HZS LNGC design: 4-stroke hybrid Wind and CII: Data analysis holds key

ALSO IN THIS ISSUE:

HZS LNGC design: 4-stroke hybrid Wind and CII: Data analysis holds key

ALSO IN THIS ISSUE:

H2 Reformation A cracking solution

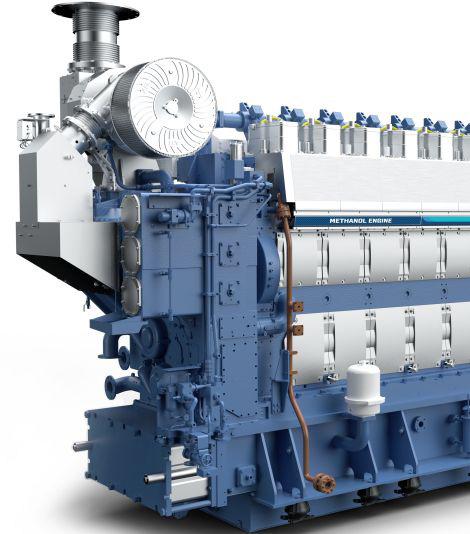

MAN’s Foldager: On ME-LGIM & MeOH

Optimize your fleet’s performance, increase uptime, and maximize profitability with Geislinger’s artificial intelligence and big data analytics-driven powertrain monitoring system.

Equip your vessel now with Geislinger Digital Solutions.

15

HHI-EMD has won the first orders for its methanol-fuelled HiMSEN H32DF-LM engine from a Japanese-owned shipyard.

15

QatarEnergy has begun a second round of LNG shipbuilding orders, confirming an order with Korean shipyard Hyundai Heavy Industries (HHI) for 17 LNG carriers.

17

MAN 21/31 DF-M gensets have been specified for two pure car and truck carriers for Chinese ship owner China Merchants Energy Shipping (CMES) alongside ME-LGIM main movers.

Bjarne Foldager, Senior Vice President & Head of Two-stroke Business at MAN Energy Solutions discusses surging demand for its methanol-fuelled MELGIM engine.

8

The beginning of the transitional period for the EU’s Carbon Border Adjustment Mechanism (CBAM) on 1 October 2023 will eventually have wide-ranging effects for shipments into the EU.

TT-Line’s two newbuildings will be the first large ro-ro/ passenger vessels to be powered by LNG dualfuel machinery south of the equator when they enter service, writes David Tinsley.

Ensuring operational technology (OT) cybersecurity onboard ships requires cross-industry collaboration and a layered and lifecycle approach.

Accurately measuring energy savings from wind-assist technologies is an area of focus, driven by customer demands for accurate fuel saving projections.

Onboard LNG reformation into hydrogen is central to an LNG and hydrogen powered MR tanker design, RINA’s Antonios Trakakis, Technical Director, Marine tells The Motorship.

ÈTA Shipping and global commodity group Mercuria are collaborating on a series of shortsea bulk carriers that will be readily adaptable to new fuels and new technologies over their lifetime.

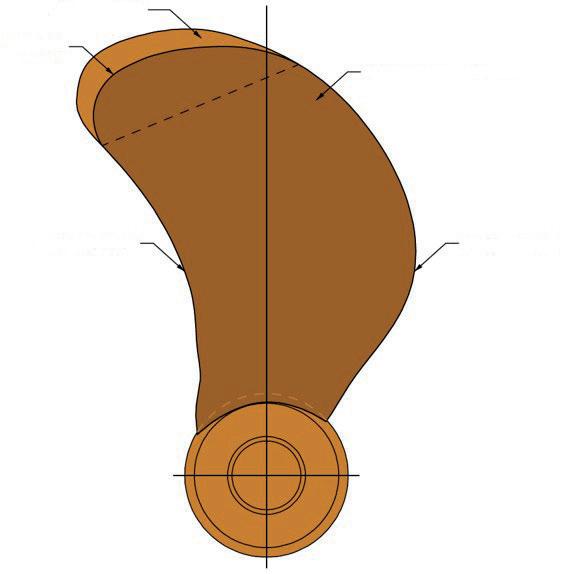

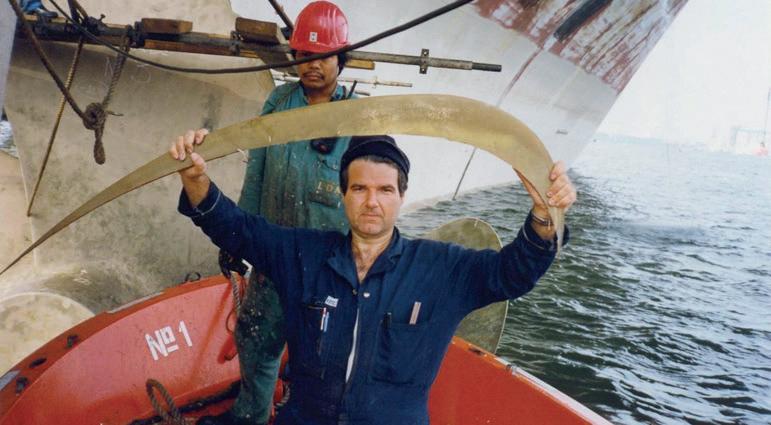

Expectations that the introduction of CII rules would prompt a surge of retrofits among commercial vessels to podded propulsion have yet to materialise, but the CII benefits remain clear.

In a month full of important announcements, the acceleration of momentum in the methanol market, driven by investments from container liner operators in methanol-fuelled tonnage and upstream green methanol production projects has been among the most notable. We feature an interview with MAN Energy Solutions’ head of 2-stroke, Bjarne Foldager, focused on the methanol market in this month’s issue.

The announcement that Maersk and CMA CGM planned to cooperate (within the limits of anti-trust legislation) on research into alternative fuel usage with an eye on future energy efficiency advances was also eye-catching.

Europe-based container operators will no doubt be keenly aware that the container market has been singled out by the European Commission as a potential demand driver for energy efficiency technologies, following its experience with the introduction of onshore power supply (OPS) system requirements.

The Motorship expects that the comparatively weak environmental emissions profile of methanol-fuelled engines from an absolute funnel perspective will lead to further regulatory pressure on producers to lower emissions further, despite their positive profile on a well-to-wake perspective, using green methanol.

The obvious solution to the problem would be the introduction of an onboard carbon capture and storage solution, designed to capture a significant proportion of the emissions from a methanol engine. While this is a technically feasible potential solutions to the challenge of improving methanol’s emissions profile, it depends to a significant extent upon the creation of a carbon capture market (and it turn upon regulatory developments at the IMO level).

Other alternatives include alternative fuels, such as ammonia and hydrogen, which were interestingly included in the initial industries cited in the EU’s Carbon Border Adjustment Mechanism (CBAM) in August. The potential impact of the trade on physical trade flows is considered in an article on page 8.

We should also note that QatarEnergy announced that it was embarking on a second round of LNG carrier orders in late September. In what is likely to be the single most important commercial announcement to be announced this year, Hyundai Heavy Industries won an initial order for 17 LNG carriers, which will lift QatarEnergy’s orderbook to 77 carriers.

The news that QatarEnergy was returning to the LNG market has been eagerly expected by market competitors, while the global LNG market is beginning to absorb the LNG carrier capacity implications of the emergence of Western Europe as a significant LNG import hub, as we predicted back in early 2022.

The growth in demand for more efficient propulsion solutions has led to a surge of technological innovations in the LNG dual-fuel market. We cover the emergence of a number of alternative dual-fuel solutions that are seeking to compete with MAN Energy Solutions’ and WinGD’s low-pressure dual-fuel two-stroke engine designs. One of the most interesting is a battery hybrid LNG carrier design developed by Wartsila and Chinese shipyard partner HZS, with the participation of energy major Shell, which we feature later in this issue.

MAN Energy Solutions is understood to have expressed concern to IACS, the International Association of Classification Societies, about the lack of a set of unified requirements relating to ammonia-fuelled engines and their supporting infrastructure.

Bjarne Foldager, Head of 2-stroke at MAN Energy Solutions told The Motorship noted that there was a strong need for IACS to establish a common playing field between the different classification societies involved in ammonia-fuelled vessel projects.

