Our cutting-edge technology offers you a one-stop solution for all your wealth management and daily banking needs.

Innovation, the word, the concept and its pervading presence in our lives is largely accepted as essential to the success of a business, and especially so for our region’s banking and finance markets. Naming just a fraction of the benefits arising from the numerous changes we have experienced during this age of innovation in banking and finance are enhanced convenience, faster payments and increased inclusivity. So, as this opening welcome to the November 2025 edition of MEA Finance Magazine clearly signals, innovation is a leading theme through this issue.

A leading hotspot in our region for banking and financial innovation is the Kingdom of Saudi Arabia. The nation, spurred by the wider goals of their Vision 2030 and the ambitions of their banking and financial sector, has prioritised the modernisation and encouragement of innovation. Underlining this was the MEA Finance KSA Banking Technology, Innovation and Payments Summit and Awards held in Riyadh at the Voco hotel on the 8th of October. You can read the full coverage of this special event from page 44.

Our cover story, featuring Dinesh Sharma, Head of International Wealth and Premier Banking for MENAT at HSBC, maintains our innovation theme. In it he describes changing client expectations and how they are transforming their proposition to match, or exceed the customers’ expectations in a highly competitive sector.

Among our features this month is a journey into the realm of Stablecoins and CBDCs where, as digital transformation reshapes the regional financial landscape, three parallel innovations— central bank digital currencies, stablecoins and tokenised deposits are converging to redefine money. In our regular look at AI in regional banking,

Sanat Rao, Cofounder and Managing Director of Within The Box.ai, contends that, “In regional banking, the winners will not be those banks with the smartest model; it will be the banks with the bravest culture, ones that learn, question and co-create with the machine”.

We focus on Treasury and Cash Management from page 40. As treasury completes its emergence from the back office to a vital liquidity tool for businesses across the region, we look at why this strategic discipline is building its status across our region and how innovation in treasury is essential.

Continuing their Africa Series with MEA Finance, Citi’s Faisal Masood Head Corporate Bank for Sub-Saharan Africa, looks at the ongoing development of more sophisticated markets across the region, underlined by recent landmark deals. Also inside, an exclusive dialogue with Virtuzone’s Group CEO George Hojeige on industry recognition, entrepreneurial ecosystems and the evolving Middle Eastern business landscape; Rihab Saad, Managing Director of Next Generation Equity (NGE) discusses global citizenship trends, regulatory evolution and the strategic value of alternative residence planning and Patryk Karczewski, Partner and Head of Tax at Amereller highlights the key importance of strict attention to accurate and timely tax administration for family offices operating in the UAE

Finally, our country focus this month rests on the United Arab Emirates, which while having pretty much established a global reputation for innovation and its enthusiastic encouragement, has moved from being a dependable Gulf hub to becoming the region’s operating system for finance, capital markets, technology-driven payments and the fast-emerging world of digital money.

As you read through this edition, we hope you will be impressed, even wowed by the scale of innovation being harnessed in the service of regional banking and finance, and its broad communities of customers.

Mastercard Agent Pay, debuted in Dubai in the presence of H.E. Omar Sultan Al Olama, UAE Minister of State for Artificial Intelligence, Digital Economy and Remote Work will enable consumers to browse, compare and purchase through AI-powered digital agents

Mastercard is introducing Agent Pay in the UAE, and as part of this pilot phase in the UAE, are collaborating with Majid Al Futtaim, a leader in shopping malls, communities, retail and leisure across the Middle East, Africa and Asia, and with fintech Dataiera.

The launch event was attended by His Excellency Omar Sultan Al Olama, Minister of State for Artificial Intelligence, Digital Economy and Remote Work Applications; Mastercard CEO Michael Miebach; and Ahmed Galal Ismail, Chief Executive Officer of Majid Al Futtaim Holding.

When launched, cardholders will be able to use their AI agent to search, discover and transact through Mastercard Agent Pay,

including booking theatre tickets at VOX Cinemas.

His Excellency Omar Sultan Al Olama, Minister of State for Artificial Intelligence, Digital Economy and Remote Work Applications, emphasised that, guided by the UAE’s leadership, the nation has become a global hub and destination for adopting and supporting advanced technologies and initiatives that enhance well-being, strengthen its global competitiveness and leadership and elevate its position as a leading hub for world-class AI applications.

His Excellency noted that the introduction of the AI Agent in payment solutions represents a significant milestone, opening new horizons for the

growth and development of the UAE’s digital economy.

“As AI becomes a trusted companion in people’s digital lives, payments must evolve to match its intelligence with integrity. Mastercard Agent Pay ensures that agentic commerce is built on transparency, consent and security, empowering consumers and businesses to engage confidently in this new era of commerce,” said Dimitrios Dosis, President, Eastern Europe, Middle East and Africa, Mastercard.

Ahmed Galal Ismail, Chief Executive Officer, Majid Al Futtaim Holding commented, “As a pioneer in retail and lifestyle innovation, Majid Al Futtaim sees AI as a transformative force shaping the future of commerce and human interaction. Collaborating with Mastercard on Agent Pay allows us to explore how intelligence and integrity can coexist in digital transactions – creating systems that prioritise trust, transparency and consumer confidence. This collaboration is not just about convenience; it’s about setting a framework for responsible innovation that redefines how people shop, pay and engage in a connected world.”

Mastercard has been supporting the UAE government’s efforts to accelerate secure commerce, drive digital transformation and lead the global adoption of Artificial Intelligence. This shared commitment resulted in the launch of Mastercard’s Centre for Advanced AI and Cyber Technology in Dubai in 2023, in collaboration with the UAE’s Artificial Intelligence, Digital Economy and Remote Work Applications Office—cementing the nation’s role as a global hub for innovation.

In a defining milestone for the UAE’s digital economy, the Central Bank of the UAE (CBUAE) has approved Zand, the nation’s AI-powered digital bank, to launch Zand AED, the country ’s first regulated, multi-chain AED-backed stablecoin on public blockchains

Zand AED represents a new era for the Dirham by bringing the national currency into global digital rails with the security of a regulated bank and the speed and openness of blockchain technology.

Zand AED is fully backed one-to-one by AED reserves that are held in segregated and regulated accounts to ensure complete

redemption value. It is supported by realtime transparency through independently audited smart contracts and reserve attestations. It is available across multiple public blockchains, enabling fast borderless settlement and seamless integration for developers, enterprises and financial institutions. The stablecoin is issued by Zand Trust, a wholly owned

subsidiary of Zand Bank PJSC, which is licensed and supervised by the CBUAE, and is rated BBB+ by Fitch Ratings.

“Launching an AED-backed stablecoin on public blockchains is not simply a milestone for Zand. It is a breakthrough for the UAE,” said Mohamed Alabbar, Chairman of Zand. “This initiative carries our national currency into the digital future and reinforces the UAE’s position as a global leader in financial innovation.”

Michael Chan, CEO of Zand, added: “Zand AED is more than a stablecoin. It is the UAE’s bridge between traditional finance and decentralised finance. It unlocks the next generation of payments, tokenisation and digital asset innovation. All of it is built on trust, transparency and regulatory clarity.”

With the global stablecoin market projected to reach $3 trillion in the coming years, Zand AED positions the UAE at the forefront of regulated digital finance. It provides a secure and futureready digital foundation for institutions, Fintechs and developers who aim to build in one of the world’s most advanced financial ecosystems.

Empower your bank with AI-driven automation for seamless integration and rapid deployment of solutions

The last 12 months have confirmed something the wider MENA financial community has been sensing for a while: the United Arab Emirates has moved from being a dependable Gulf hub to becoming the region’s operating system for finance, capital markets, technology-driven payments and the fastemerging world of digital money

Acombination of solid macro performance, a still-rising nonoil economy, deepening capital markets in both Abu Dhabi and Dubai and an assertive central bank agenda around infrastructure and digital currency has meant that, even as global markets swung between higher-for-longer rates and geopolitical noise, the UAE’s financial story remained one of continuity and execution. The question now is less “Can the UAE grow?” and more “How big can the UAE’s financial services footprint

become across the wider Middle East, Africa and South Asia corridor in the next cycle?”

