ENERGY AND RESILIENCE POLICY BRIEFS 2025

MESSAGE FROM THE DIRECTOR

Change is omnipresent It is nothing new The ability to adapt is critical for resilience, and resilience across supply chains is central to energy security and macroeconomic health. Fortunately, data analysis and research rooted in fundamentals and structure can provide a resilient path through uncertainty, regardless of the times, and they can offer salient tips for navigation when heeded. CES fellows and scholars have decades of research and experience in various roles in academia, government, and industry. I have the privilege of working with this diverse set of remarkable individuals. The briefs herein provide a snapshot into how each can elevate conversations on some of today’s most pressing policy issues.

Kenneth B. Medlock III

EnergyandResiliencePolicyBriefs2025 CompiledbyKennethB

Thismaterialmaybequotedorreproducedwithoutprior permission,providedappropriatecreditisgiventotheauthorand RiceUniversity’sBakerInstituteforPublicPolicy.Theviews expressedhereinarethoseoftheindividualauthor(s)anddonot necessarilyrepresenttheviewsofRiceUniversity’sBakerInstitute forPublicPolicy

FlipbookdesignandlayoutbyMaramHijazi

Technology Transition of the US Power Grid: Opportunities for Federal Engagement

Leading the Fight Against Global Energy Poverty Will Enhance American Security and Prosperity

Trilateral Recommendations for Pacific Energy and National Security

Hydrocarbons and Mineral Resources in the Western Hemisphere

Building Barriers, Blocking Progress: Critical Minerals and Trade

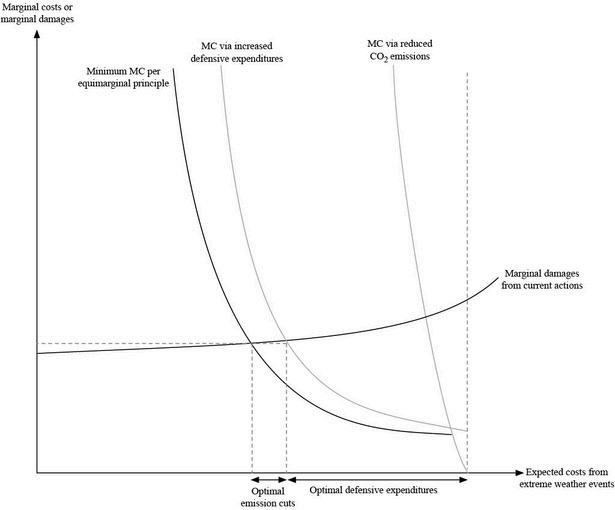

Finally, on the environment and technology fronts, there is a call to broaden thinking about policy to incorporate a much more holistic approach than has been apparent in recent years. “Recalibrate Sustainability” is Rachel Meidl’s call for a rethinking of sustainability as a system-level objective that recognizes the trade-offs inherent in achieving economic, social, and environmental objectives, all of which run deeply through supply chain resilience and long-term growth. Peter Hartley outlines the missing role of resilience in current climate discourse and offers a path that provides benefits that extend well beyond climate-related concerns in “Environmental Policy, Resilience, and a Balanced Path Forward.” In “’Capture’ Carbon-to-Value,” Ken Medlock argues for an approach to leverage the full U.S. comparative advantage in hydrocarbons through advancing carbon-to-value pathways in agriculture, materials, and manufacturing, which could pave the way for long-term economic prosperity. Finally, Ted Temzelides emphasizes the need to avoid picking winners in the energy technology race so that market forces and investor preferences can appropriately signal the most efficient outcomes in “Not So Fast: Efficient New Technology Adoption Policy.”

Together, these briefs offer a roadmap for strengthening U.S. leadership across energy, trade, international relations, and sustainability. The recommendations highlight actionable priorities that integrate domestic capabilities with international strategy to ensure long-term resilience and competitiveness.

A STRONG SUPPLY CHAIN IS THE CIRCULATORY SYSTEM OF A HEALTHY ECONOMY

Author: Ed Emmett Fellow in Energy and Transportation Policy

Introduction

A strong circulatory system is vital to human health. The better the flow through our veins and arteries, the better our overall health. Likewise, the health of the nation’s economy is dependent upon the efficient flow of goods through the supply chain. The United States has been strong because its domestic supply chain has enabled the efficient flow of both American-made and imported products. In order to maintain the nation’s supply chain, policymakers should focus on three priorities: maintaining and upgrading the interstate highway system, supporting the development and implementation of fuels most appropriate for the various transport modes, and removing obstacles to the use of the most efficient methods of moving freight.

Maintaining and Upgrading the Interstate Highway System

While almost every incoming administration has said improved infrastructure would be a priority, there has not been a specific focus on the interstate highways. Even though the general public views interstate highways as commuter and intercity routes for automobiles, the aging Interstate Highway System is actually the backbone of the domestic supply chain and the key component of the nation’s freight transportation network.

The 45,000 miles on the Interstate Highway System are in every state except for Alaska. The system was authorized in 1956 and finally completed in 1992, meaning that interstate highways, for the most part, are more than 50 years old. There have been appropriations to maintain and expand many of the interstate highways, but there needs to be an exhaustive examination of the system’s needs in light of vastly changed circumstances since most of the highways were designed and built.

One dramatic change has been the movement of the nation’s population to the Sun Belt and California from the Northeast and Midwest. Of the 10 most populous cities in 1960, five are no longer in the top 10 in 2020. Detroit, Baltimore, Cleveland, Washington, D.C., and St. Louis have been replaced by Phoenix, San Antonio, San Diego, Dallas and San Jose. If the interstate highways are to accommodate future population changes, anticipated growth in cities such as Fort Worth and Austin needs to be factored into decisions about highway improvements and expansions.

Another significant change that has occurred since the interstate highways were built is the rise of intermodalism where trains and trucks share the movement of freight. Identifying highways best situated to improve intermodal transportation will enhance the efficiency of the overall domestic supply chain.

Fueling US Transportation

The world of transportation is undergoing a fundamental change with regard to the fuels used by each transportation mode. As much of the world attempts to lessen carbon emissions, the transportation sector is front and center. Unlike in the steam age or the petroleum age in which all transport modes were propelled by very similar fuels determined primarily by efficiency and cost, future transport modes will use a wider variety of fuels. And, in a major shift, which fuels will be used in global transportation will be directed more by governmental environmental policies that give incentives to the development and use of specific fuels. U.S. policymakers and transport providers will face challenges in crafting policies for domestic transportation while simultaneously recognizing requirements for international transportation.

A notable trend has been the promotion of electric vehicles over the use of drop-in fuels such as renewable diesel. For automobiles and local delivery trucks, electrification might be a sensible alternative, but for long-haul trucks, it is not reasonable. For the millions of existing long-haul diesel trucks, many of which are owned by independent owner-operators, efforts should focus on increasing the availability and efficiency of petroleum diesel and renewable diesel. Simultaneously, research should focus on longer-term fuels for long-haul trucks. That research should involve the trucking industry, truck manufacturers, fuel suppliers, truck stop operators, and other interested parties.

1

Other freight transport modes will have varying fuel options. U.S. railroads are all privately owned and will be able to make the best decisions regarding future fuels within parameters set by the government. A similar situation exists for the barge industry. The airlines and air freight carriers will have the complicating factor of being international and, therefore, subject to the requirements of other countries, although there seems to be a coalescing view that sustainable aviation fuel may be a preferred drop-in option. In that case, the U.S. government should adopt policies to encourage the production and use of sustainable aviation fuel in this country but balanced by a realistic assessment of the cost and timeline for increasing their use. Similarly, ocean shipping is an international industry dominated by a relatively small number of major companies that are currently testing multiple fuel options. Policymakers should monitor developments and be prepared to work with U.S. ports, shippers, ocean carriers, and fuel suppliers to assure that U.S. ports will have adequate domestically produced fuel supplies. 2 3

Maximize Use of Transport Modes and New Technology

Following the economic deregulation of transportation in the 1980s, freight movement became more efficient, with modal shifts for specific cargoes and a more symbiotic relationship developing between the trucking industry and railroads. More can be done in that area, however. Some major U.S. ports are constrained by highway congestion in urban areas. As is being done at Port Savannah, there should be a concerted effort to move more containers and other international freight by rail directly from the ports to inland locations.4

For domestic freight movement, coastwise shipping has been constrained by outdated, overly onerous restrictions required by the Jones Act. The federal government should make an effort to create useable coastal water highways to supplement the interstate highway system.

5

As earlier discussed, the interstate highways are in need of upgrades and expansion, all highway projects should be done with the use of new technology as an element. By leveraging cameras, sensors, satellites, and other technologies, highway users can be routed more efficiently and accidents can be reduced. These tools also help truck drivers maximize their driving time and locate parking spaces more easily. If autonomous driving vehicles are to become a reality, the roads and highways should be improved to assist such vehicles.

Rigorous Enforcement of Interstate Commerce

The United States supply chain is complex and interconnected. Ports, roads, railroads, canals, all modes of transport, fueling facilities and vendors of all types make up the transportation circulatory system that keeps the national economy running.