“The negative consequences of a failure to do so would be that the different classes set different standards, creating a risk that the classes might compete allowing projects to meet the lowest common denominator.”

Foldager warned that the risks of a lowest common denominator effect extended beyond potential safety risks, and potentially threatened ammonia’s future acceptance and success as a fuel for decarbonisation.

The Motorship notes that the rapid expansion of commercial interest in ammonia as a potential marine fuel has seen a proliferation of research projects launched into ammonia fuel supply systems and other ammonia-related infrastructure. This has led to institutions without shorter track records in the development of solutions for alternative fuels in the maritime sector conducting research into ammonia-fuelled engines and supporting infrastructure.

Experts working for well-known suppliers in the marine safety field have noted that there are no common standards on the requirements for on board fire detection and suppression equipment for vessels powered by ammonia-fuelled engines, for example. Similarly, definitions relating to personal protection equipment for crew members have yet to be agreed.

Safety levels in terms of maximum acceptable thresholds for ammonia concentrations in terms of parts per million (PPM) have not been defined or agreed, while common standards relating to ammonia storage and bunkering infrastructure and associated infrastructure have not yet been agreed.

When contacted by The Motorship, IACS noted that it could not comment on private correspondence between the association and its stakeholders.

An IACS spokesperson noted that in relation to IACS’ work on ammonia-fuelled engines, IACS continues to support of the industry through its Safe Decarbonisation Panel which selected ammonia as one of its priority items and deals with the technical items related to safety issues for the development, application and use of alternative energy sources and technologies on board ships.

Identification of possible safety issues and the development of related requirements for loading, storage, handling and use of novel fuel onboard, including handling of leakages, are part of the Panel’s scope of work, which also includes the identification of gaps in the current regulations and requirements related to human element issues.

QatarEnergy has announced the beginning of a second round of LNG shipbuilding orders, confirming an order with Korean shipyard Hyundai Heavy Industries (HHI) for 17 LNG carriers.

The Qatari riyal 14.2 billion (US$3.9bn) order forms part of its historic shipbuilding programme to meet future LNG carrier requirements, and lifts its overall LNG carrier orderbook to 77. QatarEnergy’s LNG carrier fleet programme has been the largest in the history of the LNG industry, with the first round extending to 60 vessels, distributed between a number of Chinese and Korean shipyards.

In addition to helping QatarEnergy meet the additional requirements arising its North Field LNG expansion projects in Qatar as well as its share of output from the Golden Pass LNG export project in Sabine Pass, Texas, the tonnage would also help QatarEnergy to meet its

long-term fleet replacement requirements.

The order is expected to represent the beginning of a second round of LNG carrier orders, although the extent of QatarEnergy’s requirements remains unclear, following the cancellation of its joint marketing

agreement with ExxonMobil, Ocean LNG, in 2022.

The Motorship notes that QatarEnergy’s North Field expansion projects are expected to boost the country’s LNG production capacity to 126 million tonnes each year by 2027 from 77 million tonnes. Meanwhile,

production from the Golden Pass project in Texas is expected to come on stream in 2024: QatarEnergy will market 70% of the export volumes from the Texan project itself.

Hyundai Heavy Industries Engine & Machinery Division (HHI-EMD) has announced it will supply a methanol-fuelled HiMSEN engine package to a series of vessels on order at Tsuneishi’s Zhoushan shipyard. The order represents the first reference for HiMSEN’s H32DF-LM engines from a Japanese-owned shipyard.

The scope of supply comprises of 4 × HiMSEN 8V32DF-LM engines per shipset, along with selective catalytic reduction (SCR) units.

HiMSEN will deliver the first of

Tsuneishi Shipbuilding has announced its first order for a series of four methanol-fuelled 5,900 teu type container feeders. The order is also noteworthy as the feeders will be equipped with Mitsui-MAN B&W G80ME-LGIM engines, in the first domestic order for MAN licensee Mitsui E&S from a Japanese-owned shipyard. The vessels will also feature HiMSEN 8H32DF-LM engines, which will be supplied byHD Hyundai, a cold-ironing connection.

the shipsets to Tsuneishi’s Zhoushan shipyard in China in January 2025, and the following shipsets will be delivered sequentially.

While the order marks the first reference for HiMSEN’s methanol-fuelled engines with a Japanese shipyard, Hyundai Heavy Industries signed a contract with Imabari Shipbuilding for 15 shipsets of its latest H32C engine for 75 container vessel newbuildings. The order with Imabari was signed in the first half of 2023.

The International Association of Classification Societies (IACS) has updated two Unified Requirements (URs) relating to cyber security standards of ships. The update covers the cyber resilience of ships that were introduced in April 2022: UR E26 and UR E27. Following extensive changes to the two URs, they will now supersede the originals and will be pplied to new ships contracted for construction on and after 1 July 2024.

HiMSEN noted that it regards the first order from the Japanese market for its dual-fuel engine as an opportunity to expand its

market share in the country, particularly as the Japanese market has been “monopolised by competitors with a long history”.

n HiMSEN will supply 16 x 8H32DF-LM engines to Tsuneishi Shipbuilding in what represents its first order from a Japanese yard for its methanolfuelled engine

Corvus Energy’s Pelican hydrogen PEM fuel cell solution has been specified for a retrofit installation on board a fishing and training vessel operated by a Norwegian educational establishment. Corvus will deliver a 340-kW PEM fuel cell system for MV Skulebas and Hexagon Purus will deliver the Hydrogen storage solutions. The hydrogen fuel cell system is scheduled for delivery in Q2 2024 and will be in full operation from Q3 2024.

COSCO Shipping is participating in a Chinese project to develop a green methanol supply chain, along with SIPG, State Power Investment Corporation and a local certification group. The project goals include the development of China’s first green methanol production projects, and ensuring the methanol meets foreign certification standards. The model of industrial cooperation is expected to act as a template for other green fuels for shipping.

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctions evasionn H.E. Minister Al-Kaabi and Mr. Ka Sam-hyun, the Vice Chairman & CEO of HD KSOE

n Bjarne Foldager patiently explaining to The Motorship’s Nick Edström why he sees significant market opportunities for methanol-fuelled propulsion to expand in a number of vessel segments

Bjarne Foldager was in ebullient mood in mid-September, when he discussed the status of MAN ES’ methanol-fuelled engine programme with The Motorship. The interview followed with the christening of A.P. Moller Maersk’s first green methanol-fuelled container feeder a short distance away, in what a striking confirmation of the successful growth of the methanol-fuelled engine programme since the reference entered service in 2016.

The ME-LGIM engine programme was evolved since its beginnings, when it was initiated in response to consumer demand for a methanol-burning engine from the methanol carrier market, before the Green Transition. Since then, MAN ES has expanded its entire programme, moving from the initial 50-bore engines specified in methanol carriers to cover almost the entire range.

“We have developed a 45 bore engine for smaller ships, such as Handysize bulkers or smaller tankers, where we have seen an interest, but also a 60 bore engine, which has been applied for bulker projects, as well as the car carrier market.”

Foldager noted MAN ES has now received orders for the first car carriers.

Foldager noted that the sharp rise in methanol-fuelled engine orders has been driven by car manufacturers interest in transporting electric vehicles (EVs) in an environmentally friendly manner, while the increasing weight of car loads (reflecting the heavier weight of individual EVs compared

with conventional vehicles), and larger designs has led to an increase in engine sizes for PCTCs.

Foldager also noted that the increase in interest in methanolfuelled propulsion has been seen in the container ship market, with orders for 8,000 teu vessels with a G80 engine, and in the larger 12,000 to 24,000 teu segment of the container market, where MAN has received 70 orders for its G95 engine. While the large proportion of large bore ME-LGIM engine orders explains the rise in methanol-fuelled engine orders by engine capacity, the number of engine orders has also grown rapidly, reflecting the growth of interest in the methanol-fuelled engine from diverse segments. As of mid September, over 150 MELGIM engines have been ordered or delivered.

“If you look at the pipeline of potential projects, where we know the ship owner is in discussion with the shipyard potentially to construct a ship or a ship, we are aware of close to 200 projects where the shipowner is considering using methanol as a fuel.” The interest is not concentrated in any one segment, but includes the tanker, container, bulker and car carrier segments.

