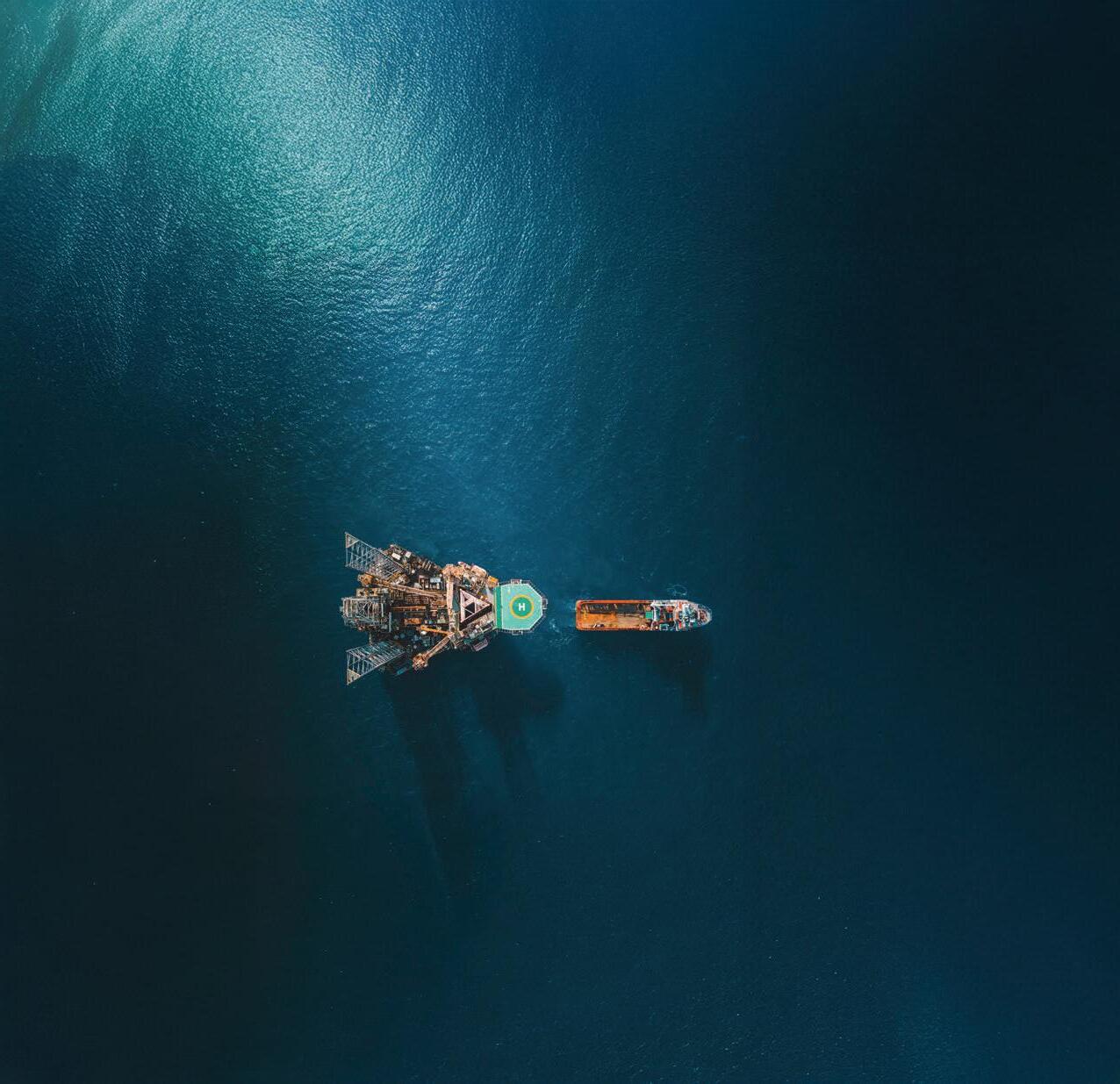

At National Bank of Fujairah, our specialised Energy & Marine division is uniquely positioned to provide bespoke solutions to Shipping, Oil, Gas and Renewable sectors. With nearly four decades of award winning services, benefit from our expertise and connect with top industry specialists worldwide as we ensure your financial strategies match the best options, leveraging our extensive local and global reach and insights.

Ship nancing

Trade nance for oil, Gas and Renewables

Assets and equipment nance

Financing for renewable projects commodity nance

• Green nancing for sustainability related projects

• Working capital nance for Energy, Marine and Renewable related activities

ENERGY AND MARINE

WHOLESALE BANKING

Call 8008NBF(623) to start our partnership

*Terms and conditions apply

As an effect of the pace of change in our lives, our attention is increasingly focused on the current moment; there is a lot happening in the world at this time. This is not necessarily a bad, nor a particularly good thing, it is just the present we find ourselves at. In a regional financial services context, the here and now is pretty positive with much of the region's banking and digital payments sectors still determinedly modernising and even taking leads in some areas. Key aspects of the industry are surging ahead with the fast development of open finance and increasing regulatory sophistication, placing our region at the top table of global financial hubs. So, and as we regularly highlight in MEA Finance, (welcome to the September 2025 edition, btw.) the here and now, when observing the current regional banking and financial zeitgeist, is vibrant, hopeful and enthusiastic.

Our cover story this month highlights this as Nina Auchoybur, Country Head for the UAE at Ocorian talks about their growth and how it parallels our region's rapid ongoing development, especially in the provision of essential services for the region’s cohort of HNWIs. Staying with the prosperous and their ongoing migration to the region, George Hojeije, Group CEO at Virtugroup points to the UAE as the dominant recipient of capital flight from traditional financial centres

This issue showcases the current speed of evolution, the expansion of new, more agile options in banking and finance, and the role of technology behind all of this with our focuses on Open Finance, Digital Payments and Neo Banking.

"The institutions that succeed will not be the ones with the biggest tech budgets, they will be the ones who move fast, scale smart and collaborate well", points out Niraj Naetsawan at additiv.

Our interview with Kawa Junad, Founder and Chairman of First Iraqi Bank, Iraq's first digital only bank, also underlines this pace, and also the importance of regional banking development, "In a country where only 30% of adults currently have a bank account, these changes are foundational for economic growth".

Taking a time-out to consider life beyond the here and now, Dinesh Sharma Head of International Wealth and Premier Banking, MENAT, at HSBC, discusses the changing shape of retirement and life planning, pointing out that, "it is interesting to see how attitudes towards retirement are evolving in the UAE".

Then back to the present with Amol K Bahuguna, regional banking industry expert and Sanat Rao, the Cofounder & Managing Director, Within The Box.ai, both with their own special takes on the AI and the development of regional banking, " The Middle East is not just joining the race; it is building the roads", states Amol, while Sanat advises that in our age of AI, our bankers must become cognitive interpreters, "The modern banker must create value not through knowledge hoarding, but through cognitive synthesis and contextual insight".

Infosys Finacle with their regular banking technology insights, this month describes how banks are offering a broad spectrum of services by transforming into comprehensive service hubs. And finally, the country focus this month is on Kuwait which, in handling its issues has, by encouraging economic diversification and fiscal sustainability, is now on the right track with the banking sector playing a vital and active role in supporting the economy.

So, here and now, it is time to enjoy your read.

The GCC, is entering a pivotal phase in its financial services evolution with Open Finance fast becoming a critical enabler of innovation, particularly in wealth, insurance and credit, says Niraj Naetsawan General Manager Middle East, Financial Services Technology, at additiv

Which recent technological and market developments have most accelerated the shift toward Open Finance?

The shift toward Open Finance is driven by a combination of regulatory push, evolving customer expectations and rapid technological advancements. Regulators are expanding Open Banking frameworks into Open Finance, promoting broader data sharing and interoperability across financial products — not just payments. Several developments are converging to accelerate Open Finance adoption across the GCC.

First, the adoption of cloud-native and API-first platforms is lowering traditional integration barriers, long considered one of the biggest obstacles to digital transformation. Historically, integration between legacy systems and new digital services has been slow, expensive and cumbersome. That is changing. With modular, API-driven platforms, institutions can integrate once and innovate continuously, extending services

Niraj Naetsawan, General Manager Middle East, Financial Services Technology at additiv

across wealth, lending, insurance, without overhauling their infrastructure.