Growth in the UAE maintains its momentum based on increased oil output, while still counting on non-oil activity to do the bulk of the work. Non-oil GDP now makes up more than three quarters of the economy and is forecast to expand by about 4.5% in 2025, supported by financial services, investment, real estate and tourism. The IMF’s October 2025 read-out largely concurs with this, seeing 4.8% growth and recognising that the UAE’s diversification policies, open commercial environment and aggressive infrastructure spending are creating a floor under activity even when oil prices soften. For banks and capital markets, these macro-economic conditions matter because credit demand will stay positive, and liquidity, which is helped by robust real estate-linked cash flows and inbound capital, will remain plentiful.

This shows up clearly in the banking numbers. The CBUAE’s latest financial stability assessment noted that banks are running with capital adequacy of about 17% and a net non-performing loan (NPL) ratio of just 1.7%, despite loans growth of more than 11% year-on-year by mid2025. These are special circumstances, bringing together fast credit growth and improving asset quality, occurring only when the underlying economy is broad and diversified enough to absorb fresh lending without creating bubbles. The market leaders are translating this into earnings: Emirates NBD, for example, beat expectations in Q1 2025 on the back of double-digit loan growth and a 14% rise in net interest income, even though margins have started to normalise from the 2023 rate-hike peak. Ratings agencies agree — profitability is holding, buffers are high and stress tests suggest that even in challenging circumstances, UAE banks can absorb shocks. In a region where some markets are still dealing with legacy NPLs or exposure to statelinked corporates, that is a genuine competitive advantage.

The engine behind a lot of this confidence is the CBUAE’s multi-year Financial Infrastructure Transformation (FIT) programme, which the Bank said was roughly 85% complete at the start of 2025. FIT more than a technology upgrade; it is a definitive attempt to provide the UAE with a payments, digital identity, datasharing and settlement stack that can support cross-border trade, instant retail payments, financial inclusion use-cases and the eventual move into tokenised assets. At the centre of that is the Digital Dirham strategy, which the Bank is rolling out in phases — starting with crossborder experiments via the mBridge platform (the world’s first operational multi-CBDC corridor) and then moving

redomiciled entities. The result is that the UAE is still viewed, alongside Saudi Arabia, as the only MENA jurisdiction capable of delivering consistent, large-ticket equity issuance to feed local institutional and family-office demand. Having flexible Securities and Commodities Authority (SCA) rules, an ADGM/DIFC holdingcompany route, and an investor base that increasingly wants yield, growth and governance — including the UAE’s one-woman-on-the-board quota now extended to private joint-stock companies — all helps to widen the addressable pool for IPOs. For UAE banks’ ECM, custody and corporate-banking desks, that translates directly into fee income and higher-quality corporate relationships.

toward broader wholesale and, eventually, retail use. For UAE-based banks, this is material: it means the infrastructure for faster, cheaper corporate payments — especially in trade with Asia — is arriving, and it is arriving under the supervision of a well-capitalised and technology friendly regulator.

Capital markets have also had a quietly significant 12 months. After a very strong 2024, when seven UAE IPOs raised around $6.2 billion across ADX and DFM, 2025 began with talk of another wave — Etihad, Dubizzle and several consumer-tech and hospitality names were flagged — but mid-year volatility saw some issuers becoming more cautious. Even so, Dubai and Abu Dhabi managed to keep the pipeline visible, they kept valuations sensible and regulators continued to refine listing routes for foreign and

If we zoom out to the regional lens, the UAE’s role over the past year has been that of a connector — taking in capital, people and ideas from across the GCC, Pakistan, India and Africa, and packaging them into bankable, regulated products. In wealth and investment management, DIFC and ADGM continued to compete to bring in global and regional family offices, with both free zones marketing the UAE’s political stability, zero income tax on many structures and proximity to growth markets. That influx is one reason why domestic banks’ deposits kept pace with loan growth. Indeed, strong deposit growth was one of the pillars of the 2025 financial stability report. In trade and corporate banking, the UAE’s positioning as a sanctions-compliant but businessfirst jurisdiction has helped it capture flows that, a decade ago, would have

gone to European or Asian centres. The dirham’s peg to the US dollar continues to reassure treasurers and asset managers, particularly at a time when tariff disputes and a lower-oil-price environment are adding uncertainty elsewhere.

Technology and digital finance are another part of the story. Because the UAE has been willing to run live CBDC pilots, green-light open-finance workstreams and promote fintech-bank collaboration inside the Financial Infrastructure Transformation (FIT) programme, it has become the test bed for regional banks that want to move from “digital channels” to “digital money.” The logic is simple: if you can settle in central-bank money instantly, pull verified customer data through standardised APIs, and do it all in a jurisdiction whose regulators are comfortable with AI-assisted compliance and RegTech, you can design products for Africa, Pakistan or Jordan and run them from Dubai. The central bank’s own documents are quite clear that the Digital Dirham is meant to “future-proof” centralbank money in a digital economy — that is an outward-facing statement, not just a domestic payments one. Bank CIOs in the UAE are budgeting for tokenisation, they are preparing for cross-border CBDC links to Asia, and they are investing in AI to make all of this safe and compliant.

— you can already see NIMs easing even as profits stay high, thanks to volume growth and fee income. Another is around the timing of capital-markets. Issuers are keeping their eyes on global conditions, and this year has already seen one or two listing plans postpones as boards look for better conditions. There is also the macro environment around the UAE to

wealth solutions for the new family-office capital setting up in the free zones; more sustainability-linked lending to match the UAE’s COP28-era positioning; and more partnerships between local banks and global fintechs who want a regulated base in the Gulf. There is also a clear need to deepen dirham capital markets — the next stage of the IPO story will be about

WHAT HAS

OVER THE LAST YEAR IS THAT THE UAE IS RUNNING A JOINED-UP STRATEGY

consider, with slower growth in the wider MENA region, lower oil prices than the 2022 peak, and tariff-related uncertainty. All imply that the UAE will have to keep attracting other people’s growth in order to sustain its own. However, these concerns also serve to highlight how diversified the economy of the UAE now is. When growth in the neighbourhood slows, capital and talent have shown a tendency to migrate to Dubai and Abu Dhabi, not away from them.

HOWEVER, THESE CONCERNS ALSO SERVE TO HIGHLIGHT HOW DIVERSIFIED THE ECONOMY OF THE UAE NOW IS

Of course, it has not been a year without some challenges. One is the slowly narrowing interest-rate tailwind. UAE banks enjoyed record Net Interest Margins (NIM)s through 2023 and early 2024, but by 2025 the margin story is about resilience rather than expansion

For financial institutions, the opportunity in the coming 12 months is to convert this national-level momentum into products. There is room for more structured trade and supply-chain finance linked to Asia–GCC flows as mBridge matures; more private banking and

diversity of issuers (more tech, more consumer, more “new economy”), but also about building a secondary-market culture that keeps international money engaged when volatility picks up. The regulators’ willingness to keep tweaking the framework, whether on listing rules, governance or digital assets, suggests they understand this.

What has become unmistakable over the last year is that the UAE is running a joined-up strategy: central bank builds rails; federal and emirate-level governments drive diversification and FDI; free zones attract global finance; banks scale regionally on top of all of that. Because each part is moving in sync, the financial sector has been able to grow fast without flashing red on asset quality, capital or liquidity — something the CBUAE itself highlighted in its September 2025 review. For MEA Finance Magazine readers — bankers, fintech founders, treasury heads, wealth managers — the takeaway is straightforward: the UAE is the one market in the region that is simultaneously growing, opening and modernising its financial infrastructure. That makes it the natural base from which to serve the rest of the GCC and, increasingly, Africa and South Asia.

