Networking Coffee Break Sponsor

Platinum Sponsor

Gold Sponsors

Silver Sponsors

Networking Cocktail Sponsor

Landyard Sponsor

A decade has passed since President Enrique Peña Nieto’s Energy Reform. Since then, the Mexican oil and gas industry has undergone profound changes. In the initial four years following the reform’s implementation, market participation expanded significantly and CNH’s bidding rounds generated valuable subsurface data for Mexico. However, concerns arose after the cancellation of bidding rounds in 2018 and PEMEX’s resurfacing as a favorite in the government’s energy policy.

Despite some operators scaling back their operations, the industry has shown remarkable resilience. Operators have found innovative ways to collaborate with PEMEX and there are promising developments on the horizon, including projects like Zama and Trion.

Experts highlight substantial potential in Mexico’s upstream sector, with major oil companies persevering and continuing their operations while adhering to strict regulations. These companies keep placing their bets on long-term investments in the country.

The upcoming 2024 elections represent a decisive moment for the industry. Mexico has fallen significantly short of its oil production and refining targets, which were revised downward during the administration. These factors pose considerable investment risks to Mexico. Nonetheless, in the global context, Mexico has emerged as an attractive option for reconfiguring commercial routes and global trade strategies. At the same time, both public and private industry participants must start looking at more environmentally friendly operations, should they wish to remain relevant in the years to come.

Months before a new change in administration and possibly further transformation to the national industry, experts shared their insights and perspectives on the state of the national oil and gas industry at Mexico Oil and Gas Summit 2023, as well as strategies to remain competitive and navigate the specific particularities of the country’s industry.

150 companies

268 conference participants

Breakdown by job title

33% Manager/VP

24% CEO/CM/GD/MD

23% Partner/Associate/ Leader/Specialist

19% Director

Mexico’s leading B2B conference organizer introduces the world’s leading event networking platform.

35 speakers

10th edition

10 sponsors

3,464 visitors to the conference website

Conference social media impact Pre-conference social media impact

9,735 direct impressions during MOGS 77,264 direct pre-conference LinkedIn impressions

3.14% click through rate during MOGS 2.42% pre-conference click through rate

5.25% conference engagement rate 3.09% pre-conference engagement rate

Delivering intent-based matchmaking powered by Artificial Intelligence that connects the right people. Network, no matter where you are.

138 participants

423 matchmaking communications

56 1:1 meetings conducted

Matchmaking intentions

Recruitment

Networking

• ABB México

• Administración del Sistema Portuario Nacional de Manzanillo

• Administración del Sistema Portuario Nacional Tuxpan

• AGBB RASARE

• Agencia Estatal de Energía

• Ainda, Energía & Infraestructura

• Akali Marine

• ALCON Laboratorios

• AMEXHI

• API Tamaulipas

• Apollo X

• Aqueos

• ASEA

• Baker Hughes

• Balam Energy

• Biaani’ Energy

• Blin Co.

• BME Shipping

• BP

• Brilliant Energy

• Buckman

• BUPA México & BUPA Global Latin America

• CBM Ingeniería Exploración y Producción

• Cemza

• Champion X

• Cheiron Holdings LTDA

• Citla Energy

• Coast Oil Dynamic

• Comisión Nacional de Hidrocarburos

• Consultant

• Control Union

• Core Laboratories

• Cotemar

• CSIPA

• Cuatre Casas

• Diavaz E&P

• DNV Energy Systems Mexico

• Dubai Chamber

• Educatrade

• Embajada de los Estados Unidos

• Emerson • Endress + Hauser Mexico

• Eni Mexico

• Eseasa Offshore

• fieldwood Energy

• frontera Offshore

• fueltrax

• GADM

• Geodis

• GESA Supplies and Services

• GOLfO ENERGy AMERICAS SA DE CV

• Gonzalez Calvillo

• Goodrich, Riquelme y Asociados

• Grupo Cofli

• Grupo Diavaz

• Grupo Industrial Águila

• GRUPO KONJIC

• Grupo roales

• GRUPO WALWORTH INDUSTRIAL DE VALVULAS SA DE CV IVA760914GV5

• Gulf Supply

• Heerema

• Hitachi Energy

• Hokchi Energy

• Holland & Knight

• Holland House Mexico

• HR Ratings de Mexico SA de CV

• IGSA

• In Hole Solutions

• Indumar

• Inerco Consultoría México

• Instituto Mexicano del Petróleo

• Integralia Consultores

• IPD Latin America

• IPS powerful People

• J RAy MCDERMOTT

• Jaguar Exploration and Production

• John Crane

• Kepler Oil & Gas

• Kiewit

• KPMG

• LATIN AMERICAN RAINMAKERS

BUSINESS MANAGEMENT SERVICES

• Lean Energy & Automation

• Lifting

• LRQA

• Lukoil Lubricants Mexico

• Lukoil Upstream Mexico

• M&L Estudio Legal

• McDermott

• McKinsey & Company

• Mexico Pacific Limited

• Moody

• Moody´s Investors Service

• Murphy Oil

• Naviera Integral

• Noatum Project Cargo

• NRGI Broker

• OCA Global

• OH Maritime Services

• OILMEX ENERGy

• Oleum Energy

• Oracle

• PC Carigali Mexico Operations

• PEMEX

• Perenco

• PETRONAS MEXICO

• PGS

• Picarro

• Porter Dos Bocas

• Porter Holding

• Prime Marine Services

• Protexa

• Qualitech

• R.H Shipping

• R9 Holdings

• RenaissanceOil Corp

• Repsol

• Repsol

• Roca Port

• ROSEN Group México

• S&P Global

• Samson Group

• SECRETARIA DE DESARROLLO ENERGÉTICO

• Secretaria de Desarrollo Energético de Tamaulipas

• Secretaria de Energia

• SEVEN SEAS ENERGy MEXICO S.A. DE C.V.

• SGS

• Shell

• SICK Sensor Intelligence

• SLB

• Sotaog

• SUMIMSA

• SUMMUM

• The Mudlogging Company

• TIP

• Total Energies E&P México

• TREBOTTI

• Tubería y Válvulas del Norte (TUVANSA)

• U.S. Commercial Service

• Vera & Associates

• Vista

• VMS Energy de México

• Wamex

• Wesco Anixter

• Westland Americas Offshore

• Wintershall Dea

• Woodside Energy

• Worldwise Consulting

• Xincheng Special Steel America, Inc

08:55 WELCOME TO MEXICO OIL & GAS SUMMIT 2023

09:00 THE POLITICAL SCENARIOS OF 2024 AND THEIR IMPACT ON ENERGY POLICY

Speaker: Carlos Ramírez, Integralia

09:30 PEMEX’S FINANCIAL, DEBT AND CASH FLOW OUTLOOK

Moderator: Alejandra León, S&P Global

Panelists: Roxana Muñóz, Moody’s Investors Service

Félix Boni, HR Ratings México

José Pablo Rinkenbach, AINDA

John Padilla, IPD latam

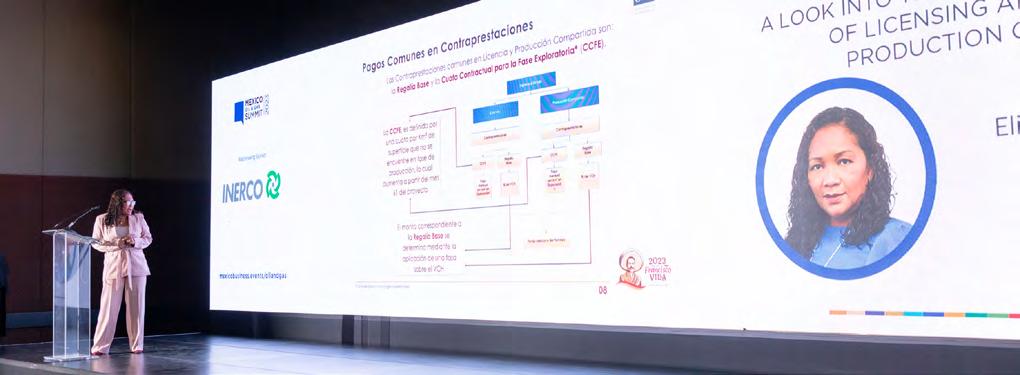

10:30 A LOOK INTO THE FISCAL REGIMEN OF LICENSING AND SHARED PRODUCTION CONTRACTS

Speaker: Elizabeth Castro, CNH

11:00 NETWORKING COFFEE BREAK

12:00 THE ROLE OF PRIVATE OPERATORS IN MEXICO’S UPSTREAM OIL & GAS INDUSTRY

Moderator: Ivan Sandrea, Westlawn Americas Offshore (WAO)

