Mill Rock

Packaging_Cover overlay_mg117.indd 1

JOIN THE WAITLIST NOW

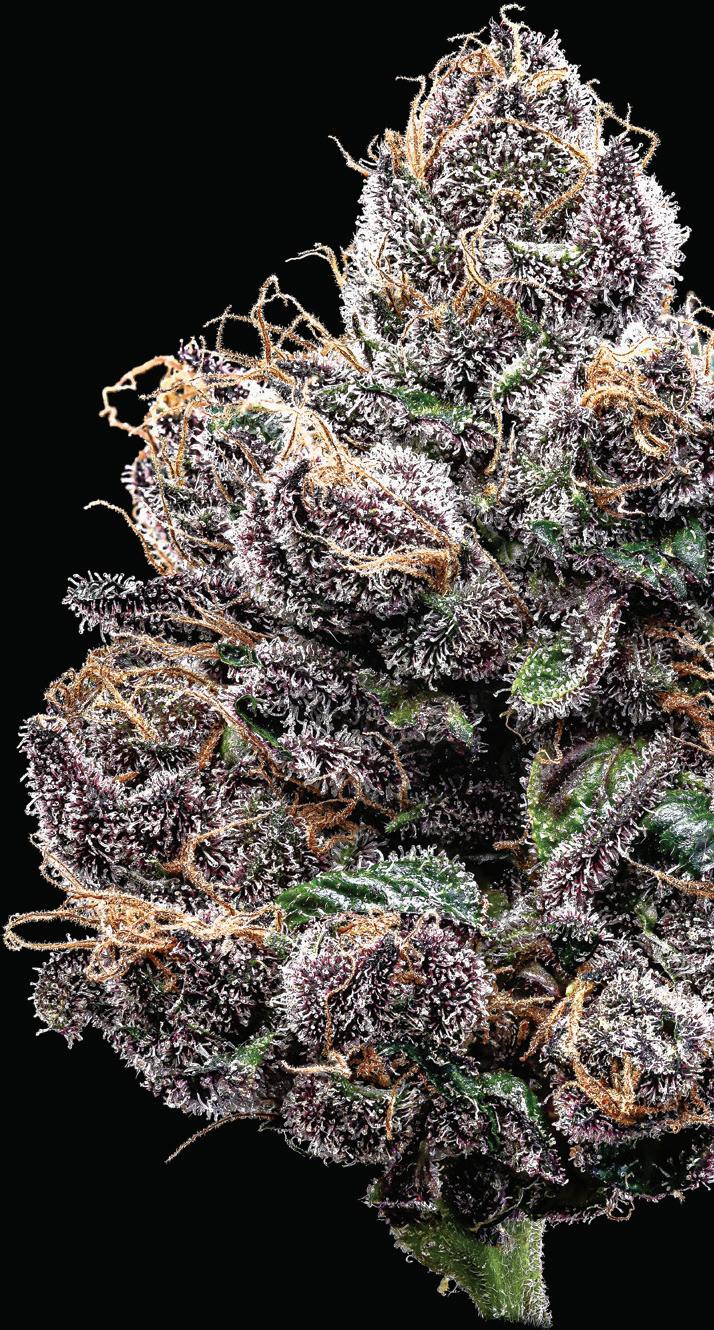

Introducing SB1 (Sensi Boost 1) — Advanced Nutrients’ 8th-Generation Breakthrough Brix, Resin & Terpene

Enhancer

Supercharge your grow with SB1 for massive, sugar-coated, resin-saturated buds exploding with flavor and aroma.

After 25+ years of research, we’ve cracked the code on crafting the sweetest, gooiest, most terpene-rich flower possible.

: Breakthrough nanotechnology enables direct sugar uptake, maximizing unsurpassed resin production and terpene enhancement. Unlike conventional products with oversized sugar molecules that only feed substrate microbes, NanoCarb’s nanosized carbohydrates are absorbed directly into your plants, fueling rapid growth, significantly enriching flavor profiles, and

: Advanced Nutrients’ exclusive compound derived from fermented sugarcane extracts. This powerful biostimulant unlocks your flower’s flavor, quality, and bag appeal like nothing else on

With over 25 years of science-backed innovation, Advanced Nutrients delivers solutions that growers in over 120 countries maximize crop value. Don’t waste your time and money on subpar carbohydrates your plants can’t absorb. Harness SB1’s cutting-edge technology and experience heavier harvests of the frostiest, most mouthwatering flower you’ve ever produced.

THE NEWSROOM

News, data, trends, and other tidbits for the well-informed professional.

The benefits of buying equipment from a domestic supplier go beyond simply avoiding tariffs.

Cannabis, culture, and community collide at The Artist Tree’s chic new lounge.

To meet a dramatic increase in demand, Germany needs more international cultivation partners.

With bold leadership and a savvy e-commerce strategy, Somia Farid Silber is reimagining her family’s iconic fruitbouquet brand for a new era.

Demand-response systems can help reduce costs, boost efficiency, and futureproof operations.

HUMAN RESOURCES

New 401(k) hurdles are testing industry employers. Proactive moves can make all the difference.

Are federal bankruptcy courts beginning to soften their stance about relief for industry businesses?

while maintaining

Packaging isn’t just protection—it’s also a strategic brand ambassador. These expert providers merge compliance, creativity, and conscience to create lasting impact.

But would a product with any other package sell as well? That’s a question psychologists have been busy trying to answer lately.

According to a 2024 study in the scholarly journal Frontiers in Nutrition, “packaging color entices and influences consumer perceptions and significantly affects the identification of products.” Authors Jie Su and Shuqi Wang found 80 percent of consumers prioritize color over shape when identifying objects. They also found consumers were 46-percent more efficient at making product choices when packaging was simplified and decorated with easy-to-recognize graphical elements. Taken together, the findings suggest that, although graphically intense packages may stand out on shelves, consumers may be less likely to choose products that are visually overstimulating.

That suggestion was supported by a 2023 study published in the American Marketing Association’s Journal of Marketing, which revealed minimalist packaging reduces cognitive overload, thereby increasing consumers’ willingness to buy a product by 27 percent.

Minimalist packages also telegraph a commitment to sustainability on the part of the company behind the product, according to a 2024 study published in Sustainability Researchers discovered simple packaging that appeared to be eco-friendly increased “green trust” by 34 percent. They attributed the effect

to consumers linking visual simplicity with transparency and ethical business practices. What does all this mean for our industry? Well, for one thing, perhaps wild packaging covered in neon colors and frenetic graphics should be consigned to the same history bin that holds green crosses and pot leaves. Consumers have moved on from cannabis’s psychedelic phase—just like they dumped peace symbols and “flower power” imagery after the early 1970s. (Of course, if retro is your niche, keep on truckin’.) Today’s consumers—bombarded from all sides by demands for their attention— apparently appreciate a kinder, gentler approach when they shop.

There’s more advice about packaging in this month’s feature, as well as a brief list of packaging professionals who undoubtedly are well informed about the latest research in their field. Times change, tastes change, even roses change—but packaging remains many consumers’ first touchpoint with your product. What do your packages say about your brand?

Kathee Brewer Editorial Director

LEAH EISENBERG

A partner at the law firm Pashman Stein Walder Hayden PC, Leah Eisenberg’s practice encompasses corporate reorganization, corporate trust default, intercreditor matters, bankruptcy litigation, cannabisrelated financing, and cross-border representation. She represents debtors, creditors, indenture trustees, committees of unsecured creditors, lenders, bidders, and acquirers. pashmanstein.com

Serial entrepreneur Niklas Kouparanis has shaped the future of the European cannabis industry since 2017. In 2020, he co-founded Bloomwell Group, which is among Europe’s largest telemedical cannabis companies. Bloomwell facilitates a reliable supply for patients and contributes to the destigmatization of the plant through data-based research. bloomwellgroup.com

MARC BEGININ

A seasoned attorney, entrepreneur, and industry pioneer in hemp and cannabis extraction technology, Prodigy Processing Solutions founder and CEO Marc Beginin is a firm believer in the quality of Americanmade products. He has been instrumental in shaping extraction industry standards, advocating for regulatory compliance, and driving innovation in cannabinoid processing. prodigyusa.com

As Enersponse’s chief business development officer, Rachel Permut relies on more than two decades of experience in business strategy, mergers and acquisitions, and product development. Previously, she led the development of new customer offerings in microgrids and e-mobility at ENGIE North America and oversaw channel sales for ENGIE Storage. enersponse.com