Connectivity

Flexibility

Exceed

Security

Protect

Innovation

Futureproof

mastercard.com/gateway

Mastercard Gateway

As digital transformation reshapes the regional financial landscape, three parallel innovations—central bank digital currencies, stablecoins and tokenised deposits—are beginning to converge. Together, they may redefine how value is stored, moved and trusted across the region’s economies

Money in the GCC is entering a new chapter. For decades, the foundations of finance were built on cash in circulation and deposits held in banks, backed by confidence in sovereign currencies and regulated financial systems. Today, that definition is being stretched by technology and policy in tandem. Across our region, central banks, commercial lenders and fintech innovators are re-examining what money means in a world that is increasingly instant, digital and programmable.

The Gulf nations have long been fertile ground for financial innovation. With smartphone penetration approaching 96 per cent, near-universal internet

access, and a population that has rapidly adopted mobile payments and digital wallets, the region has built a foundation for digital finance unlike any other in the developing world [1]. In parallel, regulators have encouraged experimentation. The Central Bank of the UAE has made the digital dirham a centrepiece of its Financial Infrastructure Transformation initiative, calling it “safe, cost-effective and efficient for making payments and storing value” [2]. Saudi Arabia’s SAMA has tested distributed-ledger settlement through Project Aber, a joint wholesale CBDC pilot with the UAE that demonstrated the potential for shared digital currency issuance [3]. Bahrain and Oman are likewise exploring tokenised payment infrastructure, while regional banks run internal proofs of concept for deposit tokenisation.

At the heart of this evolution are three related but distinct instruments. The first, the central bank digital currency (CBDC), is an electronic form of sovereign money— issued, regulated and guaranteed by the state. The second, the stablecoin, is a privately issued digital token designed to mirror the value of a fiat currency, often backed one-to-one by reserves. The third, the tokenised deposit, is a traditional bank deposit represented digitally on a distributed ledger, retaining its character as a bank liability but acquiring the advantages of programmability and instantaneous settlement. Each occupies a unique layer of the financial system, and together they form a continuum between public and private money.

In the Gulf’s context, these layers are increasingly interdependent rather than competitive. A retail CBDC such as the digital dirham could provide the sovereign foundation for digital transactions; regulated stablecoins could deliver agility and cross-border reach; and tokenised deposits could link established banking infrastructure to blockchain-based settlement systems. The convergence of these models has the potential to streamline trade finance, treasury operations and cross-border

payments across the region. Where today remittances and supplier payments traverse a maze of correspondent banks, tomorrow they may move instantly across interoperable digital ledgers underpinned by central-bank oversight.

The implications for cross-border commerce are profound. The GCC’s economies are deeply interconnected— through energy exports, logistics, tourism and an expatriate workforce that sends billions of dollars abroad each year. Instant, programmable and low-cost digital money could transform these flows. A construction firm in Dubai

could pay subcontractors in Riyadh in seconds through a CBDC bridge; a logistics provider in Manama could settle invoices using tokenised deposits that release payment only when goods are delivered; remittances could be executed through dirham-pegged stablecoins at a fraction of today’s cost. Efficiency would be matched by transparency, traceability and inclusion.

However, redefining money is not without risk. The introduction of retail CBDCs raises a structural question: if citizens can hold central-bank money directly, will they withdraw deposits from commercial banks, potentially shrinking bank balance sheets and constraining credit? Policymakers in the GCC are conscious of this risk and appear to favour a two-tier approach, in which central banks issue digital

currency to intermediaries—banks and licensed payment providers—who in turn distribute it to the public. Such a model preserves the stability of existing institutions while ensuring public access to risk-free digital cash. Stablecoins introduce another layer of complexity. Global collapses of unregulated tokens underscored the need for supervision. In response, the UAE enacted one of the world’s most comprehensive Payment Token Service Regulations, requiring licensing, governance and full reserve backing [4]. Properly regulated, dirham-denominated stablecoins could play a vital role in the digital-asset ecosystem, serving as settlement instruments for trade and fintech innovation while remaining anchored to national monetary policy. Some issuers have already announced plans for UAE-backed stablecoins fully collateralised by domestic reserves [5].

Meanwhile, tokenised deposits may emerge as the bridge between legacy banking and decentralised finance. By converting customer deposits into digital tokens on shared ledgers, banks can enable real-time, atomic settlement between institutions while retaining regulatory protection and deposit insurance. This approach preserves trust in the banking system while unlocking efficiency gains. A corporate treasury could use tokenised deposits to sweep liquidity across subsidiaries in multiple countries instantly, freeing working capital that would otherwise sit idle. The distinction between on-ledger and offledger balances would blur, giving rise to a more dynamic form of cash management. For corporates, the opportunity is as much strategic as operational. Digital money introduces the potential for programmable finance—funds that move or unlock based on verified events rather than manual intervention. Smart contracts could automate supplier payments, loan disbursements or dividend distribution. Payroll could become conditional and instantaneous, reducing administrative overheads.

For CFOs and treasurers, such innovation promises better control and transparency, though it also demands new governance frameworks to manage cyber-risk, auditability and data privacy.

Regulation will remain the cornerstone of this transformation. The Gulf’s policymakers have signalled their intent to ensure stability above all else. The CBUAE’s multi-phase CBDC strategy integrates wholesale and retail pilots with crossborder experimentation through initiatives such as Project mBridge, developed with Hong Kong, Thailand and the People’s Bank of China [6]. These collaborations illustrate a clear ambition: to build interoperable digital-currency systems that can facilitate trade and settlement across borders without relying on global correspondent networks. As digital currencies evolve, the ability of GCC central banks to coordinate standards, compliance frameworks and cyber-resilience will determine how effectively the region can capture their benefits.

Banks themselves will need to navigate an equally complex transition. Those that embrace tokenisation early— experimenting with deposit tokens, CBDC integration and programmable payment rails—stand to position themselves as leaders in digital-money services. They can offer clients enhanced settlement speed, richer transaction data and new liquidity solutions. Conversely, institutions that delay, risk ceding ground to agile fintechs and non-bank issuers that build directly on blockchain infrastructure. For banks across the GCC, the challenge will be to innovate within the boundaries of

References:

prudence, ensuring that the trust built over decades of traditional banking is carried forward into the digital realm.

At a macro level, the move toward digital money aligns with the Gulf’s broader economic diversification agendas. Initiatives under Vision 2030 in Saudi Arabia and the UAE’s national digitaleconomy strategies prioritise fintech development, cross-border connectivity and financial inclusion. Embedding CBDCs and tokenised payment rails into this vision could accelerate progress toward cashless societies, enhance the efficiency of government disbursements and create the financial infrastructure for smart cities and digital trade zones. The imminent arrival of a retail CBDC in the UAE, could may lead to programmable citizen-services payments and crossborder settlement corridors with other important trading nations.

Nevertheless, the transition will require patience and cooperation. Technical challenges remain formidable: developing secure wallet architectures, managing offline capability, preventing cyberattacks and establishing robust identity verification systems. Policy challenges are equally complex—determining how digital currencies interact with existing money supply, monetary policy and capital-flow regulations. Central banks across the Gulf are moving cautiously,

1. Marmore MENA Intelligence (2024). “How are Central Banks in GCC responding to Digital Currencies?” marmoremena.com/insights

2. Central Bank of the UAE (2024). “CBUAE Launches the Central Bank Digital Currency Strategy – The Digital Dirham.” centralbank.ae/media/q5nldmrv

3. SAMA & CBUAE (2019). Project Aber – Joint Digital Currency and Distributed Ledger Report. sama.gov.sa

4. PwC Middle East (2025). “Unlocking the Future of Finance with Stablecoins.” pwc.com/m1/en/publications

5. Reuters (2024). “Tether to Provide Stablecoin Pegged to UAE Dirham.” reuters.com/technology/tether-uaestablecoin-2024-08-21

6. Central Bank of the UAE (2024). “Project mBridge: Multi-CBDC Cross-Border Payment Platform.” centralbank. ae/media/q5nldmrv

favouring pilot projects and controlled testing over wholesale deployment, mindful that the stability of their banking systems must never be compromised for the sake of innovation.