State and local governments should avoid policies that hamper the flow of freight. The economic deregulation of airlines, trucking, and railroads occurred in the 1980s. It followed decisions by the Interstate Commerce Commission and the judiciary, which determined that state regulations on entry and rates interfered with interstate commerce. State regulation of transportation equipment should also be viewed as interfering with interstate commerce. 6

1 Stauffer, Nancy W “Reducing Carbon Emissions from Long-Haul Trucks ” MIT Energy Initiative, May 14, 2024 https://energy mit edu/news/reducing-carbon-emissions-from-long-haul-trucks-a-novel-approachto-using-clean-burning-hydrogen/

2 International Air Transport Association (IATA) “Developing Sustainable Aviation Fuel (SAF) ” IATA, 2025 https://www iata org/en/programs/sustainability/sustainable-aviation-fuels/

3 “The Future of Maritime Fuels | The Decarb Hub ” The Decarb Hub, September 11, 2023 https://www thedecarbhub org/insights-and-resources/the-future-of-maritime-fuels/

4 Georgia Ports Authority “Rail ” https://gaports com/rail/

5 Medlock III, Kenneth B , Michelle Michot Foss, Anna B Mikulska, and Ted Loch-Temzelides “Keeping up With the Jones Act Changes a Pandemic and Price War Could Bring ” Baker Institute for Public Policy, April 9, 2020 “Keeping up with the Jones Act Changes a Pandemic and Price War Could Bring ” 2020

Commentary April 9, 2020 https://www bakerinstitute org/research/blog-keeping-up-with-the-jones-actchanges-a-pandemic-and-price-war-could-bring

6 Raymond Motor Transportation, Inc v Rice, 434 U S 429 (1978) https://supreme.justia.com/cases/federal/us/434/429/

ENERGY AND SECURITY –IT’S

MATERIAL

Author: Michelle Michot Foss Fellow in Energy, Minerals, and Materials

Introduction

The Trump 2.0 administration has a window of opportunity to tackle and improve on the policy and regulatory context for materials supply chains. Trump 1.0 was notable for putting forth Executive Order 13817 which set the stage for action on minerals and materials supply and logistics. More effort is needed to prioritize and streamline, leveraging against the broader push for government efficiency.

1

Policymakers and government officials should address the mixed and often conflicting policy and regulatory signals that currently shape the minerals and materials landscape. These signals stimulate demand for minerals and materials, but at the same time, confound and burden efficient and optimal provision and use. Efforts to prioritize and streamline can be aided by recognizing the following realities.

2

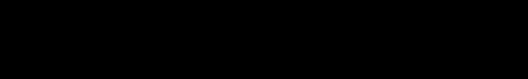

Open, transparent, competitive markets are best for fostering responsible sourcing of minerals and materials produced through commercially sustainable practices.

Wise, highest, and best use of mineral endowments for energy and security means balancing delivered, reliable energy output with materials inputs using broad sustainability metrics.

3

Policymakers can do much to support domestic supply chain resilience. For decades to come, we will rely on legacy materials for the bulk of our civilian and defense needs. Longer term, prospects for the United States energy and security hinge on decisions made now regarding how we can best foster research, development, and commercialization of advanced materials. A true materials transition is essential to underpin technology enhancements and innovations, enable increases in productivity, and ensure economic, social, and environmental sustainability.

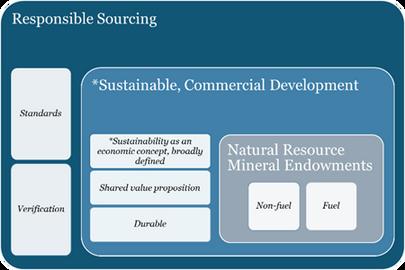

Focus, Like High-Powered Lasers

A first, high-level suggestion toward achieving wise, highest, and best use of minerals resource endowments is to operationalize the optimization pathway. A growing and resilient economy should pursue more energy with less material and high reliability — energy delivered 24/7/365 with minimal disruptions at affordable prices. That means energy systems that can run sensitive manufacturing, keep hospitals humming, move food and goods supply chains (including for defense), and power cities with sufficient robustness for extreme events at reasonable costs (our common understanding of modern quality of life and standards of living).

Defining an optimization pathway in this manner will challenge beliefs about energy technologies and systems as well as conventional definitions of sustainability, while creating a better test of propositions.

The U.S. will not be the only nation moving in this direction as energy realism begins to bite worldwide. If anything has become more clear across the myriad climate COPs and other forums it is a need to attend to basics for economic security and growth. Governments everywhere are under enormous pressure to improve conditions for their citizens by reducing costs and enhancing affordability of energy and all goods and services that flow from energy consumption.

and

5

A second, high-level suggestion is to put materials first. Can we source it? Can we build it? Is it economically competitive? If not, why promote it?

The U.S. and other societies face many competing demands for minerals and materials. Aspirations to promote shifts in energy systems impose assorted financial, environmental, and social tradeoffs too vast to comprehend. Will societies and voters accept those tradeoffs? All signs are that voters want more focused attention to the building blocks for economic growth. This can be done making full use of existing assets including our industrial hydrocarbon footprint (which yields both energy and materials), with reasonable timelines for adoption of alternatives and adaptation. A climate crisis mentality that overlooked financial and social costs led to significant inefficiencies and a waste of taxpayer resources.

Energy and Resilience – Policy Briefs 2025

Source: M Michot Foss, based on Cutifani and Michot Foss, 2024 4

Note: Fuel minerals are coal, oil and gas, uranium Hydrocarbons (oil and gas) provide both energy

key materials (plastics and resins)

Seize the Window on Domestic Resources

Harvesting legacy minerals from our domestic endowments clearly remains a crucial linchpin for economic and national security, and for anchoring future endeavors. Three recommendations can be offered based on extensive research.6

Address and resolve U.S. intragovernmental and federal-state coordination problems. If anything crops up most often from interactions with materials suppliers and manufacturers it is the regulatory conflicts across numerous government agencies and bodies that often operate under confusing, unclear, and overlapping authorities. Taxpayers bear the brunt in the form of continuous judicial reviews. Many ideas exist for how to improve “USG” and federal-state performance when it comes to domestic fuel and non-fuel minerals resources, and they should be pursued as part of this administration’s efficiency drive.

7

Permitting and project cycle times. Likewise, a great deal has been said and written regarding inefficient, lengthy cycle times for project expansions and new originations. Mixed and confused messaging prevails. Urgent need and importance are stacked against policy and regulatory protections for air, water, and hazardous waste for which enforcement has become expensive and cumbersome. The combination is counterproductive, and constitutes the most substantial impediment to improving domestic capacity and supply chain logistics. Federal lands and reform of the National Environmental Policy Act (NEPA), while often the focus of national attention, are not enough. Environmental regulations and reviews cut across federal, state, and private locations for mining, minerals processing, fabrication, and manufacturing. Novel, brownfield projects that incorporate extraction of material from waste, salvaging, and recycling are as stymied as new, greenfield smelters (although few, if any of the latter, are proposed for key metals).

Some global sourcing cannot be replaced by domestic resources (including recovery from waste, salvage, and recycling) in the foreseeable future. What of reshoring, friend shoring and the various ideas for securing materials supply chains abroad? The vast complexities, costs, and demands in terms of personnel and institutional commitments, not least defense posture, are such that clear priorities are crucial. If wise, highest, and best use entails bolstering global sourcing and supply chains then that commitment should be made crystal for voters. Minerals diplomacy is not to be taken lightly. Geopolitical risks and uncertainties require careful thought regarding how best to secure international supply chains and clear priorities for materials use. Creative strategies for hardening difficult to replace global supply chains for defense-sensitive materials and manufacturing components are crucial.8

Source: Lu, et.al., 2024. 12

Change thinking about ‘carbon.’ Carbon is the basis for life on earth, and for much of what we can do when it comes to advanced materials invention. Plastics long ago emerged as substitutes for metals. Carbon fiber was a game changer for composites, and now serves as a key materials input for an array of products from vehicles and aircraft to consumer goods. Carbon nanotubes (CNTs) hold promise to push the envelope further, including direct competition with metals. CNTs offer properties like electrical and thermal conductivity and tensile strength that could alleviate the need for copper, aluminum, and steel. CNT fibers or CNTFs are being tested and used in advanced composites and metal alloys. The U.S. has a competitive advantage from our dominant, oil and gas resources that can be used as a feedstocks for new materials through a highly proficient hydrocarbon industrial base. We can invent and innovate from our hydrocarbon resource base, leading a global materials revolution.

Cross-Cutting Policy Recommendations: How a ‘Materials

First’ Posture Can Help

Overall, the mining industry in the U.S. and abroad simply has to reinvent itself. Industry leaders argue that mining is a materials business, meaning more attention to circularity and recovery of resources from scrap and waste. That posture also means closer alliances with customers to design solutions for materials intensity. Transitioning the mining industry as a materials business also could entail new partnerships for invention of new and advanced materials. 14

Finally, with China’s dominance of minerals supply chains a prevailing theme, how can policymakers manage all of these pressing needs and concerns while also mitigating tensions surrounding US-China relations? Rushed transitions that do not accommodate scaling, cost, and geopolitical conundrums should be reconsidered. If engineered in concert with European and other governments, this approach might result in reduced demand for Chinese capacity, undermining Chinese influence. An ancillary effect would be less pressure on fragile, resource-owning governments that already are drifting toward resource nationalism tendencies.