The interest from the tanker market has recently led to MAN ES’ first reference for its methanol-fuelled engines for a pair of VLCCs for an Asian shipowner. “We think the methanolfuelled technology is ready now, and should be available for all the major segments… This [order sends] a very strong signal that [the ME-LGIM] is now also in the VLCC market.”

While Foldager is careful to recognise that not all the projects in the project pipeline will convert into orders,

previous experience suggests that further orders can be expected in the future.

Part of the growth has been driven by increasing shipowner familiarity with methanol as a fuel, as well as the operational service history of MAN’s ME-LGIM engines. The engine has now accumulated more than 500,000 hours of service history operating in methanol mode since 2016, Foldager noted.

When asked why methanol has attracted so much attention recently, Foldager responded that is seem as a pathway for shipowners looking to decarbonise their fleet that is commercially available, while beneficial cargo owners note that it will help them to decarbonise their Scope 3 emissions.

Foldager also referred to the importance of the pooling of emissions, as included in the FuelEU Maritime regulations affecting shipping operating within the waters of the European Union’s member states, and also apply to a lesser extent to vessels calling in the EU. “One of the clever things… is the pooling concept, which allows shipowners to [count] CO2 reductions from across their fleet towards overall annual reduction targets. Rather than having to reduce emissions by 10% for 10 ships, you will be able to fully decarbonise one vessel and be fully compliant.”

Widening the focus beyond the EU and European regional regulations, Foldager also noted that the agreement of a net zero decarbonisation objective for 2050 at the MEPC meeting in July was of fundamental importance for the shipping sector. While recognising that translating aspirations and commitments into actions will be hard work, Foldager noted that the IMO’s targets are more ambitious in scope than the EU’s, because of the impact of the likely growth of the fleet in the coming years will increase the scale of the reduction in absolute emissions. “We need to the immediate target is to reduce co2 emissions by 20%, striving for 30%, by 2030... compared to the baseline. But when you take into account the growth in the fleet gross since 2008, that has actually eaten up the co2 savings we have made since 2008 already.”

“Although the absolute increase in CO2 emissions will depend upon a variety of factors… we expect that to reach the IMO target by 2030 will require each individual ship to reduce its CO2 emissions by close to 40%, because of the fleet growth, especially if we strive to meet the 30% CO2 reduction goal.”

Foldager notes that such a scale of reduction is likely to exceed the scope of energy saving devices, and is likely to lead to increase in the use of alternative fuels in both newbuildings and in retrofits for existing tonnage.

He added that given the rate with which the fleet is being renewed, “[it is highly probably] we will have to retrofit a big part of the existing fleet also.”

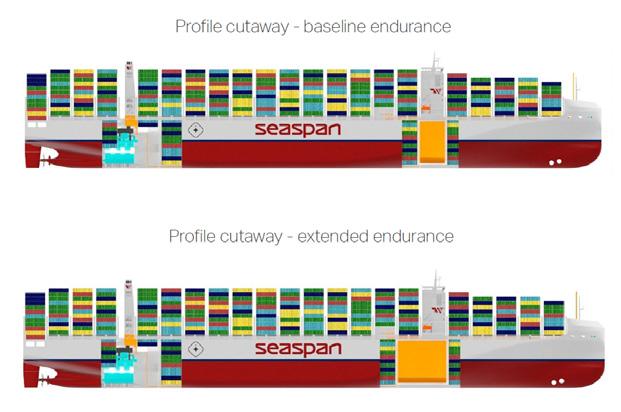

MAN ES has a successful track record of delivering alt fuel retrofits, and has already delivered 20 conversions to new fuels already. MAN ES has seen a sharp rise in enquiries about methanol retrofits, with a particular focus linked to large container ships. “We have signed a contract with Seaspan to retrofit between 15 and 60 of its big container ships to methanol over the coming years, and we have also signed a contract with Maersk to retrofit 11 of their large container ships to methanol.”

There were several other contracts where MAN ES has either signed or is close to signing contracts where the names of the operator and ship owner are not yet public. The big advantage for larger container vessels is that the existing fuel tanks can be repurposed to be used for methanol also, which means you don't lose a significant number of container slots when you have actually retrofit to methanol.

Expanding on the alternative fuel theme, Foldager noted that cost differentials between alternative e-fuels were likely to remain, even as some of the underlying conversion technologies, such as electrolysers, mature and the cost of production begins to decline.

“Eventually, we will need some kind of scheme [to distribute] some of the savings between people who are using [fuel oil] and users of new fuels, whether in terms of an emission trading scheme, like the one the EU is setting up, a green levy or a global CO2 tax.”

The technology for the use of the fuels on the ship has been developed, and the technology for the fuel production is also in place. “The key issue is the scaling and ramping up of the production, the supply, the logistics, and the port to deliver these fuels, that will be the key issue. Our hope and our prayer is that the decisionmakers will also consider this.”

The proceeds from whatever scheme is eventually introduced will need to be invested in the production, infrastructure and logistics of the alternative fuels because the supply of the fuel will be the bottleneck.

One of the interesting aspects of the Laura Maersk christening, (as well as subsequent announcements by other large container liner operators about their commitment to methanol), is that it allows early adopters to promote the development of demand for alternative fuels.

“I'm sure we will see the final investment decisions being taken on the production of [alternative] fuels… because… the demand from the market players and the customers [will act as an initial driver]. Some of the ship owners that have ordered container ships… have clearly [said] they will deploy these ships on the Europe trade between Asia and Europe.”

Foldager noted that Direct Air Capture (DAC) has also begun to emerge as a potentially interesting technology, and MAN ES has become involved in a project in Chile.

Returning to the engine development programme, Foldager is pleased to note that MAN ES has developed a dual-fuel genset, the MAN 21/31, capable of operating on methanol. The first orders for MAN’s methanol gensets have been received from a shipyard in China, where the engines will be installed in a series of car carriers that are under construction. “The series will feature our [ME-LGIM] main engine as well as the methanol-fuelled gensets.”

While MAN expected to receive further orders for the MAN 21/31 engine, it was also expanding the programme and was seeking to develop larger-bore methanol-fuelled gensets suitable for installation on larger containerships.

While discussing the dual-fuel G95 engine, he added that MAN had lowered its guaranteed fuel consumption data for the G95 in methanol mode as a result of encouraging test results from the test bed in Korea.

We think the methanolfuelled technology is ready now, and should be available for all the major segments… This [order sends] a very strong signal that [the ME-LGIM] is now also in the VLCC market

It is entirely possible that the introduction of the transitional period for the EU’s Carbon Border Adjustment Mechanism (CBAM) on 1 October 2023 may have failed to capture the attention of ship operators and owners

The effect of the introduction of the transitional period for the EU’s CBAM scheme on 1 October will be felt most keenly in the commodity carbon steel and aluminium markets, which will see reporting requirements imposed on 350 semi-finished and finished products and 58 products respectively. The breakbulk market has been preparing for the introduction of these rules for some time, and the immediate impacts will be localised.

The scheme is expected to introduce significant bureaucratic reporting requirements for importers of the products, even before the financial penalties for the scheme are introduced in 2026.

Despite fears of trade diversion, commodity market analysts expect the initial impact of the EU CBAM will be to subtly alter the purchasing behaviour of EU importers reliant on low-cost inputs, introducing additional reporting burdens for irregular or opportunistic purchasing during the initial running-in period.

While media comment has understandably focused initially on the financial implications of higher import taxes, and their expected pass through into certain commodity prices, the longer-term impact of the rules will be felt in creating an entire new set of supplier emission monitoring obligations for European importers which will also affect long-term supply relationships.

The introduction of environmental emissions submission requirements, and the subsequent exposure of importers to the risk of financial penalty if suppliers’ environmental emissions data is incomplete, inaccurate or worse will create an additional set of risks that will need to be mitigated in existing supply contracts.

The emergence of contractual risks will support the emergence of third party verification service providers, which can be expected to ramp up coverage of environmental emissions from the initial industries selected in the EU and its main suppliers. This is likely to represent a market opportunity for classification societies’ environmental services teams for

The initial phase of the CBAM will see the introduction of reporting requirement under the EU’s Carbon Border Adjustment Mechanism for the emissions embedded in imports of cement, iron and steel, aluminium, fertilisers, electricity and hydrogen into the EU from Third Countries outside the EU and a number of EEA states will enter force on 1 October 2023.

