Suppose you have a Recession Dartboard with all the possible outcomes for 2023, from dire as the bullseye and lesser degrees outward, and throw darts at it by the handful. In that case, you will get a fairly accurate representation of the economic forecasts for 2023. No one seems to have a solid grasp on the economy for 2023, including the Fed.

The Fed raising interest rates to try to cool the economy is like hoping a dart ricochets and hits the employment reduction sector of the board. But, it is the only tool they have, which is a hammer, so every economic variable must be a nail. There are some signs of employment reductions, especially in the tech sector, but that may have more to do with modifications in their future business direction than reductions in force to counterbalance the increasing costs of borrowing.

It has been difficult for employers to find skilled workers for several years. Once hired, employers invest in training those workers for tasks within their respective companies. Manufacturers will find other places to cut expenses, including combining jobs, before they consider cutting the staff that was so difficult to find. In December 2022, manufacturing added some 8,000 jobs to increase the total workforce to 12,934,000. By the time the Fed’s hammer has an appreciable impact, it may be too much, too late.

Consumer spending will more than likely be the factor that determines the depth and breadth of a 2023 recession. Consumer confidence, although softening, has remained strong. However, their savings rate has decreased to about 2.5% per month, the lowest rate since 2005. That means more money is being used for current expenses, and less money will be available for future consumption, even as bank interest rates rise to encourage savings.

Of course, more than two dozen factors swirl around in the U.S. economy and determine the economy’s direction – down the road. The yield of 2-year and 10-year bonds is one of them. It is called an inverted yield curve when 2-year bonds pay more interest than 10-year bonds. It means that investors are moving out of short-term bonds and into longer-term bonds because the economic future appears to be less favorable in the near-term. U.S. Treasury Bond yields have been inverted since May of 2022 and have preceded nearly every recession since 1960. However, it does indicate how deep or how long any downturn might be.

Thus, all those darts flung at the Recession Dartboard are about as accurate as any other measure of the 2023 economic future – at least this time around. The pandemic has thrown all the usual conditions into chaos, and none of the historic indicators seem reliable now. This may change in retrospect by the end of 2023, but for now, Manufacturing Outlook can safely predict that there might be recession in 2023, and that is about as favorable as any forecast available.

And there is so much more going on in manufacturing than forecasts for 2023. Be sure to read articles on the growth of wind, wave, tidal, and solar energy as green energy powers turbines instead of fossil fuels. Discover how to make your business more cyber-secure in 2023 with articles by Ken Fanger of On Technology Partners. And find out how North America is doing, from Canada to Mexico, in Dr. Chris Kuehl’s write-up on the continent.

If you haven’t subscribed yet, go to www.manufacturingoutlook.com to be sure you don’t miss an issue of this forward-looking, forward-thinking digital ezine. n

Lewis A. Weiss, Publisher

Lewis A. Weiss, Publisher

Contact laweiss@mfgtalkradio.com for comments, suggestions and ideas and guest requests for MFGTALKRADIO.COM podcast or any of our podcasts.

GLOBAL MANUFACTURING DOWNTURN CONTINUES AT YEAR END, AS PRODUCTION AND NEW ORDERS FALL FURTHER. GLOBAL PMI AT 30-MONTH LOW. U.S., CHINA, EURO AREA AND JAPAN SUFFERING. INDIA DOING REMARKABLY WELL. GM BACK AT NUMBER ONE.

By: Royce LoweThere is a broad consensus that the manufacturing sector will continue to slip, at least to mid-2023. At the moment, we are looking at a six-month recession and a “climb back.” This according to the ASIS Intelligence

Report. Bloomberg says that while 2022 was the worst year for equities since the great recession, 2023 isn’t looking that great either…not right now anyway. The recession many say will come this year would be

no great surprise. Bloomberg has studied 500 prognostications from top strategists, and the current consensus seems to be a mild downturn on both sides of the Atlantic in 2023. The Fed says there’s a 50-50 chance (of a recession), and Goldman Sachs says a soft landing is still a possibility. Who’s getting it right?

The increases seen in the prices of non-ferrous metals last month were mostly neutralized in December, except in the case of nickel. Nickel is a factor in the production of EV batteries as well as stainless steel. There is a prediction from MEPS in Europe that demand for stainless steel is on

the up over the near future. Aluminum went from $1.23 to $1.15 per lb. in December; copper from $3.76 to 3.77; nickel from $12.75 to $14.00 and zinc from $1.41 to $1.37.

The JP MORGAN GLOBAL MANUFACTURING PMI – a composite index produced by JPMorgan and S & P Global in association with ISM and IFPSM (International Federation of Purchasing and Supply Management) – fell from 48.8 in November to 48.6 in December. This is a 30year low.

There were production declines across the U.S., China, the Euro area and Japan. Job losses were registered for the second successive month,

and international trade volumes fell. The downturn was centered on the intermediate goods industry, with production rising slightly in the consumer and investment goods categories. Business optimism was at a four-month high.

The Bureau of Economic Analysis says the U.S. Real Gross Domestic Product increased at an annual rate of 3.2% in the third quarter of 2022, according to the third estimate. This was following a decrease of 0.6% in the second quarter of 2022.

Fourth quarter new auto sales in the U.S. were up 9.5%, with GM regaining its number one spot with a Q4 year-over-year increase of 41.8%. And up 2.5% for 12 months. U.S. sales for the year were down

8.3% at 13,379,276 units. The only other company to show an increase year-over-year for 12 months was Tesla, with a 29.6% year-over-year Q4 increase and a 44.1% year-over-year increase over 12 months.

Western European car sales were up 17% year-over-year in November to 1.01 million, on higher registrations in Germany (up 31%) and the UK (up 24%.) and increasing demand for VW and Toyota. It is expected that inflation and declining consumer confidence will hit demand in the coming months. EVs had a record share of the UK market in 2022, up 17%. Still, overall shipments were down 2% to 1.61 million, the lowest since 1992.

China vehicle sales were down 8% year-over-year in November to

continued

2,328,000. Plug-in sales were up 50% in November, with over 5.2 million rechargeable cars sold in the first 11 months of 2022.

GLOBAL CRUDE STEEL PRODUCTION WAS DOWN 2.6% YEAR-OVER-YEAR IN THE MONTH OF NOVEMBER for the 64 reporting countries – which represent 98 percent of world crude steel production – to 139.1 million tons (MT). Production for the first eleven months was down 3.7% year-over-year, at 1,691.4 million tons. The global production of primary aluminum continued at its normal pace in November, with China producing 59% of the 5.611 MT total.

THE ECONOMIST magazine, in its latest weekly report on world economies, highlights changes in Gross Domestic Product (GDP), Consumer Prices and Unemployment Rates for what it considers the world’s major economies. These data are not necessarily good to the present day, but are mostly applicable to the past two months, and show definite trends in the world economy. The figures are qualified as being the latest available, and with reference to a given quarter or month. The figures for GDP represent the percent change on the previous quarter, or annual rate. The consumer price increases represent year-over-year changes. The unemployment percentage figures are for the month noted.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

The global wind turbine forging market growth is driven by increasing demand for highperformance wind turbine parts, rising government initiatives to reduce CO2 emission & carbon footprint and advent of computer-aided engineering in wind turbine forging.

Source: The Insight Partners

Source: The Insight Partners

New York (GLOBE NEWSWIRE) -The Insight Partners published latest research study on “Wind Turbine Forging Market Size, Share, Report, Demand, Growth Strategy, Industry Trends and Forecast to 2028 – by Type (Seamless Rolled Ring and Open Die Forging), Component (Flanges, Blades, Bearings, Gears, Shafts, and Others), and Geography,” the wind turbine forging market size

is expected to grow from USD 7.28 Billion in 2022 to USD 11.15 Billion by 2028; it is estimated to grow at a CAGR of 7.4% from 2022 to 2028.

Global Wind Turbine Forging Market: Competitive Landscape and Key Developments Scot Forge Co; Frisa Industrias SA de CV; Iraeta Energy Equipment Co Ltd; ULMA Forja S Coop; Celsa

Armeringsstal AS; Bharat Forge Ltd; Specialty Ring Products Inc; Bruck GmbH; Tongyu Heavy Industry Co., Ltd; and Gerdau Summit Aços Fundidos e Forjados SA are among the key market players profiled in the wind turbine forging market analysis. Several other essential wind turbine forging market players were analyzed for a holistic view of the market size and its ecosystem. The report provides detailed market insights, which

can help major players strategize their market wind turbine forging market growth.

