22 minute read

Lube rates and GHG emissions

LUBRICATION OPTIMISATION KEY TO REDUCING GHG EMISSIONS

Rathesan Ravendran, Technology and Innovation Specialist, Hans Jensen Lubricators A/S discusses how cylinder lubrication oil consumption contributes to GHG emissions

Annual greenhouse gas emissions from shipping exceeded 1 billion tons in 2018. While this only constitutes 2.9 % of global emissions, it exceeded the annual emissions from Germany, the largest single emitter in the European Union.

The current prediction is that significant part of the emission reduction can be achieved by changeover to green fuels such as ammonia, methanol and bio-fuels as well as technologies as wind-assisted propulsion and CO₂ scrubbers. Adapting these measures is however not enough to reach a fully carbon neutral vessels. There are several hidden sources on board vessels contributing indirectly to GHG emissions – and a significant contributor is cylinder lubrication oil.

Hans Jensen Lubricators A/S have been working on this topic for many years, and delivered products that reduce lubrication oil consumption and environmental impact for vessels. The products are in continues development in order to meet the needs and requirements from the market. This article highlights the emissions related to cylinder lubrication, and how it is possible to reduce these by efficient lubrication.

Emission related to lubricating two-stroke marine diesel engines

Cylinder lubrication is essential for the performance of twostroke diesel engines. It is the key component controlling the friction loss and wear on the cylinder liner and piston rings, by providing a thin oil film between the sliding interfaces.

Increasing the dosage of lubrication oil does not mean less frictional losses and wear. It is as damaging as low oil dosage, as well as an environmental problem due to engine smoke formation and oil sludge production, which is naturally increased with the lubrication oil consumption. Therefore, balancing lubrication oil becomes important part of an engine when aiming at enhancing lubrication performance and reducing its contribution to exhaust gas emissions.

Mechanical effi ciency (reduced friction)

Proper lubrication has a significant impact on the mechanical efficiency (reduced friction), which have a direct contribution to reduced emissions, including CO₂ emissions. The less engine friction, the less energy is required to propel the vessel, the less fuel is burned. Consequently, fewer emissions are created.

Friction losses that occur at liner/ring interface led to loss in propulsion power. Research has shown that this interface contributes to about 20% of the engine’s total mechanical frictional loss. Another source for power loss comes from insufficient gas seal by the lubrication oil between cylinder liner and piston rings, which will lead to reduced compression pressure.

Engine component life time

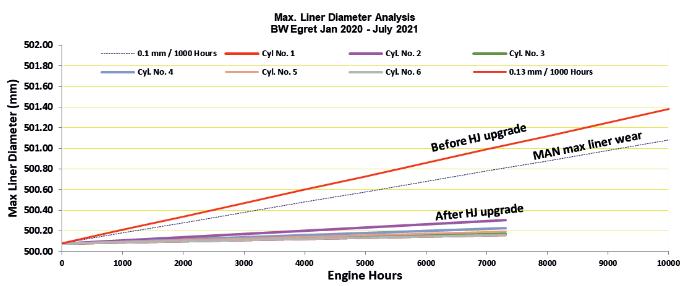

Proper lubrication can extend the lifetime of cylinder liners and piston rings. Figure 1 shows the results from a test project on the vessel BW Egret, where the lifetime of the cylinder is increased by a factor of 4.6. Extending component lifetime have an additional impact on CO₂ emissions, which are related to the production and logistics of the components.

Wear near the top-dead-center (TDC) is often the limiting factor for the lifetime of engines. High wear rates are caused by abrasive and adhesive wear which is highly influenced by the engine operating conditions of the engine. Today, engines are exposed to tougher conditions with the low-sulphur fuels, since sulphur in the fuel have a beneficial tribological effect due to build-up of a solid lubricating oil film and due to promoting a beneficial mild corrosive wear. The lost lubricity of the low sulphur fuel must be replaced by conventional cylinder lubrication oil, distributed correctly on the cylinder liner.

