TCP – Ready for the future with and effi ciency

Dr Ebbinghaus: Shell leader’s overview

ME-GA-opti: DF fuel efficiencies

Dr Ebbinghaus: Shell leader’s overview

ME-GA-opti: DF fuel efficiencies

ALSO IN THIS ISSUE:

10.6

SEPTEMBER 2023 Vol. 104 Issue 1216 ↗ More information: air-management@pbst.eu www.pbst.eu Follow us at LinkedIn

Methane slip: WinGD aims lower Dirk Bergmann: Accelleron CTO interview

MAN

cutout | WinGD’s Weisser | AEngine update | HD KSOE LH2 project

15

Hengli 2-stroke licence

FEATURES 5 6

Hengli Engine agreed a marine two-stroke manufacturing licence agreement with MAN Energy Solutions on 7 July, and plans to enter the marine engine building market.

15 Romanian reality holiday

Damen has relinquished operational control of the Mangalia shipyard, following the dilution of Damen’s involvement to a minority shareholding.

15

NH3 abatement tests

Mitsubishi Shipbuilding has begun demonstration tests of an ammonia gas abatement system at a Nagasaki R&D facility.

40 REGULARS

6 Regulation

Grant Hunter, Director of Standards, Innovation and Research at BIMCO discusses data exchanges between ports and ships, JIT arrivals clauses and harmonisation.

40 Design for Performance

The future commercial application of carbon capture and storage (CCS) technology, and its potential CII benefits for older vessels formed part of a recent Hong Kong project.

42 Ship Description

Bringing new scale to the ro-pax fleet deployed by Finnlines, the 235m Finnsirius is scheduled to start trans-Baltic service in September, writes David Tinsley.

18 EU SRR consultation

An EU consultation on revising the EU SRR is expected to increase the number of ships recycled in a responsible way and may introduce penalties for non-compliant owners.

20 MAN engine control algorithms

MAN Energy Solutions is using AI-like algorithms in the new engine control system for its Otto cycle, dual-fuel LNG ME-GA engines.

24 Taking methane slip lower WinGD outlined a series of upcoming design releases that will increase efficiency and reduce emissions in its latest X-DF2.0 engine at CIMAC 2023.

28 AEngine programme on track

Thomas S. Hansen, Head of Promotion and Customer Support at MAN Energy Solutions, 2-Stroke has provided an update on the new ammonia engine’s development schedule.

30 Direction of travel

Dr Alexandra Ebbinghaus, GM Decarbonisation at Shell Marine, highlighted the challenges and opportunities that the industry is confronting in an interview with The Motorship.

The Motorship’s Propulsion and Future Fuels Conference will take place this year in Hamburg, Germany. Stay in touch at propulsionconference.com

Social Media Linkedin Facebook Twitter YouTube Online motorship.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Weekly E-News Sign up for FREE at: www.motorship.com/enews For the latest news and analysis go to www.motorship.com SEPTEMBER 2023 | 3 CONTENTS SEPTEMBER 2023 NEWS

28

44TH

VIEWPOINT

NICK EDSTROM | Editor nedstrom@motorship.com

Shape of things to come

The confirmation by Tasmanian aluminium shipbuilder Incat that it will be building the world’s largest full-electric ferry – a 130-metre lightweight ferry that will carry 2100 passengers and 226 vehicles for Buquebús on the River Plate link between Montevideo and Argentina – came too late to be included in this month’s issue.

The project is noteworthy as it will be powered by a 40MWh energy storage system (ESS), fully four times larger than any battery installation that has been constructed and installed for a marine transport application.

The project, which includes Wärtsilä and Corvus Energy among its project partners, will also see one of the first installations of a new ESS supplied by Corvus.

The new lightweight ESS, Dolphin NextGen, is based on a new cylindrical Lithium-ion battery that uses nickel, manganese and cobalt (NMC) cathodes. Corvus notes that the design draws on the architecture of the 4-year, multi-million development program for the Corvus Blue Whale ESS, which included a ground-up redesign that reevaluated and improved every aspect of battery design, including battery chemistry, mechanical and electrical design, and software building blocks.

Corvus notes that the Dolphin NextGen ESS is a game changer for marine battery projects due to its low weight and volumetric density, robustness, and unsurpassed flexibility. Hauso told The Motorship that the new cylindrical NMC cells offer a significantly lighter weight, lower C rate and higher power density than previous Li-Ion based solutions, and that this had significantly reduced the weight required by the battery installation. The cylindrical dimensions of the ESS, and the elimination of racks, meant that more Dolphin NextGen cells could be stored within battery rooms, without compromising safety standards.

In fact, the reduction in the weight of the battery installation was such that the full-electric highspeed ferry was actually expected to be lighter than the preceding dual-fuel LNG-burning design.

The implications for the introduction of lighter weight NMC batteries for the shortsea ferry market are profound, and are likely to accelerate the introduction of hybrid and full-electric designs into the segment.

The wider implications of the introduction of lighter weight NMC batteries into more weight sensitive segments of the market remains to be seen. The first installations of hybrid systems on PCTCs have entered service, but questions remain about the business case for installing larger batteries alongside 2-stroke engines.

The introduction of lighter and more energy dense batteries into the market is likely to improve the business case for diesel-electric propulsion solutions in the deep-sea market.

One area of the maritime sector that is likely to see rapid transformation as electrification begins to penetrate more widely into the shipping industry is ship recycling and end-of-life considerations. At present, the largest proportion of the value of material recovered from ship recycling is steel scrap, as Kari Reinikainen hears in an interesting feature on the consultation on the reforms to the EU Ship Recycling Regulations in this month’s issue.

However, the scarcity of some battery materials means that the European shipping sector can expect to be drawn into critical raw materials regulations, following the precedent of the European car sector.

ALL-ELECTRIC BOXSHIP FOR YANGTZE ROUTE

In a seminal development for China’s expansive inland shipping sector, a batteryelectric container vessel is set to be commissioned during the autumn on the Yangtze River. The 700TEU newbuild was launched on July 26 at the premises of COSCO Shipping Heavy Industry (Yangzhou), where the second-of-class was laid down in May.

The unique newbuild type employs a high-capacity energy storage system based on exchangeable batteries, which will feed two 900kW main propulsion electric motors. The project signals the adoption of fully battery-powered vessels on the inland waterways system, and is in keeping with the Chinese Government endeavour to promote ‘green’ investment along the Yangtze River Economic Belt.

The vessels have been allocated by COSCO Shipping Development to Group subsidiary company Shanghai Pan Asia Shipping for service between Shanghai and Wuhan, the city port 600 miles(65km) up the Yangtze. The design is of 120m length by 23.6m width, with a draught of 5.5m to facilitate handling on the waterway and its constantly changing conditions.

Each boxship will have exceptionally large installed battery capacity, whereby the battery installation will be in replaceable containerised units, accounting for 36TEU slots. As vessels proceed along their regular route, discharged ESS units will be swapped with recharged boxes at designated stations.

In addition, a ‘smart’ ship management system will be employed to increase operational efficiency. Capabilites will include ‘intelligent’ adjustment of energy consumption matched to the ship’s needs at any point, and voyage speed planning in accordance with scheduled arrival time, river current speed, battery capacity and other factors.

The vessel layout features an aerodynamic, forward superstructure and bridge, and raised cell guides on the after part of the weatherdeck above the machinery space.

COSCO claims that the vessel will be the most prominent in her category as regards environmental standing, reducing carbon emissions by some 32t per day relative to comparable boxship tonnage burning conventional fuel. The first-of-class, still referred to as hull number N997, is expected to commence trials at the end of September, and will undergo thorough verification of the power system before being phased into Shanghai Pan Asia’s Yangtze feeder network.

COSCO is one of the founding partners and a prime mover in the China Electrical Ship Innovation Alliance, which was established in February this year to promote the development of ‘green’ solutions. The ultimate aim of achieving carbon neutrality in shipping allies with China’s broader industrial and economic net-zero goals.

NEWS REVIEW 4 | SEPTEMBER 2023 For the latest news and analysis go to www.motorship.com

8 China is set to introduce a battery-powered river container carrier

Credit: COSCO

JAPANESE NH3 BUNKER BOOM PROJECT

TB Global Technologies Ltd. (TBG), the Japanese cargo handling equipment specialist, has signed an agreement with NYK to jointly develop Japan’s first bunkering boom for ammonia, a device used to supply ammonia fuel between ships.

NYK and TBG will significantly enhance the safety of supplying ammonia, which is highly toxic, to ships by employing TBG’s technology to ensure that the liquid does not leak.

TBG will receive from NYK data related to the development of its ammonia bunkering vessel (ABV), which received Approval in Principle (AiP) from ClassNK in September 2022. NYK will also share with TBG the knowledge gained from Japan’s first LNG bunkering vessel, Kaguya, which is operated by Central LNG Marine Fuel Japan Corporation, an NYK affiliate.

A bunkering boom is a device consisting of rigid pipes and hoses that connect a bunkering vessel to the other vessel to supply fuel. It is highly durable because it is made of rigid pipe, and its swivel joints allow it to change direction freely, making it easy to operate. In this joint development, the two companies will employ TBG’s technology to prevent the liquid inside from leaking out when the bunkering boom is emergently released from a ship due to a natural disaster, thereby tackling the biggest challenge in ammonia fuel supply, i.e., preventing leakage.

TBG concluded the first liquefied hydrogen (LH2) loading

New IBIA IMO rep

Dr Edmund Hughes has been appointed as the permanent representative of IBIA at the IMO. Hughes brings first-hand experience maritime policy, primarily focused on controlling ship emissions, to the role. While serving as the Head of Air Pollution and Energy Efficiency in the Marine Environment Division at the IMO, Hughes played a significant part in developing MARPOL Annex VI.

and discharge using a loading arm for liquefied hydrogen connected to a tanker in February and March 2023.

The agreement of the development deal with NYK for ammonia bunkering follows TBG’s successful conclusion of liquefied hydrogen loading and discharge using its bunkering solution at the Kobe Hydrogen Terminal as part of the HySTRA project in late February and early March 2023. The liquefied bunkering solution applied a vacuum double-walled pipe structure to the entire 6 inch diameter pipe. The liquefied hydrogen bunkering solution also included compatibility tests of sealing materials and tests with actual liquefied hydrogen solutions.