This will see the introduction of quarterly reporting from Q4 2024 with the first reports due in January 2024. The monitoring

jurisdictions where mutual recognition of environmental monitoring standards is not likely to be acceptable.

The devil, as ever, lies in the detail. Industry representative organisations within the EU, such as Eurofer, are lobbying for the introduction of default values (applicable to all imports that do not provide specific data) at a level that will lead to more polluting exporters in targeted sectors being priced out of the market, citing concerns about ‘carbon leakage’ (or the diversion of production from the EU to jurisdictions with lower environmental emission standards).

A separate question mark hangs over the potential application of the EU’s CBAM to cross-border trade with the UK, and to an even greater extent to trade with Northern Ireland, which remains subject to EU environmental regulations under the Windsor Protocol. This is likely to be the subject of negotiations.

and reporting rules will be closely aligned with the EU Emissions Trading System (ETS) rules, but the European Commission will permit the use of default values or other monitoring and reporting methods until July 2024.

The scheme will introduce requirements for non-EU suppliers to document their emissions to avoid the application of “default values” for embedded emissions. While the precise level of the embedded emissions is still being finalised, the

n The introduction of the EU’s carbon border adjustment mechanism will require EU importers to report the embedded carbon emissions in imports from Third Countries outside the EU CBAM, such as the Tata Steel’s Port Talbot steel mill in South Wales, on a quarterly basis

levels are expected to be high enough to encourage disclosure for producers.

EU importers who fail to comply with the reporting requirements face penalties of up to EUR50/tonne during the trial phase. Once the first payments for the levy begin in 2026, the cost of imports will be based on the EU’s own carbon price, using the ETS mechanism.

Imports from countries which have their own ETS or carbon levy systems will be allowed to offset any CO2 price levied in their jurisdiction of origin from the EU price.

Wind power poses challenges when it comes to incorporating it in Carbon Intensity Indicator (CII) index: how can something that is not constant be formulated in mathematical format?

Fuel consumption data analysis forms the basis of the current formula but technology developers are increasingly gathering extensive data from modelling and live data from onboard ships to deepen analytical insights.

Wind in itself is obviously not a new alternative to power ships and there are various products on the market today to harness the wind power to serve the shipping industry. However, what has changed over time are the ships in themselves, their size and how they are operated, Kristian Knaapi, sales manager at the Finnish consulting naval architect company Deltamarin told The Motorship

“The likely effect of various kinds of sails can be established fairly accurately through calculations at the design stage. The benefit derived from the wind will be simulated several times under various conditions - on various routes, under various wind conditions and under various loading conditions of the ship,” Knaapi said, adding that Deltamarin has been involved in several such projects, involving both newbuildings and retrofits.

However, there is a caveat. Modelling can give fairly accurate results when it comes to the effect of wind systems over a long period of time, but in the short term and for individual voyages and situations the predictability will be less certain. “Predictability is mostly based on statistics and within a short frame of time, fluctuations (of performance) will be greater,” he pointed out.

It is also important to bear in mind that various wind technologies will work differently on differing types of ships

and consequently the savings that are sought can vary considerably. The number of sails that can be installed and which technology will be used affect this. “This means in practice that there is nowhere near enough verified results concerning the benefits of wind systems. More data will become available all the time as more wind assisted ships enter service,” Knaapi said.

In practice, it is the wind system manufacturers themselves that analyse the effect of these systems. The role of a design company, such as Deltamarin, is to analyse how the chosen system can be integrated onboard the ship and minimise possible risks regarded to their operations. “The benefits available from wind are tightly linked to route optimisation and in order for this to be maximised, ships will be operated in the future on routes that differ from those in use today,” Knaapi continued.

Ships in short sea trades have less room to seek optimal wind conditions than those operated in deep sea trades. Lloyd’s Register’s Ship Performance Manager, Santiago Suarez de la Fuente noted the CII formula tends to award shorter voyages (less than 1,000 nm) higher CII scores (hence Ds and Es) than longer routes, which tend to receive Cs or below. “This has to do with the amount of transport work produced on longer voyages and, proportionally speaking, spending less time manoeuvring and waiting at port which generates CO2 without any distance being covered.”

Routing also plays a role in the returns produced by wind-

assisted propulsion systems. “If you operate [a highlyefficient system] in an area/route that has minimal wind resources, and you navigate at high vessel speeds, your CII benefit will be minimal.” This poses particular challenges for vessels in spot charters which adapt to the market and frequently assign ships to routes of varying length, geography, and direction.

“As far CII is concerned, the benefits of wind power will become evident in the CII index directly as a consequence of reduced fuel consumption. However, in addition to the various uncertainties related to the predictability (of the ship’s performance), also how the ship is operated in real situations should be kept in mind,” he concluded.

Suarez de la Fuente concurred. “The contributions from WASP (Wind Assisted Propulsion), as well as any other energy efficiency technology (EET), are not explicitly considered in the CII formula, but their effects are captured by the ship’s annual fuel consumption verified data.”

It is far more complicated to establish the effect of wind power on energy saving onboard ships than e.g. in the case of solar panels due to the fact that winds do not blow at a constant speed and direction over a period of time. To tackle this problem, for their Fast Rig wing sails, the UK based wind power start up Smart Green Shipping (SGS) has opted to use two different models. The first one assesses the wing sail’s performance and creates a digital twin of the ship by including both aerodynamic and hydrodynamic modelling of the wind ship.

The second one covers weather routing and combines the digital twin with wind and ocean currents data to assess the vessel’s performance along weather optimised route, said James Mason, a data scientist at the Scotland based company. He is a ship routing expert and develops software called FastRoute, which will harness cutting-edge optimisation technology to quantify fuel savings from the SGS’s FastRig wing sails.

Data from the two models are integrated to get a picture of the wind system’s ability to reduce fuel consumption and thereby emissions, Mason continued, adding that an owner can then have a third party to verify the results. Although a lot of work remains to be done, it has become clear that the effect of a wind systems depends a lot on the angle of the sails, particularly in conditions of strong winds, making weather routing a valuable piece of the decarbonisation puzzle for ships with wind propulsion.

SGS will install the Fast Rig system on land at Hunterston on the Firth of Clyde on the west coast of Scotland for testing and data gathering purposes as it is one of the windiest

locations in the UK. While this will provide useful data in itself, several more moving variables will be added to the process once a system will be installed on a ship that operates in various locations and weather conditions.

Mason said that routing systems and weather routing is a growing topic for ships with wind propulsion. But there is more work to be done to capture wind propulsion more accurately in policy and that ship routing could play a key role.

All in all, collaboration with experts from various fields, such as hydrodynamics, aerodynamics and routing is vitally important to develop the models. Onboard testing will produce invaluable validation data. Models show what we expect to happen, whereas performance data from ships will show what happens and are both important to foster trust in the wind,” he summed up.

A beneficial factor has been introduced in both CII and EEDI rules to take into account the effect of wind power on ships that feature this technology. SGS’ Fast Rig shows promising results, particularly for routes with beneficial winds such as the North Atlantic and the Pacific. However, given the nature of the winds, significant amount of data that will be collected from real world tests, such as Hunterston, and in particular from vessels in operation, Mason stated.

Meanwhile the Finnish wind technology company Norsepower has accumulated more than 100,000 hours of third-party verified force and savings data measurements. “To refer to Peter Drucker’s famous quote, ‘you can’t manage what you can’t measure so we have continued to extensively invest in R&D to develop further measurement methods,” said Jukka Kuuskoski, chief sales officer at Norsepower.

“We’re proud to have developed an advanced, specialised real-time measurement tool to inform performance analysis. Recognised and accepted by classification societies the

The likely effect of various kinds of sails can be established fairly accurately through calculations at the design stage. The benefit derived from the wind will be simulated several times under various conditions - on various routes, under various wind conditions and under various loading conditions of the ship

Norsepower Sentient Measurement (NSM) is a measurement tool that provides information of the actual performance of Norsepower Rotor Sails at any given moment. The tool has been validated both onshore and on-board vessels and is currently included in standard Norsepower Rotor Sails. The NSM is also used to inform our patented automated control system that senses whenever the wind is strong enough to provide fuel savings, at which point the rotors start automatically without additional workload on the crew,” Kuuskoski said.