Panelists: Alma América Porres, CNH

Giorgio Guidi, Eni Mexico

Andrés Brügmann, Hokchi Energy

Warren Levy, Jaguar Exploration and Production

Martin Jungbluth, Wintershall Dea

13:00 STRATEGIC ALLIANCE WITH PEMEX: DEVELOPING ZAMA

Speaker: Sylvain Petiteau, Wintershall Dea

13:30 NETWORKING LUNCH

15:00 SUPPLY CHAIN OUTLOOK ON BUSINESS OPPORTUNITIES AND INDUSTRY TRENDS

Moderator: Alberto Galvis, Citla Energy

Panelists: William Antonio, SLB

Miguel Carreón, Baker Hughes

César Vera, BME Shipping

Daniel Zuluaga, SUMMUM

16:00 PROCUREMENT PRIORITIES, LOCAL CONTENT OPTIMIZATION AND SUPPLIER DEVELOPMENT STRATEGIES

Moderator: Miriam Grunstein, Brilliant Energy Consulting

Panelists: Marcos Ávalos, Tubería y Válvulas del Norte (TUVANSA)

Héctor Canizales, Baker Hughes

Joel Zúñiga, fieldwood Energy

Rafael Rodríguez, Grupo Industrial Águila

17:00 NETWORKING COCKTAIL

08:55 WELCOME TO MEXICO OIL & GAS SUMMIT 2023 - DAY 2

09:00 A REVIEW OF MEXICO’S ENERGY REFORM AFTER 10 YEARS

Speaker: Óscar Roldán, R9 Holdings

09:30 PERSPECTIVES ON ESG FROM THE SUSTAINABILITY COMMITTEE IN PEMEX

Speaker: Lorenzo Meyer, PEMEX

10:00 THE CHALLENGE OF OPTIMIZING PRODUCTION AND DELIVERING ON ESG OBJECTIVES

Moderator: Ignacio Quesada, McKinsey & Company

Panelists: James Buis, ChampionX Eckhard Hinrichsen, DNV Energy Systems Mexico

Brad McNeill, frontera Offshore

Sara Landon, Inerco

11:00 NETWORKING COFFEE BREAK

12:00 SUPREME COURT AND ENERGY SECTOR: WHAT ARE THE CONSTITUTIONAL LIMITS ON LEGISLATIVE, EXECUTIVE POWER

Moderator: David Enríquez, Goodrich, Riquelme y Asociados

Panelists: Claudio Rodríguez-Galán, Holland & Knight

Enrique González Calvillo, González Calvillo

13:00 TRANSFORMING MEXICO’S DEEPWATER POTENTIAL INTO RESERVES AND PRODUCTION

Speaker: Stephan Drouaud, Woodside Energy

13:30 END OF MEXICO OIL & GAS SUMMIT 2023

THE POLITICAL SCENARIOS OF 2024 AND THEIR IMPACT ON ENE RGY POLICY

Mexico’s energy landscape has undergone significant changes over the last decade. About four years after the implementation of new regulations to follow the Energy Reform, the oil and gas industry started to develop as private operators won blocks to carry out exploration activities. The cancellation of new bidding rounds and the government’s favoritism toward PEMEX, however, are creating a challenging scenario for the future of the overall industry. Now, with a new presidential election on the horizon, understanding the different visions of the two main candidates is key to preparing for future changes in industry policies and regulations.

The arrival of the new government in 2018 marked a significant shift in the direction of the oil and gas industry, prioritizing the rescue of state-owned companies. However, this move came with numerous challenges, particularly given PEMEX’s substantial debt burden, a problem the administration has been grappling with for the past five years.

The suspension of bidding rounds in 2018 created uncertainty for private operators. While the prevailing sentiment in 2018 was one of continuity. By 2019 and 2020, this shifted to cautious optimism. The current administration has made substantial investments in PEMEX and refining, injecting capital and providing tax breaks. However, the refining sector has proven to be unprofitable, as the Dos Bocas refinery project has experienced significant cost overruns and multiple delays. At the same time, energy price volatility in 2022, driven by the Russian-Ukraine conflict, heightened the importance of energy self-sufficiency for governments.

Mexico has fallen significantly short of its oil production and refining targets, which were revised downward during the administration. These factors pose considerable investment risks to Mexico. Nonetheless, in the global context, Mexico has emerged as an attractive option for reconfiguring commercial routes and global trade strategies. Disruptions caused by the pandemic and European conflicts have prompted a reevaluation of supply chains and trade routes.

Given its proximity to the world’s largest consumer market, the US, Mexico has become an obvious choice for companies seeking to relocate operations closer to their target markets. In 2023, Mexico has experienced a substantial increase in foreign direct investment (fDI). This surge, according to experts, underscores the potential that companies perceive in Mexico, driven by the nearshoring trend.

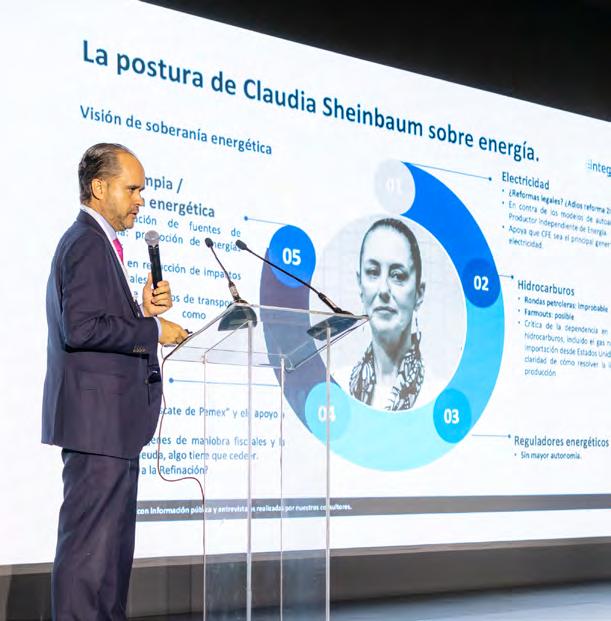

In 2024, the country is scheduled to hold presidential elections. Typically, during an election year and the first year of a new administration, investment tends to decrease as stakeholders await clarity on the strategies of the incoming government. With the announcement of the two primary presidential candidates, Claudia Sheinbaum and Xóchitl Gálvez, experts initially

anticipated that energy policy might not be a central focus of their campaigns. However, both candidates have openly articulated their energy strategies and viewpoints, including their willingness or lack thereof, to engage with the private sector.

The next few years will be a pivotal period for investors seeking opportunities in Mexico. The country will also need to determine how best to leverage this heightened investor interest.

In this context, Carlos Ramírez, Political and Economic Risk Consultant at Integralia, emphasizes the importance of monitoring not only the federal elections but also considering various other factors that influence the Mexican political landscape. These factors include elections in both the Chamber of Deputies and the Senate, as well as elections in 31 local congresses. Additionally, changes in city halls and governor elections in nine states, including Mexico City, contribute significantly to the overall political dynamics.

When considering these pivotal factors, Ramírez directs attention to potential scenarios for the federal presidential election. The first scenario envisions a presidential race with more than two

participants: Sheinbaum, Gálvez, a candidate from Movimiento Ciudadano and other independent candidates. Ramírez notes that having more than three candidates is the least likely scenario. Another scenario anticipates an election featuring only Sheinbaum and Gálvez, which is also an unlikely occurrence. finally, he underscores that the most probable scenario involves Sheinbaum, Gálvez, and a candidate from Movimiento Ciudadano, with Nuevo Leon Governor Samuel García emerging as the most likely candidate.