DENNIS BIELIK

As executive vice president and managing director at global insurance brokerage HUB International, Dennis Bielik, CFP®, CFA, FRM®, oversees operations at HUB Investment Partners, where he works to nurture relationships with clients, participants, outside vendors, and financial representatives. His goal is to help clients outperform their retirement goals. hubinternational.com

Editorial Director Kathee Brewer editorial@inc-media.com

Creative Director Angela Derasmo

Digital Strategist Dexter Nelson

Circulation Manager Faith Roberts

Contributing Writers Allison Zervopoulos, Alyson Jaen Esq., Anthony Coniglio, Brendan McKee, Chris O’Ferrell, Danny Reed, Dennis Bielik, Justin M. Brandt Esq., Kevin Hart, Kim Prince, Kris Krane, Laura A. Bianchi Esq., Leah Eisenberg Esq., Luca Boldrini, Marc Beginin Esq., Michael Mejer, Niklas Kouparanis, Rachel Gillette Esq., Rachel Permut, Ricardo Baca, Richard Proud, Robert T. Hoban Esq., Ruth Rauls Esq., Ryan Hurley Esq., Scott Thomas, Shane Johnson MD, Shawna Seldon McGregor, Stacy Litke, Sue Dehnam, Tara Coomans, Taylor Engle, Will Read

Artists/Photographers Robiee Ziegler, Eugenia Porechenskaya, James Banasiak, Mike Rosati, Christine Bishop

BRANDI MESTA

ADVERTISING SALES & CLIENT SERVICES

MEG CASHEL

Senior Account Executive

Brandi@inc-media.com (424) 703-3198

BUSINESS OFFICES

Chief Executive Darren Roberts

Tech Architect Travis Abeyta

Accounting

Diane Sarmiento

Brittany Gambrell

Subscriptions subscribe.mgmagazine.com

Back Issues store.mgmagazine.com

Mailing Address

mg Magazine

23055 Sherman Way, Box 5069 West Hills, CA 91308

(310) 421-1860 hello@inc-media.com

Account Manager

Meg@inc-media.com (424) 246-8912

mg Magazine: For The Cannabis Professional Vol.11, No.5 (ISSN 2379-1659) is published monthly by Incunabulum LLC, located at 23055 Sherman Way, No. 5069, West Hills CA 91308. Periodicals Postage Paid at Las Vegas Post O ce and additional mailing locations. POSTMASTER: Send all UAA to CFS. NON-POSTAL AND MILITARY FACILITIES: Send address corrections to mg Magazine, 23055 Sherman Way, No. 5069, West Hills CA 91308.

mg is printed in the USA and all rights are reserved. © 2025 by Incunabulum LLC. mg considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur; consequently, readers using this information do so at their own risk. Each business opportunity and/or investment inherently contains criteria understanding that the publisher is not rendering legal or financial advice. Neither Incunabulum LLC nor its employees accept any responsibility whatsoever for contributors’ activities or content provided. All letters sent to mg Magazine will be treated as unconditionally assigned for publication, copyright purposes, and use in any publication or brochure and are subject to mg’s unrestricted right to edit and comment.

ATLANTA – In April, the Trump administration named former FOX News reporter Sara Carter as its pick for director of the Office of National Drug Control Policy (ONDCP). The closest Carter has come to acquiring drug policy, public health, or law enforcement expertise is reporting on the role of foreign drug traffickers in the illicit American cannabis market.

But she looks good on TV.

Congress created the ONDCP in 1988, at the height of Ronald Reagan’s escalation of the war on drugs. The director, frequently referred to as the country’s “drug czar,” oversees all domestic and international anti-drug efforts of the executive branch and is mandated by law to “take such actions as necessary to oppose any attempt to legalize the use of a substance … listed on Schedule I” of the Controlled Substances Act.

The position requires Senate confirmation.

Carter is one of at least seventeen former FOX personalities serving in or awaiting confirmation for senior-level administration jobs. What the Columbia Journalism Review called “Trump’s TV Cabinet” also includes Secretary of Defense Pete Hegseth, Transportation Secretary Sean Duffy, Director of National Intelligence Tulsi Gabbard, National Security Advisor Michael Waltz, and “Border Czar” Tom Homan.

Representatives Dave Joyce (R-OH) and Hakeem Jeffries (DNY) reintroduced the Preparing Regulators Effectively for a PostProhibition Adult Use Regulated Environment (PREPARE) Act in mid-April. The bipartisan legislation would not end prohibition but instead “create a fair, honest, and transparent process for the federal government to establish effective regulations,” according to the congressmen.

Powered by

With summer on the horizon, Upgraded Points, which helps travelers maximize their rewards, crunched the data to find the most canna-friendly spots for vacationers. Denver topped the list, followed by, in order, Boulder, Colorado; Portland, Oregon; Missoula, Montana; Burlington, Vermont; Portland, Maine; Eugene, Oregon; and Ann Arbor, Michigan. Two traditional destinations rounded out the top ten: Las Vegas and San Francisco.

Install kiosks to manage high foot traffic and optimize the in-store experience

Self-service kiosks are becoming a powerful tool in modern dispensaries—especially those with high foot tra c or labor constraints. Allow customers to browse, learn about products, place orders, and even complete transactions without waiting for a budtender, creating a faster and more autonomous shopping experience.

ese days, consumers expect a fast and convenient checkout, so kiosks are helping dispensaries streamline operations while enhancing the overall in-store experience. Up to **65% of customers** choose to use them when given the option—particularly younger, tech-savvy demographics looking for speed and privacy.

Recommendations:

Invest in at least two self-serve kiosk stations to help keep the ow moving during peak hours. ey are ideal for locations with limited oor space or limited sta ng.

Packaging is the physical manifestation of the brand.

— Kary Radestock, executive director of strategy and sales, Treeform Packaging Solutions “ “

The munchies are real, but the stereotype may not be. According to a CBD Oracle survey, 63 percent of those who partake “always” or “sometimes” choose healthier snacks when high. About one quarter of respondents satisfy the munchies with fruit, salad, or a smoothie.

Botani’s new wraps showcase the intersection of flower-based materials and artisanal papermaking. Created in response to customer demand for natural, eco-friendly alternatives to hemp and paper, tea leaves provide rich flavors, aroma, and a smooth burn. The wraps are customizable for cones, blunts, cannagars, and booklets. botani.com

A year after it opened, Las Vegas’s first licensed consumption lounge closed after failing to generate the Strip tourist traffic owner Thrive Nevada projected. After Smoke and Mirrors’ departure, only Planet 13’s Dazed! and NuWu’s Sky High Lounge remain open in Sin City.

Fans of the dark humor and irreverent gameplay in Cards Against Humanity will enjoy Joint Decisions™, a fill-in-the-blank party game steeped in cannabis culture. Designed for two to ten players, the game launched on 4/20 with an MSRP of $29.95, or $35.95 for the 612-card deck and a companion video game. thejointdecisions.com

e more a customer can experience a product as part of their purchasing decision, the more likely they are to purchase it. —Will Smith, Bud Bar Displays

BY MARC BEGININ, ESQ.

President Donald Trump’s recent reinstatement of a 25-percent tariff on imported steel sent shockwaves across multiple industries, including hemp and cannabis extraction and processing. While many players in the space are scrambling to adjust, Trump’s move reinforces what we’ve known all along: American-made equipment is the key to long-term success.

For years, the cannabis extraction equipment market has been flooded with cheap, foreign-manufactured systems, primarily from China. Many equipment manufacturers source their stainless-steel pressure vessels, fittings, and components overseas, benefiting from lower costs at the expense of quality, reliability, and compliance.

Now, with Trump’s tariffs in effect, these manufacturers face rising costs, supply chain disruptions, and uncertain delivery timelines. Manufacturing and sourcing critical components overseas is no longer the cost-saving strategy it once was. Instead, it’s a liability.

From erratic shipping delays to inconsistent steel grades and undocumented materials, companies relying on imported hardware are about to find themselves boxed in by regulatory demands they can no longer afford to ignore.

The advantages of processing equipment “made in the USA” are clearer than ever.

Price stability and predictability: While competitors scramble to adjust to tariffs, American manufacturers remain insulated from sudden cost spikes, ensuring stable pricing for customers. When you build domestically, you control your costs. Tariffs don’t throw off the bottom line or derail customer timelines.

Compliance and traceability: As the Drug Enforcement Administration (DEA) moves toward rescheduling cannabis and state regulatory bodies shift their focus to consumer safety and compliance with Good Manufacturing Practices (GMP), processors will be held to the same material documentation standards as pharmaceutical manufacturers.

Reliable supply chains: By sourcing and building domestically, companies can avoid the logistical nightmares that plague overseas shipping: customs bottlenecks, freight congestion, and unpredictable lead times.

