Page 1 2023 Open Enrollment & Benefits Guide

A MESSAGE FROM OUR CHAIRMAN, CEO & PRESIDENT

The health and welfare of our employees has always been a top priority at Merchants. This unwavering commitment will continue under new ownership.

In fact, over the last several months I have partnered with our HR Department to conduct a comprehensive analysis of our benefit plan offerings - just to make sure that we continue to address the evolving needs of our workforce.

While our benefits stacked up favorably, I am pleased to share that we made some changes that put us on a whole new level.

In 2023, we are lowering your medical premiums, bumping up the 401(k) match, and investing in a comprehensive wellness program!

Please take some time to read through this guide for more information and share with others in your family that are also part of our benefits plans.

Finally, thank you all you do, continue the great work you are doing, and enjoy the FEARLESS JOURNEY!

Welcome

Contents What’s New For 2023 Useful Contacts Benefits Spot Resource Eligibility and Enrollment Medical Plans Flexible Spending Accounts Dental Plans 401(k) Plan Life Insurance & Disability Vision Plan Holiday Schedule Wellness Employee Assistance Program Required Notices Key Dates 3 4 5 6 7 12 13 14 15 16 17 19 21 22 23

Brendan P. Keegan

What’s New for 2023?

For your convenience, we have noted below the changes to our benefits plans for 2023:

Employee contributions to the medical premiums are decreasing, with Merchants paying, on average, 90% of medical plan premiums

The employer match to the 401(k) plan is increasing from 3.5% to 4.5% for all participants who contribute at least 6%

Merchants 401(k) plan will be transitioning to safe harbor, which means that all active and new participants will be immediately vested

For our company-paid life insurance (equivalent to 1x your annual salary), the maximum coverage is increasing from $100,000 to $150,000

The employer-funded contributions toward your Health Savings Account (HSA) and Health Reimbursement Arrangement (HRA) are changing as follows.

Medical Coverage will change from $750/annually to $500/annually Dual or Family Medical Coverage will change from $1,500/annually to $1,000/annually

Employee-Only

Page 4 Useful Contacts Contact or Vendor Phone Website & Email Benefits Manager P: 603-695-9278 F: 603 218 6835 hr@merchantsfleet.com www.healthplansinc.com/members Member Services: 877 906 5730 Pharmacy: 800-334-8134 800-401-3539 www.benstrat.com info@benstrat.com Live chat available www.nedelta.com 800 832 5700 www.401k.com 800 835 5095 https://login.standard.com/register 888-937-4783 https://individual.eyemed.com/member-login/ 844 225 3407 Medical & Rx Dental 401(k) Life/Disability Vision FSA/HSA/HRA

Page 5 5 Benefit Spot App Resource With Benefit Spot You and Your Dependents can: • Call HR Directly • Access your Benefits Guide & Basic Plan Information • Access Educational Videos & Recorded Orientation • Estimate your basic Medical Care Costs • And More! Download the App Today! Use the QR Code or search for Benefit Spot in the App Store Enter Company Code: Merchants (Case Sensitive)

Page 6 Eligibility & Enrollment At Merchants, we pride ourselves on providing you and your family a comprehensive array of benefits to protect your health, your family and your way of life. Here are some important things to know… Eligibility: All full time, permanent employees are eligible for Medical, Dental, Vision, Life & Disability & Paid Time Off All employees (Full, Part & Limited) are eligible for the Merchants 401k Plan Dependent Coverage: For dependent eligible benefits, eligible Family Members are: Your legally married spouse Your Registered Domestic Partner (RDP) and their children, where applicable by state and federal law Your children who are your natural children, stepchildren, adopted children, or children for whom you have legal custody (age restrictions may apply). Disabled children age 26 or older who meet certain criteria may continue on your health coverage Enrollment New Hires are eligible for benefits on the first of the month following date of hire. 401k eligibility is date of hire Open enrollment is held in November of each year, providing you the opportunity to make changes to your benefit plans effective January 1st If you have a qualifying life event, you have 30 days from the date of the event to update or change your current benefits Enrollment is completed in our HRIS system, UKG, and on Fidelity’s website (401k) Types of Qualifying Life Events: Marriage or divorce Birth or adoption of a child Child reaching the maximum age limit Death of a spouse, Registered Domestic Partner (RDP), or child Change in child custody Change in coverage election made by your spouse/RDP during his/her employer’s Open Enrollment period Loss of coverage under another plan