For financial leaders in the region, preparation is essential. Treasury and compliance teams should begin assessing how CBDCs, stablecoins and tokenised deposits might intersect with their operations—from settlement processes and liquidity planning to accounting treatment and regulatory reporting. Engagement with regulators and partner banks today will ensure readiness tomorrow. The firms that act early, experiment wisely and build governance frameworks capable of handling digital-asset exposures will be best placed to thrive as money itself becomes software.

Ultimately, what is unfolding in the Gulf is not the disappearance of traditional money but its evolution into something more adaptive, transparent and efficient. Just as the region once leapt from paper cheques to mobile banking, it is now poised to leap from digital payments to digital cash. The shift promises faster transactions, lower costs, improved compliance and new avenues for innovation. Yet at its core, it remains a story about trust—the same trust that underpins every currency, whether printed on paper or coded on a blockchain.

The Gulf has always stood at the crossroads of commerce, linking markets, cultures and ideas. As it pioneers the next generation of money, it has the opportunity to set the standard for how digital value can circulate securely and inclusively in a global economy. The first retail CBDCs and bank-issued tokens will not simply modernise payments; they will reimagine what money can be. And in doing so, they will affirm the region’s role as a driving force in the future of finance.

Ready to challenge the status quo? Get insights from the pioneers driving change in AI, digital transformation, and customer-first innovation, one episode at a time.

Listen on:

Janus Henderson Investors Portfolio Manager Denny Fish draws a contrast between recent artificial intelligence (AI) transactions and those of the dot.com era, noting that rather than being an example of unproductive “circularity,” the current crop of deals represents a potentially virtuous circle for a nascent industry

Since the 2022 release of ChatGPT, AI has been the driving force behind the equity market’s historic gains. Invariably, when stocks leap from record close to record close, naysayers appear, seeking to poke holes in a rally’s underlying thesis. Such critiques are an essential component of markets operating efficiently. Some criticisms, however, hold up better than others.

Those concerned that the AI rally has become unmoored from economic fundamentals have recently bandied about the term circularity. It is not a compliment. Instead, it is a not-so-veiled reference to the sometimes-dubious business practice of vendor financing that gained popularity during the 1990s rise of the Internet.

Critics point to the recent slew of deals between AI ecosystem heavyweights. Chief among these is graphic processing unit (GPU) maker Nvidia inking a $100 billion transaction with ChatGPT creator OpenAI – a tie up that includes a 10% equity stake in the startup.

On this transaction’s heels, OpenAI struck another one with chipmaker AMD where it gets access to roughly six gigawatts of GPU power. In contrast to the Nvidia deal, OpenAI gains the ability to take up to a 10% position in AMD should the partnership achieve certain milestones. And only this week, Broadcom got in on the action with its own partnership with OpenAI for data centre access.

In contrast to the vendor financing of an earlier era, these transactions, in our view, represent an effort by a nascent industry to address the current gaping supply

imbalance for AI computing capacity. This imbalance is based upon widely accepted forecasts for voracious demand over the next decade. Some estimates call for AI infrastructure investment to rise from this year’s $600 billion to potentially as high as $4 trillion by decade’s end1.

To understand why these AI pioneers are taking steps to align their interests, one must assess the current landscape, namely the frenetic race to acquire stillto-be produced compute capacity. The initial assumptions that the AI training phase would be the most compute intensive largely proved to be off target. The rise of t est-time inference – AI’s operational phase – has required much more computing power than anticipated given the need for models to digest the vast quantities of new data created during each iteration of AI queries.

To fortify their models’ rapidly expanding capabilities, AI platforms such as OpenAI need additional computing capacity in the form of advanced GPUs. As evidenced by the values attached to recent deals, this costs a lot of money. Given its swollen order books, Nvidia has funds to invest. For its part, OpenAI will deploy this capital by building out data centres powered by Nvidia chips. Central to this thesis is the anticipated demand from a massive opportunity set of global customers seeking to leverage OpenAI’s capabilities.

OpenAI’s deal with AMD also aims to secure additional computing capacity over the next several years. In addition to OpenAI purchasing multiple generations of AMD chips, the companies will become even more aligned due to possibility of the AI platform taking up to a 10% ownership stake in the chipmaker. In both transactions, these players are synchronising their economic interests so they can together achieve the necessary

Sources:

THE 1990S INTERNET ANALOGY ALSO FAILS TO CONSIDER THE DIFFERENCES BETWEEN DEBT AND EQUITY FINANCING

computing capacity to propel AI to its next stage, which is widespread implementation across the broader economy.

Vendor financing has long been an accepted – and often viable – business practice, provided its intention is for vendors to help customers maintain sufficient cash flows in the course of operations. This was often not the case in the 1990s, when vendors were not assisting customers in meeting downstream demand but rather selling their products on credit in the hopes that future demand would ultimately materialise. In many instances, it did not.

This is where critics’ AI circularity argument falls flat. In contrast to the if you build it, they will come mantra of many early Internet platforms and fibre networks, the rapid advancement of AI platforms and their equally rapid deployment by corporations, governments and research institutions, in our view, hints that current estimates could undershoot eventual demand.

The 1990s Internet analogy also fails to consider the differences between debt and equity financing. Vendor financing was much more transactional, seeking to achieve a near-term commercial objective. The risk – in addition to demand for purchased capacity never materialising – was lending corporations entering these agreements to inflate their order books.

By its nature, the residual ownership of an equity stake means the financing

1. McKinsey, as of April 2025, Brookfield, as of September 2025, Janus Henderson Investors.

2. Hyperscalers tend to be megacap technology and internet companies whose massive investment in capital expenditure is a key source of growth for technology infrastructure providers (e.g. GPU producers).Forum, Consultancy ME, Finastra, SBS Software, ARXIV, Dubai Business Capital, Menafin, Arabnews.

partner benefits only when its customer is successful. In this respect, the current crop of AI-related transactions is the most recent in a series where key players seek to ensure this nascent ecosystem has sufficient infrastructure to meet anticipated demand. Earlier deals following similar strategies include Microsoft’s seed investment in OpenAI and Amazon investing roughly $8 billion in Anthropic, which entailed the AI startup using Amazon Web Services to host its models.

Within this context, we do not believe the slight – intended or not – of circularity is the most apt description of the collaboration occurring within a quickly evolving AI ecosystem.

More accurate, in our view, is a flywheel. This term implies a virtuous circle comprised of ongoing innovation and greater capabilities leading to higher demand and, ultimately, monetization. In formalising relationships that not only could put AI adoption on a higher trajectory but also may improve their own profitability, these companies are seeking to carry out one of their most important tasks: effectively allocating capital.

Lastly – and for needed perspective –the recently announced deals between AI players represent only a sliver of the revenue streams potentially in play. Nvidia’s deals at maturity, for example, could account for just 10% of its possible sales over this time horizon. The crossfertilisation between AI infrastructure companies should, in our view, lay the groundwork for accessing the much larger earnings pie of tech hyperscalers2, sovereign buyers and innumerable other AI end users across the global economy.

An

exclusive dialogue with Virtuzone’s Group CEO on industry recognition, entrepreneurial ecosystems and the evolving Middle Eastern business landscape

Virtuzone recently won the MEAFinanceAwardforBest CompanyIncorporationand Freezone Business StartUp in the Middle East. How does this recognition reflect the organisation’s strategic positioning within the regional business services sector?

