F A I R V A L U E L E T T E R

C O M P A R A B L E S A L E S D A T A ( N E I G H B O R H O O D : U W S )

O N T H E M A R K E T

W H O W E A R E

Dear Carole,

Following a comprehensive review of recent comparable sales, market conditions, and the property’s unique features, our analysis indicates an estimated fair market value range of $625,000 to $655,000.

While the market data supports this range, it ’s worth noting that the property ’s design, layout, views, and overall appeal may create an emotional premium in the eyes of prospective buyers. For this reason, a price closer to $680,000 could be justifiable if the property resonates strongly on a lifestyle or aesthetic level.

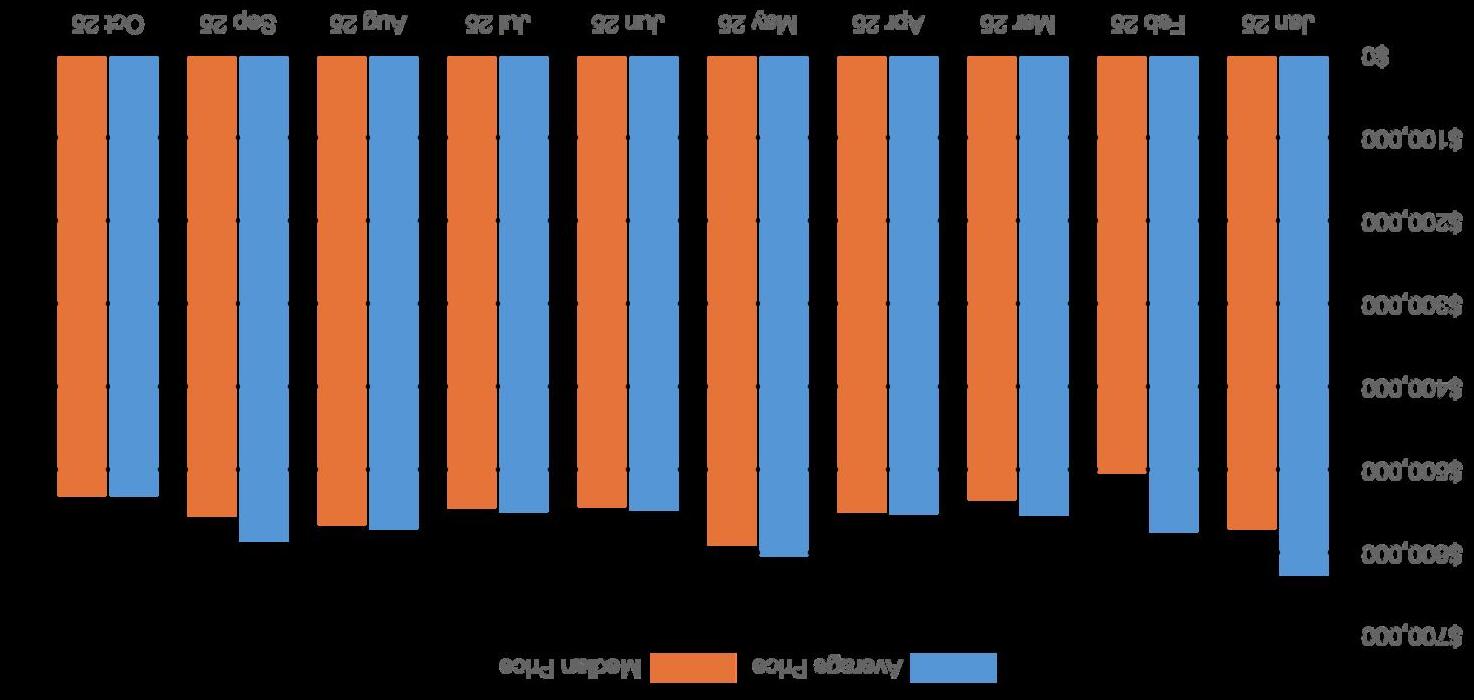

Market Analytics: UWS

Insights

For Sellers: Studios on the Upper West Side have maintained consistent pricing through 2025, with median sale prices near $560K and modest average discounts of 3–5%, indicating steady demand and a favorable environment for accurately priced listings to move efficiently.

For Buyers: Recent sales indicate a balanced market where well-priced studios typically trade between $550K and $625K. Buyers recognize that recent sales cluster between $550K–$625K and are unlikely to overpay. Positioning your unit competitively and emphasizing value or readiness to close can attract serious buyers in a steady market.

