NURTURING THE BUSINESS AND STARTUP ECOSYSTEM NEIL PETCH / GEORGE HOJEIGE / GEOFF RAPP News, Reviews and Analysis. May - June Issue 2021 News, Reviews and Analysis. March Issue 2024 A Night of Stars: The Aviation Achievement Awards 2024 Takes Dubai by Storm How to Calculate your End-ofService Gratuity Gulf Aviation Networking Event 2024: A Resounding Success Insights, Innovations, and Industry-Leading Conversations Propel Aviation Forward 6 30 26

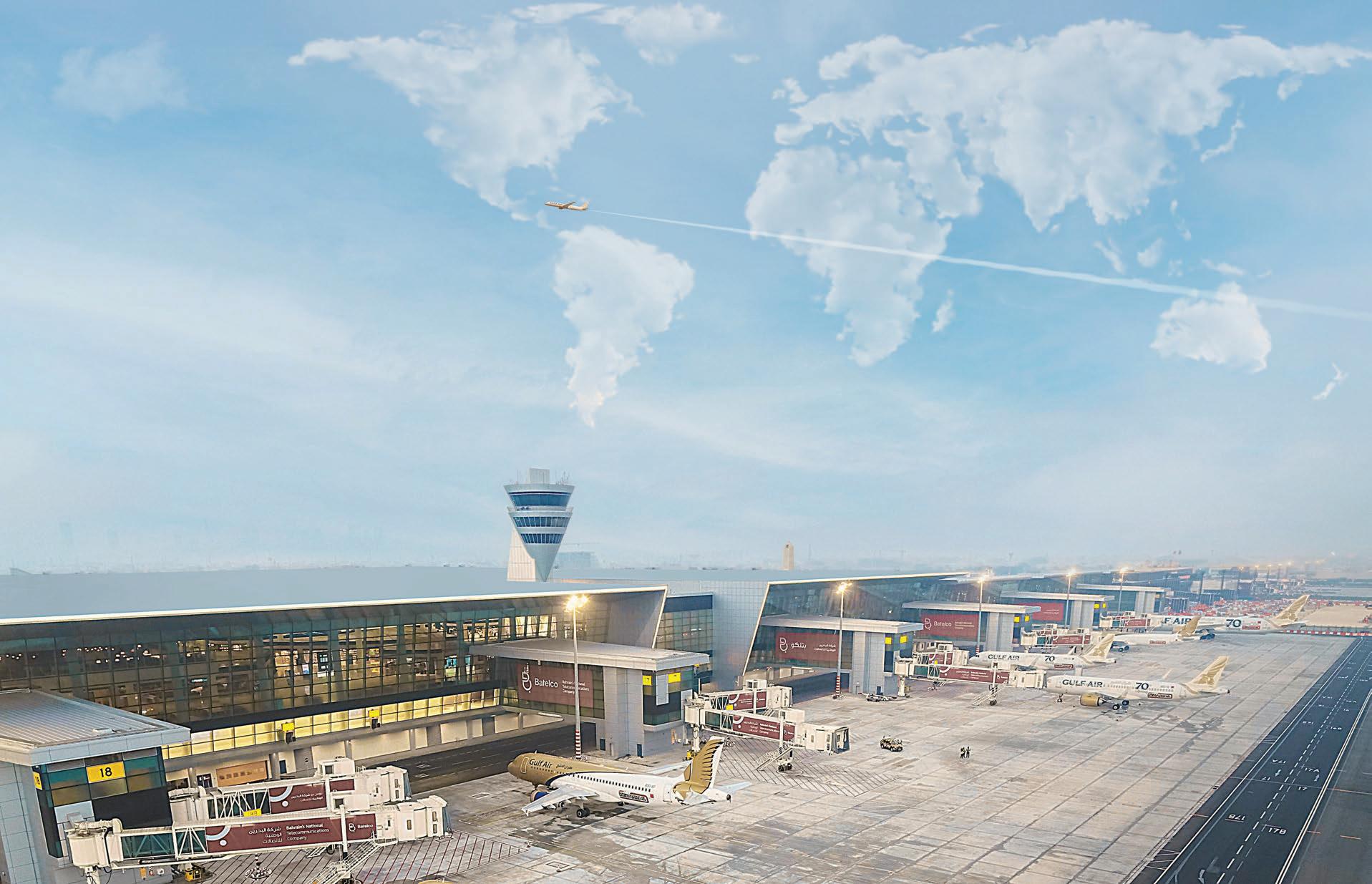

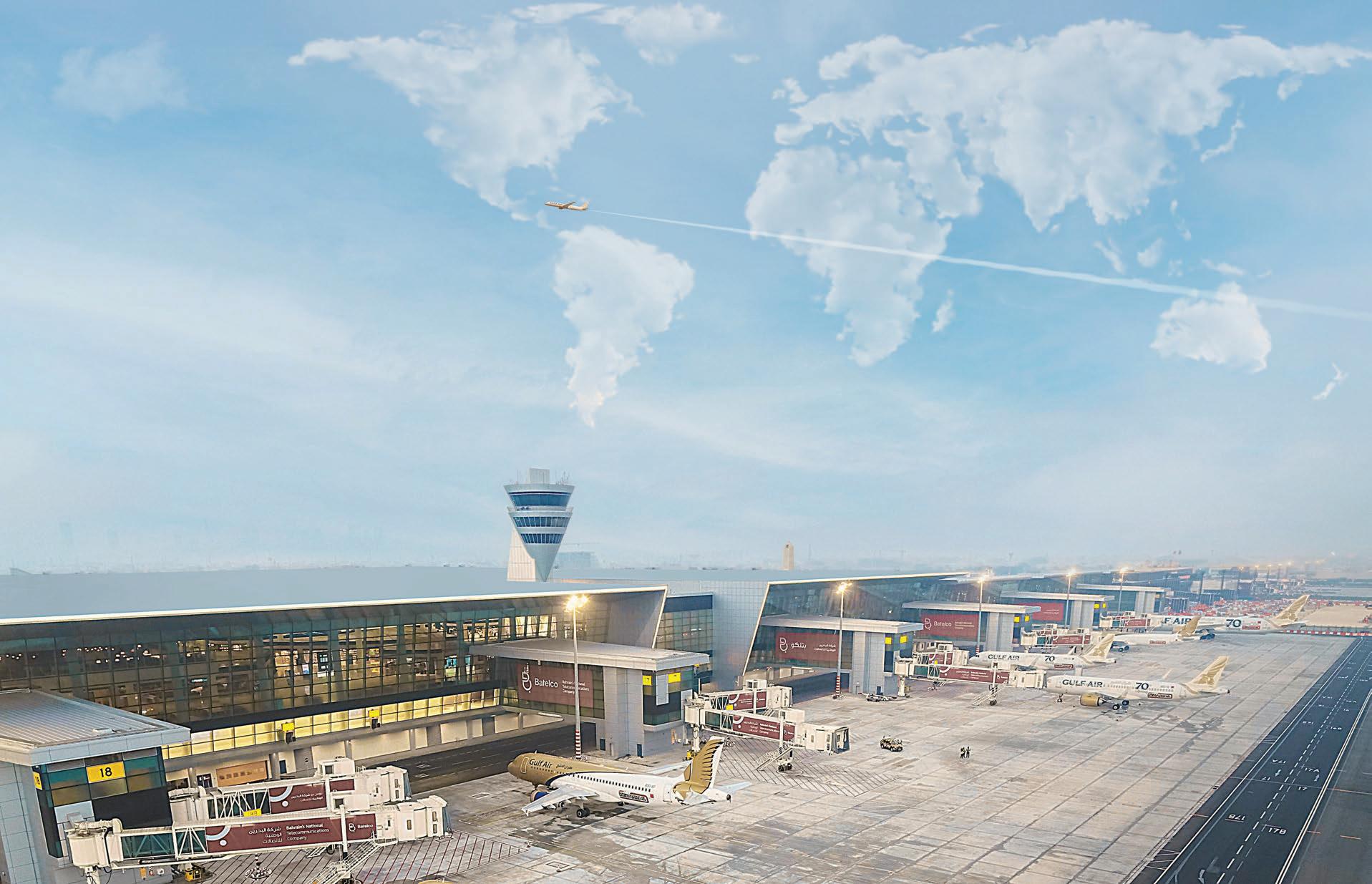

WORLD-CLASS EXPERIENCES FOR THE ENTIRE WORLD TAKES FLIGHT IN BAHRAIN

A state-of-the-art hub for the region and the globe, BIA is a world-class boutique airport that’s designed to create innovative and technology-driven experiences. Visit us as we take off to great new heights.

bahrainairport.bh

Introduction

The editorial staff of MEA Business are committed to reporting the as highlighting the business opportunities that already exist in the two regions.

