An award-winning interior designer, Mariam Aboutaam is Director, Sales and Marketing, Interior Design at Kylemore, Markham, Ont., a builder known for master-planned communities and luxury homes. kylemoreliving.com.

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm based in Toronto. thinkhomewise.com

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

Elechia Barry-Sproule is President of the Toronto Regional Real Estate Board (TRREB) and Broker/Owner of Red Apple Real Estate Inc. She is committed to mentoring and supporting real estate professionals across the industry. trreb.ca.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

Barbara Lawlor is CEO of Baker Real Estate Inc. A member of the Baker team since 1993, she oversees the marketing and sales of new home and condominium developments in the GTA, Vancouver, Calgary and Montreal, and internationally in Shanghai. baker-re.com

Dave Wilkes is president and CEO of the Building Industry and Land Development Association (BILD), the voice of the home building, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter at @bildgta or visit bildgta.ca

SENIOR VICE-PRESIDENT, SALES, NEXTHOME

Hope McLarnon

416.708.7987

hope.mclarnon@nexthome.ca

SENIOR MEDIA CONSULTANT

Amanda Bell 416.830.2911 amanda.bell@nexthome.ca

EDITORIAL DIRECTOR

Amanda Pereira

EDITOR-IN-CHIEF – GREATER TORONTO AREA

Wayne Karl wayne.karl@nexthome.ca

CONTRIBUTORS

Mariam Aboutaam, Jesse Abrams, Elechia Barry-Sproule, Mike Collins-Williams, Debbie Cosic, Barbara Lawlor, Linda Mazur, Ben Myers, Dave Wilkes

EXECUTIVE MEDIA CONSULTANTS

Jacky Hill, Michael Rosset

VICE-PRESIDENT, MARKETING – GTA

Leanne Speers

MANAGER CUSTOMER SALES/SERVICE

Marilyn Watling

SALES & MARKETING CO-ORDINATOR

Gary Chilvers

BUSINESS DEVELOPMENT MANAGER

Josh Rosset

DISTRIBUTION distributionteam@nexthome.ca

ACCOUNTING INQUIRIES

accountingteam@nexthome.ca

DIRECTOR OF PRINT MEDIA

Lauren Reid–Sachs

VICE-PRESIDENT, PRODUCTION – GTA Lisa Kelly

PRODUCTION MANAGER – GTA Yvonne Poon

GRAPHIC DESIGNER & PRE-PRESS COORDINATOR

Hannah Yarkony

Published by nexthome.ca

Advertising Call 1.888.761.3313 ext. 1, for rates and information. Fax: 1.888.861.5038

Circulation Highly targeted, free distribution network aimed at real estate buyers using street level boxes, racking and Toronto Star in-home delivery.

Canadian subscriptions 1 year = 13 issues – $70 (inc. HST). Canada Post – Canadian Publications Mail Sales Product Agreement 40065416.

Copyright 2025 All rights reserved. All copyright and other intellectual property rights in the contents hereof are the property of NextHome, and not that of the individual client. The customer has purchased the right of reproduction in NextHome and does not have the right to reproduce the ad or photo in any other place or publication without the previous written consent of NextHome.

Editorial Submissions from interested parties will be considered. Please submit to the editor at editorial@nexthome.ca.

Terms and Indemnification Advertisers and contributors: NextHome is not responsible for typographical errors, mistakes, or misprints. By approving your content and/ or submitting content for circulation, advertisers and contributors agree to indemnify and hold harmless NextHome and its parent company from any claims, liabilities, losses, and expenses (including legal fees) arising out of or in connection with the content provided, including but not limited to any claims of copyright infringement, unauthorized reproduction, or inaccuracies in the content. Advertisers acknowledge that they have the necessary rights, permissions, and licenses to provide the content for circulation, and they bear full responsibility for the content’s accuracy, legality, and compliance with applicable laws upon approval. Contributors acknowledge NextHome reserves the right to omit and modify their submissions at the publisher’s discretion.

WAYNE KARL EDITOR-IN-CHIEF HOMES Magazine

EMAIL: wayne.karl@nexthome.ca TWITTER: @WayneKarl

The federal government’s much anticipated recently released Budget 2025 held such promise – and we certainly hoped – that it would address the issues facing the housing markets in Canada.

Indeed, homebuilding and other housing stakeholders, including the Canadian Home Builders’ Association (CHBA), had been educating Ottawa in recent months on the issues, and offering potential solutions.

It is a “plan to transform our economy from one that is reliant on a single trade partner, to one that is stronger, more self-sufficient and more resilient to global shocks,” the government says. “Our plan builds on Canada’s strengths – world-class industries, skilled and talented workers, diverse trade partnerships, and a strong domestic market where Canadians can be our own best customers. We are creating an economy by Canadians, for Canadians.”

Be it due to a focus on a larger, more fundamental economic pivot to deal with increasing trade challenges, early reviews are that Ottawa came up short on the housing component in Budget 2025.

CHBA, the Ontario Home Builders’ Association (OHBA), and the Building Industry and Land Development Association (BILD) all seem less than enthralled with inclusions in the budget to address housing challenges with any immediacy.

Some good news, however, comes from the province, with its Fall Economic Statement.

Like CHBA and BILD, OHBA says it will continue to advocate for the removal of the provincial portion of the GST on all new home construction, not just for first-time homebuyers – which represent only about five per cent of the new home market.

Meanwhile, as our story on page 14 and other content in this issue explores, there are new-home buying opportunities in the GTA and elsewhere in Ontario – for those who are well prepared and can budget accordingly.

The Canadian housing market could be on the upswing looking ahead to 2026, with more buyers preparing to enter the market and home sales expected to increase by 3.4 per cent next year, according to ReMax Canada’s 2026 Housing Market Outlook. This follows signs of renewed buyer intent earlier this fall, compared to the first half of the year. There is light at the end of the tunnel following a decline in home sales from coast to coast in 2025. According to data supplied by ReMax Canada brokers and agents, as well as local boards, home sales fell year-over-year in 32 of 38 markets analyzed between Jan. 1 and Oct. 31, 2025. In contrast to the inventory shortfall that defined many markets in 2024, 2025 saw listings increase yearover-year across all regions, by as much as 21 per cent in Ontario alone.

A Leger survey commissioned by ReMax Canada reveals that one in 10 Canadians is planning to buy a home in the next 12 months, half of them being first-time buyers. One-quarter of Canadians (23 per cent) said they’d be ready to enter the market if interest rates dropped another 0.5 to one per cent. Tempering average prices, along with easing pressure on the interest-rate front, could indicate gradual market improvement.

“Amid looming economic clouds, Canadians are maintaining their interest in homeownership,” says Don Kottick, president, ReMax Canada. “The resilience that began to emerge in the fall is anticipated to continue into 2026, with firsttime buyers in particular finding creative ways to save and enter the market.”

Ten per cent of Canadians say they’re planning to purchase a home in the next 12 months – an improvement from seven per cent in the fall, ReMax says. Although more than half of Canadians are feeling the economy could worsen in 2026, following an initial economic stall as seen in the earlier part of 2025, Canadians aged 18 to 35 are more hopeful, with 21 per cent feeling the economy will fare better next year.

Following looming economic headwinds, an emerging concern among first-time homebuyers is a rise in return-to-office mandates. While nearly half of respondents overall do not believe return-tooffice will impact their situation, respondents aged 18 to 34 and those planning to buy in the future are thinking more about how this might affect their search and 17 per cent of Canadians are concerned about return to office mandates.

“Return-to-office mandates are beginning to weigh on first-time buyers’ decisions, prompting many to reconsider not just where they want to live, but how their daily routines, commute times and lifestyle needs will fit into an inperson work environment,” says Kottick. “Transit access is becoming an increasingly important factor for younger Canadians seeking their first home. Many are weighing commute times and workplace flexibility more carefully in their search, while sellers continue to adapt to a market that’s still finding its footing in this new reality.”

ReMax brokers and agents across Canada found that families, new Canadians and retirees drove a larger share of sales in 2025, marking a significant shift from 2024, when first-time buyers led sales.

“Time will tell how the buyer profile shifts we’ve seen over the past year will influence overall homebuying decisions. In such a dynamic environment, with evolving buyer needs and changing seller expectations, it’s more important than ever for buyers to work with a trusted professional agent who understands their local market and can help find what best suits them and their families,” says Kottick.

With a goal to address the issues Canada faces with regard to a rapidly changing and increasing trade and economic uncertainty, Budget 2025 was intended to focus on things the federal government can control.

Budget 2025: Canada Strong was to be “our plan to transform our economy from one that is reliant on a single trade partner, to one that is stronger, more self-sufficient and more resilient to global shocks. Our plan builds on Canada’s strengths – world-class industries, skilled and talented workers, diverse trade partnerships, and a strong domestic market where Canadians can be our own best customers. We are creating an economy by Canadians, for Canadians.”

