Introduction

Each year, Medicines Discovery Catapult (MDC) aim to connect the community by running a short series of weekly webinars: “MDC Connects”. Experts from the community and within MDC deliver the sessions to educate, inform and advise the community.

This year, we will provide an informative series outlining the journey from innovation to commercialisation.

We have an expert line up of speakers here to support the community secure funding, build their science, secure IP to ensure business growth and ultimately commercialise their asset.

UK Life Sciences – the Future is Bright

Professor Chris Molloy, CEO, MDC

Creating a Richer National R&D Pipeline

Professor Chris Molloy has a 30-year international board and executive career across a unique range of life sciences R&D discipl ines.

The founding CEO of MDC; the national centre for innovation in drug discovery. During its first five years, under Chris’ leadership MDC has leveraged its Innovate UK grant fourfold, worked with over 150 UK companies and assisted the discovery of UK drug assets worth over £1bn.

Dr Tim Newton, Senior Market Analyst, MDC

Current Climate: Decoding Therapeutics Financing

Tim joined MDC in 2018 and is currently the Senior Market Analyst. He has over 22 years of experience in strategy, business planning and market insight and transformation across various industries, including life sciences, banking and management consulting. In his current role at MDC, he uses this broad experience to support strategic initiatives by delivering market insight and analysis on the UK and Global drug discovery ecosystem.

Dr Nicola Heron, Chief Strategy Officer, MDC

Tackling the Challenges

Nicola has over 24 years of life science experience, holding senior positions across the public and private sectors in organisations including AstraZeneca and the NHS. With a broad range of experience from research to commercialisation in pharmaceuticals, medical devices and diagnostics, Nicola brings a breadth of experience to her role as Chief Strategy Officer at MDC.

Securing Funds

Samana Brannigan

, Headof Health Technologies, Innovate UK Public Funding

I am the Head of Health Technologies at Innovate UK. My areas of focus include MedTech, biotech, diagnostics, emerging technologies, engineering biology and data & digital health industry sectors. I am responsible for developing and implementing the UK innovation strategy for wealth creation in these sectors and developing a partnership approach with key stakeholders within the ecosystem.

Mark Wyatt, Investment Director, Northern Gritstone

An Introduction to External Investment and What Investors Look For

Mark has 20+ years of venture capital experience. Immediately prior to joining Northern Gritstone, Mark worked on regionally focused funds at Mercia Asset Management, based in the North of England, where he was also part of Mercia’s Responsible Investment Committee. Early in his career Mark worked at Merlin, where he was part of the teams who worked on the original business plans for Biovex (Acq by Amgen for $1bn) and Vectura (Mkt Cap > £650m). Mark has delivered 5 more public companies, with a combined mkt cap in excess of £250m, creating significant value and cash returns for investors.

Michael Salako, Investment Director, Start Codon

Importance of being "Pitch Ready"

Michael is Investment Director at Start Codon, an early-stage venture capital fund and venture builder. Previously, he worked for over 10 years at Cancer Research UK, focusing on identifying, developing, transacting, and seed-investing in next-generation oncology programmes and spin-out opportunities. Michael has a first-class degree in Biochemistry, a PhD in Molecular Virology and Molecular Toxicology, an MBA focused on finance and entrepreneurship, postdoctoral experience in immuno-oncology, drug discovery expertise to Principal Scientist level and is a Certified Licensing Professional.

Building the Science

Graeme Wilkinson, Head of Virtual R&D, MDC

Access to Skills

A pharmacologist by training, and with over 25 years of experience in the industry, Graeme has a track record of successfully leading drug discovery and capability enhancement projects in large pharma and start-up across many disease areas. In addition, Graeme has also significant experience in instigating and leading open innovation and drug repositioning programmes.

Gareth Hampton, Head of Laboratory Services, Bruntwood SciTech

Access to Labs

Mike Piper, Chief Commercial Officer, and Angelo Pugliese, Associate Director, BioAscent

Accessing drug discovery expertise: how do I find the right CRO for my project?

Mike is an experienced life sciences professional with a track record in sales and marketing strategy, general management, licensing and contract negotiation. Mike was formerly Head of Sales and Marketing at CXR Biosciences, an investigative toxicology CRO. Angelo is a highly experienced computational chemist, project leader and strategic contributor to discovery teams, and has over 15 years’ experience working across different organisations in US and UK.