Support and service: When something goes wrong with a pressure vessel or valve, having a supplier in a different

time zone with a language barrier and a three-week wait time for parts presents a distinct disadvantage. Americanmade products come with local customer support, faster part replacements, and real service warranties. That’s peace of mind you can’t put a price on.

In an industry inching toward Food and Drug Administration (FDA) regulation much like food, dietary supplements, and pharmaceuticals endure, consumer safety is more than a checkbox—it’s a moral imperative and a business necessity. Most foreign-built extraction systems lack critical elements like certified welding procedures, full material test reports, and proper pressure vessel certifications under the American Society of Mechanical Engineers’ standards. One critical, yet often overlooked, aspect of equipment quality is heat number traceability—a system that links each piece of stainless steel back to its original batch at the steel mill.

Responsible manufacturers back their components with certified material test reports that verify chemical composition and mechanical properties. This ensures processors know exactly what materials are in contact with their cannabis oil—eliminating the risks of contamination from uncertified alloys or inferior metals. Foreign-manufactured systems often lack this level of documentation, which not only jeopardizes consumer safety but could become a dealbreaker under future FDA or heightened state-level scrutiny.

In the long run, hemp and cannabis oil processors using noncompliant foreign equipment risk everything from product recalls and consumer-safety lawsuits to facility shutdowns and license revocations. Processors using noncompliant equipment may save a few bucks up front, but it could cost them millions when regulators come knocking.

With the United States industry on the brink of DEA rescheduling, the stakes are higher than ever. Pharmaceutical companies are gearing up to enter the cannabis space, and they can’t work with labs or suppliers using uncertified, foreign-built equipment. For a cannabis processor to position itself as a future pharmaceutical contract manufacturing organization (CMO) or contract development and manufacturing organization (CDMO), equipment must meet—or exceed—pharmaceutical-grade GMP standards.

American-made systems already are built to these wellestablished FDA standards.

Trump’s steel tariffs aren’t just a short-term cost factor; they’re a strategic wake-up call to the cannabis industry. For too long, companies have taken the “good enough” approach with their extraction infrastructure, prioritizing low costs over long-term value. But as regulations tighten, consumer expectations rise, and global supply chains grow more volatile, those shortcuts are beginning to show cracks.

This isn’t just about steel. It’s about how to build a business from the ground up based on values, vision, risk tolerance, and readiness for the industry’s next chapter. Forward-looking processors and manufacturers already are moving to American-made equipment. They understand the long game:

• They don’t want their capital equipment investment tied to a supply chain they can’t control.

• They don’t want to retrofit their facilities to meet stricter new regulations.

• They don’t want to be the company issuing a product recall over contaminated oil.

What they do want is traceability, reliability, and credibility. They want to walk into a licensing inspection— or a pharma partnership meeting—with confidence that their infrastructure speaks for itself.

For processors serious about growth, compliance, and long-term viability, equipment made in the USA is not a luxury. It’s a necessity. From steel traceability and GMP readiness to consumer safety and post-sale support, domestic manufacturing delivers value across every dimension of the business.

Companies that built their business on outsourcing to China are now paying the price—literally and figuratively. Trump’s tariffs didn’t change the game. They just exposed who’s been playing it right all along.

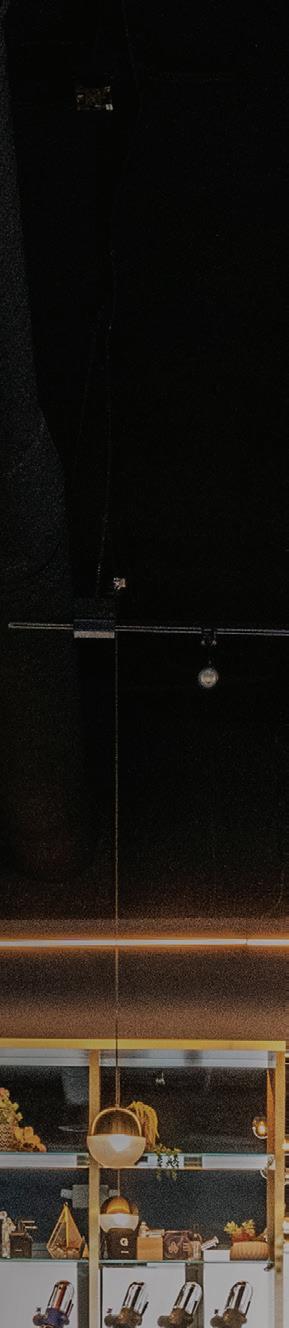

At The Artist Tree Hawthorne, cannabis meets creativity in a lounge designed to celebrate community, culture, and craft.

BY TAYLOR ENGLE

Located near a prime intersection off Interstate 405 in Hawthorne, California, the most recent addition to The Artist Tree’s growing dispensary chain is a more demure cousin to the original location in West Hollywood. In Hawthorne, locals and tourists alike will find a dispensary-slash-lounge that seamlessly combines shopping, an art gallery, and a relaxing space for discreet public consumption.

Designed to blend with the local area’s eclectic vibe, The Artist Tree Hawthorne strikes a balance between the intimacy of a cozy restaurant and the sultry allure of nightlife. Whether visitors drop in for a quick purchase, enjoy carefully curated art, or soak up the lounge’s

chill ambiance, the location is meant to be a gathering place—a bright spot for those looking to connect, unwind, and explore the intersection of culture, cannabis, and creativity.

According to founder and Chief Compliance Officer Lauren Fontein, the lounge’s location came about thanks to a stroke of luck.

“We were really lucky with the property. We got the entire building, which we were able to subdivide into the retail and lounge space,” she said. “We’re on a great intersection, very visible to the public and right off the freeway. It’s also a newer building—high ceilings

"WE ARE VERY DESIGNFOCUSED, AND OUR ART DISPLAYS ARE A HUGE COMPONENT OF THAT.

and modern bones—but it was completely empty and unfinished when we found it.”

The building was built but never occupied until The Artist Tree discovered the empty space, concrete floors and all. But much like the local artists the shop features in its informal gallery, The Artist Tree’s design team was able to start with a blank canvas, allowing them to do whatever they wanted with the aesthetic.

“Our whole mission is to combine art and cannabis and really highlight the connection between those two things by promoting local artists,” Fontein said. “That’s why our retail space is so open: It’s designed to encourage people to move throughout the space and explore freely. We have tons of art featured throughout the area, in both the retail and lounge spaces: freestanding displays, art on the walls, and our big cultivation glass cube, which is pretty unique.”

Similar to the West Hollywood location, where the glass cube concept proved its worth, Hawthorne’s retail area features a large grow space enclosed by glass walls.

“People can go in, shop, and view live clones,” Fontein said. “In general, our retail space has that modern but warm and inviting style we’ve been using for our dispensaries. But for the lounge, we wanted it to feel like a totally different space.”

" OUR MISSION IS TO COMBINE ART AND CANNABIS AND REALLY HIGHLIGHT THE CONNECTION BETWEEN THOSE TWO THINGS.

That’s why the lounge is physically separated by doors in the back part of the building. Visitors must make their way through the retail shop to get to the entrance. Fontein and her team wanted customers to be transported into a more relaxing atmosphere, ultimately arriving in an enclosed space with darker, moodier colors and an elevated style.

“It’s not necessarily its own destination, although we do welcome people to treat it as such and get all their products at the lounge,” she said. “But it’s a place where people can spend some time together and hang out. We’ve been hosting a lot of events there, like football watch nights and painting classes. And during the daytime, people come in, hang out, maybe do some work on their laptops.”

The team found regulations challenging when it came time to design the lounge, particularly because regulators mandated lounges not have windows passersby can see through.

“We always like to have open windows in our spaces because it feels nicer and safer, but in Hawthorne we had to frost the lounge windows,” Fontein said. “It was a bit of a [negative], but at the same time, it gives the space more of that dark, cozy feel. It also gives people privacy to consume, which they might want.”

The team also strategically placed plants to add some greenery to the space and custom-designed the bar, which is equipped with mirrored backing and gold shelving for an upscale look and feel.

“We picked out the barstools and finish for the counter and tile to emulate a vibe between a nice restaurant and a nightlife feel,” Fontein said. “We didn’t want it to feel like too much of a bar, but also not just a cozy room with couches. Our desired vibe was ‘elegantcomfy.’ We have tables with cafe-style chairs, but we also have cozier chairs, coffee-table-type spots, and barstools. Along one wall is the space for a projector screen where we have sound hookup, so when we have a DJ or live performance, that space can transform into a stage area.”