We also want to provide a platform for business leaders to share ideas, engage in constructive debates and form strategic partnerships. Our ultimate aim is to equip business leaders and professionals with the practical and tactical skills to thrive in the Middle East and Africa. With an emphasis on positive news stories, case studies and inspirational interviews, MEA business will inspire readers towards personal development and overall business success.

The magazine is arranged to provide clear and concise informative sections including news sections on the Middle East and Africa, CEO interviews and market updates. The magazine and news service we offer are available on a variety of platforms, these include our printed magazine, e-magazine, website and social media. Furthermore, we include augmented reality elements in some of our features to provide our readers with unparalleled coverage on the latest developments.

MA Business also publishes several sector specials throughout the year. These special issues are produced to coincide with important industry exhibitions and events. This month's issue is an Aviation Awards special. I hope you will also join me in congratulating all the winners.

Kenneth Mitchen Publisher, MEA Business

Kenneth Mitchen Publisher, MEA Business

CONTENTS

GANE EVENT HIGHLIGHTS

07 Gulf Aviation Networking Event

2024: A Resounding Success INTERVIEW

11 Navigating New Heights: Mehmet

Keyvan’s Visionary Journey in Aviation

CLIMATE CHANGE

14 Balancing Act

MARKET FOCUS - UAE

18 Upword Tragectory

OPINION PIECE

HR NEWS –COMPENSATION & 12

24 Better Than Money

MEA Business

WEB: www.mea-biz.com

www.mea-hr.com

EMAIL: info@cme-media.com

PUBLISHED BY: Creative Middle East Media FZ LLE, 19th Floor, Creative Tower, Fujairah Creative City, PO Box 4422, Fujairah, UAE

EXECUTIVE DIRECTOR AND PUBLISHER : Kenneth Mitchen

Email: ken.mitchen@mea-finance.com

With small and medium-sized enterprises making up 94% of UAE companies, industry experts anticipate the landmark corporate tax law to cause a significant, large-scale impact on the country’s start-up, micro, and SME sectors

A26 How to Calculate your End-ofService Gratuity

s the UAE heavily underpins its medium to long-term growth strategy on reducing its dependence on oil and gas by diversifying the nation’s non-oil revenue streams, the legislative shift will be pivotal in further cementing its position as a global business and financial hub.

The UAE corporate tax regime, which was officially rolled out in June 2023, holds the potential to generate revenue up to AED 47.7 billion (USD 13 billion), or approximately 15% of the country’s gross non-oil revenue, according to Marmore MENA Intelligence, a research subsidiary fully-owned by Kuwait Financial Centre “Markaz.”

AWARDS

28 Niki Mapouras-Hyder, Founder of NMH AVIATION ACHIEVEMENT

30 A Night of Stars: The Aviation Achievement Awards 2024 Takes Dubai by Storm

Along with Value Added Tax (VAT), which yielded AED 9 billion (USD 2.5 billion) in 2022, the corporate tax reform is expected to boost public funds and stabilise its fiscal framework, while accelerating national economic growth and increasing its gross domestic product (GDP) to AED 3 trillion by 2031.

Deep diving into the UAE’s corporate tax framework

With a corporate tax rate pegged at just 9%, the UAE has the lowest corporate tax

BENEFITS

SPOTLIGHT

30 32 Banking and Finance news in the MEA market

22

George Hojeige, CEO, Virtugroup

Get corporate tax ready from AED 249/month or get 20% off when you pay upfront UAE CORPORATE TAX LAWS APPLY TO ALL COMPANIES Outsource your tax and accounting services to FTA-approved experts and ensure your tax compliance. Dedicated accountant Corporate tax registration Accounting services Tax filings Top-quality accounting software Visit taxready.ae SCAN ME

Gulf Aviation Networking Event 2024: A Resounding Success

Insights, Innovations, and Industry-Leading Conversations Propel Aviation Forward

The Gulf Aviation Networking Event (GANE) 2024 successfully took place on the 29 February 2024, at the V Hotel, Dubai just hours before the much-anticipated Aviation Achievement Awards. The event provided an unparalleled opportunity for senior Aviation Leaders from across the region to connect, discuss, and shape the future of air travel. GANE 2024 stood as a cornerstone event for networking, insights, and industry advancements.

This year’s GANE focused on pivotal themes reshaping the aviation industry, including sustainability, the latest technological innovations, trends in commercial and business aviation, and strategies for navigating the postpandemic landscape. The event was uniquely positioned to foster meaningful discussions, share cutting-edge insights, and facilitate partnerships that will drive the aviation sector forward.

Since its inception in 2013, GANE has established itself as the go-to networking event for aviation professionals, attracting a diverse group of participants, from industry leaders and experts to authorities and associations. The 2024 edition built on this legacy, offering a rich program designed to encourage dialogue on the challenges and opportunities facing the industry today.

The event allowed attendees to gain valuable insights and explore collaborative opportunities in an intimate and focused setting. Whether looking to stay ahead of industry trends, develop strategic partnerships, or simply connect with fellow aviation enthusiasts, GANE 2024 was the place to be.

mea-biz.com 07 GANE Event Highlights

Business News for the MEA region 08 MEABUSINESS GANE Event Highlights

mea-biz.com 09

ROADMAP TO EMBARK ON THE GLOBAL HORIZONS

As one of the leading business banking partners in the UAE, National Bank of Fujairah takes pride in being the best Trade Finance Bank in the region to provide tailored trade finance solutions, helping our clients to grow their business on the world map. With nearly four decades of expertise, we provide innovative banking solutions using our digital platforms that are designed to complement your business and offer banking services that meet your working capital and term financing requirements in a simplified manner

SERVICES

TAILORED TO YOUR NEEDS

Structured trade & commodity nancing

Con rmation of export Letters of Credit (LCs)

Treasury & corporate advisory

Other services:

• Global connectivity through our correspondent network

• Working capital & term financing, and more

TRADE FINANCE

WHOLESALE BANKING

Call 8008NBF(623) to start our partnership nbf.ae

Navigating New Heights: Mehmet Keyvan’s Visionary Journey in Aviation

In an exclusive interview with MEA Business Aviation Magazine, Mehmet Keyvan, the founder of KEYVAN Aviation, shares his remarkable journey from a childhood dreamer to a pioneer in the aviation industry. With a passion that took flight from a young age, Keyvan’s path to establishing his company and earning the prestigious EASA approval embodies the spirit of innovation and determination.

Journey to Leadership: What key moments led you to establish KEYVAN Aviation and achieve EASA approval?

Since my childhood, my greatest dream has been to fly and to be involved with aircraft. After pursuing a degree in aeronautical engineering at university, I dedicated nearly two decades of my career to working with major airlines. However, driven by the persistent desire to fulfill my childhood dreams, I eventually took the leap to establish my own company.

Initially, I entered the consultant business, offering essential services to the aviation industry. My experience in the sector, particularly with aeronautical and navigation data, has exposed considerable gaps, particularly in terms of user experience. This revelation prompted me to apply to the European Union Aviation Safety Agency (EASA) in 2022 to become a LOA Type 1 Data Provider.

Unlike the other three companies in the field, which had been serving the market for many years, Keyvan emerged as a unique player. In an astonishingly short period of 9

months, Keyvan became the 4th globally and the first and only in Turkey to receive EASA certification.

Our success is attributed to having a highly dynamic team. The energy and strong ties to technology within our team are among our greatest assets. We closely monitor technological advancements because we understand that the data we produce holds immense value for the aviation industry. In today’s world, where everything revolves around data, we know that we have a big resource.

