DRAFT

Source Comments Year Requested Projected Sewer Fund Operating Budget 202419,000 $ 19,000 $ 2025 -2026 -2027 -2028 -19,000 $ 19,000 $ Uses Comments Year Requested Projected WWTP Polaris UTV 2024 19,000 $ 19,000 $ 2025 -2026 -2027 -2028 -19,000 $ 19,000 $

Page 81

Purpose: Source Comments Year Requested Projected Sewer Fund Operating Budget 2024775,000 $ 775,000 $ Sewer Fund Operating Budget 202525,000 25,000 2026 -2027 -2028 -800,000 $ 800,000 $ Uses Comments Year Requested Projected WWTP Furniture Fixtures for Admin Bldg 2024 25,000 $ 25,000 $ WWTP Admin Building 2024 750,000 750,000 WWTP Decommission of old admin bldg - turn into storage 2025 25,000 25,000 2026 -2027 -2028 -800,000 $ 800,000 $ Capital Improvements Program 2024 - 2028 Sewer Fund - New Admin Building and Conversion of Current Building Page 82 DRAFT

Capital Improvements Program

2024 - 2028

Sewer Fund - Waste Water Treatment Plant Dump Station

Purpose:

This allocation provides for the construction of a temporary Dump Station at the Plant that would allow for debris holding/storage from the Flush Truck reducing the number of trips the truck would make to empty its contents out.

Source Comments Year Requested Projected Sewer Fund Operating Budget 2024150,000 $ 150,000 $ 2025 -2026 -2027 -2028 -150,000 $ 150,000 $ Uses Comments Year Requested Projected WWTP Dump Station 2024 150,000 150,000 2025 -2026 -2027 -2028 -150,000 $ 150,000 $

Page 83

DRAFT

Capital Improvements Program 2024 - 2028

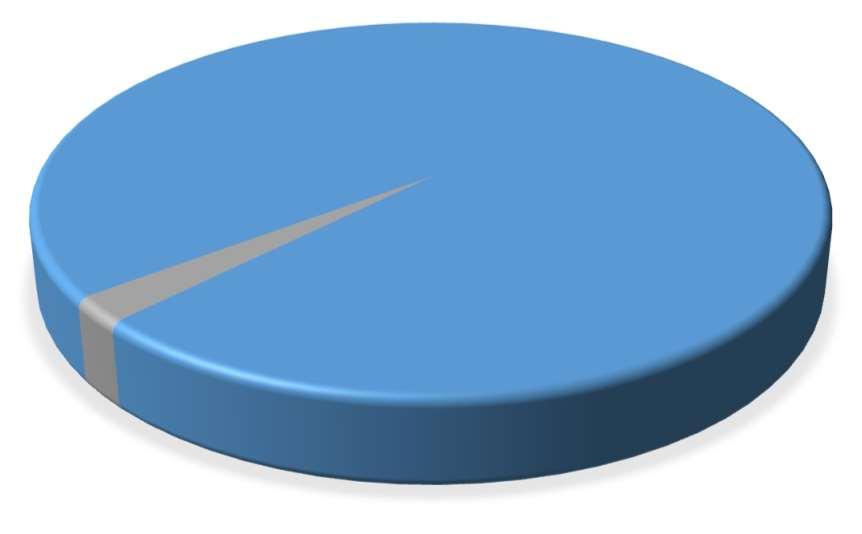

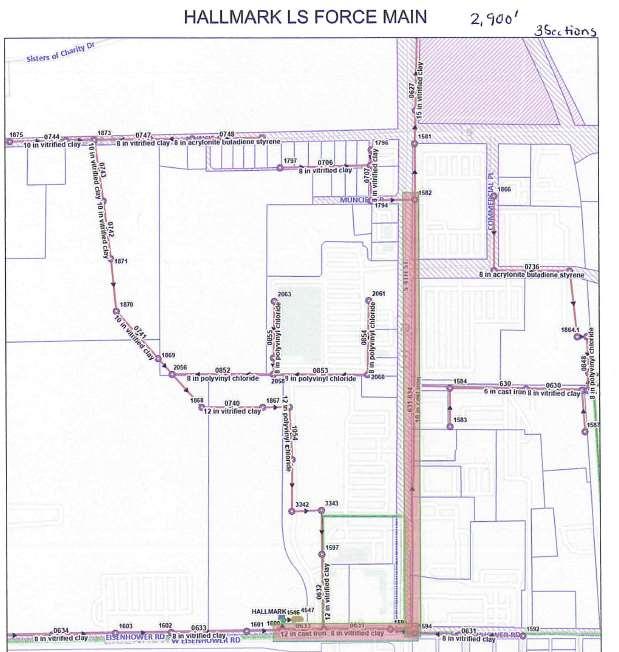

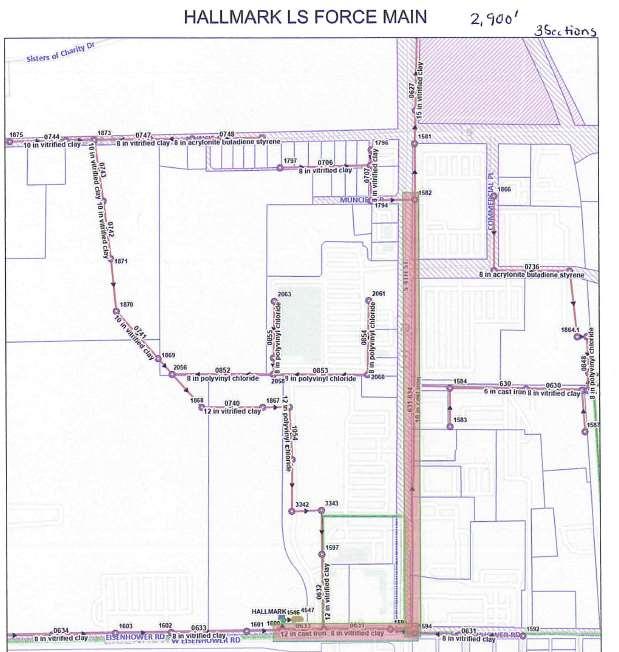

Sewer Fund - Sewer Line Maintenance at Hallmark

Purpose:

This allocation provides for the systematic repairs to sections of the force main by Hallmark. The original main was constructed in the 1970s and is currently in the process of being repaired to prevent failure.

Source Comments Year Requested Projected 2024 - $ - $ Sewer Fund Operating Budget 202590,000 90,000 2026 -Sewer Fund Operating Budget 202799,000 99,000 Sewer Fund Operating Budget 2028103,500 103,500 292,500 $ 292,500 $ Uses Comments Year Requested Projected 2024 - $ - $ Sewer Line Maint Hallmark Force Main 2025 90,000 90,000 2026Sewer Line Maint Hallmark Force Main 2027 99,000 99,000 Sewer Line Maint Hallmark Force Main 2028 103,500 103,500 292,500 $ 292,500 $

Page 84 DRAFT

Capital Improvements Program 2024 - 2028

Sewer Fund - Lift Station Pumps

Purpose:

Funding will provide replacement of critical pumps and motors at two lift station locations. Each location has unique motor sizes, length of lines, and pressures making it impracticle to maintain an inventory of replacement parts.

Source Comments Year Requested Projected 2024 - $ - $ 2025 -Sewer Fund Operating Budget 2026120,000 120,000 2027 -2028 -120,000 $ 120,000 $ Uses Comments Year Requested Projected 2024 - $ - $ 2025 -Sewer Line Maint Lift Station Pumps 2026 120,000 120,000 2027 -2028 -120,000 $ 120,000 $

Page 85

DRAFT

Capital Improvements Program 2024 - 2028

Sewer Fund - Trailer-Mounted Jetter

Purpose:

Funding will provide replacement of a 1980's flatbed truck with mounted harben pump on rear. Replacing this aging truck with a trailer-mounted unit will allow for increased mobility and enable crews to service hard-to-reach lines located in yards, fields, and parks that larger jetter trucks cannot reach.

Source Comments Year Requested Projected 2024 - $ - $ 2025 -2026 -Sewer Fund Operating Budget 202770,000 70,000 2028 -70,000 $ 70,000 $ Uses Comments Year Requested Projected 2024 - $ - $ 2025 -2026 -Sewer Line Maint Trailer-mounted

2027 70,000 70,000 2028 -70,000 $ 70,000 $

jetter

Page 86

DRAFT

Capital Improvements Program

2024 - 2028

Sewer Fund - Waste Water Treatment Plant Utility Storage Building

Purpose:

This allocation provides for the purchase of a 40' x 30' utility storage building to be constructed on the Plant grounds. This building will allow the safe storage of equipment that potentially have any leaking fluids and ensure EPA compliance and provide for the general security and preservation of housed equipment at the Plant.

Source Comments Year Requested Projected 2024 - $ - $ 2025 -2026 -Sewer Fund Operating Budget 2027300,000 300,000 2028 -300,000 $ 300,000 $ Uses Comments Year Requested Projected 2024 - $ - $ 2025 -2026 -WWTP Utility Storage Bldg 2027 300,000 300,000 2028 -300,000 $ 300,000 $

Page 87 DRAFT

Capital Improvements Program

2024 - 2028

Sewer Fund - Camera Replacement

Purpose:

This allocation provides funding for a replacement to the CCTV Camera Truck. The current truck was purchased in 2012 and its scheduled lifecycle runs through 2027. This camera truck allows crews to accurately diagnose issues, pinpoint repair locations, and reduce time for maintenance.

Source Comments Year Requested Projected 2024 - $ - $ 2025 -2026 -2027 -Sewer Fund Operating Budget 2028160,000 160,000 160,000 $ 160,000 $ Uses Comments Year Requested Projected 2024 - $ - $ 2025 -2026 -2027 -Sewer Line MaintCamera Replacement 2028 160,000 160,000 160,000 $ 160,000 $

Page 88

DRAFT

Capital Improvements Program

2024 - 2028

Refuse Fund - Roll-Off Container Purchases

Purpose:

This allocation provides for the purchase of four (4) roll-off containers Two (2) 40-yd containers will be used for collecting and hauling plastic from the recycling center, reducing the number of trips to the dump. Two (2) 30-yd containers would be used for a rental program for residents and would be a supplemental service offered to accompany the transition to poly-carts.

Source Comments Year Requested Projected Refuse Fund Operating Budget 202435,000$ 35,000$ 2025-2026-2027-2028-35,000 $ 35,000 $ Uses Comments Year Requested Projected Solid Waste Collection 2 x 30 yd & 2x 40 yd Containers 2024 35,000 $ 35,000 $ 2025-2026-2027-2028-35,000 $ 35,000 $

Page 89

DRAFT

Capital Improvements Program

2024 - 2028

Refuse Fund - Adjustable Rear Loader with Side Loader Refuse Truck

This allocation provides for the replacement of refuse trucks. Refuse trucks are scheduled to be replaced on a regular, rotating basis to keep maintenance costs low.

Source Comments Year Requested Projected Refuse Fund Operating Budget 2024201,500$ 201,500$ 2025-2026-Refuse Fund Operating Budget 2027205,224 205,224 Refuse Fund Operating Budget 2028209,496 209,496 616,220 $ 616,220 $ Uses Comments Year Requested Projected Solid Waste Collection Purchase refuse truck 2024 201,500 $ 201,500 $ 2025-2026-Solid Waste Collection Purchase refuse truck 2027 205,224 205,224 Solid Waste Collection Purchase refuse truck 2028 209,496 209,496 616,220 $ 616,220 $

Purpose:

Page 90

DRAFT

Capital Improvements Program

2024 - 2028

Refuse Fund - Office Trailer Replacement

Purpose:

Funding will provide replacement of the current office trailer at the Brush Site. The current unit is in extremely poor condition after 26 years of use. Originally slated to be replaced in 2018, the replacement was pushed back after prices for pre-owned trailers increased dramatically following the flood.

Source Comments Year Requested Projected Refuse Fund Operating Budget 202429,083$ 29,083$ 2025-2026-2027-2028-29,083 $ 29,083 $ Uses Comments Year Requested Projected Solid Waste Collection 202429,083$ 29,083$ 2025-2026-2027-2028-29,083 $ 29,083 $

Page 91

DRAFT

This allocation provides for the purchase to replace the front loader that is at the Brush Site. The front loader is also used often by the Street Department and occasionally by the Parks and Recreation Department.

Purpose: Source Comments Year Requested Projected 2024-$ -$ Refuse Fund Operating Budget 2025250,000 250,000 2026-2027-2028-250,000 $ 250,000 $ Uses Comments Year Requested Projected 2024-$ -$ Solid Waste Collection Purchase front loader for multiple uses 2025 250,000 250,000 2026-2027-2028-250,000 $ 250,000 $

Improvements Program 2024 - 2028

Fund - Front Loader

Capital

Refuse

Page 92

DRAFT

Capital Improvements Program

2024 - 2028

Refuse Fund - Sterling Roll-Off Chassis (Grapple Arm Compatible)

Purpose:

This allocation provides for the replacement of the roll-off truck that is equipped with grapple ready hydraulics. The current unit has over 150,000 miles on it. The truck is used to haul recycling and trash. It is also used to operate the grapple box for large item pick-up.

Source Comments Year Requested Projected 2024-$ -$ 2025-Refuse Fund Operating Budget 2026160,430 160,430 2027-2028-160,430 $ 160,430 $ Uses Comments Year Requested Projected 2024-$ -$ 2025-Solid Waste Collection Purchase Roll Off Chassis 2026 160,430 160,430 2027-2028-160,430 $ 160,430 $

Page 93

DRAFT

Capital Improvements Program

2024 - 2028

Storm Water Capital Projects Fund - Orange Fence Projects

This annual allocation provides for the improvement of storm water drainage throughout the City.

Source Comments Year Requested Projected Storm Water Impact Fee 2024290,000$ 290,000$ Storm Water Impact Fee 2025290,000 290,000 Storm Water Impact Fee 2026290,000 290,000 Storm Water Impact Fee 2027290,000 290,000 Storm Water Impact Fee 2028290,000 290,000 1,450,000 $ 1,450,000 $ Uses Comments Year Requested Projected Storm Water Improvement Projects selected annually 2024 290,000 $ 290,000 $ Storm Water Improvement Projects selected annually 2025 290,000 290,000 Storm Water Improvement Projects selected annually 2026 290,000 290,000 Storm Water Improvement Projects selected annually 2027 290,000 290,000 Storm Water Improvement Projects selected annually 2028 290,000 290,000 1,450,000 $ 1,450,000 $

Purpose:

Page 94

DRAFT

Capital Improvements Program

2024 - 2028

Storm Water Capital Projects Fund - Stream Bank Restoration Program

This annual allocation provides for the stabilization of stream banks and the replacement of failing stone arches throughout the City.

Source Comments Year Requested Projected Storm Water Impact Fee 2024258,000$ 258,000$ Storm Water Impact Fee 2025258,000 258,000 Storm Water Impact Fee 2026258,000 258,000 Storm Water Impact Fee 2027258,000 258,000 Storm Water Impact Fee 2028258,000 258,000 1,290,000 $ 1,290,000 $ Uses Comments Year Requested Projected Bank/Culvert Stabilization Projects selected annually 2024 258,000 $ 258,000 $ Bank/Culvert Stabilization Projects selected annually 2025 258,000 258,000 Bank/Culvert Stabilization Projects selected annually 2026 258,000 258,000 Bank/Culvert Stabilization Projects selected annually 2027 258,000 258,000 Bank/Culvert Stabilization Projects selected annually 2028 258,000 258,000 1,290,000 $ 1,290,000 $

Purpose:

Page 95 DRAFT

Capital Improvements Program

2024 - 2028

Storm Water Capital Projects Fund - Curb Inlet Replacement

This annual allocation provides for the replacement of curb inlets throughout the City.

