CEO Message & Recent Happenings

2025: A Record Year!

John Wiechmann, CEO

As we close out 2025, I’m incredibly proud of all that we’ve accomplished together. So far this year, MHEG has helped create over 2,500 units of quality affordable housing, closing 55 deals and raising more than $375 million in equity from our investor partners. All record-breaking numbers and we still have three weeks to go! These achievements reflect our unwavering commitment to Changing Lives For A Better Tomorrow!

Each of these numbers represents real impact—families finding stability, seniors aging with dignity, veterans accessing the housing they’ve earned, and communities growing stronger. Behind every deal is a partnership built on trust, shared values, and a collective determination to address the affordable housing crisis facing our nation.

Our success is built on the strength of our partnerships—with developers, investors, lenders, government officials, and the dedicated communities we serve. In a year marked by economic challenges and rising construction costs, your collaboration and commitment to affordable housing are more important than ever. Thank you for your continued trust in and partnership with us.

I’m excited to announce that Hannah Andrus has joined MHEG’s Board of Directors this year. As Chief Financial Officer of BancFirst, a $12 billion financial institution serving Oklahoma communities, Hannah brings exceptional financial expertise and strategic leadership to our Board. Her nearly 15 years at Ernst & Young, spanning multiple industries and international markets, combined with her deep commitment to community service, will be invaluable as we continue to expand our impact and strengthen our portfolio.

As we look ahead to 2026, I’m energized by the opportunities before us. Thank you for being part of the MHEG family and for letting us help you Change Lives For a Better Tomorrow!

All the best,

John Wiechmann

Recent Happenings Groundbreakings and Ribbon Cuttings

Letf to Right: Tallgrass Housing groundbreaking in Papillion, NE (May 2025); UNI Crescendo groundbreaking in Kansas City, MO (Oct 2025); Abilene Court ribbon cutting in Abilene, KS (Oct 2025)

Liberty Campus ribbon cutting in Grand Island, NE (Oct 2025)

MHEG & MHDF Updates

MHEG’s Growth and Recent Achievements

Tom Stratman, Chief Acquisitions Officer

History of Expansion

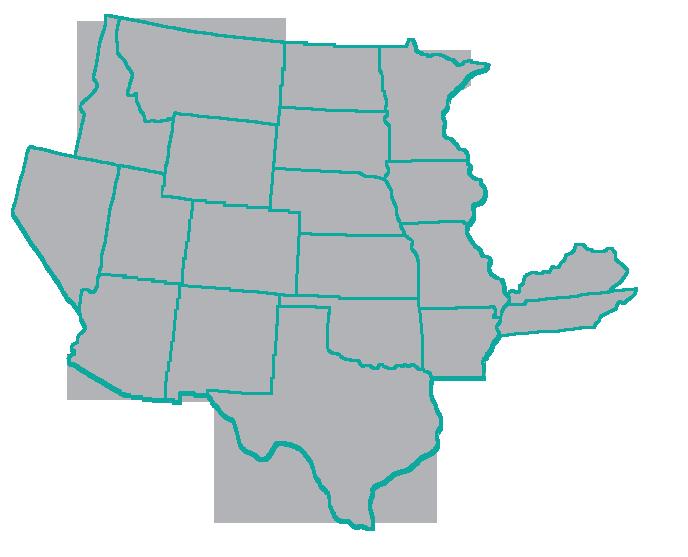

MHEG has consistently grown and broadened its reach since its founding. Originally established in Nebraska in 1993, MHEG expanded its footprint over the years by adding Kansas, Iowa, and Oklahoma between 2001 and 2005. The organization continued its growth in 2013, entering South Dakota, Minnesota, Missouri, Arkansas, Colorado, and Texas. In 2022, MHEG further extended its service area to include Arizona, Idaho, Montana, Nevada, New Mexico, North Dakota, Utah, and Wyoming. Most recently, in 2025, Kentucky and Tennessee have joined the list of states served by MHEG.

If you are considering developing in these states, we welcome the opportunity to partner with you.

First Development in Tennessee

MHEG Portfolio as of 11/30/2025

MHEG is pleased to announce its inaugural project in Tennessee, one of its newest expansion states. The Reserves at Cobalt Circle in Brownsville, Tennessee, will feature 72 newly constructed units, offering one, two, and three-bedroom options. These units are designed to serve families earning 50% and 60% of the Area Median Income (AMI) for Haywood County. Residents will benefit from a variety of amenities, including a clubhouse, fitness center, playground, and on-site management. MHEG is partnering with Overland Property Group (OPG), a Kansas-based developer, for this project. MHEG and OPG have a strong history of collaboration, having worked together on more than 40 developments throughout the Midwest.

2025 Portfolio Achievements

In 2025, MHEG has successfully closed 55 developments, with additional deals expected to finalize before the end of the year. These accomplishments have expanded MHEG’s portfolio to more than 30,000 affordable housing units, marking a significant milestone for the organization and the communities it serves.

MHEG Reaches Record $379 Million in Capital Raised Becky Christoffersen, Chief Investment Officer

*Data compiled from 9/30/25 figures using stabilized developments only, vacancy percentage is using economic vacancy.