NH3 abatement system tests

Mitsubishi Shipbuilding Co., Ltd., a part of Mitsubishi Heavy Industries (MHI) Group, has announced the beginning of demonstration tests of an ammonia gas abatement system (AGAS) at its testing facility at Nagasaki District MHI Research & Innovation Center.

Mitsubishi Shipbuilding is currently developing an Ammonia Supply and Safety System (MAmmoSS), an ammonia handling system to support the utilisation of ammonia as marine fuel. As part of this development project, Mitsubishi Shipbuilding has begun demonstration testing of the Ammonia Gas Abatement System (AGAS), a subsystem of

Hengli Engine licence

Hengli Engine (Dalian) Co., Ltd., (Hengli Engine), agreed a marine two-stroke manufacturing licence agreement with MAN Energy Solutions on 7 July, and plans to enter the marine engine building market. The licence marks the entry of a new engine builder into the market in China. Hengli Engine is a subsidiary of Hengli Heavy Industry, which acquired the assets of STX Dalian including its shipyard in July 2022.

MAmmoSS to safely treat surplus ammonia. The tests have begun following the completion of the AGAS demonstration facility.

Mitsubishi Shipbuilding will conduct demonstration tests of the abatement system’s processing performance under various scenarios simulating onboard ammonia operations and as well as explore broadening the range of maritime industry through collaboration with related equipment manufacturers, developed ammonia-related technology will be applied for various industries to support its safe handling.

MammoSS comprises several subsystems in addition to AGAS,

Mangalia ownership

Damen has been compelled to give up management and operational control of the Mangalia shipyard, Romania’s largest shipbuilder and the biggest in Damen’s international network.

Following the change to Damen’s shareholding, Damen has terminated the joint venture agreement. The move does not affect Damen’s other, longer-established presence in the country: Damen Shipyards Galati.

including a high-pressure/ low-pressure ammonia fuel supply system (AFSS) and an ammonia fuel tank system. A key feature of MAmmoSS is that each of these subsystems can be modularised, allowing Mitsubishi Shipbuilding to provide the optimal modular configuration in a package for onboard plants consisting of multiple engines and boilers.

The Motorship notes that the development of both HP and LP NH3 fuel supply systems will ensure compatibility with a range of different ammonia combustion concepts.

BRIEFS

CCS LH2 AiP

China Classification Society has awarded an Approval in Principle (AiP) to Weishi Energy Technology Hebei for a liquid hydrogen (LH2) fuel supply system design suitable for use aboard marine vessels. The AiP is the first to be awarded by CCS for an LH2 fuel supply system. CCS worked with Weishi during the evaluation, which assessed the system principle, process flow, safety as well as the reliability of the marine LH2 supply system.

NEWS REVIEW For the latest news and analysis go to www.motorship.com SEPTEMBER 2023 | 5

‘‘

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctions evasion

8 TBG concluded the first liquefied hydrogen (LH2) loading and discharge using a loading arm for liquefied hydrogen connected to a tanker in February and March 2023

Source: HYSTRA

CHARTER PARTIES TO CHANGE TO ALLOW EFFICIENT SHIP OPS

There is a growing trend towards digitalisation in shipping and part of this covers exchange of data between ports and ships to allow ships to optimise their speed to avoid the need to wait for berths at ports

On the other hand, ships are expected to make best speed under the current charter parties and any departure from this could place the owner in breach of contract.

Grant Hunter, Director of Standards, Innovation and Research at BIMCO in Denmark says that standardisation, harmonisation and clarification of various aspects of procedures and charter parties are needed to ensure that the shipping industry can move ahead smoothly on this path. A clause in charter parties to allow early adapters to optimise the speed of their vessels is a viable suggestion and ultimately, the shipping industry’s business model would change and “inefficient” principles in current charter parties would vanish.

Harmonised data input important step forward

“I think a big focus for charter parties is that they will need to set out the standards for data exchange used during the charter period and clarify ownership and usage of data. There are currently numerous proprietary formats used for sending data from the ship to owners, managers and charterers. An example of this is the’“noon report’ – a set of data issued by every ship on a daily basis that includes information on distance sailed in the previous 24 hours as well as fuel consumption. It usually also contains a lot of other information about the performance of the ship, Hunter said.

implementation of the Maritime Single Window next year.

“From the shipboard perspective we have developed a clause to support the exchange of data between the ship and shore in a standard format. It is an agreement between owners and charterers that data related to port calls be exchanged using the IMO’s data model framework,” he noted.

However, surprisingly, there is no common standard for the format of this report. It may be that a ship manager uses one format while a charterer requires the information in a different format. This exposes data not only to potential clerical errors but also requires computer systems to “work without value” in translating data from different formats. “We recognise that the exchange of data, especially emissions related data, is becoming increasingly important to the industry. BIMCO is supporting the widespread adoption of an open source noon report format to help bring about a more harmonised approach,” he told The Motor Ship.

Ports currently also have their own reporting formats and fragmented sharing of data, but it can be expected that a more harmonised approach will emerge through the

Speed optimisation requires clear wording in charter party Moving on to the question of how can an owner avoid being regarded as breaching the contract if a ship slows down to reach port at an optimal time, Hunter said that one of the fundamental principles of standard voyage and time charter parties is that the ship’s master is obliged to “prosecute voyages with due despatch” – essentially that the ship must proceed to port as fast as it can safely go. Even if the charter party does not include a due dispatch obligation it may be implied under the national laws of many countries.

“Consequently, if the owners and charterers want to operate the ship more efficiently on a voyage, then they need to have very clear wording in the charter party that overrides the obligation to proceed with due despatch. If the ship slows down without addressing this issue then the owners would be in breach,” Hunter stated.

He pointed out that Slow Steaming Clauses have been developed by BIMCO to include in charter parties, which allows the speed to be reduced without being in breach of

REGULATION 6 | SEPTEMBER 2023 For the latest news and analysis go to www.motorship.com

8 Grant Hunter BIMCO

‘‘

Consequently, if the owners and charterers want to operate the ship more efficiently on a voyage, then they need to have very clear wording in the charter party that overrides the obligation to proceed with due despatch. If the ship slows down without addressing this issue then the owners would be in breach

the charter party - and any similar obligations towards third parties under bills of lading.

Operating a ship efficiently to reduce emissions by turning waiting time into sailing time also requires amendments to the underlying principles of the charter party. A “just in time arrival” scheme operates on the basis of an agreed berthing date and then an adjustment of the speed of the ship so that it arrives in time to go straight to the berth. This process saves fuel and reduces emissions, but keeps the length of the voyage the same - this is in contrast to slow steaming which extends the length of the voyage.

“Again, BIMCO has addressed this scenario by developing a Just in Time Arrivals Clause (JIT). However, JIT is a difficult concept to implement because unlike slow steaming - which is a bilateral agreement between owners and charterers - JIT requires a multi-lateral approach between multiple stakeholders: owners, charterers, cargo owners, terminal operators, etc.,” Hunter noted.

Asked if it is viable to include a clause in charter parties that would allow this if it mainly serves early adapters, Hunter said: “Yes, it is viable because it will not apply unless the parties choose to invoke it. What is important is that we have in place a contractual architecture that supports the drive towards more efficient shipping.”

Business model to develop towards whole supply chain focus

Ultimately, BIMCO believes that the industry will head towards a new business model that takes into account the whole supply chain to gain the full benefits of efficiency. This means that the 'inefficient’ principles currently in charter parties, but

often amended, would not form part of the agreement. It would take a much more collaborative and integrated approach and build on new incentives that reward efficiency.

It has been said that traditionally, a port authority, terminal operator and shipping companies have all remained in their silos, which has complicated data flow. However, Hunter said that this is gradually changing. “Yes, I believe it is beginning to change. It is noticeable in many of the larger ports in the world that they recognise the need for data transparency and sharing as a critical component of becoming more efficient and lowering emissions. Notably, ports such as Rotterdam and Singapore, to name just two, are very focused on digitalisation.”

As to how the business of shipping and the charter parties should evolve to allow voyage optimisation to develop without contractual complications to anyone involved. Hunter noted that BIMCO believes that to gain the full benefits of efficiency the industry will need a new business model that takes into account the whole supply chain.

“The cost of seaborne transportation and its related emissions are viewed by cargo owners as marginal. The impact of delays and emissions in other parts of the supply chain are potentially far more significant and costly. We need to align the commodity side with the shipping side to gain real efficiency.”

“BIMCO has an initiative to help develop a new business model – looking not only at changes in business practice and culture, but also the application of technology combined with a new contractual architecture. We call this initiative the “4th Way Project” and we are currently engaging with multiple stakeholders to find common ground,” he concluded.

REGULATION For the latest news and analysis go to www.motorship.com SEPTEMBER 2023 | 7 the safest route to compliance UV Ballast Water Treatment www.ballast-water-treatment.com more information Up to 2100 m3/h flowrate First class marine components Easy to install, use and maintain Worldwide service Available in SKID or modular version

REGULATORY AND TECHNICAL SOLUTIONS NEEDED FOR 2050

Dirk Bergmann, Chief Technical Officer of Accelleron shared his thoughts with The Motorship in an exclusive interview at the CIMAC conference in Busan

8 Dirk Bergmann, Accelleron CTO, noted that one of his takeaways from CIMAC 2023 was that, from a technical point of view, the engine technology to run on new fuels is available

Dr Bergmann is CTO at Accelleron, and the chair of the Greenhouse Gases Strategy Group at CIMAC. Thank you so much for agreeing to this interview.

Thank you for having me.

Having introduced you or your role as the chair of the greenhouse gas Strategy Group, I guess it the right place to start would be to talk about to obtain your views on the wider decarbonisation environment. It's obviously a complex time. So anything you can do to simplify it for our listeners, and readers will be gratefully accepted.

It is a great challenge that we as a marine industry must take, and we have taken it. Looking at the presentations at the CIMAC conference, we are on our way to finding the technical solutions to bring the CO2 climate effective emissions of global shipping down to zero.

There are a lot of routes we can go. And my perspective is that we will all see them in global shipping, because there are a lot of regional or company-specific boundary conditions, which favour the one or the other way to decarbonize. So, to sum it up a bit, there's a discussion about the possibility of decarbonising with hydrogen, but hydrogen cannot store sufficient energy [within volumetric constraints]. So, therefore, it will mainly be used for short distance travel, if you go for long distance travel, you need to have liquefied chemicals to carry the energy and now, there is a huge discussion in terms of methanol or ammonia, but also liquefied methane out of a carbon neutral pathway could also be the option.