Budget 2025 delivers on the government’s Comprehensive Expenditure Review to modernise government, improve efficiencies and deliver better results and services for Canadians. It includes a total of $60 billion in savings and revenues over five years, and makes generational investments in housing, infrastructure, defence, productivity and competitiveness. These are the smart, strategic investments that will enable $1 trillion in total investments over the next five years through smarter public spending and stronger capital investment.

Despites such promise, housing industry sources say Budget 2025 comes up short in addressing the issues facing the homebuilding industry in Canada.

Nationally, Canadian Homes Builders’ Association (CHBA) is raising concerns regarding the excessive expectation being placed on initiatives for government-supported housing through Build Canada Homes – an initiative that will help homelessness and low-income households needing support, but not address homeownership for the middle class of the next generation.

Despite urgent calls for action, the budget presented no new measures to address housing affordability for the average Canadian who still wants to become a homeowner, CHBA says. It emphasized the promise of a GST exemption for first-time buyers – a measure announced earlier and still not legislated, which has left buyers on the sidelines and stalled new construction.

CHBA also the budget missed an opportunity to expand the GST relief to all buyers of new homes, and to renovations that create added housing units, such as additional dwelling units (ADUs) or secondary suites.

At the provincial level, The Ontario Home Builders Association (OHBA) says it is deeply disappointed with the lack of support for Ontario’s homebuilders and buyers. The budget presented no new measures to unlock supply and restore affordability, as Housing Minister Gregor Robertson previously indicated, and the federal approach remains focused on incremental change rather than transformative action. OHBA says there is no new measures to support the construction of market housing –the segment where most Ontarians seek to buy or rent homes.

And more locally, the Large Urban Centre Alliance, co-facilitated by the Building Industry and Land Development Association (BILD), says it is concerned with the budget’s response to the serious issues impacting the housing sector in Canada’s largest municipalities.

Budget 2025 acknowledges the affordability challenges in new home construction by confirming an increase to the GST/HST rebate thresholds to the first $1 million, with a declining rebate to $1.5 million, but only for first-time buyers – a very small fraction of the market, BILD says.

While there is an allocation of $12 billion over 10 years to housing enabling infrastructure, Budget 2025’s treatment of development charges (DCs) is particularly troubling. Not only has the federal government’s language changed markedly, backing away from the commitment to reduce DCs by 50 per cent, but the commitment is now only a framework for federal, territorial and provincial agreements, not an actionable plan to reduce municipal housing fees with any sense of urgency.

Says David Wilkes, president and CEO of BILD and co-facilitator of the Large Urban Centre Alliance: “Not only is the budget based on old data, but its commitments are centred on a reduced Build Canada Homes and vague language on a diluted framework to eventually reduce DCs following successful negotiations with provinces and ultimately municipalities – and the industry is left wondering: How long will that take?”

The Alliance continues to call on the federal government to recognize the magnitude of the crisis and reiterates the need to:

• Treat all Canadians fairly and extend the GST/HST exemption for all new-home buyers

• Keep the election promise to reduce municipal DCs by 50 per cent

• Honour its commitment to bring forward a Multi-Unit Residential Building tax incentive program

The Ontario Home Builders’ Association (OHBA) says it is pleased with the provincial government’s 2025 Fall Economic Statement, though it doesn’t introduce new policy initiatives to address housing challenges.

“We are encouraged that opportunities may still exist for the government to implement muchneeded measures due to tariffs and other economic challenges to stimulate the Ontario home construction industry and keep over 40,000 workers employed,” OHBA says.

The government is projecting deficits of $13.5 billion in 2025-26 and $7.8 billion in 2026-27, followed by a surplus of $0.2 billion in 2027-28.

The net debt-to-GDP ratio is projected to be 37.7 per cent in 202526, slightly lower than the forecasted 37.9 per cent from the 2025 Budget. This ratio fell to a 13-year low last year. The net interest as a percentage of operating revenue ratio for 202526 is forecast to be 6.4 per cent and remains close to the lowest levels it has been at since the 1980s.

Ontario’s real GDP growth has been impacted by U.S. trade policy and tariffs and is projected to decelerate from 1.4 per cent in 2024 to 0.8 per cent in 2025 and 0.9 per cent in 2026, in line with the projections at the time of the 2025 Budget. Real GDP growth is expected to pick up in subsequent years with projected increases of 1.8 per cent in 2027 and 1.9 per cent in 2028.

“It is heartening to see the additional funding of $50 million for the Better Jobs Ontario program,” OHBA says. “This program supports skills training to help job seekers train and upskill for in-demand positions. We recognize the importance of our skilled labourers, and that without additional support, Ontario was looking at losing up to 40,000 skilled trades jobs. This is an important

measure to support our members and tradespeople across Ontario.”

The Minister of Finance reaffirmed the Ontario government’s commitment to remove the eight per cent provincial sales tax for firsttime buyers on new homes valued up to $1 million, pending the passing of federal legislation. With the ratio of net debt to GDP falling to a 13year low, this will free up surplus revenues that can be diverted to priority projects, OHBA says. “We firmly believe that taking decisive action to address the housing crisis and to restart home construction in Ontario must be one of these priorities.

With that in mind, OHBA says it will continue to advocate for the removal of the provincial portion of the GST on ALL new home construction, not just for first-time homebuyers.

According to research conducted by OHBA, first-time buyers currently represent approximately five per cent of the new home market. It will take bold action by all levels of government to unlock supply and restore affordability. “We will continue to call on the government of Ontario to lead by taking bold action that will make homeownership a reality for younger generations.

“We anticipate that the next few years will be marked by uncertainty and low economic growth. Consumers are not making the largest purchase of their lives if they aren’t certain of the future. OHBA remains committed to continuing to lobby the provincial government to expand this PST relief for all new-home sales in Ontario, and spur both the purchase and ongoing construction of new homes across the province.”

Your dream home in Guelph and Cambridge with Terra View Homes

For more than 30 years, Terra View Custom Homes has been building award-winning homes in Guelph and surrounding areas, garnering industry recognition for its dedication to Green building practices and energy efficiency.

GTA builders shine at 2025 OHBA Awards of Distinction

The Ontario Home Builders’ Association has announced the winners of the 2025 OHBA Awards of Distinction, with builders in the GTA and surrounding area taking home several key awards.

Fireside elegance the beauty and benefits of a fireplace

When designing a new floorplan or model home, one element consistently brings comfort, character and timeless appeal: The fireplace. Beyond providing warmth, fireplaces create a focal point that adds both elegance and cosiness to any room.

Visit nexthome.ca

Ontario lowering costs for first-time homebuyers

As part of its plan to lower costs and help more families realize the dream of homeownership, the Ontario government is proposing to rebate the full eight-per-cent provincial portion of the HST for first-time homebuyers on new homes valued up to $1 million – a move universally lauded by the homebuilding industry.

Inventory homes and incentives a compelling opportunity for wellprepared homebuyers

As we round the fall months heading into the end of the year, with a Bank of Canada interest rate reduction in September and another on Oct. 29, prospective homebuyers on the new homes and resale fronts are wondering – is now the time to execute their well-thought-out plans. Indeed, it’s currently a buyers’ market, and there are choices and deals, particularly for inventory homes that are ready to move in.

Across Simcoe and Grey County, the rhythm of four-season living shapes more than landscapes. It defines lifestyles. From the foothills of Blue Mountain and the historic streets of Collingwood to the rolling farmland of Oro-Medonte, Georgian Communities has built a legacy of neighbourhoods where people don’t just live, but truly belong.

Based in Barrie, the award-winning builder approaches development with a philosophy rooted in connection: To nature, community and the character of each setting. Looking

ahead to 2026, that commitment continues across its portfolio, most notably at Windfall at Blue and the newly opened Craighurst Crossing, alongside the estate community of Braestone and the heritage-inspired Victoria Annex.

If there’s one place where Georgian Communities’ vision comes to life most completely, it’s Windfall. Perched at the base of Blue Mountain and a short walk from the pedestrian village, the community has become synonymous with four-season living done right.

Residents wake to views of the escarpment, spend afternoons on trails or slopes, and gather in the evenings at The Shed, the private clubhouse that has become the heart of the neighbourhood. With heated pools, a dry sauna, fitness facilities, fireplaces and communal spaces designed for connection, The Shed embodies the après-ski spirit year-round.

Location amplifies everything here. Minutes from historic downtown Collingwood and its evolving mix of restaurants, fitness studios, boutiques

and essential services, homeowners enjoy a lifestyle that balances natural beauty with everyday practicality.

Skiing in winter, cycling in spring, paddling Georgian Bay in summer, hiking through fall colours. Windfall puts residents at the centre of the region’s active heartbeat.

Over the years, this community continues to evolve. A growing collection of move-in-ready homes, including semi-detached designs with carefully curated finishes, allows buyers to step directly into the Windfall lifestyle. Meanwhile, newly released 50-ft. detached lots offer rare space at the base of the mountain, along with a refined selection of chalet-inspired models for purchasers to choose from.

Thoughtful architectural details and timeless design elements complement the landscape while creating a sense of permanence.