Purpose: Source Comments Year Requested Projected Storm Water Impact Fee 2024100,000$ 100,000$ Storm Water Impact Fee 2025100,000 100,000 Storm Water Impact Fee 2026100,000 100,000 Storm Water Impact Fee 2027100,000 100,000 Storm Water Impact Fee 2028100,000 100,000 500,000 $ 500,000 $ Uses Comments Year Requested Projected Curb Inlet Replacement Projects selected annually 2024 100,000 $ 100,000 $ Curb Inlet Replacement Projects selected annually 2025 100,000 100,000 Curb Inlet Replacement Projects selected annually 2026 100,000 100,000 Curb Inlet Replacement Projects selected annually 2027 100,000 100,000 Curb Inlet Replacement Projects selected annually 2028 100,000 100,000 500,000 $ 500,000 $

Page 96 DRAFT

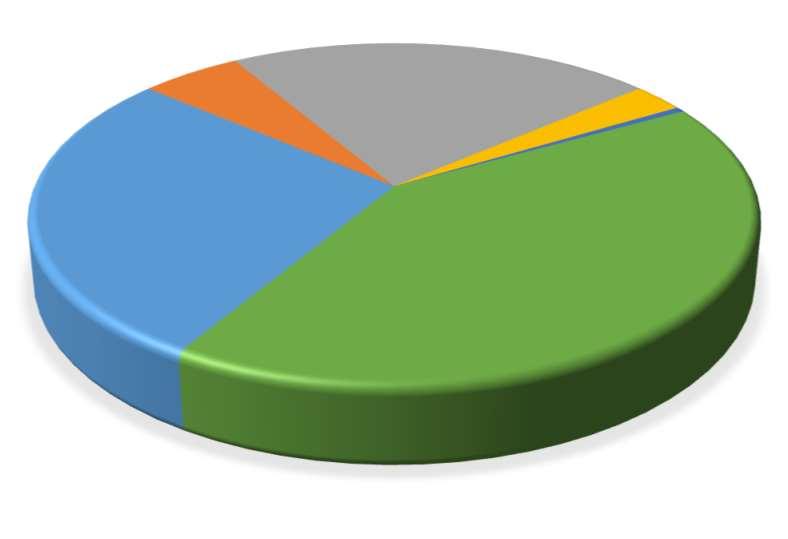

2024ProposedBudget 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget CIPSalesTax Fund Countywide SalesTaxFund 2024Proposed Budget-Sales TaxFunds Revenue TaxRevenue 5,897,387 5,745,800 6,104,509 6,366,296 2,785,727 3,580,569 6,366,296 IntergovernmentalRevenue - - - - - -Licenses&Permits - - - - - -ChargesforServices - - - - - -MiscellaneousRevenue 71,377 - - - - -BalanceForward(Reserves) - 3,567,136 6,728,233 4,058,004 1,732,071 2,325,933 4,058,004 TotalRevenue 5,968,764 $ 9,312,936 $ 12,832,742 $ 10,424,300 $ 4,517,798 $ 5,906,502 $ 10,424,300 $ Expenditures PersonalServices - - - - - -ContractualServices 46,648 - - - - -Commodities 59,021 - - - - -CapitalOutlay 289,567 - - - - -DebtService - - - - - -Miscellaneous(TransfersOut) 3,244,085 6,899,497 8,774,738 9,490,425 3,683,839 5,806,586 9,490,425 GeneralReserves - 2,413,439 4,058,004 933,875 833,959 99,916 933,875 TotalExpenditures 3,639,320 $ 9,312,936 $ 12,832,742 $ 10,424,300 $ 4,517,798 $ 5,906,502 $ 10,424,300 $ RevenueminusExpenditures 2,329,444 $ - $ - $ - $ - $ - $ - $ SalesTaxFunds 2024ProposedBudget:ByFund Page 97 DRAFT

CityofLeavenworth,Kansas SalesTaxFunds

CityofLeavenworth,Kansas

CIPSalesTaxFundProposedBudget

January1,2024-December31,2024

CIPExpensesDivision

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue TaxRevenue 290505150LocalSalesTax-CIP4008 2,604,268 2,585,800 2,685,038 2,785,727 Thisfundcollectslocalsalesandusetax. FundsaretransferredtotheCapital ProjectsFundortheBondFund,asneededtocoverbudgetrequirements. TotalTaxRevenue 2,604,268 $ 2,585,800 $ 2,685,038 $ 2,785,727 $ MiscellaneousRevenue 290505150SaleofEquipment 5806 2,465 - -290505150InsuranceProceeds 5865 68,912 - -290505150BalanceForward 5999 - 1,395,225 2,269,017 1,732,071 Projectedcashbalanceatthebeginningoftheyear TotalMiscellaneousRevenue 71,377 $ 1,395,225 $ 2,269,017 $ 1,732,071 $ TotalRevenue 2,675,645 $ 3,981,025 $ 4,954,055 $ 4,517,798 $ Expenditures ContractualServices 290505150LegalAdvertising 6453 75 - -290505150Building/GroundsM&R6802 46,573 - -ContractualServices 46,648 $ - $ - $ - $ Commodities 290505150Non-CapITEquipment7406 36,015 - -290505150Non-CapVehicleAccessories7507 3,447 - -290505150Non-CapFireEquipment7618 19,559 - -TotalCommodities 59,021 $ - $ - $ - $ CapitalOutlay 290505150ITEquipment 8306 92,432 - -290505150PoliceVehicles 8404 40,346 - -290505150HVACEquipment 8504 14,650 - -290505150TelephoneEquipment8513 61,539 - -290505150ParksEquipment 8515 14,607 - -290505150OtherEquipment 8599 65,992 - -TotalCapitalOutlay 289,567 $ - $ - $ - $ MiscellaneousExpenses 290505150TransToRecreationFund9202 1,110,864 1,710,636 1,710,636 1,768,887 TransfertoRecreationFundforrepairs,mtce.,andoperatingdeficit 290505150TransToStreetsFund9204 11,500 - -290505150TransToBond&InterestFund9220 532,412 352,065 561,728 557,878 Transferto2023DebtServiceforBusiness&TechnologyParkDebtService 290505150TransToGrantMatchingFund9230 - 1,588,092 -290505150TransToCapitalProjectsFund9232 84,410 - 949,620 1,357,075 TransfertoCapitalProjects(fund3932)forCIPProjects 290505150TransfertoStreetsProjects9234 209,969 - -290505150GeneralReserves 9399 - 330,232 1,732,071 833,959 TotalMiscellaneousExpenses 1,949,156 $ 3,981,025 $ 4,954,055 $ 4,517,798 $ TotalExpenditures 2,344,391 $ 3,981,025 $ 4,954,055 $ 4,517,798 $ RevenueminusExpenditures 331,254 $ - $ - $ - $ Page 98 DRAFT

FINANCE

City of Leavenworth, Kansas

County Wide Sales Tax Fund Proposed Budget

January 1, 2024 - December 31, 2024

County Wide Sales Tax Division FINANCE

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue TaxRevenue 290606180LocalSalesTax-Countywide4009 3,293,120 3,160,000 3,419,471 3,580,569 Thisfundcollectscountywidesalesandusetax. FundsaretransferredtotheCapital ProjectsFundortheBondFund,asneededtocoverbudgetrequirements. TotalTaxRevenue 3,293,120 $ 3,160,000 $ 3,419,471 $ 3,580,569 $ MiscellaneousRevenue 290606180BalanceForward 5999 - 2,171,911 4,459,216 2,325,933 Projectedcashbalanceatthebeginningoftheyear TotalMiscellaneousRevenue - $ 2,171,911 $ 4,459,216 $ 2,325,933 $ TotalRevenue 3,293,120 $ 5,331,911 $ 7,878,687 $ 5,906,502 $ Expenditures MiscellaneousExpenses 290606180TransToBond&InterestFund9220 825,358 1,360,286 2,110,239 842,213 TransfertoBondFundtocover2023debtservice 290606180TransToCapitalProjectsFund9232 158,871 979,918 1,384,015 1,848,374 TransfertoCapitalProjectsfundforCIPprojects 290606180TransfertoStreetsProjects9234 310,701 908,500 2,058,500 3,116,000 TransfertoStreetsFundforpavementmanagement,sidewalk,andcurbprograms 290606180GeneralReserves 9399 - 2,083,207 2,325,933 99,916 TotalMiscellaneousExpenses 1,294,929 $ 5,331,911 $ 7,878,687 $ 5,906,502 $ TotalExpenditures 1,294,929 $ 5,331,911 $ 7,878,687 $ 5,906,502 $ RevenueminusExpenditures 1,998,190 $ - $ - $ - $ Page 99 DRAFT

CityofLeavenworth,Kansas

CapitalProjectsFundS

2024ProposedBudget

2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Capital Improvements ProjectsFund StreetsCapital ProjectsFund GrantMatching CapitalProjects Fund SpecialProject Fund 2024Proposed Budget-Capital Projects Revenue TaxRevenue - - - - - - - -IntergovernmentalRevenue 536,169 535,300 483,490 3,092,956 - 1,477,956 1,615,000 - 3,092,956 Licenses&Permits - - - - - - - -ChargesforServices - - - - - - - -MiscellaneousRevenue 3,931,816 4,320,110 4,682,191 14,704,783 9,005,449 4,116,000 1,583,334 - 14,704,783 BalanceForward(Reserves) - 4,397,171 4,182,714 3,700,743 879,968 2,820,775 - - 3,700,743 TotalRevenue 4,467,985 $ 9,252,581 $ 9,348,395 $ 21,498,482 $ 9,885,417 $ 8,414,731 $ 3,198,334 $ - $ 21,498,482 $ Expenditures PersonalServices 1,560 - - - - - - -ContractualServices 372,225 5,700 - - - - - -Commodities 118,505 - - - - - - -CapitalOutlay 3,242,574 6,843,073 4,642,136 19,699,751 9,885,417 7,616,000 2,198,334 - 19,699,751 DebtService 88,333 - - - - - - -Miscellaneous 936,367 1,034,833 1,005,515 - - - - -GeneralReserves - 1,368,975 3,700,743 1,798,731 - 798,731 1,000,000 - 1,798,731 TotalExpenditures 4,759,564 $ 9,252,581 $ 9,348,395 $ 21,498,482 $ 9,885,417 $ 8,414,731 $ 3,198,334 $ - $ 21,498,482 $ RevenueminusExpenditures (291,579) $ - $ - $ - $ - $ - $ - $ - $ - $

2024ProposedBudget:ByFund Page 100 DRAFT

CapitalProjectsSummary(ExludingEnterpriseFunds)

City of Leavenworth, Kansas

Capital Projects Fund Proposed Budget

January 1, 2024 - December 31, 2024

Capital Improvement Projects Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue IntergovernmentalRevenue 393232290StateGrants 4208 61,578 35,300 28,294TotalIntergovernmentalRevenue 61,578 $ 35,300 $ 28,294 $ - $ MiscellaneousRevenue 393232290Bonds&Fines 5501 83 1,400 1,400 4,500,000 G.O.BondtofundFireStation#3 393232290AdmissionFees 5610 1,516 500 500393232290ProgramIncome 5713 19,273 15,700 15,700393232290InterestEarnings 5801 1,040 2,600 1,100393232290SaleofVehicles 5807 121,571 - 110,491393232290SaleofTemporaryNotes5852 545,000 - -393232290ContributionRev 5863 268 - -393232290LoanProceeds 5866 39,103 - -393232290Other-Miscellaneous5899 28,576 700 160,865393232290TransFromGeneralFund5901 - - - 1,300,000 TransferfromGeneralFundforencumbranceforFireApparatus. Orderin2024,will bedeliveredin2026or2027 393232290TransFromCIPFund5905 84,410 5,700 - 1,357,075 TransferfromLocalSalesTaxFundtopayfor2024CIPprojects 393232290 TransFromCountywideTaxFund5906 158,871 1,046,918 1,384,015 1,848,374 TransferfromCountywideSalesTaxFundtopayfor2024CIPProjects 393232290TransFromCIPFund5930 - 1,588,092 949,620393232290BalanceForward 5999 - - 561,619 879,968 TotalMiscellaneousRevenue 999,711 $ 2,661,610 $ 3,185,310 $ 9,885,417 $ TotalRevenue 1,061,289 $ 2,696,910 $ 3,213,604 $ 9,885,417 $ Expenditures PersonalServices 393232290FullTime 6101 1,560 - -TotalPersonalServices 1,560 $ - $ - $ - $ ContractualServices 393232290LegalAdvertising 6453 121 - -393232290Planning/Design 6605 84,410 - -393232290LaboratoryServices 6624 50 - -393232290OtherProfessionalServices6699 5,865 5,700 -393232290EquipmentRentalExp6702 - - -393232290VehicleLease 6706 54,786 - -393232290OtherRental 6799 845 - -393232290VehicleM&R 6861 1,683 - -393232290VehicleLicenseFees6902 495 - -393232290GrantPayments 6904 60,018 - -393232290SalesTax 6907 131 - -393232290OtherOperatingExpenses6917 68,761 - -Page 101 DRAFT

City of Leavenworth, Kansas

Capital Projects Fund Proposed Budget

January 1, 2024 - December 31, 2024 Capital Improvement Projects Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes 393232290OperatingTransfers 6998 69,891 - -TotalContractualServices 347,057 $ 5,700 $ - $ - $ Commodities 393232290SafetyMaterials 7314 714 - -393232290Non-CapITEquipment7406 - - -393232290Non-CapPoliceEquipment7607 - - -393232290Non-CapTelephoneEquipment7613 - - -393232290Non-CapParksEquipment7615 9,610 - -393232290Non-CapFireEquipment7618 - - -393232290Non-CapOtherImprovements7702 17,446 - -TotalCommodities 27,771 $ - $ - $ - $ CapitalOutlay 393232290Building-NewConstruction8101 379,374 - -393232290Building-Improvements8103 76,841 67,000 -393232290SidewalkConstruction8201 29,964 - -393232290 OtherImprovementConstruction8299 236,162 2,624,210 2,333,636 9,885,417 2024CIPProjects(includes$4.5millionforFireStation#3) 393232290ITEquipment 8306 - - -TotalCapitalOutlays 722,341 $ 2,691,210 $ 2,333,636 $ 9,885,417 $ DebtService 393232290Interest 9002 517 - -TotalDebtService 517 $ - $ - $ - $ MiscellaneousExpenses 393232290GeneralReserves 9399 - - 879,968TotalMiscellaneousExpenses - $ - $ 879,968 $ - $ TotalExpenditures 1,099,245 $ 2,696,910 $ 3,213,604 $ 9,885,417 $ RevenueminusExpenditures (37,957) $ - $ - $ - $ Page 102 DRAFT

City of Leavenworth, Kansas

Streets Capital Projects Fund Proposed Budget

January 1, 2024 - December 31, 2024

Streets Projects Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue IntergovernmentalRevenue 393434296StateGrants 4208 - - - 1,000,000 Matchingfundsforthe4thStreetfromSenecatoChoctawProject 393434296FederalFundExchange4218 474,591 500,000 455,196 477,956 FFEFundsreceivedannuallyfromtheState TotaIntergovernmentalRevenue 474,591 $ 500,000 $ 455,196 $ 1,477,956 $ 393434296SaleofBonds 5851 1,435,000 - -393434296SaleofTemporaryNotes5852 - 750,000 -393434296BondPremium 5862 40,068 - -393434296IntrafundTransfers 5900 936,367 - -393434296TransFromCIPFund5905 209,969 - -393434296 TransFromCountywideTaxFund5906 310,701 908,500 2,058,500 3,116,000 Sidewalks-$300,000;Curbs-$116,000;Streets$2,700,000 393434296TransFromStormwater5941 - - - 1,000,000 TransferfromStormwaterFundtopayforStormportionof4thStreetProject 393434296BalanceForward 5999 - 3,362,338 2,615,579 2,820,775 Cashbalanceavailableatthebeginningoftheyear TotalMiscellaneousRevenue 2,932,105 $ 5,020,838 $ 4,674,079 $ 6,936,775 $ TotalRevenue 3,406,696 $ 5,520,838 $ 5,129,275 $ 8,414,731 $ Expenditures ContractualServices 393434296LegalAdvertising 6453 (24,936) - -393434296Planning/Design 6605 50,103 - -TotalContractualServices 25,168 $ - $ - $ - $ Commodities 393434296Non-CapOtherImprovements7702 47,910 - -TotalCommodities 47,910 $ - $ - $ - $ CapitalOutlays 393434296Right-Of-Way 8002 26,715 - -393434296SidewalkConstruction8201 - 308,500 308,500 416,000 Annualsidewalkandcurbprograms 393434296StreetConstruction 8203 2,316,582 2,000,000 2,000,000 2,000,000 AnnualPavementManagementProgram 393434296 OtherImprovementConstruction8299 153,996 1,843,363 - 5,200,000 4thStreetSenecatoChoctawproject TotalCapitalOutlays 2,497,293 $ 4,151,863 $ 2,308,500 $ 7,616,000 $ DebtService 393434296Principal 9001 - - -393434296Interest 9002 5,011 - -393434296IssuanceCosts 9005 82,805 - -TotalDebtService 87,817 $ - $ - $ - $ MiscellaneousExpenses 393434296IntrafundTransfers 9200 936,367 - -Page 103 DRAFT

City of Leavenworth, Kansas

Streets Capital Projects Fund Proposed Budget

January 1, 2024 - December 31, 2024

Streets Projects Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes 393434296CapitalReserves 9398 - 954,883 954,883393434296GeneralReserves 9399 - 414,092 1,865,892 798,731 TotalMiscellaneousExpenses 936,367 $ 1,368,975 $ 2,820,775 $ 798,731 $ TotalExpenditures 3,594,554 $ 5,520,838 $ 5,129,275 $ 8,414,731 $ RevenueminusExpenditures (187,859) $ - $ - $ - $ Page 104 DRAFT