With our dynamic team, we leverage this privilege to pioneer solutions for all stakeholders in the aviation industry. Our focus is on providing innovative and valuable solutions, acknowledging that technology plays a pivotal role. We are committed to being at the forefront of the industry, offering services that not only meet but exceed the expectations of aviation professionals.

Leadership Philosophy: What principles guide your leadership in the aviation industry?

My leadership in the aviation industry is primarily guided by a deep understanding of our customers’

In the world of aviation, data is not just numbers; it’s the fuel that drives us towards safer, more efficient, and sustainable skies.

needs and our Team competency. We prioritize comprehending customer requirements to provide tailored solutions efficiently. Leveraging our globally produced navigation data, we strive to deliver swift and effective resolutions.

Having access to extensive navigation data places us in a unique position, allowing us to harness the power of information for the benefit

mea-biz.com 11 Interview

of our customers. Our commitment to staying technologically enables us to anticipate and proactively address challenges. We not only follow technology closely but also possess the foresight to identify emerging trends and adapt our strategies accordingly.

Furthermore, our ability to predict and understand customer needs in advance is a testament to our proactive approach. By staying ahead of the curve, we ensure that our solutions are not only effective but also aligned with the future requirements of the aviation industry. Our leadership principles revolve around a holistic understanding of customer needs, the strategic use of global navigation data, and a relentless pursuit of technological excellence. This approach positions us as a reliable and forward-thinking leader in the aviation industry, dedicated to delivering optimal solutions with efficiency and foresight.”

Data Analytics: How has your datadriven approach benefited airlines, airports, and authorities?

KEYVAN Aviation offers new solution as Airline&Airport Performance Measurement Management Tools to help airports and authority’s decision makers to manage the airports’ procedures, including SID (Standard Instrument Departure), Approach usage and effectiveness performance together with ground movement performance and time table including with Runways, Taxiways and Gates usage and occupation monitoring. The main aim of the tool is to help decision makers to design and implement better airport procedures and ground movement scenarios, to help airlines and operators to reduce the waiting time in ground or in the air and by reducing the operation time, operational cost and reduce

the carbon emission The APMMT’s ability to optimise airport procedures, reduce waiting times, minimise delays, and enhance operational efficiency all contribute to an improved passenger experience. By making air travel more predictable, comfortable, and eco-

friendly, the system can positively impact passengers’ perceptions of the airport and the airline, leading to higher satisfaction.

Future Trends: What trends do you predict in aviation, and how

Business News for the MEA region 12 MEABUSINESS Interview

Mehmet Keyvan, the founder of KEYVAN Aviation

At the heart of every technological leap we take at KEYVAN lies a simple truth: the future of aviation is not just about reaching new heights, but about bridging distances and bringing the world closer.

is KEYVAN preparing for these changes?

I can list Air Taxis, digital technologies and Artificial Intelligence Applications as my predictions about the developments awaiting the industry.

Air Taxis: The concept of flying taxis represents a significant shift towards urban air mobility, aiming to alleviate ground traffic congestion. This innovation requires the development of new types of aeronautical data sets to manage low-altitude urban flight corridors and ensure safe navigation. In anticipation of flying taxis, KEYVAN is focusing on the development of specialized navigation databases tailored to urban air mobility. This involves mapping out potential flight paths, no-fly zones, and landing/ takeoff points within the urban area. From optimising flight paths for efficiency and adhering to evolving airspace regulations to ensuring obstacle avoidance and real-time decision-making, our customtailored solutions provide that Air Taxis operators can focus on their missions.

Artificial Intelligence (AI) Applications: AI promises a transformative impact on aviation, enhancing efficiency, safety, and decision-making.

By integrating AI into database management systems, it becomes possible to automate the integration of real-time data into databases.

We can integrate AI into its database management systems to automate the processing and integration of real-time data into its databases. AI algorithms could be used to predict and prevent potential navigational hazards by analyzing historical data and current conditions. Furthermore, AI could assist in developing more efficient flight routes that reduce fuel consumption and emissions.

Sustainability: What steps is KEYVAN taking towards sustainable aviation practices?

Strategic use of different data in aviation plays a critical role in reducing carbon footprint. Optimization of flight routes, fuel efficiency improvements, increasing sustainable fuel use, effective air traffic management, energy efficiency innovations and international collaborations are important elements in reducing the environmental impacts of the aviation industry. I would like to give an example of this issue.

According to the IATA Carbon Offset Programme, approximately 3.16 kg CO2 is generated for every 1 kg of

fuel. For example, an aircraft taxiing at an airport for 20 minutes generates 300 kg of fuel and produces 948 kg of CO2. At an airport with 500 aircraft landings and 500 aircraft take-offs, CO2 production corresponds to an average of 945,000 kg per day and 11,000,000 kg per year. As a result, with the correct optimization of different aviation data layers, 1 minute of savings will prevent the generation of 11,000,000 kg of CO2 per year. Therefore, optimizing taxi times through the strategic use of different data layers in aviation is an important step towards reducing carbon emissions and achieving greener and more efficient operations, especially for airlines.

With our solutions, save on fuel costs for companies, reduce the flight time of the aircraft, shorten the flight time of the cabin crew and reduce carbon emissions. Thus, we support a sustainable world.

Advice for Aspiring Leaders: What advice would you give to future leaders in aviation?

“Leader” is more than just a word, it is a deep concept that embodies inclusion and diversity. A leader must have qualities and vision such as determination, empathy, superior communication skills, problemsolving ability and strict adherence to ethical values. I can summarize my suggestions for the next generation of leaders as follows:

Cultivate Flexibility and Adaptability, Prioritize Safety and Quality (Aviation is inherently linked to safety and quality standards.) Foster Team Collaboration and Communication, Develop a Customer-centric Approach, Strengthen Decisionmaking with Data, Lead with Integrity and Ethical Principles, and Invest in Personal Development..

mea-biz.com 13

Balancing Act

Banks face major challenges handling transition risks, but with initiatives encouraging sustainable finance and growing issuance of sustainability-linked products, a path is being hewn for this unavoidable journey.

The sustainability transition in the GCC region continues to reshape economies and financial systems, creating new opportunities and altering the cost of doing business for banks.

PwC said while the world has grown starkly aware of ESG practices, the GCC region included, there is a growing recognition of the importance of incorporating sustainable finance principles into financial systems, with a shared vision of promoting sustainable development.

The United Nations Climate Change Conference (COP28) in Dubai ended with a historic deal mentioning moving away from oil and gas in a COP text for the first time. Known as the UAE Consensus, the final agreement also highlights the need for more money.

Sustainable finance pledges grabbed the spotlight again at the COP28 climate summit as delegates turned their focus to the yawning gap in the need for climate finance and what’s on offer.

The UAE, host of the climate change summit, said it will put billions of dollars

into a new climate finance fund aimed at improving the flow of money into projects to reduce emissions while its banks pledged to mobilise $270 billion by 2030.

The financial system needs reorienting to meet the enormous financing demands needed to transition towards a net zero target by 2050. It is not a surprise that there is a growing interest in sustainable finance across the GCC. Government, regulators and industry are all taking exploratory measures.

Banks across in GCC region including First Abu Dhabi Bank (FAB), Mashreq Bank, Qatar National Bank and HSBC Bank Middle East have facilitated billions of dollars in sustainable finance and adaptation-related investments.

Climate hazards make the Middle East region vulnerable to high levels of desertification, loss of biodiversity, drought and water scarcity. However, GCC governments are undergoing massive economic transformation programs to put their economies on a more diversified and sustainable footing.

Shapers of sustainability

The amount of cash needed for the energy transition, climate adaptation and

14 Banking and Finance news in the MEA market

CLIMATE CHANGE Business News for the MEA region 14 MEABUSINESS

disaster relief is overwhelming. However, GCC countries have initiated many projects and actions – particularly within the financial sector and sustainable finance – focusing on introducing systems to deliver funds from private finance to unlock necessary infrastructure investment and meet net-zero targets.

Banks in the UAE committed to mobilise $270 billion (AED 1 trillion) in green finance at the COP28 climate talks earlier in December.