Modelling is an integral part of understanding the performance potential of Norsepower’s product. It requires different levels of information at different stages of the process. “For instance, standard simulations can be done by Norsepower's in-house developed simulator which has been proven to deliver results well in line with actual operational performance. However, if customers require a detailed simulation, then we conduct Computational Fluid Dynamics (CFD) analysis to consider the specific wind flow conditions in each rotor sail’s location,” Kuuskoski continued.

“In our experience, rigorous modelling provides a strong basis for investment decision-making and ensuring that that our solution delivers on the savings we project within the realms of what we can control. There is no substitution though for real-world operational experience. Once vessels are using our rotor sails, to pursue the highest possible performance on a given vessel, we assess how predictions match actual performance in combination with high-quality measurement and control information. These insights are then also brought back into the business to help refine our modelling for future projects,” he said.

In the actual operations, when pursuing the highest possible performance on a given vessel, models alone are not enough. They should be accompanied with high quality real-time measurement and control. “However, it’s essential that we assess how predictions match with actual operations and use these insights to refine our modelling,” Kuuskoski noted.

Moving on to CII, he said that wind propulsion is an excellent tool to support CII compliance and this seems to be increasingly recognised. “It’s particularly powerful for CII ratings as there are not many other readily available means to improve ratings at a similar level whilst still maintaining the same operational profile. Reducing fuel consumption with Norsepower Rotor Sails will also provide financial benefits if expensive low-carbon fuels are needed to reach the full CII compliance.”

In this sense it will drastically shorten payback periods and then have a bottom line impact on alternative fuel procurement costs.

“From Norsepower’s perspective, the debate is no longer

about wind’s relevance to decarbonisation, it’s about which solutions provider is the safest pair of hands to safely and reliably deliver on performance promises. As we have been operational since 2014, we’re fortunate to have a strong track record of delivering fuel and emission savings of 5% to 25%, sometimes this has been even higher. These will directly improve the CII score by the same amount,” he said.

Deviation from main challenge?

But back to the original question of CII and wind power. Not everyone is convinced that the two can be merged successfully. Hans-Otto Kristensen, a Danish naval architect, said that the question of assessing the effect of wind power solutions has been on his mind for years. “How can we prove how efficient wind systems are - how can we put a figure on this,” he asked, adding that as far as he can see, it is not possible.

“Wind is by its very nature volatile and it is also difficult to predict. A further problem is that what conditions should be regarded as the baseline (in CII calculations),” he stated. All this has raised the question whether debates such as CII are deviating the shipping industry’s attention away from the main challenge that it is facing – transition to CO2 free fuels. “That is a formidable challenge,” he concluded.

LR’s Suarez de la Fuente also holds firm opinions about CII and wind assisted propulsion solutions. “I think the CII should remain as it is, as it already takes into account the impact of WASP and all other EETs and operative measures applied during the year. The moment the CII starts to get complex, the more difficult it will get to verify and validate.”

“The CII formula captures, as it does with WASPs, the annual performance – through the fuel consumption and distance – of existing vessels (with retrofits or not) and newbuilds. The final score of a vessel will integrate all the technical and operative factors that define its carbon intensity,” he explained.

In response to questions about the CII baselines, LR’s Suarez de la Fuente pointed out that the greater availability of IMO DCS data since 2019 should permit much deeper analysis of the relationship between transport work and fuel consumption. “Now the interesting thing for the IMO to do is to analyse the now much larger pool of IMO DCS to measure how transport work is changing and its associated fuel consumption and CO2 emissions. My prediction is that the next IMO GHG Study will have a data analytic section which will complement the modelling of past studies.”

n The benefits available from wind are tightly linked to route optimisation and in order for this to be maximised, ships will be operated in the future on routes that differ from those in use today,” Kristian Knaapi, sales manager at Deltamarin said

The CII formula captures, as it does with WASPs, the annual performance – through the fuel consumption and distance – of existing vessels (with retrofits or not) and newbuilds. The final score of a vessel will integrate all the technical and operative factors that define its carbon intensity

Ensuring operational technology (OT) cybersecurity onboard ships requires cross-industry collaboration and a layered and lifecycle approach

In a recent white paper, KVH highlights that the number of attacks in maritime increased by 33% in 2021, following a 900% increase in 2020.

Rather than the data focus of IT, OT includes any hardware or software used to control and monitor industrial control systems (DCS, PLCs, Scada, etc) such as onboard automation, propulsion, and remote-control systems. It includes the hardware and software used to control and monitor the systems and the infrastructure that connects the different devices/nodes together.

Matti Suominen, Director, Maritime Cybersecurity at Wärtsilä, says the convergence of OT with IT is resulting in an escalation of cybersecurity threats with hacktivists increasingly targeting OT systems in recent years. With this shift, awareness is growing – all the way from classification societies right through to the more traditional maritime players. This is helped by the fact that maritime is a very heavily regulated industry which means the relevant bodies, organisations and agencies have the authority and ability to put in place requirements which encourage safe and secure shipping.

“Bad actors are on the rise,” says Suominen. “In general, we see two types of scenarios. First, the importance of the maritime industry to the world means that it is a lucrative target for cyber criminals. They choose their targets based on specific motives, be those, for example, financial or political. Second, increasing connectivity with vessels makes them a target for automated attacks that are common in traditional IT environments. In such cases, the bad actor may not even be aware that the system they have hacked is on a vessel.”

A unique challenge in maritime cybersecurity is the number of players involved before a vessel sets sail, he says. “No single party in this process can make a vessel secure without working with others. Even the most secure piece of equipment is at risk when everything around it is designed without security in mind. This is why collaboration between yards, owners, operators, and OEMs is crucial.

“Wärtsilä works to collaborate with all the stakeholders in the value chain. With other OEMs that we rely on, we try to help them on their cyber journey. With yards and integrators, we work to ensure that the security design of our products is considered in the security architecture of the vessel. With owners and operators, it’s all about providing them the right tools while also ensuring that they understand the operational and lifecycle needs of the vessel.

“While this all sounds simple, the reality of it is a lot of work behind the scenes. Thankfully, we have great partners who, like us, take cybersecurity seriously and are willing to join us on this journey to secure the maritime ecosystem.

“The core of our cybersecurity strategy is in enabling value creation for our customers. As cybersecurity is increasingly a global concern, the link between the work we do and the value for customers has never been clearer.”

Peter Krähenbühl, Head of Digital Transformation & Technology at WinGD, says that the more connected systems

become, the more likely - and potentially more severecyber threats will be. Newer systems which offer greater potential for diagnostics, optimisation and integration with other systems have a greater risk. Permissions needed to access systems for these functions can also potentially be used for other means without adequate security.

The basis for cybersecurity in operating systems since 2021 lies in the International Electrotechnical Commission (IEC) standards, which are themselves based on wider information technology standards developed by the International Organization for Standardization (ISO). IEC 62443 standards were designed for control systems in automated industry and have since been applied to maritime for similar applications through classification societies and the International Association of Classification Societies (IACS).

All newbuilds contracted for after 1 January 2024 will need to meet new IACS unified requirements for cyber resilience on ships (UR E26) and of on-board systems and equipment (UR E27)). “For WinGD, UR E27 will apply to our computerbased systems, including the WiCE engine control system and its sub-systems and auxiliary systems, as well as to our WiDE remote diagnostics platform. It also applies to our X-EL Hybrid Manager, which governs the energy system on vessels that have hybrid propulsion configurations and uses elements of both WiCE and WiDE,” says Krähenbühl.

“WinGD is working with DNV to secure cybersecurity type

n ku Kälkäjä, Head of Digital Business, ABB Marine & Ports, notes that shipowners are becoming increasingly aware of cybersecurity risks amid tightening standards

approvals which assure that we are technically ready to meet these standards,” he says. WiCE has already been granted the SP1 ‘Cyber Secure Essential’ notation and WiDE has reached SP0 ‘Cyber Secure Basic’, with the aim of reaching SP1 early next year. A similar timeframe is in place for X-EL Hybrid Manager.