If you look at these fuel types, they have their pros and cons… So, my favourite example is to think about a cruise ship. Everyone is sitting at the at the captain's dinner and you have the smell of ammonia wafting in. Depending on the concentration, I think you would run the risk of panic. For passenger vessels, there might be better fuels to use.

For vessels with only a trained professional crew, you can deal with small leaks with special dedicated respiratory and safety equipment. And the ammonia route has one advantage because after hydrogen, it is the e-fuel which can be produced with the fewest [conversion] losses, and it does not contain any carbon. And having nitrogen in the air with a concentration of about 70% or more, it's easy to get it out of the air. It is a very interesting fuel for international commercial shipping.

Turning to regulation, how do you see the role of regulation driving the uptake of new fuels or shipowners to invest in energy efficiency solutions?

Obviously, we're speaking before MEPC80.

As mentioned, I do expect that we will see all kinds of options in the global marine market, ranging from biofuels drop ins, as well as the already mentioned alternative fuels. We will need to have the regulations ready to use them on board a ship as a fuel… [with a] focus on the safety rules. But then the emissions legislation will have to adapt… to make it possible to run engines in vessels on these fuels. And then the major… outcome of this conference is that from a technical point of view, we as an industry can handle this and that there are already engines capable to running on these

LEADER BRIEFING 8 | SEPTEMBER 2023 For the latest news and analysis go to www.motorship.com

Q A A Q

Q A

fuels. The major question is where the fuel is going to come from and how we will be able to set up this infrastructure. This is a huge investment.

From a legislative point of view, to make these financial impacts feasible, we need pathways that provide a reliable and long-term return for investors to establish the infrastructure.

And I guess you could argue that that is one of the hopeful outcomes from regulation just to provide some certainty. I think that's a real challenge for suppliers as well as industry decisionmakers. And I guess you've spoken about alternative fuels. And that leads us neatly on to how you see the specific role of alternative fuels. I mean, there are a wide range of different solutions being considered but it seems that it's generally agreed that alternative fuels will play the leading part in in helping the industry achieve 2030 and 2050 targets.

That’s correct. There is a discussion about carbon capture technologies on board vessels for example, then you can extend the use of fossil fuel. But you then need to have the kind of CO2 bunkering and logistics behind this because you must store the captured carbon or CO2 somewhere and then you must deal with this.

Absolutely, and this leads us on to your own portfolio because there's a wide range of solutions being offered in the market. You’re having to meet the demands of quite an interesting period of development.

We're already seeing the differences between diesel or heavy fuel oil where we have normally a lambda (air to fuel ratio) of about two times more air and oxygen inside the combustion chamber compared with a lambda of about 1:1.5 for methanol. When we talk about ammonia, it seems to be in the direction of lower lambda values.

From a turbocharging perspective, within our technology portfolio we have already had to look a bit more on the performance map of our compressors and we'll need to make sure that the engine can safely run with it because ammonia is a fuel that does not really like burning.

So, there are some challenges. Addressing hydrogen, we expect to see it for power generation gas engines maybe also for short distance travel and vessels. And hydrogen is interesting because the turbocharging needs to go higher to a lambda of 2.5 up to 3. And this means the engine will need more air, the pressure needs to be increased and therefore we must do something with our turbochargers to make this happen. But again, it is within our thermodynamic knowledge to do so. Therefore, it will take some effort to adapt but I do not expect any major new research.

Another area I think will be interesting is how to deal with transient behaviour or transient operational behaviour. But even here, we are convinced that we can meet client expectations with our turbocharging portfolio and our knowledge with more than 180 R&D staff mainly located in our Swiss headquarters including our test centre.

I guess you're referring to some of the innovations seen in LNG engines 2-strokes, which looks like it is a very interesting space for squeezing a little bit more performance out and you're having to you having to fit around, I guess.

We are already gaining interesting experience with our customers.

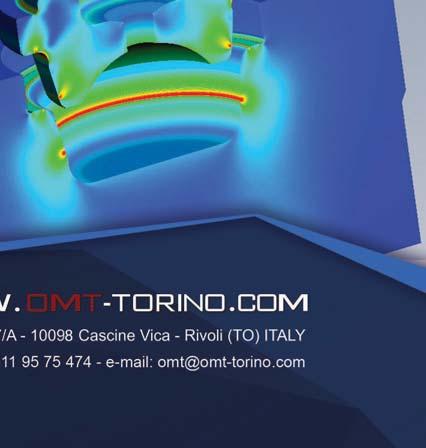

And I guess this leads on to the last question, about your recent product launch, in which you announced that you're developing a new turbocharger family, which you will bring out next year. I also understand that you're in the process of acquiring OMT in Italy. From a strategic point of view, it looks like you're going to be a really relevant company with experience in all areas around the engine. We are already a very relevant company since we are currently involved in high-level discussions with our customers, both from an engineering as well as from a strategic decarbonisation perspective. Our new low-speed 2-stroke turbochargers, which we just introduced officially during this conference, are designed to fit perfectly into next generation engines dedicated for defossilisation. And yes, the acquisition of OMT will bring us into an even better position to plan injection systems in our portfolio and support our colleagues in Italy in their research and development efforts into all the new fuels… For new types of fuels, you cannot use standard diesel fuel injectors, so there will need to be some new developments there.

It is the best time to be an engineer, as so many things need to be changed now to meet the environmental challenge we have in the global society. This will require new technical solutions to be ready soon if we want to maintain our standard of living. And this is, again, the outcome for me from this conference.

LEADER BRIEFING For the latest news and analysis go to www.motorship.com SEPTEMBER 2023 | 9

‘‘

From a legislative point of view, to make these financial impacts feasible, we need pathways that provide a reliable and long-term return for investors to establish the infrastructure

Q A Q A A Q Q

8 Worse things happen at sea: maritime media interviews hold few fears for Dr Bergmann

A

DATA IS AN ALLY IN THE MARITIME DECARBONISATION BATTLE

Across the vast expanse of the world's oceans, a revolution is underway – one that seeks to transform a major contributor to global carbon emissions: shipping. As international concerns about climate change continue to mount, the maritime industry finds itself under increasing pressure to embrace sustainable practices

8 Data-led solutions, such as the Blue Visby initiative, offer a partial solution to congestion at busy ports, such as Hong Kong (pictured)

Collectively, our industry already has a growing understanding of some of the key solutions that will help us to decarbonise. The role of alternative fuels is well understood but the transition remains some years off, with supply and infrastructure concerns still yet to be solved. Improvements to vessel design that prioritise both efficiency and the safety and comfort of seafarers are progressing at pace, and the industry has gained more trust in clean technologies and other efficiency solutions. Vessels today are harnessing wind, waves and, in some cases, air bubbles to trade whilst burning less fuel.

Amidst this challenge, a new ally has emerged from an unexpected source: navigational data. Critical to safety of life at sea, navigational data also has a new role to play in enabling us to make substantial strides towards decarbonisation.

At the heart of modern shipping lies a sophisticated network of sensors, satellite systems, and advanced technologies that constantly gather a wealth of information about a vessel's journey. From GPS and radar systems to weather forecasts and real-time traffic data, these sources of navigational data provide an intricate picture of the maritime environment. This data isn't just limited to the ship itself. Significantly, it extends to encompass the surrounding sea conditions, depths, currents, tides and more.

This information has long been understood for its role in underpinning safe, compliant ship operations. From the very earliest forays into hydrography, to today’s modern, mature data gathering and handling activities, the industry has a well of information spanning countless petabytes that can be marshalled in support of our collective decarbonisation ambitions.

This information is powerful because, by its very nature, it can provide owners and mariners with an authoritative view

of the world around them. Previously, this view has been mainly focused on hazards, depths and other issues associated with navigating in the marine environment. Now, we are ready to go much further.

Optimising routes, cutting carbon

One of the primary ways navigational data supports decarbonisation is by enabling more efficient route planning. Traditionally, ships follow established routes that might not always be the most fuel-efficient, leading to unnecessary and avoidable emissions. With the advent of advanced data analytics and machine learning algorithms, shipping companies can now analyse historical navigation patterns alongside real-time data to identify optimal routes that take advantage of favourable currents, winds, and sea conditions.

At its core, route optimisation is like a complex puzzle, with the pieces made up of wind patterns, currents, waves, and traffic lanes. By analysing this data, ship operators can chart a course that's not just the shortest, but also the smartest.

The sea is unpredictable, with conditions that can change in an instant. That's where real-time data shines. Imagine the ship receiving updates about an approaching storm or a sudden change in currents. With this knowledge, the ship's route can be adjusted on the fly, ensuring the vessel can proceed safely whilst also keeping fuel consumption in check.

Furthermore, navigational data can be integrated with sophisticated emission monitoring systems on board. This integration enables real-time tracking of a ship's fuel consumption and emissions output, allowing operators to make immediate adjustments to optimise performance. When combined with insights from navigational data, operators can make informed decisions about speed adjustments, engine load optimisation, and other factors that impact fuel efficiency.

DIGITALISATION 10 | SEPTEMBER 2023 For the latest news and analysis go to www.motorship.com

Credit: A Wilson

This not only reduces carbon emissions but also leads to substantial cost savings for shipping companies.

The power of just-in-time arrivals

Sustainability is not just about getting from point A to point B; it’s also about what happens at either end of the journey, which is why the concept of just-in-time arrivals has gained such prominence in recent months.

Imagine a ship arriving at its destination in its very own ‘Goldilocks zone’; not a moment too soon or a second too late. By leveraging navigational data in a connected marine data ecosystem, ships can effectively synchronise their journeys with port operations. No more waiting in line for a berth or idling in anchorages. Instead, ships approach the port precisely when their turn is due, minimising downtime and emissions.

The implications of just-in-time arrivals are immense. According to estimates from the International Maritime Organisation, this practice, fuelled in part by navigational data, could unlock an impressive 11% reduction in fuel consumption and emissions in the near term. In other words, if we can unlock just-in-time arrivals at scale, it would be similar to installing free clean technology on every vessel in the global fleet.

The UK Hydrographic Office (UKHO) is contributing to the advancement of just-in-time arrivals through our participation in the Blue Visby Consortium, which aims to bring to market the Blue Visby Solution (BVS).