CityofLeavenworth,Kansas

January1,2024-December31,2024

GrantMatchingCapitalProjectFund

CIPFund

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue IntergovernmentalRevenue 3930 30280StateGrants 4208 - - - 1,615,000 KDOTGrantsforVilasStreetProjectandSS4AActionPlan TotalIntergovernmentalRevenue - $ - $ - $ 1,615,000 $ MiscellaneousRevenue 3930 30280TransFromGeneralFund5901 - - - 1,583,334 FundstransferredfromGeneralFundforqualifyformatchinggrants MiscellaneousRevenue - $ - $ - $ 1,583,334 $ TotalRevenue - $ - $ - $ 3,198,334 $ Expenditures CapitalOutlay 3930 30280 OtherImprovementConstruction8299 - - - 2,198,334 VilasStreetProject;SS4AActionPlan,andIntersectionat10th/Limit(design) TotalCapitalOutlay - $ - $ - $ 2,198,334 $ MiscellaneousExpenses 3930 30280GeneralReserves 9399 - - - 1,000,000 Reservesavailableforfuturematchinggrants TotalMiscellaneousExpenses - $ - $ - $ 1,000,000 $ TotalExpenditures - $ - $ - $ 3,198,334 $ RevenueminusExpenditures - $ - $ - $ - $ Page 105 DRAFT

City of Leavenworth, Kansas

Special Projects Fund Proposed Budget

January 1, 2024 - December 31, 2024

Special Projects Division

2023:TransferredtoStormWaterCapitalFundtocoverthecostoftheStormSewer portionofthe4thStreetbetweenSenecaandChoctawproject

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue MiscellaneousRevenue 393333295BalanceForward 5999 - 1,034,833 1,005,515TotalMiscellaneousRevenue - $ 1,034,833 $ 1,005,515 $ - $ TotalRevenue - $ 1,034,833 $ 1,005,515 $ - $ Expenditures Commodities 393333295Non-CapPoliceEquipment7607 42,824 - - - 2022: Securitycamerasandradios TotalCommodities 42,824 $ - $ - $ - $ CapitalOutlay 393333295Software 8305 22,940 - - - 2022: Executimeimplementation TotalCapitalOutlays 22,940 $ - $ - $ - $ MiscellaneousExpenses 393333295TranstoGeneralFund9201 - 1,034,833 -393333295TranstoStormWaterCapital9241 - - 1,005,515 -

TotalMiscellaneousExpenses - $ 1,034,833 $ 1,005,515 $ - $ TotalExpenditures 65,764 $ 1,034,833 $ 1,005,515 $ - $ RevenueminusExpenditures (65,764) $ - $ - $ - $ Page 106 DRAFT

City of Leavenworth, Kansas

ARPA Fund

2024 Proposed Budget

2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Revenue TaxRevenue - - -IntergovernmentalRevenue 219,086 - -Licenses&Permits - - -ChargesforServices - - -MiscellaneousRevenue 243 - -BalanceForward(Reserves) - 6,000,000 7,184,687 1,470,643 Total Revenue 219,329 $ 6,000,000 $ 7,184,687 $ 1,470,643 $ Expenditures PersonalServices - -ContractualServices 178,923 1,692,705 113,199 866,801 Commodities 38,848 - -CapitalOutlay 1,315 3,000,000 5,600,845 603,842 DebtService - - -Miscellaneous 243 - -GeneralReserves - 1,307,295 1,470,643Total Expenditures 219,329 $ 6,000,000 $ 7,184,687 $ 1,470,643 $ Revenue minus Expenditures - $ - $ - $ - $

Page 107 DRAFT

ARPA Fund BudgetSummary

2024 ARPA Grant Fund Division FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue IntergovernmentalRevenue 266969111FederalGrants 4207 219,086 - - - AllARPAGrantfundshavebeenreceived TotalIntergovernmentalRevenue 219,086 $ - $ - $ - $ MiscellaneousRevenue 266969111IntrafundTransfers 5900 14 - -266969111IntrafundTransfers 5900 230 - -266969111BalanceForward 5999 - 6,000,000 7,184,687 1,470,643 Estimatedcashbalanceatbeginningoftheyear TotalMiscellaneousRevenue 243 $ 6,000,000 $ 7,184,687 $ 1,470,643 $ TotalRevenue 219,329 $ 6,000,000 $ 7,184,687 $ 1,470,643 $ Expenditures ContractualServices 266969111LegalAdvertising 6453 230 - -266969111LegalAdvertising 6453 14 - -266969111GrantPayments 6904 - 500,000 113,199 866,801 FireSuppression/ADA,AttainableHousingProject,BigBrothers/Sisters 266969111GrantPayments 6904 - - -TotalContractualServices 243 $ 1,692,705 $ 113,199 $ 866,801 $ Commodities 266969111Non-CapPoliceEquipment7607 38,848 - - - 2022-Policeradiosandencryption 266969111Non-CapRefuseEquipment7617 - - -266969111Non-CapOtherEquipment7699 - - -TotalCommodities 38,848 $ - $ - $ - $ CapitalOutlay 266969111Building-Purchased8102 - - -266969111Building-Improvements8103 1,315 - 749,171 - 2023-CityHallCondensatePiping,CityHallHVAC,RFCCOfficeRelocation 266969111 OtherImprovementConstruction8299 - - 131,130 603,842 2023-Trafficcalmingprojectin2023;2024-WilsonAveimprovements 266969111SewerEquipment 8509 - 3,000,000 3,050,000 - 2023-Repairstowastewatertreatmentplant 266969111ParksEquipment 8515 - - 191,427 - 2023-WollmanPoolupgrades 266969111RefuseEquipment 8517 - - 646,637 - 2023-Polycartsandrefusetrucktippers 266969111FireEquipment 8518 - - 832,479 - 2023-Fireapparatus TotalCapitalOutlay 1,315 $ 3,000,000 $ 5,600,845 $ 603,842 $ MiscellaneousExpenses 266969111IntrafundTransfers 9200 243 - -266969111GeneralReserves 9399 - 1,307,295 1,470,643TotalMiscellaneousExpenses 243 $ 1,307,295 $ 1,470,643 $ - $ TotalExpenditures 40,649 $ 6,000,000 $ 7,184,687 $ 1,470,643 $ RevenueminusExpenditures 178,680 $ - $ - $ - $ Page 108 DRAFT

City of Leavenworth, Kansas ARPA Grant Fund Proposed Budget January 1, 2024 - December 31,

City of Leavenworth, Kansas

ARPA Grant Fund Proposed Budget

January 1, 2024 - December 31, 2024

ARPA City Wide Expenses Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue IntergovernmentalRevenue 266969140FederalGrants 4207 - - -TotalIntergovernmentalRevenue - $ - $ - $ - $ TotalRevenue - $ - $ - $ - $ Expenditures ContractualServices 266969140LegalAdvertising 6453 (130) - -TotalContractualServices (130) $ - $ - $ - $ TotalExpenditures (130) $ - $ - $ - $ RevenueminusExpenditures 130 $ - $ - $ - $ Page 109 DRAFT

City of Leavenworth, Kansas

ARPA Grant Fund Proposed Budget

January 1, 2024 - December 31, 2024

ARPA Sewer Infrastructure Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Expenditures ContractualServices 266969545OtherProfessionalServices6699 178,810 - -TotalContractualServices 178,810 $ - $ - $ - $ TotalExpenditures 178,810 $ - $ - $ - $ RevenueminusExpenditures (178,810) $ - $ - $ - $ Page 110 DRAFT

CityofLeavenworth,Kansas

GeneralFundOverview

ThetabletotheleftprovidesanoverviewoftheGeneralFundrevenuesandexpendituresfor2022Actual,2023 AdoptedBudget,2023Projection,and2024ProposedBudget.

Thetablebelowbreaksoutthe2024ProposedBudgetbyFunction.Severalofthebelowfunctionsarecomprised ofmorethanonedepartmentordivisionasfollows:

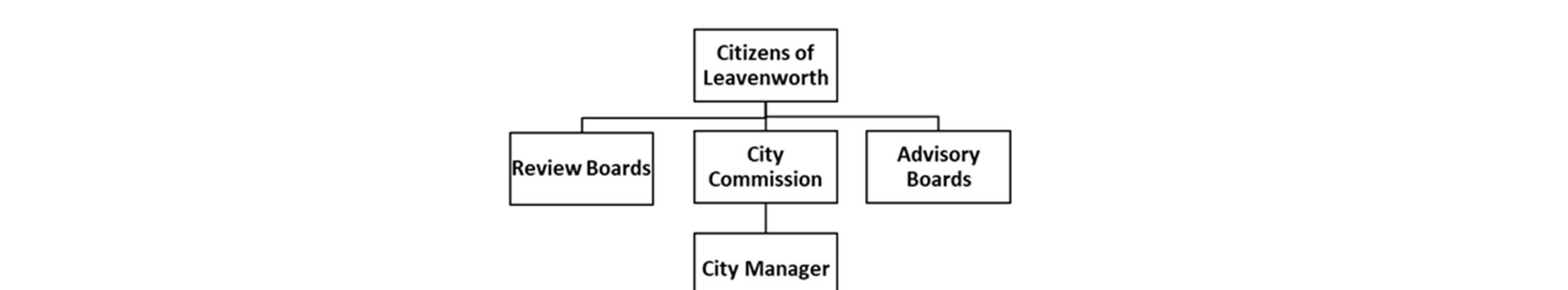

CityCommission:CityCommission

CityAdmin:CityManager'sOffice,Legal,MunicipalCourt,Contingency,CivilDefense,IT CityClerk:CityClerk'sOffice

HumanResources:HumanResourcesDepartment

Finance:FinanceDepartment,GeneralRevenueDivision,CityWideDivision

Police:PoliceAdmin,Dispatch,PoliceOperations,AnimalControl,Parking

Fire:FireAdmin,FireSuppression,FirePrevention

Engineering:Engineering,Buildings&Ground,Inspections,StreetLighting,Airport,LibraryMaintenance

MunicipalServiceCenter:ServiceCenter,Garage

Planning&CommunityDevelopment:Planning&Zoning,CodeEnforcement,RentalCoordinator

Thefollowingpagesprovideadditionaldetailsforeachfunctionandtheircomponentunits.

2024ProposedBudget: GeneralFundbyFunction

2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Revenue Tax Revenue 17,994,413 18,225,400 19,251,262 19,835,699 Intergovernmental Revenue 74,086 85,600 85,600 89,591 Licenses & Permits 392,606 486,500 486,500 436,555 Charges for Services 2,244,042 2,249,050 2,156,782 2,255,842 Miscellaneous Revenue 507,112 1,215,433 406,400 697,056 Balance Forward (Reserves) - 6,510,160 8,727,055 10,155,304 TotalRevenue 21,212,260 $ 28,772,143 $ 31,113,599 $ 33,470,047 $ Expenditures Personal Services 15,009,801 16,854,550 16,108,216 18,051,538 Contractual Services 3,341,762 3,619,370 3,665,650 4,073,445 Commodities 1,229,742 1,307,699 1,162,729 1,222,615 Capital Outlay 48,399 17,955 21,700 18,000 Debt Service - - -Miscellaneous 65 - - 3,056,821 General & Capital Reserves - 6,972,569 10,155,304 7,047,628 TotalExpenditures 19,629,768 $ 28,772,143 $ 31,113,599 $ 33,470,047 $ RevenueminusExpenditures 1,582,492 $ - $ - $ - $ City Commission CityAdmin CityClerk HumanResources Finance Police Fire Engineering Municipal Service Center Planning& Community Development TotalGeneral Fund Revenue Tax Revenue - - - - 19,792,999 - - - - 42,700 19,835,699 Intergovernmental Revenue - - - - 86,991 2,600 - - - - 89,591 Licenses & Permits - - 102,550 - - - 17,600 294,600 - 21,805 436,555 Charges for Services - 483,000 14,850 - 771,525 122,967 4,000 5,100 854,400 - 2,255,842 Miscellaneous Revenue - - 750 - 366,500 302,806 4,200 2,400 - 20,400 697,056 Balance Forward (Reserves) - - - - 10,155,304 - - - - - 10,155,304 TotalRevenue -$ 483,000 $ 118,150 $ - $ 31,173,318 $ 428,374 $ 25,800 $ 302,100 $ 854,400 $ 84,905 $ 33,470,047 $ Expenditures Personal Services 33,874.83 1,080,896 305,569 350,617 629,329 8,291,550 5,541,635 924,235 266,623 627,210 18,051,538 Contractual Services 43,525.00 742,305 177,650 66,350 163,050 1,391,625 250,580 789,420 255,700 193,240 4,073,445 Commodities 2,300.00 15,094 5,400 4,800 10,000 313,321 152,900 35,700 673,000 10,100 1,222,615 Capital Outlay - - - - - 18,000 - - - - 18,000 Debt Service - - - - - - - - - -Miscellaneous - - - - 3,056,821 - - - - - 3,056,821 General & Capital Reserves - - - - 7,047,628 - - - - - 7,047,628 TotalExpenditures 79,700 $ 1,838,295 $ 488,619 $ 421,767 $ 10,906,829 $ 10,014,496 $ 5,945,115 $ 1,749,355 $ 1,195,323 $ 830,550 $ 33,470,047 $ RevenueminusExpenditures (79,700) $ (1,355,295) $ (370,469) $ (421,767) $ 20,266,490 $ (9,586,122) $ (5,919,315) $ (1,447,255) $ (340,923) $ (745,644) $ - $

