Sally Ware

Jerry Webber

William Wegener

David Weissman

Jeffrey Wells

Wayne Whetman

Jeff White

Darlene Whitney-Morgan

Clayton Wilkinson

Thomas Wilkinson

Kimball Willey

Douglass Winder

Robert Wiskirchen

James Witherspoon

Linda Wolcott

Cynthia Wood

Isaac Field Assistant

HOMETOWN:

Pleasant Grove, Utah

WHAT DO YOU LOVE MOST ABOUT D.R. HORTON?

(Adam) “At D.R. Horton, I love what we do, who we do it for, and who we do it with. We provide a much needed product to our community, attainable homes! Our mission is to help more people achieve homeownership and have a great place to live and raise a family. We build homes for predominantly first-time homebuyers as a production spec builder. We provide a tremendous value and stand behind our work. I’m proud of that. I love our people. We are passionate, competitive, and driven experts in our field. The tenured management team speaks to our family culture and the high quality of people that work at and with the D.R. Horton Utah Division, including our thousands of trade partners. All are included in our Horton family.”

Adam (pictured center) is the DVP of Land Development at D.R. Horton Utah and is excited to have family members Isaac (pictured far left) and Ben (pictured far right) working with him at a company where family is first.

Ben Project Manager

Adam DVP of Land Development