“Active engagement from the financial sector is critical to realise our collective climate ambitions, ensuring that the crucial 1.5°C target remains within reach,” Dr. Sultan Ahmed Al Jaber, COP28 President and Minister of Industry and Advanced Technology said, adding that achieving net zero emissions hinges on the strategic allocation of capital towards sustainable and climate-resilient investments.

Mashreq Bank was hailed as one of the top contributors to the UAE Banks Federation-backed (UBF) pledge, promising to facilitate $30 billion (AED 110 billion) by the end of the decade, as part of the Dubai-based lender’s Climb2Change global initiative.

FAB pledged to facilitate $135 billion (AED 500 billion) in sustainable and transition financing by 2030, a commitment that represents half of the combined AED 1 trillion green finance pledge that was made by UAE banks.

The UAE’s biggest lender by assets also unveiled the FAB Sustainable Development Goals Fund (FAB SDG Fund) in December, an ESG-oriented fund for private banking clients that will be managed by FAB Private Bank (Suisse). FAB SDG Fund will concentrate investment flows directly towards sustainable outcomes through 17 exchange-traded funds (ETFs).

Global financial market data provider Refinitiv said the Gulf region witnessed unprecedented growth in the issuance of sustainability and ESG-linked debt in 2023 whether through bonds and Sukuk or in the form of loans. “Around $14 billion in green and ESG bonds and sukuk were sold in the

first seven months of 2023, compared to $8.9 billion in 2022,” said Refinitiv.

Similarly, RAKBANK said it is a key contributor towards the UBF’s commitment to mobilise AED 1 trillion in sustainable finance by 2030. With finance playing an important role in addressing climate change issues, Abu Dhabi Islamic Bank is engaging on multiple fronts to drive the climate change agenda including facilitating as much as $2 billion worth of sustainable projects.

Most GCC banks such as Dubai Islamic Bank, Saudi National Bank, Qatar National Bank and Kuwait Financial House now have sustainable finance frameworks in place.

investors can drive innovation, support scaling, and avoid an unruly transition to a greener global economy.

Walk the talk

The hosting of two consecutive COPs in the Middle East has positioned the region at the forefront of the net-zero transformation, with all Arabian Gulf countries pledging to reach net-zero carbon emissions by the middle of the century.

“Middle East economies’ green, social, sustainable and sustainable-linked bonds (GSSSB) issuance is increasing fast, from a low base, despite a weaker global economy and higher interest rates, with more than $19.4 billion GSSSB bond

THE LACK OF FINANCING HAS LONG BEEN ONE OF THE BIGGEST OBSTACLES TO ADVANCING CLIMATE ACTION GLOBALLY. THEREFORE, I AM PLEASED TO ANNOUNCE THE ESTABLISHMENT OF A $30 BILLION FUND FOR GLOBAL CLIMATE SOLUTIONS

– UAE’s President Sheikh Mohamed bin Zayed Al Nahyan

The frameworks allow the banks to issue green and sustainability-linked Islamic and conventional bonds to fund projects as investor demand for ESGlinked financing is surging in the GCC and wider Middle East region.

The Bahrain Association of Banks established a permanent sustainable development committee back in 2018 to “strengthen the role of banks and their contribution to sustainable development and economic growth

Banks in the GCC region will play a leading role in the transition to a netzero economy. As drivers of economic growth, financial institutions are vital contributors to the region’s climate efforts. By providing the right finance to the right place at the right time, banks and

issuance (including sustainable sukuk) in the first nine months of 2023,” according to S&P Global.

Oman unveiled its sustainable finance framework in January to help the Sultanate reduce its reliance on fossil fuels and attract ESG investments.

The country’s Ministry of Finance said the framework sets out how the government intends to allocate financing towards specific environmental and social areas to mitigate the impacts of climate change, promote socioeconomic development and ensure a just transition to a low-carbon economy.

The UAE launched ALTÉRRA, a $30 billion fund to invest in clean energy and other climate projects worldwide, at the COP28 climate change summit.

15 mea-finance.com

mea-biz.com 15

Launched in collaboration with global asset managers BlackRock, Brookfield and TPG, the fund will allocate $25 billion towards climate strategies and $5 billion specifically to incentivise investment flows into the Global South.

“The lack of financing has long been one of the biggest obstacles to advancing climate action globally. Therefore, I am pleased to announce the establishment of a $30 billion fund for global climate solutions,” the UAE’s President Sheikh Mohamed bin Zayed Al Nahyan said in a speech at COP28 following the launch of ALTÉRRA – a climate fund for global climate solutions.

ALTÉRRA’s long-term goal is to attract $250 billion in investments by 2030. The UAE authorities have been encouraging issuers to raise green debt as the country accelerates the adoption of sustainable finance.

The Dubai Financial Services Authority waived all regulatory fees for issuers listing sustainability-related debt securities in the Dubai International Financial Centre throughout 2024. Similarly, the country’s Securities and Commodities Authority exempted companies from paying listing fees for green or sustainability-linked bonds or Sukuk in 2023.

Qatar, home to the Middle East region’s biggest bank by assets, has enacted a series of initiatives to make at least $75 billion available for sustainable investments, as explained in Invest Qatar’s ESG report.

Meanwhile, Saudi Arabia is working on several fronts to lead ambitious climate action both at the national level and within the region. The Arab world’s biggest unveiled the Saudi Green Initiative (SGI) in 2021 to oversee and unite the kingdom’s efforts to combat climate change, drive sustainable innovation and accelerate the green transition.

Under the SGI, Saudi Arabia aims to reach net zero by 2060, and the Gulf state is contributing to global action on climate change through the implementation of over 80 public and private sector

initiatives representing an investment of more than $188 billion (SAR 705 billion).

Overall, GCC countries are well placed to become pioneers in climate action, not only because of their ability to do so but also because the potential for building new green industries can secure a strong economic future.

Navigating transition risks

When it comes to transition risks, banks have an even more challenging job on their hands. Financial institutions could see their earnings decline, businesses disrupted, and funding costs increase due to policy action, technological changes as well as consumer and investor demands for alignment with sustainability policies.

increasingly in the crosshairs of wealthy investors, shareholders and climate activists over their role in funding coal, oil and gas projects—the leading causes of man-made greenhouse gas emissions.

“Transition risks materialise on the asset side of financial institutions, which could incur losses on exposure to firms with business models not built around the economics of low carbon emissions,” said the International Monetary Fund.

However, the pivot toward sustainable investing has also led to greenwashing as companies and financial institutions are purporting to be environmentally conscious for marketing purposes but they are not making any notable sustainability efforts.

ACTIVE ENGAGEMENT FROM THE FINANCIAL SECTOR IS CRITICAL TO REALISE OUR COLLECTIVE CLIMATE AMBITIONS, ENSURING THAT THE CRUCIAL 1.5°C TARGET REMAINS WITHIN REACH

– Dr. Sultan Ahmed Al Jaber, COP28 President and Minister of Industry and Advanced Technology

“Financial watchdogs are stepping up their supervisory engagement with banks on climate-related efforts and this may result in punitive measures on those institutions that fail to meet expectations,” said S&P Global.

Despite the wider economic downturn last year, sustainable investments managed to weather the storm reasonably well driven by wealthy investors’ growing demand for sustainability. Capgemini said that asset and wealth managers are increasingly integrating ESG into their primary portfolios in response to growing client demand—a trend that can be attributed to a paradigm shift in client demography.

The world’s top banks including Credit Suisse, Goldman Sachs and HSBC are

The scale of the problems facing humanity are too big for any organisation, sector or country to tackle alone. It is rapidly becoming clear that without adequate climate finance, it will not be possible for the world to reach net zero emissions or adapt to a changing climate – particularly for countries in the Global South.

GCC countries continue to witness coordinated leadership across the financial industry, regulation and governments and meaningful investor and shareholder participation when it comes to devising ESG financing strategies and products. With ambitious energy investment and diversification plans in place, a driver of sustainable finance growth has been sustainabilitylinked and use of proceeds financing.