Notes

1 Federal Register “A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals ” December 26, 2017 https://www federalregister gov/documents/2017/12/26/2017-27899/a-federalstrategy-to-ensure-secure-and-reliable-supplies-of-critical-minerals

2 Foss, Michelle Michot “Minerals and Materials Challenges for Our Energy Future(s): Dateline 2024 ” Center for Energy Studies, Baker Institute for Public Policy, Rice University, September 20, 2024 https://www bakerinstitute org/research/minerals-and-materials-challenges-our-energy-futures-dateline2024

3 Since early January 2025, a number of Executive Orders have been put forth intended to accelerate mineral and metals production in the United States In particular, Executive Orders: 14153, 14156, 14213, 14241, 14154, 14272 In addition, pending and proposed Congressional legislation addresses a range of issues including permitting, federal and tribal lands, supply chain resilience, and international trade and partnerships

4 Cutifani, Mark, and Michelle Michot Foss “Building Shared Value Propositions in the Mining Industries ” In Shaping the Future of Minerals: Future Minerals Forum 2025 Report No 1, November 2024 https://www.futuremineralsforum.com/fmf25-research-report/.

5. Foss, Michelle Michot. “Minerals and Materials for Energy: We Need to Change Thinking.” Center for Energy Studies, Baker Institute for Public Policy, January 24, 2021. https://www.bakerinstitute.org/research/minerals-and-materials-energy-we-need-change-thinking.

6. Foss, Michelle Michot. See citations above for works published in 2024.

7. Foss, Michelle Michot. 2024 for discussions on project cycle times and examples of various efforts.

8. Collins, Gabriel, and Michelle Michot Foss. US Critical Minerals Geoeconomics: Actions from Past Wars and Strategic Competitions. See the Materials Genome Initiative report, https://www mgi gov/sites/mgi/files/MGI Autonomous Materials Innovation Infrastructure Workshop Report pdf and https://www mgi gov/partners/national-science-foundation for background

9 Collins, Gabriel, and Michelle Michot Foss “The Global Energy Transition’s Looming Valley of Death ” Center for Energy Studies, Baker Institute for Public Policy, January 27, 2022 https://www bakerinstitute org/research/global-energy-transitions-looming-valley-death

10 Hartley, Peter R , and Kenneth B Medlock III “The Valley of Death for New Energy Technologies ” The Energy Journal 38, no 3 (May 2017) https://www iaee org/en/publications/ejarticle aspx?id=2949

11 National Science Foundation “Materials ” https://new nsf gov/focus-areas/materials Also see: https://new nsf gov/mps/dmr/workforce-development and https://www nationalacademies org/ourwork/automation-and-the-us-workforce-an-update

12 Lu, Jun, Hong Ju Jung, Ji-Young Kim, and Nicholas A Kotov “Bright, Circularly Polarized Black-Body Radiation from Twisted Nanocarbon Filaments ” Science 386, no 6728 (December 20, 2024): 1400–1404 https://www science org/

13 Rice Carbon Hub https://carbonhub rice edu/

14.Cutifani, Mark, and Michelle Michot Foss. See Shaping the Future of Minerals: FMF25 Report above.

TECHNOLOGY TRANSITION OF THE US POWER GRID:

OPPORTUNITIES FOR FEDERAL ENGAGEMENT

Author: Julie Cohn

Nonresident Fellow

Introduction

The twenty-first-century electric power grid is in the midst of a massive technology and regulatory transition. New energy resources, new methods for transforming those resources into usable electricity, new relationships between generators and users, and new requirements for electricity and transmission to power our economic future are all placing demands on a system that was never formally designed or planned in the first place. Because access to reliable electricity is a foundational requirement of a modern economy, assuring the success of this transition is paramount. Without re-evaluation of historical regulatory requirements and elevated coordination between energy systems that include regulators, private sector investors, regulated entities, and consumers, the chance of failure looms.

Features of the Transition Demand

For the past two decades, Americans have accomplished economic growth with increasingly efficient use of energy. Demand for electricity in the United States grew only modestly. This year, however, the North American Electric Reliability Council increased its 10-year forecast of electricity demand by 60–65% over the forecast offered last year, stating “demand growth is now higher than at any point in the past two decades.” 1

Energy Resources

The Energy Information Agency has documented an ongoing shift from coal-fired power plants to natural gas-fired plants, and an increase in the presence of wind- and solar-powered generation on the grid. In addition, new nuclear and geothermal generation technologies are on the horizon, while advances in a wide array of energy storage approaches are appearing. Few of these new energy sources, and the technologies used to transform them into electricity, resemble the traditional large-scale spinning turbines that have powered the grid for the past 130 years. 2

The shift from coal to natural gas has elevated the importance of natural gas systems for electric grid reliability and resilience. The mechanisms for delivering and storing natural gas are entirely different from coal, and when weather events stress electricity networks, they may likewise increase stressors on natural gas networks. Recent weather events have demonstrated that lack of coordination between electricity and gas industries led to blackouts. 3

Wind and solar resources are location specific – often distant from users – and grid operators are already curtailing their use due to insufficient transmission infrastructure. 4

The availability of wind and solar resources is weatherdependent. It has long been well understood that these renewables are not dispatchable, and should be integrated with dispatchable generation or storage batteries for stable and reliable grid operation.

Wind, solar, and batteries do not provide the physical attributes of spinning turbines that contribute to grid control and stability. They connect to the grid using programmable power electronics devices called inverters. To date, these devices have been programmed to follow signals from the grid, but in recent years, as more wind and solar generation connects to the grid, it has become clear that following the grid can lead to power failures. 5

Advances in Computation and Data Analysis

Dramatically increased computing power, access to massive amounts of data from every node of electricity networks, and revolutionary advances in analytical tools represent the potential to increase efficiency on the grid, but generation, transmission and regulatory challenges should also be addressed.

Inverter-Based Resources and Power Electronics

While power systems have included inverter-based resources such as especially wind- and solar-generating facilities for the past two decades, much is unknown about how the increasing penetration of power electronics on the grid will undermine stability, or potentially improve grid reliability. Imagine millions of electric vehicles, rooftop solar systems, wind farms, and storage batteries providing and responding to signals from the grid. These programmable devices on both sides of the meter will soon reach a tipping point, and we do not yet know how best to control and exploit them while assuring stability of the grid. The algorithms developed in the twentieth century are still in use today to control and optimize the grid, but they may not be well suited to the physics of a grid rich with power electronics. 6

Distributed Generation

From the homeowner with a solar array and a storage battery in the garage to the Amazon or Google facility installing its own generating units and backup systems, entities that were customers in the past will increasingly become power producers in the future. Grid operators are already challenged to project how and when these distributed generators will contribute power to the grid, demand backup from the grid, or in some way provide ancillary services.

Demand-Side Grid Management (DSM)

Engineers and economists have long understood that power users can contribute to grid efficiency, mitigate peak demand, aid grid stability when there are unplanned generator or transmission line failures, and participate in grid reliability. Increasingly grid operators are adding DSM approaches to their toolboxes, and in the process changing how grids function.

Policy Recommendations

While many of the features of the current grid transition are technological in nature, the efficacy of solutions will be influenced by policy at many levels of government. The federal government plays several key roles that can frame a successful transition without blackouts, energy shortfalls, unequal access to electricity, and economic hits. But coordination with state and local governments and industry will be required. Four federal interventions are doable and essential for facilitating this successful transition:

Regulatory review: Assess current approaches to interconnection requirements and grid planning to maximize the opportunities presented by inverter-based resources and power electronics and minimize reliability and resilience risks. Successful coordination across state boundaries and within states depends on federal rules that address the complexity of the various grids across the nation and the role that non-federal agencies have to play.

Coordination between natural gas and electricity industries: Uplevel the oversight and coordination between these two energy systems to ensure that power shortages do not compromise needed natural gas production and delivery, and gas shortages do not cripple power generation.

Customer education: Help the American public understand the important role that each electricity producer and user can play in achieving the most cost- and energy-efficient, stable, reliable, and resilient grid of the twentyfirst century.

Research funding: Historically researchers turn their attention to the problems identified in federal funding opportunities. Providing research grants in the first instance, and focusing them on the technology transition underway on the grid in the second, will go a long way toward attracting the brightest minds to this critical element of a strong U.S. economy. 7

1 North American Electric Reliability Corporation (NERC) “2024 Long-Term Reliability Assessment,” p 8

Detroit, MI: NERC, December 2024

https://www nerc com/pa/RAPA/ra/Reliability%20Assessments%20DL/NERC Long%20Term%20Reliability %20Assessment 2024 pdf

2 U S Energy Information Administration (EIA) Electricity Data Browser https://www eia gov/electricity/data/browser/

3 Federal Energy Regulatory Commission (FERC) “Winter Storm Elliott Report: Inquiry into Bulk Power System Operations During December 2022 ” November 7, 2023 https://www ferc gov/media/winter-stormelliott-report-inquiry-bulk-power-system-operations-during-december-2022, Hartley, Peter R , Kenneth B Medlock III, and Shih Yu (Elsie) Hung “ERCOT Froze in February 2021: What Happened? Why Did It Happen? Can It Happen Again?” Baker Institute for Public Policy, Rice University, February 2, 2022 https://www bakerinstitute org/research/ercot-froze-february-2021-what-happened-why-did-it-happen-canit-happen-again, U S Energy Information Administration (EIA) “Why Are Midwest Grid Operators Turning Away Wind Power?” Today in Energy, June 26, 2024 https://www eia gov/todayinenergy/detail php? id=62406.