The Blue Visby Solution seeks to address the issue of justin-time arrivals by introducing a queuing system for ships bound to the same destination port. The system will synchronise and optimise the ocean passages of a group of vessels, allocating optimised arrival times, and ensuring an arrival frequency at which the port can handle.

As part of the consortium, the UKHO has contributed to the Blue Visby Solution by concepting the Blue Visby ‘Blue Box’ – a feature determining the start and end point of a BVS optimisation.

Using our ports database, coastline data and information we hold on anchorages, we were able to create a 14 nautical mile ‘arc’ that vessels will pass over at the end of a voyage, minimising navigational impact and maximising optimisation potential. From this proof-of-concept, we are continuing to work with Blue Visby to take the next step and establish how these arcs can be drawn and displayed on navigational products and back-of-bridge software applications.

Green Shipping Corridors: cooperation to drive decarbonisation

Meanwhile, navigational data also lays the foundation for the creation of green shipping corridors. These corridors, marked by optimised routes and sustainable practices, offer a blueprint for reducing the carbon footprint of maritime transportation.

Rather than a rigid set of regulations, a green shipping corridor could be better described as an ecosystem of public and private actions and initiatives, similar to a special economic zone. These actions and initiatives can include port and ship technology, fuel usage, and voyage optimisation. Green corridors can operate domestically, short-sea or across continents and multiple ports.

Public investment, extension of fossil fuel subsidies to zero-emission fuels, and targeted policies that introduce best practice guidelines all help incentivise the adoption of new technologies and our shared decarbonisation goals.

Navigational data plays such a pivotal role because of its ability to clearly and accurately represent the marine environment that ships much travel through. This information

is invaluable for planning, monitoring and optimising activity within a green shipping corridor – and may even be able to be used to underpin investments in fuel and other marine infrastructure.

Collaboration is required, not optional

All of these use cases for navigational data in shipping’s battle to decarbonise are brilliant, but we cannot achieve any of them alone. Navigational data’s potential will only be fully realised through collaboration, innovation, and by adopting a whole systems approach. Industry stakeholders, from shipping companies and technology providers to regulatory bodies and research institutions, must join forces to harness the transformative power of this data.

Initiatives such as data-sharing consortiums and collaborative research projects are now emerging across the industry. For UKHO’s part, we are collaborating with stakeholders across the maritime ecosystem to develop solutions that leverage and unlock the power of navigational data.

For example, as a knowledge partner on the Global Maritime Forum’s Short-Term Actions Taskforce, the UKHO is offering its hydrographic expertise to contribute to key research and insight pieces that will help unlock the potential of operational efficiencies and the fuel economies that come with it.

Meanwhile, the UKHO has joined the Smart Maritime Network as a Smart Maritime Council Member. Through this, UKHO representatives regularly meet with other industry stakeholders within the network to offer expertise on hydrography, maritime navigation, and data sharing to help achieve the network’s shared goals.

d features like

e to allow for

For us, all of this will be enabled by the next generation of marine navigation technologies and solutions, including the International Hydrographic Organization’s new S-100 data standards, which will enable an improved mariner experience, easier chart updates, the display of more complex navigational information, and features like dynamic under-keel clearance to allow for more accurate, safe and efficient navigation in coastal and port waters.

As the maritime industry continues its journey towards a greener future, navigational data stands as a testament to the untapped potential that lies within the intricate dance of vessel, ocean, and technology. This hidden ally is not only reshaping how ships navigate the world's oceans, but is the compass by which we will steer towards a more sustainable and resilient maritime sector.

By harnessing the full power of navigational data and fostering collaboration, the shipping industry can sail confidently toward a future where environmental stewardship and operational excellence harmoniously coexist on the open seas.

ntinues its er future, estament that lies f dden s compass a more aritime wer of ering stry

DIGITALISATION pp

nt

a al l For the latest news and analysis go to www.motorship.com SEPTEMBER 2023 | 11

The sea is unpredictable, with conditions that can change in an instant. That's where real-time data shines

ce

8 Charlie Fardon, Head of Sustainability, UK Hydrographic Offi

95-BORE LGIM ENGINE READY FOR MAERSK NEWBUILDINGS

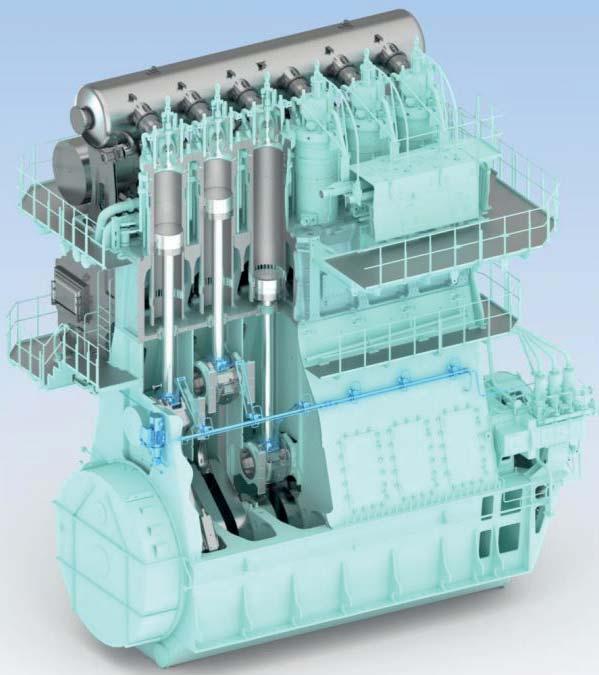

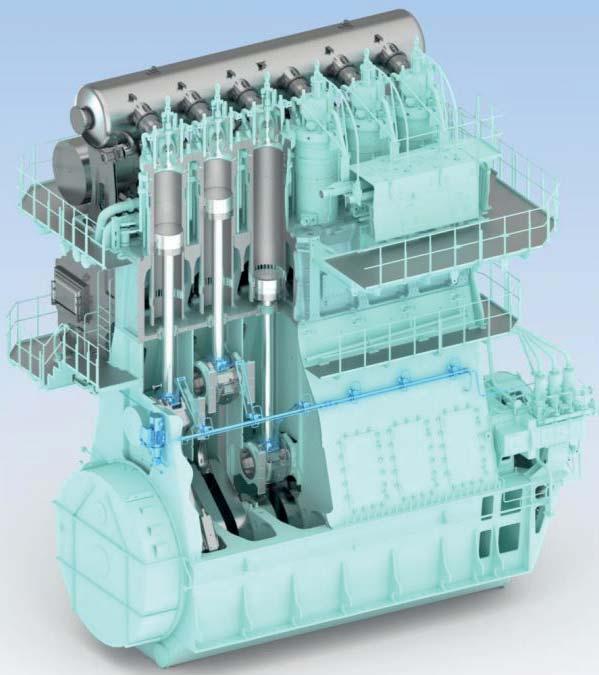

Representatives from MAN Energy Solutions and A.P. Moller – Maersk presented an update on the methanol engines powering recent newbuilding orders at CIMAC 2023, including the new 95-bore developed for larger vessels

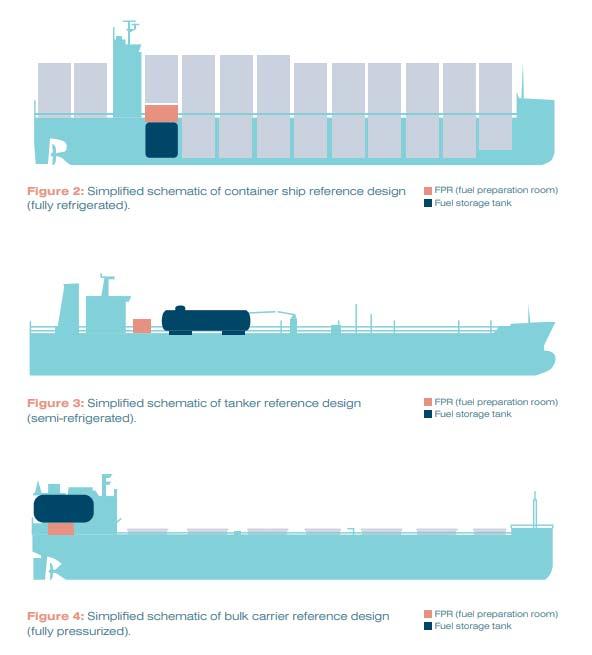

Maersk’s string of methanol-fuelled newbuilding orders has seen the demand for methanol engines skyrocket, and MAN introduced a 95-bore version of its LGIM engine, after the initial 50-bore engine, to cater for the larger vessels being ordered. Maersk has now ordered 19 vessels with the MELGIM engines design, the first being a 2,100 TEU container feeder to run on methanol using a G50ME-C9.6-LGIM engine.

Methanol engine technology for the smaller 50-bore LGIM engines has been in operation since 2016, and there are now more than 20 of these engines in service Maersk’s initial order for the feeder vessel was followed by 16,000 and 17,000 TEU vessel orders requiring a larger bore engine.