More than a development, Windfall is where people gather. Around the clubhouse pools, backyard fire pits, the village and trails connecting every corner of the community. Its success reflects what happens when design, lifestyle and location truly align.

Just north of Barrie in the emerging village of Craighurst, Georgian Communities reached an important milestone this October: Welcoming the first homeowners to Craighurst Crossing. Built around spacious 50-ft. lots and framed by modern farmhouse and craftsman

architecture, the community strikes a compelling balance between rural charm and modern comfort.

The location is strategic. Minutes from Hwy. 400, residents enjoy quick access to Barrie, the GTA, ski hills, golf courses and cottage country. It’s truly four-season territory. Winter skiing and tubing, spring and summer hiking and biking, and fall colours sweeping across the Horseshoe Valley corridor.

Nature shapes the community from within. An onsite trail network meanders through the neighbourhood, perfect for morning walks, evening runs or weekend family explorations. And beyond the property line, Craighurst itself is growing. The area now features a new public school and recreation centre, and while residents already enjoy a local Foodland, a brandnew, expanded store is on the way, placing even more convenience just steps from home.

Inside, homes feature highend finishes: Quartz countertops, thoughtful craftsmanship and layouts designed for real life. With its first families now settled and new treed lots available, Craighurst Crossing is quickly becoming a vibrant addition to the Oro-Medonte landscape. A village within a village.

A short drive away, Braestone offers something increasingly rare: True estate living on expansive halfto one-acre treed lots. The final release represents one of the last opportunities to build on this scale in the region.

The lifestyle here is unmistakably rural-luxury. Five minutes from Horseshoe Resort, 10 from Orillia’s shops and restaurants, and 25 from Barrie, Braestone blends privacy with remarkable access. Architectural styles range from sprawling bungalows to lofted designs and farmhouse-inspired elevations, all feeling perfectly at home among the trees.

The neighbouring Braestone Farm adds character and ritual to everyday life. Skating on the pond, pumpkin picking, visiting the maple sugar shack. These seasonal traditions have become part of what defines the community. With large three-car garages, coach house options and plan customization available, Braestone remains the benchmark for country estate living in Simcoe County.

On Collingwood’s tree-lined streets, steps from boutiques, restaurants and waterfront paths, Victoria Annex offers a rare blend of history and contemporary design. Only three move-in-soon units remain, each featuring refined modern aesthetics that complement the town’s historic character.

Adding to this, the revitalization of the historic schoolhouse is now underway, bringing forward two architecturally unique semidetached homes. The design honours the building’s past while introducing fresh, modern living spaces, creating a fitting addition to one of Collingwood’s most walkable neighbourhoods.

For those who value strollable summers, colourful fall walks, crisp winter mornings and the energy of downtown living, Victoria Annex represents a distinctive opportunity in an increasingly sought-after location.

Across each development, Georgian Communities demonstrates a consistent commitment to the places where its team lives and works. Whether it’s a chalet-inspired home at the foot of Blue Mountain, an emerging neighbourhood in Oro-Medonte, an estate lot framed by forest or a modern home steps from downtown Collingwood, the principle remains the same: Build thoughtfully, build beautifully and create communities that stand the test of time.

In a region defined by seasonal change and natural beauty, that approach continues to resonate. One neighbourhood, one home, one family at a time.

Visit georgiancommunities.ca to learn more about these remarkable new neighbourhoods

DAVE WILKES

On Oct. 23, Ontario took another important step toward tackling the housing crisis and strengthening the provincial economy. Rob Flack, minister of municipal affairs and housing, introduced Bill 60, the Fighting Delays, Building Faster Act, 2025 – an omnibus bill aimed at cutting red tape, speeding up housing approvals and supporting the construction of the homes and infrastructure Ontario urgently needs.

This legislation builds on the momentum of Bill 17, the Protect Ontario by Building Faster and Smarter Act, 2025, introduced earlier this year, and represents a direct response to the challenges faced by the building and development industry across the province. It is also a clear recognition by the provincial government that housing supply and affordability depend on an efficient regulatory environment, timely approvals and fair, transparent cost structures.

At its core, the new act protects Ontario’s economy by keeping workers on the job and getting shovels in the ground faster. It reflects the need to lower the cost to build, reduce bureaucratic delays and improve infrastructure planning and delivery.

Bill 60 focuses on several priorities, including:

Accelerating development near transit-oriented communities, helping to bring more homes, businesses and

amenities closer to where people live and work while maximizing the investment made in transit infrastructure.

Establishing a Peel water and wastewater corporation as a potential new model for how these services are provided in Ontario. This builds on key learning from other jurisdictions that fund water and wastewater in a different way, enabling the infrastructure while not inflating the cost of new homes. If successful, this will be a critical step in finding new ways to fund growth more sustainably by launching a review of the Ontario Building Code to discover and eliminate additional unnecessary regulatory barriers that add costs.

It will clarify which minor variances might qualify as as-of-right, simplifying approvals for small, low-impact projects and certainly making life simpler for homeowners looking to add a deck or add a small addition.

It will consult on reforms to streamline official plans, municipal application processes and Green standards as they relate to site plan control – addressing issues that result in costly delays or directly add construction costs. Furthermore, the act takes large steps to modernize development charges (DCs), which remain one of the largest and most onerous costs in new home construction. Specifically, regarding DCs, it will:

Provide clear direction on how to calculate who pays for what – newhome buyers or the existing tax base –based on who benefits the most.

It will require municipalities to develop local service policies –

policies that identify which costs in a new development are the obligation of the new development or the municipality.

Provide direction on how DCs are calculated to remove some elements that have distorted DCs levels in higher cost municipalities.

These measures will bring much-needed transparency and accountability to the system, ensuring that municipalities have the funds required to support growth, while preventing homebuyers from being unfairly burdened by inconsistent or inflated municipal fees.

The Fighting Delays, Building Faster Act, 2025 reinforces the Ontario government’s commitment to working with municipalities and the building industry to deliver more homes, faster. By modernizing approvals, reforming development charges and aligning infrastructure planning with growth, this legislation advances a pragmatic, solutions-oriented approach to housing policy. Ontario’s housing crisis is not insurmountable, but it requires focus, urgency and cooperation. The Fighting Delays, Building Faster Act, 2025 embodies all three.

Dave Wilkes is President and CEO of the Building Industry and Land Development Association (BILD), the voice of the homebuilding, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter, @bildgta or visit bildgta.ca.

+MORE CONTENT ONLINE nexthome.ca

by WAYNE KARL

As we head toward the end of the year, with yet another Bank of Canada interest rate reduction on Oct. 29, prospective homebuyers on the new homes and resale fronts are wondering – is now the time to execute their well-thought-out plans.

Uncertainty from the threat of U.S. tariffs remains, though, causing some buyers and builders to pause.

If there was pent-up demand before, these circumstances are only causing it to grow even further, as prospective buyers wait for clarity before making their move.

“The Greater Toronto Area housing market in late 2025 is offering opportunities for buyers willing to take measured risks,” says industry consultant and analyst Ben Myers.

“After years of explosive growth, the market has entered a correction phase. Some of the long-standing drivers of price appreciation have reversed: Population growth has slowed, sales have stalled and even the rental market has cooled.

Yet beneath these short-term adjustments, the same fundamentals remain: Limited land, strong long-term demand and a diverse population that still needs housing. For many, today’s lull may represent a brief pause before the next climb.”

Indeed, currently, it’s a buyers’ market, and there are choices and deals, particularly for inventory homes that are ready to move in.

“Our move-in ready homes are moving fast in this buyers’ market,”

Richard Mariani, says sales and marketing manager at CountryWide Homes. “Homebuyers see the unique opportunity to be able to get into a brand-new CountryWide home that comes with appliances, air conditioner, full warranty, zero development charges and thousands of dollars in upgraded finishes.

“Whether they’re looking for a freehold townhome, semi or detached home, there’s flexibility to move in before the holidays or early 2026 in some of our most indemand and premium communities throughout the GTA.”

CountryWide, of course, is not the only builder with such offerings.

One company, The Tricar Group, is taking move-in ready to another

level with an innovative approach. The company is launching sales of new condominium homes – after the building is complete.

“By building Gordon Square III without a pre-sales phase, we’re not only accelerating the delivery of much-needed housing, we are giving buyers peace of mind,” says Tricar’s President Adam Carapella. “They can walk through the finished suites, move in quickly and avoid the uncertainty of waiting years for a home. It’s a smarter, more reliable way to buy, focused on the needs of homeowners.”

Georgian Communities, for example, offers a collection of move-in-ready homes, including semi-detached designs, at its Windfall community at Blue Mountain.

And Doug Tarry Homes offers move-in ready Quick Possession Homes – single-family home, semi-detached or townhomes – at a number of its communities in southwestern Ontario.