16 Banking and Finance news in the MEA market

CLIMATE CHANGE Business News for the MEA region 16 MEABUSINESS

Upward Trajectory

The UAE is experiencing positive growth, bolstered by sustained reforms, numerous bilateral trade agreements and new residency and visa schemes, and is regarded as the GCC’s most competitive and diverse economy, with local banks enjoying robust performance

The UAE enjoyed a strong finish to 2023 and the Gulf state is looking to accelerate economic growth as it seeks to double its gross domestic product (GDP) to over $800 billion by the end of the decade. GDP is forecast to increase by 5.7% in 2023, according to the Central Bank of the UAE (CBUAE), a higher figure than any of its five GCC neighbours.

“The economy continues to grow, benefitting from strong domestic activity. Non-hydrocarbon GDP growth is expected

to exceed 4% in 2023 and to remain at a similar pace in 2024, driven by tourism, construction and real estate-related developments,” the International Monetary Fund (IMF) forecasted in October.

The Emirates is set to host the World Trade Organisation’s (WTO) ministerial conference, the largest global gathering of trade ministers in Abu Dhabi for the week of February 26, 2024. For the UAE, hosting the meeting is part of a broader strategy to position itself as a global hub for business and finance.

Over the past four years, the country has been rolling out bilateral trade deals called Comprehensive Economic Partnership Agreements (CEPA) with fastgrowing markets.

The UAE, the GCC’s most diversified economy, has introduced a series of reforms over the years to increase foreign direct investment and make itself more attractive for foreigners to live and work amid growing competition in the region.

Banks in the UAE had a strong performance in 2023 on the back of improved margins and favourable economic conditions. The IMF said in October that bank profitability has increased with higher interest rates and overall credit continues to grow, although at a slower rate.

Despite strong domestic activity and improving public finances, the fate of the UAE’s open economy is vulnerable to the health of key global peers, including its largest trading partner, China.

Financial matrix

UAE banks have been among the biggest beneficiaries of the country’s recent

Business News for the MEA region 18 MEABUSINESS 10 Banking and Finance news in the MEA market

MARKET FOCUS - UAE

boom, on the back of higher oil prices and a thriving local economy. Profits are on the increase and asset quality is sound, with the banks also enjoying strong capital and liquidity levels.

The five largest UAE banks’ combined bottom-line profits rose significantly in the nine months to September 2023 compared to the corresponding period a year, mainly reflecting strong growth in both interest and noninterest income.

The four largest banks – First Abu Dhabi Bank (FAB), Emirates NBD(ENBD), Abu Dhabi Commercial Bank (ADCB Group), and Dubai Islamic Bank (DIB) and Abu Dhabi Islamic Bank (ADIB) reported a combined net profit of $12.6 billion in the first nine months of 2023.

Dubai-based Emirates NBD, the second-largest lender by assets, is enjoying a particularly stellar period of growth, with net profits soaring by 92% year-on-year (y-o-y) to reach $4.8 billion (AED 17.5 billion).

FAB, the UAE’s largest lender by assets, reported a 58% increase in 9M 2023 net profits to $3.4 billion (AED 12.4 billion), ADCB Group saw its nine-month profit jump by 24% y-on-y to $1.6 billion (AED 5.75 billion), Mashreq’s net profit rose by 73.1% to $1.52 billion (AED 5.6 billion) while DIB registered an 18% growth in net profit to nearly $1.3 billion (AED 4.8 billion).

“The uptrend in interest and noninterest income resulted from greater consumer confidence as macroeconomic conditions remain strong, driven by high oil prices and strong activity in non-oil sectors in the UAE, such as trade, tourism and real estate,” said Moody’s.

The net interest income—the difference between interest revenues earned from lending activities and interest paid to depositors—at UAE’s banks has soared over the quarters as lenders are passing rate increases on to customers.

The UAE central bank followed the US Federal Reserve’s decision to keep interest rates unchanged in December to protect the Emirati dirham’s peg against the US dollar. The central bank said it would keep the base rate applicable to

the overnight deposit facility unchanged at 5.40%.

“With inflation still above the target levels, we expect rate cuts only after mid-2024. However, we believe net interest margins of the UAE banks will remain stable for the balance of 2023, before a marginal decline in 2024 post the rate cycle reversion,” said Asad Ahmed, Alvarez & Marsal (A&M) Managing Director and Head of Middle East Financial Services.

The UAE’s financial institutions have adequate capital overall and abundant liquidity while their asset quality has improved significantly over the past three years.

finance and what’s on offer. UAE banks pledged to mobilise around $270 billion (AED 1 trillion) in green finance by 2030.

Fiscally fit

The UAE’s public finances are sound. The country’s fiscal and external surpluses remain high on the back of high oil prices.

The UAE, the Arab world’s most competitive economy, approved the federal budget for the fiscal years 20242026 last October with a total expenditure of $52.3 billion (AED192 billion).

The Emirates forecasted total revenues of $69.6 billion (AED 255.7 billion) over the period while revenue

TRADE IS NOW A CENTRAL COMPONENT OF THE UAE’S DOMESTIC SUCCESS AND, AS WE PREPARE TO HOST THE WORLD TRADE ORGANISATION’S 13TH MINISTERIAL CONFERENCE IN FEBRUARY, GROWING INTERNATIONAL INFLUENCE.

– Dr. Thani bin Ahmed Al Zeyoudi, the UAE’s Minister of State for Foreign Trade

An inflow of new arrivals into the UAE over the past few years has also boosted banks’ deposits - a trend that has gathered pace since the outbreak of the war in Ukraine in February 2022. Total deposits grew by 3.9% quarter on quarter (q-o-q) in Q3 2023, according to consultancy firm A&M.

Similarly, asset quality metrics have remained solid. According to A&M, the sector’s aggregate ratio of nonperforming loans improved marginally by 14 basis points to 5.1% in the third quarter of the year.

Meanwhile, money pledges grabbed the spotlight at the COP28 summit as delegates turned their focus to the yawning gap in the need for climate

and spending for 2024 will grow by an estimated 3.3% and 1.6%, respectively. The finance ministry said that the cabinet approved the budget for the fiscal year 2024, with a total estimated expenditure of $17.5 billion (AED 64.1 billion) while total revenues are projected at $17.3 billion (AED 65.7 billion).

The UAE allocated $626.3 million (AED 2.3 billion), 4% of the total general budget, towards the financial investments sector, including $220 million (AED 807.5 million) which will go towards federal investment projects.

The IMF said the fiscal balance is expected to be around 5% of GDP in 2023, driven by oil revenue and strong economic activity.

mea-biz.com 1911 mea-finance.com

Transition economics

The efforts undertaken in recent years by the UAE to diversify its economy away from heavy reliance on oil revenues are starting to position the Gulf state for strong and sustainable growth. The country’s business-first approach to international relations is bearing fruit via growing trade partnerships.

Since 2021, the UAE has initiated a raft of bilateral trade, investment and cooperation deals with several fastgrowing economies, including Turkey, Indonesia, India and Cambodia to bolster efforts aimed at diversifying income sources and economic sectors.

The programme enjoyed exponential growth in 2023, with three deals implemented, two more signed and awaiting implementation and four agreed – taking the total number of CEPA partners since the launch of the programme to 10 across four continents.

“Trade is now a central component of the UAE’s domestic success and, as we prepare to host the World Trade Organisation’s 13th ministerial conference in February, growing international influence,” Dr. Thani bin Ahmed Al Zeyoudi, UAE’s Minister of State for Foreign Trade said earlier in January.

“As we reflect on the achievements of the past year, we believe the UAE has the conviction and the credibility to help shape a new future for global trade.”

The UAE’s CEPA with India, which was signed in May 2022, is expected to increase bilateral trade by more than $100 billion in the next five years. It also comes as the two countries look to settle more of this trade using local currencies.

Devised to increase and heighten economic competitiveness CEPAs to attract $150 billion of foreign direct investment across sectors including digital economy, advanced skills, space and advanced technology and foster entrepreneurship over the next nine years.

Meanwhile, earlier in January the UAE officially joined the BRICS (Brazil, Russia, India, China and South Africa) group of countries in a sign of its growing commitment to new international partnerships.

WITH INFLATION STILL ABOVE THE TARGET LEVELS, WE EXPECT RATE CUTS ONLY AFTER MID-2024. HOWEVER, WE BELIEVE NET INTEREST MARGINS OF THE UAE BANKS WILL REMAIN STABLE FOR THE BALANCE OF 2023, BEFORE A MARGINAL DECLINE IN 2024 POST THE RATE CYCLE REVERSION.