4.U.S. Energy Information Administration (EIA). “Solar and Wind Power Curtailments Are Rising in California.” Today in Energy, October 30, 2023. https://www.eia.gov/todayinenergy/detail.php?id=60822.

5. North American Electric Reliability Corporation (NERC) and Texas Reliability Entity. “Odessa Disturbance: Texas Events May 9, 2021 and June 26, 2021: Joint NERC and Texas RE Staff Report.” September 2021. https://www.nerc.com/pa/rrm/ea/Documents/Odessa Disturbance Report.pdf.

6. Cohn, Julie A. “Approaching a Tipping Point for the Electric Grid.” Baker Institute for Public Policy, Rice University, November 20, 2023. https://www.bakerinstitute.org/research/approaching-tipping-pointelectric-grid

7 Power Systems History Power Systems History Accessed June12,2025 https://sites google com/view/power-systems-history/home

LEADING THE FIGHT AGAINST GLOBAL ENERGY POVERTY WILL ENHANCE AMERICAN SECURITY AND PROSPERITY

Author: Gabriel Collins Baker Botts Fellow in Energy and Environmental Regulatory Affairs

Introduction

Global events during the past several years make three things crystal clear:

One, Energy security is national security

Two, Abundant energy is an irreplaceable tool for adapting to climate volatility and improving living standards

Three, U.S. diplomacy abroad is only as credible as the concrete options and solutions our country brings to the table.

If we cannot deliver, China will and while doing so, diminish our position and power. Among pressing needs, energy is front and center.

Leading the Fight Against Global Energy Poverty

We should openly embrace and lead the fight against global energy poverty. The same way the Green Revolution enhanced American power by improving food security across the Global South two generations ago, so too can an Energy Abundance Revolution bolster our strategic position in this generation’s Great Power competition.

The United States’ tremendous resource base, technological capabilities, and industrial prowess position it to first ensure that our citizens do not face heat versus eat decisions and then build a better world for the billions who still live in energy poverty. Full pursuit of these two vital priorities will cement our own prosperity and strategic position.

Energy Abundance as a Geopolitical Tool

When the United States pursues energy abundance itself and postures other countries to do the same, we fortify the world against those who would use energy as a weapon. Imagine how dark — figuratively and literally — the world would be if U.S. exporters had not been able to swing their LNG exports to Europe in a matter of days and weeks once Russia began curtailing gas supplies before and after its second invasion of Ukraine? Just as the Berlin Airlift helped the Free World stand strong in 1948, so too did the US-led GasLift of 2022 help keep Kyiv free. 1 2

Energy abundance also enriches, and saves, individual lives. It means more children drinking safe water in Nigeria and Sudan, fewer women breathing harmful wood smoke in rural India, and more parents elevating their families with better paying jobs in Ethiopia, Vietnam, and the Philippines.

Former Nigerian Vice President Yemi Osinbajo likely spoke for billions in the developing world when he wrote in 2021 that “our citizens cannot be forced to wait for battery prices to fall or new technologies to be created in order to have reliable energy and live modern, dignified lives.” Helping them fulfill aspirations of access to modern energy sources would make billions of lives better while winning hearts and minds in the process.

3 4

Energy is one of the sectors in which the U.S. has the greatest global competitive capacity. To be sure, this is not the case in every potential energy value chain. Wind and solar are dominated by China, whose industrial policy has yielded massive overcapacity relative to demand. Spending hundreds of billions of dollars in U.S. taxpayer funds to chase those manufacturing sectors would be poor fiscal stewardship. We should instead take advantage of cheap and low security risk Chinese basic hardware like solar panels and for other more security-sensitive items like inverters, require an American edition that is manufactured in the U.S., Canada, or Mexico and which runs audited, open-source software with verified datalink and internet connection hardware.5

In other critical areas that comprise much larger sectors of global energy supply now, such as oil and gas, the U.S. is extremely competitive. The Shale Boom offers a critical, and apropos, historical lens because what started as a fundamentally domestic enterprise ended up achieving transformative energy security impacts far beyond our borders. Europe’s ability to withstand Russian gas coercion before and during the first phases of the Russia-Ukraine war by surging imports of US-produced LNG in 2022-23 testifies to this reality.

Parts of Africa and Ukraine each have major gas development potential that could be accelerated with injections of U.S. firms’ capital and expertise and yield mutually beneficial partnerships. One way to begin facilitating such interactions literally requires the stroke of a pen: changing the Treasury Department’s “Guidance on Fossil Fuel Energy at the Multilateral Development Banks” so that instead of stifling natural gas development in the Global South, it encourages it. Doing so would open the landscape for public capital providers like the IMF and World Bank to help de-risk the midstream projects needed to get molecules to domestic and foreign markets and thus catalyze upstream investment. Those upstream developments could also spur increased energy available for those developing countries to accelerate their own economic growth (e.g., natural gas for local power generation) and reduce energy poverty.

6

Energy and Resilience – Policy Briefs 2025

7

Writing 65 years ago, Sen. Hubert H. Humphrey noted that “our reserves of food and fiber, and our ability to produce such commodities in abundance, are resources to be prized; to be used boldly and imaginatively, and not be dribbled away.” Substituting “energy” for “food and fiber” makes the statement as relevant in 2025 as it was in 1958.

Position the US To Be International Leaders in New Nuclear and Geothermal Technology

Energy is an opportunity space for the U.S. to do well for itself, improve lives in allied and partner countries, and short circuit our adversaries’ attempts to corrode and damage a global architecture that has delivered unprecedented prosperity and wellbeing over the past 80 years. An energy abundance agenda can help underwrite human betterment, peace, and security. We can pursue it in a fully bipartisan fashion. And most importantly, the work starts now, at home.

American producers, manufacturers, and financiers are also well-positioned to shape the development and deployment of new, low-emissions, resilient, and secure baseload energy resources from geothermal and next generation nuclear. Both sectors leverage unparalleled domestic U.S. expertise in subsurface geology, advanced manufacturing, and the marriage of technical expertise and financial prowess that is needed to achieve terawatt-sized scale up.

Depending on the reactor size, each gigawatt of need is likely to require somewhere between three and 70 modular reactors. With a global addressable market that is easily in the hundreds of gigawatts — including Africa, Latin America, South Asia, and the ASEAN region — the opportunity is enormous. China is also vying to be the energy supplier of choice for many of these areas, a reality that should invigorate American competitive spirit. To boot, meeting the emerging nuclear opportunity is not just an American venture, but an Allied one — Australian and Canadian uranium and Japanese and South Korean construction, steel, and forging capabilities will also be critical. Advanced geothermal can also strongly compete in many of the same markets at nuclear, particularly in East Africa and the Indo-Pacific. 8

Energy and Resilience – Policy Briefs 2025

To unlock nuclear and geothermal opportunities, this Administration should take three key steps.

First, the Defense Department should consider becoming an anchor customer for small modular reactors and advanced geothermal, starting in Alaska. An open competition should be used to select the most appropriate technology at the lowest cost and highest safety and scalability, with the incentive of being able to serve an electricity portfolio larger than any current developer’s prospective orderbook. 9

Second, the Administration should consider seeking supplemental funding for the Development Finance Corporation to facilitate exports of American firms’ advanced nuclear reactors and advanced geothermal systems. To ensure congruence with core U.S. national interests, the DFC should be encouraged to prioritize project financing for areas with the highest combination of strategic competition and energy poverty.

Third, the Administration should launch an Indo-Pacific energy geoeconomics initiative. Electricity and fuels are a critical competitive domain, and the United States should leverage its competitive advantages across the clean and reliable energy sources and technologies it excels at: LNG now and with the right approach, advanced geothermal and modular nuclear in the nearfuture. To win the next decade’s battle for energy supremacy, we need to lock in our advantage in the next 12 months.

Notes

1 Miles, Steven R , Gabriel Collins, and Anna Mikulska “US Needs LNG to Fight a Two Front Gas War” Houston: Rice University’s Baker Institute for Public Policy, August 18, 2022 https://doi org/10 25613/GDVP-QN45

2.Collins, Gabriel, Kenneth B. Medlock III, Anna B. Mikulska, and Steven R. Miles. “Strategic Response Options If Russia Cuts Gas Supplies to Europe.” Rice University’s Baker Institute for Public Policy, February 11, 2022. https://www.bakerinstitute.org/research/strategic-response-options-if-russia-cuts-gas-supplieseurope.