Designed for flexibility, the lounge also incorporates a movable platform stage that performers may employ to literally elevate their act.

“It’s one big continuous room with no divider, and that gives us a lot of flexibility,” Fontein said. “We can host a large event, a painting class, or even set up tables for food. There’s also not a ton of seating. We have maybe forty to fifty seats, but the space capacity is closer to 100, so it never feels cramped even if all of the tables are full. We really like that aspect.”

Much like The Artist Tree’s other locations, art is integral to Hawthorne’s identity, not just for decoration. Visitors are immersed in creative energy from the moment they step into the shop: in the hallway between the retail area and lounge, above the doorway leading to the lounge, and scattered along all the walls throughout.

“We are very design-focused, and our art displays are a huge component of that,” Fontein said. “We wanted it to be our focal point because it’s a way to enhance our spaces and make them feel more colorful, interesting, and exciting. The art also changes; we’re currently on our second exhibit at Hawthorne. This one is more neon lighting, different phrases—really a modern, street-art feel.”

All the works are for sale by the local artists who created them. Visitors find information and QR codes next to each piece, linking them to the artist’s website where they can complete a purchase.

“We love it when the art sells because it’s great for the artists, and they sell a pretty good amount,” Fontein said. “We’ve actually been trying to expand on this. We want more artists to come in person, like maybe during a reception when a new exhibit opens. We’re working on having organized events around each launch, sort of like an art gallery opening night.”

Most of Hawthorne’s consumers come from the neighborhood, but the location also welcomes a significant number of tourists looking for something

to do on their way to and from nearby Los Angeles International Airport.

“People come in with their suitcases so they can light up a joint before their flight,” Fontein said. “Or maybe they just landed and they find somewhere to chill for a bit and stock up on the stuff they want for their weekend. We see a lot of that, which is interesting— different people wanting different experiences—but we do get a lot of regulars who live nearby.

“It’s been great, because the Hawthorne community specifically has really been supporting us,” she continued. “There’s not a lot of other stores around, and ours is unique anyway. It’s a nice offering for people that they didn’t have before.”

Fontein and her team are exploring new ways to enhance the consumer experience. Future plans include more food options as the regulations governing consumption lounges evolve. She also wants to expand the events calendar to include unique experiences like brand-sponsored “hash flights” that would teach guests about the extraction process and more opportunities for artists to engage directly with visitors.

“We just had a video-game tournament, and we have monthly paint nights and comedy shows,” she said. “We have our annual high tea in [West Hollywood], and we might bring that to Hawthorne. We started slow with events, but it’s been building. We plan to keep expanding and working with our brand partners, because they have some really great ideas that are interactive, educational, and fun for the crowd.”

BY NIKLAS KOUPARANIS

A LITTLE MORE THAN A YEAR AGO, in April 2024, Germany implemented the Cannabis Act (CanG), which reclassified the plant as non-narcotic. The legislation made medical cannabis more accessible to patients and prescribing doctors by removing administrative burdens. Under reclassification, medical cannabis can be prescribed in the same manner as other prescription medications like highstrength ibuprofen. Prior to CanG, patients needed a special narcotics prescription and a qualifying chronic condition to receive prescribed medical cannabis, which often was offered only as a “last resort” treatment.

According to the most recent report from Germany’s Federal Institute for Drugs and Medical Devices (BfArM), medical cannabis imports to the country nearly doubled in 2024 due to the market’s progression under CanG. According to the report, the country imported seventy tons of dried medical cannabis flower in 2024, up from just thirty-two tons a year earlier.

During 2024’s fourth quarter alone, Germany imported 31,691 kilograms of dried cannabis flower, up 53 percent over the previous quarter and a striking 272 percent above what was imported during the fourth quarter of 2023. In 2025, imports could exceed 150 tons, and the number of patients could rise to more than two million.

To meet the needs of the country’s growing medical cannabis market, Germany leans on its foreign import partners to keep supply steady and affordable for patients. According to the BfArM, Canada and Portugal are the largest medical cannabis import providers. Canada’s import volume in 2024 rose to 33,155 kilograms, roughly double the volume in 2023 (16,895 kilograms). Portugal increased its imports to 17,230 kilograms in 2024, up 318 percent over 2023. Imports from Spain, Denmark, North Macedonia, and the United Kingdom also poured into Germany.

With continued growth of the medical cannabis market anticipated in 2025 and beyond, foreign cultivators have significant opportunities to partner with Germany. Products must adhere to the rigorous regulations of the European Union’s Good Manufacturing Practices (EU GMP) certification and the Good Agricultural and Collection Practice (GACP) guidelines. The standards require oversight of safe practices across all stages of production.

Reports like the import numbers released by the BfArM indicate a continued progression and expansion of the German medical cannabis market and, therefore, an even stronger reliance on import partners to maintain a steady supply. With its upward trajectory, the industry can benefit

from more international suppliers entering the market, especially those in regions that have cultivation and production standards in line with EU GMP and GACP standards. Both Canadian and Portuguese cannabis cultivators have demonstrated the value of the market by meeting these standards and exceeding import levels year over year.

Aside from meeting EU GMP and GACP standards, international partners seeking to engage with Germany’s thriving medical market should establish a strong understanding of the market’s expansion under CanG. They also should identify the key players in the German market who are reputable and in compliance with import and distribution regulations. Those interested may wish to attend international conferences, trade shows, or reach out to executive boards directly. Collaborating with those already established in the industry can help guide potential partners through the regulatory landscape, assist with legal approvals needed for imports, and successfully transition into the market.

The federal elections in Germany in February resulted in victory by Friedrich Merz and his center-right Christian Democratic Union (CDU) party. The likely next outcome

SEVENTY

OF DRIED FLOWER IN 2024. IN 2025, IMPORTS COULD EXCEED 150 TONS.

is a governing coalition between the CDU and the centerleft Social Democratic Party (SPD), which previously held the majority. Though some have speculated the new government may roll back portions of CanG, observers expect the impact to the medical cannabis industry to be minimal, if there is any impact at all.

Primary among the reasons no impact is expected: A rollback in legislation would put unnecessary strain on the burgeoning medical market and access for patients. Access to medical cannabis is overwhelmingly popular in Germany, as evidenced by the 1,000-percent jump in prescriptions following CanG’s enactment. Moreover, according to a poll published in December, 59 percent of Germans support full legalization of recreational cannabis. The German political parties have reassured their constituents medical products will remain accessible to patients without unnecessary administrative burdens. In addition, CDU politician Thorsten Frei, who will play a major role in the coalition negotiations, explicitly stated Germany needs to prioritize issues that are more pressing than revising cannabis regulations.

A LEGACY OF FRUIT AND FLOWERS MEETS THE NEXT WAVE OF WELLNESS AS EDIBLE BRANDS’ YOUNG CEO GUIDES THE COMPANY IN A BOLD NEW DIRECTION.

BY ELLEN HOLLAND PHOTOGRAPHY BY EDIBLE BRANDS

In March, Edible Brands touched off a media frenzy when the company, best known for creating fruit bouquets, expanded into the hemp-derived-THC marketplace. Headlines ranging from disbelieving to congratulatory blanketed mainstream outlets and the trade press alike. ABC News broadcast “Edible Arrangements Parent Company Now Selling THC.” “Edible Brands … Enters the THC Space” reported Adweek. “Edible Arrangements … Is Now Selling Actual Edibles,” Food & Wine confirmed. QSR magazine, a trade journal for the quick-service and restaurant verticals, announced “Edible Arrangements Gets into Cannabis.” And the Atlanta Journal-Constitution, the most influential newspaper in Edible Arrangements’ home state (where only limited medical use is legal), declared “Company behind Edible Arrangements Expands into Edibles. Yes, the THC Kind.”

Omni Talk Retail called the move “The Most Brilliant Pivot of the Year.”

But don’t expect to see hemp-infused fruit arrangements delivered to your doorstep anytime soon. For now, Edible Brands will sell a curated selection of products from well-known hemp brands on e-commerce platform Edibles.com. The move marks the company’s second attempt to enter the hemp industry, after launching Incredible Edibles® in 2019 to sell CBDinfused treats within its franchised shops nationwide. At the time, Edible Brands founder Tariq Farid wrote that he learned about the wellness benefits of hemp after trying to “see if anything could be done to protect our brand name from being abused by those within the drug community.”

Edible Brands and its affiliated companies own several trademarks under “edible.” The company’s current chief executive officer and Farid’s daughter,

Somia Farid Silber, acknowledged “[intellectual property] protection is very important for us” but said the company’s existing e-commerce infrastructure and supply chain network of 800 independent retail locations across the United States are what brought Edibles.com to fruition. The storefronts and e-commerce platform, combined with the development of partnerships with well-known hemp product brands, makes it possible for Edibles.com to provide infused products to consumers quickly.