Second, we are seeing the rise of financial orchestration platforms that unify fragmented data, streamline business logic and enable institutions to build hyper-personalised client journeys. With orchestration, firms can move beyond product silos and design seamless, context-aware financial experiences.

Third, AI is a game-changer. From real-

time personalisation and savings nudges to automated portfolio rebalancing and predictive client servicing, AI is enabling smarter, faster and more relevant interactions. At additiv, we are embedding AI across the wealth value chain—from onboarding and profiling, to advisory and reporting.

Finally, consumer expectations are evolving. Investors, particularly younger, affluent clients, demand real-time visibility and control. The shift toward digital-first, self-directed experiences is pushing banks and insurers to rethink how they deliver and personalise wealth services.

How are regulators and central banks in the region shaping an environment that supports scalable and secure Open Finance adoption?

GCC regulators are taking a structured, forward-looking approach to Open Finance, laying the groundwork through phased frameworks, controlled innovation environments and a strong focus on data sovereignty. In Saudi Arabia, SAMA’s staged rollout — starting with retail and moving into corporate, wealth and insurance is creating a model for gradual, use-case-driven adoption. Similarly, the UAE’s DIFC Open Finance Lab is enabling live experimentation between fintech’s and incumbents, helping validate interoperability and governance models in real market conditions.

A major enabler is the emphasis on local data hosting and sovereignty. In tightly regulated markets like KSA and the UAE, sensitive data must remain within national borders. This approach meets regulatory mandates and builds trust among mass affluent and HNW clients.

Importantly, regulators are encouraging modular adoption, allowing financial institutions to scale Open Finance one capability at a time rather than undertaking large-scale overhauls. Combined with enhanced cybersecurity and operational resilience standards, this approach ensures innovation advances without compromising safety, stability, or customer trust.

At what pace do you expect regional financial institutions to move from exploring Open Finance to embedding it in their business models?

We are already moving past the experimentation stage. Early pilots are live, particularly in the neobank, Insurtech and fintech-led wealth space. Players are aggregating data, offering embedded investment tools and integrating digital advisory into consumer apps.

Now, we are entering the acceleration phase, especially as regulators extend clarity beyond retail into wealth, insurance and pensions.

We are seeing a shift from “rip and replace” to “stop replacing, start innovating.” Institutions are realising that they do not need to replace their core systems, they just need to orchestrate them better. By layering orchestration platforms and APIs on top of legacy infrastructure, they can launch new offerings in weeks, not years.

The need to provide differentiated services to the mass affluent and retail segments will be key drivers of Open Finance adoption in wealth management. This group is hungry for digital-first, lowercost investment options, and they are less tied to traditional advisory relationships. Institutions that move quickly can capture this growing demand and expand their customer base without expanding their overhead.

There is also a growing need to bridge the advice gap, particularly for middleincome and younger investors. Digitalfirst wealth journeys, powered by AI and embedded advice, offer scalable ways to deliver contextual, regulated guidance without requiring full advisory relationships.

How will Open Finance reshape competition in the regional banking sector, and what new opportunities will it create for cross-sector collaboration?

Open Finance is redrawing the competitive lines in the region’s financial sector. Banks are no longer just competing with other banks. They are up against digital-native

challengers from adjacent industries i.e. telcos, retailers, ride-hailing apps, that are embedding financial products directly into everyday user journeys. These players do not require licenses or infrastructure of their own; they tap into BaaS models to go live fast, often delivering more intuitive, seamless experiences.

This creates a tipping point. Traditional financial institutions can no longer rely on scale or brand loyalty; they need to rethink their role entirely. They must evolve from product-centric entities into platform orchestrators: enabling, embedding and scaling financial services across thirdparty ecosystems.

This shift is unlocking a new wave of cross-sector collaboration. We are seeing banks co-create contextual experiences with insurers, asset managers and lifestyle platforms, embedding savings into salary accounts, or integrating credit within supply chain platforms.

The outcome? Financial services that are more embedded, personalised and accessible, serving more segments, more efficiently. Open Finance is not just increasing competition; it is reconfiguring the entire financial services value chain across the GCC.

What opportunities will the growth of Open Finance unlock for new distribution models and partnerships in the regional fintech ecosystem?

The growth of Open Finance is breaking down traditional distribution silos, enabling banks, insurers and fintechs to embed financial services into broader digital ecosystems. This unlocks new partnership models, where products can be distributed through super apps, e-commerce platforms and wealth marketplaces — reaching customers where they already are. BaaS models are democratising access to infrastructure.

Wealth managers, digital insurers and startups can plug into a bank’s licensed backbone to scale regulated services without needing to acquire their own licenses or infrastructure.

This creates a more level playing field and accelerates innovation.

We are also seeing the rise of fintech marketplaces, offering curated thirdparty funds, ETFs, sukuk, Crypto and ESG products. These platforms let users assemble their own financial stack, selecting services from multiple providers in a single, seamless experience.

In the GCC, we are also seeing the rise of modular offerings such as End-of-Service Benefits platforms and digital pensions, two categories gaining traction amid demographic and regulatory shifts. Open Finance allows these products to be embedded within employer platforms or offered via lifestyle apps, creating new engagement models and unlocking access to longterm financial planning for previously underserved segments.

This is the power of the open sourcing model. Institutions can offer their own products or source third-party offerings and distribute them across any channel. It is a win-win: better outcomes for customers and diversified revenue streams for providers.

How do you see Open Finance shaping the future of financial services in the region?

Open Finance is evolving from a compliance obligation to a strategic growth engine.

It allows institutions to serve more segments, more efficiently, with more relevance. The institutions that succeed will not be the ones with the biggest tech budgets, they will be the ones who move fast, scale smart and collaborate well.

For the GCC, the opportunity is unique. With progressive regulators, a digitally native population and no legacy drag, the region can leapfrog traditional models and set new standards globally.

The future of financial services is not closed, siloed, or slow; it is open, orchestrated and AI-powered — creating simpler, more inclusive and more innovative pathways for consumers and investors alike.

Sanat Rao, Co-founder & Managing Director, Within The Box.ai while acknowledging the helpfulness and inevitability of AI in banking, nevertheless explains why your AI is only as intelligent as the humans who interpret it

The algorithm did what it was supposed to do – it had crunched thousands of data points such as market volatility, risk tolerance, portfolio diversification and many more. It was brilliant. It was comprehensive. And yes, it was completely wrong.

Not technically wrong, mind you. After all, the math behind it was flawless. But the AI had missed something crucial, the client’s recent divorce, mentioned casually a few meetings ago. That event had shifted his financial priorities from wealth accumulation to liquidity preservation.

The algorithm saw numbers. The (human) banker saw narrative…and context.

This moment captures the central challenge of AI in banking today where we are building powerful digital brains but not focusing sufficiently on evolving the human minds that must interpret them.

Welcome to the era of the Algorithm Whisperer – they are bankers who don not just use AI tools, but also intuit how they think, where they misjudge and when they need help. These are not traditional relationship

managers or back-office analysts. They are cognitive interpreters, the human bridges, if you like, between machine intelligence and meaningful decisions.

In the UAE’s rapidly digitising financial system, where several banks are reporting many transactions are now digital, I am not ideating on some speculative future. In fact, it is my submission that this is almost a present-day need. Banks are deploying AI in everything from onboarding and credit scoring to fraud detection and investment advice. Yet in many cases,

the most critical decisions still demand human oversight – not because AI cannot give you the answer, but because AI’s answer necessarily needs and benefits from human oversight.

The question therefore is no longer “Should banks use AI?” That is already settled. The real question is: “Who is interpreting the AI, and how well trained are they to do it well?”

The traditional banker once held power by controlling information. That era is over. Customers now walk into branches with more data at their fingertips than the bank had ten years ago. The modern banker must create value not through knowledge hoarding, but through cognitive synthesis and contextual insight.

So, what are the key tenets of the role that the Cognitive Banker is expected to play? To my mind, there are four vital elements:

1. Contextual Pattern Recognition AI sees a sudden spike in income and flags it as positive. But a human may recognise it as a one-off crypto gain, or worse, a potential fraud. Context changes meaning.

2. Emotional & Cultural Intelligence

Sentiment analysis can identify the tone, but it does not adequately provide cultural subtext. For example, an Emirati client’s quiet withdrawal may signal discomfort, but not necessarily disinterest. On the other hand, a Lebanese trader’s directness may be borne out of passion, and not to be misunderstood as aggression.