3 Osinbajo, Yemi “The Divestment Delusion: Why Banning Fossil Fuel Investments Would Crush Africa ” Foreign Affairs, August 31, 2021 https://www foreignaffairs com/articles/africa/2021-08-31/divestmentdelusion

4 Collins, Gabriel “A US Led Energy and Food Abundance Agenda Would Reshape the Global Strategic Landscape ” Houston: Rice University’s Baker Institute for Public Policy, April 11, 2024 https://www bakerinstitute org/research/us-led-energy-and-food-abundance-agenda-would-reshape-globalstrategic-landscape

5. Collins, Gabriel. “The US China Economic Relationship Needs ‘Robust De Risking,’ and a Little Strategic ‘Decoupling.’” Houston: Rice University’s Baker Institute for Public Policy, November 13, 2023. https://www.bakerinstitute.org/research/us-china-economic-relationship-needs-robust-de-risking-and-littlestrategic-decoupling

6 U S Department of the Treasury “Guidance on Fossil Fuel Energy at the Multilateral Development Banks ” Washington, DC: U S Department of the Treasury, August 16, 2021 https://home treasury gov/system/files/136/Fossil-Fuel-Energy-Guidance-for-the-MultilateralDevelopment-Banks pdf

7 Humphrey, Hubert H Food and Fiber as a Force for Freedom Washington, DC: United States Government Printing Office, 1958. https://books.google.com/books?id=ll1xQEACAAJ&source=gbs navlinks s.https://foreignpolicy.com/2024/10/07/alaska-geothermal-militarychina/

8. Collins, Gabriel. “Alaska Geothermal Power Can Fuel U.S. Indo-Pacific Strategy.” Foreign Policy, October 7, 2024 https://foreignpolicy com/2024/10/07/alaska-geothermal-military-china/

9 Collins, Gabriel, and Anna Mikulska “Gas Geoeconomics in Europe: Using Strategic Investments to Promote Market Liberalization, Counterbalance Russian Revanchism, and Enhance European Energy Security” Research Paper, Rice University’s Baker Institute for Public Policy, May 31, 2018 https://www bakerinstitute org/research/egas-geoeconomics-europe/ Energy and Resilience – Policy Briefs 2025

TRILATERAL RECOMMENDATIONS FOR PACIFIC ENERGY AND NATIONAL SECURITY

Author: Henry Haggard Nonresident Fellow

Goal

Incorporate trilateral energy cooperation as a central pillar if Camp David trilateral engagement continues and/or start a separate, trilateral energy coordination mechanism for the United States, Japan, and South Korea.

Option 1

Camp David Summit Agenda picked up by Trump Administration.1

Method: Build a government-led trilateral energy pillar separate from and in support of the Camp David Agenda based on a Baker Institute-led study and in collaboration with Stanford’s Hoover Institute to develop the most effective areas to focus on based on Japan’s recently released energy strategy and the approach of the new U.S. administration.2

Hold a series of joint webinars and meetings with Japanese, Korean, and U.S. officials and energy policy experts to build a trilateral energy agenda.

Convene a track 1.5 trilateral energy security dialogue based on the agendas and preparatory work done between January and March. July 2025 onward: Trilateral Energy Security Dialogue held in Korea, Japan, and the U.S., alternating and on a quarterly or biannual basis.

Option 2

Camp David Summit Agenda not adopted by Trump Administration

Method: Focus efforts on Track 2 work to build trilateral energy cooperation.

Host a webinar to discuss the potential for trilateral energy cooperation. Kick off in-person meeting with think tanks and energy industry officials. Invite ROKG, GOJ and USG participants or observers.

Launch a biannual series of in-person meetings, alternating between the United States, Korea and Japan to encourage greater trilateral coordination. In 2026, present findings and progress along with recommendations to the three governments, offering a specific way forward should the governments choose to adopt trilateral energy cooperation as a key area of focus.

Areas of Focus:

Three Potential Sample Policy Areas for Trilateral

Coordination

1.

Minerals Security Partnership (MSP):

The MSP continues as a core multilateral organization since it works to Trump 1.0 goals to secure critical minerals and develop a secure supply chain not dependent on China.3 That trilateral coordination within the MSP would serve as a key driver, for policy, projects, and investment.

Ultimately, the USG would consult with the ROKG and the GOJ before any MSP meeting, much as the USG does now with the P3 (France, UK and the United States) before any UN meeting or as the USG does now with the quad (UK, France, Germany) before any NATO meeting to coordinate approach and ensure cohesion among the leading countries.

To develop such an approach, all three governments should develop a greater awareness and understanding of their current leadership role (Japan served as the chair of the MSP until June 2024, Korea currently serves as chair) as well as the potential for this type of coordination.

Engage with Trump administration State and DOE teams to highlight the potential and lay out how to institute and institutionalize such an approach.

Approach Seoul and Tokyo with same pitch through in-person meetings with their top diplomatic and energy officials.

Agree on several key initiatives and targets that the three countries could advocate for within the MSP.

Highlight the wins of a more effective MSP, energized by the three countries that have most at stake and have most capacity to invest capital, mineral extraction, and processing ability to help boost non-China dependent mineral supply chains. Potential areas for cooperation:

Japan and the United States could join the ROK-led MSP working group on the Mahenge Mine project.4

Japan (JOGMEC, JBIC) could offer a virtual briefing to Korea and the United States to describe Japanese private sector investments in upstream and midstream minerals (e.g., Sumitomo, Mitsui).

Methane Abatement 2.

Japan, the ROK, the United States, and other countries issued a Joint Statement in July 2023 to collaborate on reducing greenhouse gas (GHG) emissions, particularly methane, from LNG imports and exports. JERA and KOGAS also launched the CLEAN Initiative, a voluntary effort where gas buyers would seek methane emissions data from producers to prioritize procurement of lower-methane gas. 5 6

Establish regular meetings in which the United States, Japan, and Korea discuss policy and industry steps to mitigate methane and CO2 emissions from internationally traded fossil fuels, including through implementation of the CLEAN initiative. We recommend inviting technical experts (governmental, academia, industry, NGOs, etc.) to brief the United States, Japan, and the ROK on tools that can be used to measure and mitigate greenhouse gases (methane and CO2) from imported fossil fuels, including assessing existing policy levers, examining price and market impacts, and assessing internationally aligned approaches to cut emissions from traded fuels.

Assemble a team of experts, working with other institutions, to brief USG, ROKG, and GOJ officials, planting the seed for regular track 1.5 and track 2 trilateral meetings to advance methane abatement coordination.

Brief industry representatives based on the findings assembled during the meetings in order to encourage them to take efforts to reduce methane emissions.

Technical Assistance Coordination in the Pacific Islands Counties (PICs) 3.

USTDA has funded a mini-grid feasibility study evaluating site configurations for 75 priority sites in Fiji. USTDA is also conducting a site selection study supporting renewable energy in Tonga. USTDA is actively considering several other activities in the region from rooftop solar and BESS to utility-level smart grid roadmaps.

The three governments share information on projects through regularly scheduled calls to minimize overlap and interference in other countries’ efforts.

The Center for Energy Studies at the Baker Institute at Rice University has served to enhance collaboration between industry, think tanks and governments of ROK, Japan and US over the past year and would be willing to be a convener and policy advisor for Trilateral Energy Cooperation going forward.

Briefs 2025

Notes

1 The White House “Fact Sheet: The Trilateral Leaders Summit at Camp David ” The American Presidency Project (U S National Archives), August 18, 2023 https://bidenwhitehouse archives gov/briefingroom/statements-releases/2023/08/18/fact-sheet-the-trilateral-leaders-summit-at-campdavid/#:~:text=The%20United%20States%2C%20Japan%2C%20and%20the%20ROK%E2%80%A6

2 METI Agency for Natural Resources and Energy “Basic Plan on Energy and the Environment ” Ministry of Economy, Trade and Industry, March 19, 2025

https://www enecho meti go jp/en/category/others/basic plan/

3 U S Department of State “Minerals Security Partnership ” U S Department of State https://www state gov/minerals-security-partnership

4 U S Department of State “Joint Statement on Establishment of the Minerals Security Partnership Finance Network ” Media Note, Office of the Spokesperson, September 23, 2024 https://2021-2025 state gov/jointstatement-on-establishment-of-the-minerals-security-partnership-finance-network/

5 European Commission “EU and Global Partners Reaffirm Their Commitment to Tackling Methane Emissions in the Natural Gas Value Chain ” European Commission, DG Energy, July 18, 2023 https://energy.ec.europa.eu/news/eu-and-global-partners-reaffirm-their-commitment-tackling-methaneemissions-natural-gas-value-chain-2023-07-18 en.

6.Čučuk, Aida. “KOGAS, JERA to Reduce Methane Emissions in LNG Value Chain.” Offshore Energy, July 19, 2023. https://www.offshore-energy.biz/kogas-jera-to-reduce-methane-emissions-in-lng-value-chain/.

7. U.S. Trade and Development Agency (USTDA). “USTDA Advances Rural Electrification in Fiji.” May 18, 2023. https://www.ustda.gov/ustda-advances-rural-electrification-in-fiji/.