“We’re called Edible and Edible Arrangements,” Silber said. “In some markets, we have customers who walk into our stores asking if we sell any hemp or THC products. This is a question that we get in our retail locations. We also see it in our social comments every now and then, so [we were] eager to create that space with Edibles.com.

“It’s important for us that the Edible Arrangements business stays as is,” she continued. “One day down the road we might see a collaboration, but for those customers who are looking for hemp products, they can now shop with us at Edibles.com.”

Edible Arrangements was founded in 1999 in East Haven, Connecticut, after Farid got the idea for the company while working in the back of his familyowned flower shop.

“He was a florist in the ’90s and had seen fruit cut in shapes, fancy fruit displays, and decided to put together a fruit basket at home—fruit that’s cut to look like flowers,” Silber said. “He always does his focus group with my grandmother. He put it on the dinner table, and she said to him, ‘Honey, this is going to be big.’”

In 2001, the company opened its first franchise location in Waltham, Massachusetts. After that,

Edible Arrangements continued to grow, expanding its locations until a market downturn between 2017 and 2019 resulted in a double-digit sales decline and the company shed 150 stores, according to reporting by Franchise Times. When the pandemic shuttered nonessential businesses in March 2020, the Edible Arrangements shops were allowed to remain open as essential services and business increased. Franchise Times reported Edible Brands “pushed sales to $587 million in 2020, up 32.7 percent and a remarkable turnaround from an 11.8-percent decline the year before.” The period also marked Edible Brands’ foray into new products such as baked goods and, eventually, CBD products.

“We’ve expanded past fruit arrangements, so although that is the primary category we sell—it’s our highest performer, it’s the heritage product—we also do sell baked goods,” Silber said. “We sell other shelfstable items like chocolate, and we recently started selling fresh flowers as well.

“So we’ve gone outside of just the fruit arrangements to really a more holistic gifting experience that creates multiple reasons for a customer to interact with the brand outside of just your big-ticket occasions like a first day or anniversary or Valentine’s Day, Mother’s Day. Our focus has been on amplifying the product offering and the portfolio to create an offering that works for that next generation of consumers. [We’re] very focused on millennials and Gen Z, and we’re seeing a lot of success with that.”

Silber doesn’t believe selling hemp-sourced THC products is taking the company in a controversial direction. “I really don’t think [cannabinoids are] controversial anymore,” she said. “I feel there’s so many products available out there. It’s creating a united front and a platform where everyone can participate and learn more.

“I feel like a few years ago, something like this may have been seen as controversial, but it’s a part of people’s daily life already,” she added. “We’re just a really easy and convenient space where you can shop for these products.”

The company is not without its share of other controversies, however.

Edible Brands is fairly well known for taking legal action against companies it believes use the word “edible” in ways that infringe on its trademarks. A 2020 lawsuit by an association of Edible Arrangements franchisees alleged “self-dealing” and accused Farid of “improperly funding” the parent company’s new CBD venture “with the monies paid by the members and other Edible Arrangements franchisees.” Franchise Times reported the lawsuit was dismissed in the fall of 2020 by a federal judge who ruled the dispute belonged in arbitration instead. In 2024, Edible Brands acquired the domain Edibles.com as part of a settlement after suing the website’s previous owner for cybersquatting.

“We did have to fight to acquire that domain, and there was a settlement early last year,” Silber said.

Silber has worked for her father’s company in some way, shape, or form since the enterprise launched. She began working in Edible Arrangement stores at a young age and has worked full-time for the company since 2016. In October 2024, she was named Edible Brands’ CEO.

“He is a visionary,” Silber said of working alongside her father. “He has a lot of fantastic ideas. I’m very balanced in my approach, and I love to drive the business forward with data. We’ve always worked really well together.”

In a video interview on Fortune magazine’s YouTube channel, Farid said he handed the reins of the company

to his daughter after realizing “it comes time to pass to the next generation because the brand has to reinvent.”

According to a statement Edible Brands distributed when it launched Edibles.com, “during her tenure as president, Silber built a robust executive team and a powerful C-suite of leaders in the company’s new headquarters in Atlanta, helping to develop a new brand identity across digital and physical retail locations.”

Silber’s days start with a morning routine with her two-and-a-half-year-old daughter. One of her recent workday schedules included attending a roundtable discussion hosted by the Young Presidents’ Association, followed by one-on-one meetings in the office with field operations team members.

“I think food is a connector; food connects people and fruit, especially for my family,” Silber said. “My family is from Pakistan. When you’re going to someone’s house, you usually bring fruit with you as a gift, and it was always seasonal… In our house, even now with my two-and-a-half-year-old, fruit is dessert. We enjoy fruit very much… On the Edible Arrangements side, today, it’s more like the everyday staples like your strawberries and pineapple, but we do bring in seasonal fruits in the summertime, so you’ll see kiwi and mango, blueberries, and whatnot.”

When asked if there was an “aha” moment in the connection of the Edible Arrangements name to the word “edibles,” which has come to mean food or drinks infused with cannabis or hemp, Silber said the link has always been there.

“It’s been there since day one,” she said. “I mean, we’re called Edible Arrangements. We acquired a trademark on ‘edible’ and Edible.com in the early 2010s, and Edible is really the short name for the Edible Arrangements brand… We dabbled in the space with a CBD brand that we launched in 2019, but I’d say it was a little too early for us. It was still something that was relatively new for the market. We got in pretty early at that time.

“Since then, we decided it was really important for us to acquire the Edibles.com domain, so we did that last year. We went with the Edibles.com domain as well as 1-800-Edibles. Once we had those decided, ‘Hey, let’s go find the right person to help us build out a really stellar e-commerce marketplace experience that’s rooted in health and wellness.’”

That person was Thomas Winstanley, who previously served as the chief marketing officer for Theory Wellness, an East Coast medical and adult-use cannabis brand. He now serves as executive vice president and general manager for Edibles.com, which so far has partnered with top-tier hemp brands including Cann, Wana, and 1906.

Edibles.com’s goal, according to Silber, is to create “a safe and trusted, reliable space where someone can come and shop for gummies and beverages and learn more about what the products are and how they can help their daily life, and how they can make things a little better for them.”

She also said the response to Edible Brands launching a division to sell THC-infused products has been mostly positive. Initially, products from Edibles.com were available in only Texas, but the company plans to “expand rapidly” into legal markets across the Southeast, including Florida and Georgia.

“If anything, it’s been a very positive response and it’s been very welcomed, which we’re really excited about,” Silber said. “So nothing negative. You know, I feel like there’s so much data out there about how these hemp products can help create a better life for you.”

The idea is to keep Edibles.com within the healthand-wellness sphere, where Silber has some personal experience. She said she struggles to sleep through the night and has tried hemp-derived products to help alleviate insomnia.

“I think, for us, we’re very focused on making sure we’re selling based on outcomes and need states,” she said. “If you go to our website, you’ll see you can shop by what you’re looking for to help you sleep better or get energized or relax. And you’ll also notice the dosage is relatively low. It’s all five milligrams or less. Staying within that health-and-wellness space is really important to us and we’ve seen nothing but excitement, especially from the brands we’re partnering with, since there isn’t a distribution space like this or that can be done at the scale that we have available today.”

This aligns with her father’s vision when he launched the Incredible Edibles CBD-infused brand in 2019.

“I’ve always believed you have a choice: You can let the world define something for you, or you can define it yourself. I prefer the latter,” Farid wrote on his Medium blog in 2019. “It occurred to me that rather than let

popular culture define ‘edible,’ if I expanded my focus to hemp and eventually other superfoods, I had an opportunity to redefine edible as a verb for wellness. ‘Health, not high’ would become our mantra!”

For Incredible Edibles, Edible Brands partnered with a hemp farm in Connecticut. After the 2018 Farm Bill legalized hemp that contains less than 0.3 percent THC, many farmers in other agricultural sectors turned to growing hemp.

“Hemp will be the new tobacco of a hundred years ago, when every farm, or many farms, planted five or ten acres of broadleaf tobacco because it was a high-value cash crop,” Connecticut Commissioner of Agriculture Bryan Hulburt told Connecticut Public Radio in 2019. “That was the crop that stabilized the rest of the farm operation.”

But in this century, things didn’t turn out quite that

"warned the state’s hemp merchants and brands during a March 20 news conference. “We’re going to ban your stores for good before we leave [the legislature’s biennial meeting].”