GeneralFund 2024ProposedBudget

Page 111 DRAFT

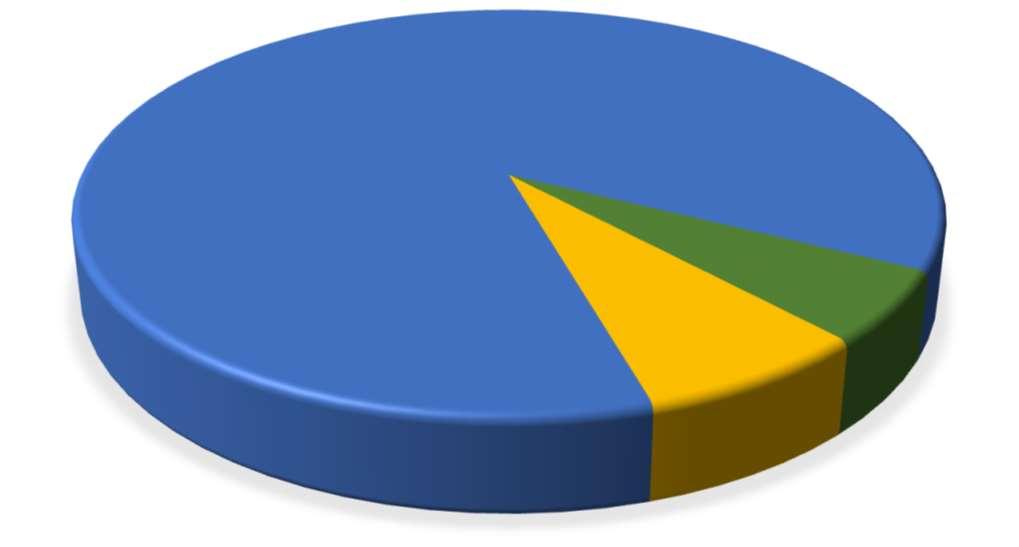

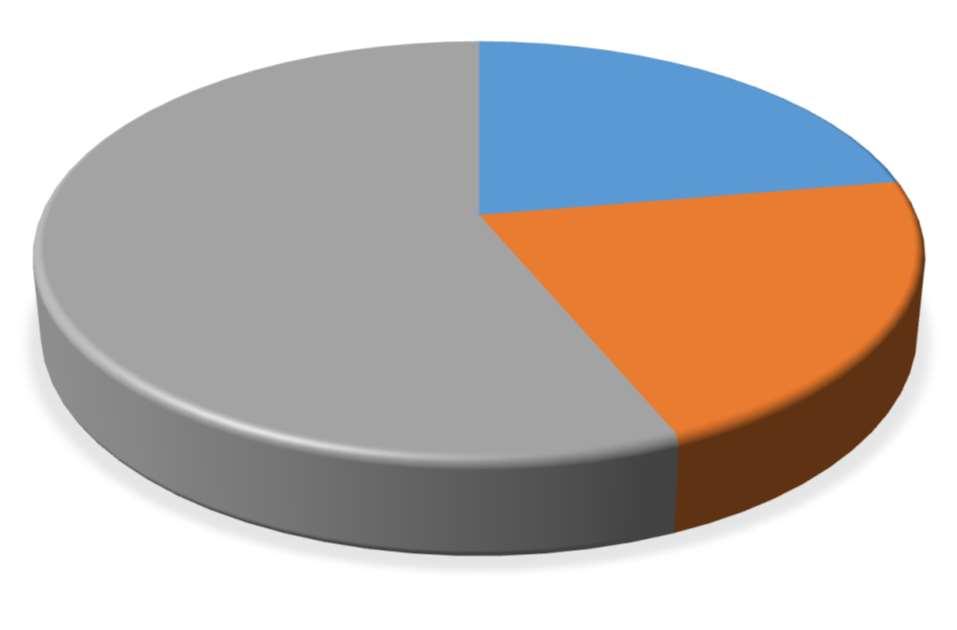

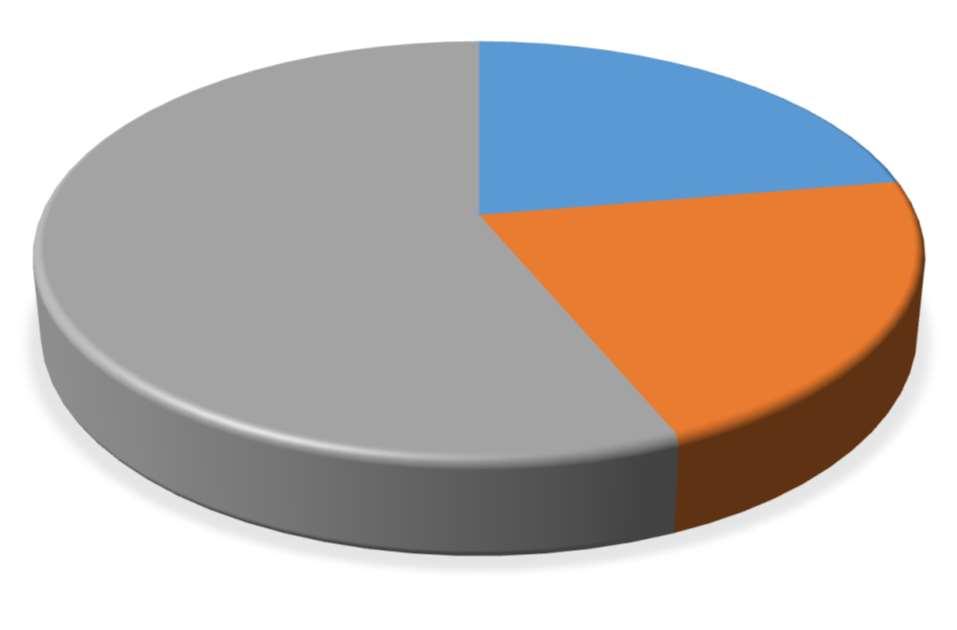

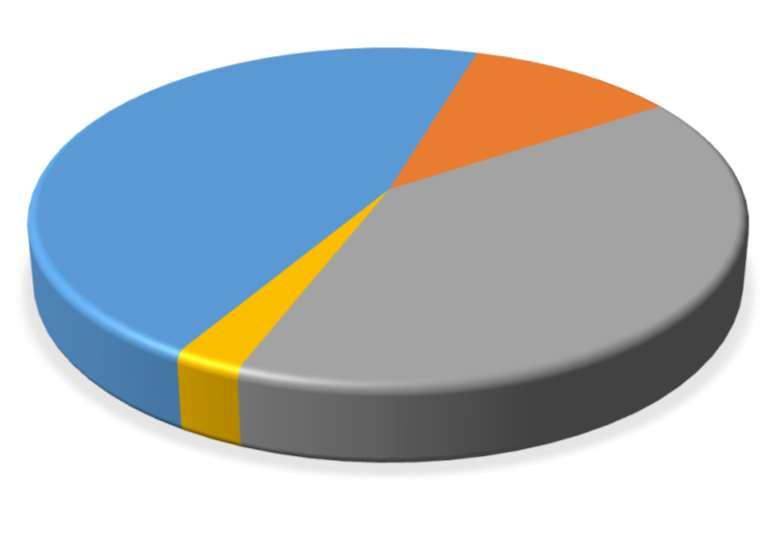

CityofLeavenworth,Kansas

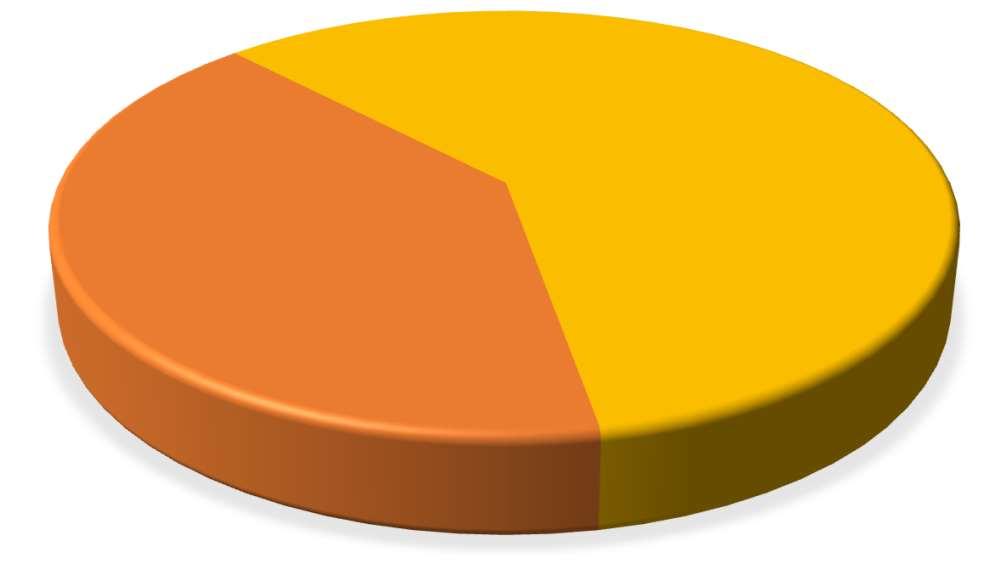

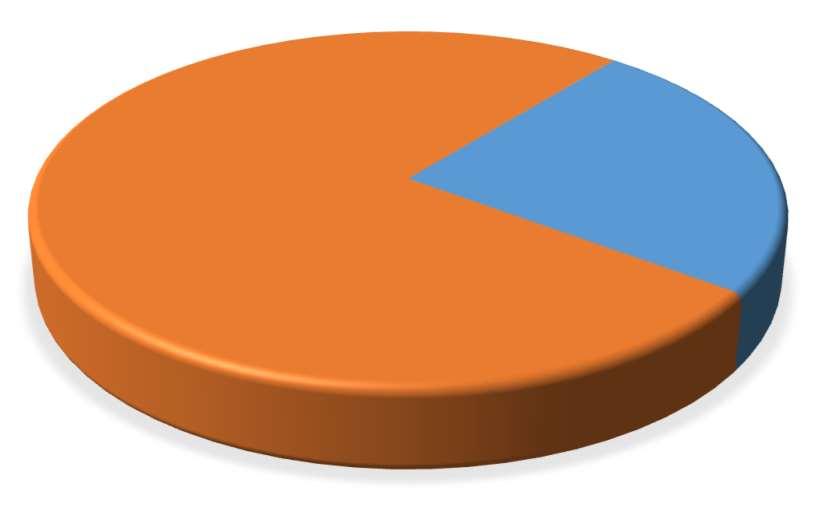

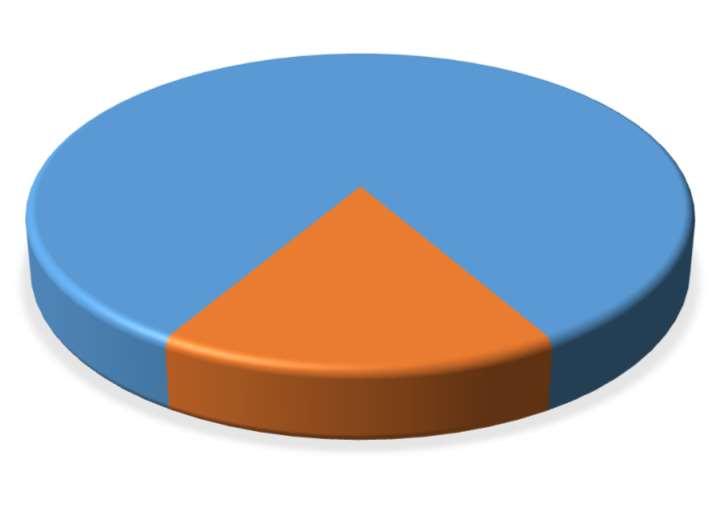

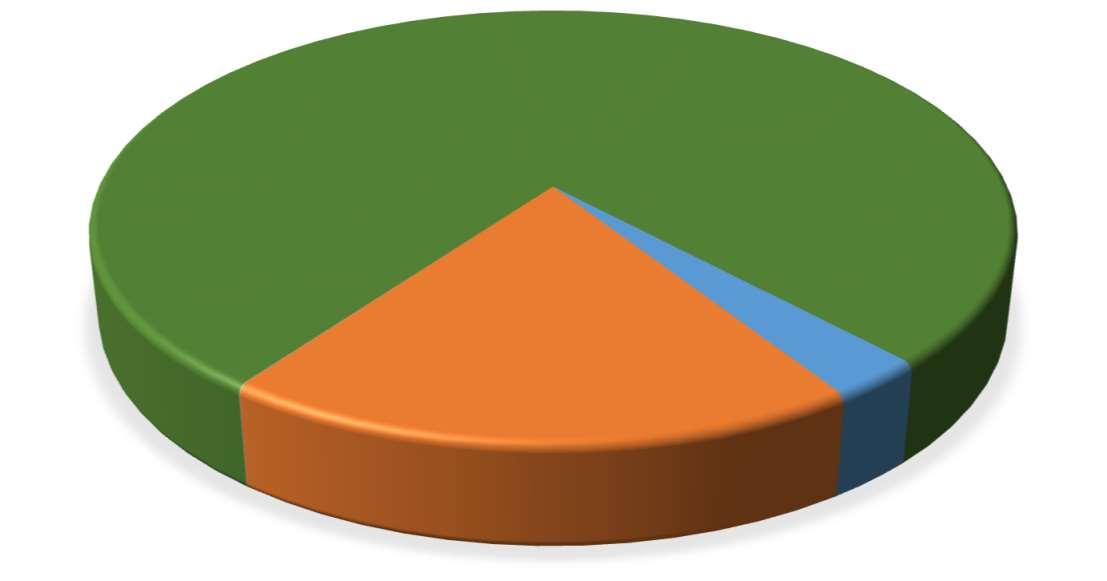

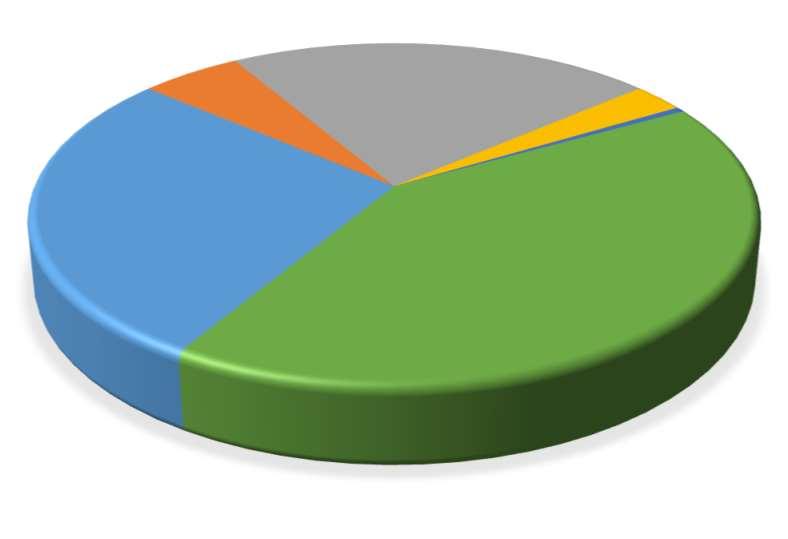

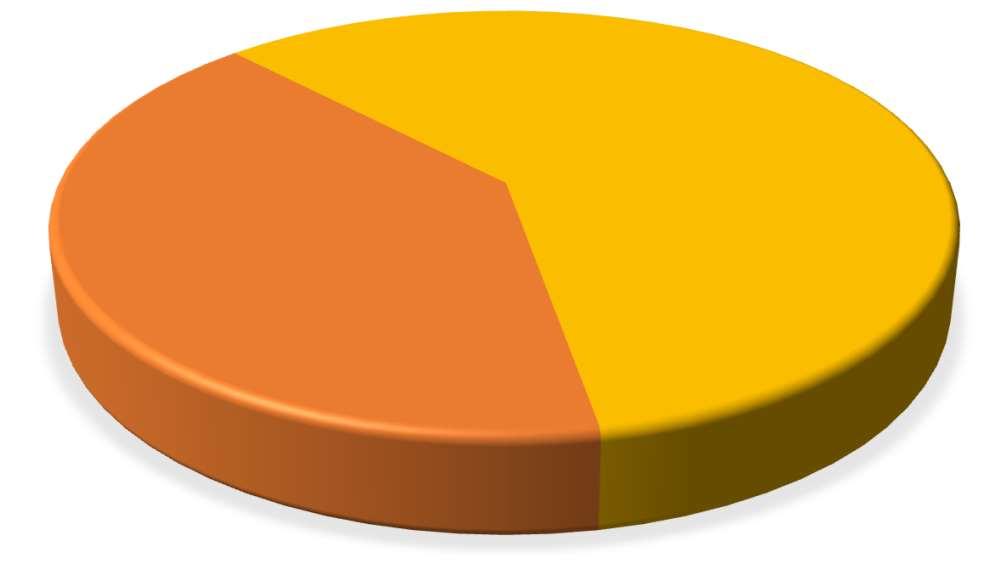

GeneralFund 2024ProposedBudget 2022Actual Expenses 2023Adopted Budget 2023Projection 2024Proposed Budget FireAdmin Fire Suppression FirePrevention TotalFire Department Revenue Tax Revenue - - - - - - -Intergovernmental Revenue - - - - - - -Licenses & Permits 4,175 18,000 18,000 17,600 - - 17,600 17,600 Charges for Services 5,198 4,100 4,100 4,000 4,000 - - 4,000 Miscellaneous Revenue 4,730 600 600 4,200 - 4,200 - 4,200 Balance Forward (Reserves) - - - - - - -TotalRevenue 14,103 $ 22,700 $ 22,700 $ 25,800 $ 4,000 $ 4,200 $ 17,600 25,800 Expenditures Personal Services 4,510,697 5,194,190 5,076,910 5,541,635 425,598 4,848,047 267,989 5,541,635 Contractual Services 246,876 272,180 261,580 250,580 120,640 125,150 4,790 250,580 Commodities 136,327 152,250 152,250 152,900 11,800 138,500 2,600 152,900 Capital Outlay - - - - - - -Debt Service - - - - - - -Miscellaneous - - - - - - -General & Capital Reserves - - - - - - -TotalExpenditures 4,893,900 $ 5,618,620 $ 5,490,740 $ 5,945,115 $ 558,038 $ 5,111,697 $ 275,379 $ 5,945,115 $ RevenueminusExpenditures (4,879,797) $ (5,595,920) $ (5,468,040) $ (5,919,315) $ (554,038) $ (5,107,497) $ (257,779) $ (5,919,315) $ FireDepartmentSummaryBudget 2024ProposedBudget: FireDepartmentbyDivision PersonalServices $5,541,635 93% ContractualServices $250,580 4% Commodities $152,900 3% FireAdmin $558,038 9% FireSuppression $5,111,697 86% FirePrevention $275,379 5% 2024Budget:FireDepartmentExpendituresbyDivision 2024Budget:FireDepartmentExpendituresbyType Page 112 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Fire Administration Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue ChargesforServices 110101390OpenPublicRecordsFees5711 85 200 200 200 110101390ChargesForService-Other5799 5,113 3,700 3,700 3,800 PioneerGroup TotalChargesforServices 5,198 $ 3,900 $ 3,900 $ 4,000 $ MiscellaneousRevenue 110101390Other-Miscellaneous5899 - 100 100TotalMiscellaneousRevenue - $ 100 $ 100 $ - $ TotalRevenue 5,198 $ 4,000 $ 4,000 $ 4,000 $ Expenditures PersonalServices 110101390FullTime 6101 259,596 274,190 274,190 297,491 3full-timeemployees:FireChief(1),DeputyFireChief(1),FireSecretary(1) 110101390Longevity 6107 960 1,080 1,080 1,200 110101390FICAExp 6108 6,095 6,600 6,600 7,298 110101390HealthInsurance 6110 45,749 49,210 49,210 49,652 110101390KPERSExp 6111 3,831 3,740 3,740 4,431 110101390KP&FExp 6115 50,585 53,620 53,620 57,945 110101390Worker'sCompensation6116 178 6,770 6,770 7,285 110101390UnemploymentInsurance6120 253 270 270 297 TotalPersonalServices 367,247 $ 395,480 $ 395,480 $ 425,598 $ ContractualServices 110101390Electricity 6201 44,187 35,000 35,000 35,000 Electricityfor3firestations 110101390NaturalGas 6202 26,377 14,000 25,000 14,000 Naturalgasfor3firestations 110101390Telephone 6206 1,875 3,060 3,060 3,060 Citytelephoneservicefor3firestations 110101390Postage 6207 - 50 50 50 110101390Cable/Internet 6208 98 240 240 240 CableTVfor3firestations(separatedfromtelephonein2023) 110101390CommercialTravel 6301 1,718 850 850 850 Airfare-outoftowntraining/conferences 110101390Lodging 6302 1,313 900 900 900 Hotels-outoftowntraining/conferences 110101390Meals 6303 225 500 500 500 Meals-outoftowntraining/conferences 110101390Parking/Tolls 6305 103 100 100 100 Parking&tolls-outoftowntraining/conferences 110101390VehicleRental 6306 73 - -110101390Registration 6403 3,037 1,000 1,000 1,000 Conferences,IAFC,MissouriValleyDivision,MARC 110101390ClassifiedAdvertising6451 - 700 700 700 Jobpostings,utilizedbyHR 110101390LegalAdvertising 6453 14 - -110101390Insurance 6501 12,286 12,900 14,000 14,000 InsurancepaidthroughCityClerk'sOffice 110101390DuesMemberships&Subs6601 3,777 3,280 3,280 3,280 NFPA,AssociationsDuesforChiefOfficers 110101390MedicalServices 6610 - 1,500 1,500 1,500 MedicalDirectorfee-Dr.McCartney,forprotocols 110101390PestControlServices6612 2,000 3,250 3,250 3,250 Annualfeeformonthlyserviceat3firestations 110101390JanitorialServices 6614 - 2,500 - - Decidednottohirecleaningserviceforfireadministrationoffices Page 113 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Administration