8. U.S. Trade and Development Agency (USTDA). “USTDA Signs Infrastructure Deal in Tonga, Expands Pacific Island Commitments.” April 22, 2022. https://www.ustda.gov/ustda-signs-infrastructure-deal-intonga-expands-pacific-island-commitments/

HYDROCARBONS AND MINERAL RESOURCES IN THE WESTERN HEMISPHERE

Author: Francisco Monaldi

Wallace S. Wilson Fellow in Latin American Energy Policy

Introduction

Latin America concentrates the largest reserves and production of critical minerals for the energy transition, such as lithium and copper. The region also holds the world’s secondlargest hydrocarbon reserves behind the Middle East, with oil and gas production surging in Guyana, Brazil, and, more recently, Argentina. Overall, resources in the Western Hemisphere play a crucial role in supporting the energy security of the United States and its allies, as well as ensuring reliable and stable energy availability.1

The world’s dependence on China for the supply of refined critical minerals poses a major geopolitical risk for the development of energy supply chains (i.e., solar, wind, electricity, batteries). Similarly, U.S. and European energy companies and policymakers are looking towards Latin America for hydrocarbons supply and energy security, as the Ukraine and Middle East conflicts have increased geopolitical risks in other major producing regions.

To promote global energy security, the U.S., its European and Asian allies, and the region’s resource policies should support the development of critical minerals in the region and, whenever competitive, the development of local supply chains. Hydrocarbon development should also be encouraged, along with significant investments in decarbonization, partially funded by hydrocarbon exports’ revenues.

Critical Minerals

The demand for minerals such as copper, nickel, cobalt, lithium, and those in the rare earths group for energy transition technologies will at least double by 2030, according to recent estimates. The ability to sustain production growth and supply chains at affordable costs and prices, while also providing sufficient margins to mining and processing companies, are major concerns ahead. Given its dominant share of reserves and production, Latin America’s supply of critical minerals would need to grow substantially to support rising global industrial demand and the expansion of sustainable energy technologies and systems. That offers a major economic opportunity for the region, but there are significant challenges to seizing it.

In 2022, Chile and Peru produced around 35% of global mined copper and held around a third of global copper reserves. Chile, Argentina, and Brazil produced 37% of the global lithium supply in 2022, with around half of the global reserves. The region produces 10% of the global nickel supply and holds close to one quarter of the global reserves. However, the region is not developing its full mining potential. In fact, Latin America’s minerals production has declined in total tonnage and even more as a share of global production. An extreme case of underdevelopment is Bolivia, whose lithium resource base is massive, but so far has not been extracted.

3

A variety of obstacles have limited the full development of the region’s potential. Historically, Latin America’s extractive sectors have seen recurrent episodes of resource nationalism, particularly in oil and gas but also in mining, characterized by increased state control over the industry and investment expropriation. These episodes have typically occurred in cycles induced by structural forces and ideological pendular movements. High resource prices/rents and the end of successful investment cycles, increasing production and reserves. During such episodes, governments increase taxes, renege on contracts with private investors, and enhance state intervention. Ideology and institutions can limit or exacerbate the intensity of these events in each country, but the cycle is typically initiated by structural factors. The reverse occurs with resource price busts, and when a new investment cycle is needed, countries tend to liberalize the sector and the state retreats.

4

Given the significant concentration of critical minerals in the region, particularly lithium and copper, and the potential for increasing rents in their extraction, the political risks of resource nationalism in the region are likely to increase. In fact, we are already witnessing a drive for more government control, ‘nationalization,’ and higher government-takes in Bolivia, Chile, and Mexico, and the cancelling of a major copper mine concession in Panama. Besides state control and higher takes, governments are increasingly pursuing domestic value-added and local-content policies, some considering protectionist, Indonesia-style, mining processing requirements that restrict raw material exports. In addition, local and indigenous communities are challenging permits over land use and resource impact concerns and/or pushing for direct revenue sharing. The failure of state royalty-distribution schemes to promote development in the mining regions has exacerbated this tendency. Between 2000 and 2020, mining-associated conflicts in Chile and Peru almost quadrupled. Paradoxically, Argentina, where macroeconomic volatility and foreign exchange controls have been a major obstacle for foreign investment in general, offers one of the most promising environments for mining growth. Provincial governments, which are the owners of the resource, have generally been favorable to private mining development, and the country has been less prone to socio-environmental conflicts than the Andean region. 5

Since the early 2000s, China has increased its control over the processing of many critical minerals. Currently, China has a dominant position in lithium (controls 60% of world processing capacity and supplies 14% of global LCE from its own resource base) and copper (China controls 50% of copper processing capacity, expected to increase another 45% in the years ahead, and supplies 42% of copper metal). The Chinese presence in many large minerals supplying countries cuts across supply chains. The implications for Latin American producers are significant. Chile controls 24% of global mined copper but only 8% of refined output. The difference for Peru is 10% mined to 1% refined, and for Mexico, 3% mined to 2% refined. China provides only 9% of global mined copper but 42% of copper metal. Chinese companies have invested in infrastructure, energy, and minerals projects in many Latin American countries, in some instances with the Chinese government providing unconditional loans.6

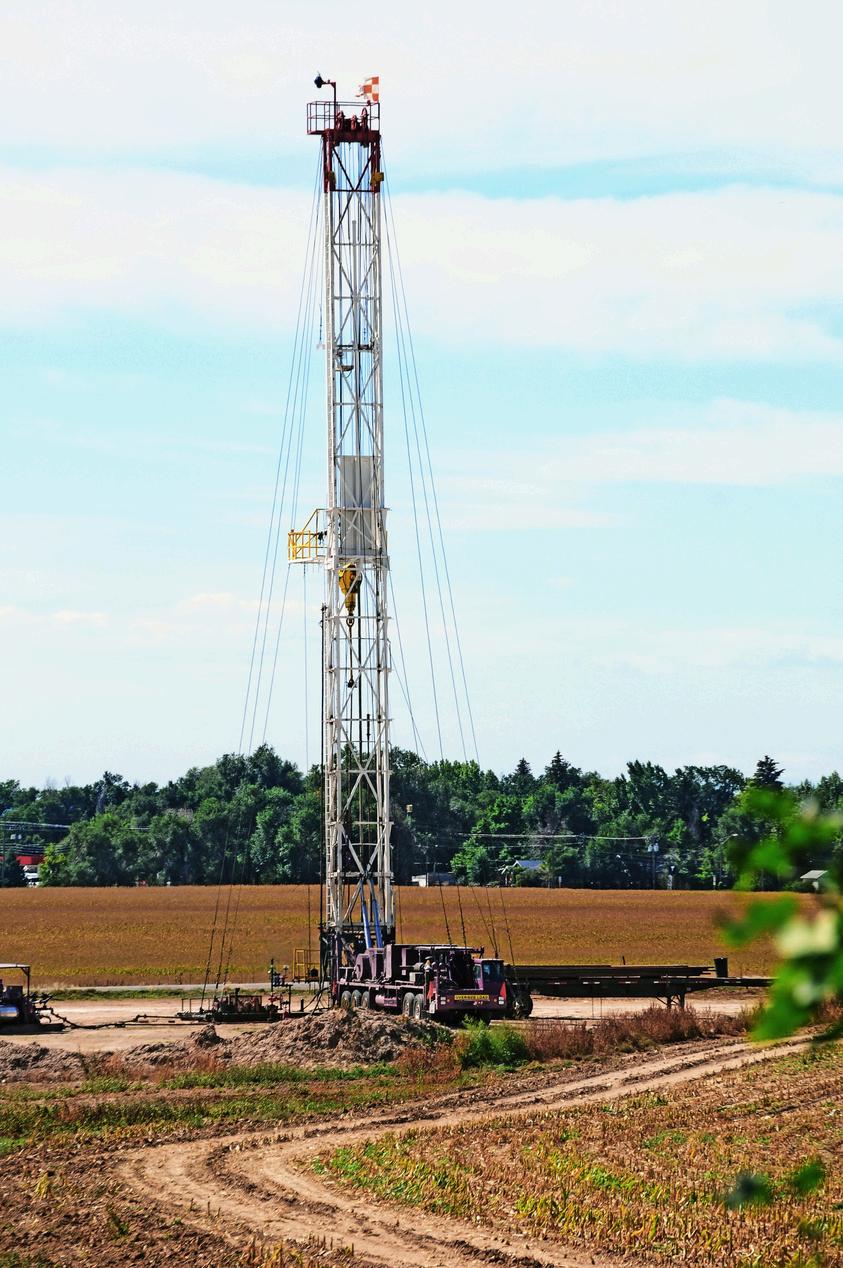

Hydrocarbons

Latin America is home to the second-largest hydrocarbon reserves in the world after the Middle East, but until recently, production was in decline due to political risks and state intervention. However, prospects for change are optimistic. Since 2022, Latin America’s regional oil production has been up, largely due to surges in Guyana and Brazil, and production promises to continue growing at least for the rest of the decade. In addition, there are good prospects for increased global natural gas exports from the region, largely from Argentina (and possibly Venezuela). Heightened geopolitical risks posed by two of the other major producing regions — Central Asia and the Middle East — have turned the attention of U.S. and European companies and policymakers to the relatively geopolitically stable -and open to investment- Latin America region.7