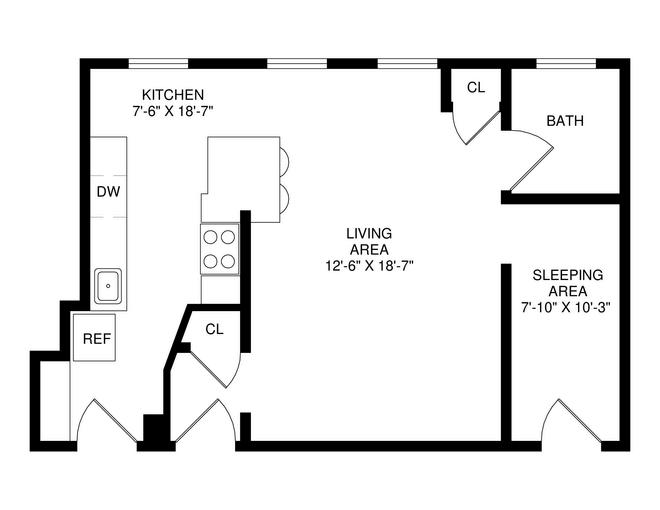

Subject Property: Unit: 11D

Studio | 1 Bath

South-West Exposures; Unobstructed views

Maintenance: $1,394

2% flip tax

C O M P A R A B L E

S A L E S

CO-OPS Studios

RECENTLY SOLD UWS

R E C E N T L Y S O L D

CO-OPS Studios

YEAR-TO-DATE MARKET ANALYTICS UWS

Apple Christie-Wallace

achristiewallace@bhhsnyp.com

M: (347) 443-4798

Created: 10/13/2025

Number of Listings: 53

(Lincoln Square, Upper West Side (UWS), Coops, Studio-Studio Bedrooms, Minimum Price $500,000, 01/01/2025 to 10/13/2025)

Reports are prepared by Broker only for Broker or the intended client and may not be relied upon or distributed to any other person All information is from sources deemed reliable but is subject to errors, omissions, change of price, prior sale or withdrawal without notice No representation is made as to accuracy of any description or information All measurements and square footage are approximate All information, particularly building details, amenities, and requirements, is subject to change and should be confirmed by client All rights to content, photographs and graphics reserved to Broker or content source Broker supports equal housing opportunity If report includes a listing that is

RLS: Participant Only, retransmission, redistribution or copying of this listing information is strictly prohibited

Reports are prepared by Broker only for Broker or the intended client and may not be relied upon or distributed to any other person All information is from sources deemed reliable but is subject to errors, omissions, change of price, prior sale or withdrawal without notice No representation is made as to accuracy of any description or information All measurements and square footage are approximate All information, particularly building details, amenities, and requirements, is subject to change and should be confirmed by client All rights to content, photographs and graphics reserved to Broker or content source Broker supports equal housing opportunity If report includes a listing that is RLS: Participant Only, retransmission, redistribution or copying of this listing information is strictly prohibited

O N T H E M A R K E T

CO-OPS Studios

ACTIVE AND IN-CONTRACT UWS

W H O W E A R E

O

u r r e p o r t s a r e g i v e n f r e e l y t o e m p o w e r

h o m e o w n e r s T o o o f t e n , w e ' v e s e e n a g e n t s

p r i o r i t i z e p e r s o n a l g a i n o v e r i n t e g r i t y , i n f l a t i n g s a l e s

n u m b e r s T h i s o f t e n r e s u l t s i n p r o p e r t i e s s i t t i n g f o r

a n e x t e n d e d t i m e o n t h e m a r k e t w i t h b a r e m i n i m u m

m a r k e t i n g e f f o r t s

D e s p i t e b e i n g a g e n t s o u r s e l v e s , w e a r e c o m m i t t e d

t o e n s u r i n g h o m e o w n e r s a r e n o t m e r e l y b e i n g ' s o l d '

t o I n s t e a d , w e p r i o r i t i z e t r a n s p a r e n c y a n d t r u s t

T h r o u g h o u r a c c u r a t e , c o m p r e h e n s i v e v a l u a t i o n