In the latter scenario, Ramírez emphasizes that the coalition led by Gálvez would be the most affected team, as García has the potential to attract votes from Gálvez’s supporters. Under these circumstances, the scenario where Sheinbaum emerges as the winner appears to be the most likely outcome. However, Ramírez cautions that nothing is set in stone and various factors could lead to different results. According to Integralia’s analysis, the most probable scenario is Sheinbaum winning the election by a moderate margin, accompanied by a balanced congress. “Another factor to consider is the Mexico-US relationship. If the republicans win the elections in the US, the upcoming Mexican government will have a difficult scenario,” he added.

Ramírez said that whoever wins the elections will inherit both positive and negative factors. The positive ones being a nearshoring momentum, relatively robust macroeconomic indicators, improvements in some social indicators and a society that trusts more on the government. On the negative side, he highlights tight public finances, significant liabilities like PEMEX’s debt burden, bottlenecks in the energy sector and low governance capabilities to make public policies.

Ramírez emphasizes that a Sheinbaum presidency means a continuation of President López Obrador’s policies but in a different context. While maintaining macroeconomic stability is a priority, it will involve additional costs due to the changed circumstances. The same challenges apply to social-focused policies, which may encounter budgetary constraints. Ramírez points out that although Sheinbaum is expected to uphold energy nationalism, her clearer stance on climate change and a constrained maneuvering margin may prompt a reevaluation of the sector, potentially opening the door to negotiations with private companies. Still, it is likely that she will maintain support for state-producing companies like PEMEX and

CfE. Ramírez also notes the unlikelihood of oil bidding rounds, with a small probability of farmouts occurring. “Sheinbaum may continue with López Obrador’s agenda, but with a tighter maneuvering margin that will force her to make hard decisions, very soon, including a fiscal reform,” he noted.

Gálvez is anticipated to prioritize macroeconomic stability, albeit with associated costs. Regarding hydrocarbons, Ramírez highlights that, despite her reservations about the sector, Gálvez recognizes its significance for attracting new investments and resources. This acknowledgment may lead to the retention of the 2013 oil legal framework. In the energy sector, Gálvez might emphasize regionalization, enabling greater involvement of state governments under the guidance of the federation. Additionally, she is likely to enhance regulatory agencies by granting them more autonomy and changing the commissioner nomination process, while ditching the country’s current hyperfocus on refining. Gálvez may also encourage increased private sector participation in PEMEX and C fE and a diminished emphasis on refinery o perations.

PEMEX’S FINANCIAL, DEBT AND CASH FLOW OUTLOOK

President Andrés Manuel López Obrador’s energy strategy has focused on strengthening state-owned companies. However, PEMEX’s debt has raised concerns due to the lack of liquidity to continue with projects. Its infrastructure continues to age and despite significant capital injections to develop new projects, projects have faced various setbacks. The following years will be crucial for the NOC as it grapples with mounting debt and difficulties in securing further financing, say experts.

PEMEX produces 90% of the oil and gas in the country and holds 75-80% of the discovered resources in the country.

“The company is a dominant player and its performance has a significant impact on

our society, especially in energy security matters,” says Alejandra León, Latin America Upstream Director, S&P Global. The NOC, however, is the most indebted state energy company in the world, with US$25 billion in short-term debt and US$4 billion in bonds that are still due in 2023. Overall, PEMEX’s total debt amounts to over US$100 billion.

Credit rating companies have closely monitored the NOC, warning of the potential risk that the company may become unable to meet its financial obligations. To continue dealing with this massive debt, PEMEX has received significant injections of federal capital. Still, according to f itch Ratings, PEMEX represents the greatest concern in terms of liquidity and debt among Latin American oil companies.

The size of the debt is a significant issue, reflects Roxana Muñoz, Vice President and Senior Analyst, Corporate finance Group, Moody’s Investors Service and achieving a sustainable balance by cutting capital expenditures (CAPEX) by 32% is not a sustainable solution. Muñoz highlights the link between PEMEX’s debt and its tax burden, noting instances where it has struggled to make Shared Profit Right (DUC) payments due to its tax obligations. Reducing this tax burden, she suggests, could improve PEMEX’s cash flow and financial stability.

félix Boni, Chief Credit Officer, Economic Analysis, HR Ratings Mexico, points out that in 2021, after accounting for CAPEX, PEMEX had a net income of MX$18 billion (US$1 billion). Still, it had to pay taxes of MX$260 billion (US$14.5 billion). Moving on to 2022, which was significant in oil price levels, PEMEX generated a net cash flow after CAPEX of MX$186 billion (US$10.3 billion). However, it had to allocate MX$367 billion (US$20.3 billion) to debt payments, while receiving MX$219 billion (US$12.1 billion) from the federal government. With such a substantial tax burden, it becomes challenging to manage its debt payments.

Moody’s Investors Service has warned that consistent support for PEMEX and priority programs such as pensions and flagship projects are making the federal

government’s spending control “more rigid.” These spending dynamics will limit the fiscal room for the government in the future. for the next fiscal year, the federal government plans a total net expenditure of MX$9.06 trillion (US$526 billion), which is 4.3% higher in real terms compared to what was approved for this year.

The NOC has refinanced its debt over the last couple of years. However, growing concerns driven by accidents in PEMEX’s installations, delays in flagship projects and other factors have affected the company’s credit rating, which has made acquiring more debt increasingly costly. PEMEX’s debt with its suppliers has also triggered a series of complaints to the SHCP. At least three affected companies have already notified the start of the dispute resolution process due to lack of payment, suspending their services, or lodging angry complaints.

Muñoz mentioned that, as part of Moody’s ratings, the firm considers a standalone rating of caa3. However, given that the NOC is so intrinsically tied to the federal government and the support it can offer, its rating is boosted to B1.

The firm estimates that in 2023-24, PEMEX will require around US$14 billion in assistance to close the year. However, José Pablo Rinkenbach, Executive Director of Asset

Management and ESG at AINDA Energía & Infraestructura, argues that the Ministry of finance and Public Credit (SHCP) has now exhausted its options for assisting PEMEX since, over the past five years, the SHCP has seen a net debt increase of US$6 billion for PEMEX. Over the years, the ministry has had to inject US$42 billion into the company. This financial infusion was divided into 50% to pay off debt, 45% for the Dos Bocas refinery and 5% for other expenses. SHCP has resorted to capital injections, reducing PEMEX’s profitsharing tax rate from 60% to 35%, granting tax credits and deferring profit-sharing taxes.

The state company is expected to fall short of meeting the administration’s initial production, export and refining objectives, including the president’s commitment to achieve energy self-sufficiency. This commitment received strong support through the construction of the Dos Bocas refinery, which experienced multiple delays and nearly doubled its original budget allocation,

further straining PEMEX’s resources. The refinery has also raised questions regarding its profitability. Rinkenbach suggests that, in terms of refining, the most prudent course of action is to exit this sector. What truly matters is the efficiency at which operations are conducted. Refineries must operate at a 96% rate to be profitable. In contrast, PEMEX has historically operated at an efficiency rate of only 30-40%, a performance level that “burns cash, rather than generating it,” Rinkenbach adds.

John Padilla, Managing Director, IPD Latin America, mentions that the NOC’s production costs have also increased by 60% in just the past two years. for years, PEMEX had maintained a low production cost against the international benchmark, comparable only to Arabian countries. However, in 2022, costs surged to US$18/b against 2020 and this upward trend is expected to continue.

As the global oil industry faces mounting pressure to meet demand while transitioning to more sustainable practices, experts caution that Mexico’s heavy reliance on fossil fuels without a clearly defined mitigation and long-term strategy, including a gradual reduction in fossil fuel dependence, could prove to be exceedingly costly for the nation. Muñoz highlights PEMEX’s risk of accessing refinancing opportunities both in the short and long term, as some banks, especially in Europe, are closing financing lines for the sector in favor of greener alternatives.

To improve PEMEX’s cash flow and address balance-related issues, Rinkenbach calls for a systemic change. This could entail a government bailout where the government assumes the debt and makes it sovereign, formalizing the current situation where PEMEX accumulates debt through the federal government. Alternatively, transitioning from assignments to contracts could be a solution. This transition would enable PEMEX to secure financing not at the corporate level but on a project-by-project basis using its reserves as assets to back up financing. This approach would lower the financing costs for PEMEX and help it face its upcoming obligations.