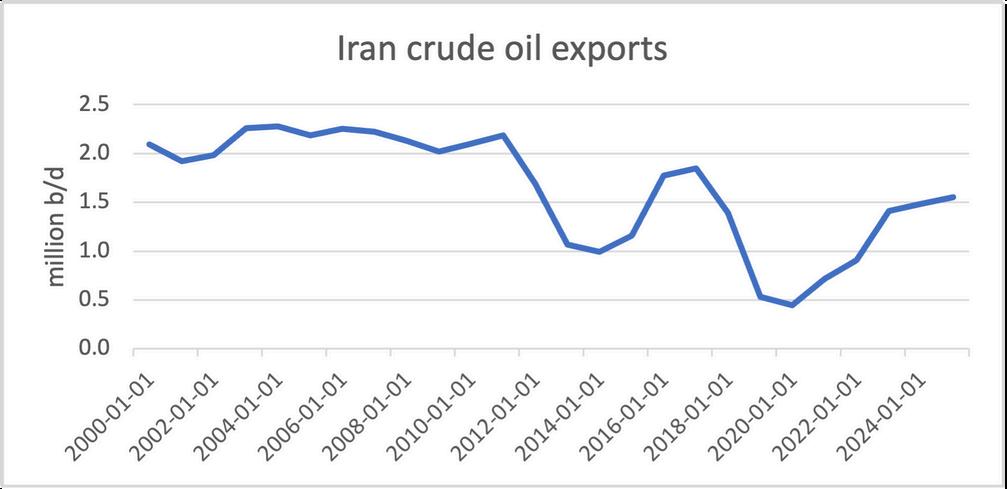

Despite calls to reduce global fossil fuel consumption, global hydrocarbon demand has kept growing. U.S. and European sanctions imposed on Russia and Iran have been limited by the need to mitigate surges in oil and gas prices as well as the risks of overdependence on other members within the OPEC+. Increases in U.S. and Canadian hydrocarbons production have been critical in moderating the economic consequences of these geopolitical disruptions, and Latin America has also been a major contributor to sufficient supplies of fossil fuels. Added Latin American supplies complement growing U.S. production in reducing the risk of major economic repercussions in the U.S. and globally from a disruption in supplies from the Middle East, for example. Increased production in the Western Hemisphere limits the market power of OPEC+ nations. Furthermore, with the strong base of U.S. corporations in the oilfield equipment, services, production, and workforce, U.S. oil and gas companies will have strong competitors in those countries, and thus, the U.S. economy will also be a beneficiary of oil/gas development there. 8

Guyana’s oil production is one of the most remarkable success stories in the last few decades. Offshore oil was first discovered there by ExxonMobil in 2015. Production started in 2019, and by the end of the first quarter of 2024, it had reached 600,000 barrels per day (bpd). The U.S. Energy Information Administration (EIA) forecasts that Guyana’s production will surpass 800,000 bpd in 2025, adding more than 300,000 bpd in two years. In turn, Brazil’s production is expected to grow by more than 250,000 bpd in the same period. These increases will make Guyana and Brazil, along with the U.S. and Canada, the largest sources of production growth in 2024–25, allowing Latin America to surpass the production levels of 2017. In fact, it is estimated that Latin America will provide the largest increase in output among private international oil companies for the remainder of this decade.

In Brazil, President Luiz Inácio Lula da Silva is following a pragmatic approach, pushing forward investments in hydrocarbon exploration and production while pursuing significant investments in decarbonization. This could prove to be a smart strategy that balances energy security, development, and climate considerations.

Argentina should continue to grow, although arguably below its potential, due to macroeconomic instability and political risks. Still, the pro-business Milei administration is working to improve the business environment to develop the country’s massive shale resource base. Even though it is years away, Argentina could become a major source of liquified natural gas (LNG) exports if it can deploy the needed infrastructure investment to ship the gas overseas.

Venezuela is a major question mark. Despite having massive resources, low geological risks, and significant brownfields ready for investment, Venezuela’s political risks, deteriorated state capacities and infrastructure, and its fraught relations with the U.S. all make large production recovery unlikely in the short term, unless there is a regime change.

Overall, Latin America’s hydrocarbons surge is a welcome development for global energy security. If global hydrocarbons demand does not fall rapidly over the next decade, Latin America’s contribution to supply will be crucial to mitigating geopolitical energy risks. In addition, revenues generated by additional oil and gas exports would boost economic growth and government revenues in the exporting countries of the region.

From a climate perspective, the industry focus should be on reducing natural gas flaring and venting, particularly in Mexico and Venezuela.9

Policy Strategy

The U.S. government should encourage the development of critical minerals and hydrocarbon resources potential in the Western Hemisphere. To further this objective, it is necessary to incentivize the U.S. and other Western companies to invest in the region. That implies reducing the political risks of investing in resource development. Reducing those risks involves, increasing foreign investors’ legal protections, supporting the competitive development of supply chains in the Western Hemisphere, as well as improving environmental standards, resource wealth management, and the delivery of benefits for local and indigenous communities.

Multilateral development banks, such as the World Bank and the Inter-American Development Bank, in which the U.S. and its allies have a significant participation, should play a role in all these areas. Providing policy advice, institutional capacity building, and loans where appropriate.

Investment treaties and trade agreements are another tool to advance these objectives, as well as a targeted use of instruments such as loans and political risk insurance by U.S. agencies.

On the minerals side, a key strategic objective should be the development of competitive supply chains in the Western Hemisphere that are needed to support industries in the U.S. At the same time, ensuring that resource nationalism, local content, and value-added policies do not become a deterrent for resource development. One policy option is to expand the existing Minerals Security Partnership to include Latin American countries such as Argentina, Brazil, Chile, and Peru.

On the Latin American hydrocarbons side, a strategic objective should be to encourage private investments in reducing emissions from hydrocarbon production. It is important to push for significant reductions in natural gas flaring and venting and/or penalization of excessive emissions. Similarly, it would be desirable to encourage the earmarking of fiscal revenues from hydrocarbons for emissions mitigation in the most cost-effective areas, which include hydrocarbon extraction (including carbon capture), natural gas flaring and venting, and land/forestry management.

1 Foss, Michelle Michot, Benigna Leiss, Tilsa Oré Mónago, and Francisco Monaldi “Political Risk and Resource Nationalism in Latin American Mining and Minerals ” Rice University’s Baker Institute for Public Policy, December 12, 2024 https://www bakerinstitute org/research/political-risk-and-resource-nationalism-latinamerican-mining-and-minerals

2 Foss, Michelle Michot “Minerals and Materials Challenges for Our Energy Future(s): Dateline2024 ” Rice University’s Baker Institute for Public Policy, September 20, 2024 https://www bakerinstitute org/research/minerals-and-materials-challenges-our-energy-futures-dateline-2024

3 Foss, Michelle Michot, Benigna Leiss, Tilsa Oré Mónago, and Francisco Monaldi “Political Risk and Resource Nationalism in Latin American Mining and Minerals ” Rice University’s Baker Institute for Public Policy, December 12, 2024 https://www bakerinstitute org/research/political-risk-and-resource-nationalism-latinamerican-mining-and-minerals

4 Monaldi, Francisco “The Cyclical Phenomenon of Resource Nationalism in Latin America ” Oxford Research Encyclopedia of Politics, March 31, 2020 https://oxfordre com/politics/display/10 1093/acrefore/9780190228637 001 0001/acrefore9780190228637-e-1523

5. Poveda, Rafael. Estudio comparativo de la gobernanza de los conflictos asociados a la minería del cobre en Chile, el Ecuador y el Perú. Santiago: United Nations Economic Commission for Latin America and the Caribbean (ECLAC), December 15, 2021. https://www.cepal.org/es/publicaciones/47569-estudiocomparativo-la-gobernanza-conflictos-asociados-la-mineria-cobre-chile.

6.Foss, Michelle Michot, Benigna Leiss, Tilsa Oré Mónago, and Francisco Monaldi. “Political Risk and Resource Nationalism in Latin American Mining and Minerals.” Rice University’s Baker Institute for Public Policy, December 12, 2024. https://www.bakerinstitute.org/research/political-risk-and-resource-nationalism-latinamerican-mining-and-minerals

7 Monaldi, Francisco J “Latin American Oil Production: A Rosy Outlook, for a Change ” Houston: Rice University’s Baker Institute for Public Policy, August 22, 2024

8 Spring, Jake “Lula Says Brazil Never to Be Full Member of OPEC+, Only Observer ” Reuters, December 3, 2023 https://www reuters com/world/americas/lula-says-brazil-never-be-full-member-opec-only-observer-2023-1203/

9 Except for Venezuela, rising oil production in the region comes from fields with lower carbon intensity than the world average

Introduction

The new administration has set goals such as improving energy security, strengthening America's manufacturing industry, and ensuring American leadership and dominance in artificial intelligence (AI) technology. Traditionally, the United States has favored liberal markets under the premise that markets, through competition, are the best mechanism to secure economic growth, innovation, and efficiency. As a result, heavy-handed government intervention has not found support in America.