3. Bias Interruption AI systems are trained on historical data, and some of that may indeed include outdated assumptions. However, a good Cognitive Banker can spot when AI misrepresents a family business or unfairly penalises a certain demographic group.

4. In terpretive Override Knowing when to trust the machine, and when to say, “this recommendation misses the bigger picture,” is becoming a core skill. Especially when decisions affect livelihoods. Interpretative override requires self-conviction and confidence that comes from true knowledge of how to interpret the data

Today, most banks are somewhere between “trying to understand what is AI” and “beginning to experiment with AI.” But few have yet built the human capabilities needed to truly partner with machines.

Here’s a simple model we use at Within The Box.ai to describe this evolution:

families to unbanked migrants to digitalfirst Gen Z professionals, each customer operates with distinct cultural, emotional and behavioural expectations.

For example:

Islamic banking compliance requires a deep understanding not just of the associated technical criteria, but equally of moral intent. No algorithm, no matter how advanced, can replace a Shariacompliant banker’s instinctive grasp of what “feels right.”

Expatriate banking in the UAE often requires decoding invisible norms like why customers from certain sociocultural backgrounds might resist credit cards due to cultural aversion to debt, even though they might be perfectly creditworthy.

A cognitive interpreter translates not only across languages but also between logic and emotion, data and trust, code and culture.

Many banks are still training their staff to use AI systems like any other tool whereby they click, submit and then interpret the

1. Tool User Accepts AI outputs at face value. No awareness of how decisions are arrived at.

2. Pattern Observer Notices inconsistencies or blind spots but cannot explain them.

3. Cognitive CollaboratorInteracts with AI meaningfully. Questions logic, understands limitations.

4. Algorithm Whisperer Achieves symbiotic intelligence - knows when to lean in, and when to override.

The UAE’s banking leaders must now ask “Where are our people on this curve, and how do we accelerate them forward?”

And this is not a question for HR alone. It is not even a question just for the line manager. It is strategic to the enterprise and ties in directly with how integral the bank wants AI to be to their strategy

Here is where regional banks hold a powerful edge. The UAE and indeed the wider GCC banking ecosystem serves one of the world’s most diverse populations. From high-net-worth GCC

output. Nothing wrong with this because maybe some roles require only this.

But real value for the bank will come from training cognitive readiness. This includes, amongst other things, -

• Algorithmic Literacy Not technical coding but understanding how AI makes decisions, what “confidence” means, and where training data can skew outcomes.

• Dialogue with Machines Knowing which questions to ask the AI, what data to feed it, when to challenge its assumptions. This is not just prompt engineering, it is prompt interpretation.

• Cultural Code Switching Building the

habit of mentally translating between local social norms and what the AI can and cannot see. Then feeding that insight back into the system, almost like a dialogue between man and machine

• Ov erride Confidence Perhaps most importantly, bankers must be empowered to override AI, not just permitted to. And they must know how to do it responsibly.

As AI becomes more accessible, what will differentiate one bank from another is not which tech stack they chose, but how they designed the human experience around it. It is very likely that those banks that develop Algorithm Whisperers within their teams will:

• Reduce false positives in fraud and compliance

• Increase customer trust in digital channels

• Improve investment advisory quality

• Lower regulatory exposure by making AI auditable and interpretable However, above all else, they are more likely than not, to create a reputation for intelligent banking that still feels human.

AI whispers data. But it does not whisper in context.

The banks that succeed in this next decade will not be the ones who shout the loudest about innovation. Rather, it will be those who listen closely, interpret wisely and whisper back with intelligence. Because in the end, your AI is only as intelligent as the humans who interpret it. It is time to look beyond the technology. It is time to train your people to become Algorithm Whisperers. It will be an investment that will be worth it.

Sanat Rao is Cofounder and Managing Director of Within The Box AI Services Limited, an AI enablement and behavioural design company. They are headquartered in the UK and operate in the UAE from the DIFC Innovation Hub. Their Applied AI Studio and Cognitive Design Practise is leveraged by banks, hedge funds and fintechs.

It is a plain truth that diversification and fiscal sustainability are key to Kuwait’s long-term development and economic resilience, and the country has now embarked along the right track with the banking sector playing a vital and active role in supporting the economy

Kuwait’s Cabinet in March signed off on a long-delayed liquidity law, paving the way for the Gulf state to tap international debt markets for the first time in eight years, signalling renewed momentum in longstalled economic reforms under previous governments.

Fitch Ratings projected that the approval of a long-delayed draft financing and liquidity law would improve fiscal financing flexibility and remove a source of credit risk.

Kuwait’s Emir Sheikh Meshal al-Ahmad al-Sabah dissolved parliament in May 2024 for four years to end years of political gridlock. Sheikh Meshal has moved to reset the country’s growth

trajectory after years of setbacks, with long-delayed reforms now beginning to take shape.

For decades, Kuwait has stood out as both a political and economic outlier in the GCC, but prolonged political infighting has hampered progress on economic policy.

Kuwait’s economic outlook is tied to the whims of the oil market, which makes up about 90% of government revenues, a dependency that leaves it more exposed to volatility than its Gulf neighbours.

“The economy is highly exposed to a variety of global risks through its oil dependence, in particular to commodity price volatility, a global growth slowdown or acceleration and the further intensification

of geopolitical tensions,” according to the International Monetary Fund.

Following two years of contraction, 3.6% in 2023 and 2.7% in 2024, the country is finally on track for a much-needed rebound. Fitch Ratings projects a 3.1% expansion in the economy for 2025, driven primarily by an increase in oil production that came into effect in early April.

The promising growth, however, does not erase the deep-seated vulnerabilities that have plagued the economy for years. To address these persistent challenges, the government in Kuwait City is implementing a series of structural reforms under the New Kuwait 2035 Vision.

Chief among them is Kuwait’s fiscal position, which has been in deficit since 2015/16 (with the exception of 2022/23 when oil prices spiked following the outbreak of Russia’s war in Ukraine) due to high public spending.

However, away from its economic woes, Kuwait is one of the wealthiest countries in the world, with its currency (the Kuwaiti Dinar) being one of the highest-valued currencies in comparison with other global currencies.

Kuwait’s banking system is stable and systemic risk is contained, supported by a strong prudential framework

that should continue to be enhanced.

“Inorganic growth has supported Kuwait’s banking sector over the past few years, as banks aim to diversify and enhance their financial profiles against the backdrop of limited organic growth opportunities,” S&P Global strategists said in March.

Building back better

Kuwait Petroleum Corporation (KPC) unveiled an ambitious $33 billion (KWD 10 billion) investment plan last November to boost the Gulf state’s oil production capacity by 40%. The target is to increase output from 3.2 million barrels per day in 2025 to 4 million b/d by 2050.

“We’re looking to make massive investments,” Sheikh Nawaf Al-Sabah, the CEO of KPC, said in an interview with Bloomberg. That’s “not only to maintain our production capacity, but ultimately grow it like our strategy calls for us to do.”

To turn ambition into reality, Kuwait is restructuring its vast network of hydrocarbon institutions to boost efficiency. Kuwait National Petroleum Company commenced the merger process with Kuwait Integrated Petroleum Industries Company in April, while Kuwait Oil Company and Kuwait Gulf Oil Company began the consolidation process in June.

Kuwait’s economic growth typically mirrors global energy market fluctuations.

The Gulf state, one of the world’s top 10 oil exporters, enjoyed a strong start to the year with GDP growth of 1% year-on-year in Q1 2025 following seven consecutive quarters of contraction.

National Bank of Kuwait (NBK) said in a research note that Kuwait’s nearterm GDP outlook points to positive growth, supported by the restoration of 135,000 barrels per day of oil production between April and September 2025. The non-oil economy is also expected to post steady gains.

However, the decision by OPEC+ to gradually increase oil production from April 2025 has compounded some of Kuwait’s fiscal challenges by increasing an already-large projected fiscal deficit for the coming year.