The approvals will give confidence to owners and operators that WinGD OT meets regulatory requirements for cybersecurity. However, Krähenbühl says cybersecurity is not to be achieved with a one-time solution, it needs to evolve. This is acknowledged in the rules, which require that different systems reach higher cybersecurity levels based on the criticality of the systems. Approvals also need to be updated when systems are revised.

“We are upgrading WiCE to version 3.5 and that will require re-certification later this year. These evolving targets are an integral part of what it means for systems to remain cybersecure and that is factored into our technology development.

“WinGD is beginning to use artificial intelligence tools to help detect and combat cyber threats. At the same time, it is clear that malicious actors will also find ways to automate and improve cyber-attacks using the same technologies. This is part of the constantly evolving landscape of cybersecurity: creativity has no limits, whether you are attacking or protecting a system.”

Svend Krogsgaard, Cybersecurity & Safety Manager –Automation at MAN Energy Solutions, says one of the key challenges at present is to ensure that individual roles and responsibilities of the many stakeholders is clear.

Additionally, he says, cybersecurity is not something you just put around a product afterwards. “It is something that should be in the mindset of the developer who’s writing the code or designing the hardware components. It should be in their mind and in the specifications from the very beginning, from the first line of code.”

Cybersecurity by design involves preventing errors from an early stage in the development phase, keeping the attack surface of the system as small as possible, providing consistent separation of the systems for better isolation in case of attacks (defence-in-depth) and continuously testing security.

Krogsgaard highlights what he calls the “crown jewels” –the most important thing for onboard power systems – which is maintaining availability. “Even if there is a breach of some systems, the first priority is to ensure that it is still possible to manoeuvre the vessel,” he says. This involves creating onionlike layers of protection on a ship. If one layer is breached, there are more layers protecting the core functional systems.

He says that cybersecurity must be understood from the top down but mitigated from the bottom up. When a yard or owner asks if a particular product is cybersecure, he says, it’s important that they understand the answer: “You cannot just build a ship with each component having its own cyber acceptance or type approval and think you have built a good

system. It might be open like a Swiss cheese. Cybersecurity is all about the overall system architecture. From an engine perspective, this involves ensuring that the interfaces are installed in the proper manner and conducting a risk assessment of the complete ship.”

Embedding cybersecurity by design into automation and control platforms is something MAN has been doing for a long time. In many cases, MAN’s solutions exceed those required by IACS as it works to increasingly high levels of compliance within the IEC 62443 standards. This is driven by MAN’s own ambitions, but Krogsgaard says it is also increasingly being pushed by customers who are requesting, and expecting, documented compliance to standards. Some contracts are now setting requirements for the highest security and maturity levels defined in the standards.

In ABB’s view, cybersecurity needs to be maintained and taken care of throughout all stages of the product lifecycle, starting from product development, product integration in project execution phase, operation phase and during decommissioning/retrofit when the product reaches the end of its lifecycle and is replaced with a new one.

“Shipowners are aware of cyber risks and their potential impact on vessel operations, however investing to upgrade obsolete systems remains an issue as it requires investment and careful planning during dry docks. Obsolete systems are challenging to maintain and protect, which means OT systems are left vulnerable to cyber threats,” says Ahmed Hassan, Global Cybersecurity Manager, ABB Marine & Ports.

“Poor network segregation and segmentation, especially for old operational vessels, can lead to spreading of a potential cyberattack between critical systems: if one of the systems is affected, the risk can increase significantly if accompanied by poor disaster recovery planning and procedures.”

ABB offers vendor-agnostic cybersecurity solutions and services by partnering with key cybersecurity software, hardware and service providers. That way, ABB can provide cybersecurity solutions that can be utilized by all OT vendors onboard the vessel. While ABB provides the overall architecture, the shipyard, acting as the system integrator, carries the overall responsibility to integrate other OT

Marine & Ports warned that obsolete systems expose OT systems to cyber threats but upgrades require investment and careful planning

The core of our cybersecurity strategy is in enabling value creation for our customers.

As cybersecurity is increasingly a global concern, the link between the work we do and the value for customers has never been clearer.

systems to the common solution. ABB will offer support to the shipyard and other vendors to integrate into the common solution. When the ship is in operation, ABB will continue to provide support to shipowner to maintain system security.

Korean Register (KR) has proactively conducted joint development projects with Korean shipyards (HD HHI, K Shipbuilding, SHI) to implement the IACS UR E26 and issue Approval in Principle certificates. KR has also established its own cybersecurity certification system by integrating digital ship survey technology with traditional ship survey techniques. As a technical advisor, KR also give cybersecurity technical services such as cybersecurity awareness training, ship cyber risk assessment, vulnerability analysis and penetration testing, a test where the latest hacking techniques are used to directly penetrate networks and systems to expose vulnerabilities and determine whether actual exploitation is possible.

Currently, a ship typically controls external access from the various vendors with a firewall, but this is not an absolute defence, says Lim Jeoungkyu, Senior Cyber Security Surveyor (Cyber Certification Team). For example, if a vendor that is allowed remote access is hacked and this route is used, the entire ship system may be vulnerable. Therefore, ships need a comprehensive cybersecurity control/monitoring system, combination of SIEM (Security information and event management), NMS (Network Monitoring System) and IDS (Intrusion Detection System).

Cybersecurity specialist CyberOwl says shipowners should be aware that whilst OT is distinct from IT, in practice it is very difficult to truly separate OT from IT interaction and connections on board a vessel. Even if successful at design and initial implementation, is it even harder to maintain that separation through the vessel’s lifetime, says CEO Daniel Ng. The only practical way is to invest in mitigations - gaining visibility of onboard systems to ensure some separation remains and undertaking regular cyber incident exercises. Cyber exercises help organisations understand how it differs from a physical safety incident and what practical steps they can take to improve readiness to respond. This includes understanding and containing a cyber incident, which may extend to multiple assets both on and offshore. Operators are advised to:

1. Harmonize their cybersecurity approach. Set up a single unit within fleet operations that covers both IT and OT. This ensures one coordinated unit can deal with incidents.

2. Practice. Develop cyber incident training and drills.

3. Engage more deeply with suppliers. New regulations coming into force will provide some level of assurance for OT equipment installed on new vessels, but supplier controls need to be well implemented and maintained. Involving suppliers in the cyber incident training and drills is also critical.

Osku Kälkäjä, Head of Digital Business, ABB Marine & Ports, says cybersecurity regulations are continuously being developed to better meet the best cybersecurity practices and to reduce cyber risks. Shipowners are also becoming increasingly aware of cybersecurity risks and paying attention to make sure they collaborate with and rely only on recognised cybersecurity experts.

As he says, cybersecurity is not only a product but a process, and one of the important parts in that process is to be able to assess the risks, detect vulnerabilities and define how to mitigate these. “Cybersecurity is always a joint collaborative effort. We need to fight this together.

n Svend Krogsgaard, Cybersecurity & Safety Manager –Automation at MAN Energy Solutions

Poor network segregation and segmentation, especially for old operational vessels, can lead to spreading of a potential cyberattack between critical systems: if one of the systems is affected, the risk can increase significantly if accompanied by poor disaster recovery planning and proceduresn Peter Krähenbühl, Head of Digital Transformation & Technology at WinGD

We are transitioning from an era where data was collected and stored passively, often leading to valuable insights being overlooked or forgotten, to a phase where data is being actively leveraged to inform business decisions and strategies, says Nick

Chrissos, Chief Digital & Information Officer

at Silverstream

TechnologiesWhen it comes to digitalisation, it’s no longer a matter of whether the industry will embrace data, but rather, when and how rapidly it will do so, and whether companies are ready for it. This actionable data has become a driving force behind both the industry’s digital transformation and its decarbonisation agenda.

The importance of data extends to industry regulations, including the International Maritime Organization’s Carbon Intensity Indicator (IMO CII). The expectation is that CII will become more impactful as it is iterated upon, and the rating criteria becomes more stringent over the coming years. And, while the IMO continues to discuss the next steps for CII and how it might incorporate energy saving devices, the regulation remains a relevant operational concern today.