In 2022, FRISA, a Mexico-based manufacturer and a leading forging supplier for the wind energy industry, introduced its portfolio of seamless rolled rings and open die forgings that offer increased value and reliability to its customers in remote locations and harsh environments. Based on region, the wind turbine forging market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America. According to the wind turbine forging market analysis, Asia Pacific is likely to witness the largest market growth during the forecast period. Based on geography, the APAC wind turbine forging market is segmented into Australia, China, India, Japan, South Korea, and the Rest of APAC. Due to the growing demand for energy across APAC, the regional government bodies have undertaken various policies to make themselves self-sufficient in the energy sector.

In Europe, wind energy is expected to grow as the future energy system during the forecast period, including

a combination of renewables, nuclear, and abated fossil fuels. According to Industry Experts, wind energy is estimated to supply 50% of the region’s energy demand by 2050. Hence, the demand for installing high-capacity wind turbines and upgrading the existing energy infrastructure has increased. Wind turbines, predominantly made of at least 70% steel, are Europe’s high-energy industries, which have been growing rapidly. The majority of steel is currently produced using fossil fuel blast furnaces that rely on coal or fossil gas, which increases cost.

Governments of various countries are concerned about the adverse impacts of a surge in CO2 emissions and global carbon footprints. As a result, they are leveraging the benefits of wind energy to reduce global warming and air pollution. Wind power has the potential to enable a sustainable future. With the rising energy demand, the availability of greener energy is likely to become a critical prerequisite. The Government of India is boosting its green energy production capacity through high-capacity wind turbine installations as part of its commitment to the Green Energy Future. Furthermore, with the

target of becoming a Net Zero Carbon Emitter by 2030, India is bolstering its lending capacity and commitment to help local authorities achieve the country’s renewable energy targets of 450 GW. In addition, the Indian government’s offshore Wind Energy Policy emphasizes on harnessing the potential of offshore wind energy along India’s coastlines. The Ministry of New and Renewable Energy is focused on installing offshore wind turbines off the coast of Indian cities. In agreement with its wind-solar hybrid policy 2018, the ministry is also promoting the establishment of large grid-connected wind-solar hybrid projects to achieve better grid stability and reduce carbon emissions.

Global Wind Turbine Forging Market: Component Overview

Based on type, the wind turbine forging market is segmented into seamless rolled ring and open die forging. Open die forging is a process that molds and forge the material into the desired shape, typically between flat-faced dies. Open die forging offers products in a vast range of shapes and sizes, and weights with optimum structural integrity, which is propelling the segment growth. Seamless rolled ring forging offers high

strengthen components with the help of elevated temperature fluctuations. Also the seamless rolled ring forging is cost-effective and reliable process along with a better heat tolerance which is anticipated to propel the growth of this segment in the wind turbine forging market.

Key Findings of Study: Asia Pacific is witnessing rapid growth in the installations of high-capacity wind turbines, which is supporting the growth of the wind turbine forging market.

For instance, in October 2022, China rolled off the production of a 13.6 MW offshore wind turbine in Fujian Province, East China. The turbine is the largest single-unit wind capacity in Asia Pacific. The region is also witnessing a few major wind energy construction projects initiated in 2022, including the construction of a 5,230 MW integrated hybrid renewable energy project at Pinnapuram village in Andhra Pradesh, India and the construction of a 400 MW offshore wind farm in Yangjiang, Guangdong, China. The growing

number of wind turbine construction projects is anticipated to boost the demand for forged components that are critical to the efficient operation of modern wind turbines, thereby propelling the wind turbine forging market growth in Asia Pacific. Further, the rising investments in wind energy and the production of related components is propelling the wind turbine forging market growth in the MEA region. Brazil is anticipated to lead in the South America wind turbine forging market on account of growing partnerships and acquisitions of small forged part suppliers by giant international players and the establishment of new manufacturing facilities.

Go through further research published by The Insight Partners:

Wind Tunnel Market– The wind tunnel market is projected to reach U.S. $3,784.56 million by 2028 from U.S. $2,706.26 million in 2021. It is expected to grow at a CAGR of 4.9% from 2021 to 2028.

Automotive Wind Tunnel Market–

Automotive Wind Tunnel market is expected to grow from U.S. $544.8 Mn in 2017 to U.S. $1557.5 Mn by 2025 at a CAGR of 14.2% between 2017 and 2025.

Forging Market– The forging market was valued at U.S. $72,890.07 million in 2019 and it is projected to reach U.S. $100,404.83 million by 2027; it is expected to grow at a CAGR of 5.1% from 2020 to 2027.

Wind Power Fastener Market–

Wind power fasteners are used to join turbine assembly of windmill. The windmill turbines require unique fastener and unique engineering. The wind power fastener are manufactured in such a way that they shall bear all the pressure and vibrations during operation of wind mill.

Automotive Forging Market– The automotive forging market is expanding has gained popularity since the inception of the technology, and the same is expanding at a healthy growth rate over the years. The key influential factor for automotive forging market is the increase in automotive production across the globe.

Forging Billets Market – Billets, also known as bar stock are semi-finished and small pieces of metals that are utilized in producing finished products. The billets are also used as feed stock or raw material in forging, rolling, extrusion, and other metal processing operations.

Closed Die Forging Market– Closed dye forging is type of forging method where dies move towards one another and cover the workpiece in parts and in whole. The heat raw material is

approximately the size and shape of final forged material.

Forging Presses Market– Forging press machine is used in the process of shaping a metal that is placed between two dies by applying mechanical pressure. The mechanical forging press machine converts the rotation of the motor into linear motion of the ram.

Regenerative Turbine Pump Market– Regenerative turbine pumps are centrifugal pumps that are used to pump pure liquids. It’s a popular choice for large delivery heads with modest volume flows.

Boiler Turbine Generator (BTG) Market– The thermal power is one of the extremely polluting nonetheless prominent sources of electricity production worldwide. Most of the

developing and developed countries are heavily dependent on the thermal power for overcoming their electricity requirements.

About Us: The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us: If you have any queries about this report or if you would like further information, please contact us. Contact Person: Sameer Joshi

E-mail: sales@theinsightpartners.com Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/wind-turbine-forging-market. n