THE ECONOMY IS HIGHLY EXPOSED TO A VARIETY OF GLOBAL RISKS THROUGH ITS OIL DEPENDENCE, IN PARTICULAR TO COMMODITY PRICE VOLATILITY, A GLOBAL GROWTH SLOWDOWN OR ACCELERATION AND THE FURTHER INTENSIFICATION OF GEOPOLITICAL TENSIONS

– the International Monetary Fund

Though higher oil output will boost the country’s economy, a lower forecast oil price will still dent the government’s primary balance. Fitch Ratings projected an average oil price of $69.4 a barrel in 2025, down 12% from a year ago, with crude output expected to rise to 2.49 million b/d as OPEC+ eases supply curbs.

Kuwait’s budget outcomes are highly sensitive to changes in oil prices and production. The fiscal break-even oil price, including investment income, is forecast at $58 a barrel in 2025/26, while the non-oil primary deficit is forecast at 70% of non-oil GDP, well above regional peers.

Earlier in February, the Gulf state approved its state budget for 2025/26, an 11.9% rise in the deficit to KWD 6.31 billion for the fiscal year that began April 1, 2025, and ends March 31, 2026.

The budget projects revenues of KWD 18.23 billion, down 3.6% and expenditures of KWD 24.54 billion, little changed from last year’s budget, according to the Ministry of Finance.

Kuwait’s 2025/26 budget sees nonoil revenue rising by KWD 2.9 billion (6% of GDP). Fitch Ratings projected the budget position to deteriorate in 2025/26, despite government spending rationalisation efforts.

The Gulf state’s heavy reliance on oil revenues makes its economy vulnerable to fluctuations in global oil prices. However, though Kuwait runs fiscal deficits, the IMF says that using a broader

definition, encompassing investment income from the sovereign wealth fund and profits transferred from state entities, the country has posted wide surpluses for several years.

Over the years, Kuwait has lagged behind its GCC neighbours in reforming and diversifying its oil-reliant economy, leaving the country particularly vulnerable. However, in an effort to tighten its belt, the government in Kuwait city has taken some decisions to rationalise spending, including cuts in health insurance for retirees and civil servants.

Kuwait introduced a 15% domestic minimum top-up tax (DMTT) for large multinational companies operating in the country, effective January 1, 2025, as part of the Gulf state’s strategy to increase non-oil revenue.

The DMTT ensures that large multinational companies pay a minimum effective tax rate of 15% on their profits generated in Kuwait. Kuwaiti authorities reckon the DMTT will raise about KWD 250 million annually, with tax collections starting from 2027.

“The law represents Kuwait’s commitment to the OECD/G20’s Inclusive Framework on the Base Erosion and Profit Shifting 2.0 project and allows Kuwait to retain the right to tax Kuwaitsourced income and prevent tax leakage of such income to foreign jurisdictions,” according to EY.

Kuwait is also set to introduce an excise tax, with Fitch Ratings research suggesting it will take effect in the 2025/26 fiscal year. The move would finally align Kuwait with other GCC states, which ratified a region-wide agreement in 2016 and have since implemented the tax.

The Gulf state is set to sell international debt for the first time in eight years after its cabinet approved a long-delayed public debt law in March. Fitch Ratings said the approval of a financing and liquidity law should improve fiscal financing flexibility and remove a source of credit risk.

“The approval of the draft law points to improved government effectiveness in advancing long-delayed reform plans from previous administrations,” the ratings agency said.

However, even without a liquidity law, Kuwait would be able to meet its financing needs, given the substantial assets at its disposal. The country’s juggernaut is the Gulf state’s $800 billion sovereign wealth fund - Kuwait Investment Authority (KIA). KIA controls the Kuwait Investment Office, which manages the General Reserve Fund and the Future Generations Fund.

Though Kuwait’s deep-seated fiscal traditions, such as generous public wages and extensive welfare programs, are proving hard to shift. The new cabinet is trying its hand at fiscal reform, with the aim of capping spending at KWD 24.5 billion or about 51% of GDP, and improving government efficiency. The initiative is a nod to the long-standing challenge of diversifying the Gulf state’s economy.

THE LAW REPRESENTS KUWAIT’S COMMITMENT TO THE OECD/G20’S INCLUSIVE FRAMEWORK ON THE BASE EROSION AND PROFIT SHIFTING 2.0 PROJECT AND ALLOWS KUWAIT TO RETAIN THE RIGHT TO TAX

KUWAIT-SOURCED INCOME AND PREVENT

TAX LEAKAGE OF SUCH INCOME TO FOREIGN JURISDICTIONS

Kuwait’s banking system is a cornerstone of the economy. Banks in the Gulf nation, both conventional and Islamic, are exceptionally well-capitalised and profitable.

“Kuwait banks’ profitability improved in the monetary tightening cycle, as higher interest rates helped to expand margins. Now, amid declining interest rates, we expect profitability to follow,” said S&P Global.

The country’s banking sector is on the cusp of a potential new era of growth, buoyed by a wave of recent structural reforms. Fitch Ratings said the new reforms, including the public debt and residential mortgages, are set to create fresh lending opportunities and spur economic expansion.

The ratings agency forecast that wholesale lending is set to expand by 7% to 8%, driven by recent public-debt reforms. The agency said the new reforms will have a ripple effect, stimulating financing across various sectors.

The new law will also allow for the issuance of sovereign bonds, a move that is expected to bolster the liquidity of Kuwait’s banks.

Kuwait’s banking sector is playing a vital role in supporting the economy by financing development projects in line with Kuwait Vision 2035, while contributing to the diversification of the economy and the growth of the non-oil sector.

Following Kuwait Finance House’s acquisition of Bahrain-based Ahli United Bank and Burgan Bank’s acquisition of Bahrain’s United Gulf Bank, Warba Bank merged with Gulf Bank in August, creating one of the largest Shariah-compliant banks in the Gulf state.

“The recent increase in Kuwaiti bank mergers and acquisitions is credit positive for the sector, particularly as the market is overbanked,” Fitch Ratings said.

Banks in Kuwait have been increasingly turning to M&A as a strategic response to the limited organic growth opportunities, to diversify their business models and to strengthen their financial profiles.

KUWAIT BANKS’ PROFITABILITY IMPROVED IN THE MONETARY TIGHTENING CYCLE, AS HIGHER INTEREST RATES HELPED TO EXPAND MARGINS. NOW, AMID DECLINING INTEREST RATES, WE EXPECT PROFITABILITY TO FOLLOW

For the first time in a long while, the winds of change are blowing through Kuwait. By modernising its fiscal framework and accelerating project activity, Kuwaiti authorities are finally demonstrating a tangible commitment to the long-awaited reforms observers have deemed essential for the Gulf state to loosen its dependence on oil.

As the Open banking evolves into Open finance, extending beyond banks to integrate data from pensions, insurance, mortgages, mutual funds and other financial products, it is inaugurating a time where modern banks are required to become trusted, behind the scenes enablers

The financial services sector is undergoing a structural shift, underpinned by frameworks that facilitate secure and transparent data exchange – arguably the most critical asset in the modern financial ecosystem.

With customers demanding more from their banking experiences, financial institutions are enhancing their offerings to deliver more seamless and engaging experiences. Open banking and Open finance present a significant opportunity

to reshape the GCC banking landscape, mirroring the tangible benefits seen in markets where these initiatives have already been successfully implemented.

“Technology forms the bedrock of Open banking and Open finance systems, providing the infrastructure and tools necessary for secure and efficient data sharing,” said the Asian Development Bank Institute.

Open banking and Open finance are prompting banks and fintechs to reassess how customer data is shared and utilised,

enabling innovation while maintaining strict controls over privacy and security.

The GCC region is accelerating the adoption of Open banking and Open finance frameworks, driven by regulatory support, technological innovation and cross-industry collaboration.

The momentum is fuelling rapid growth in digital payments, with mobile wallets, contactless cards and QR-based transactions gaining traction – particularly in the UAE and Saudi Arabia, where authorities are actively promoting cashless economies and broader digital payment ecosystems.

However, the MENA Fintech Association notes that Open finance extends beyond the account-level data of Open banking, offering “read” access to a customer’s full financial footprint, including product details, pricing and contractual information across savings accounts, mortgages, pensions, investments and equities.

Open finance represents a stepchange, moving beyond “atomic” APIs like

payment initiation requests. It establishes a unifying framework that links products and services, enabling seamless connectivity and broader data-driven innovation across the financial ecosystem.