Lubrication oil consumption

Lubrication oils are formulated to uphold sufficient performance in a very hostile environment inside the marine engine. Lubrication oils are therefore complex and containing a lot of different components. Paraffinic base oil is used because it has a good oxidation resistance, good thermal stability, low volatility, good demulsibility, and a high viscosity index. The additive package consists of various components, each of them having specific properties and functions e.g., acid neutralization.

As cylinder lubrication oil for marine diesel engines are only a once-through oil, it is necessary to utilize its properties as efficient as possible in order to reduce oil consumption and thus environmental impact. While some emissions are produced from the lubrication oil’s primary usage of lubricating in the engine, however the majority of the emissions are related to the secondary fate of the lubrication oil. A part of the lubrication oil will combust/evaporate inside

8 Figure 1: Wear

rate pr. 1,000 main engine running hours before and after HJ Lubtronic 2.0 upgrade on BW Egret. The results show that the wear rate is reduced from 0.13 to 0.028 mm/1,000 hours, which increases the lifetime of the cylinders to more than 90,000 hours

8 Figure 2:

In cylinder mechanisms connected to particulate emissions

the engine and release heat/energy. While another part will end up as oil sludge in the drain, which then will release emissions to the atmosphere in the waste treatment process.

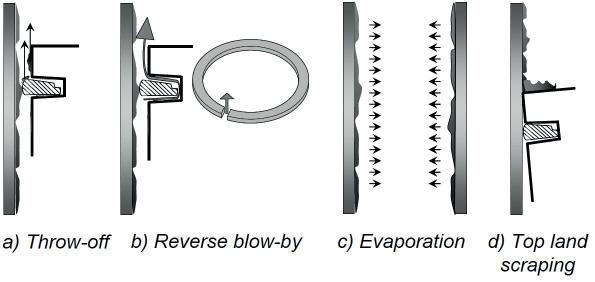

Particulate matter from cylinder lubrication oil

According to several studies, cylinder lubrication oil is a major contributor to a ship’s particulate emissions. It is reported that cylinder lubrication oil covers approximately 50% of the particulate emissions. There are several mechanisms connected to the particulate emissions; 5 Oil throw-off: Oil on the piston is driven towards the combustion chamber by inertia forces. 5 Gas flow and reverse blow-by: Oil is driven by pressure to flow towards the combustion chamber. 5 Evaporation: Oil on the piston and cylinder liner degrades and evaporates from hot surfaces. 5 Top-land scraping: Oil is scraped from the cylinder liner by the piston top land or, more likely, by carbon deposits on the top land.

Studies show a linear relation between cylinder lubrication oil feed rate and particulate matter. This means that a reduction in the consumption of cylinder lubrication will directly lead to less particulate emissions.

Technology measures for reducing emissions from lubrication oil

Achieving optimal lubrication oil consumption is highly prioritized by Hans Jensen Lubricators, meaning optimal cylinder condition clear from deposits, reduced wear of piston rings and cylinder liner as well as lowest possible cylinder oil consumption and thereof minimal emission. This is achieved by is achieved by: 1. Injecting lubrication oil at each piston stroke. This will refresh the oil film at each piston stroke and thereby minimise the stress level and degradation of the oil film on the cylinder liner. 2. Injecting only the required amount of lubrication. This will reduce excessive oil in the cylinder that will be exposed to evaporation, oil throw-off and top-land scraping. Furthermore, also preventing accumulation of oil additives, such as calcium carbonate particles which will lead to scuffing. 3. Optimal distribution of the lubrication oil at the cylinder liner. Especially, at the top of the cylinder where the wear and stresses on the oil film is highest due to temperature, pressure and corrosive environment.

All abovementioned design criteria for the lubrication system will ensure efficient utilization of the injection lubrication oil, and thereby low lubrication oil feed rates and emissions can be achieved.

For this purpose, the HJ lubrication systems operates with automated stepless stroke adjustment and timed lubrication. Combining lubrication systems with SIP injection principle is said to ensure good engine condition. This is when lubrication oil is injected as a spray, directing the lubricating oil upwards and into the engines scavenging air.