r e p o r t s p r o v i d e d a t n o c o s t o r o b l i g a t i o n , w e

e m p o w e r h o m e o w n e r s w i t h t h e k n o w l e d g e a n d

p e a c e o f m i n d t h e y d e s e r v e

“ O u r m i s s i o n i s t o e n s u r e t h a t e v e r y

h o m e o w n e r h a s a c c e s s t o t h e i n f o r m a t i o n

t h e y n e e d t o m a k e i n f o r m e d d e c i s i o n s

a b o u t t h e i r p r o p e r t y , f r e e f r o m p r e s s u r e o r

h i d d e n a g e n d a s . ” - B r i a n M e i e r

“ W e ' r e o n a m i s s i o n t o r e d e f i n e t h e r e a l

e s t a t e e x p e r i e n c e , o n e t h a t i s b u i l t o n

t r u s t a n d a n u n w a v e r i n g c o m m i t m e n t t o

q u a l i t y s e r v i c e ” - A p p l e C h r i s t i e - W a l l a c e

S i n c e r e l y ,

Apple and Brian

M E I E R M A R K E T

R E P O R T

October 2025

THIS SPACIOUS THREE-BEDROOM, TWO-BATHROOM RESIDENCE IS PERFECTLY LOCATED IN THE HEART OF CARNEGIE HILL

If you’ve been paying attention to New York City real estate over the past few months, you know the game is changing and not in favor of the little guy. The consolidation of the industry is accelerating at a pace that should make every independent broker, agent, and owner sit up and take notice.

Compass vs. Anywhere & The Acquisition Frenzy— Compass isn’t slowing down; they’re gobbling up competitors in a feeding frenzy. Anywhere Real Estate? Absorbed. Multiple boutique brands? Gone. They’re building a conglomerate that doesn’t just play the game they write the rules. This isn’t growth; it’s domination. And they’re not alone. Howard Hanna just bought Elgren, another major company. The same story keeps repeating.

We’re now staring down a future where three to five mega-firms will control the bulk of residential real estate brokerage in New York City. These firms can afford to run in the red for years, swallowing smaller companies and outlasting anyone who doesn’t have billion-dollar backing.

What This Means for Independent Firms Small and mid-sized independent brokerages are already being squeezed. The playing field isn’t fair. We’ve seen this before in farming and pharmaceuticals: independent businesses either got bought out or run out, costs skyrocketed, and quality plummeted. Now the same thing is happening in residential real estate. Independent firms simply cannot compete.

Impact on Real Estate Agents Ask yourself: where are independent agents supposed to go? Roughly 98% of licensed agents cannot operate independently they are legally tied to a brokerage. That means if you don’t want to play by the rules of the “big five,” tough luck. Leave, and you’ve got nowhere to go. These conglomerates will dictate everything: splits, commissions, marketing, exposure.

This isn’t speculation. Look back to Sotheby’s and Christie’s in the 1980s price fixing, market control. Now imagine the same tactics in residential real estate, but with the ability to enforce them across every platform. That’s what’s coming.

Brokerage Control & Client Impact The real issue isn’t just who agents work for it’s how client relationships are affected. These companies answer to their shareholders, not to individual clients. Independent contractor status is supposed to protect agent autonomy, but when firms dictate exactly how agents must operate, that protection becomes meaningless. Agents lose their freedom to serve clients. Clients lose personalized service. Firms profit.

Platform, Title, and Banking Consolidation And it doesn’t stop at brokerage. The big firms are buying up listing platforms, title companies, even banks. Soon, every step of selling a property will pass through their ecosystem. They control exposure. They control the rules. They control the fees. Want to sell a property? You’ll be forced to go through one of the mega-firms.

The Endgame The ultimate goal? Strip real estate down to algorithms. Clients reduced to a series of 1s and 0s. Lower commissions. Lower exposure. Lower property values. Skilled agents who negotiate and bring real expertise? They’ll be sidelined, restricted, or pushed out altogether.

We are watching the industry consolidate into a handful of firms with near-absolute power. The consequences for independent agents, small firms, and clients are enormous. If you value autonomy, client-first service, and transparency, know this: the landscape is changing fast and not in your favor.

Bottom line: this isn’t just a trend. It’s a structural shift that will reshape New York City’s residential real estate market. Independent players are being systematically edged out. The only way to stop it is to push back demand fair regulation and recognize that the “big five” model is designed to extract wealth from consumers while providing the least service possible.

The straightforward account of today’s market. We highlight current market action as well as trends and risk factors that keep you informed. Whether translated into great investments or gaining insight on economic characteristics before you buy, this is the up-to-date news you need for assessing today’s Real Estate Market.

3+ BEDROOMS 117 Units -12.0%

Contracts Signed/Accepted Offer Over the Past 12 Months

These numbers are offers that were accepted and contracts that were signed this month. This represents an accurate window into the Manhattan Real Estate Market.

Current residential co-op, condos, and townhouses currently for sale in Manhattan.

Available sales vs. number of units in contract at a given time. If there are 1,000 active listings and 1,000 listings in contract, the Volatility rate is 1. In a balanced market, the number will be 1-1.5.

The rate of which available homes are sold in a specific real estate market during a given time period. A balanced market will show a number between 3 and 6.

The amount of residential closings in Manhattan each month.