Most hemp bans have focused on delta-8, delta-10, and other synthesized cannabinoids that occur naturally in cannabis and hemp but not in amounts significant enough to make them commercially viable. A growing number of states also are cracking down on hempderived THC as well as THCA, a precursor that becomes THC when heated.

After a bipartisan coalition that usually passes a new farm bill every five years collapsed in September, Congress extended the 2018 Farm Bill through September 30, 2025. The most recent proposal for the reauthorization bill, brought before Congress in May, included an amendment that would modify the federal

"way. By November 2019, NPR reported, many hemp farmers struggled to succeed due to “harvest challenges: erratic weather, a spike in hemp production and a dearth of processors and buyers.”

Flash forward to 2025, and hemp has faced more challenges as states and Congress push to crack down on sales of hemp-derived products. Sixteen states have effectively banned hemp-derived cannabinoids. California has an emergency order in place that prohibits hemp products containing any THC, and the Texas legislature is considering a bill that would impose similar restrictions.

“This is a poison in our public, and we as a legislature—our number-one responsibility is life-anddeath issues,” Texas Lieutenant Governor Dan Patrick

definition of legal hemp by prohibiting cannabinoids that are not “naturally occurring, naturally derived, and non-intoxicating.”

Silber acknowledges the uncertainty currently swirling around hemp, but she’s not particularly concerned about potential changes to federal law.

“Look, it’s continuing to change,” she said. “We’re seeing a lot of change in [the market] as we go. For us, we just want to continue to build out that safe and trusted space and [are] also partnering very closely with different groups on the policy side just to make sure we have a voice at the table and we can help influence any policy in a positive way.”

Plans for Edibles.com include eventual vertical integration and launching its own product line. The brand also has signed a lease for a 600-square-foot brick-and-mortar storefront in Atlanta’s foodie-centric Inman Park.

“We’re a unique part of the supply chain because we have this brick-and-mortar fulfillment operation for last-mile [delivery], but especially with our [intellectual property] and our e-commerce prowess, those three ingredients become a real change for the landscape— especially programs like Edible Arrangements or Edible Brands coming in,” said Winstanley. “I think it’s a signal across the industry at large that ‘maybe this category isn’t as scary as we’re looking at it from a policy standpoint.’”

He said the company believes the United States hemp industry will continue to thrive, even if federal law changes.

“We are absolutely hopeful about the future of this industry in this category,” he said. “The way we discuss a lot internally, with trade partners, lobbyists, advocates, we see a very clear bifurcation between low-dose and everything in higher-testing products. And I think our general view is, essentially, we’re not really talking about regulating the plant—the cannabis plant or the hemp plant. We’re really talking about THC policy and THC regulations. And I think that’s a distinction that we find very interesting where, yes, the five-milligram size should be available at more traditional points of distribution while higher-testing products should be available at dispensaries.”

Edible Brands is as leery of outright bans and massive policy swings as anyone else in the industry, Winstanley said, although he admitted he understands legislators’ and other policymakers’ concerns.

“What we do agree with is that the spectrum of products that are not regulated—that you can get in a gas station or that are not tested with a [certificate of analysis]—there is some level of consumer harm,” he said. “But weeding out all the good actors who are trying to play by the regulatory standards … and being too aggressive with bans really creates more space for those bad actors to thrive. Inadvertently, you create a more dangerous market.”

Instead, Winstanley believes there’s a thoughtful way to approach THC policy that will result in a regulated, responsible industry.

“We know consumers’ consumption habits of these types of products are evolving, and part of that evolution is people have more points of entry for this category. We expect that to continue,” he said. “However, we also are very weary of a lot of the challenges right now at a policy level that we hope to help fortify, because we do think there is a reason people are coming to this category. We do think there are very clear health benefits that can support what people need.”

Edibles.com offers only hemp-derived delta-9 THC products, because the company believes that’s the type of product consumers seek.

“I think there is a very clear ask from the consumer, and I think that if you start to mix the message or convolute the message, it becomes [unhelpful],” Winstanley said. “The delta-9 space is really where consumers are looking and gravitating toward. I think a lot of what I’m concerned about is the synthetic supply chain and not having full visibility into where the source of origin is for raw ingredients.

“We certainly think, on the [hemp-derived] delta-9 front, that we’re still just scratching the surface on consumer adoption here,” he added. “This is a very early industry, and I think before it gets more complex than it already is, let’s get this right with what we know works and what people are looking for. Let’s also allow ourselves time to conduct the appropriate amount of research to fully understand what long-term health implications can arise from some of the other designer cannabinoids that are coming out.”

The day after Edibles.com launched, comedian Jimmy Fallon joked about Edible Arrangements as part of his monologue on The Tonight Show.

“I saw that Edible Arrangements is going to start selling actual edibles,” Fallon quipped. “Meanwhile, Cracker Barrel is like, ‘We shouldn’t… Should we?’”

Silber is a fan, but the joke didn’t land with her.

“Look, it’s very serious for us,” she said. “This is not a joke. Jimmy Fallon, he’s a comedian. He’s a funny guy; that’s his thing. But for us, this is very serious. It’s important that we are creating a safe, reliable, trusted environment with these really incredible products, and we want to be taken seriously as we do it.”

Our patented technology ensures the highest quality cannabis with:

• Reduction in Trichome damage of over 20% versus traditional methods.

• 16% higher terpene retention for enhanced flavor and aroma.

• Achieve higher yields with our patented Vaportrol® technology.

• Reduce labor costs through proven, more efficient operations.

Join the leaders in the cannabis industry who trust Cannatrol to deliver exceptional cannabis.

Custom systems for any size cultivation facility

Retrofit for existing operating facilities.

Turnkey systems for all-inclusive needs and quick install.

DESIGN, DISRUPTION, AND DIFFERENTIATION: HOW PACKAGING IS EVOLVING UNDER PRESSURE.

BY MACEY WOLFER

PACKAGING is an essential part of the supply chain and often serves as consumers’ first consideration in purchasing decisions.

Beyond communicating brand identity, packaging is crucial to keeping products safe and maintaining compliance with state, local and, in some cases, federal regulations.

In cannabis, the product-packaging market is growing apace with the industry as a whole. Grand View Research projects the market in the United States will expand at a compound annual growth rate of 28.9 percent between 2024 and 2030. The burgeoning sector includes materials sourced both domestically and from other countries, with China—at a market share of 25 percent in 2023—among the most popular sources.

This growth, paired with stringent regulatory requirements, has sparked innovations in design and function as suppliers compete to provide the best offerings at the best prices. But concerns about supply-chain affordability and economic instability are impacting virtually all businesses right now, and packaging is no exception.

United Nations Trade and Development lists trade imbalances, evolving policies, and geopolitical tensions as new risks threatening global markets. Supply-chain disruptions, potentially exacerbated by tariffs, could further aggravate the instability and economic anxiety cannabis business owners face in an already complicated industry.

With many American businesses sourcing their materials from overseas suppliers and looming concerns about trade with China and other countries, there’s plenty of room for new hurdles to crop up. Inconsistency in available materials, for example, is impacting some suppliers.

“A lot of packaging companies out there are distributors who don’t have direct control over their supply chain,” said Ron Basak-Smith, Sana Packaging’s chief executive officer. “Products may come and go, and then companies have to pivot to something different.”

Lawrence Perrigo is well acquainted with that challenge. As the founder and creative director for Seattle-based Saints Joints—a brand known for its limited-edition boxes— he has found sourcing consistent packaging can be a consistent source of headaches. “You’ll order packaging you like and then it’s hard to find again, or they sell out because so many businesses are making the same types of products,” he said.

Supply-chain disruptions, paired with sometimes significantly different state-bystate regulations, weave a complicated web for packaging providers to navigate. Michael Markarian, CEO of Contempo Specialty Packaging, said compliance across multiple states also “creates a need for more SKUs and [packaging] inventory to manage.”

The more SKUs and inventory, the more challenges arise.

“It’s difficult to manage different warning labels, requirements, design elements, fonts, and color regulations,” said John Hartsell, co-founder of Arizona-based provider DIZPOT. “Waiting for state officials to review and approve each packaging design before we go into production, in some cases, can take months.”

Communicating these obstacles to clients can prove challenging, too. “There tends to be a lack of education on how long a package takes from its conception and design all the way to the dispensary shelf,” Hartsell said.

Cannabis companies are no strangers to regulatory difficulties. It’s part of the job. But as impending trade wars and the potential for recession increase economic anxiety across the country, it’s prudent for packaging businesses to stay tuned into market trends.

Naturally, shifts in the supply chain and trade imbalances have consequences. But industry entrepreneurs are resourceful, and challenges often lead to innovation. New trends frequently emerge as companies navigate fluctuating economic realities and customer preferences.