This recognition validates our systematic approach to business formation and corporate services and our commitment to operational excellence across all client touchpoints. The MEA Finance Awards evaluates organisations based on rigorous performance metrics, client satisfaction indices and market impact—criteria that directly align with our strategic priorities.

For our organisation, this award confirms that our investment in process optimisation, comprehensive service delivery and multilingual expertise resonates with market demand.

When we examine our track record of empowering 80,000+ entrepreneurs and businesses across 180+ countries, this recognition is a natural outcome of that sustained strategic focus.

Beyond immediate recognition, how does this award influence Virtuzone’s strategic growth and long-term vision?

I believe awards function as both

validation and catalyst. We have always believed in consistently improving the quality and diversity of services we offer, and receiving accolades like this reinforces our drive to continually push the envelope in terms of excellence, innovation and market leadership.

How else can we support our clients? What solutions can we provide to further enhance their journey? What new technologies or processes can we adopt to enrich our clients’ experiences?

Finding sustainable, cost-effective and tech-powered solutions to questions like these fuels our clientcentric growth strategy and dictates our future plans.

Following our integration into Ascentium, we have amplified our

capacity to deliver comprehensive services, thus providing our clients with access to deeper market expertise, enhanced technological infrastructure and broader regional networks.

These elements, in turn, enable us to offer our clients smarter and more streamlined solutions for entry in the UAE and across key markets in the Middle East, Asia Pacific, Europe and the Americas.

The UAE has demonstrated remarkable economic resilience and growth. From your perspective, what factors continue to attract international entrepreneurs to this jurisdiction? Aside from its zero-income tax policy, which continues to draw international entrepreneurs and facilitate wealth migration to the country, the UAE’s secure political environment, progressive government and agile leadership largely contribute to attracting global businesses, investors and talent.

The UAE’s highly diversified economy also plays a huge role in driving wealth and business migration to the country. In the first quarter of 2025 alone, the UAE’s gross domestic product (GDP) reached AED 455 billion (USD 123.8 billion), with non-oil sectors accounting for AED 352 billion (USD 95.8 billion) and oil-related activities bringing in AED 103.8 billion (USD 28.3 billion).

Furthermore, according to the World Bank’s Doing Business indicators, the UAE consistently ranks among the top 20 globally for ease of doing business—a position achieved through deliberate regulatory reform and infrastructure investment.

UK tax policy changes have generated considerable discussion around residency planning and business relocation. How has this influenced demand patterns for UAE business services?

The UK government recently announced it is considering a 20% “settling up charge” on certain assets held by individuals who leave the country, which would impose tax on gains embedded in assets such as shares or bonds at the point of exit.

According to reports, this could generate around GBP 2 billion (AED 9.6 billion) every year and represents a substantial departure from current rules, where nonresidents typically pay UK capital gains tax only on UK property and land.

These proposed changes have accelerated demand for UAE business services as entrepreneurs look for opportunities to achieve higher tax efficiency and enhanced income protection.

While the UK evaluates exit taxation policies, the UAE continues to maintain 0% personal income tax with no capital gains tax on most asset classes, providing a level of stability that relocating founders increasingly prioritise.

At the same time, the UAE’s 10-year Golden Visa program has become integral to high-net-worth individual (HNWI) relocation, as it does not impose minimum physical presence requirements and appeals strongly to UK entrepreneurs who want to establish tax residency outside the UK before any potential exit charge is introduced.

We are also seeing a rise in dualjurisdiction business models, where entrepreneurs and companies retain commercial operations in the UK while establishing UAE holding structures to consolidate assets, protect global investments and position themselves for long-term growth.

Which economic sectors present the most attractive opportunities within the UAE’s evolving business landscape?

The UAE’s latest growth indicators highlight several economic sectors that

OUR PRIORITY IS TO ENSURE THE NEXT GENERATION OF UAE-BASED ENTREPRENEURS CAN GROW LOCALLY WHILE COMPETING GLOBALLY, BACKED BY A HOLISTIC ECOSYSTEM THAT MOVES AS FAST AS THEY DO

continue to shape investor sentiment and business formation trends.

Manufacturing emerged as the strongest performer in early 2025, posting a 7.7 percent increase compared with the first quarter of last year. The finance and insurance sector, along with construction, also delivered solid results with 7 percent growth, while real estate activity climbed 6.6 percent and trade registered a 3 percent rise.

Based on their overall weight in the nonoil economy, however, trade continues to be the biggest contributor, followed by finance and insurance, manufacturing, construction and real estate.

Together, these gains highlight the depth and adaptability of the UAE’s nonoil economy, with multiple industries advancing in parallel. These milestones also put the UAE on track to meet its target of generating AED 3 trillion (USD 816 billion) in total GDP by 2031, as outlined in its “We the UAE 2031” vision.

What emerging trends in entrepreneurship and business formation should stakeholders monitor over the next three to five years?

We anticipate the UAE to push toward more unified and agile business licensing models. This year, Dubai has spearheaded the introduction of gamechanging free zone licenses, namely the Free Zone Mainland Operating Permit and the Freezone One Passport initiative.

The Free Zone Mainland Operating Permit allows free zone companies in Dubai to engage in mainland activities within the emirate, giving them greater

freedom to trade domestically and access government projects and contracts.

On the other hand, the One Freezone Passport initiative permits companies licensed in one Dubai free zone to operate across other participating free zones under a single license, with Louis Vuitton becoming the first company to maximise its advantages.

We also expect other emirates to adopt similar structures, paving the way for a future unified national trade license that would further streamline compliance and elevate the UAE’s global competitiveness.

Looking forward, what strategic priorities will define Virtuzone’s approach to supporting the next generation of UAE-based entrepreneurs?

Our strategy remains rooted in the same principle that has guided us from the start: stay ahead of the market so entrepreneurs and businesses can seamlessly tap into the UAE’s thriving business landscape.

Over the years, this approach has allowed us to expand far beyond company formation into a full suite of corporate services, giving founders everything they need to build and scale in one place.

Today, with Ascentium’s international footprint and capabilities, we are extending that support even further by helping clients take their businesses globally through new markets, resources and operational channels.

Our priority is to ensure the next generation of UAE-based entrepreneurs can grow locally while competing globally, backed by a holistic ecosystem that moves as fast as they do.

Lori Schwartz Global Head of Treasury Services, J.P. Morgan Payments explains the forces leading to the region becoming a treasury hub and how modernised financial infrastructure has changed cash management in the region, with technology and particularly blockchain being transformative

What signs do you see of the growing status or importance of cash management across our region?

Cash management is becoming increasingly critical across the Middle East as economic transformation accelerates under Saudi Vision 2030 and We the UAE 2031. These national efforts are driving diversification, infrastructure expansion and rapid digital adoption, all of which elevate the treasury function’s strategic importance.

A key indicator of this growing importance is the emergence of the Gulf Cooperation Council (GCC) as a central hub for global treasury operations. More multinational companies are establishing regional treasury hubs that oversee broader markets across Africa, Southeast Asia, India and Central and Eastern Europe. This shift reflects the GCC’s geographic advantage between East and West, as well as its growing maturity as a treasury ecosystem. These hubs offer treasurers improved cash visibility, centralised liquidity management and enhanced operational efficiency. The growing relocation of senior treasury leaders and domiciling

Lori Schwartz, Global Head of Treasury Services, J.P. Morgan Payments

of invoicing entities in the region further underscores this trend.

Financial free zones, such as Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) have strengthened this environment by offering English common law frameworks, transparent governance and taxefficient structures that are attractive to corporates building large-scale treasury functions. Banks are aligning accordingly — including J.P. Morgan’s expansion through a Category 1 ADGM license, enabling liquidity management and multi-currency payments directly from the UAE.