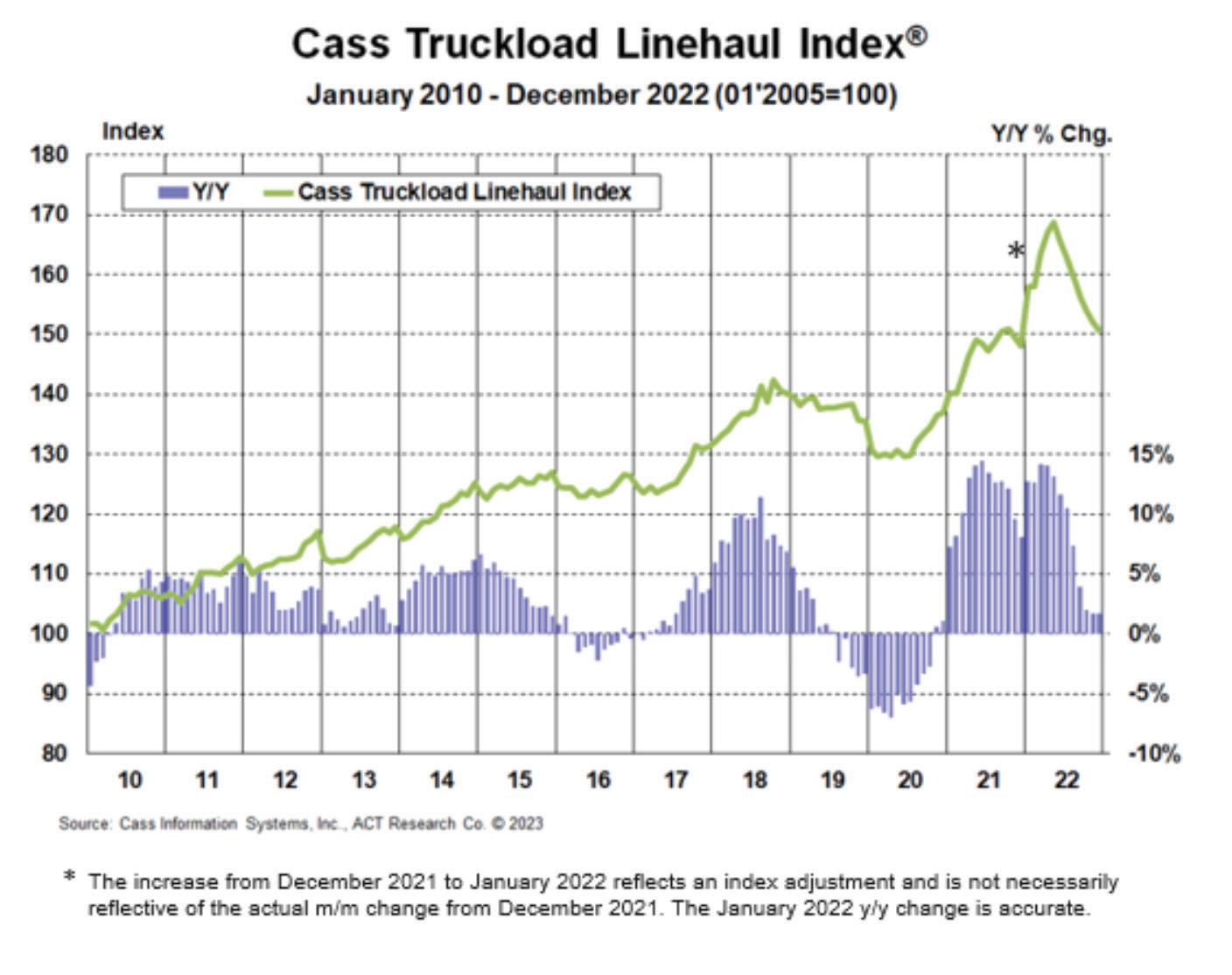

The shipments component of the Cass Freight Index® fell 3.9% y/y in December. On a m/m basis, the index fell 3.3%, but seasonality boosts December’s m/m performance to a 1.2% gain on an SA basis.

The larger y/y decline, mainly on a tough comparison, was not a surprise to our readers, but we’d characterize the sequential, seasonally adjusted increase as further evidence of resilient, but still soft freight demand. With retail sales broadly growing in line with inflation rates, it’s clear that peak holiday shipping volumes were flattish in real terms versus a year ago.

Normal seasonality from here would have shipments back in positive territory y/y in 1H’23, but sharpening declines in imports, into the West Coast in particular, suggest near-term trends may soften further.

The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, fell 4.3% y/y in December, inflecting from a 4.7% increase in November.

Expenditures fell 5.5% m/m after a 1.8% increase in November. Against a shipment decline of 3.3% m/m in December, we infer rates were down

2.2% . The decrease in rates m/m seems mainly due to lower truckload contract rates.

On an SA basis, expenditures fell 4.2% m/m in December, with shipments up 1.2% m/m and rates down 5.3%.

This index includes changes in fuel, modal mix, intramodal mix, and accessorial charges, so is a bit more volatile than the cleaner Cass Truckload Linehaul Index®.

The expenditures component of the Cass Freight Index rose 23% in 2022 after a record 38% increase in 2021 but is set to retrench in 2023.

The rates embedded in the two components of the Cass Freight Index turned to a 0.4% y/y decline in December, after 5.1% y/y growth in November.

Cass Inferred Freight Rates fell 2.2% m/m (down 5.3% SA) in November. Aside from some noise in this series as a result of fuel prices and modal mix, the trend has clearly turned lower over the course of 2022 and is poised to continue in this direction in the near term.

Freight rates are on track to fall 5% in 2023 just based on the normal seasonal pattern of this index. With loose market conditions and some welcome relief in diesel prices, the actual decline is likely to be a good bit larger.

Along with sharp declines in ocean rates and many commodity prices, lower freight costs aid the outlook for significant disinflation needed to improve economic conditions.

Cass Inferred Freight Rates are a simple calculation of the Cass Freight Index data—expenditures divided by shipments—producing a data set that explains the overall movement in cost per shipment. The data set is diversified among all modes, with truckload (TL) representing more than half of the dollars, followed by less-than-truckload (LTL), rail, parcel, and so on.

The Cass Truckload Linehaul Index fell 1.0% m/m in December to 150.5, after a 1.2% m/m decline in November.

On a y/y basis, the Cass Truckload Linehaul Index was up 1.7% after a similar increase in November. With a tougher comparison in January, this index is likely to turn down on a y/y basis. New truckload contracts are generally being renewed with considerable rate reductions, but this pressure will be partly offset by strong trends since Thanksgiving in spot rates, which have held most of

their gains even as drivers have by and large come back from holiday break.

As a broad truckload market indicator, this index includes both spot and contract freight, and with spot rates already down significantly, the larger contract market is likely to continue adjusting down more gradually but in the same direction.

As we enter 2023, we see the truckload market transitioning from the late-cycle stage to the bottoming stage. Some of the recent rise in spot rates, ex-fuel, is due to seasonality, as rates surged toward the end of peak season, and some of it is the 70¢ per gallon drop in diesel prices in the past two months. Those gains tend to be competed away in loose markets like 2022 within a few weeks but have held so far.

After a long downtrend in 2022, the recent bounce in spot rates and tightening in the spot/contract spread suggest a bottoming truckload rate cycle. This should turn the trajectory of freight markets in 2023, and the cycle is likely to enter yet another phase later in 2023.

One exciting feature of the new freight data partnership between ACT Research and DAT Freight & Analytics is that it helps us (ACT Research) elaborate on the truckload rate environment. In particular, we think the difference between spot and contract rates, or the spread, is very instructive for the near-term direction of contract rates in particular.

From the large spread, there is downward pressure on contract rates, which has been the case for much of the past year. But we also see the recent tightening of that spread as a key signpost of this new stage of the cycle, even green shoots of a new rate cycle. n

Economic activity in the manufacturing sector contracted in December for the second consecutive month after 29 consecutive months of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®

The December Manufacturing PMI® registered 48.4 percent. Regarding the overall economy, this figure indicates contraction after 30 straight months of expansion. The Manufacturing PMI® figure is the lowest since May 2020, when it registered 43.5 percent. The New Orders Index remained in contraction territory at 45.2 percent, 2 percentage points lower than the 47.2 percent recorded in November. The Production Index reading of 48.5 percent is a 3-percentage point decrease compared to November’s figure of 51.5 percent.

The Prices Index registered 39.4 percent, down 3.6 percentage points compared to the November figure of 43 percent; this is the index’s lowest reading since April 2020 (35.3 percent). The Backlog of Orders Index registered 41.4 percent, 1.4 percentage points higher than the November reading of 40 percent. The Employment Index returned to expansion territory (51.4 percent, up 3 percentage points) after contracting in November (48.4 percent).

The two manufacturing industries that reported growth in December are: Primary Metals; and Petroleum & Coal Products. ISM

‡Miscellaneous Manufacturing

Analysis by Timothy R. Fiore, CPSM, C.P.M. Chair of the Institute forSupply Management® Manufacturing Business Survey Committee

The U.S. manufacturing sector contracted in December, as the Manufacturing PMI® registered 48.4 percent, 0.6 percentage point below the reading of 49 percent recorded in November. This is the second month of contraction and, as predicted, will likely be the norm for the PMI® at least through the first quarter of 2023, with the PMI® expected to be between 48 and 52 percent. Of the five subindexes that directly factor into the Manufacturing PMI®, two (Employment and Inventories) were in growth territory, with both gaining a bit of ground.

INDEX

Dec Index Nov Index % Point Change Direction Rate of Change Trend* (months)

Manufacturing PMI® 48.4 49.0 -0.6 Contracting Faster 2 New Orders 45.2 47.2 -2.0 Contracting Faster 4 Production 48.5 51.5 -3.0 Contracting From Growing 1 Employment 51.4 48.4 +3.0 Growing From Contracting 1 Supplier Deliveries 45.1 47.2 -2.1 Faster Faster 3 Inventories 51.8 50.9 +0.9 Growing Faster 17 Customers’ Inventories 48.2 48.7 -0.5 Too Low Faster 75 Prices 39.4 43.0 -3.6 Decreasing Faster 3

Backlog of Orders 41.4 40.0 +1.4 Contracting Slower 3 New Export Orders 46.2 48.4 -2.2 Contracting Faster 5 Imports 45.1 46.6 -1.5 Contracting Faster 2

Overall Economy Contracting From Growing 1 Manufacturing Sector Contracting Faster 2

Commodities Up in Price: Copper; Electrical Components (2); Electricity (2); Electronic Components (25); Freight*; Labor — Temporary (4); Semiconductors; and Zinc.

Commodities Down in Price: Aluminum (8); Aluminum Products; Corrugate; Crude Oil; Diesel; Freight* (2); Natural Gas; Ocean Freight (4); Plastic Resins (7); Polyethylene; Polypropylene (5); Solvents; Steel (8); Steel — Cold Rolled; Steel — Hot Rolled (8); Steel — Stainless Steel Products; Steel Bars; and Steel Products (6).