FISCAL REGIMEN OF LICENSING, SHARED PRODUCTION CONTRACTS

The past five years have been marked by the suspension of bidding rounds and farmouts and numerous personnel changes at the head of PEMEX and regulatory agencies. However, rather than rip up private contracts as feared, the government instead re-stated its commitment to honor those contracts after a period of review. A closer look into the fiscal regimen of the two contracts through which operators function in Mexico is necessary to understand the fiscal importance of operators in the industry.

Private production and exploration have yielded significant results for the development of the industry. At the same time, these companies can represent an important part of income to public finances regarding hydrocarbon management. In Mexico, the legal framework allows operators to carry out exploration and extraction activities under four contractual modalities: License, Shared Production, Profit Sharing and Services contracts, explains Elizabeth Castro, Head, National Hydrocarbon Information Center (CNIH).

Operators normally work under either a License or Shared Production contract, both of which are subject to the concept of Contractual Hydrocarbon Value (VCH), defined as the volume of each type of hydrocarbon (oil, gas, and condensates) produced, multiplied by its corresponding Contractual Price (stipulated in each

contract). Companies can then calculate the project’s profit by subtracting the Project Costs (investment and operating expenses) from the VCH.

Profit comes from exploration and extraction activities and is distributed between the State and the Operator. The State receives income from compensatory payments and taxes. The Operator receives the remainder after making these payments to the State and covering the project’s costs.

Therefore, conceptually, the f iscal Regime is the mechanism that defines the distribution of oil profits between the State and the Operator, meaning the way in which the State collects income derived from hydrocarbon exploration and extraction a ctivities.

According to Castro, players in the hydrocarbon industry can reach out to the National Hydrocarbon Commission (CNH) for specific guidance regarding the fiscal regime. Audits are a mechanism through which operators can receive this guidance. Currently, in Mexico, there are 108 assigned contracts from which 76 are under a License and 31 under a Shared Producti on regime.

Castro emphasizes that it is critical that the State generates efficient and effective fiscal models for collection in

the hydrocarbon sector. As the Mexican oil and gas industry opened to private players, the Energy Reform made clear the ownership of the nation’s resources as this holds a heavy political weight in Mexico’s context.

As of 2023, the government has benefited state-owned companies like PEMEX and CfE, despite concerns about public finances and energy market management. This situation coincides with a turbulent political landscape in Mexico, particularly in the lead-up to the 2024 elections.

CNH has previously urged SENER to analyze the possibility of reactivating oil tenders in

the country. In its technical evaluation for the updated 2023 f ive-year Exploration and Production Plan, CNH revealed that there is 23% of the territory that currently lacks activity but holds characterized and available remaining reserves for development. Moreover, during the 12th extraordinary session of the governing body, CNH pushed to increase this potential an additional 5%, represented by unconventional resources ready for extraction.

In 2022, more than 20 blocks were abandoned, although CNH stated that this is a normal process as operators decide to focus on the most promising projects.

THE ROLE OF PRIVATE OPERATORS IN UPSTREAM OIL & GAS

Private offshore operators have played an important role in advancing flagship projects and striving to meet production targets. However, since 2019, these players have faced numerous obstacles and uncertainties, as the current administration has made PEMEX the focal point of their energy strategy. Nevertheless, companies have adopted various strategies to curb the growing uncertainty.

“Despite the challenges, it is important to recognize where Mexico started from,” says Alma América Porres Luna, former Commissioner, CNH. She explains that Mexico crafted regulation for

private participation from scratch and approximately 80% of contracts awarded to private companies were for exploration, a venture that represents high risk in itself. This opened the door to gain greater knowledge of previously untapped areas for Mexico. However, it should also be considered that usually this exploration must go further and the granting of more areas serves to move the industry forward as companies can progress and decide which areas are more promising, thus driving the entire industry.

Experts concur that it would be a mistake to assume that no progress has been made in Mexico’s oil and gas ventures. for Warren

Levy, CEO, Jaguar Exploration and Production, it is important to highlight that regulation in Mexico can be also seen in a positive light, as a strict approach can make operators more attention-to-detail oriented, especially given the specific context of the country. Moreover, private players can enhance Mexico’s industry and some changes are indeed necessary for it to happen.

“When we discuss the Mexican industry within its unique context, it becomes evident that merely restarting bidding rounds may not suffice. The reason being, the industry calls for more experience and expertise to navigate this intricate landscape”

Warren Levy CEO | Jaguar Exploration and Production

reflects the emergence of a brand-new industry in Mexico, despite the presence of a well-established service chain for the oil and gas sector. We transitioned from having just one company to about 70,” mentions Andrés Brügmann, Vice President, Hokchi Energy.

Regulation for the industry was initially created without prior experience, but now, after several years of hands-on involvement, operators have the opportunity to refine and adapt them for greater clarity and efficiency.

“The learning curve during this period has been quite fascinating and we have received substantial support along the way. However, an area for improvement lies in the opportunity to streamline these regulations,” says Giorgio Guidi, Managing Director, Eni Mexico. “We are not new to oil but we are new to Mexico.”

Moreover, despite the substantial support that PEMEX has received in managing its debt, the state-owned company has also struggled to meet its financial commitments to certain stakeholders, which puts strain on the company’s performance and the country’s overall production targets.

The promise of the 2014 Energy Reform has been partially realized. Private operators entered the Mexican oil and gas market with enthusiasm, attracted by the prospect of accessing previously inaccessible reserves. However, they have faced challenges along the way, such as complex regulatory frameworks, security concerns and logistical hurdles. Despite these obstacles, private operators have made substantial investments and achieved significant milestones in terms of production and exploration. “In my view, this situation

Still, experts agree on the potential there is to develop a strong oil and gas industry in Mexico, including a strong and skilled workforce. In the words of Ivan Sandrea, Co- founder and CEO, Westlawn Americas Offshore (WAO), “Mexico still holds great potential and that shows through the presence of important oil majors in the country.”

Being PEMEX a key player in this industry, its development is also of interest for all parties with stake in oil and gas, be them public or private. furthermore, private players can also help the company to leverage Mexico’s resources. As Levy mentions, all private operators work with PEMEX in some shape or form. “I firmly believe that the key to success lies in collaboration between the private and public sectors. When these two entities work together, progress can be

achieved harmoniously. It is evident that in recent years, the industry has witnessed a profound understanding of exploration and production (E&P) among its participants,” mentions Martin Jungbluth, Managing Director, Managing Director of Mexico, Wintershall Dea. A great example of this collaboration is the Zama field, which after a few years of negotiations both the private and public sectors reached an agreement that could benefit both parties.

Still, it is critical that PEMEX can also meet privates in the middle. Experts mention that

one of the particularities of the Mexican industry is the delays in PEMEX’s payments to suppliers, which in turn drive up prices. If this could get corrected, it would mean an improvement in Mexico’s industry’s competitiveness.

Sandrea highlights that the operators that remain in Mexico do so because there are things they do correctly. Porres agrees, mentioning that operators held up to regulator’s standards committing to their development plans and timings, even in difficult times such as the pandemic.

STRATEGIC ALLIANCE WITH PEMEX: DEVELOPING ZAMA

Zama is considered to be one of the most promising shallow water fields in the world. However, its development has followed a rocky path, as it was later discovered that the reservoir extended into PEMEX’s Uchukil project. Still, a resolution came in due time and now the field is line to become one of Mexico’s most important developments.

The development of the Zama field stalled due to the disagreement between PEMEX and the consortium formed by Wintershall Dea, Talos Energy and Harbour Energy. This

was the first unitization process carried out in Mexico. Nevertheless, this past October 2022, following President López Obrador’s intervention, the situation was resolved. It was announced that the Joint Development Plan of the Zama field would be presented to CNH by March 2023, with the NOC as the leading operator of the block.

PEMEX included the development of the Zama field as one of the Top 5 priority projects for its 2023-2037 investments. The 38 projects contemplated for PEMEX’s 20232037 Business Plan consider an estimated investment of MX$1.1 trillion (US$58.613 billion).

Wintershall Dea is focusing on actively contributing as a partner to the Zama asset to ensure that the field is developed in the most efficient timeframe and in the best possible technical manner.