MHEG is proud to announce a landmark year for our investor relations team and our aspiration to expand affordable housing across our footprint. In 2025, MHEG is on track to raise a record $379 million in capital—$356 million in federal capital and $23 million in state capital—bringing our total capital raised to over $4 billion since inception. In 2025, we closed investments with 34 investors including 4 new relationships. This achievement reflects the trust and commitment of our investor partners, whose support enables us to create and preserve affordable homes for families and communities in need.

Our investor relations department continues to strive to foster strong investor relationships, ensuring MHEG is a dependable and reliable syndicator partner. This year, we welcomed Cara Conway as Vice President of Investor Relations. Cara brings expertise from the CRA banking sector, enhancing our ability to be a resource for regional and community banks.

Thanks to our investors’ partnership in 2025, MHEG continues to fulfill our mission of changing lives for a better tomorrow. We are excited to announce that in January 2026, MHEG will launch a new Fund, continuing our tradition of offering quality LIHTC investments with strong real estate metrics, market returns, and meaningful CRA impact. Keep us in mind as you plan your 2026 investment strategies and join us in making a lasting difference in our communities.

Thank you to all our partners for your continued support and dedication to our mission!

Above: The Reserves at Cobalt Circle in Brownsville, TN

MHEG & MHDF Updates

Government Affairs Update

Joshua Yurek, VP Government Affairs & Community Outreach

This year yielded some historic progress for affordable housing development. In July, President Trump signed into law a reconciliation package that marks the largest investment in the Housing Credit program in decades. Key provisions include a permanent 12 percent allocation increase for the nine percent Housing Credit starting in 2026, and a permanent reduction of the bond financing threshold test for four percent Housing Credits from 50 percent to 25 percent for properties placed in service after December 31, 2025. The main Housing Credit provisions stem from the bipartisan Affordable Housing Credit Improvement Act of 2025 (H.R.2725/S.1557), which is projected to finance 1.22 million additional affordable homes and represents a historic $15.7 billion commitment to affordable housing. The package also extends the New Markets Tax Credit permanently, expands the Opportunity Zones program, and restores 100% bonus depreciation—delivering significant wins for affordable housing and community development.

In October, the Affordable Housing Tax Credit Coalition honored The Cottages by Siena Francis House with the prestigious Charles L. Edson Tax Credit Award for Housing for Special Populations. This recognition highlights outstanding achievements in affordable housing development. Developed by Arch Icon and syndicated by MHEG, The Cottages provides 50 affordable homes for individuals transitioning out of homelessness, just a half-block from the Siena Francis House main campus in Omaha, Nebraska. As Nebraska’s first “tiny homes” development, each cottage features a one-bedroom layout with a living area, kitchen, and bathroom. MHEG and our partners at Siena Francis House and Arch Icon Development received congratulations from U.S. Senator Pete Ricketts (R-NE) for winning the Edson Award. This achievement underscores how strong partnerships are essential to creating innovative housing solutions in our communities.

Recently, Congress passed, and the President signed legislation allowing federal operations to resume, ending the longest federal government shutdown in U.S. history. The legislation includes a three-bill “minibus” that funds the Department of Agriculture (USDA) and the Food and Drug Administration, the Department of Veterans Affairs and military construction projects, and congressional operations through the remainder of FY26. All other federal agencies, including the Department of Housing and Urban Development (HUD), are funded at current levels via a short-term continuing resolution (CR) until January 30, 2026. Of note, the legislation ensures that federal employees who received reduction-in-force (RIF) notices during the shutdown are fully reinstated, and all furloughed employees will receive backpay dating to October 1, when the shutdown began. Additionally, there is a ban on future RIFs for any department or agency until the CR expires on January 30. Looking ahead, lawmakers are working to advance additional appropriations bills before the CR deadline. Congressional leaders have indicated that the Transportation, Housing and Urban Development, and Related Agencies (THUD) bill may be included in the next package of funding bills.

Finally, Members of Congress consistently express the value they find in visiting affordable housing communities. These visits offer a unique opportunity for them to hear firsthand from residents, which is especially impactful as we advocate for increased affordable housing resources at the federal level. As your project is nearing construction completion, I encourage you to contact me to discuss showcasing your new development. I would be happy to assist in organizing a ribbon-cutting event with your Congressional delegation and their staff, highlighting the effectiveness of the Housing Credit in delivering affordable housing solutions within their district and state. Thank you for your partnership and commitment to expanding affordable housing.

MHDF Update

Lara Huskey, MHDF EVP

In 2025, MHDF closed over $40 million in financing for affordable housing across the Midwest and Great Plains. Notable projects include Lightning Creek Townhomes in Oklahoma City, Oklahoma, which will bring 43 new homes to a fast-growing neighborhood.

In Omaha, Nebraska, Sheltering Tree’s Purple Martin Apartments will provide 48 units designed for adults with developmental disabilities, supporting independent living and community integration.