Commodities in Short Supply: Bearings; Electrical Components (27); Electronic Components (25); Hydraulic Components (8); Labor — Temporary; Rubber Based Products (2); Semiconductors (25); Steel Products (2); Tyvek; and Wire Harnesses.

Note: To view the full report, visit the ISM ® Report On Business® website at ismrob.org The number of consecutive months the commodity has been listed is indicated after each item. *Reported as both up and down in price.

Production

The Production Index registered 48.5 percent. The four industries reporting growth in production during the month of December are: Primary Metals; Electrical Equipment, Appliances & Components; Transportation Equipment; and Machinery.

ISM’s New Orders Index contracted for the fourth consecutive month in December, registering 45.2 percent. Of the 18 manufacturing industries, three reported growth in new orders in December: Textile Mills; Primary Metals; and Transportation Equipment. Employment (Manufacturing)

ISM’s Employment Index registered 51.4 percent. Of 18 manufacturing industries, five reported employment growth in December: Petroleum & Coal Products; Furniture & Related Products; Plastics & Rubber Products; Machinery; and Miscellaneous Manufacturing‡

The delivery performance of suppliers to manufacturing organizations was faster for a third straight month in December, as the Supplier Deliveries Index registered 45.1 percent. Three of 18 manufacturing industries reported slower supplier deliveries in December: Textile Mills; Miscellaneous Manufacturing‡; and Food, Beverage & Tobacco Products.

The Inventories Index registered 51.8 percent. Of 18 manufacturing industries, the eight reporting higher inventories in December — in the following order — are: Nonmetallic Mineral Products; Paper Products; Primary Metals; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Food, Beverage & Tobacco Products; Miscellaneous Manufacturing‡; and Computer & Electronic Products. ‡Miscellaneous

Manufacturing PMI®

Customer Inventories (Manufacturing) 2023 2022 2021 48.2%

ISM’s Customers’ Inventories Index registered 48.2 percent. Five industries reported customers’ inventories as too high in December: Paper Products; Furniture & Related Products; Wood Products; Computer & Electronic Products; and Electrical Equipment, Appliances & Components.

Backlog of Orders (Manufacturing) 2023 2022 2021 41.4%

New Export Orders (Manufacturing) 2023 2022 2021 46.2%

Imports (Manufacturing) 2023 2022 2021 45.1%

ISM’s Backlog of Orders Index registered 41.4 percent. Two industries reported growth in order backlogs in December: Textile Mills; and Machinery. Twelve industries reported lower backlogs in December, in the following order: Wood Products; Paper Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Fabricated Metal Products; Furniture & Related Products; Food, Beverage & Tobacco Products; Primary Metals; Chemical Products; Miscellaneous Manufacturing‡; Computer & Electronic Products; and Transportation Equipment.

ISM’s New Export Orders Index registered 46.2 percent. Five industries reported growth in new export orders in December: Wood Products; Apparel, Leather & Allied Products; Plastics & Rubber Products; Electrical Equipment, Appliances & Components; and Miscellaneous Manufacturing‡

ISM’s Imports Index registered 45.1 percent. The only industry reporting growth in imports in December is Computer & Electronic Products. Eight industries reported lower volumes of imports in December, in the following order: Paper Products; Wood Products; Primary Metals; Plastics & Rubber Products; Chemical Products; Fabricated Metal Products; Electrical Equipment, Appliances & Components; and Miscellaneous Manufacturing‡

The ISM Prices Index registered 39.4 percent. In December, only one industry reported paying increased prices for raw materials: Apparel, Leather & Allied Products. The 10 industries reporting paying decreased prices for raw materials in December — in the following order — are: Textile Mills; Wood Products; Petroleum & Coal Products; Fabricated Metal Products; Transportation Equipment; Plastics & Rubber Products; Furniture & Related Products; Chemical Products; Food, Beverage & Tobacco Products; and Machinery. ‡Miscellaneous

JANUARY 2023

Two Reasons to Worry about 2023 and Two Reasons Not To

by Dr. Chris KuehlTo be completely honest, there are always more questions than answers when it comes to the assessment of the economy. There are a vast number of variables that can radically change expected outcomes, and most of these are not as dramatic as

those that have affected the last few years. Even without “black swans” like Covid and the Ukraine war, there are hundreds of decisions made by consumers, businesses, regulators, and politicians that can change the path of the economy. There are

four factors that will feature very prominently as far as the progress of the 2023 economy: Fed actions, the mood of the consumer, the status of the supply chain, and the reaction of the government. If these all track in a more positive direction, the impact of

a downturn will be relatively minor, but negative tracks ensure a deeper and more extended recession.

In many ways, it will start with the Federal Reserve. It has started to retreat from its very aggressive approach to inflation but is still talking higher rates. The closer the Fed gets to rates above 5.0%, the more likely the downturn, as it obviously makes all manner of lending harder (mortgages, car loans, credit cards, etc.). The Fed is still talking tough, but their last rate hike was a half point rather than a three-quarter hike. The trigger for the Fed to stop hiking rates is generally an increase in the unemployment rate, but thus far, there have been generally low levels of joblessness.

The second crucial factor is consumer mood. This is an economy that is still driven by consumer demand, and estimates continue to assert that there is close to $3 trillion in excess savings available to be spent. The question is whether that cash will stay on the sidelines. It was expected that much of it would be distributed

during the holiday season, but retail was more anemic than expected. Polls still suggest that consumers are very worried about inflation in 2023, and that tends to encourage more savings. Most of that overhang is in the hands of the upper 25% of income earners.

The number three issue has been affecting the global economy for the last two years – supply chain disruption, and it is still playing a major role. Many manufacturers are still unable to get the parts and inventory they need, and that interferes with their ability to deliver. There is a great deal of pent-up demand in the consumer sector because of these gaps, and that could be a good thing if the supply chain improves and these finished goods can be delivered. Otherwise, it is an extension of the misery experienced over the last two years. China started to show signs of returning to normal shipment flow as it backed away from the zero-tolerance policy, but with millions of people falling ill, there is no guarantee they will not resume the lockdowns.

Finally, there is the role of government. This includes both the regulatory community as well as the politicians. If the incessant squabbling over the debt ceiling continues and another credit crisis ensues, then the economy takes an enormous hit – the last time there was a shutdown, the cost to the economy was in excess of $11 billion. Another hit like that would plunge the country into a major recession and do lasting damage to the credit rating of the nation. Regulatory overreach is an ongoing issue and often hampers plans to build any sort of business momentum, but very often, agencies experience tunnel vision and fail to consider bigger impacts.

To a significant degree, the Canadians have to worry about what is happening south of the border, and in this case, that means both the U.S. and even further south in Mexico. Decisions by the U.S. Federal Reserve will obviously impact Canadian business, but there will also be a focus

on what the Bank of Canada has in mind as far as its own interest rate policy is concerned. The position of the BoC has been that the Canadian economy has been overheated and needs further rate hikes to cool things down still further, but at the same time, there is concern that hiking too far and too fast will invite a real recession – they are taking some cues from the U.S. Fed in this regard.

What they are focusing on is a deep inversion of the yield curve – deeper than that in the U.S. and the biggest inversion since 1994. The ten-year bond has fallen 100 basis points below the two-year yield. This is especially worrying as Canadians hit the lending market hard in the Covid year as they sought to get engaged in the red-hot housing market that

developed at that time. Generally speaking, an inversion like this precedes a recession, but it is not an absolute guarantee. The markets have been projecting something akin to a triple strike of collapsed domestic consumption, weaker U.S. demand, and a slump in global commodity prices. The rest of the world has been encouraged by the fall in the per barrel price of oil, but that is not good news for Canada.

On the more positive side, there are still solid signs of a resilient economy. The GDP growth in the third quarter was 2.9%, and that was as much of a surprise to Canada as that growth was in the U.S. Both of these nations expected to see anemic rates of less than 1.0%, and instead, they grew far faster than even the optimists

called for. The U.S. was driven by manufactured exports and Canada by commodity prices. The labor market remains very tight, and that suggests more issues with wage inflation. The fear is that growth will start to stall with the higher interest rates, and everyone has reacted to the lower price of oil. It seems to be something of a toss-up. If some of the positive trends from Q3 hold, the Q4 numbers may not be too bad, and 2023 may start stronger than expected, but if the more negative trends start to take over, the recession threat accelerates.