According to Block 7’s approved Unit Development Plan, the project consists of 46 wells, of which 29 are producers and 17 water injectors that could be developed with Tender-Assisted Drilling or Modular Platform rigs, featuring double frac-pack in all wells with the option of artificial lifts using ESPs when needed.

Sylvain Petiteau, Management Office at Zama Integrated Project Team, Wintershall Dea, highlighted that the project aims

to incorporate two offshore platforms. These could include a gas-liquid separator, sending the separated components to the shore. Additionally, there will be a seawater treatment plant to treat and inject water for onshore energy production. The project would need the construction of two 63.5km pipelines for transporting gas and liquids to the shore. furthermore, a power cable extending from the shore is required.

“Both the cable and the pipelines will be connected to newly constructed, exclusively Zama-dedicated onshore processing facilities along the Dos Bocas coast. This comprehensive infrastructure is designed to support the efficient processing of resources from the Zama project until achieving delivery objectives,” he highlighted.

Petiteau stressed that the Zama partners decided to create what they call an Integrated Project Team (IPT) to foster collaboration in a more efficient way. Among the objectives of this partnership are to execute activities related to the Unit Development Plan, complying with the obligations of the Unification Resolution,

capitalizing talent and capabilities of the different companies’ teams, building trust and simplifying the companies’ decisionmaking processes, among others. “The idea is to work as Zama, not as individual companies. I am not saying this is the ideal model and all companies must follow it. Every project has its specific features, but exploring the capabilities and differences between the Zama team’s members, this is something we perceived as positive,” Petiteau said.

The next phase of the plan is taking action by conducting engineering studies, which are currently in the pre-bidding process. The team expects to get the green light by the end of 2023 and conduct the studies by 2024. The Zama team is set to create a trust to give the project a bit more independence from PEMEX’s finances.

“There will be a lot of challenges as in every project, but we proved that after previous challenges, we are here talking about the development of Zama, which proves the team’s capacity to deliver,” Petite au stated.

SUPPLY CHAIN OUTLOOK ON BUSINESS OPPORTUNITIES, INDUSTRY TRENDS

In the wake of recent disruptions and challenges in global supply chains, companies operating in the Mexican oil and gas industry find themselves at a critical

juncture. Enhancing resilience and agility in supply chain operations is paramount to mitigating risks and maintaining operational continuity, experts point out.

f luctuating oil prices and market uncertainties have made it imperative for companies to manage cash flow effectively. The beginning of 2023 experienced low prices due to expectations of lower economic activity on China’s side, while OPEC kept pushing oil production cuts to increase prices. This year was vastly different to 2022, where oil prices were at an all-time high due to the Russian war on Ukraine, which also affected supply chains, underscoring once more a lesson learned through the pandemic: moving production closer to con sumption.

The pandemic’s impact on the industry’s supply chain was profound, as noted by William Antonio, Managing Director of Mexico and Central America, SLB. Delays of up to 18 months in obtaining electronic components and nearly 12 months in international shipping logistics disrupted production chains significantly. Investment in terms of capital expenditure (CAPEX) for new equipment decreased from 2020 to 2021 and there is now a concerted effort to revitalize CAPEX.

In 2014, during the last industry upswing, the Top 5 service companies worldwide invested nearly US$9 billion in CAPEX. This year, they will only invest US$3 billion, onethird of the previous amount. One of the reasons for this significant reduction is that the cash flow is lower than before.

Miguel Carreón, Regional Leader Mexico & Central America at Baker Hughes, emphasizes that high-interest rates and a green finance philosophy have made upstream projects less attractive for investment. This situation has prompted companies to emphasize the importance of cash flow to their institutional investors and to carefully manage it. Managing cash flow involves ensuring efficient billing and collection processes, proactively collaborating with customers to anticipate payment issues and working together on restructuring strategies through credit or factoring in case of unforeseen circumstances.

Companies must strive toward a costeffective operation to protect their operations against negative fluctuations. Collaboration and partnerships within the supply chain are crucial drivers for innovation, cost reduction and overall competitiveness in the Mexican oil and gas industry. Selecting the right suppliers and vendors is critical to a resilient supply chain and, when evaluating potential partners, companies should consider supplier reliability, quality standards and ethical practices. Effective supplier relationship management involves continuous assessment, communication and collaboration.

Daniel Zuluaga, Country Manager, SUMMUM, highlights this collaboration as essential. It is crucial to create spaces where multiple companies from the same industry but with different specializations can exchange their insights and address common challenges. This fosters an environment conducive to innovation and to the sector’s overall development, while strengthening the supply chain. Building strong partnerships

with suppliers can lead to long-term cost savings, improved product quality and enhanced supply chain resilience, as well. Embracing digital technologies and datasharing platforms can facilitate real-time communication and collaboration, enabling more efficient supply chain management and decision-making.

Both communication and establishing strong partnerships are key to the efficient development of nearshoring, especially since, according to Antonio, within five years, the expectation is that an additional US$150 billion in income will flow into Mexico due to nearshoring, primarily through exports to the US. He also suggests four important points to face nearshoring and be more competitive. first, he highlights creating a sufficiently stable and highquality supplier base, avoiding overreliance on a single provider and having multiple options. This practice not only helps foster the growth of the industry but also nurtures local talent. Second, he mentions that strategic planning is indispensable in any industry, particularly within the supply chain. Visibility is key because a significant part of the production process depends on having the right inventory at the right time. Hence, enhancing communication with both state-owned and international private companies is crucial. This not only leads to cost reduction but also ensures the delivery of quality and improved

service for projects. Third, Antonio points out that process variability can incur high costs, making standardization necessary to enhance efficiency. Lastly, he addresses how effective cash flow planning is vital for achieving efficient production and operational processes. Without proper financial planning, it is challenging to maintain efficient operations.

These are not nearshoring’s only challenges, however. Alberto Galvis, CEO, Citla Energy, highlights insecurity, community relations and the industry’s major player, PEMEX, facing financial difficulties that directly impact cash flow as major elements to take notice of. César Vera, Managing Director of BME Shipping, also stated that in terms of changes in sustainable regulations, it is incentivized to reduce greenhouse emissions and invest in alternative energy sources to better cater for nearshoring oppor tunities.

Carreón also addresses another significant, yet often overlooked, issue in the energy industry: human capital. With so many new and diverse industries emerging, the upstream sector does not seem appealing to young professionals. The boom across various industries will demand a skilled workforce, and there will not be enough talent to meet the growing production and development needs. Additionally, he points to a lack of adherence to international

standards, a two-way process and a substantial need for a diversified supplier base that complies with all regulations and ensures efficiency and safety in their operations.

On the side of regulation, Antonio underscores the importance of collaborating with various government agencies, including the Ministry of Energy,

the Regulatory Energy Commission, and the National Hydrocarbons Commission to ensure that regulatory issues act as catalysts for business growth in Mexico, rather than hindrances. Conducting a global benchmarking analysis to understand successful regulatory implementations in other countries is crucial, he says. This analysis can provide valuable insights into enhancing Mexico’s regulatory framework.

BOOSTING LOCAL CONTENT AND SUPPLIER DEVELOPMENT STRATEGIES

In the oil and gas industry, procurement plays a pivotal role in ensuring optimal supplier selection, cost efficiency and quality assurance. To achieve these objectives, operators in the industry must navigate a complex web of challenges and opportunities, keeping in mind the need and requirement for a stronger local sup ply chain.

One of the primary objectives for operators in the Mexican oil and gas industry is to foster local content participation. Given this administration’s emphasis on strengthening PEMEX as the linchpin of its energy policy, local content has taken on significant importance. The development of the Dos Bocas refinery, for instance, was executed with a mandate to employ as much local labor as feasibly possible. According to data from the Commission of Economy of the Chamber of Deputies, PEMEX awarded contracts

worth MX$25.77 billion (US$1.51 billion) to MSMEs in 2022, underlining its role in supporting these businesses. “Within the next year, local content will become one of the most important variables not only for the public sector but also for privates. We need to learn how to navigate this new environment,” said Marcos Ávalos, General Director, TUVANSA.