Meanwhile, Open finance is moving up the regulatory agenda in the GCC. Policymakers view it as a mechanism to advance financial management for households and small and medium-sized enterprises; while reshaping the way banks interact with one another and engage with customers.

Open finance in the GCC is still taking shape, with no clear sense yet of which players will emerge as leaders. Fintechs are leveraging the technology to compete for customers and capital, while incumbents are expected to remain embedded in the system – even if their role shifts away from direct client relationships.

Open banking and Open finance are gaining traction across the Gulf region, reshaping how financial institutions and customers interact.

The era of exclusive, singlebank relationships is giving way to interconnected ecosystems, where fintechs – enabled by Open finance frameworks – are rolling out differentiated and personalised financial services and products. The tech-enabled advancements are expanding customer choice while compelling incumbents to reevaluate their value propositions.

Haytham Yassine, the Managing Director & Partner at BCG, said the era of customers relying on a single bank for deposits, lending, investments and payments is over.

“Today, diversified financial relationships across multiple providers are driving the implementation of Open finance, as institutions seek to meet rising demand for seamless data sharing and integrated services,” said Yassine.

Building on Open banking, Open finance extends the model by emphasising transparency in data usage, storage and portability. The push is being driven by

– Asian Development Bank Institute

growing calls for transparency in how data is used, stored and transferred – a shift that could unlock new efficiencies and product innovations for both consumers and providers.

Though some markets initially treated Open finance primarily as a regulatory compliance exercise, similar to the European Union’s approach under PSD2, it has since evolved into a broader catalyst for innovation.

GCC regulators view the framework as a gateway to new business models, sharper customer experiences and greater operational efficiency across industries. Data from the Open Banking Tracker indicates a significant advancement in terms of bank APIs, API aggregators and third-party providers in the Middle East, compared to other emerging markets as of August 2025.

“Given the success of the Open banking market, which is projected to hit $123.7 billion by 2031, is any indication, Open finance represents a revolution within the financial services sector,” said PwC.

Open banking enables third-party access to select banking data. However, Open finance takes it further, spanning the full spectrum of financial services – from mortgages and investments to pensions and insurance – with the goal of creating a more integrated and comprehensive financial ecosystem.

Saudi Arabia, Bahrain and the UAE have been at the forefront of Open finance implementation in the Middle East. While the GCC region is recognised

for its progressive stance on Open banking, most countries have primarily relied on regulatory mandates to drive implementation, with the exception of the UAE.

PwC projected that Open banking has the potential to reshape the financial services landscape, and several financial centres in emerging markets, including the GCC region, are making considerable moves in this space.

Bahrain was the first to mandate open banking and the UAE and Saudi Arabia are now making moves to follow their neighbour’s example. The kingdom issued its open-banking rules in 2018, followed by a framework with guidelines on data sharing and governance in late 2020. The government is implementing a Europeanstyle regulation-driven approach.

Following the issuance of its open banking policy in January 2021, the Saudi Central Bank (SAMA) published its Open Banking Framework in November 2022, with an initial focus on account information services, to be followed in the second phase by a focus on payment initiation services.

SAMA introduced an ‘Open Banking Lab’ in December 2022 to speed up the development of open banking in Saudi Arabia. The ‘Lab’ constitutes a ‘technical testing environment’ to enable established banks and fintech companies the opportunity to ‘develop, test and certify’ open banking services to ensure compatibility with the framework.

“To succeed in Open banking, banks in Saudi Arabia and the UAE should start

thinking like platform companies, flexing their business models to connect people and processes with assets and backing that up with technology infrastructure that can manage interactions from internal and external users,” said Accenture.

The Central Bank of the UAE is spearheading a comprehensive Financial Infrastructure Transformation Programme, an ambitious initiative that encompasses nine key projects, including the establishment of Open finance platforms, with a target completion date of 2026.

Open banking platforms, powered by APIs, enable both retail and enterprise clients to access real-time consumer financial data, facilitating the secure sharing of account information and transaction history with external entities, including vendors, suppliers, business partners and other banks.

The financial landscape is undergoing a profound transformation, with Open banking rapidly morphing into Open finance. The evolution is not just a technological shift, but a fundamental re-evaluation of how financial services are delivered and consumed.

The checking and current account, long the foundational asset of the depositbearing bank, is no longer sufficient on its own. Its value will increasingly be defined by the rich utility services and bespoke offerings built around it, which anticipate and fulfil customer needs beyond simple transactions.

The true strategic frontier lies in the first layer of Open finance, where consumer data, accessed via secure APIs, becomes the catalyst for innovation. The shift is transforming the traditional Know Your Customer (KYC) model. Instead of merely verifying identities, banks must pivot to ‘Understanding Your Customer’, leveraging data to personalise experiences and deepen relationships.

The vision of a shared KYC utility, potentially backed by a national identity platform, is not a distant fantasy but a

GIVEN THE SUCCESS OF THE OPEN BANKING MARKET, WHICH IS PROJECTED TO HIT $123.7 BILLION BY 2031, IS ANY INDICATION, OPEN FINANCE REPRESENTS A REVOLUTION WITHIN THE FINANCIAL SERVICES SECTOR

logical next step to streamline operations and free up resources for value creation.

The implications for lending are equally profound. The rise of credit-as-aservice signals a move away from static, historical credit scores toward dynamic assessments based on real-time cash flow. For a bank, this means a more accurate and nuanced understanding of a borrower’s actual ability to pay, as opposed to their historical willingness to pay.

With the rise of Buy-Now, pay-later (BNPL) and micro-lending, the granular data empowers more informed and responsible lending decisions, opens new markets and reduces risk in alternative lending products. This is a strategic opportunity to modernise the loan book and improve customer outcomes.

“Open data solutions have fuelled the expansion of BNPL services, allowing consumers to split payments into interest-free instalments, making highvalue purchases more accessible,” PwC said, adding that BNPL providers use APIs to access detailed transactional data, enabling better customer credit and risk assessments.

The payments domain, long a fortress for card networks and bank-to-bank transfers, is also under siege. Open finance enables account-to-account payments at the point of sale, directly challenging the interchange fees that have long been a significant revenue stream.

BCG strategists said innovations such as the Dutch payments system, iDEAL, demonstrate that this model is not only viable but can create a more seamless

and cost-effective payment experience for both merchants and consumers.

For banks, this necessitates a proactive re-evaluation of their payment strategies, moving from a fee-based model to one that creates value through efficient, embedded solutions.

Going forward, the proliferation of embedded finance represents a significant competitive threat and a powerful partnership opportunity. Non-financial institutions, from ride-sharing companies to retailers, are integrating banking services directly into their apps, capturing the customer experience at a deeper level.

“Open banking payments can play a pivotal role in the realm of embedded payments, offering substantial benefits that streamline and enhance the consumer experience across various platforms,” according to the Asian Development Bank Institute.

Banks that cling to a standalone appcentric model risk becoming invisible. The strategic imperative is to become a trusted, behind-the-scenes enabler, providing the core banking-as-a-service infrastructure that powers these new ecosystems. The democratisation of banking is underway, and success will hinge on a bank’s ability to become a versatile and indispensable partner in this new financial landscape.

Global Open finance adoption must occur responsibly, with robust strategies for data protection and the integration of systemic API security. Leaders who prioritise trust, resilience and customercentric innovation will unlock massive market potential.

Introducing: GITEX Digital Assets Forum

Spotlighting the world's most disruptive startups and digital finance solutions. This is the region's flagship platform for alt-finance innovation.

Book Your Stand

Naman Kapoor Head of Payments for Middle East and Africa-Citi gives us an overview of the fast-expanding digital payment’s scene, detailing the leading factors that are driving its growth across our region

What are the demandside factors pushing the region’s boom in digital payments?

The young demographics of Middle East and Africa (MEA), with the median age in Africa only 19.3 years old, coupled with high smart phone dispersion, with 1.0 Bn SIM Connections in SSA 1, has led to a tech-savvy population with a preference for digital payments.

E-commerce Growth, on the back of the Covid-19 pandemic which created a surge in online shopping, has created the need for more convenient digital check out options. According to a prominent research institute, the e-commerce market in MEA is expected to reach US$854 million by 2030, with a compound annual growth rate of 21%. Additionally, Digital payments (49%) nearly reached parity with cash and cards (51%) in e-commerce transaction value in 2024, up from 29% in 2014.2

Digital assets, particularly stablecoins, are emerging as a potentially significant enabler for the next generation of digital payments. In a region where there

has long been substantial remittance flows from diaspora working in the Gulf, cryptocurrencies offer a decentralised alternative, that bypass intermediaries and potentially reduce fees and transfer times compared to traditional crossborder payment rails.