Case Story

A field test has been conducted for a year to demonstrate the effect of HJ Lubtronic 2.0 SIP system in collaboration with ”K” Line Bulk Shipping on 10 vessels. For the entire field test period, the engine has been operating on LSFO and lubrication oil of 70 BN. The main engine condition has been evaluated by scavenging-port inspections.

The result is summarized in Figure 6, where it is shown that the feed rate before installation was between 0.8 and 1.4 g/ kWh, and with HJ SIP technology all vessels have reduced the feed rate significantly and are targeting 0.5 g/kWh.

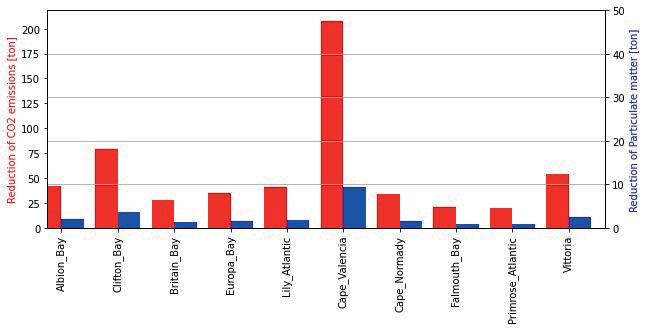

Through expertise in engineering impacts and modelling, together with a robust database of marine diesel engines, HJL has been able to calculate the impact of lubricant on CO₂ emissions and particulate matter reduction across the vessels.

Besides yearly savings of approximately US$400,000, K-line benefits from the improved cylinder lubrication by achieving yearly reductions across all 10 vessels in direct CO₂-emission of approximately 600 tons and particulate matter of 25 tons (Figure 7). This enables ship-owner to pick up cash savings as well as be a part of the transition towards greener shipping.

8 Figure 4: Yearly

reduction of CO₂ and particulate emissions achieved by optimizing lubrication oil consumption with HJ lubrication system

8 Figure 3:

Summarized test results of the lubrication oil optimization project conducted in collaboration with ”K” Line Bulk Shipping on 10 vessels

RETROFITS CRITICAL TO DECARBONISATION GOALS

Retrofi ts need to be a major focus if the industry is to meet 2050 targets, says Ulrik Dan Frorup, Chief Commercial Director at Bureau Veritas Marine & Off shore

Shipowners are already fi nding it challenging to meet decarbonisation goals – many are resorting to engine speed limitations as the only economically viable way they can see to meet 2023 goals, knowing of course, that this won’t get them anywhere near 2050 goals, or even 2030 goals. Shipyards are currently fully booked, so newbuilds are not a viable option in many cases either.

This highlights the need for retrofit solutions that can be applied to the existing fleet and offer a financially viable way to ensure its compliance, now and in the long term. At Bureau Veritas, we recently granted Approval in Principle for one such promising concept - combining LNG fuel and the upsizing of large container ships as an innovative way of reducing emissions while also building a strong business case by increasing the vessel’s lifetime and cargo capacity.

The concept was developed by GTT, Alwena Shipping, and COSCO Shipping Heavy Industry Zhoushan shipyard. BV confirmed the concept of the retrofit being in compliance with Classification requirements, as well as the layout of the LNG fuel containment system and gas fuel supply system, supported by an auxiliary safety system in accordance with the IGF Code and BV Rule NR 529.

The retrofit and upsizing is deemed a major modification. It involves cutting the vessel in two and integrating an additional 28-metre hull block containing a 12,000-cbm membranetype LNG fuel tank, topped by a gas handling system and with an additional 1,100 teu cargo capacity above that. The block is the maximum size that can be safely floated in to be welded to the fore part of the vessel before all three sections are welded together and the vessel floated back out of drydock.

While their first LNG and upsizing concept has focused on a 14,000 teu vessel, the development partners believe it is suitable for 11-13,000 teu vessels of the same width. Compared with an equivalent container ship powered by conventional fossil fuel, the converted vessel would reduce CO2 emissions by around 23% over an 83-day Europe-Asia return trip (port calls included).