In Spirit Lake, Iowa, MHDF financed Summerfield Park—a 30-unit property that will combine the rehabilitation of existing affordable homes with the construction of new units. The developer, Community Housing Initiatives, Inc. (CHI), is a non-profit with nearly three decades of experience and more than 50 affordable housing projects completed across Iowa and the region. CHI’s track record includes a focus on rural communities and a commitment to long-term affordability and quality management. At Summerfield Park, CHI will provide modern apartments for families, with amenities like in-unit laundry and secured access, helping address a critical shortage of affordable rentals in the area. Other highlights include new senior and family housing in Sioux Falls, South Dakota; Kansas City, Missouri; and Mitchell, South Dakota.

MHDF’s flexible capital continues to meet developers where their projects need it most — term loans that stabilize properties after construction, plus acquisition loans and predevelopment financing to bridge early costs. This mix helps local sponsors keep rents affordable while ensuring projects remain financially sustainable and successful over time.

The Cottages in Omaha, NE

Property & Resident Spotlight

Glenpool Ridge

Meet Beverly

A retired nurse and Tulsa native, Beverly’s journey has taken her across the country— from Arkansas to New York—before returning home to care for her aging parents. After facing personal challenges and housing instability, Beverly found herself at a crossroads. “Here I am, 78 years old, and I don’t know where I’m going to live again,” she remembers thinking. That’s when she discovered Glenpool Ridge.

Beverly admits she wasn’t sure about Glenpool at first, but her daughter encouraged her to take a look and she’s so glad that she did. Developed by Red-Wood Development, Inc., Glenpool Ridge is a 3-story building designed for persons 55+ and is located in Glenpool, just south of the Tulsa metro. The building has an elevator, and has ADA compliant units, with grab bars, shower chairs, lower cabinetry and knee space for wheelchairs. The property also has several community spaces available for the residents to use.

Now settled in her apartment for over a year, Beverly says she’s incredibly happy to be living here and to have a “home.” The community offers her the independence she cherishes, with easy access to medical care, shopping, and family. “I’m less than five minutes from my primary care doctor, and I can get groceries delivered from Walmart. It’s perfect,” she shares.

Glenpool Ridge’s affordability has been life-changing. Living on Social Security and a modest alimony, Beverly says she couldn’t afford market-rate rent, not with utilities and food. “I don’t know what I’d do, but this place made it possible. Here, I can still do what I want to do.”

Beyond the financial relief, Beverly has found a true sense of belonging. From community dinners and church services to friendly neighbors who check in and share baked goods, Glenpool Ridge feels like living in a neighborhood. “It’s quiet, safe...people are proud living here. I sing its praises all the time.”

Glenpool Ridge was made possible for Beverly and other seniors through the use of the Low Income Housing Tax Credit Program. Glenpool Ridge was funded through MHEG Fund 52, LP.

Glenpool Ridge

General Partner Schroeder Glenpool Ridge

Developer Red-Wood Development Inc.

Property Manager Bell Management, Inc.

Equity Invested $7.1 million

“It’s peaceful. It’s a community. I feel like I belong.”

~ Beverly

Staff - Additions

Monica Ullerich - Closing Manager

Monica joined MHEG as Closing Manager in February 2025 in our Omaha office. Her duties include leading the due diligence collection/review process and keeping our investments on track for timely closings. Monica comes to MHEG with over 20 years’ real estate experience and previously worked for Mosaic as a Housing Compliance Analyst.

Victor Ceballos - Financial Analyst

Victor joined MHEG as Financial Analyst in March of 2025 and works remotely from Carroll, Iowa. His duties include overseeing a development portfolio with financial reviews, site visits and problem resolution/ workouts as needed. Victor graduated from Richmond American University in London with a Finance degree and previously worked for Commerical Savings Bank.

Candace Holtapp - Fund Staff Accountant

Candi joined MHEG as Fund Staff Accountant in the spring of 2025 in our Omaha office. She performs a variety of accounting tasks to support the Senior Fund Accountant and the accounting department. Candi has over 20+ years’ accounting experience and previously worked for Financial Brokerage, Inc. She graduated from Wayne State College with an Accounting degree.

Cara Conway - Vice President - Investor Relations

Cara joined MHEG as the Vice President of Investor Relations in June 2025. She leads and executes capital-raising efforts with regional and community banks for MHEG’s various investment funds. Prior to joining MHEG in 2025, Cara was an Associate Managing Director at CIBC Bank USA where she originated and managed CRA qualified investments to assist with CIBC’s Community Development strategy. She holds a B.S. in Social Policy from Northwestern University.

Charlie Fleet - Chief Technology & Digital Transformation Officer

Charlie joined MHEG as the Chief Technology/Digital Transformation Officer in the summer of 2025. He leads MHEG’s strategic vision, architecture and execution of technology initiatives that drive innovation, operational excellence, and mission impact. Prior to joining MHEG in 2025, Charlie was the Chief Transformation Officer for Solera. He has over 25 years’ experience in technology delivery and strategy execution. He received his B.S. in Civil Engineering from the Virigina Military Institute and his Master of Engineering from Massachusetts Institute of Technology.