Thank you for considering Merchants Fleet for the next step in your career. We are delighted you’re interested in joining our team. Every day I walk through the doors of our NH headquarters even after 20 years I am energized by what I see and feel. Because together, we have built a one-of-a-kind workplace where people are empowered to lead and help others succeed.

Innovation, collaboration, and dedication are at the core of our culture. This has made us the fastest-growing and one of the largest fleet management companies in the country. As you explore opportunities with us, we encourage you to think creatively, outside of the box (because that’s part of our company DNA and logo) about how you can contribute to our mission and what we can achieve together. Our fast-paced, dynamic environment will value and reward your unique brain, ideas and creativity.

In exchange, we offer you competitive pay, topnotch benefits, invaluable training, thoughtful perks, and a company culture that prioritizes your happiness and recognition. We are proud of our Total Rewards program designed to support health, wealth, growth, work-life balance, recognition, and belonging. Keep reading to learn more.

hr@merchantsfleet.com

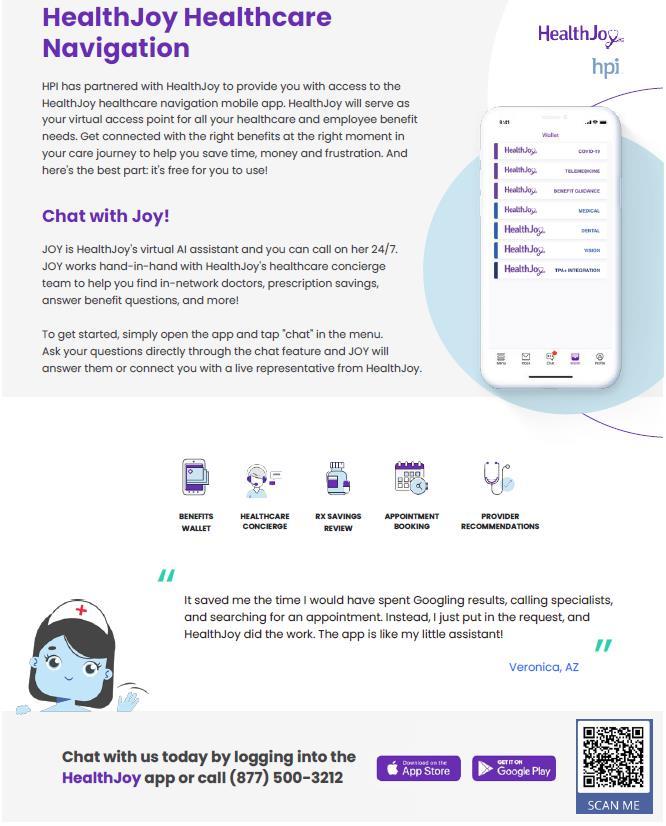

https://healthplansinc.com/members/member s-secured/

https://myhealthaccountsolutions.voya.com/ HASinfo@voya.com 1-833-232-4673

https://portal3.nedelta.com/BenefitLookup17/ Account/SubrLogin

www.401k.com

https://login.standard.com/register

https://member.eyemedvisioncare.com

At Merchants, we pride ourselves with providing you and your family a comprehensive array of benefits to protect your health, your family and your way of life.

Here are some important things to know…..

Eligibility:

▪ All full-time, permanent employees are eligible for Medical, Dental, Vision, Life & Disability & Paid Time Off

▪ All employees (Full, Part & Limited) are eligible for the Merchants 401k Plan

Dependent Coverage:

For dependent eligible benefits, eligible Family Members are:

▪ Your legally married spouse

▪ Your Registered Domestic Partner (RDP) and their children, where applicable by state and federal law

▪ Your children who are your natural children, stepchildren, adopted children, or children for whom you have legal custody (age restrictions may apply). Disabled children aged 26 or older who meet certain criteria may continue your health coverage.

Enrollment

▪ New Hires are eligible for benefits on the first of the month following date of hire.

▪ 401k eligibility is date of hire

▪ Open enrollment is offered in November each year to provide you the opportunity to edit your elections for a January 1st start date.

▪ Life Events have a 30-day window from the date of the event for you to be able to add or edit your current benefits.

▪ Enrollment is completed in our HRIS system, UKG, and on Fidelity’s website (401k).

▪ Marriage or divorce

▪ Birth or adoption of a child

▪ Child reaching the maximum age limit

▪ Death of a spouse, Registered Domestic Partner (RDP), or child

▪ Change in child custody

▪ Change in coverage election made by your spouse/RDP during his/her employer’s Open Enrollment period

▪ You lose coverage under your spouse’s/RDP’s plan

Merchants partners with HPI to provide two PPO plan options with nationwide coverage. Both

To find a provider visit the HPI Provider Lookup and choose PPO for the plan.

Expenses on this plan apply to your deductible first before the plan begins covering expenses. There are no copays on this plan.

You will have a Health Savings Account (HSA) with this plan – find more information in the Health Care Account section of this booklet.

This is a traditional copay style plan. Most services have a flat payment for services, including prescriptions.