Increasing cargo capacity to boost payback of LNG

A major aim of the upsizing concept was to demonstrate that the increased cargo capacity could reduce the payback period of the conversion. The increased length of the ship, combined with the LNG conversion of the propulsion and electrical generation systems, enables a reduction in the operating costs that limits the financial impact of the immobilisation period required for the retrofit. The project partners anticipate a payback time of less than six years, although this could be shorter still given the buoyant market and current demand for container shipping.

The concept builds on the experience

gained converting Hapag Lloyd’s 15,000 teu Sajir (renamed Brussels Express) to gas operation in 2020 at Huarun Dadong Dockyard in Shanghai. In this case, the vessel was not extended, but there have been other successful extension projects for owners such as MSC and CMA CGM. Considering the outcome of the concept, it is recommended that shipowners commence the engineering design 18 months prior to a vessel’s annual special survey to meet the emissions targets set by the IMO. The $40-41 million project is anticipated to take up to 24 months. This includes about six months for the detailed design, three months for classification, and 126 days for the vessel to be out of operation including a 42-day stay in drydock to install the new block, which would be built in advance. Block construction should not be a significant constraint as, for example, Korean yards have indicated they are interested in building blocks with LNG tanks and offering them to other shipyards.

The potential of LNG

At BV, we see LNG as a key transition fuel on the route to zero carbon. Experience gained in LNG will be leveraged to develop ship powered by zero-carbon solutions, notably in hydrogen and ammonia. vessel would Almost one third of vessels on order today are slated ver an 83-day to run on LNG. This widespread adoption has been ded). possible thanks to better infrastructure throughout the LNG value chain, excellent safety track record, making LNG an attractive option for retrofit as well. It offers shipowners a solution to comply with the environmental regulations being adopted by the IMO up to at least 2045 by reducing emissions by six grams of CO2 per tonne per nautical mile. The sustainability transition is characterised by a fast-evolving commercial, technological and regulatory landscape, and ensuring compliance with upcoming regulations is a major challenge for the industry. BV is proud to support companies in their sustainability journey whatever their starting point, identifying the best solutions for each vessel taking into account the nature of their fleets and o operational context.

back of LNG

was to cargo eriod h of G d , n nd nce

8 The new

concept combines LNG retrofi t and jumboisation for large container ships

p zero-carbon s

Almost o to run on possible t the LNG v makin we w

LARGEST ETHANE CARRIER BOOSTS US SHIPMENTS

Pioneer in regular, inter-continental shipments of ethane, the UK global petrochemicals and plastics group INEOS has given new dimension to its logistic and trading activities through the entry into service of the 99,000m3-capacity liquefi ed gas carrier Pacifi c INEOS Belstaff, writes David Tinsley

Built by Jiangnan Shipyard, the vessel is the largest ethanecapable gas tanker to date, and provides an opening reference for a Chinese-developed cargo containment system based on IMO Type B cryogenic tanks. She will be primarily engaged in the traffi c from the USA to Europe and China.

Two such carriers, powered by dual-fuel, two-stroke propulsion machinery, were contracted at Jiangnan by Chinese leasing specialists for assignment to the fleet controlled by Pacific Gas(Hong Kong), part of the stateowned Shandong Marine Group. Under INEOS long-term agreements with the Hong Kong-based operator, Pacific INEOS Belstaff and her soon-to-be-delivered consort Pacific INEOS Grenadier will transport feedstock to new crackers in northern Europe and China.

Adoption of the Jiangnan Shipyard-developed BrilliancE Type B cargo containment system in the prestigious new ship emphasises the growing technological self-reliance of China’s maritime industrial sector. The four independent, diamond-shaped tanks have been manufactured from 5% nickel steel and feature multi-layer insulation panels and sophisticated leakage detection and mitigation measures.

The vessel has been built to dual class requirements of China Classification Society(CCS) and American Bureau of Shipping(ABS). The latter granted approval in principle(AiP) for the cargo system design in September 2019, having been involved with Jiangnan’s engineers from the outset.