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes 110101390Printing/CopyingServices6617 - 100 100 100 Foranyoutsidecopyservicethatmaybeneeded 110101390ITServices 6623 - 950 950 950 UtilizedbytheITdivisionforsoftwarecost,printers 110101390TrainingServices 6641 - 3,600 3,600 3,600 OutsideEMStrainingtomaintainEMTlicense. 110101390OtherProfessionalServices6699 6,300 8,400 8,400 8,400 VectorSolutions-RecordKeepingandTrainingManagementSoftware 110101390EquipmentRentalExp6702 - - -110101390OtherRental 6799 - 1,200 1,200 1,200 Liftrentalforhighceilinglightbulbs,parkinglotlights 110101390Building/GroundsM&R6802 21,721 22,000 22,000 22,000 Buildingrepairs/maintenancefor3firestations 110101390OfficeEquipmentM&R6852 - 2,400 2,400 2,400 Repairsoncopier,fax,andprinters 110101390SoftwareMaintenance6862 (17) - -110101390OtherEquipmentM&R6899 1,763 3,400 3,400 3,400 Hazmatmonitoringequipment 110101390MiscellaneousPermits6903 270 160 160 160 StateBoilerinspections,permits TotalContractualServices 127,118 $ 122,040 $ 131,640 $ 120,640 $ Commodities 110101390OfficeSupplies 7001 1,167 2,100 2,100 2,100 Copypaper,tablets,staples,pens,all3firestations 110101390Clothing&Uniforms7101 - 1,200 1,200 1,200 Uniformsfor2administrative FireChiefs 110101390Food 7201 213 300 300 300 Retirement,promotionceremonies 110101390Gasoline 7302 - 100 100 100 Incidentalsoutofthecity 110101390JanitorialSupplies 7319 376 - -110101390OtherOperatingSupplies7399 254 1,100 1,100 1,100 Firehydrantpaint,gauges 110101390Non-CapFurniture/Furnishings7402 2,980 4,000 4,000 4,000 Chairs,desk,storagecabinets- all3firestations 110101390Non-CapSoftware 7405 199 2,000 2,000 2,000 AsneededforITupgradestosoftware 110101390Non-CapJanitorialEquipment7603 - 1,000 1,000 1,000 Vacuums,mopbuckets,miscellaneous TotalCommodities 5,188 $ 11,800 $ 11,800 $ 11,800 $ TotalExpenditures 499,554 $ 529,320 $ 538,920 $ 558,038 $ RevenueminusExpenditures (494,356) $ (525,320) $ (534,920) $ (554,038) $ Page 114 DRAFT

Fire

Division

Staffing Summary (FTEs and

Notes:2023workers'compensationinsuranceincreasedfrom$178in2022to$6,770inthe2023budget.Thisisduetocorrectingtheallocationpercentages, notduetoanincreasedcostoftheinsurance.

2024 Budget

Salaries,

2022 Actual, 2023 Adopted Budget, and 2024 Proposed Budget General Fund Fire Administration 1101-01390 FTEs - Fire Administration 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Fire Chief 1.0 1.0 1.0 1.0 Deputy Fire Chief 1.0 1.0 1.0 1.0 Fire Secretary 1.0 1.0 1.0 1.0 Total FTEs - Fire Administration 3.0 3.0 3.0 3.0 Salary - Fire Administration 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Full Time 259,596 274,190 274,190 297,491 Overtime - - -Part Time - - -Specialty Assignment Pay - - -Public Safety Holiday Pay - - -Longevity 960 1,080 1,080 1,200 Total Salaries - Fire Administration 260,556 275,270 275,270 298,691 Taxes & Benefits - Fire Administration 106,691 120,210 120,210 126,907 Total Salaries, Taxes & Benefits - Fire Adm. Div. 367,247 395,480 395,480 425,598 Compare Years - Fire Administration Salary $ Change Benefit $ Change Salary % Change Benefit % Change 2022 Actual to 2023 Budget 14,714 $ 13,519 $ 5.6% 12.7% 2023 Budget to 2023 Projection - $ - $ 0.0% 0.0% 2023 Projection to 2024 Proposed Budget 23,421 $ 6,697 $ 8.5% 5.6% 2022 Actual to 2024 Proposed Budget 38,135 $ 20,216 $ 14.6% 18.9%

Taxes & Benefits), by Fund and by Division

Page 115 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Fire Suppression Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue MiscellaneousRevenue 110101400MotorFuelTaxRefund5870 3,731 500 500 3,200 110101400Other-Miscellaneous5899 1,000 - - 1,000 TotalMiscellaneousRevenue 4,731 $ 500 $ 500 $ 4,200 $ TotalRevenue 4,731 $ 500 $ 500 $ 4,200 $ Expenditures PersonalServices 110101400FullTime 6101 2,244,338 2,753,720 2,690,000 2,989,196 49full-timeemployees: BattalionChiefs(3),FireCaptains(12),FireDriver/Operators (12),Firefighters(22) 110101400Overtime 6102 271,556 172,800 172,800 150,000 Shiftcoveragewhenstaffingdropsbelowminimum 110101400SpecialtyAssignmentPay6105 7,846 13,200 7,800 15,600 (11)Hazmattechnicians,(2)fireinvestigators 110101400HolidayPay 6106 84,987 69,000 85,000 85,000 110101400Longevity 6107 13,975 14,380 14,380 15,490 Employeeswithover5yearsofservice-max$600 110101400FICAExp 6108 35,789 43,830 40,000 47,202 110101400HealthInsurance 6110 588,243 704,840 704,840 696,432 110101400KP&FExp 6115 602,762 695,010 645,000 751,971 KPF-Assumesnovacancies 110101400Worker'sCompensation6116 54,993 87,220 77,000 93,916 110101400UnemploymentInsurance6120 2,466 3,010 3,010 3,240 110101400SickLeaveReimbursement6122 2,726 - - - Notbudgetedpayoutatresignationsandretirements 110101400 VacationLeaveReimbursement6123 10,787 - - - Notbudgetedpayoutatresignationsandretirements TotalPersonalServices 3,920,470 $ 4,557,010 $ 4,439,830 $ 4,848,047 $ ContractualServices 110101400CommercialTravel 6301 - 500 500 500 Airfare-outoftowntrainingandconferencesforuniformmembers 110101400Lodging 6302 543 1,500 1,500 1,500 Outoftowntrainingandconferencesforuniformmembers 110101400Meals 6303 282 500 500 500 Outoftowntrainingandconferencesforuniformmembers 110101400MileageReimbursement6304 15 200 200 200 Outoftowntrainingandconferencesforuniformmembers 110101400Parking/Tolls 6305 12 50 50 50 Outoftowntrainingandconferencesforuniformmembers 110101400Registration 6403 5,826 10,000 10,000 10,000 Trainingandconferencesforuniformmembers 110101400ClassifiedAdvertising6451 307 - -110101400DuesMemberships&Subs6601 780 3,000 3,000 3,000 Internationalarson,IAFC,NFPA,countyfireassociation 110101400MedicalServices 6610 13,165 12,000 12,000 12,000 Hazmatand1/3memberannualmedical physicals 110101400Printing/CopyingServices6617 - 200 200 200 UPS-FedEx,shippingoutequipmentforrepairs 110101400ITServices 6623 9,800 400 400 400 UtilizedbyourITdivision 110101400PersonnelTestingServices6631 240 300 300 300 Newhirebackgroundchecks 110101400OtherProfessionalServices6699 179 1,000 1,000 1,000 Breathingaircompressortesting,Jaws-of-Lifecalibration 110101400Building/GroundsM&R6802 669 32,200 12,000 12,000 TocoverrepairsnotincludedinCIP 110101400VehicleM&R 6861 65,679 73,000 73,000 73,000 Vehicles,fireapparatus, 110101400OtherEquipmentM&R6899 16,745 10,000 10,000 10,000 SCBA's,HazmatequipmentnotincludedinCIP 110101400ContributionsExp 6913 392 500 500 500 UtilizedbyHR-employeeserviceawards Page 116 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Fire Suppression Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes TotalContractualServices 114,635 $ 145,350 $ 125,150 $ 125,150 $ Commodities 110101400OfficeSupplies 7001 1,111 800 800 800 Officesuppliesforfirestations 110101400EducationalMaterials7004 - 1,400 1,400 1,400 Newbooksforcompanyofficers-trainingmaterials 110101400Clothing&Uniforms7101 21,954 22,000 22,000 22,000 Uniformsforallmembers 110101400Protective/SafetyApparel7102 24,354 25,000 25,000 25,000 Personalprotectivefirefightinggear 110101400Food 7201 - 300 300 300 Employeerecognition, workoverandabovestandard 110101400KitchenSupplies 7202 - 500 500 500 Stationpots,pans,utensils 110101400GeneralMedicalSupplies7252 6,918 3,800 3,800 3,800 Assortmentofmedicalsupplies 110101400Building/GroundsMaterials7301 793 200 200 200 Rock,mulchforfirestations 110101400Gasoline 7302 8,545 8,300 8,300 8,300 Vehiclefuel 110101400DieselFuel 7303 39,725 34,200 34,200 34,200 Fireapparatus 110101400VehicleTires/Batteries7305 273 - -110101400VehicularRepairParts7306 21 - -110101400SafetyMaterials 7314 22 - -110101400Equipment/MotorRepairParts7315 1,231 3,500 3,500 3,500 Smallequipmentrepairsat3firestations,compressors 110101400Tools 7317 18 2,000 2,000 2,000 Handtoolsonfiretrucksandminorstationrepairs 110101400JanitorialSupplies 7319 7,526 8,500 8,500 8,500 Stationcleaningsupplies 110101400TrainingMaterials 7327 35 2,000 2,000 2,000 Props,simulatedwalls,doors,handouts,CPRcards 110101400OtherOperatingSupplies7399 5,527 6,000 6,000 6,000 Gasdetectionmonitors, calibrationgas,SCBA-other 110101400Non-CapITEquipment7406 434 - -110101400Non-CapFireEquipment7618 11,546 19,350 19,350 20,000 Firefightingadapters,valves,nozzles,TIC's,other TotalCommodities 130,034 $ 137,850 $ 137,850 $ 138,500 $ TotalExpenditures 4,165,139.74 $ 4,840,210 $ 4,702,830 $ 5,111,697 $ RevenueminusExpenditures (4,160,409) $ (4,839,710) $ (4,702,330) $ (5,107,497) $ Page 117 DRAFT

2024 Budget

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division

2022 Actual, 2023 Adopted Budget, and 2024 Proposed Budget

Notes:AsofJanuary1,2023,FireDepartmentsalarieswereincreasedtobecompetitivewiththelocalmarket.AssumingtheFireDepartmentwillbefully staffedin2024,thisresultsina$745kbudgetedincreaseinfull-timesalariesanda$121kbudgeteddecreaseinover-time,over2022actuals.$108k(25%) increaseinhealthinsuranceand$147k(24%)increaseinKPFbetween2022and2024(assumesnovacancies).

General Fund Fire Suppression 1101-01400 FTEs - Fire Suppression 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Battalion Chief 3.0 3.0 3.0 3.0 Fire Captain 12.0 12.0 12.0 12.0 Fire Driver/Operator 12.0 12.0 12.0 12.0 Firefighter 22.0 22.0 22.0 22.0 Total FTEs - Fire Suppression Division 49.0 49.0 49.0 49.0 Salary - Fire Suppression 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Full Time 2,244,338 2,753,720 2,690,000 2,989,196 Overtime 271,556 172,800 172,800 150,000 Part Time - - -Specialty Assignment Pay 7,846 13,200 7,800 15,600 Public Safety Holiday Pay 84,987 69,000 85,000 85,000 Longevity 13,975 14,380 14,380 15,490 Total Salaries - Fire Suppression 2,622,703 3,023,100 2,969,980 3,255,286 Taxes & Benefits - Fire Suppression 1,297,767 1,533,910 1,469,850 1,592,761 Total Salaries, Taxes & Benefits - Fire Suppression 3,920,470 4,557,010 4,439,830 4,848,047 Compare Years - Fire Suppression Salary $ Change Benefit $ Change Salary % Change Benefit % Change 2022 Actual to 2023 Budget 400,397 $ 236,143 $ 15.3% 18.2% 2023 Budget to 2023 Projection (53,120) $ (64,060) $ -1.8% -4.2% 2023 Projection to 2024 Proposed Budget 285,306 $ 122,911 $ 9.6% 8.4% 2022 Actual to 2024 Proposed Budget 632,583 $ 294,994 $ 24.1% 22.7%

Page 118 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Fire Prevention Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue LicensesandPermitsRevenue 110101410Permit-FoodHandlers5310 2,970 2,600 2,600 2,600 110101410Permit-HealthInspection5311 1,205 15,400 15,400 15,000 TotalLicensesandPermitsRevenue 4,175 $ 18,000 $ 18,000 $ 17,600 $ ChargesforServices 110101410USTInspectionFees 5431 - 200 200TotalChargesforServices - $ 200 $ 200 $ - $ MiscellaneousRevenue 110101410ContributionRev 5863 (1) - -TotalMiscellaneousRevenue (1) $ - $ - $ - $ TotalRevenue 4,174 $ 18,200 $ 18,200 $ 17,600 $ Expenditures PersonalServices 110101410FullTime 6101 142,657 153,790 153,790 174,063 2full-timeemployees: SafetyOfficer/HealthInspector(1),FireMarshall(1) 110101410Overtime 6102 - 100 -110101410Longevity 6107 1,200 1,200 1,200 1,200 110101410FICAExp 6108 1,895 2,250 2,250 2,541 110101410HealthInsurance 6110 40,861 44,090 44,090 44,480 110101410KP&FExp 6115 33,067 35,660 35,660 40,486 110101410Worker'sCompensation6116 3,169 4,460 4,460 5,046 110101410UnemploymentInsurance6120 131 150 150 174 TotalPersonalServices 222,980 $ 241,700 $ 241,600 $ 267,989 $ ContractualServices 110101410Lodging 6302 - 500 500 500 Localandnonlocaltrainingconferences 110101410Meals 6303 - 150 150 150 Localandnonlocaltrainingconferences 110101410Parking/Tolls 6305 3 40 40 40 Localandnonlocaltrainingconferences 110101410Registration 6403 1,100 2,000 2,000 2,000 Localandnonlocaltrainingconferences 110101410DuesMemberships&Subs6601 230 1,900 1,900 1,900 Internationalcodecouncil,NFPA, 110101410Printing/CopyingServices6617 - 200 200 200 Arsoninvestigationphotos 110101410OtherProfessionalServices6699 3,790 - -TotalContractualServices 5,123 $ 4,790 $ 4,790 $ 4,790 $ Commodities 110101410EducationalMaterials7004 826 1,000 1,000 1,000 Publiceducationmaterial 110101410Protective/SafetyApparel7102 - 200 200 200 Specifictoarsoninvestigations 110101410Gasoline 7302 - 100 100 100 Whenneeded-foroutsideofthecitytravels 110101410Tools 7317 - 500 500 500 Page 119 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Fire Prevention Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes 110101410PhotographicSupplies7324 - 50 50 50 Camera,copies 110101410OtherOperatingSupplies7399 278 750 750 750 Miscellaneous,educationalforfirepreventionweek TotalCommodities 1,104 $ 2,600 $ 2,600 $ 2,600 $ TotalExpenditures 229,207 $ 249,090 $ 248,990 $ 275,379 $ RevenueminusExpenditures (225,033) $ (230,890) $ (230,790) $ (257,779) $ Page 120 DRAFT

2024 Budget

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division

2022 Actual, 2023 Adopted Budget, and 2024 Proposed Budget

Notes:AsofJanuary1,2023,FireDepartmentsalarieswereincreasedtobecompetitivewiththelocalmarket.Thisresultsina$34k(22%)budgetedincrease infull-timesalaries.