Protecting Intellectual Property

Catrina Carroll, Intellectual Property & Research Funding Lead, MDC

Identify the Novelty

Catrina is responsible for supporting collaborative R&D partnerships through both public and private financing and supporting our partners with developing and exploiting their assets. Her background is in technology transfer, intellectual property and asset commercialisation. She has worked with many SMEs and academic teams across the Life Sciences, supporting the translational of novel innovations from idea to market. She has a scientific background in Infection and Immunity and is passionate about accelerating the development of medicines against future epidemic threats.

Geraint Lewis, Head of Enterprise Services, Newcastle University

Defining IP Strategy in a TTO

As Head of Enterprise Services, Geraint leads a number of key functions across Newcastle University including i) intellectual property management and licensing; ii) early stage development of spin-outs; and iii) business collaboration activities. Prior to his appointment at worked at University of Leeds with responsibility for IP management and commercialisation through licensing and spin-out pathways. Prior to moving into university sector, he worked at Medipex Ltd (NHS Innovations) as an IP & Innovation Manager, working at the interface of industry, academia and the NHS supporting the development, commercialisation, adoption and scaling of promising innovations across England's NHS system for operational and patient benefit.

Anis Naidu, UK and European Patent Attorney, Marks & Clerk LLP

IP for Business Growth

Anis is a Chartered (UK) and European Patent Attorney specialising in matters relating to life sciences technologies. Anis represents a range of life sciences organisations including NHS trusts, universities, start-up companies and multinational corporations. His practice includes providing these organisations with commercially astute advice on IP protection strategy and freedom to operate considerations. In particular, Anis has extensive experience in providing patent advice on small molecule based therapies, wound management technologies as well as in the transcatheter aortic valve implantation space.

Commercialising your Innovation

Clare Terlouw, Head of LifeArc Ventures; LifeArc Options for Commercialisation

Clare Terlouw is Head of LifeArc Ventures, responsible for LifeArc’s portfolio of direct and LP investments across the life sciences sector. The venture investment fund focuses on early-stage life sciences companies at seed to Series A, with significant follow-on investment reserved for successful portfolio companies.

Lilian Alcaraz, VP, Early Innovation Partnering EMEA, Johnson & Johnson Innovation In-Licensing-what does pharma look for?

Lilian is New Ventures and Transactions lead for Neuroscience, for Johnson & Johnson Innovation. Lilian is responsible for supporting the Neuroscience Therapeutic Areas Leads in identifying and transacting on important new opportunities as well as helping to manage the existing portfolio.

Rob Grundy, CEO, Intelligent OMICS

Letting technology address the challenge: working with Pharma to commercialise IP

Anis is a Chartered (UK) and European Patent Attorney specialising in matters relating to life sciences technologies. Anis represents a range of life sciences organisations including NHS trusts, universities, start-up companies and multinational corporations. His practice includes providing these organisations with commercially astute advice on IP protection strategy and freedom to operate considerations. In particular, Anis has extensive experience in providing patent advice on small molecule based therapies, wound management technologies as well as in the transcatheter aortic valve implantation space.

Q&A

Introduction

Sarah Brockbank leads the strategy for Complex Medicines at Medicines Discovery Catapult.

In this role she draws on internal expertise and the external environment, through membership of national programmes and a portfolio of client projects, to develop and implement a core strategy for complex medicines that is responsive to the needs of this emerging area.

Sarah has 35 years’ of experience in the pharmaceutical industry. She is a molecular biologist with a focus mainly in target identification & validation and has worked across a broad range of disease areas. Sarah was a Drug Discovery Project Leader at AstraZeneca, and she also has extensive experience in the leadership and management of large public-private consortia and collaborations.

Patients’ Futures Made Bright by Biotech

The UK drug discovery sector has made the very best of the last 5 years

• Grown the national pipeline

• Diversified across disease areas

• Embraced more complex medicines

• Used the post- COVID flush of funding to turn great UK science into potential medicines for patients…and

• Used up the available space, people and money…

It’s a Hard Preclinical Winter

The global economic crisis has widened the funding gap for high-risk companies

• Reduced VC fundraising and preclinical portfolio funding

• Reduced the risk-appetite of preclinical investors

• Increased costs

• Biotech is holding its own, but underlying trends for preclinical companies are notable

Biotech’s Future Made Brighter

The coming recovery

• Early signs of funding are returning for pharma services and clinical development

• Long term promise is seen in the Mansion House Compact

• The UK Spin-out review recommends viable action to enrich our national pipeline of companies

• We must now nurture our ‘Fit-To-Fund’ companies towards growth

The National SME Pipeline

SMEs grouped by therapy area.