There is a deductible for some services and a Health ReimbursementArrangement (HRA) will assist with half of the expense find more information in the Health Care Account section of this booklet.

*Applies on all non-copay covered services once deductible is met. This includes hospital

Already have medical coverage? Opt-out of participating in Merchants’ health plan and receive $80/pay period ($2,080 annually). Proof of current coverage is necessary and can be emailed to hr@merchantsfleet.com

You may add a Domestic Partner to all dependent eligible benefits. Complete and return the Affidavit found on Merchants Central. See HR for Details. Note: Taxation does apply

There is a $19 surcharge bi-weekly for employee and/or spouse/DP tobacco use. This includes, but is not limited to cigarettes, cigars, vape & chewing tobacco. Merchants provides different options and assistance for smoking cessation. Please see the Wellness area of Merchants Central for more information

Merchants provides financial aid for eligible employees enrolled in the medical plan:

▪ For Single enrollment, employees earning less than $40,000 are eligible for $30/pay period towards premium*

▪ For Dual or Family Enrollment, employees earning less than $50,000 & are the primary wage earner are eligible for $60/pay period towards premium*

PPO with Health Reimbursement Arrangement (HRA)

Merchants funds the account through HPI on your behalf

Once you’ve met your deductible responsibility, the HRA will pay the remaining balance

Claims are paid on your behalf. There’s no administration on your end

What is an FSA?

How does it work?

An account that uses pre-tax funds to pay for eligible expenses. You must have a valid mailing address to enroll - PO boxes are not eligible.

You will receive a debit card in the mail that will need to be activated and will be invited to create an online account here

Please review the below chart to find which

for you:

*Eligible dependents must be under the age of 13 for services such as day

and non-employer-sponsored before or after school

preschool, summer

. Tax dependents age 13 and older are also eligible if they are physically or mentally incapable of self-care and reside in the employee’s home at least half the

Merchants partners with Northeast Delta Dental to provide two PPO plan options with nationwide coverage.

To find a provider visit the Northeast Delta Dental Provider Search and choose either the PPO or Premier Network.

100% Coverage on Preventive Care

60% Coverage on Basic Services

50% Coverage on Basic Services

60% Coverage on Major Services

50% Coverage on Major Services

50% Coverage on Orthodontia

▪ Provider: Fidelity Investments (www.401k.com)

▪ Available to Full-Time, Part-Time & Limited Employees

▪ Eligible to begin participating on Date of Hire

▪ Traditional Pre-Tax & Roth Post-Tax option available

▪ Merchants will make a 4.5% Employer Match when you contribute 6% or more Match Formula

▪ 100% of first 3% of your eligible contribution

▪ 50% of the next 3% of your eligible contribution

▪ 100% Vested Auto-Enrollment

▪ Employees are auto-enrolled after 30 days of employment at 6%

• Contributions apply to a Target Date Fund based on your age

▪ Changes to your contributions and investment options can be completed anytime using the NetBenefits App or Online Portal.

▪ New hires who have contributed to a different employer’s 401k during plan year must consider amount already contributed YTD to not exceed the annual IRS maximum

▪ One general loan can be active at a time

▪ Process your request through the NetBenefits portal

▪ You’re still able to contribute to 401(k) while loan is outstanding

▪ Hardship loans are available for specific circumstances ▪ See HR for assistance

your online access at www.401k.com

▪ Establish your contributions & investments

▪ Assign your Beneficiary(ies)

▪ Process a loan request

▪ Explore live & pre-recorded webinar series

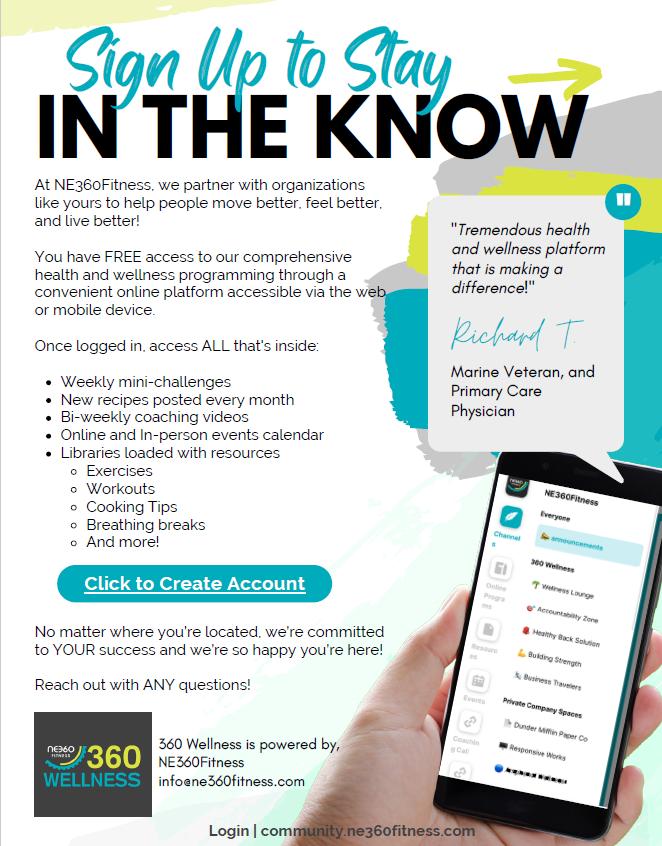

Merchants refreshed and simplified its Wellness Program around three pillars: Mind, Body, and Soul.