The design provides for a minimum cargo temperature of minus 104degC, which brings ethylene transportation within the realm of the new ships as well as affording ample margin for the carriage of ethane, which has a boiling point of minus 88.5degC, and for general trading in LPG, such as propane and propylene, maintained in a liquid state at minus 48degC. The vessel type marries record-breaking scale with cargo flexibility, providing the operators with the means to adapt to an evolving, global market.

The BrilliancE solution has been devised to optimise underdeck volume by fitting closely to the ship’s external shape. Other key objectives of the design project included a solution that would impose no liquid loading level restrictions and leave minimal cargo residue post-discharge, while ensuring high reliability, long structural fatigue life, and low maintenance costs.

8 A Chinese

technological feat: Jiangnan-built 99,000m3 ethane carrier with home-grown Type B tank system

The new entrant to the Pacific Gas fleet embodies the VSBow, conceived by the shipyard and proven in existing vessels to enhance speed-keeping performance in adverse wave conditions.

Pacific INEOS Belstaff has a dual-fuel, two-stroke propulsion engine of the ME-GIE type developed by MAN Energy Solutions, capable of ingesting cargo condensate, or the natural ‘boil-off’ that occurs during transportation. Competitive both in fuel oil and gas consumption, and derived from the ME-GI gas-injected engine, the GIE version offers operational stability and efficiency due to the use of the diesel principle.

The model employed is a six-cylinder G60ME-C9.5-GIE, specified at a rating of 13,972kW at 88.3rpm, providing direct drive to a fixed pitch screw supplied by Dalian Marine Propeller. The installation was manufactured under licence by Hyundai Heavy Industries and incorporates high-pressure, selective calalytic reduction(SCR).

Three gensets of 1,720kW apiece have been supplied from the same source, complemented by a permanent-magnet shaft generator delivered by WE Tech and designed to give an output of 2,300kW. In PTO mode, the proprietary WE Drive enables the propulsion machinery to operate in combinatory/ variable speed while the direct-drive PM generator produces power for the ship’s electrical net.

UK-developed technology in the shape of Babcock LGE’s ecoETHN cargo handling and fuel gas supply system has been adopted for the Pacific Gas ships. The ecoETHN solution allows the carriage of higher methane-content ethane cargoes by integrating the vessel’s reliquefaction system with engine fuel gas supply. It enables the reliquefaction of ethane/methane boil-off gas from the cargo for use as fuel in the main machinery and auxiliaries. Moreover, by harnessing the methane component specifically as an energy/fuel source, the methane element of the cargo is reduced during the voyage, such that ethane cargoes can be delivered at a higher purity than when originally loaded.

On a typical voyage carrying a single-grade ethane shipment from the USA to China, ecoETHN will reduce the reliquefaction requirements, necessitating operation of only one reliquefaction unit for significant periods. Through contracts with Babcock LGE and Jiangnan Shipyard, the Norwegian firm Hoglund Marine Solutions supplied the vessel’s integrated automation and gas management systems.

Pacific INEOS Belstaff takes the INEOS-engaged fleet to 11 vessels. Two other VLECs, the 85,000m3 sisters JS INEOS Marlin and JS INEOS Dolphin, were constructed by Dalian Shipyard and introduced during 2019-2020, while eight 27,500m3-capacity, Chinese-built Dragon-class, multi-gas tankers have been bringing ethane eastward across the Atlantic since 2016. The UK industrial group expects the next newbuild from Jiangnan, the 99,000m3 Pacific INEOS Grenadier, to make her debut during the spring.

The ethane shipped from the USA is a by-product of shale gas extraction. Among the highlights of the current industrial investment programme of INEOS is the project to build a new ethane gas cracker and propane dehydrogenation(PDH) unit for the production of ethylene and propylene in Antwerp. The EUR3bn(US$3.2bn) scheme represents the biggest expenditure in the European chemicals sector for about 25 years, and will reinforce the city port’s position as Europe’s leading petrochemical cluster and transport hub.

It is claimed that the ethane cracker will have the lowest carbon footprint in Europe, at three times less than the average European steam cracker and half that of the 10 best performing crackers. The target date for operational start is 2026, as construction will take approximately four years.