Another builder, Terra View Homes, has Designer Series Homes of “movein ready, quick occupancy, quality family homes. Comprised of our most sought-after and in demand floorplans, every Designer Series home is finished in today’s most

SELECT OPPORTUNITIES

BRAMPTON

• Queens Lane by Branthaven branthaven.com

BURLINGTON

• Millcroft Towns by Branthaven branthaven.com

COLLINGWOOD

• Windfall by Georgian Communities georgiancommunities.ca

GUELPH

• Gordon Square III by The Tricar Group tricar.com

trending designer finishes both inside and out.”

Branthaven offers a series of Quick Start Homes that are move-in ready, with 30- to 120-day closings. These may also include luxury upgrades and more than $500,000 in price reductions.

National Homes, too, is offering significant enticements at some of its developments, including $200,000 cash off and a bonus value at its Northshore Townhomes community in Burlington.

“While some might see the uncertainty as a reason to wait, savvy buyers know that these conditions create opportunities to secure

• Hart Village by Terra View Homes terra-view.com

• Nima Trails by Terra View Homes terra-view.com

MARKHAM

• Gallery Towers by The Remington Group downtownmarkham.ca

OAKVILLE

• West & Post by Branthaven branthaven.com

• Upper West Side 2 by Branthaven branthaven.com

fantastic pre-construction deals,” says Debbie Cosic, CEO and founder of In2ition Realty. “Developers are offering incentives to attract buyers, and those who act now can lock in incredible value before the market shifts again.”

Some builders are also offering appealing incentives to buy sooner than later. These vary from builder to builder, however, and are sometimes shared with buyers only in sales offices. They are also available for the proverbial “limited time only and subject to change without notice,” so it’s best to check with builders directly.

CountryWide, for example, had earlier partnered with TD Bank to offer firm mortgage approvals up to 24 months.

Another builder, The Remington Group, is offering a free car or $85,000 in cash value, at its Gallery Towers development in downtown Markham.

And Doug Tarry Homes has a promotion on firm agreements of purchase and sale of its Quick Possession Homes, from now to Jan. 31, 2026, offering discounts from $5,000 to $50,000.

+MORE CONTENT ONLINE nexthome.ca

Doug Tarry Homes has been a proud part of the St. Thomas story since 1954, building quality homes with care, craftsmanship and a forwardthinking approach. What began with Doug Tarry Sr. and his simple belief in “leaving every campsite better than you found it” has grown into a legacy that continues to guide everything we do today.

At Doug Tarry Homes, the company believes a home should reflect the people who live in it. That’s why it offers a wide range of thoughtfully designed floorplans to suit every lifestyle, from first-time buyers and growing families to those looking to downsize. Whether

you’re drawn to a cosy bungalow, a modern townhome or a spacious two-storey, each home is built with intention and designed to bring people together in welcoming, connected communities.

Doug Tarry Homes’ focus goes beyond beautiful design and quality craftsmanship. The company is deeply committed to sustainability and to building homes that are as responsible as they are comfortable. Every Doug Tarry Home is Energy Star certified and Net Zero Ready, designed to use less energy, provide cleaner air and create a healthier living environment for years to come.

So, what does Net Zero really mean? It’s about building a home that can produce as much energy as it consumes over the course of a year, depending on how it’s lived in. When designing Net Zero Homes, Doug Tarry Homes’ goal was to stay a decade ahead of current building standards while keeping the systems simple. Meaning no complicated technology, just efficient design that works seamlessly behind the scenes. Every home the company builds is held to the same high standard, whether it’s a single-family home, semi-detached, townhome or one of its Quick Possession Homes. Quick Possession Homes are the

perfect choice for those who want Doug Tarry quality without the wait. They are thoughtfully designed, expertly finished and move-in ready. When you choose a Doug Tarry Home, you can trust that quality, performance and comfort come standard, no matter which home you select.

Owning a Doug Tarry Home offers lasting benefits such as lower utility bills, greater comfort, better air quality and peace of mind knowing your home is built to stand the test of time. These homes are quieter, more consistent in temperature and more durable, offering fewer maintenance costs and protection against rising energy prices.

Leadership in Net Zero Ready construction continues to set the company apart. Choosing Doug Tarry Homes means investing in a healthier, more sustainable future where energy efficiency and thoughtful design come together beautifully. Lower energy use, cleaner living and a brighter tomorrow for generations to come. That’s the Doug Tarry difference.

Visit the Northgate Model Home at 1 Firefly Lane, St. Thomas. It is built Energy Star certified, Net Zero Ready and as a LifeArk home designed by Doug Tarry. This 1,898-sq.-ft. bungalow features a second garage entrance leading to

a fully equipped lower-level living space with a kitchen and room for future development.

At home or on your phone, visit dougtarryhomes.com for more information.

JESSE

ABRAMS

The Bank of Canada’s recent rate cut has led to some muted optimism across the housing market. After holding rates steady for months, the central bank trimmed its policy rate by 0.25 per cent, signaling that inflation is moving closer to its target and that borrowing costs may slowly ease ahead.

For many Canadians, this shift brings both relief and questions. Whether you’re looking to buy, renew or refinance, the impact of this change depends on where you stand.

If you’ve been waiting for signs that borrowing conditions might improve, this is one. The rate drop has already led some lenders to lower their fixed and variable mortgage rates, giving buyers a bit more room to breathe. While the difference in monthly payments might not be massive, it can make a real impact on affordability, especially for first-time buyers balancing rising home prices with tighter budgets.

Lower rates also mean slightly higher borrowing power. For example, a 0.25-per-cent cut may allow some buyers to qualify for several thousand dollars more in

purchasing capacity. That said, while home prices in many cities have been dropping, they still remain high and the stress test still requires buyers to qualify at higher benchmark rates. So, while the cut helps, it doesn’t fully solve the affordability crunch.

If you’re planning to buy soon, consider locking in a rate hold. This lets you secure today’s lower rate while giving you time to shop for a home.

RENEWALS: SOME RELIEF, BUT TIMING MATTERS

For those with mortgage renewals coming up, this rate cut brings a bit of good news, especially for anyone on a variable rate. Your payment may

decrease slightly as lenders adjust prime rates downward. If you’re on a fixed term, renewal offers might come in a touch lower than what you saw earlier this year, though still above the record-low levels we saw during the pandemic.

If your renewal is within the next year, it’s worth starting conversations early. Lenders may be more flexible in this environment, particularly if the Bank of Canada continues to ease rates over the coming months. Comparing options across lenders can help you avoid overpaying, especially if your current lender’s posted rate hasn’t yet caught up with the market. So, speak to an unbiased mortgage professional. Mortgage brokerages such as ours at Homewise provide a view of the market to let borrowers know if their current lender option is a good one or if there are better options by us shopping around. The hour or so it takes can save thousands.

For homeowners thinking about refinancing, to consolidate debt, fund renovations or invest in another property, the latest move could open new doors. Lower rates can make refinancing more attractive, as borrowing against your home becomes a bit cheaper.

Still, the decision should be made carefully. If you’re breaking an existing mortgage before its term ends, the penalty costs can be significant. The potential savings from a lower rate need to outweigh those penalties. For some, waiting until renewal to refinance might make more sense.

However, if you have high-interest debt, tapping into home equity at a lower mortgage rate can be a smart long-term play.

“

” This rate drop is a welcome sign that borrowing costs may be trending downward again.

The Bank of Canada has signaled that it will continue watching inflation and the broader economy closely. Another small rate cut later this year isn’t out of the question if price pressures keep easing. But no one expects a rapid return to the ultra-low rates of the past.

In this new environment, Canadians will likely see small,

gradual improvements rather than dramatic changes. For buyers, that means acting when the math works for your budget instead of trying to time the bottom. For those renewing or refinancing, it’s about staying informed and weighing your options early.

This rate drop is a welcome sign that borrowing costs may be trending downward again. It’s not a gamechanger, but it’s a meaningful step that offers a bit of breathing room. Whether you’re entering the market, renewing or exploring a refinance, now’s the time to review your numbers and plan your next move with a clear view of where rates and your goals stand.

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm. thinkhomewise.com

by WAYNE KARL

For discerning homebuyers, those who strive to not just live in but thrive in a meaningful neighbourhoods, well connected to nature and other truly special communities… Georgian Communities may have just the thing for you.

Inspiring architecture, from modern interpretations of farmhouses to classic ski chalets, and homes where quality is always the priority, Georgian’s master-planned communities offer unique living opportunities for families to build memories and share experiences. For insights on the company’s philosophy and its strategy to deliver,

we spoke with Vice-President of Sales and Marketing Mike Parker.

How has 2025 been for Georgian Communities?

It has been a year of steady progress in a slower market. Affordability and policy changes continued to influence buyer confidence, so activity was more measured than past years. Even so, we focused on delivering quality homes and advancing each community. A real highlight was welcoming our first homeowners at Craighurst Crossing and Victoria Annex. Traffic and engagement picked up later in the

year, which gives us confidence heading into 2026.

What is your outlook for 2026?

I think 2026 will be a healthier and more balanced year. Interest rates are starting to ease, and buyers are re-engaging in a more thoughtful way. We are not expecting dramatic swings, but a gradual return to confidence feels likely. Communities with strong value, good design and a clear sense of place will stand out.