What is important is that clean technology can support CII performance; the Silverstream® System reduces average net fuel consumption and GHG emissions by 5-10%. The air lubrication system does this by releasing a carpet of air to reduce the frictional resistance between the hull and the water. This presents the opportunity to either improve a vessel’s CII rating or remain in its current bracket for longer. Reliably mapping the impact of a technology on CII rating depends on proven and verified operational performance data, which Silverstream has prioritised since its inception. It will be interesting to see how the IMO decides to incorporate such data into CII going forward.

Looking at the bigger picture, the shipping industry is in the early stages of its data and digitalisation evolution and clean technologies have a lot of potential. In simple terms, data can and will be used by clean technology manufacturers to raise both the floor and ceiling of fuel savings potential. Because clean technologies are deeply integrated into a vessel, there is the potential for them to identify and unlock efficiencies that others may not even know exist. In other words, they become active and intelligent solutions to maximise the performance of a ship.

When it comes to data and digitalisation, the shipping industry is following the well-established path of other sectors that have successfully incorporated technology and harnessed its potential for business advancement. Like the intelligent systems within modern cars that tune the vehicle’s engine as it drives, maritime clean technologies will learn and respond to their environment and operate in a way that ensures maximum efficiency.

However, thinking about clean technologies in this way will require two key shifts in sentiment for shipping, which we believe are a safe prediction for the next phase of maritime digitalisation. First, we will have to become acquainted with humans being removed from active decision-making on some tactical elements of ship operation, and instead taking

on a supervisory role that augments the outcomes of these technologies. The systems and algorithms that will power up vessel efficiency (and, indeed, routing, navigation, berthing and more) are already at the point where they use more information than a human can comprehend. Optimising clean technologies even further will require trust in the machine learning (and soon to be artificial intelligence) systems that underpin them.

Secondly, and more significantly, shipping will have to change its technology outlook. Currently, technology –whether physical or digital, traditional or innovative – is generally seen as a means to fulfil the requirements of today, not to anticipate the future. This is something that Silverstream has observed and educated the industry on with respect to proven clean technologies. Air lubrication is seen increasingly as a mainstream solution that helps operators keep their vessels flexible to the demands of the future, as well as to improve efficiency today. We can collectively now do the same thing by applying data to all vessel efficiency technologies.

Silverstream is investing in hydrodynamicists, data scientists, data engineers and software developers to create a bridge between traditional shipowners and their data, and traditional clean technology hardware and digital software. In our ever-evolving industry, clean technology has an exciting future and data and digitalisation have a significant role to play. Looking at the here and now, whether CII is the driver or whether it’s a price on carbon, fuel cost savings or perhaps green financing, the rationale for adopting clean technology today is clear for all to see.

What do you see as the cybersecurity challenges facing the maritime industry?

Virtually 90% of global trade is conducted by shipping, making the maritime industry a prime target for adversaries.

One of the biggest challenges facing the maritime community is visibility into underway vessels and security monitoring of satellite and ship to shore communication systems. As the threat landscape evolves, adversaries may develop more effective ways of utilising these systems to gain access or to utilise land-based connections to bridge their operations into otherwise remote ship networks.

While equipment may have a limited threat surface, the interconnected nature of maritime systems broadens the threat landscape. Gaps in one sector can provide an "adversary opportunity," even if there is no specific "adversary intent" to target maritime operations.

Automated attacks generally focus on "adversary opportunity," seeking to exploit any vulnerabilities they find across a broad array of targets. These attacks often utilise malware, ransomware, or phishing campaigns and are not usually targeted at a specific entity.

On the other hand, targeted attacks, which are less frequent but could potentially be more damaging, usually signify a specific "adversary intent" to compromise a particular maritime operation or asset.

The threat surface in maritime OT is not uniform; it varies significantly between land-based and ship-based assets. While the operational complexity of maritime vessels may pose initial barriers to less capable adversaries, the reliance on land-based systems creates vulnerabilities that could lead to significant operational impact.

Given the various systems involved in modern shipping operations, the attack surface requires an adversary to perform extensive research or have access to sources that possess such knowledge about the most effective way to enact a desired effect. The complexity and diversity of vendor implementations of systems and processes also present a challenge for an adversary to identify, understand, and plan offensive operations that target maritime on a larger scale.

As increasing digitalisation in maritime occurs, especially if the maritime industry takes AI and automated piloting seriously as a course of operations, the distance between an adversary achieving the ability to perform complex, real time, interactive operations on a remote vessel shrinks.

Penetration testing is a crucial but singular component of a comprehensive cybersecurity strategy. It should neither be the initial nor the final measure in evaluating an organisation's cybersecurity posture. Rather than viewing penetration testing as a competitive exercise to either succeed in breaching defences or thwarting the test, it should be conducted collaboratively with defensive or "blue" teams.

The aim is to jointly identify the failure points of security controls and understand the reasons behind those failures.

A well-designed penetration test should have clearly defined objectives and be executed from multiple attack vectors. This could include scenarios such as an insider threat, exploitation of remotely accessible vulnerable assets, or leveraging compromised credentials. These scenarios should mirror the common initial entry points that adversaries typically target and how an adversary would operate in an environment, thereby providing more actionable insights.

The complexity of penetration tests should be incremental, starting with simpler tests and gradually moving towards more advanced techniques. Initially, one can make use of freely available offensive security tools found on platforms like GitHub, before progressing to customised methods specifically designed to challenge existing security measures. The overarching goal is to iteratively enhance the security program while continually validating and verifying the effectiveness of current security controls.

Conducting only overly complex penetration tests is counterproductive if basic security measures are not robust enough to thwart publicly available threats like web shells, Mimikatz, or commonly used malware. Moreover, if your security architecture fails to detect or counter basic attack techniques such as 'Pass-the-Hash' or other anomalous activities, the value derived from a complex penetration test would be limited. This does not mean organisations should only do extremely basic tests either with automated penetration testing tools like a Nessus scanner. The focus should be on incrementally strengthening the security posture while ensuring that foundational controls are both effective and resilient.

The primary objective of penetration testing is not to assign blame or find faults in the existing security setup, but to improve overall security measures. Security controls can fail, and human errors are inevitable; the focus should be on developing mitigating strategies to reduce the associated risks and impacts of such occurrences.

n Casey Brooks

n Casey Brooks

Powering shipping’s emissions-cutting ambitions

Keynote panel topic: The cost of decarbonisation & who is going to pay?

Topics to discuss with the keynote panel will include carbon levy funding, funding for investment, national incentives, funding for new technology & hypothecation.

Gain insight from industry experts on:

Fuel and retrofit solutions for 2030 Safety challenges for new technology

LNG beyond transition

Ammonia / Methonal / Liquefied hydrogen

Carbon capture

Advances in lubrication

Meet and network with 200 CEOs and technical directors from ship owning, operating and management companies, and senior executives from classification societies, policy makers, shipbuilding, fuel, equipment and technology suppliers.

Visit: motorship.com/PFFBOOK

Contact: +44 1329 825335

Email: conferences@propulsionconference.com

THE Media partner:

Media supporters:

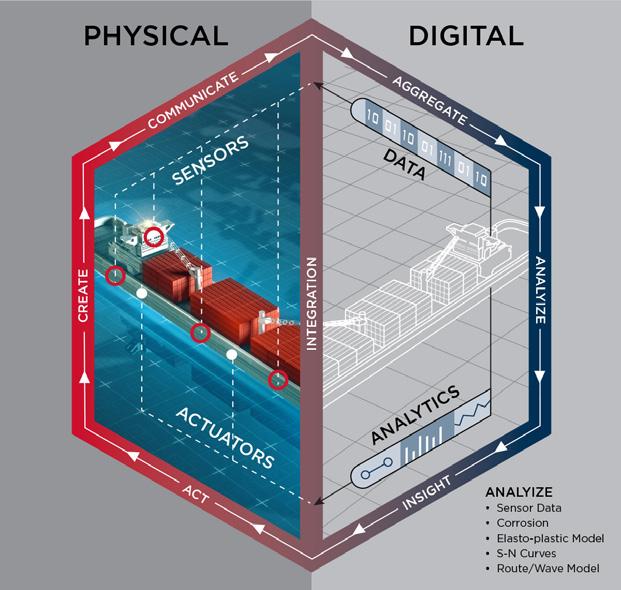

The growth of connectivity infrastructure, sensor capabilities, cloud and edge computing power and AI systems are combining to drive the evolution of digital twins. The Motorship spoke to Gareth Burton, VP Technology at ABS, about what it means for class and shipowners

A digital twin is a tool to accomplish one or more outcomes, with its construction dictated by the intended use, explains Gareth Burton, VP Technology at ABS. It is comprised of three key elements. First is a single instance of a physical asset. In the marine environment, the physical asset can comprise hull, machinery or control systems or their combinations. Second, it requires a virtual representation, which is comprised of digital models and visualisations, including related processes and environments, as needed. Thirdly, it requires a means of information exchange between the physical asset and the virtual representation used to update the models or provide feedback to change the operation of the physical system.