Mexico has been defying expectations for several months now. The growth has been driven by a combination of factors – commodity

The Flagship Reports with Dr. Chris Kuehl is both an “Officer of the Watch” briefing of economic conditions and an Executive Briefing on specific situations impacting those conditions. Written and presented by the officers of Armada Corporate Intelligence, Dr. Kuehl lightens up the mood of sometimes distressful geoeconomic news with a bit of humor. This monthly podcast includes information from the Flagship Reports issued 3 times and week, and AISI, the Armada Strategic Intelligence System, a tool for durable goods manufacturers that dives deep into the sector each month to provide more than 95% accurate near-term forecasts.

prices that have been driving better profit from the oil sector as well as expansion of the manufacturing sector. As companies have been seeking alternatives to China due to the supply chain breakdown, they still need to find low-cost production platforms, and Mexico suits these companies well with low wages and low regulatory burdens (generally). The estimate for 2022 growth is still 3.0%, and that is better than either the U.S. or Canada has been able to claim. The consumer price index remains higher than in either the U.S. or Canada as it stands at 8.4% (slightly down from 8.5% the previous month).

The Global Economic Activity Index fell slightly in November for

the first time in four months. The manufacturing sector dropped by 0.1% after rising by 0.5% in October. The service sector drop was also 0.1% after a rise of 0.1% in October. These are not necessarily alarming numbers at this point, but Mexico is watching the U.S. economy carefully. A recession in the U.S. will hit Mexico very quickly and will interfere with the recovery of the tourist sector –traditionally one of the four pillars of the national economy. The pace of remittance activity has also slowed, and a slowdown in the U.S. economy would affect this in 2023.

There is one interesting recent development that could have implications for Mexico in the next few months. California and the

other western states have been receiving a significant amount of precipitation in the last weeks, and this has been especially noticeable in the high elevations where the snowpack is deeper than it has been in years. This is not the end of the drought, but it has radically improved soil moisture, and farmers are now planning to plant far more aggressively than they had planned. If this planting decision holds, the farmers will need labor from Mexico in numbers they have not required in years. The U.S. will have to make some quick adjustments if this demand is to be met legally, but there will be an urgent demand for labor, and most of the money they earn will be headed back to Mexico as remittance. n

Vietnamese President Nguyen Xuan Phuc paid a state visit to South Korea from Dec 4-6, 2022, at the invitation of President Yoon Suk-yeol. This is the first hosting of a state visit since the inauguration of newly-elected President Yoon and also marks the 30th anniversary of bilateral relations

with Vietnam. During the visit, Vietnam officially elevated bilateral ties with South Korea to “a comprehensive and strategic partnership.” Prior to this visit, Vietnam had established what they refer to as this “pinnacle” of relationship with only three nations: China, India, and Russia.

Vietnam has for years been a lowcost labor and manufacturing development base for South Korean manufacturers. The most notable and single largest South Korea investor in Vietnam has been Samsung, which has invested $18 billion in six factories there. Two of those are for

smart phones where they manufacture approximately one-half of all of Samsung’s smart phones and represent over a fifth of Vietnam’s exports. Recently there has been a reduction in those exports due to slowing demand. But there is no doubt that overall, South Korea and Vietnam are forging ever stronger bonds. We can expect expanded cooperation in areas such as politics, security, economy, development, education and people-to-people exchanges, according to the Office of the President. The U.S. needs to explore the implications and opportunities of this developing relationship.

However, this does mask a troubling history which has rarely been acknowledged by both sides. It is well-documented that South Korea committed atrocities against both Viet Cong soldiers and innocent civilians when they sent 320,000 troops to fight brutally for the U.S. military from 1964 to 1973 during the Vietnam war in exchange for extensive economic aid. South Korea has

declared there is no evidence of these massacres, which occurred throughout the country, and no South Korean President has ever owned up to it. Vietnam itself has never pushed for an official apology or reparations. And they did not insist on it when granting South Korea its “pinnacle” of relationship last month. But it’s high time the South Korean defense establishment open up its historical records to the public and acknowledge the truth amid this burgeoning relationship. The U.S. government should insist on it. U.S. companies are also increasing manufacturing investment there. Apple is scheduled to begin shipping its first iPhones from Vietnam In mid2023.

What is happening now is a continued economic contraction with no end in sight. December’s PMI in the manufacturing sector was 47, lower than estimates and down from 48 in

November. This is -6.56% from one year ago. China is struggling to “hit the ground running” after lifting its Zero Covid policy restrictions with no guidance to manufacturers. And they’ve had to put the breaks on immediate massive spending on new semiconductor facilities and infrastructure due to the spiraling spread of COVID cases. This could change by year’s end as the workplace becomes normalized post-COVID.

One thing is for certain: the world will never know how many people have died in China during both the draconian restrictions for nearly three years trying to maintain Zero-COVID control, nor in the coming years after Zero-COVID relaxation. The government will not attribute deaths to COVID if there was any type of underlying condition in the patient. The higher the number of reported deaths from COVID, the more President Xi will lose face, which will be avoided at all costs. This is just one proof that since Xi came to power (he is now in his third term), China has been influenced by increasingly defensive and ideological policymaking, rather than the pragmatic and effective policymaking of past leaders.

Former President Jiang Zemin, credited with welcoming and driving western investment, global cooperation, and global integration for over a decade, passed away in December, and his like-minded but aging retired successor Hu Jintao, was unceremoniously removed from all powers at the November Congress. We can expect Xi’s consolidation of power to continue for another five years. The recent protests that led to Xi’s abrupt and unprepared dumping of the Zero-COVID regime across China may have led to some embarrassment but has not challenged his authority. The continued

U.S. has reached out to China quietly behind the scenes, offering ongoing supplies of more effective vaccines, but increasing xenophobia and fear of having to reveal their own vaccine technologies have prevented the government from accepting. The EU has also offered help.

All focus is now on turning around the slumping economy. The enormous opportunity cost of trying to control the spread of COVID has led to a 2-3% percent drop in GDP in 2022 alone. (We arrive at this figure by subtracting current year-end projections of 3.3% from original revised 2022 government targets of 5.5%.) Exports fell over 9% in November alone. Taiwan and South Korea also saw plummeting exports, and U.S. factories have suffered continued contraction in new export orders.

The government and its newly appointed Politburo members have seen the damage and the writing on the wall. They have been receiving reports from local governments of the uncontrollable spread of the virus for months. And it has already hit the rural communities where healthcare facilities are sorely lacking. The only threats to the ongoing one-party rule would be an ongoing failing economy, loss of jobs, and loss of faith in the government on the part of the educated middle class and its consumer base. Their talent fueled China’s economic rise. Their departure could help fuel China’s demise. It will now take China much longer to ever catch up to the level of the U.S. economy, if ever.

The world will also not know for some time how the pandemic has

affected the overall workforce numbers. At the moment, it is reported that in numerous cities over 60% of the workforce is out sick and this will continue to ripple throughout the country until the virus burns itself out or mutates. What seems almost unthinkable only one month ago is that the government is encouraging workers to go to work to keep manufacturing going if they are only mildly ill. This is an extreme “about face” and has left workers confused and wondering whom to trust. This lack of trust in government ‘wisdom’ is spreading. Professionals and people of means are emigrating to Japan, Singapore, and other attractive locations, in some cases leaving behind assets which they are not allowed to take with them. Another certainty: a continuing increase in loss of talent now that travel restrictions have been lifted. continued

At the same time, we do know that there is close to 20 percent unemployment among youth and recent college graduates. Additionally, the number of people moving out of the workforce due to aging is increasing every year and they are not being replaced. The birthrate has fallen below 1.72 per thousand since 2020. In 2021, people aged 65 and over already comprised 14% of the population. This figure is rising every year, and due to the one-child policy of prior years, there will be fewer children to take care of parents in the future.

One piece of good news: in December, China agreed to do a deep dive into tracking the genomic origins and mutations of Omicron variants and

share their results with the outside world. But they still have not offered accurate information on deaths and hospitalizations, requested by the WHO. The U.S. and other nations are fearful that the virus coming out of China will mutate into a more severe and dangerous form, leading to another pandemic spread. As of today, there is no evidence that the Omicron virus circulating in China is more dangerous that what is circulating in the U.S. Yet these fears have led to travel restrictions for admission into some countries (notably the U.S., Japan, and Italy) for travelers from China. As of January 5, 2023, the U.S. is requiring a negative PCR or antigen test taken no earlier than 48 hours prior to travel. The EU, on the

other hand, had been resisting new restrictions, stating they are unnecessary, but have finally recommended to member states to follow the U.S. lead.

Next month: U.S.-China: Shrinking Trade Gaps and China’s Tariff Complaints; Supply Chain Shake-ups.