Local content goes beyond components, however. According to Héctor Canizales, Mexico Country Sourcing Manager, Baker Hughes, the lack of specialized workers in the US is urging Mexico to develop this workforce, which also works to attract more investment to the country. “The conditions are set, now it is our time to work on harnessing this environment,” Canizales added. Similarly, Joel Zúñiga, Purchasing Manager, f ieldwood Energy, maintains that education is for workers, but also for companies. Zúñiga emphasized

that f ieldwood Energy focuses on getting to know each of the areas of the operation in which suppliers can be educated to comply with local content requ irements.

“We let companies know that if they hire 100% Mexican staff, the company will be treated as national”

Joel Zúñiga Purchasing Manager | Fieldwood Energy

Canizales said that investing in engineering majors over these years has finally paid off, as supply chains are relocating. He said that under this scenario, Mexico is set to be a western supply hub for the sector. “We are creating a China in Mexico from where we will sell to everyone, even to China and the Middle East,” he added.

While developing a stronger local content network, operators can enhance their supplier diversity by engaging in a combination of local and international suppliers. This strategy enables them to satisfy local content regulations while capitalizing on cost-effective global sourcing. To this end, long-term partnerships with suppliers are important. During this process, Ávalos stressed the importance of developing an industrial

policy consisting of training programs and resources.

The digital revolution is also transforming the procurement landscape within the Mexican oil and gas industry. Operators are now leveraging digital platforms, such as supplier portals and e-procurement systems, to streamline their operations, enhance transparency and foster effective collaboration with suppliers. “Digitalization of operations has boosted our capabilities to understand what our final client is looking for. Moreover, it has provided us with access to reliable and valuable information, thereby contributing to our overall operational effectiveness,” Rafael Rodríguez, Board Member Consultant, Grupo Industrial Águila added.

Nonetheless, Mexico has not performed well in the digital economy. Ávalos noted that Mexico ranks 49 among over 50 countries in the operation of digital platforms. Under these circumstances, experts recommend not only investing in technology but in proper training to manage such systems, which will impact the decision-making process of companies when choosing a supplier. “It is a fact that we will not be able to do business with a supplier that cannot prove its ability to manage digital platforms,” Canizales added.

A REVIEW OF MEXICO’S ENERGY REFORM AFTE R 10 YEARS

Mexico’s Energy Reform has ushered in significant changes that have transformed the country’s oil and gas industry. Right after Enrique Peña Nieto’s administration, the buzzword was continuity, to keep on track with the new concessions that the reform brought for private players to participate in the industry. The López Obrador administration, however, changed that buzzword to disruption as bidding rounds were canceled and PEMEX regained its position as the government’s golden company. Ten years after the Energy Reform, the industry landscape has transformed, although some challenges remain unchanged.

According to Óscar Roldán, Director of the Oil and Gas Division, R9 Holdings, the origins of the Energy Reform can be traced back to the change of government in 2000, which brought increased scrutiny to PEMEX. While no substantial changes were initially made to reform the regulation of PEMEX, these ideas bore fruit in altering the way public contracts functioned, as well as the establishment of regulatory agencies like the National Hydrocarbon Commission (CNH). Among some of the biggest changes in PEMEX was the change in its fiscal contributions, the NOC used to pay almost 100% of its income to public finances, which later transformed into the Right of Shared Profit (DUC).

In 2014, the Energy Reform proposed a fundamental transformation to how the industry operates. This involved a series of significant changes, including the ability for PEMEX to compete in the industry and become a world-class company. Corporate governance and transparency rules were also implemented to ensure efficient and responsible management of the company. The Reform had seven crucial objectives at its core, which included increasing oil and gas production as soon as possible, increasing reserves and transforming PEMEX, explains Roldán.

On the private sector’s side, company participation yielded important results. Onshore, 48 contracts were awarded and 4 migrations from previous service contracts were concluded. Meanwhile 59 offshore contracts were awarded and one migration from PEMEX (entitlement) was concluded. Private companies have invested US$14 billion and plan to invest about US$50 billion more, while these operations have also yielded US$3 billion for public finances in the form of taxes. Mexico’s oil and gas

data increased significantly, as well: 2D seismic data tripled, while 3D seismic coverage with WAZ technology quadrupled and new studies were conducted around the country. “All of this without the government spending one dollar,” mentions Rodán.

Regarding the expansion of hydrocarbon exploration and production, the goal was to increase the availability of reserves to drive the country’s economic growth. In 2019, the Mexican side of the Gulf of Mexico became the most explored oil and gas region globally. This milestone translated into substantial dividends in 2020, with the average rate of exploration findings significantly exceeding the global average. A substantial portion of these successes occurred in deepwater regions, some of the least explored areas. These findings renewed interest in the potential treasures within these basins and highlighted the future of Mexican deepwater development beyond PEMEX.

Still, reserves face a challenging landscape in Mexico. Despite increasing reserves and strengthening PEMEX were two of the most significant goals of the reform, a weaker PEMEX that owns 86% of 2P oil and gas reserves in Mexico proves challenging. Enrique Peña Nieto’s administration marked PEMEX with a 163% increase in its debt and very low levels of investment, which decreased by 50%. furthermore, Roldán identifies transparency as a transversal challenge that the industry and the NOC faces.

The Energy Reform established that hydrocarbons would continue to be owned by Mexico, ensuring the country’s energy sovereignty. In 2018, however, president López Obrador raised uncertainty as his new administration insisted on restating Mexico’s ownership of hydrocarbons. The president put the rescuing of PEMEX at the center of his energy strategy, which has proven to be a big challenge due to PEMEX’s level of indebtedness. Meanwhile, with the cancellation of bidding rounds in 2019, no more areas are granted for exploration,

while operators have begun to abandon several blocks.

Moving into 2022, the industry once again faced significant challenges. The US and Canada initiated an arbitration process against Mexico arguing that the latter was not honoring its commitments to the freetrade agreement and was hindering fair competition with its latest energy reforms, brought by the current administration. At the same time, the Russian-Ukraine war disrupted supply chains and drove up energy prices. In response, oil companies had to redefine their investment plans. High oil prices, however, helped stabilize the industry’s investments.

Roldán explains that the main challenges for the oil and gas industry in Mexico , at the moment, is in regulation, which is very difficult to navigate in the country and very time consuming. An improved fiscal regime is needed that could spark more interest and make many interesting areas more viable. The country needs to change its view of the oil and gas industry as a mere source of fiscal revenue.

Moving forward, Roldán mentions that bolstering PEMEX and addressing its debt to secure financial autonomy is a priority,

while enhancing its decision-making capabilities. Resuming bid rounds is also crucial, with a focus on PEMEX’s existing reserves and production areas. These bid rounds should also incorporate provisions to assist the NOC by reducing its capital requirements through farmouts for natural gas fields in key basins like Burgos, Veracruz and Macuspana, with a maximum royalty rate of 10%. farmouts for mature onshore fields in the southeast basin could also be an attractive option, with a royalty rate not exceeding 20%. Additionally, bid rounds should encompass PEMEX’s discoveries in deepwater areas like Doctus, Maximino and Nobilis, with a royalty rate around 18.5%. In cases where areas remain unallocated, Roldán says PEMEX should have the option to participate and benefit from investment contr ibutions.

Enhancing the regulatory framework is essential, states Roldán. Streamlining regulatory agencies or establishing government committees with a unified platform for addressing industry issues could prove advantageous. A renewed commitment to transparency and accountability is also imperative, as it is evident that combating corruption requires these fundamental p rinciples.

PERSPECTIVES ON ESG FROM THE SUSTAINABILITY COMMITTE E IN PEMEX

Over the past couple of years, PEMEX has grappled with numerous challenges, including high levels of debt and accidents often attributed to inadequate maintenance and rapid production.

Although the company saw a slight improvement in its finances due to surging oil prices last year, it still grapples with mounting pressure to align with environmental, social and governance

(ESG) standards. The recent creation of a Sustainability Committee is a nascent sign of change inside the NOC.However, uncertainty still lingers.

PEMEX announced to the Securities Exchange Commission the creation of the PEMEX Sustainability Committee of the Board of Directors in March 2023. This committee underscores the company’s commitment to sustainable practices and responsible energy production, as it aims to integrate ESG considerations into the NOC’s decision-making processes and contribute to a more sustainab le future.