However, recent policy measures declared by the new administration contradict such a belief: Trade tariffs and restrictive migration are used to reduce (external) competition in the local economy. Both can deeply affect economic efficiency, particularly if brought together. In this regard, two key concepts that help us understand how market players and markets, in general, function are incentives and rationality: firms, as profit maximizer agents, transform inputs (labor force, capital, intermediary goods) into outputs or products and minimize production costs. Thus, companies facing increasing production costs – due to higher labor costs, more expensive imported capital goods, or higher-cost local supply chains – are incentivized to pass such increased costs to consumers. Consumers are finally the most affected because of high prices, lower competition, and fewer choices. In the medium run, with higher final prices, domestic production also loses competitiveness in the global market, adversely affecting exports and economic growth. The impact can be worsened if retaliatory tariffs are imposed. In fact, empirical evidence shows that tariff policies can hinder economic growth. Specifically, the 2018 U.S. trade tariffs reduced U.S. real income: aggregate real income loss is estimated to equal 0.04% of GDP. 1,2,3

Tariff Impacts on Supply Chains

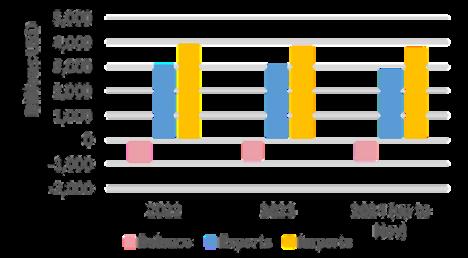

Contrary to what is promised to Americans, a tariff policy can backfire on American economic goals. The U.S. has been a net importer of traded goods and services for a long time, since the mid-70s; Figure 1 shows information for the last three years. In 2023, the U.S. exported $3 trillion U.S. dollars and imported $3.9 trillion in goods and services. From these figures, traded goods comprised roughly 65% of total U.S. exports and 80% of total U.S. imports.

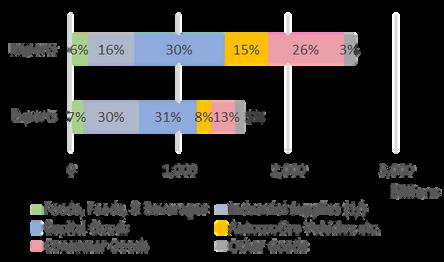

Goods imported by the U.S. mostly consist of capital goods, consumer goods, and industrial supplies, which jointly represent 72% of the total imported goods (Figure 2). These goods are precisely used by the manufacturing sector (in particular, the automotive one), the energy industry, AI technology, and end consumers.

This shows, for instance, that if tariffs are implemented on imported goods, then capitalintensive industries such as manufacturing and consumers will be vastly affected.

Figure 1 US international trade in goods and services (*)

Source: Based on US Census Bureau data on U S International Trade in Goods and Services (https://www census gov/foreign-trade/Press-Release/current press release/index html)

Notes: (*) Seasonally adjusted figures

Figure 2 — Real U.S. trade in goods by principal end-use category (2024, up to Nov)

Source: Based on US Census Bureau data on U S International Trade in Goods and Services (https://www.census.gov/foreign-trade/Press-Release/current press release/index.html).

Notes: (1/) Includes petroleum and petroleum products.

Energy and Resilience – Policy Briefs 2025

Looking at more detailed 2024 data through November, the majority of imported industrial supplies consist of minerals and related mineral materials (30%) and oil and fuels (35%). Likewise, 50% of the imported capital goods comprise semiconductors, computers, electric apparatus, and telecom-related goods, and 49% of imported consumer goods are pharmaceutical preparations, household appliances, cellphones, and other household goods. American companies and consumers depend highly on minerals, electrical appliances, materials, telecommunication-related goods, and even pharmaceutical goods. Most of these goods are imported from trading partners: Mexico, Canada, and China (Figure 3).

Imposing tariffs on goods from Mexico, Canada, and China would harm an important part of the American economy reliant on those goods. As shown in Figure 3, in 2024, these countries jointly accounted for 42% of the total goods imports and are also the top recipient countries of U.S. goods exports. Moreover, despite free trade agreements with Chile, Peru, and Colombia, U.S. trade with South America — a key player in critical minerals — remains limited, especially when compared to Mexico. South America accounts for just 4% of U.S. goods imports and 6% of goods exports.

Source: Based on US Census Bureau data on U S International Trade in Goods and Services (https://www.census.gov/foreign-trade/PressRelease/current press release/index.html). Energy and Resilience – Policy Briefs 2025

Figure 3 — Shares by trading country of US value traded goods (2024, up to Nov.)

Critical Minerals: South America’s Role

Globally, due to larger investments in new energy technologies and the increasing use of AI technologies, the demand for critical minerals will continue growing consistently in the coming years. These resources – reserves and production levels – are geographically concentrated in a few regions; South America is one of them. Chile and Peru produce around 35% of the global copper mined, accounting for around 31% of global copper reserves. Likewise, Chile, Argentina and Brazil produced 36% of Lithium and concentrated 53.2% of the global lithium reserves of 26 million tons by the end of 2023.

6,7

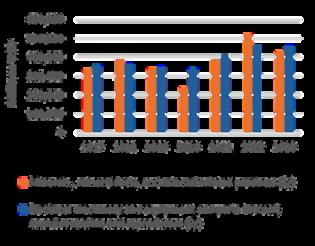

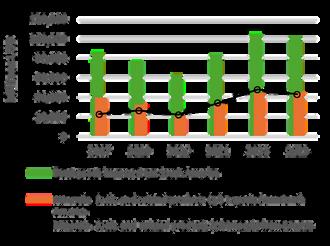

Of all U.S. imported goods’ value in 2023, USD 428 billion (roughly 14% of the value of total imported goods) comes from minerals, fuels, and materials, and another USD 455 billion –14 to 15% of the total – from electrical machinery, equipment, sound recorders, and reproducers. In both cases, the value of those imported goods has increased since 2021 (Figure 4). In 2023, USD 45 billion of minerals and related materials were imported from South America, which only represents 10% of minerals imported by the U.S., and is equivalent to the amount imported from Mexico (Figure 5). It is important to highlight that the total goods imports from South America declined during the previous Trump administration, compared to previous levels – the 2020 levels ended up below the figures observed in 2010 – and recovered since 2021. The U.S. could expand its mineral and related material imports from South America, leveraging on its existing Free Trade Agreements with some countries.

Source: US HS-2 goods imports by partner (in Millions of USD). Available at https://www.trade.gov/datavisualization/tradestats-express-us-trade-partner-countries-and-regions

Notes: Information of good imports for South America for year 2028 was missing.

(1/) Category includes HS-2 codes 25,26,27,28, 72,73,74,75,76,78,79,80, 81 and 83.

(2/) Category include HS-2 code 85

Energy and Resilience – Policy Briefs 2025

Figure 4 — U.S. goods imports for two categories of goods: minerals and related goods, and electrical machinery (incl. computers and semiconductors)

Figure 5 — U.S. goods imports from South America and Mexico

Moreover, ensuring leadership in AI technology requires vast access to critical minerals, reliable energy, energy infrastructure, and high-skill labor. As identified before, a significant share of all imported goods in the U.S. is associated with minerals and derived products. Access to critical minerals is strategic and crucial for the U.S. economy and its industries, particularly considering energy security, manufacturing leadership, and AI powerhouse goals. Key industries, such as the energy sector, need minerals such as copper, nickel, cobalt, lithium, rare earths, and related materials to expand electricity networks, storage capacity, power generation, and emerging AI technology. The expansion of AI technology –based increasingly on generative AI models – highly relies on energy (data centers, grid capacity), computing power, and hardware (semiconductors and other materials). For example, training a large language model, such as GPT-3, consumes as much electricity (1280 MWh) as the total consumption of an average American household for 10 years. Copper is also widely used in electronic appliances, wires, circuit boards, and electrical apparatuses, highlighting its importance for electricity networks and AI technologies.

China (11%), USA (11%), Argentina (5%), Netherlands (3%), Spain (3%)

Brazil (15%), China (9%), USA (8%), Chile (6%), India (5%)

China (39%), USA (14%), Japan (8%), South Korea (6%), Brazil (5%)

USA (26%), Panama (10%), Netherlands (6%), India (4%), Brazil (4%)

China (30%), USA (15%), Canada (5%), Japan (5%), South Korea (4%)

USA (27%), China, (17%) Panama (14%), Chile (4%), Colombia (3%)

India (16%), Brazil (14%), , Argentina (13%), Colombia(6%), Japan (7%)

China(24%), Brazil(14%), Argentina (8%), USA (7%), Netherlands (5%)

China (16%), Turkey (14%), Spain (12%), USA (10%), Brazil (8%)

Source: Statista

Table 1 — Top 5 export partners by share of total exports (2022)

On the other hand, in the race for AI technology leadership, attracting and working with talented and highly skilled labor is crucial. In the short run, this would require reforming the migration policies and making them more flexible for the skilled labor force to retain and attract more qualified workers and scientists. In the medium to long run, this requires increasing investment in AI research and development and promoting STEM education among Americans.

A Strategic Path Forward