Have digital payments already made a difference in the region in terms of inclusivity?

In many emerging markets, low-to moderate-income consumers rely heavily on cash as their primary payment method, often due to the lack of access to traditional bank accounts. One of the ways central banks can harness the digital revolution to help extend the benefits of financial inclusion, is by developing robust digital payment infrastructure, particularly real-time payment systems. Kenya’s M-Pesa, a mobile money service launched in 2007, has been a major driver of financial inclusion, particularly in rural and underserved communities. Financial inclusion in Kenya rose from 26% in 2006 to 85% in 2024.3

One real-life example would be Citi’s mobile money solution with the One Acre Fund (OAF), whose Kenya program proudly serves over 1 million hardworking farmers, who adopted digital payments for their farmer loan repayments. This has enabled OAF to expand its reach and serve a larger number of farmers without a proportional increase in operational complexity. Mobile money has served as an entry point into formal financial services for those who previously relied solely on cash.

What effects are digital payments having on regional economies at this time?

The main impact that the adoption of digital payments is having is the corresponding decline and hopeful elimination of Paper Instruments. We have seen the regulatory-driven elimination of checks in several countries including South Africa (2021), Botswana (2024), Malawi (2025) and Zambia (anticipated in 2026), Additionally, cash use has dropped from 82% of point-of-sale value in 2014 to 28% in 2024.4

Furthermore, the creation of Central Bank led Electronic Bill Presentment and Pay schemes that support the digitisation of statutory payments like Customs

What do you predict will be the top regional or priorities trends in digital payments in the coming five years?

Modernisation of Domestic Payment Rails - modernisation to ISO 20022, aligning with SWIFT’s cross-border transition, is driving cross-border interoperability via a global standard, increased transaction processing automation, and richer data for reconciliation. The number of ISO modernisation projects has significantly increased in 2025, with the upcoming SWIFT deadline, but also will continue into 2026 as regulators switch their focus to Automated Clearing House (ACH) and Instant Payment schemes.

Duty and Tax Payments (e.g. Fatourati Morocco, E-Finance Egypt, EFawateer Bahrain, eFawateercom Jordan) have led to increased governmental efficiency due to automated reconciliation and accurate payment values due to the enquiry leg.

Finally, we are seeing an evolving trend of digital payments as an enabler of economic integration within economic communities (Gulf Cooperation Council, East African Community, South African Development Community etc.) through the emergence of Intra-Regional Financial Market Infrastructure. These new infrastructures promote financial integration, provide an alternative to traditional correspondent banking and reduce the cost of transacting crossborder. Examples include AFAQ, EAPS and SADC RTGS - all in which Citi is a participant member.

Mobile Money Dominance – there is existing high adoption of mobile money, with 1.2 billion mobile money wallets across MEA.5 M-Pesa itself accounts for 98% of all transactions in Kenya.6 However, there is ongoing regulatory-driven integration of mobile money into real-time interoperable financial infrastructures to support financial inclusion which is expected to drive further usage. Of the ten real-time payment schemes that Citi participates in, seven support interoperability with mobile wallets, with two more in development.

Real-Time Payments Growth - the Middle East is the fastest-growing real-time payments market globally. Transactions are projected to increase from $855 million in 2023 to $3 billion by 2028, a 29% compound annual growth rate.7 Furthermore, Cross-border instant payments are emerging, with schemes having initially focused on domestic use

cases, with potential interlinking between platforms like the UAE’s AANI and India’s UPI. Recognising 24/7/365 real-time transaction processing is becoming essential for our clients in the cluster, Citi UAE will be rolling out its Citi® Payments Express Platform in 2026 which provides near instant payment verification at scale (handling volumes of more than 5,000 transactions a second) with resilience (99.99% uptime).

Disclaimer: Future product availability is subject to internal approvals and not guaranteed.

How long do you think the Middle East will remain the world’s fastest growing real-time payments market?

Real time payments in UAE in 2024 only accounted for a 1.5% share of the total payment volume and 4.9% of all electronic payment transactions. This is a low base compared to the 36% and 84% of electronic payments being real-time in Brazil and India respectively. Additionally, the launch of Aani with the required overlay services to drive adoption and an upcoming mandate to route eligible RTGS payments to Instant Payments will mean that the UAE is expected to remain one of the hot spots for real-time payments growth. Additionally, if we look at MEA more widely, most of the schemes are still nascent with a rapid creation of Instant Payment Infrastructures across MEA Presence Markets. 50% of the 10 schemes that Citi participates in (Aani UAE, RAAST Pakistan, Cliq Jordan, IPN Egypt and TIPS Tanzania) have launched since 2020. As they mature further, we expect to see increased corporate use cases that should drive growth further beyond peerto-peer transactions.

1 The State of the Industry Report on Mobile Money 2025 - GSMA

2 The Global Payments Report – WorldPay

3 Central Bank of Kenya, 2024 FinAccess Household Survey.

4 The Global Payments Report – WorldPay

5 The State of the Industry Report on Mobile Money 2025 - GSMA

6 Kenya Central Bank Supervision Annual Report 2023.

7 ACI Worldwide, 2024 Prime Time for Real-Time report

Srinivas Pramod Co-Founder & CEO, talking with MEA Finance, shares the growth story behind one of the most promising emerging companies in the region

AuraData Technologies LLC is a globally operating business with executive management counting 300+ years of financial industry experience and a team of banking domain and technology experts. We bring global best practices and a deep understanding of regional nuances to provide tailor-made solutions at an optimised cost for our customers across Middle East & Africa.

Says Srinivas Pramod, Co-Founder & CEO, “We are witnessing increasing adoption of our Digital TAPTM framework across leading banks in Middle East & Africa. Digital TAPTM is not just a methodology; it’s our promise to banks to guide them through

every step of their digital transformation journey, delivering measurable outcomes and larger stakeholder value.”

• Transform: We help reimagine core banking processes & customer interactions. We help transitioning/ modernisation by enhancing scalability, flexibility and real-time processing capabilities, through integrating and optimising diverse digital channels (mobile, web, ATM, branch) for a seamless, omnichannel customer experience, leveraging API-first architectures to facilitate open banking initiatives and foster collaboration within the financial ecosystem.

• Automate: Digital Lending Automation and Process automation is directly aimed at driving operational excellence and accelerating time to market for new financial products. We leverage advanced technologies such as digital lending, collections, Intelligent automation

and Robotic Process Automation (RPA) workflow orchestration to streamline repetitive tasks, reduce manual errors and accelerate operational processes.

• Protect: AuraData helps banks move from a reactive fraud and compliance approach to a proactive, real-time EFM approach for today’s ever-changing regulatory environment. Powered by AI and machine learning, advanced user behaviour patterns analysis, cross- channel real time enterprise fraud management, unusual system usage and anomaly detection, we ensure regulatory adherence. And with our regional regulatory reporting and comprehensive Anti-Money Laundering (AML) solutions, including transaction monitoring, customer due diligence (CDD), suspicious activity (SAR), we provide a smoother and more secure banking experience, protecting against novel and sophisticated fraudulent tactics or schemes which go unnoticed in siloed systems.

“ By harnessing a global talent pool with regional expertise and experience, we deliver on the promise to our customers using the AuraAssure Delivery framework, a combination of hybrid delivery model, agile project management, transparent communication and measurable outcomes coupled with extensive postimplementation support & continuous optimisation services, thereby maximising long-term impact and sustainable benefits for customers,” says Mahesh Cukkemane, Co- Founder & Chief Delivery Officer Kumar Dandapani, Director Financial Services adds, “The future of banking is predictive.With the advent of AI and increased regional digital thrust, banks across Middle East & Africa are trying to bolster their non-interest fee-based incomes, deliver hyper-personalised customer experience, launch new products and services rapidly at scale while striking a balancing act of managing operational efficiency, adhering to increasing compliance requirements and enhanced fraud detection. Digital TAPTM is an ideal framework to address this comprehensively.”