with

Option 2: PPO with HRA

Page 7 Medical Plans PPO with HRA Employee Only Employee + Dependent(s) Deductible $1,500 $3,000 Coinsurance* (HPI / EE) 80% / 20% 80% / 20% Office Visit $30 Copay $30 Copay Specialist $50 Copay $50 Copay Urgent Care $30 Copay $30 Copay Emergency Room $150 Copay $150 Copay OOP Max (Fam) $3,000 $6,000 Prescription Drugs Generic $10 Brand $30 Non-Formulary $40 Specialty $100 Mail Order 2x for 90 day supply Bi- Weekly Contributions PPO with HSA PPO with HRA Employee** Merchants Employee** Merchants Employee $26.47 $337.71 $53.10 $340.21 Employee + 1 $48.16 $648.15 $101.95 $653.21 Employee + 2 or more $75.70 $965.86 $151.86 $973.02 **An additional $19.00 (bi weekly) per employee and spouse/domestic partner will be applied to these rates for those that use tobacco products. PPO with HSA Employee Only Employee + Dependent(s) Deductible $2,000 $4,000 Coinsurance* (HPI / EE) 80% / 20% 80% / 20% Office Visit 20% after ded. 20% after ded. Specialist 20% after ded. 20% after ded. Urgent Care 20% after ded. 20% after ded. Emergency Room 20% after ded. 20% after ded. OOP Max (Fam) $4,000 $8,000 Prescription Drugs Generic 10% after ded. Brand 20% after ded. Non-Formulary 30% after ded. Specialty 30% after ded Mail Order 10% after ded for 90 day supply *Applies on all non copay covered services once deductible is met. This includes hospital confinements, x rays, physical therapy, etc. See Plan Summary for more detailed information and out of network benefits. Merchants partners with HPI to provide two PPO plan options with nationwide coverage. Both plans offer the same networks, medical coverage, and prescription coverage. To find a provider visit the HPI Provider Lookup and choose PPO for the plan.

Expenses on this plan apply to your deductible first before the plan begins covering expenses. There are no copays on this plan. You will have a Health Savings Account (HSA) with this plan for more information, please refer to the Health Care Account and Health Savings Account sections of this booklet.

Option 1: PPO

HSA

is a traditional copay style plan. Most services have a flat payment for services, including prescriptions.

is also a deductible for some services along with a Health Reimbursement Arrangement - for more information, please refer to the Health Care Account and Health Reimbursement sections of this booklet.

This

There

Medical Plans - Additional Information

Opt-Out Incentive

Domestic Partner

Tobacco Use Surcharge

Already have medical coverage? Opt-out of participating in Merchants’ health plan and receive $80/pay period ($2,080 annually). Proof of current coverage is necessary and can be emailed to hr@merchantsfleet.com

You may add a Domestic Partner to all dependent eligible benefits. Complete and return the Affidavit found on Merchants Central. See HR for Details. Note: Employer contributions to domestic partner health premiums are counted as counted as taxable income

There is a $19 surcharge bi-weekly for employee and/or spouse/DP tobacco use. This includes, but is not limited to cigarettes, cigars, vape & chewing tobacco. Merchants provides different options and assistance for smoking cessation. Please see the Wellness area of Merchants Central for more information

Merchants provides financial aid for eligible employees enrolled in the medical plan:

For Single enrollment, employees earning less than $40,000 are eligible for $30/pay period towards their premium*

For Dual or Family Enrollment, employees earning less than $50,000 & who are the primary wage earner are eligible for $60/pay period toward their premium*

*Subsidy cannot exceed employee cost of coverage

Page 8

Financial Aid Toward Medical Plan Premium

Health Care Accounts

Depending on your choice for medical plan, you have the option of opening one or more types of Health Care Accounts that assist with expenses and, in most cases, provide you with tax savings through your payroll deductions.