What new developments or phases is Georgian introducing next year?

Windfall at Blue will continue to grow, with new detached lots and movein-ready options. Craighurst Crossing will build on its first phase of families now living in the community, with new treed lots becoming available. At Braestone, we are in the final stretch of estate lots on large, treed properties. And in Collingwood, work has started on transforming the historic Victoria Annex schoolhouse into two architecturally unique semidetached homes.

There has been a lot of movement among governments to address housing challenges. What more do you think can be done?

More collaboration and more consistency. Builders need clarity around policy timelines and approvals. Buyers need support around affordability and financing confidence. When all levels of government, municipalities and builders work together with clear expectations, we can deliver homes faster and keep communities moving forward.

Georgian is known for developing full communities in rural, natureconnected locations. What inspired that philosophy?

It comes from understanding what people are searching for today: Space, balance and a real sense of belonging. Our sites in Simcoe and Grey County give us the chance

to design neighbourhoods around nature and lifestyle, not just density targets. The goal is to create places that feel grounded and distinct to their setting.

How have homebuyers responded to this portfolio?

Very positively. People appreciate the connection to nature, the craftsmanship, and the sense of community that forms quickly. Whether it is the energy of Windfall at Blue, the rural comfort of Braestone, or the small-town charm of Craighurst and Collingwood, buyers recognize that each neighbourhood offers something unique.

What is the typical buyer demographic?

It varies by community. Windfall attracts active couples and families who want to live near the mountain. Braestone draws buyers looking for estate living with privacy and space. Craighurst Crossing appeals to families, professionals and people seeking a quieter pace. Victoria Annex connects with those who want walkability and downtown convenience.

The communities and home designs are special. What about the interiors and finishes makes them distinctly Georgian?

We focus on timeless design, not trends. Clean lines, natural materials and thoughtful layouts are consistent across the portfolio. We want homes

What or who is your most influential inspiration for what you do?

to feel modern but warm, and to age well. Quality is always the priority.

What do you look forward to most in 2026?

A more confident market, more families moving into our communities, and the momentum that comes with both. After a few challenging years, I am excited to see people re-engage with the idea of home.

What is next for Georgian Communities?

Continuing to build communities that feel authentic to their surroundings. We are focused on improving our processes, enhancing the buyer experience and preparing for longterm demand as the region grows.

georgiancommunities.ca

The people I work with. Sales keeps the entire organization moving forward, and seeing our team deliver for homeowners is what motivates me every day.

Away from the office on your downtime, you are happiest when you…?

Spending time with family, running trails or picking up my guitar. Those are the things that help me reset.

What is on your TV or podcast list these days?

I am currently listening to Empire of AI by Karen Hao. It has been a fascinating look at how OpenAI is shaping people’s perceptions and understanding of the broader AI revolution.

If you’re in the market for a new home – particularly a new lowrise home – you may have come across the term “Net Zero,” or maybe even “Net Zero Ready.”

While it all may sound like fancy marketing-speak, there actually are some very real and tangible benefits to choosing such new technology. What is a Net Zero home?

According to the Canadian Home Builders’ Association, these are defined as homes that produce as much clean energy as they consume. As much as 80 per cent more energy efficient than typical new homes, Net Zero homes are extremely well built, with extra insulation, high-performance windows and airtightness to minimize heating and cooling needs. In addition, appliances, lighting and mechanical systems are all as energy efficient as possible. And to offset the remaining energy needed for the home’s annual consumption, Net Zero homes use renewable energy systems – commonly solar – to generate electricity.

This is not to be confused with Net Zero Ready homes, which, CHBA says, are built to the exact same efficiency standards as Net Zero homes, with the only difference being that the renewable energy system have not yet been installed. However, everything has already been designed and constructed to easily put the solar panels in place – much like a home that has a roughed-in central vacuum. Already wired for a future renewable energy system, when the homeowners are able to invest in installing solar panels, it’s ready to go.

Every part of a Net Zero home is designed to work together to create the ultimate energy efficient living space. The building envelope, mechanical systems and renewable

energy systems all work together to ensure peak performance. Through advanced building science techniques, technologies and products, builders can significantly reduce a home’s energy consumption.

For homeowners, then, the three main benefits of buying a Net Zero home are:

• Can contribute to an increase in your home’s value

• Greater comfort and healthier living

• Environmentally responsible

Plus, you may even qualify for a 25-per-cent rebate on your mortgage insurance premium, through Sagen (formerly Genworth Canada) or Canada Mortgage and Housing Corp.

Ontario homebuilders, in fact, are among the leaders of Net Zero homes. Of the five CHBA Qualified Net Zero Builders recently noted for reaching the milestone of labelling more than 100 homes through CHBA’s Net Zero Home Labelling Program, four were based in the province: Activa, in Waterloo Region; Doug Tarry Homes, St. Thomas; Mattamy Homes, based in Toronto but active in many areas of Ontario, as well as Alberta; and Sifton Properties, in London.

Doug Tarry Homes, in fact, is a big proponent of training and

even wrote a builders’ guide to Net Zero homes, which its sales staff receives in addition to in-person bootcamp training and ongoing interdepartmental training on what other departments do.

The company even recommends that builders considering offering Net Zero/Ready homes “lean out” their building processes (find the wasted money in materials and processes), and then offer it as their standard. Doug Tarry offers sub-slab insulation that doubles as a radon soil gas barrier, wind resilient roofs, triple-glazed low solar glass windows with a warm edge spacer and flange extension, AeroBarrier for every unit and Graphenstone Paints as standard in their Net Zero Ready offering, among other features.

Another Ontario builder, Guelphbased Terra View Custom Homes, has been garnering industry recognition for its dedication to Green building practices and energy efficiency. Recently named Ontario Builder of the Year – Small Volume at the 2025 OHBA Awards of Distinction, Terra View’s commitment to sustainability is recognized at the local, provincial and national levels. The builder specializes in new, custom and Net Zero homes.

To search Net Zero builders, visit netzerohome.com.

DEBBIE COSIC

As we move into the final months of 2025, reflecting on one of the toughest real estate cycles in recent decades, there’s still room for cautious optimism throughout the Canadian market. Despite ongoing uncertainty, today’s conditions present a unique opportunity for buyers and investors alike. Factors such as moderating interest rates, appealing purchase incentives and a tightening supply of new housing options are aligning to make this a strategic moment to consider investing in real estate.

Many of today’s pre-construction projects offer extended closing timelines, often four to five years for condos and up to two years for detached homes or townhomes, allowing buyers extra time to save for their deposits while locking in today’s prices. Many developers are also introducing flexible deposit structures, often requiring as little as 10 per cent in total, sometimes spread over several years in installments as low as three per cent annually. This staggered approach helps ease the upfront financial commitment, making homeownership or investment more attainable.

Another advantage is the availability of substantial discounts offered by developers. With recent market slowdowns, many projects are incentivizing buyers with

reduced prices, creating a rare opportunity to buy at a discount. Additionally, with fewer new developments breaking ground, future inventory will be limited, which could lead to a classic supply-demand imbalance and rising prices when the market regains momentum.

While historic gains in real estate may not replicate at the same speed in the near term, the potential for long-term appreciation remains strong. Real estate has consistently been a solid investment over the years, offering stability and tangible value. This trend, coupled with the current market conditions, means that those who enter the market now may benefit significantly as demand eventually outpaces supply.

For those considering buying pre-construction, this period offers a unique combination of lowering interest rates, favourable purchase terms, and in today’s market an abundance of inventory to choose from. In2ition Realty offers a diverse

portfolio of projects across the GTA, each designed to match these ideal conditions. Whether you’re looking for a first home, a strategic investment, or a luxury property, our range of options caters to various needs and budgets.

This is your window of opportunity. This is your chance to secure today’s value before the next market upswing and benefit from the growth ahead.

Explore these opportunities with us at in2ition.ca or follow us on social media @in2itionrealty for the latest updates.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

+MORE CONTENT ONLINE nexthome.ca

The reasons to buy a new, preconstruction house or condominium – especially for first-time buyers – just keep increasing. Recently, Ontario proposed to remove the eight-per-cent provincial portion of the HST for first-time buyers on new homes valued at up to $1 million. This is a major step, as it will save potential purchasers looking to enter the pre-construction housing market up to $80,000, which increases to $130,000 when combined with the proposed federal rebate. If this is your first journey into homeownership, think about what that money could go toward.

Plus, it was only a few months ago that the federal government eliminated the Goods and Services Tax (GST) for first-time home buyers on new homes up to $1 million and reduced the GST for firsttime home buyers on new homes between $1 million and $1.5 million. More information on how first-time homebuyers can take advantage of government incentives and rebates is available from Canada Mortgage and Housing Corp. (cmhc-schl.gc.ca). We can hope that in the future, these steps will happen for all new home and condo purchasers, not just firsttime buyers.