As companies expand into sectors such as metals and mining, renewable power, logistics, EV manufacturing and data center operations, the scale and complexity of treasury flows are increasing. Collectively, these developments demonstrate that cash management has become a core strategic priority across the region.

Is the continued non-oil growth of key regional economies putting a greater focus on liquidity management?

Economic diversification is significantly heightening the focus on liquidity management across the region. As governments expand into advanced manufacturing, tourism, health, transport and technology, treasury operations must support more complex, multimarket structures.

Saudi Arabia’s non-oil private sector, for example, has grown at its strongest pace in more than a decade, driven by new orders and investment activity. These newer sectors often involve longer working capital cycles, new supply chains and more cross-border settlement requirements.

Treasurers must also navigate regulatory differences and foreign exchange controls, often resulting in “trapped liquidity” across subsidiaries. This challenge is a key catalyst behind the rise of centralised regional treasury hubs, which can harmonise liquidity structures, reduce inefficiencies and support global investment strategies.

Global market volatility reinforces this trend. Many corporates are proactively strengthening liquidity buffers and implementing more disciplined working capital strategies. As the region’s non-oil economy accelerates, liquidity management is becoming a strategic lever for resilience and growth.

How has the modernisation of regional financial infrastructure influenced bank’s cash management services?

Modernised financial infrastructure has reshaped cash management in the Middle

East by enabling faster, more integrated and more globally aligned services.

ADGM and DIFC have created regulatory ecosystems that attract global banks, asset managers and fintechs, while also enabling MNCs to build regional treasury centers and in-house banks. This modernisation has prompted banks to expand their capabilities — including J.P. Morgan’s enhanced Category 1 ADGM presence, which supports liquidity management and multi-currency payments within the UAE while connecting directly to global booking locations.

Technological modernisation is equally impactful. AI, machine learning and cloud computing are improving analytics, automation and scalability of treasury platforms. The region is also laying the foundational groundwork for open banking frameworks.

Payments infrastructure has advanced through the expansion of instant payment rails, cross-border linkages and blockchainbased corridors. Kinexys by J.P. Morgan, for example, works with several major regional financial institutions in the Middle East, supporting 24/7 multi-currency settlement and programmable payments.

Digital payments also enhance data availability and AML/CFT compliance, while streamlined onboarding and verification processes help accelerate account opening and regulatory adherence.

Together, these developments enable banks to deliver higher-speed, data-rich, globally interoperable cash management services.

Now that the Swift ISO20022 deadline has come, what will be, or already have been the effects of this standardisation on regional cash management?

Data and systems become increasingly diverse as the global economy becomes more interconnected. A complex payments industry relies on a common language to keep dialogue open, and ISO 20022 is set to become that universal language. With structure and dedicated

COLLECTIVELY, THESE DEVELOPMENTS DEMONSTRATE THAT CASH MANAGEMENT HAS BECOME A CORE

fields for payment details, the formatting standard creates communication efficiency. Rather than managing multiple market systems that speak different languages, ISO 20022 offers a universal messaging language.

It is a unique opportunity to capture rich data benefits and embrace datadriven innovation. The highly structured messaging format means machines can read messages better for faster automation and resolution.

From the corporate client perspective, benefits include efficient reconciliation, enhanced invoice information at scale and fewer manual processes to improve working capital. While clearing the way for more flexible payment structures, ISO 20022 helps accommodate corporate needs, along with evolving market dependencies.

Can current cash management and treasury technology allow liquidity to be optimised rather than just managed?

Modern treasury technology enables liquidity optimisation through real-time visibility, automation and predictive insights — expanding far beyond traditional liquidity management.

Regional treasury hubs provide centralised oversight across markets, enabling efficient pooling, funding and forecasting. Advanced technologies such as API-driven reporting, automated reconciliation and intelligent payment routing give treasurers enhanced control, transparency and decisionmaking capabilities.

Blockchain innovation is especially transformative. Blockchain deposit

account networks and tokenised liquidity models allow just-in-time funding and continuous settlement without the need to pre-fund multiple currency accounts. Platforms like Kinexys Digital Payments introduce programmable payments that trigger actions based on specific conditions, further improving automation and efficiency.

Over time, enhanced cash pooling, realtime treasury capabilities and integrated cross-border liquidity networks will continue to strengthen liquidity optimisation.

Have global economic and geopolitical circumstances spurred banks into developing more flexible or creative working capital solutions?

Geopolitical uncertainty, evolving supply chains and fluctuating global demand have accelerated the need for flexible, sector-specific working capital solutions. Treasurers are prioritising visibility, control and resilience across increasingly complex and volatile markets.

Banks are responding with more adaptable products – for example, our Trade & Working Capital solutions support clients in optimising liquidity, managing supplier risk and improving cashflow cycles. Economic diversification is also driving new, industry-specific offerings — particularly in metals and mining, renewable energy and advanced manufacturing, where working capital needs differ from traditional sectors. Despite external headwinds, major institutions maintain a long-term commitment to the region, leveraging global scale and local expertise to help corporates navigate uncertainty.

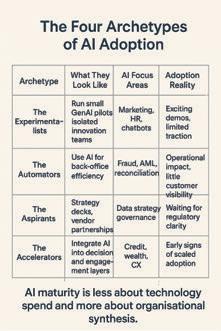

Across the region, banking leaders are unanimous about one thing - artificial intelligence is no longer optional. Many major institutions, from the largest universal banks in the GCC to the nimblest digital challengers, have announced AI strategies, appointed data leaders and launched pilots across risk, compliance and customer engagement

The Promise and the Paradox

And yet, despite this visible momentum, there is a quiet paradox. For all the enthusiasm and investment, true AI adoption remains limited. Few banks have moved beyond isolated proofs of concept or departmental initiatives to build the kind

of AI-native enterprise that global peers are now attempting.

In a region that has consistently been an early adopter of digital transformation, this is both surprising and revealing. The foundations are strong - modern cores, rich customer data, supportive regulators - but the translation of potential into scale is still lagging.

So, the question facing Middle East banking leaders today is not whether to adopt AI, but it’s how to make adoption real.

The Mirage of AI Readiness

Governments across the region have shown extraordinary foresight in promoting national AI agendas. The UAE launched its AI Strategy 2031, while Saudi Arabia’s Vision 2030 and Qatar’s National AI Strategy have each positioned AI as a central driver of competitiveness.

Yet, within banks, the definition of “AI readiness” is often technocentric, focused on data lakes, MLOps platforms and vendor ecosystems. What is often missing is human readiness, the organisational cognition, trust architecture and decision velocity needed to make AI not just work, but fit for purpose.

At WithinTheBox.ai, our research reveals a clear pattern. AI maturity is not determined only by how advanced a bank’s

models are, it is also largely determined by how deeply the organisation understands itself. Adoption slows down not because technology fails, but because human systems do.

It is tempting to believe that scaling AI is a matter of investment or talent. But the evidence suggests otherwise. The deeper barriers are cognitive, cultural and structural.

Four recurring blockers define the AI adoption gap:

1. Fragmented Vision – AI is treated as a toolkit, not a new operating model.

2. Fear of Autonomy – Controloriented cultures resist delegating judgment to machines.

3. Gov ernance by Committee –Responsible AI managed via policy, not design.

4. Dat a Without Design – Banks invest in data platforms but overlook human trust calibration.

Globally, we are seeing a clear shift.

Sanat Rao, Co-founder & Managing Director, WithinTheBox.ai

Several leading banks in other parts of the world are moving from fragmented AI initiatives to AI-native architectures, where intelligence is embedded into every decision, process and customer touchpoint.