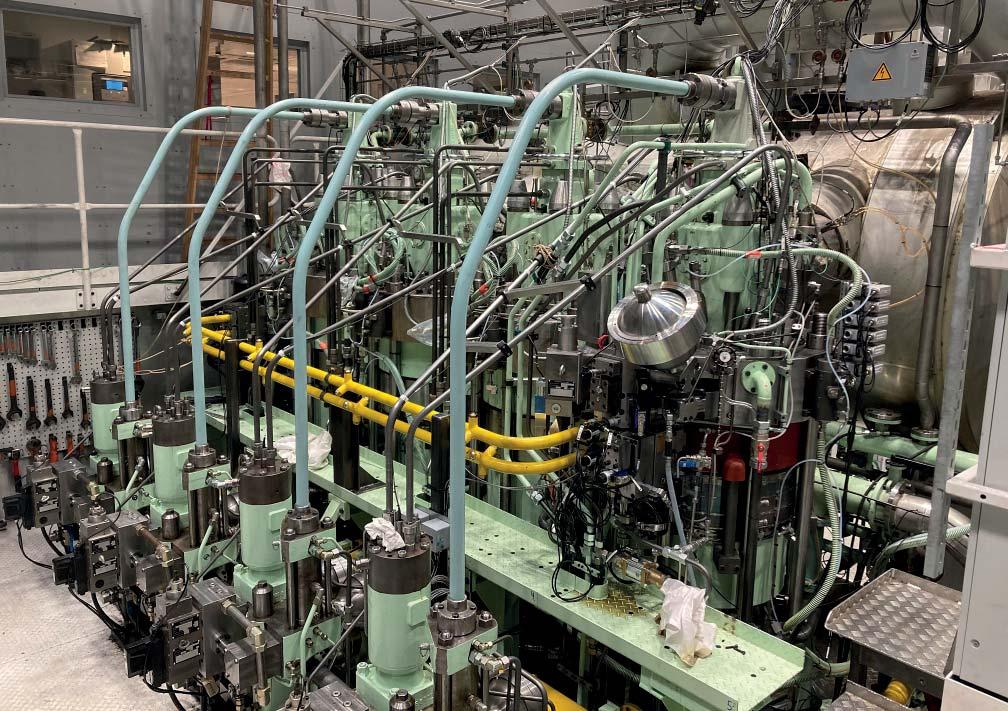

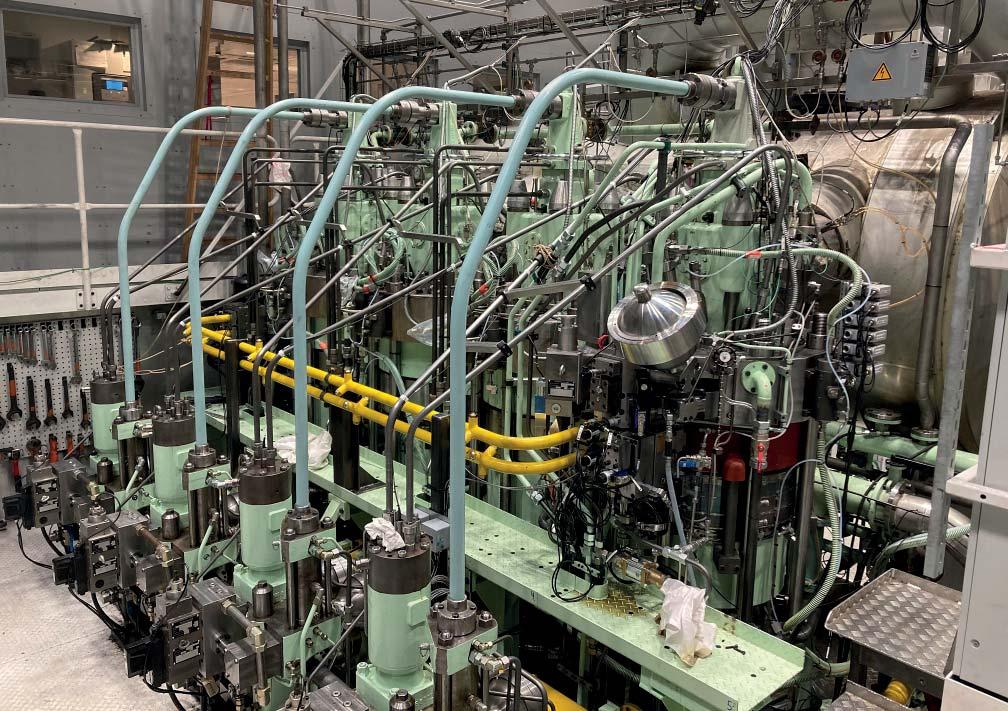

Development of the G95ME-LGIM required more than just scaling. Differences in injection pattern and engine component sizes were required to ensure high efficiency, adequate power and Tier III NOx compliance in both methanol and fuel oil modes. This engine requires injection of methanol of 1.8m3/hour per cylinder which is about twice that required for diesel mode due to its lower calorific value. This required increased supply of high-pressure hydraulic oil and a power supply that was approximately 66% higher than the 50-bore engine. This in turn required an upgraded chain drive delivering the power, and the design had to allow for engine vibration.

The new 95-bore LGIM engine has similar combustion chamber components to the G95ME-C10.5 standard design except that the injection system includes a hydraulic power supply, control block for liquid gas injection, diesel fuel injection valve and fuel booster injection valves for methanol. The control block includes high-speed analogue control valves for regulation the methanol injection pattern and timing. The cylinder cover is also similar to the G95ME-C10.5 except that there are channels and holes for the extra valves.

Specific fuel oil consumption (SFOC) is optimized. This was possible because methanol’s lower flame temperature means intrinsically lower NOx production in the jet flame –NOx emissions are approximately 30% lower on MAN’s twostroke B&W engine when compared to fuel oil under the same engine performance adjustments. The late cycle heat release attained for methanol also increased thermodynamic efficiency with respect to engine load.

Methanol use also results in lower exhaust gas temperatures, although this is countered by increased mass flow and the increased specific heat capacity of the exhaust gas. Therefore, turbocharger speed remains very similar to that required for diesel. The same matching can be used without compromising cylinder boundary conditions such as scavenge air pressure and temperature.

CO2 exhaust emissions are around 10% less for methanol than fossil fuel oil. Particulate matter and SOx are also reduced significantly

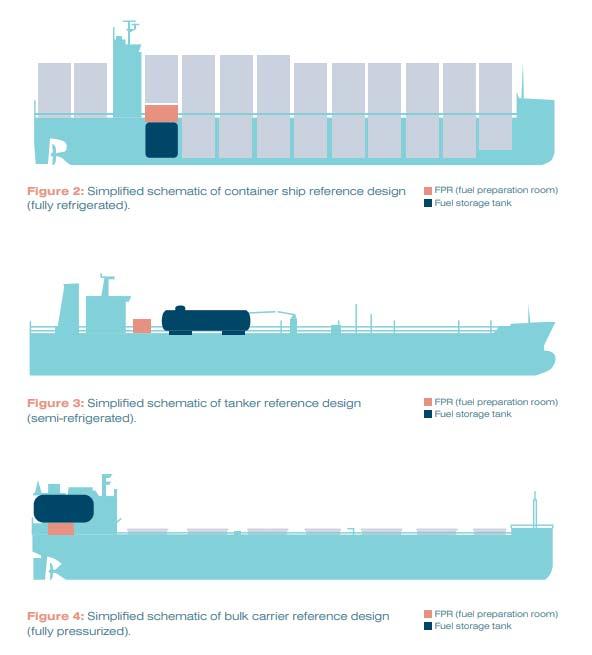

According to MSC.1/Circ.1621, the interim guidelines for the safety of ships using methyl/ethyl alcohol, methanol must always be handled using the double-barrier principle.

The fuel pipe system is therefore double-walled and similar in concept to that used for all MAN dual-fuel engines. The design ensures that methanol cannot escape directly to the engine room and that potential leakages are detected within the double wall piping system.

Any equipment used to prepare the methanol before injection must be placed outside the engine room, and fuel tanks must have cofferdams towards the engine room and cargo spaces. High capacity ventilation, gas and leak detection systems are required anywhere where there is a risk of methanol leaking, and firefighting systems must be capable of handling methanol fires.

However, MAN says that these requirements stem from safety assessments of LNG, and some need reconsideration. Liquid methanol is supplied to the engine at 13 bar, and a leak would slowly evaporate. Even a very large leak and pool of methanol would not be detected by the systems called for in the guidance – gas detection at 20% of the lower explosion level of methanol or 10,000ppm. Detection levels were therefore reduced.

Having overcome the design challenges, MAN now has over 50 orders for the G95ME-C10.5-LGIM. Maersk is increasing its commitment, and in June, it signed a contract with MAN PrimeServ for the retrofit of the main engines aboard 11 container vessels equipped with MAN B&W 8G95ME-C9.5 prime movers. They will be retrofitted to dualfuel MAN B&W 8G95ME-LGIM10.5 engines. The first vessel will be retrofitted in mid-2024.

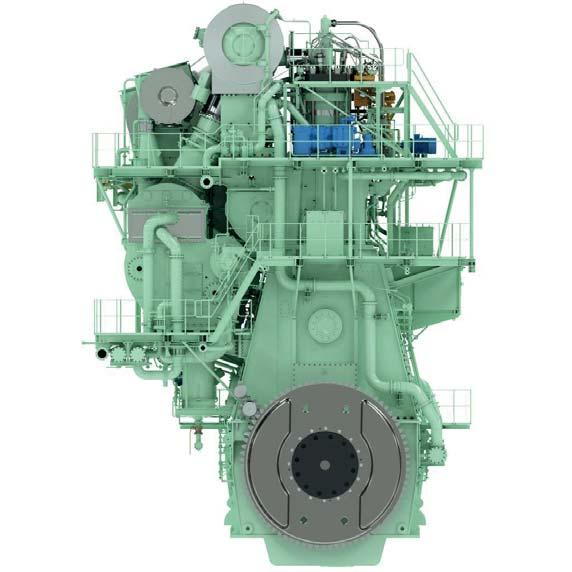

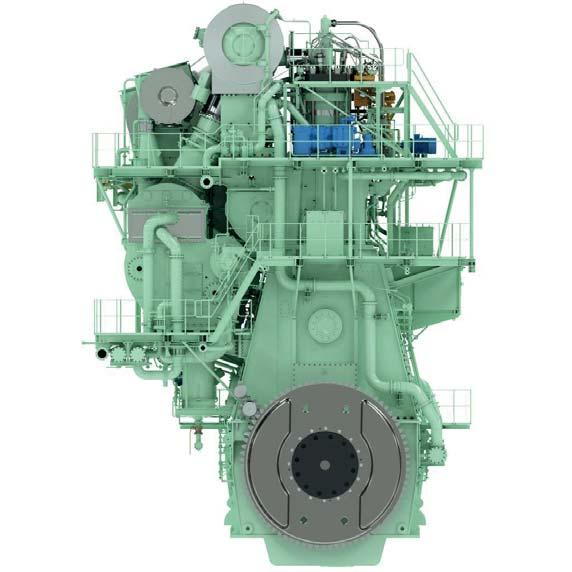

8 Rendering of an MAN B&W 8G95MEC-10.5-LGIM dual-fuel engine capable of burning methanol

Source: MAN Energy Solutions

TWO-STROKE ENGINES 12 | SEPTEMBER 2023 For the latest news and analysis go to www.motorship.com

We´re exhibiting at Gastech

5-8 September in Singapore German Pavilion booth B108

THE GAS EXPERTSInnovations for Greener Shipping

TGE Marine Gas Engineering is the leading liquified gas systems‘ provider specialising in cargo handling systems for gas carriers (LPG, LEG, NH3, Ethane, CO2 & LNG),FSRUs and bunker vessels, including tanks.