(website: https://www.auradatacorp.com/ )

Modern banks are transforming into comprehensive service hubs, offering a broad spectrum of services, including digital payments, trade finance, embedded banking and interconnected APIs, creating new opportunities for fee-based income and sustainable growth

Siva Subramaniam, Head – Product Management – Payments, Cash & Revenue Management, Infosys Finacle

W. Edwards Deming famously said, “Profit in business comes from repeat customers, customers that boast about your product or service and that bring friends with them.” For financial institutions, this principle remains central, but the strategic approach to achieving it is evolving swiftly.

Sriranga Sampathkumar, Head of Business, VP and General Manager –Middle East and Africa, Infosys Ltd

Today, every digital transaction and service touchpoint holds potential revenue if managed effectively. However, financial institutions often leave substantial profit on the table due to: Transactions that go unbilled or are underpriced because of outdated, inflexible legacy systems.

Zero-balance accounts, fee waivers and free services that dilute overall profitability when not strategically managed.

Static pricing models that fail to recognise the complexity and value of individual customer relationships. By modernising revenue management practices, banks can unlock significant value already embedded within their dayto-day operations, directly impacting their bottom line.

• Modern Revenue Management: Plug Leaks, Offer Personalisation and Drive Growth

Banks can improve revenue performance by:

• Treating every customer interaction as a revenue opportunity - capturing and pricing each service, transaction or value-added feature accurately, so the bank is fairly compensated for the value it provides.

• Using dat a to tailor pricing and offers - creating targeted

propositions and adjusting charges for specific customer segments in real time, improving satisfaction while maximising revenue potential.

• Automating controls to prevent revenue loss - ensuring charges align with agreed services and bundled offers, protecting earned revenue and maintaining compliance.

A modern revenue management platform brings transparency and flexibility needed to optimise income streams while improving customer experience.

Modern banking requires pricing and billing to be dynamic, customer-aware and consistent across all products and channels. To achieve this, banks need a composable, enterprise-grade revenue management layer.

With such a layer, banks can:

• Develop dynamic, context-specific pricing and bring innovative offerings to the market faster, securing a competitive advantage.

• Provide transparent, personalised billing, building trust and strengthening long-term relationships.

• Enable new monetisation models such as subscriptions, outcomebased pricing and bundled services, diversifying income while staying compliant and managing high transaction volumes with ease.

• Pr event revenue leakage and maintain strong regulatory compliance across all operations.

A robust revenue management solution must be purpose-built for banking, capable of managing product complexity, real-time transactions, transparent fees and the varied pricing models that define today’s banking environment.

For end-to-end transformation, banks need a holistic revenue management system built on five strategic pillars:

1. R evenue Enhancement – Use customer, and product-level pricing capabilities to offer loyalty-based rates, targeted segment offers and relationship-based bundles.

2. Revenue Assurance – Capture and collect charges in real time or on schedule, ensuring accurate billing as transactions occur.

3. Re venue Leakage Prevention

– Apply rule-based controls to enforce client commitments, such as minimum balances or service thresholds, and centrally track missed revenue opportunities.

if the price was zero. The vision also emphasised high scalability, given the massive transaction volumes processed daily and monthly. To support this, the bank leveraged Finacle Revenue Management hub.

The transformation enabled:

• A cen tralised pricing and billing system for current products and services, addressing revenue loss, unlocking new revenue streams and enhancing operational efficiency.

• Flagship application o f the federation layer in bank to enable seamless work with host systems

4. Customer Engagement – Deliver personalised offers and unified invoices across multiple products to improve satisfaction and loyalty.

5. Operational Efficiency – Replace manual, spreadsheet-based processes with automated business rules, enabling dynamic pricing and faster go-to-market for new offerings.

One of India’s largest banks embarked on a multi-phase revenue transformation initiative. The bank wanted to centralise its pricing and billing across its 30+ product lines and various customer segments through a platform that could serve as a horizontal capability spanning the entire enterprise.

Key objective was to consolidate billing into a single platform and ensure no transaction went unpriced, even

like Core, Loans, WMS etc., and customer-facing applications

• Cloud-native and highly scalable architecture handling 400 million transactions monthly (up to 6,000 transactions per second). Flexible integration framework – files, APIs, etc.

In markets like the Middle East, where regulatory reforms and rapid digital transformation are reshaping the banking landscape, pricing has moved beyond mere back-office functions to become a strategic driver of growth and competitive differentiation. For industry leaders, transforming revenue management capabilities means gaining critical business flexibility, ensuring robust compliance and strengthening monetisation, delivering tangible benefits for both customer experience and the bank’s ultimate profitability.

Digital payments in all their forms, allowing the rollout of real-time payment systems in the GCC region, and with AI nestling in, are yielding clear benefits for businesses and consumers alike, spurring financial innovation and new growth opportunities

The GCC payments landscape is undergoing rapid transformation, with a surge of new payment alternatives and channels competing for market share. Over the years, innovative technologies such as contactless and QR payments have gained traction, while ancillary services like Buy Now, Pay Later have become increasingly popular.

KPMG said the evolution and revolution of the payments industry is putting pressure on financial institutions and nonbanking players alike to deliver on shifting customer expectations.

Customers are increasingly clamouring for diverse payment options that are fast,

convenient and secure. Banking customers in the Gulf region now expect retailers and financial service providers to deliver seamless and consistent experiences across channels and payment platforms.

The modernisation of the payments industry is a crucial undertaking. Globally, more than 85 jurisdictions across six continents now support real-time payments, ensuring immediate fund availability to beneficiaries and providing a reliable and efficient system.

“Real-time payments are transforming the future of payments by broadening the speed, innovation and efficiency of digital payments solutions,” said J.P.Morgan.

The Middle East is now the fastestgrowing Real-time payments region in the world, with a projected CAGR of 30.6% between 2022 and 2027, reaching a value of $2.6 billion, driven by payments infrastructure modernisation initiatives in Saudi Arabia, Bahrain and the UAE.

Swift, the global financial messaging network, is at the forefront of reshaping cross-border payments, spearheading the industry’s shift to ISO 20022 and rolling out its Cross-Border Payments and Reporting Plus (CBPR+) initiative to deliver greater efficiency, transparency and interoperability.

With the value of cross-border payments forecasted to increase from $150 trillion in 2017 to over $250 trillion by 2027, according to Boston Consulting Group (BCG), making cross-border payments cheaper, faster, more transparent and easier to access globally is a priority for the G20.

“Traditionally, cross-border payments flow via the correspondent banking network, which most front-end providers use to settle the payment, but new back-end networks are emerging to optimise cross-border payments and enable interoperability between payment

methods and provide senders with more possibilities to reach the receiver,” according to EY.

Meanwhile, artificial intelligence (AI) is poised to transform the payments landscape, enhancing personalisation and security while driving greater efficiency across digital transactions. Its application stands to deliver tangible benefits for both businesses and consumers, marking a step-change in the way value is exchanged.

The GCC payments landscape has undergone significant evolution, shaped by shifting market dynamics, regulatory developments, technological innovation and the entry of new players. Market forces such as real-time payments and new regulatory requirements have created a springboard for financial institutions to advance customer experience and introduce value-added services.

Real-time instant payments, driven by regulatory push and rising market demand, have grown steadily since the UK launched Faster Payments in 2008. Globally, realtime payments are projected to reach 575.1 billion by 2028, growing at a CAGR of 16.7%, according to a joint report by ACI Worldwide and GlobalData.

The implementation of real-time payment systems across the GCC region is revolutionising the banking landscape, accelerating transaction speeds while enhancing convenience and security for consumers and businesses alike.

Saudi Arabia currently leads the Middle East in real-time payment adoption, while the UAE’s Aani processed 64.1 million transactions worth AED 164.7 billion in 2023. Bahrain stands out globally for its high consumer adoption rate, and Qatar, Kuwait and Oman each launched their national real-time payment schemes in 2023.

“Navigating the evolving global payments landscape requires more than just adopting the latest technologies – it demands strategic partnerships, agile infrastructure and a forwardlooking approach to liquidity and risk management,” according to BNY.

ACI Worldwide and Kuwait’s KNET reported that WAMD, the country’s realtime payment platform, has experienced strong transaction growth since its launch in June 2024, positioning it among the fastest-adopted real-time payment systems globally.