– Asad Ahmed, Alvarez & Marsal

Despite geopolitical risks stemming from the war in Gaza and Eastern Europe, economists say the country is wellpositioned over the near to medium term.

Boosting competitiveness

The UAE started levying a 9% federal corporate tax on business profits exceeding $102,110 (AED 375,000) for the first-time starting June 1, 2023, as the country moves to align itself with new international standards, particularly the move toward a global minimum tax on multinational corporations.

The ambitious plan, which will see the UAE ditching the tax-free regime that made it the Middle East’s business hub, aims to eventually set 15% as the base levy to stem international competition to offer more attractive rates.

“The phased introduction of a corporate income tax that began in June 2023 will support higher non-oil revenue over the medium term,” said the IMF.

However, Fitch Ratings cautioned that the UAE’s federal corporate tax could have uneven credit implications on rated corporates, with privately-owned corporates and government-related entities rated on a bottom-up basis most affected.

Moody’s also said that although the introduction of a corporate tax will broaden the federal government’s income base, it would negatively affect the credit profiles of companies operating in the country.

The UAE also revamped its Commercial Companies Law by scrapping a law that required an Emirati shareholder or agent when foreigners are opening a company in the country. The new company law came into effect last June and it is expected to boost the country’s economic competitiveness.

The government plans to offer Emirati citizenship and passport to a set group of foreigners, including investors, professionals and special talents – a first in the Gulf region as it looks to give its huge expat population a bigger stake in the economy to drive growth.

The UAE also approved regulations on the entry and residence of foreigners in April 2022 formalising a process aimed at giving expatriates a bigger stake in the economy.

The country’s residence schemes, and entry permits now include the golden residence scheme, green residence, five-year residence visa, job exploration entry visa as well as multientry business and tourist visas that do not require sponsorship.

The UAE’s sustained reform efforts support medium-term growth and a smooth energy transition, but prioritisation and sequencing remain key to ensuring effective outcomes. The IMF said the ongoing efforts to boost private sector employment, further develop the domestic capital market and leverage trade and investment in digital and green initiatives will further advance diversification and lift medium-term growth.

Business News for the MEA region 20 MEABUSINESS 12 Banking and Finance news in the MEA market

MARKET FOCUS - UAE

EMBRACE THE FUTURE OF BANKING WITH MODERN BUSINESS ARCHITECTURE

Clo u d - Ba s ed Sol ut ion s | A rt i icial In t elli ence | Blockchain | A I - D r i v en A r chi t ec tur e

Da t a Anal yt ic s & Bi Da t a | C y be r Sec ur i ty | Mobile & Di i t al Bankin | Io A ut oma t ion | mnichannel Bankin

In t oda y ' s a st - chan in inancial land s ca p e , emb r acin t echnolo y i s n ' t ust im p o rt an t — i t ' s c ru cial . Bank s need mode r n a r chi t ec tur e s t o com p e t e , inno v a t e , and t h r i v e di i t all y.

GBM u nde rst and s t he challen e s bank s ace ur e xp e rts w o r k w i t h y o u t o t ailo r s ol ut ion s , o pt imi z e o p e r a t ion s , enhance c ust ome r e xp e r ience , and im pr o v e s ec ur i ty and com p liance .

Di s co v e r ho w GBM can hel p y o u st a y ahead , ada pt t o ma r ke t s hi ts , and achie v e r o wt h

Emarat Atrium Block B - 3rd Floor, Dubai UAE

gbmdubaimarketing@gbmme.com www.gbmme.com

Weighing the Impact of the UAE Corporate Tax Law

With small and medium-sized enterprises making up 94% of UAE companies, industry experts anticipate the landmark corporate tax law to cause a significant, large-scale impact on the country’s start-up, micro, and SME sectors

As the UAE heavily underpins its medium to long-term growth strategy on reducing its dependence on oil and gas by diversifying the nation’s non-oil revenue streams, the legislative shift will be pivotal in further cementing its position as a global business and financial hub.

The UAE corporate tax regime, which was officially rolled out in June 2023, holds the potential to generate revenue up to AED 47.7 billion (USD 13 billion), or approximately 15% of the country’s gross non-oil revenue, according to Marmore MENA Intelligence, a research subsidiary fully-owned by Kuwait Financial Centre “Markaz.”

Along with Value Added Tax (VAT), which yielded AED 9 billion (USD 2.5 billion) in 2022, the corporate tax reform is expected to boost public funds and stabilise its fiscal framework, while accelerating national economic growth and increasing its gross domestic product (GDP) to AED 3 trillion by 2031.

Deep diving into the UAE’s corporate tax framework

With a corporate tax rate pegged at just 9%, the UAE has the lowest corporate tax

Business News for the MEA region 22 MEABUSINESS 32 Banking and Finance news in the MEA market

CORPORATE TAX

George Hojeige, CEO, Virtugroup

rate among Gulf Cooperation Council (GCC) countries.

Globally, the UAE remains an extremely competitive low-tax business destination, especially in comparison with other low corporate tax countries, such as Montenegro, which levies a corporate tax rate ranging from 9% to 15% depending on profits; Ireland, which has a 12.5% corporate tax; and Hong Kong and Singapore, which charge 16.5% and 17% corporate tax rates, respectively.

Furthermore, the UAE’s 9% corporate tax rate will only apply to companies that generate annual net profits higher than AED 375,000 (USD 102,000), while a 0% corporate tax rate will apply to companies generating annual net profits equal to or less than that amount.

On the other hand, multinational conglomerates that earn profits over AED 3.5 billion (USD 952.9 million) will be subject to a higher tax rate based on the Organisation for Economic Cooperation and Development (OECD) base erosion and profit shifting (BEPS) policy.

The UAE Government has also introduced the Small Business Relief programme for small businesses. Available until the end of 2026, this tax relief grants exemption to SMEs whose total revenues are below or equal to AED 3 million for the relevant tax period.

How is corporate tax reshaping the UAE’s business ecosystem?

In addition to opening up new revenue sources and enhancing the UAE’s attractiveness as a global economic hub, corporate tax is also expected to promote transparency and drive accountability among companies incorporated and operating in the country, thus solidifying its international reputation and bringing the reporting standards of UAE-based businesses in line with global benchmarks.

These factors – and a favourable corporate tax scheme – will aid the UAE in maintaining a business-friendly environment and achieving its goal of having one million SMEs by 2030.

As of 2022, it is already home to 557,000 SMEs, around 46% of which are based in Dubai.

Lack of awareness and misinformation pose challenges to tax compliance among SMEs

More than a year after the announcement of corporate tax, however, numerous businesses are still uncertain if the law applies to them, or unaware of the steps they must take to achieve tax compliance.

While the new corporate tax legislation has outlined tax exemptions and a taxfree threshold, all companies based in

AED 20,000, depending on the case of non-compliance.

While adapting to the new tax reform may be challenging for some start-ups and SMEs, the initiative is ultimately designed to further enhance the UAE’s standing as a premier business and trade destination, making it an even more attractive hub for foreign direct investment (FDI) and venture capital.

The latest statistics show the UAE ranks first in the Middle East and North Africa region in terms of FDI inflows, and was the top FDI destination in the GCC economic bloc in 2022. During the same

ESSENTIALLY, BUSINESSES ARE REQUIRED TO RECORD THEIR TRANSACTIONS AND PROVE THEIR TAX POSITION, EVEN IF THEY ARE EXEMPT OR UNDER THE TAXABLE THRESHOLD

the UAE must still register for corporate tax, keep correct accounting records and complete their annual corporate tax filings with the Federal Tax Authority (FTA).

These mandatory steps apply to both mainland and free zone companies, as well as to companies with a single shareholder, businesses with zero revenues and even those that qualify for exemptions.

Essentially, businesses are required to record their transactions and prove their tax position, even if they are exempt or under the taxable threshold.

The launch of corporate tax law in the UAE has also highlighted the critical role of corporate service providers in guiding entrepreneurs and small business owners into tax compliance and helping them navigate the new rules and requirements, enabling them to avoid penalties that range from AED 500 to

year, the UAE was also the only MENA country to cross the USD 1 billion mark in venture capital funding, reinforcing its lead in the region.