Furthermore, TGE Marine is a pioneer in fuel gas systems for LNG, NH3 and other alternative fuels. The company has designed and supplied more than 250 gas handling, fuel gas and storage systems globally.

TGE Marine‘s broad expertise in liquefied gasand cryogenic systems is based on more than 40 years‘ of engineering experience in the marine industry.

www.tge-marine.com

Floating UnitsCO2 carriers

Gas carriersBunker Vessels

NH3 carriers & Fuel Gas Systems

Fuel Gas Systems

Join the TGE Marine Crew Our collaboration is based on trust, fairness and respect. Diversity is our strength and basis for innovation.

NEW TURBO CUT OUT ENSURES

ME-C10.6 SYSTEM EFFICIENCY

MAN Energy Solutions has developed a new turbocharger cut out system to optimize the low load performance of its new high efficiency G95ME-C10.6 engines, and researchers shared details of its development at CIMAC 2023 along with new EGR developments across a range of engines

Lars Ascanius, Senior Manager Design Small Bore, and Henrik Møller Hansen, Senior Manager, Design Large Bore, at MAN Energy Solutions discussed the development of the 10.6 engine and also the latest exhaust gas recirculation (EGR) developments at CIMAC, highlighting that they are some of the steps the company is taking to future-proof its engines.

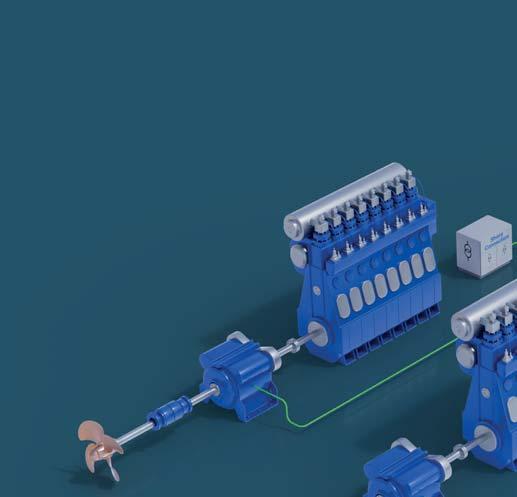

Currently the new large 2-stroke 10.6 engine types that have been developed by MAN are based on the S50ME-C9.7 and S60ME-C10.5 engine and include 50, 60, 80 and 95cm bore. The aim is to continue boosting the efficiency of MAN’s single-fuel engines which currently make up about half of its engine sales. The changes made to create the 10.6 version include the development of a sequential fuel injection system and for the G95 version a new turbocharger cut out system.

Sequential fuel injection

The engines feature a new sequential fuel injection system which is based on MAN’s existing technology but provides for flexibility in the injector sequences of each cylinder to enable performance optimisation and NOx formation management. The high engine efficiency of the new engine necessitated a NOx solution to ensure the engine remained Tier II compliant. The production of NOx emissions is related to fuel consumption and the mechanical and thermal load of the combustion chamber. Each of these parameters is interrelated, and the sequential fuel injection optimisation involves carefully timed sequencing of each injector. The concept is able to reduce NOx formation, and when combined with higher maximum cylinder pressures, fuel oil consumption is also reduced, as it only results in a small fuel oil consumption penalty.

The process is electronically controlled, with fuel booster injection valves hydraulically operated and controlled by window injection valve actuation. This ensures precise control for the system as the fuel enters via pipes to a sleeve in the cylinder cover. A hydraulic cylinder unit sequential replaces the existing hydraulic cylinder unit as it no longer requires a booster, and the new unit takes up half the space of previous units.

The exhaust valves and actuators are similar to those in existing hydraulic cylinder units and fuel injection valve actuators, but they are now located on the manoeuvring side of the cylinder cover rather than being placed on the baseplate.

The overall increased maximum combustion pressure of the 10.6 has led to reinforcement of both moving and structural engine parts, but this has been achieved with minimal change to engine room layout. The cylinder distance and height of interfaces are maintained.

Turbocharger cut out system

In addition to the sequential fuel injection system, the 95bore variant has an advanced version of the manufacturer’s traditional turbocharger cut out system which involves taking

one turbocharger out of operation at low load. This ensures optimal efficiency of the available turbochargers, and dynamic control ensures seamless changeover.

An exhaust gas bypass is typically used to control scavenge air pressure by matching the turbochargers to a specific pressure at 100% load with an open bypass to reduce turbocharger power. This is analogous to having a lower efficiency turbocharger temporarily, with scavenge air pressure returning to higher levels when the bypass is again closed.

In contrast, the sequential turbocharging system developed by MAN instead cuts out one of the turbochargers at low load and smoothly cut it back in at high load (up to Four turbochargers can be installed on each engine) so that the active turbochargers always receive the full exhaust gas power. This avoids the reduction in scavenging quality at high load that would have occurred with the traditional bypass system.

The turbocharger to be cut out is sized according to the desired magnitude of the effect on the scavenge air pressure, and is typically smaller than the other turbochargers installed. Cutting a turbocharger can restrict engine load below 100% as the active turbochargers are unable to handle

TWO-STROKE ENGINES 14 | SEPTEMBER 2023For the latest news and analysis go to www.motorship.com

8 Rendering of an MAN B&W 7S60MEC-10.6 engine equipped with a highpressure SCR

Powering shipping’s emissions-cutting ambitions

Keynote

Safety

44TH 23 TO NOV 3 21 Hamburg Germany Propulsion stream | Alternative fuels stream | Technical visit Meet and network with 200 CEOs and technical directors from ship owning, operating and management policy makers, shipbuilding, fuel, equipment and technology suppliers. Visit: motorship.com/PFFBOOK Contact: +44 1329 825335

conferences@propulsionconference.com #MotorshipPFF

Email:

panel topic: The cost of decarbonisation & who is going to pay?

to discuss with the keynote panel will include carbon levy funding, funding for investment, national incentives,

for new technology & hypothecation.

out now - Book now and save 20%

Topics

funding

Programme

Learn from C-suite keynote panel

challenges for new technology

LNG beyond transition

Carbon capture

Advances in lubrication

MOTORSHIP MARINE TECHNOLOGY

Media partner: Media supporters:

Gain insight from industry experts on:

THE

MODERATOR

Lars Robert Pedersen, Deputy Secretary General, BIMCO

Annika Kroon, Head of Unit, Directorate General for Mobility and Commission

Simon Bennett, Deputy Secretary General, International Chamber of Shipping

Martin Kröger, Shipowners’ Association (VDR)

Wolfram Guntermann, Director Regulatory Lloyd AG

by:

by:

Markus Münz, Managing Director, VDMA Large

Supported

Sponsored

8 MAN ES is introducing refinements to its EGR system on other engine types including the 10.6, having originally developed them as part of its ME-GA engine optimisation programme

MAN has also designed a lowspeed blower with a standard industrial electric motor that operates below 3,600 rpm (60 Hz). The detailed design was developed in partnership with blower manufacturer

all the exhaust gas, so cutting only occurs between 50 and 75% engine load so efficiency isn’t impeded.

The cut-out control MAN has developed involves one butterfly valve at the compressor outlet and one at the turbine inlet. These valves can complete their designed trajectories in 1-2 seconds. The control sequence for their operation has been integrated into the engine control system and ensures that compressor surging doesn’t occur. It also prevents excessive pressure drop during the cutting-in and cutting-out transition phases.

Engine testing has confirmed that the positive effects from the exhaust gas bypass are preserved without the efficiency of the turbochargers being impacted at high load. MAN states that the SFOC reduction is obtained by applying sequential fuel injection and sequential turbocharger combined with the increased maximum combustion pressure. This makes it possible to improve the fuel consumption by up to 4 g/kWh for S50ME-C10.6, up to 6 g/ kWh for S60ME-C10.6, up to 3 g/kWh for G80ME-C10.6 and up to 3 g/kWh for G95ME-C10.6. The larger reduction for the S60ME-C10.6 engine is the result of the engine’s larger increase of the maximum combustion pressure.

Mechanical changes

Some mechanical changes were made for the S60ME-C10.6 engine due to the maximum combustion pressure increase achieved for the engine. The platform used for its development was the S60ME-C10.5, but moving and structural parts were reinforced to maintain the desired safety margin against fatigue and bearing failure. These reinforcements didn’t, however, result in significant changes to engine room layout.

Main bearing size remains unchanged, as the main bearing zero is now introduced on the fore end of the engine to avoid having a bearing edge load that is too high. The crankpin bearing has increased diameter and width, and main bearing

support side machining has now been introduced, along with crosshead bearing changed from white metal to tin-aluminium.

A main bearing zero has been introduced to avoid excessive edge load and to prevent oil film thickness becoming too thin on main bearing No. 1. The main bearing zero has been located ahead of the axial and torsional vibration damper. The crankshaft inclination has also been reduced in main bearing No. 1.

While the mechanical changes made to the S60ME-C10.6 engine increase its weight by around 4.6%, the greater efficiency of the engine results in fuel saving of up to -6 g/kWh.

EGR developments

MAN has made developments on its EGR system to optimise performance, reliability and cost, noting that increased environmental awareness, expansion of emission control areas as well as increased focus on operational aspects of low or zero sulphur fuels for dual fuel engines call for a simple and reliable emission reduction system. Initially standard in the ME-GA engine, they will also be introduced on other engine types, including the 10.6.

Oxygen levels are integral to the control of any EGR system, and the sensor cabinet unit typically has a relatively large footprint, so MAN has developed a simpler system. A new oxygen sensor unit is now standard for all EGR systems, and it is located closer to the oxygen probe to ensure faster response times as well as simpler operation.

MAN has also designed a low-speed blower with a standard industrial electric motor that operates below 3,600 rpm (60 Hz). The detailed design was developed in partnership with blower manufacturer.

A new exhaust gas recirculation cooler has been developed as the Tier III solution that is a stainless steel version of seawater box coolers. This provides increased reliability and durability. The detailed design was developed in partnership with cooler manufacturer Kelvion and includes bent tubes as a replacement for a reversing chamber. The tubes are supported in a way that enables free movement of the side plates during different levels of thermal expansion.