Pacific INEOS Belstaff and Pacific INEOS Grenadier signal the start of a more extensive new chapter of production at Jiangnan Shipyard, where two 93,000m3 ethane tankers of the Panda design are also under construction for Tianjin Southwest Marine. In addition, Wanhua Chemical Group has contracted for two ethane carriers of the 99,000m3 design using BrilliancE containment, to be delivered during 2025. Wanhua has options on a further pair.

Contract signing with Pacific Gas took place at the end of 2019, and Pacific INEOS Belstaff was handed over on 31 December 2021. Jiangnan and the suppliers involved have shown their mettle in achieving a two-year order-to-delivery timeframe for a first-of-class at such scale and technical complexity.

PRINCIPAL PARTICULARS - Pacifi c INEOS Belstaff

Length overall 230.0m Length bp 226.0m Breadth, moulded 36.6m Depth, moulded 22.5m Draught, scantling 12.8m Deadweight 60,227t Gross tonnage c.60,000t Displacement 82,572t Cargo capacity 99,000m3 Cargoes Ethane, ethylene, LPG Main engine power 13,972kW Speed, design 16kts Block coefficient 0.76 Generator sets 3 x 1,720kW Shaft generator 2,300kW Class ABS/CCS ABS class notations +1A1, Liquefied gas carrier with independent tanks, +AMS, +ACCU, CPS, SH, SHCM Additional notations CRC, RRDA, SC-PL, SP, UWILD, RW, DFD-Ethane, NBLES, BWE, BWT, Enviro, DM-A, IHM, TCM

Registry

Hong Kong

ETHANE

Ethane(C2H6) is the second largest component of natural gas following methane.Extracted from natural gas, or as a by-product of petroleum refining, ethane serves predominantly as a feedstock for the production of ethylene, used as a basic component in the manufacture of many chemicals and plastics. The US shale gas revolution has created plentiful supplies of competitively-priced ethane.

What’s in the name?

BELSTAFF

The new ship has the Belstaff symbol and slogan ‘Built for Life’ emblazoned on the hull sides. Belstaff is a contemporary, luxury clothing brand originating in the UK and owned by INEOS since 2017.

GRENADIER

The Grenadier is a robust, 4x4 utility vehicle developed by INEOS Automotive, to fill the market gap left by the 2016 ending of production of the older model of Land Rover Defender. The Grenadier is set to go into volume manufacture this year at the company’s Hambach factory in France.

JAPAN LOOKS WESTWARD

In March 1972 a number of articles examined the Japanese industry, which was beginning to dominate the shipbuilding world.

Representatives from Japan’s equipment companies had carried out a tour of European shipyards, looking for interest from European export customers. Japanese yards had previously relied on imported machinery and equipment from Europe, including engines built to European designs under licence in Japan. It was recognised that European products were familiar, and often seen as cheaper and better quality, but Japan was determined to change that.

As a result, the Japanese delegation returned home with the view that if price and quality were right, Japan could sell its products to European customers. However, it had to ensure that after-sales service could be provided, that Japanese products would be compatible with European items, delivery costs for larger and heavier items could be controlled, and that Japanese OEMs were represented by knowledgeable and respected European agents.

Japanese shipbuilding continued to develop, the yards endeavouring to offer quick delivery schedules and high-quality workmanship. Mitsui’s ‘Rotas’ system was beginning to show its worth – this being a conveyor-belt style approach, with blocks assembled under cover using rotating welding machinery – the idea being to turn shipbuilding from a labour-intensive to a technology-led exercise. The approach was believed to offer a 10% reduction in building time as well as improved quality.