Author profile: Christine is cofounder and President of China Human Resources Group, Inc, a management consulting firm based in Princeton NJ. She has provided U.S. companies with strategic development and project implementation services for projects in China since 1986. n

by Chris Anderson

by Chris Anderson

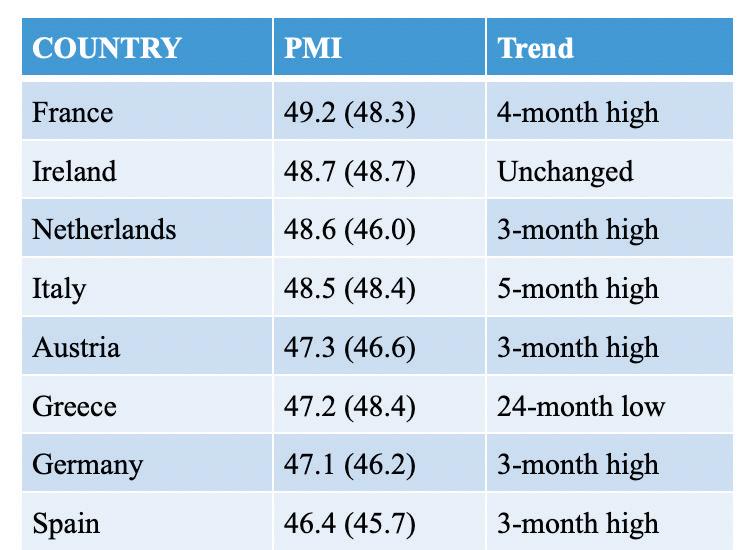

S&P Global Eurozone Manufacturing Composite Purchasing Managers’ Index (PMI), rose from 47.1 in November to 47.8 in December. The manufacturing production index rose from 46.0 in November to 47.8 in December.

The manufacturing downturn eased further as supply conditions stabilized and inflation cooled. All eight countries in the surveywhich represent 89% of European production - saw continuing contraction. In France, the manufacturing sector contracted further during December, with output and new orders falling for a seventh successive month. However, these declines moderated, signaling an easing of the downturn. There was even a slight pick-up of business confidence to a four-month high. And although business confidence improved, it remained historically subdued as inflation, recession concerns, and high energy costs weighed on sentiment.

French manufacturers cut their staffing levels back for the first time since January 2021, but according to people surveyed, this reflected the non-replacement of departing employees. French manufacturers faced another month of sharp rises in their operating costs during

December, this being generally linked to increases in energy prices, although there were some reports of suppliers hiking their fees. Overall, the rate of input cost inflation was the weakest in almost two years. n

The market for open die forgings and seamless rolled rings for wind, wave, tidal, and solar turbine parts is forecast to grow from 7.28 billion in 2022 to 11.15 billion by 2028, a CARG of 7.4% from 2022 to 2028. Forged parts offer the benefits of soundness instead of the porosity of cast parts, strength from reduced grain size and uniform grain direction versus parts hogged from thick plate or round bar, and a wider selection of metal alloys for harsh environment conditions.

Forged parts for turbine components include flanges, sleeves, impellers, seamless rolled rings, spacers, blades, buckets, adapters, casings, discs, hubs, bearings, bearing blocks, gears, shafts, step shafts, and single or double flanged shafts. These parts can be

delivered as rough machined forgings near net shape or finish machined parts that save time and money for new or replacement part installations.

Key among the forged turbine part makers is All Metals & Forge Group (AMFG), a manufacturer of open dies forgings and seamless rolled rings for the hydroelectric, steam, wind, wave, tidal, and solar turbine industry. AMFG can forge turbine parts in nickel alloys, stainless steel, alloy, and carbon steel. It also forges aluminum, titanium, and tool steels for many component or end uses.

Proof of Quality and Soundness AMFG is an unusual manufacturer in the forging industry. Rather than stating “Capable of ASTM A388,” an

ultrasonic test benchmark, AMFG actually tests each and every forging for part soundness using tighter requirements than the standard for flat bottom hole (FBH) or voids within a forging. It then certifies each forging to ASTM A388 or more stringent specifications rather than stating ‘capable of.’

The quality of forged turbine parts is crucial to the performance and life of turbines and support structures. AMFG produces forgings to material industry specifications including ASTM, AMS, ASME, AISI, SAE, and many standards from Germany (DIN), Great Britain (GB), and other material chemistry and physical properties specifications. However, the company goes a step further than relying on the

mill test report (MTR) for chemistry of the starting stock. AMFG runs an analysis of ingot or billet chemistry before that material is used for forging, documents those results, and compares them to the MTR chemistry compostion. Billets or ingots out of specification are rejected.

One aspect of forging quality that is often overlooked is the cleanliness of the billet or ingot for forging starting stock, which measures impurities within the material at one of five levels. In addition, the actual melting of the ingot or billet is considered for the customer’s desired end use, from ESR (most common) to VIM-VAR which yields high purity for critical aerospace and special industrial uses.

The Forging Itself Forgings are manufactured to the chemistry and physical properties of industry standard material specifications. These standards also define hardness, acceptable methods of heat treatment, and the target ranges for physical properties after processes like annealing, or quench and tempering. However, to prove that the target results were actually achieved, AMFG takes yet another step before the material is shipped to the customer for their end use.

Specifications call for coupons to be produced or extracted from the forging. AMFG produces four coupons for every heat of material, and in required cases, from the forgings as designated by the spec. It then tests one of the coupons to confirm achievement of the chemistry and physical properties of the material specification. Those test results are shared with the customer. Separately, AMFG sends a coupon to a thirdparty, independent testing laboratory for them to test the chemistry and physical properties. These reconfirmation results are provided

to the customer, as well. The third coupon is stored by AMFG to comply with various traceability requirements by the customer or the end user. The fourth coupon is delivered to the customer, so they can conduct their own reconfirmation tests.

All Metals & Forge Group has been producing critical component parts for the turbine industry for several decades. Demand for clean, renewable power generation is driving up demand for sources of energy beyond hydroelectric, coal or gas-fired steam turbines. Wind has been the most common use of turbines, and hundreds of onshore and offshore wind farms are in operation or being installed.

Wave, tidal, and solar energy has been explored for many years. Technology is improving the efficiency of surface, subsea, and solar energy that is driving the demand for forged turbine components and forged structural parts. Countries and companies on every continent are actively installing various designs to capture the energy produced by wind, water, and the sun.

The key to controlling installation and repair costs of turbines lies in the quality and durability of the forged parts of the support structure and internal components of the turbines. The failure of a forged part 300 feet in the air or 300 feet underwater is a major repair expense and loss of power generation.

AMFG recognizes that proven quality is better than assumed quality, and takes the extra steps in testing from billet or ingot to finish machined parts (when finish machined is required by the customer) so that failures in the field should not be a concern other than normal life cycle wear and tear requiring refurbishment.

AMFG ships rough machined forgings or finish machined parts anywhere

they are needed. In addition, the company can forge and store critical components to reduce installation or repair lead times from months to days. Generally, the customer’s first order can be produced and shipped in 8 to 10 weeks; a bit longer if finish machined parts are required, or disruptions occured in the supply chain. However, most of the supply chain disruptions experienced between 2020 and 2022 have been resolved. Thus, the 8 to 10 week delivery time has become quite reliable.

AMFG works with OEMs and any of their subcontractors to provide open die forgings and seamless rolled rings for structural parts or turbine components, including machine shops and machinery builders designated by the OEM. Either the OEM or the subcontractor can purchase the quality forgings they need to meet the demanding needs of hydroelectric, wind, wave, tidal, and solar energy installations.

The ability to shift from fossil fuels to renewable energy sources that require a turbine driven by wind, wave, tidal, or solar will replace as much as 50% of existing energy sources by 2050, as well as augment future demand. Hundreds of new installations in countries around the world are underway, and hundreds of wind farms are reaching their refurbishment age.

Proven quality forgings with reliable deliveries for initial installations, refurbishment, or emergency replacement will be critical to controlling costs and generating an ROI sooner rather than later. For these reasons, All Metals & Forge Group is a sound source for open die forgings and seamless rolled rings for the energy turbine industry.

Tim Grady is the Editor-in-Chief for Manufacturing Outlook ezine and co-host of Manufacturing Talk Radio. He can be reached at timgrady@mfgtalkradio. com n

Air India looks set to purchase up to 500 jetliners, with as many as 400 narrow-body and 100 or more wide-bodies making up the contract. Airbus had earmarked A350 production slots for Russia’s Aeroflot, but these are now left open because of sanctions against Moscow. There have been no comments from Airbus or Boeing, nor from Tata-owned Air India. The potential order, worth tens-of-billions-of dollars, comes days after Tata announced the merger of Air India with Vistara, a jointventure with Singapore Airlines, to create a bigger, full-service carrier and strengthen its presence on domestic and international routes.