A new and simplified water handling system has also been developed that consists of an on-engine buffer tank, treated water supply unit and related piping located on-engine. This significantly simplifies engine room installation, says MAN.

With these developments, and the latest 10.6 engines, MAN says it is pursuing the best possible efficiency and the lowest possible carbon footprint for the industry.

TWO-STROKE ENGINES 16 | SEPTEMBER 2023 For the latest news and analysis go to www.motorship.com

Source: MAN Energy Solutions

ATHENS IMPA Events 2023 World-leading Maritime Procurement Events IMPA E V E NT S Maritime Procurement Events www.impaevents.com Queen Elizabeth II Centre London Eugenides Foundation Athens Suntec Convention Centre Singapore

EU SRR REVIEW TO PUSH RESPONSIBLE RECYCLING

The European Commission (EC) launched in the spring an online consultation to evaluate its Ship Recycling Regulation that ran until early June. The results of the work will probably increase the number of ships recycled in a responsible way and owners that fail to do this may face penalties in the future

“Since 2013, the EU Ship Recycling Regulation has provided a regulatory framework for the recycling of EU-flagged ships. It acts as a benchmark for ship recycling legislation around the world. Most ships are built with materials that are suitable for recycling,” the Commission said in a statement at the time of the start of the consultation process.

“When ships are dismantled, steel, other scrap metals and various types of equipment become available and can be reuse further. Many ships, however, are dismantled outside the EU, under conditions that are often harmful to workers' health and the environment,” it noted.

The work has three objectives. The first one is to assess how well the regulation has been applied and its impact to date; the second one is to assess how well it contributes to the general policy objectives of the European Green Deal and the circular economy action plan and finally, to identify shortcomings with its implementation and enforcement.

Ehud Bar-Lev, LR’s Global Manager, Ship Inspection & Assessment said that there is no reason to assume that there would be material changes to the regulations, although ultimately that is down to the EC to decide based on feedback from consultees.

“The process as I understand it is that the EC is currently carrying out an evaluation of the regulation, with the support of a consortium, in order to analyse the efficiency of the regulation and to identify areas for possible improvement. An EC working document will be published off the back of this in Spring 2024. After that an Impact assessment phase will happen. Only after that can any amendments to the regulation be considered,” he told The Motor Ship.

Penalty for those that do not recycle at Hong Kong Convention facilities potential threat

A possible concern to ship owners could relate to the “Financial Instrument” - in simple word: penalty - that is in discussion to apply to owners of ships that do not recycle in Hong Kong Convention (HKC) or EU Ship Recycling Regulation certified yards. “The idea of a financial mechanism has previously been considered in the past and pushed by the European Parliament, it could be re-considered to avoid a rising reflagging trend - if this is confirmed based on EMSA (European Maritime Safety Agency) statistics,” he said.

As a result of the work, sound and responsible ship recycling will expand both geographically and in capacity with the number of ships to be recycled expected to more than double within the next five years.

Efforts to decarbonise shipping will mean that more high value materials, such as rare earths in batteries, will be found on a growing number of ships. This can have implications for ship recycling. “It is expected that the Inventory of Hazardous Materials (IHMs) will include materials that were never used as common practice onboard ships, especially those using alternative sources of energy. Batteries and other power

cells are a good example. This will likely drive additional change in the ship recycling industry over the coming years,” Bar – Lev stated.

As the wider regulatory framework is reviewed in light of the IMO greenhouse gas strategy pushing the industry on the road to decarbonisation, the HKC should also be considered for necessary review and updated as well, to keep it relevant and in line with the technologies and materials that will be found on ships in the coming years.

Moving to the question whether we can anticipate a switch to large scale ship recycling in Europe as a result of the growing use of more high value materials in ships, he said: “Not necessarily, unless the reward per ton of steel significantly increases, closer to the reward received in other locations.”

“Ship recycling often takes place in different geographical areas to shipbuilding, so the high-quality shipping steel is often melted down with other scrap locally to the recycling facilities in places such as South Asia and used in applications where the high-quality steel isn’t needed. Steel remains the main material that is ‘harvested’ from the majority of ship recycling,” he concluded.

Three forces likely to drive change

Martin Davies, Principal Consultant, in DNV said that heightened attention on end-of-life practices would have an impact on the ship recycling industry, but whether these would be significant or not is too early to determine. “New methods, technologies and business cases for greener and safer ship recycling are being developed in some locations, and it will be interesting see how these are received by the shipping industry,” he told The Motorship.

Forces that are likely to drive the change include greater focus on environmental, social, and corporate governance (ESG), consideration of recyclability already in the design phase - for example, by way of Life Cycle Analysis - and the circular economy.

Regarding efforts to decarbonise the shipping industry and the use of more high value materials ships on ships as a result would mean that ship recyclers would need to align their business and operating practices to the design and materials utilised in vessels being designed to meet the need for decarbonisation in shipping.

gh ships an that would

n and materials utilised in ed to meet the need for pping.

reasonable to anticipate a hip

g use of more value vies said: ‘There are -faceted ributing

Asked if it would be reasonable to anticipate a switch to large scale ship recycling in Europe as a result of the growing use of more high value materials in ships, Davies said: ‘There are several drivers in multi-faceted ship recycling market contributing to the type and location of ship recycling activities. There are development opportunities for ship recycling in all locations.”

n of here are nities for cations.”

REGULATION

18 | SEPTEMBER 2023For the latest news and analysis go to www.motorship.com

8 Ehud Bar-Lev, LR’s Global Manager, Ship Inspection & Assessment said that there is no reason to assume that there would be material changes to the regulations

Hosted by:

Delegate place includes 2-day conference attendance including lunch & refreshments

Technical Visit Electronic documentation

2024 Programme and Topics

Sponsor: Supporters:

coastlink.co.uk

+44 1329 825335

info@coastlink.co.uk

Media partners: GREENPORT INSIGHT FOR PORT EXECUTIVES

Book now and save 15%•

TECHNOLOGY THE

MOTORSHIP MARINE

of Amsterdam The Netherlands 24 25 TO

APRIL Port

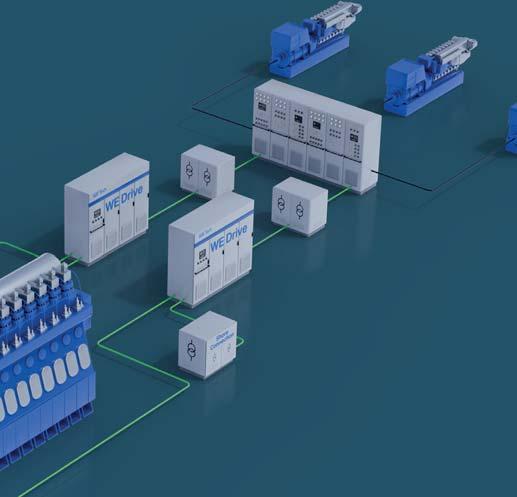

NEW ECS SYSTEM KEEPS ME-GA CLOSE TO ISO CONDITIONS

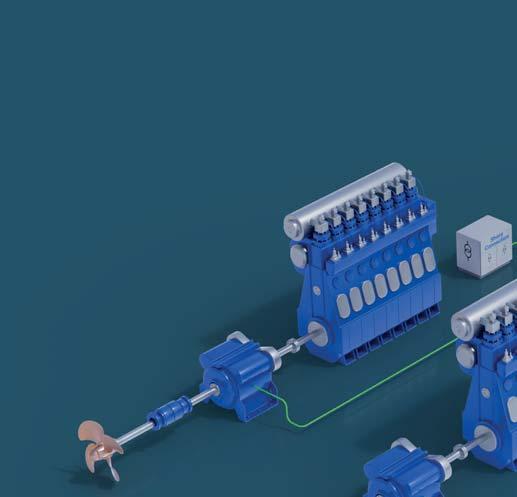

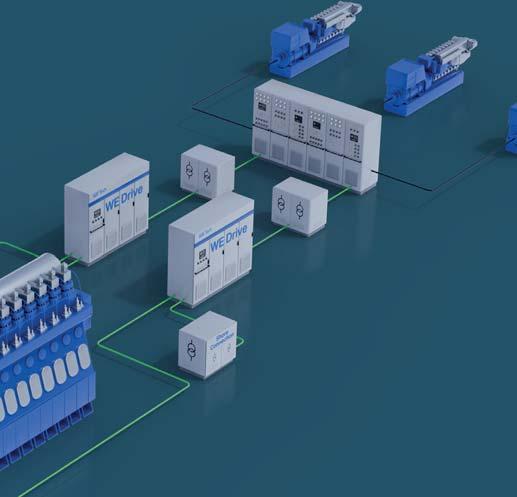

MAN Energy Solutions is using AI-like algorithms in the new engine control system for its Otto cycle, dual-fuel LNG ME-GA engines

Typically, the combustion process in Otto cycle engines isn’t as stable as Diesel cycle, but it allows for the intake of low pressure gas, which is a good match for the use of boil off gas (BOG) from LNG carriers as a fuel. It has therefore become a popular choice for LNG carrier newbuilds. The ME-GA is also touted to have lower capex, opex and NOx emissions than current-generation Diesel engines, for many contemporary LNG carrier designs, when the overall cost, consumptions and emissions for the vessel are considered

However, there are potential challenges to its performance at sea. The combustion process can be affected by variations in charge gas delivery or pressure pulses that may affect some cylinders differently to others. Additionally, when not running under ISO conditions, fuel consumption may be suboptimal, and this can occur, for example, in adverse weather conditions.

These drawbacks do not show in shop tests, says Thomas S. Hansen, Head of Promotion and Customer Support, MAN Energy Solutions, where the combustion control parameters are manually tuned for ISO conditions. This also means that MAN’s new improvements as part of its ME-GA-opti control system aren’t really apparent during shop trials either.

Still, Hansen is confident that in-service results for the MEGA-opti will demonstrate lower fuel consumption, lower NOx and lower methane slip than the standard ME-GA engine. Additionally, the engine will be much less likely to slip into fuel oil mode – another cost saving, as charterers, while happy for BOG to be used, are unwilling to pay for fuel oil as well.