Real-time payments are revolutionising the payment industry by addressing inefficiencies in traditional payment systems and enabling entirely new business models and use cases that were previously unimaginable.

Many instant payment systems leverage ISO 20022 messaging standards, enabling two-way communication through messages such as requests for payment, requests for information and confirmation of payment.

Domestic payment infrastructures across the GCC – from instant payment platforms such as Saudi Arabia’s Sarie and the UAE’s Aani, to national card schemes like Mada and Jaywan and local digital wallets including Barq and Hala in Saudi Arabia, together with e& money and du Pay in the UAE - deliver instant and secure transactions backed by strong regulatory support.

The UAE central bank’s payments unit, Al Etihad Payments, rolled out Aani, its instant payments platform, in October 2023. The service has drawn 1.5 million users and onboarded 57 financial institutions and 80,000 merchants as of February 2025.

“Real-time payments have become ingrained in the fabric of the payment landscape and have spawned new expectations and demands from businesses to their financial services providers,” according to BNY Mellon’s The Current State of Play of Emerging Payments report.

Beyond the UAE’s Aani, GCC countries have rolled out their own real-time payment systems. Bahrain uses FAWRI+, Saudi Arabia runs SARIE, while Oman, Kuwait and Qatar all introduced instant payment schemes in 2023. The rapid uptake underscores the region’s push toward faster transactions and the broader digitisation of financial services.

“The contributions from real-time payments to Bahrain’s GDP are projected to rise from $537.0 million in 2023 to $677.6 million by 2028, 1.32% of formal GDP or equivalent to the output of 12,500 workers,” according to ACI Worldwide.

Similarly, Qatar’s payments industry is poised for significant growth, with total revenues projected to reach $4.15 billion by 2028, according to BCG.

Real-time payments are reshaping the GCC’s financial landscape, eliminating the delays and inefficiencies of traditional systems while opening the door to new business models and applications that were once considered out of reach.

The future of payments lies in adapting and catering to the diverse needs of customer segments and emerging trends. There is a rising demand for a cross-border payment system that offers speed, security and efficiency as global economies become increasingly interconnected.

Cross-border payments are an integral feature of today’s world. They play a vital role in maintaining a healthy and stable economy. The payments typically require three to five days of endto-end processing before reaching the intended recipient and the shortcomings are compounded by high costs, lengthy settlement times and opaque processes.

However, the cross-border payment space is being jolted by several trends that could fundamentally change competitive dynamics. The introduction of ISO 20022 has already displaced many legacy payment messaging schemes and this process is accelerating.

“The ISO 20022 messaging standard continues to gain momentum as more and more clearing and settlement mechanisms adopt the new ISO 20022 standard,” Celent said in a report, adding that payment modernisation enables banks to break free from legacy technology infrastructures and accelerate the evolution of their payments businesses to meet today’s demands.

The migration to ISO 20022, which began in 2022 and is set to be fully

implemented by November 2025, is a critical step toward enabling real-time cross-border payments. Through the standardisation of the way payment messages are formatted and transmitted, the standard eliminates inconsistencies and inefficiencies that have long plagued cross-border payments.

For real-time cross-border payments, ISO 20022 is a game-changer. It supports end-to-end data exchange, allowing financial institutions to include detailed remittance information, such as invoice details, tax information and payment purpose codes, directly within payment messages.

Meanwhile, in addition to the adoption of ISO 20022, Swift’s CBPR+ programme aims to standardise the implementation of the new messaging standard across borders. CBPR+ ensures that financial institutions worldwide can exchange ISO 20022 messages seamlessly, regardless of their internal systems or regional differences.

ISO 20022 and CBPR+ are pushing the financial industry toward real-time cross-border payments. While domestic systems, such as the UAE’s Jaywan and Saudi Arabia’s Mada, have already gained widespread adoption, cross-border transactions have lagged due to the complexities of different jurisdictions, currencies and regulations. Swift is tackling these hurdles with a unified, standardised framework.

Agentic AI, a subset of deep learning, made headlines in 2024, encouraging banks to delve into its possibilities and fueling conversations about the potential of AI to revolutionise the payments landscape.

“AI presents many opportunities for treasurers and broader payments leaders. It can help automatically create insights such as cashflow forecasting while fortifying payments with account validation and fraud management,” according to J.P. Morgan.

The integration of AI technology in the payments industry offers businesses

substantial opportunities, including streamlining operations, reducing costs and delivering personalised experiences to customers.

Infosys said that while traditional automation and current AI tools have enhanced efficiency in areas such as fraud detection, they still fall short of achieving full end-to-end automation across the payment life cycle.

The gap has opened the door for agentic AI, autonomous agents capable of making decisions and carrying out tasks without human input, a shift that could redefine how money moves around the world.

For an industry that processes $26 trillion annually, according to Infosys, agentic AI represents an opportunity to address long-standing inefficiencies in payment processing while creating new capabilities for customer service and operational excellence.

However, the question confronting GCC financial institutions today is not if, but how quickly they can navigate the complex path from promise to practice.

Globally, Visa and Mastercard are experimenting with AI-driven agents while Circle is integrating blockchain into its stablecoin ecosystem. However, until regulators, banks and consumers are aligned on security and standards, autonomous payments will remain a fragmented reality.

PwC said that the implementation of agentic AI in the payments sector necessitates regulatory compliance, security considerations and stakeholder trust. It is a journey of evolution, not revolution and financial institutions that lead the charge will be positioned to capture substantial rewards.

AI-powered identity checks, blockchain audit trails and real-time transaction monitoring are crucial in combating money laundering and fraud. The global RegTech market, projected to top $22 billion by mid-2025, reflects growing demand for these tools.

Meanwhile, GenAI also has the potential to significantly impact largerscale operations, such as enabling virtual assistants for treasury tasks, supporting payments-related dispute resolution and providing developer tools.

The impact of AI on specific payment operations is projected to be profound as industry experts expect it to boost productivity by more than 20% at various stages of the development process.

Globally, some payment process giants have already started experimenting with cutting-edge technology. American Express is leveraging GenAI to accelerate product development, while Visa and Mastercard are utilising it to enhance fraud detection capabilities.

AI holds the potential to revolutionise payments by advancing personalisation, security and efficiency. The technology’s multifaceted approach benefits both businesses and consumers. From marketing and sales to eKYC, customer service and risk management, it offers comprehensive solutions for the entire payments ecosystem.

The payments landscape in the GCC is undergoing a period of rapid transformation, underpinned by advances in technology, the proliferation of new payment instruments and a market environment shaped by both regulatory oversight and new entrants.

Uzair Kapadia Head of Cash Products, AME & MENA Cluster, Standard Chartered discusses the roles and outcomes of digital payments for businesses and corporations and the effects it will have on performance, economies and the relationship between banks and their business clients

What client demands and industry trends are accelerating the adoption of digital payments among corporates in the region?

Over the past few years, we have seen a fundamental shift in how corporates approach payments. The demand for speed, transparency and cost efficiency is reshaping expectations across every industry. Clients are increasingly asking for real-time settlement capabilities, better visibility of their cash positions and integrated payment solutions that support both domestic and crossborder flows.

A younger and digitally savvy customer base is also playing a role. Many corporates want to mirror the convenience and immediacy of consumer payments within their own ecosystems, particularly for payroll, supplier payments and e-commerce settlement. On top of this, supply chain diversification is driving corporates to seek out faster and more reliable ways to transact across multiple markets. Together, these factors are creating unprecedented momentum behind digital payments adoption.

How are digital payments transforming financial inclusion for corporates, particularly in sectors traditionally reliant on cash?

Financial inclusion has historically been seen through the lens of individuals, but it is just as relevant for corporates and businesses. In markets where cash has

long dominated, digital payments are enabling businesses to participate more effectively in regional and global trade. Digital platforms lower entry barriers, provide secure transaction records and open doors to financial products such as credit and insurance that are often inaccessible to cash-based enterprises.

For example, businesses in retail and logistics are increasingly using digital payment channels to manage receivables and pay suppliers, which reduces cash-handling risks and builds stronger relationships with banks. Over time, this not only improves business efficiency but also broadens the overall reach of the financial system. Digital payments are, in that sense, a catalyst for economic empowerment across multiple layers of the corporate landscape.

How are innovations in digital payments changing cash management, liquidity and crossborder trade for businesses in the region?