Which Spending Account is Right for You?

Account Features

This side by side comparison provides a highlevel overview of the Health Savings Account (HSA), Health Reimbursement Arrangement (HRA) and Flexible Spending Account (FSA)

The following pages will provide you additional details on which health care accounts are available to you, how they are funded, and how you can use them to your advantage to manage your healthcare expenses.

HSA HRA FSA

You can use it to pay your deductibles X X X

You can use the money in the account before it’s fully funded. X

You own the account X Your employer owns the account X X

Money put into the account that has already been taxed (for example, money that was a gift) is tax deductible

X

It could be deposited as an untaxed payroll deduction or it could also be after tax X X

You can invest the money X

You are provided a credit card to access the funds X

You can use the money on child and elder care expenses

Page 9

X

X

Page 10 Health Savings Account PPO with Health Savings Account (HSA) plan Highlights of an HSA: 1. Tax Free Contributions 2. Tax Free Interest 3. Tax Free on Eligible Purchases Merchants will contribute a guaranteed amount bi weekly If you leave Merchants, the account remains accessible for you to use What can I use my Health Savings Account for? Medical Pharmacy Vision Dental First Aid & OTC Products Coverage Level for Medical Bi-Weekly Employer Contribution Maximum Employee Contribution Total Contribution Employee Only $19.23/Pay Period ($500 Annually) $3,350 $3,850 Employee + Dependent(s) $38.46/Pay Period ($1,000 Annually) $6,750 $7,750 * Employees who are 55+ can contribute an additional $1,000 * Beneficiaries are recorded in UKG and can be updated anytime. 2023 Contribution Limits (Debit Card provided) Employer Contributions Triple Tax Advantaged Take it With You

Page 11 Health Reimbursement Arrangement PPO with Health Reimbursement Arrangement (HRA) What is an HRA? Once you’ve met your deductible responsibility, the HRA will pay the remaining balance Claims are paid on your behalf. There’s no administration on your end What services apply to your deductible? Coverage Level for Medical Employee Deductible Responsibility HRA Deductible Responsibility Total Deductible Employee Only $1,000 $500 $1,500 Employee + Dependent(s) $2,000 $1,000 $3,000 * Employee responsibility occurs first, HRA responsibility occurs second 2023 Contributions Surgery Lab Work Scans & X-Ray Inpatient Stays Ambulance Service Employer Funded Automatic Administration Pays for Deductible Expenses Merchants funds the account through HPI on your behalf

Page 12 Page 12 What expenses apply? Flexible Spending Accounts Which medical plan did you choose? General Purpose FSA (Annual Max) Limited Purpose FSA (Annual Max) Dependent Care FSA (Annual Max) PPO with HSA $3,050 $5,000 PPO with HRA $3,050 $5,000 Waive Medical $3,050 $5,000 Limited Purpose FSA General Purpose FSA Medical Pharmacy Vision Dental First Aid & OTC Products Vision Dental An account that uses pre-tax funds to pay for eligible expenses. Funds are use it or lose it, however $500 can rollover from 2022 to 2023 ($610 from 2023 to 2024) What is an FSA? Your election (min. $250/year) is front loaded on a credit card and your bi weekly premium pays the balance in full by year end How does it work? Your choice is based on the election you made for the medical plan. Below are your choices and IRS Maximums for 2023 Which FSA is for me? Child Care* Elder Care* *Must be a legal dependent Dependent Care FSA