General Fund Fire Prevention 1101-01410 FTEs - Fire Prevention 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Safety Officer/Health Inspector 1.0 1.0 1.0 1.0 Fire Marshall 1.0 1.0 1.0 1.0 Total FTEs - Fire Prevention Division 2.0 2.0 2.0 2.0 Salary - Fire Prevention 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Full Time 142,657 153,790 153,790 174,063 Overtime - 100 -Part Time - - -Specialty Assignment Pay - - -Public Safety Holiday Pay - - -Longevity 1,200 1,200 1,200 1,200 Total Salaries - Fire Prevention 143,857 155,090 154,990 175,263 Taxes & Benefits - Fire Prevention 79,123 86,610 86,610 92,727 Total Salaries, Taxes & Benefits - Fire Prevention 222,980 241,700 241,600 267,989 Compare Years - Fire Prevention Salary $ Change Benefit $ Change Salary % Change Benefit % Change 2022 Actual to 2023 Budget 11,233 $ 7,487 $ 7.8% 9.5% 2023 Budget to 2023 Projection (100) $ - $ -0.1% 0.0% 2023 Projection to 2024 Proposed Budget 20,273 $ 6,117 $ 13.1% 7.1% 2022 Actual to 2024 Proposed Budget 31,406 $ 13,604 $ 21.8% 17.2%