This holistic approach recognizes the importance of the whole self and the different care we all need for our personal well-being. We are pleased to share our Mind, Body, and Soul resources and support with you.

Prioritizing and taking care of our mental well-being is essential for achieving overall wellness and a better quality of life. Explore our related benefits below:

• Behavioral Health through HPI

• EmployeeAssistance Program (EAP)

• Mental Health First Aid Training

• Financial Wellness Seminars

• MerchantsiQ

Physical fitness is essential for good health, disease prevention, and optimal physical performance. Learn about our related benefits below:

• 360 Wellness

• Nutrition in Motion No-Cost Nutrition Counseling

• Onsite Gym, Basketball Courts, and Pickleball Courts

• Preventative Care Incentive = 50 Points

• HealthyActivity Incentive = 150 Points

Nurturing the soul is important for achieving inner peace, purpose, and a sense of fulfillment in life. Explore our related benefits below:

• Ambassadors & Allies

• Employee Resource Groups

• World Kitchen

• Merchants Gardens

• DE&I Virtual Events

The following paid holidays will be granted to all eligible employees

▪ Eligible full-time employees who are entitled to holiday pay are those who:

▪ Worked the day before and after the scheduled Holiday, unless PTO was approved prior to the holiday by your manager

▪ Employees who are scheduled for work on a holiday and fail to report for and perform the day’s work, shall not receive holiday pay.

▪ Holiday pay of eight (8) hours will be calculated at the employee’s current hourly rate.

▪ Due to the nature of the automotive business, management reserves the right to alter this holiday schedule as it deems necessary to accommodate the public.

Monday, January 1st New Year’s Day

Monday, May 27th Memorial Day

Wednesday, June 19th Juneteenth

Thursday, July 4th Independence Day

Monday, September 2nd Labor Day

Thursday, November 28th Thanksgiving Day

Friday, November 29th Post-Thanksgiving Day

Tuesday, December 25th Christmas Eve

Wednesday, December 26th Christmas Day

Early Office Close at 3pm on Wednesday, July 3rd.

Early Office Close at 3PM on Wednesday, November 27th

FLOATING HOLIDAYS (2) To be taken as an additional holiday and needs to be approved prior to using the time. Floating holiday may be used by an employee as requested subject to approval by their manager. Employees must be employed prior to October 1st of the current calendar year to receive a floating holiday.

Please Note: You must receive manager approval to use your Floating Holiday and any additional PTO days in advance. Thank you!

The following paid holidays will be granted to all eligible employees

▪ Eligible full-time employees who are entitled to holiday pay are those who:

▪ Worked the day before and after the scheduled Holiday, unless PTO was approved prior to the holiday by your manager

▪ Employees who are scheduled for work on a holiday and fail to report for and perform the day’s work, shall not receive holiday pay.

▪ Holiday pay of eight (8) hours will be calculated at the employee’s current hourly rate.

▪ Due to the nature of the automotive business, management reserves the right to alter this holiday schedule as it deems necessary to accommodate the public.

Monday, January 1st New Year’s Day Retail division open 10-4 on 12/31

Sunday, March 31st Easter Sunday

Monday, May 27th Memorial Day

Wednesday, June 19th Juneteenth

Tuesday, July 4th

Monday, September 2nd

Thursday, November 28th

Friday, November 29th

Monday, December 24th

Tuesday, December 25th Christmas Day

FLOATING HOLIDAYS (2)

– Not a paid holiday

division open 10-4

To be taken as an additional holiday and needs to be approved prior to using the time. Floating holiday may be used by an employee as requested subject to approval by their manager. Employees must be employed prior to October 1st of the current calendar year to receive a floating holiday.

Please Note: You must receive manager approval to use your Floating Holiday and any additional PTO days in advance. Thank you!

Information regarding these notices may be found on Merchants Central in the Benefits folder or by contacting Human Resources at hr@merchantsfleet.com

▪ COBRA Information

▪ HIPAA Information

▪ Medicare Part D

▪ CHIPRA Information

▪ Affordable Care Act (ACA)

Important Note:

▪ Summary Plan Document

▪ Newborns and Mothers Health Protection Act Notice

▪ Women’s Health & Cancer Rights Act of 1998 (WHCRA)

▪ Summary of Benefits Coverage (SBC)

▪ Summary Annual Report

The material enclosed is for informational purposes only and is neither an offer of coverage or medical or legal advice. It contains only a partial description of the plan or program and does not constitute a contract. Please refer to the Summary Plan Description (SPD) for complete plan details. In case of a conflict between your plan documents and this information, the plan documents will always govern.

Annual Notices:

ERISA and various other state and Federal law requires that employers provide disclosures and annual notices to their plan participants. The company distributes all required notices electronically annually.