Air India was founded by JRD Tata in 1932, and was nationalised in 1953. Tata recently took over in January and has since been working to revive its reputation. The 500 jets, to be delivered over the next decade, would replace and expand fleets in the world’s fastest-growing air travel market, while contributing to Prime Minister Modi’s economic expansion goals. But experts warn that many hurdles stand in the way of Air India’s ambition to recover a strong global position, including frail domestic infrastructure, pilot shortages, and the threat of tough competition from established Gulf and other carriers. It may also struggle to get the medium-haul Airbus A321neos being ordered for

the Air India-Vistara tie-up as quickly as it would like, with the European planemaker sold out until 2028 or beyond. One industry source said new Boeing 737 MAXs will most likely go to Air India Express, the company’s budget operator, which could be renamed.

Insiders say plane and engine makers have been clamoring at Air India’s door for months, with new Chief Executive Campbell Wilson - a New Zealander - refusing to rush the make-or-break fleet decision. Air India is taking more time to study Airbus A350s and Boeing widebody 787 and 777 models, on top of a probable mixed order for smaller single-aisle jets. Campbell recently

confirmed talks to “greatly expand” Air India’s fleet over the next five years and said, “At the risk of gross understatement, the investment will be substantial.”

Meanwhile, China’s aircraft maker Commercial Aircraft Corporation of China (COMAC) delivered its first domestically produced C919

passenger plane to China Eastern Airlines, after some 15 years of development. For the time being, the C919 will be produced mainly for the domestic market as it has not obtained safety certification outside of China. Orders from China Eastern and from state-owned leasing companies are trickling through, but as yet there is no definite delivery

schedule for the jets. Ryanair, which has been in discussions with COMAC since 2011, says it is still interested in the C919.

It should be noted, as it already has been, that significant components of the C919 are manufactured in the West, and are likely to be for quite some time. There is scheduled “action” for the C919 in the early part of 2023. Past this point, there is nothing certain on the subject of the C919, and China will continue for the near future to purchase from Boeing and Airbus. The arrival of Air India on the scene suggests we’re in for a production traffic jam.

Author profile:Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

The Champlain Hudson Power Express (CHPE), at 545 km (340 miles) is a transmission line that will carry hydropower from Quebec’s far north to New York City. This represents one of New York’s biggest renewable energy projects in over half a century.

The project is in no small part due to the new eyes and tenacity of Hydro-Québec’s new CEO, Sophie Brochu, who was named to the post in 2020. She is an energy economist by training, and ran Montreal-based natural-gas distributor Énergir before

joining Hydro-Québec. The Crown Corporation has historically done the bulk of its spot-market electricity sales in New England, but Brochu came at New York with a different view, and quickly applied herself to getting a deal done that will be Hydro Québec’s biggest-ever export contract, a 25year pact that could generate over $20 billion in revenue for the provincial Crown Corporation. In New York, Brochu found political leaders and communities looking for change. A spokesman for private equity giant Blackstone, the project’s main promoter, said “Sophie was special in

her ability to engage, listen and be truly passionate about seeing this project to fruition. This is nothing against prior leadership, but Sophie took things to a different level.” In its 78-year history, prior to Brochu, Hydro-Québec had been “governed” by 13 white male CEOs.

The export of clean energy is only part of Brochu’s leadership propensities. She is also rewriting the book on the Crown Corporations’s relations with Indigenous communities. She doesn’t go along with the decades-long supplyand-demand idea that says the best

way to meet future power demand is to continue to build more generating stations. Plus she’s coming up with a five-year strategy that some leading environmental policy experts say is far ahead of that of other Canadian utilities. New York authorities selected CHPE as a winning project in September 2021, and provision of 10.4 terawatt hours of electricity was approved this past spring. The project is a definite go, and construction on the first section is cleared to start.

In many ways, Quebec has a head start in the coming energy transition. More than 90% of its electricity mix comes from hydroelectric dams and from the partly-owned Churchill Falls project in Labrador. With an installed generation capacity of 37,231 megawatts from 61 hydroelectric stations and 24 thermal generating stations, its grid stretches over 261,578 kilometers. Brochu delivered record earnings of $3.5 billion for Hydro-Québec last year as the utility sold an unprecedented volume of power within the province and increased exports.

A big chunk of Quebec’s power is going south. In part, that’s because Americans will pay well for it. But it’s also because the Canadian provinces just don’t collaborate well on energy. Ontario’s reliance on nuclear power means it has its own priorities. HydroQuébec has swapped power with New Brunswick for 50 years, but other talks with Atlantic provinces have yielded few results. And so Canada’s dysfunction is America’s gain.

Blackstone says CHPE will create U.S. $23 billion in new economic output, another U.S. $23 billion in carbon dioxide reduction benefits and $1.4 billion in new tax revenue. A pair of high-voltage cables, each no wider than an adult hand, will provide 1,250 megawatts to New York, enough to supply more than a million homes, or about 20% of the city’s needs.

In New York, meanwhile, Blackstone and Hydro-Québec are committing $117 million to improve the environmental health of Lake Champlain and the Hudson and Harlem Rivers, including restoring oyster reefs around New York. They’ll spend another $40 million to retrain workers and $9 million on community initiatives. They’ve also done less formal outreach, such as inviting kids from New York’s Queensbridge area (North America’s largest public-housing complex) to Quebec to see its installations there. “Where does it stop? It never does,” Brochu says as she explains HydroQuébec’s business-with-a-conscience approach, which mirrors her own sensibility. “When you get there, it has to be with a philosophy that says, ‘This all has to make sense.’ There are things that will be very structured. Beyond that, you just become a partner of the place.”

Hydro-Québec already offers the cheapest rates in North America for power from its decades-old dams. Montrealers, for example, pay just $76 a month for 1,000 kilowatt hours of electricity, roughly half what

Torontonians pay and close to five times lower than rates in New York and Boston. Industry benefits from low rates and clean-power bragging rights, and Brochu says the Crown Corp should be properly paid for it. “I don’t want to become the Dollarama” of utilities, Brochu says. “We need to support our businesses. But at a time when our costs are rising, and the value of their green product is rising, our rates have to rise.” Most importantly, Brochu has plotted a new five-year plan to prepare for a future other utility CEOs have barely acknowledged.

Its basic conclusion is that Quebec will need over 100 terawatt hours of additional clean power to achieve neutrality by 2050. That’s more than half of all of Hydro-Québec’s current annual generating capacity. To get there, it proposes to significantly step up energy efficiency efforts, modernize existing equipment to crank out more output, and develop more wind power. The plan also pledges to explore whether building more hydro capacity makes sense and how that could be done. Brochu has succeeded in bringing both government and industry more into the picture. She has significantly expanded the province’s EV charging system and has reorganized the utility’s internal operations, combining the three main functions that had long been separated, namely production, transmission, and distribution. She feels this will encourage more employee collaboration.

The only thing likely to prompt Brochu to leave her post would be a wrong turn on the part of the provincial government on decarbonization. Otherwise, she is there to see her plans through to the end.

2023

by Royce Lowe

by Royce Lowe

“Insane” says Elon Musk; “Unreasonable” says China’s BYD Co., when talking about the rise in the price of lithium, that metal labeled white gold by those in the EV and battery business. The price of the metal has cooled off somewhat following a very impressive two-year surge. This trend is predicted to continue as more supply surfaces to cut back on abnormally high margins for lithium producers, according to Wang Pingwei, chairman of Sinomine Resource Group Co.

Battery-grade lithium carbonate flew from around 50,000 Yuan (around $7,200) a ton in late 2020, to some 600,000 yuan (around $86,200) in

November 2022. The price has since settled to around $520,000 yuan ($75,000).

Such extraordinary price increases have hurt buyers and contributed to the first annual increase in battery costs since BloombergNEF started tracking them nearly a decade ago. Benchmark prices in China are still about twice as high as at the start of 2022 - despite declining this month - as demand from the fast-expanding EV sector outstrips supply. Sinomine’s Wang said he sees lithium carbonate prices dropping to about 400,000 yuan (over $57,000) a ton in 2023.

Wang is not alone in his forecasts. BYD is looking to more supply from mines pushing the market into a surplus in 2023, thus softening prices. China’s withdrawal of EV credits, plus uncertainties over the pandemic and the global economy, may also affect the overall situation. There are lithium deposits in abundance around the globe. Production capacity and the ongoing supply and demand situation for EVs will determine the price of lithium over the years to come.