Page 121 DRAFT

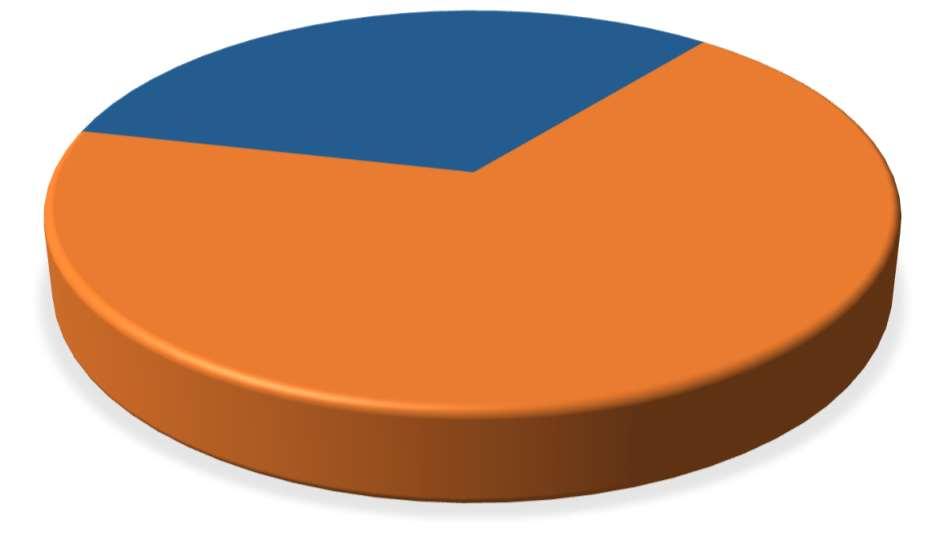

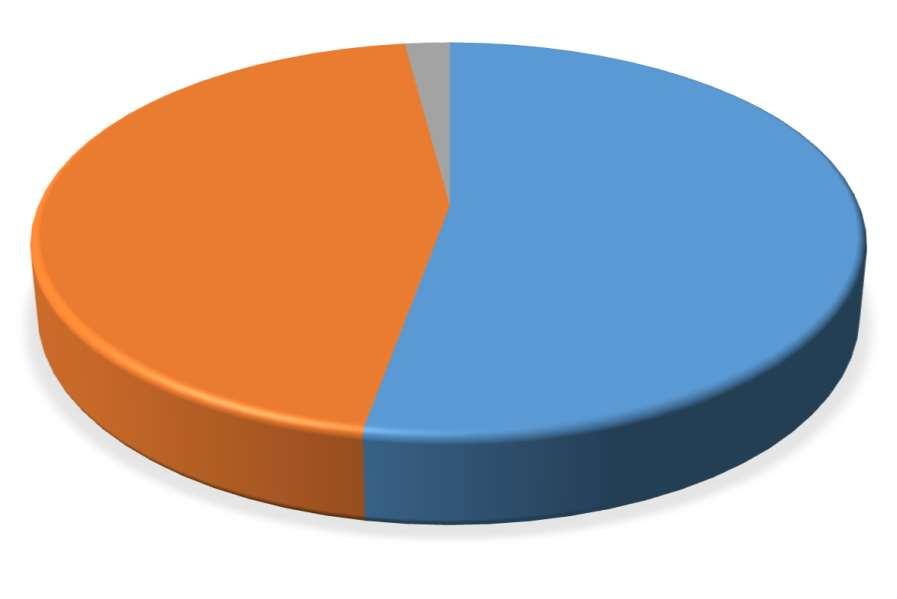

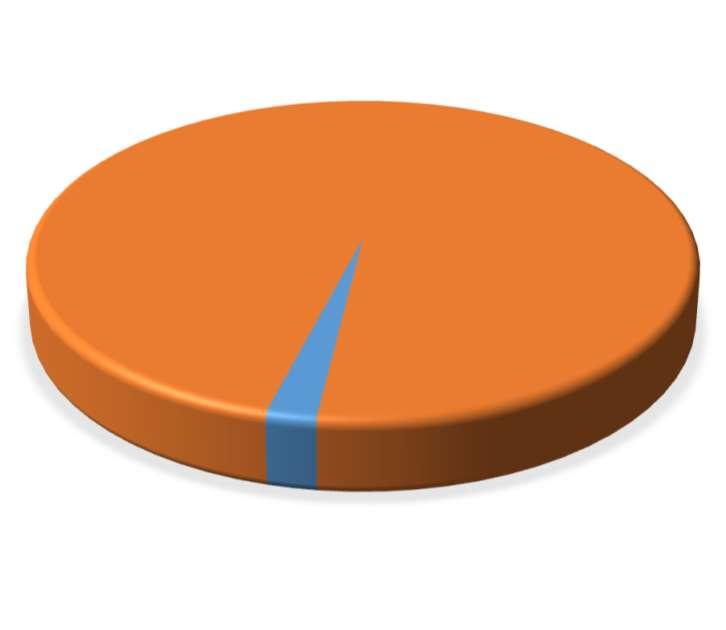

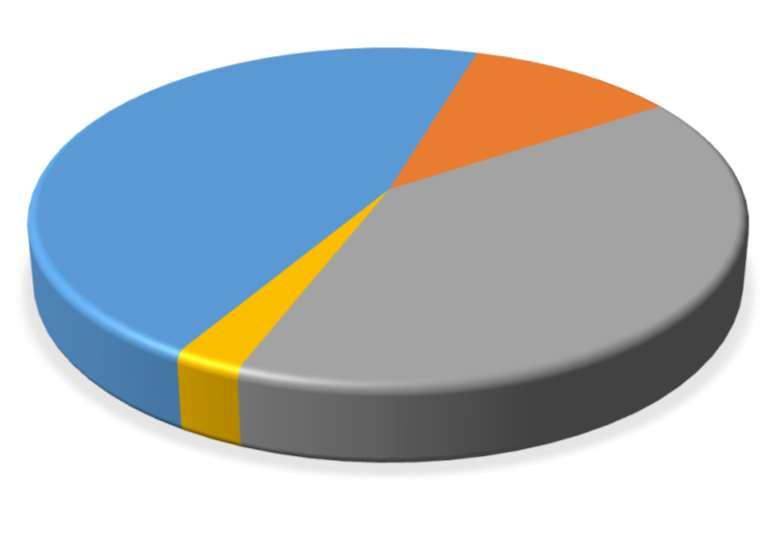

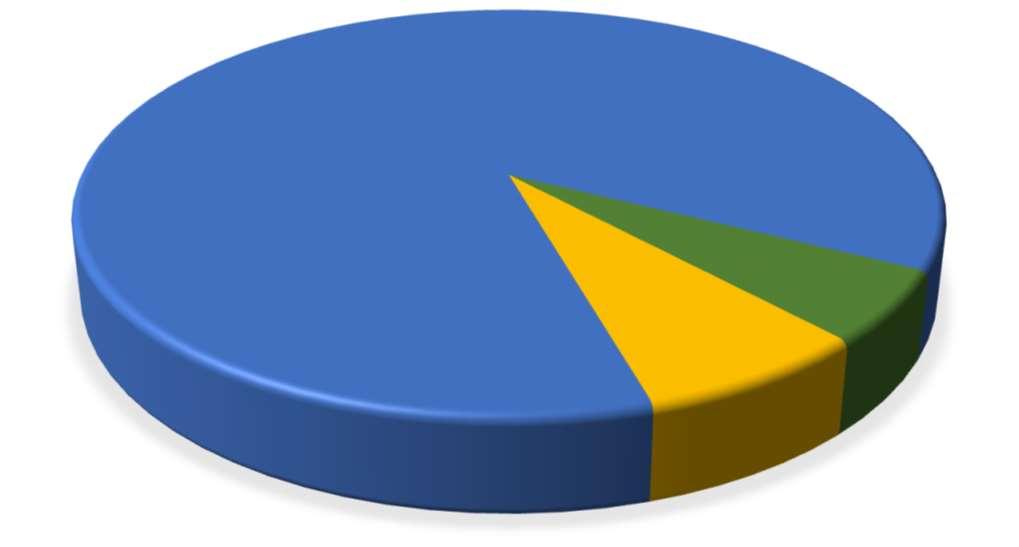

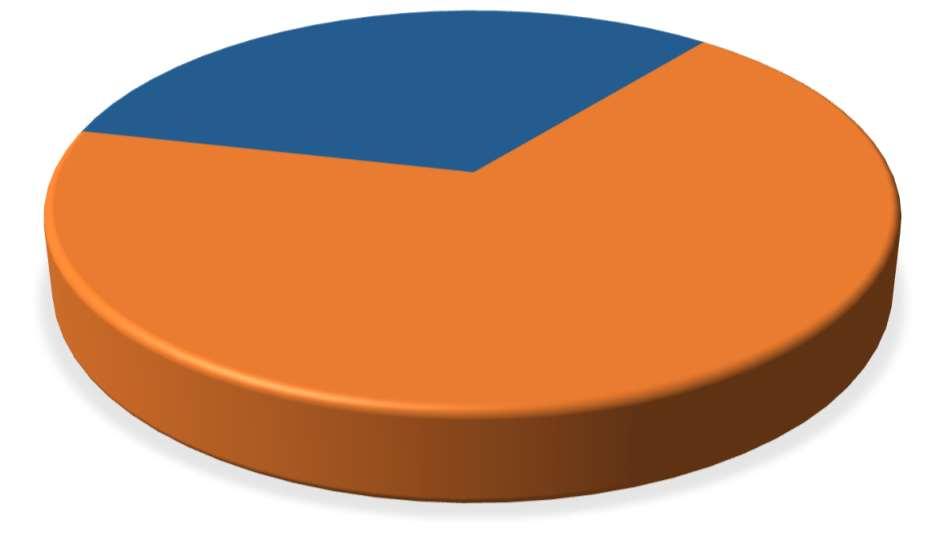

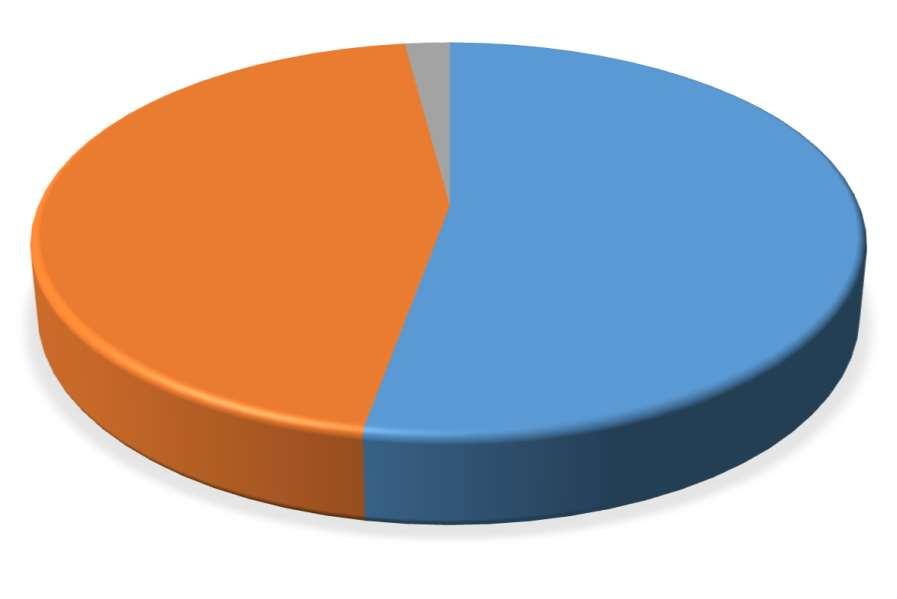

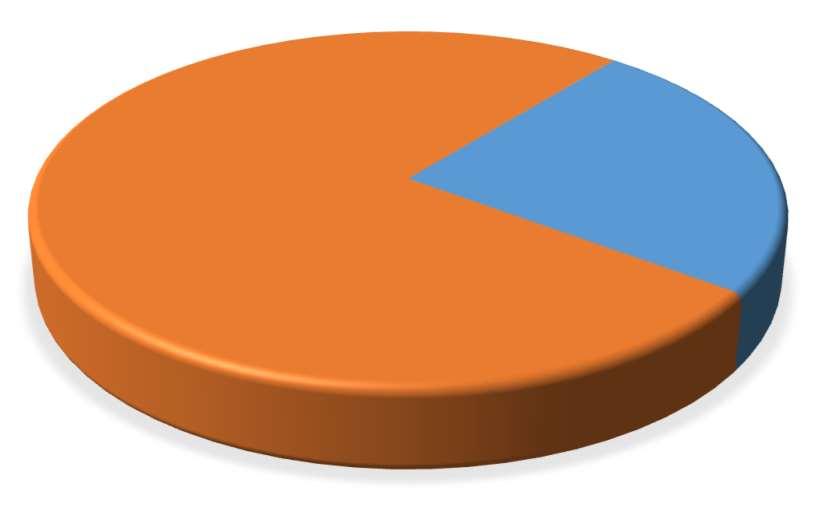

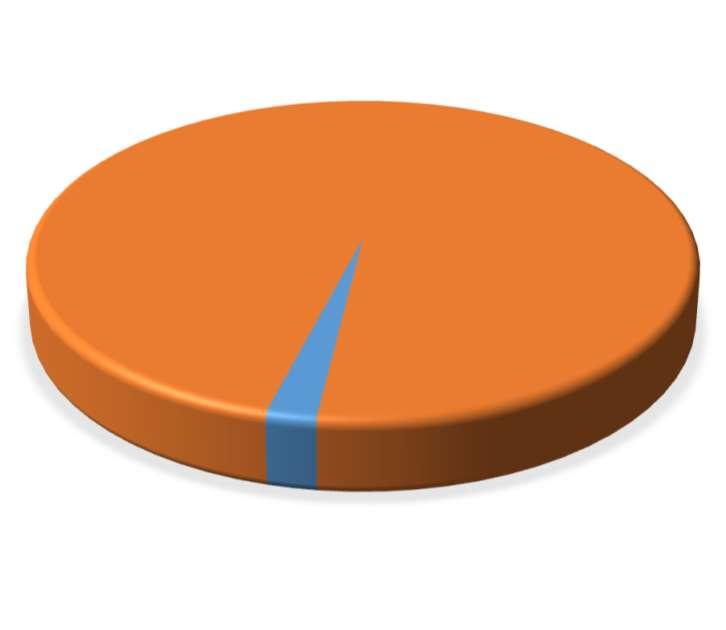

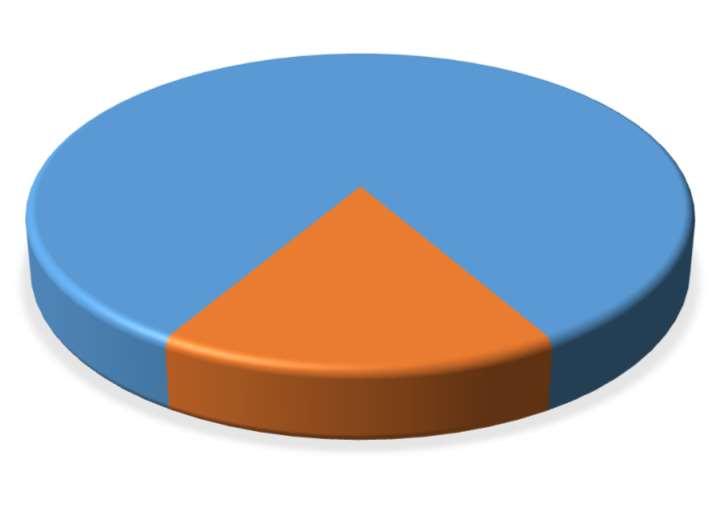

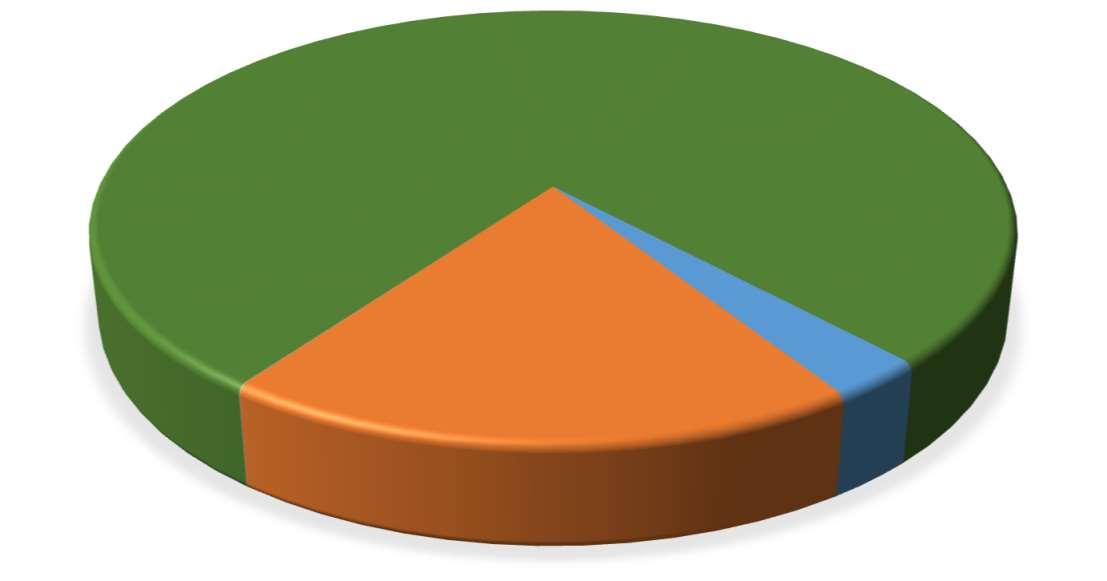

General Fund 2024 Proposed Budget 2022 Actual Expenses 2023 Adopted Budget2023 Projection 2024 Proposed Budget Administration Dispatch Police Operations Animal Control Parking Enforcement Total 2024 Police Budget Revenue TaxRevenue - - - - - - - - -IntergovernmentalRevenue - 2,600 2,600 2,600 - - 2,600 - - 2,600 Licenses&Permits - - - - - - - - -ChargesforServices 95,102 125,100 113,200 122,967 15,800 - 69,967 36,000 1,200 122,967 MiscellaneousRevenue 24,635 3,700 25,400 302,806 - 297,106 1,000 4,700 - 302,806 BalanceForward(Reserves) - - - - - - - - -Total Revenue 119,737 $ 131,400 $ 141,200 $ 428,374 $ 15,800 $ 297,106 $ 73,567 $ 40,700 $ 1,200 $ 428,374 $ Expenditures PersonalServices 6,883,466 7,493,040 7,205,875 8,291,550 1,321,722 832,496 5,772,221 365,112 - 8,291,550 ContractualServices 910,984 1,037,778 1,046,838 1,391,625 817,975 297,606 186,350 89,694 - 1,391,625 Commodities 313,622 308,160 314,160 313,321 34,480 - 253,975 24,866 - 313,321 CapitalOutlay 4,519 17,955 21,700 18,000 - - 18,000 - - 18,000 DebtService - - - - - - - - -Miscellaneous - - - - - - - - -General&CapitalReserves - - - - - - - - -Total Expenditures 8,112,591 $ 8,856,933 $ 8,588,573 $ 10,014,496 $ 2,174,177 $ 1,130,102 $ 6,230,546 $ 479,672 $ - $ 10,014,496 $ Revenue minus Expenditures (7,992,854) $ (8,725,533) $ (8,447,373) $ (9,586,122) $ (2,158,377) $ (832,995) $ (6,156,979) $ (438,972) $ 1,200 $ (9,586,122) $ Police Department Summary Budget 2024 Proposed Budget: Police Department by Division PersonalServices $8,291,550 83% ContractualServices $1,391,625 14% Commodities $313,321 3% CapitalOutlay $18,000 0% Administration $2,174,177 22% Dispatch $1,130,102 11% PoliceOperations $6,230,546 62% AnimalControl $479,672 5% 2024Budget:PoliceDepartmentExpendituresbyDivision 2024Budget:PoliceDepartmentExpendituresbyType Page 122 DRAFT

City of Leavenworth, Kansas

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Police Administration Division

13full-timeemployees: PoliceChief(1),DeputyPoliceChief(1),Lieutenant(1), Sergeant(1),Secretary(1),AdminSpecialist(1),EvidenceCustodian(1),Records Supervisor(1),RecordsClerk(3),ITSpecialist(2)

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue ChargesforServices 110101330AlarmResponseFees5455 150 400 400 400 ExcessiveAlarmResponseFees 110101330OpenPublicRecordsFees5711 7,633 10,300 10,300 8,600 Copiesofreports/videos 110101330ChargesForService-Other5799 9,798 5,800 5,800 6,800 Fingerprinting/PioneerGroup-VA TotalChargesforServices 17,581 $ 16,500 $ 16,500 $ 15,800 $ MiscellaneousRevenue 110101330Other-Miscellaneous5899 200 - 21,700 - 2023Projectedisinsuranceproceedsfordrone. TotalMiscellaneousRevenue 200 $ - $ 21,700 $ - $ TotalRevenue 17,781 $ 16,500 $ 38,200 $ 15,800 $ Expenditures PersonalServices 110101330FullTime 6101 736,991 781,710 750,000 885,954

110101330Overtime 6102 15,695 13,600 13,600 15,500 110101330SpecialtyAssignmentPay6105 1,800 1,800 1,800 1,800 110101330HolidayPay 6106 1,129 3,100 3,100 1,500 110101330Longevity 6107 3,975 4,950 4,950 4,060 110101330FICAExp 6108 26,348 31,860 10,875 36,552 110101330HealthInsurance 6110 195,056 216,750 216,750 191,829 110101330KPERSExp 6111 27,456 28,810 28,810 34,653 110101330KP&FExp 6115 110,483 112,600 110,000 126,239 110101330Worker'sCompensation6116 465 10,050 10,050 10,829 110101330UnemploymentInsurance6120 707 800 800 905 110101330SickLeaveReimbursement6122 207 - -110101330 VacationLeaveReimbursement6123 195 - -110101330ClothingAllowance 6125 1,750 2,000 2,000 2,000 110101330AutomobileAllowance6126 9,900 6,300 6,300 9,900 Chief-300,DC-275,LT-250*12=9,900 +$3,600 TotalPersonalServices 1,132,157 $ 1,214,330 $ 1,159,035 $ 1,321,722 $ ContractualServices 110101330Telephone 6206 37,381 37,000 37,000 12,000 FaxMachinesandlandlines.Moved$25,000to6639 110101330Postage 6207 700 1,500 1,500 1,500 Shippingforrepairs/misc. 110101330OtherUtilities 6299 199 600 600 600 SpectrumCable 110101330CommercialTravel 6301 - 998 998 1,000 Training/Conferences 110101330Lodging 6302 2,906 1,200 1,200 1,200 Training/Conferences 110101330Meals 6303 375 700 700 700 PerDiem 110101330Parking/Tolls 6305 608 1,200 1,200 1,200 K-Tag 110101330Registration 6403 5,253 3,500 3,500 3,500 Training/Conferences Page 123 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes 110101330ClassifiedAdvertising6451 21,557 6,000 20,000 20,000 RecruitingAdcostsremainhightogetpoliceofficerapplicants +14,000 110101330LegalAdvertising 6453 22 250 250 250 JobAds-Newspaper 110101330Insurance 6501 95,238 100,000 100,000 100,000 110101330DuesMemberships&Subs6601 2,676 1,800 1,800 1,800 ProfessionalAssociations 110101330Admin&Supervision6607 65 - - - In-custodymedicalcosts 110101330MedicalServices 6610 - 5,000 5,000 5,000 Contingencyfundformedicalcostsassociatedwithapprehendedpersons 110101330Laundry&Cleaning 6613 19 100 100 100 110101330RelocationExpenses6615 - 998 998 1,000 Recruitmentrelated 110101330Printing/CopyingServices6617 3,343 1,600 1,600 1,600 Multi-partforms/citations/letterhead 110101330FoodServicesExp 6619 - 400 400 400 110101330CareOfPrisoners 6621 97,460 130,000 100,000 142,000 Effective1JAN2024-jailfeesincreased$5/dayto$60.+$12,000 110101330ITServices 6623 140,517 178,000 43,000 34,000 Internet&Firewall--Moved$144,000inbackupfeesto6639 110101330PersonnelTestingServices6631 4,325 6,983 6,983 7,000 PsychologicalTesting 110101330PDAdmin-BackupFees6639 - - 135,000 169,000 BackupFees--Moved$25,000from6206&$144,000from6623 110101330TrainingServices 6641 122 300 300 300 110101330OtherProfessionalServices6699 44,567 45,000 45,000 46,000 JusticeCenterSecurity-ReflectsamountneededafterMCseparates 110101330EquipmentRentalExp6702 - - -110101330OtherRental 6799 112,839 150,000 150,000 150,000 JusticeCenterelectricity/gas/water/rentcostincreases 110101330Building/GroundsM&R6802 8,728 11,800 11,800 11,800 Replacecarpet/paint 110101330ITEquipmentM&R 6851 240 4,489 4,489 4,500 Body-worncamera(BWC)repairs 110101330OfficeEquipmentM&R6852 2,294 500 500 500 Toner 110101330VehicleM&R 6861 1,835 698 698 700 Leasedvehiclesreducedmaintenancecosts 110101330SoftwareMaintenance6862 91,115 98,700 98,700 98,700 AnnualSoftwareMaintenance&SupportCosts 110101330OtherEquipmentM&R6899 14 - -110101330VehicleLicenseFees6902 - 200 200 200 vehicleregistration 110101330MiscellaneousPermits6903 525 600 600 600 K-9/BombTeam 110101330ContributionsExp 6913 528 125 125 125 KSLeagueofMunicipalities 110101330BankCharges 6918 660 700 700 700 Misc.creditcardexpenses TotalContractualServices 676,110 $ 790,941 $ 774,941 $ 817,975 $ Commodities 110101330OfficeSupplies 7001 15,373 13,400 13,400 13,400 Copypaper/folders/pens 110101330Books/Magazines 7002 2,327 5,600 5,600 5,600 professionaljournals/media 110101330Clothing&Uniforms7101 1,280 1,995 1,995 1,995 110101330Protective/SafetyApparel7102 338 - -110101330OtherPoliceMaterials7199 6,113 3,990 3,990 3,990 EvidencePackingsupplies 110101330Food 7201 5,368 5,985 5,985 6,000 Departmenttraining/coffeeservice 110101330Building/GroundsMaterials7301 92 - -110101330Gasoline 7302 1,269 1,500 1,500 1,500 110101330JanitorialSupplies 7319 18 - -110101330OtherOperatingSupplies7399 3,315 1,995 1,995 1,995 plaques/batteries/misc. 110101330Non-CapOfficeEquipment7401 379 - -110101330Non-CapAppliances7403 80 - -Page 124 DRAFT

Police Administration Division

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Police Administration Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes 110101330Non-CapITEquipment7406 1,719 - -110101330Non-CapPoliceEquipment7607 56 - -110101330Non-CapTelephoneEquipment7613 52 - -TotalCommodities 37,778 $ 34,465 $ 34,465 $ 34,480 $ TotalExpenditures 1,846,045 $ 2,039,736 $ 1,968,441 $ 2,174,177 $ RevenueminusExpenditures (1,828,264) $ (2,023,236) $ (1,930,241) $ (2,158,377) $ Page 125 DRAFT

Staffing

Budget

2024

and Salaries, Taxes & Benefits),

Division 2022 Actual, 2023 Adopted Budget, and 2024 Proposed Budget General Fund Police Administration 1101-01330 FTEs - Police Admin 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Police Chief 1.0 1.0 1.0 1.0 Deputy Police Chief 1.0 1.0 1.0 1.0 Lieutenant 1.0 1.0 1.0 1.0 Sergeant (In operations budget in 2022) - 1.0 1.0 1.0 Secretary 1.0 1.0 1.0 1.0 Administrative Specialist 1.0 1.0 1.0 1.0 Evidence Custodian 1.0 1.0 1.0 1.0 Records Supervisor 1.0 1.0 1.0 1.0 Records Clerk 3.0 3.0 3.0 3.0 IT Specialist II 1.0 1.0 1.0 1.0 IT Specialist I - - 1.0 1.0 Total FTEs - Police Admin Division 11.0 12.0 13.0 13.0 Salary - Police Admin 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Full Time 736,991 781,710 750,000 885,954 Overtime 15,695 13,600 13,600 15,500 Part Time - - -Specialty Assignment Pay 1,800 1,800 1,800 1,800 Public Safety Holiday Pay 1,129 3,100 3,100 1,500 Longevity 3,975 4,950 4,950 4,060 Total Salaries - Police Admin 759,591 805,160 773,450 908,814 Taxes & Benefits - Police Admin 372,566 409,170 385,585 412,908 Total Salaries, Taxes & Benefits - Police Admin. Div. 1,132,157 1,214,330 1,159,035 1,321,722 Compare Years - Police Admin Salary $ Change Benefit $ Change Salary % Change Benefit % Change 2022 Actual to 2023 Budget 45,569 $ 36,604 $ 6.0% 9.8% 2023 Budget to 2023 Projection (31,710) $ (23,585) $ -3.9% -5.8% 2023 Projection to 2024 Proposed Budget 135,364 $ 27,323 $ 17.5% 7.1% 2022 Actual to 2024 Proposed Budget 149,223 $ 40,342 $ 19.6% 10.8% Notes:The2022PoliceAdminactualdidnotincludeone(1)Sergeant(budgetedinoperationsin2022)andonlyincludedone(1)ITSpecialist.TheSergeant wasaddedtothePoliceAdminbudget(fromPoliceOperationsbudget)in2023andthesecondITSpecialistwasaddedtothePoliceAdminbudget(fromtheIT budget)in2024.The2023projectionincludesthesecondITSpecialist. Page 126 DRAFT

Summary (FTEs

by Fund and by

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Police Dispatch Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue IntergovermentalRevenue 110101335911WirelessFee 4206 - $ - $ - $ 297,106 $ 911Fundclosedasof12/31/2023. Revenuefrom911feeallocatedtodispatch. 100%ofthefundswillbetransferredtotheCountytosupporttheDispatchCall Center TotalIntergovernmentalRevenue - $ - $ - $ 297,106 $ TotalRevenue - $ - $ - $ 297,106 $ Expenditures PersonalServices 110101335FullTime 6101 396,730 432,170 410,000 495,924 10full-timeemployees: Dispatchers(10) 110101335Overtime 6102 53,594 65,900 54,000 54,000 110101335HolidayPay 6106 14,203 10,700 14,200 14,500 110101335Longevity 6107 3,250 3,530 3,530 3,765 110101335FICAExp 6108 31,990 39,190 36,850 43,466 110101335HealthInsurance 6110 150,142 165,700 182,000 167,167 110101335KPERSExp 6111 44,305 45,590 45,590 52,614 110101335Worker'sCompensation6116 259 1,890 1,890 494 110101335UnemploymentInsurance6120 418 510 510 564 110101335SickLeaveReimbursement6122 270 - -110101335 VacationLeaveReimbursement6123 273 - -TotalPersonalServices 695,434 $ 765,180 $ 748,570 $ 832,496 $ ContractualServices 110101335ClassifiedAdvertising6451 366 500 500 500 Recruiting 110101335OperatingTransfers6998 - - - 297,106 911FeetransferredtotheCountytosupporttheDispatchCallCenter TotalContractualServices 366 $ 500 $ 500 $ 297,606 $ TotalExpenditures 695,799 $ 765,680 $ 749,070 $ 1,130,102 $ RevenueminusExpenditures (695,799) $ (765,680) $ (749,070) $ (832,995) $ Page 127 DRAFT

2024 Budget

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division

2022 Actual, 2023 Adopted Budget, and 2024 Proposed Budget

Notes:The2022actualsincludedanequivalentofonevacancy.The2023and2024budgetsincludeten(10)Dispatcherpositionsfilledfortheentireyear.The 2023projectionincludesapartialyearvacancy.