There are, of course, numerous other reasons for all homebuyers to purchase new over resale, starting with our new home warranty, which provides priceless peace of mind. The seven-year warranty

takes effect upon possession and protects major structural defects (tarion.com). Imagine how good it feels to know you have deposit protection, coverage for delayed closing/occupancy, condominium cancellations and financial loss coverage for contract houses – not to mention expensive repairs and refurbishing so often necessary with resale homes.

And speaking of peace of mind, keep in mind that the Ontario Building Code is updated regularly to keep pace with the most advanced technologies and materials. Thinking ahead, this bodes well for the value of your house or condo over time.

And speaking of condos, the perks of this type of living are exciting, with elegant amenities under your roof. No need to leave the building when there are fitness facilities, theatres, entertainment spaces and/or rooftop terraces, etc. The condominium suites of today come with chic standard features and finishes, as well as layouts that maximize every square foot.

The up to $80,000 that would normally go to the provincial portion

of the HST could be spent on highor lowrise upgrades, if you are so inclined. And if you buy early enough in the selling cycle, you will be able to select those standards and upgrades, which means your surroundings will feel like “home” from day one.

Whether you are a potential first-time homebuyer or a savvy experienced one, consider buying new soon. As soon as sales pick up – which they always do after a low cycle – prices and demand will increase as well. The signs of recovery are there. Next year, it may be difficult to find what you want at a price you can afford. Buy new and buy now.

Barbara Lawlor is CEO of Baker Real Estate Inc. A member of the Baker team since 1993, she oversees the marketing and sales of new home and condominium developments in the GTA, Vancouver, Calgary and Montreal, and internationally in Shanghai. baker-re.com

ELECHIA BARRY-SPROULE

If you’re trying to buy or rent a home in Toronto, the challenge is clear: Prices remain high and supply continues to fall short. Meeting the city’s housing goals isn’t just about achieving a number, it’s about creating real options for families, first-time buyers and newcomers who want to call this region home.

In the latest episode of TRREB’s podcast, Ready to Real Estate, TRREB Chief Information Officer Jason Mercer is joined by urban planners Alex Beheshti and Graig Uens to explore how governments, builders and communities can work together to turn plans into actual places to live.

The conversation begins with the federal government’s Build Canada Homes Agency, an initiative that could accelerate construction by purchasing prefabricated homes in bulk. Prefabricated and modular homes are built faster and with less waste, at a lower cost, offering a promising way to increase supply without sacrificing quality or design.

Toronto’s recent zoning changes are another critical step forward. New permissions for multiplexes, garden suites and midrise buildings

are opening more neighbourhoods to a broader range of housing types and price points. These policies help bridge the gap between single-detached houses and highrise apartments, helping residents remain in their communities as their needs evolve.

One of the biggest challenges in building new homes: Development charges. While these fees fund essential infrastructure, they’ve risen over time, making many projects financially difficult to complete. Better alignment on funding, zoning and approvals across all three levels of government can make construction more viable and move good ideas from planning to production.

Toronto’s housing challenges won’t be solved overnight, but

collaboration, innovation and a shared sense of purpose can bring lasting progress. By focusing on practical solutions and removing unnecessary barriers, governments can help create the conditions for more homes, built faster, for the people who need them most.

To hear more insights from Alex Beheshti and Graig Uens, and to explore additional discussions on housing supply, market trends and policy, listen to Ready to Real Estate at trreb.ca.

Elechia Barry-Sproule is President of the Toronto Regional Real Estate Board (TRREB) and Broker/Owner of Red Apple Real Estate Inc. She is committed to mentoring and supporting real estate professionals across the industry. trreb.ca.

+MORE CONTENT ONLINE nexthome.ca

MIKE COLLINS-WILLIAMS

Collaboration was the name of the game at the Central Ontario Housing Summit, co-hosted by the West End Home Builders’ Association (WEHBA) and the Ontario Home Builders’ Association (OHBA) and our presenting sponsor Enbridge in early November. The event was jam packed with productive discussions and valuable insights from industry leaders, elected officials and experts across Ontario.

The day began with opening remarks from WEHBA Chair David Ionico and Presenting Sponsor, Enbridge, followed by an address from Rob Flack, minister of municipal affairs and housing. Minister Flack summed up development in Ontario in one short sentence: It takes too long and costs too much to deliver housing in Ontario. The Minister outlined actions the provincial government is taking, such as removing the provincial portion of the HST for new-home buyers purchasing homes of less than $1 million and reforming development charges. OHBA CEO Scott Andison emphasized the importance of recognizing the new home industry as a system that needs to be examined holistically to deliver better outcomes.

A Local Politics of Housing panel brought together Mayor Joe Preston

(City of St. Thomas), Councillor Maureen Wilson (City of Hamilton) and Councillor Paul Sharman (City of Burlington) for a thoughtful discussion exploring the challenges of representing their constituents, building consensus with the private sector and advancing housing supply amidst the difficult political climate.

We also heard an insightful economic overview from Derek Burleton, vice-president and deputy chief economist at TD, who predicts Canada will avoid a recession but experience lacklustre growth and a challenging 2026 and 2027 for development. Burlington Mayor Marianne Meed Ward, Chair of Ontario Big City Mayors, shared valuable municipal perspectives on housing and growth and the actions her city is taking to move development from the application pipeline to shovels in the ground, such as exploring options for a temporary elimination of local development charges.

Dr. Mike Moffatt, founding director of the Missing Middle Initiative, explored the need for ground-oriented, family-sized housing in the GTHA to prevent continued migration from the region to smaller Ontario communities. Dr. Moffat was followed by the Builders Who Survived the 1990s panel, moderated by Terri Johns (Landwise). Panelists Jeff Paikin (New Horizon Development Group), Danny Gabriele (Marz Homes) and Bob Finnigan (Heathwood Homes) shared lessons from past market

challenges and insights for surviving the current downturn and building a stronger future.

A Fireside Chat featured Paula Tenuta (BILD), Andrew Whittemore (City of Mississauga), and Arvin Prasad (City of Hamilton), offering candid discussion on the policy, planning and process improvements needed to move housing projects forward. The cultural attitude within municipal planning departments was identified as vital, with planners needing to be facilitators and not regulators.

The day was concluded remarks from Andrea Khanjin, ninister of red-tape reduction, and Christina Giannone, chair of OHBA, who summarized efforts to smooth out the process and items for future OHBA advocacy, respectively.

Together, we are taking action to break down silos and improve collaboration between municipal, federal, provincial and private stakeholders. Collaboration is necessary to improve the speed, efficiency and cost effectiveness of delivering the housing that Ontarians desperately need.

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

+MORE CONTENT ONLINE nexthome.ca

by MARIAM ABOUTAAM

Designing model homes for Kylemore means paying attention to laundry rooms and mudrooms as essential, hardworking spaces. These areas of the home must deliver practical use, while receiving the same level of thoughtful finish and design cohesion seen throughout the rest of the model. With the right planning, these often-overlooked service zones become enjoyable environments that support daily living.

Mudrooms are important transition points between attached garages and

the main living areas. Incorporating built-in seating, cabinets and cupboards, cubbies, storage shelves and shoe racks creates a wellorganized space with a designated place for every family member’s items from backpacks to hockey bags. This approach ensures that order is maintained and clutter is kept in check.

If space permits, pet-friendly features can enhance functionality. This might include a wash station complete with shower pan, bed or crate space, and storage for food, toys and grooming supplies. These additions keep everyday items

out of high-traffic areas yet also add convenience.

In a recent award-winning model townhome, recognized as Best Model Home 2025 at the Ontario Home Builder’s Associations’ Awards of Distinction, the laundry and mudroom were combined to maximize efficiency. This room is located near the garage entry on the ground floor. Custom closets, shelving, bench and coat hooks line one wall, providing quick access to outerwear and essentials. On the opposite wall, full-

size stacked laundry appliances freeup valuable space for a deep sink set into a countertop, a hanging rod, tall broom and mop closet and enclosed cabinetry for supplies. Generous drawers below the counter expand storage. A window adds natural light, resulting in a bright, functional room that is ready for daily use and homeowner appreciation.

Selecting durable finishes is important in utility spaces that must withstand moisture and heavy use. Non-slip, hard-wearing porcelain or ceramic tiles are long-lasting materials, which provide effortless cleaning and are visually appealing.

For a luxurious effect, porcelain or quartz countertops deliver the look

of marble without the maintenance requirements or higher cost. When budgets allow, extending the material behind the sink as a fullheight backsplash creates a clean, sophisticated finish.

Utility spaces are often among the smaller rooms in the home, so being creative in planning becomes vital. We look to the vertical to extend cabinetry and shelving to the ceiling providing extra storage for seasonal items that require only occasional access. As well, a built-in bench with a lift-up seat offers concealed storage alongside comfort and useability.

Beautifully designed laundry and mudrooms ensure that these high-function areas serve the family efficiently while harmonizing with the home’s overall style. These are much-used rooms deserving our attention and benefiting homeowners with comfort, organization and lasting enjoyment.

An award-winning in-house designer, Mariam Aboutaam is Director, Sales and Marketing, Interior Design at Kylemore, Markham, Ont., a builder known for masterplanned communities and luxury homes. kylemoreliving.com.

