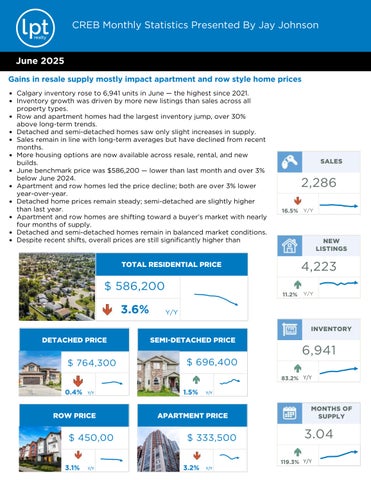

CREB Monthly Statistics Presented By Jay Johnson

Gains in resale supply mostly impact apartment and row style home prices

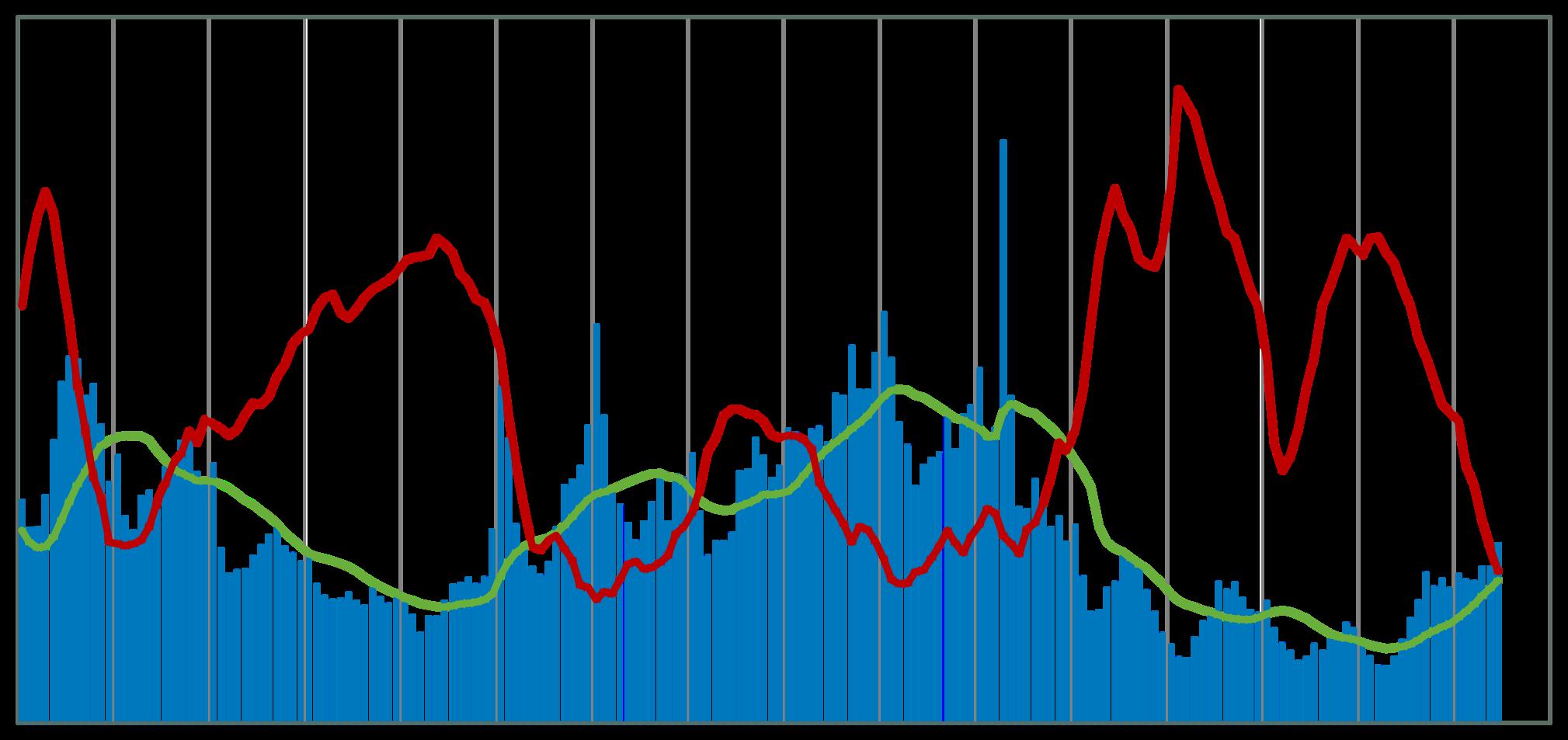

Calgary inventory rose to 6,941 units in June the highest since 2021 Inventory growth was driven by more new listings than sales across all property types.

Row and apartment homes had the largest inventory jump, over 30% above long-term trends.

Detached and semi-detached homes saw only slight increases in supply. Sales remain in line with long-term averages but have declined from recent months

More housing options are now available across resale, rental, and new builds

June benchmark price was $586,200 lower than last month and over 3% below June 2024

Apartment and row homes led the price decline; both are over 3% lower year-over-year.

Detached home prices remain steady; semi-detached are slightly higher than last year.

Apartment and row homes are shifting toward a buyer’s market with nearly four months of supply

Detached and semi-detached homes remain in balanced market conditions Despite recent shifts, overall prices are still significantly higher than

SALES NEW LISTINGS INVENTORY MONTHS OF SUPPLY 3.04 2,286 4,223 6,941

CREB Monthly Statistics Presented By Jay Johnson

Detached

June sales were 1,194 units down 6% from both last month and last year

Most sales declines were in higher-priced resale homes, likely due to competition from new builds

Largest sales drops occurred in City Centre and North East (over 20%)

Year-over-year sales increased in the West and South East districts

Inventory and new listings rose across most price ranges and areas

Only the North East district is currently in a buyer’s market, with prices down 4% from last June

Calgary’s June benchmark price was $764,300 less than 1% lower than both last month and last year

Semi-Deta ched Row

Sales activity continued to slow in June, leading to a year-to-date drop of nearly 12%

New listings have increased compared to last year, boosting inventory and moving the market toward balanced conditions

Months of supply rose to 2 6 a major improvement from last year’s tight market

More supply has slowed price growth for semi-detached homes

June benchmark price for semidetached homes was $696,400 flat from last month but 1% higher than last year

Prices varied by district:

City Centre prices are over 3% higher year-over-year and at record highs

North, North East, and East districts saw prices over 2% lower than last year and 3% below their peak

Sales-to-new-listings ratio dropped to 50% in June, leading to rising inventory Inventory reached 1,167 units by month-end

Months of supply increased to over 3 months, signaling a shift in market conditions

Supply varies by district: nearly 6 months in the North East, 2 5 months in the North West

Higher supply is putting downward pressure on prices

June benchmark price was $450,300 down from last month and 3% lower than last year

Price trends vary by area: City Centre prices are stable, just 1% below last year’s peak

North East prices dropped nearly 6% year-over-year

Apartment

Both new listings (1,024) and sales (532) declined compared to last month and last year

Inventory continued to rise, pushing months of supply to nearly 4 months

Slower international migration is reducing housing demand, especially for apartment-style homes

Increased supply in both new and resale markets is putting downward pressure on prices

June benchmark price for apartment homes was $333,500 over 3% lower than last year

All districts saw price declines, with the largest drops in the North East, North, and South East

CREB Monthly Statistics Presented

$1,705,647,786

CREB Monthly Statistics Presented By Jay Johnson

Total Sales

Total Sales

Total

Sales to New Listings Ratio