While benchmarking and reporting ESG metrics is not mandatory, these criteria are now essential for measuring risk regarding how sustainable a company is.

furthermore, it is becoming increasingly relevant for investors that business models align with sustainability s tandards.

Lorenzo Meyer, Member of the Board of Directors and President of the Sustainability Committee, PEMEX, acknowledges that, at the beginning, the PEMEX board did not recognize ESG as a priority. “This not a trend anymore, however. We need ESG now,” he added. Meyer pointed out that the sustainability team, consisting of members from PEMEX, the Ministry of f inance (SHCP) and SEMARNAT,

is responsible for recommending the NOC comprehensive policies, guidelines and best practices related to ESG. The committee’s duties involve assessing ESG risks, identifying opportunities, proposing relevant strategies, overseeing reports and management plans, as well as encouraging transparency and disclosure rega rding ESG.

“Still, our recommendations are not binding. We advise and PEMEX needs to make a decision,” he added.

Despite the creation of this committee, ESG efforts on PEMEX’s side, particularly regarding sustainability, are still a work in progress. President López Obrador’s energy strategy has drawn criticism for prioritizing the rescue of PEMEX and showing a general preference for fossil fuels. While it is acknowledged in research and accepted by various governments, including the US, that the world will continue to rely on oil for decades, the oil industry is compelled to advance the energy transition. Several private oil companies have already reported investments in renewable energy technologies. In contrast, PEMEX’s ESG efforts remain vague, as the company grapples with issues like high levels of flaring, oil spills and unprofitable refining operations, which also result in the production of low-value, polluting fuel oil.

ESG efforts are necessary if PEMEX wants to keep investors happy, which is something that Meyer highlights as a priority. The NOC has announced several measures to update its safety and environmental procedures to ensure it can attract financing from banks and investors demanding more robust ESG standards from fossil fuel companies. “The most contentious goal we have in the midterm is a roadmap for our Sustainability Plan. We must have very clear goals to present to investors, regulators and banks,” stressed Meyer. The committee has met with several stakeholders including BBVA, JP Morgan, Sumimoto, Standard & Poors and Swiss Re. to analyze the perspectives on each of these

goals to address the development of the NOC’s Sustainability Plan.

Meyer pointed out that PEMEX’s goals during his time leading the committee remain to drive a sustainable operational strategy and to construct business models that ensure profit, considering energy efficiency, GHG emissions reduction, health and safety protocols and an anticorruption and transparency policy. Goals also include aligning with international best practices and adopting new regulatory frameworks like SEC and EC. “I think PEMEX is slowly realizing that it needs a robust sustainability strategy if it wants to survive in the long run,” he concluded.

THE CHALLENGE OF OPTIMIZING PRODUCTION, DELIVERING ESG OBJECTIVES

The oil and gas industry faces increasing scrutiny in its environmental, social and governance (ESG) practices. ESG standards have evolved into a critical factor for companies in determining their access to financing. Balancing the imperative to optimize production in mature fields with the responsibility to uphold ESG principles is a critical challenge for all operators, agree experts.

Addressing these complex issues requires a multifaceted ecosystem involving customers, corporations and regulatory bodies, says Ignacio Quesada, Partner, McKinsey & Company. Solutions must be approached from diverse perspectives and encompass a range of elements.

In this regard, Brad McNeill, CEO, frontera Offshore, emphasizes that the primary

focus should be on transparency, as capital markets exert influence on both the accessibility and cost of capital allocated to support oil and gas initiatives. It has become crucial for companies seeking capital or operating within the market to express their dedication to ESG, exhibit transparency in their commitments and demonstrate tangible evidence in the application of these practices. He also underlines the importance of systematically assessing strategies for reducing carbon emissions and integrating cutting-edge technologies to enhance operational efficiency, especially in ongoing projects or mature fields.

Ensuring success in the implementation of ESG methodologies requires a close examination of available tools and facilities. Recognizing sustainability concerns in an existing operational framework also differs significantly from incorporating such measures into entirely new projects, especially when existing assets are already deployed.

The oil and gas sector faces several challenges due to its nature and impact on the environment and local communities. The negative environmental impacts frequently associated with fossil fuel activities have led to global concern, especially over the climate change crisis. Consequently, several countries are considering or have already implemented measures to transition away from fossil fuels. They are even contemplating or have announced plans to ban the hydrocarbon industry from their te rritories.

Sara Landon, Executive Director, Inerco, mentions that the objectives for the year 2050 are clearly defined and, based on these, there will be a decrease in oil consumption. Technology will gradually integrate into the industry and only the most efficient and profitable reservoirs will endure, considering not only economic but also environmental and social factors. However, to achieve this transition successfully, it is imperative to

establish public policies and collaborate with governmental bodies and educational institutions, while promoting social and economic development.

Preparing for the future through a welldefined strategy, collaborative efforts and a diversified portfolio of business ventures becomes essential. This preparation involves adopting the best available technologies and evaluating the feasibility of ongoing projects, particularly regarding energy efficiency, monetization, storage, effluent and emission m anagement.

Eckhard Hinrichsen, Country Manager and Market Area Manager, DNV Energy Systems Mexico, states that the focus should not primarily be on cost considerations when deciding how to implement such measures, as ESG initiatives are no longer discretionary. Instead, it is crucial to proactively seek opportunities within social assets and invest in communitycentric endeavors. These opportunities should be viewed as yielding more advantages than mere financ ial costs.

The journey to minimize carbon emissions continues and requires the oil industry to innovate based on how oil-based products are used in various industries. Investors are now heavily focused on aligning their portfolios with renewable or greenfocused investments. ESG has emerged as a central theme in investment decisions. The oil industry, often seen as a climate adversary, can play a pivotal role in the decarbonization transition, especially with government incentives. James Buis, District Manager - Mexico, ChampionX, emphasized that diversifying portfolios is also imperative to address emerging challenges eff ectively.

Landon notes that approximately 50% of greenhouse gas emissions originate from the oil and gas industry. However, comprehensive guidelines have been issued to provide a clear roadmap for addressing this challenge. Most companies within the petroleum sector are affiliated

with the Global Reporting Initiative (GRI).

As of January 2023, oil and gas enterprises must adhere to Sectoral Standard Number

11. This standard is closely aligned with the fulfillment of SDGs and underscores the necessity for industrial activities to be sustainable, not only from an economic standpoint but also environmental and social perspectives. Within these standards, best practices are articulated, serving as a framework for sector companies to establish their commitments in the ye ars ahead.

Landon underscores that tools have been developed for mitigating significant effects within the oil sector. These tools involve a structured four-step process: proactively preventing the occurrence of adverse impacts, minimizing their magnitude, remedying and restoring

biodiversity and compensating for any remaining significan t impacts.

ESG in Mature Operations

Oil and gas operators in mature fields face a dual challenge: optimizing production while upholding ESG responsibilities. By considering environmental impacts and implementing mitigation measures, integrating ESG principles into field rejuvenation projects, embracing technology for efficiency and sustainability and employing advanced reservoir management techniques with an ESG perspective, operators can navigate this challenge suc cessfully.

The innovative integration of technologies, such as combining Offshore Wind with Enhanced Oil Recovery (EOR), represents a forward-thinking approach, according to Hinrichsen. This involves electrifying offshore operation platforms to minimize carbon footprint and gradually transitioning toward renewable energy sources. Additionally, using solar energy is a strategic measure aimed at reducing carbon emissions within the industry. furthermore, incorporating biodegradable agents in fracking underscores a commitment to environmental sustai nability.

McNeill stated that significant technological opportunities persist in Mexico, particularly in bridging existing gaps. There is a growing awareness among individuals regarding available technologies, although challenges persist in their adoption. Nevertheless, it is undeniable that continued progress is essential, encompassing the incorporation of AI, data analytics and augmented reality for training and various applications.

Moving forward, a strategic approach for mature fields should involve a comprehensive assessment of the current landscape. This assessment should aim to determine feasible and cost-effective actions and identify technologies that can be deployed to execute these plans effectively.