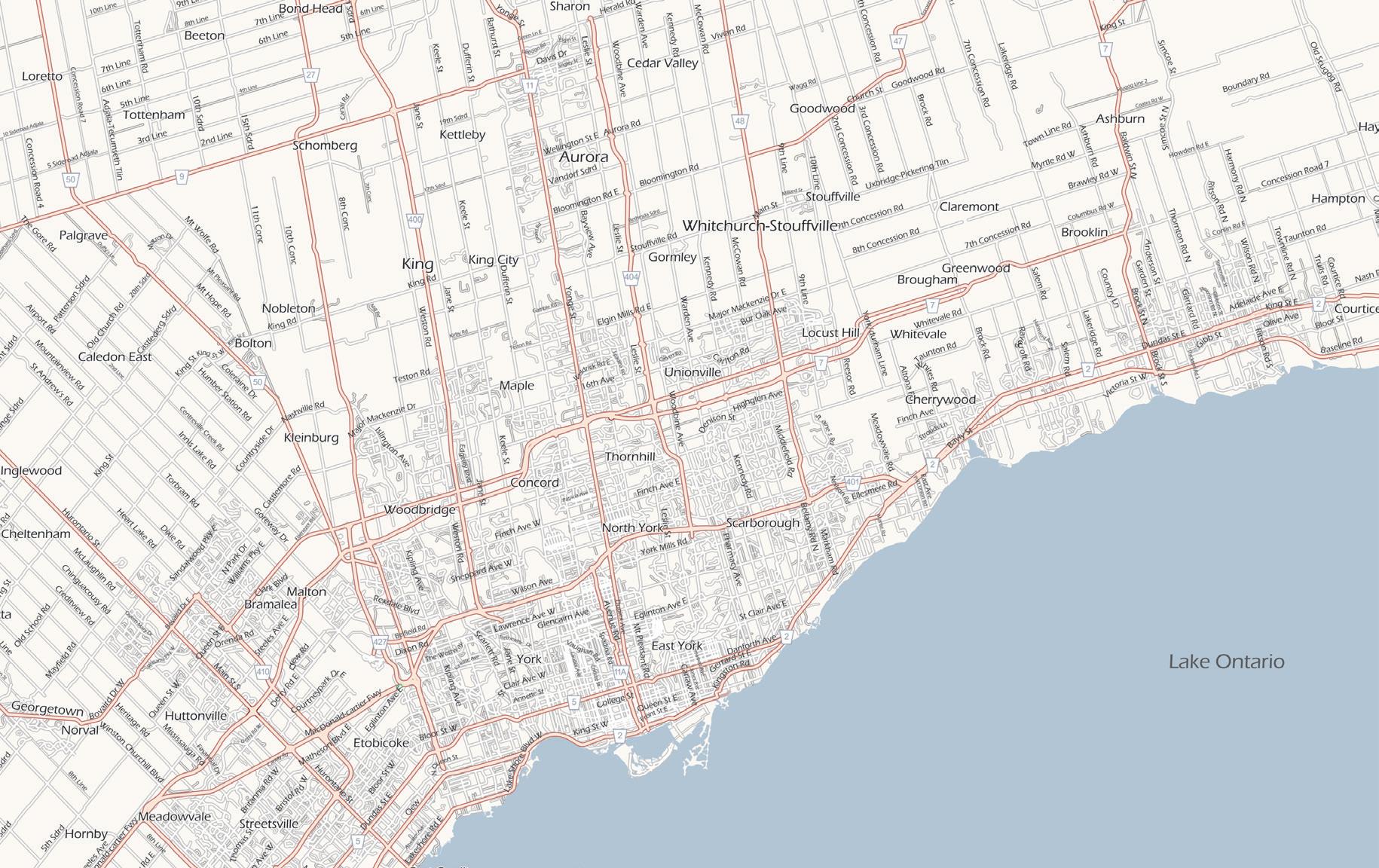

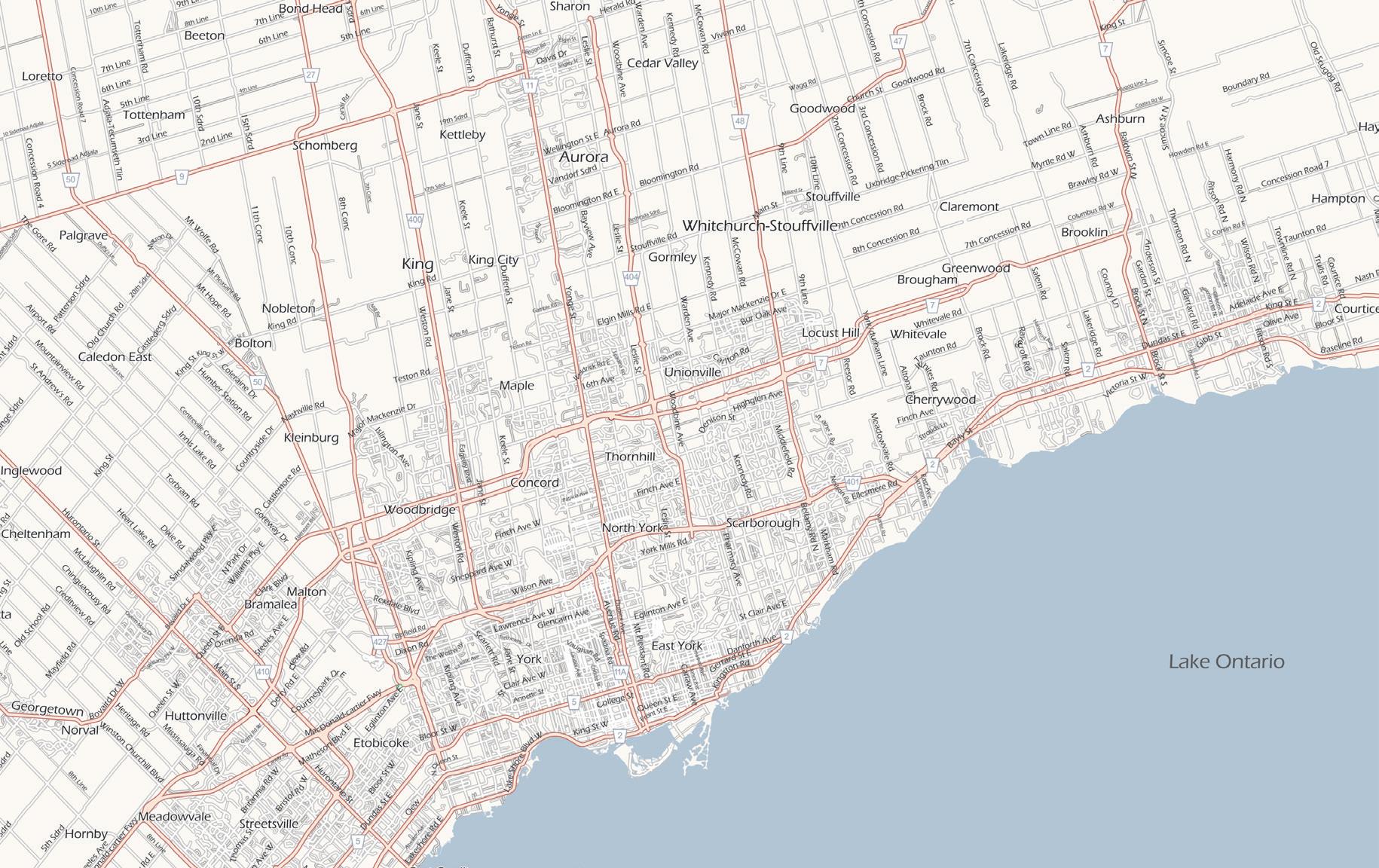

AJAX

1. Time Rossland Road marshallhomes.ca

AURORA

2. Queen’s Grove Collection Yonge St. & Bloomington Rd. northstarhomes.com

3. Allegro 36 Klees Cres. geranium.com

4. Shinning Hill 24 St John’s Sideroad countrywide.ca

BRAMPTON

5. Bodhi Towns Fogal Road & Nexus Ave. countrywide.ca

6. DUO Condos 245 Steeles Ave. W. duocondos.ca

7. Queens Lane Townhomes Mississauga Rd. & Queen St. branthavenbrampton.com

8. Classic Drive Creditview’s Valley Lands & Lionshead Golf and Country Club branthaven.com

9. Union Mississauga Rd. & Bovaird Dr. mattamyhomes.com

10. Canvas Hill Queen St. W. & Creditview Rd. branthaven.com

11. Brant West 501 Shellard Lane losanihomes.com

CALEDON

12. Palgrave Estates Mount Pleasant Rd. & Hunsden Rd. flatogroup.com

13. Ellis Lane Chinguacousy Rd. & Mayfield Rd, mattamyhome.com

14. Mayfield Collection 22 Stratford Dr. rosehaven.com

COURTICE

15. The Vale 57 Glen Eagles Dr. nationalhomes.com

ETOBICOKE

16. Blvd Q 3300 Bloor Street W. mattamyhomes.com 17. Westbend Residences Bloor & High Park mattamyhomes.com

18. The Clove 240 The East Mall Cres. mattmayhomes.com

ERIN

19. Everwood 6578 Ninth Line, Mississauga mattamyhomes.com

20. Triple Crown Estates Dufferin St.t & 15th Sideroad remingtonhomes.ca

KLEINBURG

21. Kleinburg Hills Appleyard Ave. countrywidehomes.ca MARKHAM/ UNIONVILLE

22. Spring Water 3217 Elgins Mills Rd. mattamyhomes.com

23. Angus Glen South Village 9980 Kennedy Rd., #200 kylemorecommunities.com

24. Kennedy Manors 4500 Major Mackenzie Dr. E. kylemorecommunities.com NORTH YORK

25. 28 Hunslow Yonge and Finch mattamyhomes.com OSHAWA

26. Park Ridge Conlin & Townline Rd. tributecommunities.com

27. Mackenzie Park 65 Athabasca St. brightstone.ca

28. Schoolhaus 555 Rossland Rd. W. brightstone.ca

29. Seaton Whitevale 1535 Whitevale Rd. mattamyhomes.com

30. Seaton Mulberry 1075 Taunton Rd. mattamyhomes.com

31. Courts of King’s Bay Near Port Perry geranium.com

32. Jefferson Reserve 363 Jefferson Side Rd. countrywide.ca

33. Observatory Hill Bayview Ave. & 16th Ave. myobservatoryhill.ca

34. Lambtown Towns 2650 St. Clair Ave. W. dunparhomes.com

35. 2650 St. Clair Ave W. 2650 St. Clair Ave. W. dunparhomes.com

36. Westbend Residences Bloor & High Park mattamyhomes.com

37. The Briar 386 Briar Hill Ave. brightstone.ca

38. The Elms Thornhill Wood Dr. & Elmway Court brightstone.ca

39. Country Lane Taunton Rd. & Country Lane countrylanewhitby.com

40. Wellings of Whitby 372 Taunton Rd. E. wellingsofwhitby.com

41. Sora Vista Pine Valley & Teston Rd. soravista.ca

42. Woodend Place Major MacKenzie & Pine Valley Dr. woodendtowns.ca

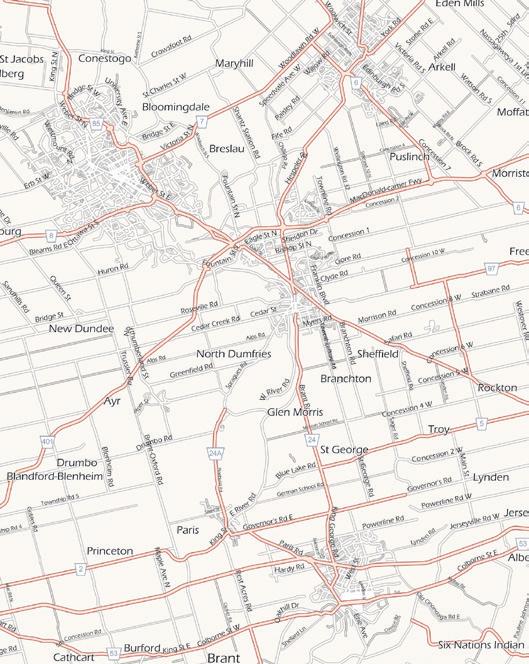

1. Northshore Condo 484-490 Plains Rd. E. nationalhomes.com

2. Tyandaga Heights Burlington nationalhomes.com

4. Northshore Towns 490 Plains Rd. E. nationalhomes.com

5. Martha James Condominiums Martha and James St mattamyhomes.com

6. Moffat Creek 3 Ritchie Court terra-view.ca

ELORA

7. South River 133 South River Rd. granitehomes.ca FERGUS

8. Bellwood Estates Fergus geranium.com

GEORGETOWN

9. Juniper Gate 10130 10 Line, Norval remingtonhomes.com

GUELPH

10. Heart Village 62 Lovett Lane terra-view.ca

11. Argyle Village Lowes Rd E & Gordon Street argylevillage.ca

12. Northside Guelph Woolrich St & 7 granitehomes.ca

13. The Block on Clair 331 Clair Rd E. reidsheritagehomes.ca

14. Clairmont 25 Poppy Street mattmyhomes.com

15. Nima

2 Nicholas Way terra-view.com