Source: GlobalData, MDC Analysis

• 1200 assets : up 30% on 2019

• 62% Oncology, Infectious disease, CNS : down 8%

• Increases in Metabolic and GI

• 'Other' includes ; cardiovascular, musculoskeletal, ophthalmology and dermatology

• New R&D Initiatives in Vital Areas

• PACE - AMR

• National Dementia Mission

• Motor Neurone Disease Challenge

• Psychiatry Consortium

Large vs Small Pipeline Mix

A More Diverse Future?

80% R

Source: GlobalData, MDC Analysis

65% D

A More Complex Future?

Source: GlobalData, MDC Analysis

Funding Pressures

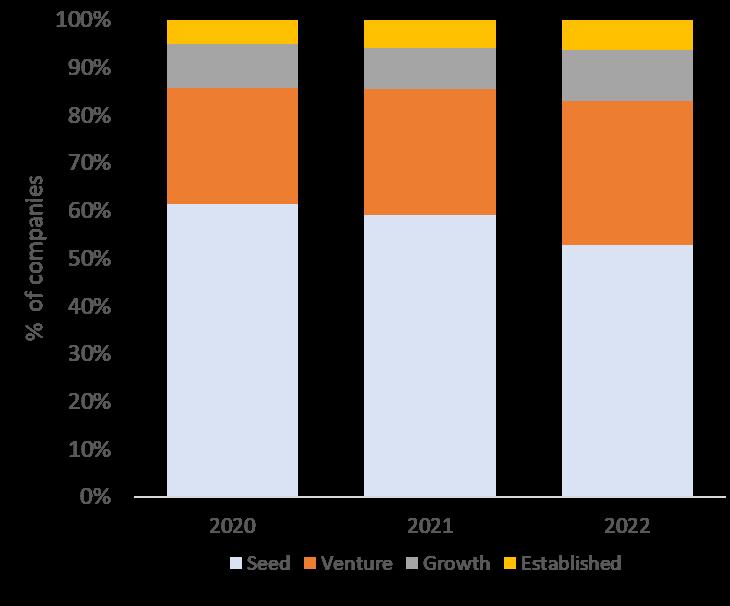

The Changing SME Mix

Cost Pressures

Skills Pressures

Space

UK Spin-out Review

Supporting an Innovation Nation

De-Risk – Prove – Adopt

Spin-outs are one form of driving innovation

Valued at £5.3bn in 2021 but we can do better..

Of 11 Enabling Recommendations…

• Create a Visible/Transparent National Pipeline

• Create both National Scale and Critical Mass

• Enable and harness critical Support Services

• Provide Real World Entrepreneurial Experience

Fit To Fund : Fit to Grow

Absorbing a future flow of funding – means that we must start now De-risk assets for investment wherever they are in the UK

• Nurture and showcase a national pipeline of people and assets

• Create visibility of these companies to investors

• Enable ‘fundable’ biotech leaders across the range of SME skill-sets, from scientific translation to management

• Create and support critical-path R&D plans, using our CROs

• Connect facilities and incubators, with translational experts with knowledge and access to scare resources capabilities, at the right time

• Channel funding for innovative medicines R&D that target seed and high-risk portfolios

Q&A

Introduction

Tim joined Medicines Discovery Catapult (MDC) in 2018 and is currently the Senior Market Analyst. He has over 22 years of experience in strategy, business planning and market insight and transformation across various industries, including life sciences, retail banking and management consulting.

In his current role at MDC, he uses this broad experience to support strategic initiatives by delivering insight and analysis on the UK and Global drug discovery ecosystem.

Tim Newton

Senior Market Analyst

Medicines Discovery Catapult

Gathering the Data

Public Equity

Understanding the Financing of UK Therapeutic SMEs

Aggregated

Summary

• We have looked at the financing of UK therapeutic SMEs from 2020 to H1 2023

• Following the good years in 2020 and 2021, financing has reduced in 2022 and H1 2023

• The impact of this reduced financing is exacerbated in real terms by inflation

• Different sub-segments of therapeutic companies have been impacted differently depending on their main sources of finance

• Seed – Impacted by falling Private Capital and numbers of deals, eroded further by inflation

• Venture – Reduced, they have still been able to attract investment

• Growth / Established – Impacted by the ability to raise public equity

Q&A

Introduction

Nicola has over 24 years of life science experience, holding senior positions across the public and private sectors in organisations including AstraZeneca and the NHS. With a broad range of experience from research to commercialisation in pharmaceuticals, medical devices and diagnostics, Nicola brings a breadth of experience to her role as Chief Strategy Officer at Medicines Discovery Catapult (MDC).