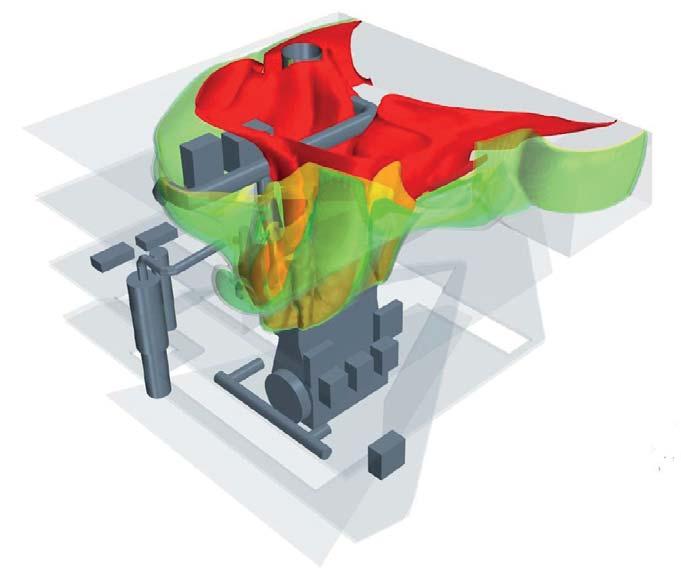

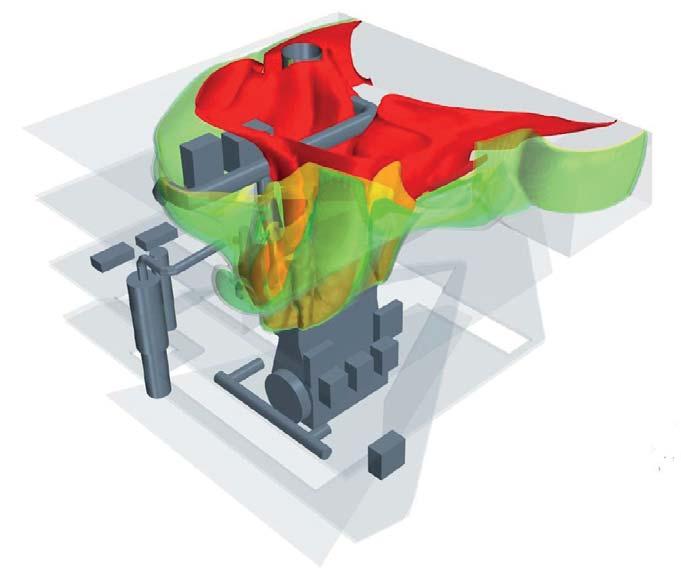

ME-GA Otto cycle combustion

In the standard ME-GA Otto-cycle combustion process, scavenge air enters into the cylinder around bottom dead centre when the piston uncovers the scavenging air ports. Next, the gas admission valves admit fuel gas as the piston travels upwards in the cylinder. Pilot oil ignites the premixed air/fuel gas mixture, and the combustion starts.

As fuel gas and air mixes in the cylinder during the compression stroke, it increases the risk of misfire and/or pre-ignition (knocking) of the air/fuel gas mixture. The risk of pre-ignition increases when fuel gas is mixed into the entire swept volume of the engine, where the pressure and temperature can support ignition.

To increase the combustion stability significantly, a narrow engine-operating window has been introduced. The operating window gives a reliable control of the combustion process and, in particular, of the air/fuel gas ratio. The window reduces the compression ratio and the mean effective pressure to avoid pre-ignition, which results in a lower thermal efficiency compared to the Diesel cycle. Combustion and maximum pressures will be reduced, and, thermodynamically, this influences the maximum power output and the engine efficiency.

However, as the peak temperature of the combustion is lowered, this in turn lowers NOx formation enough so the engine is IMO Tier III compliant in dual-fuel mode without

NOx abatement technology. Even so, for MAN’s Otto-cycle engines, EGR is an integral part of the engine tuning to improve performance and lower methane emissions

In dual-fuel mode, the EGR has proven to have a considerable and beneficial impact on the methane slip and the specific gas consumption, thus becoming a standard for this engine type. It efficiently suppresses pre-ignition, reduces excessive combustion rates, and reduces the maximum heat load on combustion chamber components.

The ME-GA engine, in addition, is suitable for driving shaftmounted power take-off devices with a large power output. This means that even a ship with high power consumption, for example an LNG carrier, can be designed to trade without the need for generators to be running to provide onboard power production. Further, the new control interface between engine and power take-off device maximizes the output at any given time thus achieving maximum financial and environmental benefit for the owner.

MAN initially introduced the ME-GA range with a 70-bore engine aimed at the LNG market. Hansen highlights that the engine has unique gas admission components. The gas regulating unit, safe gas admission valves, and N2 purging

8 MAN ES plans to introduce the MEGA-opti technology (pictured) as standard on all new ME-GA deliveries. It will also be retrofitted on the few ME-GA engines already in service

LNG 20 | SEPTEMBER 2023For the latest news and analysis go to www.motorship.com

block were all developed in-house to ensure a safe and reliable fuel gas supply to the ME-GA engine. The ME-GA engine also has a simple LNG supply and purging concept, low fuel gas supply system maintenance costs, cost-optimised BOG handling and a well-known engine room design similar to those for the ME-C, ME-GI, and ME-LGI engines.

These benefits are maintained with the ME-GA-opti which adds the new and unique AI-like engine control system.

The Opti development

There are no hardware changes involved in the ME-GA-opti development. It only involves changes to engine control software and input parameters designed to improve efficiency and performance under real-world conditions.

If humidity or ambient temperature is high or low compared to the ISO conditions, compression moves away from the optimal point – due to the higher combustion pressure in the case of higher temperatures or lower combustion pressure due to lower temperatures. While the EGR can ameliorate the conditions and provide a wider operating window to prevent knocking or misfiring, the ME-GA-opti engine control system works to keep the combustion conditions of each cylinder much closer to ISO, operating independently for each of the engine’s cylinders.

“It’s an on-going process, revolution to revolution, where we adjust the exhaust valve closing time,” says Hansen. “That way, we regulate the relationship between scavenge air pressure and compression pressure in each cycle in each cylinder revolution.” This enables the engine to respond to and counteract any differences in ambient conditions that might affect combustion.

Traditionally, the control system will have a set off parameters which controls the opening and closing of the exhaust value, the injection time and other parameters. “Here we shift to another way of working where the exhaust valve closing time is floating. It’s not on a fixed degree crank angle. It is happening at the closest time possible to get back to ISO conditions and therefore back to optimal. Now the engine is able to run in the same condition as it was when tested, referenced and guaranteed – not just during trials, but during the whole life of the engine.”

that metal components are running at shortens their lifetime, and here we can shave off the peaks, where they get too hot too early, and this will influence the lifetime of the components. We expect to demonstrate that when we have some field service experience,” says Hansen.

Testing and Implementation

The first gas trial for MAN’s ME-GA engine was completed in September 2022 on the vessel Gordon Waters Knutsen at Hyundai Samho shipyard. The two 5G70ME-C10.5-GA engines tested were built by HHI-EMD.

The experience gained was then applied to trials in June on the Celsius Geneva at Samsung Heavy Industries, the first in a series of LNG carriers currently under construction at the yard. Again, the trial was performed on 5G70ME-C10.5-GA engines, this time built by HSD Engine.

The ME-GA-opti feature was successfully validated during this trial with performance measured at 25, 50, 75, NCR and MCR engine load points. Fuel Ratio Control (FRC) was rarely activated in either of the tests, and occurred less often with the ME-GA-opti engine control system in operation. For example, FRC was not activated when heavy rudder activation was requested while the engine was at 80% load.

The ME-GA-opti technology will become standard on all new ME-GA deliveries. It will also be retrofitted on the few ME-GA engines already in service.

nificantly limited stem will benefit

The solution has the capacity to match ideal running conditions for the engine even in the harshest weather conditions and without oil activation. Oil activation is still a feature, but its usage is expected to be signi with the new engine control system. The system will bene the engine most days, says Hansen, not just in adverse weather conditions.

Test results have been positive, and he expects that as well as leading to better fuel efficiency, the new system will reduce NOx formation and methane slip. “ME-GA-opti can reduce the average gas consumption up to 2% in service, depending on the fluctuations in the ambient conditions, and reduce the use of FRC dramatically and thus lower the fuel oil consumption as well,” says Hansen. “ME-GA-opti can also reduce the average methane slip by up to 10% in service, depending on the fluctuations in ambient conditions, mainly due to the reduced use of FRC where methane slip can increase.”

pects that as well stem will reduce ti can reduce the e, on d reduce the use also reduce the e, ainly due to the increase.”

For NOx: “The engine is certified as a Tier III engine so MEGA-opti is keeping the values well within the limits. The fact that the algorithms are maintaining the optimum operating conditions for the engine is a guarantee that the limits are kept, and will in many cases even have a positive impact in the emissions,” he says.

Having better control of combustion will also reduce wear and tear on the combustion chamber components that can come with high temperatures. “The higher the temperature

II so MEe limits. The fact imum at the limits are ositive in lso reduce wear ponents that can the

“ME-GA-opti is the latest and most advanced control feature for the ME-GA engine and significantly improves its operation, maintaining its position as the best-in-class technology,” says Hansen. “It comprises an advanced and intelligent network of control algorithms that have been developed to optimise the combustion process on an individual-cylinder basis, and which ensure optimal operating conditions. I’m certain it will be received well by the market.”

and conditions. I’m certain it will be received well the market.”

8 Thomas S Hansen Head of Promotion and Customer Support MAN

8 Thomas S Hansen Head of Promotion and Customer Support MAN

LNG For the latest news and analysis go to www.motorship.com SEPTEMBER 2023 | 21

‘‘

ME-GA-opti can reduce the average gas consumption up to 2% in service, depending on the fluctuations in the ambient conditions, and reduce the use of FRC dramatically and thus lower the fuel oil consumption as well

WEISSER: AIMING AT LOWER GHG EMISSIONS FOR X-DF 2.0

Dr German Weisser, Senior R&D Advisor at WinGD shared the engine designer’s plans to leverage EGR advances and VCR technology to lower methane slip emissions to 0.6g/kWh

Dr German Weisser is Senior R&D Advisor at Winterthur Gas & Diesel (WinGD). Dr Weisser has been kind enough to provide some insights into the extension of the EGR technology in WinGD’s X-DF portfolio. Thank you for joining us.

Thank you very much for having me.