General Fund Police Dispatch 1101-01335 FTEs - Dispatch 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Dispatchers (Telecom Specialists) 9.0 10.0 10.0 10.0 Total FTEs - Dispatch Division 9.0 10.0 10.0 10.0 Salary - Dispatch 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Full Time 396,730 432,170 410,000 495,924 Overtime 53,594 65,900 54,000 54,000 Part Time - - -Specialty Assignment Pay - - -Public Safety Holiday Pay 14,203 10,700 14,200 14,500 Longevity 3,250 3,530 3,530 3,765 Total Salaries - Dispatch 467,777 512,300 481,730 568,189 Taxes & Benefits - Dispatch 227,657 252,880 266,840 264,306 Total Salaries, Taxes & Benefits - Police Dispatch 695,434 765,180 748,570 832,496 Compare Years - Dispatch Salary $ Change Benefit $ Change Salary % Change Benefit % Change 2022 Actual to 2023 Budget 44,523 $ 25,223 $ 9.5% 11.1% 2023 Budget to 2023 Projection (30,570) $ 13,960 $ -6.0% 5.5% 2023 Projection to 2024 Proposed Budget 86,459 $ (2,534) $ 17.9% -0.9% 2022 Actual to 2024 Proposed Budget 100,412 $ 36,649 $ 21.5% 16.1%

Page 128 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Police Operations Division

(8),PoliceOfficers(32)

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue IntergovernmentalRevenue 110101340FederalGrants 4207 - 2,600 2,600 2,600 BulletProofVestReimbursementGrant TotalIntergovernmentalRevenue - $ 2,600 $ 2,600 $ 2,600 $ ChargesforServices 110101340PoliceSecurity 5452 3,938 2,700 4,000 4,000 Off-DutySecurity 110101340ChargesForService-Other5799 53,738 71,200 58,000 65,967 CopsinSchoolsprogram-schoolsreimburse75%ofcostforofficer TotalChargesforServices 57,675 $ 73,900 $ 62,000 $ 69,967 $ MiscellaneousRevenue 110101340ContributionRev 5863 1,600 - - 800 110101340Other-Miscellaneous5899 19,258 - - 200 TotalMiscellaneousRevenue 20,858 $ - $ - $ 1,000 $ TotalRevenue 78,533 $ 76,500 $ 64,600 $ 73,567 $ Expenditures PersonalServices 110101340FullTime 6101 2,764,884 3,170,000 2,900,000 3,439,241 53full-timeemployees:AdminClerk(1),Lieutenants(2),Sergeants(10),Detectives

110101340Overtime 6102 307,001 159,850 300,000 307,500 Overtimewillcontinuetobeapproximately$300kayearduetovacanies. 110101340PartTime 6104 4,866 2,000 6,000 6,000 Polygraphs-$400pertest 110101340SpecialtyAssignmentPay6105 35,129 36,000 36,000 33,600 110101340HolidayPay 6106 79,913 65,000 80,000 80,000 110101340Longevity 6107 9,350 10,480 10,480 10,985 110101340FICAExp 6108 46,901 52,860 11,730 59,615 110101340HealthInsurance 6110 708,146 838,570 838,570 855,428 110101340KPERSExp 6111 4,120 3,980 4,300 4,831 110101340KP&FExp 6115 727,689 783,400 730,000 884,766 110101340Worker'sCompensation6116 49,543 66,970 58,000 75,389 110101340UnemploymentInsurance6120 3,067 3,430 3,430 3,866 110101340SickLeaveReimbursement6122 3,195 - -110101340VacationLeaveReimbursement6123 11,899 - -110101340ClothingAllowance 6125 5,250 5,000 5,000 5,000 110101340AutomobileAllowance6126 6,000 6,000 6,000 6,000 TotalPersonalServices 4,766,952 $ 5,203,540 $ 4,989,510 $ 5,772,221 $ ContractualServices 110101340Telephone 6206 1,888 2,000 2,000 2,000 InvestigativeEquipment/servicefees 110101340Postage 6207 66 100 100 100 110101340CommercialTravel 6301 798 600 600 600 110101340Lodging 6302 7,199 8,000 8,000 8,000 Training Page 129 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes 110101340Meals 6303 5,326 5,600 5,600 5,600 Per-Diem 110101340Parking/Tolls 6305 - 100 100 100 parkingfees 110101340VehicleRental 6306 413 - -110101340Registration 6403 30,868 25,000 30,000 30,000 Officertrainingandcertificationexpenses 110101340ClassifiedAdvertising6451 - 1,000 1,000 1,000 PublicNotices 110101340DuesMemberships&Subs6601 2,656 3,700 3,700 3,700 professionalmembershipdues 110101340MedicalServices 6610 28 400 400 400 110101340VeterinaryServices 6611 737 249 249 250 PoliceK-9 110101340Laundry&Cleaning 6613 13 100 100 100 110101340Printing/CopyingServices6617 538 500 500 500 BusinessCards 110101340TowingServices 6630 1,980 1,700 1,700 1,700 Impoundedvehicles 110101340PersonnelTestingServices6631 714 2,494 2,494 2,500 EntranceExams/Promotionalexams 110101340TrainingServices 6641 845 - -110101340OtherProfessionalServices6699 5,377 6,400 6,400 6,400 Documentshredding/uniformalterations 110101340ITEquipmentM&R 6851 10,000 11,300 25,000 25,000 Annualfeeformaintenance/supporttometro-areadatasharing(ETAC) 110101340VehicleM&R 6861 69,079 83,000 83,000 83,000 Patrolvehiclesaging;fleetrepaircostsincreasewhileawaitingnewunits 110101340OtherEquipmentM&R6899 16,410 14,400 14,400 14,400 Repairin-carcameras/MDTs 110101340VehicleLicenseFees6902 537 1,000 1,000 1,000 vehicleregistration 110101340ContributionsExp 6913 512 - -TotalContractualServices 155,983 $ 167,643 $ 186,343 $ 186,350 $ Commodities 110101340OfficeSupplies 7001 1,702 2,993 2,993 3,000 Misc.OfficeSupplies 110101340Books/Magazines 7002 34 500 500 500 110101340AudioVisualSupplies7003 - 500 500 500 CDs/DVDs 110101340Clothing&Uniforms7101 24,111 29,400 29,400 29,400 PatrolUniforms 110101340Protective/SafetyApparel7102 21,208 25,000 25,000 25,000 Boots/Vests 110101340Ammunition&Targets7151 30,450 25,800 25,800 25,800 Ammo/Tasercartridges 110101340OtherPoliceMaterials7199 4,639 5,786 5,786 5,800 Gunparts/cleaningsupplies/misc. 110101340Food 7201 236 299 299 300 110101340Gasoline 7302 139,859 139,200 139,200 139,200 110101340DieselFuel 7303 1,031 1,000 1,000 1,000 110101340VehicularRepairParts7306 39 4,988 4,988 5,000 LightBarrepairs/Patrolcarequipmentrepairs 110101340Concrete 7308 - 400 400 400 110101340Tools 7317 230 - -110101340AnimalSupplies 7321 498 600 600 600 K-9Equipment/Food 110101340DARECampSupplies7329 9,723 9,975 9,975 9,975 PDSummerCampExpenses 110101340OtherOperatingSupplies7399 5,169 4,988 4,988 5,000 Drugtestkits/intox&pbtmouthpieces 110101340Non-CapFurniture/Furnishings7402 180 - -110101340Non-CapITEquipment7406 1,193 1,500 1,500 2,500 Monitors/screens/printerreplacement+$1,000 110101340Non-CapPoliceEquipment7607 15,450 - -110101340Non-CapSafetyEquipment7612 380 - -TotalCommodities 256,130 $ 252,929 $ 252,929 $ 253,975 $ Page 130 DRAFT

Police Operations Division

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Police Operations Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes CapitalOutlays 110101340OtherEquipment 8599 4,519 17,955 21,700 18,000 2023: Dronepurchase,receivedinsurancereimbursementinPoliceAdminDivision TotalCapitalOutlays 4,519 $ 17,955 $ 21,700 $ 18,000 $ TotalExpenditures 5,183,584 $ 5,642,067 $ 5,450,482 $ 6,230,546 $ RevenueminusExpenditures (5,105,050) $ (5,565,567) $ (5,385,882) $ (6,156,979) $ Page 131 DRAFT

Staffing

Notes:2023budgetedsalariesincreasedover2022actualsalariesduetobudgetingallpositionfullfortheentireyear.2022actualsincludevacancies.There wasamid-yearsalaryadjustmentin2022tobringpolicesalariestomarketrate,whichwasineffectforallof2023.2024budgetassumesnovacancies.

UniformedOfficersreceivespecialtyassignmentpayiftheyareassignedtoSWAT,K9,CrisisNegotiator,RangeMaster,FTO,DronePilots,orBombTeam.Allof theseassignmentsrequirespecialtraining.IfanOfficerservesononeoftheseassignments,theyreceive$100/month.Iftheyserveintwoormore assignments,theyreceive$150/month.PolygraphExaminerreceives$400perpolygraphtestadministered.

2024 Budget

Summary

and Salaries, Taxes & Benefits), by Fund and by Division 2022 Actual, 2023 Adopted Budget, and 2024 Proposed Budget General Fund Police Operations 1101-01340 FTEs - Police Operations 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Administrative Clerk 1.0 1.0 1.0 1.0 Lieutenant 2.0 2.0 2.0 2.0 Sergeant 11.0 10.0 10.0 10.0 Detective 7.0 8.0 8.0 8.0 Police Officer 35.0 32.0 32.0 32.0 PT - Polygraph Examiner - on call, as needed - - -Total FTEs - Police Operations Division 56.0 53.0 53.0 53.0 Salary - Police Operations 2022 Actual 2023 Adopted Budget 2023 Projection 2024 Proposed Budget Full Time 2,764,884 3,170,000 2,900,000 3,439,241 Overtime 307,001 159,850 300,000 307,500 Part Time 4,866 2,000 6,000 6,000 Specialty Assignment Pay 35,129 36,000 36,000 33,600 Public Safety Holiday Pay 79,913 65,000 80,000 80,000 Longevity 9,350 10,480 10,480 10,985 Total Salaries - Police Operations 3,201,142 3,443,330 3,332,480 3,877,326 Taxes & Benefits - Police Operations 1,565,810 1,760,210 1,657,030 1,894,895 Total Salaries, Taxes & Benefits - Police Ops 4,766,952 5,203,540 4,989,510 5,772,221 Compare Years - Police Operations Salary $ Change Benefit $ Change Salary % Change Benefit % Change 2022 Actual to 2023 Budget 242,188 $ 194,400 $ 7.6% 12.4% 2023 Budget to 2023 Projection (110,850) $ (103,180) $ -3.2% -5.9% 2023 Projection to 2024 Proposed Budget 544,846 $ 237,865 $ 16.3% 14.4% 2022 Actual to 2024 Proposed Budget 676,184 $ 329,085 $ 21.1% 21.0%

(FTEs

Page 132 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Animal Control Division

FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes Revenue ChargesforServices 110101350AnimalPickUpFees 5462 12,275 16,900 16,900 16,000 Runningat-largefees/housingfee 110101350ChargesForService-Other5799 6,370 16,600 16,600 20,000 Adoptionfees/feesfromLansing,Tonganoxie,etc. TotalChargesforServices 18,645 $ 33,500 $ 33,500 $ 36,000 $ MiscellaneousRevenue 110101350ContributionRev 5863 145 - - 200 110101350DepositsShort&Over5896 - - -110101350Other-Miscellaneous5899 3,432 3,700 3,700 4,500 Traprental/surrenderfees TotalMiscellaneousRevenue 3,577 $ 3,700 $ 3,700 $ 4,700 $ TotalRevenue 22,222 $ 37,200 $ 37,200 $ 40,700 $ Expenditures PersonalServices 110101350FullTime 6101 193,439 211,930 210,000 238,803 6full-timeemployees: AnimalControl[AC]Supervisor(1),ACOfficers(2),Records Clerk(1),KennelAttendants(2) 110101350Overtime 6102 5,427 3,300 4,000 5,500 110101350Longevity 6107 570 690 690 810 110101350FICAExp 6108 14,788 16,520 16,520 18,751 110101350HealthInsurance 6110 50,554 54,380 54,380 68,567 110101350KPERSExp 6111 20,392 21,020 21,020 30,307 110101350Worker'sCompensation6116 1,757 1,930 1,930 2,129 110101350UnemploymentInsurance6120 193 220 220 244 110101350SickLeaveReimbursement6122 385 - -110101350VacationLeaveReimbursement6123 1,418 - -TotalPersonalServices 288,923 $ 309,990 $ 308,760 $ 365,112 $ ContractualServices 110101350Electricity 6201 13,899 13,000 14,000 15,000 Increaseincostofelectricity +$2,000 110101350NaturalGas 6202 9,188 4,500 5,700 6,000 Increaseinpriceofnaturalgas +$5,500 110101350Water 6203 1,172 800 1,000 1,300 Increaseinpriceofwater +$500 110101350Telephone 6206 844 1,000 1,000 1,000 Landlines/cellphones 110101350Meals 6303 - 150 150 150 Per-diemfortraining 110101350Registration 6403 373 1,000 1,000 1,000 Training/conferenceregistration 110101350ClassifiedAdvertising6451 216 - -110101350Insurance 6501 2,234 2,300 2,300 2,300 110101350DuesMemberships&Subs6601 25 200 200 200 ProfessionalAssociationMembership/resources 110101350VeterinaryServices 6611 21,819 15,000 22,000 22,000 Spay/neuter/vaccinationcosts-HOPEClinic&Vet +$7,000 110101350PestControlServices6612 772 800 800 800 Professionalpestcontrol 110101350JanitorialServices 6614 9,960 11,000 9,960 11,000 2023JanitorialContractis$9,960peryear 110101350Printing/CopyingServices6617 1,465 800 800 800 Citations/forms/businesscards Page 133 DRAFT

City of Leavenworth, Kansas

General Fund Proposed Budget

January 1, 2024 - December 31, 2024

Animal Control Division FUNDORGAccountDescriptionOBJ 2022Actual 2023Adopted Budget 2023Projection 2024Proposed Budget Notes 110101350Landscaping&LawnServices6618 700 750 750 750 Lawnmowingservice 110101350OtherProfessionalServices6699 1,735 5,000 3,000 5,000 Cremation 110101350Building/GroundsM&R6802 9,198 18,500 18,500 18,500 Increasingcostsasbuildingages 110101350VehicleM&R 6861 3,706 2,494 2,494 2,494 Repairfleetvehicles 110101350MiscellaneousPermits6903 400 400 400 400 Stateshelterlicense 110101350OtherOperatingExpenses6917 50 - -110101350BankCharges 6918 770 1,000 1,000 1,000 Misc.creditcardpurchases TotalContractualServices 78,526 $ 78,694 $ 85,054 $ 89,694 $ Commodities 110101350OfficeSupplies 7001 987 2,125 2,125 2,125 Copypaper/misc.officesupplies 110101350Books/Magazines 7002 - 100 100 100 110101350Clothing&Uniforms7101 867 998 998 998 ACuniforms 110101350Protective/SafetyApparel7102 759 600 600 600 PPE/Boots 110101350Drugs 7251 2,340 1,600 1,600 3,700 Euthanasiadrugs/vaccines-Donationsdown +$2,100 110101350Building/GroundsMaterials7301 91 - 6,000 - Addoutdoorkennelsin2023duetoovercrowdingofanimals 110101350Gasoline 7302 5,783 7,500 7,500 7,500 Patrolvehiclefuel 110101350SafetyMaterials 7314 37 - -110101350JanitorialSupplies 7319 1,031 1,000 1,000 1,000 Cleaningsupplies 110101350AnimalSupplies 7321 3,243 2,494 2,494 4,494 AnimalFood/decreaseddonations +$2,000 110101350OtherOperatingSupplies7399 2,438 2,793 2,793 2,793 Kittylitter/syringes/bowls/misc. 110101350Non-CapSoftware 7405 - 1,556 1,556 1,556 Misc.officesoftware 110101350Non-CapITEquipment7406 2,137 - -TotalCommodities 19,714 $ 20,766 $ 26,766 $ 24,866 $ TotalExpenditures 387,162 $ 409,450 $ 420,580 $ 479,672 $ RevenueminusExpenditures (364,940) $ (372,250) $ (383,380) $ (438,972) $ Page 134 DRAFT

2024 Budget

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division

2022 Actual, 2023 Adopted Budget, and 2024 Proposed Budget

Notes:2022ActualsincludedvacantKennelAttendantforpartoftheyear.