Sinomine wants to expand output worldwide, just as geopolitical tensions are growing with the U.S., Canada, and

other nations that are moving to restrict China’s role in the EV supply chain. Wang’s firm was one of three Chinese companies ordered by Ottawa to divest stakes in Canadian-listed firms under tougher rules for foreign investment. Separately, it still owns the Tanco mine in Manitoba, Canada, as well as the Bikita lithium site in Zimbabwe. “Our confidence to invest in more mines in North America is relatively low at present,” Wang said.

The company is currently in talks for potential projects in South America, and will continue to look for opportunities in Africa, where developing mines is easier than in other jurisdictions, he said. Central Asia is another prospect — including Afghanistan once the security situation improves there.

Sinomine currently has 25,000 tons of annual production capacity for batterygrade lithium hydroxide and carbonate. The company expects that to increase to 60,000 tons next year, and is targeting 100,000 tons of capacity by 2025, Wang said.

About a year and a half ago the going price for hot-rolled steel coil in the U.S. was brushing $2,000 per ton. It is understood that several high-volume transactions were recently completed at below U.S. $600 per ton. Many buyers in the U.S. took advantage of the heavily discounted prices. They placed orders for December delivery, despite end-of-year stock considerations.

Although November and December are t raditionally slow months, integrated mills were quick to announce a price increase of $60 per ton. The consensus view from MEPS’ U.S. research, this month, is that steel coil prices have reached the bottom of the current cycle. Domestic suppliers - whose first aim was to halt the downward price trend - are likely to be encouraged to push further on their price aspirations. Following MEPS’ December price assessment, some U.S. mills announced a further U.S. $50 per short ton list increase. This may, at least, raise the likelihood that the full extent of the first price hike will be achieved.

U.S. mills are openly looking to secure US $750 per short ton for hot-rolled coil and U.S. $1,000 per short ton for cold-rolled and hot-dipped galvanized coil, during the first quarter of 2023. Several purchasing managers report that such price levels are a realistic proposition. The year-end sees prices for stainless steel cold-rolled coil remain at elevated levels, compared with pre-pandemic values, in all regions, with the U.S. having some of the highest global prices.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

Most of the UK’s auto industry is going through what might be termed the worst of times, but Bentley Motors, wholly owned by VW, is going through the best. The maker of luxury automobiles, in its 103rd year, has just completed its most successful year ever, with record sales and profit.

The average selling price of a Bentley is around $230,000, and as such, the company can afford to pay an electricity bill that’s quadrupled, and

to attract and maintain a skilled workforce in the midst of a labor shortage. It can also import a relatively small number of expensive batteries to increasingly replace domestically built combustion engines. But Bentley went through some jittery times due to the Russian invasion of Ukraine, where most of the wire harnesses are manufactured, a complex tangle of cables and plugs woven together by hand that together form what might be termed the neurological command

center of modern cars. Many components used in these factories are imported from Western Europe, the U.S., and China. But initially, delivery trucks from the European Union couldn’t enter. And many male Ukrainian truck drivers were barred by law from leaving the country. But ingenuity prevailed, and Bentley was able to carry on with a minimal loss of production. Some parts of the harness come from Shanghai, at times on lockdown. Bentley was at one point

down to a three-week stock of these parts but managed to muddle through.

Bentley sells, to its relatively small clientele, what can best be described as opulence. It effectively allows its customers to specify what comes off the production line. The costs of some of the extras are guaranteed to bring water to one’s eyes. All this on a capacity of 15,000 cars, a figure it will have hit in 2022. Bentley’s future, like that of most automakers, is to move to hybrids and all-electric vehicles. The company plans to offer only plug-in hybrid and electric cars by 2026 and to switch its entire lineup to fully batterypowered vehicles by the end of the decade.

Warren Buffett’s Berkshire Hathaway Group chose some time ago to back Chinese automaker BYD. Good move. BYD has resisted Covid lockdowns, supply chain disruptions, and power shortages that hampered China’s auto industry. It continues a relentless advance to dominate the world’s biggest electric-vehicle market. And now it has Elon Musk’s Tesla in its sights.

BYD is on a roll, and will come into 2023 with record vehicle sales, revenue, and profitability behind it, all a result of the appeal of its affordable cars in China’s mass market. It’s now looking to the premium end of the market with two luxury brands, going against

Tesla’s pricier cars. BYD is not yet into the luxury SUV and sports car markets, the two most profitable vehicle segments, but analysts expect it to enter these sectors in 2023. The new brands also happen to be the kind of EVs fit for the US, a market BYD has yet to enter with its ever-growing electric lineup. The Chinese EV giant has managed to withstand most production disruptions thanks to its vertically integrated supply chain. Production and deliveries hit another record in November, topping 230,000 vehicles.

Registration data from Automotive News for the first ten months of 2022 states that some 604,638 new batteryelectric cars (BEVs) were registered in the U.S., which is about 60% more than a year ago. BEVs accounted for about 5.3% of the total number of registrations, compared to 2.9% a year ago. Tesla maintains its dominant position in the segment with almost two-thirds of all BEV registrations (65% share), but non-Tesla BEV sales increase faster (by 81% year-over-year). BEV registrations in January-October 2022:

• Tesla (65% BEVs): 391,937 (up 50.2% from 260,932)

• Non-Tesla (35% BEVs): 212,701 (up 81% from 117,534)

• Total: 604,638 (up 60% from 378,466) and 5.3% share (up from 2.9%)

Ford, with 44,219 registrations, strengthened its position as the second most popular BEV brand in the U.S. With its waiting list for the F150 Lightning, Ford should see a good 2023 for EVs. Meanwhile, BloombergNEF recently released its updated Zero-Emission Vehicles Factbook, which estimates that cumulative investment in EV charging hardware and installation will reach $62 billion at the end of 2022, with $28.6 billion having been invested just in 2022, up 228% from the year before. Of the total investment in 2022, 61% is attributed to more than 600,000 public chargers built in China. Cumulative global investment will probably pass the $100 billion mark in 2023 if China keeps up its relentless pace.

The EV surge in the U.S. will hang largely on the pickup, with the effect of Ford’s electrifying its best-selling F150 already being felt. In 2023, new models will join the F150, like the R1T from Rivian, an electric Chevrolet Silverado, and Tesla’s long-awaited Cybertruck. The first half of 2022 saw EVs in the U.S. account for 6% of passenger vehicle sales, or a 62% year-over-year increase. Pickups went from zero to 15% of EV sales. But these figures are way behind those in Europe and China. The Lightning has an impressive range and performance, good for those motorists who’d really like a sports car.

It will not be easy to persuade change in those seven in ten American drivers who want nothing to do with EVs at the moment, but California’s recent decision to ban the sale of internal combustion vehicles, together with that of other states, will surely speed up EV sales. But Americans love internal combustion, and the road to electrification will be a long one.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

JANUARY 2023

By Ken Fanger, MBA, CMMC-RP, President, On Technology Partners

By Ken Fanger, MBA, CMMC-RP, President, On Technology Partners

Learning is a life-long process that should never end, and that is no less true when it comes to cybersecurity. Changing cyber trends and increasingly sophisticated attacks from cyber criminals make well-rounded, consistent cybersecurity training vital to protecting your business and employees.

Training is the best way to ensure that your team is on the same page. The cost of training often offsets itself in the long run when it’s done right. If you have employees that want to learn, encourage them— they’ll be some of your best team members.

Some may not view training as betterment for the company as a whole; they think of it as a requirement to be

met or a way to encourage employees to move on to new employers with new skills. For example, I once was denied a promotion because taking the required certification would make me “too valuable.” When I realized they would never train me to be a more valuable employee, I ended up leaving the company within a year. It was a simple decision when I realized that my future career goals would require training (and working with companies that valued and encouraged professional development).

The reality is that training provides your employees with skills that improve your business, and in terms of cybersecurity, it produces a team of

people who are prepared and invested in protecting the business. We might have established the importance of training, but let it be said that all training is not created equally. I know I’ve had to sit through some of the most painfully dull training sessions in the world. Cybersecurity training in particular can be boring and dry – and, often, that seems to be the impression of it across many of the companies I’ve worked at.

First and foremost, cybersecurity training needs to be specific and personal. I want to know what it could cost me and how I can address it. The oft-repeated warnings and stories that cybersecurity experts have to say just don’t resonate

with the average employee. I don’t care that 45,000 cyber attacks just happened in the last ten seconds, or that companies have lost millions in each attack, but I do care that entering my password to the wrong website could risk my personal bank account.