Three common threads stand out:

1. Decision Velocit y - namely governance redesigned to enable fast, risk-aware decisions.

2. Human Oversight - that is, humanin-the-loop frameworks preserve judgment alignment.

3. Trus t Architecture - where explainability, bias testing and traceability as technical requirements.

These institutions understand that adoption is as much a behavioural challenge as a technical one.

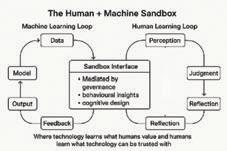

In the technology world, sandboxes test code safely. But in the AI world, we need a different kind of sandbox, one where humans and machines learn together.

The AI Adoption Sandbox is a controlled environment where AI systems and human users interact under observation, thereby testing not only performance but also perception, trust and behavioural response. Within these sandboxes, banks can:

• Obser ve how staff interpret AI recommendations.

• Identif y when human intuition complements or contradicts machine logic.

• Re fine protocols that balance autonomy with oversight.

• E xperiment with responsible AI before full deployment.

This creates a continuous feedback loop between technical accuracy and human acceptance, the very essence of real adoption.

These sandboxes are to be seen as not merely compliance experiments but as co-design platforms for responsible AI. This represents a larger philosophical shift of regulators moving from scorekeepers to co-architects of AI transformation. Banks that engage them early do not just de-risk innovation, they help shape the rules of responsible intelligence.

At WithinTheBox.ai, we think of a Cognitive Design framework as a blueprint for

banks that are serious about addressing the adoption challenge.

Our ethnographic work across banks reveals a striking duality - executives describe AI as a strategic enabler; frontline teams describe it as a compliance risk.

That disconnect explains why many initiatives stall after the pilot phase. The solution is not another policy deck; it is shared experience.

As one innovation head told us during a sandbox session - “We don’t need another

dashboard to monitor AI. We need a playground to understand it.”

That is the difference between deployment and adoption, between using AI as a tool and living with AI as a collaborator.

AI adoption in banking is not about replacing judgment; it is about augmenting human intelligence with machine precision.

REGIONAL

Adoption happens when:

• Technology learns what humans value.

• Humans learn what technology can be trusted with.

• Both evolve together within ethical guardrails.

That is the true purpose of the AI Adoption Sandbox, a place where trust, governance and innovation meet.

THE WINNERS WILL NOT BE THOSE BANKS WITH THE SMARTEST MODEL; IT WILL BE THE BANKS WITH THE BRAVEST CULTURE, ONES THAT LEARN, QUESTION AND COCREATE WITH THE MACHINE

To achieve that, banks must ask “Is our data ready?” but also ask “Are our people ready to trust what AI can do?”

As AI moves from experiment to enterprise, banks in the Middle East have a rare opportunity to redefine the global narrative not as late adopters, but as thoughtful innovators.

They can show that in an age of autonomy, the differentiator is not intelligence, it is intentionality. Because the banks that will lead the AI era are not those that automate the fastest, but those that humanise the deepest.

In regional banking, the winners will not be those banks with the smartest model; it will be the banks with the bravest culture, ones that learn, question and co-create with the machine.

Behaviour wins. Technology follows.

Sanat Rao is Cofounder and Managing Director of Within The Box.ai, an AI enablement and behavioural design company headquartered in the UK with a base in the UAE. Their Cognitive Design Practice helps banks, fintechs and hedge funds build Human + Machine architectures that drive adoption, impact and performance.

Faisal Masood Head Corporate Bank for SubSaharan Africa at Citi, backs an affirmative look at the continuing developments of credible markets across Africa with examples of recent landscape changing deals supported by the bank’s long presence and deep commitment to the continent

The investment landscape in Africa presents a compelling, albeit complex, picture. While challenges persist, these are outweighed by significant opportunities for growth and return. These growth opportunities are increasingly being driven by demographic shifts, digital transformation and the burgeoning potential of intra-continental trade, further propelled by initiatives like the African Continental Free Trade Area (AfCFTA) agreement.

Citi’s unparalleled presence and deep engagement in Africa underscores its role as a trusted advisor, driving economic development and facilitating financing across the continent. The bank has spent decades connecting global liquidity to local opportunity, consistently demonstrating its commitment to supporting sovereigns, financial institutions and corporates through a range of banking solutions.

Citi’s long-term influence in Africa is built on a robust foundation of local expertise combined with global reach. The bank’s operations across sixteen countries in Africa, and its business conducted in an additional twenty one countries, demonstrate its pan-African footprint. The bank’s philosophy as a trusted advisor extends far beyond mere transaction execution. From Eurobonds and private placements, hedging, export credit agency facilities to syndicated loans, Citi’s banking franchise across Africa is actively shaping a new generation of transformative deals. It is not just about mobilising funding; it is about structuring transactions for maximum impact and sustainable outcomes.

corporate growth across sectors. We are in the business of delivering outcomes that matter.”

Africa is rapidly emerging as one of the world’s most dynamic financing frontiers. According to the IMF,

Claude-Stephanie Ngningha, Head of Investment Banking for Africa (excluding Egypt & South Africa) at Citi, encapsulates this philosophy: “We connect capital to opportunity, from sovereign debt sustainability and ESG-linked development, to enabling

nine of the top twenty fastest-growing economies globally in 2024 are in Africa. This growth is underpinned by several factors, including the discovery and exploitation of oil and gas reserves, valuable minerals, public investment in critical infrastructure, reconstruction

spending, improved agricultural output and strategic reforms coupled with effective resource management. Historically, many African economies were heavily reliant on government spending. However, there is a visible shift occurring, driven by private business and consumers giving rise to a growing need for corporate issuances and use of innovative financial products. From facilitating Eurobond issuances to arranging cross-border liquidity solutions for corporates, Citi’s strategy centers on building depth and sophistication into Africa’s capital markets. The bank’s hybrid model, combining hub-managed coverage in some countries with a full investment banking presence in key African economies, has enabled it to originate and execute complex transactions with greater agility and efficiency. As Claude-Stephanie emphasises, “Our clients increasingly seek solutions that can compete globally but execute locally. That is where Citi’s scale and structuring expertise make a real difference.”

Few institutions have played as enduring and impactful a role in Africa’s sovereign debt financing story as Citi. The bank has been instrumental in enabling African governments to access international capital markets for budgetary support and developmental projects. It recently co-led the Republic of Kenya’s US$1.5 billion Eurobond issuance and buyback, its first return to the international markets in over a year. The dual-tranche deal marked a turning point in Kenya’s debt management strategy, helping the country extend maturities and reduce refinancing risk. “Kenya’s re-entry into global markets demonstrates how disciplined debt management and transparency can restore investor confidence,” Head of Corporate Bank for Sub-Saharan Africa at Citi, Faisal Masood notes. “It proves that African issuers can access capital competitively when backed by credible structuring.

Citi in fact played a pivotal role as joint lead manager in Côte d’Ivoire’s landmark US$2.1 billion dual tranche bond-offering, which included a West African CFA franc (XOF) denominated bond issued in international markets – the first of its kind. The bank was able to successfully structure this complex transaction by bridging local currency needs with global investor demand, setting a new model for African sovereign financing.

Together with British International Investment (BII), Citi also launched a US$100 million risk-sharing facility across Benin, Côte d’Ivoire, Rwanda and Uganda to extend trade finance to SMEs, a move that anchors financial inclusion and supply-chain resilience.

Beyond the sovereign sphere, Africa’s private sector is increasingly taking center stage in capital markets, and Citi is actively powering that shift. The bank facilitates financing for growth, expansion, and strategic transformations for various corporate entities. In July 2025, Prosus, one of the world’s largest technology investors, priced a €750 million Eurobond under its Global Medium-Term Note Program. Proceeds were used to refinance maturing notes, underlining the growing sophistication of African-linked issuers in managing global capital cycles.