Here’s what packaging companies are noticing right now.

Mylar bags and pouches tend to be less expensive than glass jars, tubes, and other common container options. Packaging providers report clients switching to these options as a first effort to cut costs without sacrificing crucial compliance elements.

The shift contrasts with a 2023 Grand View Research report that found rigid packaging to be the dominant choice at more than 66 percent of cannabis brands worldwide. While rigid containers are less susceptible to damage like crushing

and puncturing and make child-resistant features easier to implement, many suppliers report discovering their customers are primarily concerned with securing affordable packaging, even if affordability means making minor compromises on convenience and damage-resistance.

“We’re seeing a lot of movement from rigid to flexible packaging,” said Tony Reyes, president of Illinois-based CannaCarton. “Back in the early days of [the industry in] Colorado and California, there were these polypropylene pop tops, then people went to glass jars and mylar. That’s what you see when the new markets open up. There’s more money to spend on packaging. People start in a glass jar and then, as the market gets more dense and competitive, they have to try to manage costs and move to lower-cost options.”

Kary Radestock, executive director of strategy and sales at California-based Treeform Packaging Solutions, also has seen some companies cut costs by switching from rigid containers like tins and jars to less expensive mylar bags and pouches.

Though flexible packaging may be more economical, Radestock questioned whether the savings are worth the potential effect on consumer perception. Packaging’s quality subliminally communicates a lot about the product inside.

“Packaging is brand positioning,” Radestock said. “What you put your product in communicates the type of product it is. If it’s an upscale or high-end flower, it’s going to be in a glass jar. If it’s a mid-shelf flower, it’ll probably be in a bag.”

For Markarian, packaging’s role in brand image can create tough choices. Brands may have to choose between compromising consumer perception to reduce costs or investing in packaging that differentiates their products from others on the market.

“Many brands thrive in other industries using flexible packaging, [but] some brands rely on beautiful packaging as part of their marketing strategy,” Markarian said. “The tequila brand Patron does not downgrade to plastic bottles during a recession, because they know the glass bottle, cork, and branded box are central to their brand positioning. The right decision may [sometimes] be to cut costs and downgrade to mylars—and that is a growing sector in our business—but it’s not always the right decision.”

Providers also report seeing an increase in bulk purchases by both businesses and consumers.

Reyes has noticed more brands inquiring about ways to be costeffective, with many wondering whether they can save money by ordering containers in larger quantities. Because CannaCarton manufactures domestically, ordering in bulk is a practical solution, he said. “Get it faster, get it in the U.S., and maybe order a little higher quantity,” he suggested.

Contempo’s Markarian agreed bulk orders can reduce per-unit costs, but other considerations also affect the equation. “A fiftycent package might be great for a five-pack of pre-rolls but is cost-prohibitive for a single one-gram pre-roll,” he said.

Product brands aren’t the only ones reconsidering their packaging strategies. Cultivators are trying to move inventory

more quickly to combat oversupply. Oregon farmers, for example, harvested more than 9 million pounds of flower in 2023, at a time when the state’s sales continued a steady downward trend. And Oregon is not alone. Colorado faces a crushing combination of oversupply and price compression, as does Washington state. Even younger markets like Michigan are seeing wholesale and retail prices plummet. According to Whitney Economics founder Beau Whitney, restoring the balance between supply and demand could take years.

Reyes said the need to reduce inventory means more cultivators and brands are looking to sell as much as they can in a single package. Thus, he’s noticed a trend in demand for containers that provide more interior space. “In Michigan, you’re seeing fifty and seventy-five joints in a pack,” he said. “You’re seeing flights of products. ‘How can I sell three grams of cannabis concentrate instead of just one? Let’s offer a flight; let’s put things in a flight box.’”

Even faced with supply-chain and affordability challenges, companies rely on their packaging to communicate with customers and stand out from the competition.

“Brands are homing in on their key differentiators and investing in their shelf appeal,” said Hartsell. “Creating special-edition packaging for more mainstream holidays such as St. Patrick’s Day, Mother’s Day, and Veterans Day is becoming more and more popular, because it also doubles as a great tool for marketing.”

Packaging Digest backed this claim last year by examining consumer responses to Valentine’s Day packaging. The trade journal evaluated Seattle-based House of Cultivar’s limitededition Valentine’s Day product, which featured one-eighth ounce of the Lobster Roll strain.

House of Cultivar turned to Roland DGA and GoldLeaf Packaging to create labels printed with ultraviolet ink on a holographic substrate. The result was a colorful, textured label that produced a rippling rainbow effect when the jar was turned.

The eye-catching graphic design was developed in response to a 2023 Physis + Agency survey of more than 1,000 flower consumers. According to Physis+, survey respondents were willing to pay up to 26 percent more for an eighth if they considered the packaging “special.” More than 72 percent of respondents said they’d pay more for a jar of flower if it came in a collectible or repurposable container.

Depending on where companies source their materials, the cost to make packaging special may or may not be prohibitive.

“Everybody loves holographic foil or embossing,” said Radestock. “When producing in China, it doesn’t cost that much more to add some bells and whistles.”

Hartsell pointed to DIZPOT’s auditory consumer engagement (ACE) box as another example of innovative packaging that is building momentum. “Think of a jewelry box that plays a tune when you open it. This is the same concept,” he said. “The ACE box is unconventional and something consumers will remember, which speaks to brands.”

Despite attempting to reduce costs by swapping package formats, ordering in bulk, and increasing container sizes, the industry hasn’t ditched its environmental consciousness. But affordability challenges can make maintaining a commitment to sustainability difficult.

“I’ve been in packaging for twenty years,” said Reyes. From its earliest days, the industry sought Earth-friendly ways to conduct business, but “when COVID hit, sustainability was sort of shelved for a lot of industries. Sustainability is in a backseat position right now. There is plenty of innovation in materials and formats, but there’s not enough scale. People aren’t buying enough [sustainable packaging] to drive the price down and bring it to cost parity with the traditional options.”

Not everyone is price-driven, though. Reyes said he sees many customers who don’t care about packaging design at all as long as the materials used are sustainable.

Basak-Smith explained Sana Packaging— which “designs and develops cannabis

packaging for a circular economy using plant-based, reclaimed, and recycled materials”—can keep prices for sustainable options affordable because the company is not dependent on global supply chains. Economic concerns aside, he emphasized that achieving a truly sustainable product involves significant logistics and some compromise.

“It’s a world of tradeoffs,” he said. “You might see pouches have a lower impact on the upstream: To produce a pouch is going to require less material; to ship a pouch costs less. But on the flip side, you can’t recycle pouches, and that’s difficult to relay to the consumer.”

Although some operators may have relocated sustainability to the back burner, at least temporarily, consumers haven’t. They still want sustainable packaging. A 2023 Brightfield Group report indicated consumers prioritize plant-based, plastic-free, biodegradable, and compostable options.

But as Markarian explained, there is still some uncertainty about what the word “sustainable” means. He pointed to two examples of diverging regulatory definitions: New York state’s mandate that all plastic packaging be made of at least 25 percent post-consumer recycled materials and Vermont’s no-plasticpackaging rule.

“Cost-cutting and the move to mylar bags are becoming more common in mature markets,” he said. “Sustainability-wise, the flexible packaging industry makes the argument that mylars are sustainable due to using less materials and resources in production and transport. Whether this is a marketing spin or valid is openly debated and a hot topic.”

He also pointed to Oregon’s upcoming extended producer responsibility (EPR) law, which broadly targets recyclable materials to increase recycling rates in the state. The EPR law, with an effective date in July, will require producers to pay a fee based on the weight and type of packaging used.

“Operators need some relief,” said Markarian, who suggested a tax credit for sustainable packaging choices. Tax credits would “be a great step forward in incentivising eco-friendly practices, especially in markets with EPR.”

He also said he lives by the mantra “progress, not perfection” when it comes to sustainability. “While we may have an opinion on moving to mylars versus differentiating, we are most concerned with executing the vision of our clients and will go down whatever path they want,” he said. “We can make really beautiful mylars at great prices that are sustainable too.”

Supply-chain issues occasionally arise in any industry that manufactures consumer packaged goods. Although most represent minor snarls, the global collapse that accompanied the COVID-19 pandemic introduced a whole new level of disruption. By early 2024, the global turmoil had settled down, but the struggle left scars.