Background

The 2021 Life Sciences Vision aims to establish the UK as a world leader in the development, testing, access and update of new and innovative treatments and technologies.

The 'Mansion House Reforms' could unlock up to £75bn of investment from pension funds for high-growth businesses, including life sciences.

SMEs, large pharma, venture capitalists, academia, government, charities and the service sector all contribute to the UK Life Sciences ecosystem

We examined the UK medicines discovery ecosystem to identify the challenges and opportunities ahead

Key Challenges

Increasing costs and difficulties accessing funding

• While these issues affect many stakeholders, they are exacerbated for seed SMEs

• These companies are smaller with comparatively fewer resources than more established companies and therefore typically are more dependent on gaining access to grant and private funding

• Partnerships are also important to sustain and build their science programmes

Key Challenges

Skills shortages

• The majority of stakeholders consulted, regardless of size or sector, highlighted challenges in accessing sufficient numbers of skilled individuals to drive forward cutting-edge medicines discovery

• Although a challenge across all organisation types this was especially a challenge for seed and CRO companies

Key Challenges

Access to lab space, equipment and specialist services

• This problem was keenly felt by SMEs that are reliant on access to specific technologies, expertise and laboratory space at specific stages of product development, to generate the necessary evidence required to unlock future investment

Case for Change – a Collaborative Approach

Our early-stage SMEs are most impacted by current challenges, these vital sources of future drug pipelines are the least resilient

Finance for seed companies – seen as too high risk for investment/larger grants but need funding to de-risk

Case for Change – a Collaborative Approach

For the UK to achieve its ambition to become a global superpower in life sciences, supporting a strong discovery medicine pipeline, we must:

• Foster partnerships with translational experts to de-risk assets for investment - wherever they are in the UK

• Provide high quality laboratory facilities and incubator spaces that are available for companies at all stages

• Develop capability and capacity that encompass the breadth of skills required to meet today’s research needs

• Nurture great scientists and future leaders across the range of skill-sets, from scientific translation to management

• Make funds available, visible and accessible to support SMEs and more use of private/public initiatives to codevelop pipelines of high-quality ‘Fit-To-Fund’ companies

This series of webinars will explore opportunities to address challenges and areas where the ecosystem can work together to secure a sustainable and vibrant medicines discovery pipeline into the future

Case for Change – Securing Funds

Make funds available, visible and accessible to support SMEs and more use of private/public initiatives to co-develop pipelines of high-quality ‘Fit-To-Fund’ companies

Samana Brannigan , Head of Health Technologies, Innovate UK Public Funding

Mark Wyatt

Investment Director, Northern Gritstone

An Introduction to External Investment and What Investors Look For Michael Salako

Investment Director, Start Codon

Importance of being "Pitch Ready"

Case for Change – Building the Science

Foster partnerships with translational experts at the right time to de-risk assets for investment, wherever they are in the UK

Provide high quality laboratory facilities and incubator spaces that are available for companies at all stages

Graeme Wilkinson, Head of Virtual R&D, Medicines Discovery Catapult Access to Skills

Gareth Hampton, Head of Laboratory Services, Bruntwood SciTech Access to Labs

Mike Piper, Chief Commercial Officer, and Angelo Pugliese, Associate Director, BioAscent Accessing drug discovery expertise: how do I find the right CRO for my project?

Case for Change – Protecting Intellectual Property

• Develop capability and capacity that encompass the breadth of skills required to meet today’s research needs

• Nurture great scientists and future leaders across range of skill-sets

Catrina Carroll

Intellectual Property & Research Funding

Lead, Medicines Discovery Catapult

Identify the Novelty

Geraint Lewis

Head of Enterprise Services

Newcastle University

Defining IP Strategy in a TTO

Anis Naidu

UK and European Patent Attorney

Marks & Clerk LLP

IP for Business Growth

Case for Change – Commercialising Your Innovation

• Use of private/public initiatives to co-develop pipelines of highquality ‘Fit-To-Fund’ companies

• Foster partnerships with translational experts to de-risk assets

• Develop capability and capacity that encompass breadth of skills

Clare Terlouw , Head of LifeArc Ventures

LifeArc

Options for Commercialisation

Lilian Alcaraz

VP, Early Innovation Partnering EMEA, Johnson & Johnson Innovation

In-Licensing-what does pharma look for?

Rob Grundy, CEO Intelligent OMICS

Letting technology address the challenge: working with Pharma to commercialise IP

Q&A