In South Africa’s mining sector, Citi has also played a leading role in high-value corporate financings. In May 2025, Gold Fields successfully issued US$750 million in seven-year notes through its subsidiary Windfall Mining, guaranteed by its parent group. The funds refinanced a bridge facility used to acquire Canada’s Osisko Mining, cementing Gold Fields’ capitalmarket credibility and strategic agility.

The same trend was evident when Harmony Gold secured a US$1.25 billion bridge facility, jointly arranged by Citi and other global coordinators, to finance its acquisition of the CSA Copper Mine. “These transactions illustrate how African

corporates are no longer just regional players, they’re active participants in global capital markets,” Masood explains. “By providing both bridge and long-term financing, we’re enabling clients to execute strategic transformations.”

Citi has been a significant financier of infrastructure and energy projects in Africa, recognising this to be the backbone of long-term economic growth. In a second transaction of its kind, arranged and structured by Citi, Sun King closed a landmark local currency securitisation deal of US$156 million (KES20.1 billion) to scale affordable solar across Kenya. The deal is the largest securitisation ever completed in SSA outside South Africa.

more sustainable. Each deal, whether a Eurobond, a risk-sharing platform, or a bridge loan, is a building block for market credibility. By leveraging its distribution network and structuring depth, Citi has enabled governments and corporates to access more efficient, transparent, and ESG-aligned capital. The result is an increasingly robust investmentbanking landscape that aligns Africa’s growth trajectory with global investor expectations.

If Africa’s next growth chapter is defined by capital access, then execution will determine who leads it. Citi’s long history on the continent, spanning over five decades, provides both institutional memory and trusted relationships in markets where continuity is often scarce. More than a

ESG-ALIGNED CAPITAL

Focusing on digital infrastructure, Citi, with guarantees from the US ExportImport Bank, is the major US financier for a state-of-the-art data center and digitalisation projects in Côte d’Ivoire through a US$66 million in financing. This initiative aims to de-risk US private sector investment and position American companies to capture growth in one of Africa’s fastest-expanding tech markets.

Together, these sovereign and corporate transactions point to a deeper structural trend as Africa’s financing ecosystem becomes broader, more competitive and

financier, Citi acts as a bridge between policy, markets, and purpose. Its repeat mandates in sovereign, corporate and green finance illustrate a model built not only on scale but on sustained local partnership. In the end, landmark transactions go beyond headlines; they are evidence that global markets can be harnessed to work for African development when banks combine market access, structuring and local insight. Citi’s recent mandates offer a pattern of sophisticated, multidimensional deals led by a bank with both global reach and an Africa playbook. For African issuers and corporates, that combination will continue to matter.

Rihab Saad Managing Director of Next Generation Equity (NGE) discusses global citizenship trends, regulatory evolution and the strategic value of alternative residence planning

Next Generation Equity has been recognised as the Best Residency and Citizenship by Investment Firm at the MEA Finance Awards. What does this distinction represent for your company, and what does it mean for your clients?

This recognition comes at a defining moment for the investment migration sector. The industry has matured from straightforward application processing to a strategic advisory model that incorporates legal guidance, long-term wealth planning, tax considerations and family security. Our award reflects this shift and the growing expectation for higher-quality and more comprehensive support.

Clients today arrive with more complex questions. They want to understand how a second residency or citizenship will influence their global tax exposure, future inheritance planning and overall risk management. This is why we have invested in strong government relationships, a rigorous due diligence framework and a focus on clear educational guidance.

Saad, Managing Director, Next Generation Equity

For NGE, this distinction signals to clients that they are working with a partner that prioritises accuracy, transparency and experienced advisory. It reinforces that our approach is aligned with what families now value most: thoughtful planning, reliable expertise and long-term protection.

How has your firm’s approach to client advisory evolved in response to heightened international regulatory scrutiny of citizenship programs?

The regulatory environment surrounding citizenship-by-investment has intensified, particularly following increased attention from the Organisation for Economic Co-operation and Development (OECD), European Union (EU) and Financial Action Task Force (FATF).

This fundamentally reshaped our advisory methodology and operational infrastructure, but rather than viewing enhanced regulation as a constraint, we have recognised it as an opportunity to strengthen program integrity and client outcomes.

For one, we have substantially expanded our compliance frameworks, implementing enhanced due diligence protocols that exceed minimum governmental requirements.

We have also become more selective about the programs we recommend, with jurisdictions demonstrating commitment to international regulatory standards, transparent governance and sustainable program management receiving our endorsement.

This ultimately benefits our clients, as we are able to direct them toward programs with long-term stability and international legitimacy, which are key factors in determining the lasting impact and overall strategic benefit of their investment.

Caribbean citizenship-byinvestment programs have recently increased minimum investment thresholds. What strategic factors are driving these changes, and how do they affect the competitive landscape?

Yes, several Caribbean nations have established a baseline contribution level of USD 200,000 for single applicants, reflecting a coordinated approach to program sustainability and international positioning.

This change primarily comes from Caribbean nations responding to calls for increased program integrity and sustainability. Implementing higher investment thresholds naturally reduces application volumes while increasing per-applicant economic contribution, and allows stricter due diligence and more meticulous background checks.

Additionally, these adjustments address long-term fiscal planning, since citizenship program revenues fund critical infrastructure development, climate resilience initiatives and economic diversification projects.

From a competitive perspective, this means programs now compete less on price and more on processing efficiency, passport strength and additional benefits like visa-free travel access or residency flexibility.

Global wealth migration patterns have intensified over recent years. What underlying factors are driving high-net-worth individuals and families to pursue alternative citizenship options?

I believe this acceleration is driven by overlapping factors that include geopolitical uncertainty, tax optimisation and changing global mobility needs.

Most of our clients are families that view second citizenship as essential risk mitigation—a “Plan B” that provides options during political instability, economic disruption or social unrest.

Another key factor is tax optimisation, as entrepreneurs and business owners seek citizenship options that enable legitimate tax efficiency through proper residency planning and wealth structuring.

For these clients, jurisdictions offering territorial tax systems or favorable treatment of foreign-sourced income are attractive options. However, they still need to establish genuine residential ties and comply fully with reporting obligations in their home countries.

Access to world-class education and visa-free travel is another critical factor

for many families, particularly those from regions with limited educational infrastructure. These clients prefer citizenship in countries offering visafree access to the United Kingdom, the Schengen Area or other destinations with premier academic institutions.

Beyond citizenship acquisition, how does NGE support clients in maximising the strategic value of their alternative citizenship throughout their lifetime?

Obtaining a second citizenship represents the beginning rather than the conclusion of our relationships with our clients. Our advisory extends to the strategic use of their second citizenship benefits across multiple aspects,

owners in exploring channels that can help them expand into new markets, maximize preferential trade agreements or establish regional operational centers. We also specialise in helping clients plan and lay the foundation for the education of their children, advising them on programs that offer the best access to internationally renowned universities and educational institutions.

What emerging patterns in global mobility and wealth preservation do you see shaping how families approach citizenship planning over the next decade?

Over the next ten years, I expect citizenship planning to move much earlier in life, especially among individuals and

particularly in terms of personal and financial planning.

For instance, achieving tax efficiency requires sophisticated planning that extends well beyond citizenship itself. We work closely with international tax advisors to ensure clients understand reporting obligations, establish compliant residency structures and optimise their tax positioning across multiple jurisdictions.

We also advise families on how to structure cross-border estates, understand heirship rules in different jurisdiction and ensure seamless wealth transfer across generations.

Since second citizenship gives access to international business opportunities, we guide entrepreneurs and business

families who prioritise long-term wealth protection and lifestyle flexibility rather than treating it as a late-stage safeguard.

As the global migration sector continues to be reshaped by factors such as increasing taxes on HNWIs, economic opportunities in emerging markets and changing immigration policies, having a second citizenship or residency is set to be one of the most valuable tools one can secure for stability, freedom and generational opportunity.