Page 13 Dental Plans Service Core Plan Ortho Plan 4 Cleanings per year 90% Coverage on Preventive Care 60% Coverage on Basic Services 50% Coverage on Basic Services 60% Coverage on Major Services 50% Coverage on Major Services 50% Coverage on Orthodontia Benefit Maximum Per Participant $1,500 $1,500 Orthodontia Maximum Per Participant (Child & Adult Coverage) $2,000 Bi- Weekly Contributions Core Plan Ortho Plan Employee Merchants Employee Merchants Employee $5.95 $13.19 $8.58 $13.19 Employee + 1 $10.22 $25.41 $15.27 $25.40 Employee + 2 or more $16.43 $44.21 $28.56 $44.21 Merchants partners with Northeast Delta Dental to provide two PPO plan options with nationwide coverage. To find a provider visit the Northeast Delta Dental Provider Search and choose either the PPO or Premier Network.

Confidential 14 Page 14 401k - 2023 Plan Details Plan Administrator & Eligibility Provider: Fidelity Investments (www.401k.com) Available to Full-Time, Part-Time & Limited Employees Eligible to begin participating on Date of Permanent Hire Traditional Pre Tax & Roth Post Tax option available Company Match & Vesting

Employer

you

New Match Formula 100%

contribution 50%

vested Auto-Enrollment Employees are auto enrolled after 30 days of employment at 6% • Contributions apply to a Target Date Fund based on your age Changes to your contributions and investment options can be completed anytime using the NetBenefits App or Online Portal. My NetBenefits App & Online Portal Set up your online access at www.401k.com Establish your contributions & investments Assign your Beneficiary(ies) Process a loan request Explore live & pre recorded webinar series Loans One general loan can be active at a time Process your request through the NetBenefits portal You’re still able to contribute to 401(k) while loan is outstanding Hardship loans are available for specific circumstances See HR for assistance 2023 Maximum Contributions 2023 IRS Maximum <50 years old: $22,500 >50 years old: $30,000 New hires who have contributed to a different employer’s 401k during plan year must consider amount already contributed YTD to not exceed the annual IRS maximum

Effective 1/1/23, Merchants will make a 4.5%

Match when

contribute 6% or more

of first 3% of your eligible

of the next 3% of your eligible contribution

Effective 1/1/23, all active and new employees will be 100%

Page 15 Page 15 Life Insurance & Disability Basic Life & AD/D Insurance • Life insurance policy equal to 1x your annual salary to a maximum of $150,000 • Coverage is updated annually to reflect W2 Gross earnings Company Paid Benefits Supplemental Life& AD/D Insurance You can elect 1x, 2x, or 3x, your salary in coverage Guaranteed issued amount is $100,000 Spousal coverage is up to $100,000 Guaranteed issue amount is $30,000 Child coverage is $10,000 Voluntary Benefits Beneficiaries Filing a Short-Term Claim To file a short-term claim, contact The Standard at 800-368-2859 Beneficiaries are recorded in our HRIS (UKG) and can be updated at anytime Short Term Disability Provides 66.67% of your bi-weekly pay (max. $4,000/wk.) Covers up to a 13 week leave of absence after completing the 7-day waiting period. Long Term Disability Provides 60% of your monthly pay (maximum $7,500/month) Payments begin after 13 weeks of disability Benefit reduction occurs when eligible for social security

Page 16 Page 16 Vision Benefits Available every 2 years; $120; 20% off balance over $120 $135 annually; Can be used in addition to frame benefit Eye Exams Contact Lens Allowance Frame Allowance $10 Copay; Offered annually with or without dilation Up to 40% off exams and aids Hearing Exams & Hearing Aids www.eyemed.com 866 723 0596 Find a Local Provider Bi-Weekly Premium Employee Only $3.08 Employee +1 $5.83 Employee +2 or more $8.57 Merchants partners with EyeMed to provide voluntary, employee paid Vision benefits. Vision exams are covered once every two years on the HPI Medical Plan. EyeMed helps by providing coverage for glasses and contacts along with other services. $25 Copay for Standard Lenses; Additional copays for other options Lenses and Additional Options