Although most marine engines coming out of Japan were licensee-bult European designs, Mitsubishi’s own UE series was gaining favour, particularly in the medium-sized categories for domestic owners. The latest engines, known as the D series, offered a 15% increase in power over their predecessors. All UE engines were said to be designed for reliability, with high rigidity of major components, and carefully designed air and scavenging systems for optimum combustion. Interestingly, the UE range comprised both crosshead and trunk-piston designs. The latest versions were equipped with Mitsubishi’s own MET

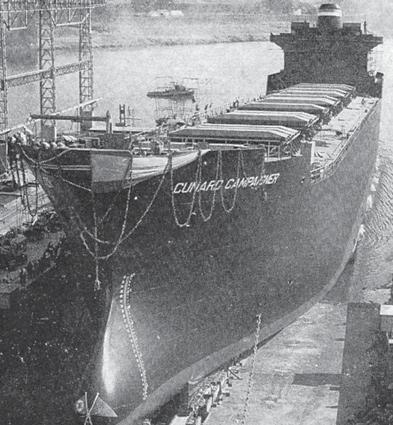

8 Bulk carrier Cunard Campaigner prepares for launch

at Astilleros Espanoles

non-water-cooled turbochargers, allowing efficient and reliable operation with low-grade fuel oils.

It was not only Japan that featured strongly 50 years ago. Articles looked at shipbuilding in both Spain and Greece. Thanks to mergers of leading Spanish yards, the national industry had built up a healthy order book, driven by the need for replacement of an ageing merchant fleet, and supported by generous government aid and credits. This meant that production had increased almost tenfold since the start of the replacement programme in 1956. The economies of scale achieved through mergers and investment in yards to build ever-larger ships had led to a growth in export orders, notably in bulk carriers and large tankers.

Greece was hoping to achieve similar success – it being noted that the nation was second only to Japan in shipbuilding expansion plans. However, many of these were lacking in certainty, with Greek owners in dry cargo and tanker markets suffering from dismal freight rates. It was hoped that a new licence agreement between Hellenic Shipyards’ Skaramanga yard – one of the few that was actually in existence and building new ships - and Italian engine designer Fiat would bring some firm backing for the ambitious plans. A few km away, Eleusis was building its first new vessel.

Finally, automation continued to attract interest. Although manufacturers were upbeat, owners still remained to be convinced. The systems themselves had proved mainly reliable, but crew needed to be trained properly in operation and maintenance. Some owners recognised the desirability of removing the human element, but were unconvinced of the overall cost benefits. Moreover, skilled and experienced engineer officers were still believed better able to deal with problems onboard than automatic systems, however comprehensively programmed.

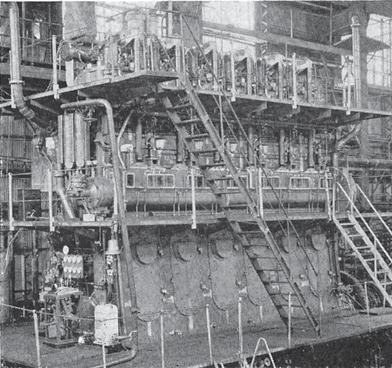

8 Mitsubishi’s 6 UEC 52/105D engine, rated 6,200 bhp

at 175 rpm

The international magazine for senior marine engineers

EDITORIAL & CONTENT

Editor: Nick Edstrom editor@mercatormedia.com

Correspondents

Please contact our correspondents at editor@motorship.com Bill Thomson, David Tinsley, Tom Todd, Stevie Knight, Wendy Laursen

Production

David Blake, Gary Betteridge production@mercatormedia.com

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Brand manager: Sue Stevens sstevens@mercatormedia.com

Marketing marketing@mercatormedia.com

EXECUTIVE

Chief Executive: Andrew Webster awebster@mercatormedia.com

TMS magazine is published monthly by Mercator Media Limited Spinnaker House, Waterside Gardens, Fareham, Hampshire PO16 8SD, UK

t +44 1329 825335 f +44 1329 550192

info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@motorship.com or subscribe online at www.motorship.com Also, sign up to the weekly TMS E-Newsletter 1 year’s magazine subscription Digital Edition: £GBP177.00

© Mercator Media Limited 2022. ISSN 2633-4488 (online). Established 1920. The Motorship is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered offi ce: Spinnaker House, Waterside Gardens, Fareham, Hampshire PO16 8SD, UK