THE CONSTITUTIONAL LIMITS ON LEGISLATIVE AND EXECUTIVE POWER

The dynamics of Mexico’s hydrocarbon market have been under scrutiny throughout this administration. In July 2022, the US and Canada initiated dispute settlement discussions with Mexico under USMCA, concerning the latter country’s energy policies. The following month, Mexico’s Minister of Economy, Raquel Buenrostro, stated that there was no conflict with the US and Canada because reforms to the Electricity Industry Law were suspended by the judicial power due to amparo lawsuits filed by various affected parties. US President Joe Biden, however, recently requested companies to document violations of USMCA in the energy sector, which means the dispute continues. Disputes remain unresolved and now, the Supreme Court must definitely rule on the constitutionality of reforms proposed by the López Obrador administration.

During former President Peña Nieto’s government, asymmetric laws were introduced to counterbalance PEMEX’s dominant position in the market and provide an opportunity for private operators to enter the sector. However, the 2021 amendment resulted in CRE losing its authority to apply asymmetric regulations

to private companies involved in first-hand hydrocarbon sales. This shift in regulations is believed to have favored PEMEX, hindering other market players.

According to experts, rule of law is a very important pillar in any economy. David Enriquez, Partner, Goodrich, Riquelme y Asociados, states that Mexico’s recent energy disputes and amparos are a reflection of contradictions with what is established in the Constitution itself. “Giving greater preponderance to state energy companies violates the principles of competition in businesses that are valid and are the cornerstone of any market in the world,” adds Enrique González Calvillo, Partner, González Calvillo.

The elimination of asymmetric measures in 2021 raised concerns among private companies, who said that this change allowed PEMEX to exert even greater dominance over the hydrocarbon market. Companies challenged the regulatory changes and secured a protective order under the A/015/2021 agreement, effectively nullifying the transitional article that stripped CRE of its authority to apply asymmetric regulations. However,

the protective order faced opposition from Congress, the Executive and the commission itself.

In response to lingering concerns, Judge Javier Laynez of the Mexican Supreme Court (SCJN) plans to propose a constitutional revision to the Hydrocarbons Law to level the playing field. His proposal aims to declare PEMEX’s advantage in the hydrocarbon market as unconstitutional, potentially allowing private entities to be regulated by the previously established asymmetric laws without needing to seek individual legal protection.

Laynez’s argument centers on the principle that Congress does not possess the authority to determine the competitive development level of specific markets, which justifies the elimination of asymmetries. Laynez’s goal is to confirm the declaration that a part of the reform is unconstitutional, particularly regarding granting an advantage to PEMEX in the hydrocarbon sector. Laynez’s proposal seeks to uphold the 2021 protective order and establish a more balanced regulatory environment within the hydrocarbon sector.

Enriquez explains that Judge Laynez wisely knew how to connect a previous case of market competition regarding the telecommunications sector to argue his case, and that, in the same way, the law can use the outcome of amparos in energy

matters to create an expansion wave and come to a fairer conclusion for the market. “The strength of institutions is critical because they are designed to preserve the constitution. All of this is based on the law, so we can be optimistic that the outcome will be the best for the market.” discusses Rodríguez.

These changes have escalated and reached the Supreme Court through the amparos presented by different companies to defy what they identify as unconstitutional unfair competition. According to González, Mexico is going through a decisive moment regarding a possible outcome to these discussions, as this could affect the entire energy industry, including oil and gas.

Nonetheless, experts concur that the fact that these disputes have reached the Supreme Court and are being decided there represents a “light at the end of the tunnel.” However, this also means that it is the “last line of defense” toward ensuring fair competition and against favoring state companies in detriment of private ones, explains Enriquez. “The good news is that all of this is based on the Energy Reform, the Constitution and trusting in the impartial job that the Supreme Court must exercise. We have a very strong case to defend what is right constitutionally and by law,” mentions Panelist Claudio Rodríguez, Partner, Holland & Knight.

CONVERTING MEXICO’S DEEPWATER POTENTIAL INTO RESERVES, PRODUCTION

Mexico’s oil production has been on a steady decline for years. With the Energy Reform, Mexico sought to expand hydrocarbon exploration and production to increase the availability of these resources and drive the country’s economic growth. One of the key opportunities is in Mexico’s deep waters, which PEMEX had left mostly untouched but that private players see as a greenfield venture. Trion, a Woodside-PEMEX venture, is the first major discovery in these areas and is now entering its development stage.

Woodside is one of Mexico’s most prominent oil industry players and is currently working in the ultra-deepwater Trion farmout project with PEMEX. The Trion field was discovered by PEMEX Exploration and Production (PEP) in 2012. However, development was put on hold due to the substantial investment required, along with technological capacity limitations. Now, in partnership with Australian Woodside, both entities anticipate oil production by 2028. Trion’s prospects include substantial hydrocarbon production, with estimates

projecting a peak output of 100-120Mb/d of oil and 145MMcf/d of gas.

Woodside shares that delivering a deepwater development is a complex undertaking and therefore takes more time to achieve first production when compared to onshore or shallow-water developments. According to Stephan Drouaud, Vice President Trion Mexico, Woodside Energy, the complexity of such investment has been compounded by pandemic-related supply chain issues and the current geopolitical challenges that drive a high level of volatility in commodity prices, as well as in the cost and delivery time of goods and services. While some of these elements are outside operators’ control, Woodside focuses on providing cost and schedule predictability through its contracting strategies and by engaging with the market to find beneficial solutions for all involved.

According to Drouaud, the merger of Woodside with BHP’s oil and gas business has delivered a stronger balance sheet, increased cash flow and financial strength to fund planned short-term developments and new energy sources in the future. following the merger, Woodside became the largest energy company listed on the Australian Stock Exchange (ASX). Woodside is now a global company with a truly international footprint and secondary listings on the London Stock Exchange (LSE) and New york Stock Exchange (N ySE). Woodside’s larger, more diversified portfolio is expected to deliver significant cash flow to help fund growth, Woodside’s participation in the energy transition and shareholder returns.

“We believe in energy transition and in climate change. We are proud to be able to provide affordable energy to our clients while developing new energies,” Drouaud added.

Over a decade after its discovery, the Trion ultra-deepwater field in the Gulf of Mexico will be developed following CNH’s approval of Woodside and PEMEX´s plan proposal: a

meticulous strategy tailored to the field’s characteristics and sustained operability. This marks the first development plan for the extraction of an oil field in ultra-deep waters in Mexico. “This also marks the first time we work together with a national oil company,” Drouaud m entioned.

This milestone will contribute to an increased understanding of the subsurface, facilitating additional development activities in the Perdido Basin, a region presently characterized by the presence of exploratory assignments or contracts, emphasizing the strategic importance of this forward-looking initiative. The project is also expected to establish infrastructure in the Perdido Basin, which currently has not any infrastructure development.

In terms of numerical potential, the Trion deepwater field holds remarkable significance. Woodside reports gross proved undeveloped reserves totaling 324.7MMboe. Of these, the Australian IOC holds 194.8MMboe. When factoring in probable undeveloped reserves, the site’s total reaches 478.7MMboe, with Woodside’s share accounting for 287.2MMboe. To realize the field´s full potential, the project will employ a floating production unit ( f PU) with an oil production capacity of 100M/d. This f PU will be connected to a floating storage and offloading (fSO) vessel capable of storing up to 950Mb.

According to Drouaud, this kind of floating facility is a technology never before seen in Mexico, which makes it a bit more challenging to develop. “The complexity of this project made it difficult to comply with the local content requirements of Mexico, so we had to negotiate and make PEMEX understand that this technology could not be acquired or developed in Mexico. We would have loved to do it, but the complexity of the project requires us to look at it globally,” Drouaud added.

According to CNH projections, the estimated volume of hydrocarbons to be recovered during the contract’s validity period from 2023 to 2052 is approximately 434MMb of oil and 790Bcf of gas. Of this gas volume, 570Bcf will be reinjected into the reservoir, leaving 219Bcf planned for sale and selfconsumption. Collectively, Trion is one of the most interesting projects presented to the commission, says CNH Commissioner Héctor Moreira. Its projected production will generate an income of MX$80 billion (US$47.7 billion) for the Mexican government.

f or 2H23, Drouaud’s priorities for Trion consist of progress-detailed engineering and procurement across fPU, fSO, as well as Subsea, Umbilicals, Risers and flowlines (SUR f ) developments. Other priorities include initiating preparations for regulatory permits for execution activities and continuing to award key contracts, working toward the first oil in 2028.