As a class society, ABS is involved in building and using digital twins to support class activities. These include supporting vessel-specific risk profiling to guide future survey activities, verification and validation of client and third-party digital twins to ensure they are valid for use in ABS class business models.

ABS is a mission-based organization focused on promoting the security of life and property and preserving the natural environment, says Burton. “New digital technologies provide insights into the health and performance condition of the assets based on their service history and operational parameters, enabling more targeted and focused surveys, thereby enhancing the safety of the vessel and its operations. As vessels become more complex, digital twins have an increasingly important role in the safety of physical assets.”

A key focus for ABS is the use of lifecycle digital twins where the twin is designed and built in parallel with the vessel and delivered in tandem. The digital twin is then updated and maintained throughout the vessel’s operational life cycle. “The outcomes of a lifecycle digital twin are measured in optimised acquisition costs, increased reliability and operational flexibility and a reduction in the total cost of ownership,” says Burton.

ABS has several ongoing use cases for digital twins throughout the vessel lifecycle, with topics including calibration of fuel consumption models, health state monitoring of critical machinery, digital twins in support of virtual commissioning and life extension of vessels through detailed tracking of load and condition of the hull.

Ongoing activities also include utilising digital twins to track and forecast hull condition and exposure for integrity management and survey planning.

ABS is currently delivering a condition-based program for US government vessels that uses digital twins for predictive compliance monitoring for better survey planning and execution. It further supports improved maintenance and availability planning for the client and enables optimised operations based on fleet balancing and operational ranges.

“What makes the digital twin unique from other tools, such

as condition monitoring, is that a digital twin’s capability and understanding continue to evolve and mature, making it able to achieve a better understanding of overall health and performance state,” says Burton. “Traditional condition monitoring approaches, while proven, simply monitor a parameter related to a certain condition or failure mode to a prescribed, static threshold.”

Asked what would be the most important considerations for shipowners considering digital twin use cases, Burton says: “The first point for discussion is to develop robust use cases and the identify if there is sufficient data available to support these use cases. There also needs to be a team available to the owner that is able and willing to support and sustain the use of the digital twin.

“Shipowners need to start with a well-defined intended use case or at the very least a statement and understanding of the problem they are trying to solve. Part of that process is making a determination if a digital twin really is the right tool to solve that problem.

“Once the owner has determined that a digital twin is the right approach for their problem, the next step is to focus on where they will be able to get good, usable data. This is currently one of the biggest challenges of creating a digital twin and one that needs to be resolved. This requires the creation of a strong set of requirements for the capability, accuracy and usability of the digital twin.”

For chief engineers, a digital twin is to some extent, just another tool for them to understand how their vessel is operating and support taking decisions based on data, says Burton. “They need to understand and embrace this technology – while there may be some resistance to adopting and relying on this technology, as there are with other changes - this is the future for large capital-intensive assets, leading to an easier and more informed work process.”

A customised future

ABS has several areas of ongoing research related to digital twins. “We are investigating Reduced-Order Modelling approaches on hull structures with the goal of optimising accuracy and the number of sensors to provide data points. This enables us to maximize the inferred knowledge from a limited sensor set, which helps reduce the burden associated with sensor installations while maximizing the accuracy of the computed vessel response.

“We are developing a Verification and Validation framework to improve trust in the credibility of multiple types of digital twins for their intended use cases, both our own Digital Twins and those of third parties.”

Different streams of data can be used to build, customise and optimise asset-specific health and degradation models. “We are ingesting many types of structured and unstructured data and conducting research in techniques such as data fusion, machine learning, AI and the use of natural language processing to support these processes.

Future visualisation

“In addition, at ABS, we are leveraging the use of visualisation technologies to collect data, which can then be used to enhance the fidelity of the digital twin.” In the future, this could include a digital twin metaverse that could connect various digital twins, AI and advanced simulations to optimize decision-making across all assets. Visualization technologies, such as virtual reality (VR), augmented reality (AR), and mixed reality (MR), could then enable a fully immersive experience for users in the digital twin metaverse.

VR, AR and MR could work with edge computing and digital twins to provide visual information for systems that cannot be perceived directly, such as the inner workings of an operating pump. This information could provide an in-depth understanding of a system and be used for operational decision-making as part of a condition-based maintenance program.

Human-level decision making

Expanding on future potential, Burton points to the report Technology Trends: Exploring the Future of Maritime Innovation that ABS released late last year. This forecasts that initially, real-time monitoring will support human-level decision making, such as voyage optimisation, fuel management, maintenance timing and decisions regarding remaining life. In time, though, digital twin systems are expected to reach selflearning and self-awareness benchmarks that will form the foundation of fully autonomous functioning.

As digital twin technology advances alongside improvements in connectivity, computational power and machine learning, digital twins will be capable of proactively seeking relevant data from potential inputs, such as sensors, drones or video systems. It could then choose data and continuously update its own model. With enough awareness, the twin could model its own environment and account for possible outside variables during decision-making. Key steps will include self-replication

for multi-physics, multi-data model simulations and communicating with other digital twins and Internet of Things (IoT) systems to gather even more data.

“As digital twin technology advances and achieves elements of cognition, such as perception, comprehension, memory, reasoning, prediction, reaction and problemsolving, it has the potential to enable fully autonomous functions with zero human input — making optimal databased decisions for the asset in various situations.”

The report further expects that a vessel-based digital twin could eventually connect with twins across industries to integrate with cargo and port operations, transportation logistics and commercial operations to enable more efficient global commerce. As owners start to allow their twins to communicate with other twins, they could then collaborate as a single interconnected entity, like a swarm. Swarm digital twins could therefore potentially be made up of hundreds of digital twins acting as a single, interconnected entity. Members of the swarm could subtly influence each other to predict behaviour for the entire swarm and optimise the whole system. A possible use case is autonomous tugs working together to tow a vessel.

As the report states: “Steamships ushered in a new era of global trade 200 years ago. Today, we stand at the precipice of not just a singular leap forward, but a watershed of emerging technologies that will revolutionize the marine and offshore industries.”

We are developing a Verification and Validation framework to improve trust in the credibility of multiple types of digital twins for their intended use cases, both our own Digital Twins and those of third partiesn Gareth Burton

Methanol is making its way into IGF Code training programs, but there’s a broader evolution underway for STCW training

Earlier this year, training specialist Aboa Mare announced the development of a tailor-made IGF Code training program for crews on Maersk’s methanol-powered newbuildings. The expansion of methanol training in the industry was also highlighted in August, when Kongsberg Digital announced delivery of a full mission K-Sim engine simulator package to Danish training company Maskinmesterskole in February 2024 that will include modelling of a hybrid passenger vessel with four methanol dual-fuel generators.

With a new generation of new-fuel and dual-fuel engines coming to market and the expansion of IGF Code training to methanol comes the question of whether the industry supports the idea of expanding the scope of IGF Code refresher training to cover practical engine specific training?

Mr Tony in’t Hout, Director of Glasgow-based training consultancy Stream Marine Technical, says it would be a good idea. “Many of the engines used on IGF Code vessels have unique features and components that you do not find on conventional-fuelled engines. These unique features are best explained on a manufacturer-specific course.

“The best people to guarantee a suitable level of training are the equipment manufacturers themselves,” he says, and training covering the unique equipment other than engines found on IGF-fuelled ships should also be included.