6 minute read

Arctic analysis

ARCTIC POTENTIAL CAPPED

Market analyst Andrew Penfold explores the viability of the Northern Sea Route and the implications for the port sector

The continuing reduction in Arctic ice levels has been hailed as off ering a potential alternative to trade between East Asia and Northern Europe. There are economic arguments in favour of this but take up has been slow and some resistance evidenced.

Given recent upheavals in established container trades what are the realistic prospects for this option?

ECONOMIC ADVANTAGES

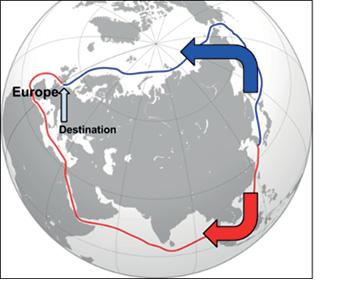

Routeing ships via the north of Canada has been considered but by far the greatest potential is for movements of goods between Asia and Europe. There are cost savings, but there are also major difficulties for this part of the market Of course, the key driver is the shorter haul lengths involved – Shanghai to Rotterdam via Suez is some 10,520nm, via the Northern Sea Route (NSR) its 8350nm. This means (in theory at least) lower shipping costs and no fees for Suez transit.

According to the latest data from PAME (Protection of the Arctic Marine Environment) the number of vessels utilising at least a part of the NMR has increased from 784 in 2013 to 977 in 2019 – although the total has since stabilised. Fishing vessels accounted for 45 per cent of the total but there has been an increase in bulkers and tankers in the region with some experimental container voyages.

WHICH TRADES COULD BENEFIT?

MPL has undertaken a review of the different trades where this short haul length could see some redirection of trade. The following have some potential:

West to East 4 Steam coal and coking coal – Poland to NE Asia / China 4 Iron ore Norway/Sweden to NE Asia /China 4 Oil & oil products – northern fields to Asia 4 LNG – northern fields to Asia 4 Other bulk cargoes 4 Containerised cargoes – on a liner basis 4 Cars and vehicles 4 Frozen fish

East to West 4 Containerised cargoes – on a liner basis 4 Cars and vehicles 4 Neo-bulks – steel products / forest products, etc. 4 Frozen fish

There is no doubt that these cargoes could be shipped on this route but in addition to shipping costs there are several other factors that need to be considered, if the theoretical

Trade Category Ship Size Capacity Liner Service Feasibility All-year Service (Seasonality) Cost Savings Time Savings Potential Growth Total

Dry Bulk ** ***** *** *** ** *** 18 Tankers ** ***** *** *** ** *** 18

LNG *** **** ** *** ** ***** 19 Containers ** * * **** **** *** 15 Cars/Vehicles **** ** *** *** **** *** 19

8 MSC is among

the non-believers recently confi rming its commitment to avoiding the North Sea Route on environmental grounds

8 Table 1: NSR

potential by shipping sector

potential is to be realised. These include the ship size capacity of the route (there are some restrictions around the New Siberian Islands and the Sannikov and Dmitry Laptev Straits). The requirement for regular liner capacity can be critical – especially for containers together with no seasonality considerations. Cost and timing savings and also scope for rapid demand expansion are also critical. These different factors have been synthesised and summarised in Table 1.

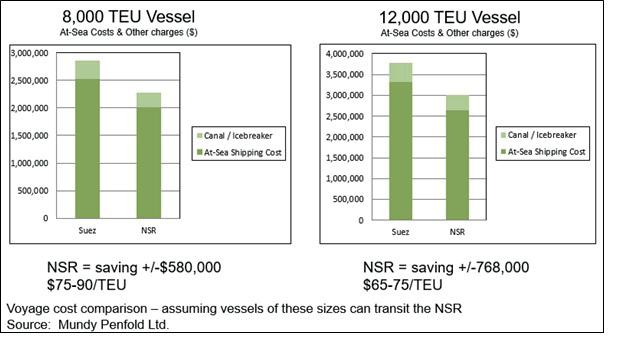

Clearly, the greatest interest has been focused on the container sector where the shorter haul length, in theory at least, offers a real potential saving. A sample analysis has been developed looking at voyage costs for shipments from Shanghai to Rotterdam via Suez and comparing this with the NSR. The results are summarised in Figure 2.

There are some uncertainties as to the viability of routeing container vessels via the NSR given draught restriction in the least ice-effected routes. However, on the basis of current vessel trading costs it has been calculated that a deployment of an 8000TEU capacity vessel would record a saving of between US$75-90 per TEU if routed via the NSR. The saving is larger for 12,000TEU vessels.

These vessels have been selected on the basis of estimated maximum draught clearances on the least iceeffected routeings. It should be noted, however, that much larger vessels – up to 24,000TEU – are the norm in the direct Asia-Europe trades via Suez, so the comparative cost saving is, in reality, much less.

WHAT ARE THE PRACTICAL CONSTRAINTS?

These cost savings suggest some potential for the NSR but there remain severe practical difficulties, including: 4 The distance advantage is limited to the north-east Asian export region. The relative position is rapidly undermined for SE Asian suppliers – this is the region where post-

Chinese growth will expand most rapidly. 4 The vessel size limitations will undermine the theoretical cost savings stemming from the shorter sea route. The rapid increase in vessel sizes in the past ten years has reduced some of the urgency in developing this route. 4 Although the trend is clearly for a reduction in ice cover in the Arctic, there reman significant year-on-year fluctuations. This would clearly upset the round-the-year reliability necessary for stable liner services. 4 Seasonality is a further constraint, with liner services potentially operating unimpeded between July and

November. Services will be problematic outside this window. 4 There is a lack of supporting infrastructure on the NSR. Any problems with vessel breakdown or other upsets would be extremely difficult to manage. It will take some time to build-up the necessary supporting tug, icebreaker, and associated services. 4 The full insurance position for routeing high value vessels and cargoes on the NSR is not established. 4 The geopolitical position is less favourable than it was as recently as five years ago. There will be reluctance to utilise this routeing by independent liners in the current climate.

THE REAL POTENTIAL AND TIMEFRAME

There are clear advantages for some types of commercial shipping via the NSR, but these advantages are focused on commodities where strict liner deliveries are not the top priority. This means bulk cargoes.

Comprehensive stocking and management policies could be employed for selected dry bulk cargoes in order to benefit from lower transport costs. In addition, local LNG production and required services for these developments will also offer potential for increased use of the NSR. These changes could proceed rapidly with little additional investment requirements.

When it comes to liner container services it seems certain that the practical difficulties will constrain and delay any take-up of this option. Indeed, without some governmentled initiative it seems unlikely that this will be a serious option in the foreseeable future.

Demand will be a result of regional bulk and liquid commodity production with limited transit flows between Asia and Northern Europe.

PORT IMPLICATIONS

Proposals have been brought forward for the establishment of significant capacity in northern Norway and Russia for hub ports that could link putative NSR Asian container services to various north-European ports by means of feeders. On paper, the economics make some sense, although these advantages have been eroded in recent years as costs on Suez routes have fallen as a result of improved scale economies.

For port developers the real opportunities will lie in the development of facilities to service the local LNG production facilities and to facilitate the transit of bulk cargoes via the north. It is in these sectors that near term future expansion can be anticipated.

8 Figure 1 – the

Northern Sea Route

8 Figure 2 –

Comparative container shipping costs