Fuelling exponential and sustainable growth in the future

Though the full effects of corporate tax are yet to be seen, market analysts are optimistic that corporate tax will help boost local infrastructure development and spur investment in megaprojects that will drastically elevate the country’s competitive edge, thereby benefitting UAE-based businesses in the long run.

Additionally, it can create new markets and business opportunities that can further promote long-term and sustainable economic growth, while advancing and refining local business practices to meet international standards for quality, excellence and transparency.

mea-biz.com 2333 mea-finance.com

Better Than Money

David Chaum inventor of the first electronic cash, eCash, and often hailed as the godfather of cryptocurrency, joined Oscar Wendel for an interview at COP28 to share his journey and inspiration for his new breakthrough invention ‘Better than Money’ (BTM), revealing a breakthrough replacement for the payments industry

BTM is a new transaction platform that removes cost and friction in global payments and remittances and critically helps evade the risks and depreciations of fiat currencies by instead using any form of asset-based value for instant transactions. The platform interfaces with portfolios holding essentially any type of tokenised asset; the cryptography is quantumsafe and protects against forgery of the underlying digital instruments while protecting privacy. It combines security with transparency, mitigates systemic risk of a liquidity crisis and improves the market efficiency of assets.

The current money system contributes to income inequality in that it imposes high transaction costs, particularly affecting less affluent individuals. Holding money in its traditional form leads to a loss in value due to inflation and high costs for global transactions.

“I had this epiphany, forty years after inventing electronic money, I realised how important it is for the poor to have good money. You can trace a lot of strife, division and struggle to income inequality. It is not a healthy thing for the world. Not only for the global poor, but actually for everybody, because a rising tide will lift all boats,” David said.

David elaborated on the inefficiencies of traditional monetary systems, where individuals hold assets in money without accruing interest. BTM addresses this by allowing users to retain all the value they hold invested where they choose, providing a hedge against market fluctuations and accruing value. Such an innovative approach benefits individuals and SMEs, empowering them to manage their assets even more effectively.

“When I was a graduate student at Berkeley, I realised how critically important

David Chaum and Oscar Wendel

Business News for the MEA region 24 MEABUSINESS 48 Banking and Finance news in the MEA market

OPINION PIECE

cryptography was for the survival of humanity and democracy. It’s the only way for people to protect themselves in the information age. I realised that in 1982. I organised a conference, and the paper I presented there was how to use blind signatures to make a digital bearer instrument. Blockchain technology can be traced back to that. If you go back and look at my dissertation at Berkeley, which came out the same year, it has a full specification for a blockchain in it that is executable and has all the elements of blockchain except for proof of work,” said David.

eCash, David’s brainchild, was developed by his company Digicash in the late 1990s. It faced challenges during the dotcom collapse due to the unpreparedness of platforms to handle the intricate cryptography required on personal computers of that era. However, the core concept of eCash, representing a form of digital currency, persisted. It has now resurfaced in a more advanced form as eCash 2.0, which was recently implemented and proven out by IBM for the Bank for International Settlement (BIS) and the Swiss National Bank

Speaking about the fundamental differences between eCash and its upgraded version, David highlighted a key innovation—a public ready-to-spend list of all valid serial numbers. This list, unlike the ‘spent coin list’ of the original eCash, is not linked to individuals but undergoes encryption through a mix network, making sure it’s un-linkable to the withdrawal before being published.

This advance ensures the prevention of double spending without the need to maintain a list of previously spent serial numbers, allows for auditability of all outstanding coins, and thwarts counterfeiters even with infinite computing power.

David argues that the current payment industry, representing a $2 trillion annual tax on global transactions, disproportionately impacts the poor. By enabling individuals to hold and invest their assets directly, BTM could contribute to reducing this regressive burden.

WHEN I WAS A GRADUATE STUDENT AT BERKELEY, I REALISED HOW CRITICALLY IMPORTANT CRYPTOGRAPHY WAS FOR THE SURVIVAL OF HUMANITY AND DEMOCRACY

“Money is not the answer to anything. It is a misdirection, and we have to get over it because it is the problem. It is not something that we can improve. If you hold money, you are going to stay poor. You are paying around 7% for remittances globally. It is unconscionable. Even the World Bank was against it and forced companies to go to 5%. They all agreed but now they’re back up to 7%.”

David continued: “BTM is, simply put, a system that interfaces portfolios of all types of assets and settles the transactions by value coming out of my portfolio in proportion to my holdings. No one can see what the counterparty has in their portfolio; and neither the government, nor anyone else, can see the transaction. That is the basic idea of the direct asset portfolio and asset-portfolio

MONEY IS NOT THE ANSWER TO ANYTHING

value transfer. You do not want to hold money; you want to hold assets that stay invested all the time and don’t depreciate in value due to inflation,” David explained.

The unveiling of eCash 2.0 took place earlier this year around the Point Zero Forum hosted by Elevandi and the Bank of International Settlements in July. David expressed his excitement about the demonstration and the transformative potential of the upgraded system. The enhanced security features and

public ready-to-spend-list make eCash 2.0 a robust contender in the digital currency arena.

Addressing the participants of the Elevandi Insights Forum roundtable on CBDCs in Singapore, Chaum made his case for privacy. “The contest, or cooperation, between public-sectorissued money versus non-publicsector-issued money may potentially be completely changed by one getting the ‘unfair’ advantage of offering privacy, and that is the elephant in the room.”

At the Point Zero forum in Zurich in July, David presented eCash 2.0, a concept and pilot for a payment system built by the Bank of International Settlements (BIS), Swiss National Bank (SNB), and IBM. David explained: “What that system has, which other systems do not, is real user-controlled privacy. If the private sector provides privacy and the public sector does not, I think it will be game over in the [digital currency] competition. This is the secret weapon, and it is available now! That’s how to take the moral high ground in this whole contest.”

David elaborated: “There are a lot of very angry people concerned with the privacy issue [around CBDC] and I do not think they are going to go away. I would, moreover, like to suggest that maybe money is not the ultimate thing for consummating transactions between counterparties. What if two parties could each just exchange value between their asset portfolios directly, and with privacy?

I was shocked when I realised that this can be built with a very similar kind of technology [to eCash 2.0], which has already been demonstrated as possible in the very near term.”

mea-biz.com 2549 mea-finance.com

How to Calculate your End-of-Service Gratuity

GPSSA explains steps to calculate retirement pension, endof-service Gratuity

The General Pension and Social Security Authority (GPSSA) explained ways by which insured individuals working in government and private sector entities can calculate their retirement pension and end-of-service gratuity as per the UAE Federal Pension and Social Security Law.

As an initial step, registered employees need to be aware of how their contribution salaries are calculated each month.

For government sector employees, the calculation method is based on five elements, namely: basic salary (including monthly bonus and allowance specified by the UAE Pension Law), cost of living allowance, children allowance, the insured’s social

For the private sector contribution, salaries are calculated based on details stipulated in the employment contract with up to a maximum of AED50,000.

The second step includes deducting and calculating the average contribution account salary over the last three years of employment amongst government sector employees or for the entire contribution period if the service years are less than that.

The account salary for private sector employees is calculated over the last five working years or for the entire contribution period if the service years are less than that.

The average contribution account salary is calculated for each of the last

months. The amount is then collected and divided by 36 months for government sector employees and 60 months for private sector employees.

The final step includes calculating the pension account salary or endof-service gratuity, whereby the pension is calculated based on the average contribution account salary according to the years of service.

A service period of 20 years grants the pension to the insured at a rate of 70% of the average contribution account salary, and the insured is given an increase of 2% for each year exceeding 20 years, while there are some cases by which the pension is granted at a rate of 60% for a period over 15 years, and at a maximum rate of 100% when the insured spends 35 years in service.

The insured is granted a bonus of three salaries from the pension account for any year exceeding 35 years in service.

Calculating a government and private sector employee’s end-of-service gratuity is based on the average salary for calculating the gratuity, similar to the average salary for the contribution account that was extracted when calculating the pension, resulting in the insured receiving a bonus at the rate of 1.5 months’ worth salary for each year of the first five years of service from the average salary; while calculating the gratuity at the rate of two months for each year for the following five years of service, and at a rate of three months for each additional year.