Holiday Schedule

Holidays

2023 Fleet & Corporate Holiday Schedule

The following paid holidays will be granted to all eligible employees

Eligible full-time employees who are entitled to holiday pay are those who:

Worked the day before and after the scheduled Holiday, unless PTO was approved prior to the holiday by your manager

Employees who are scheduled for work on a holiday and fail to report for and perform the day’s work, shall not receive holiday pay

Holiday pay of eight (8) hours will be calculated at the employee’s current hourly rate

Holiday pay is paid at straight time; meaning it’s not counted towards overtime pay

Due to the nature of the automotive business, management reserves the right to alter this holiday schedule as it deems necessary to accommodate the public

Date

Holiday Notes

Monday, January 2nd New Year’s Day

Monday, May 29th Memorial Day

Monday, June 19th Juneteenth Tuesday, July 4th Independence Day

Early Office Close at 3pm on Monday, July 3rd Monday, September 4th Labor Day Thursday, November 23rd Thanksgiving Day

Early Office Close at 3PM on Wednesday, November 23rd

Friday, November 24th Post Thanksgiving Day

Monday, December 25th Christmas Holiday Tuesday, December 26th Christmas Holiday

FLOATING HOLIDAYS (2) To be taken as an additional holiday and needs to be approved prior to using the time. Floating holiday may be used by an employee as requested subject to approval by their manager. Employees must be employed prior to October 1st of the current calendar year to receive a floating holiday.

Please Note: You must receive manager approval to use your Floating Holiday and any additional PTO days in advance. Thank you!

Page 17 Page 17

Holiday Schedule

Holidays

2023 Auto & RDFS Holiday Schedule

The following paid holidays will be granted to all eligible employees

Eligible full-time employees who are entitled to holiday pay are those who:

Worked the day before and after the scheduled Holiday, unless PTO was approved prior to the holiday by your manager

Employees who are scheduled for work on a holiday and fail to report for and perform the day’s work, shall not receive holiday pay.

Holiday pay of eight (8) hours will be calculated at the employee’s current hourly rate

Hourly employees who work on the holiday will be paid for hours worked and holiday pay

Holiday pay is paid at straight time; meaning its not counted towards overtime pay

Due to the nature of the automotive business, management reserves the right to alter this holiday schedule as it deems necessary to accommodate the public Date Holiday Notes Sunday, January 1st

Day

division open 10 4

November 23rd

Day

Friday, November 24th

Day

division open regular hours Monday, December 25th

Tuesday, December 26th

Holiday

Holiday

FLOATING HOLIDAYS (2) To be taken as an additional holiday and needs to be approved prior to using the time. Floating holiday may be used by an employee as requested subject to approval by their manager. Employees must be employed prior to October 1st of the current calendar year to receive a floating holiday. Please Note: You must receive manager approval to use your Floating Holiday and any additional PTO days in advance. Thank you!

Page 18 Page 18

Easter

Labor

New Year’s Day Retail division open 10 5 on 12/31 Sunday, April 9th

Sunday Closed Not a paid holiday Monday, May 29th Memorial Day Retail division open 10 4 Monday, June 19th Juneteenth Retail division open regular hours Tuesday, July 4th Independence Day Closed Monday, September 4th

Retail

Thursday,

Thanksgiving

Closed

Post-Thanksgiving

Retail

Christmas

Closed

Christmas

Closed

Merchants Wellness

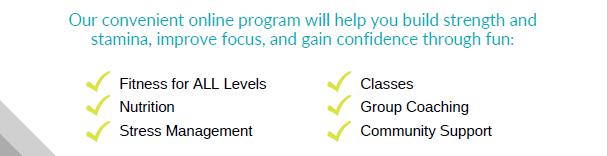

As we transition into 2023, Merchants will be refreshing, enhancing, and simplifying its Wellness Program around three pillars Mind, Body, and Soul. This holistic approach recognizes the importance of the whole self and will provide various options for employee self care.