16. Rebecca Condos 212 King William St. rosehaven.com

17. Wildflowers Huron Rd & Trussler Rd mattamyhomes.com

18. Lackner Ridge Lackner Blvd & Ottawa St N lacknerridgetowns.ca

19. Trussler West Hwy 8 & Trussler Rd fusionhomes.com

20. Mile & Creek

760 Whitlock Ave. mattamyhomes.com

21. Hawthrone East Village Louis & Lavert Ave mattamyhomes.com

22. The Laurels Brittania Rd & Hwy 25 mattamyhomes.com

23. Whitehorn Woods 1240 Britannia Rd. W. nationalhomes.com

24. OG Urban Towns 2532 Argyle Rd brigtstone.ca

25. The Nine 6578 Ninth Line mattamyhomes.com

26. Everwood 6578 Ninth Line, Mississauga mattamyhomes.com

27. Luna 205 St. Davids Rd, Thorold silvergatehomes.com

28. Harbourtown Village

574 Seneca Drive, Fort Erie silvergatehomes.com

29. Bench Mark Ontario St. & Drake Losanihomes.com

30. Upper Joshua Creek 1254 Burnamthorpe Rd. mattamyhomes.com

31. Carding House 292 Ironside Drive mattamyhomes.com

32. Clock Works at Upper Joshua Creek 1388 Dundas Street W. Oakville mattmyhomes.com

33. Kerr Village 109 Garden Drive brightsone.ca

34. Ivy Rouge 310 Randal Street rosehaven.com

35. Riverbank Estates Nirh River losanihomes.com

36. Lincoln Estates Lincoln Ave. & King St. losanihomes.com

37. Lusso Urban Towns Martindale Rd. & Grapeview Dr, St. Catharines lucchettahomes.com

38. Merritton Mills St. Catharines silvergatehomes.com

ST. THOMAS

39. Harvest Run Centennial Parkway & Elm Street dougtarryhomes.com

40. Prudhomme’s Landing 1051 Old Thorold Stone Road silvergatehomes.com

41. Poet & Perth Quinlan Rd & O’Loane Ave, Stratford. poetperth.ca

42 Maplewood Park Upper Creswood maplewoodstoneycreek.com

43. Sweetberry Barton & Glover sweetberrytowns.ca

TILLSONBURG

44. The Bridge Estates Greenhill Dr. tdinewhomes.ca

WELLAND

45. WaterCrest at Hunters Pointe 6 Alvira Trail lucchettahomes.com

46. St. George Village Concession 2 & Woodhill Rd. losanihomes.com

47. Brant West 562 Shellard Ln losanihomes.com

48. Expressions & Riverbank Estates 1021 Rest Acres Rd., Paris losanihomes.com

49. Cottonwood Dingle St. sifton.com

50. Edgewood Suites 270 Hagan Street East, Dundalk flato.com

51. Discoverie Condos 7 Central Ave Fort Erie DiscoverieCondos.ca

1. Vicinity & Vicinity West Essa Rd & McKay Rd W mattamyhomes.com

2. Midhurst Valley 1296 Carson Rd. geranium.com

3. Heartland Hwy 89 & Yonge St., Baxter brookfieldhomes.ca

4. Midhurst Hwy 26 & Bayfield Rd. Brookfieldhomes.ca

BELLVILLE

5. Riverstone Just off Farnham Road geertsma.ca

6. Haven on the Trent Forest Hill Rd. & Riverside Trail sifton.com

7. Mountain House at Windfall Mountain Rd. & Crosswinds Blvd. georgianinternational.com

8. Collingwood Maple & Sixth Street georgianinternational.ca

9. Reverie 391 First St, Collingwood reverietowns.com

10. The Vale Prestonvale Rd. & Bloor St. nationalhomes.com

11. Hastings Estates 16 Old Trafford Drive bataviahomes.ca

12. Craighurst Horseshoe Valley Rd. & Hwy. 93 georgianinternational.com

13. Braestone Horseshoe Valley 3246 Line 9 North georgianinternational.com

14. Muskoka Forest 174 Earls Rd. Huntsville bataviahomes.ca

INNISFIL

15. Lakehaven 25th Side Road & 10th Line mattamyhomes.com

16. Simcoe Woods 2153 Donnelly Cres. rosehaven.com

17. Sunshine Harbour Orillia sunshineharbour.com

18. Parklands & The Condo Arbour Villas 1224 Chemong Rd. masonhomes.ca

19. Port Hope Lakeside Village 415 Lakeshore Rd. masonhomes.ca

20. Kingswood Cobourg 425 King St. E. masonhomes.ca

21. Meadow Heights 82 Hillcrest Road, Port Colborne dunsire.com