Then, in January 2025, a new presidential administration assumed office, bringing

OPPOSITE: A CLASSIC CIGARETTE BOX FOR PRE-ROLLS. ABOVE: CUSTOMIZED FLOWER JARS. BELOW: FLOWER BOXES. ALL BY CONTEMPO SPECIALTY PACKAGING.

with it a series of on-again, off-again tariff policies that unsettled the global supply chain. By early April, the administration had placed a punitive tariff of 145 percent on goods from China—a primary packaging resource. So-called reciprocal tariffs on imports from about ninety other nations leapt from an average of 2.5 percent to percentages ranging from 11 to 50. Days after imposing the levies, the president deferred most of them for ninety days, leaving in place the unprecedented duty on Chinese goods and lowering the tariff on almost everyone else to a base level of 10 percent.

Indecision in the White House has left industries across the spectrum uneasy about the potential for trade-war escalation and consequent price increases, but there’s no consensus on just how worried packaging suppliers and their customers should be. While some suppliers consider their domestic networks to be a key selling point, those working with overseas vendors don’t seem too concerned about tariffs’ potential impact.

“It’s shaking things up a little bit,” said Reyes. “We’re going to get tariffs passed on to us, and then we’re going to have to pass them on. CannaCarton is already

paying more for everything and, unfortunately, we have to pass the costs to our customers.”

He suggested higher costs will remain a challenge until more domestic capacity develops or companies shift toward vendors in non-tariffed countries. Although he admits tariff concerns are valid, Reyes projects increased costs won’t impact the industry too harshly. “The good news is that we make a lot of things ourselves here in the U.S.,” he said. “With labels, pouches, boxes, and many other items, there is no impact from tariffs.”

He also said his customers are very receptive to U.S. manufacturers. As the new tariffs have sparked conversations, he’s noticed increased curiosity about employing Americanmade materials.

Sana’s Basak-Smith also has noticed increased interest in transitioning to local suppliers. The company recently announced a significant price reduction for its core made-in-the-USA products as a way to help businesses manage their costs during a period of uncertainty.

“We’ve always produced our products domestically, so the tariffs don’t affect what’s happening in our world,” he said.

Markarian wonders whether tariffs will cause a shift toward domestic production or become just another tax on operators. He observed that in the short term, operators probably should expect elevated costs and packaging manufacturers should prepare for increased pressure.

Nevertheless, he said, with some exceptions “the cost of the tariff is still less than the cost to produce the product domestically,” at least for now. Domestic investments are on Contempo’s radar, and the company is preparing for the moment when production in China is no longer the most cost-effective option.

Radestock isn’t ready to panic. “People have been freaking out, saying ‘we’ve got to go somewhere else. We’re going to have to move production,’” she said. The more

prudent course, she believes, is “let’s just hold on a minute and see what this really means to us.”

Although tariffs have, indeed, increased shipping costs, she said the hike hasn’t reached the point at which moving Treeform’s business elsewhere would make sense. “We’re seeing nominal increases in the shipping costs,” she said. “Most companies are absorbing those extra costs. If anything is passed along, it’s usually pretty nominal.

“We always have to be flexible,” Radestock added. “If all of a sudden the price goes up 5 percent because of this or that, we have to go back and try to reengineer the project to make sure it still fits in the client’s budget without sacrificing quality. Those types of things are happening right now, but they also happen nearly every day anyway. I wouldn’t say things have changed that much.”

Hartsell harbors a similar view. “Tariffs should only impact the cannabis packaging industry to an extent—and the extent varies by product, where said product is sourced, and the negotiating power the supplier has with their vendors,” he said. “We actually charge less for certain packaging today than we did in 2017, because of our relationships, negotiating power, and the strength of our international partnerships.”

Whether trade imbalances, geopolitical tensions, or other supply-chain concerns will impact the packaging industry—and, if so, how substantially—remains to be seen. For now, suppliers are skipping the panic and opting for practical solutions that balance the need for affordability with their customers’ need for containers that do the best possible job of protecting their products and representing their brand.

Abraham Lincoln, Peter Drucker, and Alan Kay all have been credited with coining the phrase “the best way to predict the future is to create it.”

Brothers Corey and Dustin Koffler founded Greentank Technologies on the concept.

Greentank develops and manufactures cutting-edge vaporizer hardware. From its foundation in 2016, the company has focused on engineering products optimized for cannabis extracts.

At the time, “the hardware just wasn’t built for cannabis,” said Chief Executive Officer Corey Koffler. “The devices were originally designed for lowviscosity e-liquids, and consumers were struggling with performance issues when using much thicker, more complex cannabis extracts.”

Their goal “wasn’t just about [improving] functionality or form factor,” he added. “It was about elevating the entire experience. We committed to delivering unmatched performance, reliability, and safety.”

Today, Greentank employs more than 100 people across North America and other regions. The company’s team

includes in-house engineers, designers, scientists, and product specialists, all of whom Koffler said are passionate about Greentank’s mission and helping the company maintain end-to-end control over product development.

“Our device lab, located at our Toronto headquarters, is where innovation meets precision,” Koffler said.

“Equipped with state-of-the-art equipment, our expert team—including material scientists, engineers, product designers, and testing specialists—conducts meticulous ‘oil-to-coil’ testing to optimize performance and analyze safety metrics for every device we bring to market. But what truly sets us apart is our ability to fine-tune our products with real cannabis extracts.”

Greentank is the only vape technology company that has been issued a federal research license by Health Canada.

“With our research license, we can simulate cannabis oil profiles to conduct rapid and efficient optimization testing,” Koffler said. “This level of precision ensures that when our products hit shelves, they do so with unmatched reliability and performance. Our license allows us to work hands-on with our brand partners, testing a wide range

of cannabis extract formulations to ensure the highest levels of performance, consistency, and safety. For us, this isn’t just a regulatory advantage—it’s a core part of how we push the boundaries of vape technology, refining and evolving our products to meet the ever-growing demands of the industry.”

Greentank’s Quantum Vape™ is the most recent example of what combining an in-house lab with a federal research license can produce. Although vaping cannabis may be healthier than smoking, concerns about risks like inhaling heavy metals continue to plague traditional vaping hardware. Standard vapes rely on ceramic coils for heating. The core can corrode or degrade over time— especially at the higher temperatures required to vaporize thick cannabis oils—allowing particles to leach into and contaminate the vaping liquid. Quantum Vape uses a

RED DOT DESIGN AWARD

GOLDEN LEAF

MOST PROMISING INNOVATION AWARD

CANNABIS BUSINESS INSIGHTS MANUFACTURER OF THE YEAR – USA

CANNABIS BUSINESS INSIGHTS MANUFACTURER OF THE YEAR – CANADA

CANNABIS INDEPENDENT TOP VAPE TANK OF THE YEAR

CANNABIS INDEPENDENT TOP SINGLE USE VAPORIZER OF THE YEAR

GREEN ENTREPRENEUR TOP 100 CANNABIS COMPANY

biocompatible heating element called Quantum Chip™ technology, which instantly vaporizes liquid without allowing it to contact any metal components. As a bonus, Quantum Vape’s Coldstream™ technology produces vapor that is up to 52-percent cooler than other leading vaporizers.

“For the past four years, our team has been rethinking the very engine of vaporizers,” Koffler explained. “We moved away from ceramics and their outdated absorptionbased atomization, instead developing Quantum Chip technology—a game-changing system that uses microfluidics and capillary action. Think of an ultramodern pump that seamlessly draws cannabis oil through the chip to a heating layer where it is converted into vapor. The impact has been monumental.”

Although Quantum Vape represents a bold new future, Greentank’s innovation doesn’t stop there. The company also produces traditional cartridges, disposable vapes, and batteries. All receive the same attention to detail to ensure reliability and high performance, Koffler said.

“Every single device that leaves our facility undergoes rigorous quality-control testing—triple-checked for consistency and performance,” he said. “Our manufacturing standards are second to none, ensuring that when consumers pick up a Greentank device, they’re getting an experience they can trust every single time.”

Any brand in the cannabis industry can customize their own Greentank vape. To date, the company has helped more than 300 brands in the United States and Canada launch vaporizer products.

“We collaborate closely with our brand partners to develop one-of-a-kind vape products that command attention on dispensary shelves,” Koffler said. “Whether it’s bold aesthetics, innovative features, or a unique form factor, our team brings concepts to life with a wide range of customization capabilities. For brands that want to push boundaries even further, our in-house design and engineering teams can create a completely custom vaporizer from the ground up.”

Although the Greentank team harnesses complex science to power its products, the company is grounded in elegantly simple concepts.

“At the end of the day, we’re focused on three things: quality, safety, and user satisfaction,” Koffler said. “We work backward from these goals, striving to innovate the vape hardware industry one product at a time. We stand behind everything we produce because we believe in what we breathe, and we know that superior products will always win.”

greentanktech.com