While some of these programs are still in development and will be communicated at the start of the new year, we are pleased to announce that the pillar “Body” will be administered by Karen Koutsavlis from NE360 Fitness. Karen has been a wonderful partner to Merchants over the last two years and will introduce a comprehensive fitness and nutrition program for us, highlighted on the following page.

In the interim, we would like to reassure you that our Healthy Activity and Preventative Screening Incentives will continue to be a part of our Wellness Program into the new year.

You can earn up to 250 Wellness Points in Merchants Prime by submitting receipts for Healthy Activity expenses. Qualifying examples include gym memberships, home exercise equipment, mindfulness apps, and chiropractic or acupuncture therapy. You could also earn up to 75 points annually for receiving your health, dental, or vision preventive exams. To submit for these incentives, go to the online form on the HR Page of Merchants Central.

We look forward to sharing more about our new Wellness Program at the start of the new year.

Page 19

Merchants Wellness

Page 20

Employee Assistance Program

There are times in life when you might need a little help coping or figuring out what to do. Take advantage of the Employee Assistance Program, which includes WorkLife Services and is available to you and your family in connection with your group insurance from Standard Insurance Company (The Standard). It’s confidential — information will be released only with your permission or as required by law.

Connection to Resources, Support and Guidance

You, your dependents (including children to age 26) and all household members can contact master’s-degreed clinicians 24/7 by phone, online, live chat, email and text. There’s even a mobile EAP app. Receive referrals to support groups, a network counselor, community resources or your health plan. If necessary, you’ll be connected to emergency services.

Your program includes up to three assessment and counseling sessions per issue. Sessions can be done in person, on the phone or by video. EAP services can help with:

Depression, grief, loss & Emotional Wellbeing

Family, Marital & Other Relationship Issues

Life Improvement & Goal Setting

Addiction Support

Financial & Legal Concerns

Identity Theft & Legal Concerns

Online Will Preparation

Page 21

it.

the

(EAP).

A helping hand when you need

Rely on

support, guidance and resources of your Employee Assistance Program

888-293-6948 Workhealthlife.com/Standard3

Required Notices

Information regarding these notices may be found on Merchants Central in the Benefits folder or by contacting Human Resources at hr@merchantsfleet.com

COBRA Information

HIPAA Information

Medicare Part D

CHIPRA Information

Affordable Care Act (ACA)

Important Note:

Summary Plan Document

Newborns and Mothers’ Health Protection Act Notice

Women’s Health & Cancer Rights Act of 1998 (WHCRA)

Summary of Benefits Coverage (SBC)

The material enclosed is for informational purposes only and is neither an offer of coverage or medical or legal advice. It contains only a partial description of the plan or program and does not constitute a contract. Please refer to the Summary Plan Description (SPD) for complete plan details. In case of a conflict between your plan documents and this information, the plan documents will always govern.

Annual Notices:

ERISA and various other state and Federal law requires that employers provide disclosures and annual notices to their plan participants. The company distributes all required notices electronically annually.

Page 22

Your HR Team

From left to right, top: Christine Fredericks, Julia Therrien, Victoria Goudreau, Jen Raimer, Sarah Rossetti. Second row: Alicia Hart, Joe Wentworth, Trinley Glaude, Penny Desaulniers, Brenda Kelley, Meaghan Hull, Camille Nadon Tasse, Richie Coladarci, Chip Clarke

November 14 – Start of Open Enrollment November 15 – Information Session 1, 10:00am November 16 – Information Session 2, 1:30pm November 17 – Information Session 3, 9:00am November 30 – End of Open Enrollment Key Dates