The employee is eligible to receive their bonus starting from one to 19 years and 11 months of employment.

If an additional day is spent working, they will be eligible to receive the same pension amount since working for less than a month is calculated and considered as working one full month as per the UAE pension law

HR NEWS – COMPENSATION & BENEFITS

+352 2 786 6577

Niki Mapouras-Hyder, Founder of NMH

Niki Mapouras-Hyder talks about NMH a community for returning mothers to the workforce

Tell us about you, your experience and your time in the ME?

I have been in Dubai for six years, after following my husband here as many women do. We were newly married and both eager to grow our careers here in the Middle East. I got to experience the UAE pre-children as it gave me a glimpse into the corporate world from a different angle. I worked in Private Equity where it was fast-paced and high-intensity. I moved to a big consultancy who were exemplary in supporting the transition out to have children before encouraging you back to work after maternity leave. However, I still struggled when I re-joined.

What inspired you to set up your business in the UAE?

Having returned to the corporate world twice after having children, I lost my identity and purpose at work. It was very difficult and I couldn’t understand why it had happened. I was confused about what my role was and it frustrated me. I looked for a place to find answers, yet couldn’t find a community I resonated with. I wanted to connect with other women who were equally focused on returning to the corporate world and I founded NMH to provide that practical and supportive community to returning mothers

Niki Mapouras-Hyder, Founder NMH, Dubai

Niki Mapouras-Hyder, Founder NMH, Dubai

Do you think organisations in the UAE are becoming more flexible in their approach to working parents and those returning after a career break?

In short, yes. Covid played a key role in challenging corporates and showing

them the importance of examining the traditional structure versus flexible working. I believe the big corporates recognise that there is a large talented pool of candidates who are not being utilised in the correct way and who would benefit their organisation. You see more part-time and flexible options for returning mothers and others returning from a career break. Also, more returnships are being offered and encouraged.

What more can companies do to support returners and ease their transition back into the workforce?

In addition to offering formal returnship

programmes (i.e. paid internships for professionals who have taken career breaks) and flexible options, they could support through the following:

1. Mentorship and coaching to help people navigate their re-entry into the workforce.

2. Training & development programs to help returners update their knowledge & address any skill gaps.

3. Create a supportive and inclusive work environment where everyone feels valued.

4. Recognise and reward employees’ contributions with promotions and

Business News for the MEA region 28 MEABUSINESS SPOTLIGHT

pay rises.

Building a strong employer brand. Companies can attract more returners by building a strong brand that emphasises their commitment to diversity, equity, and inclusion, as well as their focus on employee wellbeing and worklife balance.

5. Building a strong employer brand. Companies can attract more returners by building a strong brand that emphasises their commitment to diversity, equity, and inclusion, as well as their focus on employee well-being and work-life balance.

What are some of the biggest challenges companies will face over the next 5 years?

1. Skill gaps and outdated knowledge: Returners may face skill gaps or lack knowledge about the latest trends and tools.

2. Bias and stigma: Unfortunately, there may be a stigma associated with career breaks, leading to unconscious bias during the recruitment process and a lack of inclusion in the workplace. Fostering a welcoming, inclusive environment will be crucial.

3. Transience: We live in such a fastmoving and transient place, there is an abundance of people and skill levels and this never-ending revolving door of candidates can impact quality.

4. Demographic shifts and talent acquisition: The Middle East’s population is growing rapidly, with a

large youth demographic. Companies will need to attract, retain, and develop this young talent pool to meet their workforce needs.

What are the main skills employees need to meet the region’s talent requirements?

Hard skills:

Digital literacy: Dubai is embracing digital transformation, and employees need to be digitally literate to adapt to the changing workplace

Multilingualism: Dubai’s diverse population and global connections make multilingualism an asset.

Soft Skills:

Continuous learning and upskilling: The pace of technological advancements and industry shifts necessitates a commitment to continuous learning and upskilling, with a focus on cultural sensitivity and cross-cultural collaboration:

Agility, Problem-solving and adaptability: Companies need employees who can effectively identify and solve problems, adapt to changing circumstances, and think creatively to overcome challenges.

mea-biz.com 29

A Night of Stars: The Aviation Achievement Awards 2024 Takes Dubai by Storm

Honouring Excellence, Innovation, and Leadership: A Grand Gathering of Aviation leaders Celebrates the Pioneering Spirit and Resilience of the Industry in a Spectacular Evening of Recognition and Networking

On the evening of February 29, 2024, the aviation industry’s finest gathered at the V Hotel on Sheikh Zayed Road, Dubai, for an event that was nothing short of spectacular. The Aviation Achievement Awards 2024, hosted by Creative Middle East Media, soared beyond expectations, setting a new benchmark for recognition in the aviation sector. With an air of anticipation, the night unfolded to reveal the true spirit of excellence that drives this dynamic industry forward.

The event commenced with a stylish reception, where industry leaders and professionals mingled, setting the stage for an evening of celebration and camaraderie. The gala dinner that followed was a testament to the event’s impeccable organization, featuring gourmet cuisine and a setting that mirrored the grandeur of aviation’s ambitions. As the awards presentation began, the atmosphere was electric, each trophy presentation and winner’s photoshoot capturing moments of triumph and pride that will be remembered for years to come.

This year’s awards highlighted the remarkable resilience, innovation, teamwork, and leadership within the aviation industry, especially significant in the wake of the challenges posed by the global pandemic. The recognition of these achievements resonated deeply with all attendees, serving as a reminder of the sector’s vital role in connecting and advancing our world.

Earlier in the day, the Gulf Aviation Networking Event (GANE) 2024 provided a powerful platform for discussion and networking among senior aviation leaders. Topics of sustainability, technology,

commercial, and business aviation were at the forefront, fostering insightful dialogues and collaborations. Established in 2013, GANE has consistently contributed to shaping the future direction of the aviation sector, and this year’s event was no exception.

Kenneth Mitchen, Executive Director of MEA Finance at Creative Middle East Media, captured the essence of the evening in his remarks, emphasizing the dual role of these events not only as a celebration but as a cornerstone for future growth and innovation in aviation. “These events are not merely a celebration of the industry’s achievements but also a vital opportunity for industry leaders to engage in discussions and collaborations that will shape the future of aviation,” Mitchen stated.

The Aviation Achievement Awards 2024 and GANE have once again underscored the importance of recognizing excellence, fostering innovation, and encouraging collaboration within the aviation industry. As we look to a future filled with challenges and opportunities, the contributions and achievements celebrated tonight pave the way for a brighter, more connected world.

For those who missed this unforgettable night or wish to relive its most memorable moments, stay tuned for the full event highlights in the next issue of MEA Business Magazine. The upcoming feature will delve deeper into the achievements recognized and the distinguished personalities who graced the event, ensuring that the spirit of the Aviation Achievement Awards 2024 continues to inspire the industry well beyond the night.

Business News for the MEA region 30 MEABUSINESS Aviation Achievement Awards

Managing investments in developing markets is not smooth sailing

AMERELLER has been piloting clients in the Middle East through uncharted waters for twenty-five years.

Whether it’s negotiating with sovereigns, litigating in court, or managing complex regulatory matters, AMERELLER has done it all.

When business charts a course to the Middle East - THINK AMERELLER

www.amereller.com

A full service international law firm built for the Middle East

Baghdad . Basra . Berlin . Cairo . Dubai . Erbil . Munich . RasAlKhaimah . Tripoli

Regulatory Compliance

Dispute Resolution

Deals and Transactions

ZA’ABEEL HALLS 1-3 DUBAI WORLD TRADE CENTRE, UAE 5–6 MARCH 2024 MROMIDDLEEAST.AVIATIONWEEK.COM #MROME AIME.AERO #AIME

BY

ORGANISED

HERE

Connecting the airline supply chain REGISTER

Kenneth Mitchen Publisher, MEA Business

Kenneth Mitchen Publisher, MEA Business

Niki Mapouras-Hyder, Founder NMH, Dubai

Niki Mapouras-Hyder, Founder NMH, Dubai